The recent move towards the automatic exchange of financial account information between tax administrations creates opportunities for Slovenia to revisit the way it taxes household savings. Tax rates on capital income at the individual level are not particularly high and effective tax rates on household savings vary widely across assets. Some assets, such as owner-occupied and rental immovable property and voluntary private pension savings, are taxed lightly. The capital income tax system lacks progressivity, which tends to be more common under dual income tax systems. Increasing the progressivity of the capital income tax system would require administrative reform as taxpayers would have to start declaring their capital income annually. Recurrent taxes on immovable property should also play a more significant role in the tax mix. The introduction of the new real estate tax is much-awaited as it creates opportunities to rebalance the tax mix and to reform the financing mix of local governments.

OECD Tax Policy Reviews: Slovenia 2018

Chapter 6. Strengthening the taxation of capital income at the individual level

Abstract

6.1. Slovenia faces modest opportunities to rebalance the tax mix towards higher taxes on capital income at the individual level

Slovenia has opportunities to strengthen the way it taxes capital income at the individual level. Households’ savings in Slovenia are relatively high compared with other countries. In 2016, Slovenians saved 7% of their disposable income, which was in the upper half of the distribution among OECD countries. The analysis in this chapter will show that current tax rates on savings in Slovenia are not particularly high, although effective tax rates vary significantly across asset types. Moreover, the recent move towards the automatic exchange of financial account information between tax administrations creates opportunities to revisit the way countries tax savings. For example, it will be easier to levy taxes on capital income without income and assets necessarily shifting offshore in response (OECD, 2018[1]).

The shift in revenues from taxes on labour towards capital income might be limited because of relatively low levels of capital income earned. As labour income constitutes a much larger share of total income, any shift from labour to capital income taxes will therefore be modest.

