This chapter provides an overview of the main challenges and opportunities for sustainable development in Chile, and presents a summary of the main findings of the study, which show the role that foreign direct investment currently plays in supporting trade and GVC integration, productivity and innovation, job quality and skills, gender equality and the low-carbon transition. Based on an assessment of Chile’s regulatory and policy framework, the chapter also derives overarching policy considerations to strengthen the economic, social and environmental benefits of foreign investment.

FDI Qualities Review of Chile

1. Overview and key policy considerations

Abstract

Policy considerations

Continue policy efforts to diversify the economy and shift to knowledge‑intensive and green activities will be crucial for Chile to address pressing sustainable development challenges, including stimulating productivity growth to support the continued improvement of living standards of its citizens, reducing social inequalities and combating climate change. Attracting FDI in a broader spectrum of sectors can help Chile achieve a higher level of economic sophistication and become a more prosperous, equitable and resilient economy.

Streamline sectoral licensing requirements for high-tech manufacturing and knowledge‑intensive services, including by digitalising compliance processes related to setting up a business, acquiring permits and undertaking investments in strategic sectors of the economy.

Remove barriers to foreign supplier participation in public procurement and integrate environmental and social criteria into public tenders as well as clearly defined rules to avoid discretionary decisions.

Continue efforts to integrate sustainability considerations into Chile’s international trade and investment agreements.

Strengthen InvestChile’s capacity to target high value‑added investments (e.g. through incentives) and measure the contribution of investment promotion activities to the SDGs and sustainability more generally.

Consider ways to strengthen InvestChile’s investment promotion activities in key markets abroad, including by establishing overseas offices and strengthening co‑ordination with ProChile and the Ministry of Foreign Affairs.

Specify policy co‑ordination mechanisms and monitoring and evaluation (M&E) tools for the implementation of the National Strategy for the Promotion of Foreign Investment.

Adjust the R&D tax incentive scheme to make it more attractive for foreign and domestic firms that seek to engage in innovation-based partnerships.

Consider ways to streamline and consolidate Chile’s investment incentives framework to support the financing of low-carbon and technology-intensive investments, including through enhanced co‑ordination and joint management of the incentives system or through new funding tools by CORFO or the Banco del Estado.

Implement FDI-SME linkage programmes and provide technical assistance to domestic firms, in particular SMEs, to help them become successful suppliers and partners of foreign investors.

Incentivise foreign MNEs to undertake training activities for their employees and local suppliers, by encouraging greater levels of permanent employment and allowing firms to tailor skills development programmes to the needs of their employees.

Continue policy efforts to create an enabling environment for renewable energy investments by removing regulatory barriers, providing specific incentives, and reforming the current carbon pricing framework.

Explore measures to attract investment in the emerging green hydrogen industry – while taking into consideration the early technological maturity of hydrogen technologies and the high risks involved – including through public-private partnerships, incentives for investments in enabling infrastructure, capacity building and training programmes, R&D collaborations and regulation addressing demand-side bottlenecks.

1.1. Main challenges and opportunities for sustainable development in Chile

1.1.1. Low productivity, labour market imbalances and environmental risks are the main challenges to sustainable development in Chile

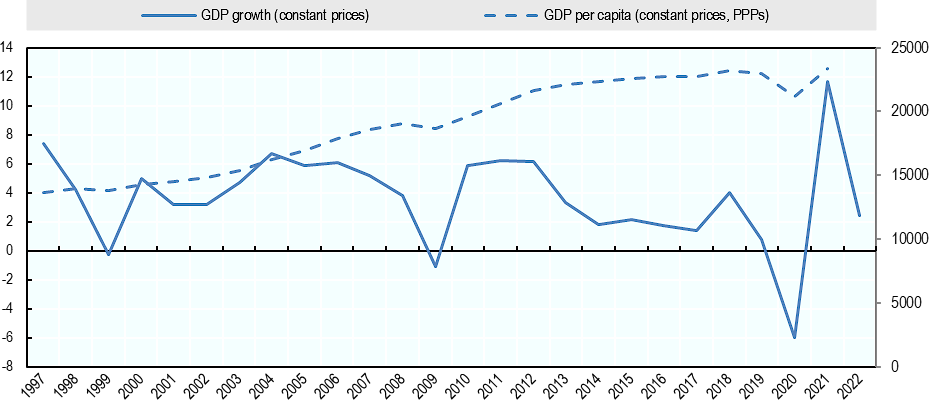

In recent decades, Chile has experienced significant economic growth that has helped to improve the living standards of its citizens and reduce poverty (Figure 1.1). As a small, open economy rich in natural resources, Chile relies heavily on trade and foreign direct investment (FDI) to sustain its economic growth. In 2020, the country faced a severe economic downturn caused by two major shocks, the social protests in late 2019 and the COVID‑19 epidemic. A solid institutional and macroeconomic framework helped Chile recover quickly from these shocks. However, the COVID‑19 pandemic exacerbated the already high income inequality, increasing the number of households in a state of economic vulnerability and the number of indebted firms (OECD, 2021[1]).

