This chapter studies the dynamics of trade integration in the Euro-Mediterranean region since the launch of the Barcelona Process in 1995. It analyses the evolution of trade flows within the region and with the rest of the world, focusing on patterns at the sub-regional level to observe progress of trade integration besides trade between EU and non-EU countries. The chapter considers key dimensions of integration, from the regulatory approach to participation in regional value chains to the composition of export flows. The final section presents a set of policy recommendations to support further trade integration in the region, oriented towards more competitive, diversified and resilient economies.

Regional Integration in the Union for the Mediterranean

1. Trade

Abstract

Key takeaways

Trade among countries of the Union for the Mediterranean (UfM’s) has gained relevance over the last 20 years, in terms of both trade in final products and trade in intermediate goods, as well as integration into regional value chains. The analysis of export performance for the UfM countries confirms this trend: overall, merchandise trade among the UfM countries is in line with or above the levels predicted by a gravity model of trade, and that, albeit modestly, the integration within the group has accelerated since the start of the Barcelona Process.

The biggest progress in regional trade in goods is observed among the UfM sub-regions of the Southern shore and the Western Balkans. However, despite the progress, considerable untapped potential exists for trade expansion between non-EU UfM countries, and also among specific sub-groups –notably the Western Balkans with Israel and Levant countries, and Israel with Levant and North Africa countries.

The UfM countries’ aspiration to reduce existing obstacles to trade and meet global standards in border procedures is reflected in the general improvement of indicators measuring trade facilitation. While the progress is general, the differences between the Northern and Southern shores of the Mediterranean are however still notable.

The region lacks ambitious regulation on services trade, with the exception of the EU association agreements with the Western Balkan countries. Enhancing the collaboration on trade regulations, including the adoption of more ambitious trade-in-services agreements and the homogenisation of common procedures, such as the adoption of common rules of origin, would further advance the region’s economic integration and strengthen its value chains.

Exports within the UfM have become more diversified and sophisticated in recent decades. Manufactured goods have increased their share in exports, reducing the relevance of oil and mining products, while exports of agricultural products have remained stable over time. The analysis of relative export performance at the product level highlights nevertheless a heterogeneous evolution across the different countries, as some remain highly dependent on few products (e.g. hydrocarbon exports).

Improving the general environment for trade, including regulatory cooperation, infrastructure and access to finance, creates the enabling conditions but could remain ineffective in the absence of industrial diversification. Therefore, UfM countries should continue to encourage and facilitate industrial diversification, as the untapped South-South trade potential seems to be a consequence of limited or inadequate product offer.

Many UfM countries in the Southern shore lack the statistics needed to assess their capacity to leverage the megatrends of globalisation and digitalisation to improve their international competitiveness.

Introduction

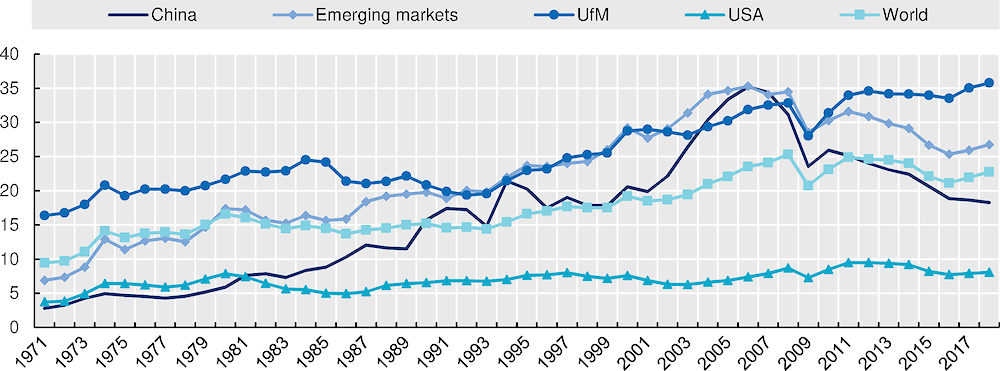

The pace of global trade integration in the second half of the 20th century reflected the increasing contribution of commerce to the global economy, positioning itself as a fundamental growth engine for most countries. Between 1990 and 2008, the share of total merchandise in the world’s gross domestic product (GDP) increased more than 60%. The expansion of trade as an important dimension of economic integration was led mainly by the strong role of the emerging economies. If in 1990 merchandise trade represented 19% of the emerging economies’ GDP, in 2008 this share amounted to more than one-third. In the Union for the Mediterranean (UfM) region, trade also experienced a significant increase; in 2018, it represented an important part of the region’s economy, namely 35% of the GDP.

Trade in services, too, began accelerating in the last quarter of the 20th century – and more strongly in the beginning of the 21st century, with an increase of 125% between 2005 and 2018. Today, trade in services represents around 7% of global GDP1.

While the expansion of trade suffered a deceleration after the global financial crisis and more recently the pandemic crisis, trade remains a crucial pillar of the world’s economy (Figure 1.1).

Figure 1.1. Trade intensity in the world

Exports of goods as a percentage of GDP, 1972-2018

Indeed, international trade is widely recognised as an engine of economic growth for both developed and developing economies, notwithstanding the need for policies aimed at ‘making trade work for all’ (UN 2030 Agenda for Sustainable Development; (OECD, 2017[1]). In particular, international trade creates jobs: the share of employment sustained by foreign demand can be as high as 50% for small, highly integrated economies when both direct and indirect channels are considered (where the indirect channel includes not only employment linked to goods and services directly exported, but also labour used in the production of intermediate inputs employed in the production of exports).

To encourage and facilitate trade development, countries have over the years signed trade agreements that have traditionally targeted the reduction of tariff barriers. These type of agreements were the norm between World War II and the late 20th century, as a response to a scenario of overall protectionism, where high tariffs were implemented to limit competition from foreign products in domestic markets. The implementation of trade agreements throughout the 20th century managed to significantly reduce the tariff levels worldwide (WTO, 2007[2]).

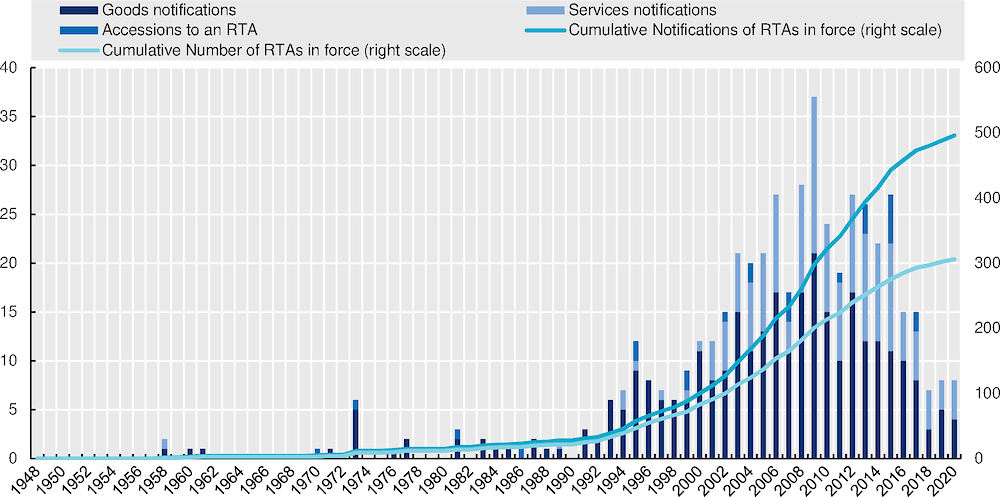

Today, import tariffs and quotas are one of the many topics covered by trade agreements (Rodrik, 2018[3]). States have progressively embarked on trade negotiations that tackle complex policy areas, including areas where the economic theory behind free trade lacks more consensual solutions. The new agreements attempt to address a diverse set of issues, such as patent rules, product standards, labour standards or environmental protection, and good governance. The complexity of such agreements illustrates how impactful a higher degree of trade integration for a local economy can be. Indeed, in recent years many countries have actively sought to establish new and often more modern bilateral and regional trade agreements that aim to increase trade and boost economic growth (Figure 1.2).

Figure 1.2. Evolution of world’s regional trade agreements (RTAs)

Source: WTO, Regional Trade Agreements Information System, https://rtais.wto.org/, extracted on 28/09/2020.

Monitoring trade integration

The indicators selected to monitor trade integration in the UfM region provide a picture of the current level of integration through regional, sub-regional and national trade dynamics on different dimensions, including legislation, trade volumes and value-chain integration (Table 1.1). These indicators reflect a heterogeneous coverage of the UfM’s countries, with a less complete coverage for the Southern Mediterranean countries, but nevertheless offer a comprehensive analysis of trade patterns in the region.

Table 1.1. Key monitoring indicators of trade integration

|

Description |

Coverage |

Frequency |

|

|---|---|---|---|

|

Indicator T1. Trade Agreements covering goods and services |

The Regional Trade Agreements (RTAs) database contains information on the number, nature (goods and services) and selected provisions of RTAs notified to the WTO by its members. RTAs are reciprocal, preferential trade agreements between two or more partners. |

All UfM member states |

Updated to March 2020 |

|

Indicator T2. OECD Trade Facilitation Indicators (TFIs) |

These indicators cover the full spectrum of cross-border procedures. They measure the actual extent to which countries have introduced and implemented trade facilitation measures in absolute terms, as well as their performance relative to others. Each sub-indicator is composed of several precise and fact-based variables related to existing trade-related policies and regulations and their implementation in practice. |

All UfM member states except the Palestinian Authority |

Biannual; last available year: 2019 |

|

Indicator T3. Intra-regional trade in goods |

This quantitative indicator assesses the extent of regional integration through intra-regional and regional trade flows of goods. It measures the volume of traded goods of UfM member states within the region and outside the region (rest of the world): Intra-MENA, MENA-EU, MENA-Western Balkans, and MENA-Africa. Source: OECD International Trade and Balance of Payments; UN Comtrade Database, UNCTAD Intra-trade and extra-trade; IMF database; national statistics. |

All UfM member states |

Annual; last available year: 2019, 2018, 2017 (year of availability depends on the country) |

|

Indicator T4. Trade in Value Added (TiVA) |

These indicators measure the value added by each country in the production of goods and services consumed worldwide, providing insights on the extent of countries’ participation in global production networks and value chains. They include measures of domestic and foreign value-added content of gross exports (by exporting industry); participation in regional value chains (RVCs) via intermediate imports embodied in exports (backward linkages) and domestic value-added in partners’ exports (forward linkages); and inter-regional and intra-regional relationships. Source: OECD-WTO Trade in Value Added (TiVA) database: https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm#access, https://www.oecd.org/sdd/its/tiva-nowcast.htm |

EU, Israel, Morocco, Tunisia, Turkey |

Annual; last available year: 2015 |

Indicator T1. Trade Agreements covering goods and services

Trade flows are highly dependent on a multitude of factors, from trade agreements to regulatory practices to geographical distance. In the 1990s and early 2000s, trade agreements within the Euro-Mediterranean region focused mostly on reducing existing tariffs in the trade of agricultural and manufactured goods, while not covering trade in services (Annex Table 1.A.1).

The two major South-South regional trade agreements – the Pan-Arab Free Trade Area (PAFTA), in force since 1998, and the Agadir agreement, in force since 2007 – both target tariff elimination on traded goods, but set goals and mechanisms with different degrees of complexity. The PAFTA aims at facilitating the exchange of goods across borders, but does not target essential elements linked to production and trade, such as investment, services or intellectual property. The Agadir Agreement too focuses on trade in goods, but also sets the basis for a future platform of economic integration by acknowledging the importance of services trade and addressing relevant issues on taxes, finance, customs coordination, industrial policies and foreign trade. By the time the Agadir Agreement entered into force, the signatory countries had realised the Agreement commitments concerning tariff elimination2. This is not the case for the PAFTA, which is considered to have been less successfully enforced (UNESCWA, 2019[4]).

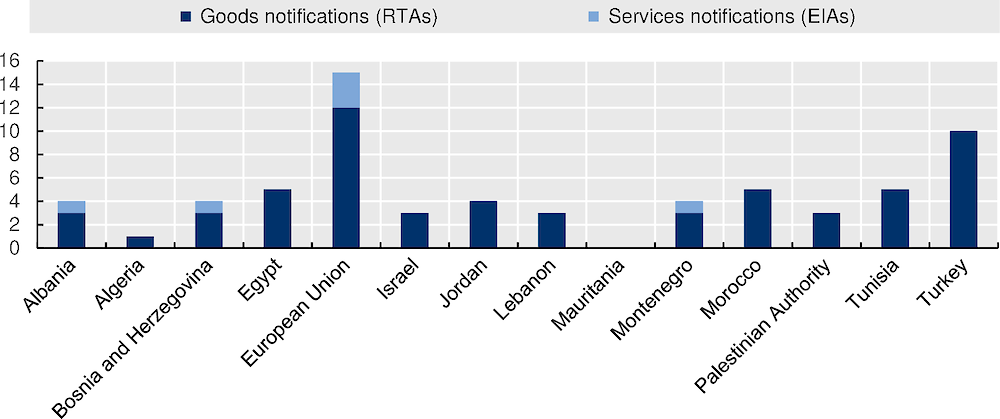

Figure 1.3. Trade agreements between UfM countries, 2020

Number of trade agreements enforced

Note: RTAs refer to regional trade agreements; EIAs refer to economic integration agreements. WTO’s “European Union” aggregate includes also the United Kingdom. The European Union and the United Kingdom notified WTO members that the United Kingdom was treated as a member state of the European Union for the purposes of relevant international agreements during the transition period that ended 31 December 2020. The number for Mauritania is zero.

Source: WTO (2020), Regional Trade Agreements Information System, https://rtais.wto.org/, extracted on 28/09/2020.

The North-South trade agreements are reflected mainly in the European Union’s Association Agreements and the European Free Trade Association (EFTA) agreements. In both cases, although the agreements with Southern Mediterranean countries are negotiated bilaterally and regulate tariff elimination for trade in goods, they do not address the facilitation of trade in services.

The relation between the European Union and Turkey is more complex, as the country held the status of eligible EU candidate since 1997 and set up a customs union with the EU in 1995. Turkey’s accession negotiations (started in 2005) include a diverse set of policy areas3, reflecting the goal of establishing an actual economic integration association, and not only a free trade area. Apart from the EU, Turkey is the UfM economy that has engaged in the largest number of bilateral trade agreements with other UfM countries, all related to liberalising trade in goods.4

As the region advances towards fewer tariffs, the ambition and nature of modern trade agreements involve the creation of new rules on the movement of goods and services. Non-tariff measures (NTMs) play a relevant role ensuring that countries engage in trade relations that, among other things, respect social, safety and environmental practices. These rules address important issues related to international trade, but represent a potential burden for enterprises, especially, Small and medium-sized enterprises (SMEs), that lack the capacities to process and meet such regulations.

