Abstract

The COVID-19 pandemic has placed unprecedented stresses on food supply chains, with bottlenecks in farm labour, processing, transport and logistics, as well as momentous shifts in demand. Most of these disruptions are a result of policies adopted to contain the spread of the virus. Food supply chains have demonstrated a remarkable resilience in the face of these stresses. Grocery store shelves have been replenished over time, as stockpiling behaviour disappeared and as supply chains responded to increased demand. Long lines at borders shrank quickly in response to policies to alleviate unnecessary restrictions. While the impacts of COVID-19 are still unfolding, experience so far shows the importance of an open and predictable international trade environment to ensure food can move to where it is needed. The biggest risk for food security is not with food availability but with consumers’ access to food: safety nets are essential to avoid an increase in hunger and food insecurity.

The COVID-19 pandemic introduced unexpected stresses on food systems, creating many immediate challenges. Yet what is remarkable is the speed with which supply chain actors have to date been able to reorganise themselves to ensure the continued availability of food, at least in the developed world. Some bottlenecks remain, and some new disruptions may emerge as COVID-19 continues to spread. The rapid response of food supply chains has underscored the importance of an open and predictable international trading environment, which allows firms to tap into new sources of supply when existing sources are compromised. Policy makers have also so far mostly avoided the mistakes made during the food price crisis of 2007-8, and have also taken a range of other steps which have helped ensure the continued functioning of food supply chains.

This note summarises what is known today about the extent of the stresses COVID-19 has placed on food supply chains; the response and resilience of these supply chains to date; and remaining bottlenecks. The note updates and complements COVID-19 and the Food and Agriculture Sector: Issues and Policy Responses (29 April 2020). The focus here is on food availability and consumers’ access to food; other important aspects, such as livelihoods of farmers and other supply chain actors, and environmental and health implications, are not covered in the present note. This note also focuses on OECD countries, in part because much less is currently known about the impacts of COVID-19 in developing countries. It seems likely that food supply chains in developing countries will be harder hit, to the extent that health services are less widely available, informal work is widespread, logistics chains are less developed and farming is more labour intensive.1

1. COVID-19 has placed unprecedented stresses on food supply chains

COVID-19 has imposed shocks on all segments of food supply chains, simultaneously affecting farm production, food processing, transport and logistics, and final demand. Not all sectors and products have been equally affected, and different products have experienced disruptions at different stages of the supply chain.

Farm production faces bottlenecks for some inputs

Farm production has been affected by bottlenecks for inputs, most notably labour. Some farm sectors are more dependent on (seasonal) labour than others: fruits and vegetables are more labour-intensive, while cereals and oilseeds typically require less labour. Limits on the mobility of people have reduced the availability of seasonal workers for planting and harvesting in the fruit and vegetable sector in many countries.2

In addition to farm labour, other important inputs are seed, pesticides, fertilisers, and energy. While seed shortages have not been a major problem to date, there is a risk of disruption in the coming months. The seed sector is highly globalised, and seed can travel through several countries for multiplication, production, processing and packaging. Most seed needed for the March, April and May sowing period (spring crops in the northern hemisphere, such as maize, soybean, and spring wheat; and autumn crops in the southern hemisphere) had arrived before travel restrictions were put in place. But it remains to be seen whether seed for the next growing seasons will arrive in time.3 Seed is also often transported by air, a mode of transport which has been severely disrupted (see below). Concerns were also initially voiced regarding the availability of pesticides, for which China is a major supplier.4 As China emerged from lockdown, these concerns appear to have waned. Supplies of fertilisers and energy have been relatively less disrupted, and prices for major fertilisers are relatively low (including due to the falling oil price as production of some fertilisers is energy intensive). Global availability of fertilisers is not a bottleneck, although local disruptions have occurred because of transport difficulties.5

Processing has been disrupted by labour shortages and shutdowns

COVID-19 has led to disruptions in food processing industries, which have been affected by rules on social distancing, by labour shortages due to sickness, and by lockdown measures to contain the spread of the virus. In confined spaces such as packing plants for fruits and vegetables or meat processing facilities, necessary social distancing measures may reduce the efficiency of operations and there is a need to ensure adequate protections for employees. Many firms have also reported high rates of worker absences; for example, staff availability was reduced by up to 30% in French meat processing facilities in the regions of the country worst hit by COVID-19.6

COVID-19 clusters have been found in meat processing plants in various countries.7 Employees often work in close proximity to each other, making it more difficult to respect physical distancing requirements. In some cases, workers also live together in overcrowded conditions, which further facilitates the spread of the virus.8 Meat processing appears to be more sensitive than other types of food processing in part because of the labour intensive nature of operations. By contrast, grain handling and processing is highly automated and less labour intensive, and has not experienced the same disruptions as the meat processing sector.

