Abstract

The COVID-19 pandemic has caused a significant deterioration in public finances, adding to pre-existing strains from long-term structural challenges including population ageing, climate change, rising inequality, digitalisation and automation. This report, originally prepared for G20 Finance Ministers and Central Bank Governors at the request of the Italian G20 Presidency, considers the challenges and opportunities of developing public fiscal policy strategies as countries seek to “build back better”. The report focuses in particular on how tax policy can be designed comprehensively so that fiscal systems can deliver a balance of equity, growth and sustainability, highlighting some of the key considerations that policymakers should take into account to ensure optimal tax policy design and the successful implementation of tax reform.

Executive summary

The report has been prepared for G20 Finance Ministers and Central Bank Governors (FMCBG) at the request of the Italian G20 Presidency. It builds upon the earlier OECD reports on Tax and Fiscal Policy Responses to the COVID-19 Crisis, which were presented to the G20 FMCBGs in April 2020 and April 2021, respectively.

The COVID-19 pandemic resulted in a global health crisis and precipitated a sharp decline in economic activity that is without precedent in recent history. In just a few months, the COVID-19 pandemic turned from a health crisis into a global economic crisis causing a much larger contraction in global GDP than the global financial crisis in 2008.

Swift and sustained policy actions have supported the health and economic recovery with global GDP now returning to pre-pandemic levels. The ongoing deployment of effective vaccines, continued policy support for businesses and households and the gradual resumption of many economic activities has seen global economic growth pick up this year.

However, the recovery remains uneven, with strikingly different outcomes across countries, sectors and demographic groups. Output and employment gaps remain in many countries, particularly in emerging market and developing economies where vaccination rates are low. This means that countries face vastly different policy challenges in recovery and beyond.

The COVID-19 crisis has caused a significant deterioration in public finances, which calls for a rethink of tax and spending policies once the recovery is well underway. Containment measures, increased government spending and lower tax revenues have driven an increase in budget deficits and government debt, which as a percentage of GDP has reached its highest levels over the past several decades. While current interest payments on sovereign debt are manageable for most countries, due to low bond yields and accommodative monetary policy, maintaining high debt increases vulnerability to interest rate increases and growth slowdowns, and raises debt rollover risks.

Today, most G20 economies are in the recovery phase where it will be essential to create the conditions for robust, resilient and inclusive economic growth, which will in turn support government finances in the future. The premature withdrawal of fiscal support or increased taxes could risk undermining the recovery, as happened in many countries after the global financial crisis. However, once the recovery is firmly in place, the post-crisis environment will provide an opportunity for countries to undertake a fundamental reassessment of their tax and spending policies along with their overall fiscal frameworks.

A return to “business as usual” will not suffice as, in addition to the impacts of the pandemic on public finances, countries are facing many long-term structural challenges. Even before the crisis, countries were facing many long-term structural trends, such as climate change, population ageing, the acceleration of digitalisation and automation, the slowdown in economic growth, as well as rising inequalities. In fact, the COVID-19 crisis amplified and exposed a number of pre-existing structural weaknesses, such as rising inequalities, inadequate social safety nets, and unequal access to health care and to digital infrastructure. Addressing the challenges and taking advantage of the opportunities presented by structural trends will require countries to implement a mix of tax and spending policies, as part of well-designed policy packages. Fiscal frameworks may also need to be adapted given increased financing needs and higher average debt levels.

The report provides a first look at how tax policies can support inclusive and sustainable growth beyond the COVID-19 crisis. While this report initiates a discussion on how tax policy can support inclusive and sustainable economic growth beyond the pandemic, future work will be needed to elaborate on these themes and extend this work to incorporate a more comprehensive view of the interactions between tax and spending policies, and overarching fiscal frameworks.

In adapting their tax policies to address the structural challenges they face, countries should put growth, equity and sustainability on an equal footing. Over the last decade, tax policy reform discussions have moved away from a focus on the link between taxation and economic growth towards tax reform that takes into account both equity and economic growth objectives. Increasingly, tax policy reform recommendations for inclusive growth have recognised that equity and growth can go hand in hand, and where they do not, the impact of trade-offs needs to be carefully managed. In addition, it will be increasingly important for countries to also take into account the sustainability of the tax system, both from a fiscal and environmental perspective. While improving the design of individual taxes is important, it is not sufficient on its own, as a “tax systems” approach is needed to develop a coherent tax system that promotes inclusive and sustainable growth.

Tax policies that stimulate economic growth will remain central in allowing countries to tackle the challenges confronting them beyond the COVID-19 crisis. The changing economic landscape (e.g. a marked productivity slowdown, increased digitalisation, the growing relevance of intangible assets, and increased market concentration in some countries), creates challenges but also opportunities for improving tax design to support inclusive and sustainable growth. Business tax design should take into account the heterogeneous response of firms to taxation and, in particular, to tax instruments going beyond the statutory rate such as capital allowances. Innovation and productivity diffusion are crucial and the tax system can stimulate investment in research and development, and related activities through well‑designed tax policies, especially those targeting young, small and low-productivity firms. Digitalisation, as well as the continuing challenges of tax avoidance and evasion, require increased international tax co‑operation, including through the implementation of the two-pillar solution to address the tax challenges of the digitalisation of the economy. Moreover, given evidence on the relatively modest growth impacts, increasing the taxes on capital income at the personal level could be reconsidered. Finally, countries should continue to build upon the lessons learned from country experiences of implementing improved standards for the effective collection of VAT on the online sales of goods, services and digital products.

Tax policy has an important role to play in enhancing equity through policies to address the distribution of income and wealth. With rising public revenue needs and increasing inequalities since the start of the pandemic, governments have started turning to new or under-utilised sources of tax revenue that could be compatible with inequality reduction objectives. In this context, taxes on personal capital income and property will likely need to play a bigger role in the future. More specifically, there has been an increasing focus on top income and wealth taxation. Reforms in this area will require carefully measuring the effective tax burden on households at the top of the income and the wealth distribution, and examining the drivers of lower effective tax rates on the wealthiest households. In particular, a better understanding of existing tax arbitrage and avoidance opportunities, including those with a cross-border dimension, will be key to identifying reform options that could help ensure that the wealthiest households pay their fair share of tax. In the longer run, the priority will be to ensure that tax systems are adapted to future challenges and can continue to deliver on their equity objectives. Indeed, structural trends that are shaping the future, including automation and digitalisation, could make it more difficult for tax systems to achieve their equity objectives if reforms are not undertaken. Automation may have a positive effect on productivity but could also lead to further increases in inequality and have long-term implications for revenues from labour taxes. Digitalisation will also pose significant challenges to the functioning of personal tax systems by facilitating taxpayer mobility as well as the rise of new forms of work and types of assets.

Tax policy should support sustainability. Tax systems should be aligned with environmentally sustainable outcomes, whether it be in the context of environmentally related taxes or other provisions more generally. In relation to climate change, most greenhouse gas emissions are priced too low or not priced at all. Moreover, fossil-fuel subsidies persist, further incentivising emission-intensive consumption, production and investment. This increases the risk of stranded assets and hence increasing the costs of the future transition. As countries seek deeper emission cuts, the need to avoid negative spillovers on trade, development and growth agendas increases. For example, more cross-border co-operation on climate policies, including but not limited to carbon pricing, would help mitigate leakage, allow emissions reductions at a lower cost and improve access to and development of low-emission technologies. Such co-operation has the potential to boost economic growth and make the transition less costly.

