Responsible business conduct implications of Russia's invasion of Ukraine

OECD standards on responsible business conduct (RBC) set out the expectations for how businesses should prevent and address adverse impacts of their operations and supply chains on people, planet and society, while also contributing to sustainable development in the countries where they operate. RBC can help inform how companies respond to the war, including with regard to human rights and integrity risks in their supply chains. This will be relevant both within the region and around the world as supply chains shift in some cases.

RBC can guide and enable businesses to stay engaged in Ukraine responsibly, in order to safeguard jobs, economic activity and essential goods for Ukraine, while taking into account the context of extreme strain under which Ukrainian workers and supply chains are operating.

Due diligence framework of RBC standards can help enhance sanctions compliance where it is a legal obligation by improving visibility over complex business relationships that heighten the risk of sanctions evasion – including in the context of export restrictions on certain dual use technologies to Russia. For companies and policy makers, this makes a compelling case for enhanced due diligence based on RBC standards, including in relation to down-stream impacts and business relationships.

While RBC standards are foremost guiding tools for engaging in business relationships, they also recognise that in some contexts disengagement from a business relationship may be necessary. While many companies have disengaged from Russia, most multinational enterprises active in Russia prior to the full-scale invasion continue to operate there. This highlights the need to conduct enhanced due diligence to avoid causing, contributing or being directly linked to adverse impacts, related to the war or in other contexts.

RBC can help set baseline expectations for the sustainable reconstruction of Ukraine. Integrating RBC across all steps of the infrastructure lifecycle will help deliver high-quality, high-performing and sustainable infrastructure during reconstruction.

Executive summary

Russia’s invasion of Ukraine has had devastating impacts on the people of Ukraine. The consequences stemming from the war have imperilled the world's economic recovery from the COVID-19 pandemic and are reshaping and disrupting global supply chains, with ramifications for food security, energy, and other critical sectors. The war has also put a spotlight on the role of businesses operating in the region, facing heightened challenges in maintaining responsible business conduct (RBC) in high-risk settings. In this highly dynamic context, businesses should consider risks of being linked or contributing to adverse impacts on people, planet and society via their operations or business relationships. This note takes stock of how Russia’s war against Ukraine has had an impact on and shaped considerations for RBC.1

RBC principles and standards set out the expectations for how businesses should prevent and address adverse impacts of their operations and supply chains, while also contributing to sustainable development in the countries where they operate. RBC can help inform how companies respond to the war in the immediate and medium-terms – notably by providing a due diligence framework to help them gain visibility over the main human rights and integrity risks present in their supply chains, including those that have emerged or been made worse by the war. Conducting effective supply chain due diligence can help support the resilience of Ukraine’s economy in the short term, and its reconstruction later. Being complementary to more traditional compliance systems, RBC standards on risk-based due diligence can also help companies enhance legal compliance in the context of sanctions. RBC instruments can also help address broader risks in a context of shifting trade and investment relationships in the wake of the war, including by supporting efforts to secure a reliable and responsible supply of critical raw materials.

Short and medium-term considerations

RBC in support of the people of Ukraine. Many businesses are eager to demonstrate support for Ukraine. RBC can guide and enable businesses to stay engaged or re-engage responsibly, or disengage in a responsible manner where necessary. RBC standards provide companies with a framework for consultation with workers and rights-holders to formulate responses that safeguard jobs, economic activities and essential goods for Ukraine, while taking into account the context of extreme strain – psychosocial, financial and logistical – under which Ukrainian workers and supply chains are operating. This entails practical support guided by RBC principles, for example avoiding abrupt cancellation of orders, revising contract terms with Ukrainian business counterparts to make faster payment to Ukrainian suppliers, or establishing more lenient payment terms for Ukrainian customers. In-kind assistance that supports Ukrainian volunteer activities of a humanitarian character and maintaining any existing charity or social contributions are also of relevance, although are not a substitute for due diligence in line with RBC standards to prevent and address adverse impacts that may be associated with their operations or business relationships. The note reviews a range of examples of RBC in action, and related factors to consider when businesses are designing a response to the situation. It also addresses how the network of National Contact Points for responsible business conduct can support businesses’ responses and foster a conducive environment for effective RBC, during both the war and reconstruction. Taken together, RBC, both through its standards as well as the institutional capacity of the NCPs, presents a range of possibilities for businesses and policy makers to contribute to strengthening Ukraine’s economic resilience under very difficult circumstances.

Enhancing and complementing legal compliance. The OECD Guidelines for Multinational Enterprises (“MNE Guidelines”) state that the first obligation of enterprises is obeying domestic laws. Sanctions compliance is relevant to this as a legal obligation for companies with exposure to certain jurisdictions, including those that have enacted sanctions in response to the war. Where relevant, RBC due diligence can help improve companies’ understanding of how their supply chains and business relationships potentially intersect with exposed entities or sectors, while ensuring that related issues and relevant RBC risks are identified and addressed, whether operating in or from a sanctioning jurisdiction or not. This may include better understanding opaque corners of supply chains, where ultimate beneficial ownership arrangements are not always transparent and where the risk of sanctions evasion may be heightened, including risks related to business relationships several tiers away in supply chains. This includes understanding downstream risks related to the sale of products and services in the context of export restrictions on certain dual use technologies with military applications to Russia, for which evidence suggests there are significant and long-standing shortcomings on compliance. While few businesses may have been able to foresee the drastic escalation of the war in Ukraine in the form of the full-scale invasion in 2022, business relationships in Russia may have warranted better due diligence in previous years. Had such knowledge been acquired before the invasion, companies could have been better prepared to address risks arising from the escalation.

To stay or to go – RBC in high-risk contexts. In high-risk contexts, RBC due diligence provides businesses with a framework to assess their relationship to the conflict and their potential links to adverse impacts. In that context, due diligence should be enhanced and remain ongoing, proactive and reactive. In the context of Russia’s war against Ukraine, business decisions to remain engaged in or to disengage from Russia altogether have entailed a variety of legal, commercial, reputational, ethical and logistical considerations. Although a large number of companies have reduced, suspended or ended operations in the Russian and Belarussian markets, based on available data, many, if not most, multinational enterprises active in Russia prior to the full-scale invasion continue to operate there. For multinational businesses that remain in Russia or continue to do business with Russia, RBC considerations remain highly relevant, including the need to conduct enhanced due diligence to avoid causing, contributing to or being directly linked to adverse impacts, related to the war or in other contexts.

Longer-term considerations

Addressing RBC risks arising from shifting trade and investment relationships. Disruptions in global markets are spurring a search for new sources of supply – all of which present a distinct risk profile. The massive scale of these changes presents real challenges to conducting RBC due diligence effectively, leaving open the possibility that products from illicit sources or linked to unmitigated risks or adverse impacts could reach global markets. In the minerals supply chain, for example, informal and high-risk sources with short lead times may be called upon to fill supply shortages. With the right, proactive approach to due diligence, this shift could present opportunities for businesses to make significant and positive contributions to sustainable development; but otherwise could also incentivise greater involvement of criminal or terrorist groups in the supply chain. Companies and policy makers need to be vigilant of these risks and act now to establish and promote robust RBC due diligence by companies in strategic supply chains.

