This chapter provides an overview of taxation in agriculture comparing general systems and special tax provisions for agriculture among 35 OECD countries and emerging economies. This cross-country comparison covers a wide range of tax areas: on income, profits and capital gains; on corporate income; on property; on goods and services and fuels; environmental taxes; and on incentives for research and development and innovation.

Taxation in Agriculture

Chapter 2. Cross country comparison of taxation in agriculture

Abstract

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

2.1. General observations

The typology of concessions from the OECD 2005 report (OECD, 2005[1]) was used to structure this section, which offers comparative analysis between countries. Comparisons of tax provisions for agriculture are qualitative only and all the information is based on that provided by countries and contained in the country notes. Comparison of general tax rates come from the OECD tax database.

Where it has been provided, tax expenditure information is included, in particular to highlight the significant value of fuel tax concessions to the sector. Data on tax concessions included in the OECD database on agricultural support indicators (PSE database) have been included for the analysis of the fuel tax concessions.

As noted in the literature review there is limited transparency concerning the estimated costs of the differential tax treatment of agriculture in terms of revenue foregone. In many instances there is no information available to be able to quantify measures and make comparisons between countries.

Lack of transparency of tax expenditure generally remains an issue. Countries that provided information on revenue foregone from tax measures for this study were Australia, Belgium, France, Germany, Ireland, Korea, and the United States.

This is consistent with findings from Redonda and Neubig (2018[85]) who compared the tax expenditure reporting of 43 developed G20 and OECD countries against good practice criteria. From their analysis, the following nine countries are assessed as having comprehensive and publicly available tax expenditure reports: Australia, Austria, Canada, France, Germany, Italy, Korea, the Netherlands, and Sweden.

2.2. Agricultural tax policy changes since the early 2000s

For many countries tax measures that target agriculture remain largely unchanged, for example in Australia, Canada, New Zealand, and the United Kingdom. It should be noted, however, that observations are limited to tax measures that target agriculture rather than tax reforms that countries have carried out more generally.

New or enhanced tax concessions for farmers have been enacted in some countries. For instance, as a result of its agri-taxation review undertaken in 2014, Ireland’s use of the tax mechanism has been boosted with many measures having been implemented or enhanced in 2015. Tax measures are being used to deliver policy objectives including to increase the productive use of land, assist with farm succession, increase investment, encourage the entry of young farmers to the sector, and to respond to income violability.

Reforms to the Mexican Tax Law in 2014 saw Mexico establish its Agriculture, Forestry and Fisheries Regime (AGAPE) offering tax exemptions and reduced rates to taxpayers engaged in the sector. Before that, farmers were included in a so-called Simplified Tax Regime for small taxpayers.

As a result of major reforms initiated in 2015, France has changed how taxable income of farmers is treated. It has replaced the estimation method of calculating taxable income (régime forfait collectif) with the micro-BA scheme in 2017. Farmers with average turnover of less than EUR 82 800 (USD 97 700) can reduce their taxable incomes by 87% for tax purposes. Although similar to schemes applying to other sectors, farmers have a higher rate of abatement, i.e. 87% as opposed to 72% and 34% for other businesses.

In Italy, tax reforms implemented in the last ten years have further lowered farm taxation compared with other sectors. In particular, the Stability Law 2016 exempts farmers from having to pay the regional tax on economic activities (IRAP) and the municipal tax on land property (IMU).

Other countries have removed special tax treatments previously available for the agricultural sector. As part of a wider reform of its tax system, in 2004 the Slovak Republic ended all the tax treatments for farmers so that now there are virtually no specific tax exemptions. From 2009 onwards, farmers in Lithuania have been required to pay personal income tax, which previously was not the case.

Greece has made changes to the way it taxes personal and corporation income from the agricultural sector. Up until 2013, personal income from farming was assessed using an estimation method, afterwards income was calculated like other business income but was taxed at a flat rate of 13% and since 2015 farm income faces the same progressive tax rates as other sectors. Additionally, income derived from agricultural co-operatives and producer groups was exempt from corporate income tax until 2012, then in tax year 2013 income from these entities was taxed at 26%, and since 2014 a reduced corporate tax rate of 13% applies (compared with the usual rate of 28%).

In terms of taxes on inputs, the Slovak Republic removed its tax rebates on fuel for agriculture in 2011, with Austria and the Netherlands taking this approach in 2013 (although the latter maintains a reduced energy tax rate for gas used for heating greenhouses).

In some countries, tax rates for agriculture may have changed to reflect the changes in general tax rates, but further investigation is needed. Prompted by the administrative ease of online tax filing, since the beginning of 2018 farmers in the Netherlands are now subject to the usual VAT rules.

To encourage farm transfers Norway changed how it taxes capital gains on farmland sold to people outside of the immediate family in 2016. This is now taxed at the standard rate of 22%. Prior to this, the combined capital gains taxes were up to 50%, seriously disincentivising the turnover of farmland.

Given the variability of farm income, countries have added tax measures for income smoothing. In 2019, both Austria and Belgium have implemented new carry back schemes to reduce farm income volatility. In 2019, France replaced two programmes, the deduction for unforeseen circumstances (la déduction pour aléas) (DPA) and tax deductions for investment (DPI) schemes, with an annual tax deduction for precautionary savings (déduction pour épargne de précaution) (DEP).

Implemented in 2018, the United States’ Tax Cuts and Jobs Act (TCJA) 2017 has made extensive changes to the federal income tax system. As highlighted in the literature review in Section 2, according to research by Williamson and Bawa (2018[8]), the biggest impact for farmers from the TCJA comes from the reduced marginal income tax rates reducing their effective income tax rate.

Several countries have put in place carbon or energy taxes to price CO2 emissions (Canada, the Netherlands, Switzerland, and the United Kingdom). Counter intuitively in some cases, these same countries retain discounted excise taxes on fuels used for agriculture.

In some countries (Netherlands and Sweden), nutrient taxes were eliminated because cost-effectiveness was deemed insufficient. Similarly, the Netherlands abolished a groundwater tax at the end of 2011 (Section 2).

2.3. Overview of special tax provisions for agriculture by countries

From Table 2.1 below it is evident that all countries offer differential tax treatment for their agricultural sectors under their tax regimes. The following sections outline and discuss these tax measures in more detail.

Based on typology of concessions from the OECD 2005 report (OECD, 2005[1]) and the order of questions from the initial questionnaire the following kinds of differential tax treatments will be covered in the ensuing pages:

Preferential treatment in taxes on income, profits and capital gains

Ability to use cash accounting rather than accrual methods

Simplified accounting with taxable incomes calculated on the basis of standard or notional income and expenses

Taxes levied on income from real estate instead of actual farm activities

Tax exemptions

Special allowances

Tax exemptions for small or low-income farmers

Tax exemptions for subsidies

Tax exemptions for income from particular products

Tax exemptions for income from particular regions

Tax exemptions for income from young farmers’ activities

Tax exemptions averaging, income smoothing, deferrals and income offsetting schemes

Valuation of livestock for tax purposes

Special treatment of capital consumption estimation (depreciation) in calculating income, in particular accelerated rates or write-off

Capital gains exemptions

Preferential treatment in taxes on corporate income

Preferential treatment in taxes on property

Exemptions from paying land taxes

Valuation of land for tax purposes that is lower than its market value

Discounted tax rates for property taxes

Discounts on land taxes to discourage land abandonment and encourage farming practices

