Russia’s invasion of Ukraine had a major impact on fiscal revenues from non-renewable natural resources in Latin America and the Caribbean in 2022

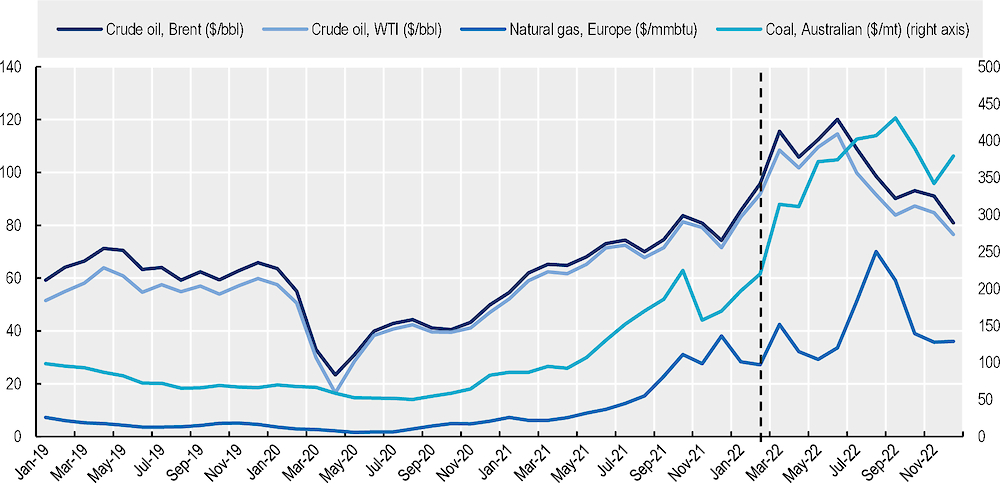

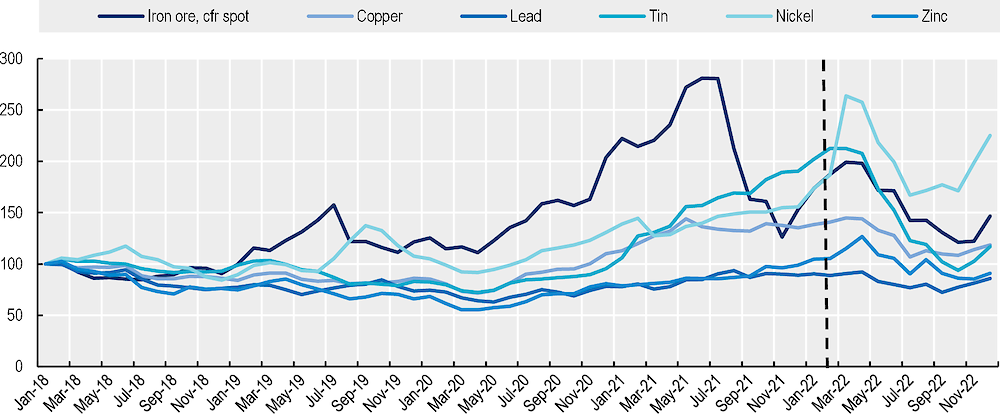

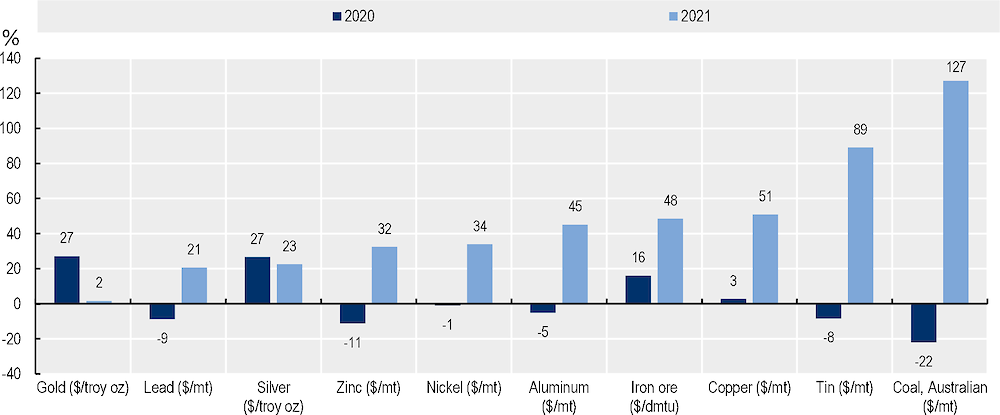

Producers of non-renewable natural resources in Latin America and the Caribbean (LAC) were strongly affected by the volatility in international commodities markets caused by Russia’s invasion of Ukraine. Prices for a wide range of energy commodities and minerals and metals rose with the outbreak of the crisis, reinforcing the rapid gains experienced in 2021. However, in the second half of the year, there was a generalised fall in benchmark prices as global economic activity slowed and COVID-19 restrictions in the People’s Republic of China, the world’s largest consumer of many non-renewable natural resources, weighed on demand.

