This study examines the potential for the misuse of small parcels for trade in counterfeit and pirated goods. It presents the legal and economic contexts of the operation of express and postal services. It also looks at the available data on volumes of small consignments, via postal and courier streams, in the context of seizures of counterfeit and pirated goods. Furthermore it analyses the links between the observed dynamics in markets for small parcels and the available information on misuse of this service by traffickers in counterfeit and pirated goods.

Misuse of Small Parcels for Trade in Counterfeit Goods

Abstract

Executive Summary

Trade in counterfeit goods represents a longstanding, and growing, worldwide socio-economic risk that threatens effective public governance, efficient business and the well-being of consumers. At the same time, it is becoming a major source of income for organised criminal groups. It also damages economic growth, by greatly affecting business revenue and undermining their incentive to innovate.

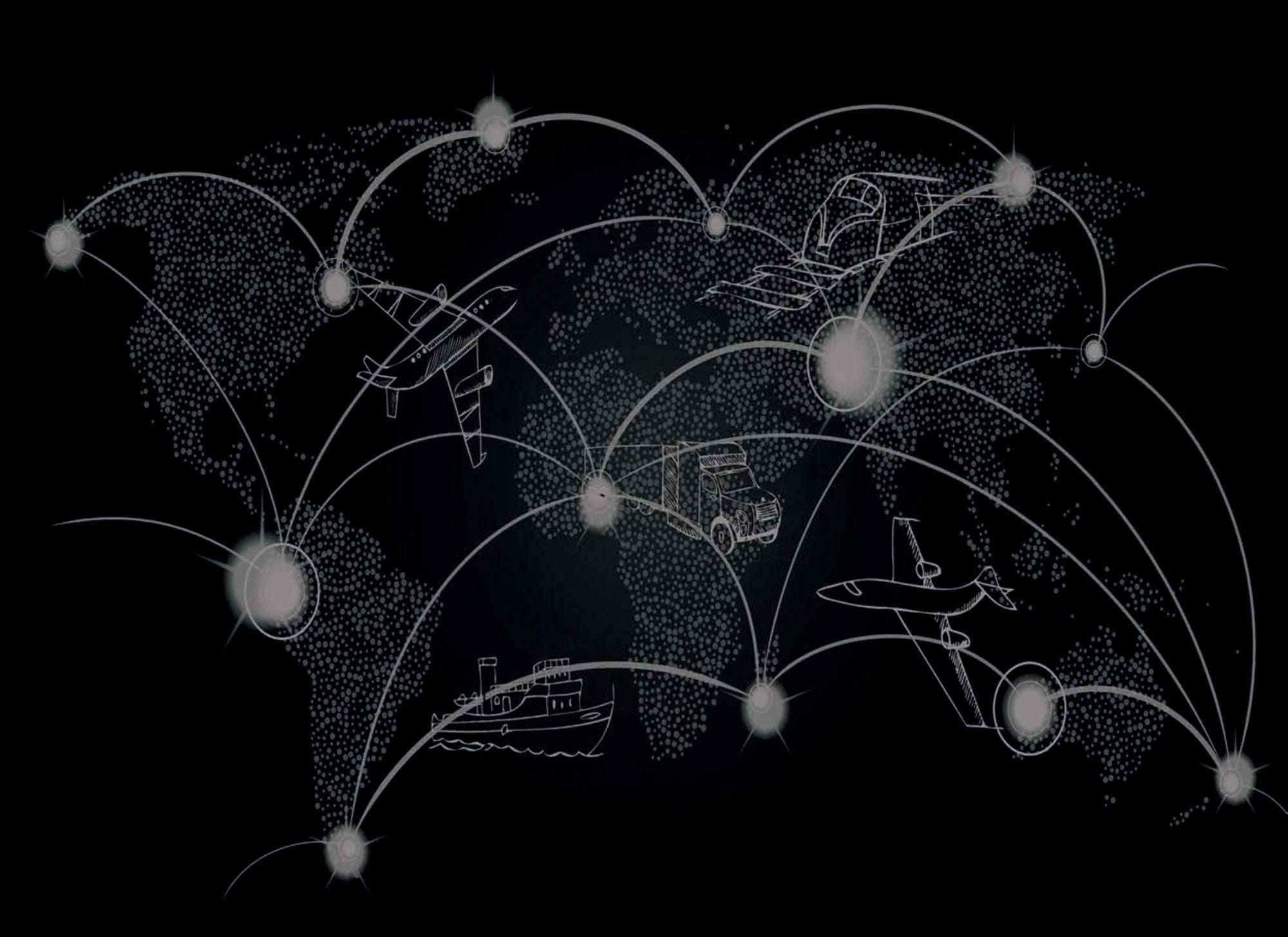

Counterfeit and pirated products tend to be shipped by virtually every means of transport. In the analysed period, in terms of value, counterfeits transported by container ship clearly dominated. In terms of number of seizures, trafficking fakes by small parcels is growing, becoming a significant problem in terms of enforcement. The small parcels used by counterfeiters for trafficking are shipped either through postal or express services.

This creates significant challenges for customs authorities and has led to calls for increased attention at the international level, including at the World Customs Organization (WCO). Traditionally available information such as ship manifests and the supporting role of customs brokers are often absent in small volume trade.

Currently, only simplified documentation is required to send small volume items shipped by post. The information contained in the documents is certified by the sender and is not usually verified, which creates scope for legitimate errors as well as fraud. The information has traditionally been provided in paper form and thus was not available electronically. It was usually only available to customs authorities in destination countries, upon arrival of the item. While progress has been made in implementing electronic data exchanges, much still needs to be done in this regard. This creates a dilemma for customs, which have to process imports on an expedited basis, while properly assessing duties and monitoring imports with a view towards countering illicit trade.