Figure 1.1. In recent decades, economic growth has supported rising living standards

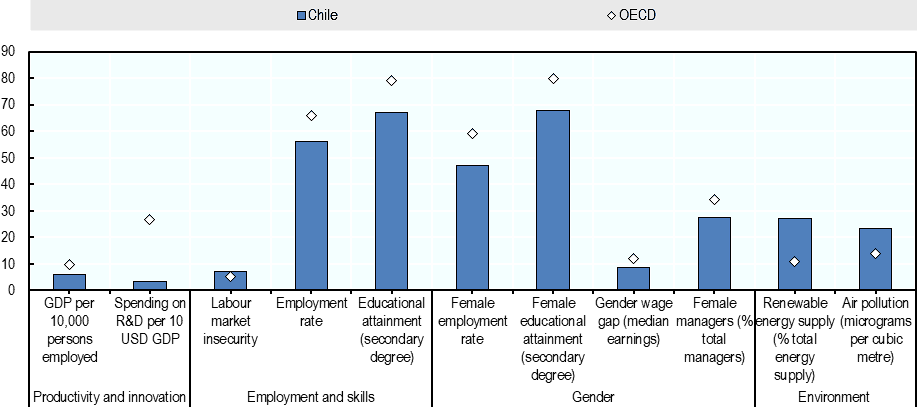

Chile has productivity levels below the OECD average (Figure 1.2). Productivity growth has been modest in recent years, due to a combination of factors. The low productivity is partly due to insufficient investment in innovation and R&D, but also to a polarisation of enterprises, i.e. a small number of large, highly productive enterprises and a wide range of small and medium-sized enterprises with low productivity (OECD, 2021[1]). The low economic diversification of the Chilean economy also plays an important role. A significant share of economic activity is concentrated in services, low value‑added industries and natural resources. FDI and exports are also largely concentrated in these sectors. Moreover, Chile’s dependence on exports of natural resources has increased its vulnerability to external shocks and fluctuations in commodity prices.

Chile’s opportunity to diversify its economy and move towards more knowledge‑intensive and sustainable activities is hampered by low skill levels. In recent decades, Chile has made remarkable progress in improving the quality of education, but significant challenges remain. The percentage of Chilean adults with at least an upper secondary degree is below the OECD average. While Chile has the best performance for 15‑year‑olds in reading, science and mathematics among the LAC countries participating in PISA, it ranks among the lowest in the OECD. Gender imbalances persist in education and employment, creating inefficiencies and perpetuating social inequalities. The gender gap among graduates in science, technology, engineering and mathematics (so-called STEM subjects) is higher than the OECD average (OECD, 2021[3]). As globally, women in Chile are more likely to work part-time and informally. They are paid less, although the gender pay gap has decreased recently and is now lower than the OECD average. As elsewhere, a lower percentage of women reach leadership positions, as shown by the share of female managers (Figure 1.2). This share is below the OECD average.

Figure 1.2. Chile underperforms the OECD average across many sustainability indicators

Note: Labour market insecurity is defined in terms of the expected earnings loss, measured as the percentage of the previous earnings, associated with unemployment.

Source: OECD (2022[4]), Better Life Index, https://www.oecdbetterlifeindex.org/; OECD (2022[5]), Gender Portal, https://www.oecd.org/gender/ ; OECD (2022[6]), Green Growth Indicators, https://stats.oecd.org/.

Chile faces several pressing environmental challenges. CO2 emissions and energy consumption have increased in line with the strong economic growth of recent decades. The country still depends on fossil fuels to meet its energy needs. Less than one‑third of the total energy supply in Chile comes from renewable sources, although this share is higher than the OECD average (IEA, 2022[7]). Mining for fossil fuels and minerals, deforestation, fishing, and water and land use can deplete natural resources and increase the risk of environmental degradation. Chile has recently made a number of environmental commitments, including achieving carbon neutrality of its economy by 2050, which, if implemented, could reverse these trends.

1.1.2. Diversifying the economy into knowledge‑intensive and green activities can help Chile become a more inclusive and sustainable economy

Improving the sophistication of the economy, understood as a wealth of competitive and international firms in a variety of productive sectors, has long been an important policy objective for Chile. Since the 1970s, successive governments have sought to diversify Chile’s production base and export basket, including through initiatives to strengthen the role of the private sector. Although these efforts have led to some diversification, economic activity, as well as exports and FDI, remain concentrated in a few low-value added sectors and in natural resources. Dependence on exports of raw materials, particularly copper, and the lack of a strong policy framework for innovation and R&D, human capital development and some regulatory barriers have hindered further economic diversification towards more knowledge‑intensive activities.

Economic activity in Chile is focused in sectors that generate less added value per employee, namely services (particularly professional activities, trade and the public sector) and medium and low-tech industries (food, plastics and rubber, and electronics). An important driver of economic activity is also the natural resources sector, including mining and energy, as well as forestry, fishing and agriculture. Chile’s strong economic growth in recent decades, also based on the exploitation of natural resources, has not been without costs to the environment, especially in terms of air pollution, water scarcity and pollution, overfishing and deforestation.