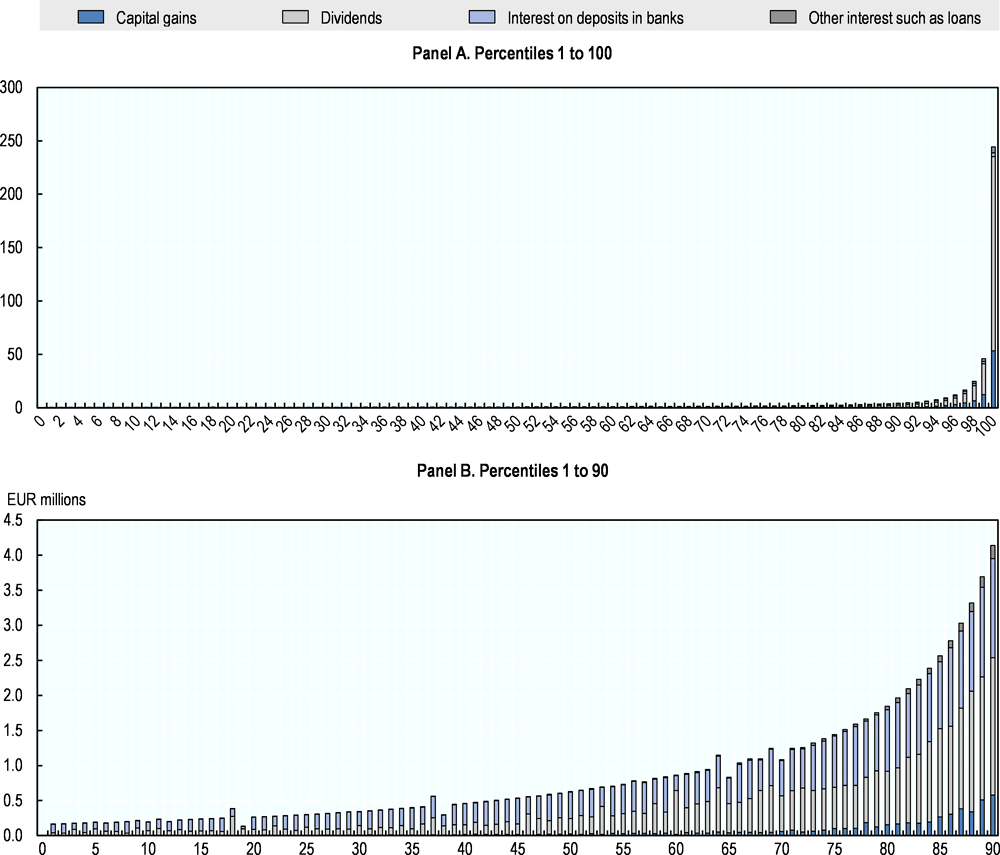

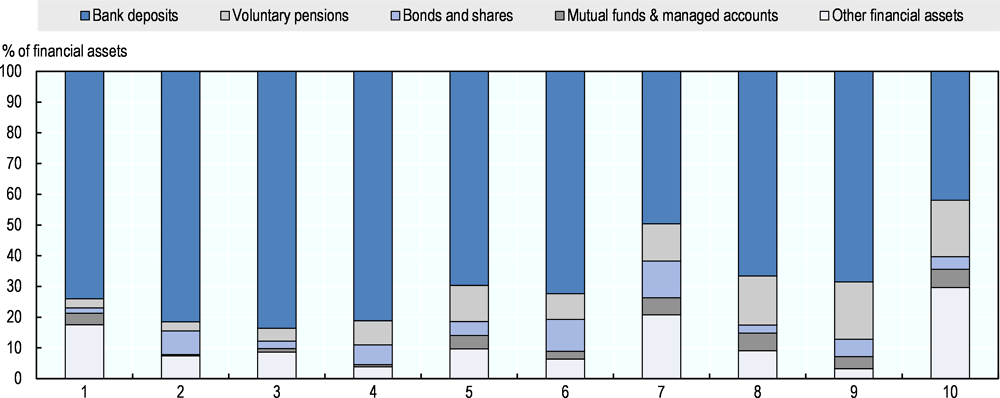

Capital income in Slovenia is highly concentrated in the top income deciles, suggesting that increasing capital income taxation at the individual level will be borne by the wealthier individuals (Figure 6.1 Panel A). For all percentiles, the vast majority of capital income is comprised of interest income from bank deposits and income dividends. At the bottom of the distribution, the composition is mostly the former while at the top it is mostly the latter. Due to the high level of concentration in the top decile, Panel B presents the capital income distribution for the first 9 deciles. It is seen that, for the first half of the distribution, interest income from bank deposits typically comprises between half and three-quarters of capital income, with most of the remainder being dividends. Income from capital gains does not start to become a significant component of capital income until after about the 85th percentile. While increasing tax rates at higher income levels may be more equitable, governments should know that increased rates may also induce some taxpayers to shift their capital income elsewhere.

Figure 6.1. Capital incomes are highly concentrated at the very top of the distribution

Note: Analysis only includes taxpayers with capital incomes of at least EUR 100. Capital income is comprised of dividends, capital gains (shares), income from interest on deposits in banks and savings banks (interest on deposit) and income from other interest such as loans and debt securities). Methodological information on the microdata is available in the annex. The total capital income decreases in some percentiles due to identical values for different taxpayers are assigned to the same percentile. Methodological information on the microdata is available in the annex.

Source: Authors’ calculations based on Ministry of Finance of Slovenia tax records microdata.

6.2. Strengthen the taxation of household savings

Capital income is primarily comprised of income from dividends. Overall, there is EUR 455 million in capital income in Slovenia and EUR 92 million is collected in personal income tax (PIT) (Table 6.1). The effective rate, defined as PIT as a percentage of income, is 20.2%.

Table 6.1. Capital income is primarily income from dividends

Capital income, by type, 2016

|

Income |

PIT |

Effective rate (%) |

|

|---|---|---|---|

|

Total capital income |

455 |

92 |

20.2% |

|

Dividends |

290 |

70 |

24.3% |

|

Capital gains |

92 |

14 |

14.7% |

|

Interest on deposits in banks |

58 |

5 |

8.0% |

|

Other Interest such as loans |

16 |

3 |

21.3% |

Note: Analysis only includes taxpayers with capital incomes of at least EUR 100. Capital income is comprised of dividends, capital gains (shares), income from interest on deposits in banks and savings banks (interest on deposit) and income from other interest such as loans and debt securities. The effective tax burden on capital is higher than presented here as the analysis does not include corporate income tax. Methodological information on the microdata is available in the annex.

Source: Authors’ calculations based on Ministry of Finance of Slovenia tax records microdata.

6.2.1. Statutory tax rates on capital income remain relatively low

Slovenia’s statutory corporate income tax (CIT) rate has increased from 17% to 19% in 2017 (see Box 1.2) but the rate remains relatively low internationally. While the CIT rate in Slovenia is equal to the rate in the Czech Republic and in Poland, it remains significantly below the average rate in the OECD (23.9% in 2018), although above the rates in other South East European economies where it ranges between 9% and 15%.

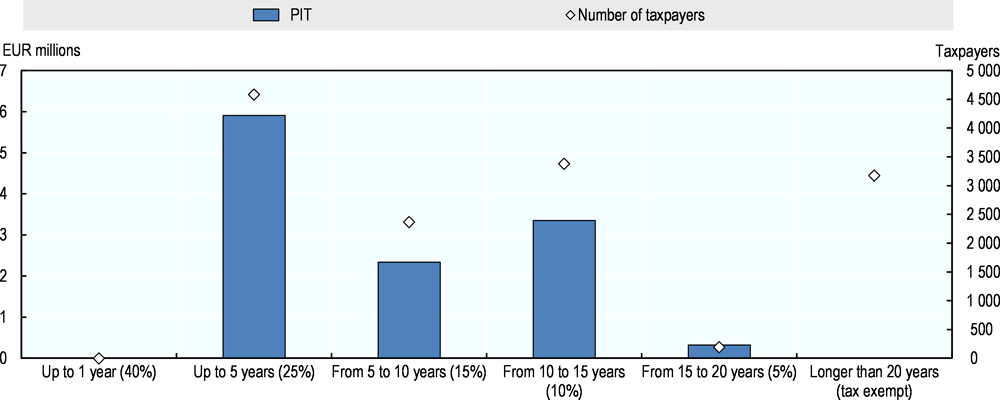

Dividends, interest and rental income are taxed at a flat final withholding tax of 25%. The first EUR 1 000 of interest from bank deposits is tax-exempt. The tax rate on realised capital gains decreases with the length of the period that the asset has been held. The capital gains tax rate is 25% for a holding period up to 5 years; 15% for a holding period from 5 to 10 years; 10% for a holding period from 10 to 15 years; 5% for a holding period from 15 to 20 years and assets that have been held for more than 20 years are tax exempt.

The effective rate on capital income is lower than the statutory tax rate (Table 6.1) due to different tax rates for capital gains depending on the holding period and the tax exemption up to EUR 1 000 for interest income on bank deposits. Increasing the rate will therefore be more effective at increasing capital income tax from dividends than from capital gains for example. About one-third of taxpayers have a capital gains tax rate of 25% indicating that gains were realised within a five year period (Figure 6.2). 23% of taxpayers paid no capital gains tax suggesting a holding period of 20 years or more.

