Regulations of product markets serve legitimate objectives but, when ill-designed, can impose unnecessary restrictions on competition, and therefore on business dynamism, productivity and ultimately well-being. A recent update of the OECD’s Product Market Regulation indicator for Costa Rica shows that there is ample room to improve regulations. Costa Rica’s economic development is hindered by heavy state involvement and high barriers to entry, compared to both OECD countries and regional peers. This chapter discusses options to improve product market regulations, based on international best practices. Regulatory reform can improve consumer welfare by boosting competition and thus lowering prices of key goods and services, which in turn increases the purchasing power of low-income households and reduces poverty. By raising productivity, stronger competition will also allow higher wages. Reducing barriers to entry can facilitate firm creation, boosting investment and jobs.

OECD Economic Surveys: Costa Rica 2020

2. Enhancing business dynamism and consumer welfare with regulatory reform

Abstract

Pro-competition regulation in product markets helps to boost living standards (Koske et al., 2015[1]). Competition raises output per capita by increasing investment and employment as well as by encouraging companies to be more innovative and efficient, thereby lifting productivity (e.g. (Bouis and Duval, 2011[2]); (Égert and Gal, 2016[3])) and the ability to pay higher wages. Competition reduces prices of key goods and services, boosting households’ purchasing power and firms’ competitiveness. Thus, OECD countries have gradually made their regulations in product markets more competition friendly over the past decades, reduced state involvement in business sectors, thereby making it easier to create and expand firms, and facilitating the entry of foreign products and firms. In some cases regulations were phased out, whereas in others regulations were modified with a view to enhance competition.

Costa Rica itself can attest to the benefits of having a market-friendly regulatory stance, as this has been a building block for its successful foreign direct investment framework. As a result, Costa Rica hosts in its free trade zones modern and highly productive firms operating in high value added sectors, such as services and medical devices. There is abundant evidence of positive spillovers between firms in and outside the free trade zones (OECD, 2018[4]), (Alfaro-Urena et al., 2019[5]), (Sandoval et al., 2018[6]). But firms productivity in the non-exporting sector clearly lags behind. Productivity is hampered by multiple factors, such as skills and infrastructure gaps or weak innovation, as described in Chapter 1. But one critical factor hampering productivity is the costly and burdensome regulatory framework faced by local firms. This chapter examines this issue in detail through the lens of the OECD’s Product Market Regulation indicator.

