Assia Elgouacem, Herwig Immervoll, Anasuya Raj, Jules Linden, Cathal O’Donoghue and Denisa Sologon

OECD Employment Outlook 2024: The Net-Zero Transition and the Labour Market

5. Who pays for higher carbon prices? Mitigating climate change and adverse distributional effects

Abstract

Carbon pricing incentivises a reduction in emissions and is one of the key climate change mitigation policies. It may raise a number of concerns, however, not least in the context of recent inflation surges and the energy crisis brought about by Russia’s war of aggression against Ukraine. A key concern is that carbon pricing measures may have adverse distributional consequences, which in turn can hinder support for necessary climate change mitigation action. This chapter estimates the carbon content of households’ consumption baskets and examines how higher carbon prices alter household budgets and consumer prices – and therefore the real value of workers’ wages. It examines whether carbon pricing measures are regressive and explores how burdens differ across groups, including disadvantaged ones. Based on the distributional impact and associated carbon price revenues, the chapter considers the scope for offsetting household burdens by channelling revenues back to households in the form of income transfers.

In Brief

To address the causes of climate change, OECD countries have implemented different climate change mitigation policy packages that include carbon pricing measures to varying degrees. These measures, whether explicit such as carbon taxes or emissions trading systems or implicit such as fuel excise taxes, incentivise a reduction in emissions. Prices for carbon emissions built into current measures are generally far from the levels that are considered in line with national and international commitments, notably the targets agreed upon in the Paris Agreement. Numerous governments are therefore considering reforms to increase these prices, broaden the share of emissions covered by such instruments or introduce new carbon pricing measures.

By charging producers and consumers for emissions, carbon pricing may result in potentially sizable burdens for households, which can differ substantially between population groups. There are concerns that this may aggravate existing disparities and worsen economic challenges for specific groups, notably in a context of recent and on-going cost-of-living crises. The size and distribution of carbon price burdens can also weaken support for more ambitious climate change mitigation policies. There can be a case for shielding vulnerable groups from adverse impacts of higher carbon prices, not only for social equity reasons, but also as a means to build or maintain public support for the required transition to a net-zero emission economy.

This chapter examines the impact of carbon pricing policies on households. It discusses different channels for distributive effects and quantifies household burdens stemming from the effects of carbon prices on consumption expenditures. The chapter also explores possible compensation measures that governments can finance with carbon pricing revenues and the extent to which they can attenuate the burdens for different income groups. The empirical analysis calculates carbon footprints for households in five OECD countries that differ in terms of carbon prices, greenhouse gas emissions and GDP levels: France, Germany, Mexico, Poland and Türkiye. Estimates account for households’ own use of fossil fuels and for emissions released in the production of all other goods and services that they consume. The resulting footprints are combined with granular data from the OECD’s Effective Carbon Rates database to approximate household burdens from carbon pricing reforms introduced over the 2012‑21 period. The analysis of distributional impacts from carbon pricing conducted in this chapter adopts the status quo as a counterfactual without factoring in the costs of policy inaction on household living standards, which are expected to be significant (see Chapter 2).

The main findings of the chapter include the following:

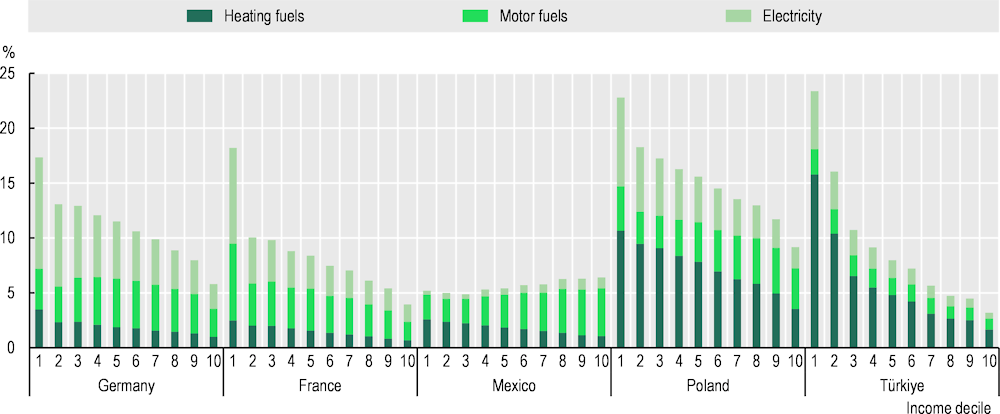

Large parts of households’ energy use are related to basic needs. Poorer households tend to spend large shares of their incomes on energy, giving rise to equity and affordability concerns when prices for fuel, electricity or other necessities go up. Results in this chapter mostly confirm regressive spending patterns for energy. For instance, in the years prior to the COVID‑19 pandemic, low-income households (the bottom 10%) in Poland and Türkiye spent more than one‑fifth of their incomes on energy – 3 to 10 times the shares spent by those on the highest incomes (the top 10%). But not all forms of energy are necessities. Spending shares for motor fuel increase with income in Mexico and Poland, and motor fuel spending shares in Germany vary little between income groups. In Mexico, high-income households in fact devote larger parts of their income to energy than poorer households, indicating that energy can be a luxury item in middle‑income countries.

The immediate impact of carbon pricing on households’ budgets depends on their reliance on different fuels for heating and transportation (direct effect), and on emissions embodied in all other goods that give rise to carbon emissions (indirect effect). Across the five countries, non-fuel consumption in the years preceding the COVID‑19 pandemic accounted for between 45% and 71% of all CO2 emissions linked to household spending. This result highlights that assessments of distributional impacts need to go beyond examining households’ own fuel and energy consumption, which has sometimes dominated policy debates.

Carbon footprints are very unequal both across and within countries. Before the COVID‑19 pandemic, average annual emissions related to household consumption ranged from around 1 tonne of CO2 per household in Mexico and Türkiye, to 6 tonnes in Poland, and 8 to 9 tonnes in France and Germany. Carbon footprints differ markedly between income groups. On average across the five countries, the highest-income households (top 10%) accounted for 4.5 times the emissions of those in the bottom 10%. But emissions also vary within income groups, e.g. by employment status, age, family size and between urban and rural areas. These findings can help to anticipate patterns of public support for, or resistance to, carbon pricing policies. A granular picture of emissions by demographic group is also needed for targeting support to the most impacted groups, and for anticipating future emission trends and associated policy priorities, e.g. in the context of population ageing.

Households’ carbon footprints are a primary determinant of carbon pricing burdens, but they are not the only one. Carbon pricing measures do not apply uniformly across sectors and fuels and therefore not all emissions are priced equally. For instance, excise taxes, carbon taxes and emissions trading systems can, and often do, vary substantially between industries and fuel types, and each measure can therefore affect consumers and households differently.

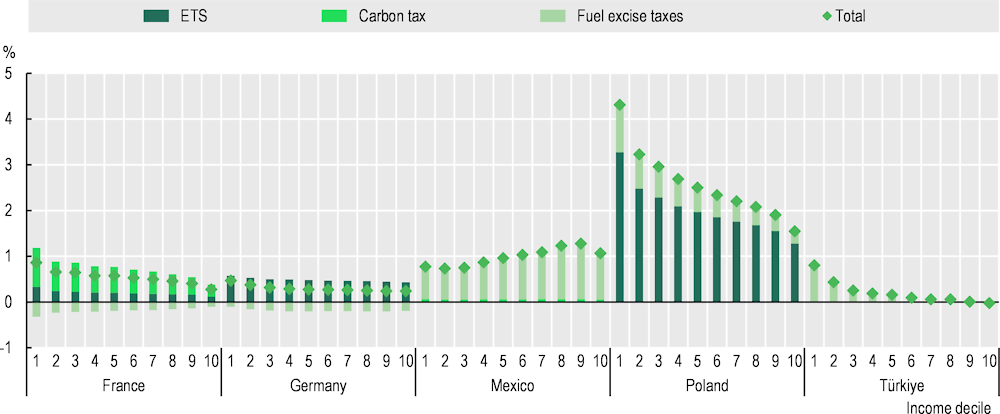

Increases in carbon prices and the resulting burdens on households were limited in five of the five countries over the 2012‑21 period, altering the cost of an average households’ consumption basket by 1% of income or less. This is small, relative to both recent annual inflation rates and cumulative inflation over the decade prior to the cost-of-living crisis. Average additional burdens were largest in Poland, at 2.3% of household income, but they were negligible in Türkiye.

Additional carbon price burdens linked to these reforms were sizeable for some income groups, however, and effects were mostly regressive, reflecting the reliance of low-income households on high-emitting consumption items. In France, estimated additional burdens as a share of household incomes for the bottom 10% were three times those for the top 10%, and in Germany, they were approximately twice as big. A notable exception is Mexico, where relative additional burdens were bigger among high-income households, reflecting the top-heavy pattern of energy spending.

Although lower-income households often saw the biggest burdens relative to their incomes, losses for many middle‑class households were mostly of a similar order of magnitude. Therefore, while carbon pricing impacts the living standards of the poor, it also matters for middle‑class workers.

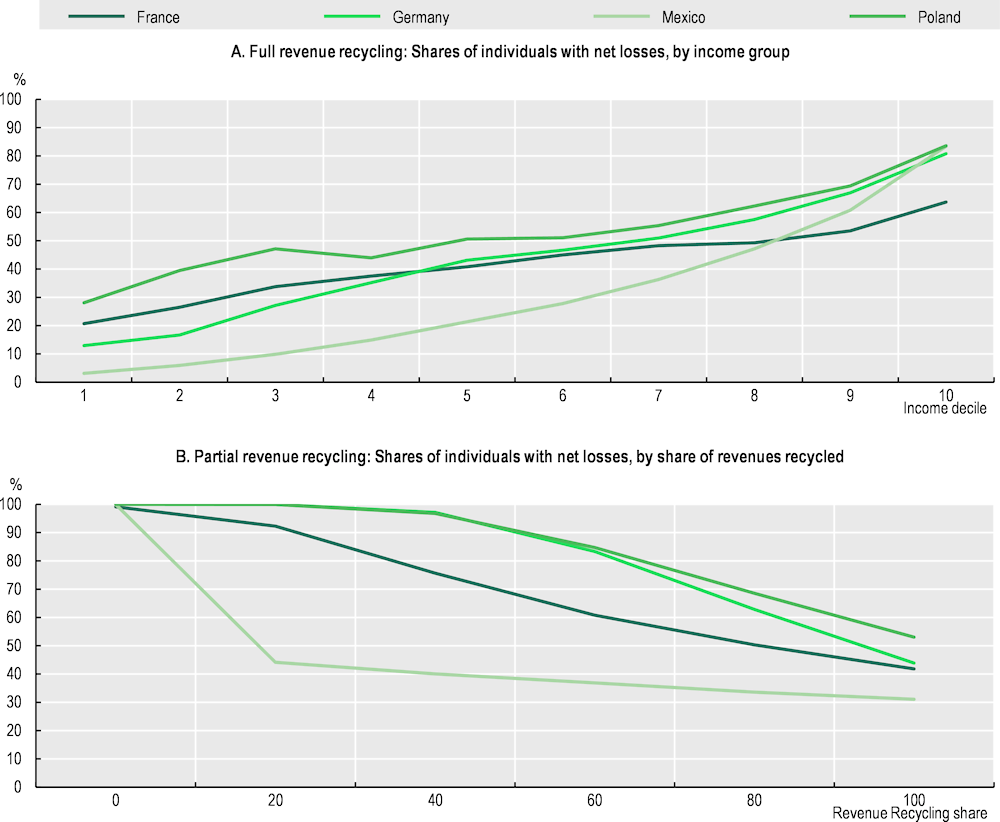

As part of broader policy packages, channelling some or all revenues from carbon pricing back to households allows governments considerable scope to cushion losses and shape distributional outcomes. Some past studies have suggested possible trade‑offs between equity and environmental objectives, as redistribution can increase overall emissions when low-income groups spend larger shares of their incomes on carbon-intensive goods than better-off households. Results in this chapter indicate that such differences in carbon intensity between most income groups are, in fact, small overall and carbon footprints are larger for high-income groups, pointing to opportunities for compensating households without increasing emissions.