Supply chain resilience. The debate on how to enhance resilience in supply chains has been at the forefront of policy discussions, amplified successively by the COVID-19 pandemic and now the Russian war against Ukraine. Nowhere perhaps is this more evident than for critical raw materials, particularly for energy transition minerals. Given Russia’s role in energy and minerals, the war is lending more urgency to realising greater resilience in such supply chains, in particular underlining the value of supply chain diversification as a strategy. Most low-carbon technologies are much more mineral-intensive than their fossil fuel-dependent counterparts, and the range of minerals required are distributed widely across the world, necessitating diverse sourcing, including from high-risk areas, where RBC standards will be critical to supply chain resilience.

Ensuring consistent application of RBC standards. The war has highlighted the extent to which there may be conflicting and differing expectations from various stakeholders on how businesses should respond to this and similar crises. While every situation is unique and requires a mix of considerations, RBC principles and standards can help guide policy makers, businesses and other stakeholders in formulating coherent and consistent strategies in line with the widely shared policy objectives that underpin RBC standards. They do so most fundamentally by guiding each company in assessing its risk of potential connection to abuses arising from the war or humanitarian situation, while contributing to sustainable development. Russia’s war against Ukraine, may point to a need for greater clarity for policy makers, businesses and stakeholders when addressing the role of businesses in contexts of armed conflict.

Supporting Ukraine through RBC

RBC as a guide for businesses to remain responsibly engaged in Ukraine

The MNE Guidelines acknowledge and encourage the positive contributions that business can make to economic, environmental and social progress, and also recognise that business activities can result in adverse impacts on people, planet and society. The MNE Guidelines therefore recommend that businesses carry out risk-based due diligence to avoid and address such adverse impacts associated with their operations, supply chains and other business relationships, including in conflict-affected and high-risk areas.

The MNE Guidelines specifically outline that in situations of armed conflict, enterprises should respect the standards of international humanitarian law, which can help enterprises avoid the risks of causing or contributing to adverse impacts when operating in such complex environments (OECD, 2011[1]). Some RBC instruments, such as the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (“Minerals Guidance”), were conceived specifically to foster responsible investment and business engagement in high-risk areas. Situations of armed conflict represent more complex operating environments in which conditions can evolve and deteriorate rapidly and in which adverse risks and impacts are often more severe (i.e. in terms of scale, scope and irremediable character), more likely and could potentially change the business’ relation to the impact (e.g. shifting from directly linked to contributing to an adverse impact). Interrelated risks for workers and working conditions linked to migration and internally displaced people can also arise. Business conduct with regard to operations and supply chains in Ukraine therefore has an outsized impact and can shape positive or adverse outcomes for people and society in Ukraine.

Businesses have a vital role to play in helping keep Ukraine’s economy afloat, securing in so far as possible jobs, livelihoods and the supply of essential goods and services. The right set of responses anchored in RBC can help businesses realise this role while mitigating potential risks, particularly when operating in or sourcing from territories under foreign control, some of which are subject to sanctions in several jurisdictions. Ukrainian companies (particularly small and medium-sized enterprises (SMEs)) and workers have been heavily affected by the war, with severe impacts on their ability to operate normally. This includes:

Fatalities, wounded and displaced people among the workforce. The most direct impact of Russia’s war against Ukraine has been on the people of Ukraine and, by extension, the country’s workforce, with significant numbers of deaths, injuries and displacement.

Material destruction. Material destruction is likely to affect business operations beyond the end of the war and could have long-term structural impacts on the Ukrainian economy, including its productive capacity, which will also have knock-on effects on their downstream value chains. Based on a survey of 355 SME owners in Ukraine, 86% were forced to either reduce or halt their activities within a month after the invasion due to fewer orders, logistical challenges, destruction of facilities, lack of raw materials and shortage of staff (Kyiv School of Economics, 2022[2]).2

Disruption to logistics. Supply chains have faced extensive disruption from the war. This may generate uncertainty about the reliability of supplies from Ukraine. In certain sectors, activities seem to be less affected. For example, towards the beginning of May 2022, the IT sector in Ukraine was estimated to be operating at 80% of capacity.

Decrease in domestic demand. With GDP contracting significantly, loss of income may only partly be compensated by foreign aid and a surge in remittances from Ukrainian workers (estimated for example to increase by 20% in 2022 from EU countries). Domestic economic recovery and the future of the SME sector will depend, to a large extent, on the scale and ambition of the reconstruction plan and its timely implementation.

In this context, conducting supply chain due diligence in line with the OECD Due Diligence Guidance for Responsible Business Conduct (“Due Diligence Guidance for RBC”) and other sectoral due diligence instruments can help businesses avoid and address adverse impacts associated with their operations, supply chains and other business relationships arising from or exacerbated by the war, including by prioritising and addressing risks through a conflict-sensitive lens. This can span a range of issues that are more acute in conflict-affected and high-risk areas, such as:

Elevated risks to occupational health and safety and working conditions, resulting not only from proximity to armed conflict or bombardment, but also from damage to infrastructure and lack of access to potable water, sanitation, heating, electricity, food, telecommunications or public services, such as emergency response.

Limitations on workers’ freedom of association due to actions by agents of the Russian Federation in occupied territories that curtail workers’ rights; or labour rights limitations on working hours and wages enacted through regulatory changes due to the extraordinary circumstances.3

Increased risks of forced labour and child labour, especially for displaced persons.

Human rights abuses and heightened risk of causing, contributing or being directly linked to them, with potential liability for associated violations of international human rights law.

Risks related to bribery and extortion, particularly in areas where institutions are not functioning normally and the rule of law has been eroded.

Direct or indirect support to non-state armed groups (e.g. the self-proclaimed separatist Luhansk People’s Republic and Donetsk People’s Republic (LDNR)), in addition to other separatist authorities, which could present a condition for disengagement.

Elevated environmental hazards or water pollution risks due, for example, to damaged infrastructure.

Elevated risks to consumer health and safety, particularly due to damaged infrastructure (e.g. integrity of the cold chain), availability of production inputs and availability of essential goods.

Businesses should take into account the context of extreme strain, financial, logistical and psychosocial, under which Ukrainian workers and supply chains are operating (Guardian, 2022[3]). Enterprises can proactively formulate responses that facilitate Ukraine’s continued participation in international supply chains. This could entail revising contract terms with Ukrainian business counterparts, to make faster payment to Ukrainian suppliers or more lenient payment terms for Ukrainian customers. It could entail in-kind assistance to support Ukrainians’ volunteer activities of a humanitarian character, avoiding abrupt cancellation of orders and maintaining continuity of social contributions. Companies should bear in mind that support of charitable or humanitarian endeavours does not substitute for due diligence in line with RBC standards to prevent and address adverse impacts associated with their operations or supply chains. Overall, businesses are encouraged to maintain wage payment throughout the war to the extent possible and, when feasible, facilitate the transfer of employees and workers in their supply chains from high-risk areas to less severely impacted areas. The Business and Human Rights Resource Centre maintains a database of corporate responses to the war, some spanning similar responses to the above that demonstrate adaptation, particularly those aimed at protecting employees and others in Ukraine through financial, psycho-social and physical support in ways that are adapted to the current circumstances, for example by supporting mobile health services. More specific examples of responses include:

Identifying alternative merchant and carrier haulage routes to avoid conflict-related hazards and logistical disruptions and keep routes to Ukraine open (BHRRC, 2022[4]).