The options for public finances will depend heavily on country-specific circumstances. For some countries, especially those with low-incomes, increased domestic resource mobilisation will be needed to fund additional spending, whereas countries with already high levels of taxation and spending may need to reprioritise expenditure. The optimal combination of fiscal instruments will depend on a wide range of country-specific factors, including current levels and structures of taxation and spending, the country’s institutional setting and the preferences and perceptions of its citizens.

The need to focus on domestic resource mobilisation is particularly acute in developing countries where tax revenues as a share of GDP were already low prior to the COVID-19 crisis. Using the tax system as a lever to finance their development and the attainment of the Sustainable Development Goals is a priority for many developing countries. In addition to the aforementioned reforms, developing countries could also improve the design of their presumptive and simplified tax regimes in order to induce workers and businesses to operate within the formal economy, broaden tax bases by abolishing ineffective tax incentives for investment and inequitable tax expenditures, and better use health taxes to increase funding of the healthcare sector.

The political economy aspects of tax reform are crucial. Significant fiscal changes will not only require good policy design, but effective policy communication and consensus-building if political acceptance is to be secured. The externalities of public finance choices make international dialogue and co-operation imperative to counter structural challenges. The attitudes of citizens towards taxes will also impact how tax systems can be designed. Providing credible and easy-to-understand information on how tax systems work will be essential for democratic debate and informed decision making of citizens.

1. Introduction

The COVID-19 pandemic resulted in a global health crisis and precipitated a sharp decline in economic activity that is without precedent in recent history. In just a few months, the COVID-19 pandemic turned from a health crisis into a global economic crisis causing a much larger contraction in global GDP than the global financial crisis in 2008, reaching nearly 10% in the first half of 2020 and an estimated 3.4% overall in 2020.

Swift and sustained policy actions have supported the health and economic recovery with global GDP now returning to pre-pandemic levels. The policy response to the COVID-19 crisis has involved considerable fiscal support for businesses and households, which has prevented even greater declines in employment, income and output. The ongoing deployment of effective vaccines, continued policy support and the gradual resumption of many economic activities has seen global economic growth pick up this year.

As the global economy recovers, policymakers are turning their attention to the broader question of how to manage their public finances through the recovery and beyond the health crisis. For the recovery to be inclusive and sustainable, countries will need to consider the sectors and demographics most affected by the crisis and develop tailored strategies that put these groups at the centre of the recovery effort.

The COVID-19 crisis has led to a major deterioration in public finances. Containment measures, increased government spending and lower tax revenues have driven an increase in budget deficits and government debt, which as a percentage of GDP has reached its highest levels over the past several decades. While current low bond yields in many countries, supported by accommodative monetary policy, help to keep interest payments on sovereign debt at manageable levels, maintaining high debt increases vulnerability to interest rate increases and growth slowdowns, and raises debt rollover risks. Restoring public finances will likely continue to be a priority for countries for many years into the future.

In addition to the impacts of the pandemic on public finances, countries were already facing many long-term structural challenges. They include climate change, population ageing, the acceleration of digitalisation and automation, the slowdown in economic growth, as well as rising inequalities. While the pandemic may have temporarily shifted the focus away from many of these long-standing challenges, the COVID-19 crisis has also exposed a number of pre-existing structural weaknesses, such as rising inequalities, inadequate social safety nets, and unequal access to health care and digital infrastructure.

The crisis and a desire to “build back better” presents countries with an opportunity to rethink their approach to public finances, with the aim of achieving inclusive and sustainable economic growth. As most G20 countries navigate their way through the recovery phase, there is an opportunity for countries to undertake a fundamental reassessment of their tax and spending policies along with their overall fiscal frameworks. Such a reassessment will need to take into account both the challenges brought to the fore by the crisis as well as those related to the many long-term structural trends they face, in order to determine the appropriate mix and range of fiscal policies needed to deliver inclusive and sustainable economic growth over the medium to long term.

Countries will need to develop public finance strategies that take account of their country-specific circumstances and involve a combination of measures to support sustainable tax revenues and to improve the quality of public spending, including through improved public finance governance. For some countries, increased domestic resource mobilisation will be needed to fund additional spending, whereas in countries with already high current levels of taxation and spending, there may be a need to contain spending growth and improve its efficiency. While tax revenues can be bolstered through changes to the tax system, such as adjusting tax rates, broadening tax bases and altering the tax mix, they can also be augmented with structural reforms that support long-term economic growth and, in turn, larger tax bases, for example, through better education and training, and reforms in the labour and product markets. On the spending side, expenditure reviews could help countries select priorities, identify areas for saving and efficiency-improvements by reducing low-priority or ineffective expenditure and freeing up resources for policy areas of priority.

The aim of this paper is to initiate a discussion on the tax policy design options that countries may wish to consider that can foster inclusive growth that is both fiscally and environmentally sustainable over the medium to long term. This discussion will acknowledge the breadth of public policy objectives, including inclusiveness, improved health outcomes, resilience, environmental sustainability and economic growth. The paper builds on earlier OECD work, revisiting findings and recommendations in light of the specific impacts of the COVID-19 crisis, as well as the pre-existing long-term structural challenges that countries continue to face.

2. Economic and societal trends shaping public finances

A wide range of long-term structural trends are impacting the functioning of economies and societies worldwide. The structural trends include slowing productivity growth, accelerating digitalisation, automation and artificial intelligence, rising inequalities, population ageing, changes arising from globalisation and mobility, climate change and environmental degradation and rising health risks. Some of these trends are interrelated, and most have been influenced in some way by the COVID-19 crisis. These trends can affect public finances in many ways: directly through changes in the number of taxpayers and benefit recipients, as population ageing is causing; by influencing policy priorities in the post-crisis environment; and impacting the different tax and spending policy instruments available to policymakers.

A forward-looking public finance strategy should carefully consider these trends. Fiscal strategies should reassess tax and spending priorities and which instruments could be most effective in achieving countries’ objectives given these structural changes, both now and as they evolve in the future. Section 2 briefly describes some of these structural trends. Section 3 will then zoom in on their main tax policy implications.

2.1. Economic growth has slowed

Sustained periods of low economic growth undermine tax revenues and make it difficult to address spending pressures, maintain public debt sustainability, and – more generally – improve populations’ living standards. Productivity growth has decreased in the majority of G20 countries over the past decades. Possible causes of this slowdown include, among other factors, disappointing gains from recent innovation waves, likely due to some extent to adjustment costs and insufficient diffusion of new technologies and innovations across firms; a decline in business dynamism and reallocation of resources; and a levelling of educational attainments. The COVID-19 crisis could have positive effects on long-term productivity, for example by accelerating digitalisation, in particular the adoption of digital technologies by small and medium-sized businesses in services sectors. However, large recessions can have long-lasting and negative effects on productivity, including on the productivity of labour market entrants. As past crises have shown, even if some scarring effects could be mitigated by well-designed temporary job-retention schemes that support productivity-enhancing job reallocation (Andrews et al., 2020[1]; Andrews, Charlton and Moore, 2021[2]; von Wachter, 2020[3]).1 In the case of the COVID-19 crisis, disruptions in education are likely to reduce skills, productivity and earnings of the current students, with possible negative effects on future GDP (Hanushek and Woessmann, 2020[4]).

Higher economic growth would lower the debt-to-GDP ratio on its own. Towards this end, governments should implement ambitious structural reforms to boost potential growth (OECD, 2021[5]). However, the experience from the past decade suggests that achieving higher growth quickly through structural reforms may be challenging without monetary and fiscal support. The sequencing of reforms will be particularly important to help the economic recovery gain traction, which implies starting with reforms that do not dampen aggregate demand in the near term and work particularly well in periods of economic slack. Such reforms include lowering regulatory barriers to entry in professional services or strengthening active labour market policies and expanding access to childcare and family benefits to promote labour force participation. Enhancing activation and skills acquisition, as well as facilitating competition and business entry and exit, will also improve labour market opportunities for all and help to foster productivity‑enhancing reallocation.