Many meat processing plants have shut down or have been forced to operate at reduced capacity. In the United States, cattle and pig slaughter fell by about 40% in April compared to the same period in 2019. Low demand from meat processors has left producers in North America with unsold mature animals. Increasingly, they are forced to resort to euthanizing animals to prevent overcrowding, particularly for pigs.9 In Europe, conditions currently do not yet appear to warrant such drastic measures.10 The effects of meat processing plant closures may be especially pronounced in North America due to the concentrated nature of the industry; in the United States, almost 60% of pork processing capacity comes from just 15 plants.11

Some modes of transport have been affected more than others

Bottlenecks in transport and logistics have disrupted the movement of products along supply chains. Broadly speaking, agricultural and food products are transported using three main modes of transport: bulk (ships and barges); containers (by boat, rail or truck) and other road transport; and air freight. Different products use different modes of transport: cereals and oilseeds, for example, are typically shipped in bulk; meat and dairy products are often shipped in refrigerated containers and trucks; and perishable products with a high value-to-weight ratio are transported by air in the “bellies” of passenger planes.

The impact of COVID-19 on these transport modes varies considerably.12 Bulk shipments have not seen any major disruptions, and prices for bulk freight are actually near multi-year lows.13 However, air freight has been severely disrupted. Global air cargo capacity in the week of 10 to 16 May was 26% lower than during the same period last year, with the largest decline in capacity on routes between Europe and Latin America (with declines of more than 80%). The disruption is caused by the steep decline in passenger air travel, which normally accounts for the majority of air cargo capacity.14 Disruptions to container and truck transport fall somewhere in-between; the number of container ships is currently 8% below normal due to COVID-19 restrictions such as limitations on crew changes, additional screening, mandatory quarantines, and reduced demand.15 Commercial road transport in April was about 20% lower than usual in Canada and the United States.16 In Europe, truck traffic initially fell by more than 50% in Spain, 46% in France and 37% in Italy, although it has subsequently recovered. In mid-April, the total distance driven by trucks in Europe was 24% below normal.17

Transport and logistics problems have thus been most pronounced for perishable high-value products, such as fruits and vegetables. The fruits and vegetables sector is also affected by quarantine measures and delays in border inspections (including as the number of import/export inspectors has fallen).18 By contrast, cereal supplies have not faced major disruptions: bulk transport has been less affected, and cereals can be loaded, shipped and handled with minimal labour input.19