Chile is well integrated in global value chains (GVCs), although its position is rather upstream: it mainly exports raw materials and intermediate goods that are then further processed and exported by third countries. Chile’s upstream position in GVCs is consistent with its comparative advantage in natural resource sectors, particularly agriculture, fishery, mining and energy, and in medium and low-tech industries, such as chemicals, processed metals, non-metallic minerals, food and beverages. The country also has a competitive edge in exports of transport services, travel and insurance. These sectors have contributed significantly to Chile’s economic growth and job creation, but they offer less prospects in terms of sustainable development.

The potential for diversification lies in manufacturing and services activities, which can support innovation, productivity growth, the creation of better jobs and the green transition. Traditional comparative advantages could be leveraged to create new competitive advantages in related sectors with better prospects for sustainable growth. Chile’s vast endowment of natural resources and geographical characteristics (the wide variety of climates, including glaciers, volcanoes, rainforests and deserts) make it one of the countries with the highest potential for developing renewable energies (solar, hydroelectric and wind power). The development of these activities, which can help Chile become a more inclusive and green economy, will require new investments in the future, both domestic and foreign.

1.2. FDI can help Chile become a more inclusive and sustainable economy

1.2.1. FDI contributes significantly to sustainable development in Chile

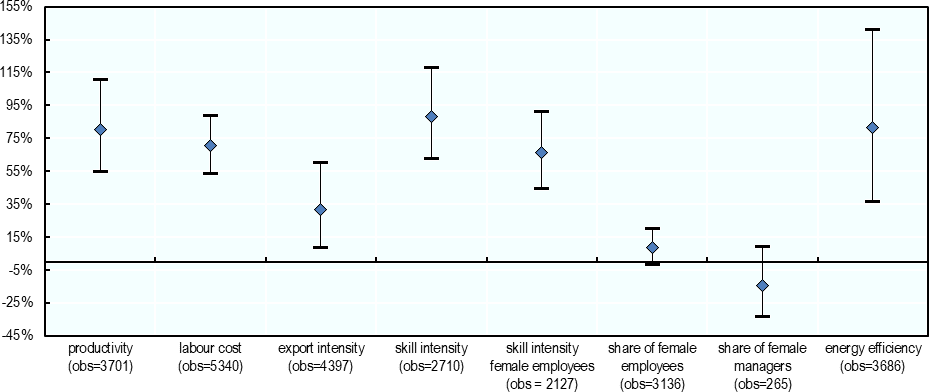

The importance of FDI for the Chilean economy has grown significantly in recent decades, reaching almost the same size as the national GDP in 2020 (a description of the data used in the report can be found in Box 1.1). Since 2012, however, inward FDI flows have decreased, in line with the global trend, but also due to the collapse in commodity prices and recently, the economic recession following the COVID‑19 crisis. Through the activities of foreign companies, FDI has contributed significantly to sustainable development in Chile in recent decades. Foreign companies have helped Chile integrate in GVCs and are responsible for a significant share of exports in most sectors, including high-tech and knowledge‑intensive sectors. For example, they account for around 80% of exports in telecommunications and information services activities, 55% in IT activities, 50% in electronics and machinery and equipment. Moreover, foreign companies are more export-oriented than Chilean companies: on average, a foreign company exports 32% more of its sales than a domestic company (Figure 1.3).

Foreign firms also participate intensively in domestic value chains, developing business linkages with Chilean companies. They purchase about 73% of their intermediate goods on the domestic market, mainly from small and medium-sized Chilean companies. In addition, they sell about 70% of their production in Chile, partly as inputs to Chilean firms and partly on the final goods market. Several studies point to a positive impact of FDI on productivity and innovation in Chile (Table 2.1). Foreign companies are on average 80% more productive and engage more in R&D activities than Chilean firms.

Figure 1.3. Foreign companies contribute positively to many dimensions of sustainable development

Note: The figure shows the percentage impact of foreign ownership on various business performance variables and their respective confidence interval. When the confidence interval includes 0, the impact is not statistically significant. The percentage impact is calculated using regression analysis. Methodological details can be found in Annex 2.B.

Source: OECD elaboration based on Sexta Encuesta Longitudinal de Empresas (2019[8]), https://www.ine.cl/estadisticas/economia/ciencia-y-tecnologia/encuesta-longitudinal-de-empresas.

Between 2010 and 2020, greenfield FDI generated more than 100 000 jobs in Chile, mainly in mining, energy and manufacturing. However, 1 million dollars of greenfield FDI invested generates fewer jobs in Chile than in other comparator countries as it is directed to sectors with less potential for job creation (i.e. mining and energy). Nevertheless, foreign companies generate a significant number of jobs in many sectors and these jobs are on average better paid and require higher skill levels than those created by domestic companies. Foreign firms have higher proportions of skilled women in most sectors. They are also playing an important role in helping Chile curb its CO2 emissions by promoting a shift from fossil fuels to renewable energy. Foreign investment, particularly greenfield projects, in renewable energy has grown considerably in the past decade and represents today close to 90% of total foreign investment in the energy sector. Foreign firms are also more energy efficient than domestic firms, as they are able to produce a unit of output using less energy.

