For four decades, the SWAC/OECD Secretariat, in partnership with the Economic Community of West African States (ECOWAS), the West African Economic and Monetary Union (UEMOA) and the Permanent Interstate Committee for Drought Control in the Sahel (CILSS), has facilitated the Food Crisis Prevention Network (RPCA). The RPCA is a platform for policy dialogue and co-ordination. The network provides data and evidence-based analysis on food and nutrition security for 17 countries in the Sahel and West Africa, as well as for ECOWAS, UEMOA, CILSS, technical and financial partners, and regional and international civil society stakeholders. Network members meet twice a year to discuss policy issues related to food crises.

Food systems, food security and nutrition

As the food and nutrition security situation deteriorates in many parts of the world, it is more important than ever to provide evidence and tools to assess and address the challenges. Through the Food Crisis Prevention Network (RPCA), SWAC/OECD provides a critical space for policy dialogue and co-ordination for the Sahel and West Africa region. At the same time, food systems are changing rapidly. West Africa’s population is projected to grow from 400 million in 2020 to 540 million in 2030, with two-thirds of the increase taking place in urban areas, where incomes are relatively higher. We analyse and engage with policy makers on how these structural forces are transforming food production, purchasing and consumption patterns.

Key messages

SWAC is a vehicle for the OECD to invest in food security tools, evidence generation and policy dialogue to address these challenges. New factors are exacerbating these crises, including rampant inflation, security crises in some Sahel countries, and the adverse effects of climate change in the region. The RPCA has established a platform dialogue based on a comprehensive framework for analysing food security and nutrition in the Sahel and West Africa, including a cycle of analysis, a code of conduct (Charter) and tools for prevention, management and governance. Countries in West Africa and the Sahel, together with partners, are stepping up their efforts to address the increasingly complex challenges of food security and nutrition. This shift aims to improve countries' preparedness to effectively prevent and manage food crises, while building the resilience of communities to such challenges.

West Africa's population is growing rapidly, especially in urban areas, and is getting most of its food from markets. Consumers have more money and less time to cook and prepare food. This is driving rapid changes in food systems as West Africans demand more diverse and higher-value foods: processed, animal-based, fruits and vegetables. These changes represent a challenge to access adequate and healthy diets, but also an opportunity for the two-thirds of West Africans who work in the food economy. SWAC/OECD explores these changing patterns through a series of notes and reports on urbanisation, healthy diets and the changing food environment.

Intra-regional food trade is a key driver of agricultural development, food security and regional integration in West Africa. It moves food from areas of production to centres of demand, builds food and nutrition resilience, and stimulates investment and job creation in all segments of the food economy. Yet it is largely absent from regional and national policy debates and remains hampered by constraining policies such as non-tariff barriers and underinvestment in transport and marketing infrastructure. This is partly due to a lack of data on its true size and composition. Much of the region's food trade is unaccounted for, either because it is not recorded by customs officials or because it takes place through informal crossings. A better understanding of intra-regional food trade is also becoming increasingly important as countries in the region begin to implement the African Continental Free Trade Area (AfCFTA). To address this, SWAC/OECD is providing evidence on intra-regional food trade and informing trade facilitation policies in the ECOWAS region.

Meanwhile, global and local shocks such as COVID, Russia's war of aggression against Ukraine , insecurity and exchange rate devaluations have exacerbated food price inflation, but also its variation and volatility across time, space and food groups. Food prices in the region are already structurally high - 30% to 40% above their level in comparable economies - and households allocate a very large share of their budget to food, in the range of 40% to 50%. This makes it crucial to have good evidence on the drivers and dynamics of food prices across the region, but also across different markets and products, in order to anticipate impacts on food and nutrition security and to inform food and agricultural policies. SWAC/OECD is a member of the CILSS-led Observatory on Regional Markets and is leading the analysis of spatial variation in food prices across markets in the region.