Regulations are burdensome

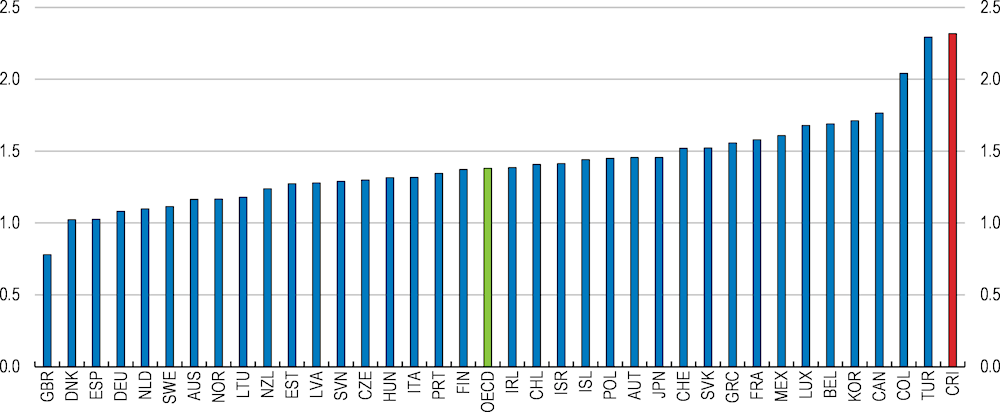

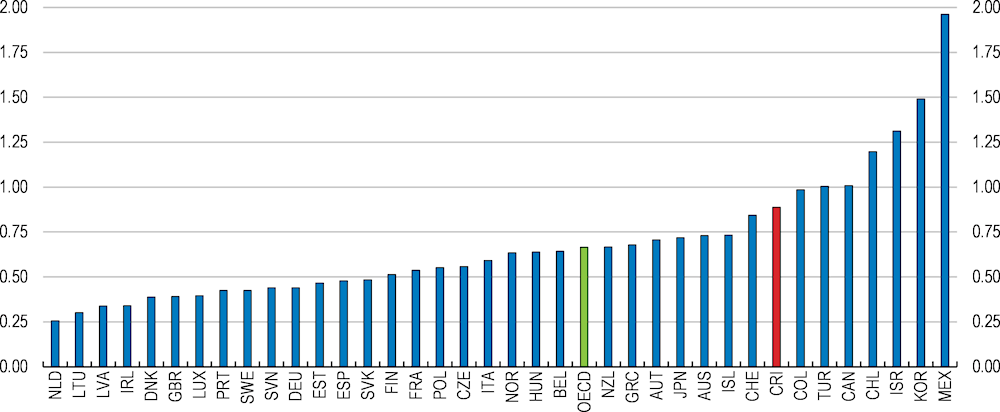

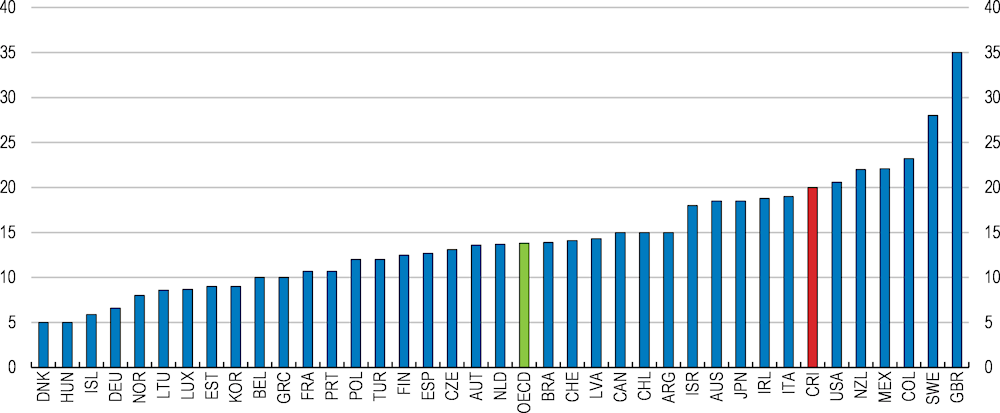

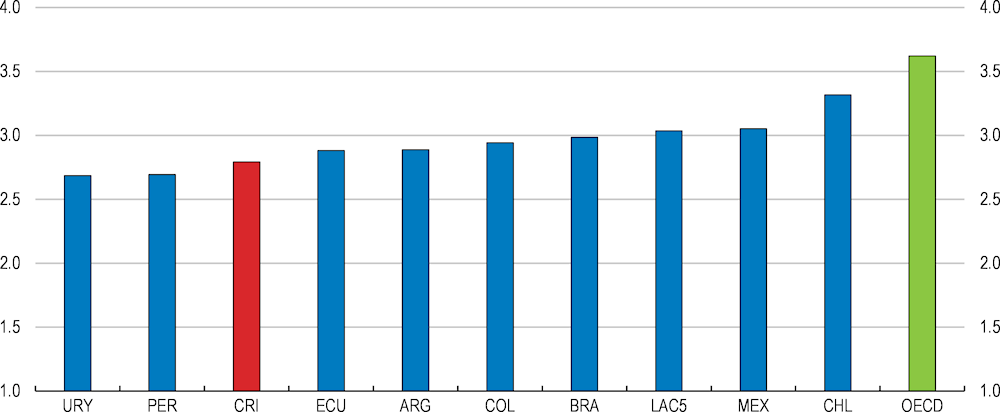

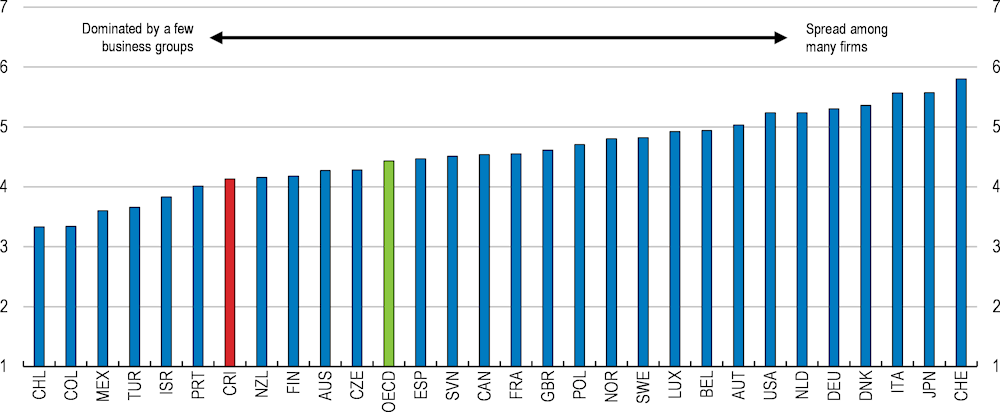

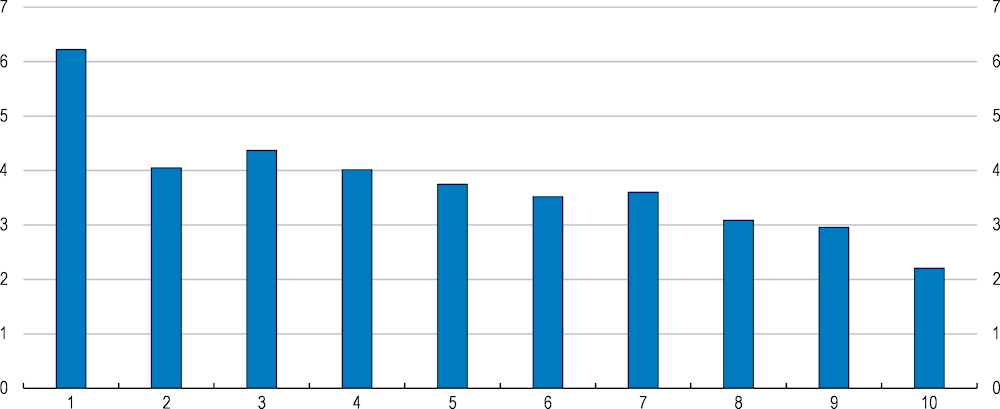

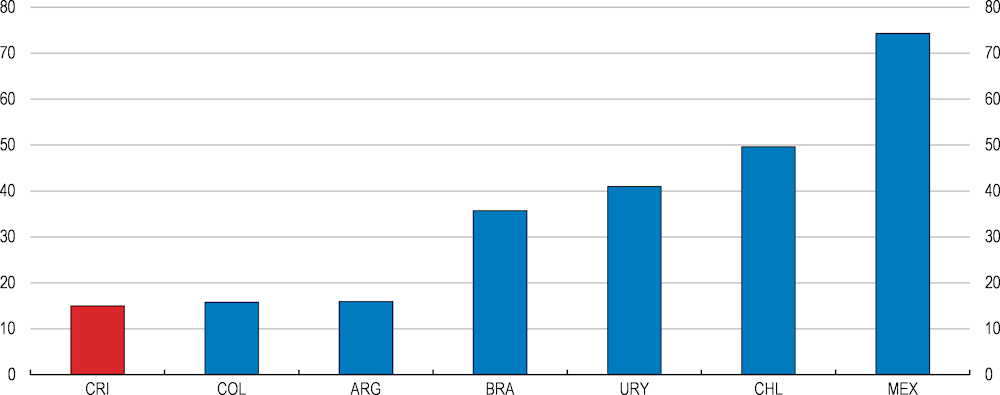

According to a recent update of the OECD’s Product Market Regulation indicator (Vitale et al., 2020[7]), Costa Rican markets are subject to regulations more stringent than in any OECD country (Figure 2.1). Latin American peers, such as Chile, Mexico and Colombia, perform significantly better than Costa Rica.