Exemptions from paying local or regional business taxes

Transfer/acquisition and stamp duty concessions

Inheritance and gift tax concessions

Preferential treatment in taxes on goods and services and fuels

Environmental taxes and related concessions in agriculture

Tax incentives for R&D and innovation and the uptake by the agricultural sector

Table 2.1. Overview of special tax provisions for agriculture by countries

|

Income taxation |

Property taxation |

Tax on goods and services |

Environ-mental taxes |

Tax incentives for R&D and innovation |

Social security measures |

Other taxes |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

PIT |

CGT |

CIT |

Property and land tax |

Transfers Acquisitions and Stamp Duties |

Inheritance and gift taxes |

Outputs |

Inputs |

Fuel |

All sectors |

|||

|

Australia |

X |

X |

X |

X |

X |

X |

|||||||

|

Austria |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||

|

Belgium |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||

|

Canada |

X |

X |

X |

X |

X |

X |

X |

X |

|||||

|

Chile |

X |

X |

X |

||||||||||

|

Colombia |

X |

X |

X |

X |

X |

X |

X |

X |

|||||

|

Costa Rica |

X |

X |

X |

X |

|||||||||

|

Croatia |

X |

X |

X |

X |

X |

X |

|||||||

|

Czech Republic |

X |

X |

X |

X |

X |

X |

X |

X |

|||||

|

Denmark |

X |

X |

X |

X |

|||||||||

|

Estonia |

X |

X |

X |

X |

|||||||||

|

Finland |

X |

X |

X |

X |

X |

X |

X |

X |

|||||

|

France |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||

|

Germany |

X |

X |

X |

X |

X |

||||||||

|

Greece |

X |

X |

X |

X |

X |

X |

X |

||||||

|

Hungary |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||

|

Ireland |

X |

X |

X |

X |

X |

X |

X |

X |

|||||

|

Israel |

X |

X |

X |

X |

|||||||||

|

Italy |

X |

X |

X |

X |

X |

X |

X |

X |

|||||

|

Japan |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||

|

Korea |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||

|

Latvia |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||

|

Lithuania |

X |

X |

X |

X |

X |

X |

X |

||||||

|

Mexico |

X |

X |

X |

X |

X |

X |

|||||||

|

Netherlands |

X |

X |

X |

X |

X |

X |

X |

X |

|||||

|

New Zealand |

X |

X |

X |

X |

|||||||||

|

Norway |

X |

X |

X |

X |

X |

X |

|||||||

|

Poland |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|||

|

Slovak Republic |

X |

X |

X |

||||||||||

|

Slovenia |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|||

|

Spain |

X |

X |

X |

X |

X |

X |

X |

X |

X |

||||

|

Sweden |

X |

X |

X |

X |

X |

X |

|||||||

|

Switzerland |

X |

X |

X |

X |

X |

X |

|||||||

|

United Kingdom |

X |

X |

X |

X |

X |

X |

|||||||

|

United States |

X |

X |

X |

X |

X |

X |

X |

X |

|||||

Note: * indicates presence of a tax/preferential treatment; NA – no information available. PIT: Personal Income Tax; CGT: Capital Gains Tax; CIT: Corporate Income Tax.

Source: Country responses to the OECD questionnaire on taxation in agriculture.

2.4. Taxes on income, profits and capital gains, and related concessions in agriculture

The most common business structure in the agricultural sector is an owner-operator family farm (unincorporated business) which is subject to personal income taxation.

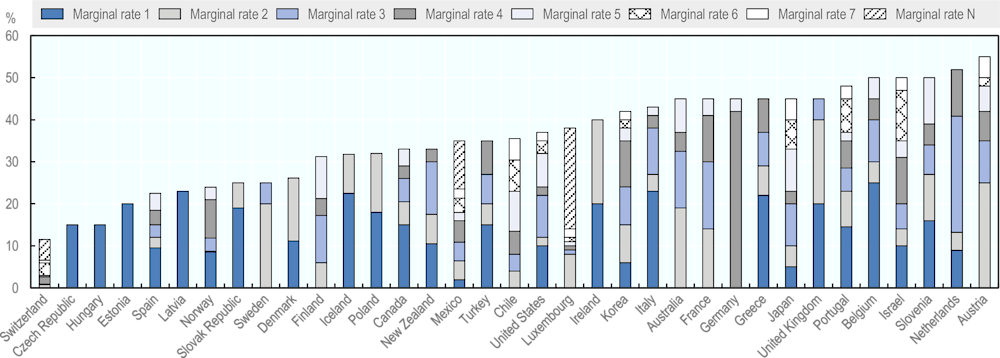

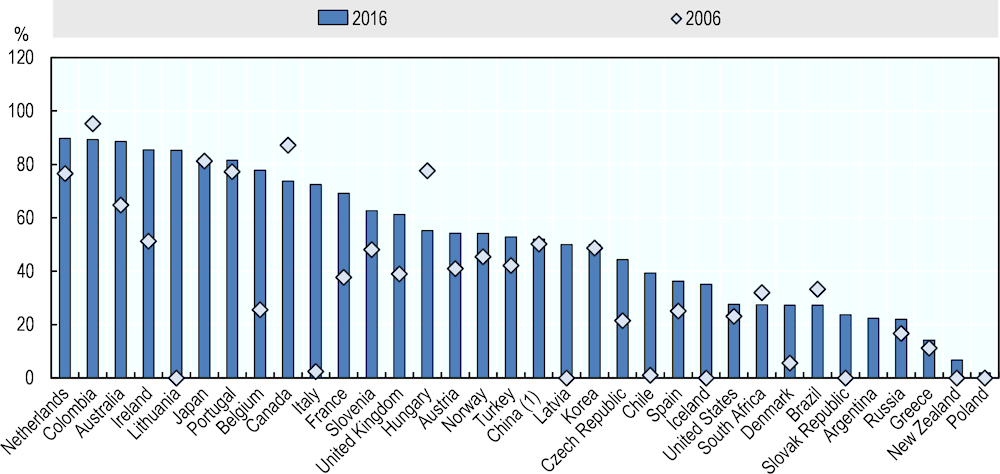

General tax rates from the central government on personal income vary by country, income level and number of marginal tax rates (Figure 2.1). For example, among countries with low marginal taxation rates (below 15%), Switzerland and Luxembourg have multiple rates, while the Czech Republic, Estonia, Hungary and Latvia have a unique rate, whatever the income level. Similarly among countries with a higher upper tax rate, Germany only has two rates, and the United Kingdom and the Netherlands have three, while Israel and Austria have seven rates. One might expect agricultural tax concessions to be associated to high general rates (and vice versa), but the evidence suggests that this is not necessarily the case. For example, Switzerland does not offer tax concessions to farmers because general tax rates are very low. At the same time, Czech farmers benefit from income tax concessions in spite of low income tax rates. At the opposite end of the scale, Dutch farmers pay the general tax rate, which is relatively high and do not benefit from personal income tax concessions.

Figure 2.1. Central government personal income tax rates, 2018

Note: See thresholds for marginal rates in Table A B.1.

Source: OECD (2019), OECD Tax Database, http://www.oecd.org/tax/tax-policy/tax-database.htm (extracted April 2019).

To enable cross-country comparisons, the main forms of concessions for farmer’s personal income taxation are discussed in the subsections below and summarised in Table 2.2. It is evident from the comparison of Table 2.2 and Table 2.3 that tax concessions are more frequent under personal income tax regimes (only two countries report no preferential treatment) than under corporate income tax regimes (18 of the 35 countries report no preferential treatment). While these concessions generally reduce the tax base and thus payment of farm households, some aim to alleviate specific issues, such as reducing income variability, compensating for higher costs in certain regions or for young farmers, reducing the administrative burden for small farms by allowing cash accounting, and exempting (part of) capital gains to facilitate farm transfers. However, as noted in OECD (2005[1]), low income problems could be more effectively addressed using the general tax and social security system. This would require that all of a household’s actual income is known, but due to sector specific exemptions many farmers fall outside of the tax system altogether. Furthermore it is generally observed that households supplement farm income with income from other sources. This is another argument for actual income from all activities being registered via the tax system.

Table 2.2. Personal income taxes: Concessions for agriculture

|

Special system and concessions |

Capital gains tax |

|

|---|---|---|

|

Australia |

- Income averaging system for primary producers - Farm Management Deposit Scheme (income stabilisation tool) - Deferral of profit from early sale of double wool clips - Deferral or spreading of income from the forced disposal or death of livestock - Spreading insurance recoveries for loss, timber or livestock - Income tax exemption on payments from Sustainable Rural Water Use and Infrastructure Programme - Valuation of livestock from natural increase - Deductions for various activities (e.g. accelerated depreciation for water management costs, accelerated depreciation for fencing and fodder storage). |

- No preferential treatment |

|

Austria |

- Liability is based on assessed value of farm (capitalised value) rather than market value for tax - An assessed value of below EUR 75 000, taxable income is 42% of the assessed value (full flat rate) - An assessed value of between EUR 75 000 and EUR 130 000, farmers can reduce 70% (80% in the case of livestock farm) from their taxable income as expenses (partial flat rate) - Small producers can use cash accounting |

- Capital gains from farmland sale are subject to a special tax rate of 30% |

|

Belgium |

- 80% of farmers calculate profits on the basis of sector average per unit valuation - EU direct support payments are taxed at 12.5% and 16.5% for other EU support measures - Capital and interest subsidies are tax exempt - Carry back to off-set losses against profits made in the three preceding years |

|

|

Canada |

- Cash accounting - One tax instalment per year (not four) - Deduct 50% of farm business losses against income (when farming main source of income) - Carry forward 20 years and back 3 years restricted losses (when farming is not the main source of personal income and the farm generates a loss) - Income smoothing for cash basis farmers adding inventory to income in years of loss - Deduction of certain types of capital expenditures - Deferred Cash Purchase Tickets as a form of payment delaying the payment until after the end of the tax year - Deferral of Income Received from Destruction of Livestock - Tax Deferral for Drought or Flood Induced Sales of Breeding Livestock |

