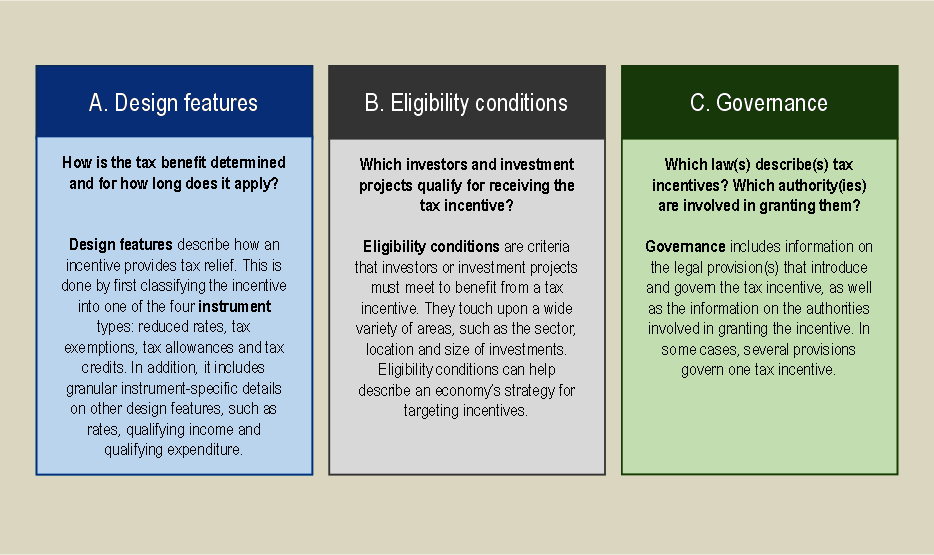

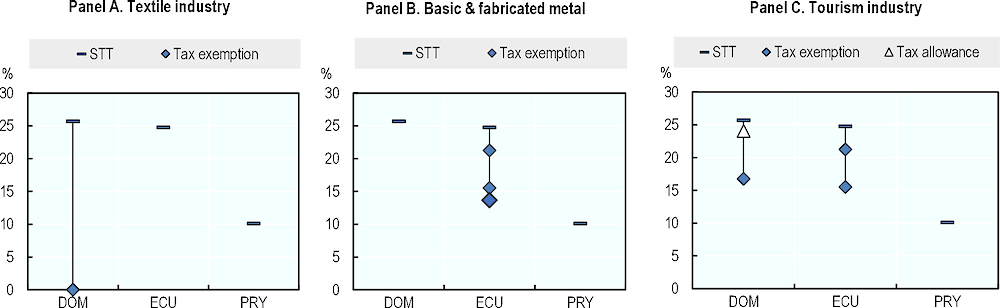

Tax expenditures are an important policy tool that can promote economic and social development. The use of preferential tax treatments to pursue economic and social objectives is well established in Latin America and the Caribbean (LAC). Countries use tax expenditures to promote investment (especially in strategic sectors), create employment and support low-income households. However, tax expenditures may not always be the most efficient policy tool for achieving policy objectives, and the foregone revenues associated with these measures can be large.

More can be done to identify and measure tax expenditures through the definition of consistent benchmarks. There is significant variation across LAC countries in terms of what constitutes tax expenditures and the methodologies employed to estimate their size. These differences make it difficult to compare the magnitude and composition of tax expenditures across and within countries over time. Caution is also warranted in the analysis of potential revenue gains from eliminating certain tax expenditures, as these estimates may not capture the dynamic interactions between different preferential treatments.