Box 1.1. Databases used to assess FDI trends and impacts in Chile

Central Bank of Chile’s FDI statistics: provides flows and stocks of inward and outward FDI for Chile, from 2012 to 2021, by economic sector and country of origin. In March 2022, the Central Bank of Chile has introduced some improvements in the methodology and data sources used to compile FDI and more generally BOP and IIP statistics. Additional details can be found in Central Bank of Chile (2021[9])

Financial Times’ fDi Markets Greenfield FDI database: is a database of crossborder greenfield investments covering all countries. It provides real-time information on capital investment and job creation by economic activity, source country, and location (region). For this study, crossborder greenfield investment projects directed to Chile from 2003 to 2021 were selected, from all countries of origin and covering all economic activities. Economic activities were reclassified to correspond to the ISIC Rev4 sectoral classification.

Thomson Reuters’ Mergers and Acquisitions (M&As) database: provides coverage of global M&A deals by country of acquiring company, country of the acquired company and economic activity. For this project, cross-border M&A deals targeting Chilean companies from 2005 to 2021 were selected. Information on the location (headquarters) of the company was retrieved from the business description of the acquired company.

Sexta and Quinta Encuesta Longitudinal de Empresa (ELE6 and ELE5): consist of two representative samples of companies from all economic sectors in Chile in 2019 and 2016/2017, respectively. ELE6 covers 4 006 firms, 391 of which are foreign-owned (a foreign investor directly owns 10% or more of the ordinary shares). ELE5 covers 6 480 companies, 549 of which are foreign-owned. ELE6 and ELE5 provide firm-level information, including on value added, wages, input costs, and employment by gender and skill intensity. ELE5 also includes information on innovation and R&D.

Chile’s Internal Revenue Service: information from taxpayer records was used to extract statistical moments for groups of companies based on some relevant characteristics (ownership, company size, location, sector). The extracted information excludes ‘non-firm’ taxpayers (i.e. households, NGOs or public enterprises) and only considers firms with a median sales greater or equal to USD 100 000 and a median number of workers greater or equal to five.1

In addition, several other OECD and non-OECD databases have been used in this report including the OECD FDI statistics, OECD Annual National Accounts, OECD Trade in Value Added (TiVA) indicators, OECD AMNE analytical database, OECD Research & Development Statistics, OECD Gender Portal, OECD Green Growth Indicators, UN Comtrade Database, and the IEA’s World Energy Balances.

1.2.2. FDI can play a key role in helping Chile diversify its economy

FDI can help Chile diversify its economy towards more sustainable activities, making it more competitive and resilient to external shocks. In Chile, FDI has traditionally been attracted by natural resources and concentrated in a small number of sectors: mining, energy, finance, trade and low value added sectors (food, chemicals). In the last decade, a smaller share of FDI has been directed to mining, while an increasing share has gone to finance, trade and renewable energy. In general, FDI appears to favour sectors where it can rely on an existing network of local suppliers and a workforce with the required skills. Attracting FDI in a broader spectrum of sectors can contribute to increasing the economic sophistication of the Chilean economy. Foreign firms in Chile are on average more productive, as they use more advanced technologies and are on average more skill-intensive than domestic firms. Foreign firms are also more active in terms of R&D, which is an important driver of innovation and productivity growth. They can contribute indirectly to national productivity, for example by transferring technology and knowledge that can help Chilean companies become more productive.

FDI can also help develop new comparative advantages. Chile specialises and has a comparative advantage in natural resources, medium and low-tech manufacturing industries and some services (transport, tourism, insurance activities, and other business services). FDI can bring new technologies and knowledge to the host economy, which can be used to create new sources of excellence. Foreign companies already present in Chile can be incentivised to invest in new sectors in areas considered strategic from a sustainable development point of view, for example in high-tech, knowledge‑intensive and green activities that can boost domestic productivity and improve sustainability. Foreign companies contribute significantly to exports in various technology- and knowledge‑intensive sectors, indicating that there is potential to further exploit the benefits of FDI in these sectors. Moreover, diversifying FDI into high-tech and knowledge‑intensive activities can lead to the creation of better quality jobs. This is because jobs created in these sectors are on average more skilled and better paid than those created in medium and low-tech industries, mining and construction.

1.3. The policy framework for investment promotion

FDI provides technological and financial resources necessary to improve living standards, boost employment, trigger innovation and deliver green growth. However, FDI does not always go where it is most needed and its impacts on sustainable development are not always positive. The quality of the regulatory environment can determine whether a country can attract sustainable investment, and whether spillovers on the domestic economy can occur. A number of more targeted policies at the intersection of investment policy and sustainable development can also avoid negative implications that may result from the presence of foreign firms, such as crowding out of local SMEs, skills and jobs. These laws, regulations and policy initiatives cannot be considered in silos but in the framework of an adequate and coherent policy mix.