Public investment can also support long-term growth if it allows for the accumulation of productive capital (Bom and Ligthart, 2014[6]). In addition, public investment in sectors that have large positive externalities for the rest of the economy could help to meet important social and environmental objectives, where market failures (among other factors) cause underinvestment by the private sector, and boost potential growth (Égert, Botev and Turner, 2019[7]; Hendren and Sprung-Keyser, 2020[8]). This applies in particular to public infrastructure investment in digital networks, transportation and energy, and in education and health care. Public investment in these areas can improve productivity and be an important source of new jobs for displaced workers – provided there is adequate support for the transition, while helping to support demand as they usually have strong multipliers (Pain et al., 2018[9]). Current very low, and in some cases negative, bond yields make public investment particularly attractive. In this context, the initiatives in the European Union and the United States are welcome.2

There are, however, a number of challenges that can hinder public investment. These difficulties may include the need for co‑ordination across sectors, jurisdictions and governmental bodies; having sufficient capacity to design and implement investment strategies; and framework conditions related to good practices in budgeting, procurement and regulatory quality. Governments can improve the governance framework for infrastructure spending by moving to OECD best-practice principles in this area (OECD, 2017[10]).

2.2. Digitalisation is accelerating

The digitalisation of the economy has been ongoing for several decades and is being accelerated by the COVID-19 crisis. While offering opportunities to enhance productivity and long-term growth with subsequent benefits for tax revenues and debt sustainability, digitalisation also poses challenges. For instance, a key challenge is that skills to use digital technologies are crucial in a more digitalised world, increasing the importance of public spending on education and lifelong learning (Gal et al., 2019[11]; OECD, 2019[12]). Digitalisation also affects workers through the rise of the “gig economy” which offers flexible business models but can result in tax distortions and gaps in social protection systems (Milanez and Bratta, 2019[13]; OECD, 2018[14]). In addition, specific features of digital markets that are conducive to a “winner‑takes-most” dynamic can contribute to the concentration of activities among a small number of highly profitable and intangible-intensive “superstar” firms, posing challenges for competition policy and corporate taxation (OECD, 2018[15]). Finally, school closures during the pandemic have also highlighted remaining gaps in access, quality and use of digital resources for learning by, and teaching of, children and students, requiring means to level up digitalisation take-up (OECD, 2021[16]).

Fiscal policy will need to adapt to a digitalising world, which imposes new pressures and constraints on social protection systems and income tax bases. Improving broadband connectivity, helping firms to develop online business models, enhancing acquisition of digital skills, and ensuring secure online payments and data privacy, are all areas of reform that would help to foster the digital transformation and ensure that poorer households, small firms and remote regions also have access and can benefit. Digitalisation thus provides opportunities for progress that fiscal policy can and should harness, as it will require investment in infrastructure and skills (OECD, 2019[17]; OECD, 2019[18]), while allowing for more efficient public administration and enhanced tax compliance (big data are for example increasingly used by tax administrations to combat tax fraud) (OECD, 2021[19]).

Good progress is being made through the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS) to address the tax challenges arising from the digitalisation of the economy. The “Statement on a Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy” of 1 July 2021 (OECD, 2021[20]), which has been agreed to by 134 jurisdictions, marks a significant development in multilateral efforts to reform the international tax rules and ensure that they are “fit-for-purpose” in the modern economy. Under the two-pillar package, Pillar One seeks to ensure a fairer distribution of taxing rights among countries with respect to the largest and most profitable multinational enterprises (MNEs), including digital companies. It would re-allocate some taxing rights over MNEs from their home countries to the markets where they have business activities and earn profits, regardless of whether firms have a physical presence there. Pillar Two seeks to put a floor on competition over corporate income tax, through the introduction of a global minimum corporate tax rate that countries can use to protect their tax bases.

2.3. Inequalities are rising

Increasing inequality across different economic and social dimensions adds pressures on government social programmes and undermines growth and political stability. Top income and wealth shares have grown notably in most OECD countries since the 1980s, and the incomes of the poorest 50% of the distribution have stagnated in many of the richer nations (Balestra and Tonkin, 2018[21]; Alvaredo, 2018[22]). G20 emerging-market economies are still home to almost half of the world’s people living in poverty (OECD/UNDP, 2020[23]).

Furthermore, in many G20 countries, real incomes of the lower and middle-classes have stagnated given higher consumer price inflation than wage inflation. Particularly strong inflation in education, energy, healthcare and housing costs has added to constrained opportunities for social mobility (OECD, 2018[24]; OECD, 2019[25]). The low-carbon transition will potentially create energy affordability concerns, at least in the short run, in particular for lower- and middle-income households that will need to be addressed.

The increase in inequality within advanced economies is partly due to automation and globalisation, which have affected the distribution of market incomes, inequality of opportunities and tax and transfer systems that have been less effective from a redistributive perspective (Causa, Browne and Vindics, 2019[26]). The COVID-19 crisis is likely to exacerbate economic inequalities in the medium to long‑run as its impacts have been disproportionately felt by already vulnerable groups, such as the young, low-skilled and women (OECD, 2020[27]). For example, school closures during the crisis have had a relatively more negative impact on the education of children from disadvantaged backgrounds, likely increasing the gap between their future employment opportunities (and earnings potential) and those from more affluent backgrounds (OECD, 2021[28]; Hanushek and Woessmann, 2020[4]).

Fiscal policy can address different forms of inequality, not only via a progressive tax and transfer system but also by promoting greater equality of opportunities. Inequality can be tackled by improving access to high‑quality education, health care, affordable housing and lifelong training programmes (O’Reilly, 2018[29]). The tax system can play a role in improving levels of inequality both before and after tax. For example, changes in inheritance taxation, such as limiting generous and regressive tax exemptions, could partially address wealth inequality while raising revenue for additional social spending (OECD, 2021[30]; Blanchard and Rodrik, 2021[31]). Adapting the support given to low-income households as countries emerge from the COVID-19 pandemic is likely to be an important component of government policy responses as they seek to tackle poverty and income inequality. In particular, including non-standard forms of work within the coverage of traditional social protection systems would strengthen equity (Milanez and Bratta, 2019[13]). A number of G20 and OECD governments have also recently increased income taxes and/or enacted wealth taxes on the highest earners and wealthiest households to increase revenue (OECD, 2021[32]).3 This suggests that there is space available to increase the progressivity of the tax system in some countries in response to rising inequalities.

Tax policy also needs to reflect ongoing challenges and progress in international co-operation on taxation. Broadening tax bases and improving compliance might be a way to increase tax collection and reduce the negative fiscal and social consequences of tax avoidance. For example, capital taxation may gain greater importance in future tax systems as the potential for more effective taxation of capital incomes has been enhanced by the implementation of the automatic exchange of taxpayer information (AEOI). The AEOI has ensured that countries now have increased tools available to detect any offshore assets and income (O’Reilly, Parra Ramirez and Stemmer, 2019[33]). Increasing the resources of tax administrations could boost tax revenues significantly and, likely, in a progressive way (Sarin and Summers, 2019[34]; Alstadsaeter, Johannesen and Zucman, 2019[35]; Londoño-Vélez and Ávila-Mahecha, 2021[36]).