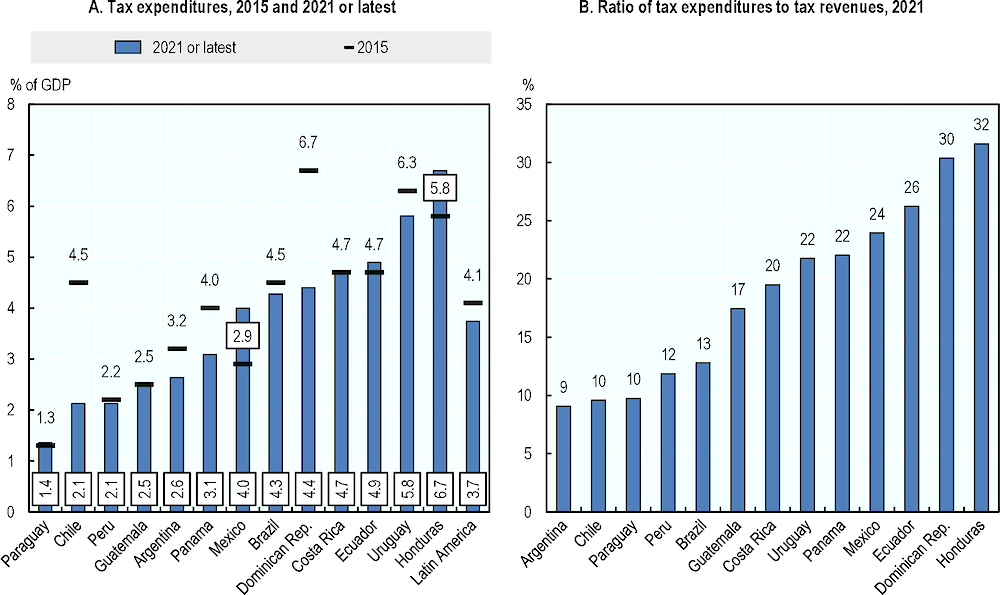

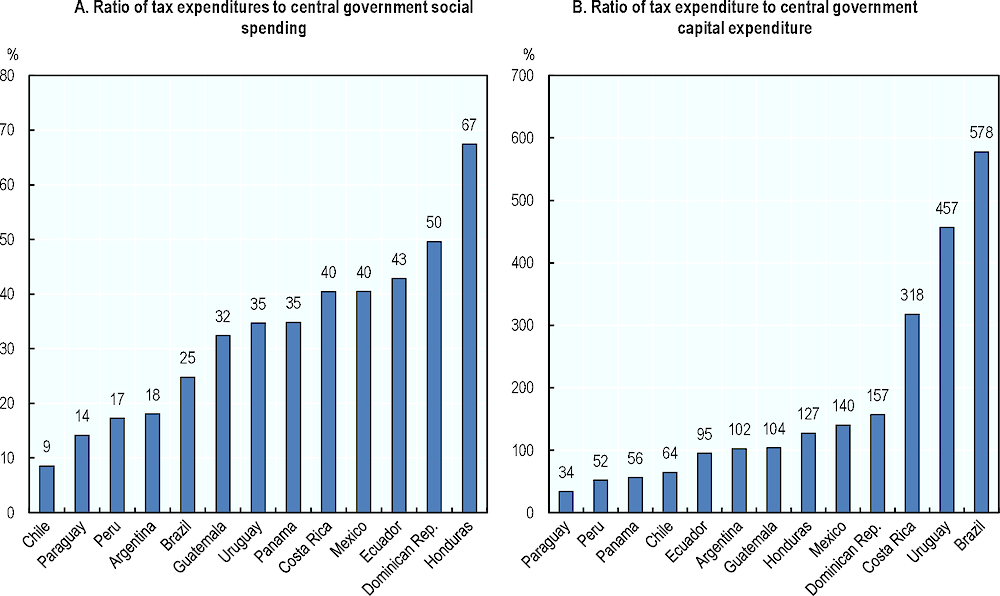

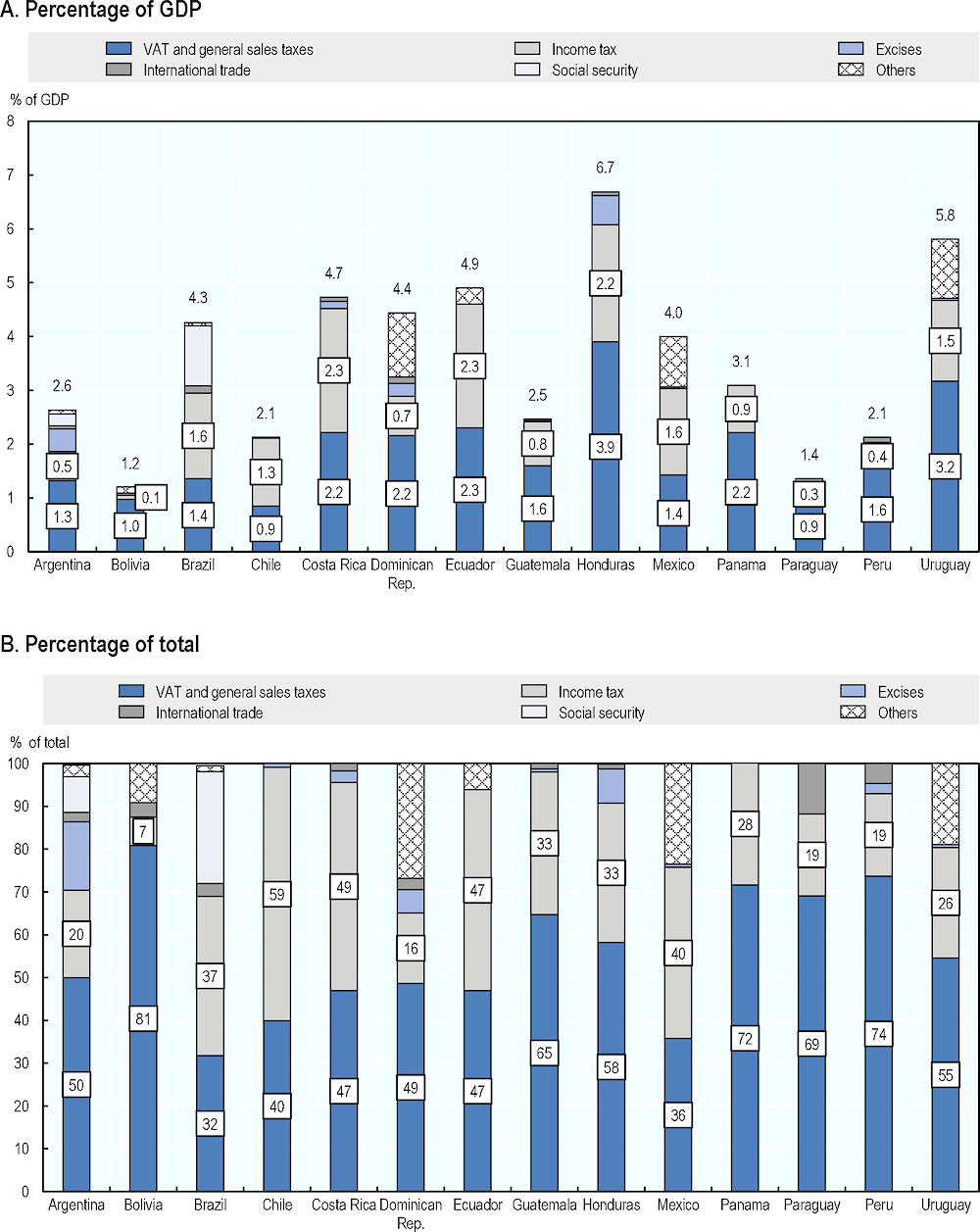

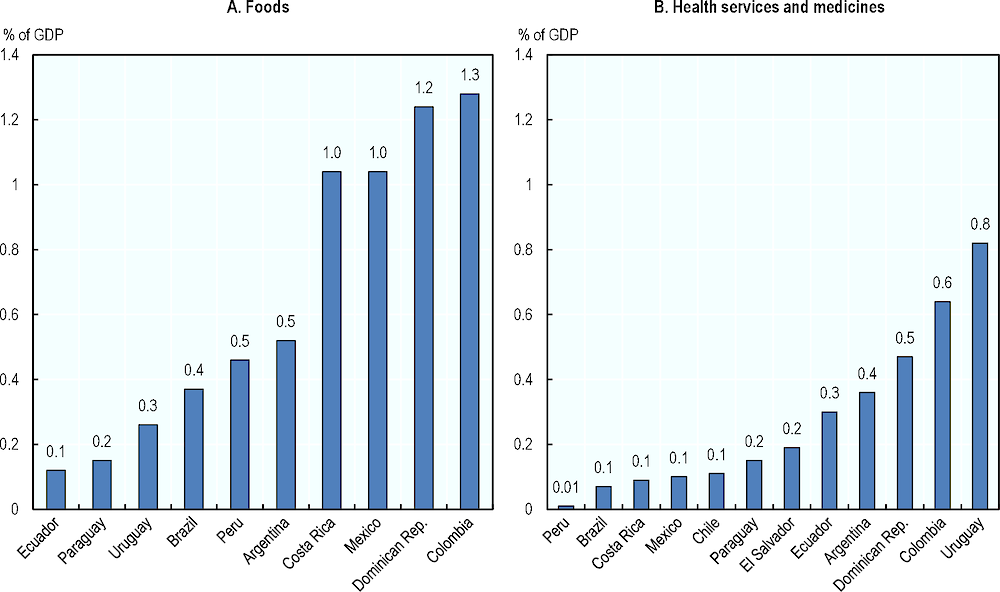

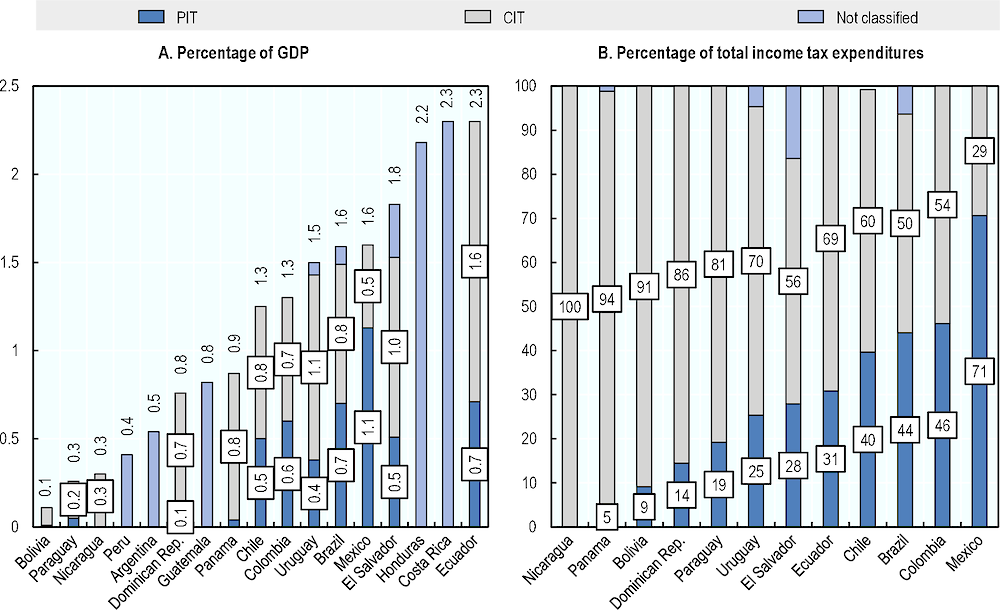

Foregone revenues from tax expenditures are significant. In 2021, foregone revenues in Latin America averaged 3.7% of GDP, equivalent to 19% of general government tax revenues. They are also large relative to public expenditures in priority sectors such as social spending and public investment. Preferential treatments for value-added tax (VAT), largely directed towards