Exploring anticipative options for enhancing the resilience of food retail supply chains in Ukraine by reducing dependencies on trade links exposed to disruption due to the war (BHRRC, 2022[5]).

Identifying temporary postings elsewhere for employees who have been forced to leave Ukraine (BHRRC, 2022[6]).

In-kind donations of software designed to accelerate procurement of medical equipment for the Ministry of Health of Ukraine (BHRRC, 2022[7]).

Evacuating employees to safer locations in Ukraine and maintaining business continuity as much as possible in such locations (BHRRC, 2022[8]).

Establishment of an employment referral scheme for those directly impacted by the war (BHRRC, 2022[9]).

For companies engaged in the provision of essential goods and services, using best efforts to find a way to maintain access to them is considered critical (Uvarova, 2022[10]).

Other economies in the region have been particularly affected by the war, and have also traditionally been more closely connected with the Ukrainian economy. Data suggests that these bonds have endured, with an analysis by the Polish Economic Institute and Bank Gospodarstwa Krajowego showing that 86% of large Polish enterprises have supported Ukraine through donations and financial assistance (Nawrocka, 2022[11]). While many foreign companies had temporarily closed or suspended operations after the invasion began, some have begun to resume operations, with phased re-openings taking place across areas deemed safe (BBC, 2022[12]). This trend can deliver meaningful, positive contributions to the Ukrainian economy, livelihoods and tax base if carried out in a way that takes account of the exceptional circumstances and is sensitive to the operating environment.

Fostering a responsive business interface with refugees fleeing the war

RBC instruments give great importance to effective engagement with vulnerable stakeholders, particularly since they may be especially affected by adverse impacts and because barriers to their inclusion in meaningful consultation often exist. Refugees forced to flee Ukraine due to the war represent a vulnerable group that businesses should devote particular attention to.

Business can play a key role in their domestic markets by providing support to refugees fleeing war zones. As of September 2022, 7.2 million Ukrainian refugees had registered in Europe in addition to 7 million people who have been displaced internally and 13 million estimated to be stranded within Ukraine (UNHCR, 2022[13]) (UNHCR, n.d.[14]). Under the European Union’s Temporary Protection Directive, EU Member States are working to provide immediate support and resettlement for Ukrainian refugees. A number of businesses have stepped in to support displaced Ukrainians in different ways. Businesses can dedicate resources to address barriers related to the recruitment and employment of Ukrainians and encourage business partners and suppliers to do the same. Businesses are also encouraged to adapt their training and human capital management programmes to address the psychological and integration needs of refugees, including administrative assistance to regularise status, obtain temporary protection, identify short and long-term housing opportunities, and get children into day-care or schools (IOM/ICC, 2022[15]). Businesses should further pay particular attention to impacts on women, who face a higher risk of sexual harassment and may also be bearing full parenting responsibility. Thus adopting a gender-responsive approach, e.g. through dedicated counselling or by establishing flexible working arrangements for displaced single parents, is important.

As has also been seen in various conflict-affected parts of the world, displaced persons and refugees can be especially susceptible to child labour, forced labour and human trafficking, both during transit and in destination countries. Companies with supply chains in Ukraine and surrounding countries should be aware of the increased risk of human trafficking and should conduct RBC due diligence accordingly, with a specific focus on recruitment practices of third-party service providers and recruitment agencies, on alert for payment of illegal recruitment fees and related expenses.

RBC’s contribution to reconstruction efforts and investment in Ukraine

Russia’s war against Ukraine is causing considerable destruction to Ukraine’s infrastructure, capital stock, cities and neighbourhoods, particularly across the housing, transport, utilities and industrial sectors. A joint assessment of the World Bank, the European Commission and the Government of Ukraine estimates that the cost of reconstruction and recovery in Ukraine amounts to USD 349 billion (as of August 2022). The report further estimates recovery and reconstruction needs across social, productive, and infrastructure sectors, including USD 105 billion necessary to address urgent needs such as restoring education, agriculture and health systems and infrastructure (World Bank, 2022[16]). International assistance, including public financing, will be vital to assist Ukraine in the recovery phase, but so too will private investment (OECD, 2022[17]).

Looking ahead, RBC can serve to help set baseline expectations for sustainable reconstruction of Ukraine, in particular in the financing of infrastructure, in addition to supporting the re-building of institutional capacity relevant to overseeing and setting the direction for such efforts. Integrating RBC across all steps of the infrastructure lifecycle will help deliver high-quality, high-performing and sustainable infrastructure. Public infrastructure financing schemes also increasingly recognise the role of RBC – from sourcing of materials to construction, delivery and operation – in enhancing the value proposition of such schemes, as well as the extent to which the projects they fund contribute to sustainable development. This is especially relevant due to the complexity of infrastructure projects, with long supply chains, a wide range of stakeholders, and exposure to corruption, social and environmental risks.

OECD RBC standards are already embedded in international standards on fighting corruption in international transactions and on quality infrastructure investment and can serve as a suitable framework for sustainable infrastructure financing (OECD, 2022[18]). The OECD has developed guidance on how to conduct due diligence in project and asset finance transactions that provides recommendations on how to identify, to respond to, and publicly communicate on environmental and social risks associated with project and asset they finance (OECD, 2022[19]). Such recommendations can prove useful for financial institutions wishing to enable provisions of financing towards projects, infrastructure and other assets that will help reconstruction efforts in Ukraine (Box 1).

The scale of investments needed for rebuilding Ukraine’s infrastructure will make collaboration with the private sector essential. Over the past decade, donor agencies and development finance institutions (DFIs) – both public and private – have taken important steps to promote, incentivise and integrate RBC issues in their policies and processes (OECD, 2018[20]). Mainstreaming RBC standards as a useful tool that development actors can rely on could help create a level-playing field and support public actors engaging the private sector (e.g. from selecting partners and bidding, executing contracts and payments) to ensure that the partners they work with or invest in are acting responsibly according to international standards. Reconstruction programmes for Ukraine should incorporate and leverage these good practices.

The network of National Contact Points (NCPs) for responsible business conduct can also play an important role in accompanying and supporting reconstruction in Ukraine.4 NCPs are set up by adherent countries to further the effectiveness of the MNE Guidelines by undertaking promotional activities, handling enquiries and contributing to the resolution of issues that arise relating to the implementation of the Guidelines in specific instances (OECD, 2011[1]). In 2017, Ukraine became an adherent to the OECD Declaration on International Investment and Multinational Enterprises. As an adherent country to the OECD Declaration, Ukraine has established an NCP under the Ministry of Economy. NCPs can be useful channels for promoting RBC practices and advising companies operating in Ukraine, as well as handling specific instances and providing access to remedy, including for harms that may have occurred during Russia’s war against Ukraine.

Notably, within the context of reconstruction, adhering governments could ask their NCPs to take on related responsibilities, such as (i) serve as a trusted hub of information and training for responsible and sustainable private sector development in a post-war environment; (ii) advise on RBC aspects of post-war reconstruction projects; (iii) contribute to the resolution of specific cases if RBC standards are not being upheld in reconstruction projects; or (iv) assist with the coordination of Ukrainian government reconstruction policies, so as to ensure policy coherence with RBC. Moreover, some NCPs for RBC have direct experience of handling RBC issues in a post-war context, which could be relied upon for building the capacity of the Ukrainian NCP in responding to the challenges of reconstruction.