Figure 2.1. Costa Rica has more stringent regulations than any OECD country

Overall PMR score, index from 0 to 6 (most restrictive)

Other rankings examining the regulatory stance confirm that regulations in Costa Rica are among the most burdensome in advanced and emerging economies (Figure 2.2). Costa Rica has also been slipping positions in the World’s Bank doing business rankings, and its current position (74th) is below other peer countries in Latin America, such as Chile (59th), Mexico (60th) or Colombia (67th), as well as other emerging economies, such as Thailand (21st) or Morocco (53th).

Figure 2.2. The regulatory burden is perceived to be very high

Index from 1 to 7 (best), 2018

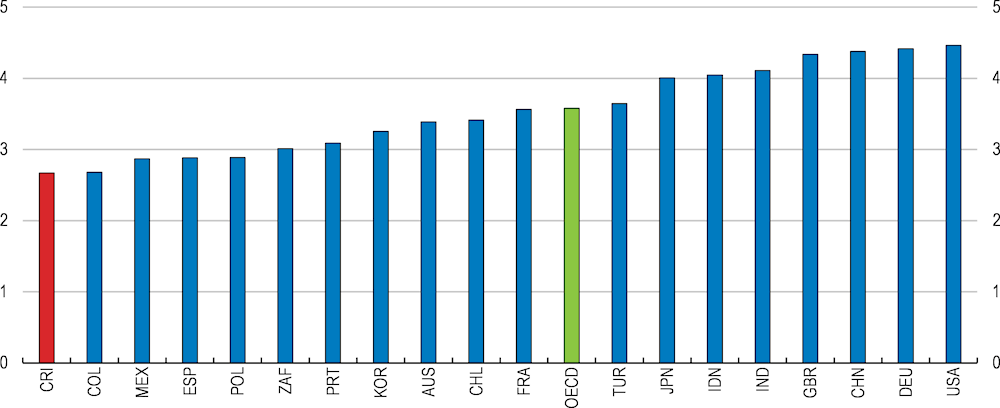

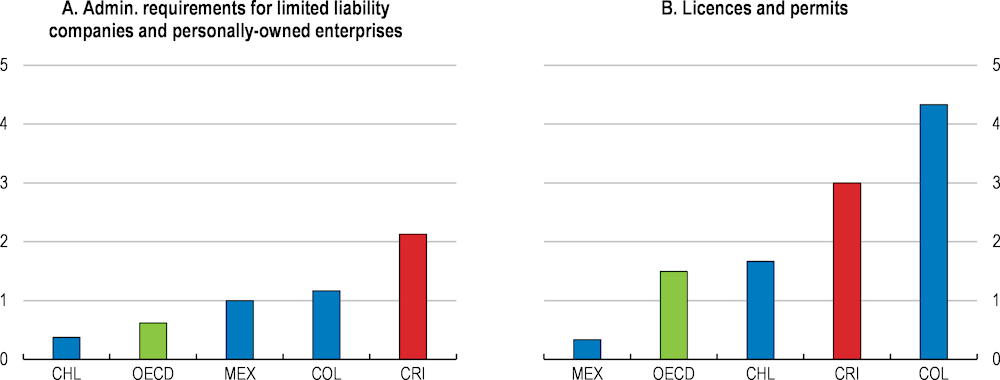

Examining the Product Market Regulator indicator results at sub-indicator level provides further valuable insights. Only two OECD countries have higher barriers administrative burdens than Costa Rica (Figure 2.3). Large barriers to entry are due to a combination of lengthy and costly licencing and permits systems and administrative burdens on small firms. These barriers to entry particularly affect SMEs. Dealing with regulations involve fixed costs, which are a bigger burden for SMES than for large firms, as SME’s turnover is smaller. Entry barriers protect existing activities and firms at the cost of new dynamic and productive firms and jobs. This hampers competition, which in turn, creates rents and lowers the share of wages in value-added, worsening income distribution. Higher prices for consumers reduce purchasing power, affecting disproportionally low-income households.

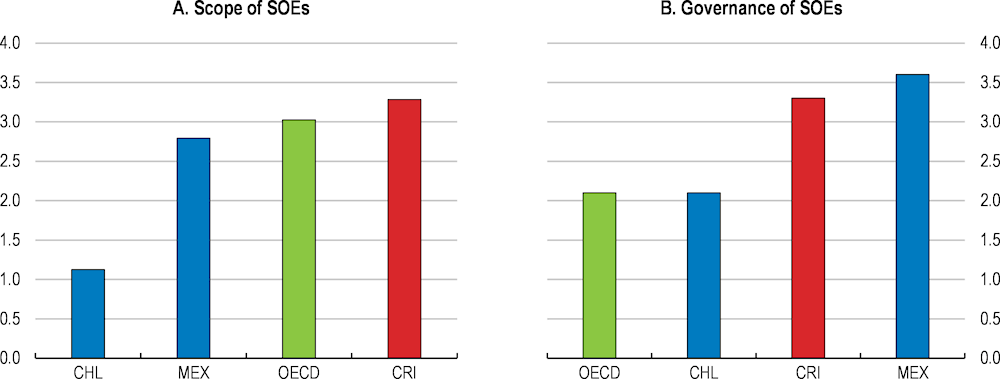

State controls are particularly restrictive in Costa Rica (Figure 2.4). The scope of the state-owned enterprises sector is very wide, with significant room to improve governance. The mobile telecommunication sector was opened to competition following the adoption of the Central America Free Trade Agreement. A significant number of other sectors remain state monopolies or state-owned enterprises play a dominant role. This includes key sectors, such as electricity, transport, banking, insurance and petroleum products.

Costa Rica fares somewhat better in terms of barriers to trade and investment (Figure 2.5), reflecting the transparency and accountability of its trade and investment framework. Costa Rica’s tariffs are on average 4% higher than in the OECD. The top 20 highest tariffs apply to some agricultural products, such as meat, dairy products, sugar and rice.

