The global economy has been hit by Russia’s invasion of Ukraine. Global economic growth stalled in the second quarter of 2022, and indicators in many economies now point to an extended period of subdued growth.

The war has pushed up energy and food prices substantially, aggravating inflationary pressures at a time when the cost of living was already rising rapidly around the world.

Global growth is projected to slow from 3% in 2022 to 2¼ per cent in 2023, well below the pace foreseen prior to the war. In 2023, real global incomes could be around USD 2.8 trillion lower than expected a year ago (a shortfall of just over 2% of GDP in PPP terms).

Annual GDP growth is projected to slow sharply to ½ per cent in the United States in 2023, and ¼ per cent in the euro area, with risks of output declines in several European economies during the winter months. Growth in China is projected to drop to 3.2% this year, amidst COVID‑19 shutdowns and property market weakness, but policy support could help growth recover in 2023.

Inflation has become broad-based in many economies. Tighter monetary policy and easing supply bottlenecks should moderate inflation pressures next year, but elevated energy prices and higher labour costs are likely to slow the pace of decline.

Headline inflation is projected to ease from 8.2% in 2022 to 6½ per cent in 2023 in the G20 economies, and decline from 6.2% in the G20 advanced economies this year to 4% in 2023.

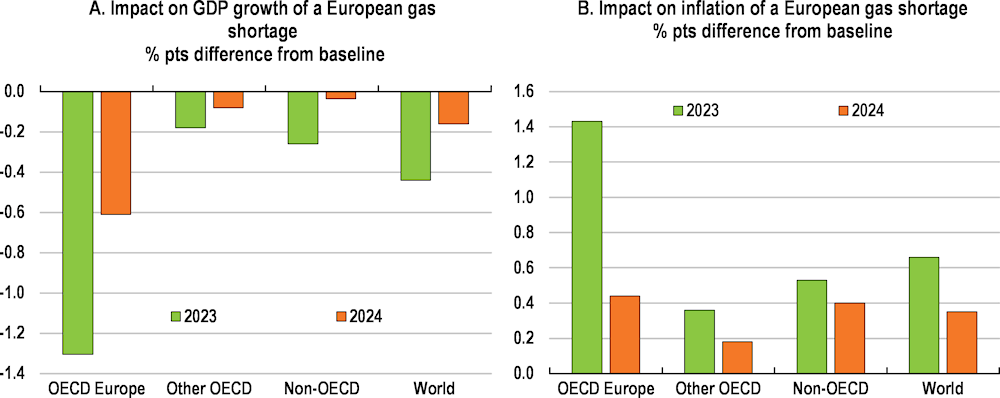

Significant uncertainty surrounds the projections. More severe fuel shortages, especially for gas, could reduce growth in Europe by a further 1¼ percentage points in 2023, with global growth lowered by ½ percentage point, and raise European inflation by over 1½ percentage points.

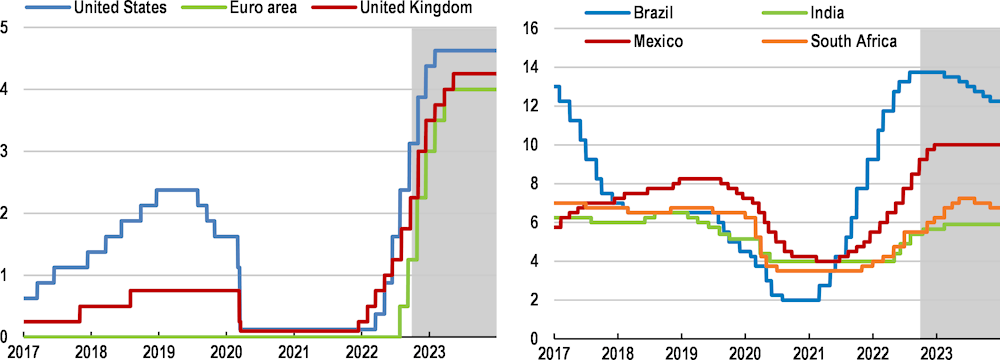

Further interest rate increases are needed in most major economies to anchor inflation expectations and ensure that inflation pressures are reduced durably.

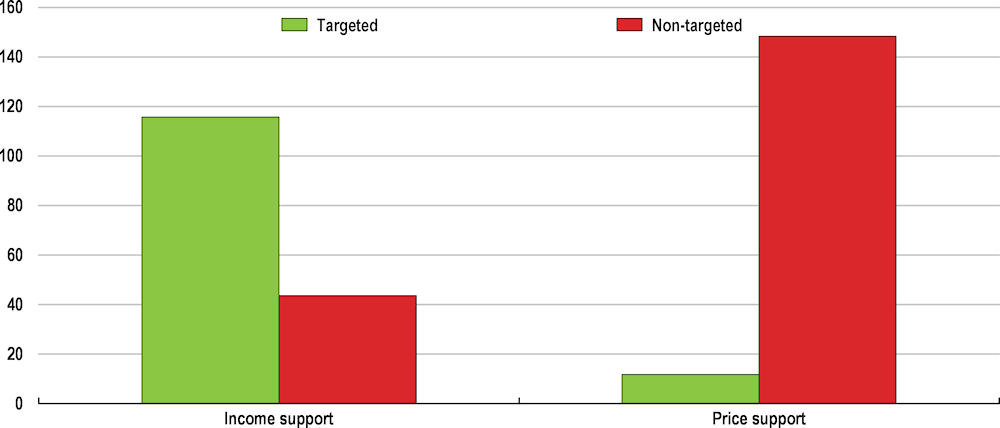

Fiscal support is needed to help cushion the impact of high energy costs on households and companies. However, this should be temporary, concentrated on the most vulnerable, preserve incentives to reduce energy consumption and be withdrawn as energy price pressures wane.

Short-term fiscal actions to cushion living standards should take into account the need to avoid a further persistent stimulus at a time of high inflation and ensure fiscal sustainability.

Governments need to ensure that the goals of energy security and climate change mitigation are aligned. Efforts to ensure near-term energy security and affordability through fiscal support, supply diversification and lower energy consumption should be accompanied by stronger policy measures to enhance investment in clean technologies and energy efficiency.

The fallout from the war remains a threat to global food security, particularly if combined with further extreme weather events resulting from climate change. International cooperation is needed to keep agricultural markets open, address emergency needs and strengthen supply.