the consumption of foods and other items in the basic consumption basket, are generally the most important in terms of size. Tax expenditures related to income taxes vary in the region, with a high relative share for corporate income tax (CIT) in some countries and for personal income tax (PIT) in others.

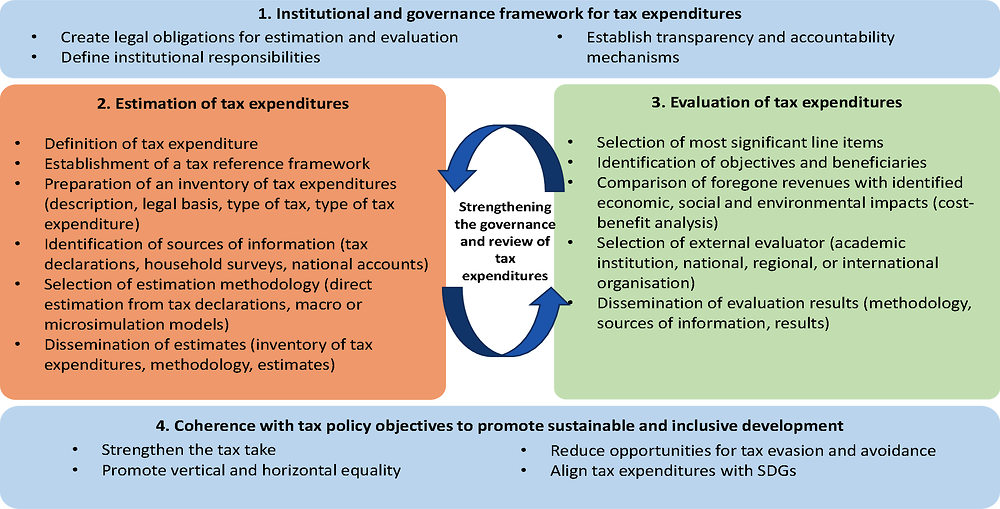

Evaluating the effectiveness of tax expenditures is key to realising their potential contribution to development. Given the magnitude of foregone revenues due to tax expenditures in the region, it is crucial to evaluate their costs and benefits. However, the evaluation of tax expenditures is in its infancy in the LAC region, with few comprehensive studies undertaken so far.

To enhance the developmental impact of tax expenditures in the LAC region, a thorough review of preferential tax treatments should be complemented by an institutional framework that ensures good governance and creates binding legal requirements for the quantification and evaluation of tax expenditures. The use of tax expenditures should be consistent with broad tax policy priorities and aligned to the Sustainable Development Goals (SDGs).