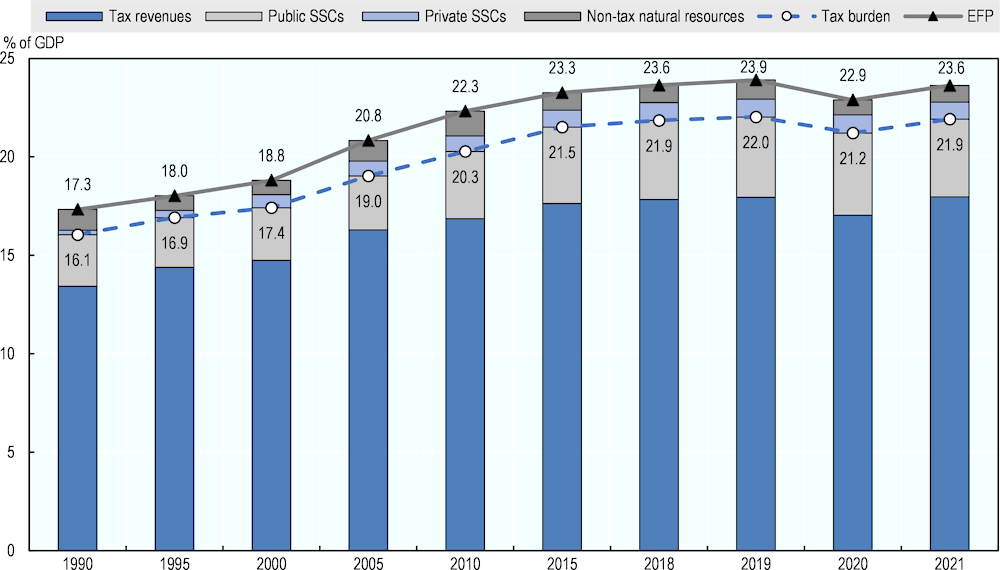

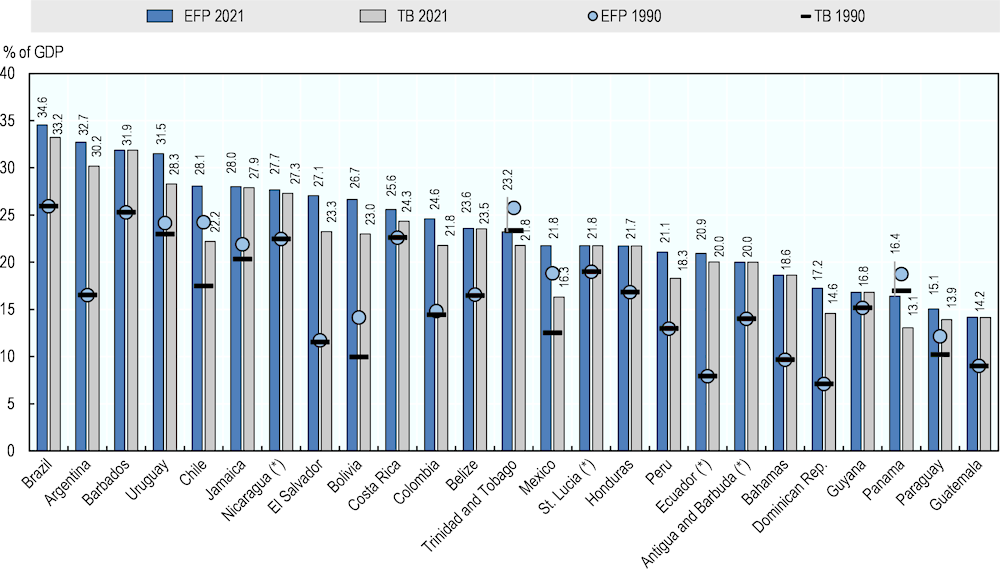

The tax burden is a crucial variable for public policies, defined as the amount of financial resources – as a percentage of the gross domestic product (GDP) – that a country raises through taxes and contributions to public social security arrangements to finance public spending. However, other sources of public revenues and alternative configurations of the basic functions of the State exist in different countries, which could affect the comparability of tax burden indicators.

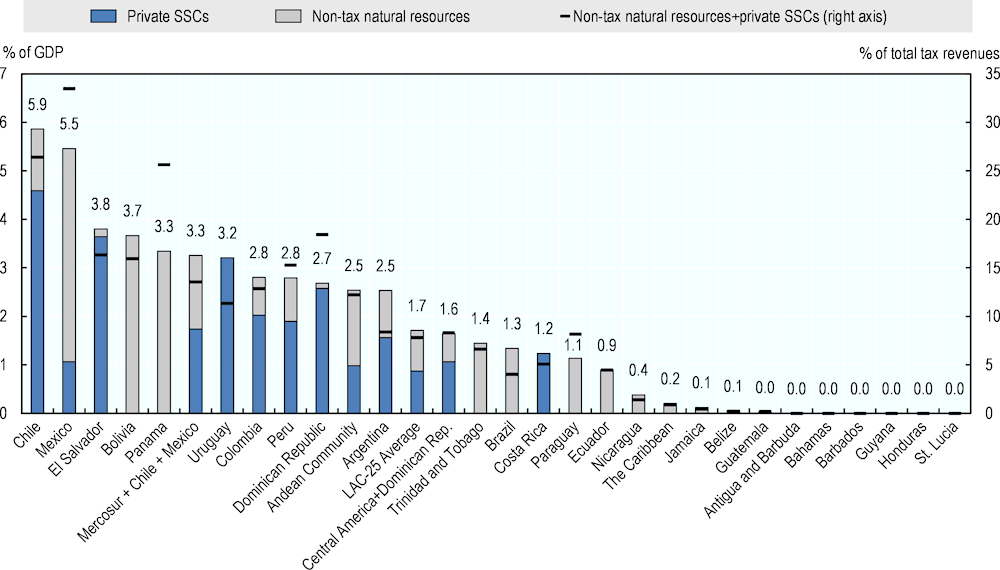

For example, the availability of natural resources – whether renewable or non-renewable – may allow governments to supplement public finances by raising revenues through non-tax instruments such as royalties or dividends and interests, revenues not computed in the tax burden ratio. This is the case for certain hydrocarbon and mineral resources, of great relevance in several Latin American and Caribbean (LAC) countries, as well as the management of other infrastructure, such as the the Transoceanic Canal in Panama or the hydroelectric power stations of Itaipú and Yacyretá in Paraguay.

In a similar vein, in the areas of health and social security, some countries implement private schemes of individual capitalisation – of a mandatory nature, established in legislation – that replace, complement or compete with the public social security system. These private social security contributions, although not included in public financing and administered by private entities, are part of the overall amount of resources that are compulsory and collectively mobilised; their consideration allows for more homogeneous comparisons between countries.

In order to take into account these alternative ways to finance public spending, this chapter discusses the concept of ‘Equivalent Fiscal Pressure’ (EFP), which includes two additional sources of revenue beyond those traditionally considered (tax revenues including public social security contributions [SSCs]), which also represent a fiscal effort required from taxpayers when they are mandatory: contributions to a private social security system (pensions and health) and non-tax revenues (dividends, royalties, among others) from the exploitation of natural resources. .

Consideration of all these additional components (when official data are available) helps nourish and enrich analyses of fiscal conditions in LAC countries. However, the EFP indicator does not invalidate or contradict conventional measures of public financing. Rather, the aim is to expand the possibilities for regional and international comparison and to provide new elements that are, at least for the specific context in LAC, crucial to a broad and comprehensive perspective of these issues1.