Debt is incurred when governments spend more than they receive. Debt represents governments’ outstanding liabilities resulting from the need to finance deficits by borrowing. While debt is not negative per se, high levels could threaten the sustainability of public finances, sending negative signals to lenders and private investors. The size of public debt can be influenced by factors such as the exchange rate (e.g. depending on the currency in which the debt is issued) and interest rate fluctuations.

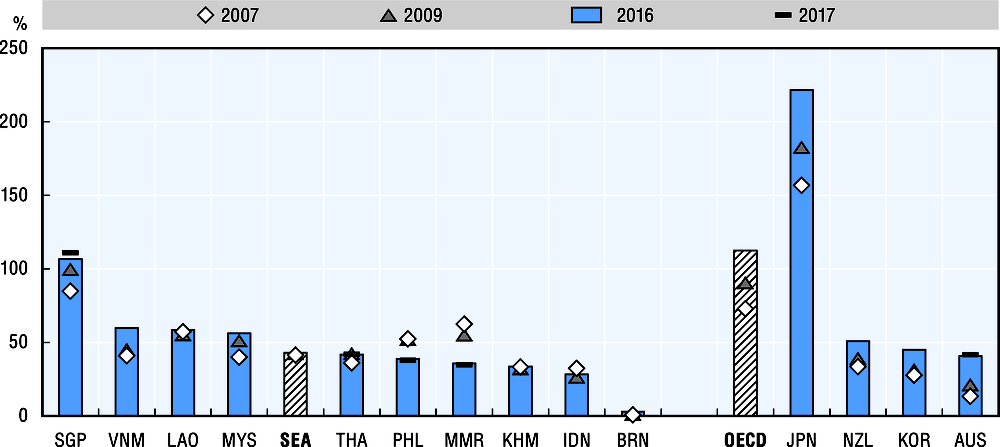

Average government debt in SEA countries was 43.1% of GDP in 2016, much lower than the OECD average (112.5%) but, except Japan (221.5%), similar to debt levels in New Zealand (51%), Korea (45%) and Australia (41%). Of SEA countries, Singapore (106.8%), Viet Nam (59.8%) and Lao PDR (58.5%) have the highest levels of government debt as a share of GDP. Debt levels were lowest in Cambodia (33.7%), Indonesia (28.3%) and Brunei Darussalam (0.7%). While Singapore’s debt is relatively high, like Japan’s it is exclusively internal debt. By law, money raised through debt instruments cannot be used for current expenditures and must be invested. Thus a growing set of public assets backs Singaporean debt. Brunei Darussalam has low debt levels as it relies heavily on its oil and gas reserves to fund public spending.

While OECD average debt as a share of GDP grew by 39.7 p.p. in 2007-16, in SEA countries it remained fairly stable, increasing by only 1.79 p.p. Debt grew the most in Singapore (22.1 p.p.) and Viet Nam (18.9 p.p.). In Viet Nam, despite increased revenue collection, strong spending has pushed deficits above the 3.5% upper target and may challenge government capacity to maintain its self-imposed statutory debt ceiling of 65% (IMF, 2017). In contrast, Myanmar (26.7 p.p.) and the Philippines (13.4 p.p.) reduced public debt levels in 2007-16. Keeping debt sustainable is crucial for these countries. Myanmar recently passed a public debt law and is progressing towards a medium-term expenditure framework, while the Philippines plan further consolidation efforts.

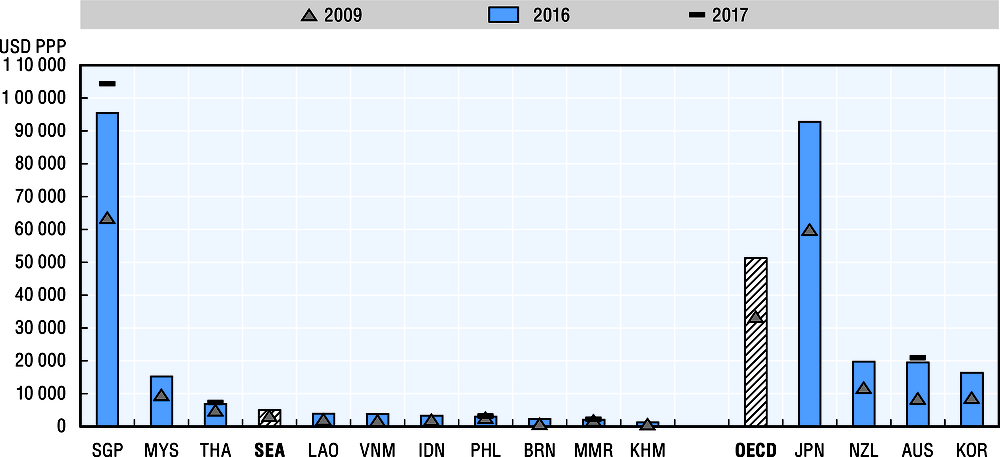

Gross debt per capita in SEA countries reached on average USD 5 018 PPP in 2016, increasing at an annual rate of 4.1% since 2007 in terms of real debt per capita, slower than OECD countries (5.5%). At USD 105 365 PPP in 2017, Singapore has the highest levels of per capita debt. The pace of debt growth varies widely in SEA countries, from an annual growth rate of 16.3% in Brunei Darussalam to reduction of 0.9% in Myanmar during 2007-16. Debt in Brunei Darussalam has grown relatively quickly, but started close to zero, so the sustainability of public finances is not under strain.