Several other countries tax shareholder income via a final withholding system, including Austria, the Czech Republic, Italy, and Poland. Under this system, tax is withheld either by the distributing company or by the withholding agent on behalf of the individual shareholder and no further tax is payable at the shareholder level. While such a system reduces tax compliance costs for taxpayers who do not have to declare the dividend income in their annual tax return and tax administration costs, it comes at a cost in terms of tax policy design. Final withholding systems typically levy a flat tax rate instead of taxing dividends at progressive rates and/or exempting a basic amount of dividend income from tax.

Figure 6.2. About one-third of taxpayers have a capital gains tax rate of 25%

Note: Analysis only includes taxpayers with capital incomes of at least EUR 100. Holding periods are inferred through the effective tax rates that are calculated for each taxpayer in the microdata and categorised. Only tax rates with the rate categories shown are included in the analysis.

Source: Authors’ calculations based on Ministry of Finance of Slovenia tax records microdata.

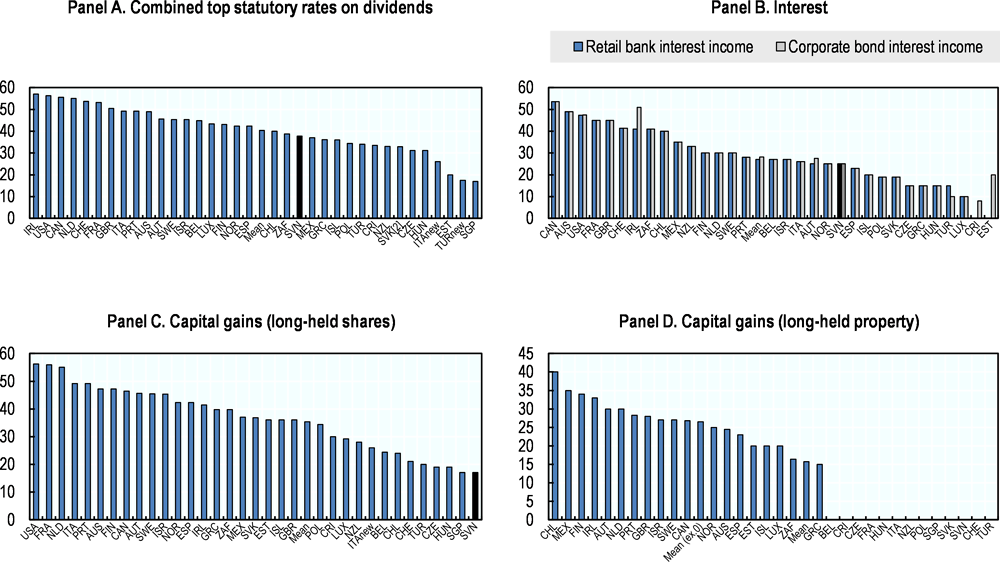

The combined “top” statutory tax rate on dividends in Slovenia is close to the OECD average. The overall tax burden on capital income consists of the tax rates levied at the corporate and individual level, and takes into account the interaction of the tax rates levied at both investor levels (if any) (Figure 6.3). The combined top statutory rate on dividends is 39.25% in 2018 (taking into account the increase in the statutory CIT rate) (Figure 6.3 Panel A). This rate is close to the average rate of 40.4% in the OECD and below the rates in Italy and Austria although above the rate in the Czech Republic and Hungary (31.2%) (Harding and Marten, 2018[2]). Combined top statutory tax rates on dividends are lower in some of the other South East Europe (SEE) economies. For instance, the rate was 10% in Bosnia and Herzegovina and Kosovo, 27.8% in Albania and Serbia, 19% in the Former Yugoslav Republic of Macedonia, and 17.2% in Montenegro.

The combined “top” tax rates on capital gains are significantly lower than the tax rate on dividends. The statutory tax rates on capital gains on assets which have been held for more than 20 years in Slovenia are particularly low (Figure 6.3 Panels C and D) because of the capital gains tax exemption; hence only the statutory CIT rate is paid. For shares which are sold earlier, the combined top tax rate on capital gains ranges between the top tax rate on dividends and the statutory CIT rate.

The statutory tax rate on interest income is also relatively low. Irrespective of the source of interest income (retail bank accounts or corporate bonds), the tax rate is 25%. This is lower than in Austria or Italy but above the rate in the Slovak Republic (19%) and the tax rate in Hungary and the Czech Republic (15%) (Harding and Marten, 2018[2]). Other SEE economies levy also very low tax rates on interest. The rate is 15% in Albania and Serbia, 10% in Kosovo and the Former Yugoslav Republic of Macedonia, 5% in Montenegro and 0% in Bosnia and Herzegovina.

The combined top statutory tax rates on capital income are significantly lower than the top tax burdens on labour income in Slovenia. As pointed out in section 4.3.2, the important tax differential between labour and capital income creates significant tax-induced incentives for businesses to incorporate.

Figure 6.3. The combined “top” statutory capital income tax rates in Slovenia are below the OECD average

Note: Combined statutory tax rates take into account both the statutory CIT rate (if applicable) and the statutory tax rates on capital income at the individual level (including final withholding tax rates, if any), as well as the interaction of both tax rates (if any). OECD calculations based on questionnaire responses. The rates presented are “top” rates meaning that they take into account the top capital income tax rates levied at the individual level. Panel A: The unweighted mean includes the tax rate on new equity in Italy and in Turkey and not the tax rates on existing equity. Panel C: The unweighted mean includes the tax rate on new equity in Italy and in Turkey and does not include the tax rates on existing equity. If the combined tax rates on existing equity were used, the unweighted average combined rate would be 36.8%. Panel D: The unweighted means does not include the capital gains tax rate for the United States, which varies under a certain number of assumptions.

Source: Harding and Marten (2018[2]).

