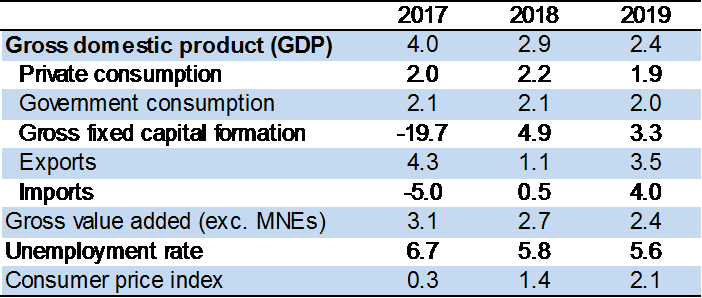

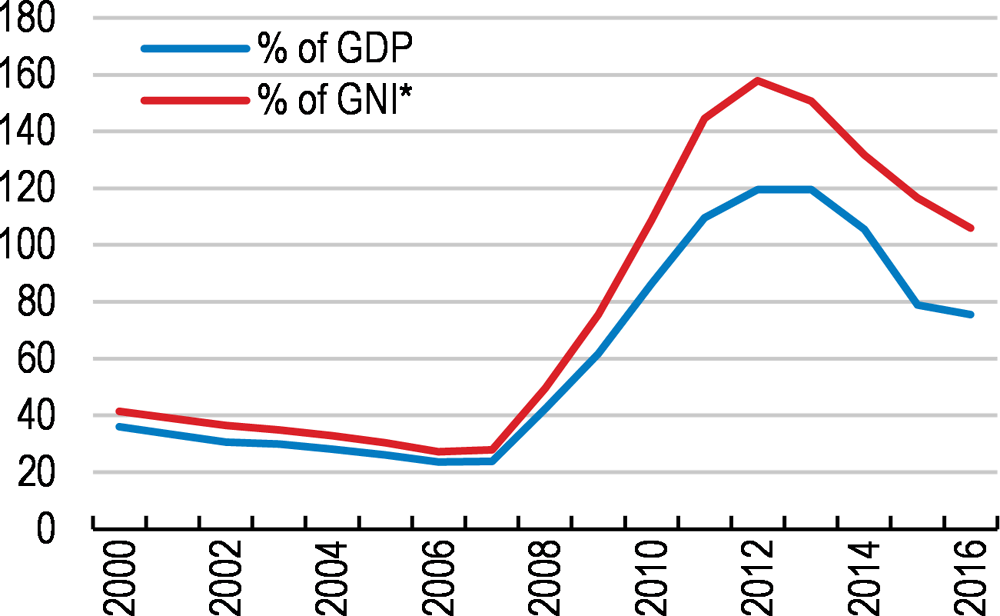

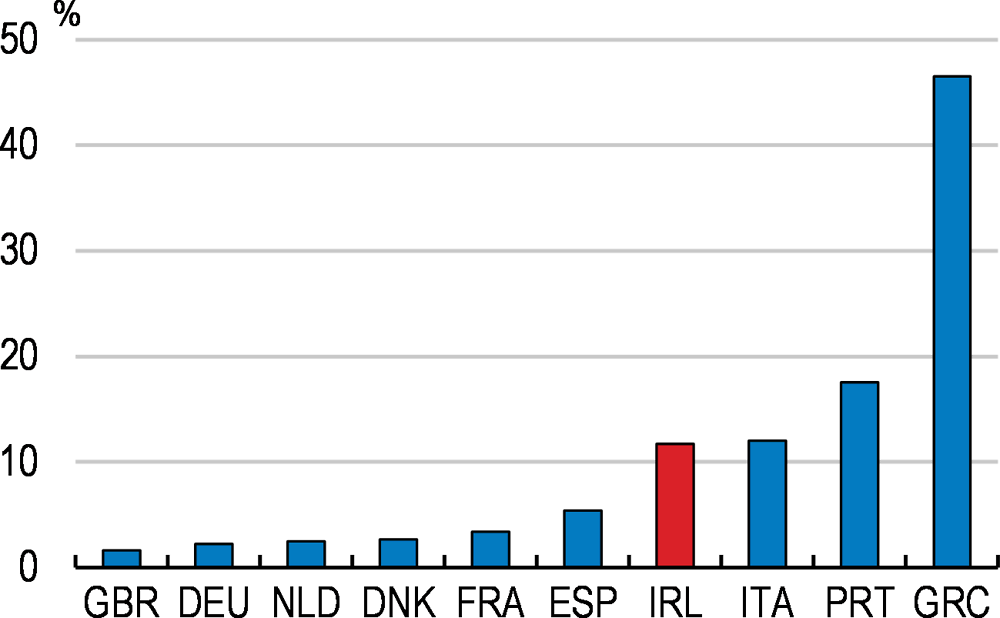

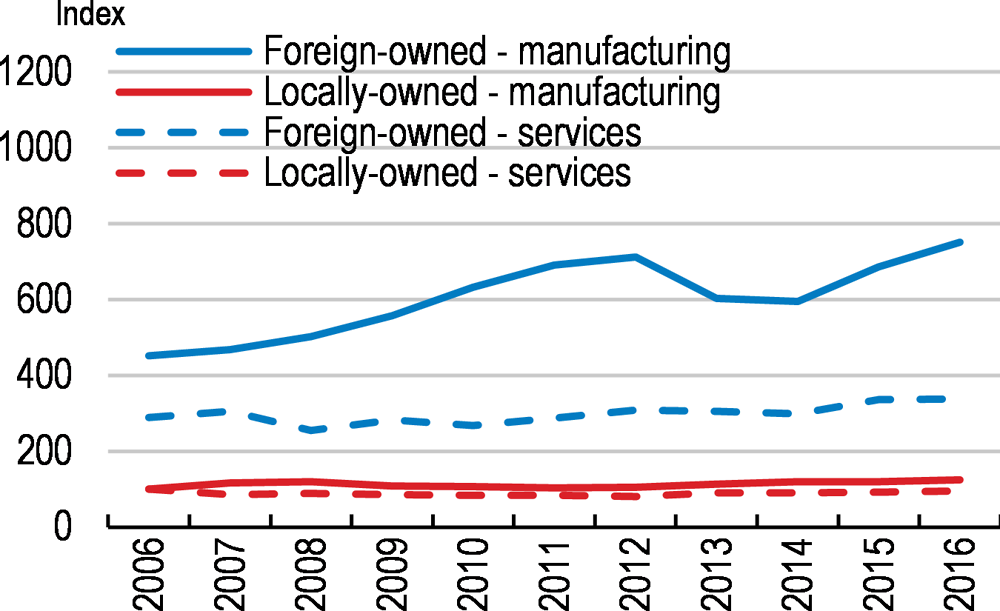

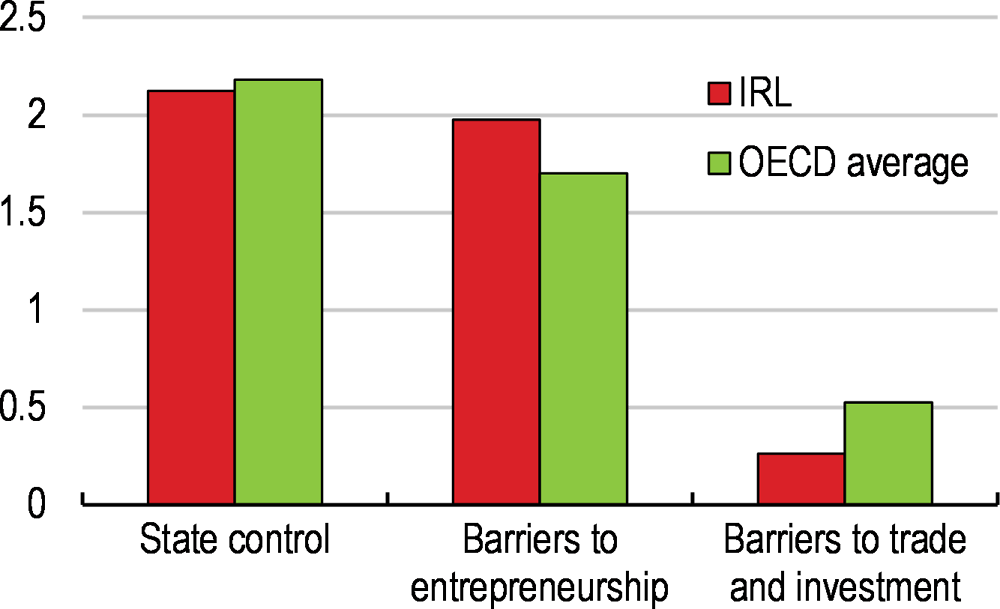

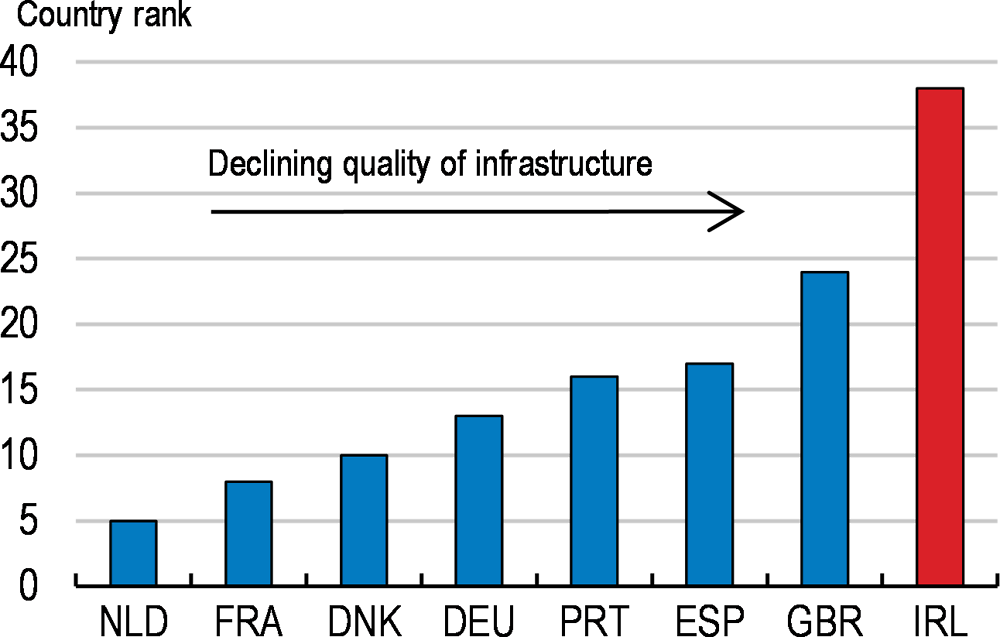

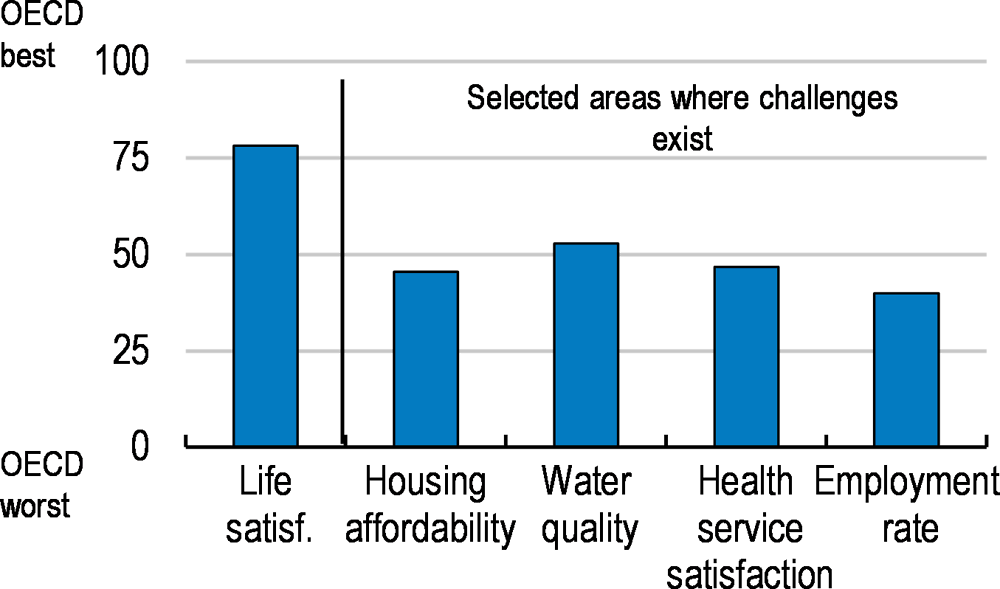

Living standards are high in Ireland, with recent improvements underpinned by the strongest post-crisis output recovery in the OECD. The economy is projected to continue expanding over the next two years, albeit at a more sustainable pace and amid heightened economic uncertainty primarily relating to the future trading relationship with the United Kingdom. Greater uncertainty makes it vital to further improve the fiscal position, which could be partly achieved by broadening the tax base and raising the property tax yield. Vulnerabilities in the financial sector also need to be further addressed by introducing stronger incentives for banks to reduce the high level of non-performing loans that remain on their balance sheets. The future resilience of the Irish economy hinges on unblocking the productivity potential of local enterprises and enhancing productivity spillovers; most Irish firms have experienced declining productivity over the past decade, causing the large productivity gap between foreign-owned and local enterprises to widen. Given strong international competition to attract foreign-owned firms, the economy should not be overly reliant on the performance of such entities. Improving the productivity performance of the local business sector can be achieved by reducing high regulatory barriers to entrepreneurship, further improving Irish infrastructure and raising the absorptive capacity of local businesses. Other significant challenges for wellbeing and inclusiveness exist in the areas of housing, health and getting people into work. To address these challenges, stringent housing regulations that are constraining dwelling supply should be rationalised, universal healthcare coverage provided and some social benefits withdrawn more gradually as labour earnings rise.

SPECIAL FEATURE: RAISING PRODUCTIVITY