Small and medium-sized enterprises (SMEs) are particularly dependent from external networks to access strategic resources, such as knowledge, technology, finance or skills, and to innovate and grow. Networks are also a source of resilience and sustainability. They can take different forms beyond buyer-supplier relationships, reflecting the linkages SMEs develop with their ecosystem through exchanges of products, services, assets, or through open innovation and collaboration. Such networks encompass production networks, knowledge and innovation networks (involving universities and providers of knowledge-intensive business service), and strategic partnerships. Clusters are often needed to create proximity and agglomeration benefits. Digital platforms and technologies are instrumental for knowledge transfer and network effects. This chapter discusses SMEs’ ability to join innovation and growth networks and to take advantage of them. It presents an overview of the wide range of policy measures to support SME network expansion, and it introduces the following thematic chapters of the report.

OECD SME and Entrepreneurship Outlook 2023

2. The role of networks for SME innovation, resilience and sustainability

Abstract

In Brief

Relative to their larger counterparts, small- and medium-sized enterprises (SMEs) typically underperform across a range of performance indicators, reflecting, in large part, difficulties in accessing new technologies, finance, data and skills, which, in turn, hamper innovation.

Networks are strategic assets to ease access, capture and leverage knowledge spillovers, and achieve external economies of scale.

Networks are also a source of resilience to better manage interdependencies and cope with uncertainty and disruptions. They can help SMEs accelerate the adoption of new environmental standards and due diligence requirements. Indeed, greater compliance with more sustainable and responsible practices is increasingly required for their integration into these same networks.

The importance of networks has been heightened by the growing volume of specialised knowledge required to remain at the knowledge frontier. The providers of knowledge-intensive business services (KIBS), including universities, increasingly act as co-producers of innovation, with SMEs using them to compensate for limited internal capacities. And for networks to deliver their full benefits, a certain degree of proximity and agglomeration between actors, notably through clusters, is often needed.

Open innovation has become a means for accelerating innovation processes and market diffusion (e.g. SME digital transformation during COVID-19). Indeed, collaborative firms – even smaller ones – tend to be more innovative than non-collaborative firms.

Digital platforms and information and communication technology (ICT) are also instrumental, enhancing knowledge and technology transfer possibilities and enabling external economies of scale through network effects.

Yet, SMEs’ ability to join different networks and take advantage of them remains limited and varies by network type and firm characteristics. For instance, between 29-41% of SMEs with a Facebook page indicate not being a member of any formal professional network. Those numbers are higher for women-led SMEs. And even if they can engage, size also affects the scope for capturing spillovers or conducting in-house innovation.

There is a large range of policy measures in place to reinforce SME integration across different networks. A mapping of 601 policy initiatives across OECD countries shows around half target stronger SME integration into production/supply chain networks with a third targeting knowledge and innovation networks, albeit with significant variations across countries.

SMEs need to transform and their networks can enable them to leapfrog

As countries and regions navigate between post-COVID-19 recovery and multiple global crises, rebuilding economies and making them stronger, greener and fairer is crucial. This will require more innovation, achieving greater resilience and sustainability and, in turn, stronger economic and productivity growth (OECD, 2021[1]). Because they account for 99% of the business population, SMEs and entrepreneurs can be critical drivers of these goals but they will need to transform and adapt to new business conditions (Chapter 1).

SMEs’ performance and adaptative and scale-up capacity are closely related to their ability to connect and expand their networks, tap into external pools of resources and achieve external economies of scale (OECD, 2019[2]; 2022[3]). Through networks, SMEs can overcome many size-related barriers to accessing resources (such as technology, data and skills), finding new business partners, new markets and more diversified sources of finance, and capturing knowledge spillovers. In fact, SMEs, due to their more limited internal capacities, tend to be more dependent on external sources of knowledge, so their integration into local, national and global innovation and knowledge networks is critical for their transformation and scaling up. Strong networks are also a key attribute of successful entrepreneurial ecosystems and critical in stimulating and growing start-ups.

Recent years have seen SME networks significantly disrupted, with growing magnitude and frequency, raising concerns about their capacity to adapt and steer future growth. Most recently, shocks such as the COVID-19 crisis and Russia’s war of aggression against Ukraine have both had cascading effects on global supply chains. But natural disasters, as well as an upsurge of cyberattacks, have also had strong repercussions on SME networks. More than ever, innovation systems are shaped by geopolitics and global economic interests. Multinationals through their optimisation and supply chain due diligence strategies are playing a leading role in the reorganisation of global industrial and innovation systems and the transformation of SMEs.

Preparedness and capacity to be reliable and resilient nodes in these emerging networks is critical, for SMEs, the networks and all actors within them. Yet, their ability to integrate and take advantage of these connections remains limited. The density and diversity of external linkages they can create are lower and the scope for network engagement to influence in-house innovation processes or create spillovers is more limited than for larger firms.

SMEs are part of a complex network of networks

In general terms, networks designate a set of nodes, links (or connectors/arcs) and transfer mechanisms that enable flows, for instance of data and codified information in the case of information technology (IT) networks or of products, services and assets in the case of business networks. The interactions of network actors over time can also lead to the sharing of common objectives, information or costs. Networks can be materialised with infrastructure, formalised through contracts and agreements, or remain informal (Annex 2.B).

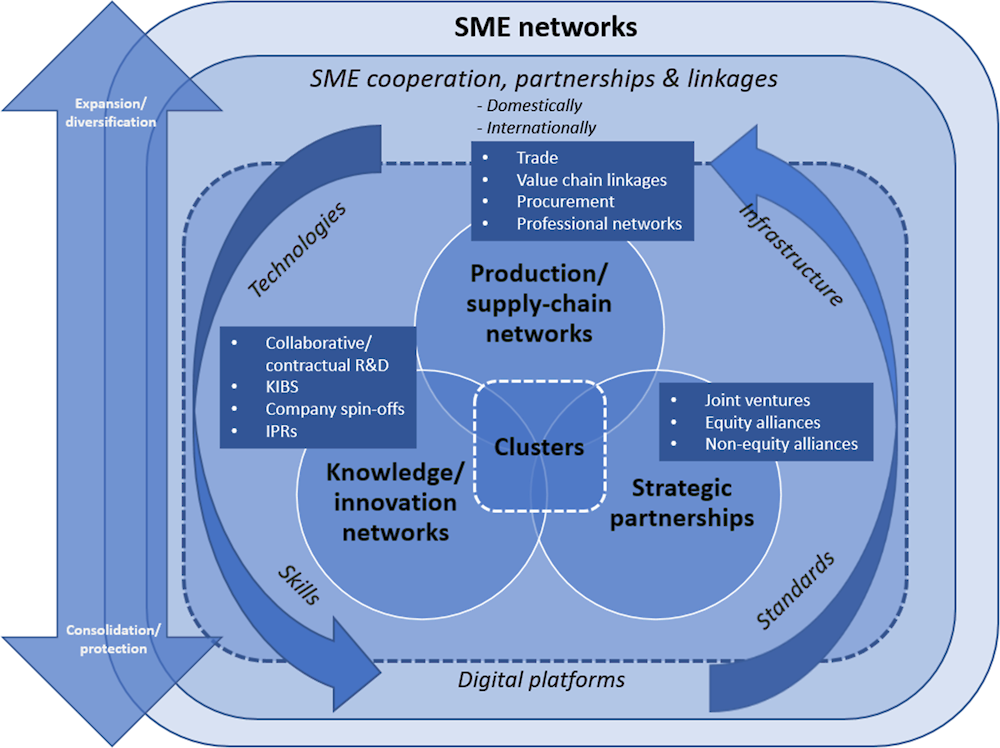

SME networks can take different forms and go beyond buyer-supplier relationships. They reflect the wide range of ties SMEs develop with the multitude of actors that make up their ecosystem and with whom they exchange products and services, knowledge and assets. They include formal or informal arrangements that enable access to resources (Ahuja, 2000[4]). Four key types of SME networks are considered in this report (Figure 2.1):

Production/supply chain networks are a “nexus of interconnected functions, operations, and transactions through which a specific product or service is produced, distributed and consumed” (Coe, Dicken and Hess, 2008[5]). They link business actors engaged in the production process, from pre-production (e.g. research and development [R&D], design, etc.) to production (e.g. sourcing, assembly, etc.) and post-production (e.g. marketing, distribution, etc.). Production networks are designed for cost efficiency, lean management or just-in-time requirements, with a strong focus on optimising the interfaces between participating companies (Nilsson, Magnusson and Enquist, 2003[6]). Of particular focus in this work are production networks that generate knowledge and innovation spillovers for the SMEs engaged.

Knowledge/innovation networks connect institutions and businesses within global, national and regional innovation systems, across organisational, spatial and disciplinary boundaries, to develop and share knowledge, pool innovation resources and support skills transfer. They include co‑operation on R&D, applications, technology transfer and commercialisation (OECD, 1999[7]).

Strategic partnerships refer to formal agreements between a set of firms, even competitors, or public and private actors (e.g. industry, universities, public research/technology institutions) that pool resources and/or share costs, with a main motivation of innovation and/or commercialisation (OECD, 2023[8]; 2016[9]). These forms of co‑operation are relevant for enabling SMEs to access strategic resources and have distinct but also common characteristics with production and innovation networks. They include licensing agreements, franchising, integrated product offering, joint ventures, equity sharing, R&D consortia, centres of excellence, etc. In a strategic partnership, a company exerts some influence over the activities of another (Andrenelli et al., 2019[10]).