OECD Economic Outlook, Interim Report September 2022

Summary

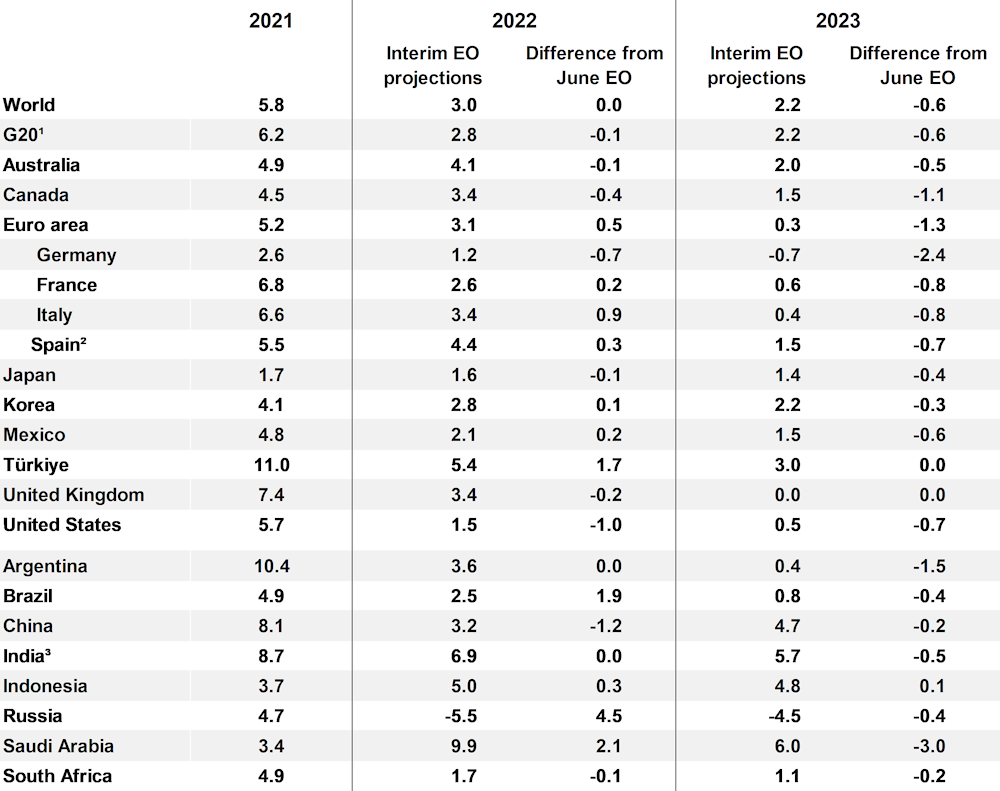

Table 1. OECD Interim Economic Outlook GDP projections September 2022

Real GDP growth, year-on-year, per cent

Note: Difference from June 2022 Economic Outlook in percentage points, based on rounded figures. World and G20 aggregates use moving nominal GDP weights at purchasing power parities. Based on information available up to September 22, 2022.

1. The European Union is a full member of the G20, but the G20 aggregate only includes countries that are also members in their own right.

2. Spain is a permanent invitee to the G20.

3. Fiscal years, starting in April.

Source: Interim Economic Outlook 112 database; and Economic Outlook 111 database.

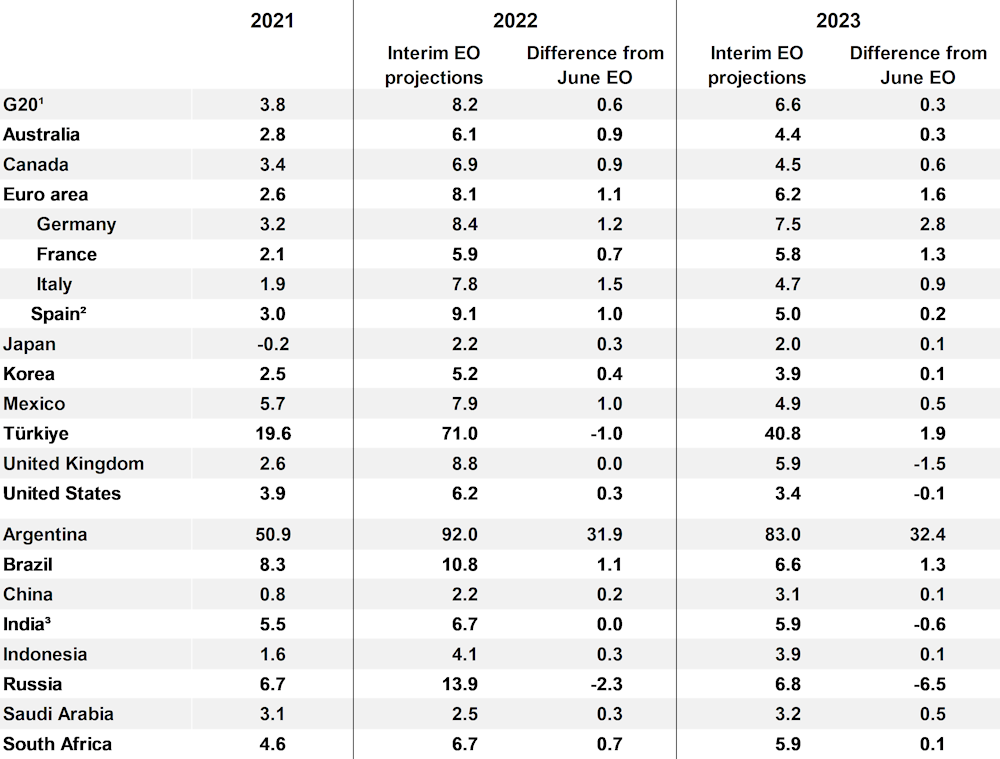

Table 2. OECD Interim Economic Outlook headline inflation projections September 2022

Headline inflation, per cent

Note: Difference from June 2022 Economic Outlook in percentage points, based on rounded figures. G20 aggregate uses moving nominal GDP weights at purchasing power parities. Based on information available up to September 22, 2022.

1. The European Union is a full member of the G20, but the G20 aggregate only includes countries that are also members in their own right.

2. Spain is a permanent invitee to the G20.

3. Fiscal years, starting in April.

Source: Interim Economic Outlook 112 database; and Economic Outlook 111 database.

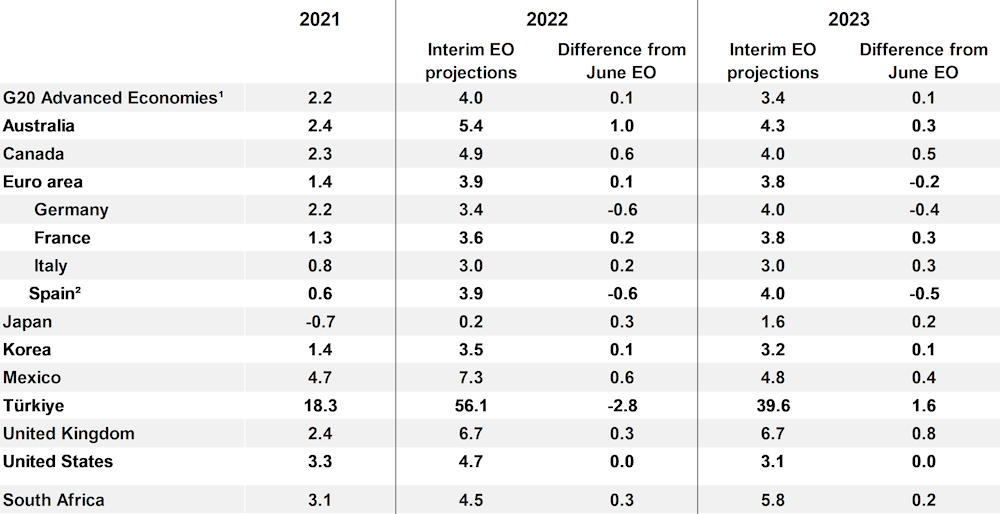

Table 3. OECD Interim Economic Outlook core inflation projections September 2022

Core inflation, per cent

Note: Difference from June 2022 Economic Outlook in percentage points, based on rounded figures. G20 advanced economies aggregate uses moving nominal GDP weights at purchasing power parities. Based on information available up to September 22, 2022.