Context

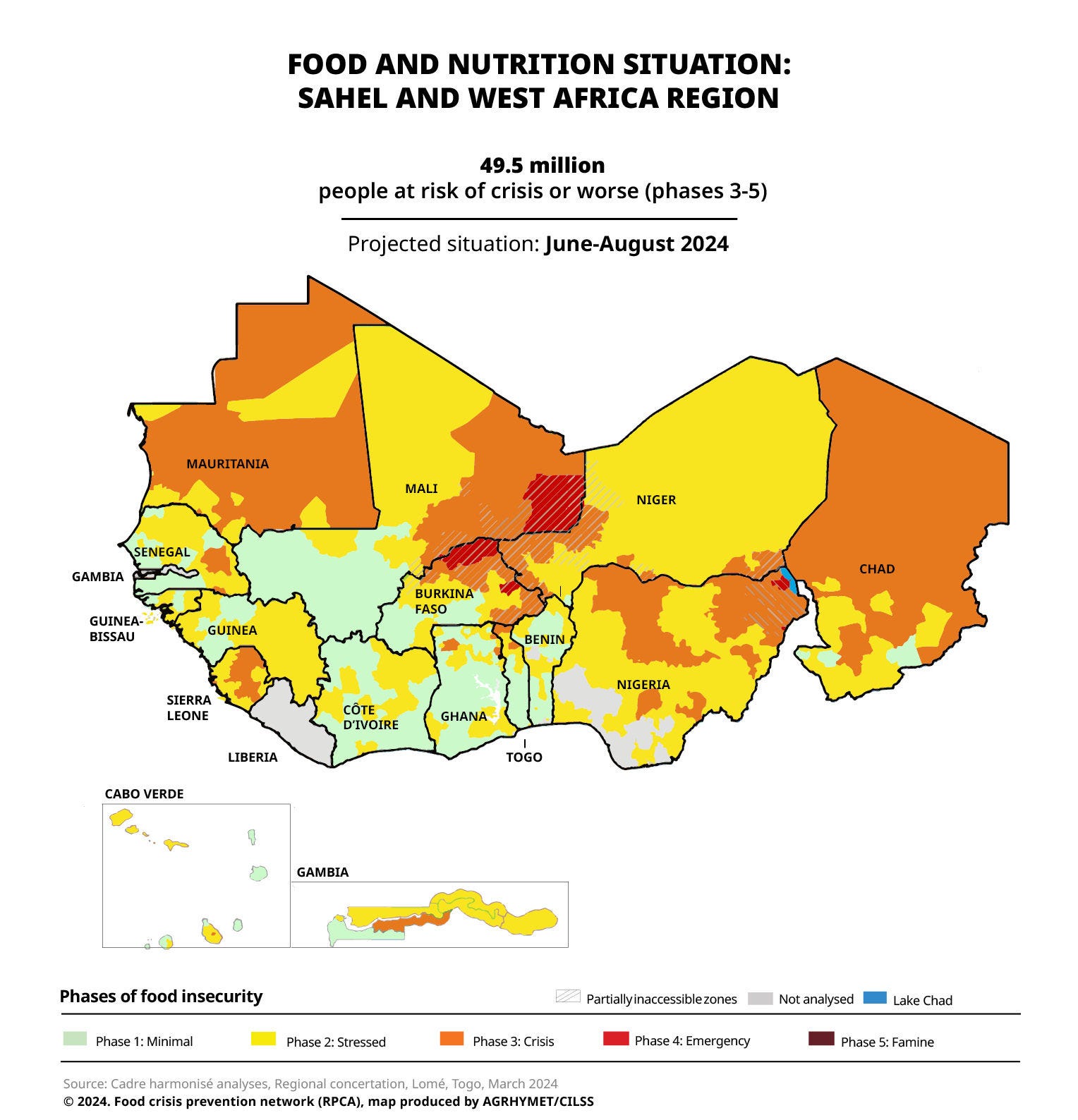

Food insecurity remains a major challenge in the Sahel and West Africa

The number of people facing food insecurity is estimated at 35.3 million in April 2024, up from 30.3 million in April 2019. Moreover, without appropriate action, 126.5 million people currently under pressure could fall into food crisis during the lean season in 2024, particularly in Nigeria (82.6 million), Niger (7.3 million) and Burkina Faso (5.2 million). Acute malnutrition also persists, affecting some 16.7 million children under five in the region.

The deterioration in food insecurity and acute malnutrition remains a cause for concern

Between April 2019 and April 2024, the number of people affected by the food crisis multiplied by seven, soaring from 5 to 35.3 million. Insecurity and inflation exacerbate the crisis. The adverse effects of climate change continue to negatively impact the region's food systems, in particular through significant disruptions in rainfall patterns, reduced productivity of certain crops and reduced fertility of certain livestock species.

