Public-private partnerships (PPPs) are long-term contractual agreements between the government and a private sector partner. The latter typically finances and delivers public services using a capital asset (e.g. transport infrastructure, hospital), sharing the associated risks. PPPs may deliver public services both with regard to infrastructure assets (such as bridges, roads) and social assets (such as hospitals, utilities, prisons).

The private party is often responsible for the design, construction, financing, operation, management and delivery of the service for a pre-determined period of time, receiving its compensation from fixed unitary payments or tolls charged to users. An effective management and a strong institutional capacity are necessary to ensure the success of PPP projects and their fiscal sustainability in the long term. Without a comprehensive legal and regulatory framework, risk sharing, budget liabilities and renegotiations later in the process can become objects of dispute and hinder the project’s outcome. PPPs also risk being used to keep government spending and liabilities out of deficit and debt headline measures. Moreover, the long-term nature of PPPs can prove too inflexible, costly and burdensome for the changing needs of the public sector and evolving technology.

All SEA countries use PPPs. However, the institutional arrangements at the central/federal level of government are quite diverse in the region. Out of the seven SEA countries with PPP units, four created PPP units within their ministry of finance to manage the partnerships; two have a PPP unit within line ministries; and Malaysia’s PPP unit is in the Prime Minister’s Office. In comparison, while all OECD countries that responded to the survey use PPPs (26), 11 do not have PPP units. Out of the 15 OECD countries with PPP units, 12 have dedicated PPP units reporting to the ministry of finance and 8 have PPP units reporting to line ministries; some have both. Dedicated PPP units have been shown to help in the design and procurement process of PPPs and to increase effectiveness in project delivery.

Absolute and relative value for money assessments are commonly carried out by SEA countries. Absolute value for money tests determine whether a project provides overall value for money for society. In turn, relative assessments compare different forms of procurement and establish which is most efficient. The assessments judge in particular whether PPPs or traditional infrastructure procurement (TIP) projects are the most efficient form of delivery.

Half of SEA countries perform relative assessments for all PPPs (public sector comparators) to evaluate whether PPPs are more efficient than TIPs, while Myanmar and Singapore only do so for projects above a certain threshold. Absolute value for money assessments for TIPs and PPPs are also common in the SEA region (70% of SEA countries undertake them for all projects). All the OECD countries in the SEA region that responded to the survey use relative and absolute assessments for all projects, or at least for projects above a certain monetary threshold.

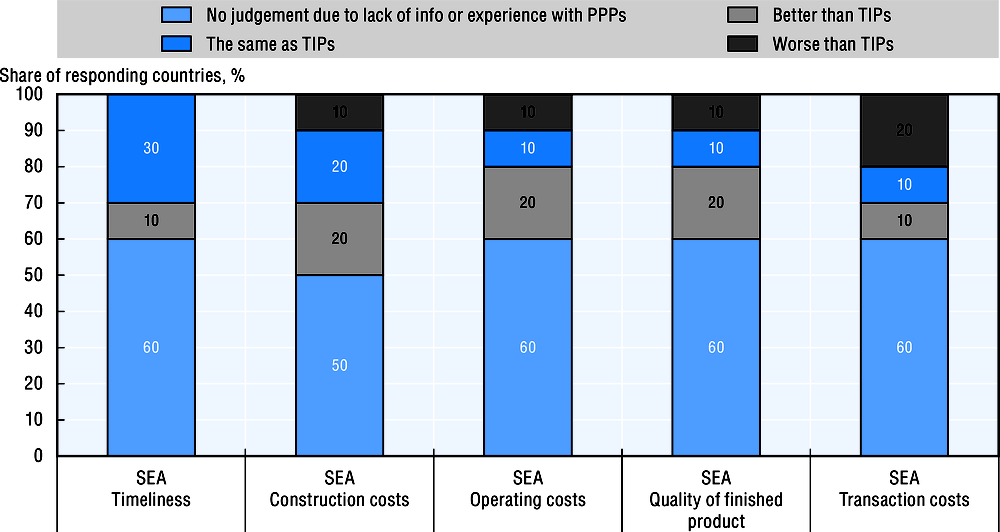

Results suggest that few SEA countries perceive PPPs to perform better than TIPs. However, most SEA countries reported that it is hard to make a judgment due to the lack of data or expertise. Further analyses and assessments are needed for informed decision making and hence to improve PPP implementation.