1.3.1. Regulatory restrictions to FDI are limited, but challenges remain for foreign firms

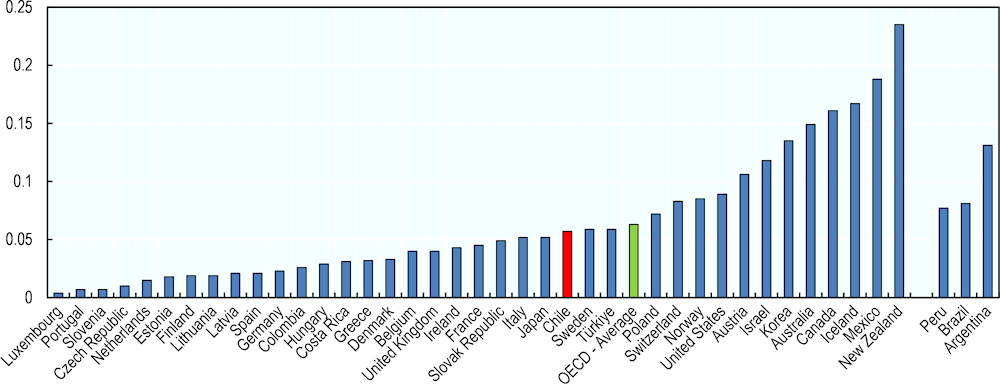

The sound macroeconomic fundamentals, judicial certainty as well as economic and political stability of the past decades have made Chile one of the strongest investment destinations in the LAC region. Chile’s statutory restrictions to foreign investment are slightly below the OECD average according to the OECD FDI Regulatory Restrictiveness (FDIRR) index (Figure 1.4). Investment-related policies are non-discriminatory and foreign-owned companies are provided with national treatment, i.e. they receive a treatment no less favourable than domestic companies. Certain market access restrictions are found only in the fisheries and transport sectors, while specific authorisation is required to invest in the exploration and exploitation of hydrocarbons, mining and the production of nuclear energy.

Figure 1.4. Chile’s statutory restrictions to FDI are close to the OECD average

Note: The OECD FDI Regulatory Restrictiveness Index only covers statutory measures discriminating against foreign investors.

Source: OECD (2020[10]), FDI Regulatory Restrictiveness Index, www.oecd.org/investment/fdiindex.htm.

Chile has a competition-friendly regulatory environment that incentivises existing firms to innovate while also supporting the reallocation of resources towards more productive firms. However, one area with significantly more obstacles is the complexity of regulatory procedures, in particular for large investment projects in strategic sectors. The Government of Chile has recently established a digital platform as a single point of contact to deal with sectoral licensing applications; however, significant delays and discretionary decisions are still observed regarding the authorisation of certain investment projects due to the lack of clearly defined approval processes (OECD, 2022[11]). Further digitalisation of business registration and investment licensing processes could help reduce the administrative burden on investors and foster greater certainty and predictability. Similarly, in the case of non-risk economic activities, sectoral licensing requirements could be replaced by a simple prior notification to the authorities. To address these challenges, the government’s Productivity Agenda, adopted in 2023, includes more than 40 measures that aim to lift regulatory barriers to productivity growth, including through the structural reform of sectoral permits for investments.

The framework that regulates the public procurement of goods, services and public works is another area that could be further aligned with OECD best practices. While barriers to FDI are low, foreign suppliers of goods and services face higher barriers to participating in public procurement processes than in many OECD countries (OECD, 2021[12]). The buying power of governments can be a lever for promoting sustainable investment practices, in particular in sectors of strategic importance for the Chilean economy. Removing barriers to foreign supplier participation should be combined with the integration of environmental and social criteria in public procurement tenders as well as clearly defined rules to avoid discretionary decisions and ensure integrity and accountability.

1.3.2. Sustainability considerations could be further mainstreamed into Chile’s international investment agreements

International investment and trade agreements that are aligned with climate objectives, international labour standards and principles on gender equality and encourage co‑operation and monitoring of commitments can complement government efforts to enhance the positive impact of investment on sustainable development (OECD, 2022[12]). Chile is one of the leading Latin American countries in investment treaty-making. The Ministry of Foreign Affairs’ Undersecretariat for International Economic Relations (SUBREI) is responsible for negotiating international treaties on economic, trade and investment policy matters. In previous decades, Chile engaged in the negotiation of a wide‑ranging network of bilateral investment treaties (BITs) and free trade agreements (FTAs) that led to low tariffs and higher trade and investment, GDP per capital and employment.

In contrast to older agreements, FTAs with investment chapters concluded over the past few years (e.g. FTAs with Canada and the Pacific Alliance countries) have been significantly geared towards sustainable development principles (e.g. gender, labour standards, OECD MNE Guidelines). The inclusion of such provisions is a step in the right direction. However, the bulk of Chile’s international investment agreements (IIAs), most of which were concluded in previous decades, does not contain strong commitments to sustainable development principles, and when they do, references are mainly found in the preamble of FTAs (WTI, 2022[13]). Chile could continue efforts to integrate sustainability considerations into new IIAs while at the same time engage in dialogue with its international partners to explore opportunities to update “old generation” agreements (as was the case recently with Canada). Efforts should be also made to improve the quality of these provisions by ensuring that they make reference to a wider set of sustainability principles and international standards (e.g. ILO and RBC standards), and are not limited to the preamble of IIAs.