Consumer demand has seen rapid and unprecedented shifts

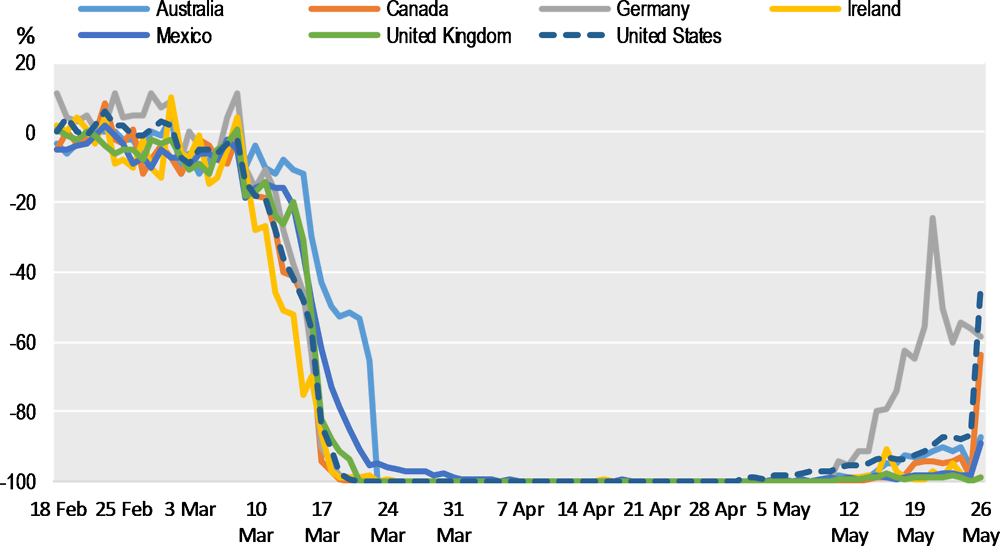

COVID-19 has led to a drastic shift in consumer demand away from restaurants, food service and other types of “food away from home” towards food consumed at home, requiring important changes in the way food supply chains operate. As the COVID-19 pandemic gathered pace, sales of food away from home (consumed in hotels, restaurants, catering and cafés) collapsed. Restaurant reservations declined sharply in early March and fell to practically zero as lockdowns were enforced.20

Note: Data includes online reservations, phone reservations, and walk-ins at restaurants on the OpenTable network; estimates are based on a sample of approximately 20 000 restaurants.

Source: OpenTable.com.

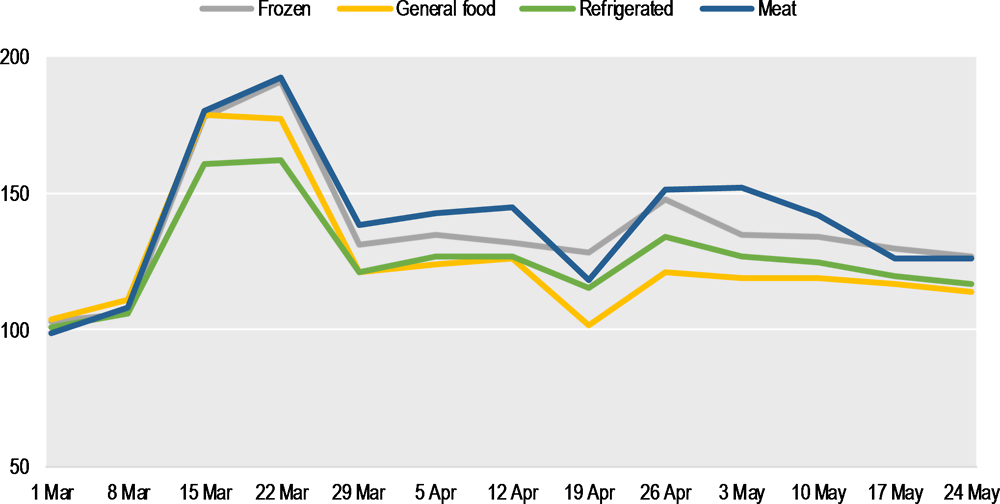

At the same time, retail demand for food soared. Sales of frozen and packaged foods in particular increased dramatically: at their peak in the second half of March, weekly sales of frozen foods were 63% higher than the year before in France, while sales of packaged foods were 56% higher year-on-year in Germany. Similar demand spikes were seen in other countries. Following this initial spike, retail demand for fresh, frozen or packaged foods has remained about 15-20% higher than usual.21

Note: The IRI CPG Demand Index measures weekly changes in consumer purchases (in dollar terms) relative to the same period in the previous year.

Source: IRI, https://advantage.iriworldwide.com/Engineering/covid19/.

The impact of this shift in demand is considerable. In the United States, for instance, the “food away from home” sector normally accounts for 10% of the consumption of fruits, 32% of vegetables, 25% of dairy, 31% of cereals, and 33% of protein foods (a category which includes among other things meat, seafood, and eggs).22 Across most countries, the sector accounts for at least 25% to 30% of total sales of fresh fruit and vegetables.23 Shifting these volumes to the retail sector is not easy. In addition to logistical challenges, households’ consumption patterns at home are different from those away from home. For example, food away from home tends to use more cheese (e.g. as toppings on pizza) than consumers use at home, and also involve more expensive meat cuts (e.g. steaks vs minced meat at home). Even where similar products are consumed, products normally sold to restaurants and foodservice operations cannot always be sold to retailers without incurring extra costs. For example, while the foodservice industry buys large blocks of cheese, much smaller packages are needed for retail sales.24 Retailers may also have different quality expectations or other extra requirements. Finally, hotels and restaurants can be important contributors to food banks, and their closure has reduced supply to these outlets at a time when demand for their services is increasing.

