In recent years, the government has made significant progress in improving the ease and reliability of the de jure and de facto conditions in which firms conduct their business and manage their interactions with public bodies. Responses to the survey suggest that while the business community feels generally positive about the business environment in Kazakhstan, there are issues that continue to affect their operations, and in turn which may mitigate government efforts to diversify its economy. Building on survey insights, this chapter focusses on two such issues: trade facilitation and contract enforcement.

Insights on the Business Climate in Kazakhstan

5. Improving the operational environment for firms: focus on trade facilitation and contract enforcement

Abstract

5.1. Survey observations and overview

Responses to the survey indicated that firms were largely positive on the progress of numerous reforms to support the business climate. Respondents overwhelmingly reported that many aspects of the regulatory and policy environment that affect their daily operations are conducive to doing business and had improved over recent years. This positive assessment reflects the significant efforts that the government has made in recent years to reform these areas. This is true both in terms of operational reforms, such as expanded service delivery through digitalisation, as well as in terms of legal clarity, for example through the introduction of the 2015 Entrepreneurial Code of Kazakhstan in 2015, and the Environmental Code in 2021.

The generally high level of positivity for the direction of reforms was reflected in a broad optimism and enthusiasm for doing business in Kazakhstan. Only 6% of respondents considered the business climate to be unfriendly, whereas 23% of respondents reported that it was very friendly, with another 68% describing it as somewhat friendly.1 Respondents also noted their commitment to Kazakhstan despite uncertainty in the external environment due to Russia’s war of aggression in Ukraine and the disruptions causes by the COVID-19 pandemic; almost half of respondents expected to see an increase in profits and trade turnover in 2022 (48% and 42% respectively). The picture that emerges from respondents is therefore of a country where doing business is becoming easier, and where doing so is increasingly attractive.

At the same time, praise for reform progress was not uniform, and survey responses indicates concerns with a number of policy areas that may particularly affect the operations of local SMEs. Issues faced by SMEs are a bellwether for the business climate more broadly; if a local firm faces challenges in diversifying its production due to cumbersome customs arrangements, or to settling disputes with other firms or public bodies due to inefficient contract enforcement, then the implications are significant for any foreign or domestic investor entering or considering entry into the market. It is therefore vital that the government sees the barriers faced in the day-to-day running of a local business as being deeply intertwined with the success of other policy agendas, such as attracting investment into non-oil sectors of the economy and supporting the diversification and competitiveness of Kazakhstan in the green and digital transitions.

Building on insights from the survey, this chapter focusses on two policy areas that are important for private sector development and diversification in Kazakhstan: customs policy and contract enforcement. These are crucial if domestic firms are to have the confidence to invest and contribute to the country’s diversification agenda, but they also give international investors confidence in the ability of the local private and public sector to play a role in their value chains and be predictable clients.

5.1.1. Reforms have made doing business in Kazakhstan significantly easier, but harder-to-tackle challenges continue to beset the business climate