OECD Guidelines for Multinational Enterprises (MNE Guidelines) provide principles and standards for responsible business conduct in a global context consistent with applicable laws and internationally recognised standards.

OECD Due Diligence Guidance for Responsible Business Conduct provides plain-language explanations of the MNE Guidelines’ due diligence recommendations to help enterprises avoid and address adverse impacts related to workers, human rights, the environment, bribery, consumers and corporate governance that may be associated with their operations, supply chains and other business relationships.

OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas provides detailed recommendations to help companies respect human rights, prevent corruption and financial crime and avoid contributing to conflict through their mineral purchasing decisions and practices.

OECD-FAO Guidance for Responsible Agricultural Supply Chains was developed to help enterprises observe standards of responsible business conduct and undertake due diligence along agricultural supply chains in order to ensure that their operations contribute to sustainable development.

Responsible Business Conduct in the Financial Sector highlights that promoting RBC in the financial sector is vital to building a sustainable global economy, though certain characteristics of the sector, including diverse and extensive business relationships, a complex landscape of regulatory obligations, and the nature of various transactions, can make the practical application of effective due diligence systems challenging. The OECD Centre for RBC has worked to operationalise RBC due diligence for different financial transactions and actors through developing fit-for-purpose guidance.

OECD Due Diligence Guidance for Meaningful Stakeholder Engagement in the Extractive Sector provides practical guidance to mining, oil and gas enterprises in addressing the challenges related to stakeholder engagement related to social, economic and environmental impacts.

Frequently Asked Questions: How to address bribery and corruption risks in mineral supply chains provides practical answers on how companies can identify, prevent, mitigate and report on risks of contributing to bribery and corruption through their mineral sourcing.

Responsible business conduct, sanctions and disengagement

Russia’s war against Ukraine has underlined a range of areas where responsible business conduct is and will be highly relevant to help companies enhance legal compliance. It has also revealed areas where greater clarity might be needed in how RBC principles and standards can be applied consistently in decision making by both businesses and policy makers, especially in contexts in which conflict or human rights abuses are widespread.

RBC due diligence and sanctions compliance as distinct but complementary

The MNE Guidelines state that the first obligation of enterprises is obeying domestic laws. While the Guidelines extend beyond the law in many cases, they should not and are not intended to place an enterprise in situations where it faces conflicting requirements. However, in countries where domestic laws and regulations conflict with the principles and standards of the Guidelines, enterprises should seek ways to honour such principles and standards to the fullest extent which does not place them in violation of domestic law. RBC standards and sanctions differ in purpose and approach, but also share important features. Promoting clarity and understanding of this relationship can help guide policy makers and RBC stakeholders as they navigate situations to which both are relevant, such as Russia’s war against Ukraine. Legal obligations of enterprises may include national, regional and international sanctions regimes. In parallel, the proliferation of legislation which authorises governments to sanction individuals and entities – including foreign officials – for serious human rights abuses has further increased the mutual relevance of RBC due diligence and economic sanctions in some cases (IHRB, 2020[21]).5

Notwithstanding these areas of alignment and complementarity, economic sanctions compliance and RBC due diligence entail distinct processes and outcomes. RBC due diligence is a risk-based approach for companies to build leverage with their business relationships to prevent and mitigate actual or potential adverse impacts on people, the environment and society that enterprises cause, contribute to, or to which they are directly linked in their supply chains with provision for remediation to impacted stakeholders. This approach to risk is outward-facing in the sense that it is focused on impacts beyond solely those on the company. While sanctions are enacted in response to many of the same risks, the ways in which companies comply with them tends to emphasise the risks to the company from non-compliance.

As policy tools that seek to restrict market access and sources of funding to certain entities and individuals, economic and financial sanctions rarely make provision for remediation for those harmed by the targeted entity or individual.6 One common aim of sanctions is to change behaviour, so they may be temporary and may be revoked once the sanctioned behaviour ceases. Companies sometimes interpret sanctions broadly, leading to over-compliance, de-risking practices and other risk-averse approaches without considering that there may be unintended consequences from disengagement from activities when these are not actually subject to sanctions. Moreover, economic sanctions may not include cooperation mechanisms or scope for progressive improvement and engagement. The risk-based approach of RBC due diligence can assist companies to ensure that, where their operations or business relationships warrant sanctions compliance measures, they comply in a manner that considers unintended consequences for operations and business relationships outside the scope of sanctions.

This complementarity has already been tested in the case of money-laundering and RBC. For example, the guidance and standards of the Financial Action Task Force (FATF) require the application of a case-by-case risk-based approach, as opposed to wholesale de-risking for business, when dealing with money laundering and terrorism financing risks (ML/TF), only recommending that financial institutions terminate customer relationships where the ML/TF risks cannot be mitigated (FATF, 2015[22]). Efforts by jurisdictions subject to increased monitoring by FATF to strengthen the effectiveness of their anti-money laundering and countering terrorist financing (AML/CTF) regimes have accordingly included embedding OECD RBC standards into their regulatory frameworks for relevant sectors of the economy (UAE Ministry of Economy, 2022[23])

In the context of the Russian war against Ukraine, RBC due diligence standards provide elements that can assist companies where relevant, especially through a whole-of-supply-chain approach. In some instances, the extent to which sanctions regimes address business relationships several tiers away in supply chains is limited, including due to legal interpretation. Having a broader understanding of the risk profile in the supply chain can help ensure that companies are cognisant of the wider set of RBC risks. For example, while sanctions have targeted the Central Bank of Russia, the Russian Ministry of Finance and the National Wealth Fund of the Russian Federation, they have not to date targeted most Russian mining and metals companies (US Treasury, 2022[24]). However, the State Fund of Precious Metals and Precious Stones of the Russian Federation, an entity of the Russian Ministry of Finance, both buys from and sells to other Russian mining and metals firms, which leaves open the possibility that such firms may still be associated with RBC risks related to the war or could serve as conduits to bypass sanctions targeting institutions of the Russian Ministry of Finance (Gokhran, 2022[25]).

Similarly, while Russian diamond giant Alrosa has been sanctioned, cutting and polishing of Alrosa-produced stones takes place outside of Russia (primarily in India), which means that Russian diamonds continue to reach the international market. This is despite the fact that Alrosa’s connection to the war appears to go well beyond contributions to Russian government revenue. For example, Alrosa newsletters have described direct sponsorship of a Russian submarine that participated in the 2014 occupation of Crimea to “increase [its] combat readiness” (Merket, 2022[26]). This provides a strong basis for enhanced RBC due diligence, beyond what is generally understood to be required by current sanctions (The Guardian, 2022[27]) (Bates, 2022[28]) (The Guardian, 2022[29]). While few businesses may have been able to foresee the drastic escalation of the war against Ukraine in the form of the full-scale invasion it took in 2022, it is clear that there are business relationships in Russia that warranted better due diligence in years prior.

As these examples suggest, jurisdictions and trading hubs that have not enacted sanctions may risk being used as intermediary nodes facilitating the introduction of goods (including precious metals) from sanctioned entities, such as the Russian Central Bank or sanctioned Russian-origin export sectors like gold and diamonds, into the global market. In part to avoid this risk, the London Bullion Market Exchange suspended six Russia-based gold and silver refiners from its Good Delivery List (LBMA, 2022[30]).7 This kind of response, however, is far from universal, and supply chain due diligence can help companies understand whether they might be exposed to such risks. Policy makers and regulators could consider strengthening due diligence requirements at exchanges and trading hubs and, where sanctions violations are at issue, increasing law enforcement cooperation, in support of broader sanctions goals.