Implications

The significance of COVID-19 for food supply chains thus comes less from its impact on primary production or overall food demand than from its disruptive effects on the complex web of actors connecting farm to fork, and the sudden change in the demand mix. Disruptions in processing, in particular for meat, can “disconnect” supply and demand, creating simultaneous surpluses for producers and shortages for consumers, while for some specific products demand has also decreased, leading to a temporary oversupply (e.g. potatoes for French fries, or milk for cheese).25 At the same time, shoppers sometimes experienced empty shelves in supermarkets during the early days of COVID-19, as food supply chains adjusted to the sudden demand surge.26

The risk to food security currently does not come from disruptions along supply chains, but rather from the devastating effects of COVID-19 on jobs and livelihoods. Especially in developing countries, where social safety nets are less well-developed, COVID-19 may lead to a severe increase in poverty and hunger.27 The World Food Programme projects that the number of people in acute food insecurity could double to 265 million in 2020 unless swift action is taken.28 But even within developed countries, more vulnerable groups such as the elderly, chronically ill and poorer households may be at risk, and COVID-19 has laid bare pre-existing gaps in social protection systems.29

2. Yet food supply chains in the developed world have largely been remarkably resilient to date

While there have clearly been stresses and issues, overall, food supply chains in the developed world have demonstrated remarkable robustness and resilience in the face of COVID-19.30 Responses by policy makers have helped, facilitating the functioning of supply chains and avoiding the costly mistakes of the 2007-8 food price crisis.

Grocery store shelves have been replenished over time, as consumers reduced the volume of food purchases after initial stockpiling, and as supply chains responded to the exceptional increase in demand. Stocks acted as a first buffer. Despite a general trend towards “just in time” models with limited inventories, various actors along the food supply chain held safety stocks which were drawn down in response to the demand spike.31 At the global level, stocks of cereals were also considerably greater than they were on the eve of the 2007-8 food price crisis.32

In addition, food processors and retailers took several steps to adapt to COVID-19.33 First, they increased operating hours in factories and hired additional employees, with many retailers hiring extra staff.34 Second, they reduced the variety of different products to focus on the most popular only. This prevented costly and time-consuming changeovers for manufacturers, and simplified inventory management for retailers.35 Third, they found alternative sources of supply when faced with disruptions. For example, when Indian exports of rice became temporarily unavailable, French retailer Carrefour found new suppliers in Pakistan.36 Firms which had invested in creating more visibility in their supply chain (and thus which had a better understanding of the operation of their supply networks) seem to have fared better.37 Similarly, companies which had experience with other types of disruptions (such as those caused by hurricanes) seem to have been better prepared.38

Supply chain actors also expanded the use of new delivery methods such as “click and collect” services and online sales. Farmers started using digital technologies and platforms to sell their produce directly to consumers.39 Restaurants switched to providing take-out and delivery, with some offering grocery-like services (e.g. selling meal kits rather than prepared food).40 Initiatives also emerged to link farmers and restaurants directly to food banks.41

The logistics sector has similarly adapted to the shocks of COVID-19. As passenger airline travel collapsed in February and March, removing a daily cargo capacity of around 80 000 tonnes, the use of specialised private aircraft for freight has expanded, adding more than 20 000 tonnes of daily capacity. Road transport faced different challenges as activity in non-essential sectors was greatly reduced, while other sectors such as food retail faced demand spikes. Yet the industry adapted quickly: within two weeks, capacity had reoriented.42 As transport of food and agriculture products in Europe remained robust relative to other goods, the share of trucks delivering these products increased from one-third of the total before lockdown to more than half during lockdown.43

The recovery of logistics was facilitated by policy decisions. Long lines at borders shrank quickly in response to measures taken by policy makers, such as the creation of “green lanes” at intra-EU border crossings where the total time spent on border crossing now should not exceed 15 minutes. While new restrictions limiting the number of drivers in a vehicle were necessary, EU Member States suspended other restrictions (e.g. bans on driving at night or driving on weekends).44 Policy makers also streamlined certification procedures (e.g. by allowing scanned copies or electronic signatures) and relaxed regulations on trade in food (e.g. some labelling requirements).45