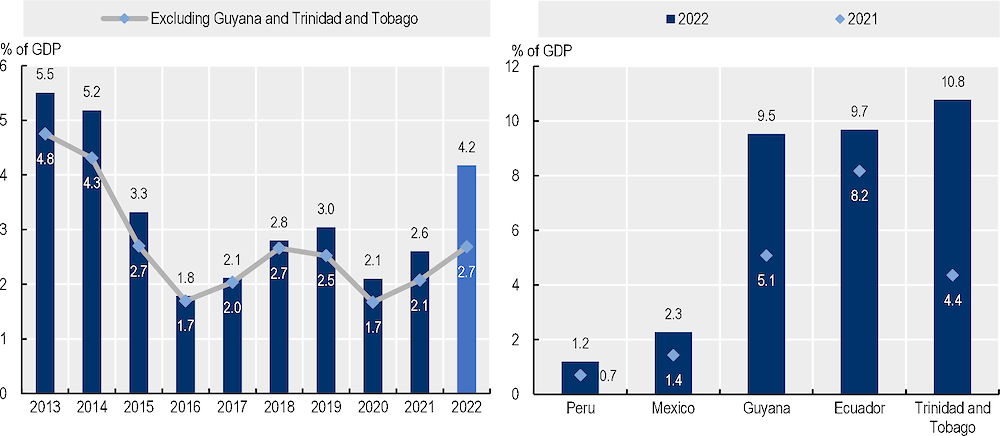

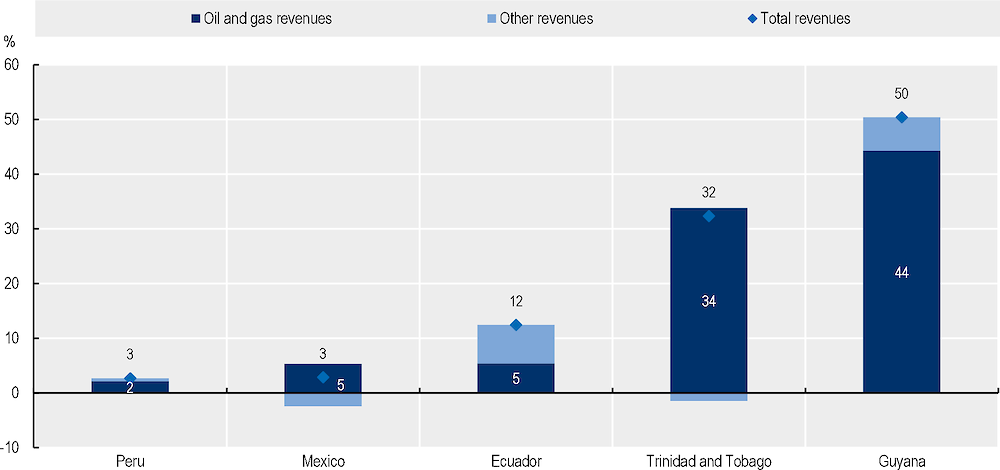

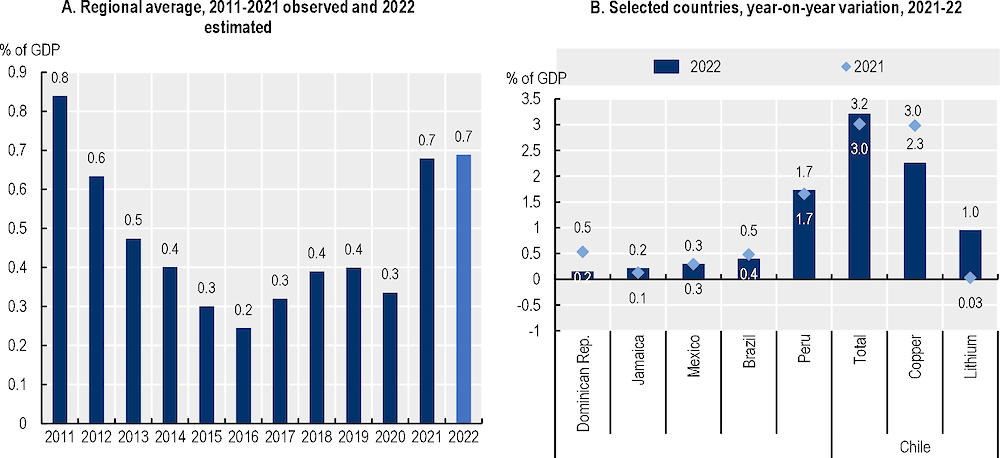

Trends in fiscal revenues from non-renewable natural resources in the LAC region varied by type of commodity in 2022. Hydrocarbon revenues rose sharply, rising to an estimated 4.2% of GDP from 2.6% of GDP in 2021. In some countries the rise in hydrocarbon revenues accounted for a significant share of the increase in overall public revenues. Mining revenues are estimated to have remained at their 2021 level of 0.7% of GDP despite a moderate contraction in prices for many base metals and lower production volumes, thanks in part to large annual corporate income tax (CIT) payments in 2022 for fiscal year 2021.

