In PISA 2018, the mean financial literacy score across the 13 OECD countries and economies with valid data was 505 points, while the mean financial literacy score across 20 participating countries and economies with valid data was 478 points. On average, students in Estonia (547 points) Finland (537 points) and the Canadian provinces (532 points) outperformed students from all other countries and economies.

Student financial literacy

Financial literacy entails having the knowledge and comprehension of financial concepts and risks, along with the skills and attitudes needed to apply this understanding to make effective decisions across a range of financial contexts. Its aim is to improve the financial well-being of individuals and society, enabling active participation in economic life.

Key messages

PISA 2018 results show that some 85% of students scored at Level 2 or above on average across OECD countries and economies. At a minimum, these students can apply their knowledge of common financial products and commonly used financial terms to situations that are immediately relevant to them, and can recognise the value of a simple budget. Some 10% of students attained the highest level of proficiency, Level 5, across OECD countries and economies. These students can apply their knowledge to contexts that may only become relevant to their lives later on, can analyse complex financial products, and can take into account features of financial documents that are not immediately obvious.

According to the PISA 2018 results, socio-economically advantaged students performed better in financial literacy than disadvantaged students, by approximately one proficiency level, on average across OECD countries and economies. Boys scored a small but significant 2 points higher than girls on average across OECD countries and economies. However, this does not reflect a notable disparity in the types of tasks that boys and girls are able to do.

Context

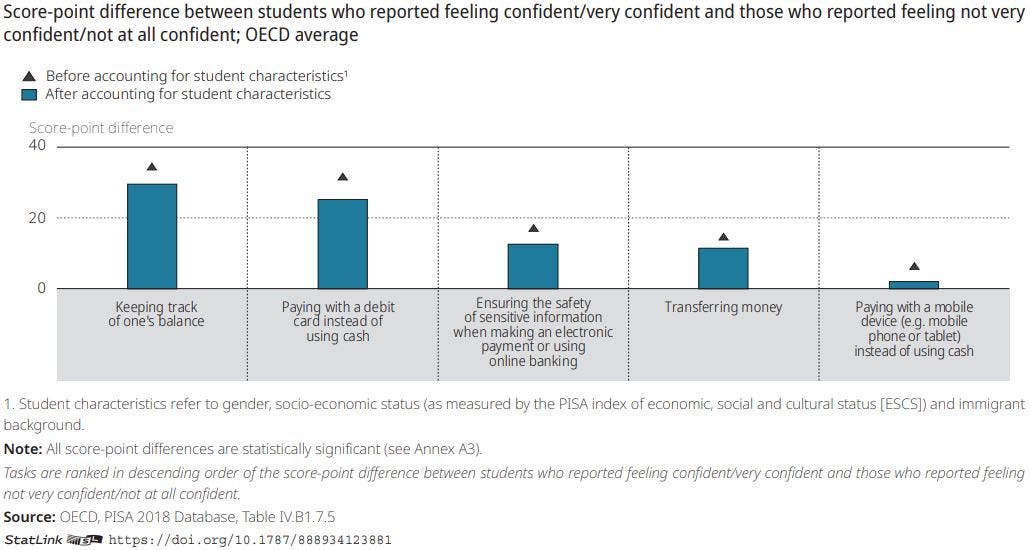

Financial literacy performance and students’ confidence in using digital financial services

PISA 2018 results show that students who reported that they are confident in performing each of the five digital finance-related tasks also scored higher in the financial literacy assessment, on average across OECD countries and economies. However, the difference in performance varied across tasks.

Financial literacy performance and students’ confidence in using digital financial services (2018)

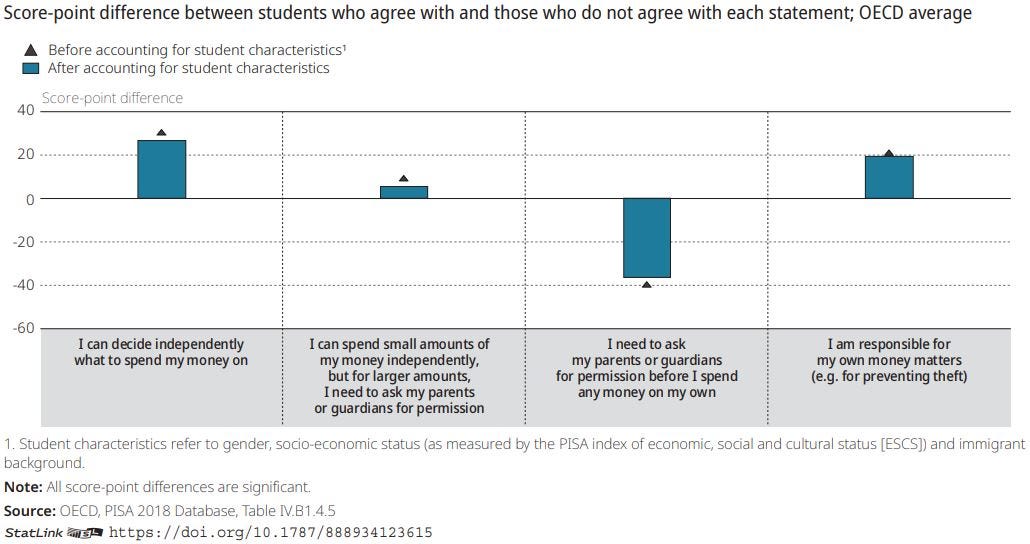

Financial literacy performance and students’ autonomy in financial affairs

PISA 2018 results show that students who were more independent in their financial affairs performed better in the financial literacy assessment, both before and after accounting for gender, socio-economic status and immigrant background.

Financial literacy performance, by students’ autonomy in spending decisions (2018)

Related publications

Programmes and projects

-

PISA is the OECD's Programme for International Student Assessment. PISA measures 15-year-olds’ ability to use their reading, mathematics and science knowledge and skills to meet real-life challenges.Learn more

-

OECD Future of Education and Skills 2030 aims to build a common understanding of the knowledge, skills, attitudes and values students need in the 21st century.Learn more

-

The PISA-based Test for Schools provides school-level estimates of performance and information about the learning environment and students’ attitudes gathered from student questionnaires. Find out more and how schools and their networks can take part.Learn more

-

Preparing for the future means taking a careful look at how the world is changing. Reflecting on alternative futures helps anticipate and strategically plan for potential shocks and surprises.Learn more