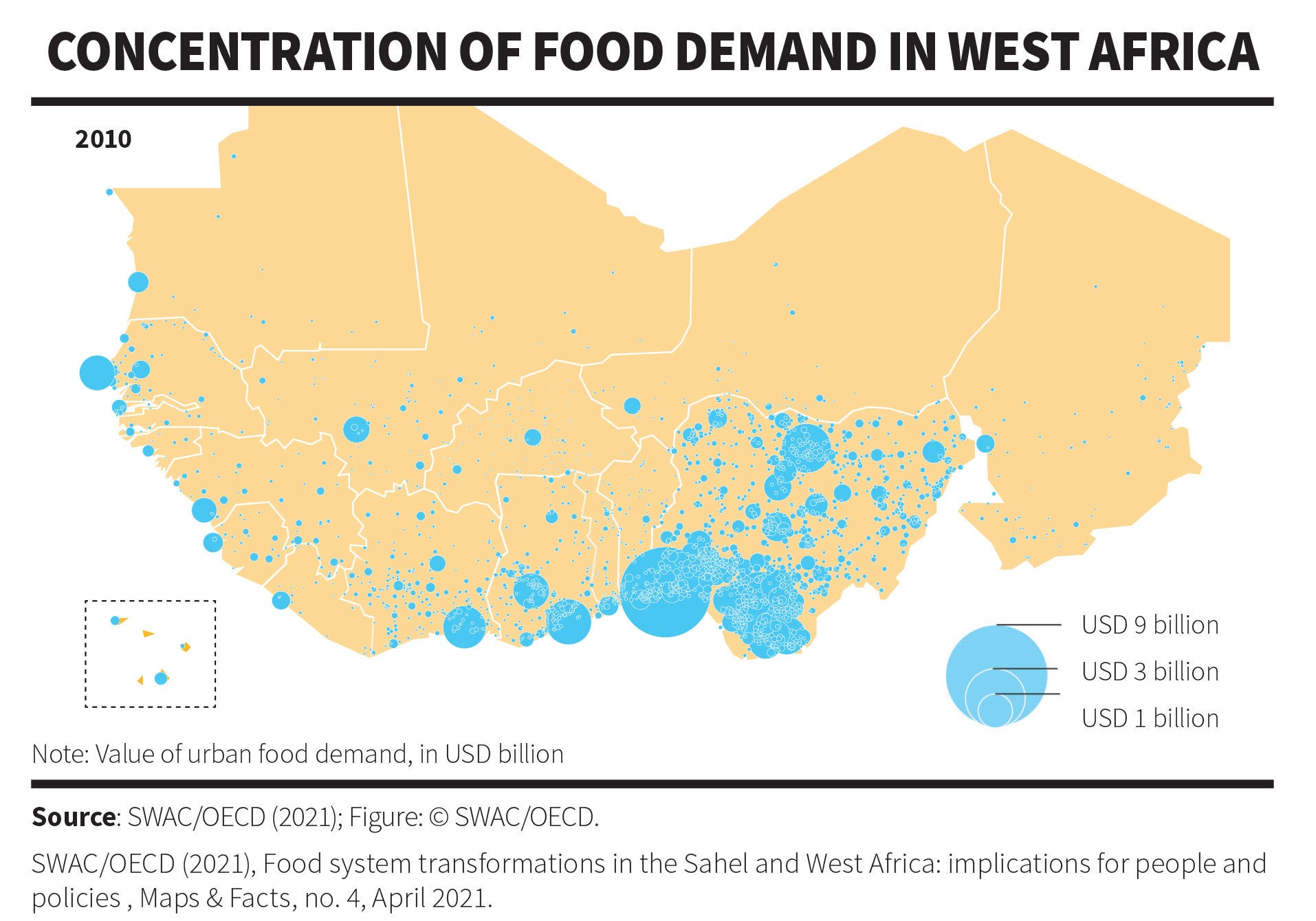

Urbanisation is driving food consumption in West Africa, with demand exceeding USD 1 billion in many urban centres

Between 1950 and 2015, West Africa’s population grew from 73 million to 367 million inhabitants. Over the same period, the urban population increased from 5 million to 169 million. While cities and towns drive the demand for food, they do not produce their own food and rely heavily on markets: urban centres account for 67% of total food demand in the region and more than 90% of food in cities is purchased from markets. Urban areas therefore act as a magnet for regional production, while at the same time acting as hubs for the spatial organisation of food trade and markets.