A series of business surveys carried-out by the International Trade Centre (ITC)5 during the 2010s highlighted that a relevant share of companies face NTM-related trade obstacles, in particular in developing economies. Approximately one-third of the EU’s exporter businesses experienced NTM-related obstacles while the ITC estimates that half of developing economies’ exporter businesses are affected. Among the surveyed6 Middle East and North Africa (MENA) countries, Jordan’s exporter businesses are the most affected by NTMs (64%), followed by the Palestinian Authority (56%), Tunisia (52%), Egypt (37%) and Morocco (23%). Also, agricultural businesses express more concerns about NTMs than manufacturing businesses, in all surveyed countries. The three most common types of NTM-related obstacles reported by companies in the region are conformity assessment, export related measures (e.g. prohibition of exports of certain products due to internal shortages; sanitary inspections on processed food to be exported; etc.) and rules of origin7. The potential negative impact of NTMs can be minimised by promoting the harmonisation of rules and making them more transparent and easier to understand for businesses. An important development in the UfM region concerns the attempt to harmonise the rules of origin for products set in trade agreements, which could help boost regional trade (Box 1.1).

Box 1.1. Harmonisation of rules of origin in the Euro-Mediterranean region

In the context of trade agreements, rules of origin are fundamental tools for determining which goods should benefit from preferential treatment considering their national origin. The rules indicate the conditions products must meet in order to enjoy the preferential treatment, which usually include a minimum of local processing, contents or value added. Rules of origin are applied by customs authorities to assess the origin of a product that is being imported. If all the requirements are met, the product will be eligible to be imported with no or lower duty rates, depending on the trade agreement. In addition, rules of origin are necessary to implement instruments such as anti-dumping duties or safeguard measures, and to enable countries to properly collect trade statistics.

There is a broad variety of rules of origin applied in different trade agreements. According to the WTO, all countries recognise that the harmonisation of rules of origin will facilitate international trade.

The Pan-Euro-Mediterranean (PEM) convention on preferential rules of origin is an example of a harmonisation effort at the regional level to establish common rules of origin and cumulation among the partner countries and the EU. A new set of rules of origin is expected to come into force in countries of the region through 2021. These include revised provisions on cumulation, duty drawback and tolerance as well as a non-alteration rule. The objective is to help countries of the Southern and Eastern Mediterranean trade more easily with the European Union under existing trade agreements. The discussion acknowledges that more flexible cumulation rules will also facilitate economic integration and the consolidation and development of integrated supply chains within the countries of the region applying them. As a final step, the PEM convention will replace the network of about 60 bilateral protocols on rules of origin in force in the PEM zone.

Source: WTO, Technical Information on Rules of Origin; European Commission, The Pan-Euro-Mediterranean cumulation and the PEM Convention. https://www.wto.org/english/tratop_e/roi_e/roi_e.htm

Finally, agreements addressing the regulation of trade in services are covered by the EU’s Stabilisation and Association Agreements8 with the Western Balkan countries, including also Albania, Bosnia and Herzegovina and Montenegro. The nature of such agreements – they target a diverse set of areas besides trade, such as the rule of law, institutional stability, economic cooperation and closer political dialogue – reflects the status of EU accession candidates (Albania and Montenegro) and potential candidates (Bosnia and Herzegovina) of the countries concerned.

Indicator T2. Trade Facilitation Indicators (TFIs)

The WTO Trade Facilitation Agreement (TFA) entered into force in 2017. The agreement established multilateral rules to address specific obstacles in trade procedures, allowing countries to reap the economic benefits of improvements in the speed and efficiency of border procedures. The OECD has since developed a specific set of “Trade Facilitation Indicators” that mirror the substantive provisions of the WTO agreement, with a view to measuring the extent to which countries have introduced and implemented trade facilitation measures. These measures are designed to streamline and simplify the technical and legal procedures for products entering or leaving a country to be traded internationally. Trade facilitation covers the full spectrum of border procedures, from the electronic exchange of data about a shipment, to the simplification and harmonisation of trade documents, to the option of appealing administrative decisions by border agencies.

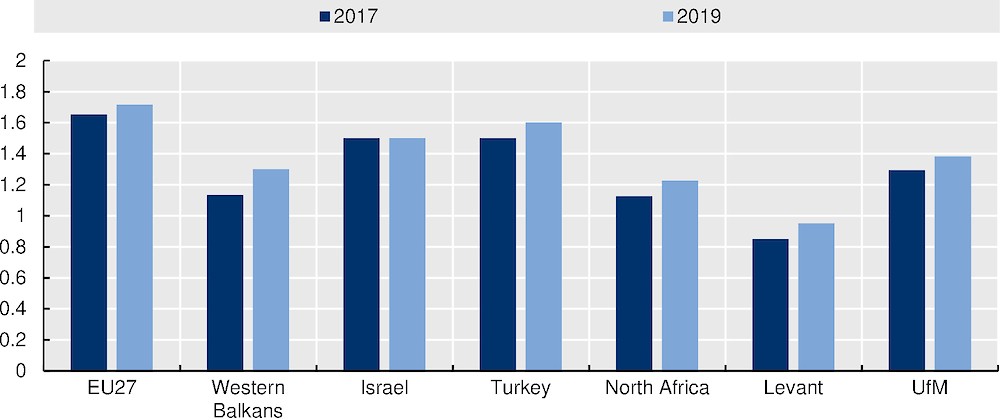

In virtually all UfM sub-regions, recent years have witnessed improvements in trade facilitation (Figure 1.4). At the national level, on a scale from 0 to 2 (best performance), the values for Algeria (0.8), Jordan (1) and Lebanon (0.9) are relatively low, while Morocco (1.6) shows the highest average performance among the Middle East and North Africa (MENA) countries.

Figure 1.4. Average trade facilitation performance, UfM countries and sub-regions, 2017-19

From 0 to 2 (best performance)

Note: Average performance based on eleven trade facilitation indicators. Each indicator take values from 0 to 2 (best performance). Variables in the TFI dataset are coded with 0, 1, or 2. These seek to reflect not only the regulatory framework in the concerned countries but, to the extent possible, the state of implementation of various trade facilitation measures. Mauritania and the Palestinian Authority are not covered by the TFI dataset.

Source: OECD, Trade Facilitation, https://www.oecd.org/trade/topics/trade-facilitation/

Most of the UfM countries are relatively similar across the 11 indicators that determine their average trade facilitation performance. There are some exceptions, however. For instance, in Algeria results indicate that improvements are needed in the areas of formalities, mostly related to documentation requirements and lack of document harmonisation (0.3), cooperation with neighbouring and third countries (0.4), automation of necessary trade formalities (0.6) and governance and impartiality issues (0.6); while in other areas – such as fees and charges (1.25), advance rulings (1.25) and appeal procedures (1.56) – the performance is already high. The analysis of each of the eleven indicators helps countries to assess the state of their trade facilitation efforts and identify opportunities for progress. This is particularly important for the efforts of Southern UfM countries to maximise their trade potential regionally and at the global level.

Indicator T3. Intra-regional trade in goods

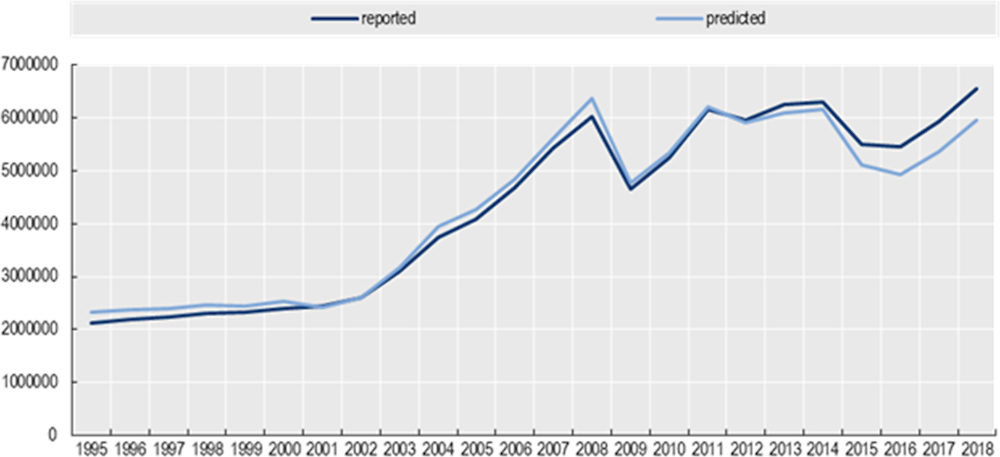

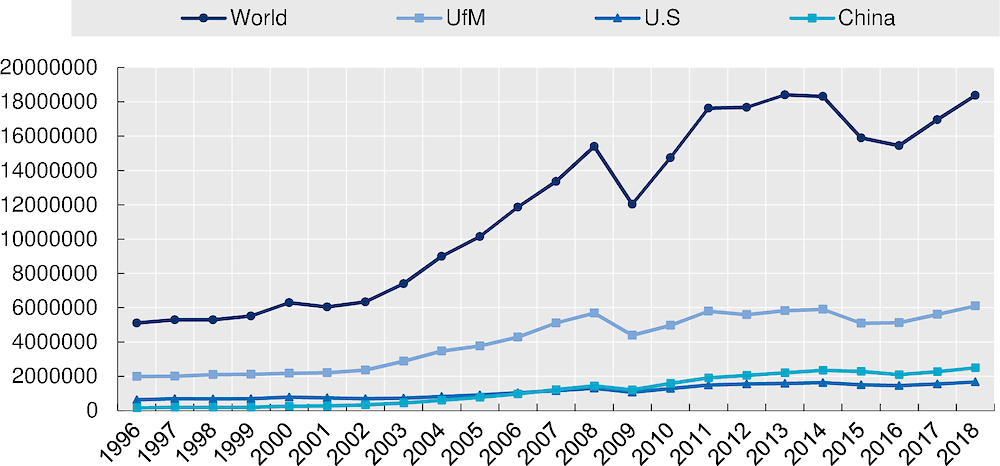

In 2018 the UfM region exported more than USD 6 trillion in goods, representing 33% of the world’s total merchandise exports (Figure 1.5). However, even as the total value of the region’s merchandise exports has increased threefold since 1996, its relative global weight has decreased almost 6 percentage points (from 39% in 1996), as emerging economies, in particular the People’s Republic of China, augmented considerably their participation in international trade in goods. In the past three decades, all major developed economies lost relevance, in relative terms, in the global markets; on the other hand, China’s global weight in goods exports experienced an average annual increase of 0.5 percentage points since 1996.

Figure 1.5. The share of the UfM in the world’s merchandise exports, 1996-2018

Exports in goods, million USD

Note: Missing data for Albania, Jordan, Lebanon, Mauritania, Montenegro, the Palestinian Authority and Tunisia do not allow for the compilation of regional aggregates for 2019. Algeria and Mauritania are missing for 2018.

Source: UN Comtrade database, https://comtrade.un.org

The UfM’s intra-regional market is the main destination for the region’s merchandise exports, representing over 61% (3.7 trillion USD) of the UfM’s member countries’ exports in 2018. The importance of the region’s intra-regional market has remained relatively constant since 1996 (56% of total merchandise exports), after reaching a peak in 2007 (63%). With over 20% of the world’s trade in goods in 2018, the intra-regional market of the UfM continues to be one of the most relevant global markets.

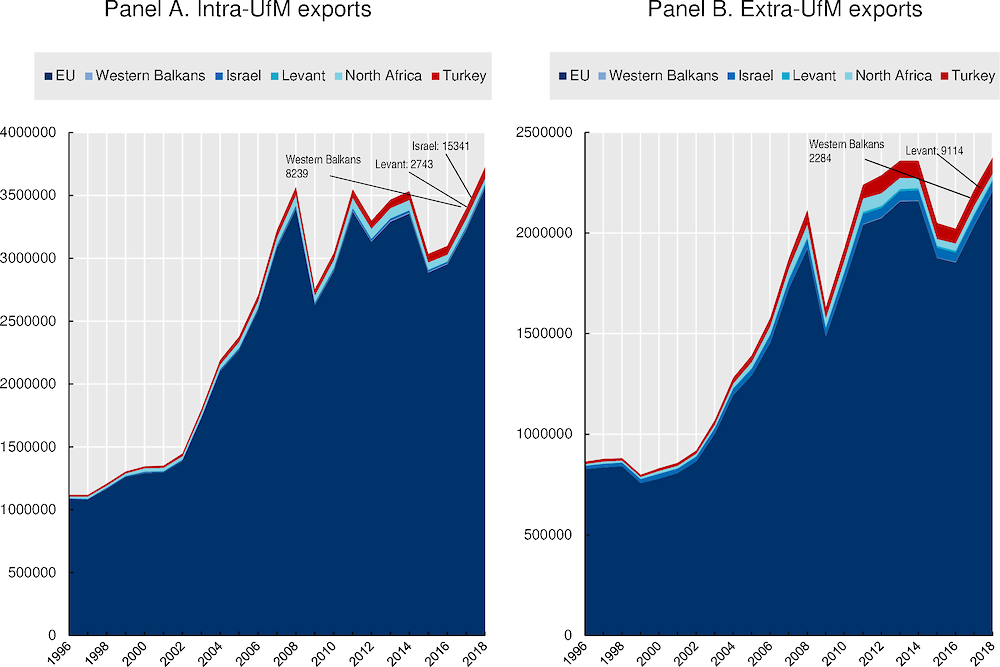

The distribution of this intra-regional market is, however, concentrated in the Northern shore of the Mediterranean. The European Union is responsible for over 95% of the region’s internal merchandise exports (approximately USD 3.6 trillion in 2018), and 93% of the external merchandise exports (over USD 2.2 trillion) (Figure 1.6). Turkey is the region’s third-largest exporter, accounting for 2.3% of the intra-UfM merchandise exports market. The sub-region of North Africa is the fourth main merchandise export partner (1.8% in 2017), notably due to the importance of Algeria’s hydrocarbon sector and Morocco’s growing manufacturing sector. Finally, Israel (0.41%), the Balkan countries (0.228%) and the Levant countries (0.07%) account for minor shares.

Figure 1.6. Total merchandise exports of the UfM area

Exports in goods by UfM sub-regions, million USD

Note: North Africa includes Algeria, Egypt, Mauritania, Morocco and Tunisia; the Levant countries include Jordan, Lebanon and the Palestinian Authority. The sub-regional aggregate for the Balkan region starts in 2006, the first year of data available for Montenegro.

Source: UN Comtrade database, https://comtrade.un.org/.

Apart from the European Union and Israel, the remaining countriesand sub-regions of the UfM have increased their share in the intra-UfM regional merchandise exports market since 1996, as follows:

The biggest increase is observed in Turkey, whose share of intra-UfM merchandise exports has more than doubled over the past two decades.

The share of the Levant region, North Africa and the Western Balkans also increased, respectively by 78%, 30% and 56%. In the case of the Levant, the region started from very low initial intra-UfM merchandise export levels.

Israel, which relies on the UfM’s intra-regional market significantly less than most of the other partners, has seen its weight stay relatively stable, with a decrease of 5% since 1996, but with an average weight of 0.48% in the last two decades.

Finally, the EU’s share of the UfM’s internal merchandise exports market has declined slightly (1.34%) since 1996. Nevertheless, as expected, the EU remains among the main trade partners for most UfM economies, including for countries of the Levant region that trade more intensively with the Gulf countries (Table 1.2).