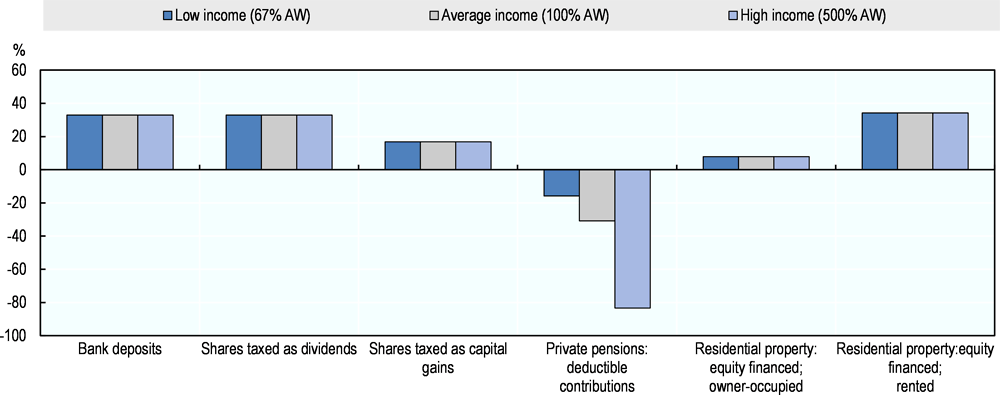

6.2.2. METRs on household savings vary widely across asset types

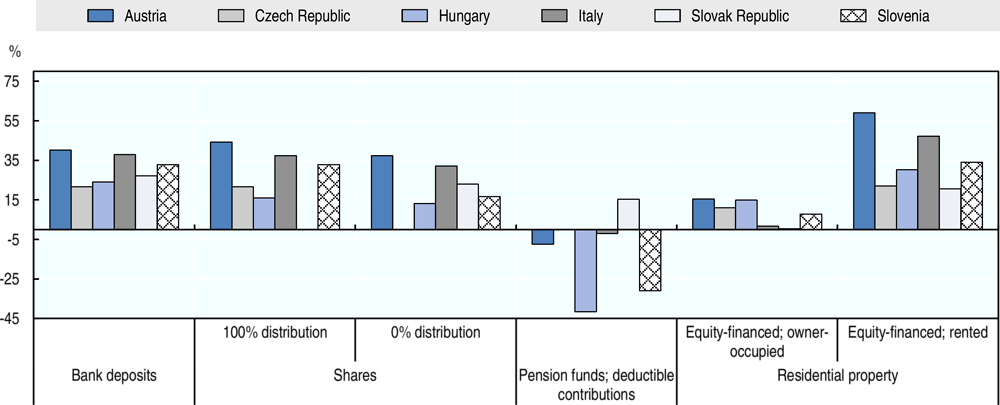

The effective tax rates on household savings in Slovenia differ from the statutory tax burdens. Figure 6.4, Figure 6.6 and Figure 6.7 present marginal effective tax rates (METRs) on a wide variety of saving vehicles. In contrast to the analysis in the previous section, these METRs only include the taxes levied on capital income at the individual level; they do not take into account the CIT. The OECD calculates METRs on household savings to assess the impact of a wide range of taxes and tax design features on the incentives to save in different assets; large differences in METRs reflect significant tax-induced incentives for households to adjust their savings portfolio in order to minimise their capital income tax liabilities. The METR calculations take into account all taxes levied on household savings, deductions and variations in the tax base, different asset holding periods and the potential build-up of untaxed or tax-deferred returns. METRs also incorporate the impact of inflation, which can impose a substantial additional tax on the return to savings.

The taxation of nominal rather than real returns increases METRs considerably. In 2016, the METR on bank deposits and dividends in Slovenia was 33% rather than the 25% withholding tax rate as a result of the taxation of the inflation component in the return that is earned. The lack of indexing of returns in Slovenia, as is the case in most OECD countries, results in METRs on savings which are increasing in the inflation rate.

Equity-financed investment in owner-occupied residential properties is taxed lightly in Slovenia. Across the OECD, investment in owner-occupied housing is taxed at low rates (Figure 6.7). The METRs on equity-financed investment in owner-occupied residential property are particular low in Slovenia, although they are even lower in Italy and in the Slovak Republic (Figure 6.4). The effective tax burden on rental properties in Slovenia is higher but remains relatively low compared to other OECD countries (Figure 6.4).

Figure 6.4. Marginal effective tax rates on savings in Slovenia are relatively low

Source: OECD (2018[1]).

Voluntary private pension savings in Slovenia are tax-favoured, especially for richer households. Many countries provide a special tax treatment to induce households to save for an additional pension. Such a strategy is often justified because of pressures on the financing of adequate pensions in the future often linked to the ageing of the population. When private pension savings are deductible (up to certain limits in most countries) from taxable personal income, the marginal effective tax rate is low or even negative as the tax gain that arises because of the upfront deduction offsets the taxes on the return on investment. Negative METRs arise when the tax rate at which pension savings can be deducted is higher than the tax rate at which the pension is eventually taxed. If the value of the upfront deduction of private pension savings increases with the taxpayer’s marginal tax rate, METRs will be lower for taxpayers with higher incomes. This is the case in Slovenia, where those on higher incomes benefit the most from the tax treatment of private pension savings (Figure 6.6).

The effective tax rates on interest income (bank deposits and bonds) exceed the rates on capital gains and other tax-favoured saving vehicles. As interest is not taxed under the CIT while the return on equity is typically taxed at both corporate and individual shareholder level, slightly higher taxes on interest at the individual level may be a way to integrate the differential tax treatment of debt and equity at the corporate level. In European Union (EU) countries including Slovenia, bank deposits are the most common form of financial asset and make up a larger share of the asset mix for those at the bottom of the income distribution (Figure 6.5). This means that higher levels of taxation of interest on bank deposits hit poorer households more as richer households typically hold a more diversified savings portfolio. Nevertheless, the overall effective tax burden on interest income (Figure 6.4 and Figure 6.6) remains relatively low in Slovenia, in particular when compared to wage earnings. Moreover, the negative distributional impact of higher taxes on interest income in Slovenia has been offset through the EUR 1 000 of interest exemption.