Figure 2.3. Administrative burdens on start-ups are high

Index from most (0) to least (6) competition-friendly regulation

Figure 2.4. Distortions induced by state involvement are large

Index from most (0) to least (6) competition-friendly regulation

Figure 2.5. Barriers to trade and investment are closer to the OECD average

Index from most (0) to least (6) competition-friendly regulation

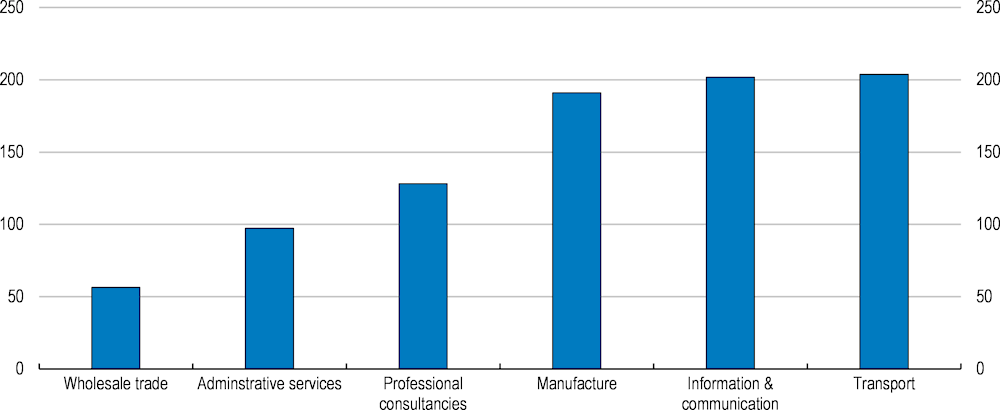

Costa Rica is a dual economy

Costa Rica remains a dual economy. Highly productive exporting firms in high value added sectors, predominantly located in free trade zones coexist with a non-exporting sector, mainly composed of local SMEs, which clearly lag behind in terms of productivity (Figure 2.6). As a consequence, overall, Costa Rica has lower labour productivity than most emerging economies, including China, or regional peers such as Chile and Mexico (Chapter 1).

Figure 2.6. Firms outside the free trade zone lag behind

% difference in median labour productivity between firms within free trade zones and the non-exporting sector

Note: The bars show the percentage difference in median labour productivity (expressed as value added per worker) of firms in and outside free trade zones; some sectors are not reported because of no or too low number of firms operating in free trade zones.

Source: OECD calculations; and Central Bank of Costa Rica.

Two factors help explain the productivity gap in Costa Rica. On the one hand, a high proportion of resources are used in firms of lower productivity, such as micro and informal firms. On the other hand, even the average and typical firm is less efficient than the average firm in other economies (Monge-González and Torres-Carballo, 2014[8]). The lower productivity of the typical firm can be linked to lower growth over the life cycle, as few Costa Rican firms grow over time (Figure 2.7). This hinders investment, jobs, knowledge spillovers, and specialisation of employees.

These features are typical of economies where competition is not strong enough to create an environment in which the disciplining effect from new entrants prompts incumbents to become more efficient (Klapper et al., 2006[9]), allowing resources to flow to their most productive uses. Competition has been weak in key sectors of the Costa Rican economy, such as banking, food, electricity or transportation (OECD, 2016[10]), contributing to low productivity, low wages and higher prices to consumers. A relatively small number of large firms dominate the economy (Figure 2.7), indicating the need to improve regulations to promote a more competitive business environment. Computations undertaken for this survey signal that mark-ups are higher in Costa Rica than in most OECD countries (Box 2.1).

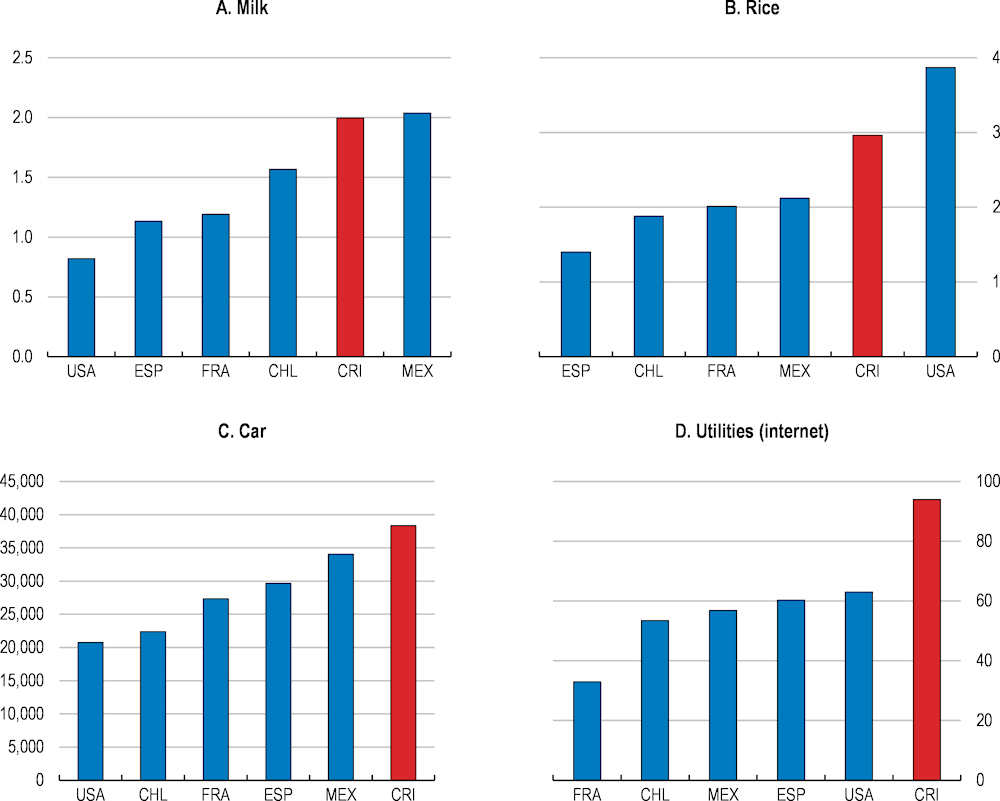

Weak competition tends to translate into relatively high prices of goods for consumers and of inputs for firms. Both features can be found in Costa Rica (Figure 2.8). This has led to a general categorization of Costa Rica as an expensive country, where a basic basket of goods and services costs significantly more than in neighbouring countries (Angulo, 2014[11]). Private firms report that rising costs is the main barrier to their operations (UCCAEP, 2019[12]), particularly in the agriculture and manufacturing sector. This is hampering Costa Rica’s competitiveness in low-value added sectors (World Bank, 2015[13]).