Clusters are networks of interdependent firms, knowledge-producing institutions (higher education institutions [HEIs], research institutes and technology-providing firms), bridging institutions (e.g. providers of technical or consultancy services, technology transfer offices) and customers, linked in a production chain, sector-specialisation or geographical area.

Figure 2.1. A typology of SME networks: Stylised view

Source: EC/OECD (2023[11]), Unleashing SME Potential to Scale Up, https://www.oecd.org/cfe/smes/sme-scale-up.htm, Phase II on Network expansion; EC/OECD (2023[12]), Fostering FDI-SME Ecosystems to Boost Productivity and Innovation, https://www.oecd.org/industry/smes/fdi-sme.htm, Phase II on FDI-SME linkages and ecosystems.

KIBS form a particular set of networks embedded in SME innovation networks and encompass professional and science and technology (S&T) services, including legal, accounting and management services, engineering, R&D and computer systems services, design and advertising services, etc. They are increasingly used to compensate for a lack of internal capacity in SMEs, to develop innovation-related skills, or outsource knowledge and R&D, and to complement the capacities of universities and public research institutions (PRIs) (Cervantes and Meissner, 2014[13]). KIBS may act as co‑producers of innovation thanks to their close relationship with client firms (Den Hertog, 2000[14]). They form part of knowledge markets that also include searchable repositories that facilitate the transfer of existing knowledge, platforms for (crowd)sourcing solutions, intellectual property (IP) marketplaces (e.g. IP brokers, patent pools) or standard-setting and accreditation organisations (Kergroach, 2020[15]; OECD, 2013[16]).

Table 2.1. SMEs networks: Typologies, partners, linkages and benefits

|

SME networks |

Actors and partners (nodes) |

Linkages (connectors) |

Flows |

Benefits |

|---|---|---|---|---|

|

Production/supply chain networks |

Equipment and component suppliers – Users and competitors - Multinationals |

Trade, value chain relationships, foreign direct investment (FDI), intra-group exchanges, public procurement, professional networks (industry-based), digital platforms and networking facilities |

Products, services, finance, technology and innovation spillovers, intangibles (intellectual property rights or IPRs) |

Cost efficiency, increased quality and traceability, lean management and just-in-time process, proximity to and feedback from the market, applied solutions |

|

Knowledge / innovation networks |

SMEs – actors in the knowledge triangle including other R&D and innovative enterprises (multinationals-MNE- labs), HEIs and PRIs, government and intermediaries (technology transfer offices) |

Contractual R&D, collaborative R&D, consultancy, KIBS, training, labour mobility, patenting and licensing, spin-off, digital platforms and networking facilities |

Codified and tacit knowledge, R&D, data (research results and experiments), skills, technology, financing, intangibles (IPRs) |

Reducing the costs of R&D, reducing time to market, reducing uncertainty, increasing ability to deal with complexity |

|

Strategic partnerships |

All types of enterprises, start-ups and multinationals, SMEs, all actors of the innovation systems |

Agreements - strategic technology alliances (such as R&D joint ventures, research consortium, joint R&D agreements and minority holdings), licensing, franchising |

Codified and tacit knowledge, R&D, data (research results and experiments), skills, technology, financing, intangibles (IPRs), infrastructure (transport, production), etc. |

Knowledge and asset sharing (IPRs, finance), reduced costs for accessing resources and markets |

|

Clusters |

All of the above, cluster management organisations |

Market-based relationships |

All of the above |

All of the above, agglomeration and specialisation benefits, e.g. reduced costs for accessing local infrastructure and services, lower transaction costs (contracts), easier access to specialised skills, input and suppliers, enhanced knowledge transfer, etc. |

Note: See (Rosenfeld, 2001[17]) for a discussion on differences between networks and clusters. The knowledge triangle is a policy framework that stresses the need for an integrated approach towards research, innovation and education policies, especially those directed towards HEIs which fulfil several important roles in national innovation systems (OECD, 2016[9]).

Source: Based on OECD (1999[7]), Managing National Innovation Systems, https://doi.org/10.1787/9789264189416-en; OECD (2004[18]), Networks, Partnerships, Clusters and Intellectual Property Rights: An Opportunity and Challenges for Innovative SMEs in a Global Economy, https://www.oecd.org/cfe/smes/31919244.pdf; OECD (2013[16]), Commercialising Public Research: New Trends and Strategies, https://doi.org/10.1787/9789264193321-en; Kergroach, S., D. Meissner and N. Vonortas (2017[19]), “Technology transfer and commercialisation by universities and PRIs: Benchmarking OECD country policy approaches”, https://doi.org/10.1080/10438599.2017.1376167; OECD (2023[8]), Policy Toolkit for Strengthening FDI and SME Linkageshttps://doi.org/10.1787/688bde9a-en.

Digital platforms and ICT are instrumental for knowledge and production networks, serving as connectors, offering enhanced transfer possibilities and enabling external economies of scale through network effects (OECD, 2019[2]; 2021[20]). They are of particular relevance for smaller businesses. ICT has substantially reduced the cost of copying, storing and sharing data and enabled new models of knowledge sourcing. Digital platforms have allowed the centralisation of software, technology or databases (e.g. through cloud computing services), ideas and solutions (e.g. through crowdsourcing and collaborative platforms on specialised software solutions), and user and client data (e.g. through e-commerce platforms), giving the firm greater access to a larger portfolio of innovation assets at a reduced cost. In addition, beyond famous platform leaders (e.g. Apple, Alphabet, Google YouTube, Google Search, Twitter, Meta Facebook, etc.),1 platform developments are also conducted by smaller actors in sectors such as the sharing economy (Sanasi et al., 2020[21]), healthcare (Fürstenau et al., 2018[22]) or fashion (Schmidt et al., 2020[23]), and a number of agricultural industry or business-to-business (B2B) services (Box 2.1). These industry platforms rely heavily on complementary innovations to succeed and orchestrate innovation in their own innovation ecosystems around a specific technological core (Gawer and Cusumano, 2013[24]; Thomas et al., 2020[25]).

Box 2.1. Collaborative platforms for opening digital innovation to SMEs: Selected examples

SME AgrodatAi (Colombia) is a technological platform that connects actors in agricultural value chains, from producers to insurance entities, and provides them information on supply and demand for agricultural and livestock products, inputs, technology, credit and insurance through tools, such as a web platform, mobile application and chatbot. Launched in 2019, the platform also has plans to connect producers with members from the agrifood value chain through a marketplace associated with the commercialisation of agricultural products and the purchase of inputs.

Tre-e consortium (Italy) is a B2B technology provider founded by 18 SMEs in the lift sector. The platform enables traditional SMEs operating in the sector to enhance productivity through more efficient monitoring. Technologies using the Internet of Things (IoT) allow them to co‑ordinate logistics along the supply chain and share administrative and historical data for improvements in service efficiency. Blockchain and artificial intelligence (AI) are being integrated into the platform for further efficiency, e.g. predictive maintenance.

DIGITAL SME Alliance (Europe) is Europe’s largest association of digital small firms and entrepreneurs. The alliance launched a platform for traditional and non-technological SMEs to access a catalogue of digital solutions, from smart working or video conferencing tools to 3D printing, e-learning and AI-modelling technologies. The platform was designed to promote small suppliers of digital services and solutions to compete with larger technology firms.

Source: OECD (2022[26]), OECD Digital for SMEs Global Initiative (D4SME), OECD, Paris, https://www.oecd.org/digital/sme/; conversations with small business owners.

Networks are critical for SME transitions towards higher productivity, resilience and sustainability

The importance of domestic and international linkages for SME performance is widely documented (see below and OECD (2019[2])). Indeed, competing requires SMEs to access strategic resources (i.e. finance, skills and innovation assets) that are more often found externally, since their size limits the scope for pooling and internalising. The spread and quality of linkages is also a determinant for creating external economies of scale. In fact, recent evidence shows that SMEs that experience high growth and succeed in maintaining their new size over time, i.e. reaching a higher scale of performance and productivity durably, have developed strategies of innovation, investment or network expansion, often combining these different drivers in different ways and at different stages of their transformation (OECD, 2022[3]).

Networks can enable SMEs to leapfrog

Firms that lag in the innovation process can compensate by actively networking for resources and capabilities (Hilmersson and Hilmersson, 2021[27]), as seen for example in the case of the digital transformation of SMEs (OECD, 2021[20]), especially during the COVID-19 pandemic (OECD, 2021[1]).

Production networks have increasingly been a channel for accessing finance, skills and innovation assets. Within production networks, SMEs, as buyers or suppliers – and in particular through strategic relationships (Box 2.2) – can access know-how and technology embedded in business transactions and capitalise on diverse supply chain finance mechanisms (OECD, 2023[8]; 2019[2]; 2008[28]).

The importance of networks for innovating has been heightened by the growing volume of specialised knowledge required to remain at the knowledge frontier. Firms seldom innovate in isolation and networks of innovation involving multiple actors are the rule rather than the exception (DeBresson, 1996[29]). As a consequence, networks are increasingly recognised as an innovation asset (Corrado et al., 2005[30]; OECD/Eurostat, 2018[31]).