Table 1.2. Main export destinations for UfM sub-regions, 2018

% of total exports

|

1st |

2nd |

3rd |

4th |

5th |

|

|---|---|---|---|---|---|

|

Western Balkans |

EU (73%) |

Serbia (12%) |

Western Balkans (4%) |

Turkey (2%) |

Macedonia (1.5%) |

|

EU |

EU (59%) |

USA (7%) |

GBR (6%) |

China (3.9%) |

Switzerland (2.8%) |

|

Israel |

USA (29%) |

EU (23%) |

China (8%) |

UK (7.5%) |

Hong Kong (7.1%) |

|

Levant |

GCC (24%) |

USA (17%) |

Israel (10%) |

India (6.5%) |

EU (5%) |

|

North Africa |

EU (52%) |

GCC (6%) |

USA (4.9%) |

Rest of Africa (4.9%) |

Turkey (3.8%) |

|

Turkey |

EU (44%) |

GBR (7%) |

Iraq (5%) |

USA (5%) |

GCC (4.9%) |

Note: GCC refers to the Gulf Cooperation Council countries; Rest of Africa includes all African countries not part of the UfM.

Source: UN Comtrade database, https://comtrade.un.org/.

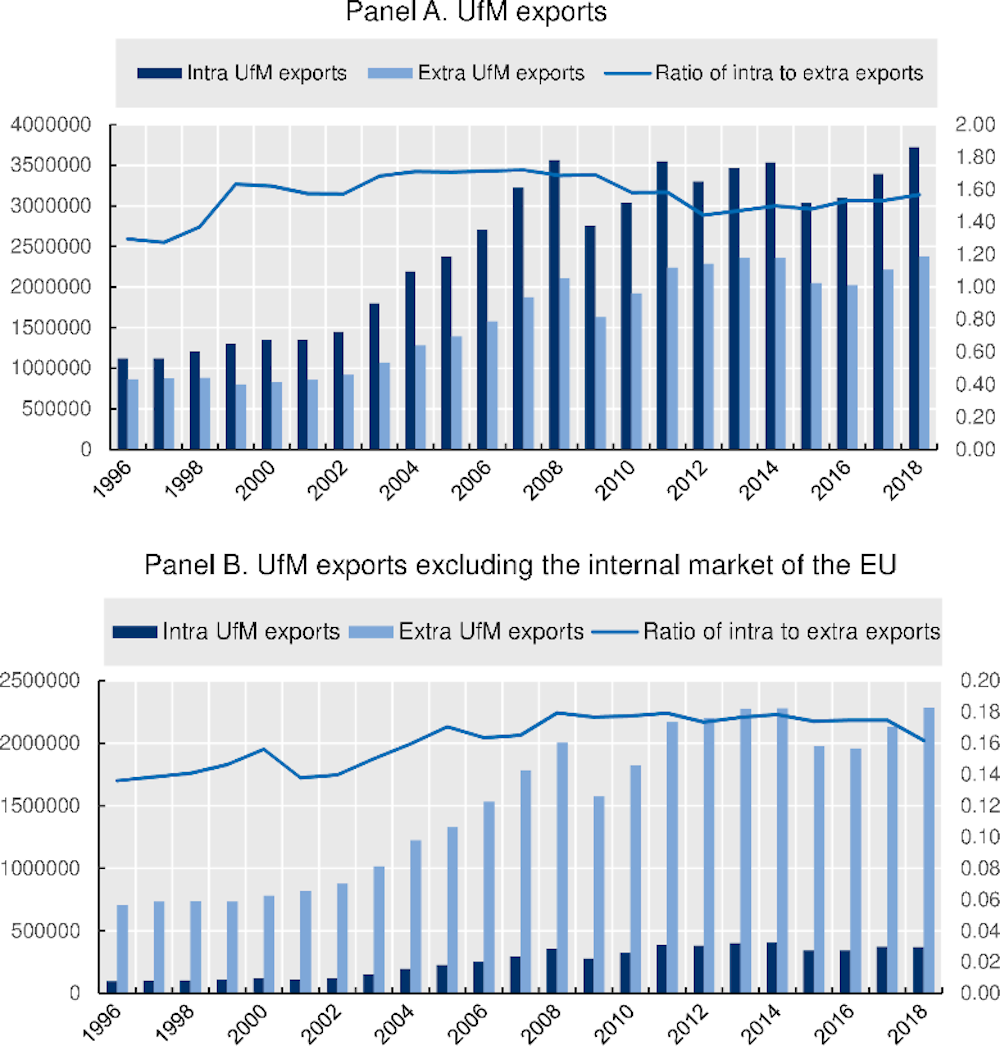

In 2018, the UfM countries exported almost two times more merchandise to other UfM countries than to the rest of the world (Figure 1.7 Panel A).

However, the high level of intra-regional merchandise exports compared to extra-regional merchandise exports is largely explained by the exchanges within the European Union’s internal market. Once the EU internal market is excluded, UfM countries export over 80% of their gross merchandise exports to other regions of the world (Figure 1.7 Panel B). UfM extra-regional merchandise exports amounted to USD 2.2 trillion as compared to USD 3.7 trillion exported within the region. Nonetheless, even when excluding the market of the EU, the ratio of intra- versus extra-regional merchandise exports shows a slightly positive trend, pointing to progress in regional integration.

Figure 1.7. The ratio of intra-regional to extra-regional exports in the UfM, 1996-2018

Amount (left scale, in million USD) and ratio (right scale) of intra-regional exports to extra regional exports, merchandise

Note: A ratio value of more than one (1) indicates that intra-regional exports exceed the region’s exports to the rest of the world. In Panel B, the internal market of the EU (e.g. exports from France to Germany) is excluded from the calculation, but exports from EU member countries to Tunisia (as part of intra-UfM exports) or from the Netherlands to China (as part of extra-UfM exports) are included.

Source: UN Comtrade database, https://comtrade.un.org

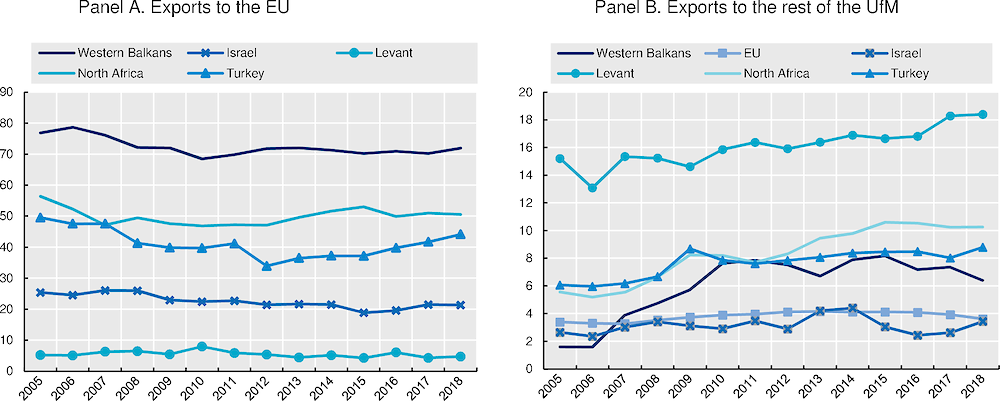

An in depth analysis of the evolution of main export partners of the different UfM economies since 2005 highlights a positive trend in regional integration of the Southern shore of the Mediterranean (Figure 1.8). Merchandise exports increased more intensively among economies of a same sub-region (Annex Table 1.A.2) but there is an overall improvement among bilateral trade among the non-EU economies (Table 1.3). This is particularly true for the Western Balkans and the Levant sub-regions. Egypt relies more on the economies of the Levant sub-region as trade partners, while Turkey has a more heterogeneous presence across the Southern shore.

Figure 1.8. Share in total exports of reporting country, 2005-18

As a percentage of total exports

Note: “Rest of the UfM” includes Israel, Turkey, and the Western Balkan, Levant and North African sub-regions.

Source: UN Comtrade database, https://comtrade.un.org/.