2.4. Populations are ageing

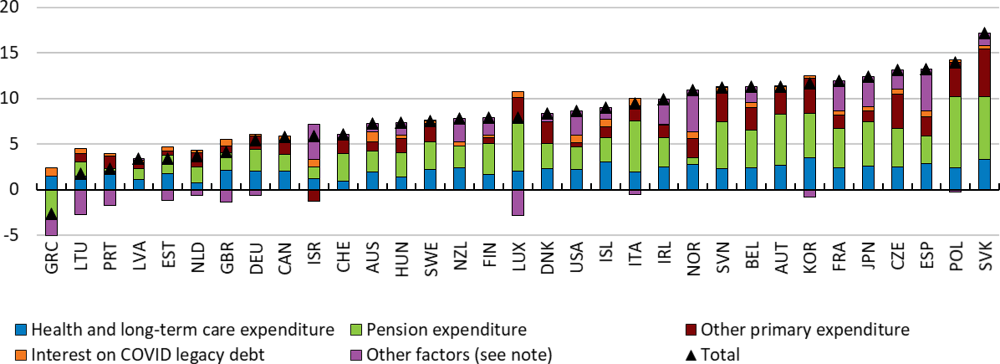

In most G20 countries, populations are ageing, in particular in high income economies, resulting from declining fertility and increases in life expectancy (UN DESA, 2020[37]). This process puts strong upward pressure on public spending related to pensions, health care and long-term care (Rouzet et al., 2019[38]). According to the OECD long-term projections, the median OECD country would require an increase in structural revenue of 8 percentage points of GDP by 2060 to stabilise public debt ratios near current levels, mostly due to higher expenditures linked to population ageing (see Figure 1).

Note: The chart shows the ratio of structural primary revenue to GDP must evolve between 2021 and 2060 to keep the gross debt-to-GDP ratio stable near its projected 2022 value over the projection period (which also implies a stable net debt-to-GDP ratio given the assumption that government financial assets remain stable as a share of GDP). The underlying projected growth rates, interest rates, etc., are from the baseline long-term scenario presented in Guillemette and Turner (2021[41]). Expenditure on temporary support programmes during the COVID pandemic are assumed to decline to zero within a few years. The component “Interest on COVID legacy debt” approximates the permanent increase in interest payments due to the COVID-related increase in public debt between 2019 and 2022. The component “Other factors” mostly reflects the correction of any initial disequilibrium between the 2021 structural primary balance and the one that would stabilise the debt ratio.

Source: Guillemette and Turner (2021[41]), “The Long Game: Fiscal Outlooks to 2060 Underline Need for Structural Reforms”, OECD Economics Department Policy Papers n°29, forthcoming.

One of the most effective ways of alleviating future fiscal pressures stemming from population ageing would be to undertake reforms to labour market policies and public pension programmes that raise employment rates and extend working lives (Rouzet et al., 2019[38]). Improving active labour market participation is likely to require changes in tax and spending policies to enhance financial incentives to work, such as by reducing marginal tax rates for second earners, and providing employment support services, including affordable, quality childcare provision. Another effective way would be to index long‑term fiscal programmes to their underlying drivers, such as life expectancy in the case of pensions, which can also help reduce fiscal uncertainty (Orszag, Rubin and Stiglitz, 2021[39]). Many countries have already moved in this direction (such as Denmark), although some of them have later seen some reform reversals (OECD, 2019[40]). According to stylised OECD simulations wherein OECD countries undertake ambitious labour market reforms and increase effective retirement ages, fiscal pressure in 2060 could be reduced substantially relative to a no-reform scenario, by between 2 and 8 percentage points of GDP (Guillemette and Turner, 2021[41]). The fiscal dividends would mostly accrue due to longer working lives reducing future pension and other primary expenditure as a share of GDP, with much less impact on health expenditure.

Countries will also need to consider how they ensure the sustainable financing of health systems. Where health financing currently relies strongly upon health social security contributions, the impact of an increasing share of older persons living beyond their working life may require new approaches to health financing. There is a limit to the extent that higher health (and pension) expenditure can be financed by increasing social security contribution (SSC) rates, as this will increase the tax-inclusive price of labour and price certain types of (in particular lower-productive) workers out of the labour market. Therefore, countries may want to consider a partial shift in the funding of health funds away from SSCs towards (less distortive types of) general taxation, in particular because the link between health contributions and health benefits received is weak. The financing of health could also be supported by greater reliance on well-designed health taxes (on alcohol, tobacco, sugar, pesticides, etc.), which could play a more central role in the tax system to help strengthen the resilience of health systems to the ageing of their populations. These taxes have significant revenue potential, including in developing countries. In addition, if these health taxes can support a healthier workforce, they could deliver additional benefits of greater productivity, longer participation in the labour market and a greener and healthier natural environment.

2.5. Environmental sustainability and climate change call for urgent change

Climate change risks dire social and economic consequences. While the precise nature of the negative effects of climate change are uncertain, frequent extreme climate events (e.g. climate catastrophes) have the potential to reduce economic growth, increase its volatility and undermine political stability, with the destruction of physical infrastructure, disruptions to production, and population migration (Office for Budget Responsibility, 2021[42]). Such conditions could undermine fiscal sustainability as they would require, among other things, extra spending in response to climate events, as well as on social benefits and health care and would erode certain tax bases.

Mitigating climate change and associated negative risks calls for urgent action across a wide range of policy areas, with tax and government spending playing a key role. A crucial priority for the coming decades is to reduce carbon emissions, with an objective of net zero emissions by the middle of the century. The transition to a low-carbon economy could offer new opportunities for growth, improvements in the quality of life, new sources of government revenues and could bring a range of significant longer‑term benefits. However, it may also create disruptions to current business models and require substantial financial resources during the transition.

Effective pricing of harmful emissions and polluting activities, through either taxes or cap-and-trade systems of emissions permits, is needed. Ambitious emissions pricing could raise large amounts of revenue in the short and medium terms, however the resulting lower consumption of fossil fuels, particularly in the transport sector, could also reduce tax revenues (Marten and van Dender, 2019[43]).4 Fossil fuel subsidies also continue to distort price signals and weigh on public budgets, and should be phased out.

Fiscal policy could directly support environmental sustainability through fiscal incentives to R&D, direct grants, public research and support for early-stage development (OECD, 2011[44]; Hepburn, Pless and Popp, 2018[45]), as well as new infrastructure investment projects, including expanding and modernising electricity grids, renewables capacity and transport network.

All such steps would need to be accompanied by a package of compensating measures to mitigate the adverse impact on poorer households, affected regions and small businesses, and to help displaced workers acquire new skills and take advantage of new employment opportunities, and consequently ensure public acceptance.5 They will also require international co-ordination due to the potential for emissions leakages (e.g. through supply chains) and the implications of tax and subsidies for countries’ competitiveness.

Efforts to significantly reduce climate change need to be complemented with measures to build resilience to climate change induced impacts. Even if global average temperature increases are limited to below 2°C, there will still be serious climate impacts. This implies that mitigation and adaptation are complementary, and adaptation can reduce the earliest costs of climate change (OECD, 2015[46]). Measures to adapt to climate change will be indispensable to not only safeguard lives and secure livelihoods, but also to contain rising inequalities exacerbated by a changing climate (Gamper and Lamhauge, 2021[47]). Such conditions will require, among other things, protective measures for vulnerable communities and infrastructure. However, climate adaptation measures should not undermine investment in mitigation as this would ultimately worsen the medium to long-term impact of climate change (Gamper and Rambali, 2021[48]).