- Lifetime Capital Gains Deduction of CAD 866 912 (2019). When the farm is being transferred to a direct descendant the exemption is CAD 1 million (CAD 2 million if both the farmer and their spouse qualify) - Tax deferrals on the transfer of farm to direct descendants - Claim a capital gains reserve over a 10-year period (5-year period if the transfer is to persons other than a child) to average capitals gains. A minimum of 10% (20%) of the taxable portion of the gain must be bought into income each year. - Part of restricted farm losses can be used to offset capital gains from selling up farms |

|

Chile |

- Low-income farmers (miners and transporters) pay taxes on a presumed income |

- No preferential treatment |

|

Colombia |

- Special calculation to determine taxable income - Exemptions for income derived from sale of energy generated from wind, biomass and agricultural residues - Preferential tax rate for new perennial crops cultivated before 2014 - Investments in agricultural companies listed on the stock market can be deducted as a tax credit - Tax relief for new businesses established in one of the Zones Most Affected by Conflict - Exemption of subsidies paid to farmers as part of the Rural Capitalisation Incentive (ICR) - Income derived from investments of over USD 260 000 is exempt from income tax for 10 years |

- No preferential treatment |

|

Costa Rica |

- Organic producers are exempt from import taxes on equipment, machinery and inputs used in different stages of production and import taxes on work vehicles |

- No preferential treatment |

|

Croatia |

- Farmers with income below HRK 300 000 may be taxed on a flat-rate basis - Small farmers with income below HRK 80 500 are exempt from income tax - Farmers in less favoured areas may benefit from tax exemptions |

- No preferential treatment |

|

Czech Republic |

- Self-employed farmers can deduct a flat rate of 80% of income as expenses (provision not exclusive to farmers but the maximum amount for farmers is greater than other self-employed) |

- Tax relief granted on gains when farmland is transferred between close relatives when a farmer retires |

|

Denmark |

- No preferential treatment |

- No preferential treatment |

|

Estonia |

- A sole proprietor farmer can deduct up to EUR 2 877 from the income received from selling self-produced unprocessed agricultural products |

- No preferential treatment |

|

Finland |

- No preferential treatment |

- No preferential treatment |

|

France |

- Cash accounting for farmers with 2-year average turnover below EUR 350 000 - Income smoothing using the micro-BA scheme for farmers with 3-year average turnover below EUR 82 800. Taxable income is equal to the three-year average of revenues for the tax year and the two previous years minus a flat rate 87% deduction for expenses - An annual tax deduction for precautionary savings (déduction pour épargne de précaution) (DEP) scheme whereby farmers make tax deductions with at least 50% to 100% of the income deducted needs to be saved and should be used within ten years on all business expenses at which point they become taxable. - Income smoothing measures - Young farmers farming under settlement aids are allowed to reduce their taxable agricultural income for their first five consecutive years - Accounting for livestock inventories until the sale of these goods - Spreading tax over five years |

|

|

Germany |

- Small scale farmers with less than 20 hectares estimate taxable income using flat rate method - Gross income below EUR 30 700 for single (EUR 61 400 for married) special tax income allowance deducted from annual taxable income (EUR 900 for single farmers and EUR 1 800 for married farmers) - Income smoothing |

- No preferential treatment |

|

Greece |

- Investment subsidies and other subsidies under Pillar I are not taxed - Profit includes only amounts of the direct aid subsidies under Pillar I of the Common Agricultural Policy of the European Union as follows: basic aid and the sum of green payments and coupled aid exceeding EUR 12 000 |

|

|

Hungary |

- Special tax regimes for small-scale agricultural producers (89% of all farmers) and for the agricultural smallholders (a subset within the small-scale category (accounting for 97% of the category) with an income less than HUF 8 million - Income from leasing agricultural land is tax exempt if the lease is for 5 years or more |

- Tax exempt up to HUF 200 000 on capital gains conditional on the farm being sold to a registered farmer who will farm the land for at least 5 years or to an employee who will lease the land for at least 10 years |

|

Ireland |

- Income averaging system for primary producers - Capital allowances for certain expenditure - Capital allowance for farm buildings and other works - Stock relief of 25% for general stock relief, 100% for certain young trained farmers, 50% for registered farm partnerships, relief for stock transfer due to discontinued farming - Deferral or spreading of income from the forced disposal or death of livestock and 100% stock relief during the deferral period - Annual tax credits for Succession Farm Partnerships Scheme |

- Retirement relief from CGT - Retirement relief from CGT – parent to child transfers Retirement relief from CGT – transfers to other than a child Capital Gains Tax Relief on Farm Restructuring Capital Gains Tax Relief for Transfer of a Site from Parent to Child Capital Gain |

|

Israel |

- Accelerated depreciation for equipment and buildings - Reduced tax rate for five years on dividends from an agricultural enterprise (20% instead of 25% or 30%) - Reduced personal income tax (top bracket subject to a tax rate of 30% instead of 47%) - Foreign resident experts invited to render services to an agricultural enterprise are subject to reduced tax rate |

- No preferential treatment |

|

Italy |

- Income from agriculture and forestry is defined as income from real estate properties and determined on a cadastral basis and not actual yields or income generated. Yields in the land register are estimated as average values of land and buildings and are very low. |

|

|

Japan |

- Full deduction of salaries and compensation for all self-employed, including farm workers - Farmers can defer the loss of farm income for three years - Farmers receiving crop income stabilisation direct payments can accumulate payments and deduct them from farm income provided that payments are used for farm expansion - Farmers can defer losses of agricultural assets due to natural disaster for three years following the incident |

- Concessions given to encourage agricultural land transfers - Capital gains on land transferred to consolidate farmland are eligible for a special tax deduction of JPY 8 million |

|

Korea |

- Income from grains and other food crops are exempt from taxation - Income from plant cultivation is tax exempt if the revenue is less than KRW 1 billion - Dividends from agricultural enterprises generating income from crops for human consumption are fully or partially exempt from personal income tax with the remaining dividends taxed separately from other types of income |

- Farmers selling land near where they live or land that they have been farming for more than eight years are exempt from paying capital gains tax |

|

Latvia |

- Small farmers with income below EUR 3 000 are exempt from income tax - State aid and EU support for agriculture and rural development are exempt from income tax |

- Sale of agricultural land to be continued to be farmed is exempt from capital gains tax |

|

Lithuania |

- Sales of less than EUR 45 000 are tax exempt - Direct and otherwise agricultural subsidy payments are not subject to income tax |

- No preferential treatment |

|

Mexico |

- Special tax treatment of agricultural activities under the “Agricultural, Forestry, and Fisheries Regime” (AGAPE) resulting in tax exemptions and reduced tax rates |

- No preferential treatment |

|

Netherlands |

- Subsidy payments for specific woodland and nature programmes are exempt from income tax |

- Capital gains on land are free from tax under certain conditions |

|

New Zealand |

- Income equalisation scheme (applicable also to forestry and fisheries) - Land improvements for farming can be deducted in full immediately from taxable income, rather than treated as capital and amortised over time - Costs associated with planting or maintaining trees for erosion on farms can be immediately deducted from income tax. - Farmers can claim a tax deduction of a maximum of NZD 7 500 for planting trees - Tax deductions for expenditure on farming, horticultural, aquacultural and forestry improvements are calculated using a deduction percentage multiplied by the diminished value - Various tax relief assistance measures for farmers experiencing adverse climatic events and natural disasters - Deductibility of expenses associated with farmhouses based on the extent to which they are incurred in the running of the farming business - Two methods for valuing livestock - the natural standard cost scheme or the herd scheme |

- No preferential treatment (there are no capital gains taxes) |

|

Norway |

- Farmers with an income from agriculture up to NOK 90 000 can deduct 100% of this from their taxable income. Income above NOK 90 000 can be reduced by 38% until tax deductions reach a maximum of NOK 190 000 (at an income level of NOK 353 000). Incomes over NOK 353 000 can deduct up to NOK 190 000 from general income giving a maximum tax saving of NOK 42 000 (approximately USD 4 580) per farmer. - Deduct the expense of breaking in new land - The total cost of buildings constructed using investment subsidies in less favoured areas is the basis for depreciation (rather than the subsidy being deducted from the book value of buildings) creating a tax advantage - Income equalisation for production of furskins. |

- Sales of farms are exempt from tax under specific conditions |

|

Poland |

- Only the production of specific products is subject to income tax (farms producing such products represent only 2% to 5% of all farms). - Taxable income is established based on average production standards or based on accounts - Farm incomes are not taxed on the basis of revenue for 95% of farmers but instead an agricultural property tax is applied |

|

|

Slovak Republic |

- No preferential treatment |

|

|

Slovenia |

- Small family farm income is established based on the five-year average of representative income (taken from economic accounts) calculated per ha of agricultural and forest land (from land cadastre) - Approximately 50% of agricultural subsidies (subsidies that support environmentally-friendly production, investment subsidies, etc.) are excluded from taxable income - Investments in machinery and equipment may be deducted from income tax |

|

|

Spain |

- An estimation method is used to calculate taxable income multiplying sales by fixed index numbers that estimate average costs for each agricultural production system then adjusted by multipliers taking into account production circumstances - 2% of agricultural income withheld - 1% of pig and poultry farming income withheld - Farmers must pay a 2% tax on their volume of sales for each quarter - Certain EU agricultural subsidies are excluded from taxable income and those included are adjusted by a multiplier under the estimation method - 25% reduction of taxable income for young farmers applied for 5 years |

|

|

Sweden |

- No preferential treatment |

- No preferential treatment |

|

Switzerland |

- No preferential treatment |

- Zero or reduced capital gains taxes levied on sales of farms |

|

United Kingdom |

- Income averaging for tax purposes - Hobby farmers can offset losses in agriculture against income from elsewhere - Able to treat livestock as capital assets not as a trading stock |

- No preferential treatment |

|

United States |

- Allowed to use the cash method of accounting - Income averaging - Deducing capital assets in the first year of purchase - Ability to deduct the cost of developing certain farm assets from taxable income in the year where the costs were incurred includes costs associated with raising dairy, draft, breeding, or raising livestock to their age for mature use - Claim tax deductions for expenditures on soil and water conservation or for the prevention of erosion of land used in farming - Income generated by the sale of assets used in farming businesses (i.e. farmland, buildings, machinery and livestock held for draft, dairy, breeding, or sporting purposes) not subject to income tax but taxed as capital gains or losses at more favourable rates |

Note: CGT: Capital Gain Tax.