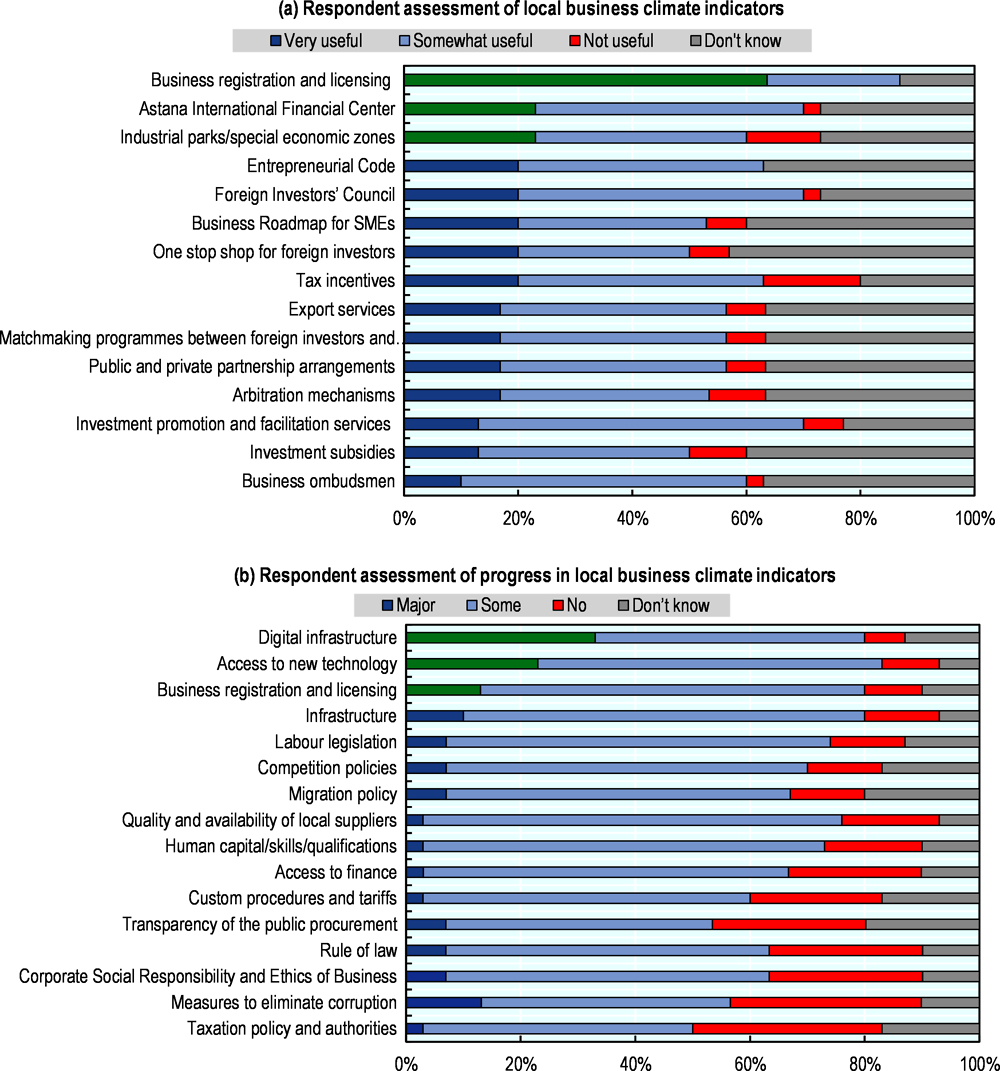

A majority of firms rated each of the surveyed indicators as either very useful or somewhat useful. While the share of firms ranking most indicators as very useful was below 25%, very few firms indicated that they found the given policy area not useful. This was not a relative ranking, and firms were not asked to rate one policy area over another in terms of its utility for their business operations, but it does suggest that survey respondents broadly agreed with the direction of travel of policy intervention (Figure 5.1 a).

Respondent firms were most positive on reform progress to improve business registration and licensing, which may have contributed to easing bureaucratic constraints on doing business in the country. The only indicator where a clear majority of respondents rated progress in a given policy area strongly was registration and licensing measures (63% of respondents reported reforms to the registration and licensing framework as very useful, with a further 22% rating them somewhat useful). To a certain extent, these reforms involved the rationalisation and simplification of the procedures and costs required for doing business in Kazakhstan. These reforms were therefore very important to establishing a more attractive operational environment, but they were also, in the context of limited progress in other areas of pro-competition and pro-market reforms, relatively easy to implement.

A large majority of firms thought that either major or a certain amount of progress had been made in almost all of the local business climate indicators over the past five years. The most significant areas of progress were linked to areas that involved a technological or digital component: improvements in digital infrastructure, access to new technologies, and the digitally driven improvements in business and licensing procedures (Figure 5.1 b). With the exception of taxation, a majority of respondents deemed each surveyed reform area to be moving in the right direction, if at an uneven pace. Nevertheless, there was a significantly higher proportion of respondents who were either ambivalent or negative about reform progress than those who were positive. The positivity of respondents to reform progress in Kazakhstan was also markedly lower than responses to the survey in Uzbekistan, though this may in part reflect the particularly strong reform momentum with certain reforms to support the business climate taken by the government in Tashkent since 2017, as well as higher firm-level expectations of the Kazakh authorities due to the relative maturity of the reform process in the country.

Figure 5.1. Firm-level evaluation of the status of reforms in Kazakhstan

Note: As a percentage of the total number of respondents.

Source: EU-OECD Business Climate Assessment Survey in Kazakhstan

A sizeable plurality of firms reported limited progress with a number of key operational aspects of the local business climate, including customs procedures. Almost a quarter of respondents (23%) claimed that there had been no improvements to customs procedures and tariffs, with another 57% claiming only limited progress. These two issues highlight the persistent challenge that the government faces in ensuring that de jure improvements to the business climate are properly implemented, since, for example, the country has in fact made relatively strong progress in OECD assessments of customs and trade policies, such as the OECD Trade Facilitation Indicators. That the de jure progress in these areas has not been felt in the de facto operations of respondents in Kazakhstan indicates that on the ground implementation remains challenging for the authorities.

