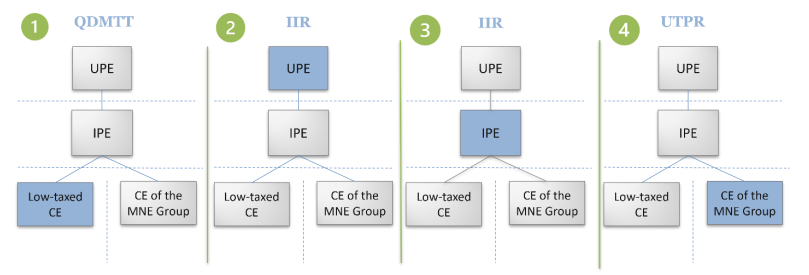

The GloBE rules introduced in domestic law are designed to work together with those of other jurisdictions to create a co-ordinated and comprehensive system of minimum taxation that imposes a top-up tax on profits arising in a jurisdiction whenever the effective tax rate, determined on a jurisdictional basis, is below the minimum rate.

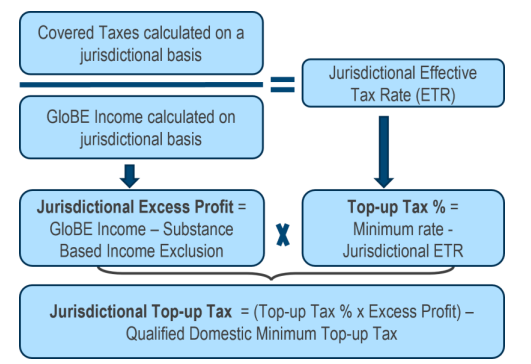

These rules require in-scope large multinational enterprise groups (MNE Groups) to calculate their income, and the taxes on that income, on a jurisdictional basis. Where this calculation results in an effective tax rate (ETR) that is below 15%, the rules require the MNE Group to pay a top-up tax that will bring the total amount of tax on the MNE Group’s excess profits (GloBE Income – Substance Based Income Exclusion) in that low-tax jurisdiction up to the 15% rate.