Simple compensation measures, such as a uniform lump-sum transfer to all households, are sometimes favoured among researchers and in policy debates. But results illustrate that they may be insufficient to protect all disadvantaged households. They are also not cost effective, leaving little to no room for financing other priorities such as public investment, programmes to boost household investments in energy efficiency or to help workers transition between jobs as part of a green transition. This calls for efforts to reduce the fiscal costs of direct compensation measures, by linking transfer amounts to household burdens and support needs.

As the urgency of action to mitigate the potential dramatic effects of climate change escalates, future carbon price increases may be much more sizeable and fast-paced in some countries than they have been during the past decade. The mostly regressive patterns of past reforms analysed in this chapter underscore the need to carefully consider distributional impacts of future policy changes, along with suitable compensation, both for equity reasons, and to ensure necessary public and political support.

Introduction

Climate change and climate‑change mitigation both have potentially major welfare and distributional effects.1 In the medium to long term, large sections of the global and national populations will be significantly better off with effective climate‑change mitigation that averts rapid-onset disasters (floods, hurricanes, wildfires) and slow-onset events (desertification, heat waves, rising sea levels, etc.). In the short term, however, there can be notable trade‑offs between the intended effects of mitigation policies, such as incentives from higher carbon prices, and unintended distributional effects (Baumol and Oates, 1988[1]; Baranzini, Goldemberg and Speck, 2000[2]).The specific patterns of short-term losses, in turn, have been found to be key drivers of public and political support for necessary policy action to fight climate change (Büchs, Bardsley and Duwe, 2011[3]; Tatham and Peters, 2022[4]).

Carbon pricing is frequently seen as one of several policy tools for turning national and international net-zero commitments into reality. Like other mitigation measures, carbon pricing can be controversial, not least in the context of recent cost-of-living increases.2 Unlike other abatement strategies, however, it generates revenues, which governments can employ to accelerate the net-zero transition, to make it more equitable, to adapt to consequences of climate change that can no longer be avoided (Boyce, 2018[5]), or also to lower other distortionary taxes or reduce public debt.3

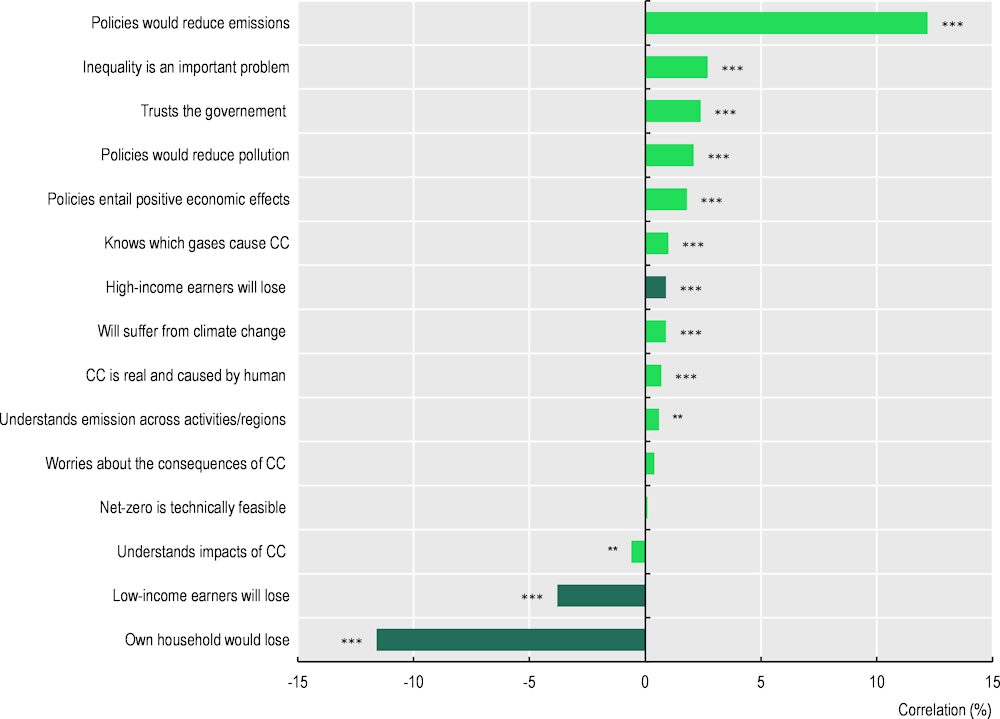

The implementation of carbon pricing measures remains uneven globally and across the OECD. There are concerns among policy makers and the public about undue burdens on households, workers and firms (see also Chapters 2 and 3), with notable controversies and recent protests by specific groups in some countries. Surveys asking households directly about their concerns indicate that economic worries (such as unemployment, price growth or poverty) frequently rank more prominently than environmental ones (OECD, 2023[6]), suggesting that voters may tend to resist carbon pricing if they perceive that it will create significant costs for them. A recent large‑scale survey of 40 000 people across 20 OECD countries and emerging economies (Dechezleprêtre et al., 2022[7]) shows that public support hinges not only on respondents’ assessment of their own household’s gains and losses, but also on broader distributional impacts, such as respondents’ perception of burdens on lower-income households (Figure 5.1). There can therefore be a growing tension between the escalating need for decisive climate action and the political feasibility of agreeing and implementing it.

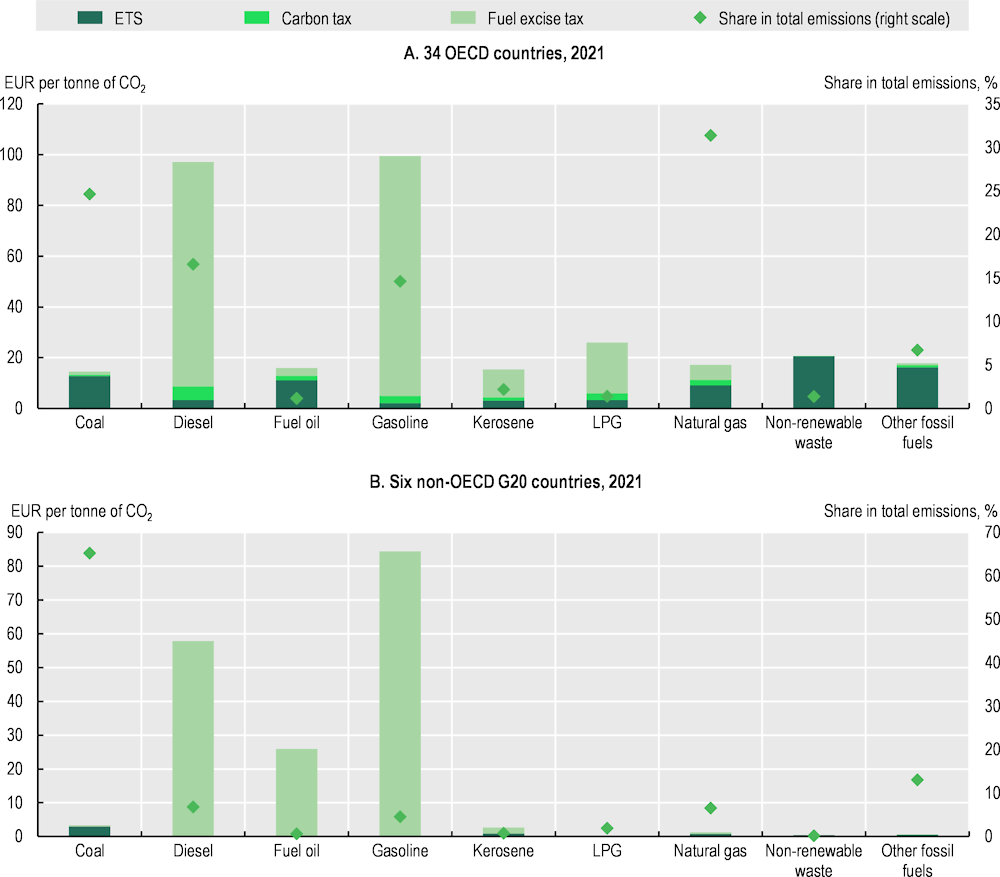

Current carbon prices remain well below levels that are considered in line with national and international commitments, notably the targets affirmed in the Paris Agreement (OECD, 2023[8]; OECD, 2022[9]). For instance, to reach net zero emissions by 2050, scenarios developed by a network of 127 central banks point to a globally weighted implicit price on all emissions of more than EUR 600 per tonne of CO2 (Network for Greening the Finanical System, 2023[10]), when using carbon prices as a proxy for all climate policies. Some studies warn that even carbon prices of this order of magnitude will not suffice to meet net-zero emission targets, without accompanying policies to markedly raise the responsiveness of emissions to carbon pricing, such as regulations concerning certain uses of fossil fuels or support for clean technology (D’Arcangelo et al., 2022[11]). Yet, in 72 OECD and non-OECD countries that together account for 80% of global greenhouse gas (GHG) emissions, less than half of all emissions were covered by some form of carbon pricing measure4 in 2021 (OECD, 2023[8]), and prevailing price levels are mostly much too low to incentivise deep emission cuts. In OECD countries, only a small share of emissions is priced at or above EUR 60 per tonne of CO2. Globally, sizeable fossil-fuel subsidies reduce effective carbon prices, sometimes turning them negative in countries with little or no carbon pricing measures in place (OECD, 2022[12]).