Figure 6.5. Bank deposits tend to make up a greater share of wealth for lower-income households in Slovenia

Source: OECD (2018[1]).

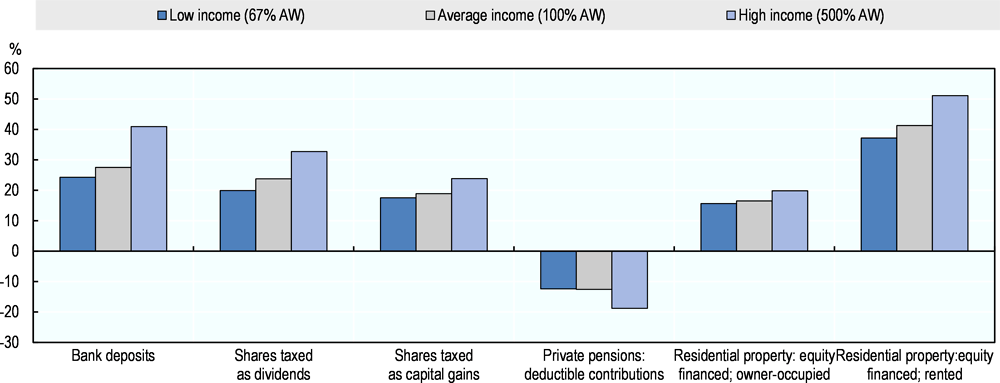

METRs do not increase with income in Slovenia. The proportional tax rate on capital income is reflected in METRs that are constant across income levels, with the exception of private pensions (Figure 6.6). Proportional tax rates are a typical characteristic of dual income tax systems which are widespread in the OECD. Some countries, however, tax capital income at the individual level at progressive rates, the effect of which is reflected in the 40-country average results presented in Figure 6.7.

Figure 6.6. The proportional rate on capital income in Slovenia results in METRs which are constant across income except for private pension savings

Source: OECD (2018[1]).

Figure 6.7. Marginal effective tax rates on household savings are increasing with income on average across the OECD

Source: OECD (2018[1]).

6.2.3. Slovenia faces different capital income tax reform options

Slovenia faces several reform options to raise more revenues from taxing capital income at the individual level while increasing the tax system’s progressivity.

As combined and effective tax rates on capital income in Slovenia are relatively low, the flat tax rate of 25% on dividends, interest, and rental income could be increased modestly. This would raise additional revenues and enhance the progressivity of the tax system as richer households typically earn more capital income. Box 6.1 presents estimates of the impact on revenues from an increase in the capital income tax rate.

While the use of a final withholding tax reduces administrative costs, it limits the tax policy design options. While withholding of taxes by third parties remains the best solution to ensure tax compliance, the tax administration should reform its administrative processes such that taxpayers can be asked to file their capital income as part of their annual tax return (as is already the case for interest income from bank deposits). This will allow Slovenia to tax capital income at progressive rates.

Slovenia could consider broadening the scope of the EUR 1 000 of exempt interest income to other types of capital income including interest on bonds and dividends. This would prevent the current tax-induced distortion against investment in businesses.

Slovenia could abolish the phasing-out of the capital gains tax with the holding period or levy a minimum capital gains tax rate for longer-held assets. While a too high tax rate on capital gains might create lock-in effects in the sense that shareholders would prefer to hold on to their shares instead of realising their gains, a similar distortion arises when the capital gains tax rate is decreasing in the asset’s holding period. A minimum capital gains tax rate would also help reducing the tax-induced incentives for self-employed businesses to incorporate and it would reduce incentives to invest in real estate over other types of investment.

In order to increase the progressivity of the tax system, Slovenia could consider moving from a (semi-) dual income tax towards a dual progressive income tax system. As is the case in many other OECD countries, Slovenia implements a (semi-) dual income tax system. Dual income tax systems tax different types of income separately at different tax rates. Capital income is typically taxed at low (and often flat) rates while labour income is taxed at higher and progressive rates (OECD, 2006[3]). Dual progressive income tax systems would maintain the separation between capital and labour income, but would tax both types of income at, albeit different, progressive rate schedules.

The social security tax base could be broadened to include capital income at the individual level. Box 6.2 presents the example of France where contributions for the social security system are not only levied on wages but on a broader tax base which includes capital income. In designing such a broad based social tax, countries need to take into account that SSCs can be challenging to implement when levied on the income of non-residents. According to a decision of the European Court of Justice in 2015, social security contributions (SSCs) cannot be levied on foreigners as they are not entitled to social security benefits in the jurisdiction where they have paid SSCs.