Government agencies and industry associations also provided information to food supply chain actors to help them cope with COVID-19, including on best practices for safety and hygiene, on exceptional government support, and market conditions.46 Other policy measures to protect the functioning of food supply chains included exemptions of food and agriculture from lockdown restrictions, measures to ensure the health of agriculture and food workers, loosening visa restrictions to attract foreign seasonal workers, and administrative flexibility. These are discussed in detail in Agricultural Policy Monitoring and Evaluation 2020 (OECD, forthcoming).

However, the most impactful policy response is probably that policy makers have so far avoided a repeat of the mistakes of the 2007-8 food price crisis, when initial food price increases were greatly exacerbated by export bans imposed by major exporters (they are estimated, for example, to have accounted for almost half of the increase in rice prices).47 Although some countries have introduced export restrictions during the current crisis, so far their number and impact has been limited.48 Moreover, WTO members responsible for two-thirds of global exports of agriculture and agri-food products issued a joint declaration expressing their commitment to keep international trade open.49

3. Some bottlenecks remain and require attention

While food systems have shown remarkable resilience and many problems have been resolved, some bottlenecks remain and require attention from policy makers. A first bottleneck relates to the availability of inputs for farming, notably labour for harvesting fruits and vegetables. A second relates to plant shutdowns in the food processing sector, notably in meat processing. A third relates to the ongoing disruption of air freight, which affects high-value perishable products, again notably fruits and vegetables. What these bottlenecks have in common is that they are difficult to overcome in the short run. As the COVID-19 pandemic spreads in Latin America, home to important global suppliers, new risks to global food supply chains may also be emerging.

However, the biggest risk for food security is not with food availability but with consumers’ access to food. As lockdown measures and other COVID-19-related disruptions lead to a global recession, millions are losing their livelihoods or experiencing a severe drop in their incomes. Social safety nets and food assistance programs are thus essential to avoid an increase in hunger and food insecurity.

4. Policy lessons so far

While the impacts of the pandemic on food chains are still unfolding, several lessons have emerged. Open and predictable markets have been critical in order to smooth distribution of food along supply chains and to ensure it can move to where it is needed. Diversified sources of supply have allowed firms along the food chain to adapt rapidly when specific input sources were compromised by transport or logistics disruptions. Finally, meeting the needs of vulnerable groups requires attention to food access, such as by ensuring targeted, flexible safety nets.

Notes

Three types of food supply chains can be distinguished in the developing world: traditional models based around subsistence agriculture or short local supply chains (which account for approximately 10% of the food economy in Africa and South Asia), modern food supply chains based around supermarkets and large processors (about 20%), and a large “transitional” sector (some 70% of the total) connecting rural producers to urban consumers through a web of labour-intensive small and medium-size enterprises. Farmers are likely to be less affected than the “midstream” and “downstream” segments of the food chain; and modern food supply chains are likely to be best prepared. By contrast, the impact is likely to be larger for transitional food supply chains. COVID-19 is also likely to lead to higher food prices in the developing world due to disruptions to logistics. See Reardon, Bellemare and Zilberman, “How COVID-19 May Disrupt Food Supply Chains in Developing Countries”, IFPRI Blog, 2 April 2020, https://www.ifpri.org/blog/how-covid-19-may-disrupt-food-supply-chains-developing-countries.

For a detailed discussion of disruptions in the fruit and vegetables sector, see OECD Scheme for the Application of International Standards for Fruit and Vegetables, “Preliminary Report: Evaluation of the Impact of the Coronavirus (COVID-19) on Fruit and Vegetables Trade”, 11 May 2020, https://www.oecd.org/agriculture/fruit-vegetables/oecd-covid-19-impact-on-fruit-and-vegetables-trade.pdf (TAD/CA/FVS/WD(2020)1/REV7).