Figure 2.7. A few firms dominate the markets

Extent of market dominance, 2019

Note: This indicator shows the extent of market dominance, 1-7 (best).

Source: World Economic Forum, The Global Competitiveness Index 4.0 2019 dataset (version 04 October 2019).

Figure 2.8. Prices are high

Note: Car prices are proxied by the price of a Toyota Corolla or equivalent new car. Mobile prices are those of 1 min. of prepaid mobile tariff local. Prices are converted to PPP dollars by using 2018 conversion rates.

Source: OECD computations based on Numbeo; and OECD data.

Box 2.1. Measuring market power in Costa Rica

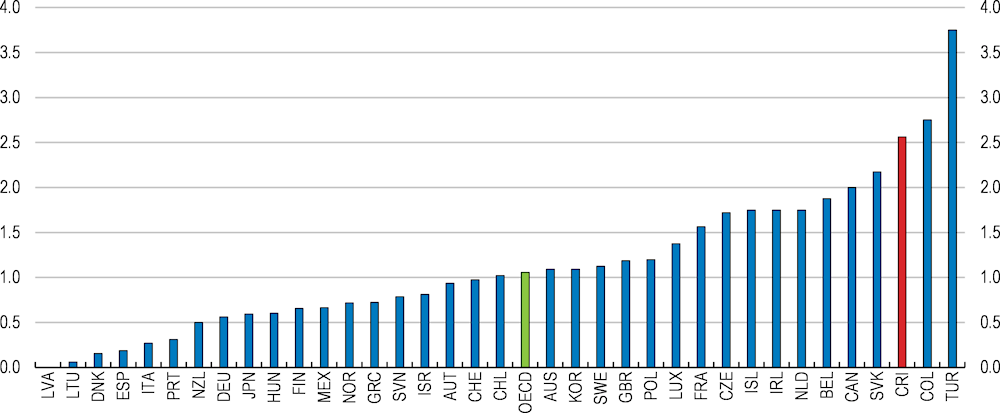

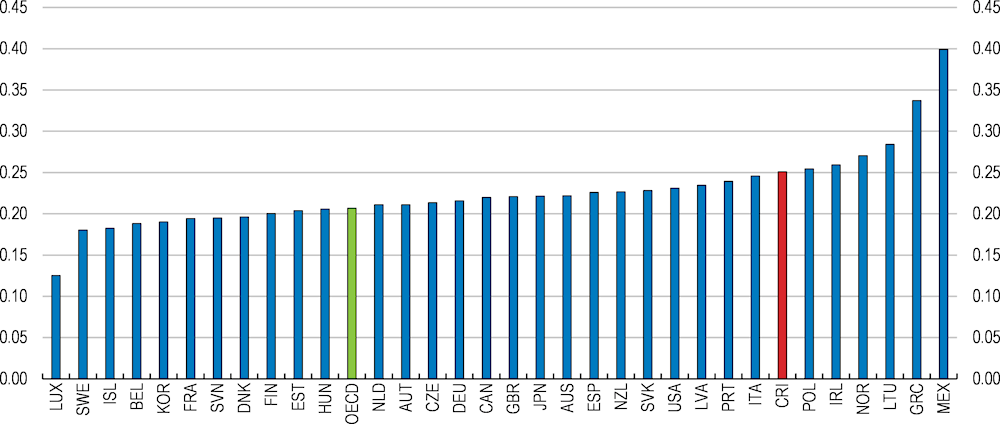

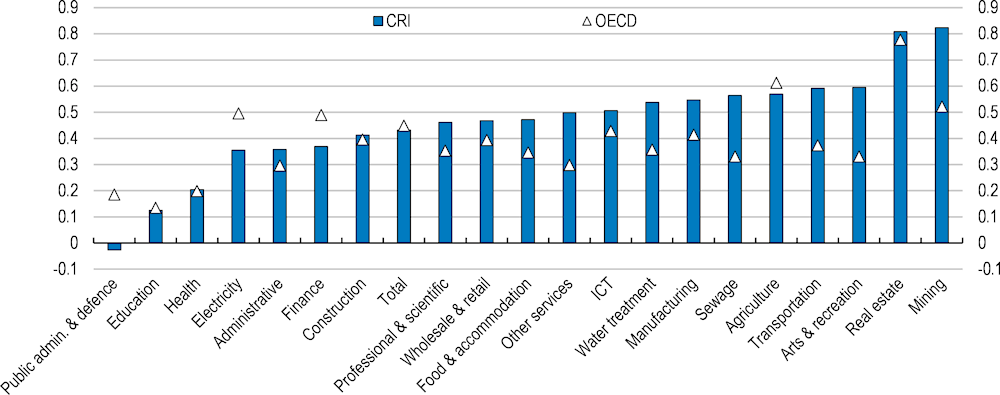

The pressure of competitors and new entrants leads firms to set prices that reflect costs, which is to the benefit of consumers. In the absence of competition, firms gain market power and command high prices (De Loecker and Eeckhout, 2017[14]). Measuring market power can thus provide valuable insights about the degree of competition. Mark-ups measures help to assess to what extent firms are able to price their goods above their costs. High mark-ups can indicate weak competition in an industry or sector. Mark-up indicators have advantages over other measures aimed at measuring market power such as market concentration measures, which can lead to misleading results. For example stronger competition may lead to more productive firms gaining market share resulting in higher, not lower, concentration (IMF, 2019[15]). Measures of mark-ups at sectoral level, computed for this Economic Survey (Gonzalez Pandiella, Rodriquez Vargas and Tusz, 2020[16]), suggest that mark-ups in Costa Rica are higher than in most OECD countries (Figure 2.9). Transportation, manufacturing and food and accommodation are among key sectors where mark-ups indicators are highest and larger than in OECD countries (Figure 2.10)

Figure 2.9. The average mark-up at sector level is relatively high

Index from 0 to 1 (highest mark-ups)

Note: Mark-ups are defined as gross output divided by gross operating surplus, following the methodology presented in (Nordas and Ragoussis, 2015[17]) and (Egert and Vindics, 2017[18]).

