Comparative information on tax administrations is published in three main forms:

The annual Tax Administration Series makes available comparative data on performance and organisational systems for nearly 60 tax administrations globally, identifies trends over time and showcases new innovations and approaches in tax administration.

The Inventory of Tax Technology Initiatives, produced jointly with a range of global partners, contains information about the adoption of new technology tools in different jurisdictions as well as case-studies giving more detail on particular initiatives.

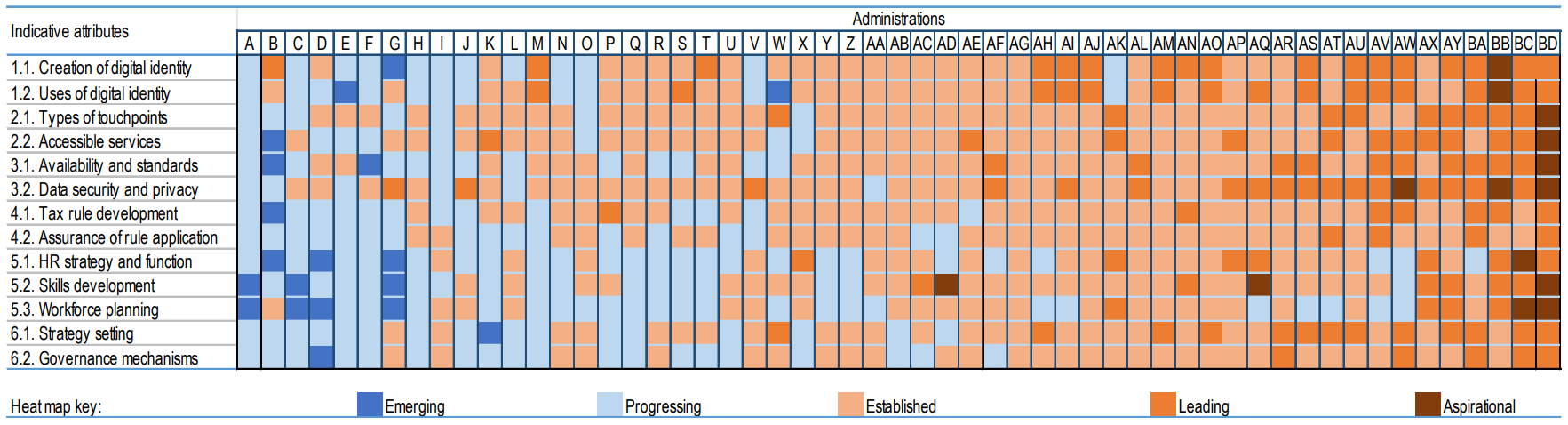

The Forum on Tax Administration Maturity models, which have been produced on a range of tax administration issues, are tools that allow tax administrations to self-assess their level of maturity, and provide an anonymised picture of global maturity in a particular area.