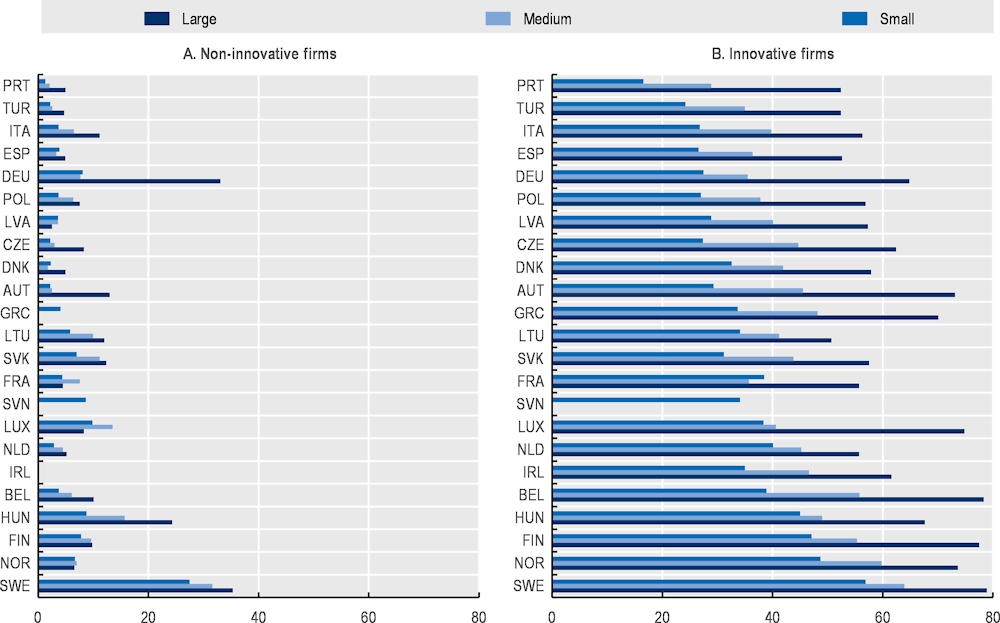

Collaborative firms tend to be more innovative than non-collaborative ones and, vice-versa, the most innovative ones tend to collaborate more (OECD, 2004[18]; Eurostat, 2022[32]). Innovation survey data show that there are more firms co‑operating on business activities with other enterprises or organisations among innovative firms than among non-innovative ones (Figure 2.2). Whilst there may be some differences across sectors (but where data are not available), this finding holds across all firm size classes, with even small innovative firms engaging more in co‑operation than large non-innovative ones. Open innovation has increasingly been seen as a means of accelerating internal innovation and market diffusion (Chesbrough, 2003[33]). And the shift towards “open innovation” has considerably reduced the investments needed, making the innovation endeavour more accessible to SMEs (OECD, 2010[34]; 2019[2]).

Box 2.2. Productivity spillovers between multinationals and domestic SMEs

The conditions of productivity spillovers between multinationals and domestic SMEs

Beyond its direct contribution to capital and job creation, foreign direct investment (FDI) can benefit host economies through knowledge and technology spillovers (Chapter 3). This is due to a productivity gap between foreign-owned affiliates and SMEs in the same economy, which often arises because of the larger size, better processes and higher capital or technological intensity of the former compared to the latter.

But FDI spillovers only occur if domestic SMEs are exposed to the activities of foreign firms and have the absorptive capacities to capture them. SMEs are exposed directly through value chain linkages and strategic partnerships, or indirectly, through market mechanisms or the influence that foreign firms may exert on their ecosystem (e.g. competition, imitation, labour mobility).

The magnitude of spillovers also depends on the FDI (e.g. greenfield versus brownfield investments). A greenfield investment is more likely to involve the direct transfer of knowledge and technology from the parent firm to the new affiliate in the host country (Farole and Winkler, 2013[35]). The strategy of the lead firm in the global value chain (GVC) and its willingness to share knowledge with the members of the chain can also determine the nature and intensity of spillovers.

Strategic partnerships – The example of Niaga-DSM (Netherlands)

Niaga (“again” in reverse), a Dutch start-up, was founded in 2010 to develop a carpet material that can be fully recycled. While the company had developed the fibre-binding technology necessary to produce the carpets, it lacked a proper adhesive that would allow for the different materials to be easily taken apart after use.

In 2012, the two founders of Niaga approached Royal DSM, a Dutch multinational corporation working in the fields of health, nutrition and materials, which expressed interest in developing a sustainable solution for the materials industry. In turn, the start-up needed access to DSM adhesive technology, along with capital and scientific know-how, to scale up its product to a commercially viable stage. The companies initiated a joint venture. The partnership allowed Niaga to commercialise its innovation in 2015. Together, Niaga and DSM have developed over seven patent families since their collaboration began.

Source: OECD (2023[8]), Policy Toolkit for Strengthening FDI and SME Linkages, https://doi.org/10.1787/688bde9a-en; WEF (2015[36]), Collaborative Innovation: Transforming Business, Driving Growth,

https://www3.weforum.org/docs/WEF_Collaborative_Innovation_report_2015.pdf; Ellen MacArthur Foundation (2023[37]), Redesigning Medium-life Bulky Products from Scratch: Niaga, https://ellenmacarthurfoundation.org/circular-examples/redesigning-medium-life-bulky-products-from-scratch.

Figure 2.2. Innovative firms (even smaller ones) co‑operate more than non-innovative ones (even the larger)

Source: Eurostat (2022[32]), Community Innovation Survey 2020 (CIS2020) (database), https://ec.europa.eu/eurostat/web/science-technology-innovation/data/database.

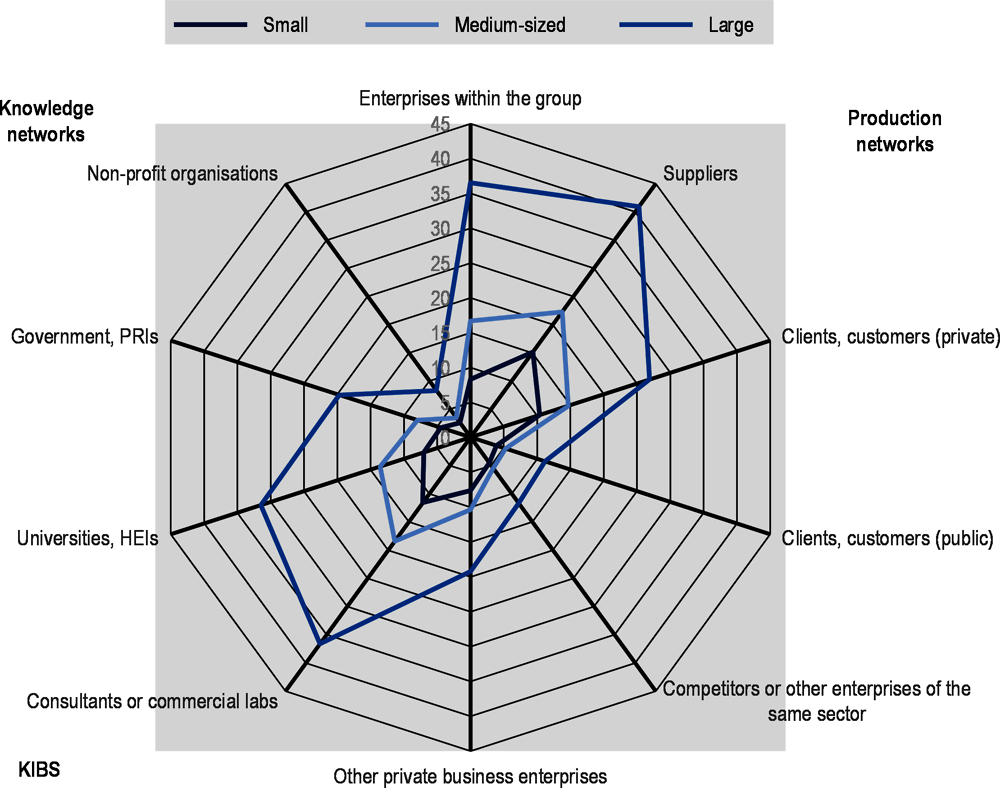

Universities and other PRIs are key actors in SME innovation networks, by generating positive spillovers to local firms and workers (Kantor and Whalley, 2014[38]) and contributing to knowledge co-creation, i.e. a joint production of innovation between industry, research and civil society (Kreiling and Paunov, 2021[39]). Universities and HEIs are important partners for co‑operation on R&D and innovation for enterprises of all size classes (Figure 2.3). Beyond the immediate economic returns from academic research that are not always easy to demonstrate (OECD, 2015[40]), universities also play a key role in upskilling and reskilling SMEs (Chapter 5), in developing applied solutions to their needs (sometimes through collaborative research with SMEs) or in providing them with consultancy services or access to advanced facilities. In turn, start-ups and SMEs are prime users of academic research. In its 2021 report on academic technology transfer, the United States (US) Association of University Technology Managers reported that 68% of university licenses are awarded to start-ups and small companies and two-thirds of the new businesses set up from academic research are headquartered in their institution’s home state (AUTM, 2021[41]), further consolidating university-SME networks.

Figure 2.3. Co‑operation more often takes place within production and knowledge networks but with substantial gaps between small and large firms

Note: EU average based on countries for which data are available. Refers to firm responses to the question: “Did your enterprise co-operate with other enterprises or organisations (Yes/No)? And what type of innovation co-operation partner?”.