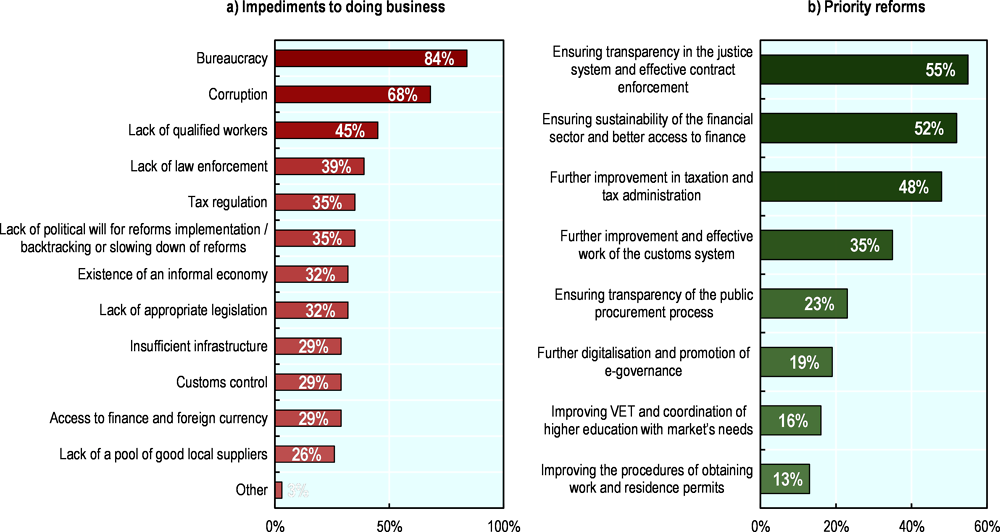

The two biggest weaknesses of the business climate were reported to be bureaucracy and corruption. These are transversal issues, affecting a wide variety of policy areas, but they are strongly relevant to the issues of customs procedures and contract enforcement, where previous OECD work has highlighted how corruption, bureaucracy and transparency issues can undermine the business environment (OECD, 2021[1]). Rather than being separate issues to be treated independently, bureaucracy and corruption can instead be both the drivers and symptoms of the challenges faced by firms in different policy areas, including trade and contract enforcement.

Figure 5.2. Challenges in the business climate and priority reforms

Note: As a percentage of the total number of respondents.

Source: EU-OECD Business Climate Assessment Survey in Kazakhstan

Respondents considered reforms to improve contract enforcement to be the most important area for action the government to consider. When asked which reforms they considered most important for the government to pursue, over half of respondents suggested reforms to improve transparency in the justice system and effective contract enforcement (55%) and improving the health of the financial sector and access to finance (52%). A significant proportion of respondents suggested reforms to the tax administration (48%) and the customs system (35%).

5.2. Supporting firm internationalisation through trade facilitation and customs reform

Kazakhstan’s government has long recognised the importance of international trade for the country’s economy. Yet despite ambitions to deepen economic internationalisation, firms continue to face significant barriers in accessing international markets. In part this reflects questions of economic structure, since many of the country’s SMEs are active in non-tradable sectors, and the productivity of those in tradable sectors is often insufficient to make them competitive internationally. Those that do or could trade abroad face higher distance penalties than competitors in many OECD countries, in part due to the vast distances that goods must travel to reach their destinations, but in part also to the ineffectiveness of the policies and regulations that govern trade, which raise the fixed costs associated with internationalising.

There is much that the government can do and is doing to improve physical infrastructure for trade, though these interventions often involve significant investment and raise complex questions of governance and sustainability. Yet as discussed in a joint OECD-ITF report on freight connectivity in Central Asia, a significant proportion of the connectivity penalty facing firms in the region is attributable neither to geography nor to physical infrastructure, but to policies, the “soft infrastructure” that dictates the movement of goods, services and people (ITF, 2019[2]).

The government has made significant efforts to improve the “soft connectivity” that shapes the country’s international trade conditions. The country formalised its commitment to developing an open and fair regulatory framework for trade through its accession to the World Trade Organisation (WTO) in 2015, and has signalled its intention to deepen its work with the relevant substantive committees on trade and agriculture at the OECD. As of 2023, Kazakhstan was not yet fully compliant with its WTO accession requirements, having implemented 61% of WTO commitments (of which Cat. A: 44.5%, Cat. B 16.8%, Cat. C 0%), below the implementation level of Tajikistan (79.4%) and the Kyrgyz Republic (77.7%).2

The country has also deepened its integration into regional blocs. Kazakhstan’s membership of the Eurasian Economic Union (EEU) and prior integration into the Eurasian Customs Union (Belarus-Kazakhstan-Russia), as well as its active membership in the Central Asia Regional Economic Cooperation (CAREC) could enhance intra- and inter-regional economic integration. As in other countries of the EEU, it is unclear how existing trade and investment agreements have been and will be reconciled with its treaty obligations, nor how the government will navigate any tensions arising from sanctions on Russia and their shared membership of these blocs. Nonetheless, 70% of respondents to the survey are in favour of a greater integration of Kazakhstan in international trade with the opening of new exportations routes, while the other 30% has either no opinion or doesn’t know.

Major modernisation of the customs infrastructure has helped to simplify procedures for traders. The introduction of fully automated customs procedures and the harmonisation and digitisation of all customs- and trade-related documentation through the Automated System of Customs and Tax Authorities ASTANA-1, which is fully compliant with the WTO, European Union and UNCTAD Customs standards, in January 2020 have been important steps to bring down the time and cost of trade. Their effects on businesses will have to be assessed in the coming years. In the meantime, improved co-ordination between customs and the Risk Management System inspections could provide additional improvements by avoiding overlapping or artificially lengthy procedures.