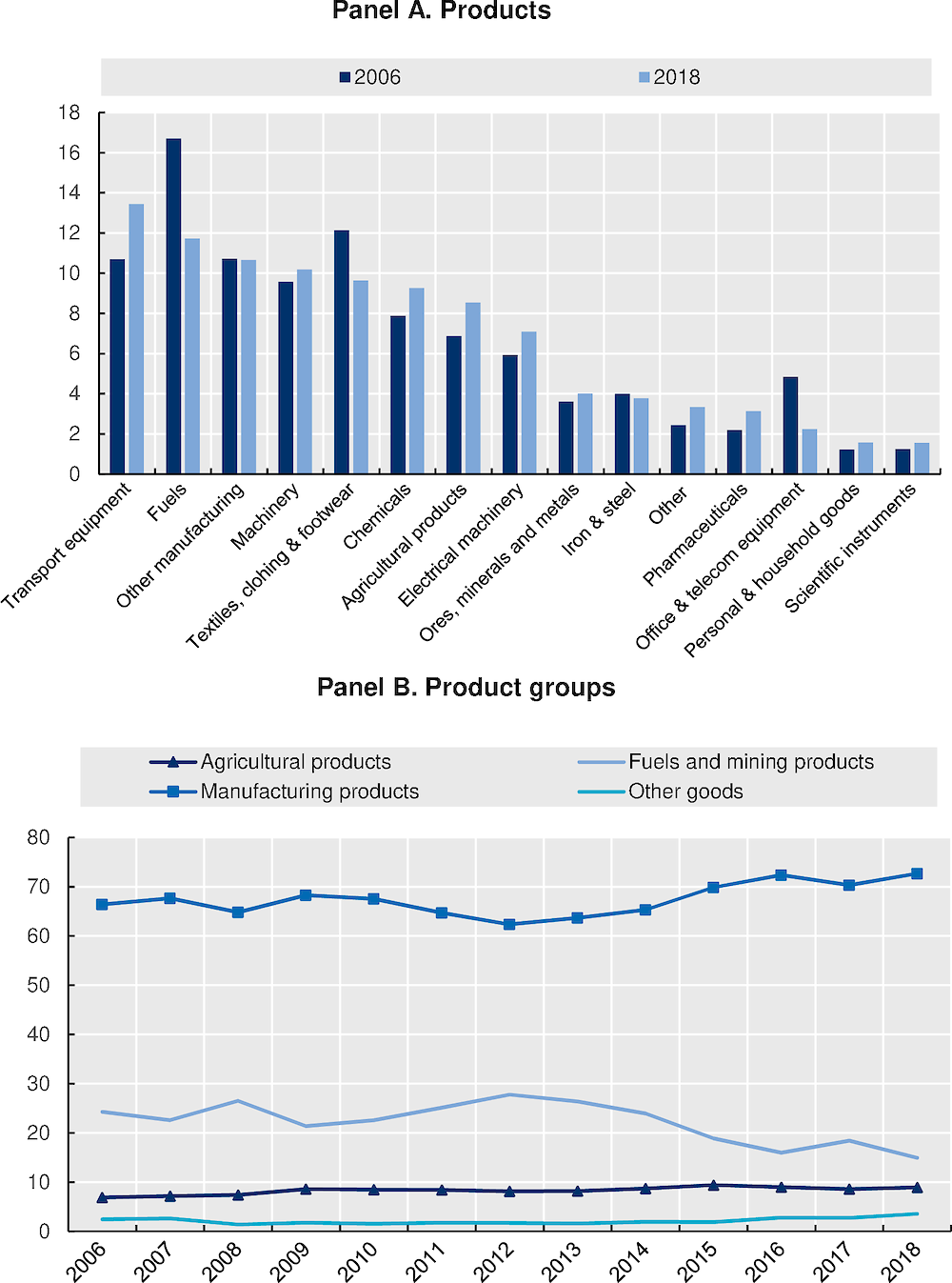

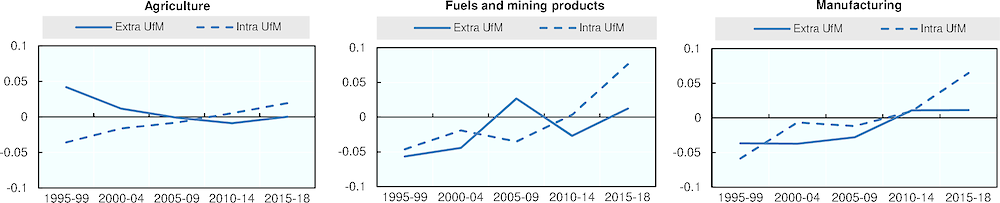

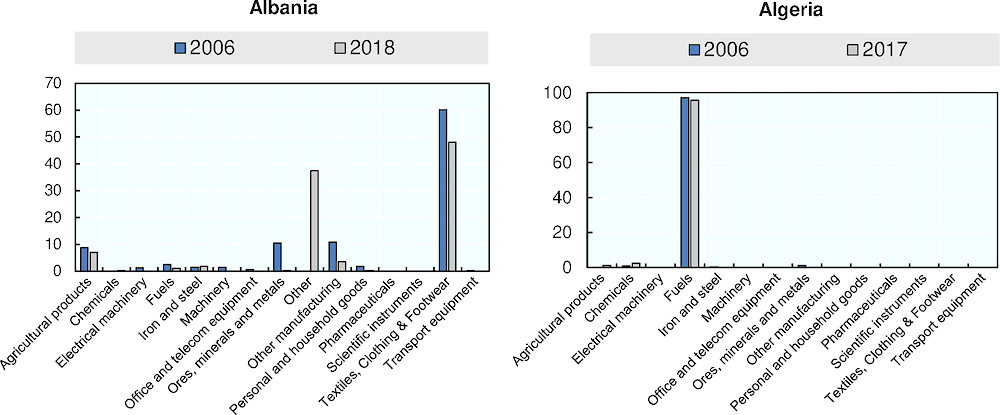

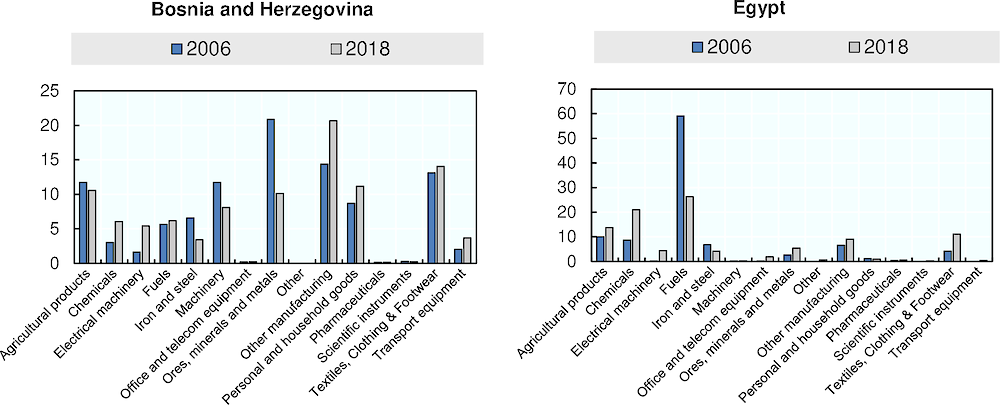

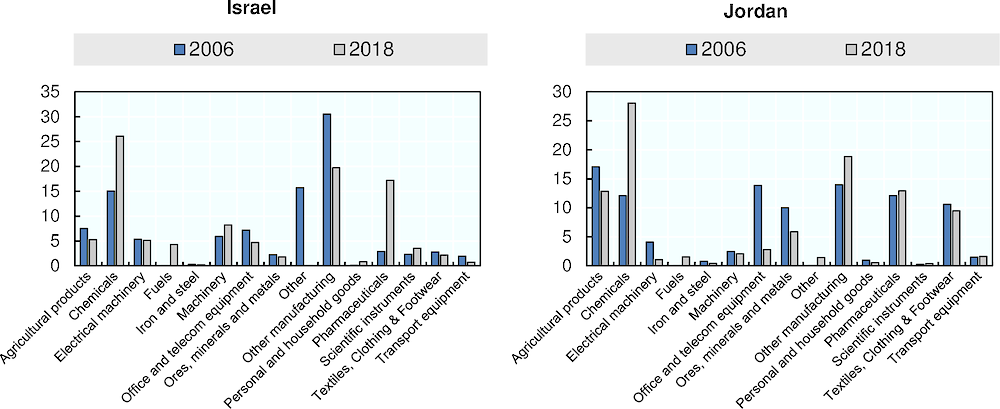

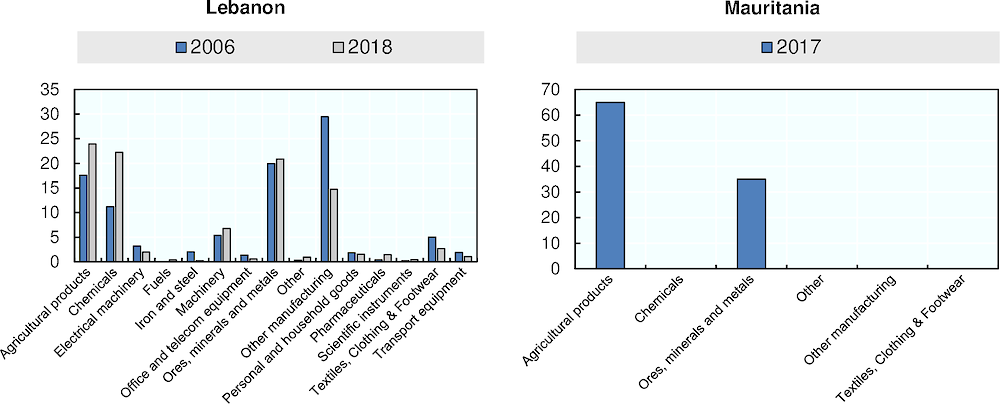

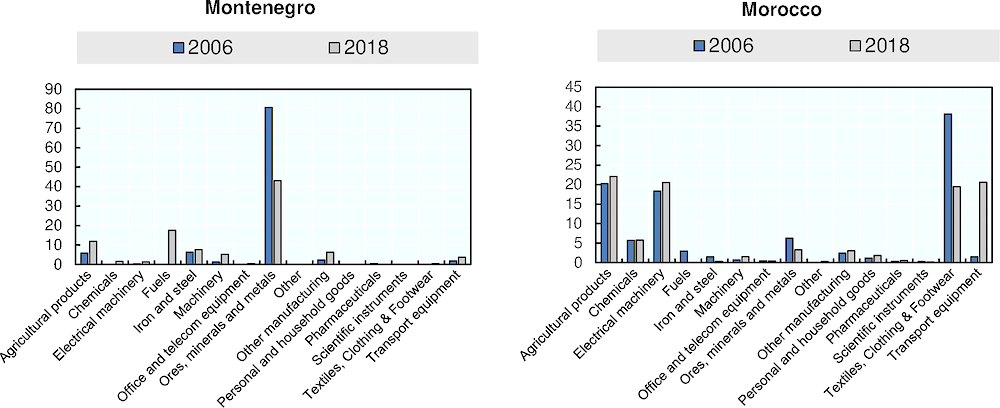

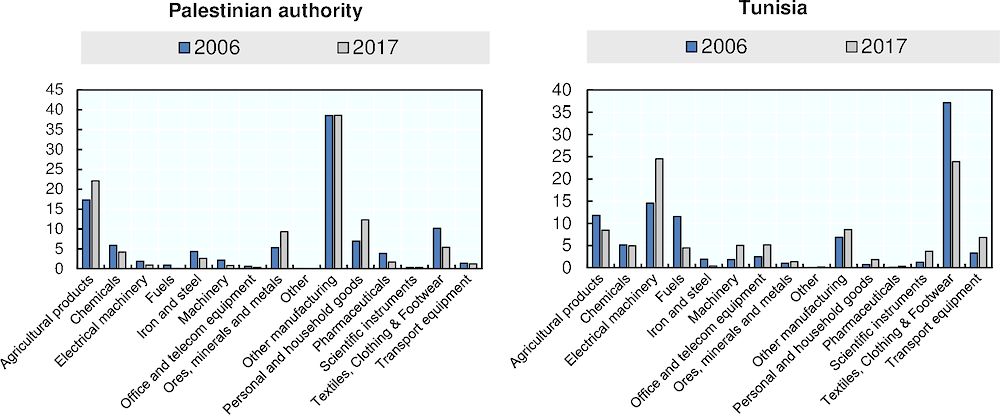

What types of goods are exchanged?

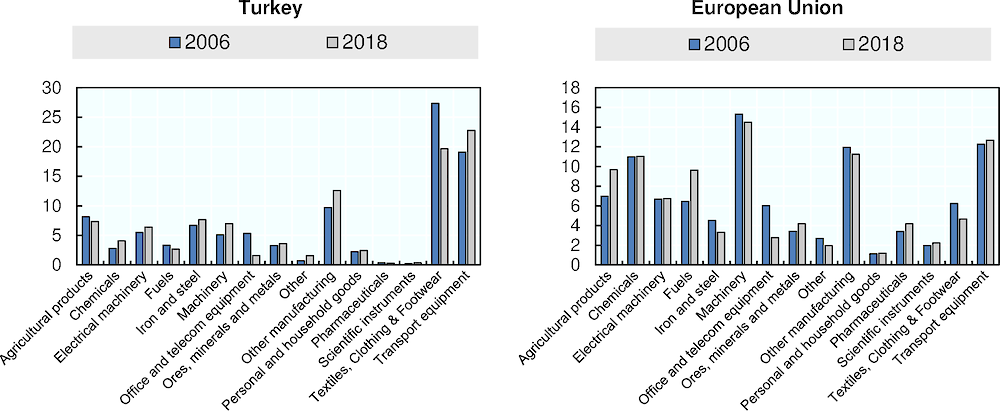

The analysis of the intra-UfM trade by type of goods reveals the increasing importance of the exchange of more sophisticated manufactured products (Figure 1.9). In 2006 fuel was the commodity with the highest share in the internal UfM market, representing over 16% of the region’s total internal exports, 60% of which originating in Algeria. In 2018, the most relevant commodity was transport equipment, representing 13% of the region’s internal exports. In general, manufactured goods, scientific instruments, pharmaceutical and chemical goods increased their relevance in the region’s market, at the expense of exports of fuel, textiles, clothing and footwear, and iron and steel.

The evolution of the main product groups confirms the trend towards an intra-UfM exports basket with higher content of manufactured goods (Figure 1.9). The share of manufactured goods exports within the UfM has increased from 66% of the total volume of exports in 2006, to 73% in 2018, while the share of fuels and mining products exports, which represented 24% in 2006, has recently declined to less than 15%. Agricultural exports have also experienced a significant increase (almost 29% since 2006), although their share in the intra-UfM exports remains below 9%.

Figure 1.9. Composition of intra-UfM exports, by type of commodity, 2006-18

Share in total exports, by type of commodity (%)

Note: Internal trade of the EU is excluded. For Algeria and Mauritania, 2018 refers to 2017. In panels A and B, shares of exports of products and of product groups respectively add to 100%.

Source: UN Comtrade database, https://comtrade.un.org/.

Indicator T4. Trade in Value Added (TiVA)

The traditional analysis of trade flows provides insights mostly on the final price of a given good, while the value of all the parts that compose the good – and, more importantly, its origins – are not captured by the data. As global and regional value chains gained complexity and relevancy in the flows of traded goods during the last century, data on the trade of intermediate goods that are used to produce new components and final goods are critical to understanding the deeper relations among interlinked economies, as they not only share goods and services, but also add value to each other.

For instance, the automobile industry requires a complex set of components and materials that originate from dozens of locations across the globe. Morocco’s emerging automobile industry has significantly increased the weight of the domestic manufacturing sector in its exports. The rise in Moroccan exports occurred in a context of higher flows of manufactured goods to and from EU member countries, showing an increase in the integration of Morocco with countries in the Northern shore of the Mediterranean.

Data on trade in value-added (TiVA) can describe how different economies and sub-regions of the UfM connect with each other, in particular as concerns the creation and origin of value along the different stages of production (Box 1.2). Data on trade in value added allow to appreciate the actual integration of the UfM economies in the regional and global value chains (GVCs).

Box 1.2. Why TiVA is useful

The OECD’s Trade in Value-Added (TiVA) describes a statistical approach used to estimate the sources (broken down by country and industry) of the value that is added in producing goods and services for export (and import). Data presented in the OECD TiVA database provide insights into:

Domestic and foreign value-added content of gross exports, by exporting industry

Services content of gross exports, by exporting industry, type of service and value-added origin

Participation in global value chains (GVCs) via intermediate imports embodied in exports (backward linkages) and domestic value added in partners’ exports and final demand (forward linkages)

a. Backward integration in GVCs is the use of foreign inputs to produce final and intermediate goods exported by a country’s firms. It facilitates the diffusion of knowledge either indirectly through learning from suppliers or directly via knowledge spillovers from foreign direct investment (FDI).

b. Forward integration in GVCs is the production of intermediate inputs used in other countries’ exports. Increased production for foreign markets requires convergence of product standards toward international best practices and triggers virtuous feedback loops between productivity, innovation, human capital endowment and living standards.

'Global orientation' of industrial activity, i.e. share of industry value added that meets foreign final demand

Country and industry origins of value added in final demand, including the origin of value added in final consumption (by households and government) and in gross fixed capital formation (GFCF)

Bilateral trade relationships based on flows of value added embodied in domestic final demand

Inter-regional and intra-regional relationships

Domestic value added content of imports

Source: OECD (2018), Trade in Value Added (TiVA) database, http://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm.

All EU27 countries, as well as Israel, Turkey, Morocco and Tunisia, are included in the OECD TiVA database. While a number of countries are missing, the overall size of the set of UfM economies covered by TiVA data allows for an insightful analysis of the trade and production connections of an important share of the UfM economy.

At the global level, the pace of GVC integration has slowed since 2011, despite a modest recovery after the global financial crisis9. The integration of a given economy into GVCs can in part be observed through the analysis of the foreign component of its production. Countries with relatively liberal trade policies that are open to trade and foreign investment will tend to have high levels of foreign value-added in the goods they produce and export. More specifically, service-intensive economies and economies specialised in the final stages of the manufacturing process will have high levels of foreign value-added in their production and exports, while economies specialised in activities at the beginning of the production chain (e.g. extractive industries) will have high shares of domestic value-added in their exports.

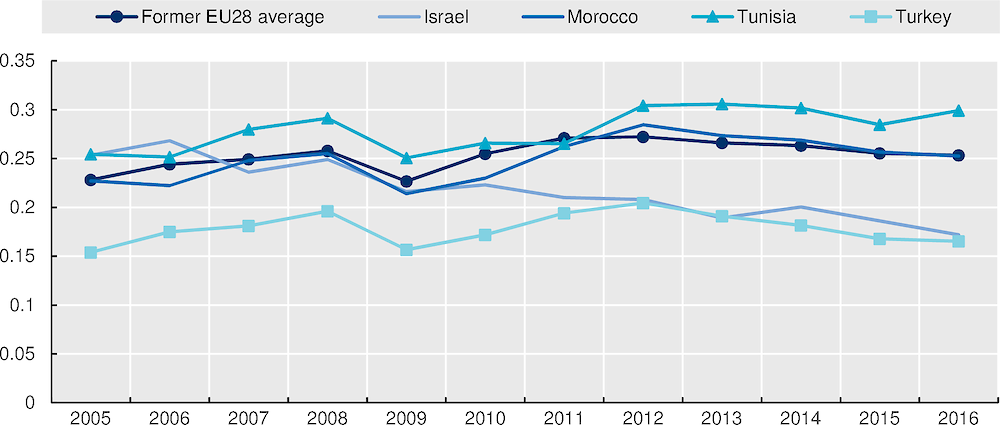

Figure 1.10 shows the percentage of foreign value-added in a country’s exports basket, which include exports of manufacturing, agriculture, extractive industries and services. Following the global trend, the UfM economies’ integration into the global value chains has decelerated. In 2016, Tunisia was the country with the highest percentage of foreign content in its exports (30%), in part reflecting tourism, and was the only country where this share remained stable after 2012. Foreign content in Morocco’s gross exports accounted for 25%, a rate similar to that of the EU countries and the United Kingdom, where the share of foreign value added slightly dropped after 2012. Israel and Turkey present lower levels of backward integration in GVCs, as 17% of their gross exports’ value originated in other countries. Also, Israel shows an important decline in the share of foreign value-added in its exports, i.e. 8 percentage points since 2005.

Figure 1.10. Foreign value-added content of exports, all sectors, 2005-16

As a percentage of total gross exports

Note: The sectors of agriculture, manufacturing, extractive industries and services are covered by both the data on exports and on foreign value-added content. OECD TiVA’s aggregate for the European Union includes on its last version (2018) the United Kingdom.

Source: OECD, (2018) Trade in Value Added (TiVA) database, http://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm.

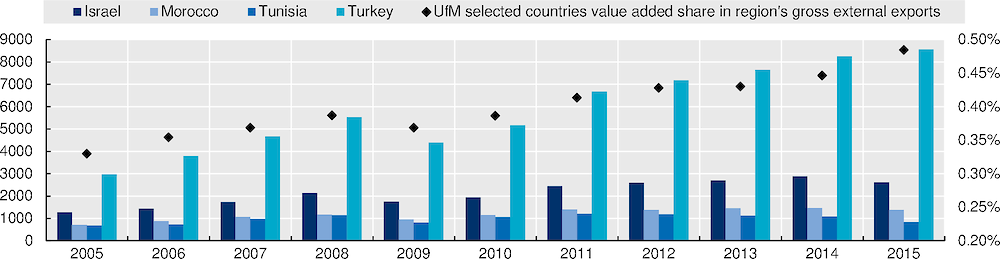

At the regional level, forward integration of Israel, Morocco, Tunisia and Turkey into the production chains of the EU and the United Kingdom increased significantly since 2005, although the contribution of the four economies to the EU and the United Kingdom external exports remains modest, i.e. 0.48% of the value of the gross external exports originates from the four countries (Figure 1.11).

Forward integration, that is the production of intermediate inputs used in other countries’ exports, increases the potential market, leverages the use of Turkey’s human, capital and natural resources, and, as a result, contributes to rebalancing the Turkish economy. Increased production for foreign markets requires convergence of product standards toward international best practices and triggers virtuous feedback loops between productivity, innovation, human capital endowment and living standards.

Turkey is the country that experienced the highest growth of the share of value-added contributed to the EU and the United Kingdom external exports. Israel and Morocco also increased their relative contribution since 2005.

Figure 1.11. Foreign value-added contribution of selected UfM countries to EU and UK exports, all sectors, 2005-15

Amount (left scale, in million USD) and percentage (right scale) of total gross exports

Note: Data refer to exports of the EU 27 and the United Kingdom to the rest of the world (including UfM countries but excluding exports within EU member countries and the United Kingdom). The graph shows the foreign value added from agriculture, manufacturing, extractive industries and services of Israel, Morocco, Tunisia and Turkey to total exports of the EU27 and United Kingdom. OECD TiVA’s aggregate for the European Union includes on its last version (2018) the United Kingdom.