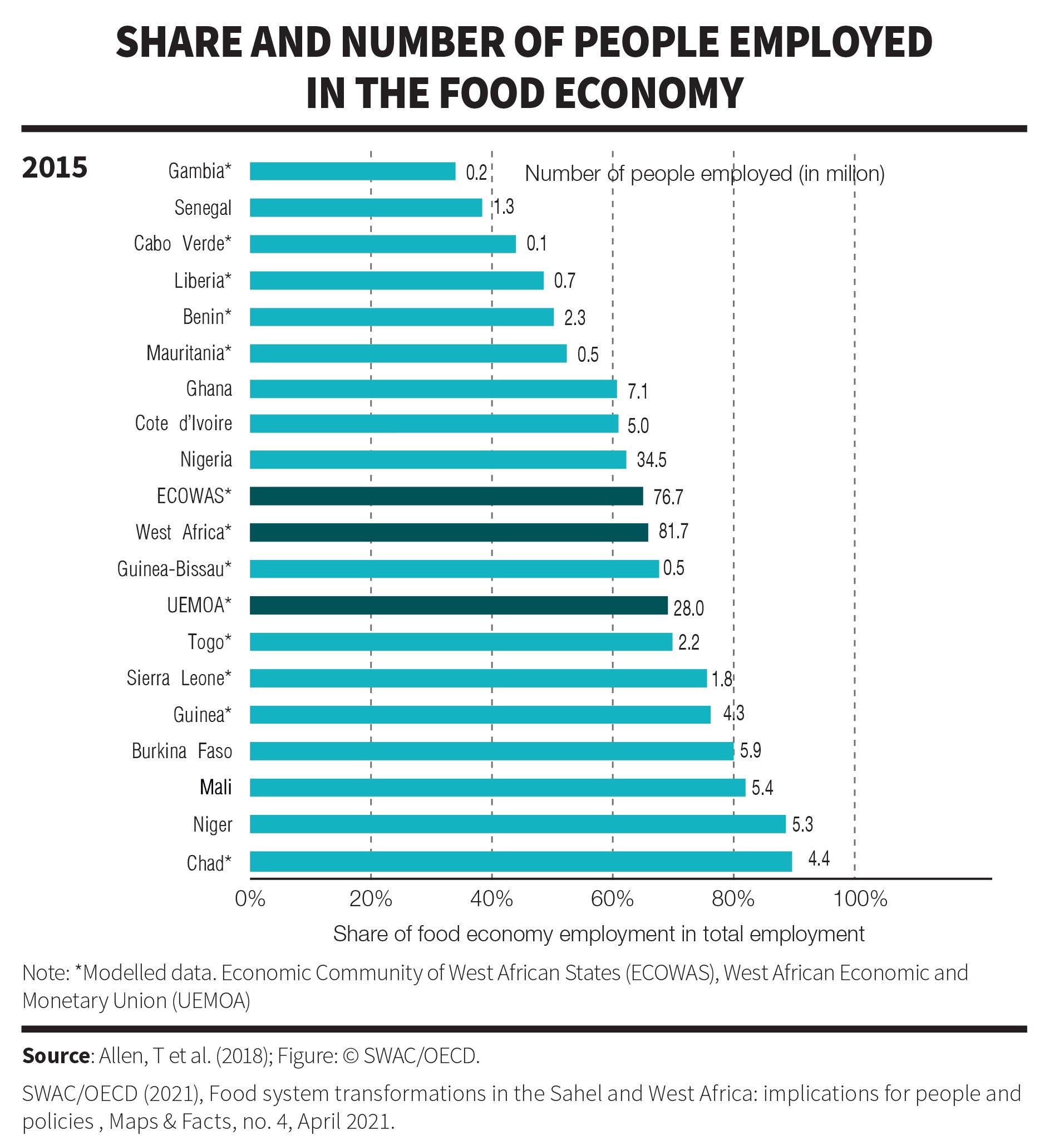

Two-thirds of West Africans make their living from the food economy

Twenty-two percent of food workers are involved in off-farm activities such as retailing, marketing and processing. Driven by population growth, urbanisation and rising incomes, the regional food market is expanding. In response, an increasing number of West Africans are involved in food processing and marketing, both nationally and regionally. Regional food trade has historically been undervalued - both in official statistics and policy frameworks - but it represents an opportunity to harness the potential of the food economy and generate employment and income for millions of West Africans.

