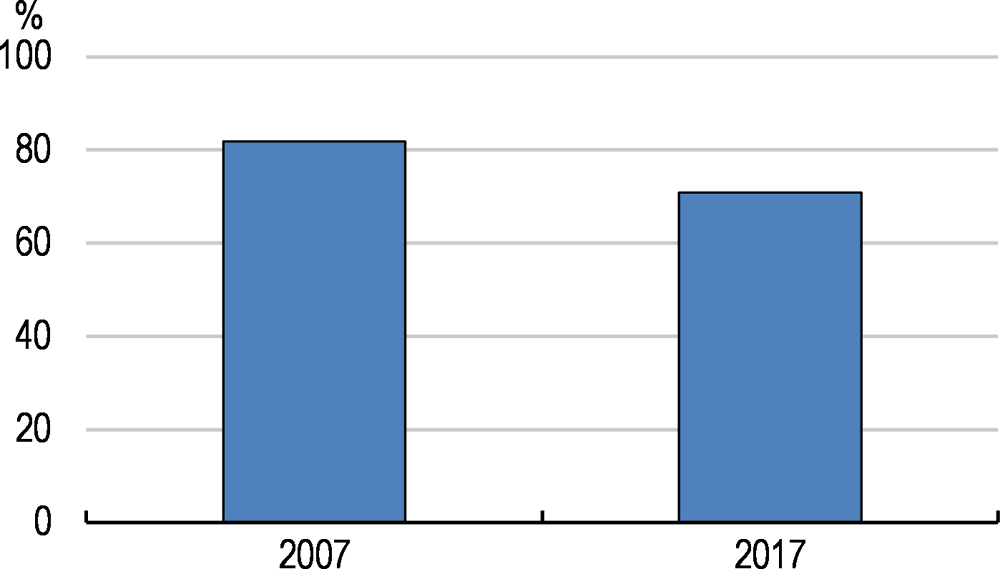

Strengthening the tax administration is a government priority and is crucial for improving compliance. Modernising IT systems and processes can promote compliance and improve enforcement. But it will increase demands for highly skilled staff who are in short supply. Effectively using the swathes of new data is crucial to deter future evasion and could help boost revenues. Complexity and frequent policy changes make compliance more difficult. Wider public consultation ahead of proposed changes to tax legislation would enhance the quality of legislation over time.

Low incomes and widespread informality imply that the personal income tax net currently includes few individuals and raises scant revenue. The initial income threshold for paying income tax is relatively high. At medium-to-high incomes, marginal tax rates are well below those in other emerging economies. Gradually lowering the top income tax thresholds would make the system more progressive and raise additional revenue. High-income earners disproportionately benefit from the tax-free treatment of fringe benefits within personal income tax.