Source: Country responses to the OECD questionnaire on taxation in agriculture.

Ability to use cash accounting rather than accrual methods

Frequently, countries offer special tax treatment for farmers by allowing them to use cash accounting (or not requiring them to keep accounts) when other businesses are generally required to use the accrual method of accounting for tax reporting. Cash accounting recognises revenues and expenses at the time physical cash is actually received or paid. This gives farmers flexibility on when to report revenue and expenses for tax purposes. Farmers with turnovers below certain thresholds in Canada, France, Germany and the United States are able to use cash-based accounting. It should be noted that the thresholds are typically high. In Germany, the threshold is turnover less than EUR 600 000 (USD 708 100), making one-third of German farmers eligible in 2016. In the United States, farm sole proprietors, farm partnerships, small business corporations and corporations with gross cash farm income receipts of less than USD 25 million are able to use a cash-based method.

Simplified accounting with taxable incomes calculated on the basis of standard or notional income and expenses

Keeping accounts is not necessary for farmers when calculations of taxable income from agricultural activities are based on valuation or estimation methods rather than being determined by actual income. While simpler, this system does not provide farmers with reliable information on which to base business decisions. As noted in (OECD, 2005[1]), this special approach for calculating taxable farm incomes dates back to when bookkeeping in agriculture was rare. Although now in many countries taxing farm income is treated in the same manner as taxing other self-employed, benefits from the simplified methods are still enjoyed by a significant number of farmers within the OECD area.

Taxable income is calculated on the per unit basis set by the relevant authorities. Per unit bases are usually lower than market prices (lower than actual – real income). Presumptive income estimations lessen the tax burden for farmers by reducing administration through not having to keep accounts and by reducing the tax base. OECD countries offering this tax calculation to their farmers are: Austria, Belgium, Chile (offered to low-income farmers as well as to miners and transporters), Croatia, Czech Republic, France, Germany, Norway, Slovenia and Spain. A significant number of farmers are using estimation methods. For example, 80% of farmers in Belgium, more than 95% of farmers in Slovenia, and 94% of farmers in Spain.

Eligibility for using simplified accounting via an estimation method can be restricted to small or low-income farmers. For instance, in Germany, farmers with less than 20 hectares or 50 livestock units are eligible to use a flat rate calculation.

Similarly, expenses can be estimates applied as flat rates to determine taxable incomes. In Austria, the concept of “assessed value” on the productive capacity of a farm determines farmers’ eligibility to use cash accounting and flat rates. Farms with an assessed value of less than EUR 75 000 (USD 88 500) have taxable incomes of 42% of that assessed value, while farms with an assessed value between EUR 75 000 and EUR 130 000 (USD 153 400) can deduct 70% (or 80% for livestock activities) from taxable income as expenses.

Taxes levied on income from real estate instead of actual farm activities

Income from farming activities is sometimes not even calculated on the activity itself. In Italy, income from agriculture and forestry is defined as income from real estate properties. Income is determined by registered assigned yields (on a cadastral basis) and not on actual yields. Yields in the land register are estimated as average values of land and are very low. This results in a preferential tax treatment. In Poland, 95% of farmers are exempt from paying income tax and instead pay agricultural property tax calculated on area multiplied by the value of a set number of hundredweights of rye per hectare.

Tax exemptions

Exemptions for tax purposes are common in OECD countries’ treatment of agriculture. Special allowances can be granted to farmers that reduce their tax bill. Exemptions are also granted on income from: small and low income farmers, subsidies, products, unfavourable regions, small or young farmers starting out. These are examples whereby the tax system is being used to address low income households via sector specific tax measures.

Special allowances

In Norway, farmers with income from agriculture of up to NOK 90 000 (USD 9 800) can deduct 100% of this from their taxable income. Income above NOK 90 000 can be reduced by 38% until the maximum tax deduction amount of NOK 190 000 is reached, at an income level of NOK 353 000 after which the tax deduction is held constant at NOK 190 000 giving a maximum tax saving of NOK 42 000 (USD 4 580). German farmers can deduct EUR 900 (USD 1 062) (or EUR 1 800 (USD 2 124) for married farmers) as an allowance if gross income is below EUR 30 700 (USD 36 232) (or EUR 61 400 (USD 72 463) for married farmers).

Tax exemptions for small or low income farmers

Tax exemptions for small or low income farmers are common. In Hungary farmers earning less than HUF 600 000 (USD 2 220) are exempt from paying tax. For more profitable but still small-scale Hungarian farmers, there are various standard cost taxation options offered. These measures reduce the tax burden for all small-scale agricultural producers who earn less than HUF 8 million (EUR 29 600) and who account for 89% of all farmers.

Farmers earning less than EUR 3 000 (USD 3 541) do not pay income tax in Latvia and in Croatia farmers are only taxed if their earnings are more than HRK 80 500 (USD 12 817). Mexico offers tax exemptions and reduced tax rates and farmers earning less than USD 64 341 are exempt from personal income tax.

Tax exemptions for subsidies

Concessions in the treatment of agricultural subsidies in income tax exist in countries covered in this report. In Belgium, EU subsidies are taxed separately at a reduced rate of 12.5% for direct support payments and 16.5% for other EU support measures. Subsidies paid to farmers under the Rural Capitalisation Incentive (ICR) in Colombia are not included as income for tax purposes. Coupled aid above EUR 12 000 (USD 14 162) is included as income as is all basic aid and green payments in Greece, but investment support and other Pillar I payments are not. Latvia exempts all state provided agricultural subsidies and all EU agricultural and rural development support, as does Lithuania. While in the Netherlands, payments for woodland and nature programmes are excluded for tax purposes.

Investment support granted in Norway for farm building construction projects in less favoured areas are included in the book value of the asset providing the basis for depreciation. Spain excludes from the calculation of taxable income certain EU agricultural subsidies (some of which are no longer granted). Those included are then adjusted by a corrective multiplier applied to all farm income effectively reducing the tax paid by Spanish farmers on the subsidy.

In Japan, crop farmers receiving direct payments under the Law on Farm Income Stabilisation introduced in 2007 are allowed to accumulate their payments and deduct them from the declared farm income. Accumulated payments must be used to expand farmland or farm assets within five years. In Croatia, self-employed farmers may deduct from the tax base any employment incentives, state aid for education and training, and incentives for research and development.

Tax exemptions for income from particular products

Tax exemptions for the income from specific products is another concession. The support this provides has implications for production distortions and product specific subsidies. For example, in Korea income from grains and other food crops are exempt from taxation and income from plant cultivation is not taxed if the revenue is less than KRW 1 billion (USD 862 890).

In some instances, the production of certain products is liable for income tax when other farm systems are exempt or taxed differently. Farms in Poland producing the following products are liable for income tax: greenhouse production, poultry, mushrooms, bee keeping, silkworm production. As a result, only 2% to 5% of all the farms in Poland are liable for income taxes.

Tax exemptions for income from particular regions

Income tax exemptions can be applied to farmers in certain regions. Farmers (and all other tax payers) from regions in Croatia experiencing difficult economic conditions can benefit from tax reliefs (50% exemption rate in Group I areas and complete exemption from personal income taxes for taxpayers from the Vukovar region).

Tax exemptions for income from young farmers’ activities

To facilitate structural changes in France, beneficiaries of the young farmer settlement aid are able to reduce their taxable incomes for the first five years they are farming (this tax option also applies to tradespeople and craftspeople who are starting out). Ireland offers 100% stock relief for income tax for certain young trained farmers to enable investment in livestock.

Income averaging, income smoothing, deferrals and income offsetting schemes

Income averaging, income smoothing, deferrals and income offsetting schemes are popular tax tools used by OECD countries to support producers’ income risk management.