Improvements to trade facilitation could further reduce costs for Kazakhstan’s firms. Against the background of the country’s landlocked location and the legacy of Russia-oriented hard infrastructure, significant connectivity improvements could be made through trade facilitation, in particular by improving the effectiveness of border crossing procedures and raising levels of intra-agency co-operation (ITF, 2019[2]). Despite significant improvements over time, Kazakhstan continues to underperform on customs and border procedures relative to OECD countries, which is reflected in the country’s performance in the OECD Trade Facilitation Indicators (TFI). Poor trade facilitation arrangements serve to increase the “distance penalties” that producers in Kazakhstan already face as a result of their location and the constraints imposed by physical infrastructure bottlenecks.

Firms continue to complain of cumbersome trade procedures and their inconsistent implementation. Over a third of survey respondents claimed that improvements to trade and customs regulation should be a government priority, while only 3% said that major progress had been made in this area over the past five years, despite Kazakhstan’s de jure improvement in this area. The gap between firm-level experience and the de jure framework for operations speaks to a persistent implementation gap, which undermines government ambitions to provide the private sector with greater clarity in international trade, and limits the effectiveness of measures aimed at improving the ability of the local private sector to be competitive abroad.

5.2.1. Kazakhstan’s performance in the OECD TFIs suggests indicates an improved trade facilitation framework in recent years

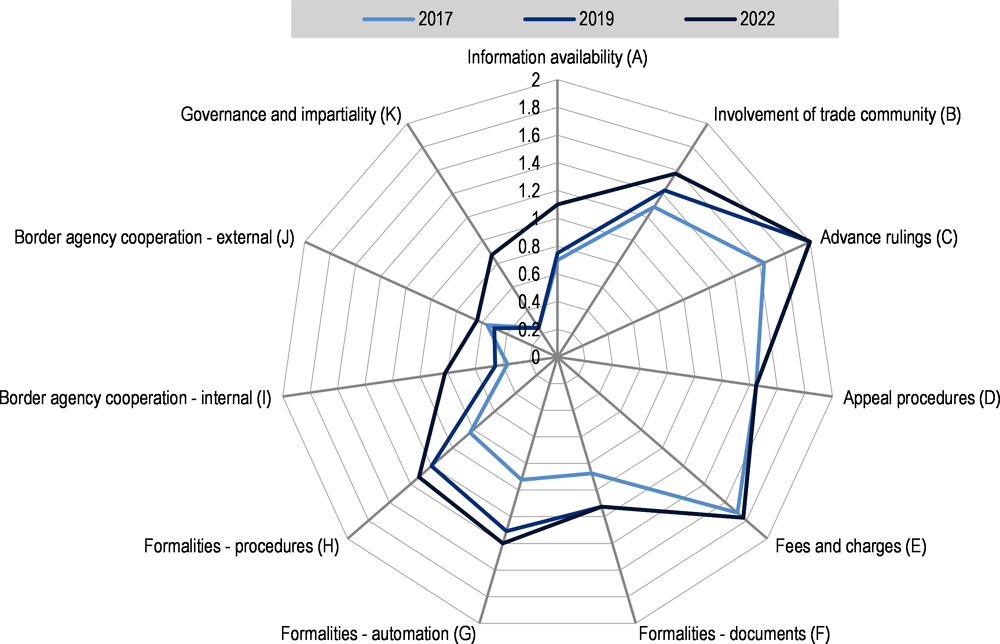

In the 2022 edition of the OECD TFIs, the OECD found that Kazakhstan had improved its performance in almost all areas covered by the indicators since the previous assessment in 2017. Particular progress was seen in improving the transparency and predictability of trade-related information, the streamlining of documentation requirements and processes, including an increased use of digital tools, and improving internal border agency co-operation (Figure 5.3)

Figure 5.3. Kazakhstan: Progress 2017-22 in the OECD TFIs

Improvements in the overall TFI indicators have been driven by changes in particular policy areas. The improvements to the availability of trade-related information result from the country making more information available on its trade agreements and appeal procedures, by improving the operation of its enquiry points, and publishing user manuals on new systems that have been implemented. Guidelines and procedures that govern public consultation processes have also been developed, and the government is increasingly looking to involve the trade community in the design and day-to-day operation of border-related policies and procedures, with drafts of new changes also increasingly made available before entering into force. Progress has also been made regarding the publication of rules applicable to advance rulings, the opportunity to receive an advance ruling, and the publication of advance rulings that are of a general interest.

As in other areas of public service delivery, the government has also made significant progress in using digitalisation to streamline documentation and process requirements. Since 2017, the authorities have increasingly accepted copies of trade-related documents rather than originals, and they have also reduced the number and complexity of the documents required for foreign trade. Much of this progress is attributable to increased use of automation tools, which has improved pre-arrival processing possibilities (the ability to lodge trade documents in advance in an electronic format, including through a digital single window).

Internal and external border co-operation was one of the major areas for improvement highlighted in earlier versions of the OECD TFIs as well as a 2021 OECD report (OECD, 2021[1]). Here too the government has made notable progress, due in part to increased levels of coordination and harmonisation of data requirements and documentary controls among agencies involved in the management of cross-border trade. This has been complemented by increased real time availability of relevant data among domestic agencies, and in setting a clear basis for the coordination of risk management systems implemented by various agencies, including the shared results of inspections and controls.