1.3.3. InvestChile could further improve its capacity to track and measure the contribution of investment promotion activities to the SDGs

Chile’s investment promotion agency (IPA), InvestChile, plays a key role in promoting the country as an attractive investment destination and generating leads and investment projects that contribute to sustainable development. In recent years, InvestChile has developed new initiatives to improve the quality of its investment promotion activities and pro‑actively target foreign MNEs that contribute to FDI diversification. The prioritisation of low-carbon, technology-intensive and high value added FDI is reflected in InvestChile’s portfolio of clients. In 2021, 42% of the supported FDI projects took place in knowledge‑intensive services and the technology industry, followed by the agri-food (18%) and energy (11%) sectors (InvestChile, 2022[14]). In terms of value, almost half of supported investments went into the renewables energy sector followed by tourism and mining. InvestChile could consider ways to strengthen its investment promotion activities in key markets abroad to promote Chile as an attractive investment destination, including by establishing a small number of overseas offices in the form of “regional hubs” and by strengthening co‑ordination mechanisms with ProChile’s international network of offices and the Ministry of Foreign Affairs. Furthermore, the Government of Chile could consider how investment promotion activities and incentive schemes could be better integrated and streamlined to create a systemic support to foreign firms. Effective targeting of quality FDI requires a mix of different types of policy instruments that support firms at every stage of the investment process.

InvestChile is using a basic set of Key Performance Indicators (KPIs) mostly related to the total amount of investment and number of jobs created. These types of indicators are common among OECD IPAs and also reflect the relatively young age of the agency. However, over time OECD IPAs have added additional and more targeted criteria, including those related to sustainability and inclusiveness (Sztajerowska and Volpe Martincus, 2021[15]). In addition, numerous OECD IPAs developed dedicated sustainability scoring mechanisms to guide their prioritisation efforts. In this context, building on examples from other OECD countries, it could be considered how tracking and measuring InvestChile’s contribution to the SDGs, and sustainable and inclusive development more generally, could be improved further. The OECD stands ready to assist the agency in this process.

The recent adoption of a new National Strategy for the Promotion of Foreign Investment provides a good opportunity to clarify the role of government institutions that should be involved in the implementation of policies at the intersection of investment promotion and sustainable development. The strategy presents a new investment prioritisation framework that relies on criteria linking investment projects to specific sustainable development outcomes. The latter will be also linked to concrete policy initiatives and government reforms that will seek to address regulatory barriers to FDI and strengthen the capacities of the Chilean economy. The successful implementation of the strategy will require increased attention on the issues of policy alignment and co‑ordination as well as the use of robust monitoring and evaluation tools to identify policy inefficiencies and assess the impact of investment promotion policies on the Chilean economy. InvestChile’s co‑ordinating role should be strengthened through the agency’s participation in high-level government councils that deal with sustainable development policy areas such as the Inter-Ministerial Committee for Science, Technology, Knowledge and Innovation, the Inter-Ministerial Committee for Sustainable Productive Development, and the Council of Ministers for Sustainability and Climate Change.

1.4. Policies at the intersection of investment promotion and sustainable development

1.4.1. Public support to R&D-intensive investment could be better co‑ordinated and targeted

Chile provides one of the lowest levels of total government support for business R&D among OECD and partner economies (OECD, 2021[16]). The Chilean support to business R&D – both direct (e.g. grants, loans) and indirect (e.g. tax relief) – ranks far from top innovators such as the US, Canada, France and Portugal. A tax incentive for extramural R&D was first introduced in 2008, whereby enterprises operating in Chile are entitled to a 35% tax credit for R&D certified contracts entered into with a registered research centre. The low level of R&D government support could be a barrier to attracting additional investment in knowledge‑intensive activities, in particular given that certain LAC countries may provide more generous schemes (e.g. Brazil, Colombia). The low uptake of R&D tax relief by Chilean SMEs may also be a sign of weak domestic capacities in the area of innovation, which could be an important barrier for domestic enterprises to develop value chain linkages and knowledge‑intensive partnerships with foreign MNEs operating in Chile. The government could consider further adjusting the current scheme to make it more attractive and less burdensome for both foreign and domestic firms who seek to engage in innovative activities. Such a reform should be also accompanied by measures to remedy a lack of awareness of the tax credit among smaller enterprises and other R&D institutions that operate in FDI-intensive sectors.

Direct government funding in the form of grants and loans could be also increased and better co‑ordinated and targeted in order to promote Chile’s strategic priorities in the area of sustainable development and FDI diversification. Financial support for innovative and productive investments is offered by a number of public institutions. For instance, the Chilean Economic Development Agency (CORFO) has launched several financing calls inviting domestic and foreign firms to benefit from preferential pricing schemes and other financial support for investments in the mineral resources, agricultural and green hydrogen industries. Similarly, the National Agency for Research and Development (ANID), which reports to the Ministry of Science, Technology, Knowledge and Innovation, offers a wide range of short-term funding tenders as well as technical assistance programmes. However, existing institutional arrangements, funding mechanisms and policy mix lack an overarching framework that could identify strategic opportunities across sectors and provide the necessary long-term finance to diversify the country’s production structure and hasten its transition towards a knowledge‑based economy.