Source: Based on Eurostat (2022[32]), Community Innovation Survey 2020 (CIS2020) (database), https://ec.europa.eu/eurostat/web/science-technology-innovation/data/database.

For networks to shape and deliver their full benefits, a certain degree of geographical, social and technological proximity between actors is needed. Proximity facilitates not only knowledge transfer, especially of tacit knowledge, but also fosters trust between actors (Box 2.3). Relational constructs play an important role in shaping network structure (Camanzi and Giua, 2020[42]). Likewise, technological proximity can facilitate knowledge flows. Knowledge transfer to domestic firms is greater when technology gaps between MNEs and domestic firms are smaller (OECD, 2023[8]).

Agglomeration benefits provide a strong rationale for clusters to form, and efficient business networks are at the core of successful clusters. Economic drivers of cluster formation include proximity to markets and suppliers, higher level of specialisation, availability of sector-relevant assets and infrastructures, and easier access to information and knowledge. The frequency of interactions among the cluster members tends to lower transaction costs, e.g. in contract negotiation and enforcement. Social norms prevailing in the networks can also increase trust (OECD, 2004[18]).

Box 2.3. Agglomeration benefits in innovation and production networks

Agglomeration economies occur when the spatial proximity of firms, workers and customers provides scope to reduce production costs through both external “supply-side” economies of scale (e.g. reduced transaction costs in accessing information or supplying skills and input from local concentrated markets and partners) and network effects (i.e. “demand-side” economies of scale whereby the value and utility of a good or service increase with the number of users) (OECD, 2019[2]; Arzaghi and Henderson, 2008[43]).

Domestic firms which are located near foreign firms in the same region are more likely to benefit from knowledge spillovers than other firms (Lembcke and Wildnerova, 2020[44]). Knowledge spillovers from MNEs have been found to be the strongest up to 10 km from the lead firm and progressively decrease between 10 and 50 km, partly reflecting production linkages but also other channels such as the mobility of managers.

KIBS are disproportionately concentrated in larger cities, where a larger pool of potential clients allows for increasingly specialised services (OECD, forthcoming[45]).

Geographical proximity to HEIs can increase knowledge transfer to the business sector, through university-industry linkages and co‑operation but also through the important contribution HEIs make to developing human capital, creativity and skills in their ecosystems. A 10% increase in distance between a university and a firm decreases the proportion of total R&D paid to the university by 1.4% (for enterprises that do not report any codified transfer of knowledge) and by half as much (for enterprises that do report codified knowledge flows) (Rosa and Mohnen, 2007[46]).

Proximity can also affect SME financing capacities. The British Business Bank found that in 82% of equity investment stakes, investors had an office within two hours of travel time of the company that they were backing. In 61% of stakes, the proximity was even closer: 1 hour or less (British Business Bank, 2021[47]).

Source: OECD (2019[2]), OECD SME and Entrepreneurship Outlook 2019, https://doi.org/10.1787/34907e9c-en; Arzaghi, M. and J. Henderson (2008[43]), “Networking off Madison Avenue”, https://doi.org/10.1111/j.1467-937X.2008.00499.x; Lembcke, A. and L. Wildnerova (2020[44]), “Does FDI benefit incumbent SMEs?: FDI spillovers and competition effects at the local level”, https://doi.org/10.1787/47763241-en; OECD (forthcoming[45]), Identifying Challenges in Regional Innovation Diffusion, OECD, Paris; Rosa, J. and P. Mohnen (2007[46]), “Knowledge transfers between Canadian business enterprises and universities: Does distance matter?”, https://about.jstor.org/terms; British Business Bank (2021[47]), Regions and Nations Tracker 2021.

SMEs can achieve greater resilience through their networks

Networks are a cornerstone for SME strategies of resilience, for anticipation, i.e. preparedness to avoid and face potential crises/disruption (ex ante), for mitigation, i.e. the ability to reduce the economic and social costs of shocks and disruptions, and for adaptation, i.e. the ability to bounce back after disruption (ex post) and innovate and scale up (Table 2.2).

Networks can be an asset for resilience (Table 2.2) but they can equally be a source of vulnerability. In stable environments, it may be sufficient for firms to engage in exclusive relationships with only a few partners. Firms in dynamic environments, such as international markets or innovation systems, need however to explore continuously multiple contacts and even accept a certain degree of redundancy in their external linkages, to cope with uncertainty and evolving and unpredictable knowledge needs (OECD, 2004[18]). A key measure that increases the resilience of individual businesses against disruptive shocks is business continuity planning, which includes backup suppliers and redundancy measures in supply chains (McKinnon, 2014[48]). Networks that provide flexibility and reduce interdependencies permit a wider range of solutions to emerge and be shared quickly among participants (Brende and Sternfels, 2022[49]). Firms that export and depend on downstream demand, market conditions and logistics abroad, can build resilience by diversifying market prospects and locations, especially in a closer neighbourhood, and by diversifying their supply (e.g. products or services in related sectors or segments). Likewise, firms that import and have access to markets abroad can build resilience through a broader supplier base that creates a certain degree of redundancy, as well as by diversifying sourcing and production locations (OECD, 2023[8]) (Chapter 3). Other strategic approaches include diversifying products, shortening production chains, creating inventory buffers or promoting a risk management culture in the firm.

Table 2.2. Achieving resilience through networks

|

SME strategies |

Objectives |

Means |

Strategic assets |

|---|---|---|---|

|

Anticipation (ex ante) |

Reduce exposure to risks |

Relocate, reduce interdependencies, create redundancy and diversify products, markets and suppliers, shorten both production chains and inventory buffers, promote a risk management culture |

Networks, data, managerial skills |

|

Mitigation |

Reduce economic, reputational and social damages due to shocks/disruptions |

Corporate governance (business continuity planning), insurance, financial buffers, risk sharing and transfer mechanisms |

Finance, processes, networks, managerial skills |

|

Adaptation (ex post) |

Bounced back faster and better after stress (also able to endure greater stresses) |

Agility, reactivity, innovation, co‑operation and information sharing |

Skills, data, technology, networks, finance |

Source: Based on McKinnon, A. (2014[48]), “Building Supply Chain Resilience: A Review of Challenges and Strategies”, https://doi.org/10.1787/5jrw2z6nnxlq-en; OECD (2021[20]), The Digital Transformation of SMEs, https://doi.org/10.1787/bdb9256a-en; OECD (2014[50]), Boosting Resilience through Innovative Risk Governance, https://doi.org/10.1787/9789264209114-en.

Greater sustainability for networking and networks for greater sustainability

Complying with environmental, social and governance (ESG) criteria or adopting more responsible business conduct (RBC) is increasingly a prerequisite for integrating production and innovation networks or engaging in strategic partnerships (see annex definitions). To address growing consumer concerns around sustainability and new related regulatory requirements, enterprises of all sizes have been implementing sustainable practices in their production strategies. This not only involves adapting own production processes but also making sourcing and contracting arrangements more sustainable (Kumar, Prakash and Kumar, 2021[51]). MNEs in particular have been taking steps to mitigate the environmental and social risks associated with their activities. Accordingly, they have been implementing due diligence principles in order to ensure that their supply chains adhere to RBC standards and to identify and address areas of concern (OECD, 2022[52]).

Integrating into more sustainable GVCs and production networks can result in knowledge spillovers for SMEs able to upgrade to new sustainability standards (OECD, 2023[8]). SME participation in more sustainable GVCs can also contribute to the wider diffusion of green and ecotechnology innovation (WTO, 2021[53]), which in turn could bring new business prospects for SMEs that would boost their reputation among customers, investors and professional networks. Adopting sustainable practices could also facilitate SME access to finance, in particular green financing (OECD, 2022[3]).

SMEs’ ability to integrate networks and take advantage of them remains limited

Despite evidence that the benefits of network integration can accrue to all of the participating firms, the density and diversity of external linkages tend to be lower in smaller firms. Smaller businesses are less likely to engage in international trade and connect to global markets (OECD, 2019[2]; 2023[8]), they have a more limited number of business partners, suppliers and customers, are less likely to co‑operate on R&D and innovation activities with external partners and are less likely to use digital platforms and digital tools that could support networking (OECD, 2021[20]).

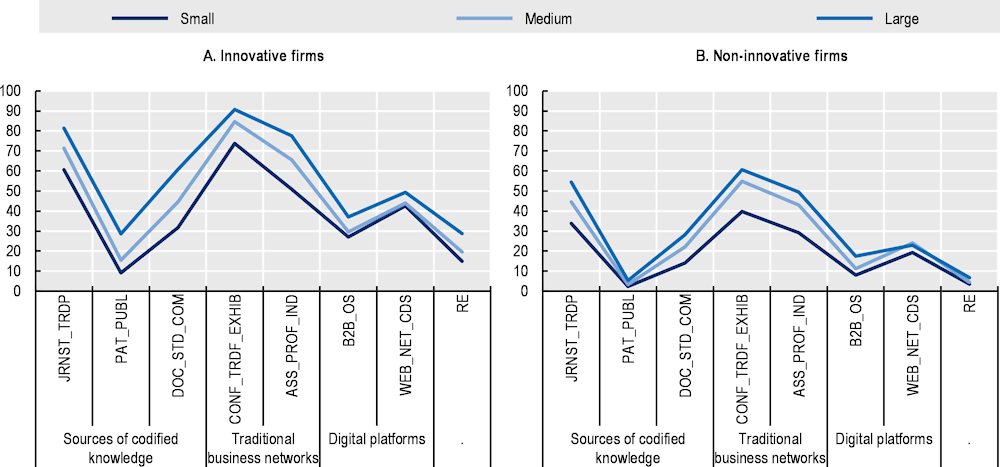

Even if they seem to follow similar knowledge-sourcing strategies, SMEs rely less on external sources of knowledge than large firms overall. The largest differences (20 percentage points, or more, across EU countries on average in 2018) can be observed in the use of highly technical or standardised sources and the sourcing of information from professional or industry associations (EC, 2022[54]). Non-innovative small firms also make relatively little use of conferences, trade fairs or exhibitions to inform their business decisions.