The following countries have income averaging measures for their farmers: Australia, Canada, France, Germany (introduced in 2016), Ireland, New Zealand, Norway (available only for furskin production which will be banned from 2025), the United Kingdom, and the United States. A similar system exists in the Netherlands but it is not specific to agriculture.

Australia and Ireland have recently made changes to their programmes to enable flexibility. From 2017, Australia allowed farmers who opted out of the scheme 10 years ago or earlier to re-join. Farmers in Ireland have the flexibility to opt out of averaging for a single year, and from 2019 onwards the 50% of Ireland’s farm households that have off-farm income can join the scheme.

Australia’s popular Farm Management Deposit (FMD) scheme is an example of a tax deferral measure where taxation is partially put off to a later period, improving liquidity and lower tax progression. Under the scheme, farmers can claim deductions for farm income deposited in an FMD account in the year it is earned with the deposited FMD monies included in taxable income in the year it is withdrawn. As of June 2019, under the FMD there were 53 790 accounts with AUD 6.8 billion (USD 4.6 billion) deposited. In 2016, Australia doubled the maximum limit on deposits to AUD 800 000 (USD 597 615).

As of 1 January 2019, France has implemented its new annual tax deduction for precautionary savings scheme (DEP). Similar to Australia’s FMD scheme, farmers can make tax deductions provided that the income deducted is placed in a savings account (although unlike Australia’s scheme French farmers are only obligated to deposit between 50% to 100% of the money deducted). Savings can be used in the following ten years on all business expenses, at which point they become taxable.

In the event of exceptional circumstances in some countries, tax deferrals measures are available for farmers. For example, farmers in Australia, Canada, Ireland and the United Kingdom can defer income received from the destruction of livestock as a result of livestock disease. In Canada, income from the sale of livestock as a result of a climatic event can be deferred, as can income from the sale of early shearing double wool clips in Australia. In Japan, farmers can defer losses of agricultural assets due to a natural disaster for three years.

Policies of offsetting losses, either carrying forward or back, to reduce farm income volatility are offered to farmers in Canada, Costa Rica (for two years longer than non-agricultural businesses), Japan, and Korea. Austria and Belgium have recently implemented offsetting measures also.

Valuation of livestock for tax purposes

Tax concessions are provided in the valuing of livestock and changes in livestock numbers over a tax period. In New Zealand, farmers can use one of two methods for tax purposes – either the natural standard cost method (a cost of production approach) or the herd scheme (whereby livestock are capital assets and only changes in livestock numbers are assessable income not changes in stock values). The United Kingdom allows for livestock kept for the sake of the product (e.g. milk or eggs) or offspring (breeding livestock) to be treated as capital assets rather than trading stock, meaning farmers can benefit in terms of allowable deductions.

Stock relief is offered in Ireland whereby the value of the trading stock between the beginning and the end of an accounting period is reduced by 25% to 100% and then deducted from taxable income.

Under certain conditions, income generated by the sale of livestock is not subject to income tax and is instead taxed as capital gains or losses in the United States. To be eligible livestock must be held for a minimum amount of time (the required holding period).

Special treatment of capital consumption estimation (depreciation) in calculating income, in particular accelerated rates or write-off

Accelerated depreciation and write-offs are offered by governments to promote capital investment in certain areas such as improvements towards environmental sustainability. The following countries allow accelerated depreciation or write-offs of certain on-farm expenditure: Canada, New Zealand (for farm improvements), and the United States. Ireland offers capital allowances for tax purposes in lieu of a deduction for the depreciation of certain expenditures on farm buildings, fences, farm roadways and other works.

Farmers in some countries are able to deduct certain costs from income taxes, which under general rules would be depreciated. In New Zealand, costs associated with planting trees for soil erosion can be deducted from income tax, as can expenditure to prevent erosion in the United States. Costs associated with breaking in new land in Norway can be deducted, and in Slovenia farmers can claim 40% of the amount invested in agricultural machinery and investments in plantations.

Costs for developing certain farm assets in the tax year when the costs are incurred can be deducted in the United States. Examples of pre-productive development costs include raising dairy, draft, breeding, or raising livestock to their age for mature use, caring for orchards and vineyards before they are ready to produce crops, and clearing land and building long-term soil fertility by applying fertiliser.

Capital gains exemptions

Many countries offer special tax treatment for capital gains generated in the agricultural sector. To encourage farm succession and restructuring, and ultimately the productivity of the sector, capital gains are either excluded from income taxes in some countries, or else only a proportion is taxed. Farms are sometimes valued in such a way that the gain is zero. As with all tax instruments economy-wide these special tax concessions can actually reduce agricultural output when speculators purchase farmland as part of their wealth maximisation strategies through tax offsetting, increasing land values.

Capital gains on farmland are exempt from taxes in Korea and in the Netherlands capital gains are exempt from personal and corporate income tax (under certain conditions). In Hungary and Latvia, the capital gains tax exemptions are conditional on the farmland remaining in agricultural production.

Frequently the special treatment is linked to the land being sold to a descendant who will continue to farm the land, as is the case in the Czech Republic. Canada excludes a proportion of the capital gains income when the farm is sold to direct descendants, provides averaging capital gains income from farm transfers over a number of years, and allows capital gains to be offset by restricted farm losses. Ireland also offers a capital gains tax relief scheme.

Some countries exclude a proportion of the gain from capital gains tax. In Japan this approach is used to incentivise farmland consolidation; eligible land transfers receive a special tax deduction of JPY 8 million (USD 72 400).

Capital gains in Switzerland are automatically zero when farmland is sold to a family member at a price set at the capitalised earnings value (a price much lower than the real estate market price).

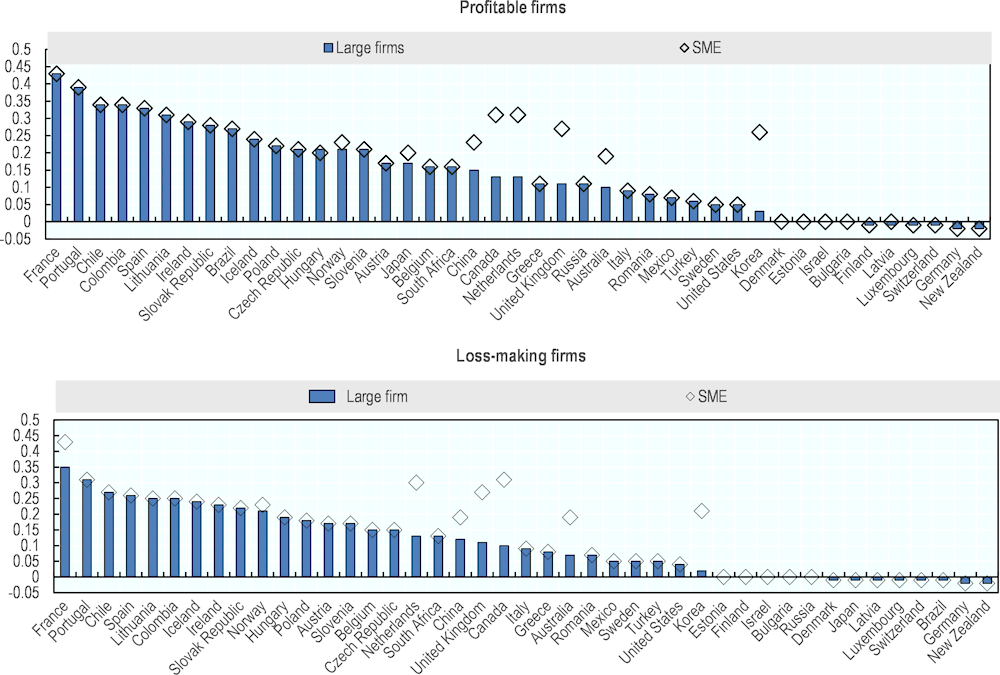

2.5. Taxes on corporate income and related concessions in agriculture

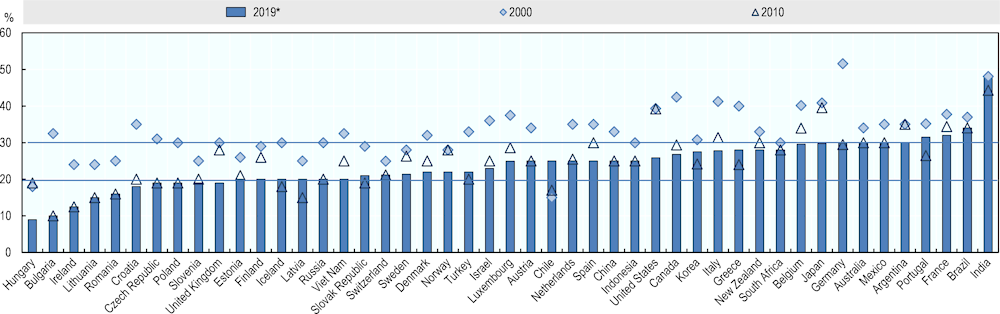

Increasingly, farming businesses are organised as corporate businesses, and thus are subject to corporate taxes on profit. In some countries, farm business can also be organised as agricultural cooperatives and producer organisations. Tax rates on corporate profits range between 9% in Hungary to 48% in India. However, most countries tax corporate profits at rates between 20-30% (Figure 2.2).