3. Tax reform for inclusive and sustainable economic growth

The COVID-19 crisis has caused a significant deterioration in public finances, which calls for a rethink of tax and spending policies once the recovery is well underway. The unprecedented fiscal response to the COVID-19 crisis has been necessary and has prevented larger declines in employment, income and output, paving the way for a sustainable recovery. However, government debt in relation to GDP has reached the highest levels seen over the past several decades, which means that once the recovery is well advanced, policymakers will have to grapple with the challenge of ensuring public debt sustainability over a medium to long-term horizon.

In rethinking their approach to public finances, countries will need to adapt their tax policies to address the structural trends and challenges they face. Over the last decade, tax policy reform discussions have moved away from a relatively narrow focus on the link between taxation and economic growth (Arnold et al., 2011[49]; Lee and Gordon, 2005[50]) towards tax reform that puts equity and economic growth on an equal footing. Increasingly, tax policy reform recommendations for inclusive growth have recognised that equity and growth can go hand in hand (Brys et al., 2016[51]). Tax policy is not static and needs to evolve in light of structural challenges and changing policy priorities so that it can continue to play a role in stimulating inclusive and sustainable growth. Moreover, the financial and economic crisis of 2008 and the COVID-19 crisis have highlighted the central role governments have in absorbing shocks, providing relief and promoting recovery. This role requires significant financial resources, the majority of which policymakers will be looking to tax systems to provide. As a result, there is a need for countries and policymakers to re-evaluate their tax systems and their previous tax policy advice to ensure that they take into account the changing economic and social landscape.

While taxes are the principal means through which governments raise revenues, the role of tax systems goes beyond revenue raising. Tax systems need to address multiple challenges. Tax systems can simultaneously raise revenues, while contributing to addressing the problems of low productivity growth and rising inequality in a context where debt levels have increased considerably as a result of the COVID-19 crisis. These challenges arise in a context of increasing fiscal pressures as a result of ageing populations and climate change. The mobility of capital and of (certain types of) labour in a globalised and rapidly innovating world raise the efficiency costs of using taxes on labour and capital to further enhance domestic equity goals. Technological change and its implications for the future of work challenge traditional social protection systems and require adjustment mechanisms to help individuals navigate the transition.

In many instances developing countries face additional challenges in the design of their tax systems. As fiscal space has become more limited and debt burdens even heavier in many developing countries as a result of the COVID-19 crisis, renewed efforts will be required to improve domestic resource mobilisation. Increasing levels of formalisation amongst businesses and in the labour market will be crucial to raise revenues for public spending in general, and social protection systems in particular, as will reviewing inefficient tax expenditure provisions. Finding ways to enhance the role of social security contributions and health taxes to better finance health systems and encourage healthier behaviours should also be a priority.

Following a systems approach to tax policy design

While improving the design of individual taxes is important, it is not sufficient to develop a coherent tax system that promotes inclusive and sustainable growth. Efficiency-equity trade-offs depend on the interactions between many factors both within and beyond tax systems (Alt, Preston and Sibieta, 2011[52]; Brys et al., 2016[51]; Slemrod and Gillitzer, 2013[53]). While this report focusses on tax policy, it is important to highlight that its interactions with other key fiscal policy design features, such as those related to public spending and the governance of the fiscal system are equally important in determining its effectiveness.

Tax system design will be influenced by a country’s spending priorities and, therefore, cannot be considered in isolation. The tax system needs to raise sufficient revenues to finance the spending priorities that governments have identified. Therefore, discussions about tax system design should not occur in isolation from discussions around the level and quality of public spending. In this context, the COVID-19 crisis and the ongoing structural challenges that countries face highlight the importance of ensuring that tax systems have the capacity to raise the revenues necessary to finance certain public spending priorities, including education and lifelong learning, resilience to health challenges, and investment in digital and green innovation and infrastructure.

Tax systems should be aligned with a country’s broader policy objectives. Tax systems should be designed in a way that provides direct and indirect support to the country’s broader policy objectives. For instance, tax systems can induce individuals to engage in certain behaviours and refrain from engaging in others, such as by promoting healthy consumption decisions through the use of health taxes.

Fiscal frameworks may also need to be adapted given increased financing needs and higher average debt levels. In general, fiscal frameworks will need to support resilient public finances by internalising future socio-economic and political uncertainties, for instance through the design of automatic stabilisers and fiscal rules, and active debt management (Orszag, Rubin and Stiglitz, 2021[39]). More specifically, rules that have led to excessive complexity, governance issues and poor design should be revised. Pro-cyclical fiscal policy should be avoided. Efficient governance of tax and public spending will also play a role, e.g. through independent fiscal institutions, spending reviews, multi-year budgeting and tax expenditure reports, as well as the relationships between different levels of government in taxation and public procurement, for instance.

Revisiting tax policy design criteria

The design of tax systems must be coherent to address the structural challenges countries face. Tax policy coherence has received little attention in the tax policy literature, resulting in tax policies that can provide contradictory incentives or have conflicting implications for equity. For instance, in the context of tackling the climate change challenge, some countries have introduced R&D tax incentives for green investment or subsidise building insulation while continuing to provide fossil fuel subsidies and tax pollution at a rate below its social cost. While some countries that have raised carbon prices continue to provide tax incentives for the use of company cars or to tax diesel more favourably than gasoline. In the personal income context, some countries have increased personal income tax rates at the top of the income distribution, while at the same time providing generous and highly regressive tax expenditures that benefit high-income earners.

The structural tendency towards further increases in inequality demand improvements in the redistributive capacity of the tax and transfer system. The tax system must account for forms of inequality that go beyond the standard concepts of horizontal and vertical equity to include a more explicit focus on equality of opportunity, gender and racial equity, intergenerational equity, regional equity, as well as equity between countries. While the distributional effects of taxes (and transfers) has received a lot of attention in the tax policy literature, of at least equal importance is whether the taxes imposed are affordable for those on whom they are imposed, which is necessary to avoid that the tax system pushing taxpayers into poverty. Finally, tax morale and the integrity of tax systems are increasingly challenged if certain societal groups perceive that the tax burden they pay is too large relative to the benefits and opportunities they receive. Similarly, taxpayers can lose confidence in the integrity of the tax system when corrective taxes are levied to induce behavioural change where there are limited alternatives to those behaviours or where there is insufficient time or resources to adjust their behaviours.

Longer time horizons should also be more explicitly incorporated into the design of tax systems to help tackle long-term challenges. This may involve tax measures that evolve over time. For instance, countries could further increase excise duties on transport to encourage electrification of vehicles, but gradually move towards some form of distance-based charging. Clear communication of policy direction will also be important if governments are to successfully induce behavioural change, such as clear long‑run trajectories for tax rates and prices. The increased digitalisation of the tax administration may enable certain types of income to be taxed on a lifetime rather than an annual basis, by averaging income over time in calculating personal income tax liabilities. Indeed, some countries have already been able to introduce a tax-free amount for lifetime wealth transfers in the context of their inheritance tax regimes.

Making tax reform happen

Changes to tax policy must consider the different ways and varying degrees that structural trends will affect households. Households who have lower incomes, are less skilled and are not active in the labour market are estimated to be hit harder by many of the structural trends than higher-income and higher-skilled workers who have greater financial means to absorb transition costs and may also be more likely to benefit from these longer-term changes. The implications of climate change will be felt by all, but richer households have a greater financial capacity to adapt to changing life conditions. In order to ensure that everyone has an opportunity to thrive, governments will have to carefully assess the impacts of policy changes and, where appropriate, design effective compensation mechanisms.