Restrictions on high technology with military applications to Russia make an especially compelling case for enhanced downstream due diligence based on RBC standards – that is, conducting due diligence on how products and services are being used by customers or, in this case, figuring out who a business’ ultimate customers even are. Researchers examining Russian armaments that were captured in Ukraine since the invasion began found 80 different foreign-manufactured components under export restriction for decades, all of which likely have no Russian-made alternative (Royal United Services Institute, 2022[31]). False end-user certificates, front companies and transhipments were all found to be tactics used to divert exports and evade restrictions. While calls have been made for stronger enforcement of export controls and other export restrictions in response to these findings, responsibility also lies with the manufacturers. In practical terms, by taking a risk-based and whole-of-supply chain approach, enhanced due diligence could be instrumental in reducing Russia’s ability to evade such measures, especially considering that traditional sanctions compliance approaches appear to be falling short in this regard. A number of resources exist that can guide companies and policy makers on due diligence related to down-stream impacts and business relationships (U.S. Department of State, 2020[32]; GBI, 2023[33]; DIHR, 2023[34]). Nonetheless, it is also clear that greater support for industry and policy makers on applying RBC standards for downstream due diligence and addressing related implementation challenges may be warranted.

Business decisions to disengage from Russia

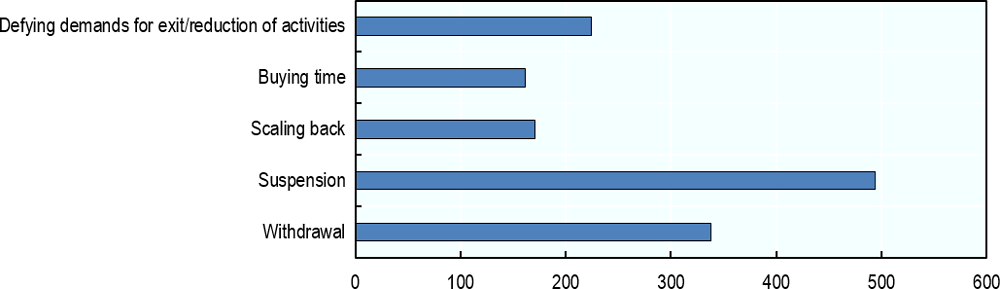

More than 1000 companies have reduced, suspended or halted business engagement in Russia for reasons spanning sanctions compliance, markets disruptions, logistical challenges, safety of staff and assets, ethical considerations and reputational risks (Figure 1). Divestments have also been driven by volatile market conditions and new challenges companies face when operating in Russia. For example, sanctions on the Russian financial sector, challenges in making payments and reduced access to foreign capital have put a strain on balance sheets of Russian-owned or Russia-based companies, including affiliates or subsidiaries of foreign companies. Companies have faced complexities in supporting affiliates through intracompany loans and injections of equity capital, while also facing transport disruptions. In some cases, responses have been constrained by their business models (e.g. franchises) or the scale of operations in Russia (OECD, 2022[17]). Since the Russian government announced a partial mobilisation of the country in September 2022, a new law has also been enacted requiring businesses in the country, including many multinational enterprises, to assist with the mobilisation. This includes help with identifying employees eligible to be drafted, but also potential material support to the war effort if called upon to do so. This obviously presents businesses with a new challenge, and new concerns regarding their presence in Russia (Carter, 2022[35]).

Some companies have also emphasised sector-specific considerations and opted for more selective disengagement in order, for example, to sustain supply of foodstuffs, medicines and humanitarian supplies, or to provide services to independent Russian civil society or opposition figures (Maersk, 2022[36]) (AgWeb, 2022[37]). Having said that, according to some analyses, many if not most multinational enterprises active in Russia prior to the full-scale invasion continue to operate in Russia (Atlantic Council, 2022[38]). Considerations related to responsible exit as outlined in Box 2, are particularly relevant in this regard.

Note: Figure updated as of 13 January 2023

Source: (Yale School of Management, 2023[39])

When companies take the decision to disengage from and exit markets or a business relationship, they are expected to take into account the impact of that decision. In practice, decisions to disengage are based on a wide variety of criteria, which can often be competing and sometimes conflicting, and respond to specific circumstances. Nonetheless, the general principle and expectation to exit responsibly is relevant even in the most complex circumstances and contexts and including where sanctions apply. In those circumstances, even for sectors and business relationships not covered by sanctions, enhanced due diligence is directly relevant.

Due diligence under the OECD Guidelines is designed to be a tool for engagement. The OECD Guidelines and the supporting OECD sector due diligence guidance provide a range of recommendations that companies can use to prevent and mitigate risks of harm, e.g. use of leverage, corrective action measures, pre-qualification of suppliers and other methods.

At the same time, OECD standards also recognise that disengagement from a business relationship may be necessary in some contexts. Disengagement is considered to be a last resort where mitigation has failed or where the enterprise deems mitigation not feasible, or because of the severity of the adverse impact. Certain conditions in particular have been outlined in this regard, notably when the harm is too severe to remain engaged; after failed attempts at preventing or mitigating severe impacts; when impacts are irremediable; where there is no reasonable prospect of change, or when severe adverse impacts or risks are identified and the entity causing the impact does not take immediate action to prevent or mitigate them. These conditions anticipate situations where no leverage for change may exist, and in which the risk of severe adverse impacts may be the foremost consideration shaping decision-making. The due diligence process, importantly, is meant to shed light on this nexus and on criteria which may be relevant to a decision to disengage.

One recurring question and challenge for business in terms of decisions to disengage has been the extent to which merely operating in a country or area where systemic and large-scale human rights abuses take place can amount to linkage with or involvement by companies in such abuses. In the context of formulating the UN Guiding Principles on Business and Human Rights (UNGPs), Professor John G. Ruggie noted that the “mere presence in a country, paying taxes, or silence in the face of abuses is unlikely to amount to the practical assistance required for legal liability” (OHCHR, 2008[40]).

The UNGPs, with which Chapter IV (on Human Rights) of the OECD Guidelines is aligned, specify that when a company lacks the leverage to prevent or mitigate the adverse impacts (and is unable to increase its leverage), then it should consider disengagement, including “taking into account credible assessments of potential adverse human rights impacts of doing so”. The UNGPs also add that if the company decides to remain in the relationship, it should be able to demonstrate its ongoing efforts to mitigate the impact and be prepared to accept any consequences – reputational, financial or legal – of the continuing connection (OHCHR, 2011[41]).

In neither standard is the presence of armed conflict listed among the criteria that should prompt businesses to disengage, even if it should trigger enhanced due diligence. Practically speaking, due diligence is the process through which companies can understand the thresholds for disengagement (and any potential unintended consequences) and conversely understand how to provide for or cooperate in remediation to meaningfully address adverse impacts resulting from such disengagement. For example, write-offs and asset transfers resulting from disengagement from Russia, which benefit Russian state-owned enterprises or other entities connected with the Russian state or sanctioned entities could be give rise to RBC risks (Reuters, 2022[42]).