Source: OECD, (2018) Trade in Value Added (TiVA) database, http://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm.

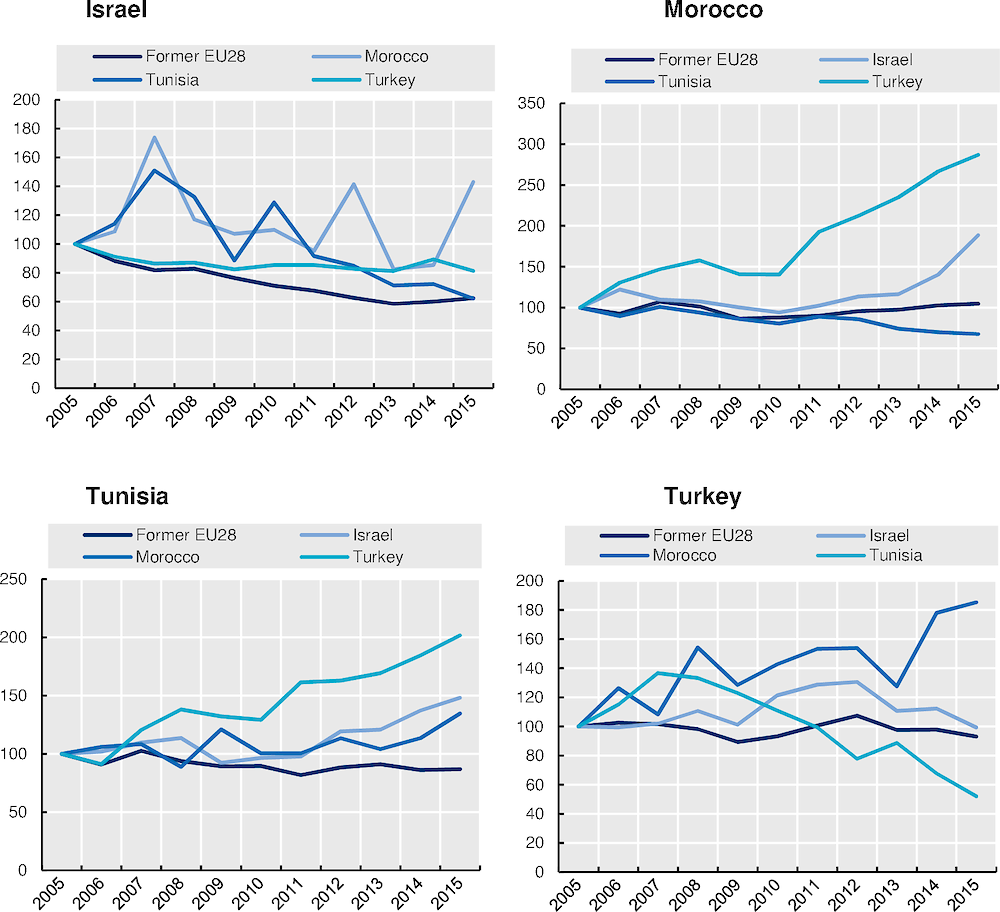

Figure 1.12 shows the contribution of selected UfM economies to the total gross exports value of Israel, Morocco, Tunisia and Turkey from 2005 to 2015. The share of EU and the United Kingdom in the gross exports of the other UfM economies declined in every case, with the exception of Morocco. This decline was particularly strong in the case of Israel, where the EU and the United Kingdom content in Israeli exports dropped by over 37% after 2005. In Tunisia, the EU and the United Kingdom content decreased by 13% and by 0.7% in Turkey. By contrast, the EU and the United Kingdom value added to the Morocco’s exports increased by 4.5% during the period.

Figure 1.12. Origin of value-added in exports of selected UfM countries, all sectors, 2005-15

Evolution of value-added to total gross exports, Index 2005 = 100

Note: The index shows the evolution of foreign value-added content from agriculture, manufacturing, extractive industries and services in total exports of Israel, Morocco, Tunisia and Turkey respectively. OECD TiVA’s aggregate for the European Union includes the United Kingdom in the latest available version of TiVA, 2018.

Source: OECD, (2018) Trade in Value Added (TiVA) database, http://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm

While the EU and the United Kingdom contribution to the gross exports of the other UfM countries has generally declined, this is not the case for the other countries. Morocco has seen a significant increase in Israel’s and Turkey’s share of value added to its gross exports since 2005. Tunisia has seen an increase of Turkey’s value-added content in its exports of over 100%, and of Israel and Morocco by 48% and 34%, respectively. Turkey has seen a decline of the value-added content from Tunisia and Israel (slightly), but Morocco’s value-added share in Turkey’s gross exports has increased by 85%. Israel is the only economy that has experienced a general decline of the value-added contributed by other UfM economies to its gross exports; this is consistent with the general trend in foreign value-added content of Israeli gross exports (Figure 1.10). The peak of Morocco’s value-added share in Israel’s gross exports is mostly due to the country’s very low relative weight in Israel’s gross exports value-added.

Table 1.3. Origin of value-added, by percentage of exports in 2015, all sectors

|

Recipient |

|||||

|---|---|---|---|---|---|

|

Origin |

|||||

|

EU & UK |

Israel |

Morocco |

Tunisia |

Turkey |

|

|

EU & UK |

6.02% |

11.97% |

14.59% |

5.74% |

|

|

Israel |

0.09% |

0.04% |

0.03% |

0.10% |

|

|

Morocco |

0.05% |

0.02% |

0.16% |

0.06% |

|

|

Tunisia |

0.03% |

0.003% |

0.11% |

0.02% |

|

|

Turkey |

0.31% |

0.65% |

1.20% |

1.32% |

|

Note: Origin = economy of origin of the value-added in recipient economy’s gross exports; Recipient = economy reporting exports. The sectors of agriculture, manufacturing, extractive industries and services are covered by the data on both exports and foreign value-added content. OECD TiVA’s aggregate for the European Union includes the United Kingdom in the latest available version of TiVA, 2018.

Source: OECD, (2018) Trade in Value Added (TiVA) database, http://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm

In 2015, the EU and the United Kingdom together contributed to 14.5% of the value of Tunisia’s gross exports, 12% of Morocco’s, 6% of Israel’s, and 5.7% of Turkey’s. Turkey was the second greatest contributor to other UfM partners’ gross-exports value, in particular for Morocco and Tunisia. Relative to its economic size, Israel’s value-added share in exports of the other UfM economies seems to be below its potential. This will be further analysed in the section that discusses the cost of non-integration in the UfM region.

Trade in services and economic integration

The importance of services in the global economy was acknowledged by the General Agreement on Trade in Services (GATS) adopted by the WTO in 1995. Since then, the notifications and enforcement of agreements on trade in services have increased greatly, even if they remain limited to certain regions. As observed earlier in this chapter, the only trade agreements currently enforced within the UfM that address trade in services are the EU’s Association Agreements with Albania, Bosnia and Herzegovina and Montenegro.

Trade in services represents only 25% of global trade flows10. However, the service sector employs one out of two workers globally11 and represents approximately two-thirds of the world’s total production12, revealing its importance as a key engine for economic development and integration.

Despite the importance of trade in services, however, the data necessary for a thorough analysis are missing for many UfM countries. For instance, the OECD Services Trade Restrictiveness Index (STRI) database, an important tool for the analysis of trade in services, currently covers only part of the UfM members, notably the EU member states, Israel, Turkey. Ongoing work should allow to include Albania and Bosnia and Herzegovina in the near future.

The OECD TiVA database provides trade data disaggregated by economic sectors13 and sub-sectors for the following UfM members: the EU27, Israel, Turkey, Morocco and Tunisia. These UfM countries are relatively aligned to the global trend regarding the importance of services in their economies. Among them, Israel has the highest share of services in national value added (79%), followed by the former EU2814 (78%) and Turkey (69%). Tunisia (61%) and Morocco (59%) are both slightly below the global average15. The share of services in the total exports of these selected UfM countries is above the global mean, with the exception of Tunisia, but still under-represented compared to the weight of services in the economy (Table 1.4). The United Kingdom (UK), covered by the OECD TiVA database, is considered in the analysis when relevant, as former member of the European Union.

Table 1.4. Services share of gross exports for selected UfM countries, 2010-15

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

|

|---|---|---|---|---|---|---|

|

EU & UK |

39.2% |

38.1% |

38.2% |

38.8% |

40.0% |

40.9% |

|

Israel |

41.3% |

45.2% |

46.6% |

48.7% |

47.1% |

50.2% |

|

Morocco |

42.4% |

39.0% |

38.0% |

35.7% |

37.7% |

38.4% |

|

Tunisia |

26.1% |

25.0% |

23.4% |

22.4% |

21.9% |

22.0% |

|

Turkey |

33.4% |

32.3% |

32.3% |

33.0% |

33.4% |

33.6% |

Note: EU covers the 27 member countries of the European Union. OECD TiVA’s aggregate for the European Union includes the United Kingdom in the latest available version of TiVA, 2018.

Source: OECD, (2018), Trade in Value Added (TiVA) database, http://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm

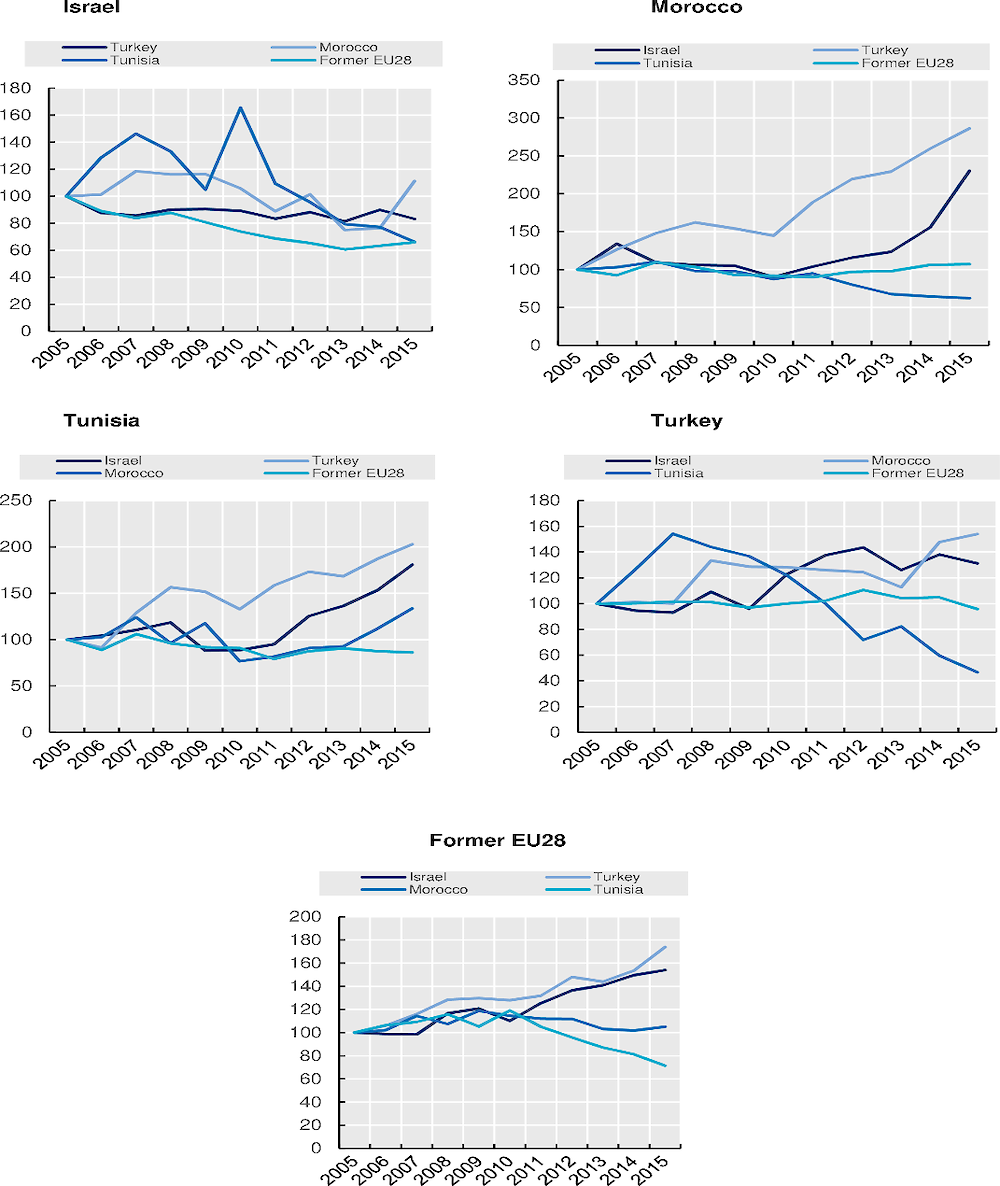

Figure 1.13 shows the evolution of the contribution of foreign services to the gross exports value of Israel, Morocco, Tunisia, Turkey and the former EU28 in 2005-15. It deepens the analysis of Figure 1.12 that considered the contribution from all agriculture, manufacturing, extractive industries, and services altogether.

Figure 1.13. Origin of value-added from services in gross exports of selected UfM economies

Evolution of value-added originating from foreign services to gross exports, Index 2005 = 100

Note: OECD TiVA’s aggregate for the European Union includes the United Kingdom in the latest available version of TiVA, 2018.

Source: OECD, (2018) Trade in Value Added (TiVA) database, http://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm.

Although with different intensities, the trends show the same evolution (i.e. increase or decrease) of integration observed for aggregate contribution. The only exception is the case of Israel’s services sector: while Israel’s total value-added in Turkey’s gross exports decreased almost 1% after 2005, Israel’s services value-added to Turkey’s gross exports increased by over 30%.

Another important note is that, for the former EU28, the share of the other analysed UfM economies’ services industries value-added in its gross exports has been lower, or showed a higher decline than when considering the value-added of all the economic sectors. The only exception is once again Israel, whose services industry value-added experienced a higher increase in its share of gross exports of the former EU28 (54%) (Figure 1.13), as compared to Israel’s total value added (26%) to the former EU28 gross exports (Figure 1.12). Morocco’s services industry value added to Israel and Turkey’s gross exports experienced also an important increase since 2005 (11% and 54% respectively). For the remaining economies, their services industries’ value-added share of the other UfM countries’ gross exports has either increased more strongly, or behaved similarly, when considering the value-added of all the productive sectors.

The cost of non-integration: Assessing the trade potential of the UfM region

This section examines the trade potential among UfM member countries, focusing on exports, with the objective of assessing the scope for improved trade integration in the region. The key metric used in this analysis is an indicator of relative export performance, which provides a measure of a country’s export performance relative to the level of exports predicted by a conventional gravity model of trade. This relative export performance indicator is expressed as the ratio of actual exports to theoretical exports16 and can provide insights into both the pace of intra- and extra-UfM integration and the potential scope for increasing exports.

The theoretical exports serving as benchmark in this exercise are derived using a gravity model of trade which takes into account the relative sizes of the trading pair, the trade costs between them, and other observable and unobservable country-specific characteristics that affect bilateral trade17.