For a detailed discussion of the impact of COVID-19 in the seed sector, see OECD (2020), “Policy responses to COVID-19 in the seed sector”, 4 May 2020, http://www.oecd.org/coronavirus/policy-responses/policy-responses-to-covid-19-in-the-seed-sector-1e9291db/;

See for India, https://www.thehindu.com/business/pesticide-sector-hit-by-input-issues/article31043301.ece; for Brazil: https://www.reuters.com/article/brazil-china-pesticides/brazil-farm-sector-frets-over-possible-china-pesticide-supply-disruptions-idUSL1N2B42XI. Other analysts disputed the vulnerability of Brazil’s agriculture to disruptions of herbicide supply chains, however: see Rabobank, “Covid-19 Casts Shadow Over Fertiliser and Crop Protection Supply Chains”, April 2020, https://research.rabobank.com/far/en/sectors/farm-inputs/covid-19-casts-shadow-over-fertiliser-and-crop-protection-supply-chains.html;

Data on energy and fertiliser prices are provided by the monthly AMIS Market Monitor, available at www.amis-outlook.org.

See https://www.wired.com/story/why-meatpacking-plants-have-become-covid-19-hot-spots/ and https://www.lemonde.fr/planete/article/2020/05/18/coronavirus-pourquoi-des-foyers-d-infection-apparaissent-ils-dans-des-abattoirs_6040056_3244.html.

See, for example, https://www.foxbusiness.com/markets/farmers-euthanize-10-million-pigs-coronavirus for the United States and https://ici.radio-canada.ca/nouvelle/1698646/covid-porcs-euthanasie-quebec-abattoirs-olymel for Canada.

See Jayson Lusk, “These 15 plants slaughter 59% of all hogs in the US”, 9 April 2020, http://jaysonlusk.com/blog/2020/4/9/these-15-plants-slaughter-59-of-all-hogs-in-the-us.

See Schmidhuber and Qiao, “Comparing Crises: Great Lockdown versus Great Recession”, FAO Publicaitons, Rome, https://doi.org/10.4060/ca8833en.

For information on developments in dry bulk freight markets, see the monthly AMIS Market Monitor, available at www.amis-outlook.org.

See Accenture, “COVID-19: Impact on air cargo capacity”, 21 May 2020, https://www.accenture.com/us-en/insights/travel/coronavirus-air-cargo-capacity.

See Inga Heiland and Karen-Helene Ulltveit-Moe, “An unintended crisis: COVID-19 restrictions hit sea transportation,” 17 May 2020, https://voxeu.org/article/covid-19-restrictions-hit-sea-transportation.

See GeoTab, “The impact of COVID-19 on commercial transportation and trade activity”, 12 May 2020, https://www.geotab.com/blog/impact-of-covid-19/.

See Sixfold.com, “Covid impact on logistics – share of idling trucks almost triples”, 22 April 2020, https://sixfold.com/news/covid-impact-on-logistics-share-of-idling-trucks-almost-triples.

See OECD Scheme for the Application of International Standards for Fruit and Vegetables, “Preliminary Report: Evaluation of the Impact of the Coronavirus (COVID-19) on Fruit and Vegetables Trade”, 11 May 2020, https://www.oecd.org/agriculture/fruit-vegetables/oecd-covid-19-impact-on-fruit-and-vegetables-trade.pdf (TAD/CA/FVS/WD(2020)1/REV7).

See AMIS Market Monitor No. 78 (May 2020), www.amis-outlook.org.

See OpenTable.com, “The state of the restaurant industry”, https://www.opentable.com/state-of-industry.

See IRI and Boston Consulting Group, “Consumer Spending Tracker for Measured Channels”, 15 May 2020, https://www.iriworldwide.com/IRI/media/Library/2020-05-15-IRI-BCG-COVID-Global-Consumer-Spend-Tracker.pdf.

See United States Department of Agriculture, Economic Research Service, “Average daily intake of food by food source and demographic characteristics, 2007-10”, https://www.ers.usda.gov/data-products/food-consumption-and-nutrient-intakes/.

See OECD Scheme for the Application of International Standards for Fruit and Vegetables, “Preliminary Report: Evaluation of the Impact of the Coronavirus (COVID-19) on Fruit and Vegetables Trade”, 11 May 2020, https://www.oecd.org/agriculture/fruit-vegetables/oecd-covid-19-impact-on-fruit-and-vegetables-trade.pdf (TAD/CA/FVS/WD(2020)1/REV7).