Figure 5.1. Support for climate policies hinges on perceived gains and losses

Correlation between beliefs (as listed) and support for a carbon tax package with cash transfers

Note: Results of regressions of support on standardised variables measuring respondents’ beliefs and perceptions. Dark green indicates variables measuring expected gains and losses. Country fixed effects, treatment indicators, and individual socio‑economic characteristics are included but not displayed. The dependent variable is an indicator variable equal to 1 if the respondent (somewhat or strongly) supports each of the main climate policies. N=40 680, R2=0.378. CC: climate change.

Source: Adapted from Dechezleprêtre, A. et al. (2022[7]), “Fighting climate change: International attitudes toward climate policies”, https://doi.org/10.1787/3406f29a-en.

As the time available for bridging gaps between current and required climate change abatement efforts becomes shorter, a prospect of drastic and fast-paced policy changes carries growing risks of significant adjustment burdens for households, and of trade‑offs between carbon pricing and household living standards.5 These trade‑offs are currently not well understood, however. In particular, there is a lack of evidence on the distributional effects of policies, and their drivers, especially in a comparative context. In practice, countries have implemented a range of different carbon pricing measures (such as cap and trade emissions certificates, explicit carbon taxes and implicit measures like excise taxes) – all with different rates and bases and with potentially quite different effects on households.

This chapter estimates the carbon content of households’ consumption baskets and assesses how higher carbon prices alter household budgets and consumer prices – and therefore the real value of workers’ wages. It considers carbon pricing in the broad sense of the term, to account for explicit carbon pricing policies (carbon taxes and emissions trading systems), but also implicit carbon pricing through fuel excise taxes. It examines whether carbon pricing measures are regressive and explores differences in carbon price burdens across groups, including those that may be of particular policy interest, such as low-income, older or rural populations, or by gender. In a final step, the chapter considers the scope for offsetting household burdens by channelling carbon price revenues, or certain portions of them, back to households in the form of income transfers (“revenue recycling”). The results enable assessing the patterns of gains and losses and, hence, the feasibility of ensuring that a majority are better off than in the absence of carbon pricing and revenue recycling. The chapter builds on two companion papers. An earlier country-specific OECD analysis developed and illustrated the methodology in the context of a hypothetical reform in one OECD country (Immervoll et al., 2023[13]). A longer technical paper undertakes the comparative assessment of recent real-world policy reforms, and presents the results discussed in this chapter (Elgouacem et al., forthcoming[14]).

The empirical part of the chapter draws on granular information on different types of carbon pricing that countries have introduced over the past decade, using Effective Carbon Rates data collected by the OECD Centre for Tax Policy and Administration (OECD, 2016[15]; OECD, 2023[8]). The analysis combines granular Effective Carbon Rates data with emission factors for different fuels, and with input-output information to approximate the carbon content across fuel types and product categories and, ultimately, the carbon footprint of household consumption baskets. This makes it possible to trace carbon prices through the value chain, and to quantify carbon price burdens at the household level using household budget surveys. Although climate change mitigation impacts current and future generations for years to come, the focus in this chapter is on short-term distributional effects following carbon-pricing reforms. This choice is partly made for methodological reasons, such as the difficulty of accounting for households’ medium-term behavioural adjustments in a realistic manner. In addition, the political-economy implications of perceived gains and losses arising from climate mitigation policies suggest that evidence on short-term impacts can be critical for initiating or accelerating policy action.

As with all modelling approaches, the analysis is subject to a number of simplifying assumptions and limitations, which may be addressed in further empirical work. It draws on granular input-output and household budget data, assuming that production technologies and product demand remain as given. A choice was also made not to model consumers’ subsequent behavioural responses to the calculated price changes across goods and services, due to data and methodological limitations. A novelty of the approach is that it combines sectoral and household-level data with detailed policy information on recent carbon price changes. However, the current version of the analysis focuses on domestic policy changes and does not account for differential changes in carbon pricing across countries and the resulting impact on consumer prices through trade linkages. Finally, the analysis leaves out the effects of carbon pricing on the labour market for tractability reasons (see Chapters 2 and 3 for a discussion of the green transition’s effects on labour markets more generally). The text discusses the rationale and possible effects of simplifying assumptions in more detail and the concluding section suggests associated priorities for future work.

Section 5.1 briefly sets out the objectives of carbon pricing, discusses distributional effects of different climate change mitigation measures, and the channels through which they operate, and summarises carbon pricing policies and recent policy changes across countries. Section 5.2 describes existing evidence on the distribution of carbon price burdens, along with evidence gaps. Sections 5.3 and 5.4 present an empirical analysis of carbon price burdens across five OECD countries. Section 5.3 outlines patterns of energy spending, which are a key driver of household emissions. It then analyses carbon footprints associated with all types of household consumption, comparing them across income levels and other household characteristics. Section 5.4 calculates household burdens resulting from carbon pricing reforms between 2012 and 2021, quantifying effects on household budgets across income groups. The section also considers the effects of a simple compensation measure, simulating the extent to which full or partial revenue recycling could offset carbon pricing burdens, and discussing implications for redistribution strategies. A final section offers concluding remarks.

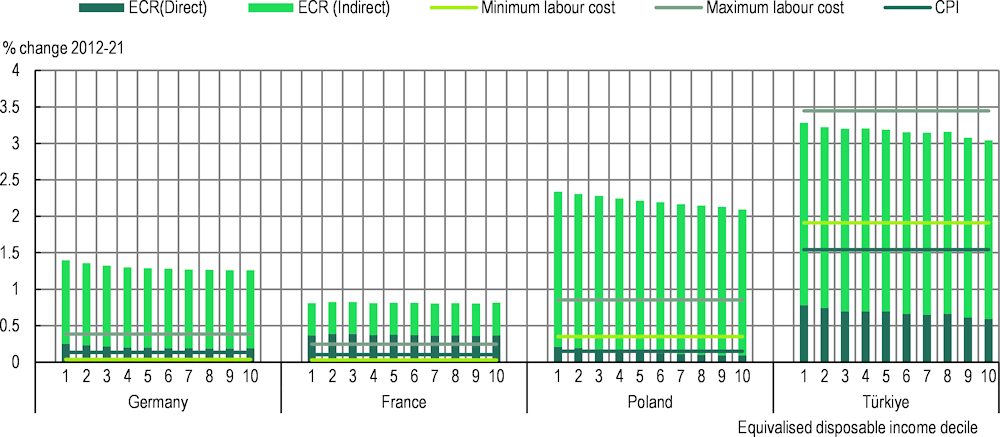

The distributional impacts of carbon prices matter for labour market policies on multiple fronts. These include the use of revenues raised from carbon pricing to reduce other distortionary taxes such as labour taxes, and the link between labour costs growth and carbon price growth, which affects the welfare impacts of carbon pricing and the real value of wages. The concept of a “double dividend” in the context of carbon taxes (Goulder, 1995[16]) describes the situation where carbon pricing could yield both environmental benefits (by reducing emissions) and economic benefits (through an efficient recycling of the generated revenue, such as reducing distortionary labour taxes) and has been extensively discussed in the literature. Labour costs growth rates can proxy income growth rates and compared against carbon price growth rates may better help evaluate the welfare impacts of carbon price reforms. Such a comparison also helps inform on the effect of carbon price reforms on the real value of wages. These aspects are touched upon in various parts of the chapter (in particular Sections 5.3 and 5.4). Finally, the distributional impacts of carbon pricing measures on households’ consumption may aggravate some of the labour market inequalities induced by the net-zero transition (see Chapters 2 and 3) and reinforce the need for investment in skills (see Chapter 4).

An overarching objective of the chapter is to explore key drivers of distributional outcomes, such as the type of carbon pricing measure, patterns of households’ fuel consumption and the carbon intensity of different goods and services. The presentation of results seeks to inform policy decisions about alternative carbon pricing reform paths, including strategies for providing compensation to households. As countries seek to narrow gaps between the private and social costs of GHG emissions over the coming decades, the empirical analysis may serve as one possible template for a regular monitoring of the distributional implications of carbon pricing initiatives, while also highlighting important future methodological extensions.

5.1. Carbon pricing: Objectives and policy evolution

Measures to contain carbon emissions are progressing, but so is the urgency of greater commitments and corresponding decisive and sustained action – see IEA (2022[17]). Since 2020, the Paris Agreement requires countries to outline and communicate their national climate action plans, known as nationally determined contributions (NDCs) and update them every five years. These NDCs aim to achieve deeper emission reductions, with many countries striving for net-zero targets: globally, net-zero targets have been pledged by 105 countries covering more than 80% of global GHG emissions (OECD, 2023[18]). Most of these targets are not legally binding, however, and global emissions continue to rise (IEA, 2024[19]; Climate Watch, 2024[20]). The anticipated mitigation effect of current international and national commitments is nowhere near sufficient and even full implementation of existing conditional and unconditional commitments made under the Paris Agreement for 2030 will put the world on a course of temperature increases of at least 2.5°C this century (United Nations Environment Programme, 2023[21]). By 2030, GHG emissions would need to fall by 14% and 42% relative to 2019 levels to correct course in line with the Agreement’s 2oC and 1.5oC goals, respectively (Pouille et al., 2023[22]).

The relative advantages and challenges of different climate‑change mitigation strategies remain subject to debate, including among climate scientists (Drews, Savin and van den Bergh, 2024[23]), and countries’ mitigation commitments and approaches differ. A consensus view among climate scientists is that a series of transformative step changes, involving a combination of multiple policy levers, are needed to reach net zero at a pace that is consistent with avoiding catastrophic effects of climate change (Lenton et al., 2023[24]; Jaakkola, Van der Ploeg and Venables, 2023[25]). Such policy packages may encompass measures on both the demand and the supply side, including carbon pricing, as well as regulatory measures, subsidies targeted to specific sectors and direct investments to advance technological solutions (Blanchard, Gollier and Tirole, 2023[26]; OECD, 2023[27]). Each of these mitigation approaches has distributional consequences, impacting households through numerous channels (Box 5.1).