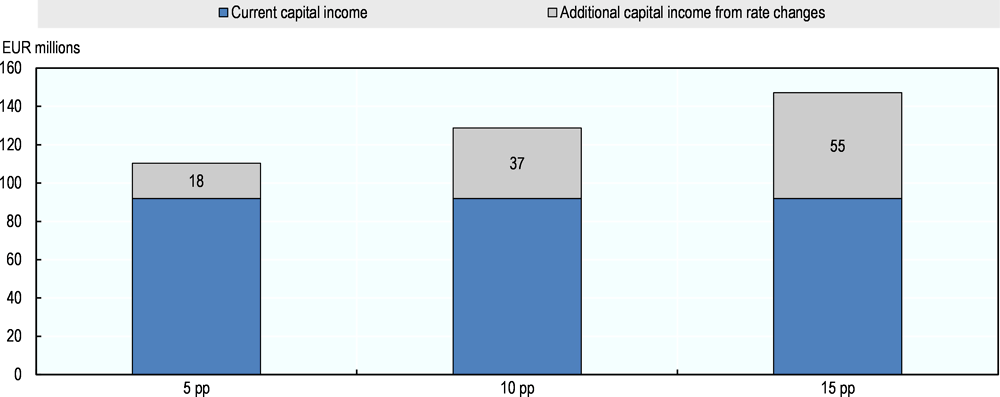

Box 6.1. Impact of an increase in the capital income tax rate

Total income from capital in 2016 is EUR 455 million and PIT is EUR 92 million, or an effective rate of 20.2%. The analysis shows that increasing the capital income tax rate by 5, 10 and 15 percentage points could cumulatively produce an additional EUR 18 million, EUR 37 million and EUR 55 million respectively (or approximately EUR 18 million for each 5 percentage points increase), assuming no behavioural changes in response to these tax rate increases (Figure 6.8).

Figure 6.8. EUR 18 million can be raised for each 5 percentage points increase of the capital income tax rate

Note: The effective rate is taken as a proportion of the statutory rate (25%), which is assumed to be constant for further rate increases. On this basis, an increase to the rate of 26% for example would only produce about four-fifths of that percentage in PIT (or an effective rate of 21.0%) or EUR 3.7 million. The estimate assumes no behavioural changes in income shifting or compliance and that linearity for higher rate increases.

Source: Authors’ calculations based on Ministry of Finance of Slovenia tax records microdata.

The tax privileges for voluntary (third pillar) private pension savings benefit richer households more. Taxpayers may deduct voluntary private pension savings from taxable personal income up to 24% of the compulsory contributions for pension and disability insurance with a maximum of EUR 2 819.09 per year (Ministry of Finance, 2018[4]). Contributions above the cap are not tax deductible (OECD, 2015[5]). On average, low incomes in Slovenia do not save very much for a tax-favoured third pillar private pension. Private pension savings constitute 16% to 19% of total financial assets in the top three income deciles while they constitute only 3% to 5% of total financial wealth in the bottom three income deciles (Figure 6.5). In light of the low public pensions and the increasing ageing related costs, Slovenia might evaluate whether the design of the tax privileges for private pension savings is effective. Possible reform options to consider include: 1) express the maximum amount of tax-deductible private pension savings in EUR rather than as a percentage of compulsory pension SSCs; 2) allow the un-used tax privilege to be carried forward over time; and 3) turn the tax allowance into a tax credit such that the value of the tax deduction is similar for low and high income earners.

The recent move towards the automatic exchange of financial account information (AEOI) between tax administrations offers an opportunity to revisit the way countries tax capital income at the individual level. AEOI will provide information to the tax administration of the capital income earned by tax residents in other jurisdictions. Evading taxes by moving assets offshore and not declaring the income in the jurisdiction where the tax payer is tax-resident is becoming increasingly difficult. AEOI therefore creates opportunities for countries to tax capital income at slightly higher rates than currently is the case and/or to shift part of the capital income tax burden from the corporate to the individual level, without running the risk that assets leave the country in response (OECD, 2018[1]). However, in order to seize the opportunities created by AEOI, the Slovenian tax administration will have to strengthen its operational framework and data analysis tools in order to be able to process the taxpayer information it will receive from other jurisdictions.

Box 6.2. Broadening the tax base to passive income for financing social security system: the case of France with the contribution sociale généralisée (CSG)

In France, the CSG was created in 1990. The CSG is the most sizeable of all the various taxes earmarked for funding social insurance. Contributions are based on all sources of household income (wages, income from financial assets and investments, pensions, unemployment benefits, disability benefits and gambling proceeds) and are withheld at source.

Revenues from the CSG went up from EUR 58 billion in 2000 to nearly EUR 84 billion in 2010, exceeding income tax revenues by nearly EUR 30 billion. The CSG now represents two-thirds of earmarked tax revenues for social insurance financing. One of the effects (and advantage) of the CSG is the diversification of sources of funding for social protection which is based on both SSCs and taxes (i.e. the CSG). The CSG has largely replaced regressive contributions based on wages and salaries with a proportional and very broad base contribution based on all sources of household income. In parallel wage-based contributions (primarily levied on employers) have progressively declined.

Contrary to its initial objectives of simplicity and transparency, the CSG has become complex. The CSG has now six different rates depending on the types and levels of income (instead of one proportional rate). In addition the CSG combines different progressivity elements whereas at the start it was designed to be strictly proportional. Finally different taxes following the same logic of the CSG (i.e. with the same tax base) have been created without being merged with the CSG (such as social contributions on capital income), thereby further increasing the complexity of the tax system.

Source: OECD (2017[6]); Cour des comptes (2011[7]).

6.3. Raise more revenues from taxes on immovable property

Slovenia should strengthen the role of immovable property taxes. Revenues from property taxes in Slovenia are currently low (0.5% of GDP in 2015) and below the EU and the OECD averages (1.1% of GDP). Slovenia faces a significant opportunity to rebalance its tax mix away from more distortive taxes towards recurrent taxes on immovable property which is considered to be the least distortive tax for economic growth. The new recurrent tax on immovable property, which is scheduled to be implemented over the coming years, creates great opportunities for Slovenia to rebalance its tax mix. Slovenia should consider levying a higher recurrent tax on second houses and holidays homes.