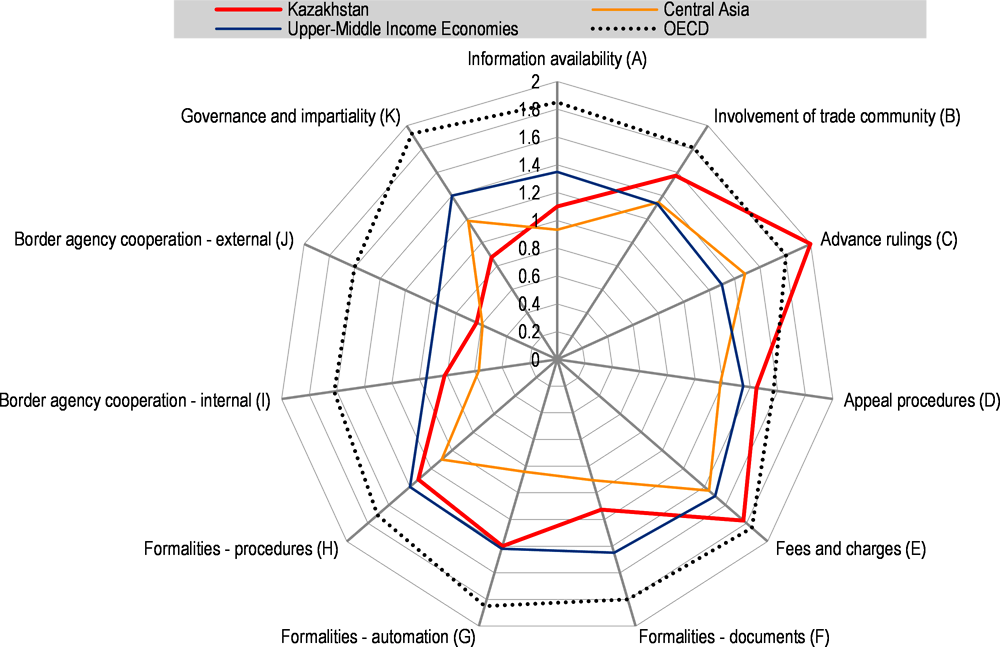

Figure 5.4. Kazakhstan: OECD TFI performance in global context

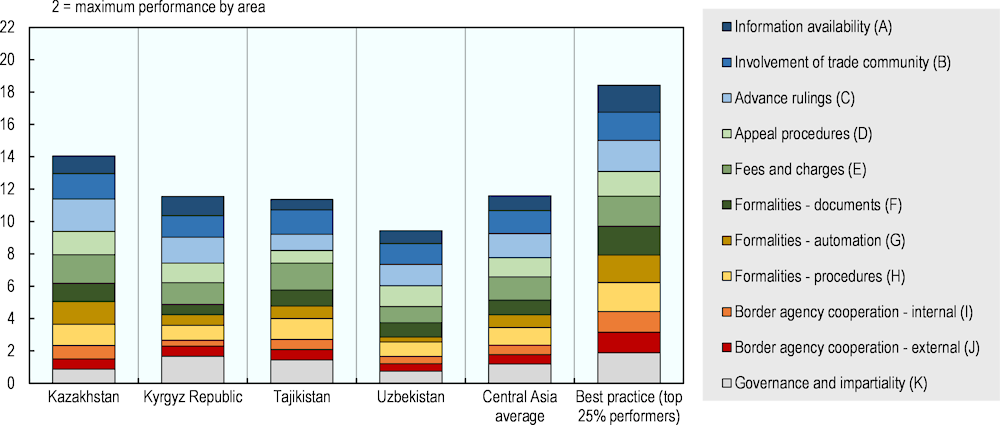

Kazakhstan’s performance in an international context demonstrates that the country still has significant scope to cut the cost of trade through additional customs reform and simplification. Nevertheless, while Kazakhstan performs relatively well in comparison to other upper-middle income countries, it continues to lag the OECD average in most areas covered by the indicators (Figure 5.4 . Kazakhstan is Central Asia’s top performer on each of the indicators with the exception of the governance and impartiality of customs procedures (Figure 5.5)

Figure 5.5. Kazakhstan: OECD TFI performance in a regional context

Internal co-operation of government agencies in customs-related procedures is a challenge throughout Central Asia. Better data-sharing and coordination of customs-related interventions and policies could significantly improve the management of border and customs agencies, reducing the cost for trading firms. The government should enhance internal agency co-operation by improving internal co-ordination across public institutions, particularly those that conduct inspections of goods and issue certificates or permissions (OECD, 2021[1]). Developing interconnected transit information systems with other countries in the region and harmonising customs documents and requirements would also support external border agency co-operation.

5.3. Kazakhstan’s private sector requires more reliable property rights protection and effective dispute resolution

A clear majority (55%) of survey respondents considered reforms to improve contract enforcement to be the number one reform priority for the government. Such reforms were also highlighted as one of the three priority areas for action by the OECD in 2021, with the Organisation placing an emphasis on the importance of the reliability of dispute settlement and contract enforcement, this reflecting firm-level feedback on the predictability of decisions relating to dispute resolution and property rights enforcement at that time (OECD, 2021[1]).