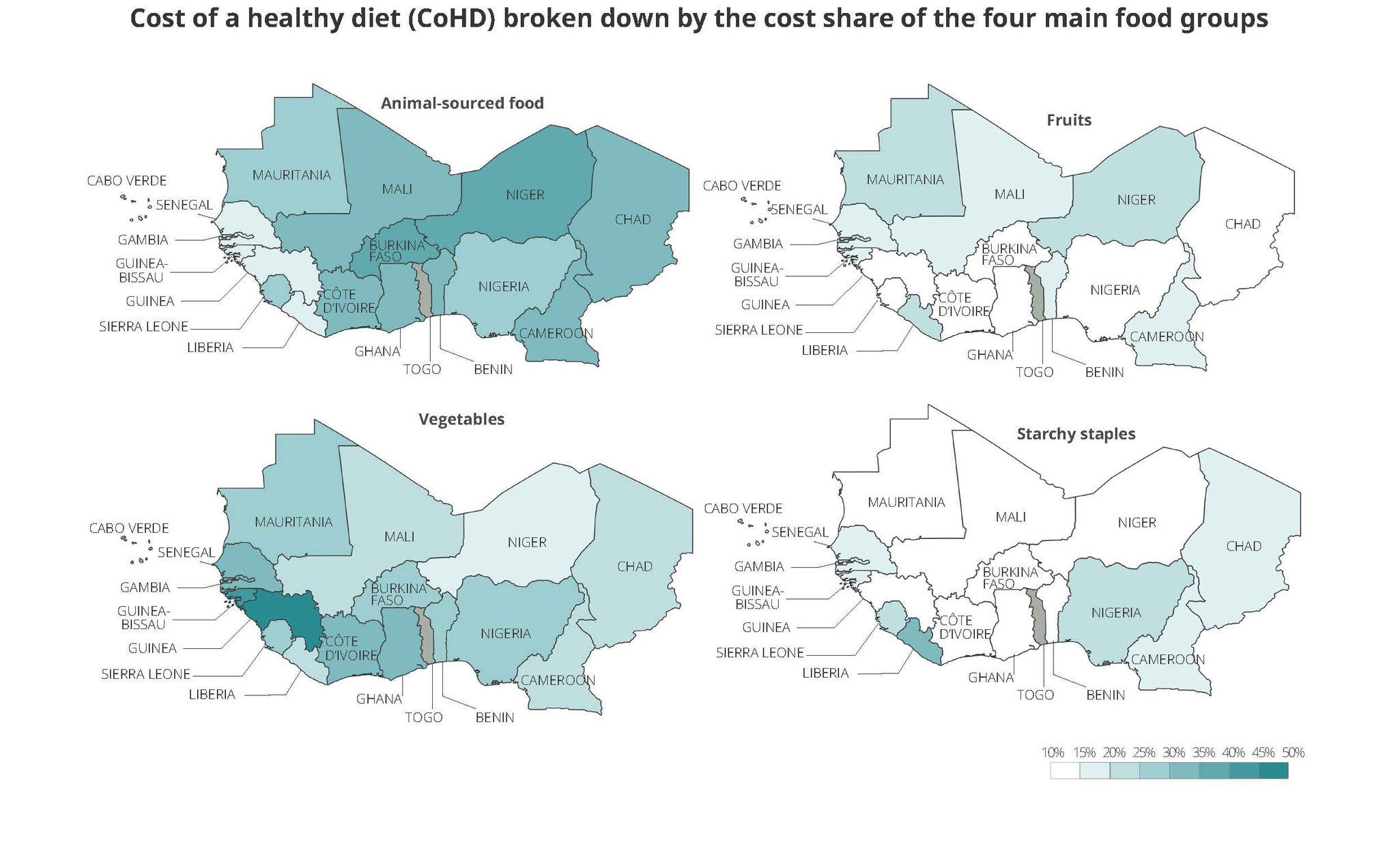

There are significant regional differences in the cost of the foods that make up a healthy diet

The cost of food in West Africa is strongly influenced by the local context: agro-climatic and economic conditions, infrastructure, distance and isolation. For example, animal foods account for 50% of the healthy diet on average in countries in the region, but the middle 50% of values range from 19% to 34%. The variation within countries is likely to be as great, if not greater, than between countries. Food prices are also highly seasonal. The variety of spatial drivers of food prices underlines the importance of location- and product-specific information on food markets in the region.

Related publications

-

16 October 2024

16 October 2024 -

Working paper5 April 2019

Working paper5 April 2019 -

27 September 2017

27 September 2017