When companies decide to disengage, they should seek a responsible exit. This includes:

Being transparent about their decision to disengage

Consulting with business relationships

Consulting impacted and potentially impacted rights-holders and their representatives, e.g. workers and trade unions

Paying special attention to vulnerable groups

Seeking relevant internal and external expertise as needed

Using leverage, where the company has leverage, to mitigate any remaining impacts to the greatest extent possible

Co-operating with other actors, including other businesses, to mitigate impacts

Considering developing and clearly communicating conditions that would need to be in place in order to resume their activities.

RBC considerations related to supply chain shifts resulting from Russia’s war against Ukraine

Navigating shifting trade and investment relationships in the medium-term

Ukraine and Russia together account for less than 3% of global GDP and approximately 2% of world trade flows. However, both represent significant “upstream” producers across value chains and exporters in manufacturing processes. For example, 55% of Russia’s exported value added is being used as intermediate inputs embedded in trading partners’ exports, particularly in the energy sector. Russia and Ukraine both also play major roles in the metals and agriculture sectors, and the war has had a particularly disruptive effect on global markets for raw materials as a result.

The disruptions in global supply chains and markets due to Russia’s war against Ukraine are already spurring a search for new sources of supply. These shifts will likely put pressure on new sources which will all have a distinct risk profile. The massive scale of expected changes presents real challenges to conducting RBC due diligence effectively, leaving open the possibility that products from illicit sources or linked to unmitigated risks or adverse impacts could reach global markets. Companies and policy makers need to be vigilant in this regard and act to establish robust RBC due diligence, especially at parts of the supply chain that trade and process raw materials or otherwise serve as control points and trading hubs.

Notably, these developments will have unique ramifications for the informal sector. Artisanal and small-scale mining may be called upon to make up for deficits in gold, diamonds, cobalt, copper and other metals. With the appropriate support from donors and the local public sector, higher commodity prices could help finance formalisation of such activities. Unfortunately, however, armed and criminal groups are likely better positioned to react more quickly and further embed themselves in such supply chains, similarly to what took place initially with the emergence of the COVID-19 pandemic when traditional means of getting gold to market were unavailable (INTERPOL, 2021[43]).

A relevant example of this is Russia’s reported use of mercenaries to illicitly profit from the trade in gold and diamonds in conflict zones like the Central African Republic and in countries with authoritarian governments like Sudan (International Crisis Group, 2021[44]) (CNN, 2022[45]). While this predated Russia’s war against Ukraine, it could be leveraged to bypass sanctions and acquire foreign exchange. Taken together, these risks will represent an additional challenge for trading hubs, regulators and law enforcement to stem the risk that such a reconfiguration of precious metal supply chains fuels money laundering and terrorist and conflict financing.

The effects on agricultural supply chains may be even less predictable. Globally, the FAO estimates that the number of undernourished people could increase by 8 to 13 million people by 2023, with the most pronounced increases occurring in Asia-Pacific, followed by sub-Saharan Africa, and the Near East and North Africa (FAO, 2022[46]). If the war continues to disrupt Ukrainian agricultural exports or, more broadly, efforts to promote access to international markets for Ukrainian and Russian agricultural commodities and fertiliser falter, not only may food insecurity increase, but informal suppliers of alternative staple foodstuffs will likely be tapped at least in part, including in sectors with poor working conditions.

Building long-term resilience through comprehensive and consistent application of RBC standards

The debate on how to build long-term resilience in global supply chains and the different approaches proposed for doing so, including diversification and commitment to open and rules-based trade, is at the forefront of policy discussions and amplified especially by the COVID-19 pandemic and now by Russia’s war against Ukraine. Nowhere perhaps is this more evident than for critical raw materials, particularly energy transition minerals. Given Russia’s role in energy and minerals supply, the war is lending more urgency to realising greater resilience of such supply chains. In order to diversify in earnest, however, high-risk sources of supply will be unavoidable. RBC standards like the OECD Minerals Guidance will have a crucial role in both engaging such sources responsibly, as well as in mitigating risks sufficiently to attract the investment and for avoiding slowing down the transition to low-carbon technologies. Nearly 50% or more of current volumes of cobalt, copper and nickel – all critical to low-carbon technologies – are estimated to be from areas with significant governance challenges, yet these areas and their mineral resources remain indispensable (International Energy Agency, 2021[47]). Responsible engagement through due diligence will be key.

In order to enable RBC principles and standards to meaningfully contribute to resilience on a global scale, efforts must also be made to safeguard their integrity through consistent and global application across diverse geographies and supply chains. While the specific circumstances of Russia’s war against Ukraine are unique, armed conflict is unfortunately a constant in world affairs, including in many other regions integrated into global value chains. In this context, RBC will have a vital role to play in mitigating conflict-related adverse impacts and other systemic risks while enabling businesses to stay engaged and contribute to sustainable development outcomes in high-risk areas when conditions allow.

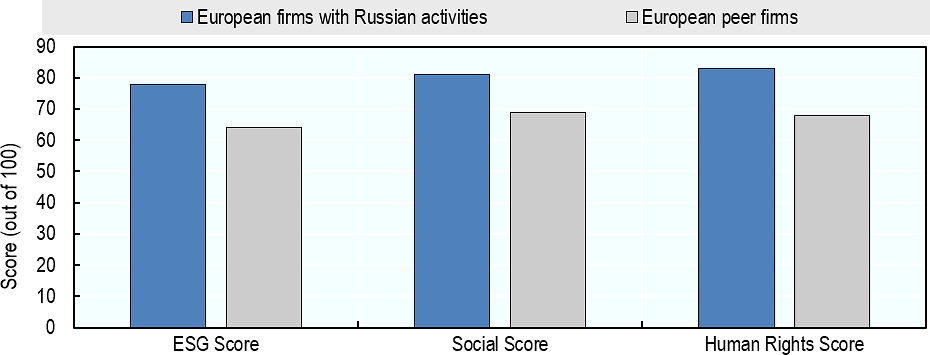

Among the challenges facing businesses in this regard is anticipating future risks. Russia’s war against Ukraine, sanction regimes and a deteriorating political climate have highlighted the challenges for environmental, social and governance (ESG) ratings to accurately reflect growing social and governance risks in Russia (Figure 2). According to some sustainable finance analysts, ESG-focused frameworks may not have been sufficiently captured relevant ESG factors, such as the impact of the annexation of Crimea by Russia in March 2014 on ESG labelled sovereign issuance. At least USD 8.3 billion in Russian assets were held by ESG labelled funds at the start of Russia’s war against Ukraine, while another study found that 60 of the top European Green-labelled funds had stakes in Russian companies (Bloomberg, 2022[48]) (Financial News, 2022[49]).8

Source: (Lev, 2022[50])

Investors’ reliance on ESG metrics and ratings and outsourcing of risk assessment to ESG data analytics – in lieu of conducting their own due diligence – may have hindered investors and asset managers’ ability to grasp the full extent of their material exposure to social, environmental or governance risks and impacts. Many ESG ratings providers use backward-looking data and information (i.e. controversies) to develop their scoring and ratings of companies and sectors. This approach makes it difficult to assess impacts of events or unforeseen crises. For instance, since Russia’s full-scale invasion of Ukraine began, a prominent ESG data provider announced that it was reviewing its ESG risk ratings and country risk rating methodologies to better assess such risk in the future and avoid siloed approach to risk ratings (FT, 2022[51]).