Box 5.1. .Distributional effects of different mitigation strategies: Overview and key mechanisms

Climate mitigation policies have distributional effects that impact households economically (by altering their capacity to consume), and otherwise (through direct effects on people’s well-being and health, and through co-benefits, e.g. better air quality, of reducing CO2 emissions) (Zachmann, Frederikson and Clayes, 2018[28]; Rudolph, Beyeler and Patel, 2022[29]). Economic effects include price changes, the focus of this chapter. In addition, mitigation alters the incomes of workers and asset owners through changing returns to different production factors, including labour, natural resources, and equity in “green” or “brown” industries (Rausch, Metcalf and Reilly, 2011[30]). Several meta studies provide systematic reviews (Peñasco, Anadón and Verdolini, 2021[31]; Lamb et al., 2020[32]; Markkanen and Anger-Kraavi, 2019[33]) and Chapters 2 and 3 in this publication discuss employment effects of climate‑change mitigation. This box illustrates relevant distributional mechanisms via other channels, focussing on non-price mitigation. The distributional impact of carbon pricing is discussed in greater detail in the main text.

Energy efficient and clean technologies play a central role in the climate change‑ mitigation agenda. Demand-side policies, including subsidies and related incentives (such as preferential feed-in tariffs for solar power) tend to accelerate technology adoption and diffusion and can be politically attractive (Giraudet, Guivarch and Quirion, 2011[34]; Douenne and Fabre, 2022[35]). Yet, assessments of past measures generally show that they are regressive, and generally more so than carbon pricing, as they primarily benefit higher-income households with the necessary capital to invest in low-emitting assets (Lihtmaa, Hess and Leetmaa, 2018[36]; Lekavičius et al., 2020[37]; Winter and Schlesewsky, 2019[38]; West, 2004[39]; Levinson, 2019[40]). Findings differ, however, across technologies, with more regressive impacts of subsidies for electric vehicles than for home insulation or solar panels, and little correlation between heat pump adoption and income (Borenstein and Davis, 2016[41]; Davis, 2023[42]). Design features of subsidies or tax credits, such as refundability, timing and targeting, all shape distributional impacts (Giraudet, Bourgeois and Quirion, 2021[43]; Borenstein and Davis, 2016[41]). Outright bans on the demand side are relatively common in Europe, placing restrictions on the use of cars or certain types of residential heating (Braungardt et al., 2023[44]). Bans also raise equity issues, e.g. by creating large and possibly unaffordable asset-replacement costs for the poorest, unless bans are combined with targeted exemptions or compensation (Torné and Trutnevyte, 2024[45]).

Supply-side measures shape production processes via regulation or through subsidies, such as those provided for in the US Inflation Reduction Act (Bistline et al., 2023[46]; Bistline, Mehrotra and Wolfram, 2023[47]) and the European Union’s Net-Zero Industry Act. Comprehensive studies are not yet available but there is some initial evidence of progressive impacts of “supply-push” policies that form part of such packages (Brown et al., 2023[48]). Regulatory approaches can take the form of targeted measures, such as building energy codes, fuel economy standards and vehicle pollution-control, including outright bans of high-emission technologies, with some evidence of high burdens for lower-income households (Davis and Knittel, 2019[49]; Jacobsen, 2013[50]; West, 2009[51]; Bruegge, Deryugina and Myers, 2019[52]). Regulation can also take the form of encompassing packages involving multiple levers, such as the US Clean Air Act (Robinson, 1985[53]) and equivalent provisions in other countries. The scope of these packages varies, as do their distributional impacts, with some evidence of regressive effects (Levinson, 2019[40]).

As part of strategies to tackle the causes of climate change, different types of carbon pricing measures have been introduced to shift the marginal private cost of carbon towards its marginal social cost and to align with climate neutrality targets.6,7 Carbon pricing incentivises a reduction in emissions, including through the reduced use of fossil fuels and the substitution from dirtier to cleaner fuels and technologies. It is usually recommended for its effectiveness in reducing GHG emissions, and because it can be administratively simple, requiring less information than other types of regulation. A key argument for pricing carbon is economic efficiency, in the sense of reducing emissions where it is least costly to do so, without being technologically prescriptive. Moreover, carbon pricing does not weigh on government budgets but instead generates revenue (High-Level Commission on Carbon Prices, 2017[54]; Pigou, 1920[55]; Nordhaus, 1991[56]; Pearce, 1991[57]; Blanchard, Gollier and Tirole, 2023[26]).

Political traction of carbon pricing has increased globally, and there are currently more than 70 explicit carbon pricing initiatives, at regional, national and subnational levels.8 Available estimates suggest that significant emission reductions are possible as a result of carbon pricing, e.g. in the order of 3‑7% for a price increase of EUR 10 per tonne of CO2 applying to all emissions (Sen and Vollebergh, 2018[58]; D’Arcangelo et al., 2022[11]). For a USD 40/tCO2 tax covering only 30% of emissions in the European Union, Metcalf and Stock (2023[59]) estimate a cumulative emissions reduction of 4‑6%, with a low impact on employment and growth – see also Chapter 2. To put these values into perspective, a carbon price of USD 1/tCO2 adds about 0.3 cents to the price of one litre of petrol, or about 1 cent per gallon.

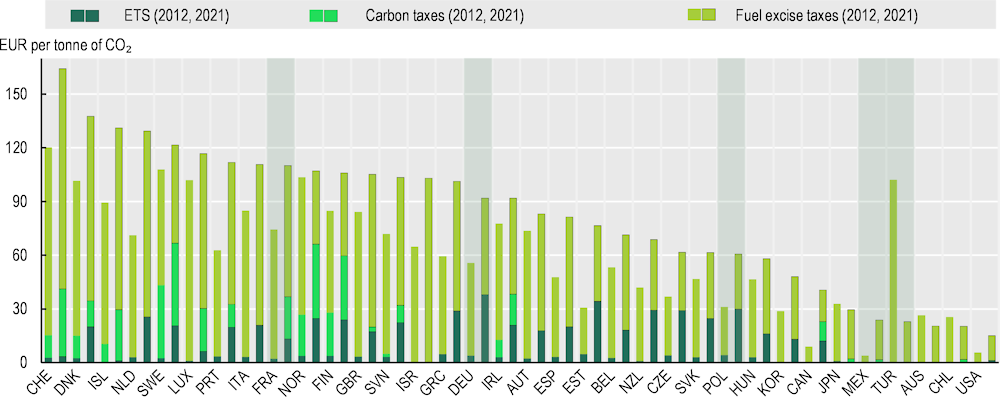

But the speed of adoption varies greatly and recent data point to a growing divide between countries with high and low prices (OECD, 2022[12]). Numerous governments are therefore considering reforms to introduce new carbon pricing measures, to increase prices in existing measures, or to expand them to cover greater shares of emissions. Crucially, and as highlighted by the Intergovernmental Panel on Climate Change (IPCC), “coverage and prices have been insufficient to achieve deep reductions” (Calvin et al., 2023, p. 53[60]). In 72 countries accounting for 80% of worldwide GHG emissions, and including 45 OECD and G20 countries, less than half of GHG emissions (42%) were priced in some form in 2021, either directly through carbon pricing instruments or indirectly through fuel excise taxes or similar. In OECD countries, only 14.6% of GHG emissions were priced at EUR 60/tCO2 or more in 2021 (and 18.5% of CO2 emissions from energy use only). Prices were lower in G20 countries,9 with only 6.6% of GHG emissions (and 8.7% of CO2 emissions from energy use) priced at EUR 60 or more.

A price of EUR 60/tCO2 corresponds to a low-end estimate of the social cost of carbon in 2030, and a mid-range estimate for 2020 (High-Level Commission on Carbon Prices, 2017[54]) and the US Government currently relies on a mean value of USD 51/tCO2 (Interagency Working Group on Social Cost of Greenhouse Gases (IWG), 2021[61]). Recent and forward-looking studies typically support significantly higher values. A 2021 report by the European Commission (2021[62]) suggests a central value of EUR 100/tCO2 already through to 2030, while a recent comprehensive review indicates a preferred mean estimate of USD 185/tCO2, at 2020 prices (Rennert et al., 2022[63]). Estimates of prices that are compatible with longer-term net-zero commitments vary but are higher still.10 Scenarios developed by a network of 127 central banks, and using carbon prices as a proxy for all climate policies, point to a Net Zero 2050 weighted global price of USD 600/tCO2, at 2010 prices (Network for Greening the Finanical System, 2023[10]).

5.1.1. Evolution of carbon prices: Effective carbon rates

The OECD’s Effective Carbon Rates (ECR) database traces the evolution of carbon price policies starting in 2012. The ECR database maps carbon prices to the emissions they cover for each country, by sector and by fuel type. It includes carbon taxes, permit prices from emissions trading systems (ETSs) as well as fuel excise taxes. Carbon taxes and emissions trading systems are explicit forms of carbon prices, as they directly price CO2 (or GHG) emissions. Fuel excise taxes are economically similar to explicit carbon prices, since their base, fuel use, is directly proportional to associated CO2 emissions. Fuel excise taxes, however, can vary across fuel types in ways that do not reflect emissions (e.g. through preferential tax treatment of diesel of heating fuel). Excise tax rates are often higher than explicit carbon prices and they exist in almost all countries. Box 5.2 describes the ECR database and measurement approach in further detail.

Box 5.2. Effective Carbon Rates: Concept, measurement, and interpretation

The OECD Effective Carbon Rates 2021 (ECRs) database covers 72 countries, collectively emitting approximately 80% of global greenhouse gas (GHG) emissions in 2021. It presents carbon prices arising from carbon taxes, emissions trading systems (ETSs) and fuel excise taxes. Effective carbon rates account for implicit fossil fuel support / subsidies when delivered through preferential excise or carbon tax rates, so total ECRs are always greater than or equal to zero. They do not account for government measures that lower pre‑tax prices of fossil fuels, i.e. for negative carbon prices.1 “Carbon taxes” include explicit taxes not only on CO2 emissions, but also on emissions of GHGs other than CO2, such as taxes on fluorinated gases (F-gases).

The pricing instruments included in the ECR dataset either set an explicit price per unit of GHG (e.g. per tonne of CO2e, as in the case of ETSs or carbon taxes), or on a base which is proportional to the resulting GHG emissions (e.g. excise taxes per unit of fuel):

Carbon taxes generally set a rate on fuel consumption based on its carbon content (e.g. on average, a EUR 30/tCO2 tax on carbon emissions from diesel use would translate into a 7.99 eurocent per litre tax on diesel) or less frequently, apply directly to GHG emissions.

Fuel excise taxes are typically set per physical unit (e.g. litre, kilogram, cubic metre) or per unit of energy (e.g. gigajoule), which can be translated into rates per tonne of CO2.

The price of tradable emission permits issued under ETSs, regardless of the permit allocation method, represent the opportunity cost of emitting an extra unit of CO2e (the CO2 equivalent of GHG including CO2 as well as other GHG, see below).2

The considerable granularity of the ECR data is key for capturing differences in emission prices across sectors and, therefore, across the consumption categories that shape carbon price burdens for households. The database covers six sectors that together span all energy uses: road transport, electricity, industry, buildings, off-road transport, agriculture and fisheries. Fuels are grouped into nine categories: coal and other solid fossil fuels, fuel oil, diesel, kerosene, gasoline, liquified petroleum gas (LPG), natural gas, other fossil fuels and non-renewable waste, and biofuels.