There has been a general decline in corporate tax rates of profit since 2000, when more than half of countries considered had rates equal to or above 30%. Chile is the only country where tax rates increased from 15% to 25% between 2000 and 2019, but additional countries increased tax rates between 2010 and 2019 (Greece, Iceland, India, Korea, Latvia, Portugal, the Slovak Republic, and Turkey).

Figure 2.2. Total corporate tax rate of profit, 2000, 2010 and 2019*

Notes: See Table A B.2.

* 2018 for non-OECD countries.

1. Basic combined central and sub-central (statutory) corporate income tax rate given by the adjusted central government rate plus the sub-central rate.

2. Netherlands: applies to taxable income over EUR 200 000.

Source: OECD (2019), OECD Tax Database, http://www.oecd.org/tax/tax-policy/tax-database.htm (extracted August 2019).

Various countries offer special corporate income tax treatments for agriculture structures organised as corporate entities (Table 2.3). These are less widespread and diverse than concessions on personal income tax for farmers. For example, while the flexibility to use cash accounting for taxation purpose is frequent for family farms, only Austria and the United States allow companies producing agricultural goods to use cash accounting, which deviates from the usual tax treatment of companies.

The corporate income tax concession may vary depending on business size, location or activity. For example, Mexico applies tax exemptions and reduced tax rates for agricultural corporations depending on their scale under its Agricultural, Forestry and Fisheries Regime (AGAPE). To encourage regional development, new businesses established in one of the Zones Most Affected by Conflict of Colombia benefit from tax relief, while corporate farms located in Croatian less favoured areas benefit from lower tax rates. In Korea, income earned from crops for human consumption is exempt from corporate income tax (this product specific tax concession is aimed at rice).

Preferential taxes or exemptions are applied on income from agricultural cooperatives in the following countries: Austria (partial tax exemptions), Israel (tax holiday for five years), Italy (exemptions), Japan and Lithuania (reduced tax rates). In Greece, agricultural co-operatives and producer organisations are taxed at a rate that is half of the usual corporate income tax rate.

Table 2.3. Corporate income taxation: Concessions in agriculture

|

Corporate income taxation concessions |

|

|---|---|

|

Australia |

- No preferential treatment |

|

Austria |

- Cash accounting permitted to determine taxable income - Some agricultural co-operatives are partially tax exempt under certain conditions |

|

Belgium |

- A reduced corporate income tax rate of 5% is applied to capital and interest subsidies under certain conditions - Carry back to offset losses against profits made in the three preceding years |

|

Canada |

- No preferential treatment |

|

Chile |

- No preferential treatment |

|

Colombia |

- Investments in agricultural companies listed on the stock market can be deducted as a tax credit - Tax relief for new businesses established in one of the Zones Most Affected by Conflict |

|

Costa Rica |

- No preferential treatment |

|

Croatia |

- Corporate farms located in less favoured areas (City of Vukovar or Group I areas) benefit from lower tax rates |

|

Czech Republic |

- Agricultural enterprises can apply 20% higher depreciation rates on eligible farm machinery in the first year of depreciation. |

|

Denmark |

- No preferential treatment |

|

Estonia |

- No preferential treatment |

|

Finland |

- No preferential treatment |

|

France |

- No preferential treatment |

|

Germany |

- No preferential treatment |

|

Greece |

- Profits from agricultural cooperatives and producer groups are taxed at a tax rate of half the usual corporate tax rate |

|

Hungary |

- Agricultural enterprises have special exemptions to the general CIT rules concerning the carryover of losses and tax advances and may account for deferred losses from the tax year by reducing the pre-tax profit of the preceding 2 tax years by 30% of the deferred loss (as opposed to carrying over losses for 5 years). |

|

Ireland |

- No preferential treatment |

|

Israel |

- Accelerated depreciation for equipment and buildings - Reduced tax rate for 5 years on dividends from an agricultural enterprise (20% instead of 25% or 30%) - Foreign resident experts invited to render services to an agricultural enterprise are subject to reduced tax rate for 3 to 5 years with the top bracket subject to a tax rate of 25% instead of 47%. - Qualifying agricultural companies enjoy a 5-year tax holiday. However, corporate tax is collected upon payment of dividends from the exempt revenue in addition to tax imposed on the dividends at a rate of 20%. |

|

Italy |

- Some exceptions from the tax liability, e.g. incomes of agricultural cooperatives |

|

Japan |

- Reduced corporate tax rates for agricultural co-operatives that provide banking, insurance, farm input supply, marketing, and technical advice services to their members |

|

Korea |

- Income generated from crops for human consumption is excluded from corporate income tax - Agricultural corporations are exempted from paying the registration and license tax when they are registered as corporations until 2020 |

|

Latvia |

- Corporate income tax is paid by the producers of agricultural production with a turnover during the previous taxation year of greater than EUR 300 000 (or those who have opted to pay CIT) - Farmers who are CIT payers are entitled to reduce amounts received as state aid to agriculture or EU support for agriculture and rural development from the taxable base by up to 50% (and no more than the total taxable income) |

|

Lithuania |

- A reduced 5% tax rate applies to cooperatives when more than 50% of the cooperatives income is generated from agricultural activities |

|

Mexico |

- Special tax treatment of agricultural activities under the “Agricultural, Forestry, and Fisheries Regime” (AGAPE) resulting in tax exemptions and reduced tax rates for corporations and other societies that vary depending on their size |

|

Netherlands |

- Capital gains on land sold are in some circumstances exempt from corporate income tax |

|

New Zealand |

- No preferential treatment |

|

Norway |

- No preferential treatment |

|

Poland |

- Advantages in particular in regard to the recovery of value added taxes |

|

Slovak Republic |

- No preferential treatment |

|

Slovenia |

- No preferential treatment |

|

Spain |

- No preferential treatment |

|

Sweden |

- No preferential treatment |

|

Switzerland |

- No preferential treatment |

|

United Kingdom |

- No preferential treatment |

|

United States |

- Able to use cash accounting if gross receipts are less than USD 1 million or a family corporation that has gross receipts of less than USD 25 million for any tax year |

Source: Country responses to the OECD questionnaire on taxation in agriculture.

2.6. Taxes on property and related concessions in agriculture

Land is the biggest asset of farmers in comparison to other similarly sized businesses. As such, capital taxes can have a significant impact on farmers. In recognition of this, almost all OECD countries provide tax concessions on annual property taxes for farmers. Special tax treatment is also provided for the transfer of farm properties by sale or inheritance to family members to address structural issues associated with entry to and exit from farming (Table 2.4). As highlighted in (OECD, 2005[1]) the relative effectiveness of tax measures to encourage structural change may be offset by the resultant increases in land prices making it more difficult for new entrants, apart from those from farming families, to enter the profession. Moreover, farmland may be purchased as part of wealth maximisation strategies for inheritance tax. In such cases farms may be run as hobby farms or lifestyle units. All these tax treatments on land are capitalised into land values.

Table 2.4. Property taxes: Concessions in agriculture

|

|

Property |

Transfers/Acquisition taxes and Stamp duty |

Inheritance and gifts |

|---|---|---|---|

|

Australia |

- Each State and Territory provides an exemption from land tax for ‘Land for primary production’ (except the Northern Territory which does not have land tax) |

||

|

Austria |

- An assessed value (taxable value) specific to agriculture is used as the basis of the annual property tax |

- Transfers of agricultural property within family are subject to preferential tax rate of 2% applicable on the land’s assessed value (productive value) |

- No taxes |

|

Belgium |

- Reduced annual property taxes charged on agricultural land in the regions - Tax is calculated on an average “cadastral” income - Tax credits of 25% and 50% for small properties |

- Trade of land between farmers when land is of similar values is exempt from sales tax - If land is not of similar value then sales tax applies on the difference - If the difference is less than 25% a lower rate of 6% applies to the excess |

- No preferential treatment |

|

Canada |

- Exemptions of some properties, such as farm dwellings and farmland - Assessments of farm properties that are less than the fair market/actual value - Rebates by provincial governments on some of the taxes paid by farmers - Deferral (and forgiveness) of taxes due unless the use of the farmland changes to non-farm use - Lower maximum tax rates that can be paid by the agriculture sector |

- No taxes |

|

|

Chile |

- Lower real estate tax rates apply to farms than for other land - Valuation of agricultural land is an assessed value not a market value |

- No preferential treatment |

- No preferential treatment |

|

Colombia |

- Lower tax rates apply to small rural property |

- Exempt |

- No preferential treatment |

|

Costa Rica |

- Valuation of agricultural land is based on the land use, not its market value - Farmers eligible for a 40% reduction of the annual property taxes for soil conservation |