Conclusion

Continuing to provide evidence-based research and advice on these issues will enable RBC to make a meaningful and enduring contribution to Ukraine’s reconstruction. Further work may also be undertaken to address wider questions raised by Russia’s war against Ukraine on the translation and application of RBC standards in conflict and high-risk settings, which can each be complex and with their own characteristics, and where policy makers and businesses need to weigh several policy considerations. The ongoing war has also shown the challenges with practical application of RBC standards when doing business in high-risk contexts, or in which a government has initiated a war of aggression, which all have implications for how to disengage responsibly or – when deciding to stay – how to stay responsibly. Finally, building a greater understanding of how RBC can improve supply chain resilience can help address the current strain and future challenges related to critical goods. This is most evident for critical raw materials.

References

[37] AgWeb (2022), Bayer Announces Stoppage of ‘Non-Essential’ Business in Russia and Belarus, https://www.agweb.com/news/crops/crop-production/bayer-announces-stoppage-non-essential-business-russia-and-belarus.

[38] Atlantic Council (2022), Most multinationals remain in Russia and fund Putin’s invasion of Ukraine, https://www.atlanticcouncil.org/blogs/ukrainealert/most-multinationals-remain-in-russia-and-fund-putins-genocidal-invasion/.

[28] Bates, R. (2022), “With Russia, Industry Must Prove It Learned The “Blood Diamond“”, https://www.jckonline.com/editorial-article/russia-industry-blood-diamond/.

[12] BBC (2022), McDonald’s plans to reopen in Kyiv and western Ukraine, BBC, https://www.bbc.com/news/business-62508898.

[9] BHRRC (2022), Credit Suisse response, https://www.business-humanrights.org/en/latest-news/credit-suisse-response-3/.

[8] BHRRC (2022), Hitachi response, https://www.business-humanrights.org/en/latest-news/hitachi-response/.

[5] BHRRC (2022), Marks & Spencer response, https://www.business-humanrights.org/en/latest-news/marks-spencer-response-2/.

[6] BHRRC (2022), Novartis Response, https://www.business-humanrights.org/en/latest-news/novartis-response/.

[4] BHRRC (2022), Russia / Ukraine update [Maersk], https://www.maersk.com/news/articles/2022/02/24/russia-ukraine-situation-update.

[7] BHRRC (2022), SAP SE response, https://www.business-humanrights.org/en/latest-news/sap-response/.

[48] Bloomberg (2022), “ESG Funds Had $8.3 Billion in Russia Assets Right Before War”, https://www.bnnbloomberg.ca/esg-funds-had-8-3-billion-in-russia-assets-right-before-war-1.1734272.

[35] Carter, D. (2022), Multinationals still in Russia forced to assist with army mobilisation, The Brussels Times, https://www.brusselstimes.com/297415/multinational-companies-staying-in-russia-to-be-forced-to-assist-with-army-mobilisation.

[45] CNN (2022), Russia is plundering gold in Sudan to boost Putin’s war effort in Ukraine, https://edition.cnn.com/2022/07/29/africa/sudan-russia-gold-investigation-cmd-intl/index.html.

[58] Deloitte (2022), Major Changes Introduced by the Law of Ukraine “On Organization of Labor Relations under Martial Law” No.2136-ІХ, https://www2.deloitte.com/ua/en/pages/press-room/tax-and-legal-alerts/2022/04-08.html.

[34] DIHR (2023), Due diligence in the downstream value chain: case studies of current company practice, Danish Institute for Human Rights, https://media.business-humanrights.org/media/documents/Due_diligence_in_the_downstream_value_chain.pdf.

[46] FAO (2022), “Information Note: the importance of Ukraine and the Russian Federation for global agricultural markets and the risks associated with the current conflict”, https://www.fao.org/fileadmin/user_upload/faoweb/2022/Info-Note-Ukraine-Russian-Federation.pdf.

[22] FATF (2015), “Guidance for a risk-based approach: effective supervision and enforcement by AML/CFT supervisors of the financial sector and law enforcement”, https://www.fatf-gafi.org/publications/fatfrecommendations/documents/rba-effective-supervision-and-enforcement.html.

[49] Financial News (2022), “Ukraine invasion ups pressure over claims for ESG investing”.

[51] FT (2022), “ESG investors accused of ‘failing’ over Russia”, https://www.ft.com/content/fad3e241-08fa-47fc-bdbd-32dd5b72403d.

[33] GBI (2023), Effective downstream human rights due diligence: Key questions for companies, Global Business Initiative on Human Rights, https://gbihr.org/images/docs/GBI_Effective-Downstream-HRDD_Key-Questions-for-Companies_-_Feb_2023.pdf.

[25] Gokhran (2022), , https://www.gokhran.ru/en/.

[3] Guardian (2022), ’We’re not getting paid’: the Kyiv businesses trying to re-open, https://www.theguardian.com/world/2022/mar/11/were-not-getting-paid-the-kyiv-businesses-trying-to-reopen.

[21] IHRB (2020), “The Magnitsky Effect – Economic Consequences for Human Rights Abuse?”, https://www.ihrb.org/focus-areas/finance/magnitsky-effect.

[55] ILO (2022), Nearly 5 million jobs have been lost in Ukraine since the start of the Russian aggression, says ILO, International Labour Organization, https://www.ilo.org/global/about-the-ilo/newsroom/news/WCMS_844625/lang--en/index.htm.

[44] International Crisis Group (2021), Russia’s Influence in the Central African Republic, https://www.crisisgroup.org/africa/central-africa/central-african-republic/russias-influence-central-african-republic.

[47] International Energy Agency (2021), The Role of Critical Minerals in Clean Energy Transitions, https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf.

[43] INTERPOL (2021), Central Africa: Criminals are cashing in on COVID-19 surge in gold prices, https://www.interpol.int/en/News-and-Events/News/2021/Central-Africa-Criminals-are-cashing-in-on-COVID-19-surge-in-gold-prices.

[15] IOM/ICC (2022), “What can business do to support people displaced by the conflict in Ukraine?”, https://iccwbo.org/content/uploads/sites/3/2022/04/icc-iom-employer-ukraine-guidance-dye-1.pdf.

[2] Kyiv School of Economics (2022), The war slowed down or suspended the work of 86% of Ukrainian companies, Kyiv School of Economics, https://kse.ua/ua/about-the-school/news/naybilshe-ochikuvannya-biznesa-vid-uryadu-sogodni-podatkovi-kanikuli/.

[30] LBMA (2022), Good Delivery List Update: Gold & Silver Russian Refiners Suspended, https://www.lbma.org.uk/articles/good-delivery-list-update-gold-silver-russian-refiners-suspended.

[50] Lev, B. (2022), The False Promise of ESG, Harvard Law School Forum on Corporate, https://corpgov.law.harvard.edu/2022/03/16/the-false-promise-of-esg/.

[36] Maersk (2022), Are there any exceptions when it comes to shipping cargo to/from Russia?, https://www.maersk.com/support/faqs/exceptions-when-it-comes-to-shipping-cargo-to-from-russia.

[26] Merket, H. (2022), “Russian diamonds and the war in Ukraine”, https://ipisresearch.be/wp-content/uploads/2022/04/20220404_Russian-diamonds-and-the-war-in-Ukraine.pdf.

[11] Nawrocka, O. (2022), More than half of Polish companies help Ukrainians, InPoland, https://inpoland.net.pl/novosti/glawnoe/ponad-polovina-polskikh-firm-dopomagaeh-ukra%D1%97ncyam/.

