In 2017, Colombia launched a novel public policy to stimulate the creative economy, building on the success of previous policy initiatives to support the cultural and creative sectors. The Orange Economy policy is unique for its transversal approach to supporting the creative economy and mainstreaming culture across diverse policy portfolios, beyond cultural policy. The report provides a comparative overview of Colombia’s culture and creative sectors relative to OECD peers and reviews progress in policy implementation. It provides a specific focus on Colombia’s push to foster creative districts as tool for local development across the country, including policy examples based on nine districts across the globe. The report maps the financial ecosystem for the creative economy in Colombia. Recommendations draw on international good practice to suggest ways Colombia can best leverage creative economy opportunities.

Culture and the Creative Economy in Colombia

Abstract

Executive Summary

Colombia’s Orange Economy policy framework puts culture and creativity at the centre of its development agenda

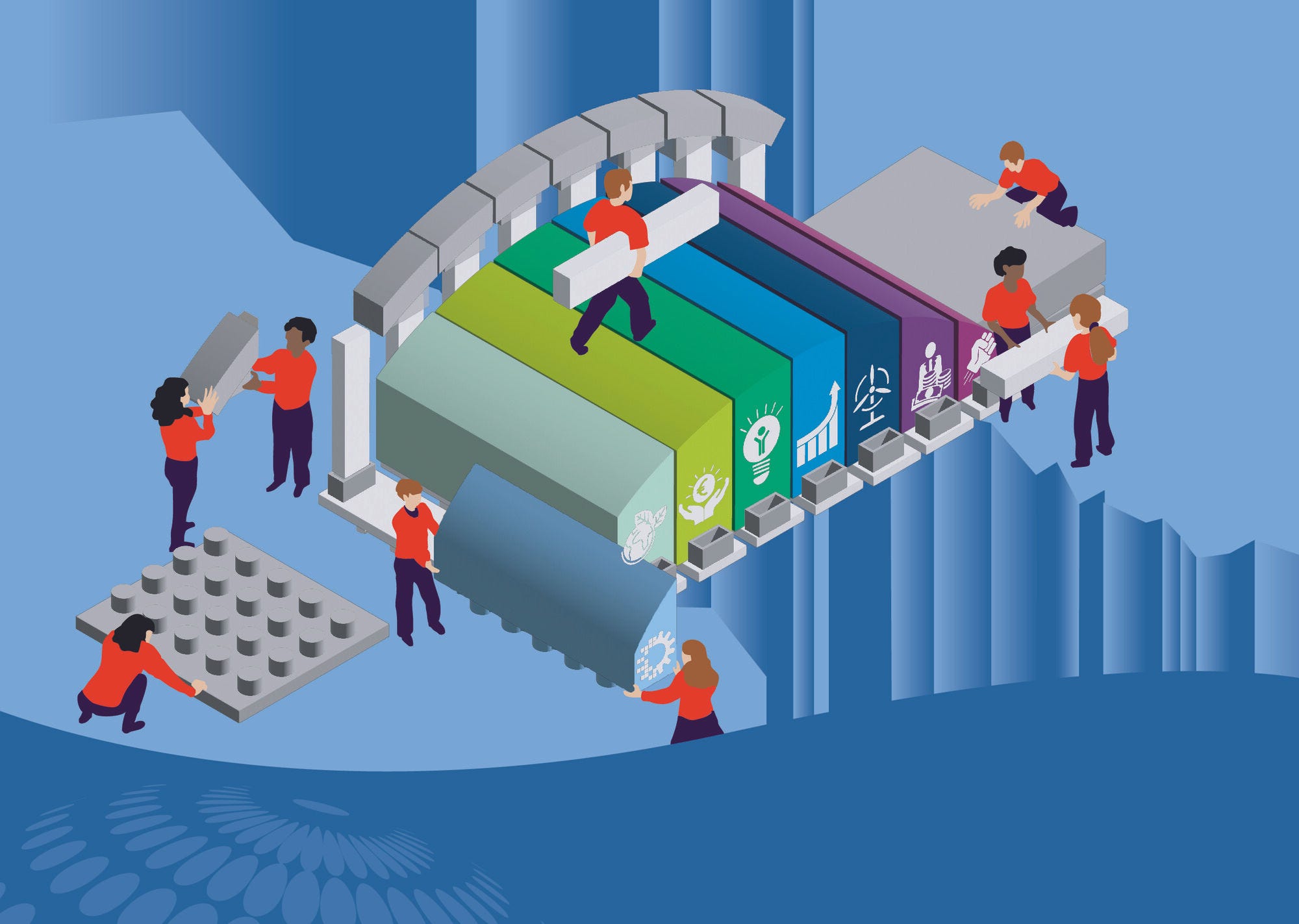

Colombia’s National Development Plan (PND) 2018-2022 embeds the creative (Orange) economy within broader development objectives. The Orange Economy policy recognises culture and creativity not only for their intrinsic value, but also for their contribution to job creation, income and wealth generation and as a tool to foster local development, social cohesion and well-being. A comprehensive Orange Economy policy approach, designed and implemented through a whole-of-government effort, is structured around seven pillars: Information and knowledge – to inform better decisions; Institutions – institutional strengthening and coordination, financing and incentives; Infrastructure – (territorial) infrastructure for the deployment of creative processes; Industry – sustainable start-ups and companies; Integration – networks and market development; Inclusion – tackling inequalities through capacity building; and Inspiration – audience development, intellectual property and innovation.