The smallest differences between small and large enterprises are seen in the use of digital platforms, such as social web-based networks or crowdsourcing and open B2B platforms or open-source software. Indeed, the typical business model of digital platforms revolves around their ability to attract as many users as possible by lowering costs of entry (in terms of finance, time and skills) in order to unlock network effects. This makes such platforms particularly attractive for resource-constrained SMEs (Gawer, 2021[55]; OECD, 2021[20]).

In fact, many SMEs do not belong to any formal network and membership varies across sectors. Between 29-41% of SMEs with a Facebook page indicate not being a member of any network. They are more likely to be involved in a professional network when they operate in knowledge-intensive information and communication services. Chambers of commerce seem to play a greater role in SME networking in wholesale and retail trade. SMEs are more often engaged in industry groups when they are in transportation and storage services or agriculture and mining.

In addition, SMEs also have a more limited capacity to take advantage of integration. Firm size affects the scope for collaboration and network engagement to influence in-house innovation processes or for business linkages to create spillovers (OECD, 2004[18]). Whereas for larger firms, collaboration leads to increased spending on innovation, for smaller innovative firms, collaboration is often a substitute for internal spending rather than a trigger for internal activities. In fact, a key challenge for them is to develop the necessary skills and management practices for co-ordinating and integrating external knowledge in in‑house practices and innovation processes (OECD, 2015[56]).

Figure 2.4. Despite similar sourcing strategies, SMEs rely less on external sources of knowledge than large firms overall, especially highly technical sources and professional networks

Note: [JRNST_TRDP] Scientific/technical journals or trade publications; [PAT_PUBL] Published patents; [DOC_STD_COM] Standardisation documents or committees; [CONF_TRDF_EXHIB] Conferences, trade fairs or exhibitions; [ASS_PROF_IND] Professional or industry associations; [B2B_OS] Open business-to-business platforms or open-source software; [WEB_NET_CDS] Social web-based networks or crowdsourcing; [RE] Reverse engineering.

Source: Based on Eurostat (2022[32]), Community Innovation Survey 2020 (CIS2020) (database), https://ec.europa.eu/eurostat/web/science-technology-innovation/data/database.

Figure 2.5. Many SMEs do not belong to any formal network and membership varies across sectors

Note: Share of firms by professional group. Shares were obtained using the question: “Which of these kinds of professional groups, if any, are you a part of?”. SMEs – firms with up to 250 employees – operating in 33 OECD countries (excludes Estonia, Iceland, Latvia, Luxembourg and Slovenia) are the subpopulation of analysis.

Source: Based on the OECD-World Bank-Meta Future of Business Survey, Data for Good, (March 2022).

There is a large range of policy measures to support SME network expansion

Governments deploy a broad range of measures – some targeted directly at SMEs, others more generic – to support SME network expansion. A cross-country analysis of national policy mixes in place across OECD countries, carried out as part of a multiannual EC/OECD project Unleashing SME Potential to Scale Up, provides an overview of the character and intensity of government efforts (OECD, 2023[57]). The analysis, based on 601 policy initiatives identified across OECD countries, shows that priority is given to expanding SME connections through (global) trade networks (Figure 2.6), with 52% of total measures dedicated to strengthening SME integration into production/supply chain networks and one-third of public efforts dedicated to fostering linkages within knowledge/innovation networks. Lower focus is given to the development of strategic partnerships and SME integration into clusters, accounting for on average only 12% and 3% respectively, of all policies mapped.

Table 2.3 below provides an overview of selected policy initiatives across the four main network categories identified for this edition of the OECD SME and Entrepreneurship (SME&E) Outlook, with further analysis provided in the following chapters.

Figure 2.6. Most OECD governments place the strongest focus on integrating SMEs into production and supply chain networks

Note: Figures in parenthesis indicate the number of policies mapped for each country.

Source: Calculations based on an international mapping of national policies and institutions supporting SME network expansion (OECD, 2023[57]), EC/OECD project on Helping SMEs Scale Up (data extracted on 21 April 2023). The mapping forms a building block of the OECD Data Lake on SMEs and Entrepreneurship (OECD, 2023[58]).

Table 2.3. Policies in support of SME network expansion: selected OECD country examples

|

Typologies of policy instruments |

Targeted/ Generic |

Timing |

Country initiatives |

KIN |

PSCN |

SP |

C |

|

|---|---|---|---|---|---|---|---|---|

|

Creating a supportive business environment |

||||||||

|

Institutional & regulatory framework |

Regulation |

Generic (with focus on SMEs) |

2020 |

Solidarity network contracts (ITA) Law No. 77 of 17 July 2020 amends the law establishing business networks, creating a type of network company "with reason of solidarity". The intention is to encourage the establishment of networks of supply chain companies, to maintain the level of employment, resorting to the institutions of secondment and co- ownership. |

✓ |

✓ |

||

|

Regulation |

Generic |

1993 - |

National Cooperative Research and production Act (USA) - A federal law that establishes certain protections for any joint research, development, or production venture. |

✓ |

✓ |

✓ |

||

|

Non-financial support |

Generic |

n/a |

Toolkit for national R&D collaborations (LUX) – The toolkit provides companies with practical information for cooperation with research organisations including IP law, forms of cooperation and contracts |

✓ |

||||

|

Market conditions |

Non-financial support |

Targeted (SMEs) |

2017 - |

SESAM (POL) – In line with Directive 2014/24/EU, the initiative aims to facilitate SME participation in domestic and cross-border procurement, with a focus on France, Germany, Italy and Poland, by providing relevant knowledge and support, in particular through seminars, trainings, factsheets and guidelines, networking events and advisory services. |

✓ |

|||

|

Financial support |

Targeted (SMEs) |

2022 - |

Consortia for internationalization (ITA) – A non-refundable grant for promoting the international dissemination of products and services of SMEs, as well as support for their presence on foreign markets, incl. through collaboration and partnerships with foreign companies. |

✓ |

||||

|

Infrastructure |

Platforms and networking infrastructure |

Generic |

2014 - |

Switzerland Innovation (CHE) - the innovation park consists of six sites nationwide, which together form an ecosystem that aims to facilitate collaboration between domestic and international companies, start-ups, and universities to accelerate the transformation of research results into marketable products and services. |

✓ |

✓ |

||

|

Platforms and networking infrastructure |

Targeted (Start-ups) |

2015 - |

Start-up Hub (PRT) - an online platform that allows to identify and geolocate start-ups, incubators, and tech hubs, and which provides information on the various support mechanisms available in Portugal. It also serves as a tool for matchmaking, networking and to further nourish the start-tup scene in Portugal. |

✓ |

||||

|

Mix of financial and non-financial support |

Targeted (Start-ups) |

2018 - |

Strategic Global Partners and Networks (LVA) – the initiative seeks to secure strategic partnerships with the most known startup ecosystems and networks around the globe, including e.g., a partnership with San Francisco’s WE WORK, a government-to-government Memorandum of Understanding with Gyeonggi province (South Korea), as well as a partnership with the Google Cloud for Startups Program. |

✓ |

||||

|

Improving access to strategic resources |

||||||||

|

Finance |

Financial support |

Generic |

2008 - |

SIB Subsidy (NLD) - Businesses can use the subsidy to participate in a trade mission or fair in a specific country to promote products or services to potential customers and connect with possible trading partners and investors. |

✓ |

|||

|

Financial support |

Targeted (SMEs, entrepre-neurs) |

n/a |

R&D&I grants in an international consortium (BEL) - By participating in international networks, Flemish project partners can receive direct subsidies from Flanders for their international cooperation on research, development, and innovation (R&D&I) activities. |

✓ |

||||

|

Skills |

Financial support |

Generic (with focus on SMEs) |

2007 - |

Impulse Training Networks (AUT) – a grant to support companies in providing cost-efficient and work-relevant training, with a focus on promoting joint training and learning in SMEs. Company networks need to be composed of at least three companies, with at least 50% of them being SMEs to be eligible for the grant. Funding is provided for building and operating the network, identifying training needs and designing training plans, advising on the development of HRD programs, organising trainings, etc. |

✓ |

|||

|

Non-financial support |

Generic (with focus on SMEs) |

2013 - |

Education for international business (SVN) - The aim of the programme is to prepare Slovenian companies for accessing international markets through various online tools for self-assessment, export education and consulting services, and provision of information related to overseas expansion. |