Significant revenues could be raised if revenues from recurrent taxes on immovable property were increased to the average level in the OECD. Estimations presented in Table 6.2 show that this would increase tax revenues with EUR 280 million (compared to 2015). Table 6.2 also presents how much additional revenues could be raised if Slovenia were to collect revenues similar to the level of the OECD’s best performers (the United Kingdom, Canada, France, or the United States), which levy between 2.5% and 3.1% of GDP in revenues from recurrent taxes on immovable property.

Table 6.2. Recurrent taxes on immovable property could raise significant additional revenues

|

% of GDP |

EUR billion |

Additional revenues raised compared to 2015 (EUR million) |

|

|---|---|---|---|

|

2015 (latest info available) |

0.5 |

0.19 |

|

|

Scenarios |

1.1* |

0.48 |

280 |

|

2.5** |

1.08 |

890 |

|

|

3.1** |

1.34 |

1 150 |

Note: Calculations are based on GDP figures from the Statistical Office of Slovenia (EUR 38.837 billion in 2015; EUR 43.278 billion in 2017, current prices). * OECD average in 2015. ** OECD best performers.

Source: OECD Revenues Statistics database.

Slovenian households hold a larger share of their total gross wealth in the form of real assets rather than in the form of financial assets (OECD, 2018[1]). The main residence is by far the largest single asset category in Slovenia. Table 6.3 describes the taxes that are levied on occupied and rental property in Slovenia. Rental income is currently taxed at a flat 25% tax rate whereas it is typically taxed at progressive rates in other countries. As part of a property tax reform, Slovenia may also want to assess whether it could tax rental income at higher and, possibly, progressive rates.

Table 6.3. Tax treatment of property at different stages

|

Owner-occupied residential property |

Rented residential property |

|

|---|---|---|

|

Acquisition |

No tax relief for mortgage interest paid. Transaction tax only |

|

|

Holding |

No capital income tax on the imputed rental income, but recurrent property tax |

Rental income is taxed at flat rate of 25% |

|

Disposal |

Tax on capital gains (recurrent property tax) phasing out with holding period |

|

Note: Capital gains derived by the disposal of immovable property purchased or otherwise obtained before January 2002 are not taxable (Article 153 of the PIT Act).

Source: OECD (2018[1]).

Distributional analysis indicates that there might be scope to increase the taxes on property rental income in Slovenia. In 2016, approximately 90 000 taxpayers earned rental income representing EUR 216 million in income and EUR 48 million in tax revenues. Table 6.4 shows a breakdown of income and tax revenues from rent for taxpayers with rental property income by rental income decile. The top 20% of taxpayers pay 80% of property rents. Due to limited deductions on property rent, the proportion of income that is taxable remains approximately stable at 90% across the income distribution. In addition, those with property have relatively high gross incomes. Even those in lower deciles have higher than the average income in the taxpayer population. For these reasons, increasing the PIT on rental property could be both effective and equitable.

Table 6.4. There is scope to increase property rental income

EUR

|

Number of taxpayers |

Mean rental income |

Total rental income |

Mean gross income |

Mean PIT |

Total PIT |

|

|---|---|---|---|---|---|---|

|

Bottom decile |

8 978 |

5 |

42 563 |

17 462 |

1 |

9 573 |

|

2 |

8 974 |

14 |

122 934 |

17 250 |

3 |

27 605 |

|

3 |

8 974 |

26 |

235 854 |

17 712 |

6 |

52 995 |

|

4 |

8 975 |

51 |

459 445 |

18 487 |

12 |

103 946 |

|

5 |

8 974 |

195 |

1 747 534 |

18 042 |

44 |

398 368 |

|

6 |

8 976 |

760 |

6 821 042 |

17 045 |

167 |

1 495 698 |

|

7 |

8 975 |

1 465 |

13 148 947 |

18 340 |

316 |

2 840 409 |

|

8 |

8 971 |

2 442 |

21 904 071 |

21 885 |

529 |

4 748 545 |

|

9 |

8 979 |

4 123 |

37 018 490 |

24 124 |

906 |

8 138 786 |

|

Top decile |

8 975 |

15 000 |

134 627 370 |

38 126 |

3 345 |

30 019 091 |

Note: Methodological information on the microdata is available in the annex.

Source: Authors’ calculations based on Ministry of Finance of Slovenia tax records microdata.

6.3.1. The revision of the recurrent property tax is on going

The 2013 Real Property Tax Act was annulled by the Constitutional Court in March 2014, two months after entering into force, and the previous legislation was reinstated. The goal of the reform was to substitute the two existing property tax systems with a unified real estate tax with a tax base linked to the market value of the property using a computer assisted mass appraisal system. The introduction of a revised version of the real estate tax which will broaden the tax base has been postponed until 2019 (European Commission, 2017[8]).

The current property tax system consists of two taxes which owners of real property have to pay: the property tax and the “charge for the use of building land” (Ministry of Finance, 2018[4]). The property tax base for premises (building, apartment, secondary houses etc.) is the value ascertained according to special criteria issued by the government and local communities. The tax rate depends on the type of property (dwellings, premises used for rest and recreation, business premises) and its value. Exemptions include buildings of less than 160 square meters; buildings used for agricultural purposes; business premises used by the owner or user for business activity; and cultural or historical monuments. In addition, a 10-year temporary exemption applies to taxpayers who own a newly constructed building or repaired or renovated buildings if the value of the buildings has increased by more than 50% as a result of the renovation. Finally, for a taxpayer with more than three family members who lives in the owner’s house, the tax decreases by 10% for the fourth and every additional family member.

The charge for the use of building land is levied on vacant and constructed building land owned by individuals or legal entities. It is set by local communities and paid on an annual basis by both individuals and companies. The tax administration collects the tax based on information provided by municipalities.