Designing effective compensation mechanisms has proven to be an exceptionally challenging aspect of implementing successful tax reforms. There are many reasons as to why this has been so difficult. From the growing pressures on governments to implement reforms with no or virtually no “losers” to the increasing challenge of not only adequately compensating households, but doing so to the extent that they also perceive this to be the case. Firstly, designing effective compensation mechanisms requires a detailed understanding of the distributional impacts of these long-term structural trends and the policies to be implemented in response to them. Secondly, governments need to decide who will be compensated, the value of the compensation and its duration. Thirdly, there are wide range of forms that compensation can take that may influence the success of any reform, including personal income tax reductions, increased pensions or cash benefits, training provisions, and subsidies for purchases of specified goods. Furthermore, reaching all households within the target group can be challenging, and different types of households might have to receive different types of compensation depending on their needs.

Introducing tax reforms that address the multiple challenges and opportunities that our economies face will be challenging and many different issues will need to be addressed simultaneously. The remainder of this section presents some initial insights in three areas of ongoing work: growth-friendly tax policies (Section 3.1), tax policies for equitable societies (Section 3.2) and taxation for a sustainable environment (Section 3.3), as well as highlighting the tax policy challenges faced by developing countries (Section 3.4). While the analysis does not aim to provide definitive answers, it offers some direction for reforms that will be explored as part of further work in the future.

3.1. Growth-friendly tax policies

Tax policies to support inclusive and sustainable economic growth beyond COVID-19 will need to support the efficient use of productive factors, by encouraging labour market participation and skills development, and by increasing business investment, productivity growth and diffusion.

Structural trends and challenges are prompting a reconsideration of the relationship between tax design, investment and economic growth. While the literature on the impact of taxation and growth is long-standing, recent structural trends are prompting a rethink. Continued globalisation, through expansion in foreign direct investment (FDI) and deepening global value chains (GVCs), changing patterns of market concentration, and substantial changes to the international tax system all require a deeper analysis of the relationship between tax and investment, including of its international aspects, as well as how it varies across firms. There is also a need to understand how investment can support climate goals. Ageing societies, increased geographic worker mobility, and the growth of non-standard work are also prompting a reconsideration of the role of labour tax systems, focusing not only on the quantity of labour supply, but who supplies it, how, where and in what form. Skill-biased technological change, digitalisation, and automation all highlight the important role of human capital investment. The productivity slowdown, the rising role of intangibles, as well as concerns about productivity dispersion across firms, highlight the importance of considering how tax policies can support productivity growth, innovation, productivity diffusion, and business dynamism.

Tax and capital investment

Earlier research linking tax structures to economic activity has stressed the adverse effect of taxes on capital and labour income relative to other tax categories. Earlier studies have suggested that shifts in the tax mix from direct taxes to indirect taxes such as taxes on immovable property or consumption, are likely to be growth-enhancing (Johansson et al., 2008[54]; Arnold et al., 2011[49]). There is strong evidence to suggest that both tax levels and structures can affect economic performance across countries (OECD, 2010[55]).

However, many of these earlier studies focussed on the growth impacts of tax structures, without paying equal regard to the distributional and sustainability implications of tax policy. More recently, tax policy reform recommendations for inclusive growth have recognised that equity and growth can go hand in hand (Brys et al., 2016[51]). In light of structural challenges and changing policy priorities, tax policy will have to evolve further so that it can continue to play a role in stimulating inclusive and sustainable growth.

The behavioural impact of taxes may vary across contexts, in particular between countries who are at different stages of development, and good tax policy design will also depend on the tax system that is already in place. Aligned with a tax systems approach, the distortive impact of a shift in the tax mix, for instance, will depend on the tax mix that is in place and the level of the tax rates that are levied at the time reform is contemplated. Tax reform recommendations themselves can produce decreasing returns to scale and may have to be nuanced and even re-evaluated to the extent that they have already been successfully implemented in the past. These findings also imply that tax impacts on economic activity are likely to vary across a wide range of circumstances and that policy recommendations should therefore build on additional research using more disaggregated data.

In many countries, limited scope exists to further increase statutory VAT/GST rates, however, in many countries opportunities to broaden the VAT/GST base remain. In response to the financial and economic crisis of 2008/9, many OECD and G20 countries have increased their statutory VAT/GST rate in order to collect more tax revenues. For many countries, there is merit in prioritising reforms that broaden the VAT/GST base, in particular by abolishing targeted reductions and exemptions that are more beneficial to high income and wealthier households. Recent research has shown that broadening the VAT base through fewer reduced rates and exemptions is more conducive to higher long-run growth than a rise in the standard rate (Acosta-Ormaechea and Morozumi, 2019[56]).

The impact of tax structures may have been changing as the economy has evolved over recent decades. Key trends include expanding digitalisation, low interest rates, increased prominence of intangibles and expanding market concentration. An increasing amount of international evidence suggests that firm-level mark-ups and industry concentration are rising, particularly in digital-intensive and services sectors (Calligaris, Criscuolo and Marcolin, 2018[57]; Bajgar, Criscuolo and Timmis, 2020[58]; Syverson, 2019[59]) (De Loecker, Eeckhout and Unger, 2020[60]). The ability of firms to charge higher mark-ups may be due to a decrease in competition intensity; but it may also be the result of “winner-takes-most” dynamics where the most productive firms gain a larger share of the market (Autor et al., 2020[61]). Higher mark-ups and lower competition intensity have been associated with lower investment (Gutiérrez and Philippon, 2018[62]; Gutiérrez and Philippon, 2017[63]). Prolonged periods of low interest rates could have implications for the design of growth-enhancing tax policies (Auerbach and Gale, 2021[64]) as for example low rates may narrow the difference between accelerated and standard depreciation.

The international tax landscape is also evolving rapidly, as evidenced by the steady decline in statutory corporate income tax rates, an expansion of tax incentives and continued concerns about profit shifting. The average statutory corporate income tax (CIT) rate in OECD countries has declined from above 32% in 2000 to around 23% in 2020. A similar trend is observed across a sample of more than 90 developing and developed countries over the same time horizon, with the average CIT rate declining from around 28% to just below 21% (OECD, 2021[151]). Forward-looking effective average tax rates, capturing not only the statutory rates but also standard components of the corporate tax base, point in the same direction, declining on average from 29% to around 23% in a balanced panel of OECD and G20 countries over the period 1999 to 2017 (OECD, 2020[65]). Expenditure- and income-based tax incentives for R&D are increasingly used to promote business R&D in OECD countries and beyond (Appelt, Galindo-Rueda and González Cabral, 2019[97]; Evers, Miller and Spengel, 2014[149]; Gaessler, Hall and Harhoff, 2021[100]; OECD, 2021[151]), while developing and emerging countries make extensive use of tax incentives as discussed below. In addition, most major economies have now shifted from worldwide to territorial systems, implying that tax rate differentials have potentially become more relevant for real economic decisions. Given this background, countries face the challenge to combine growth-enhancing policies with the need to sustain tax revenues as well as ensure tax certainty.

Competitive pressures in the area of business taxation can be seen through the widespread use of tax incentives to encourage investment. In particular, emerging and developing economies often adopt tax incentives to attract FDI (Abbas and Klemm, 2013[70]; James, 2013[71]; IMF OECD UN World Bank, 2015[72]; Andersen, Kett and Von Uexkull, 2017[73]). These incentives are used in search of the positive spillovers on output, local employment and productivity that may come with increased investment activity, as well as due to domestic capital scarcity and lack of, or costly, development financing mechanisms.