The government has made numerous efforts to improve the quality of contract enforcement. These efforts have been closely linked to the more transversal reform processes of reducing bureaucracy, addressing corruption and using digital technologies to improve efficiency and transparency in public service delivery. The progress in improving contract enforcement in many ways reflects reform progress in other policy areas. On the one hand, the legal and regulatory framework for contract enforcement and intellectual property protection is relatively strong, there are legal avenues for formal and alternative dispute resolution, and new institutions such as the Court of the Astana International Financial Centre (AIFC) have been established. On the other hand, respondent firms continue to raise concerns, particularly in terms of the predictability and impartiality of decisions.

The gap between the de facto experience of firms and the de jure provisions that ought protect them is a major point of concern. As with other policy areas that affect the private sector, the predictability of contract enforcement is a major determinant of a country’s investment attractiveness (North, 1990[4]) (La Porta et al., 1997[5]). While new institutions such as the AIFC can be a welcome addition to the legal framework conditions for business, there is a risk that such special centres become islands within the legal landscape. That a foreign firm can be assured of highly competent common law judges may well raise the attractiveness of Kazakhstan as an investment destination, but that attractiveness will be decidedly lessened if an investor perceives the legal landscape in which their potential suppliers and clients operate lacks the predictability offered to them.

5.3.1. The legal framework for contract enforcement and dispute settlement

Kazakhstan has a clear and well-developed legal framework for contract enforcement and dispute settlement. The legal framework for contract disputes is clearly set out in Article 27 of the Civil Code (CC) which stipulates that both foreign investors and domestic businesses can seek dispute settlement either in Kazakhstan’s courts or at international arbitration, with Kazakhstan’s courts required by law to enforce contractual arbitration clauses (Art. 501, 502, 503 CC) (Republic of Kazakhstan, 2005[6]), as well as arbitration awards. Kazakhstan is a signatory to the 1958 New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards.

Efforts in recent years have focused on the procedural efficiency of the court system, which has been significantly streamlined. The Astana City Court and the Supreme Court are the only courts in Kazakhstan that consider investment dispute cases, and the government has established a Specialised Judicial Board under the Supreme Court for disputes related to the performance of mutual obligations under investment contracts between large investors and government bodies (OECD, 2018[7]). The Board is composed of seven judges of the Supreme Court, specialised in investment-disputes, and it acts as a Court of first instance (International Tax and Investment Center, 2016[8]). In addition, the legality of a wide range of ADR mechanisms for disputes between two private parties has been codified in the Entrepreneurial Code and the Law on Mediation.

Predictable contract enforcement with public agencies is important for expanding the role of the private sector in public-private partnerships (PPPs) and procurement, areas that are critical for issues such as increasing the level of private and foreign investment in sustainable infrastructure. Unpredictable contract enforcement with public agencies is a key issue for the ability and willingness of firms to enter into public private partnerships and public procurement agreements with the government or other public bodies. The perception that the public entities are not upholding contractual commitments on account of pressures arising from domestic economic conditions may undermine business confidence and damage the government’s reputation as a reliable partner, reducing Kazakhstan’s attractiveness as an investment destination (OECD, 2021[1]).

Recent efforts under the Supreme Court’s “Seven Pillar Strategy” have been targeting this issue, by focusing on the quality of court decisions to raise both the quality and coherence of judgements, and the trust of businesses and citizens in the judicial bodies. As a first step, the Supreme Court has developed a decision template to guide the process of drafting judgements and increase its reliability. In addition, the reform also targets the skills and capacity of judicial staff through the development of a new system of judicial recruitment and oversight under the High Judicial Council. The focus is set on the selection and retention of competent judges, and enhanced training on drafting judgements in accordance with international standards.

As noted above, corruption is a transversal issue for the business community, and it applies to the judiciary as elsewhere. Concerns about judicial corruption and integrity continue to undermine business confidence. Some of the major issues in this regard are: judicial staff lacking employment security due to an absence of tenured positions and low remuneration; political supervision of court judgements by chiefs of courts or public prosecutors; and lack of automated case management (OECD, 2017[9]). Such problems may dissuade foreign investors from entering Kazakhstan, and may discourage domestic firms from pursuing dispute resolution through formal avenues.

The protection of intellectual property (IP) rights is an essential element of a good business climate and can play a key role in helping to attract investors with proprietary technologies. The legal framework for IP rights in Kazakhstan has improved greatly over time, notably through harmonisation of international best practices as part of Kazakhstan’s accession to the WTO and ratification of World Intellectual Property Organisation (WIPO) treaties.

Despite extensive legal provisions for guaranteeing IPR (the Civil Code, the Law on Patents, and the Law on Copyrights and Neighbouring Rights), enforcement proceeds through civil and criminal courts where judges lack specialised IPR knowledge. No designated public institution seems to be responsible for managing IPR disputes, nor is there evidence that public organisations that do have a role in IPR-related disputes have clearly defined responsibilities and functions.