Before describing the results, it is important to set out a couple of caveats that will help with interpretation. The chief limitation concerns the use of gravity models in a world increasingly defined by global production processes. While it is widely accepted that the gravity framework applies for intermediate as well as final goods, the models used here do not discriminate between exports that are entirely consumed in the destination economy and those that are used as intermediate inputs to be further processed and exported, meaning that the same elasticities are computed with respect to the explanatory variables. It is likely, however, that the relationship between, say, exports and bilateral distance is different for final products and intermediate goods18. In this sense, the theoretical (benchmark) exports derived from the gravity model will only capture part of these fragmentation aspects. This analysis therefore aims at giving an indication of performance in regional trade integration, rather than a precise quantification of the gap between the reported and the predicted level of exports.

A second important warning concerns the impact of data limitations, meaning that the focus of the analysis in this section is specifically on goods, and not services, where the available evidence (i.e. services exports as a share of GDP) points to under-performance (excluding tourism) in many UfM economies.

It is also important to note that the gravity model computes the trade flows of the United Kingdom in the intra-UfM trade. Integrated in the EU single market and included in the EU’s bilateral trade agreements with other UfM member countries until the end of 2020, the United Kingdom has been an important trade partner for the region in the analysed period, i.e. 1995-2018.

Notwithstanding the caveats above concerning the interpretation of theoretical exports, the results provide strong evidence that overall intra-UfM exports are in line with or above the benchmark levels specified by the gravity model, and more so now than at the beginning of the Barcelona Process. The result holds true for all broad sectors: agricultural, mining and manufacturing products. However, the results also indicate a sizeable potential to expand exports to fellow UfM members through the South-South trade corridor and to extra-UfM economies.

Further work will be needed to expand the analysis to services trade and indeed to take into account the value-added dimension in the observed trade flows. This, however, would require investment in underlying statistics in many of the UfM economies.

Intra-UfM relative export performance has picked up strongly in recent years

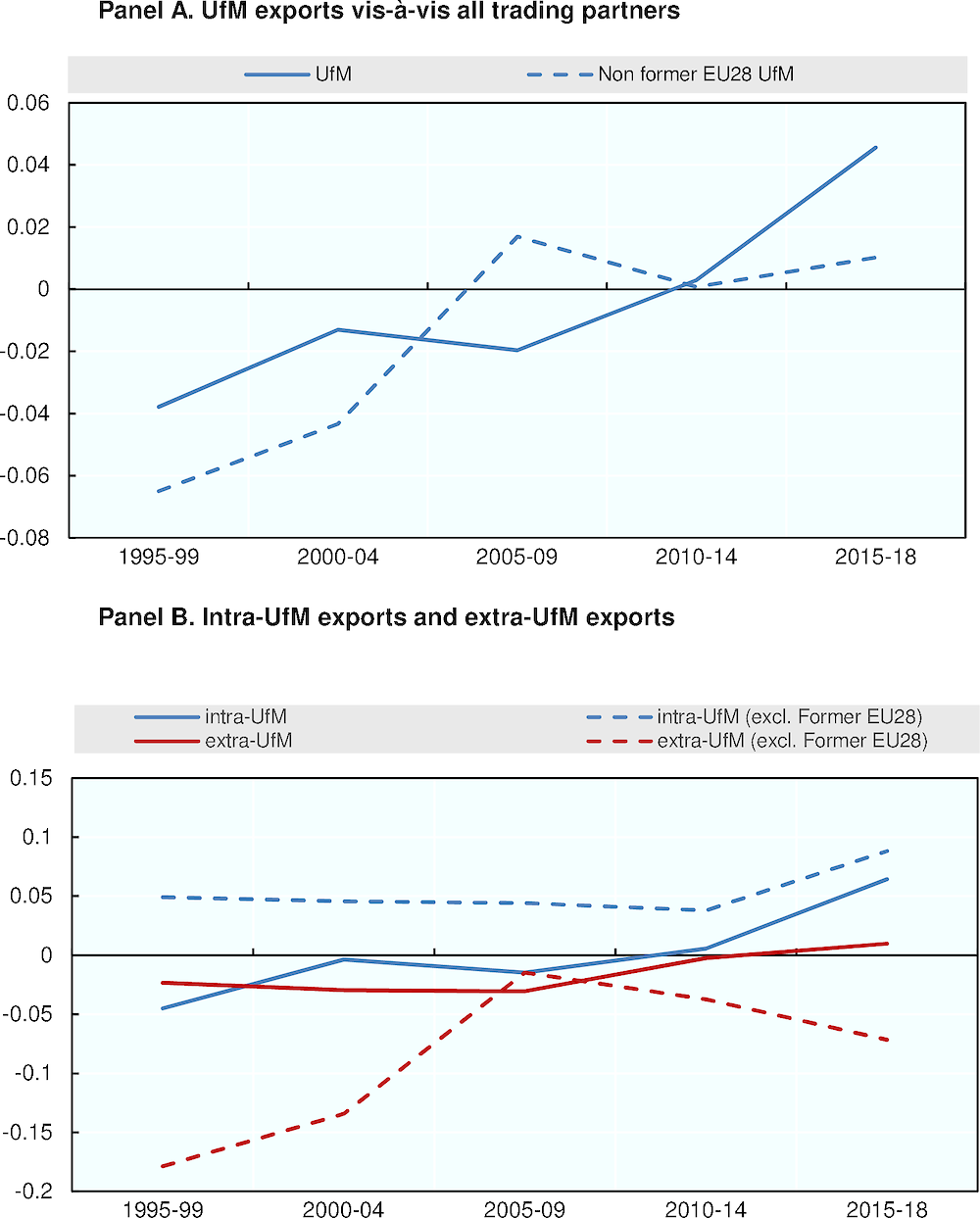

Figure 1.14, Panel A shows the standardised relative export performance (SREP) indicator19 for the UfM members vis-à-vis all their trading partners. While the group’s exports were about 7% lower than the theoretical benchmark at the beginning of the period, they exceeded the expectations of the gravity model by almost 10% in 2015-18. A similar trend is also observed if the EU and the United Kingdom are excluded.

Breaking down total merchandise trade into intra- and extra-UfM exports (Figure 1.14) reveals that the primary engine of improvement has been intra-UfM exports, especially in recent years (2015-18). Moreover, the measure of relative performance (REP) is even higher if the EU members and the United Kingdom are excluded, with intra-UfM exports outperforming the theoretical model by almost 20% (compared to 14% for the overall group).

On the other hand, the closer integration of these economies within European value chains (serving markets within Europe) appears to have resulted in a gravitational shift away from other markets, as the SREP began to deteriorate again following a gradual improvement up until the 2008/9 financial crisis.

Figure 1.14. Export performance for the UfM members, total and by partner group

Note: The graphs present the standardised relative export performance (SREP). Values above 0 represent exports above the model’s predictions.

Source: Authors’ calculations.

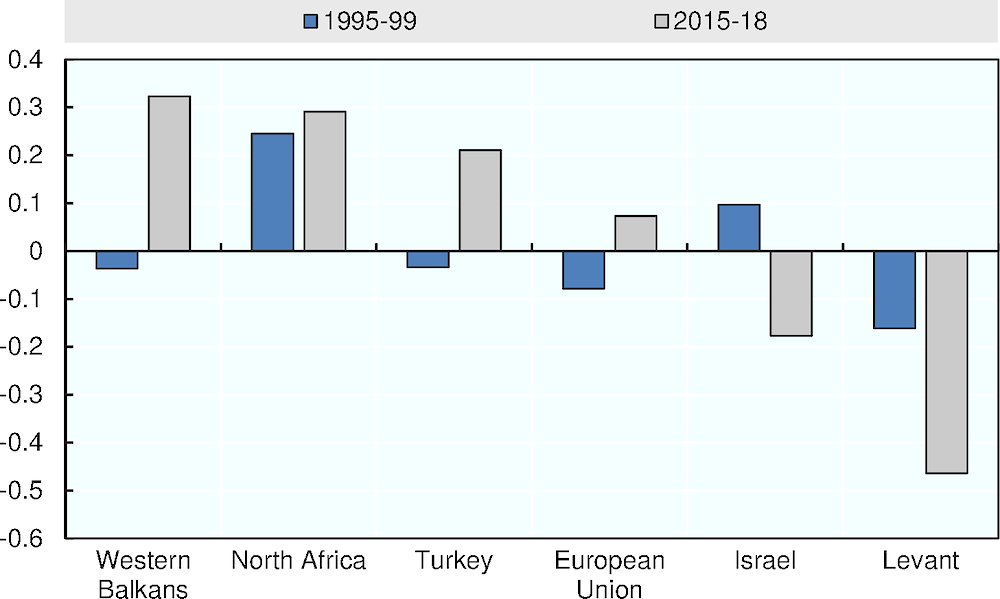

The Western Balkans, North Africa and Turkey have been integrating more closely with the rest of the UfM but trends in the Levant and Israel have moved in opposite directions

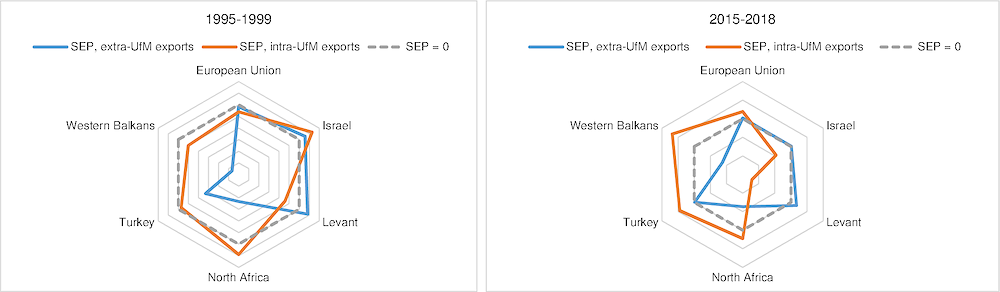

A further breakdown of the results by UfM sub-group reveals the potential for improved trade among some of the sub-groups of countries, in particular in the South-South dimension (Figure 1.15 and Table 1.5).

In the late 1990s the exports of the European Union and the United Kingdom were close to the theoretical expectations both with fellow UfM members and with the rest of the world. While the European Union saw closer integration in recent years (2015-18), the United Kingdom saw its relative position deteriorate, with extra-UfM exports picking up instead.

The Western Balkans, already highly integrated with the EU in the late 1990s, saw a significant improvement in their SREP in recent years but their extra-UfM trade performance remained weak.

North African economies and Turkey saw a similar pattern to the Western Balkans. However, whilst extra-UfM exports remain low compared to theoretical expectations, the relative position of intra-UfM exports has improved in recent years compared to the late 1990s.

The Levant group and Israel appear to be more integrated with the rest of the world than with the UfM throughout the period, with the SREP indicating a significant degree of untapped export potential for intra-UfM exports in recent years.

Figure 1.15. Intra- and extra-UfM export performance of UfM members

Note: The graphs present the standardised relative export performance (SREP) indicator. Values inside the dotted line represent exports below the model’s predictions and values outside the dotted line represent exports above the model’s predictions.

Source: Authors’ calculations.

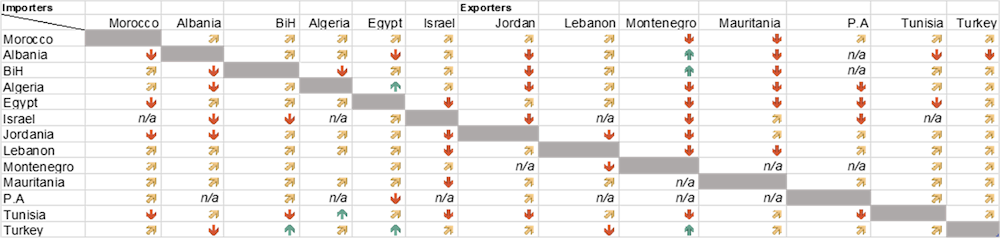

Table 1.5. Intra-UfM export performance, by exporter and importer

Note: Rows correspond to exporters and columns to importers. The table presents the standardised relative export performance (SREP) indicator. In panel A, the observations refer to 1995-99 or earliest available. In panel B, the observations refer to 2015-18 or latest available.

Source: Author’s calculations.

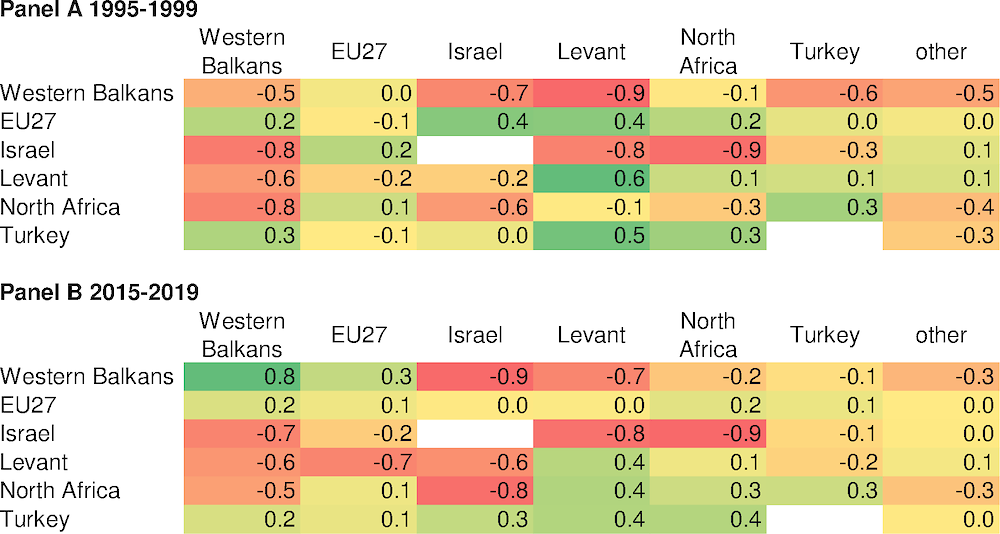

High integration in intra-UfM exports across all categories of merchandise trade

The preferred model specification (Model 4 in Annex Table 1.B.1) was also used at the product level, firstly at a more aggregated level – agriculture, fuels and mining products, and manufacturing – and secondly by detailed manufacturing group (see (Annex 1.C for the definition of the product groups).

The general tendency towards closer trade integration among UfM member countries is confirmed across all product groups, with the relative export performance of intra-UfM trade outperforming extra-UfM trade across all product groups. In 2015-18, intra-UfM exports of agriculture, fuels and mining, and manufacturing are 4%, 17% and 14% above the theoretical model, respectively (Figure 1.16).

Figure 1.16. Export performance for the UfM members, by product group and by partner

Note: The graphs present the standardised relative export performance (SREP) indicator. The label n_ufm indicates extra-UfM exports, while the label ufm indicates intra-UfM exports. T1, t2, t3, t4 and t5 correspond to the periods 1995-99, 2000-04, 2005-09, 2010-14 and 2015-18, respectively.

Source: Author’s calculations.

The Western Balkans, Turkey and North Africa have seen their intra-UfM exports of manufacturing products increase the most

Zooming in on manufacturing products, the Western Balkans, Turkey and North Africa saw a significantly improved performance in intra-UfM exports over the past 25 years (Figure 1.17).