The Government of Chile is currently considering ways to streamline and consolidate its financial incentives framework. One option would be to leverage the potential of the new Inter-Ministerial Committee for Sustainable Productive Development to co‑ordinate the administration and granting of the various incentive schemes in a more coherent way. Another option would be for the government to leverage the already established Banco del Estado and/or CORFO to make available a diverse portfolio of funding tools (e.g. loans, grants, guarantees, equity investments) and network-building initiatives to crowd-in private investors, including foreign MNEs, through risk-sharing, co-financing strategies and public-private partnerships. It will be important that the bank relies on clear strategies, policies and targets that align its activities and financing tools with Chile’s investment promotion, innovation and low-carbon priorities. Such alignment can be achieved through the participation of key government agencies such as InvestChile, CORFO and ProChile in the management of the new incentives framework. The activities should be also evaluated periodically to ensure that the benefits outweigh potential costs (e.g. economic distortions, forgone public revenue, etc).

1.4.2. Investment promotion has a crucial role to play in supporting skills development

Existing skills imbalances in the Chilean labour market can be a significant barrier for foreign MNEs that seek to invest in knowledge‑intensive activities. Chile ranks in the bottom 20% of OECD countries for the skills development of youth and adults while around half of Chilean workers has only basic proficiency in problem solving skills in technology-rich environments (OECD, 2019[17]). Qualification mismatch is very close to the OECD average; however, Chile has one of the highest prevalence of skills mismatch in OECD countries and a larger-than-average proportion of adults with low literacy and numeracy skills.

Regarding its labour market regime, Chile has one of the highest shares of temporary employment in the OECD area and a high job turnover, which negatively affect domestic and foreign firms’ incentives to invest in job training. The government has sought to encourage on-the‑job training through a tax franchise scheme, which allows companies to benefit from tax credits if their workers participate in training courses offered by the National Training and Employment Service (SENCE). However, the number of workers benefitting from the scheme has been following a downward trend over the past decade, and there is little involvement of employers on the type of training that their workers get. Foreign MNEs operating in Chile should be further incentivised to undertake training activities for their own employees and for their local suppliers. Existing training incentives should become flexible enough to allow foreign MNEs to tailor their content and scope to the needs of their employees.

Although skills development programmes are implemented by various sectoral ministries and their implementing agencies, evidence suggests that they are not always of good quality, face challenges in targeting their objective population and are insufficiently aligned with the needs of the labour market (Bogliaccini et al., 2022[18]). There is also a lack in demand for training and, when it occurs, training benefits mostly highly educated workers (e.g. senior professionals) or workers in occupations with high demand for specific skills. Skills development programmes should better target job seekers and vulnerable groups of workers, including women and unemployed, who may be adversely affected by foreign MNEs’ changing needs or FDI’s diversification away from natural resources sectors. To this end, sectoral retraining programmes can be more impactful than general training courses, as they reduce skills shortages in target sectors where FDI may crowd out competitors unable to retain their talented staff. InvestChile should co‑ordinate with SENCE, CORFO and Chile’s labour intermediation offices for the development of joint programmes and initiatives that allow foreign MNEs to find the skills they need. The agency could also further promote sectors and activities in alignment with the existing skills base and provide appropriate information to investors on labour market characteristics.

If Chile wants to diversify into high-tech and knowledge‑intensive activities, including by attracting more FDI in these sectors, it needs to invest in a broader set of skills, beyond those required in sectors where FDI is already present. This will require robust skills anticipation systems that involve the investment community and allow to design evidence‑based and forward-looking programmes that match expected skills needs in various industrial sectors. The Advisory Council on Technical and Vocational Training could play a more active role in the implementation of skills needs assessments and, in collaboration with InvestChile, help better identify the skills needs driven by FDI.

1.4.3. Promoting green FDI will require reforms in carbon pricing and incentives for renewable energy expansion

Creating an enabling environment for green and low-carbon investment has been an important and longstanding policy priority for the Government of. Recent initiatives have focused on setting low-carbon transition targets and long-term policy strategies that send investors, including foreign ones, strong signals regarding the government’s climate ambitions. Chile is the first Latin American country that made emission targets legally binding through its 2022 Framework Law on Climate Change. It has also been a regional leader in attracting FDI in renewable energy by addressing regulatory barriers in the energy market and facilitating the connection of the electrical system to renewable energy plants. Despite progress, Chile still heavily relies on carbon energies due to the weight of the transport sector and the growth in the energy-intensive needs of certain industries (e.g. mining).