5.3.2. Broadening the use of alternative dispute resolution

Kazakhstan has begun to develop a comprehensive legal framework for alternative dispute resolution (ADR), bringing the country closer to international best practices and legal standards. The Law on Arbitration, which governs dispute settlement for both domestic and international businesses, has brought national legislation in line with the United Nations Commission on International Trade Law (UNCITRAL) Model on International Commercial Arbitration, the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards, and the European Convention on International Commercial Arbitration. However, investors cite a number of shortcomings in the legal regulation for initiating and managing arbitration procedures, particularly as regards the impartiality of the necessary institutions and the transparency in their relations to the parties, be they public or private (OECD, 2021[1]). Since 2017, the Supreme Court has given priority to the development of ADR and mediation under the seven-pillar strategy, launching pilot court annexed and out-of-court mediation programmes in early 2019, complemented by outreach activities to increase the awareness of citizens on mediation (OECD, n.d.[10]).

The framework nevertheless requires further development, and there remain issues around the impartiality of ADR processes, particularly in public-private disputes. For the resolution of disputes between government organisations and local companies, government organisations need to obtain the consent of the relevant ministry. Given the high share of SOEs among medium and large enterprises, this requirement hinders arbitration processes (NCE "Atameken", 2019[11]). In the last Investment Policy Review of Kazakhstan, launched in 2017, the OECD noted that mediation, though foreseen in the legislation as a valid means of dispute resolution, was not at that point widely used (OECD, n.d.[10]). For investors to have clarity and certainty, it is imperative that the right to initiate arbitration proceedings is codified in the contract ex ante and not introduced when parties are already in dispute. At the same time, as in other CIS countries, the ability of the Supreme Court to overturn arbitration rulings on the pretext of malpractice “oversight” undermines the legal certainty of the process, reducing its appeal to international and domestic firms.

The government has created a business ombudsman, the Commissioner for Protection of the Rights of Entrepreneurs of Kazakhstan under the National Chamber of Entrepreneurs. This institution could play an important role in out-of-court dispute settlement (OECD, 2018[12]). It receives complaints from businesses about unfair treatment by government authorities, including instances of maladministration and unfair law enforcement, such as repetitive audits or inspections, unreasonable fines and penalties, or threats and acts of retaliation by officials. The Commissioner also sends recommendations to state bodies and can recommend prosecution of the relevant state authority. From 2016 to 2018, the Ombudsman received 17,053 appeals, 46% of which received full or partial outcomes (OECD, 2021[1]). The decreasing trend in the number of appeals is attributed to a positive dynamic of lower number of complaints submitted to the Ombudsman each year (NCE "Atameken", 2019[11]). However, it could also be attributable to a diminishing impact and of an initial backlog of complaints. Disputes are concentrated in such areas as land, tax, law enforcement, and public procurement, the rest being mainly related to administrative barriers, investments or loans (Ombudsman for the Protection of the Rights of Entrepreneurs of Kazakhstan, 2019[13]). Sixty percent of respondents to the survey assessed the creation of the Business Ombudsman as useful or very useful for foreign investors; however, 37% could not give an evaluation of such a measure.

However, general rule of law concerns remain, particularly regarding enforcement of international arbitration rulings in domestic courts (EBRD, 2015[14]; World Justice Project, 2019[15]; OECD, n.d.[10]). Despite a legal requirement to do so, enforcement problems have been known to arise. To support dispute resolution, the government has expanded ADR services. In what was a first in Central Asia, it established the Astana International Financial Centre to support international arbitration through an English-law governed International Arbitration Centre (IAC) for civil and commercial disputes. When asked about the effective measures implemented to assist foreign investors, 70% of respondents to the survey considered that the establishment of the AIFC was either useful or very useful. However, the IAC has so far been used too rarely to assess its effectiveness in handling disputes, having handled 1743 arbitration and mediation cases since its establishment in 2018 (IAC, 2023[16]). In addition, for the IAC to contribute to the creation of a wider arbitration culture in Kazakhstan, the government should ensure that best practices are shared with domestic courts and that investors and businesses routinely have sufficient certainty that local jurisdictions will enforce IAC awards.

References

[23] Council of Europe (2019), Action Document for EU-Central Asia Rule of Law Programme, https://rm.coe.int/ca-project-one-page-summary/16809fb95a.

[14] EBRD (2015), Business Environment and Enterprise Performance Survey (BEEPS) V: Kazakhstan, https://beeps-ebrd.com/wp-content/uploads/2015/09/kazakhstan.pdf.

[16] IAC (2023), International Arbitration Centre, AIFC, Astan, https://iac.aifc.kz/en.

[8] International Tax and Investment Center (2016), Kazakh Supreme Court Specialized Board on Investor Disputes, https://www.iticnet.org/blog/2016/01/07/kazakh-supreme-court-specialized-board-on-investor-disputes.

[2] ITF (2019), “Enhancing Connectivity and Freight in Central Asia”, International Transport Forum Policy Papers, No. 71, OECD Publishing, Paris, https://doi.org/10.1787/0492621a-en.