The intra-UfM exports of the Western Balkans and Turkey, below the theoretical benchmark at the beginning of the period, were 95% and 53% higher, respectively, at the end of the period, with the strong integration in EU value chains driving growth.

North African UfM member countries were already above the theoretical benchmark in the late 1990s, through good integration in EU value chains, and recent years have also seen higher integration with Turkey, Levant, and fellow North African UfM countries, in part reflecting more complex (fragmented parts of) European value chains.

Israel, which is heavily reliant in services exports, saw a gradual deterioration in its measures of SREP for manufacturing.

The Levant group, already under-performing relative to the benchmark in the 1990s, saw a significant deterioration in its performance in recent years.

Figure 1.17. Export performance by UfM member group, intra-UfM exports, manufacturing products

Standardised relative export performance indicator (SREP)

Note: The graphs present the standardised relative export performance (SREP) indicator.

Source: Authors’ calculations.

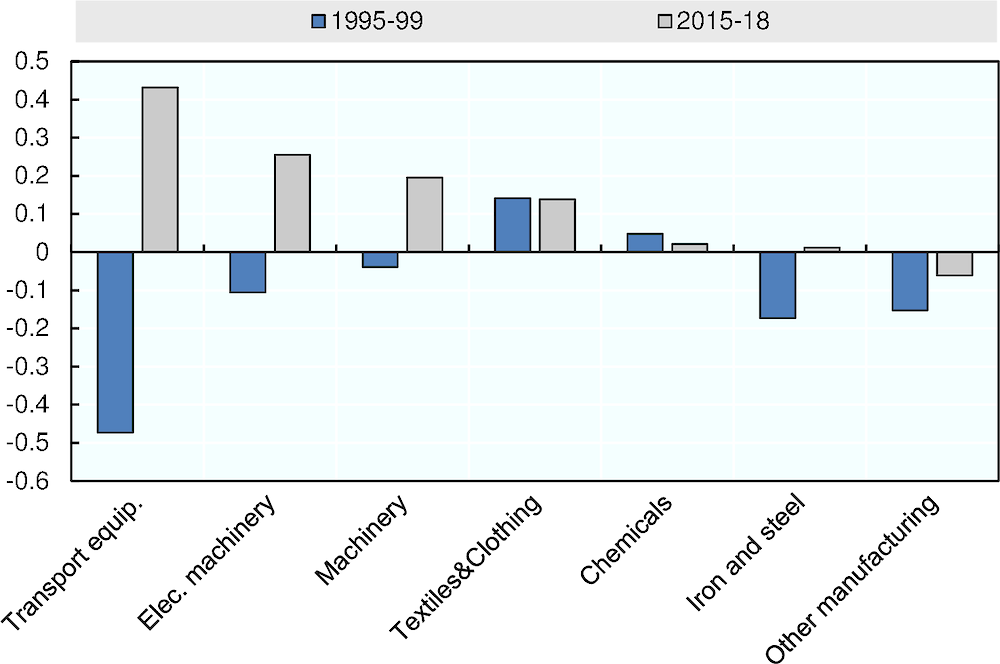

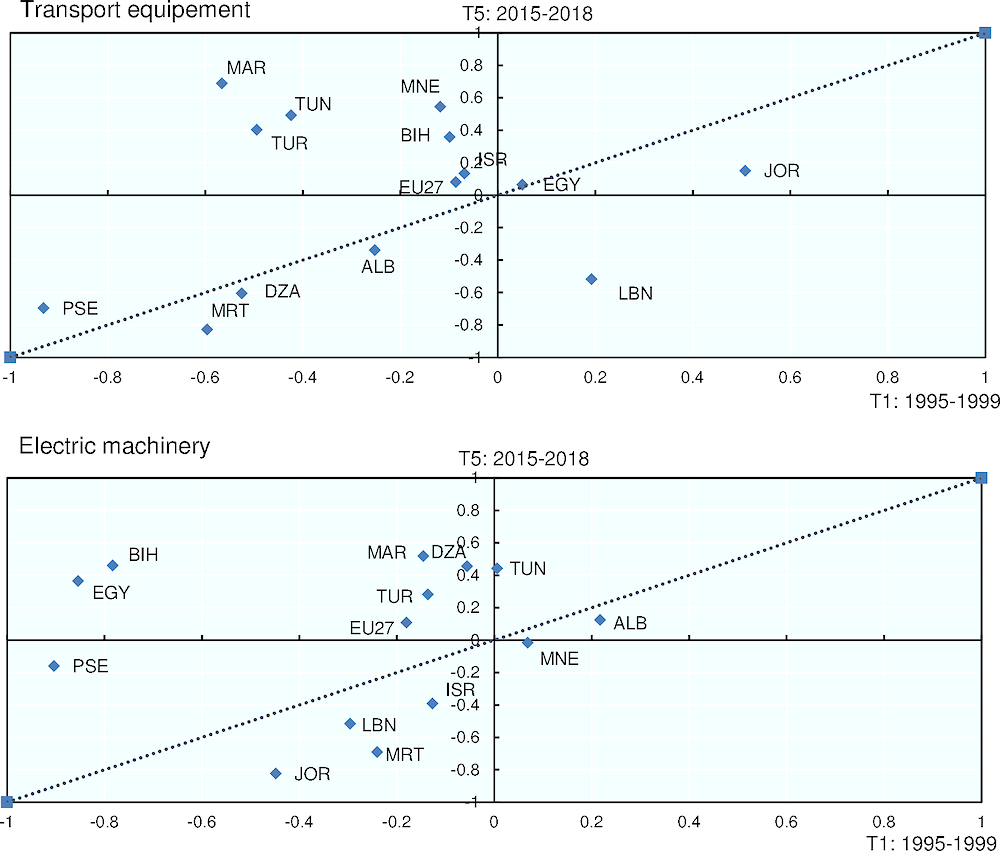

For UfM members (excluding the former EU28), signs of upgrading have appeared through integration into higher-value manufacturing

In the late 1990s, textile products accounted for about one-half of UfM members’ (excluding the former EU28) manufacturing exports to other UfM members. However, the most recent data show that textile products as a share of total manufacturing exports have declined significantly to about one-quarter, even though textiles remain the largest exported product in value terms. Other, more sophisticated manufactured products have been growing faster than textiles, namely transport equipment, electrical machinery and machinery (see also Annex Figure 1.A.1).

The evolution over time of the SREP at the detailed manufacturing-product level is shown in Figure 1.18. While textile products recorded the highest indicator score at the beginning of the period, over time they have been overtaken by transport, electronic machinery and machinery, for which reported exports exceed the theoretical model by 250%, 168% and 148%, respectively.

Figure 1.18. Export performance by manufacturing sector, intra-UfM exports of UfM members (excluding the former EU28)

Standardised relative export performance indicator (SREP)

Note: The graphs present the standardised relative export performance (SREP) indicator.

Source: Authors’ calculations.

Intra-UfM exports of transport equipment showed the largest improvement over time. Montenegro, Morocco, Tunisia and Turkey performed particularly well in this sector: transport equipment, which used to represent less than 5% of these countries’ merchandise exports, increased to over 20% by the end of the period. Morocco in particular appears to have greatly capitalised on foreign investment by European multinational enterprises (MNEs) to integrate into EU transport equipment value chains, whilst also expanding into Turkey and Egypt. The automotive groups Renault and PSA, among others, established important production sites in Morocco; see, for instance (Hahn and Auktor, 2017[5]). Similarly, intra-UfM exports of electronic machinery and machinery grew sevenfold since 1995 in value terms, led by Morocco, Turkey and Tunisia. Bosnia and Herzegovina, Turkey and Tunisia showed the highest improvement in their export performance for a wide range of products.

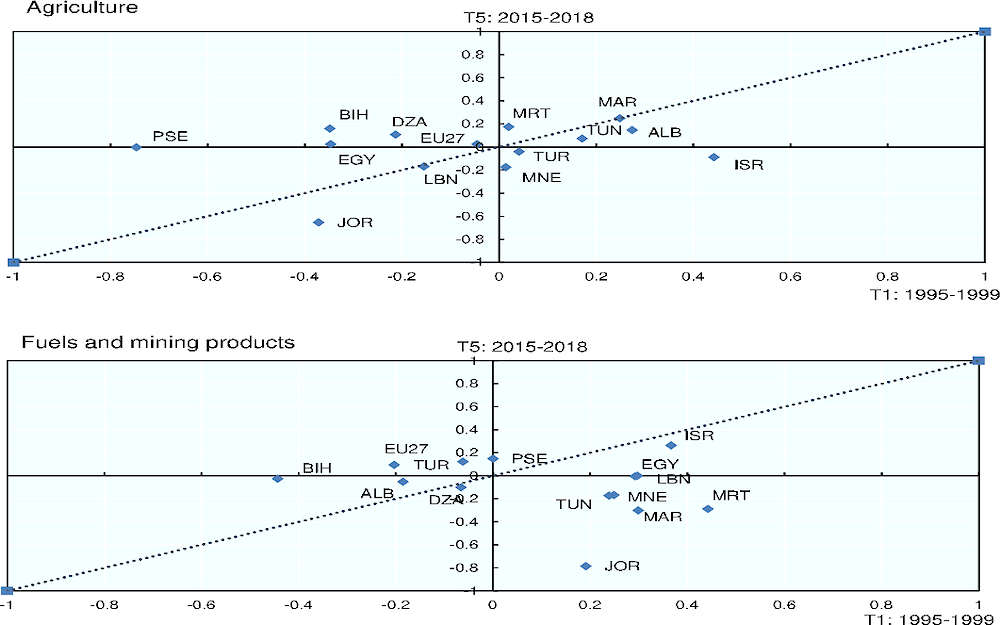

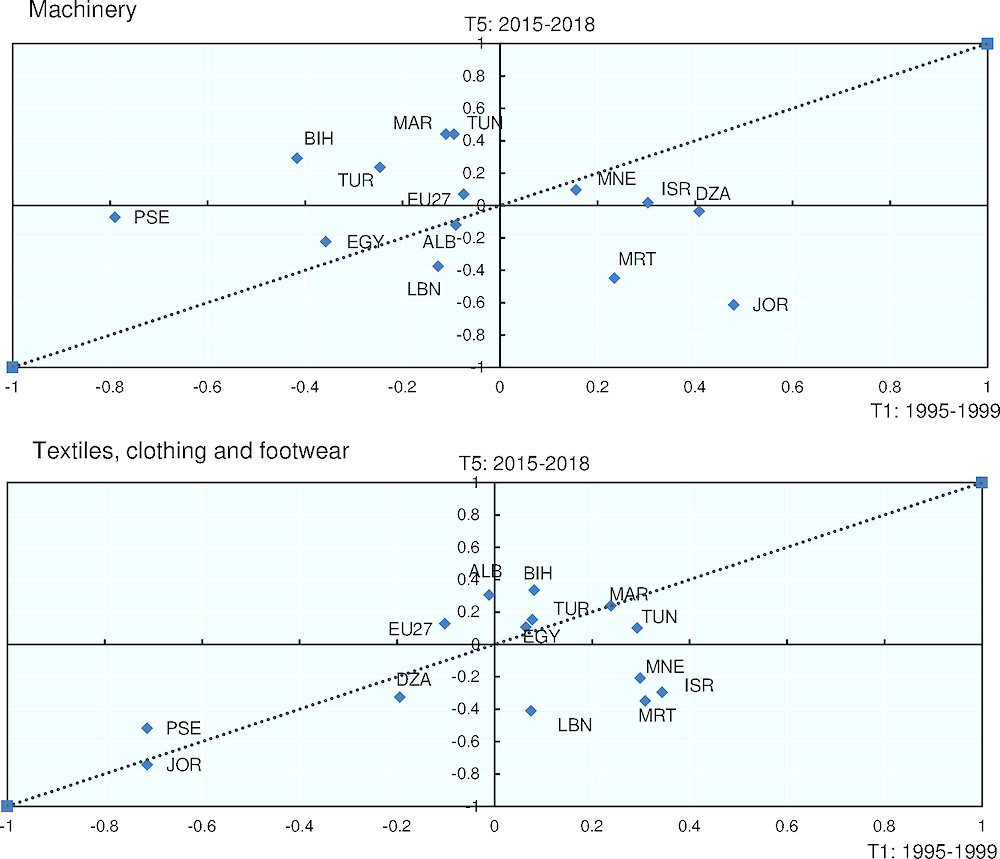

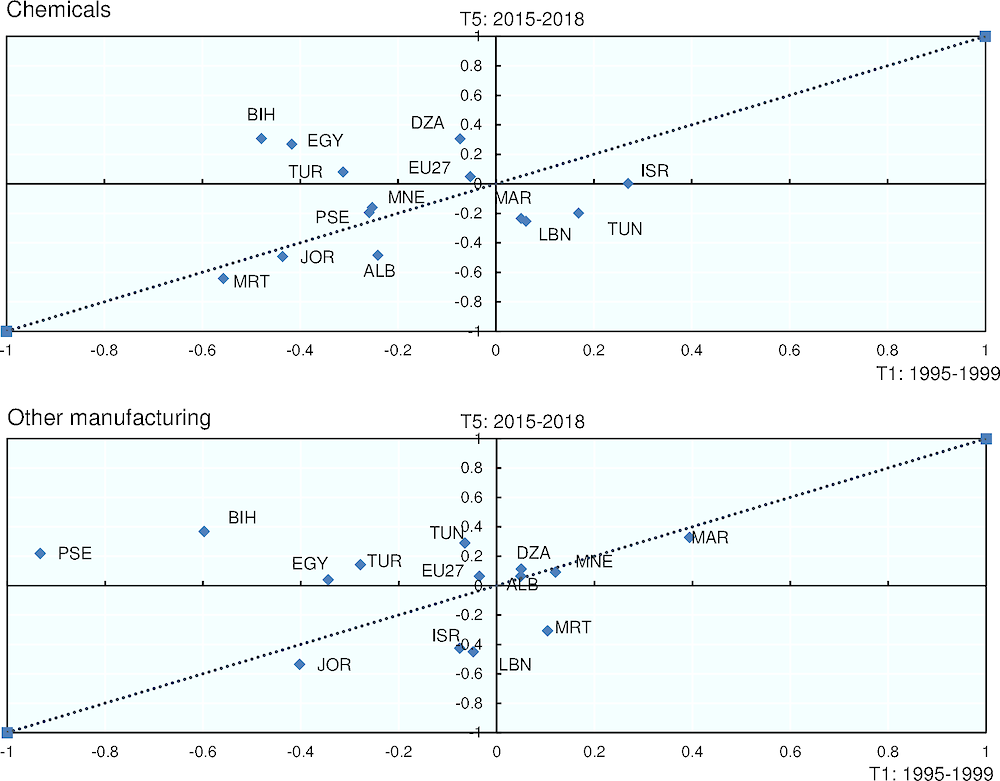

The SREP for individual UfM members (excluding the former EU28), evaluated across a range of manufacturing products, shows a considerable degree of variation. Figure 1.19 shows, for agricultural and mining products as well as for six subsets of manufacturing products, the SREP indicator for 1995-99 on the x-axis and the corresponding indicator for 2015-18 on the y-axis. Countries above the 45-degree line have improved their intra-UfM export performance over time compared to the theoretical benchmark, whilst countries below the line have seen their exports lag behind the predictions of the gravity model.