Source: OECD calculations based on OECD Structural Analysis (STAN) database; and OECD Economic Outlook database.

Figure 2.10. Most sectors have larger mark-ups than the OECD average

Index from 0 to 1 (highest mark-ups)

Source: OECD calculations based on Structural Analysis (STAN) database; OECD Economic Outlook database.

Low income households could benefit the most from enhanced regulations and competition

Strengthening competition can boost living standards and welfare, by increasing productivity and product quality and lowering product prices (OECD, 2016[10]). Reinforcing competition can also make growth more inclusive by reducing income and wealth inequalities. In the absence of competition, market power drives prices above costs; these higher prices increase everyone’s consumption expenditure and redistribute the extra money spent towards business owners and financial asset holders, who are concentrated at the top of the income distribution (Ennis and Kim, 2017[19]). This increases the income of the upper deciles and reduces consumption power and savings for the rest of the population. In the long run, this helps upper deciles to accumulate wealth and raise their income, while at the same time it is more difficult for lower deciles to build savings.

Regulations can create unnecessary barriers to competition thus leading to situations where key sectors of the economy show high prices and low productivity (Philippon, 2019[20]). The lack of competitive pressures permits incumbents in a given market to extract rents from consumers in the form of high-mark ups. At the same time, these incumbents, sheltered from competition, have no incentive to boost productivity. This leads to highly inefficient outcomes, not only in terms of consumer welfare of inclusiveness but also in terms of productivity and economic growth.

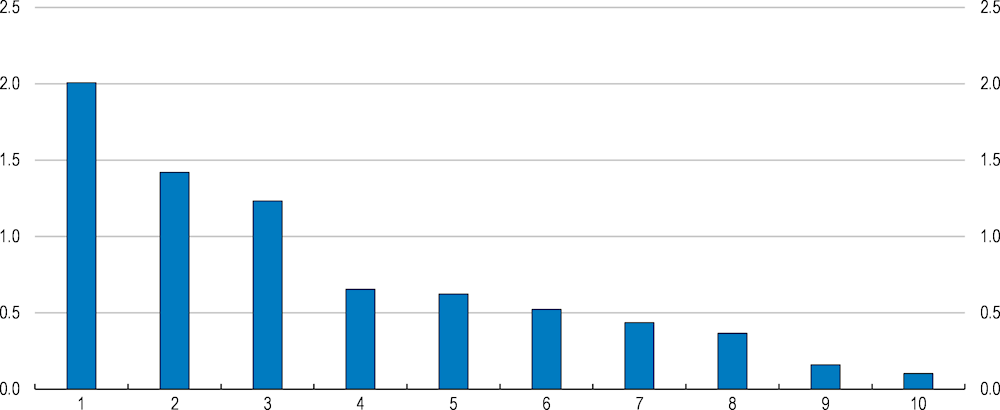

Costa Rica’s experience in the telecommunications and rice sectors exemplifies the significant impact that the competition stance can have on consumers’ welfare. The legal monopoly in the mobile telecommunication sector was effectively abrogated in 2011, as one of the requirements for the signing of the Central American-Dominican Republic Free Trade Agreement with the United States. Today, four private companies, in addition to the former state monopolist, operate in the mobile-phone market and more than ten companies are active in each of the fixed telephony and internet-access markets (SUTEL, 2018[21]). This drastic increase in competition resulted in a large expansion of telecommunications services and lower prices (OECD, 2016[10]). Costa Rice nowadays is one of the leaders in the region in terms of mobile penetration), which creates huge potential for financial inclusion (Chapter 3). OECD computations undertaken for this survey, show that lower income households benefited particularly from the lower prices (Figure 2.11). The reform had also a positive effect on employment, which grew in the telecommunication sector four times more than for the whole economy (OECD, 2016[10]). The opening up has also a positive effect in favouring a higher degree of digitalization among more vulnerable households (Box 2.2 and (Lang and Gonzalez Pandiella, 2020[22]).

Figure 2.11. Opening the telecommunication sector to competition benefited particularly low-income households

Gains in purchasing power by income decile, %

Note: This scenario shows the impact across the income distribution of the fall in prices following the opening of the telecommunication sector.

Source: OECD calculations based on Costa Rican Households and Consumption surveys.

Box 2.2. Assessing the impact of the opening of Costa Rican mobile telecommunication sector: a machine learning approach

