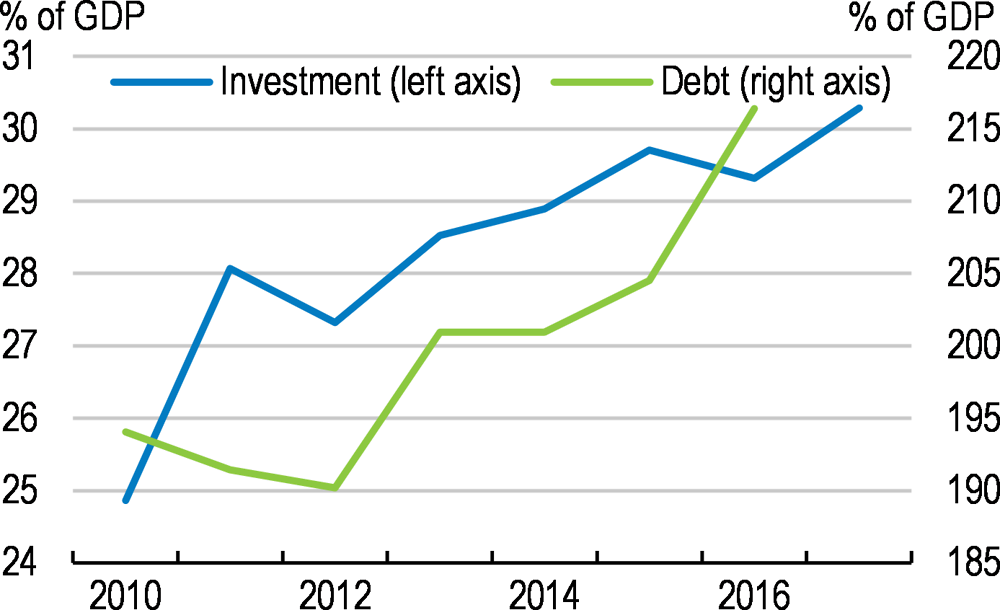

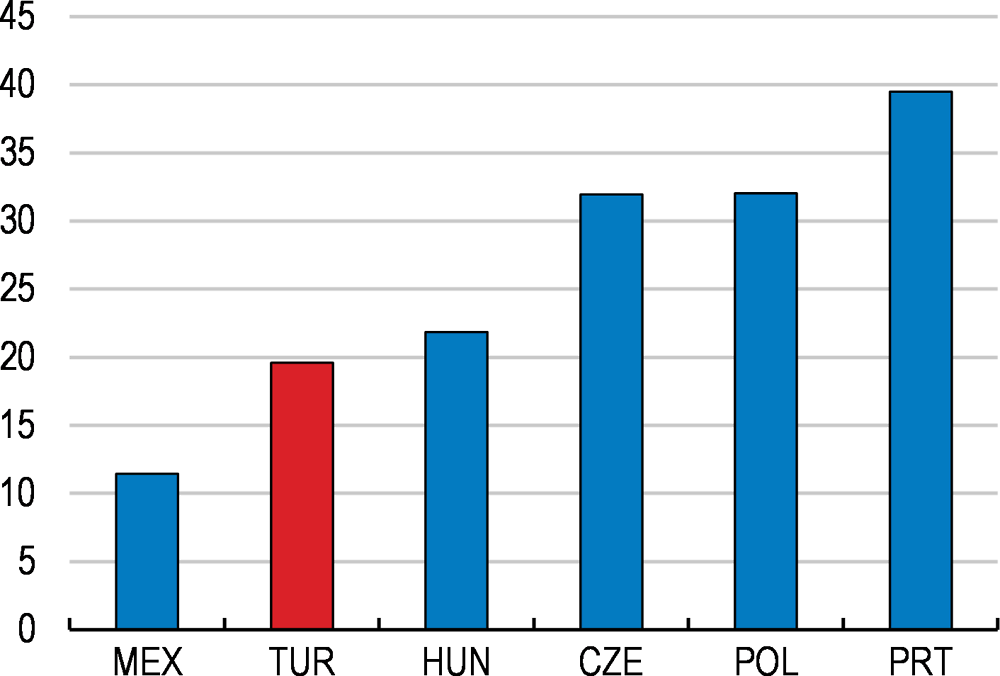

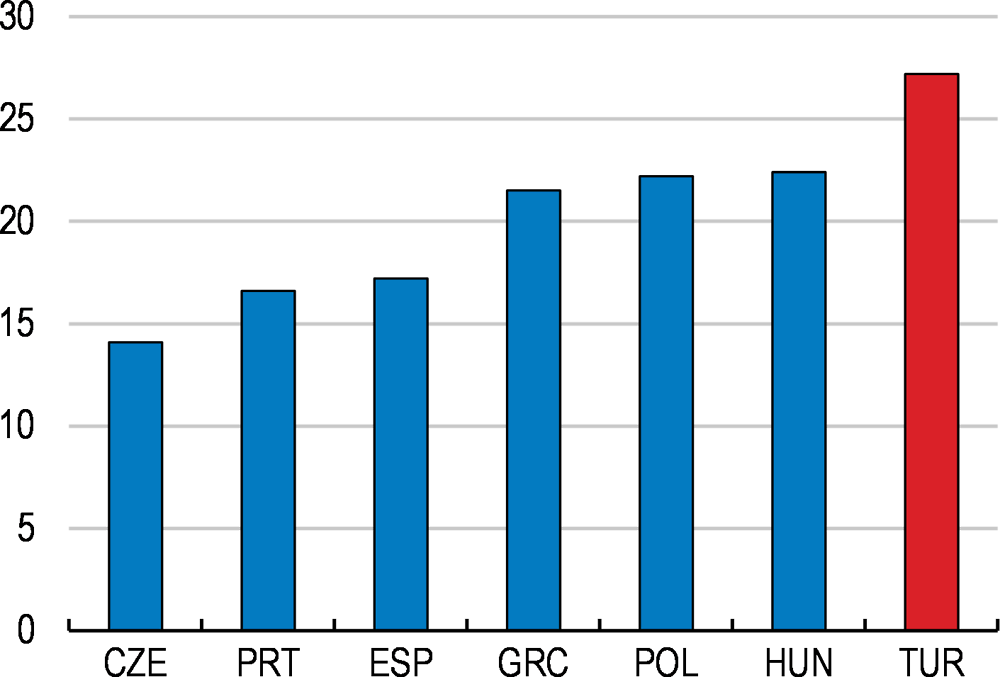

iii) Turkish firms have accumulated excessive debt over the past decade. Leverage is higher than in other catching-up countries. Evidence suggests that easier access to debt improved productive capital formation in Turkey over the past decade, but excessive leverage is now curbing additional investments. The most productive and highest-growth firms, including in the regions that are catching up, are the most leveraged, suggesting that non-debt financing alternatives would relax constraints on their growth.

While debt has steadily risen, profitability and internal saving rates have declined in many firms. Young ones, particularly R&D-intensive firms in high-technology sectors, appear to have higher needs for external funding. Given the more immaterial composition of their assets, and their already high debt levels, their future investments and development will largely depend on their access to external equity sources.

