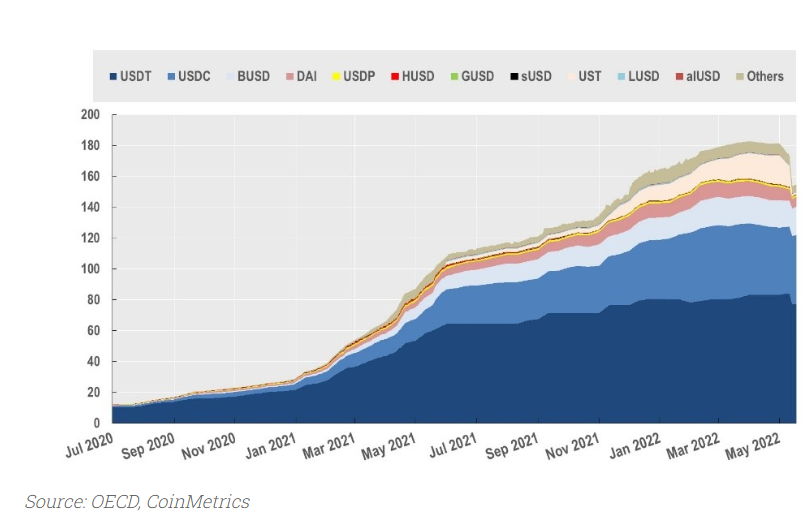

Stablecoins are digital assets designed to maintain a stable value relative to a fiat currency or other reference asset. Their issuance and usage has grown to a multitude of their initial size in a very short time span, reaching nearly USD 180 bn in February 2022, although the market for such assets is highly concentrated in a few issuers, with the top four stablecoins accounting for 90% of total stablecoin supply (as of 1 May 2022). Concentration in stablecoin issuance decreased earlier this year, with the emergence of TerraUSD (UST), an algorithmic stablecoin that was based on a stabilising mechanism involving the creation (“minting”) and destruction (“burning”) of LUNA crypto-asset. UST issuance grew exponentially and captured 10% of the total stablecoin market in early May 2022 (from 2% a year ago), driven to a large extent by the unrealistically high yields offered by protocols connected to UST holders (e.g. 20% annual yield offered by Terra’s Anchor decentralised money market).

Stablecoin market capitalisation (USD bn) – July 2020 to May 2022

Stablecoins are an indispensable ingredient and a foundational basis of DeFi markets. Consensys estimated that the top three DeFi lending protocols (Aave, Maker and Compound) held around 23% of the total Circle’s USDC stablecoin supply as of Q2 2021. As stablecoins are perceived to be more stable than highly volatile crypto-assets, they are used by DeFi participants as a way to hedge against crypto-asset volatility without being obliged to convert their crypto-assets into fiat currency through a centralised exchange and without the use of fiat or traditional financial institutions. Stablecoins are also used as collateral in leveraged lending, and as trading facilitators within DeFi in decentralised exchanges.

But stablecoins also constitute one of the greatest points of vulnerability of the DeFi market, and the connecting tissue that links DeFi and TradFi. Recent OECD analysis around DeFi and the institutionalisation of crypto-assets anticipates a scenario where a major stablecoin loses its peg and describes the risks of disruption to digital asset markets that could result from mass redemptions of such stablecoin arrangements.

The recent failure of Terra’s UST stablecoin is a good case study of such risks. On 7 May, UST broke its peg and suffered a “death spiral” that resulted in significant losses for holders, becoming a valueless stablecoin in less than a week despite many attempts by the Terra-connected Luna Foundation Council to defend the peg. The price of LUNA dropped to USD 0.1 from USD 31.0 in the course of that week, with a corresponding USD 41bn loss of market cap compared to early April when the crypto-asset was trading at around USD 110. Many factors may have contributed to the recent UST case. These include faults in the design model backing the algorithmic stablecoin, possible coordinated attempts of crypto-whales to manipulate the market, oracles failing to update the price and a massive loss of confidence in the stablecoin. The outcome is a complete loss of investment for the average small UST holder, without any recourse for compensation.

Although there are indeed differences between the different types and design models of stablecoins, the run-risk that UST experienced applies across the board for such arrangements. Stablecoins backed by reserve assets held by the issuer, a fall in the price of reserve assets, failure to safeguard them appropriately, lack of clarity regarding the redemption rights of holders or operational risks and disruption related to cybersecurity are all factors that can undermine investor confidence. This could, in turn, lead to self-reinforcing cycles of redemptions and fire sales of underlying assets. A negative sentiment toward crypto-assets or a severe disruption in DeFi platform could spike large demand for stablecoin redemptions that would as well turn into a classic run due to an insufficient amount of liquid backing assets. Such fire sales could disrupt critical funding markets (e.g. commercial paper markets as CP constitutes a large part of dominant stablecoin reserves) with potential impact on financial stability overall, especially given that traditional financial institutions may hold assets of stablecoin reserves.

The subsequent de-pegging of Tether’s USDT stablecoin on 12 May, when it traded at 0.95 to the dollar, and the USD 7bn of Tether redemptions that day amid a broader downturn in crypto-asset markets, points to these risks – and this was not the only time USDT has de-pegged in the past year. Although the price of Tether’s stablecoin recovered quickly back to its peg, the incident highlighted the vulnerabilities related to such arrangements and the important role of trust and confidence in the market for crypto-assets and beyond. This is particularly critical amid a broader market sell-off of mainstream crypto-assets in recent weeks and given the possible spillovers of risks from decentralised finance to traditional financial markets. As OECD analysis highlights, given the significant holdings of commercial paper as part of reserves backing major stablecoins such as Tether, sudden mass redemptions of stablecoin arrangements can affect the stability of broader short-term credit markets. Any failure or disruption of a large DeFi participant could equally trigger such runs on stablecoins.

If the adoption of crypto-assets continues to increase, the linkages between DeFi and TradFi may become stronger, possibly increasing the risk of spillovers into traditional financial markets and the real economy. The role of policy makers will be to evaluate and address emerging risks and consider policy actions to address them. The promotion and encouragement of investor protection disclosures is another area where policy makers may intervene to mitigate risks related to the holding of crypto-assets and participation in DeFi. The UST incident highlights that many investors are driven into this market by speculative motives without being aware of the risks related to such investments. A better understanding of the mechanisms involved, and in particular of the limitations and related risks, should be fostered.

All that said, the potential benefits of decentralised finance should not be underestimated or overlooked (e.g. atomic settlement). It is important that policy makers consider ways to enable safe and responsible DeFi innovation in a compliant manner, while anticipating and addressing emerging risks for both participants and the markets.