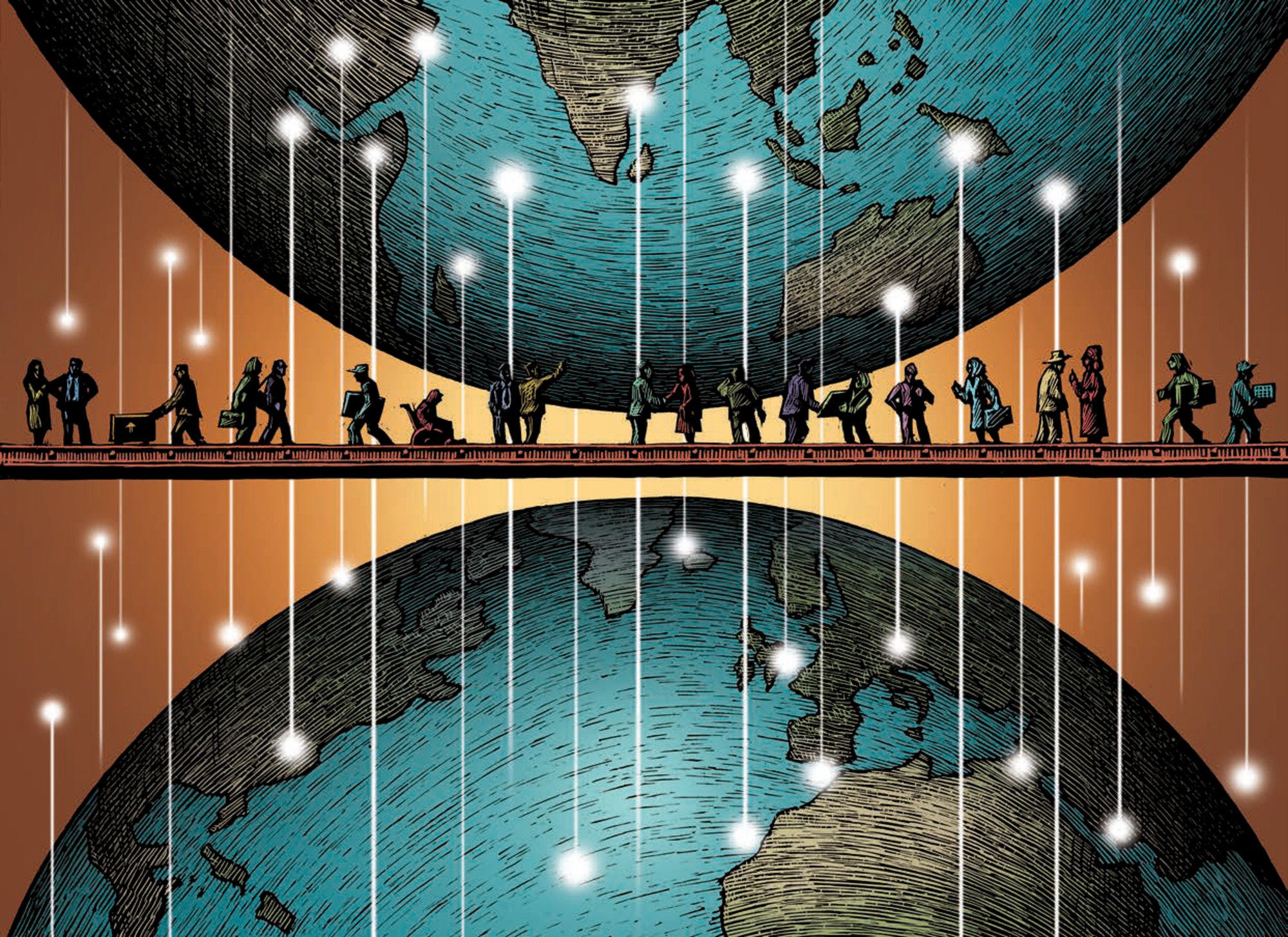

Working from home or from any other independent location has become a growing trend among skilled workers, particularly in highly digitalised occupations. In 2020, the first “Digital Nomad Visa” schemes appeared in OECD countries, and special status for remote workers continues to spread. While these pathways may differ in names, eligibility requirements or associated rights, they all seek to attract crossborder remote workers with foreign income, whether employees or self-employed in a company abroad. However, the benefit for the host country brought by digital nomads remains unclear. The benefit - local consumption should also be weighed against the tax implications and efforts required to oversee these programmes.

Should OECD countries develop new Digital Nomad Visas?