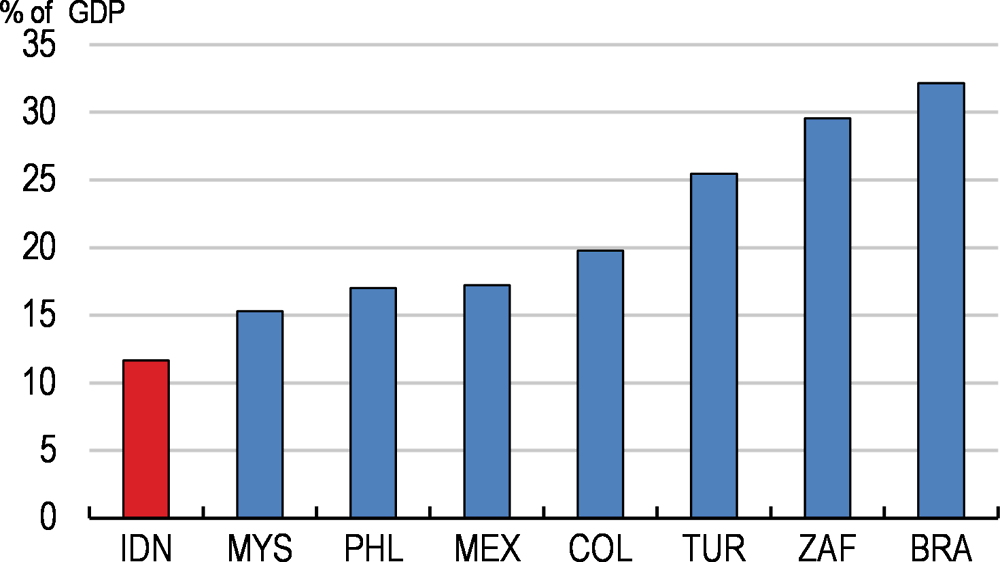

The corporate income tax base is also reduced by informality and the prevalence of small firms. Tax holidays and other incentives target specific sectors and locations and have been expanded recently to attract new investment. However, these risk eroding the tax base, creating distortions and spurring further regional tax competition. The recent publication of revenue forgone due to tax incentives improves transparency. These estimates should be published annually, as planned. Shifting to cost-based tax incentives would sharpen investment incentives. Competitiveness concerns could be addressed through greater regional co-operation.

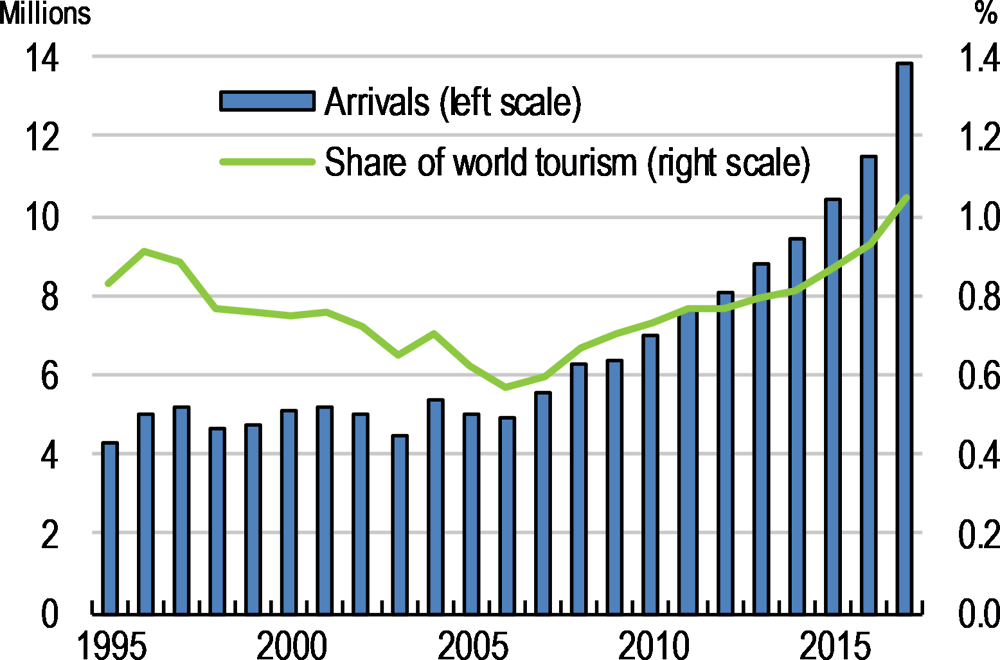

Value-added tax generates sizeable revenue but its revenue-raising potential is undermined by exemptions, including for hotels and restaurants, which are subject to local sales tax, and some intermediate inputs. A high threshold for compulsory registration for firms weakens the self-enforcement mechanism embodied in the tax. A reform package removing most exemptions, replacing local sales tax by VAT, compensating local governments for lost sales tax revenue, and lowering the registration threshold would raise compliance. An accommodation tax for local governments would incentivise them to develop tourism.

There is scope to better use taxes for health and environmental aims. Smoking rates are high and tobacco taxes are lower than elsewhere. Motor vehicle taxes can be better linked to environmental effects. Phasing out fuel subsidies would be a first step towards more cost-reflective energy pricing.

Recurrent taxes on land and structures raise relatively little revenue. The first step is to ensure local governments are able to maintain and update their property tax databases. Then the cap on rates should be raised.