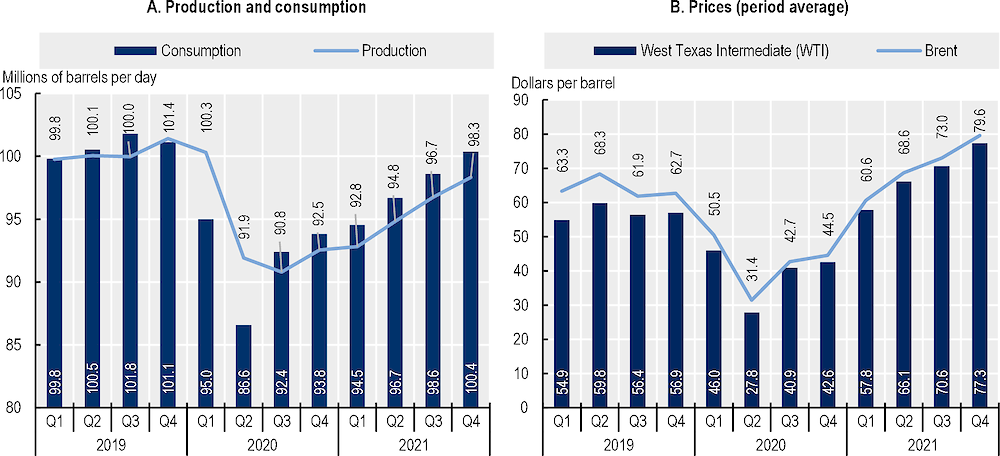

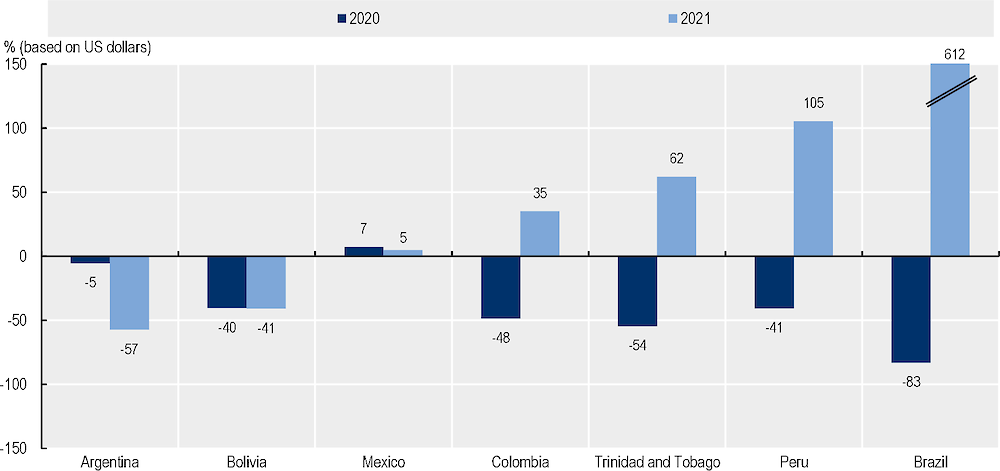

Surging oil prices supported a jump in fiscal revenues from oil and gas exploration and production in 2021

