By blending Official Development Assistance (ODA) and domestic public funds with commercial financing, co-operation between Japan and the United States in partnership with the Philippines government succeeded in increasing commercial lending to the water sector. Key success factors included increasing the capacity of banks and utilities, ownership for political reform and a change in the interest rate environment.

Using blended finance to unlock commercial investments

Abstract

Challenge

The Philippines aimed to mobilise commercial banks to engage in lending to the water and sanitation sector to further increase access to water and sanitation. However, banks were reluctant to lend to water service providers, due to a lack of experience and perceived credit risk. Moreover, the market was characterised by high interest rates, and some water districts and local government units were not able to meet loan requirements.

Approach

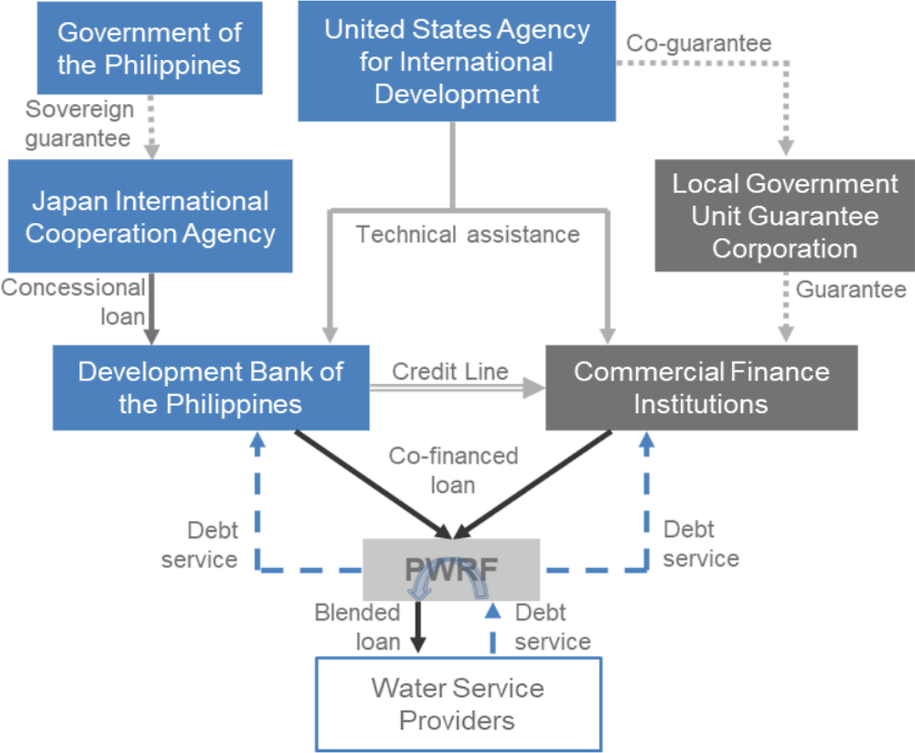

To incentivise commercial banks to lend to the water and sanitation sector at affordable rates, the Development Bank of the Philippines (DBP) initiated the Philippine Water Revolving Fund (PWRF) as a co-financing facility. With support from Japan and the United States, the initiative had the following key features:

A sovereign guarantee: The Philippines Department of Finance guaranteed a concessional loan, provided by the Japan International Cooperation Agency (JICA) to the Development Bank of the Philippines (DBP).

Addressing liquidity constraints: Capital-constrained commercial banks were not able to lend to water utilities with the tenor needed for a sustainable debt service capacity. To facilitate longer tenors, commercial finance institutions were initially able to participate using only 25% of their own funds when on-lending to water service providers.

Reducing the credit risk: Commercial financial institutions could apply for a credit risk guarantee covering a maximum of 85% of their exposure in case of the loan recipient’s default, backed or co‑guaranteed up to 50% by the USAID Development Credit Authority.

Capacity building: Technical co-operation helped to build capacity in financial institutions (for ratings and appraisals) and in water service providers (for internal management and project development).