[57] Nekrasov, V. (2022), “Expect a wave of returns in August and September.” Head of BlaBlaCar in Ukraine on migration and bus transportation, Economic Truth, https://www.epravda.com.ua/rus/publications/2022/07/27/689654/.

[17] OECD (2022), International investment implications of Russia’s war against Ukraine, OECD Publishing, https://www.oecd-ilibrary.org/docserver/a24af3d7-en.pdf?expires=1654613438&id=id&accname=ocid84004878&checksum=D554C043CE63C751B103C29B11F7D22B.

[19] OECD (2022), “Responsible Business Conduct Due Diligence for Project and Asset finance transactions”, https://www.oecd.org/publications/responsible-business-conduct-due-diligence-for-project-and-asset-finance-transactions-952805e9-en.htm.

[18] OECD (2022), “The Blue Dot Network: A proposal for a global certification framework for quality infrastructure”, https://www.oecd.org/daf/blue-dot-network-proposal-certification.pdf.

[53] OECD (2018), Good Jobs for All in a Changing World of Work: The OECD Jobs Strategy, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264308817-en.

[20] OECD (2018), Promoting and enabling responsible business conduct through development co-operation efforts, OECD Publishing, https://mneguidelines.oecd.org/Promoting-and-enabling-RBC-through-development-cooperation.pdf.

[54] OECD (2014), “The crisis and its aftermath: A stress test for societies and for social policies”, in Society at a Glance 2014: OECD Social Indicators, OECD Publishing, Paris, https://dx.doi.org/10.1787/soc_glance-2014-5-en.

[1] OECD (2011), OECD Guidelines for Multinational Enterprises, https://www.oecd.org/daf/inv/mne/48004323.pdf.

[52] OECD (2010), OECD Employment Outlook 2010: Moving beyond the Jobs Crisis, OECD Publishing, Paris, https://dx.doi.org/10.1787/empl_outlook-2010-en.

[41] OHCHR (2011), “HR/PUB/11/04 - UN Guiding Principles on Business and Human Rights”, https://www.ohchr.org/sites/default/files/documents/publications/guidingprinciplesbusinesshr_en.pdf.

[40] OHCHR (2008), “Protect, Respect and Remedy: a Framework for Business and Human Rights”, https://media.business-humanrights.org/media/documents/files/reports-and-materials/Ruggie-report-7-Apr-2008.pdf.

[56] Rating Group (2022), Fifteenth National Survey: Ukraine during teh War, Employment and Income, Rating Group, https://ratinggroup.ua/research/ukraine/pyatnadcat_obschenaci_opros_ukraina_vo_vremya_voyny_zanyatost_i_dohody_23-24_iyulya_2022_goda.html.

[42] Reuters (2022), Factbox: Companies sell their businesses in Russia, https://www.reuters.com/business/companies-sell-their-businesses-russia-2022-06-17/.

[31] Royal United Services Institute (2022), Silicon Lifeline, Western Electronics at the Heart of Russia’s War Machine, https://static.rusi.org/RUSI-Silicon-Lifeline-final-updated-web_1.pdf.

[27] The Guardian (2022), “Jewellery industry accused of silence over Russian diamonds”, https://www.theguardian.com/world/2022/mar/19/jewellery-industry-accused-of-silence-over-russian-diamonds.

[29] The Guardian (2022), “Major jewellers to cease buying Russian-origin diamonds after increased scrutiny”, https://www.theguardian.com/world/2022/mar/31/major-jewellers-to-cease-buying-russian-origin-diamonds-after-increased-scrutiny.

[32] U.S. Department of State (2020), Guidance on Implementing the “UN Guiding Principles” for Transactions Linked to Foreign Government End-Users for Products or Services with Surveillance Capabilities, U.S. Department of State, https://www.state.gov/wp-content/uploads/2020/09/DRL-Industry-Guidance-Project-FINAL-508.pdf.

[23] UAE Ministry of Economy (2022), Due Diligence Regulations for Responsible Sourcing of Gold, https://www.moec.gov.ae/documents/20121/296716/MOE_Due+Diligince+Regulations+V9_EN.pdf.

[13] UNHCR (2022), “Operational Data Portal - Ukraine refugee situation”, https://data.unhcr.org/en/situations/ukraine.

[14] UNHCR (n.d.), Internally Displaced Persons (IDP), https://www.unhcr.org/ua/en/internally-displaced-persons.

[24] US Treasury (2022), Treasury Prohibits Transactions with Central Bank of Russia and Imposes Sanctions on Key Sources of Russia’s Wealth, https://home.treasury.gov/news/press-releases/jy0612#:~:text=Pursuant%20to%20the%20Russia%2Drelated,Finance%20of%20the%20Russian%20Federation.

[10] Uvarova, O. (2022), Responsible Business Conduct in Times of War: implications for essential goods and services providers in Ukraine, https://media.business-humanrights.org/media/documents/Essential_services_in_times_of_war_in_Ukraine_3.pdf.

[16] World Bank (2022), “Ukraine Rapid Damage and Needs Assessment”, https://documents1.worldbank.org/curated/en/099445209072239810/pdf/P17884304837910630b9c6040ac12428d5c.pdf.

[39] Yale School of Management (2023), Over 600 Companies Have Withdrawn from Russia—But Some Remain, Yale Chief Executive Leadership Institute 2022, https://som.yale.edu/story/2022/over-600-companies-have-withdrawn-russia-some-remain.

Contact

Allan JORGENSEN (✉ allan.jorgensen@oecd.org)

Tihana BULE (✉ tihana.bule@oecd.org)

Benjamin KATZ (✉ benjamin.katz@oecd.org)

Benjamin MICHEL (✉ benjamin.michel@oecd.org)

Nina CHITAIA (✉ nina.chitaia@oecd.org)

Notes

This document uses “Russia’s war against Ukraine” to refer to the ongoing full-scale invasion of Ukraine by Russia commenced on 24 February 2022.

It is worth noting that between February-May 2022, nearly 5 million people lost their jobs in Ukraine (ILO, 2022[55]). According to a sociological group survey, among those who had a job before the war, 59% are working, including 34% full time, 19% remotely or part time, and 6% who have found a new job. Half of those employed have witnessed salary cuts (Rating Group, 2022[56]). Majority of those currently searching for employment are maintaining a positive outlook, particularly as certain sectors (e.g. transport) are expected to recover (Nekrasov, 2022[57]).

A number of legislative changes have been adopted in Ukraine, including the introduction of a 60-hour work week and possibility of wage suspension. Labour rights inspections have also been suspended (Deloitte, 2022[58]).

For example, the 2016 Global Magnitsky Act in the United States, 2017 Justice for Victims of Corrupt Foreign Officials Act in Canada, and 2018 Sanctions and Anti-Money Laundering Act in the UK and others.

Import bans for example can be associated with provisions of remedy. The customs authority can set a ‘grace period’ during which the exporter must provide remedy to impacted stakeholders and demonstrate that corrective measures have been introduced to prevent future instances of risk.

The LBMA also maintains a set of responsible sourcing requirements for approved refiners designed to implement the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas.

Based on research conducted by Bloomberg on 4,800 ESG funds representing USD 2.3 trillion of AUM. Of those, about 300 were directly exposed to Russia