Chile’s long-term goal of 100% zero‑emission electricity generation and 80% renewable energy by 2050 will require to keep a fast pace of investment in clean energy. Achieving this target will require strong co‑ordination for the implementation of targeted policies, in particular for hard-to‑abate sectors and industries for which FDI could significantly contribute to their decarbonisation. The current carbon pricing framework should be reviewed with the aim to increase carbon taxes at levels comparable to international standards and improve their sectoral coverage. In terms of regulation, regulatory restrictions in the transport sector, a major CO2 pollutant, should be lifted to attract FDI that contributes to the transfer of know-how and the deployment of low-carbon technologies.

Additional measures could be also explored for the attraction of private investment in Chile’s emerging green hydrogen industry. Given the early technological maturity of hydrogen technologies and the high risks involved, regulatory reforms across the value chain and targeted public policy interventions will be necessary to create the conditions for private investment. For the initial phase, time‑limited financial support schemes could reduce the investment risk for industry and close part of the cost differential with other types of energy sources (IEA, 2021[19]). Specific financial tools by the Banco del Estado or CORFO, as suggested previously, could help in the deployment of grants, concessional loans and guarantees to make investment projects more bankable. Scaling up low-carbon hydrogen and use will also require timely investments in enabling infrastructure, including new transmission lines (for low-carbon electricity to reach the electrolysers for on-grid projects), hydrogen transport and storage infrastructure and port terminals. Demand-side bottlenecks could be also resolved for investments to scale up. However, if the Government of Chile decides to pursue the development of the green hydrogen industry, uncertainties about the demand for green hydrogen versus other energy-related sources and technologies, which are currently more cost-competitive, should be taken into consideration since they are a key obstacle for mobilising private capital.

References

[19] Bogliaccini, J. et al. (2022), (Un)Employment and skills formation in Chile: An exploration of the effects of training in labour market transitions.

[9] Central Bank of Chile (2021), Balanza de Pagos de Chile, Positión de Inversión International y Deuda Externa, https://si3.bcentral.cl/estadisticas/Principal1/Informes/AnuarioBDP/pdf/ANUARIO_BP_2021.pdf.

[8] Government of Chile, The National Institute of Statistics and the Ministry of the Economy (2019), Encuesta Longitudinal de Empresas 6 (ELE6), https://www.ine.cl/estadisticas/economia/ciencia-y-tecnologia/encuesta-longitudinal-de-empresas.

[7] IEA (2022), World Energy Balances, https://www.iea.org/data-and-statistics/data-product/world-energy-balances.

[20] IEA (2021), Hydrogen in Latin America: From near-term opportunities to large-scale deployment, OECD Publishing, Paris, https://doi.org/10.1787/68467068-en.

[15] InvestChile (2022), Foreign Investment in Chile in 2021, https://investchile.gob.cl/wp-content/uploads/2022/03/reporte-ied-en-chile-a-marzo2022.pdf.

[2] OECD (2022), Annual National Accounts, https://stats.oecd.org/.

[4] OECD (2022), Better Life Index, https://www.oecdbetterlifeindex.org/.

[13] OECD (2022), FDI Qualities Policy Toolkit, OECD Publishing, Paris, https://doi.org/10.1787/7ba74100-en.

[5] OECD (2022), Gender Portal, https://www.oecd.org/gender/.

[6] OECD (2022), Green Growth Indicators, https://stats.oecd.org/.

[11] OECD (2022), OECD Economic Surveys: Chile 2022, OECD Publishing, Paris, https://doi.org/10.1787/311ec37e-en.

[3] OECD (2021), Gender Equality in Chile: Towards a Better Sharing of Paid and Unpaid Work, https://doi.org/10.1787/6cc8ea3e-en.

[1] OECD (2021), OECD Economic Surveys: Chile 2021, https://doi.org/10.1787/79b39420-en.

[12] OECD (2021), OECD Product Market Regulation Indicators, http://www.oecd.org/economy/reform/indicators-of-product-market-regulation/.

[17] OECD (2021), R&D Tax Incentives: Chile, 2021, http://www.oecd.org/sti/rd-tax-stats-chile.pdf.

[10] OECD (2020), OECD FDI Regulatory Restrictiveness Index, http://www.oecd.org/investment/fdiindex.htm.

[18] OECD (2019), 2019 OECD Skills Strategy: Chile, http://www.oecd.org/chile/Skills-Strategy-Chile-EN.pdf.

[16] Sztajerowska, M. and C. Volpe Martincus (2021), Together or apart: investment promotion agencies’ prioritisation and monitoring and evaluation for sustainable investment promotion, https://www.oecd.org/daf/inv/investment-policy/Investment-Insights-Investment-Promotion-Prioritisation-OECD.pdf.

[14] WTI (2022), Sustainable Development in Chilean International Investment Agreements, World Trade Institute, http://www.wti.org/media/filer_public/d3/96/d3967dfa-0393-42bf-a3e9-cb519943562e/wti_working_paper_07_2022_sustainable_development_in_chilean_international_investment_agreements.pdf.

Note

← 1. The information has been compiled in accordance with legal standards of aggregation that prevent the disclosure of private information. The Internal Revenue Service assumes no responsibility or warranty for the use or application of this information.