Beyond young firms, the access by profitable, but debt-constrained medium-sized family-owned firms to outside equity sources is equally crucial – and problematic. These firms are generally not fully formal and may refrain from full financial transparency and independent monitoring, perpetuating the standard information asymmetries which hinder outside equity participation. Global institutional investors and FDI firms also face risks arising from the gap between local and international governance standards. In particular, state aid transparency falls short of national legal requirements for the monitoring and control of state aid, hinting at a risk of a non-level playing field, especially between large investment projects. The fight against corruption should also be strengthened to back open competition.

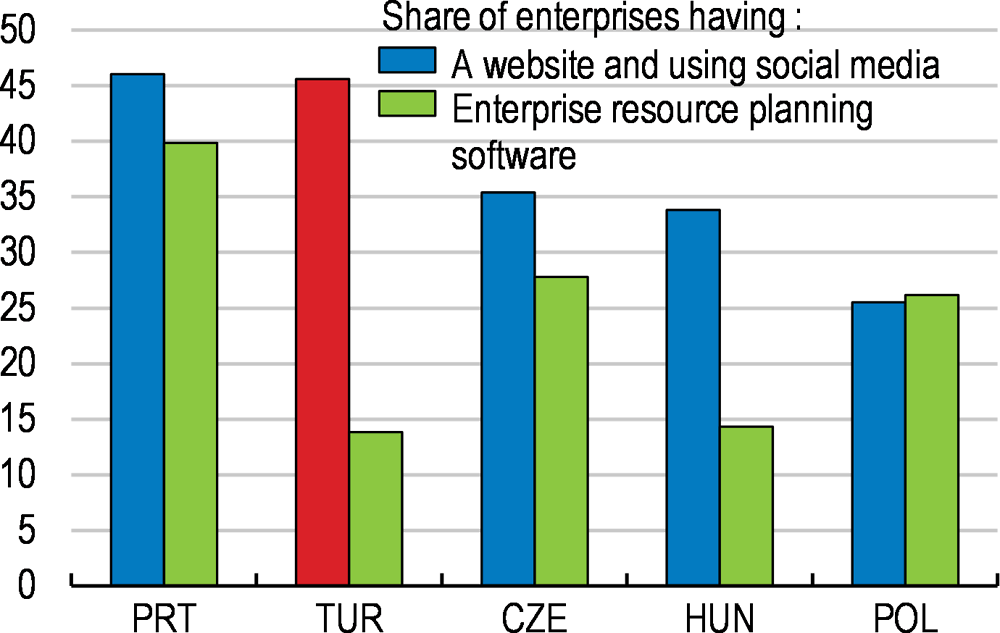

Freeing up equity participation in firms of all types, sizes and regions requires a supportive ecosystem. This includes legal and regulatory provisions, business practices and local professional expertise that Turkey largely lacks. One important component is equity-friendly corporate tax arrangements. There is also room to make public support to knowledge-based capital formation more efficient.