See “Dairy outlook: COVID-19 lockdowns impact cheese and butter”, 8 April 2020, https://www.foodprocessing.com.au/content/business-solutions/news/dairy-outlook-covid-19-lockdowns-impact-cheese-and-butter-882083603; and Ben Laine, “For dairy, COVID-19 will have three waves,” 22 April 2020, https://hoards.com/article-27711-for-dairy-covid-19-will-have-three-waves.html.

See Rabobank, “European Food Supply: Business Is Far From Usual”, April 2020, https://research.rabobank.com/far/en/sectors/regional-food-agri/european-food-supply-business-far-from-usual.html; and Bloomberg Business, “Food Makers Get Shot of Reality Now that Panic Buying Has Waned”, 16 April 2020, https://www.bloomberg.com/news/articles/2020-04-16/with-panic-buying-waning-big-food-sees-life-without-restaurants.

Peter Rubinstein, “Why grocery shelves won’t be empty for long,” BBC Worklife, 2 April 2020, https://www.bbc.com/worklife/article/20200401-covid-19-why-we-wont-run-out-of-food-during-coronavirus. As shown above, weekly demand for some food products in retail stores increased by 50% or more during the initial phases of the pandemic, but eventually demand settled at levels some 20% above what would normally be expected.

See, for example, David Laborde, Will Martin and Rob Vos, “Poverty and food insecurity could grow dramatically as COVID-19 spreads”, 16 April 2020, IFPRI Blog, https://www.ifpri.org/blog/poverty-and-food-insecurity-could-grow-dramatically-covid-19-spreads.

World Food Programme, 21 April 2020, “COVID-19 will double number of people facing food crises unless swift action is taken”, https://www.wfp.org/news/covid-19-will-double-number-people-facing-food-crises-unless-swift-action-taken.

See OECD (2020), “Supporting livelihoods during the Covid-19 crisis: Closing the gaps in safety nets”, 20 May 2020, http://www.oecd.org/coronavirus/en/.

See, for example, The Economist, “The World’s Food System Has So Far Weathered The Challenge of COVID-19 – But things could still go awry”, 9 May 2020, https://www.economist.com/briefing/2020/05/09/the-worlds-food-system-has-so-far-weathered-the-challenge-of-covid-19; and Peter Rubinstein, “Why Grocery Shelves Won’t Be Empty for Long,” BBC Worklife, 2 April 2020, https://www.bbc.com/worklife/article/20200401-covid-19-why-we-wont-run-out-of-food-during-coronavirus. On the distinction between robustness (a limited impact of shocks) and resilience (a quick rebound after a shock) of Global Value Chains in the context of COVID-19, see for example S. Miroudot, “Resilience Versus Robustness in Global Value Chains: Some Policy Implications”, in: Richard Baldwin and Simon Evenett (eds.), COVID-19 and Trade Policy: Why Turning Inward Won’t Work, VoxEU.org e-book, 29 April 2020, https://voxeu.org/content/covid-19-and-trade-policy-why-turning-inward-won-t-work.

See Peter Rubinstein, “Why Grocery Shelves Won’t be Empty for Long,” BBC Worklife, 2 April 2020, https://www.bbc.com/worklife/article/20200401-covid-19-why-we-wont-run-out-of-food-during-coronavirus.

See Schmidhuber, J. and Qiao, B., “Comparing Crises: Great Lockdown versus Great Recession”, FAO Publications, Rome, https://doi.org/10.4060/ca8833en.

The mechanisms discussed here were outlined by Peter Rubinstein, “Why Grocery Shelves Won’t Be Empty for Long,” BBC Worklife, 2 April 2020, https://www.bbc.com/worklife/article/20200401-covid-19-why-we-wont-run-out-of-food-during-coronavirus.

See, for example, in the United Kingdom: “Supermarkets Tesco, Asda, Aldi and Lidl go on hiring spree”, BBC News, 21 March 2020, https://www.bbc.com/news/business-51976075. For Amazon and Walmart, see Hayley Peterson, “Amazon and Walmart are ramping up hiring to add 250,000 new jobs”, 23 March 2020, https://www.businessinsider.fr/us/amazon-walmart-hiring-how-to-apply-2020-3.