Orange Economy policies have helped to boost income and employment in the creative economy

Prior to the COVID-19 pandemic, the Orange Economy was an important driver of economic growth, with employment increasing by 16% between 2014 and 2019 and gross value added by 3%. While the COVID-19 pandemic hit the Orange Economy hard (21% decline in GVA and 11% decline in employment between 2019-2020), early indications show that the sector is bouncing back. For example, employment increased by 8% in the first three quarters of 2021 compared to the same period in the previous year.

Household expenditure on recreation and culture in Colombia is lower than the majority of OECD countries

In 2019, 6.1% of household spending in Colombia was on recreation and culture, compared to an OECD average of 8.5%. This may, in part, reflect the lower average disposable income per capita in Colombia and the discretionary nature of spending on cultural and creative sector products, as well as, potentially, purchasing price differences across countries. However, national survey data also suggest significant differences within the country, with those living in urban areas (municipal capitals) spending, on average, over twice as much on recreation and culture than those in more rural areas.

One in three jobs in the creative economy are informal, but formalisation policies are having an impact

The Ministry of Culture estimates that one in three workers in the creative economy were informal in 2020. However, there are a number of initiatives in place to address this and related challenges. The expansion of the Periodic Economic Benefits programme to creative workers, for example, has encouraged formalisation through access to social insurance (namely pension) benefits. Indeed, in 2022, the Ministry of Culture noted over 11 thousand workers had registered since the programme’s expansion in 2018. In addition, a repertoire of cultural policies for vulnerable groups (e.g. Soy Cultura which incentivises informal workers to sign up to a national registry to receive grants and support) are helping to formalise workers. Ongoing efforts to universalise social protection could consider steps to ensure creative workers are also integrated into programmes that provide other forms of protection (e.g. unemployment). Policies can also capitalise on the social and solidarity economy to tackle informality. It has the capacity to reach disadvantaged groups and individuals as well as facilitate access to training, formal work, property, information, and equitable distribution of profit to its members.

Cultural participation policies can drive demand and multiply culture’s impact

Evidence on culture’s social impact in areas such as health, social inclusion and education is growing across the OECD. Policies to support citizen engagement in culture can maximise these effects. Cultural participation (including in free activities) is uneven across regions in Colombia, with participation rates far higher in Bogotá than in other places.

Colombia’s creative economy policy has recognised the role of education from an early age to develop interest in, and an appetite for, culture, especially to boost participation in low and middle-income groups. Policy efforts are already in place, however further opportunities for cultural participation outside of the larger urban areas will also be important to develop the future talent pipeline, promote inclusion and contribute to community vitality. Calibrated voucher or pass programmes for low income or vulnerable groups could complement existing supply side opportunities for cultural entrepreneurs.

Subnational governments play a very important role in policy implementation, and capacity building efforts could strengthen policy implementation

In 2019, subnational governments in Colombia represented over 84% of total government spending on cultural services, compared to the OECD average of 58%. Continued coordination across levels of government, as well as capacity building efforts, could help Colombia’s subnational governments seize opportunities brought by the national Orange Economy policy.

Subnational governments carry forward Colombia’s national initiative for creative districts. Linked to the tax incentive for creative economy investment, Colombia’s PND 2018-2022 launched Orange Development Zones (Áreas de Desarrollo Naranja – ADN) resulting in the creation of 96 districts across the country. ADNs strengthen creative clusters in a range of subsectors. In terms of their financing, in 2021, 40% of district revenues originated from municipal governments, and 17% from national government. Programmes to further strengthen local government capacities to promote cross-overs between cultural and creative sectors and the rest of the local economy, to cultivate more public-private partnerships and financing in the ADNs and to engage citizens in district life, including in more rural areas, could help strengthen the ADNs.

The creative economy policy is evidence driven. A further refinement of measurement frameworks could support policy efforts

The progressive expansion of the Orange Economy Satellite Account, including at the local level, as well as regional mapping studies, have transformed Colombia’s ability to monitor and evaluate the sector. More regular and disaggregated reporting of business trends in the Orange Economy could help in further interpreting trends in GVA and employment. In addition, enhanced reporting on the characteristics of both full and part time work (such as average hours worked, income distribution, contractual status, motivation for working in the sector) could help in identifying those in precarious forms of work. Colombia could also look to produce data on creative occupations throughout the economy (e.g. designers working in car manufacturing). As much of the Orange Economy policy concerns skills provision, gaining a greater understanding of how this policy may be enhancing employment prospects for those in cultural and creative jobs outside of the Orange Economy is needed.

A recently expanded legal and fiscal framework offers many incentives for creative economy development

A host of instruments are helping cultural and creative sectors overcome barriers to access finance, address skills gaps, and access international markets. To drive entrepreneurship, Colombia introduced a five-year exemption from income tax for creative economy actors in 2018. In addition, Colombia created a tax incentive aimed at investors. Those investing or donating in specific creative economy projects can benefit from a tax deduction on an investor’s tax base equal to 165% of real value invested or donated. This instrument helps attract investors usually hesitant to provide capital due to difficulties in assessing economic potential. In addition, to address the impact of the COVID-19 crisis, which has exacerbated the precarious situation of many creative professionals, Colombia introduced new social protection (as described above) and public lending measures, such as favourable credit lines within the public entrepreneurship bank, Bancóldex.

In the same series

-

20 March 2023

20 March 2023

Related publications

-

16 September 2024

16 September 2024 -

30 July 2024

-

Country note10 July 2024

Country note10 July 2024