1. The G20 advanced economies aggregate includes Australia, Canada, France, Germany, Italy, Japan, Korea, the United Kingdom and the United States.

2. Spain is a permanent invitee to the G20.

Source: Interim Economic Outlook 112 database; and Economic Outlook 111 database.

The recovery has slowed and inflation has continued to rise

A loss of economic momentum is visible globally, but especially in Europe

The global economy has lost momentum this year. After bouncing back strongly from the COVID‑19 pandemic, a return to a more normal economic situation appeared to be in prospect prior to Russia’s unprovoked, unjustifiable and illegal war of aggression against Ukraine. The effects of the war and the continuing impacts of COVID-19 outbreaks in some parts of the world have dented growth and put additional upward pressure on prices, above all for energy and food. Global GDP stagnated in the second quarter of 2022 and output declined in the G20 economies. While it is likely that growth in the third quarter has been positive, helped by a pick-up in China, a number of indicators have taken a turn for the worse, and the global growth outlook has darkened.

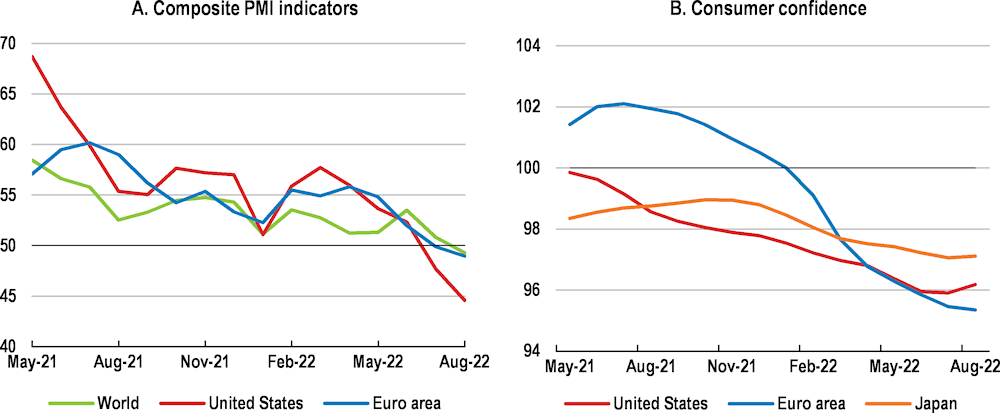

Survey-based indicators are particularly weak. Business survey indicators point to stagnating output in many economies (Figure 1, Panel A), while consumer confidence has fallen to strikingly low levels in most advanced economies (Figure 1, Panel B). The OECD Composite Leading Indicator for the OECD economies is also now at the lowest level since the global financial crisis, barring a brief drop at the beginning of the pandemic in the spring of 2020. With nominal wage growth failing to keep pace with inflation, household real disposable incomes have declined in many OECD economies, curbing private consumption growth.

Figure 1. Survey indicators point to a weakening of activity

Note: In Panel B, the series are standardised indicators with the long-run average equal to 100.

Source: OECD Main Economic Indicators database; S&P Global; and OECD calculations.

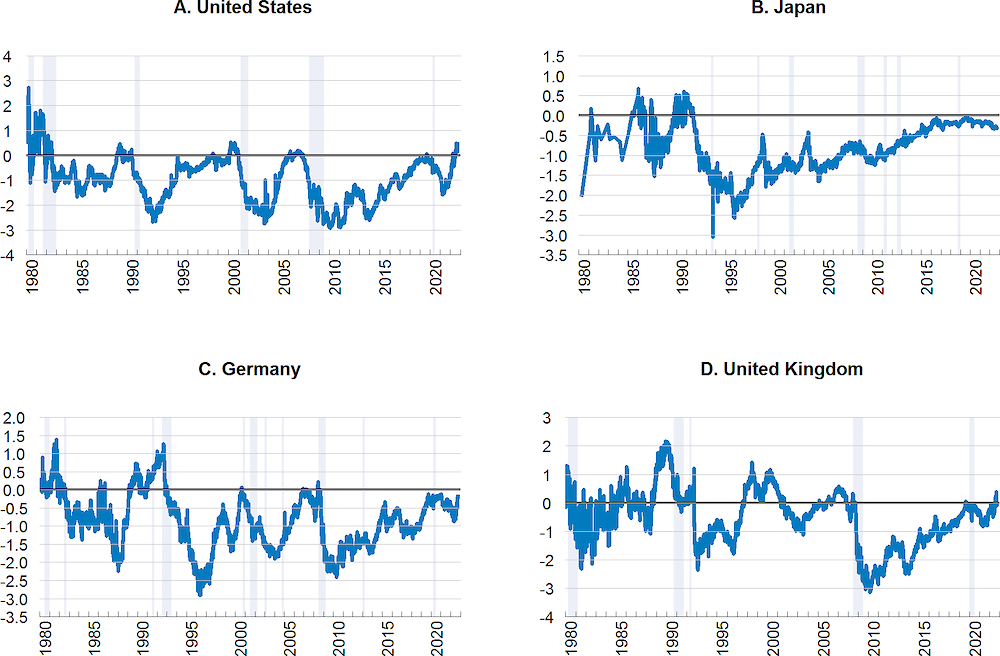

Financial conditions have tightened as central banks have responded increasingly vigorously to above‑target inflation, pushing up market-based measures of real interest rates. Equity markets in much of the world have fallen sharply this year, nominal bond yields have risen, the US dollar has appreciated significantly, and risk appetite has diminished. Corporate bond spreads have risen, particularly in Europe, and capital outflows from emerging-market economies have intensified. In the United States, the differential between ten-year and two-year government bond yields has turned negative, a phenomenon often followed in the past by cyclical downturns; yield curves have tilted in a similar way in some other advanced economies, especially the United Kingdom (Figure 2). Higher interest rates are also denting momentum in housing markets. Sales, mortgage lending and housing starts have turned down sharply in many countries, and prices are now falling on a month-on-month basis in some.

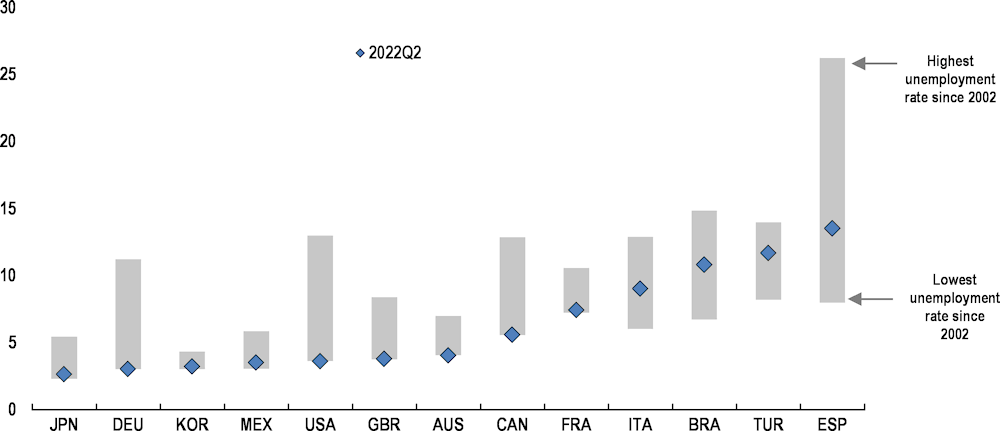

Labour market conditions are tight almost everywhere (Figure 3). In many OECD economies, unemployment rates are at their lowest levels of the past 20 years, while the ratio of jobseekers to vacancies remains historically low. Nonetheless, the pace of job growth in North America and Europe has slowed, vacancies have begun to decline in some countries, and the reduction in the unemployment rate appears to have bottomed out or even reversed in some countries.