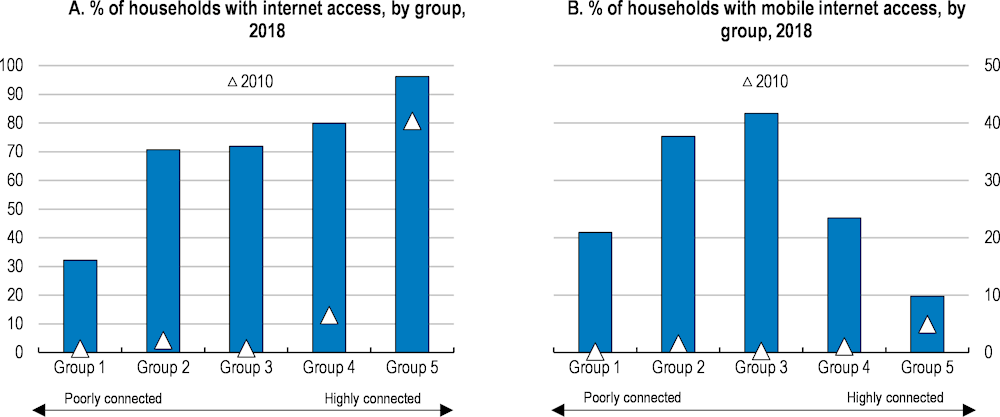

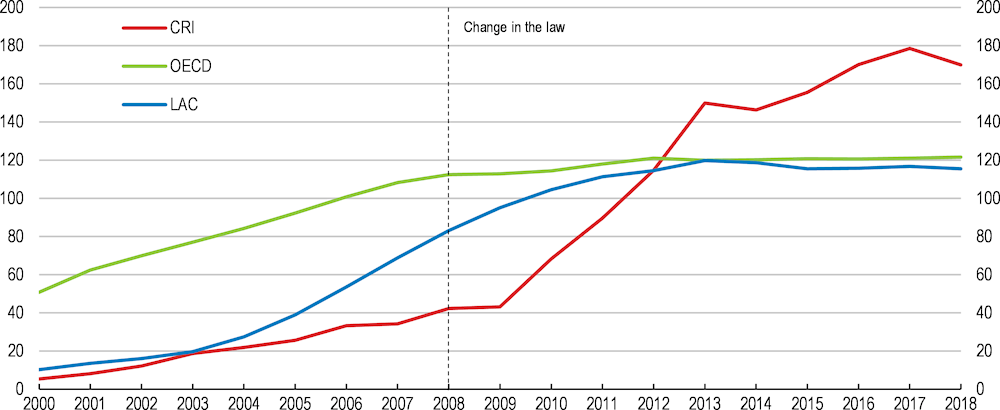

The opening of Costa Rica mobile telecommunication sector started in 2008, after a long and polarized national debate. The opening process was gradual. Private providers started to offer telecommunication services such as fixed internet connections in 2009. Two years later two private companies officially entered the mobile services market. The increase in competition resulted in a large expansion of mobile telecommunication services. Costa Rica, who lagged behind Latina America in terms of mobile-cellular subscription before the opening, has now higher mobile penetration than in Latin America and OECD averages (Figure 2.12).

Figure 2.12. Mobile penetration has increased

Mobile-cellular subscriptions per 100 people

Note: LAC refers to the simple average of Argentina, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Peru, Uruguay and Venezuela.

Source: ITU World Telecommunication / ICT Indicators Database.

Machine learning techniques can help to assess whether the benefits of the opening of the sector in terms of access was concentrated in certain segments of the population, or whether the opening also facilitated the access by individuals in more disadvantaged situations (Lang and Gonzalez Pandiella, 2020[22]). Using clustering techniques, particularly Hierarchical Ascending Clustering and K-means, households can be grouped according to different characteristics, such as type of internet access they have (fixed or mobile), labour status, income level or whether they are located in a rural or urban area. This results in five categories, which can be ranked according to their level of digital connectivity. The results of the analysis suggest that, over the period of 10 years following the opening of the sector, all groups increased access to Internet technologies (Figure 2.13), helping to close connectivity gaps.

Figure 2.13. Opening the mobile market helped to close connectivity gaps

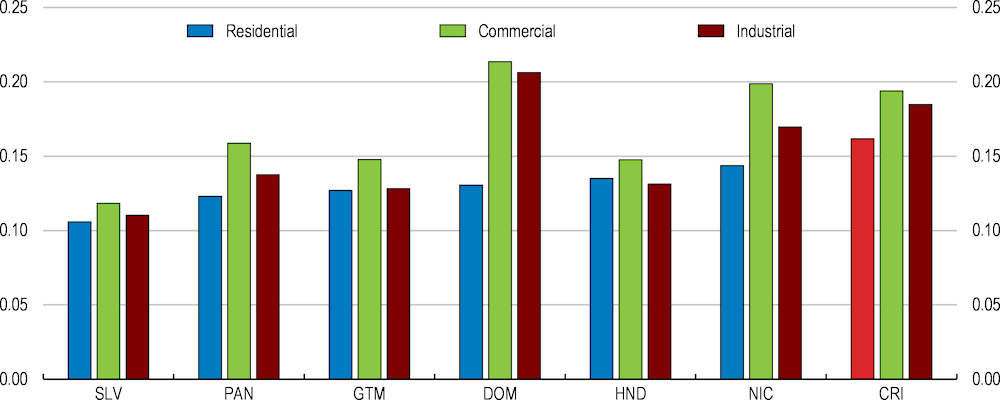

At the other side of the spectrum is the rice sector. Rice is at the same time a staple item in the food basket of the poor and the most protected commodity in Costa Rica (OECD, 2017[23]). 70% of the population consume rice everyday (Mata and Santamaría, 2017[24]). Import tariffs for all types of rice is currently 35%. It was 58% for processed rice with the application of a general safeguard which is no longer active. Costa Rica has maintained an administered minimum price for rice over recent decades. Reforms to the minimum price took place in 2015, when it became a reference minimum price for rice; however, in reality, the reference price continues to function as a minimum price (OECD, 2017[23]). The reference minimum price is based on a domestic production costs analysis by the National Rice Corporation (CONARROZ). These policies have brought prices well above international prices, creating rents that benefit a handful of large producers. The rice market is highly concentrated (Mata and Santamaría, 2017[24]), with 19 large farmers accounting for more than half of the rice produced in Costa Rica. Large producers also benefit from tariff-free import quotas, assigned proportionally to their processing capacity. Thus, they can purchase rice at international market prices, and sell the processed rice domestically with a high profit. Some estimates suggest that the current regulations in the rice market entail a transfer from consumers to producers, which for the poorest households represents 8% of their income (Monge-Gonzalez et al., 2015[25]). Current policies have done little to improve productivity among rice producers or improve the economic well-being of the small producers (Barquero, 2017[26]); (OECD/BID, 2014[27]), but have created incentives to maintain the status quo. All this suggests that the current regulatory setting in the rice market is regressive and contributes to higher poverty and income inequality. Increasing competition, so that domestic prices get closer to international prices, would particularly benefit individuals in lower income deciles (Figure 2.14).

Figure 2.14. Boosting competition further would benefit low-income households

Potential gains in purchasing power by income decile, %

Note: This illustrative scenario shows the impact across the income distribution of a decreased by 40% in rice prices.