6.3.2. Slovenia should use the current property tax reform as an opportunity to rebalance how municipalities are financed

Municipalities rely heavily on PIT revenues which are shared between central and local government (see Chapter 1). Financing local governments mainly through revenues from PIT is uncommon and has disadvantages. PIT revenues are more volatile than property taxes. It results in large disparities in revenues as municipalities with a larger share of higher-income inhabitants will receive more funding. It also reduces incentives for municipalities to optimally use the recurrent tax on immovable property, which is the main tax used to finance sub-central governments across the OECD.

Raising more property taxes would give financial leeway to the general government to finance a cut in employee SSC. Additional revenues from recurrent taxes on immovable property could progressively, and partially, replace transferred PIT revenues from the general government to municipalities. As a result, more revenues from the PIT would gradually remain for the general government, which could be used to finance a decrease in employee SSC.

The new recurrent tax on immovable property should be turned into a local tax. Central government, however, should define the tax base and provides valuation guidance. Municipalities should not receive the power to provide tax exemptions. Central government might also want to set the tax rates within a minimum and maximum band to avoid a race to the bottom type of tax competition. Finally the central government could introduce a fiscal equalisation grant system to provide additional funding to municipalities that are collecting too little revenue from the new property tax. Sharing of PIT revenues with local governments should be as limited as possible to ensure that municipalities have an incentive to use the recurrent immovable property tax efficiently.

Additional revenues from the recurrent tax on immovable property would allow changing the financing mix of municipalities, away from a heavy reliance on PIT revenues. Recurrent taxes on immovable property are a more stable source of revenues than the PIT, and this is reflect in that they are the most widely used source of local financing across the world.

The formula that assigns additional tax revenues to municipalities could be lowered and adjusted to take into account the extent to which municipalities face the opportunity to collect revenues from recurrent taxes on immovable property. The higher the property values in a municipality, the greater potential for that municipality to collect revenues from recurrent taxes on immovable property and the lower the share of PIT revenues it should receive. Such a reform would strengthen the role of property taxes in Slovenia and would allow a significant reduction in the overall share of PIT revenues which are shared with municipalities – currently 54% of PIT revenues are shared – which would free-up PIT revenues which could be used to finance other priorities. In 2014, for instance, municipalities received PIT revenues equal to about 3% of GDP (Figure 1.13). Given the current revenues of 0.5% of GDP, an increase in recurrent taxes on immovable property with about 1% of GPD, would allow reducing the overall 54% sharing ratio with one-third to 36%. Raising revenues from immovable property equal to 2.5% of GDP, which is similar to the OECD best performers, would allow reducing the sharing ratio with two-thirds, to 18%. Central government should lower the PIT revenue sharing ratio from 54% to 36% once the recurrent tax on immovable property is put in place and then continue lowering the ratio gradually over time to a ratio between 30% and 18%.

6.4. Main recommendations

Box 6.3. Recommendations to improve the taxation of capital income at the individual level

Objective: Raise more revenues from taxing capital income at the individual level

Consider increasing moderately the taxes on capital income at the individual level to help finance a cut in employee SSCs

Consider moving towards a dual progressive income tax system

Tax capital income at mildly progressive rates

Broaden the scope of the interest exemption (of EUR 1 000) to other types of capital income

Strengthen the efficiency of the tax-privileges for voluntary third-pillar private pension savings

Express the ceiling in EUR rather than linking it to pension SSCs paid

Replace the deduction for private pension contributions with a tax credit

Strengthen the capital income tax administration

Strengthen IT tools in order to use information received from foreign tax administrations under the AEOI effectively

Make it compulsory for individual taxpayers to declare capital income on an annual basis (as is already the case for interest on bank deposits), but maintain the withholding of taxes at source

Objective: Revise the tax treatment of immovable property

Tax owner-occupied property at higher rates than currently is the case

Tax rental income at higher and possibly progressive tax rates

Implement the real estate tax reform as quickly as possible

Levy a higher recurrent tax on second houses and holidays homes

Objective: Reform the financing of municipalities

Turn the new recurrent tax on immovable property into a local tax

Ensure that the tax base is set by central government and ensure that local governments can value property according to central government rules

No longer allow municipalities to introduce tax exemptions and special tax provisions

Set rates within a minimum and maximum band to avoid a race to the bottom type of tax competition between municipalities

Adjust the formula that shares PIT revenues such that municipalities with higher valued properties receive less PIT revenues

Adjust the fiscal equalisation grants such that municipalities which are not able to collect sufficient revenues from recurrent taxes on immovable property are compensated

Lower the 54% PIT revenue sharing ratio to 36% once the new recurrent tax on immovable property is operational and continue lowering the ratio gradually over time

References

[7] Cour des comptes (2011), Taxes and social contributions in France and in Germany, thematic Public Report, (accessed on 09 April 2018).

[8] European Commission (2017), “Country Report Slovenia”, European Commission, Brussels.

[2] Harding, M. and M. Marten (2018), “Statutory tax rates on dividends, interest and capital gains: The debt equity bias at the personal level”, OECD Taxation Working Papers, No. 34, OECD Publishing, Paris, http://dx.doi.org/10.1787/1aa2825f-en.

[4] Ministry of Finance (2018), Taxation in Slovenia 2018, Ministry of Finance.

[3] OECD (2006), Fundamental Reform of Personal Income Tax, OECD Tax Policy Studies, No. 13, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264025783-en.

[5] OECD (2015), The tax treatment of funded private pension plans, https://www.oecd.org/daf/fin/private-pensions/tax-treatment-pension-plans-country-profiles.pdf (accessed on 03 May 2018).

[6] OECD (2017), OECD Economic Surveys: France 2017, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-fra-2017-en.

[1] OECD (2018), Taxation of Household Savings, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264289536-en.