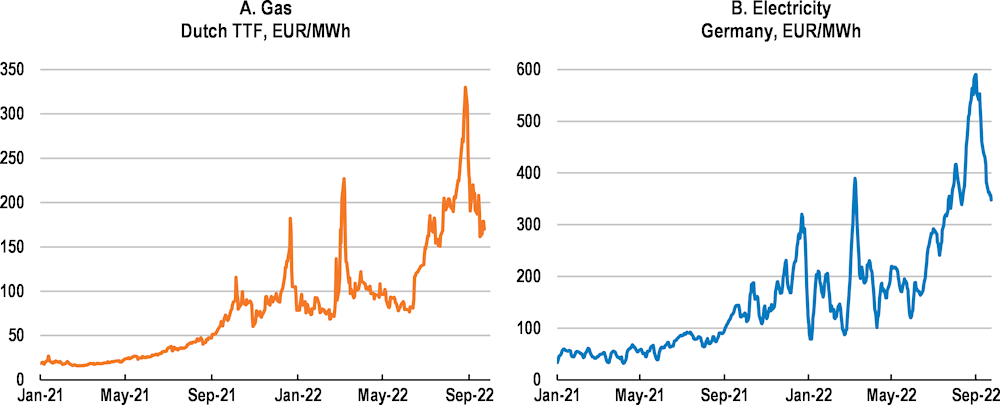

Energy prices have risen sharply, particularly for natural gas. Russia’s progressive reduction in gas flows to Europe this year has forced European economies to buy more liquefied natural gas (LNG) on spot markets, driving up LNG prices. Wholesale gas prices in Europe have surged (Figure 4, Panel A), and with wholesale electricity prices in Europe linked to gas (the marginal source of electricity generation), a similar electricity price spike has taken place (Figure 4, Panel B). Coal prices are also near record levels, as electricity generators and some industrial sectors substituted from gas to coal and oil. These phenomena have been most acute in Europe, but have affected prices in other regions as well, especially Asia.

Figure 2. Flat or inverted yield curves can signal cyclical recessions

Difference between 2-year and 10-year government bond yields, percentage points

Note: Recessions, marked by shaded areas, are defined as two consecutive quarters of negative GDP growth, except for the United States, where NBER business cycle dates are used.

Source: Refinitiv; NBER US Business Cycle Expansions and Contractions; OECD Interim Economic Outlook 112 database; and OECD calculations.

Figure 3. Labour markets remain tight in almost all OECD countries

Unemployment rate, per cent of labour force

Note: The shaded areas represent the highest and lowest unemployment rates since 2002.

Source: OECD Labour Market Statistics; and OECD calculations.

Figure 4. European gas and electricity prices have surged in recent months

Note: TTF Neutral Gas Price for Europe in Panel A. Rolling 7-day average of daily day-ahead wholesale electricity price in Panel B.

Source: Refinitiv; ENTSO-E; IEA Real-Time Electricity Tracker; and OECD calculations.

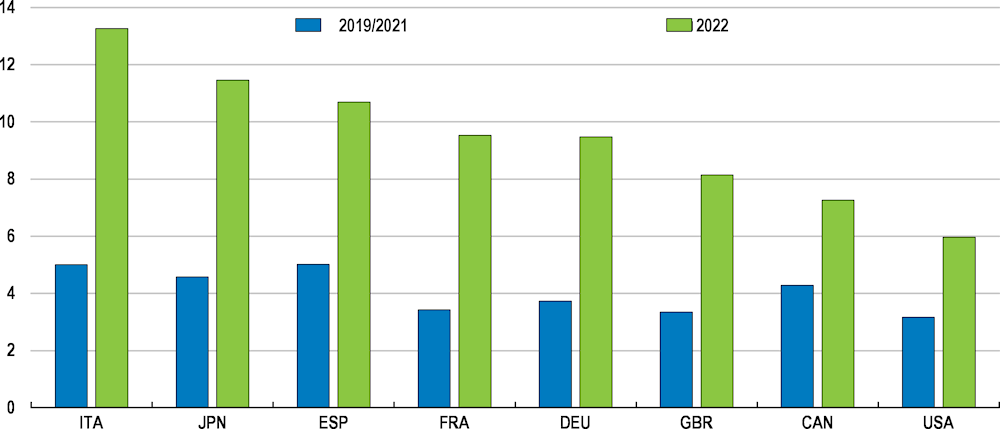

At current levels, gas prices in Europe have still more than tripled over the past year and are roughly ten times their average over 2010‑19. Together with elevated average oil, coal and electricity prices so far this year, illustrative calculations suggest that the ratio of economy‑wide expenditures on energy to GDP is likely to have risen significantly in many countries in 2022, especially in Europe (Figure 5). The world, and Europe in particular, is bearing the cost of the war in Ukraine, and many economies face a difficult winter.

Figure 5. High prices are pushing economy-wide energy expenditures up significantly this year

Energy expenditures, in per cent of GDP, total economy, selected OECD countries

Note: Illustrative estimates of 2022 expenditures on coal, oil, natural gas and electricity based on average consumption of 2019 and 2021 except for coal (2019 only), and proxies for average year-to-date energy prices in 2022. For coal, the price used corresponds to the Newcastle coal price; for oil, to Brent; for natural gas, to the TTF hub price for the European countries, the Henry Hub price for Canada and the United States, and the Asia LNG reference price for Japan; for electricity, it corresponds to the market spot price in each country.

Source: IEA; OECD Economic Outlook 111 database; EIA; JEPX; IESA; EPSIS; and Refinitiv.

High inflation is becoming entrenched

Even before Russia’s invasion of Ukraine, inflation was above central bank targets in most G20 economies, driven by the initial surge in energy prices as economies reopened after the pandemic, bottlenecks in supply chains, rising freight costs and the shift in the composition of private consumption towards goods. Food prices also increased strongly in many countries. The war in Ukraine has reinforced these price pressures. With fears of disruptions of the supply of commodities produced by Russia and Ukraine, prices of oil, gas, coal and industrial metals, as well as of wheat, corn and edible oils, all soared in March 2022, and fluctuated around higher levels over the next few months. Energy prices remain elevated, but agreements permitting some agricultural exports from Ukraine to resume have helped food prices move back down, and weaker demand from China has eased pressures on metals prices.