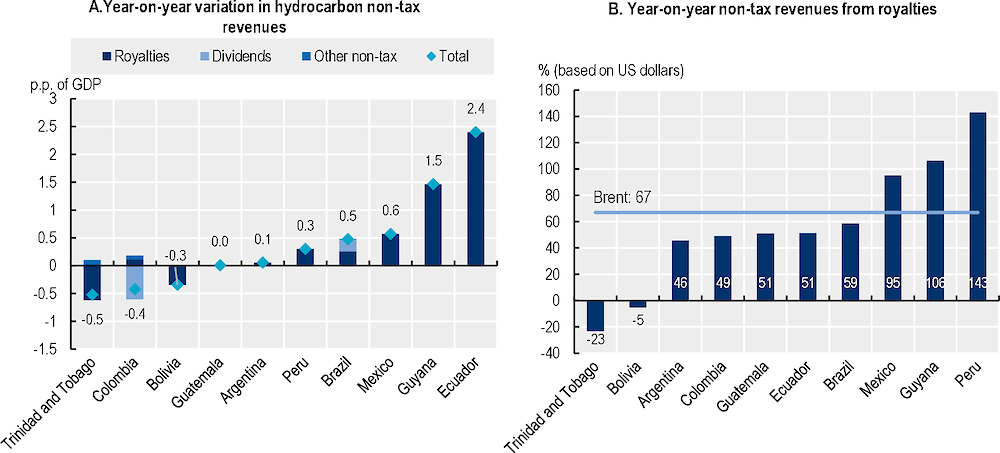

Benchmark oil prices, such as Brent and West Texas Intermediate (WTI), rose sharply during 2021, as global macroeconomic conditions improved and supply lagged. Profits at the region’s major oil producers surged, leading to a dramatic increase in CIT receipts in some countries. Non-tax revenues were also buoyant, despite sluggish production levels, driven by higher royalty payments and, in some cases, dividends paid to national governments. For the year, hydrocarbon revenues reached 2.6% of GDP, up from 2.1% of GDP in 2020, but well below the levels seen before the oil price crash of late 2014 and early 2015.

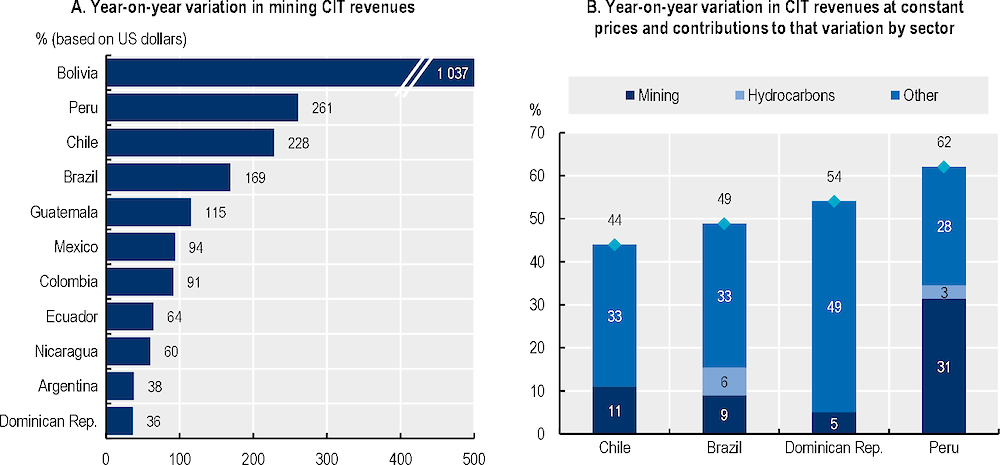

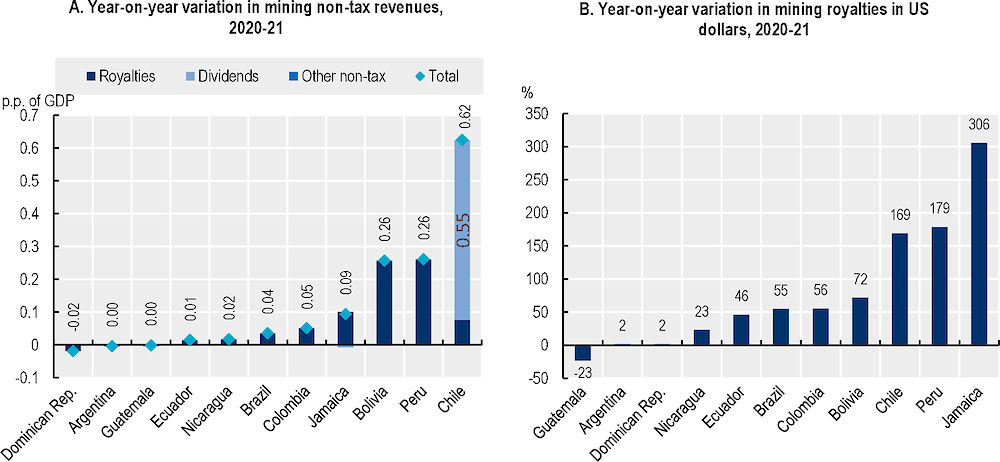

Mining revenues rose significantly in 2021, pushed by a rapid recovery in global industrial production

A recovery in mining production, coupled with higher international prices, led to a sharp increase in mining profits and CIT payments in the region in 2021.1 Higher CIT payments by mining companies accounted for an important share of the growth in overall CIT receipts in mineral and metals producing countries, reaching upwards of 51% in the case of Peru. Non-tax revenues also rose, with royalty payments increasing in line with prices and production. Tax and non-tax revenues were also impacted by large one-off transactions in some countries. On average, mining revenues rose from 0.34% of GDP in 2020 to 0.68% of GDP in 2021 – the highest level since 2011.