See, for example, Simon Jack, “Coronavirus : Supermarkets ‘Drastically’ Cutting Product Ranges”, BBC News, 19 March 2020, https://www.bbc.com/news/business-51961624; World Economic Forum, “5 Things Supermarkets Want You to Know Right Now”, 20 March 2020, https://www.weforum.org/agenda/2020/03/supermarkets-grocery-coronavirus-covid19-supply/.

The Economist, “The world’s food system has so far weathered the challenge of COVID-19 – But things could still go awry”, 9 May 2020, https://www.economist.com/briefing/2020/05/09/the-worlds-food-system-has-so-far-weathered-the-challenge-of-covid-19 . Indian supplies were disrupted as Indian rice traders stopped signing rice export deals due to logistics bottlenecks; exports resumed in mid-April after a three week pause. See Reuters, “Indian traders signing rice export deals again after 3-week pause”, 16 April 2020, https://economictimes.indiatimes.com/markets/commodities/news/indian-traders-signing-rice-export-deals-again-after-3-week-pause/articleshow/75184584.cms?from=mdr.

See, for example, Thomas Y. Choi, Dale Rogers and Bindiya Vakil, “Coronavirus Is a Wake-Up Call for Supply Chain Management,” Harvard Business Review, 27 March 2020, https://hbr.org/2020/03/coronavirus-is-a-wake-up-call-for-supply-chain-management; Lisa Goller, “COVID-19 Impact: The State – and Future – of the Supply Chain,” 18 May 2020, https://www.rangeme.com/blog/covid19-impact-the-state-and-future-of-the-supply-chain/.

See, for example, Dan Solomon and Paula Forbes, “Inside the Story of How H-E-B Planned for the Pandemic”, TexasMonthly, 26 March 2020, https://www.texasmonthly.com/food/heb-prepared-coronavirus-pandemic/.

See Natasha Foote, “Innovation spurred by COVID-19 crisis highlights ‘potential of small-scale farmers’”, Euractiv, 2 April 2020, https://www.euractiv.com/section/agriculture-food/news/innovation-spurred-by-covid-19-crisis-highlights-potential-of-small-scale-farmers/.

See, for example, Holly Petre, “Restaurants pivot to groceries and meal kits to save business during the COVID-19 pandemic”, Nation’s Restaurant News, 20 March 2020, https://www.nrn.com/delivery-takeout-solutions/restaurants-pivot-groceries-and-meal-kits-save-business-during-covid-19.

See, for example, Esther Taunton, “Farmers to ‘Meat the Need’ of food banks”, 21 April 2020, https://www.stuff.co.nz/business/farming/121123117/farmers-to-meat-the-need-of-food-banks.

See Sixfold.com, “Effects of Covid-19 on Europe’s Road Freight Market”, 12 May 2020, https://sixfold.com/news/effects-of-covid-19-on-europe-s-road-freight-market.

See Shippeo.com, “COVID-19: The new delivery landscape”, 23 April 2020, https://www.shippeo.com/blog/infographic-covid-19-the-new-delivery-landscape.

See European Commission, “Communication from the Commission on the implementation of the Green Lanes under the Guidelines for border management measures to protect health and ensure the availability of goods and essential services”, C(2020) 1897 final, 23 March 2020.

See World Trade Organization, “Standards, Regulations and COVID-19: What Actions Taken by WTO Members ?”, 20 May 2020, https://www.wto.org/english/tratop_e/covid19_e/standards_report_e.pdf.

See Will Martin and Kym Anderson (2011), “Export Restrictions and Price Insulation during Commodity Price Booms”, World Bank Policy Research Working Paper 5645, May 2011.

See, for example, David Laborde, Abdullah Mamun and Marie Parent (2020), “COVID-19 Food Trade Policy Tracker” (dataset), International Food Policy Research Institute (IFPRI), https://www.ifpri.org/project/covid-19-food-trade-policy-tracker.

World Trade Organization, “Responding to the COVID-19 Pandemic with Open and Predictable Trade in Agricultural and Food Products”, 14 May 2020, WT/GC/208/Rev.1; G/AG/30/Rev.1.