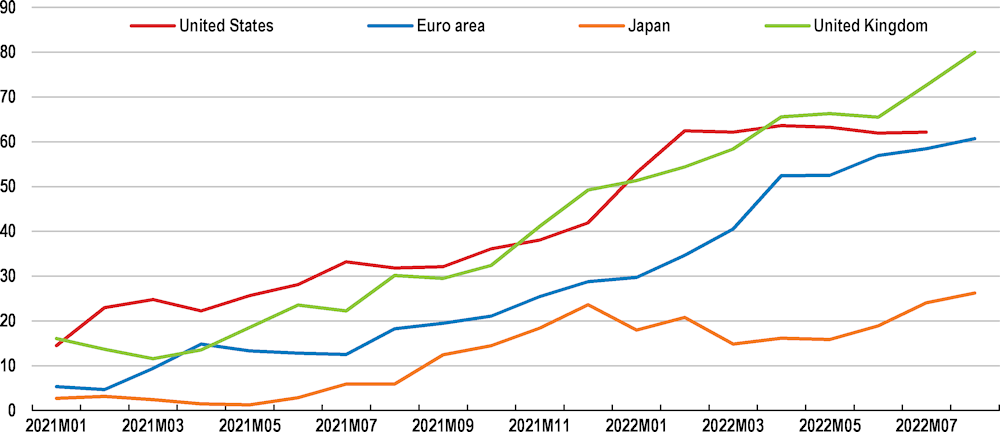

At the same time, inflationary pressures have become increasingly broad-based, with higher energy, transportation and other costs being passed through into prices (Figure 6). Wage and unit labour cost growth has strengthened in many countries, particularly the United States, Canada and the United Kingdom, putting upward pressure on a wide range of goods and services prices. There has yet to be strong evidence of an acceleration of nominal wages in the euro area, in part due to the relatively low incidence of automatic wage indexation but, with high headline inflation and a tight labour market, wage growth is likely to strengthen.

Figure 6. Inflation has become broad-based in most major advanced economies

Percentage share of products in the inflation basket that have a year-on-year inflation rate above 4%

Note: Headline inflation based on the personal consumption expenditures deflator in the United States, harmonised consumer prices in

the euro area and the United Kingdom, and national consumer prices in Japan.

Source: Bureau of Economic Analysis; Eurostat; Statistics Japan; Office of National Statistics; and OECD calculations.

Global growth is projected to weaken further in 2023 with inflation easing gradually

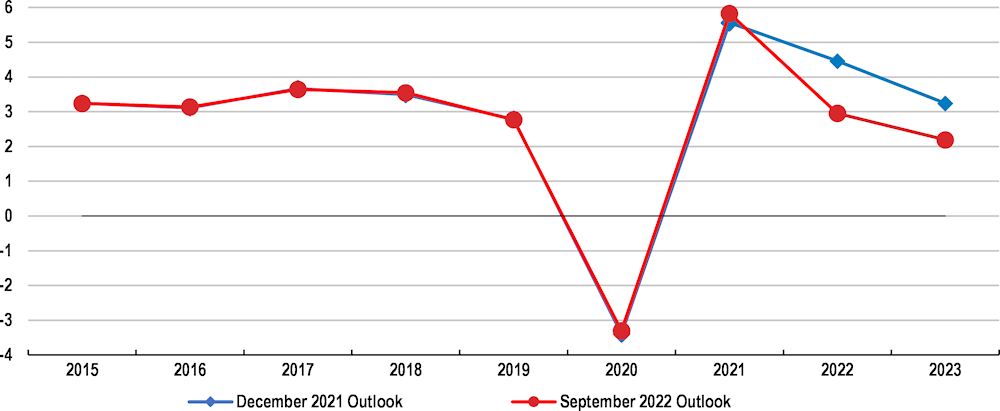

Global growth is projected to remain subdued in the second half of 2022 and ease further in 2023, resulting in annual average increases of just under 3% in 2022 and 2¼ per cent in 2023 (Figure 7). Relative to OECD projections made in December 2021, before the war in Ukraine, global output in 2023 is now projected to be some USD 2.8 trillion lower (in PPP terms and 2015 prices).

Figure 7. Global growth is significantly weaker than expected prior to the war in Ukraine

World GDP growth, per cent

Source: OECD Economic Outlook 110 database; and OECD Interim Economic Outlook 112 database.

One key factor slowing global growth is the ongoing generalised tightening of monetary policy in most major economies in response to the greater-than-expected overshoot of inflation targets over the past year. In addition, the erosion of real disposable household incomes, low consumer confidence and high prices for some energy products, especially natural gas in Europe, will negatively affect both private consumption and business investment.

GDP growth is projected to slow in both 2022 and 2023 in most G20 economies (Table 1). For the United States, annualised growth is projected to be well below potential, at around ½ per cent during the latter half of 2022 and through 2023. In Europe, many economies are likely to have at best weak growth in the second half of 2022 and the first quarter of 2023 before some improvement through the remainder of 2023. Near-term output declines are likely in some, including Germany, Italy, the United Kingdom and the aggregate euro area given the drag exerted by declining real incomes and the disruptions in energy markets. Japan, Korea and Australia have somewhat stronger growth momentum currently than Europe and the United States, but that is projected to wane over the coming quarters, in part due to softer external demand.

In China, policy measures worth up to 2% of GDP to strengthen infrastructure investment, and a rebound effect from COVID-related restrictions this year, are expected to help growth recover to 4¾ per cent in 2023 after unusually weak growth of 3.2% in 2022. Softer external demand is a factor in India’s projected slowdown from 8.7% annual growth in FY 2021-22 to around 7% in FY 2022-23 and around 5¾ per cent in FY 2023-24, but this still represents rapid growth in the context of a weak global economy. Indonesia is expected to experience a slowdown in the second part of the current year as higher inflation erodes the growth of private consumption, but GDP is projected to expand by around 5% in 2022 and 4¾ per cent in 2023. Output growth in Saudi Arabia has been buoyed by high energy prices, and while growth rates are projected to moderate over the forecast horizon, annual growth could be close to 10% in 2022 and 6% in 2023. Annual growth in 2023 in Argentina, Brazil, Mexico and South Africa, countries relatively exposed to the global economic cycle and demand in the advanced economies, is projected to slow to between ½-1½ per cent.

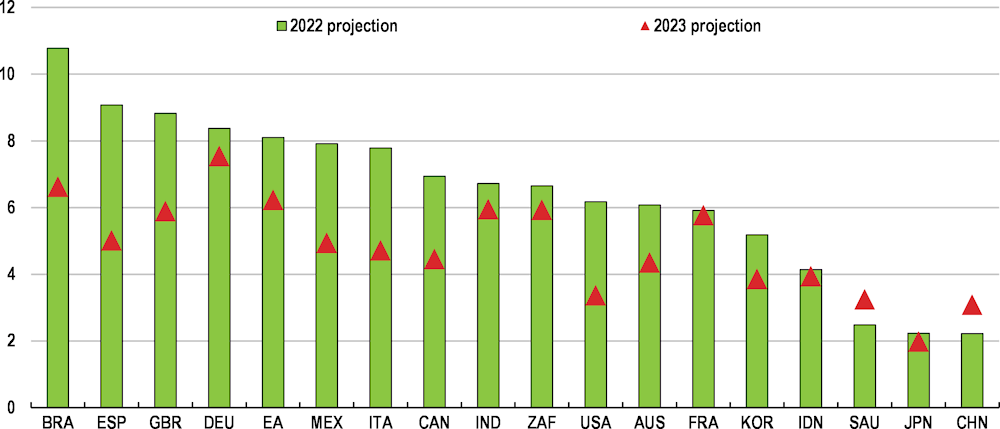

With the global economic cycle turning, energy price inflation subsiding and monetary tightening by most of the major central banks increasingly taking effect, consumer price inflation is expected to moderate gradually. Based on energy prices at the level observed in the first half of September, headline inflation is projected to peak in the current quarter in most major economies and to decline in the fourth quarter and throughout 2023 in most G20 countries (Table 2). Even so, annual inflation in 2023 will remain well above target almost everywhere (Figure 8).