- No preferential treatment |

|

|

Croatia |

- No preferential treatment |

- No preferential treatment |

|

|

Czech Republic |

- Tax rate depends land use and location municipalities set coefficients for these parameters based on the relevant cadastre - Arable land, hop gardens, vineyards, fruit orchards and permanent grasslands may be exempt from land taxes or pay two to five times less tax - The tax rate ranges from 0.25% (for pasture and forestry) to 0.75% (for arable crops) - Reclaimed agricultural land is exempt from tax for 5 years (25 years for reclaimed forest land) |

- No preferential treatment |

- No preferential treatment |

|

Denmark |

- Valuation of agricultural land lower and discounted tax rates apply for municipal land taxes |

- No preferential treatment |

- No preferential treatment |

|

Estonia |

- Reduced land tax rates |

- No preferential treatment |

- No preferential treatment |

|

Finland |

- Exempt from land taxes |

- Young farmers are exempt from paying transfer tax |

- Farm valued at a lower taxation value instead of its market value and the heir is obligated to farm for the next 10 years |

|

France |

- Buildings used for rural farms are exempt from property tax - Agricultural land benefits from a 20% reduction on the property tax on non-developed land (TFNB) - Farmers can claim a reduction on the TFNB proportional to income losses from climate events - Farmers can request a rebate on the property tax corresponding to losses resulting from an animal disease epidemic - Young farmers receiving settlement aids benefit from a 50% rebate on property taxes for the first five years - Exemption from paying local business taxes for farms - Exemption from the company property tax (CFE) and the property tax on buildings used for agricultural methanisation using at least 50% of matter coming from the farm |

- Acquisitions of rural buildings and agricultural land leased by farmers benefit from reduced transfer duties of 0.75% (instead of 5.80%) provided that the tenant has been using the land for 2 years and will develop the property for at least 5 years - Young farmers under the settlement aid scheme are charged a reduced transfer tax rate of 0.715% (instead of 5.80%) on the first EUR 99 000 of the sales price of farms located in rural revitalisation zones |

- Rural property leased on a long-term basis is partially exemption from transfer duties on donations or inheritances (DMTG) |

|

Germany |

- No preferential treatment |

||

|

Greece |

- Agricultural land is excluded from the total value calculations for the supplementary tax applied when the total value of the immovable property exceeds EUR 200 000 |

- Exempt |

- No preferential treatment |

|

Hungary |

- Buildings used for animal husbandry or plant cultivation or for storage purposes (e.g. stables, greenhouses, facilities for storing crops or fertiliser, barns) are exempt from paying the local building tax - Incorporated land used for agricultural purposes is exempt from municipal government property tax. |

- Exempt (under certain conditions) |

- 50% of the regular inheritance tax shall be paid on inheritance of land ownership or land user rights for agricultural land - 25% of the regular inheritance tax shall be paid if the heir is a registered farmer |

|

Ireland |

- Full relief from stamp duty for farm transfers to young trained farmers - Consanguinity relief for stamp duties - Stamp Duty Relief for Farm Consolidation (for transactions under Capital Gains Tax Relief on Farm Restructuring) - Capital Acquisition Tax relief - Capital Gains Tax/ Capital Acquisition Tax relief Lower interest rate on instalment payments for Capital Acquisition Tax |

- Capital Acquisition Tax relief available reducing market value of agricultural property by 90% - inheritance tax levied on this amount - Lower interest rate on instalment payments of the Capital Acquisition tax for agricultural properties |

|

|

Israel |

- No preferential treatment |

- No taxes |

- No preferential treatment |

|

Italy |

- Exempt from the property tax - Exempt from the regional tax on productive activities |

- Reduced tax rates apply when the purchaser is a professional farmer and they are exempt from paying stamp duty |

|

|

Japan |

- Preferential assessment of the value of farmland for municipal land taxes - Farm land is exempted from the City Planning Tax and the Special Land Holding Tax (municipal tax) - Real estate tax reduced by 50% on land leased through a Farmland Bank. - Tax rates imposed on idle land are increased by 1.8 times if owners do not lease out land or resume cultivation |

- A reduced Real Estate Acquisition Tax rate is applied to transfers of farmland |

- Preferential tax base assessment and deferral of taxation are allowed for farmland subject to inheritance taxes |

|

Korea |

- Property tax on farmland is a flat rate of 0.07% (instead of progressive rates starting from 0.07%) - The landowner is exempt from property taxes if they belong to the farmland pension programme and are currently actively farming the land |

- Acquisition tax reduced by 50% for farmland bought by a person who has engaged in farming for at least two years (until 2021) - Acquisition taxes on farmland reduced by 50% for a person who moved from an urban area for farming within three years of moving (until 2021) - Agricultural corporations exempt from paying acquisition taxes for farmland for farming within two years of the registration of the incorporation (until 2019). |

- Partial or full exemption from inheritance tax and gift tax conditional on relationship between heir and donor and the continued farming of land - Farm assets are excluded from inheritance tax with maximum deduction of KRW 1.5 billion from the taxable value of inherited property when inherited by direct descendant who is a farmer and who will continue farming the land for up to 5 years |

|

Latvia |

- Agricultural buildings and land in conservation areas or newly planted forests are exempt from real estate tax - The real estate tax is levied on the cadastral value of land; the growth rate of cadastral value of agricultural land has been constrained by government regulation (2016-2025) |

||

|

Lithuania |

- Buildings used in agricultural activities are not taxed - Other buildings not used in agricultural activities are taxed at reduced rates depending on their value - Buildings of agricultural companies and cooperatives are not taxed when more than 50% of their income is generated by agricultural activities - Land tax on agricultural land is reduced by 35% for cultivated land but if abandoned land areas are found within land holdings the discount is not applied - Land acquired to establish a new family farm is exempt from land tax for 3 years |

- No preferential treatment |

|

|

Mexico |

- Tax is levied on the basis of the cadastral value |

||

|

Netherlands |

- Greenhouses are exempt from real estate tax |

- Acquisition of land under commercial cultivation for agricultural or forestry purpose is exempt |

- No preferential treatment |

|

New Zealand |

- No preferential treatment |

- No taxes |

- No taxes |

|

Norway |

- Agricultural property used in the agricultural business is exempt from municipal property tax (except farm housing etc.) |

- No taxes |

- No taxes |

|

Poland |

- Farmers are subject to a specific local agricultural property tax instead of income tax and a number of exemptions may apply - Farm buildings exempt from real estate tax |

- Exempt when farmers retire and transfer ownership of farm to relatives |

- Agricultural property and farm buildings are exempt from gift and inheritance tax; farmer housing may also be exempt under specific conditions |

|

Slovak Republic |

- Lower tax rates apply to agricultural buildings |

- No taxes |

- No taxes |

|

Slovenia |

- Agricultural buildings are exempt from real estate tax - Agricultural and forest land is exempt from land tax (but not agricultural buildings) |

- Transfers of farmland within the agrarian bond operations is exempt from tax otherwise transfer taxes apply |

- Exempt when agricultural land is transferred to another farmer |

|

Spain |

- No preferential treatment |

- Full or partial exemption of transfer taxes when transferring farms qualifying as priority holdings between family members |

- No preferential treatment |

|

Sweden |

- Farm land, farm buildings and forest land exempt from property taxes |

- No preferential taxes |

- No taxes |

|

Switzerland |

- A capitalised earnings value is used as the basis of the annual property taxes (this is 25% to 33% of the actual market value for land including buildings and 10% of the value of land without buildings) |

||

|

United Kingdom |

- Agricultural land and buildings exempt from annual property tax |

- Exemption or significantly reduced inheritance and gifts taxes provided that the land is being farmed |

|

|

United States |

- Reduced state and local property taxes by valuing farmland at its “farm use value” rather than its fair market value |

- Value of the farm for inheritance tax purposes is its use value which is 40-70% lower than the fair market value |

Source: Country responses to the OECD questionnaire on taxation in agriculture.

Land taxes are usually set and levied by municipal governments within bounds directed by central governments. Farm land location can influence the coefficient applied by the municipality to the valuation of agricultural land determined by the cadastre (or land registry). Therefore, tax rates and rules applying to the sector can vary across a country and within regions.

To illustrate the complexity, in the case of Canada different provinces take the following different approaches to farmland taxation: exemptions of some properties, such as farm dwellings and farmland; assessments of farm properties that are less than the fair market, actual value; rebates by provincial governments on some of the taxes paid by farmers; deferral of taxes due unless the use of the farmland changes to non-farm use; and lower maximum tax rates that can be paid by the agriculture sector.

To enable cross-country comparisons, the main forms of concessions for property taxation are discussed in the subsections below.