Bosnia and Herzegovina, Egypt, Morocco, Tunisia and Turkey dramatically improved their scores, while Jordan and Lebanon, in contrast, were under expectations.

Bosnia and Herzegovina has been the leading force behind the Western Balkans’ rapid integration with fellow UfM members over the past two decades. The SREP indicator for Bosnia and Herzegovina often saw the largest increase over the time period considered notably for electronic machinery.

At the same time, Tunisia – and, to a lesser extent, Egypt and Morocco – have widely contributed to North Africa’s higher integration with UfM member countries, although specialising in different products. While Morocco and Tunisia saw higher integration in the transport equipment, machinery and electronic machinery sectors, Egypt saw significant improvement in chemical products.

Turkey’s export performance with other UfM members also improved significantly across all manufacturing sectors and notably for transport equipment, electronic machinery and machinery.

Jordan and Lebanon have lost ground across many manufacturing products, while Algeria and Albania have struggled to diversify their exports

Jordan’s and Lebanon’s intra-UfM exports of manufacturing were below the benchmark at the beginning of the period, and they remained substantially below the benchmark in recent years. Jordan’s main manufacturing export, chemical products, stood at half the predicted level in 2015-18, with most other products also scoring badly (with the exception of transport equipment) (Figure 1.19). Similarly, Lebanon saw its SREP deteriorate across all manufacturing products.

Algeria’s exports of fuels and mining products, accounting for over 90% of the total merchandise exports, remained slightly below benchmark over the years, with the country barely changing its export basket. However, Algerian exports of chemical products and electronic machinery improved over the years thanks to its stronger connections with Turkey, although the levels of exports in these products remain very low.

Since the late 1990s, Albania’s exports of textiles, clothing and footwear as a share of total merchandise exports has remained largely stable (from 58% to 60%), while the majority of the other UfM members shifted towards more ‘advanced’ manufacturing. In fact, the textile sector is the only one where Albania improved its intra-UfM export performance over time, beating the benchmark by more than 30% in the latest period.

Figure 1.19. Trade integration in the UfM region: Have export baskets diversified?

Note: The graphs present the standardised relative export performance (SREP). The first observation for Montenegro refers to t3: 2005-09.

Source: Authors’ calculations.

Conclusions and policy considerations

The UfM countries represented 33% of the world’s exports in 2018, which accounted for over USD 6 trillion in traded goods, three times higher than the value they had in 1996. Nevertheless, the region’s global weight has declined in the recent decades, as a consequence of the increasing relevance of emerging economies in global trade.

In the UfM region, North-South trade and South-South trade are regulated by trade in goods agreements. While the importance of trade in services is acknowledged by the parties and reflected in specific regional agreements such as the Agadir trade agreement (and ongoing-but-not-yet-enforced bilateral negotiations, e.g. EU-Morocco and EU-Tunisia), only the EU-Western Balkans association agreements regulate trade in services.

The UfM countries’ aspiration to reduce existing obstacles to trade and meet global standards in border procedures is reflected in the general improvement of indicators measuring trade facilitation. But while the progress is general, the differences between the Northern and Southern shores of the Mediterranean are still notable.

Although modest, over time the UfM’s intra-regional market has gained relevance for most of the UfM economies, in terms of both trade in final products and trade in intermediate goods, as well as integration into regional value chains. The examination of export performance for the UfM countries (by comparing their reported exports to a benchmark generated through a gravity model of trade) confirms this trend. Results indicate that, overall, merchandise trade among the UfM countries is in line with or above the levels predicted by the model, and that the integration within the group has accelerated since the start of the Barcelona Process.

The biggest progress in regional trade in goods, as measured by the ratio of intra-UfM to extra-UfM regional exports, is observed among the UfM sub-regions of the Southern shore and the Western Balkans. The assessment of the export potential also confirms this:

The Western Balkans, the North Africa sub-region and Turkey have been integrating more closely with the rest of the UfM.

In contrast, exports from the Levant countries and Israel to the rest of the UfM remained nearly 50% and 20% below theoretical expectations, respectively.

Although the UfM countries are in general well integrated in their own sub-region (e.g. intra-Western Balkans, intra-North Africa) and with the European Union, untapped potential exists for trade expansion among specific sub-groups – most notably the Western Balkans with Israel and Levant, and Israel with Levant countries and North Africa countries.

Intra-UfM exports have become more diversified and sophisticated in recent decades. Manufactured goods have increased their share, reducing the relevance of exports of oil and mining products, while exports of agricultural products have remained stable over time. The analysis of relative export performance at the product level confirms the general pattern but also highlights interesting heterogeneity across the different countries and product groups:

Tunisia, Turkey, and Bosnia and Herzegovina have been able to shift away from their traditional exports (agriculture, textiles) and are now beating the benchmark levels of exports for a wide range of products, including transport equipment and electronic machinery.

Jordan and Lebanon seem instead to under-export to the rest of the UfM countries across many products.

Because the exports of Algeria and Albania are highly concentrated in two sectors (mining and textiles, respectively), the two countries perform worse than the benchmark export potential for most other products.

The analysis of integration via participation in regional value chains also discloses positive developments. The contribution of UfM economies to the EU’s exports has steadily increased since 2005. At the same time, the integration of the Southern Mediterranean economies in the Southern value chains is heterogeneous, but particularly positive for Morocco. Israel and Turkey have increased their share of value added in exports of both Morocco and Tunisia. Also, despite the lack of economic integration agreements targeting services, the services sector of UfM countries (excluding the former EU28) has overall contributed more intensively to integration in regional value chains than the other sectors. The contribution of services from UfM countries to the value-added of the EU and UK’s exports has been modest, however.

The findings point to several policy initiatives that UfM countries in the Southern shore and the Western Balkans could implement to unleash the untapped trade potential in the region and seize the benefits of regional integration:

Enhance border cooperation with neighbouring countries, as reflected by the OECD Trade Facilitation Indicators, and advance the automation of trade formalities to further reduce existing trade costs. Improved transport infrastructure, discussed in Chapter 3 of this report, is also critical to reducing trade costs, as currently the transport time and costs to trade with neighbouring countries in the MENA and Levant sub-regions can be dissuasive for businesses that envisage starting or expanding their exporting activities. Better transport infrastructure also allows businesses in rural and remote areas to connect to national and international production networks.

Promote access to finance to support the internationalisation of enterprises. The development of the financial sector in the Southern and Eastern Mediterranean countries should improve access to finance especially for small and medium-sized enterprises (see Chapter 2).

Improving the general environment for trade, including access to transport and finance, creates the enabling conditions but could remain ineffective in the absence of industrial diversification. Therefore, continue to encourage and facilitate industrial diversification, as the untapped South-South trade potential seems to be a consequence of limited or inadequate product offer.

Enhance the collaboration on trade regulations, including the adoption of more ambitious trade-in-services agreements and the homogenisation of common procedures, such as the adoption of common rules of origin. Facilitating trade in goods and services across the Euro-Mediterranean region should be accompanied by a committed action plan to tackle the socio-economic effects on wages, employment and regional imbalances within countries.

Finally, sound and reliable statistics are critical for informing the design of effective trade policies and for monitoring their implementation and impact, which can in turn ensure effective and targeted use of valuable strategic resources. Today, many UfM countries in the Southern shore lack the statistics needed to assess their capacity to leverage the megatrends of globalisation and digitalisation to improve their international competitiveness. In particular, apart from the OECD member countries of the UfM, only Morocco and Tunisia are currently included in the OECD’s Trade in Value-Added (TiVA) database, which is an essential statistical tool for supporting policies that help countries capitalise on global value chains. This highlights the importance of accelerating the UfM countries’ efforts to develop and align their data with international standards.

References

[7] Dadakas et al (2020), “Examining the trade potential of the UAE using a gravity model and a Poisson pseudo maximum likelihood estimator”, Vol. Journal of International Trade & Economic Development 29 (5): 619-646,, https://doi.org/10.1080/09638199.2019.1710551.

[5] Hahn and Auktor (2017), The effectiveness of Morocco’s industrial policy in promoting a national automotive industry, German Development Institute, https://ideas.repec.org/p/zbw/diedps/272017.html.

[1] OECD (2017), “Making trade work for all”, OECD Trade Policy Papers, No. 202, OECD Publishing, Paris, https://dx.doi.org/10.1787/6e27effd-en.

[3] Rodrik (2018), What Do Trade Agreements Really Do?, Journal of Economic Perspectives 23 (2):73-90, https://drodrik.scholar.harvard.edu/publications/what-do-trade-agreements-really-do.

[6] Santos and Tenreyro, (2006), “The Log of Gravity,” Review of Economics and Statistics 88 (4):641–658,, https://www.jstor.org/stable/40043025?seq=1#metadata_info_tab_contents.

[4] UNESCWA (2019), Towards modernisation of the Pan-Arab Free Trade Area Agreement, United Nations Organization, Economic and Social Commission for Western Asia,, https://www.unescwa.org/sites/www.unescwa.org/files/events/files/1901034.pdf.

[2] WTO (2007), World Trade Report: Six Decades of Multilateral Cooperation, What Have we Learnt?, WTO, https://www.wto.org/english/res_e/publications_e/wtr07_e.htm.

Annex 1.A. Additional figures and tables

Annex Table 1.A.1. Trade agreements in force within the Euro-Mediterranean region

|

Agreement |

Target |

Type of agreement |

Date of entry into force |

Members |

|---|---|---|---|---|

|

South-South RTAs |

||||

|

Agadir Agreement |

Goods |

Free Trade Agreement |

2007 |

Egypt; Jordan; Morocco; Tunisia |

|

Pan-Arab Free Trade Area (PAFTA) / Greater-Arab Free Trade Area (GAFTA) |

Goods |

Free Trade Agreement |

1998 |

Algeria*, Bahrain, Kingdom of; Egypt; Iraq; Jordan; Kuwait, the State of; Lebanese Republic; Libya; Morocco; Oman; Palestinian Authority*; Qatar; Saudi Arabia, Kingdom of; Sudan; Syrian Arab Republic; Tunisia; United Arab Emirates; Yemen |

|

North-South bilateral agreements |

||||

|

EU-Algeria |

Goods |

Free Trade Agreement |

2005 |

|

|

EU-Egypt |

Goods |

Free Trade Agreement |

2004 |

|

|

EFTA-Egypt |

Goods |

Free Trade Agreement |

2007 |

|

|

EU-Israel |

Goods |

Free Trade Agreement |

2000 |

|

|

EFTA-Israel |

Goods |

Free Trade Agreement |

1993 |

|

|

EU-Jordan |

Goods |

Free Trade Agreement |

2002 |

|

|

EFTA-Jordan |

Goods |

Free Trade Agreement |

1993 |

|

|

EU-Lebanon |

Goods |

Free Trade Agreement |

2003 |

|

|

EFTA-Lebanon |

Goods |

Free Trade Agreement |

2007 |

|

|

EU-Morocco |

Goods |

Free Trade Agreement |

2000 |

|

|

EFTA-Morocco |

Goods |

Free Trade Agreement |

1999 |

|

|

EU-Palestinian Authority |

Goods |

Free Trade Agreement |

1997 |

|

|

EFTA-Palestinian Authority |

Goods |

Free Trade Agreement |

1999 |

|

|

EU-Tunisia |

Goods |

Free Trade Agreement |

1998 |

|

|

EFTA-Tunisia |

Goods |

Free Trade Agreement |

2005 |

|

|

EU-Turkey |

Goods |

Customs Union |

1996 |

|

|

EFTA-Turkey |

Goods |

Free Trade Agreement |

1992 |

|

|

Albania-Turkey |

Goods |

Free Trade Agreement |

2008 |

|

|

Bosnia and Herzegovina-Turkey |

Goods |

Free Trade Agreement |

2003 |

|

|

Montenegro-Turkey |

Goods |

Free Trade Agreement |

2010 |

|

|

South-South bilateral agreements |

||||

|

Egypt-Turkey |

Goods |

Free Trade Agreement |

2007 |

|

|

Israel-Turkey |

Goods |

Free Trade Agreement |

1997 |

|

|

Morocco-Turkey |

Goods |

Free Trade Agreement |

2006 |

|

|

Palestinian Authority – Turkey |

Goods |

Free Trade Agreement |

2005 |

|

|

Tunisia-Turkey |

Goods |

Free Trade Agreement |

2005 |

|

|

Western Balkans RTAs and bilateral agreements |

||||

|

Central European Free Trade Agreement (CEFTA) 2006 |

Goods |

Free Trade Agreements |

2007 |

Albania; Bosnia and Herzegovina; Moldova, Republic of; Montenegro; Kosovo**; North Macedonia; Serbia. |

|

EU-Albania |

Goods & Services |

Free Trade & Economic Integration Agreement |

2006 (goods) 2009 (services) |

|

|

EU-Bosnia and Herzegovina |

Goods & Services |

Free Trade & Economic Integration Agreement |

2008 (goods) 2015 (services) |

|

|

EU-Montenegro |

Goods & Services |

Free Trade & Economic Integration Agreement |

2008 (goods) 2010 (services) |

|

*Algeria and the Palestinian Authority are also parties to the PAFTA; however, a formal notification by the Parties to the WTO is still missing. ** This designation is without prejudice to positions on status, and is in line with United Nations Security Council Resolution 1244/99 and the Advisory Opinion of the International Court of Justice on Kosovo’s declaration of independence.

Source: WTO Regional Trade Agreements Database, https://www.wto.org/english/tratop_e/region_e/region_e.htm.

Annex Table 1.A.2. UfM countries: Main export partners in 1997, 2006 and 2018

Four main trade partners (exports), million USD. Global = any partner in the world; UfM = only UfM partners.

|

|

1997 |

2006 |

2018 |

|||||||||

|

|

Global |

UfM |

Global |

UfM |

Global |

UfM |

||||||

|

Albania |

TUR |

1.27 |

EGY |

0.01 |

CHN |

9.03 |

ISR |

0.87 |

CHN |

52.74 |

BIH |

12.98 |

|

USA |

2.01 |

JOR |

0.01 |

TUR |

10.04 |

BIH |

4.32 |

MKD |

79.14 |

TUR |

19.94 |

|

|

MKD |

3.63 |

TUR |

1.27 |

MKD |

12.65 |

TUR |

10.04 |

SRB |

325.43 |

MNE |

52.71 |

|

|

EU & UK |

128.72 |

EU & UK |

128.72 |

EU & UK |

704.4 |

EU & UK |

704.4 |

EU & UK |

2194.9 |

EU & UK |

2194.9 |

|

|

Algeria |

BRA |

746.62 |

TUN |

59.51 |

BRA |

1892.29 |

MAR |

387.8 |

TUR |

1837.06 |

EGY |

456.83 |

|

TUR |

810.92 |

MAR |

94.27 |

CAN |

3579.05 |

EGY |

451.41 |

BRA |

2127.96 |

TUN |

753.42 |

|

|

USA |

2221.85 |

TUR |

810.92 |

USA |

14856.77 |

TUR |

1864.36 |

USA |

3467.91 |

TUR |

1837.06 |

|

|

EU & UK |

8384.27 |

EU & UK |

8384.27 |

EU & UK |

28686.86 |

EU & UK |

28686.86 |

EU & UK |

20366.14 |

EU & UK |

20366.14 |

|

|

Bosnia and Herzegovina |

n/a |

n/a |

CHE |

64.57 |

ALB |

7.13 |

TUR |