Figure 8. Inflation is projected to fall slowly in 2023 but remain above target in many economies

Annual consumer price inflation, per cent

Note: Projections for India refer to fiscal years.

Source: OECD Interim Economic Outlook 112 database.

In the United States, where inflation may have now peaked and where the tightening of monetary policy began earlier than in most other large advanced economies, faster progress in bringing inflation back to target is expected than in the euro area or the United Kingdom. US core inflation (based on the private consumption deflator) is projected to average around 3% in 2023 (Table 3), and to be around 2¾ per cent by the end of the year. Inflation pressures in Japan have risen, but remain moderate compared to other advanced economies. Core inflation is projected to remain below 2% throughout this year and next, with the current jump in headline inflation slowly fading. By contrast, with the recent spike in energy costs working its way through the economy and with monetary policy tightening beginning later than in the United States, both headline and core inflation are projected to remain elevated in much of Europe. Headline inflation in the euro area is projected to peak at just over 9% and average 6¼ per cent in 2023. Core inflation in the euro area will remain more moderate, peaking at 4½ per cent around the end of 2022 and falling below 4% during the latter half of 2023. Similarly, headline inflation in the United Kingdom is projected to be around 10% in late 2022 before falling back gradually, with average annual inflation in 2023 of just under 6% on a headline basis and 6¾ per cent excluding food and energy.

The inflation outlook across the major emerging-market economies varies widely. China continues to have relatively low and stable inflation, despite the upward pressures coming from food and energy, but projected headline inflation in 2023 is somewhat higher than in the recent past, at around 3%. Headline inflation in the other major Asian emerging-market economies, India and Indonesia, is currently above the objective of the respective central banks, but monetary policy tightening and weaker global demand are projected to help bring inflation close to target by the end of 2023. In the largest Latin American economies, Brazil and Mexico, central banks have raised interest rates quite sharply already, and combined with an easing of energy price inflation this is expected to bring headline inflation down substantially in 2023. Argentina and Türkiye have had very high inflation rates for some time, and this is projected to continue in 2023, even if average annual headline inflation will be somewhat lower than in 2022.

The major risks to the projections are on the downside

The growth and inflation projections are sensitive to a number of key assumptions, including the absence of further waves of COVID-19 infections, no escalation or broadening of the war in Ukraine, and the gradual dissipation of the energy market pressures in Europe.

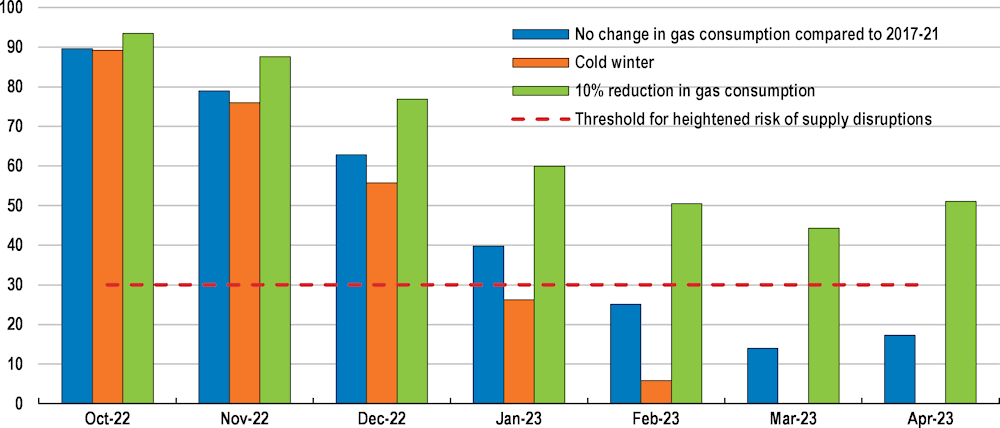

A key risk around the projections is that the ongoing and planned reductions in energy supplies from Russia to the EU prove much more disruptive than assumed in the baseline projections. Gas and electricity prices are already elevated and could jump further in the event of shortages emerging in Europe. Such shortages could occur if additional non-Russian supplies from outside the EU fail to materialise to the extent expected, or if the demand for gas is exceptionally high due to a cold winter. EU gas storage levels have been raised considerably through the course of this year, and are now between 80‑90% on average in most member states. Even at this level, there may not be sufficient storage to ensure that demand in a typical winter can be met without storage levels in the European gas market being pushed below effective operational levels (Figure 9). A cold winter could raise shortfalls significantly further unless additional gas supplies could be obtained in the near term, which would inevitably require substantially higher prices.

Additional supplies, diversification of supply sources and sizeable demand reduction measures are thus required to minimise the risk of supply disruptions. Such reductions could hit many businesses, and potentially households. Several manufacturing sectors are especially exposed to gas supply reductions, particularly metals manufacturers, although the extent of exposure varies considerably across European economies (Figure 10). Even if the European economies do succeed in obtaining significant additional supplies, there will still be global costs, given the associated upward pressure on gas prices around the world and reductions in the supplies available for other countries.

Figure 9. Demand reductions are required to avoid excessively low EU gas storage levels

Scenarios for European gas storage levels, per cent of available storage

Note: Illustrative scenarios for the European gas market based on the assumptions of 90% EU storage levels at the end of September; no further gas imports from Russia, imports from other sources of 30 bcm/month, and domestic production in the EU and the United Kingdom at average 2019-2021 levels. The “No change” scenario assumes monthly consumption in the EU and the United Kingdom at the average levels observed between 2017 and 2021 in the corresponding month. The “Cold winter” scenario assumes consumption at the maximum levels observed in the corresponding months between 2017 and 2021. The ‘10% change in gas demand’ scenario reduces monthly consumption in the ‘No change’ scenario by 10%. A heightened risk of gas supply disruptions is assumed to occur if gas storage levels fall below 30%.

Source: Bruegel; ENTSO-G; Eurostat; IEA; ONS; and OECD calculations.

Figure 10. An enforced reduction in gas usage could hit some European sectors significantly

Per cent reduction in total energy supply

Note: Illustrative decline in total sectoral energy supply in event of a 10% reduction in gas usage and a 10% reduction in the use of gas for electricity. Calculations based on the pattern of energy use in 2020. The figure shows the median sector impact across all EU economies plus the United Kingdom and the upper and lower quartile thresholds.