Exemptions from paying land taxes

Farm land in the following countries is exempt from land or property taxes: Australia, Canada (in some provinces), Finland, Italy, Japan, Slovenia (except agricultural buildings and farm housing), Sweden, and the United Kingdom.

In the following countries, buildings used in agricultural production are exempt from property or land taxes: Australia, Canada (in some provinces), France, Hungary, Latvia, Lithuania, the Netherlands (greenhouses), Norway, Poland, Slovenia, and Ukraine.

Exemptions can be production or crop specific. In the Czech Republic, arable land, hop gardens, vineyards, fruit orchards and permanent grasslands may be exempt from taxes or pay two to five times less tax.

Valuation of land for tax purposes that is lower than its market value

Alternatively, farmers in some countries pay taxes on the basis of a lower valuation of the land than its market value. Often the value is the cadastral value of land. This is the case in the following countries: Austria, Belgium, Chile, Costa Rica, Canada (in some provinces), Denmark, Japan, Latvia, Switzerland and the United States. In 2018, foregone federal estate tax revenue from the “special use valuation” programme for farmers in the United States is estimated as being USD 59.7 million.

Discounted tax rates for property taxes

Farmers are charged reduced property tax rates on farmland and farm buildings in the following countries: Belgium (where there are also tax credits for small properties), Canada (in some provinces), Chile, Colombia (applying to small rural properties), Czech Republic, Denmark, Estonia (landowners), France (agricultural land receives a 20% reduction on the property tax on non-developed land), Korea (where the property tax on farmland is set at a very low flat rate tax instead of the usual progressive tax), Slovak Republic (on agricultural buildings) and Ukraine.

Chilean authorities assess the value of agricultural land. A reduced tax rate is charged on agricultural land in comparison to other land. Increases in land taxes paid by farmers as a result of a re-assessment of the land values cannot exceed 10% cap.

Discounts on land taxes to discourage land abandonment and encourage farming practices

Exemptions or discounts on land taxes are sometimes offered for not abandoning farmland. Landowners in Korea do not pay property taxes if they belong to the farmland pension programme and are actively farming their land (until 2021). In Japan, taxes are used as incentives for landowners to lease land through a Farm Land Bank. From 2017, leasing landowners pay only half the real estate tax while tax rates on idle land that is not cultivated or leased out have been increased by 1.8 times. Lithuania offers a discount of 35% on land taxes for cultivated land while discounts are withheld if any abandoned land areas are found within the land holding.

To encourage certain farming practices, some countries offer discounts on property taxes. Soil conservation practices earn farmers in Costa Rica a 40% discount on land taxes. In the Czech Republic, no property taxes are paid on reclaimed agricultural land for five years and for 25 years on reclaimed forest land. Land in conservation areas is excluded from taxes in Latvia.

Young farmers can be charged reduced property taxes for time limited periods while they are starting out. In France, young farmers are eligible for a 50% rebate on property tax on non-developed land for the first five years. Land acquired to establish a new family farm is exempt from paying property taxes for three years in Lithuania.

Exemptions from paying local or regional business taxes

Farmers in France and Italy are exempt from paying other local or regional taxes or company property taxes. In Greece, agricultural land is excluded from calculations of the supplementary tax paid by taxpayers with property and buildings valued over EUR 200 000.

Transfer/acquisition and stamp duty concessions

Purchases of farms and agricultural buildings are exempt from paying the usually applicable transfer/acquisition taxes or stamp duties in many countries. The exemption is often conditional on ongoing agricultural production in order to encourage business continuity.

The following countries do not charge taxes on transfers: Colombia, Greece, Hungary, and the Netherlands (conditional on the land remaining under commercial cultivation). In France and Japan, reduced or discounted tax rates apply for the acquisition of farmland.

Transfer taxes can also be charged on agricultural land valued at a price lower than the market price. To support the continuation of family farm enterprises in Austria, the tax base for transfers is the lower assessed value (i.e. the farm’s capitalised value which is lower than the farm’s likely annual income) taxed at a concessional tax rate.

Exemptions or reduced rates can apply when agricultural land is transferred to a family member or professional farmers who will run the farm business. Such special treatment is offered in France, Ireland, Italy, Korea, Poland and Spain.

In France, Finland and Ireland, young farmers pay reduced transfer taxes or are fully exempt.

Farm land acquired in Korea by a person who is taking up occupancy in a rural community as an urban returner is charged 50% less on the acquisition tax.

In Slovenia transfers of farmland within the agrarian bond operations are exempt from transfer taxes, and in Korea purchases of farmland by agricultural corporations for farming purposes within two years of the registration of the incorporation are also exempt until 2019.

Inheritance and gift tax concessions

Countries exempt or apply reduced inheritance taxes rates on farms inherited by family members usually on the condition that the farming activities continue. The policy objectives of these measures are to ensure that farms remain viable and undivided. This approach is taken by the following countries: France (partially exempt donation or inheritance charges if the rural property is leased on a long-term basis), Hungary (only 50% of regular inheritance tax shall be paid, or 25% if the heir is a registered farmer), Ireland, Korea (depending on the relation between the heir and the donor), Poland, Slovenia (exempt if the farm is transferred to another farmer), the United Kingdom and the United States (where a progressive tax rate is applied to inheritances of all family businesses above the threshold of USD 11.18 million as amended (and doubled) by the TCJA).

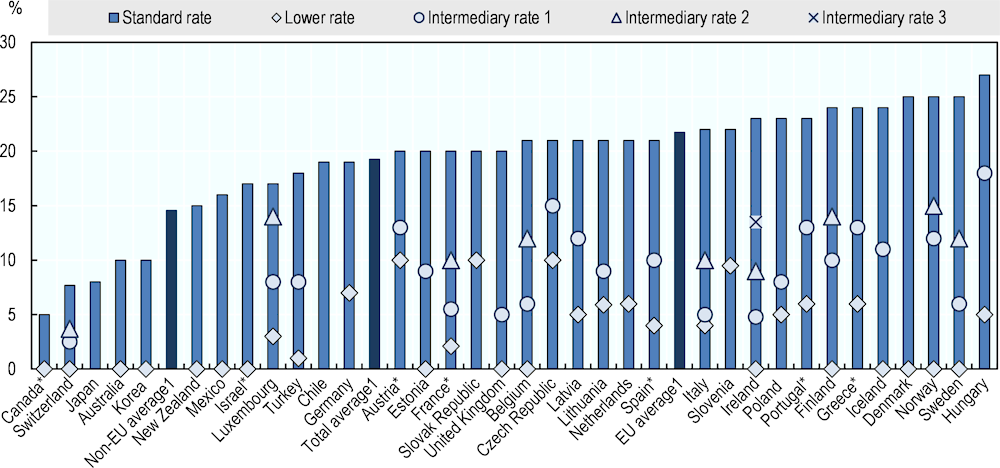

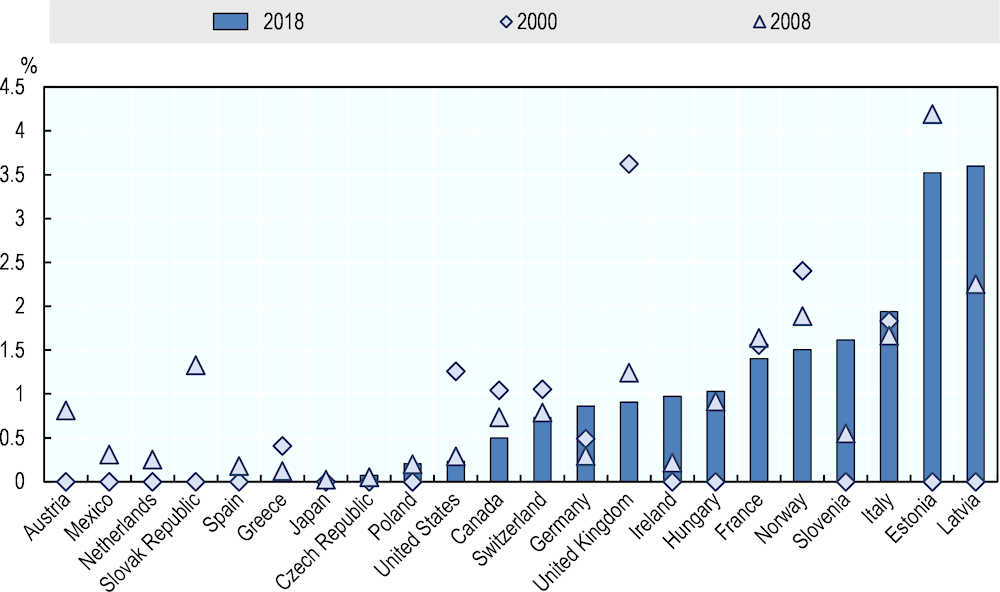

In Korea farm assets are excluded from inheritance tax with a maximum deduction of KRW 1.5 billion (USD 1.36 million) from the taxable value of inherited property, when inherited by direct descendant who is a farmer and who will continue farming the land for up to five years.