CO2 emissions in the ECR database are based on energy use data from the International Energy Agency’s World Energy Statistics and Balances (IEA, 2020[64]). The ECR database covers CO2 emissions from energy use from six sectors (mentioned above). Since its 2018 vintage, it also covers other GHG emissions – i.e. emissions from methane (CH4), nitrous oxide (N2O), F-gases3 and process CO2 emissions (excluding land use change and forestry, LUCF). These are sourced from the CAIT database (Climate Watch, 2024[20]).4 Due to data limitations, and to facilitate comparisons with previous ECR vintages, other GHG emissions are not allocated to the six economic sectors but are considered separately (as a seventh sector).5

In the context of this chapter, the standard ECR indicator is used as the price that is passed on to consumers. This does not account for free emissions allocations to producers. Using it as a basis for assessing consumer prices, therefore effectively assumes full marginal-cost pass-through, regardless of the permit allocation method, with any free allocations being a rent for emitting firms. There is some empirical evidence of marginal-cost pass-through, and associated “windfall profits”, in the energy sector (Fabra and Reguant, 2014[65]; Nazifi, Trück and Zhu, 2021[66]). Nevertheless, full marginal-cost pass-through is a simplifying assumption and the actual incidence will vary across countries and sectors.

Annex 5.B provides additional details on the methodology and discusses a number of core issues related to the ECR indicator and its interpretation.

1. Net Effective Carbon Rates, available from year 2018, account for a broader range of fossil fuel subsidies, i.e. those that decrease pre‑tax prices of fossil fuels, and hence include negative carbon prices (Garsous et al., 2023[67]).

2. Thus, effective carbon rates are sometimes also referred to as effective marginal carbon rates. Effective average carbon rates, which account for free allocations, are discussed in Annex 5.B.

3. HFCs, PFCs, and SF6.

4. Excluding Land-use Change and Forestry (LUCF).

5. See e.g. the International Energy Agency’s documentation on GHG emissions from energy use (IEA, 2021[68]).

Source: OECD (2023[8]), Effective Carbon Rates 2023: Pricing Greenhouse Gas Emissions through Taxes and Emissions Trading, https://doi.org/10.1787/b84d5b36-en; OECD (2022[12]), Pricing Greenhouse Gas Emissions: Turning Climate Targets into Climate Action, https://doi.org/10.1787/e9778969-en; OECD (2016[69]), Effective Carbon Rates: Pricing CO2 through Taxes and Emissions Trading Systems, https://doi.org/10.1787/9789264260115-en.

Effective carbon rates have been increasing in most OECD countries over the 2012 to 2021 period (Figure 5.2), both in nominal and in real terms. Where they decreased, this was in general due to inflation or exchange rate fluctuations. In most OECD countries, fuel excise taxes clearly make up the largest part of total ECR. EU countries as well as Iceland and Norway have been subject to the EU ETS since 2005 and permit prices substantially increased between 2018 and 2021. As part of its Fit for 55 package, the European Union plans to extend carbon pricing through emissions trading to transportation and buildings sectors. Explicit carbon taxes were first introduced in Finland in 1990 and in Norway in 1991, with numerous countries implementing or announcing them since then. In addition, countries variously commit to phasing out fossil fuel subsidies (G20 Leaders Statement, 2009[70]; OECD/IEA, 2021[71]).

Figure 5.2. Evolution of effective carbon rates in 34 OECD countries, 2012‑21

In 2021 EUR per tonne of CO2, levels for 2012 and 2021

Note: For each country, the two bars refer to the two years (2012, 2021). Highlighted countries are those included in the empirical analysis of this chapter. The chart presents emissions-weighted average Effective Carbon Rates (ECR) over the whole economy, by pricing instrument, presented in 2021 constant EUR. Effective Carbon Rates are the sum of carbon taxes, permit prices from emissions trading systems (ETS) and fuel excise taxes. The emissions-weighted average effective carbon rates presented here are computed excluding emissions from the combustion of biomass.

Reading: In 2012, the average ECR in France was of EUR 74.5 per tonne of CO2, with carbon pricing mostly resulting from fuel excise taxes (with an average of EUR 72 per tonne of CO2 across the economy). In 2021, the average ECR in France was of EUR 110 per tonne of CO2, with carbon taxes and ETS prices increasing the most since 2012: the French economy-wide average carbon price resulting from the EU ETS was of EUR 13/tCO2 and from carbon taxes of EUR 23.6/tCO2.

Source: OECD Effective Carbon Rates database.

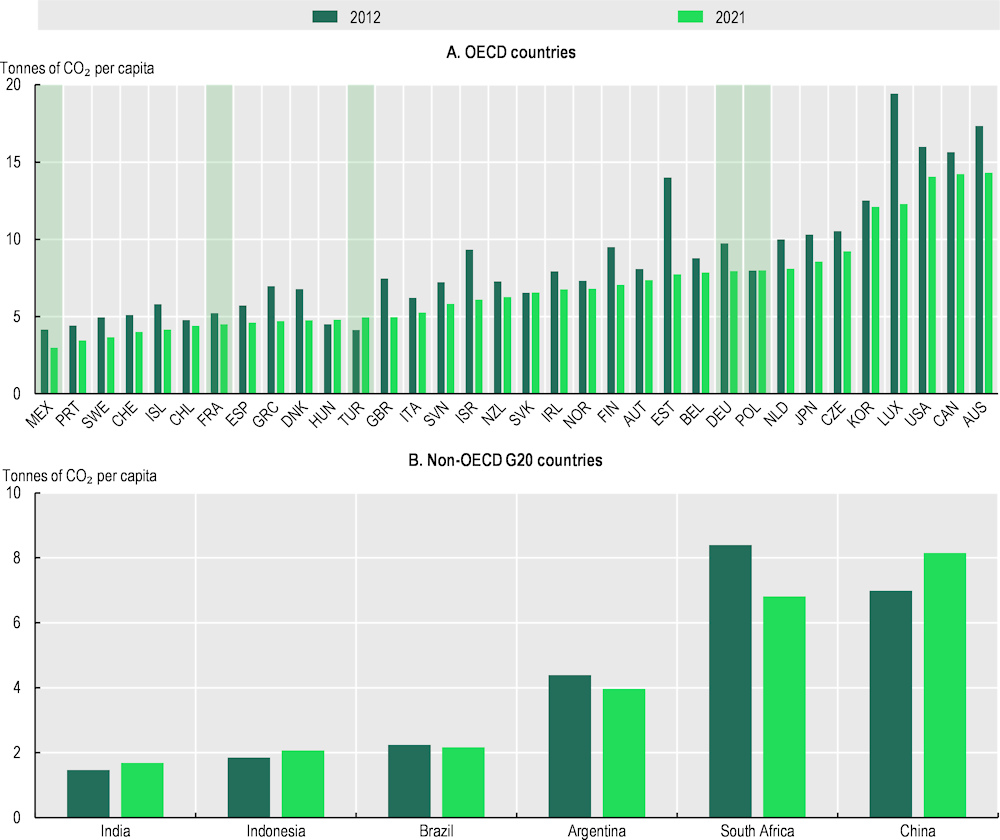

In parallel, per-capita carbon emissions from energy use declined in most OECD countries (Figure 5.3). By contrast, in spite of lower average emissions than OECD countries in 2012, non-OECD G20 countries have not all followed the decreasing trend in the OECD area. In particular, China, India and Indonesia have seen a rise in per capita emissions. In India and Indonesia, they nevertheless remained lower than in most OECD countries in 2021. These differences arise due to many factors, including the different levels of developments between most OECD and non-OECD G20 countries. Less developed countries may rely more on energy-intensive resources to foster their development.

Figure 5.3. Carbon emissions from energy use

In tonnes of CO2 per capita, 2012 and 2021

Note: Highlighted countries are those included in the empirical analysis of this chapter. Emissions are on a territorial basis generated in each country. This contrasts with average carbon footprints, as derived in the empirical part of this chapter, which are linked to domestic consumption, i.e. taking into account emissions along the value chain. The emissions presented here are carbon emissions from energy use and exclude emissions from the combustion of biomass.

Source: OECD Effective Carbon Rates database.

The main fuels responsible for CO2 emissions from energy use in OECD countries are natural gas (33%), followed by coal (25%), diesel (16%) and gasoline (13%) (Annex Figure 5.B.1). In non-OECD G20 countries, coal holds a much more important share (65%).11 Carbon prices levied on these fuels are very heterogeneous, in terms of both the rates and the type of policy measure.12

5.2. Previous results on the distribution of carbon price burdens

In part, concerns about the distributional impacts of carbon pricing stem from the fact that domestic fuels are, at the same time, necessities for many households, and a main source of their GHG emissions. When prices go up, the poorest households may be ill-equipped to draw on savings, to cut back on other expenditures, or to reduce their reliance on high-emission products (OECD, 2022[72]; Sologon et al., 2022[73]). As a result, low-income groups may bear a substantial burden from higher carbon prices. A regressive impact, in turn, risks worsening key aspects of inequality, material deprivation and social exclusion, such as energy poverty (including fuel poverty) or food insecurity. Aspects of poverty and deprivation may also worsen even if carbon pricing is not regressive. The current cost-of-living crisis has dramatically heightened concerns over the economic burdens on households from rising living costs, and higher energy prices in particular.

There are numerous drivers of distributional outcomes. Studies tend to focus on the gradient of carbon price burdens by income group and a common question is whether this overall pattern is “regressive”, in the sense that relative burdens decline with income. Other inequalities, such as difference between age groups, education levels, dwelling types or geography have received comparatively little attention in past studies, though a few have shown that such “horizontal” inequalities, even for a given income level, can be greater than “vertical” differences between income groups (Labrousse and Perdereau, 2024[74]; Missbach, Steckel and Vogt-Schilb, 2024[75]; Cronin, Fullerton and Sexton, 2019[76]). For instance, Causa et el. (2022[77]) find that energy price inflation between 2021 and 2022 had stronger impacts on rural households.