Source: IEA World Energy Balances database; Eurostat; and OECD calculations.

Illustrative simulations, using the NiGEM global macroeconomic model, highlight the potential hit to growth and additional inflation that could arise from gas shortages in the European economies. Shortages are assumed to push up global energy prices, hit confidence and financial conditions and require a temporary period of enforced reductions in gas use by businesses.

In this scenario, global gas prices are assumed to rise by 50% from the first quarter of 2023, reflecting the pressures in global gas markets from European economies attempting to source additional supply. Higher gas prices are expected to push up fertiliser prices, which are assumed to rise by 25%, and increased demand for energy supplies is expected to spill over into oil markets, with oil prices assumed to rise by 10%. These shocks are assumed to last for at least one calendar year before fading away.

Given the greater uncertainty that is likely to accompany energy supply disruptions, additional effects are likely to arise in the EU economies and the United Kingdom from a decline in confidence and higher financing costs for companies. These effects are modelled by an ex-ante increase of 1 percentage point in the household saving rate and a 1 percentage point rise in the user cost of capital.

A temporary period of enforced reductions in business gas usage in early 2023, a negative supply shock, is modelled as a 3% decline in potential output in all EU economies (and the United Kingdom) in the first quarter of 2023 via a combination of reduced technical efficiency and a fall in average hours worked. The decline in output is proportional to the decline in total energy supply for the business sector in the typical economy in event of an enforced reduction of 10% in gas usage. This shock is assumed to fade gradually through the course of 2023.

Monetary policy reacts to the upturn in inflation in this scenario, with policy interest rates initially raised before returning towards baseline as inflationary pressures subside. The automatic fiscal stabilisers provide some help in moderating the impact of the shock, but additional discretionary measures would be needed to fully cushion household incomes

Taken together, the shocks could reduce growth in the European economies by over 1¼ percentage point in 2023, relative to baseline, and raise inflation by over 1½ percentage point (Figure 11). This would push many countries into a full-year recession in 2023. Growth would also be weakened in 2024. Real household disposable incomes would be hit further, reflecting the drag exerted by higher prices and the decline in hours worked, and business investment would also be severely affected. Outside Europe, the impact of the shocks would be smaller, but there would still be adverse impacts from higher inflation on real incomes (except in gas‑producing economies) and weaker demand from Europe. For the world as a whole, inflation is pushed up by over ½ percentage point in 2023, with growth reduced by just under ½ percentage point.

A related risk is that the impact of Western sanctions against Russian oil exports, which is incorporated in the baseline projections, could also prove more disruptive than anticipated. At recent levels of supply, around 2 million barrels per day of Russian crude and refined oil exports to the EU are likely to cease once the EU sanctions on seaborne oil supplies from Russia take effect. If the result is the temporary withdrawal from global markets of this supply (close to 2% of global supply) due to difficulties in transporting it to alternative markets, international prices for some products could be much higher than assumed in the baseline projections. The forthcoming EU ban on the provision of maritime insurance for Russian oil shipments to non-EU destinations raises the chances of such disruptions. In addition, shortages of particular types of fuels previously supplied by Russia could emerge this winter, causing significant economic difficulties. This could be the case, for example, for diesel in some parts of Europe. These factors increase the risk that the costs of the war for the global economy could be even higher than assumed in the baseline. For instance, an additional 20% increase in global oil prices for one year, with a spike at the start of 2023 that subsequently fades, could add a further 0.6 percentage point to global consumer price inflation in 2023 and reduce global growth by between 0.1-0.2 percentage points.

Figure 11. Gas shortages in Europe would hit growth and raise inflation

Note: Illustrative scenario of the impact of gas shortages in Europe following the end of imports of gas from Russia. See text for details of the shocks considered.

Source: OECD calculations using the NiGEM macroeconomic model.

Other key risks to the outlook are the uncertain evolution of food prices and the risks associated with high debt and the weak property sector in China.

The impact to date of the war in Ukraine, together with a succession of extreme weather events this year, have left markets for some foodstuffs vulnerable to further shocks. The sharp rise in fertiliser prices this year may have a negative impact on harvests next year and food security, especially in emerging-market and developing countries. With extreme weather events becoming increasingly frequent and severe owing to climate change, and droughts in Europe and China, there is a clear risk of further spikes in food prices that would place additional upward pressure on inflation and increase poverty and hunger.

China faces significant challenges in dealing with its ongoing real estate downturn amidst elevated levels of corporate debt. If successful, solid economic growth can resume, as projected in the final part of 2022 and into 2023. However, risks remain of a sustained downturn driven by significantly weaker private domestic demand. This would be associated with much slower global growth, but would also push down the prices of energy and other commodities.

Policy requirements

Elevated uncertainty, slowing growth, strong inflationary pressures and the ongoing impact of the war in Ukraine on energy markets leave policymakers facing difficult choices. Continued monetary policy tightening is needed to lower inflation durably. Domestic policy measures will need to be carefully calibrated given uncertainty about the growth outlook, the speed at which higher interest rates take effect and the potential spillovers from restrictive policy in other countries. Temporary fiscal measures are appropriately being used to cushion the immediate impact of higher food and energy costs for consumers and businesses, but these should be balanced against the need to lower energy consumption, limit further demand stimulus at a time of high inflation and ensure debt sustainability. Policy choices should also ensure that efforts to strengthen energy security do not hamper the need to hasten the green transition. Effective and well-targeted reform efforts are required to enhance productivity, reduce inequality, strengthen resilience and boost living standards. Well-chosen policies, such as increased support for childcare and reduced tax wedges for lower paid workers, could help to address the current pressures faced by lower-income households and offer medium-term benefits for employment and inclusion.

Additional monetary policy tightening is required to lower inflation

Interest rates have been raised sharply by most major central banks in recent months, with policy choices becoming increasingly contingent on current developments. In a number of countries, including the United States, financial conditions are also being tightened due to ongoing reductions in central bank balance sheets. Broadening price pressures throughout the economy have led to more forceful policy rate rises than suggested by earlier forward guidance to minimise the risks of high inflation becoming entrenched in inflation expectations and feeding through into wage growth in historically‑tight labour markets. Delaying action would have heightened the risk of even more forceful measures eventually being required to bring inflation down. The differential between domestic and US policy rates is also becoming an important policy consideration in those economies in which price pressures are being pushed up by sizeable bilateral currency depreciations against the US dollar over the past few months.

Further policy rate increases are needed in most major advanced economies to ensure that forward-looking measures of real interest rates become positive and inflation pressures are reduced durably. This is likely to involve a period of below-trend growth to help lower resource pressures. Policy interest rates are projected to rise to 4½-4¾ per cent in the United States, 4½ per cent in Canada, and 4¼ per cent in the United Kingdom in 2023, reflecting the visible labour market pressures in these countries, and 3.6% in Australia (Figure 12). In the euro area, the ECB is facing a challenging environment given the very uncertain outlook but increasingly widespread inflationary pressures. The main refinancing rate is projected to rise to 4% in 2023, with use being made of all margins of flexibility when reinvesting the proceeds of maturing bonds on the ECB balance sheet to limit financial fragmentation in the euro area. In Japan, where underlying price pressures remain mild, the Bank of Japan is projected to maintain its current policy stance focused on yield curve control, with policy rates remaining unchanged.