Tax incentives often come at a substantial cost to a country and their use deserves careful monitoring and analysis to understand whether their benefits outweigh these costs. Poorly designed incentives may restrict revenue-raising capacity without yielding significant investment increases, thereby limiting efforts to mobilise domestic resources and creating windfall gains to investors, or yielding investments of low quality, with limited spillovers on productivity and employment (IMF OECD UN World Bank, 2015[72]). It is therefore essential that these incentives be well designed, transparent, maximise additionality, and minimise windfall gains. To maximise positive spillovers, investment tax incentives should align with broader policy goals such as advancing decarbonisation strategies, improving job quality, or improving local supply linkages.

The impacts of investment tax incentives depend on their design; with evidence suggesting that expenditure based incentives may perform better than income-based incentives although they can still involve substantial costs. The costs and benefits of investment tax incentives are highly design- and context-specific and are not always well understood. The empirical evidence on the benefits of tax incentives is limited but so far the evidence suggests that the design of incentives is critical for their success. Expenditure-based incentives (e.g., accelerated depreciation, allowances, and credits) increase the likelihood of generating additional investment as they directly target investment expenses. The value of income-based incentives (e.g., reduced rates and exemptions), on the other hand, relates to the profit rate of a firm. This may provide benefits to companies that plausibly would have invested regardless of the preferential treatment. Some of the literature has suggested limited investment responses to income-based incentives in developing economies (Klemm and Van Parys, 2012[74]; Chai and Goyal, 2008[75]). By contrast, there is evidence suggesting that expenditure based incentives have increased investment in OECD countries (Maffini, Xing and Devereux, 2019[76]; Zwick and Mahon, 2017[77]; House and Shapiro, 2008[78]; Cohen and Cummins, 2006[79]).

Recent research suggests that investment responses to taxation vary significantly across different firms. Empirical studies generally find a negative correlation between business taxation and investment (De Mooij and Ederveen, 2003[80]; Feld and Heckemeyer, 2011[81]). Higher corporate income tax, by reducing the after-tax returns on investment, can lead some firms to forgo, downscale or relocate some investment projects. However, in contrast to domestic firms, MNEs are able to shift profits to lower-tax jurisdictions thus avoiding the full tax burden associated with their investments and making them less sensitive to taxation (Sorbe and Johansson, 2017[82]). Higher mark-ups have been associated with lower sensitivity to investment, as mentioned above, an effect that could be driven by economic rents or an increased reliance on intangible assets (Crouzet and Eberly, 2020[83]) or competitive advantages gained through international tax planning (Sorbe and Johansson, 2017[82]). Investment of MNE entities located in jurisdictions with stronger transfer pricing regulations is more sensitive to tax changes, while global investment at the MNE group level does not show a significant response to a strengthening of these regulations (De Mooij and Liu, 2018[84]). New evidence also suggests that investment responses of entities that are part of highly-profitable MNE groups are more limited compared to entities in other groups (Millot et al., 2020[85]).

Given the evolving international environment, global coordination on tax policies may be even more important to support tax certainty, fiscal stabilisation and growth. Such coordination can play an important role in supporting revenues while limiting potentially negative impacts on investment. The two-pillar solution to address the tax challenges of the digital economy will introduce significant changes to the international tax rules targeted to large, highly profitable MNE groups (Pillar One) and MNE entities with low effective tax rates (Pillar Two). While global investment impacts are expected to be limited (OECD, 2020[65]), the reforms are likely to produce a more level playing field among MNEs, and relative to their smaller and domestic-only competitors, as well as those firms not engaging in profit shifting, due to the reform’s focus on the largest and most profitable MNEs, especially those engaging in profit shifting.

Policymakers should also consider the limited investment impacts of personal capital taxes. Some authors have argued that a potential reaction to competitive pressures is to reduce corporate taxes while increasing the taxation of capital at the shareholder level (Grubert and Altshuler, 2016[86]). Empirical evidence suggests that the impact of dividend taxes on investment is modest (Yagan, 2015[87]; Kari, Karikallio and Pirttilä, 2009[88]; Alstadsæter, Jacob and Michaely, 2017[89]). While these findings point to limited negative economic consequences from additional capital taxes at the personal level, such taxes may have significant equity benefits (see Section 3.2).

Tax and labour market participation

In the aftermath of the COVID-19 crisis, as well as in the context of ageing societies, it is important to support labour market participation, especially amongst those with low incomes and low levels of labour market attachment. Labour taxes can have potentially important consequences for both job quantity and job quality, particularly in the case of low-productivity workers (OECD, 2018[90]). Social security contributions (SSCs) in particular have risen as a share of the tax mix in recent decades. These contributions are typically less progressive than personal income taxes, with some studies suggesting that much of the negative effect of tax wedges on employment, in particular at lower income levels, is driven by the impact of SSCs (OECD, 2007[91]). It is thus possible that shifting the tax mix from SSCs to personal income taxes and/ or by introducing lower SSC rates at lower incomes could have positive impacts on labour market activation. Such shifts are particularly important in the context of ageing societies, where there is an increasing necessity to broaden the base of social protection financing (Brys et al., 2016[51]). Policymakers can strengthen (and in many countries already have strengthened) work incentives through an expansion of in-work benefits such as earned-income tax credits or related types of in-work benefits. Policymakers should design labour income tax burdens to incentivise work, and should carefully consider the impacts on informal workers, women, and the low-skilled, whose labour market attachment may be lower, including by carefully considering the impact of tax systems on the labour market incentives of second earners (Thomas and O’Reilly, 2016[92]).

Tax and skills investment

Investment in human capital can support growth and inclusiveness, and will be an important response to the ongoing technological change in the economy and the ageing of populations (OECD, 2016[93]). While much of the impact of public finances on incentives to invest in skills is concentrated on the spending side, the impact of taxes should also be considered. OECD research suggests that, on average, skills investments at the tertiary level may be at least partially self-financing from the governments’ perspective in terms of additional personal income tax (PIT) and other forms of revenue. While skills investments are important, empirical evidence suggests that many tax incentives for skills may have limited efficacy (OECD, 2017[130]).

Incentives to invest in human capital should be taken into account when considering the level and progressivity of personal income taxes, as well as the mix of labour and capital taxes at the personal level. The need to incentivise investment in skills highlights why tax progressivity discussions should focus on the whole of the tax system, and not simply the progressivity of the labour income tax system. Stantcheva (2014[94]) argues that while progressive labour taxation can discourage investment in skills, it can also incentivise riskier skills investments by providing partial insurance against losses in earnings. She also stresses that full deductibility of skills investments can come close to an optimal policy mix. Deductibility, however, may mean that tax incentives for skills provide higher benefits to those at the top of the income distribution. Policymakers should therefore consider refundable credits, while noting that the tax system may be a second best instrument with which to incentivise skills investment. The incentive to invest in human capital is also a function of the tax burden on physical capital. Some studies have suggested that very low levels of capital taxation relative to labour taxation can distort the mix of productive factors in ways that can reduce productivity, though this finding depends on the substitutability between physical capital and labour (Acemoglu, Manera and Restrepo, 2020[95]).

Tax and productivity

In the context of an investment slowdown in some advanced economies, as well as ageing populations, supporting productivity will be key in supporting growth. However, productivity growth has been lacklustre in the majority of G20 countries over the past decades. Supporting productivity growth through productivity diffusion, business dynamism and investment in intangible assets is crucial for policymakers. However, the links between tax policy and productivity are complex and understudied. A key policy challenge is how to support productivity increases not only by firms at the productivity frontier, but also by non-frontier firms. Developing countries have often large informal sectors, which reduces productivity even further (Andrews, Criscuolo and Gal, 2016[96]).