Results are available for several countries, but country coverage is far from comprehensive. The scope, objectives and approaches of studies vary greatly, making findings difficult to compare and interpret. Many studies focus on fuel expenditures but do not consider the effects of carbon prices on the affordability of everything else. Likewise, studies frequently do not account for compensation measures that can be financed from carbon-tax revenues (“revenue recycling”). A common focus is on specific hypothetical policy changes (such as the introduction of a comprehensive across-the‑board carbon tax), without considering real-world price variations due to differentiation between sectors, exemptions or linkages between different types of carbon pricing that typically exist in parallel (such as carbon taxes, excise taxes on fuel and/or ETS). To date, there is no comparative13 distributional assessment of real-world policies that governments have already implemented, including combinations of different carbon pricing measures, and associated lessons for the design of future reforms – single‑country distributional analysis of specific components of carbon pricing may nonetheless be found (Gonzalez, 2012[78]; Sajeewani, Siriwardana and McNeill, 2015[79]; Callan et al., 2009[80]).

The net effects of carbon pricing on the cost of households’ entire consumption baskets vary strongly between countries and policy measures, depending not only on spending patterns, but also on population characteristics and existing inequalities (Ohlendorf et al., 2020[81]; Andersson and Atkinson, 2020[82]). Importantly, carbon prices affect not only the cost of transportation and heating but, subject to the carbon intensity of the production process, also the prices of other goods and services (Vogt-Schilb et al., 2019[83]; Immervoll et al., 2023[13]).

There is a common conjecture that carbon taxation and other forms of carbon pricing are regressive in high-income countries (Klenert and Mattauch, 2016[84]). However, home fuel and electricity taxation tends to be more regressive than fuel taxation in the transport sector (Büchs, Ivanova and Schnepf, 2021[85]; Köppl and Schratzenstaller, 2022[86]; Pizer and Sexton, 2019[87]), which can be progressive, especially in countries with moderate car ownership and well-developed public transport systems (Wang et al., 2016[88]; Missbach, Steckel and Vogt-Schilb, 2024[75]; Flues and Thomas, 2015[89]). Constrained energy consumption among low-income households can make carbon pricing somewhat less regressive, although even small increases in energy costs are a concern for households who already consume below their needs.

In countries with lower GDP levels, including in the OECD area, households at the bottom of the income distribution tend to face significant risks of energy affordability (Flues and van Dender, 2017[90]). Outside the OECD, progressive impacts are also more likely in poorer countries, where energy can be a luxury that is unaffordable for large parts of the population, home fuels can be less important due to patchy heating provisions or climatic conditions, and car ownership is highly concentrated at the top of the income distribution (Ohlendorf et al., 2020[81]; Dorband et al., 2019[91]; Mardones, Di Capua and Vogt-Schilb, 2023[92]; Steckel et al., 2021[93]; Missbach, Steckel and Vogt-Schilb, 2024[75]; Klenert and Mattauch, 2016[84]).

Most studies do not compare distributional impacts between different types of carbon pricing. Those that do suggest that pricing direct emission through taxes on fuel consumption (excise taxes) is more regressive than pricing all emissions, including also indirect ones from the consumption of everything else (e.g. through a carbon tax) (Ohlendorf et al., 2020[81]; Immervoll et al., 2023[13]). Yet, extending pricing to GHG other than CO2 can make emissions pricing more regressive, primarily through the impacts on food prices. Exemptions of specific energy carriers or sectors also affects the distribution of carbon price burdens. For instance for a federal carbon tax in Mexico, which exempts natural gas, Renner (2018[94]) finds that burdens are relatively equal across income groups, but that it would be regressive if natural gas were included.

Behavioural responses, which are the primary purpose of carbon pricing, can also differ by population group and can therefore influence distributional outcomes. Households’ consumption decisions respond to changes in relative prices (substitution effect) but also to average price levels (which then impact available income – income effect). The resulting distributional impact depends on preferences and the ability of low and high-income households to adjust their consumption of carbon intensive goods. There is no clear evidence on whether high or low-income households respond more strongly to carbon prices, with some studies suggesting greater responses among low-income households (West and Williams, 2004[95]) and others finding the opposite (Campagnolo and De Cian, 2022[96]). Overall, the impact of households’ behavioural response on the distributional impact of carbon prices seems limited at current carbon price levels (Renner, Lay and Greve, 2018[97]; Immervoll et al., 2023[13]), though this may not hold for bigger and/or fast-paced increases in the future. The lack of any clearer income gradient of behavioural responses reflects multiple drivers of price reactions, but also significant methodological challenges and data limitations (Annex 5.B). Within a country, behavioural impacts may differ across income groups due to many factors, including their composition: for example, if higher income households tend to live in more densely populated areas, they may have more substitution options for lower-emitting transport; or if lower income households tend to commute more, they may have less possibilities to reduce their car usage (and related emissions).

The literature commonly considers revenue recycling as an appropriate tool to alleviate any undesirable distributional impact of carbon pricing (Klenert et al., 2018[98]; Immervoll et al., 2023[13]). Even simple revenue recycling schemes, such as per capita transfers, can lead to progressive impacts of carbon pricing (Feindt et al., 2021[99]; Budolfson et al., 2021[100]). Moreover, available results suggest that it may be feasible to ensure favourable distributional outcomes by redistributing less than the full amount of carbon pricing revenues, leaving some of it for other purposes (Landis, 2019[101]). As carbon price burdens are typically highly heterogeneous, however, redistributing the tax take through an across-the‑board lump-sum transfer will create both gainers and losers (Sallee, 2019[102]; Cronin, Fullerton and Sexton, 2019[76]).

Beyond the consumption and revenue‑recycling channels, carbon pricing has further distributional effects, similar to those of other climate‑mitigation measures, notably by altering the demand or supply of production factors, including labour (see Box 5.1 above).14

5.3. Carbon footprints and distributional impact of carbon pricing reforms

This section combines a range of data sources to explore the impact of carbon pricing measures in five selected OECD economies: France, Germany, Mexico, Poland and Türkiye. These five countries were chosen based on data availability and quality, and they capture a reasonable spread of geographic region, GDP levels, emissions per capita and carbon price levels (see Figure 5.2 and Figure 5.3).

A particular focus of the empirical assessment is to link information on carbon prices and emissions (which is needed for tracing carbon price burdens through the value chain) with micro-data data on consumption patterns (needed for quantifying burdens at the household level, and for assessing government policies that aim to cushion or offset those burdens). Existing studies have tended to be country-specific, or to look at simplified hypothetical reforms or a specific type of carbon pricing, such as excise taxes (see literature overview in Section 5.2). By contrast, this section compares a broad range of carbon pricing reforms that countries have implemented between 2012 and 2021, drawing on the OECD’s ECR database.

The assessment builds on a recent analysis on Lithuania (OECD, 2023[103]; Immervoll et al., 2023[13]). Annex 5.A describes the methodology. In a nutshell, it draws on granular input-output data, which capture emissions by sector and allow tracing them from source inputs to final consumer products and services. Emissions for different output categories are then matched with household spending information from available budget surveys to approximate the carbon footprint from household consumption across groups in a bottom-up manner, incorporating emissions from producing and combining relevant inputs. Apart from the comparative perspective using data sources for different countries, this approach is similar to that followed in some national studies (Pottier, 2022[104]).15

This chapter does not report households’ subsequent reactions to price changes at this stage, because of data and methodological limitations. Households do respond to price changes, and the earlier study that this chapter partly builds on illustrates an approach for estimating a full set of budget and price elasticities (Immervoll et al., 2023[13]). That study estimates that behavioural reactions, mainly in the form of shifts to less polluting goods and services, reduces carbon price burdens by less than 10% for most income groups. However, estimated responses differ significantly across studies and across and within countries. More importantly for the present study, evidence on the overall distributional impact arguably remains inconclusive. Section 5.2 and Box 5.3 provide an overview of previous studies and of the estimation difficulties in the context of carbon pricing. The considerable range of available results on behavioural responses, and the lack of an empirical consensus on the direction of the distributional impact of consumer behaviour, suggests that the effects of methodological and data choices may currently dominate the variation in responses across population groups. Studying households’ evolving responsiveness to carbon price changes is an important topic for future research (see Section 5.5).

Box 5.3. Consumer response to carbon prices: Estimates, driving factors and knowledge gaps

Behavioural responses to carbon pricing are central for effective mitigation, and households play a crucial role in lowering emissions. When emission prices go up, households adjust consumption patterns towards lower-emitting products and services in response to price increases (price elasticities). In addition, higher prices change consumption as a result of reduced overall budgets (in real terms, budget elasticities). Household responses shape the effectiveness of Pigouvian taxes in tackling negative externalities. They are potentially also relevant for estimating second-order distributional consequences of price changes.

Both own and cross-price responses are relevant when assessing behavioural reactions. But a key focus of existing studies is on the responsiveness of fuel demand to changing fuel prices. This is commonly captured in a single number, the own-price elasticity of fuel demand, with a large literature using a number of different estimation strategies and data sources (Labandeira, Labeaga and López-Otero, 2017[105]; Zhu et al., 2018[106]; Havranek, Irsova and Janda, 2012[107]; Brons et al., 2008[108]; Espey, 1998[109]; Dahl, 2012[110]).

Published estimates vary markedly across studies. Considering residential, commercial and industrial actors’ elasticities, Labandeira, Labeaga and López-Otero (2017[105]) find central estimates for energy elasticities of –.221 in the short run, and –.584 in the long-run. They highlight large differences across energy commodities, with the largest elasticities for gasoline (‑.293, ‑.773), natural gas (‑.180, ‑.684) and diesel (‑.153, ‑.443), and lower values for electricity (‑.126, ‑.365) and heating oil (-.017, -.185). Other studies, however, find markedly lower price elasticities for gasoline, providing central estimates of ‑.09 in the short run and ‑.31 over longer time horizons (Havranek, Irsova and Janda, 2012[107]). A range of country characteristics can shape these differences, for instance fuel demand is typically more elastic in densely populated areas and those well-served by public transport.

But the wide range of estimates is also driven by empirical methods and measurement choices, including time horizons. Most studies focus on short-run elasticities and assume that the responsiveness to price changes is independent of the initial price level. In reality, elasticities and price levels vary over time. Households may be unable to adjust their consumption of fuels quickly. But in the medium term, they may invest into new heating systems, improved insulation, and energy efficient transport assets. Indeed, these responses are a key policy objective of carbon pricing and ignoring them is therefore problematic. A further limitation is that demand elasticities are typically estimated linearly, without allowing them to vary depending on the magnitude of price changes (Immervoll et al., 2023[13]). In effect, this approach predominantly captures continuous changes in consumption of a given good (intensive margin), but not complete shifts between consumption categories once prices surpass specific thresholds (extensive margin, such as transitioning entirely from cars to public transport or bicycles). The latter can be particularly important in the context of efforts to lower emissions.