Figure 12. Further monetary policy tightening is needed in many economies

Policy interest rates, end of period, per cent

Source: OECD Interim Economic Outlook 112 database.

Tighter global financial conditions and persistent inflation pressures are also likely to require further monetary policy tightening in many major emerging‑market economies, and limit the scope for any easing in countries where growth is slowing and interest rates have already been raised substantially. Food, fertiliser and energy prices are all elevated, have a sizeable weight in national inflation measures, and a significant impact on inflation expectations. Reserve requirement ratios and benchmark interest rates have recently been reduced in China to address the slowdown in growth, but little further monetary policy easing is projected.

The calibration of monetary policy tightening is particularly challenging given uncertainty about the outlook, the balance of the different channels through which higher interest rates impact the economy, and the potential spillovers from tightening in other countries. In many economies it is two decades since a sustained policy tightening last occurred. Higher debt levels, elevated asset prices, changes in the flexibility of product and labour markets, financial innovation and the increased importance of non-bank credit provision, and greater trade and financial openness may all increase the pace at which policy rate changes feed through, particularly with widespread tightening throughout most of the world. Careful monitoring will be required to guard against the risk that policy rates could be tightened excessively, or for longer than necessary to bring down inflation.

Fiscal policy support measures to address the energy crisis should be timely and temporary

The war in Ukraine and soaring energy prices have led to a reconsideration of near‑term budgetary objectives, despite the higher debt accumulated during the pandemic, rising bond yields and longer-term spending pressures. New fiscal measures have been implemented to shield households and companies from surging energy and food prices in almost all countries. Several large European countries have already announced successive support packages that cumulatively amount to 2% of GDP, or more, with most likely to continue support measures well into 2023 at least. Additional support measures for next year have already been announced in Germany, France and the United Kingdom, and the projections assume that current measures are extended in Italy, Japan and Spain. The overall impact of these policies on debt is uncertain, with higher-than-expected revenue gains due to rising inflation, and – in some countries - windfall taxes on the exceptional profits of some energy producers and suppliers appropriately helping to offset the overall budgetary cost. The proposed EU-level cap on the prices paid to lower‑cost electricity producers (renewables and nuclear) and a possible additional tax on the windfall profits of fossil fuel producers could provide some additional resources for countries who do not currently impose such levies, but is not incorporated in the projections. In the United States, fiscal tightening is projected to continue into 2023.

Short-term actions to cushion living standards need to be balanced against the need to avoid a further persistent stimulus at a time of high inflation, which would require monetary policy to be tighter for longer than otherwise and raise debt service costs, and the need to ensure fiscal sustainability. Credible fiscal frameworks would help to provide clear guidance about the medium-term trajectory of the public finances and mitigate concerns about debt sustainability. A careful reassessment of the composition of public expenditure and taxation would also help to preserve investment to enhance infrastructure and energy security whilst fiscal buffers are rebuilt.

Fiscal policy action to help cushion the impact of higher energy prices should ideally be well targeted on the most vulnerable, not outlast the period of exceptional price pressures and preserve incentives to reduce energy consumption. Additional means-tested transfers to households while high prices persist generally meet these criteria, though are more administratively complex and potentially less timely than less well‑targeted measures that cap energy prices or reduce indirect taxes on energy. The latter measures also damp short-run inflationary pressures, but typically involve larger fiscal costs (Figure 13). In Europe, the exceptional surge in gas and electricity prices seen since mid-2022 has temporarily shifted the balance towards more broad-based but costly support via price caps for consumers and businesses, particularly SMEs. Careful design of these different policies is necessary to ensure that consumers and businesses clearly face a higher relative price of energy, and to avoid hampering reallocation by preserving energy-intensive activities that are not sustainable in the medium term. Governments also need to keep in mind the risk that the energy crisis could continue for several years.

Slow global growth, rising debt levels, higher interest rates and a strong US dollar limit the room for fiscal policy manoeuvre in many emerging-market economies, especially ones with high levels of foreign-currency-denominated debt or fiscal deficits considerably above pre-pandemic levels. Commodity-exporting countries have some scope to use windfall revenues to support vulnerable citizens, but many also need to continue to take action to restore sound public finances. A rising number of lower‑income developing countries are already experiencing debt distress, with a few having already defaulted, and the risk of contagion means that even economies with relatively low debt levels may come under increased pressure. Stronger international co-operation on debt relief, including through the G20, is necessary to minimise the potential adverse economic and social consequences of default.

Governments should promote climate change mitigation and longer-term resilience as well as short-term energy security

The Russian invasion of Ukraine has brought a heightened awareness of the link between energy policy and security, with many OECD countries still heavily reliant on fossil fuel energy and supply from Russia. There may be tensions, especially in Europe, between the immediate imperative of adjusting to the gas supply crunch created by Russia and the need to hasten the transition to net zero emissions by 2050. The extreme swings in European gas prices have, for example, triggered some gas-to-coal and gas-to-oil switching, which supports near-term supply but is unhelpful from the perspective of the net-zero transition. Policy action needs to make sure that the goals of energy security and climate change mitigation are aligned. Accelerating the transition away from fossil fuels represents the best way of responding to the reduction in energy supply from Russia.

Figure 13. Fiscal measures to offset energy costs have been poorly targeted

Billion USD

Note: Estimated expenditures incurred between October 2021 and December 2022, covering 32 OECD countries and 3 non-OECD countries. Loans, guarantees and capital transfers that do not immediately add to general government net lending are not included. Measures classified as income support are those that provide lump-sum transfers to energy consumers, i.e., households or businesses, to help alleviate energy cost increases. Price support includes all measures that reduce the post-tax energy price such as price controls, reduced electricity charges and network fees, VAT and excise tax reductions, and compensation to distributors for selling energy products at reduced prices. Measures classified as targeted are ones provided to specific groups, such as vulnerable households or businesses. Non-targeted measures apply to all consumers with no eligibility conditions. Based on data as of September 2022.

Source: OECD calculations.

Building on the momentum established by initiatives such as REPowerEU in the European Union and the US Inflation Reduction Act, governments should pursue a range of policies to promote both energy security and the green transition. This will require a variety of different policy instruments – price-based, non-price regulation and public investment – the relative importance of which will differ across countries depending on their initial circumstances. IEA estimates suggest that global investment in clean energy and energy infrastructure will need to more than triple by 2030 in order to ensure the world is on a credible path to zero net emissions by 2050. Meeting that objective is likely to require long-term carbon pricing trajectories to render such investments more viable. A clear policy framework combining price signals and regulatory and fiscal tools is therefore necessary.

Closer international cooperation is needed for both near-term energy security and an effective approach to climate change. Within Europe there is an urgent need to co-ordinate on supply diversification and the reduction in energy consumption, improve gas and electricity interconnections and reinforce solidarity among EU members to prevent energy hardship this winter in the Northern hemisphere countries most affected by the disruption of energy imports from Russia. More broadly, greater cross-border co-operation on climate policies, including carbon pricing, would help mitigate leakage, lower the cost of emission reductions and improve worldwide access to low‑emission technologies.