Figure 1. The Philippine Water Revolving Fund (PWRF) Financing Structure

Source: OECD (2019), Making Blended Finance Work for Water and Sanitation: Unlocking Commercial Finance for SDG 6, https://doi.org/10.1787/5efc8950-en

Results

The programme was successful in increasing access to water and sanitation, and incentivising local commercial financial institutions to increase lending to water service providers.

Two commercial banks participated: Bank of the Philippine Islands (BPI) and Security Bank Corporation (SBC). As the first blended finance programme in the water sector in the Philippines, and given that private finance institutions had no experience lending to the sector, collaborating with two institutions was in line with the project's expectations.

The commercial loans to water service providers are associated with an estimated 216 872 new household connections to water services as of January 2017.

The loan terms and conditions for water service providers have improved. For example, tenor has increased from 7 years to 15-20 years, and loans are provided at a lower fixed rate. This has helped water service providers to reduce borrowing costs and better manage their debt capacity.

Lessons learnt

The following key lessons have been learnt from the PWRF project:

Effective partner co-ordination helps leverage synergies and capitalise on different areas of expertise. The PWRF project benefitted from a longstanding partnership between JICA and USAID and continuous and frequent communication between all partners. This limited implementation delays.

Blended finance should be transitory to avoid market distortions. With a growing track record and familiarity with the water sector, local institutions showed less interest in making use of the blending scheme.

The overall decrease in interest rates was an important enabling factor. Changes in the interest rate environment helped to address the high costs of borrowing, a key barrier to the mobilisation of private finance.

Blended finance should build on national efforts to enhance the financing environment. Policy reforms by the Philippines required creditworthy utilities to shift their financing to market and cost-based lending from banks.

Capacity building was a critical complement. Building capacity among key stakeholders ensured quality appraisals and effective project management.

Further information

JICA, A Case Study of The Philippine Water Revolving Fund (PWRF), https://programme.worldwaterweek.org/Content/ProposalResources/PDF/2019/pdf-2019-8516-4-2.The%20Philippines%20Water%20Revolving%20Fund_%20JICA%20Asia%20focus.pdf.

World Bank, Case Studies in Blended Finance for Water and Sanitation, http://documents1.worldbank.org/curated/en/651521472032148001/pdf/107979-BRI-P159188-BlendedFinanceCasesPhilippines-PUBLIC.pdf.

OECD resources

OECD (2019), Making Blended Finance Work for Water and Sanitation: Unlocking Commercial Finance for SDG 6, https://doi.org/10.1787/5efc8950-en.

OECD (2018), Making Blended Finance Work for the Sustainable Development Goals, https://dx.doi.org/10.1787/9789264288768-en.

“Making Water Reform Happen: The experience of the Philippine Water Revolving Fund”, A background paper prepared for the OECD Global Forum on Environment: Making Water Reform Happen, October 2011, by Jeremias N. Paul, Jr., Undersecretary, Department of Finance, Republic of the Philippines.

To learn more about Japan’s and United States’ development co-operation see:

OECD (2020), OECD Development Co-operation Peer Reviews: Japan 2020, Development Co-operation Peer Reviews, https://doi.org/10.1787/b2229106-en.

OECD (2021), "Japan", in Development Co-operation Profiles, OECD Publishing, Paris, https://doi.org/10.1787/b8cf3944-en.

OECD (2016), OECD Development Co-operation Peer Reviews: United States 2016, Development Co-operation Peer Reviews, https://doi.org/10.1787/9789264266971-en.

OECD (2021), "United States", in Development Co-operation Profiles, OECD Publishing, Paris, https://doi.org/10.1787/45472e20-en.

Related content

-

30 September 2024

30 September 2024 -

Case study27 September 2024

Case study27 September 2024 -

27 September 2024

27 September 2024 -

16 September 2024

16 September 2024 -

11 September 2024

11 September 2024 -

10 September 2024

10 September 2024