A comparatively small literature examines differences in price elasticities across socio-economic and income groups – see e.g. Wadud, Graham and Noland (2010[111]), who identify the number of vehicles owned, number of wage earners and household location as determinants of price elasticity. The same study assesses the importance of behavioural responses for the distributional impact of a gasoline tax, finding that the inclusion of heterogeneous behavioural responses does not alter the distributional profile of the tax, a finding also echoed in a study of carbon pricing by Renner, Lay and Greve (2018[97]). As noted in Section 5.2, there is no consensus on whether low-or high-income households are more responsive to fuel price increases, with some other studies finding stronger responses among low-income households (West and Williams, 2004[95]), while others find larger elasticities for higher incomes (Zhu et al., 2018[106]).

In summary, households’ responses to price changes in energy commodities are larger in the long run than the short run, and they differ across energy types, although differences are often small to moderate. For all energy commodities, increases in prices are associated with a less than proportional decrease in consumption. Households will therefore typically face larger energy bills when carbon prices go up, even after considering behavioural responses. Some studies suggest that behavioural responses play a limited role in determining the overall distributional impact of price changes, but evidence on the difference in behavioural responses across household types remains inconclusive, partly due to methodological and data-related challenges.

5.3.1. Energy spending is one key driver of household emissions

Carbon prices affect household budgets both directly through households’ own fuel consumption, and indirectly via the consumption of other goods and services that give rise to CO2 emissions during the production process. The direct effect is shaped by the pattern of expenditures on heating and transport (fossil-)fuel (Figure 5.4). The figure also shows spending on electricity, which is a derived good, whose production can be fuel intensive.16 Energy-related emissions embodied in the full set of derived goods, including, e.g. food and public transport, form one part of the overall carbon footprints presented in the next sub-section.

Poor households save less than the rich, or they dissave, and total consumption therefore accounts for larger portions of their income than for better-off households. In four of the five countries included in Figure 5.4, such a regressive spending pattern holds also for energy consumption. This is particularly visible in Poland and Türkiye, where low-income households spent more than one fifth of their incomes on energy.17 Spending on electricity and heating is also regressive in the other European countries. This makes them particularly vulnerable to energy poverty.18 But the share of resources devoted to some categories of energy can in fact increase with income. Spending shares for motor fuel are increasing with income in Mexico and Poland, reflecting both income inequality and unequal car ownership. In Germany, motor fuel spending is mostly flat. Mexico is the only country where richer households devote bigger portions of their income to energy overall, confirming that energy can be a luxury item in middle‑income countries.19 Average spending shares also vary strongly across countries, with plausible drivers including average incomes, climatic factors, as well as energy taxation and subsidies.

Figure 5.4. Poorer households typically spend large parts of their income on energy, but spending is “top-heavy” in some middle-income countries

Household expenditures on fuel and other energy, as a percentage of disposable income, by income decile

Note: Groups 1‑10 refer to income deciles (equivalised disposable household income). Heating fuel includes expenditure on gas (natural gas and town gas), liquified hydrocarbons, kerosene and other liquid fuels, coal and other solid fuels. Motor fuel includes expenditure on diesel and petrol for transportation.

Source: OECD calculations using household budget surveys (2015 for EU countries, 2016 for Mexico, 2019 for Türkiye) and WIOD input-output data (for electricity).

5.3.2. Who pollutes the most? Carbon footprints linked to household consumption

Energy consumption is a key driver of emissions, but it is not the only one. There are several reasons why energy spending is only a partial indicator of households’ carbon footprints. First, emissions from electricity generation vary enormously between countries, by a factor of 15 across the five countries considered here.20 Relatedly, for each of the main fuel consumption categories, emissions vary by type of fuel (see Annex Figure 5.B.1), as do prices before accounting for carbon pricing. For lower-income or rural households, domestic fuels can include high shares of solid fuels (coal, coke, peat, firewood), which have much higher emission factors than liquid fuel. Emission factors are lower for natural gas, an energy source that can be more common in urban areas. Motor fuels are commonly more expensive than domestic fuels and produce fewer emissions per energy unit than firewood, coal, or heating oil. Per unit of fuel expenditure, emissions – and therefore also the effect of a given carbon price – thus tend to be higher for domestic fuels than for motor fuels.

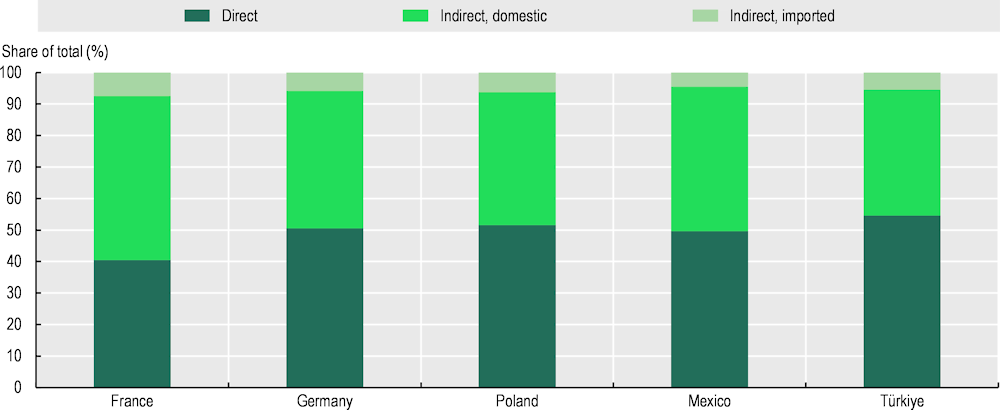

Second, non-fuel expenditures account for a large share of household spending.21 Per unit of spending, fuel use creates more emissions than other consumption, but due to the size of non-fuel spending, the production of non-fuel goods and services is a significant driver of carbon footprints. Across the five countries, direct emissions from households’ own use of fossil fuels mostly account for around half of the total emissions linked to consumption (Figure 5.5). These estimates incorporate all household consumption, following the “consumer responsibility” principle (see figure note). Fuel spending was a lesser driver of total emissions in France, partly reflecting the balance of spending on fossil fuels and electricity, but also the types of fuel (coal and other solid fuel, liquid fuel, gas) used by households and in production processes.22 Emissions linked to imported inputs or final goods (other than fuel) are also significant but comparatively small, accounting for less than 10% of emissions in each of the five countries. (This small share is reassuring in the context of the chapter’s later estimates of carbon price burdens, which do not account for differential carbon price trends in source countries.)

Figure 5.5. Fuel expenditure is not the only driver of households’ carbon footprints

Emissions from fuel (“direct”) and non-fuel (“indirect”) consumption, in percentage of total

Note: “Direct” includes households’ own consumption of fossil fuels, both domestically sourced and imported. “Indirect, domestic” includes households’ own non-fuel, domestically sourced consumption. “Indirect imported” accounts for emissions linked to all other non-domestically sourced inputs and consumption goods. Estimates are based on the “consumer responsibility” principle, accounting for all household consumption. They therefore attribute emissions to the country where the final good is consumed, and this differs from the emissions per capita that are physically released in a given country. It is important to account for the consumption of imported goods in order to determine the carbon price embedded in households’ consumption baskets.

Source: OECD calculations using IEA emissions factors for different fuels, World Input-Output Database (WIOD) as well as household budget surveys (2015 for EU countries, 2016 for Mexico, 2019 for Türkiye).

Quantifying indirect emissions embodied in non-fuel consumption is thus crucial for assessing distributional effects. Embodied emissions are not observed directly. Consumption patterns, and their carbon content, vary in complex ways between countries and households, making the net effect impossible to anticipate without careful modelling. Results in the remainder of this chapter trace emissions from both direct and indirect consumption to individual households, using the modelling approach summarised in Annex 5.A.

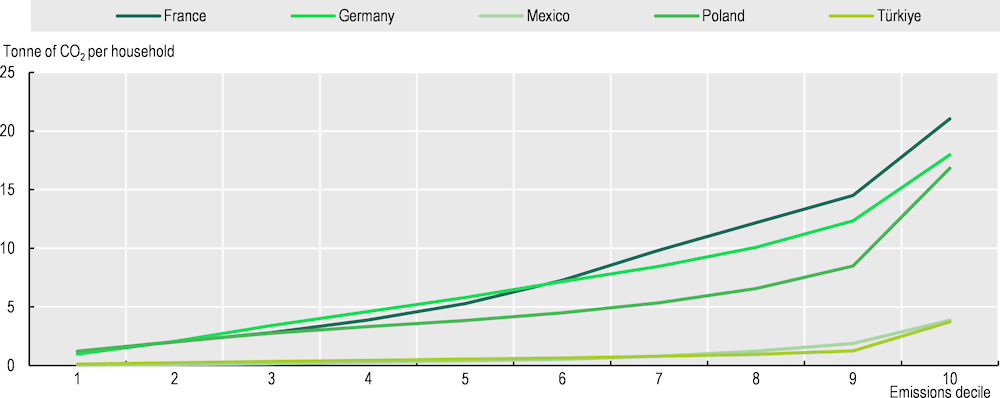

Across countries, differences in carbon footprints are very large, reflecting various factors, including levels of development, population density, consumption patterns, and production technology. Figure 5.6 shows emissions linked to household consumption across countries, at different points of the national emissions distribution (rather than the income distribution). Average emissions (not shown) range from around 1 tonne of CO2 per household and year in Mexico and Türkiye, to 6 tonnes in Poland, and 8 to 9 tonnes in France and Germany. Median emissions of German households were nearly as high as for households at the 8th decile of the Polish emissions range. The average consumption for the top 10% emitting households in Mexico and Türkiye produced the same amount of emissions as the bottom 3rd decile in Germany. These country differences in emissions attributed to domestic household consumption can be much bigger than those in terms of per-capita emissions that are physically released in each country (compare with Figure 5.3).

Figure 5.6. Emissions from household consumption are very unequal across and within countries

Emissions from household consumption, tCO2 per household at different points in the national emissions distribution

Note: Average emissions across the national emissions distribution (not income distribution), from lowest-emitting to the highest-emitting households. The ranking variable is emissions linked to household consumption, equivalised to account for household size. Estimates follow the “consumer responsibility” principle, accounting for all household consumption, including both domestically produced and imported goods. They therefore attribute emissions to the country where the final good is consumed, and this differs from the emissions per capita that are physically released in a given country.

Source: OECD calculations using IEA emissions factors for different fuels, World Input-Output Database (WIOD) as well as household budget surveys (2015 for EU countries, 2016 for Mexico, 2019 for Türkiye).