✓ |

||||

|

Innovation assets (e.g., data, networks, tech etc.) |

Financial support |

Targeted (SMEs) |

2016 - |

KMU-NetC (GER) – a non-repayable grant that supports networks and clusters in Germany who can initiate new application-oriented innovation activities with SMEs. The cooperation should be geared to both the needs of SMEs and the innovation strategies of the networks and clusters. |

✓ |

✓ |

||

|

Non-financial support |

Targeted (women entrepre-neurs) |

2008 - |

National Women’s Enterprise Day (IRL) - Ireland’s largest female enterprise event, organised by the Local Enterprise Office along with Enterprise Ireland. The all-day event opens the prospect of entrepreneurship to women who may not have considered it before and highlights what support is available, including financial incentives, training, and development programmes. It also provides networking opportunities and connections with industry experts. |

✓ |

||||

|

Financial support |

Generic |

2018 - |

SAYEM - Industrial Innovation Networks (TUR) – a grant to support the development of high value-added products or product groups by creating innovation networks in cooperation with the private sector (with a particular focus on firms that operate an R&D and product design centre), universities and the public in line with national high / medium-high technology targets. Actors in the network have the opportunity to co-create high value-added products and technologies for market commercialisation. |

✓ |

||||

|

Platforms and networking infrastructure |

Generic |

2001 - |

Kea Connect (NZL) - A free service of the Kea agency that connects NZL businesses with an extensive, international community of national experts and industry professionals who are ready to provide market intelligence, connections, and mentorship. |

✓ |

✓ |

|||

|

Improving SME&E policy governance |

||||||||

|

Policy coordination and monitoring |

National strategies and action plans |

Generic |

2016-2025 |

Open Innovation Strategy (AUT) - Addresses the goals, measures and methods of open innovation in Austria. One of these measures refers to further developing and providing open innovation methods and instruments specifically for SMEs. |

✓ |

|||

|

National strategies and action plans |

Generic (with focus on SMEs) |

2017 - |

Britain Open for Business (GBR) - The UK Department for International Trade’s five-year strategy outlines ways to encourage and support more SMEs to enter international markets. It raises awareness of the benefits of exports through the web and social media, as well as through programmes and regional events on opportunities in high growth and emerging markets. |

✓ |

||||

|

Government settings, agencies |

Generic |

2015- |

Business France (FRA) - a national agency that supports companies in their export and international expansion projects. It prepares companies and puts them in contact with commercial partners in target markets to promote the creation of business flows and to sustain exports. |

✓ |

✓ |

|||

Note: KIN - Knowledge/ innovation networks; PSCN - Production/ supply-chain networks; SP - Strategic partnerships, C – Clusters.

Source: Based on an international mapping of national policies and institutions supporting SME network expansion (OECD, 2023[57]), EC/OECD project on Helping SMEs Scale Up (data extracted on 21 April 2023). The mapping forms a building block of the OECD Data Lake on SMEs and Entrepreneurship (OECD, 2023[58]).

Annex 2.A. Definitions

Circular economy (CE)

CE is built on three principles: i) to reduce waste and pollution; ii) to optimise resource use and productivity, and reduce consumption of new primary materials; and iii) to improve the preservation of natural resources and their regeneration (Ellen MacArthur Foundation, 2023[59]; OECD, 2019[2]). In economies of “take, make and dispose”, most of the value created is “lost” in landfills and products, components and materials are under-utilised. In addition to driving a sub-optimal factor productivity, this linear system increases firms’ exposure to risks, notably related to higher and less predictable resource prices and supply disruptions. The circular economy, whereby the value of products, materials and resources is maintained in the economy for as long as possible and the generation of waste minimised, has emerged as a new paradigm for further decoupling economic growth from resource use.

Circular trade

Circular trade could be understood as any international transaction, either material or immaterial, that contributes to circular economy activities at the local, national and global levels. This includes trade in circularity-enabling goods, services and IP, as well as trade in end-of-life products (e.g. second-hand or refurbished and remanufactured goods, secondary raw materials and waste, scraps, and residues) (Tamminen et al., 2020[60]). In fact, if circular industrial systems aim to create “local value loops”, there is also growing awareness of the strong linkages these production systems can have with international trade due to the interconnectedness of global value chains (GVCs) (Moïsé and Rubínová, 2023[61]) (Yamaguchi, 2018[62]). Notwithstanding, very little is currently known about how supply chains can align with circular economy principles.

Corporate social responsibility (CSR)

CSR means different things to different groups but there is general agreement that in a global economy, businesses are often playing a greater role beyond job and wealth creation (OECD, 2001[63]). Consequently, corporate behaviour must not only ensure returns to shareholders, wages to employees and products and services to consumers but they must respond to societal and environmental concerns and values. The European Commission has defined CSR as “a concept whereby companies integrate social and environmental concerns in their business operations and in their interaction with their stakeholders on a voluntary basis”. CSR and RBC are often used interchangeably (EC, 2022[64]).

Environmental, social and governance (ESG)

ESG criteria focus mainly on the assessment of business performance and are adopted for informing sustainable and responsible or social impact investment strategies (Boffo and Patalano, 2020[65]). ESG investing responds to growing demand by institutional and retail investors, as well as certain public sector authorities, to incorporate long-term financial risks into decision making and improve risk management while improving portfolio returns (Boffo and Patalano, 2020[65]). It also reflects a growing awareness among firms of the potential ESG approaches could bring to boost efficiency-driven productivity and profits.

Growth

SME growth is measured in different ways and different studies have used different criteria. Growth is most commonly measured in terms of employment (number of employees) or turnover (sales) (Coad et al., 2014[66]). Of these, employment-based metrics are more commonly used as employee headcount is more often available in administrative datasets on enterprises. Metrics of growth (absolute or relative), the period over which growth is measured and the process of growth (organic-internal versus acquired-external) vary (Monteiro, 2019[67]; Schreyer, 2000[68]; Delmar and Davidsson, 2020[69]; OECD, 2021[70]).

Scale-ups or, more explicitly, high-growth firms (HGFs) are defined in the Eurostat-OECD Manual on Business Demography Statistics as enterprises with at least 10 employees at the beginning of a 3-year period that saw average annual growth of over 10% (or 20%) in employment or turnover (OECD, 2007, p. 61[71]). Recent OECD work documents the heterogeneity of firms that scale up and the very diverse trajectories they go through. The work calls for broader measures and notions of scaling up in order to account for the social and/or environmental benefits that a larger set of firms, which are rarely captured by traditional economic performance and high-growth indicators, can bring (OECD, 2021[70]; 2022[72]).

Innovation

The OECD/Eurostat Oslo Manual defines innovation as “a new or improved product or process (or a combination thereof) that differs significantly from the unit’s previous products or processes and that has been made available to potential users (product) or brought into use by the unit (process)” (OECD/Eurostat, 2005[73]). The term “innovation” refers to both an activity and the (successful) outcome of this activity. It is a broad concept that encompasses a wide range of diverse activities. R&D, for instance, is one of the activities that can generate innovations, or through which useful knowledge for innovation can be acquired or created. The diffusion of new technology is also central to the process of innovation and its diffusion. In that sense, innovation is both a channel for improving SME performance and a measure of its performance (OECD, 2022[72]). Innovation, together with investments and network expansion, can drive SMEs to scale up (high growth) and triggers their transformation in a durable manner.

Open innovation

Open innovation denotes the flow of innovation-relevant knowledge across the boundaries of individual organisations (OECD/Eurostat, 2018[31]). Networking with other companies, R&D facilities, interacting with start-up ventures, public research institutions (PRIs), universities and external suppliers and sharing and accessing outside information and technology is central to the approach. To note, the notion of “openness” does not imply that knowledge is free of charge (“gratis”) or exempt from use restrictions (“libre”). On the contrary, pricing and use restrictions are often key conditions for access to knowledge (OECD/Eurostat, 2018[31]). While “open source” refers to royalty-free technologies, open innovation refers to collaborative networking, and may still involve the (significant) payment of license fees for intellectual property (IP).

Essential components of open innovation include: i) networking, building contacts, meeting colleagues and creating opportunities; ii) collaboration, working synergistically with partners; iii) entrepreneurship, thinking creatively to find solutions; iv) IP management, maximising value; v) global vision, recognising that the 21st-century marketplace is planet earth; vi) knowledge, the key asset in the global knowledge-based economy; vii) access to finance, learning how to be a magnet for investment; and viii) access to information, which is the key driver of innovation (Kowalski, n.d.[74]).

Resilience

The OECD Recommendation on the Governance of Critical Risks defines resilience as “the ability to resist, absorb, recover from or successfully adapt to adversity or a change in conditions” (OECD, 2014[75]), so for a system to absorb disturbance and reorganise itself so as to still retain essentially the same function, structure, identity and feedbacks (OECD, 2014[50]). While traditionally used in an information technology (IT) context – i.e. ensuring that applications and data remain available and secure during a disruptive event such as a cyberattack - the term has increasingly referred to an organisation’s ability to adapt operations and continue to thrive. More recently, the concept has also been broadened to social and environmental improvements for increasing well-being (OECD, 2020[76]).

There is a general trend among enterprises towards acknowledging the need for an engagement vis-à-vis civil society and greater awareness of social, societal and environmental concerns. The latter could be integrated into corporate decision making, be at the core of a firm’s objectives, its business and its governance model, and constitutes its “social purpose”, regardless of size or legal form. Increasingly, firm performance is therefore evaluated on sustainability criteria, being for stock valuation, investment, certification or business and partnership purposes, etc.