Investment in intangibles such as investment in research and development (R&D), data or software are a source of increased productivity and growth, but not all firms are equally able to make and obtain the benefits from these investments. Financing intangible development is an important barrier for start-ups and young firms as intangible capital is harder to collateralise than physical capital (Demmou, Franco and Stefanescu, 2020[97]). Aside from collateral, large firms, particularly MNEs, may have access to financing channels and rates that are unavailable to young and small firms, and are also able scale-up intangible asset investment at a lower marginal cost. Such financing barriers can be compounded by differences in tax costs of MNEs versus non-MNEs and large firms versus small firms, for example where MNEs can lower tax burdens through profit-shifting (Sorbe and Johansson, 2017[82]). Aside from financing constraints, firms at the bottom of the productivity distribution also lack the skills and the absorptive capacity to reap the benefits from these investments. These barriers to technology and knowledge diffusion become particularly acute in digital and knowledge intensive sectors, where productivity dispersion is greater (Berlingieri et al., 2020[98]).

The tax system can support the development of intangibles but there is a need to consider design issues. Absent any preferential tax treatment, the current tax system provides greater incentives for investment in intangible capital, typically expensed, than to most forms of tangible capital. To address certain market failures, governments may consider the use of tax incentives to promote investment in certain types of intangible capital, particularly where spillovers are greatest, e.g. by providing tax incentives for R&D and innovation (Appelt et al., 2016[99]; González Cabral, Appelt and Hanappi, 2021[100]; Appelt, Galindo-Rueda and González Cabral, 2019[66]). Further research is needed to understand the short- and long-term effects of different forms of tax support for intangibles on investment and productivity.

Incentives to invest in intangibles should be designed in ways that address the market failures for targeted firms without providing unintended windfall gains to other market participants. Poorly designed incentives may lead to policies that entrench the position of incumbents further deepening the productivity gaps, particularly where market characteristics generate winner-takes-all or winner-takes-most dynamics. Tax policies need to be carefully calibrated to ensure that they do not exacerbate incumbency advantages or create opportunities for tax arbitrage. Tax incentives can generate substantial tax expenditures and should be assessed to ensure their effectiveness and value for money. The effectiveness of expenditure-based R&D tax incentives in promoting business R&D is well documented in the literature, while that of income-based incentives is less conclusive (Hall and Van Reenen, 2000[101]; OECD, 2020[102]; Gaessler, Hall and Harhoff, 2021[68]).

Beyond supporting intangible investment, other aspects of the tax system may also affect productivity growth, and productivity gaps between frontier and non-frontier firms. Combining policies that enable access to intangible investments with policies that facilitate access to complementary tangible investments, e.g. ICT infrastructure and skills, could help firms reap the benefits from digitalisation (Corrado et al., 2021[103]). As discussed above, certain tax incentives for investment beyond intangibles, can also contribute to supporting productivity increases, not least where they support integration in GVCs, which can support productivity diffusion (Criscuolo and Timmis, 2017[104]). Beyond targeted provisions, the general corporate tax system can also affect productivity growth (Vartia, 2008[105]; Hanappi, 2018[106]). More analysis is required to understand the impact of tax systems on productivity, by considering both baseline CIT provisions and targeted tax provisions.

Productivity growth may be supported by international tax reform that supports an efficient allocation of capital and other productive factors across jurisdictions. Both capital allocation and profit shifting can be key drivers of productivity dynamics across countries. (Bartelsman, Haltiwanger and Scarpetta, 2013[107]; Baqaee and Farhi, 2020[108]; Guvenen et al., 2017[109]; Bricongne, Delpeuch and Lopez Forero, 2021[110]). Firms with access to tax planning opportunities, e.g. more intangible intensive firms, may respond to tax differentials by shifting profits to jurisdictions where they can obtain a tax advantage (Grubert, 2003[111]; Heckemeyer and Overesch, 2017[112]). Recent evidence has also suggested that tax differentials can inhibit the realization of productivity improvements (Todtenhaupt and Voget, 2021[113]). Reductions in tax differentials through international tax reforms, such as those being advanced under the two-pillar solution, may therefore support the efficient allocation of capital and productivity growth.

Tax and digitalisation

In addition to work carried out by the Inclusive Framework on BEPS, digitalisation creates challenges and opportunities in other tax areas. Digitalisation enables improvements in the functioning of the tax administration through better use of data, which itself creates opportunities to refine the design of tax systems. The automatic exchange of information for tax purposes between jurisdictions allows countries to revisit the design of their capital income tax system and tax household savings in a more coherent manner. Digitalisation has also created opportunities to broaden the VAT base and improve its functioning notably by introducing reporting and VAT collection responsibilities on foreign online vendors and on digital platforms.

In response to increasing digitalisation and growing needs for revenue, an increasing number of countries are implementing the OECD standards for the effective collection of VAT on online sales of goods, services and digital products. These standards and the recommended solutions for their effective and consistent implementation were included in the 2015 BEPS Action 1 Report and in the detailed implementation guidance that has been developed since then (OECD, 2017[114]; OECD, 2015[115]; OECD, 2019[116]). These rules and mechanisms are particularly relevant given the continuously growing volume of online sales by offshore vendors, made directly to consumers or through the intervention of digital platforms. To date, more than 70 countries, including the overwhelming majority of OECD and G20 countries, have implemented reform in accordance with these standards. Recent adopters of these rules and mechanisms include Canada, Chile, Indonesia, Mexico and Singapore. Many other countries are considering similar reforms.

Policymakers also continue to grapple with the implications of rapid developments in virtual currencies and crypto-assets. The nature of these assets pose a number challenges for policymakers due to their lack of centralised control, (pseudo-)anonymity, valuation difficulties and hybrid characteristics (i.e. including both aspects of financial instruments and intangible assets). Other challenges may arise from the swift evolution of their underpinning technology and of virtual currencies themselves, including the greater prevalence of stablecoins and central bank digital currencies (CBDCs).

Tax systems need to be adjusted to address the risks and opportunities posed by crypto-assets. In its October 2020 report to G20 Finance Ministers and Central Bank Governors, the OECD provided guidance to policymakers on a number of areas including on how virtual currencies and other forms of crypto-assets fit within existing tax frameworks and on the definition of the taxable events associated with virtual currencies (OECD, 2020). Particular consideration was suggested for the consistency of the tax treatment of virtual currencies and assets vis-à-vis existing sources of income and wealth, as well as the importance of establishing their taxation within a coherent broader regulatory framework. Formalising a process for regularly reviewing and updating taxation guidance for crypto-assets and currencies was also recommended, given their rapid development, as was communicating the rationale behind the adopted tax treatments to support tax compliance.

The OECD is working to develop a reporting framework to exchange information on crypto-assets, as noted in the April 2021 communiqué of the G20 Finance Ministers and Central Bank Governors (Italian G20 Presidency, 2021[117]). This reporting standard will build on and complement the OECD Common Reporting Standards for automatic exchange of financial account information. The objective is to present it to the G20 in 2022.

3.2. Tax policies for equitable societies

Tax policy can play an important role in enhancing equity. Tax policies play a key role in addressing income inequality, along with direct transfers. To a lesser extent, tax policies are also used to address wealth inequality (OECD, 2018[118]). Beyond their role in narrowing income and wealth gaps, recent work has emphasised the role of tax policy in enhancing intergenerational equity, equality of opportunity (OECD, 2021[30]), and gender equality (Harding et al., Forthcoming[119]). Ultimately, tax policies that support greater equity can also contribute to economic growth and political stability (Cingano, 2014[120]; Alesina and Perotti, 1996[121]).