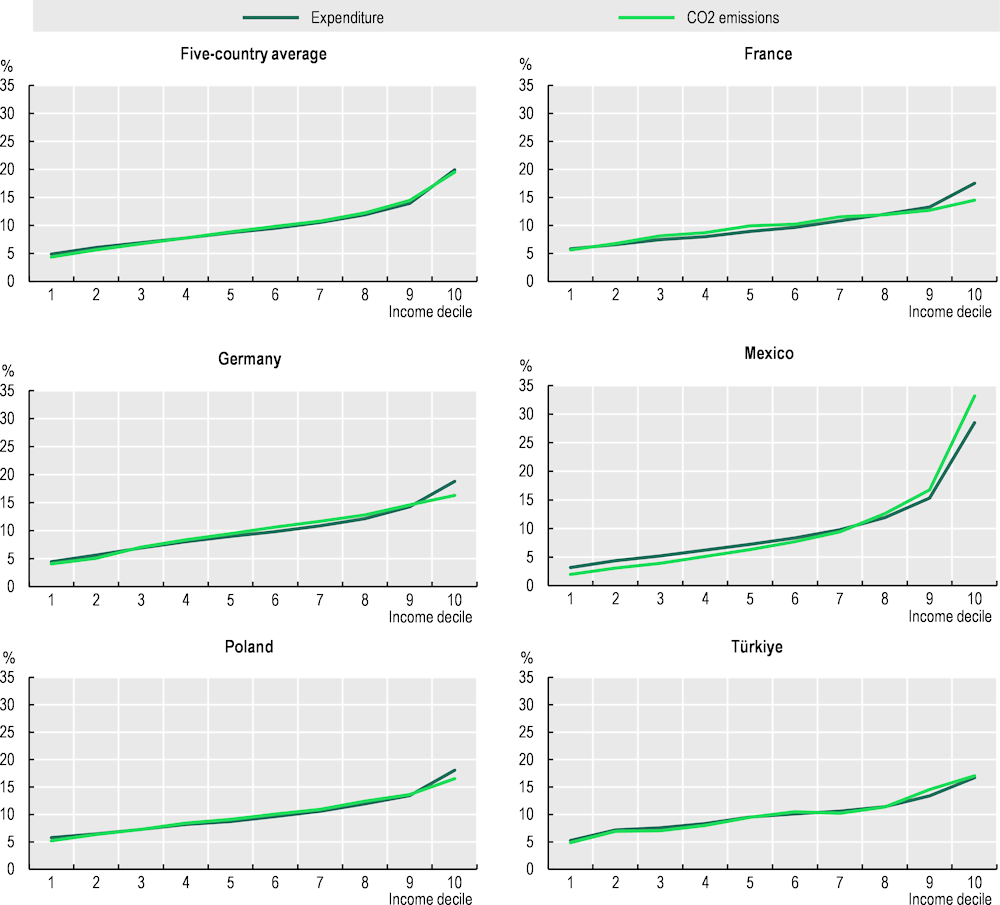

Within countries, the key driver of emissions disparities between poor and rich households is total consumption. In the five countries, on average, high-income households (top 10%) spent 4.5 times as much as the poorest 10% (Figure 5.7, top-left panel). Spending inequality was lowest in France and Poland (total spending for the top and bottom 10% differ by a factor of 3) and highest in Mexico (a factor of 9). Emissions associated with consumption therefore also rose strongly with income. On average across countries, profiles of total spending and emissions are very similar, pointing to the importance of total spending levels as a driver of carbon footprints. The findings on the income gradient of consumption-based emissions echo those found in Chancel, Bothe and Voituriez (2023[112])’s recent study, even though the results presented here are less skewed.

Figure 5.7. Carbon footprints are much bigger at high income levels, but in some countries low-income households consume greater shares of high-emission goods

Household expenditure and emissions shares of total, by (disposable) income decile

Note: Average expenditure (resp. emissions) by income group (equivalised disposable household income) as a percentage of overall expenditure (resp. emissions). Estimates follow the “consumer responsibility” principle, accounting for all household consumption, including both domestically produced and imported goods. They therefore attribute emissions to the country where the final good is consumed, and this differs from the emissions per capita that are physically released in a given country.

Reading: in Poland, expenditure from the lowest income decile accounts for about 6% of total national expenditure and expenditure from the highest income decile accounts for about 18%. About 5% of emissions accrued to the lowest income decile while 16.5% of emissions accrued to the highest income decile.

Source: OECD calculations using IEA emissions factors for different fuels, World Input-Output Database (WIOD) as well as household budget surveys (2015 for EU countries, 2016 for Mexico, 2019 for Türkiye).

But results for individual countries highlight that emissions can be reduced not only by spending less, but also by spending differently.23 In addition to total spending, the share of spending on particularly carbon-intensive items differs across income groups as well. Due to carbon-intensive necessities, including categories of energy and food, emissions per spending unit can be higher at the bottom of the distribution. Consumption among high-income households, although much larger than for poorer households in total, is then less carbon intensive. Figure 5.7 shows such a pattern in several high-income countries (France, Germany, Poland): for instance, in France, similar shares of total expenditure and carbon emissions accrue to the lowest income decile (resp. 5.8% and 5.6%) whereas the share of total expenditure was higher than that of emissions for the highest income decile (17.5% versus 14.5%). But differences are largely driven by consumption of the highest-income groups (top 10%) and differences in the incidence of emissions and total spending are small or very small in most individual countries and in the five countries on average. Calculations for Mexico indicate that the richest households not only consume more, but that their consumption is also associated with higher carbon emissions per spending unit: 3.2% of total expenditure and 1.9% of total carbon emissions accrue to the lowest income decile, while 28.5% of total expenditure and 33.2% of total carbon emissions accrue to the highest income decile. Section 5.4 discusses implications of these results for strategies to compensate households for carbon price burdens.

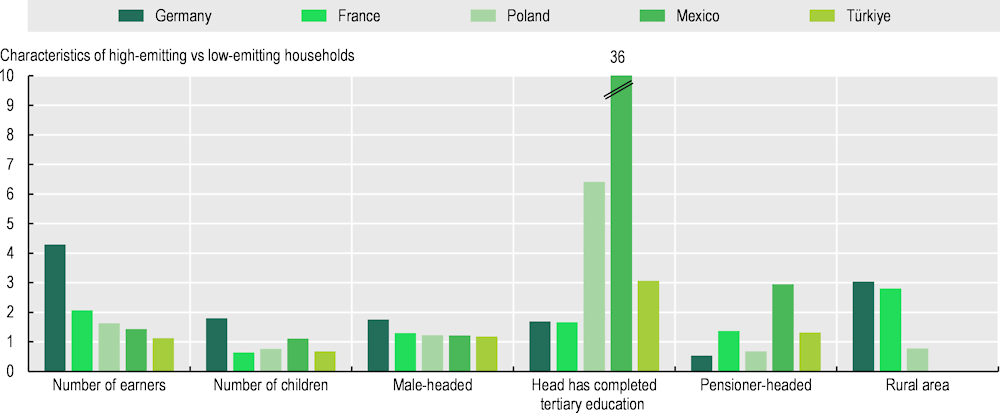

An exclusive focus on emissions differences by income misses many other characteristics that may drive the reliance on high-emitting products. As noted in the literature review, past research has often focussed on income‑emission gradients. Yet, a number of studies have documented large carbon-footprints disparities within income groups, pointing to the importance of drivers other than income. These may, for instance, include age, household size, or living in a rural area rather than a city – for the latter, see e.g. recent findings by the Swedish National Institute of Economic Research (Konjunktur Institutet, 2023[113]) – but also individuals’ consumption habits and environmental considerations. The broader social stratification of GHG emissions vary by country and can drive patterns of public support for, or resistance to, carbon pricing policies.24 These patterns need to be understood to design policy packages that do not disproportionately harm disadvantaged groups. A granular picture of emissions by demographic group is also needed for anticipating future emission trends and policy priorities, notably in the context of population ageing (Tian et al., 2023[114]).

Figure 5.8 compares a range of household characteristics between high-emitting and low-emitting households (see figure notes). Emissions in some EU countries are strongly related to the number of earners in the household, likely reflecting the importance of motor fuel for commuting purposes. Relatedly, in several countries, high emissions are more likely in rural areas, reflecting longer commuting times and typically different heating provisions and older housing stock with less insulation (urban/rural flags are not available from the Mexican and Turkish budget survey). There is also a notable gender dimension to carbon emissions with more male-headed‑ households among the top emitters, consistent with prevailing gender income gaps. The education gradient is also notable, and tertiary education is a particularly strong correlate of high emissions in Mexico and Poland. In practice, these and other characteristics are correlated, potentially strongly so. Future work should further analyse carbon footprints for a range of household characteristics, while controlling for others.25

Figure 5.8. Various household characteristics shape carbon footprints

Household characteristics at different emission levels (see figure note)

Note: Ratios compare socio‑economic characteristics between high-emitting households (the top 10% of emissions) and low-emitting households (the bottom 10% of emissions) as follows. Number of earners and number of children in the household: Ratio of average numbers of earners and children per household; Other categories: Ratio of number of households in a rural area, or headed by a male, by a person with completed tertiary education, or by a pensioner. Urban/rural indicators are not available from the Mexican and Turkish household budget surveys.

Reading, using the example of Germany: The average number of earners in the top 10% emitting households is 4.3 times that in the bottom 10% emitting households (note that the reason for this large relative difference is that almost 80% of the bottom 10% emitting households in Germany had no earner – and the average number of earners in the top 10% emitting households is 1.4). Reading is equivalent for “number of children”. For the other categories, ratios relate to the number of households in the top 10% and bottom 10% emitting households: the number of households located in rural areas, and the number headed by a male, by somebody with tertiary education, and by a pensioner. In other (less technical) terms, in Germany, high-emitting households were three times more likely to live in a rural area than low-emitting households.

Source: OECD calculations using IEA emissions factors for different fuels, World Input-Output Database (WIOD) as well as household budget surveys (2015 for EU countries, 2016 for Mexico, 2019 for Türkiye).

5.3.3. Policy changes: Who paid for recent carbon pricing measures?

Households’ carbon footprints are a primary determinant of carbon pricing burdens. But they are not the only one, as real-world carbon pricing measures do not apply uniformly, and not all emissions are therefore priced equally. For instance, excise taxes, carbon taxes and emissions trading systems can, and often do, vary substantially between industry and fuel type. For instance, in the 72 countries covered by the OECD ECR database, the road transport sector faces the highest carbon rates (rates above EUR 60 and EUR 120 per tonne of CO2 mostly occur in that sector), followed by the electricity and off-road transport sectors. In the industry and building sectors 72% and 64%, respectively, of emissions remain unpriced, while almost three‑quarters of emissions in the electricity sector face a positive carbon price (OECD, 2023[8]). The correspondence between household emissions and their carbon price burden is thus neither perfect nor straightforward, and depends on the specific design of carbon pricing measures.