On this front, SMEs may however have less capacity than large firms to engage the organisational, monitoring and accountability changes needed, or to comply with standards, reporting requirements and a growing legislative demand for coherent and robust circularity metrics (Barrie et al., 2022[77]).

Responsible business conduct (RBC)

RBC is a foundation of sustainable economic development, whereby a company takes responsibility for its value chain in dialogue with stakeholders and intends to minimise the adverse impacts of its operations and other business relationships (e.g. with suppliers, franchisees, licensees, joint ventures, investors, clients, contractors, customers, consultants, advisers and any other non-state or state entities linked to its business operations, products or services) (OECD, 2021[78]). RBC issues include human rights abuses, financial crime, corruption or environmental degradation, etc.

Sustainability

Sustainability refers to the use of the biosphere by present generations while maintaining its potential yield (benefit) for future generations; and/or non-declining trends of economic growth and development that might be impaired by natural resource depletion and environmental degradation (OECD, 2022[79]). The United Nations (UN) Sustainable Development Goals (SDGs) provide a framework for monitoring public action towards achieving a better and more sustainable future for all and the implementation of the 2030 Agenda for Sustainable Development (UN, 2015[80]). The SDGs recognise that ending poverty and deprivation must go hand-in-hand with strategies to improve health and education, reduce inequality and spur economic growth – all while tackling climate change and preserving oceans and forests.

Annex 2.B. Networks and their impact on SME performance: Insights from the literature

The organisation of networks depends on a number of features: e.g. of their nodes (i.e. firms, institutions, people, within the same industry/territory or across industries/territories etc.), the types of connections that link them (i.e. formal or informal, vertical or horizontal, their frequency) and the nature of the flows and benefits the networks enable (i.e. products, services, knowledge, technology, spillovers, etc.). As a result, networks are dynamic constructs that can transform and evolve over time, as the interests and strategies of their members evolve, e.g. via expansion, contraction, extension and consolidation (Leminen, Nyström and Westerlund, 2020[81]).

Annex Table 2.B.1. below presents a stylised taxonomy of structural features and approaches that may characterise SME and entrepreneurship networks. Horizontal networks refer to firms in the same market, sharing capacities to jointly (or as a consortium) develop new markets, improve products and present product innovations. Vertical networks on the other hand denote co‑operation along the supply chain and include suppliers (upstream) and/or customers/marketing (downstream).

Yet most of the time, the network systems around SMEs tend to be multidirectional, as illustrated by a recent study on export performance in the Spanish wine industry, which analyses how competing small- and medium-sized wineries located within the same region collaborate across a horizontal network for commercial purposes, while conjunctively also forming part of a vertical network, whereby they supply wine to larger wine-exporting firms, highlighting how firms can benefit from both the positive effects of horizontal collaboration with competitors, as well as those of downstream vertical marketing networks (Ferrer, Abella-Garcés and Serrano, 2021[82]).

Annex Table 2.B.1. Structures and approaches of SME and entrepreneurship networks

|

Description |

Examples/involved actors |

Expected impact on SME business operations |

|

|---|---|---|---|

|

Direction |

Vertical networks |

|

|

|

Vertical networks typically denote co‑operation along the supply chain, often also including some sense of hierarchy. |

Collaborations between buyers, suppliers and customers but also between manufacturers and research institutions, governmental institutions or communication agencies (…). |

||

|

Horizontal networks |

|||

|

Horizontal networks refer to firms in the same market, sharing capacities to jointly (or as a consortium) develop new markets, improve products and present product innovations. |

Co‑operatives, industrial and R&D clusters, (…). |

||

|

Relational nature of interactions |

Formal networks |

|

|

|

Formal networks typically refer to contractual relationships among organisations but there are also networks that take a formal yet not binding nature. |

Strategic alliances, buyer-supplier contracts, joint ventures but also affiliations to innovation associations or shared committee memberships. |

||

|

Informal networks |

|||

|

Informal networks involve looser structures, where members interact on a more personal level. Social capital is usually central to informal networks, where collaborative business transactions depend strongly on the underlying trust between individual actors. |

Inter-organisational relationships, executive clubs and personal relationships. |

||

|

Social distance |

Low social distance |

|

|

|

The firms in question are highly connected within a (social) network. |

Firms that have (often frequent) interactions or an established relationship with each other. |

||

|

High social distance |

|||

|

The firms in question are not well connected within a (social) network. |

Firms do not share direct ties within a network but are rather connected through loose relationships via one or several other actors (e.g., social networks or business organisations). |

||

|

Scope |

Within the same industry (specialised) |

|

|

|

Proximate firms, sometimes within a same industrial district, typically focused on a specific industry or production process. |

Businesses specialised in the same production process, i.e., Detroit’s auto concentration industry or a network formed by pharmaceutical companies. |

||

|

Across different industries (generic) |

|||

|

Collaboration across different industries or fields of expertise. Need for common ground build-up. |

Collaboration of different field experts, i.e., smart clothing or business networks where members of various industries come together to lobby for common interests and goals (e.g., chambers of commerce). |

||

Source: Building on Behne, A., J. Heinrich Beinke and F. Teuteberg (2021[83]), “A framework for cross-industry innovation: Transferring technologies between industries”, https://doi.org/10.1142/S0219877021500115; den Hamer, P. and K. Frenken (2021[84]), “A network-based model of exploration and exploitation”, https://doi.org/10.1016/j.jbusres.2019.12.040; Prusak, L. and D. Cohen (2021[85]), “How to invest in social capital”, https://hbr.org/2001/06/how-to-invest-in-social-capital (accessed on 20 September 2022); O’Donnell, A. et al. (2001[86]), “The network construct in entrepreneurship research: A review and critique”, https://doi.org/10.1108/EUM0000000006220; OECD (2001[87]), Innovative Networks: Co-operation in National Innovation Systems, https://doi.org/10.1787/9789264195660-en.

Annex 2.C. Agglomeration benefits in innovation and production networks

Agglomeration economies occur when the spatial proximity of firms, workers and customers allows for reducing production costs through both external economies of scale and network effects. Proximate location amongst firms of the same network or industry can lead to greater rents and productivity in urban industries (Arzaghi and Henderson, 2008[43]).

The capability of MNE affiliates or subsidiaries to contribute to innovation diffusion depends on the extent to which the foreign venture is embedded in the local environment (OECD, 2023[8]; Crescenzi and Harman, 2022[88]). Domestic firms which are located near foreign firms in the same region are more likely to benefit from knowledge spillovers than other firms. Knowledge spillovers from MNEs have been found to be the strongest up to 10 km from the lead firm and progressively decrease between 10 and 50 km, partly reflecting production linkages but also through other channels such as the mobility of managers.

KIBS are disproportionately concentrated in larger cities, where a larger pool of potential clients allows for increasingly specialised services (OECD, forthcoming[45]).

Geographical proximity from HEIs may increase knowledge transfer to the business sector, through university-industry linkages and co‑operation, but also through the important contribution HEIs make to developing human capital, creativity and skills in their ecosystem. A 10% increase in distance between a university and a firm decreases the proportion of total R&D paid to the university by 1.4% (for enterprises that do not report any codified transfer of knowledge) and by half as much (for enterprises that do report codified knowledge flows) (Rosa and Mohnen, 2007[46]).

Proximity can also affect SME financing capacities. The British Business Bank found that in 82% of equity investment stakes, investors had an office within 2 hours of travel time of the company that they were backing. In 61% of stakes, the proximity was even closer: one hour or less (British Business Bank, 2021[47]).

References

[4] Ahuja, G. (2000), “The duality of collaboration: Inducements and opportunities in the formation of interfirm linkages”, Strategic Management Journal, Vol. 21/3, pp. 317-343, https://onlinelibrary.wiley.com/doi/10.1002/(SICI)1097-0266(200003)21:3%3C317::AID-SMJ90%3E3.0.CO;2-B.

[10] Andrenelli, A. et al. (2019), “Micro-evidence on corporate relationships in global value chains: The role of trade, FDI and strategic partnerships”, https://www.wita.org/wp-content/uploads/2019/05/OECD-micro.pdf.

[43] Arzaghi, M. and J. Henderson (2008), “Networking off Madison Avenue”, Review of Economic Studies, Vol. 75/4, https://doi.org/10.1111/j.1467-937X.2008.00499.x.

[41] AUTM (2021), AUTM Licensing Activity Survey, https://autm.net/surveys-and-tools/surveys/licensing-survey/2021-licensing-survey.

[77] Barrie, J. et al. (2022), “The role of international trade in realizing an inclusive circular economy”, Royal Institute of International Affairs, https://doi.org/10.55317/9781784135393.

[83] Behne, A., J. Heinrich Beinke and F. Teuteberg (2021), “A framework for cross-industry innovation: Transferring technologies between industries”, International Journal of Innovation and Technology Management, Vol. 18/3, https://doi.org/10.1142/S0219877021500115.

[65] Boffo, R. and R. Patalano (2020), ESG Investing: Practices, Progress and Challenges.

[49] Brende, B. and B. Sternfels (2022), “Resilience for sustainable, inclusive growth”, McKinsey & Company, https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/resilience-for-sustainable-inclusive-growth (accessed on 24 January 2023).

[47] British Business Bank (2021), Regions and Nations Tracker 2021.