[5] La Porta, R. et al. (1997), Legal Determinants of External Finance, https://doi.org/10.1111/j.1540-6261.1997.tb02727.x.

[11] NCE "Atameken" (2019), National Report on Entrepreneurship in Kazakhstan.

[4] North, D. (1990), Institutions, Institutional Change, and Economic Performance, Cambridge University Press, https://doi.org/10.1017/CBO9780511808678.

[3] OECD (2023), OECD Trade Facilitation Indicators, Uzbekistan, OECD Publishing, Paris, https://www.oecd.org/trade/topics/trade-facilitation/.

[1] OECD (2021), Improving the Legal Environment for Business and Investment in Central Asia, OECD Publishing, Paris, https://www.oecd.org/eurasia/Improving-LEB-CA-ENG%2020%20April.pdf.

[17] OECD (2021), Improving the Legal Environment for Business and Investment in Central Asia, OECD Publishing, Paris, https://www.oecd.org/eurasia/Improving-LEB-CA-ENG%2020%20April.pdf.

[18] OECD (2021), Informality and COVID-19 in Eurasia: The Sudden Loss of a Social Buffer, OECD Eurasia Policy Insights, OECD Publishing, Paris, https://www.oecd.org/eurasia/COVID-19-informality-Eurasia.pdf.

[20] OECD (2021), OECD Skills Strategy Kazakhstan, OECD Skills Studies, OECD Publishing, Paris, https://www.oecd-ilibrary.org/docserver/39629b47-en.pdf?expires=1680001847&id=id&accname=ocid84004878&checksum=D3595A6C0999F042419701A870241E13.

[25] OECD (2020), OECD investment policy responses to COVID-19.

[26] OECD (2019), OECD Trade Facilitation Indicators, http://www.oecd.org/trade/topics/trade-facilitation/.

[7] OECD (2018), Reforming Kazakhstan: Progress, Challenges and Opportunities.

[12] OECD (2018), SME and Entrepreneurship Policy in Kazakhstan.

[9] OECD (2017), 4th round of monitoring of the Istanbul Anti-Corruption Action Plan: Kazakhstan.

[19] OECD (2017), Anti-Corruption Reforms in Kazakhstan: 4th Round of Monitoring of the Istanbul Anti-Corruption Action Plan, OECD Publishing, Paris, https://www.oecd.org/corruption/acn/OECD-ACN-Kazakhstan-Round-4-Monitoring-Report-ENG.pdf.

[10] OECD (n.d.), OECD Investment Policy Reviews, OECD Publishing, Paris, https://doi.org/10.1787/19900910.

[29] OECD (n.d.), OECD Policy Responses to Coronavirus (COVID-19), OECD Publishing, Paris, https://doi.org/10.1787/5b0fd8cd-en.

[30] OECD (n.d.), OECD Policy Responses to Coronavirus (COVID-19), OECD Publishing, Paris, https://doi.org/10.1787/5b0fd8cd-en.

[13] Ombudsman for the Protection of the Rights of Entrepreneurs of Kazakhstan (2019), Annual Report, https://ombudsmanbiz.kz/details/ndownload.php?fn=31&lang=rus.

[22] Republic of Kazakhstan (2015), Law on the High Judicial Council (No. 436-IV), https://www.venice.coe.int/webforms/documents/default.aspx?pdffile=CDL-REF(2018)050-e.

[6] Republic of Kazakhstan (2005), Civil Code of Kazakhstan, http://adilet.zan.kz/eng/docs/K940001000_.

[27] Transparency International (2018), Customs corruption in Kazakhstan: a trade mirror analysis, https://knowledgehub.transparency.org/product/customs-corruption-in-kazakhstan-a-trade-mirror-analysis.

[24] US Department of State (2019), 2019 Investment Climate: Kazakhstan, https://www.state.gov/reports/2019-investment-climate-statements/kazakhstan/.

[21] World Bank (2019), World Bank Indicators, https://data.worldbank.org/indicator.

[15] World Justice Project (2019), WJP Rule of Law Index, https://www.worldjusticeproject.org/rule-of-law-index/ (accessed on 8 July 2020).

[28] WTO (2023), Notification Requirements: Trade Facilitation Agreement, WTO, Geneva, https://notifications.wto.org/en/notification-requirements/trade-facilitation-agreement.

Notes

← 1. As elsewhere in this report, percentages relating to the survey include the 27 firm respondents and four organisational respondents (e.g., trade representation offices or business associations).

← 2. As part of the accession process to the World Trade Organisation (WTO), a country is required to make certain commitments in various areas to ensure compliance with WTO rules and regulations. These commitments are split across three categories (A, B and C). Commitments in Category A refer to the implementation of WTO provisions as soon as a country becomes a member; commitments in Category B refer to transitional periods that a country may require for implementing certain WTO provisions, allowing the acceding country time to make adjustments to domestic laws and regulations to ensure compliance; commitments in Category C relate to technical assistance and capacity-building measures, acknowledging that some acceding countries may require additional support and resources to implement WTO agreements (WTO, 2023[28]).