The larger express companies generally provide door-to-door services that are tracked and traced electronically. Additional information concerning the shipper, product and recipient is also collected this way. This provides a potentially rich data source that, if made available to customs authorities, could greatly assist in risk assessment. Express service providers and customs are increasingly working together to improve data and information exchanges. There is still scope for improvement, as privacy issues and confidentiality concerns need to be addressed. As with postal transactions, the information provided by the sender may contain errors, deliberate misrepresentations, or constitute fraud.

The analysis in this report uses two sorts of data: information on trade in counterfeit goods, which is based on customs data regarding seizures of counterfeit goods obtained from the World Customs Organization, the European Commission’s Directorate-General for Taxation and Customs Union and from the US Customs and Border Protection Agency (CBP). These data are complemented with available statistics from the Universal Postal Union and from Eurostat’s Comext database that illustrate international trade in small parcels.

The detailed analysis of the 2011-2013 data shows that, although fakes shipped in containers clearly dominate in terms of value of seized goods and the number of items, small parcels are important in terms of number of seizures; nearly 63% of customs seizures of counterfeit and pirated goods involve small parcels. The size of these mail or express courier shipments tends to be very small. Packages with 10 items or less account for the majority of all seizures.

In terms of industry-specific patterns, virtually all industry sectors prone to counterfeiting are concerned, albeit to different degrees. For example, 84% of seized shipments of counterfeit footwear, 77% of fake optical, photographic and medical equipment (mostly sunglasses), and 66% of customs seizures of information and communications technology (ICT) devices involved postal parcels or express shipments. This is also the case for more than 63% of customs seizures of counterfeit watches, leather articles and handbags, and jewellery.

In terms of economy-specific patterns, the analysis indicated that a few provenance economies dominate small parcel trade. These include China, Hong Kong (China), India, Singapore, Thailand and Turkey. While some of these key provenance economies, such as China, India and Thailand, have been identified as potential producers of counterfeit and pirated products, others, such as Hong Kong (China) and Singapore, are key transit points.