[42] Camanzi, L. and C. Giua (2020), “SME network relationships and competitive strategies in the agri-food sector: Some empirical evidence and a provisional conceptual framework”, European Business Review, Vol. 32/3, pp. 405-424, https://doi.org/10.1108/EBR-08-2019-0150/FULL/PDF.

[13] Cervantes, M. and D. Meissner (2014), “Commercialising public research under the open innovation model: new trends”, Foresight-Russia, Vol. 8/3, https://doi.org/10.17323/1995-459x.2014.3.70.81.

[33] Chesbrough, H. (2003), Open Innovation: The New Imperative for Creating and Profiting from Technology, Harvard Business School Press, Boston, MA.

[66] Coad, A. et al. (2014), “High-growth firms: Introduction to the special section”, Industrial and Corporate Change, Vol. 23/1, pp. 91-112, https://doi.org/10.1093/icc/dtt052.

[5] Coe, N., P. Dicken and M. Hess (2008), “Global production networks: Realizing the potential”, Journal of Economic Geography, Vol. 8/3, pp. 271-295, https://doi.org/10.1093/jeg/lbn002.

[30] Corrado, C. et al. (2005), Measuring Capital in the New Economy, University of Chicago Press, https://www.nber.org/books-and-chapters/measuring-capital-new-economy (accessed on 7 February 2023).

[88] Crescenzi, R. and O. Harman (2022), “How to upgrade through regional policy, FDI and trade”, in Harnessing Global Value Chains for Regional Development, https://doi.org/10.1080/2578711X.2022.2099169.

[29] DeBresson, C. (1996), Economic Interdependence and Innovative Activity, Edward Elgar.

[69] Delmar, F. and P. Davidsson (2020), “Where do they come from? Prevalence and characteristics of nascent entrepreneurs”, Entrepreneurship & Regional Development, Vol. 12/1, pp. 1-23.

[84] den Hamer, P. and K. Frenken (2021), “A network-based model of exploration and exploitation”, Journal of Business Research, Vol. 129, pp. 589-599, https://doi.org/10.1016/j.jbusres.2019.12.040.

[14] Den Hertog, P. (2000), “Knowledge intensive business services as co-producers of innovation”, International Journal of Innovation Management.

[54] EC (2022), Annual Report on European SMEs 2021/2022, European Commission, https://ec.europa.eu/docsroom/documents/50654/attachments/1/translations/en/renditions/native.

[64] EC (2022), Corporate Social Responsibility & Responsible Business Conduct, European Commission, https://ec.europa.eu/growth/industry/sustainability/corporate-social-responsibility-responsible-business-conduct_en (accessed on 24 June 2022).

[12] EC/OECD (2023), Fostering FDI-SME Ecosystems to Boost Productivity and Innovation, European Commission/OECD, https://www.oecd.org/industry/smes/fdi-sme.htm.

[11] EC/OECD (2023), Unleashing SME Potential to Scale Up, OECD/European Commission, https://www.oecd.org/cfe/smes/sme-scale-up.htm.

[59] Ellen MacArthur Foundation (2023), Circular Economy Growth Potential by Sector, https://ellenmacarthurfoundation.org/topics/finance/sector-insights.

[37] Ellen MacArthur Foundation (2023), Redesigning Medium-life Bulky Products from Scratch: Niaga, https://ellenmacarthurfoundation.org/circular-examples/redesigning-medium-life-bulky-products-from-scratch.

[32] Eurostat (2022), Community Innovation Survey 2020 (CIS2020) (database), https://ec.europa.eu/eurostat/web/science-technology-innovation/data/database.

[35] Farole, T. and D. Winkler (2013), “Firm location and the determinants of exporting in low- and middle-income countries”, Journal of Economic Geography, Vol. 14/2, pp. 395-420, https://doi.org/10.1093/jeg/lbs060.

[82] Ferrer, J., S. Abella-Garcés and R. Serrano (2021), “Vertical and horizontal networks and export performance in the Spanish wine industry”, Journal of Wine Economics, Vol. 16/4, https://doi.org/10.1017/jwe.2021.35.

[22] Fürstenau, D. et al. (2018), “A process perspective on platform design and management: Evidence from a digital platform in health care”, Electronic Markets, Vol. 29/4, pp. 581-596, https://doi.org/10.1007/s12525-018-0323-4.

[55] Gawer, A. (2021), “Digital platforms’ boundaries: The interplay of firm scope, platform sides, and digital interfaces”, Long Range Planning, Vol. 54/5, p. 102045, https://doi.org/10.1016/j.lrp.2020.102045.

[24] Gawer, A. and M. Cusumano (2013), “Industry platforms and ecosystem innovation”, Journal of Product Innovation Management, Vol. 31/3, pp. 417-433, https://doi.org/10.1111/jpim.12105.

[27] Hilmersson, F. and M. Hilmersson (2021), “Networking to accelerate the pace of SME innovations”, Journal of Innovation and Knowledge, Vol. 6/1, pp. 43-49, https://doi.org/10.1016/j.jik.2020.10.001.

[38] Kantor, S. and A. Whalley (2014), “Knowledge spillovers from research universities: Evidence from endowment value shocks”, The Review of Economics and Statistics, Vol. 96/1, pp. 171-188.

[15] Kergroach, S. (2020), Benchmarking National Innovation Policy Mixes for Technology Diffusion.

[19] Kergroach, S., D. Meissner and N. Vonortas (2017), “Technology transfer and commercialisation by universities and PRIs: Benchmarking OECD country policy approaches”, Economics of Innovation and New Technology, Vol. 27/5-6, pp. 510-530, https://doi.org/10.1080/10438599.2017.1376167.

[74] Kowalski, S. (n.d.), “SMES, open innovation and IP management: Advancing global development”, https://www.wipo.int/edocs/mdocs/sme/en/wipo_smes_rom_09/wipo_smes_rom_09_b_theme02_2-related1.pdf.

[39] Kreiling, L. and C. Paunov (2021), “Knowledge co-creation in the 21st century: A cross-country experience-based policy report”, OECD Science, Technology and Industry Policy Papers, No. 115, OECD Publishing, Paris, https://doi.org/10.1787/c067606f-en.

[51] Kumar, A., G. Prakash and G. Kumar (2021), “Does environmentally responsible purchase intention matter for consumers? A predictive sustainable model developed through an empirical study”, Journal of Retailing and Consumer Services, Vol. 58, p. 102270, https://doi.org/10.1016/j.jretconser.2020.102270.

[44] Lembcke, A. and L. Wildnerova (2020), “Does FDI benefit incumbent SMEs?: FDI spillovers and competition effects at the local level”, OECD Regional Development Working Papers, No. 2020/02, OECD Publishing, Paris, https://doi.org/10.1787/47763241-en.

[81] Leminen, S., A. Nyström and M. Westerlund (2020), “Change processes in open innovation networks – Exploring living labs”, Industrial Marketing Management, Vol. 91, pp. 701-718, https://doi.org/10.1016/J.INDMARMAN.2019.01.013.

[48] McKinnon, A. (2014), “Building Supply Chain Resilience: A Review of Challenges and Strategies”, International Transport Forum Discussion Papers, No. 2014/6, OECD Publishing, Paris, https://doi.org/10.1787/5jrw2z6nnxlq-en.

[61] Moïsé, E. and S. Rubínová (2023), “Trade policies to promote the circular economy: A case study of lithium-ion batteries”, OECD Trade and Environment Working Papers, No. 2023/01, OECD Publishing, Paris, https://doi.org/10.1787/d75a7f46-en.

[67] Monteiro, G. (2019), “High-growth firms and scale-ups: A review and research agenda”, RAUSP Management Journal, Vol. 54/1, pp. 96-111, https://doi.org/10.1108/rausp-03-2018-0004.

[6] Nilsson, A., J. Magnusson and H. Enquist (2003), “SME network practice: A qualitative study of network management practice and design implications for ICT-support”, Proceedings of the 11th European Conference on Information Systems, ECIS 2003, Naples, Italy 16-21 June 2003, https://www.researchgate.net/publication/221408025_SME_network_practice_a_qualitative_study_of_network_management_practice_and_design_implications_for_ICT-support (accessed on 6 September 2022).

[86] O’Donnell, A. et al. (2001), “The network construct in entrepreneurship research: A review and critique”, Management Decision, Vol. 39/9, pp. 749-760, https://doi.org/10.1108/EUM0000000006220.

[58] OECD (2023), OECD Data Lake on SMEs and Entrepeneurship, https://www.oecd.org/cfe/datalake.htm

[8] OECD (2023), Policy Toolkit for Strengthening FDI and SME Linkages, OECD Publishing, Paris, https://doi.org/10.1787/688bde9a-en.

[57] OECD (2023), Unleashing SME potential to scale up, https://www.oecd.org/cfe/smes/sme-scale-up.htm (accessed on 21 June 2023).

[72] OECD (2022), “Financing growth”, in Financing Growth and Turning Data into Business: Helping SMEs Scale Up, OECD Publishing, Paris, https://doi.org/10.1787/6962c7a9-en (accessed on 11 October 2022).

[3] OECD (2022), Financing Growth and Turning Data into Business: Helping SMEs Scale Up, OECD Studies on SMEs and Entrepreneurship, OECD Publishing, Paris, https://doi.org/10.1787/81c738f0-en.