Source: OECD calculations based on Households and Consumption surveys.

Reducing administrative barriers to firm entry

Before a firm can compete in a market, it has to be able to enter it. OECD countries have been facilitating entry, as a way to boost competition in their goods and services markets. Costa Rica has ample to room to follow suit. The OECD’s Product Market Regulation index can serve as a diagnosis tool to detect which issues need to be addressed. Among barriers hampering entry, administrative burdens and the license and permits system are the most problematic in Costa Rica (Figure 2.15).

Figure 2.15. Complex requirements hamper firm creation

Index from most (0) to least (6) competition-friendly regulation

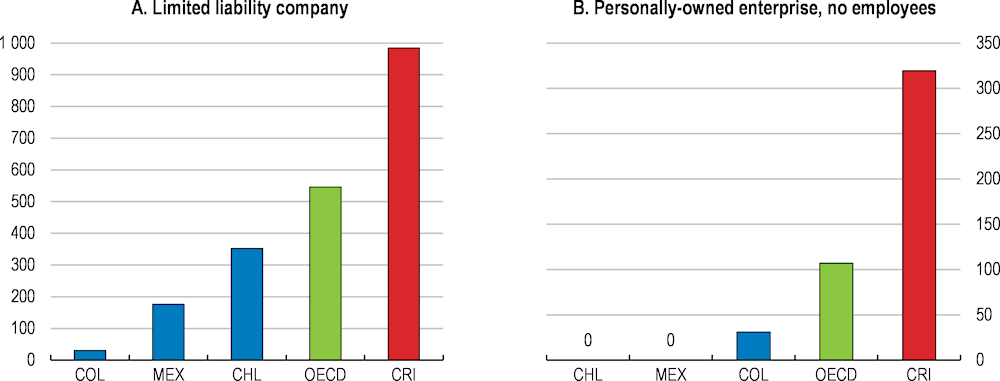

Reducing the cost to start up

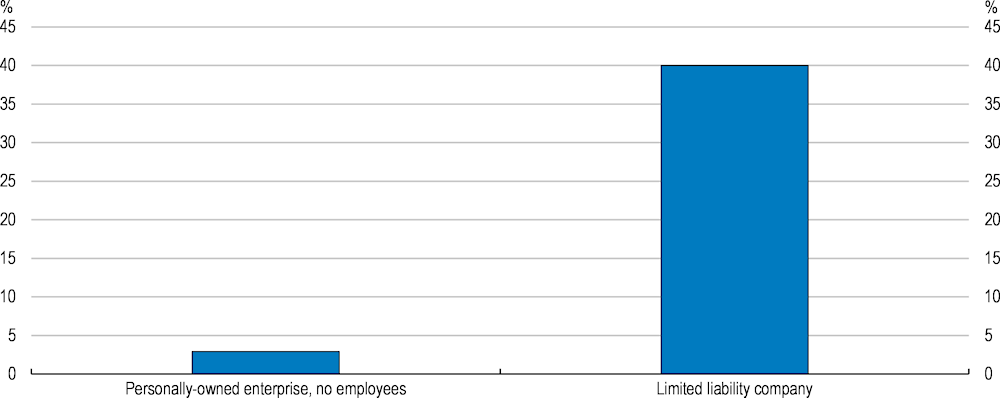

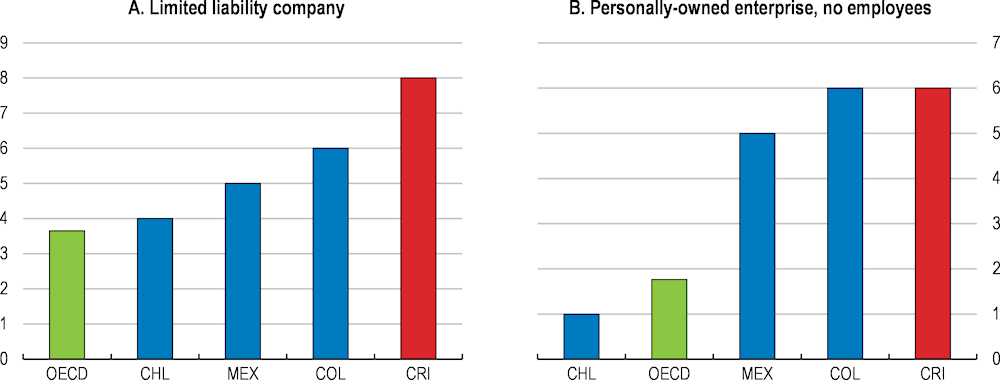

Establishing a company in Costa Rica is significantly more costly (Figure 2.16) and burdensome than in OECD countries and in peer Latin American countries. The largest cost to start a business in Costa Rica relates to the requirement to use a notary, who is in charge of drafting and notarizing public deeds and, upon signature by the entrepreneur, submits the deeds for registration. Notary fees are regulated, have been increasing and amount currently to CRC 185,000 (World Bank, 2020[28]). Costa Rica requires the use of a notary both for personally-owned firms with and without employees and for limited liability accompany. Both OECD and emerging countries have been phasing out the need for a notary as a way to reduce the cost of start-up (World Bank, 2016[29]). Currently, very few OECD countries require the use of a notary to establish a small firm (Figure 2.17. Phasing out this requirement in Costa Rica would reduce the cost to start up significantly. Other administrative requirements to start up are certifying that all social security charges are paid, having the tax office certifying the account books, applying for tax identification number, obtaining mandatory pension and civil insurances or notifying the social security office. These are administrative steps not required in most OECD countries to start up a company, particularly if they are personally-owned.

Figure 2.16. Establishing a company is relatively costly

PPP-adjusted USD

Figure 2.17. Few OECD countries require a lawyer or notary to register a company

Share of OECD countries requiring a lawyer or notary when registering a company

Reducing administrative burden and improving licences and permits

Starting a company in Costa Rica also entails a higher administrative burden than in most OECD countries (Figure 2.18). It takes 23 days to start a business, the majority of which are accounted by the issuing of business license (patente municipal), which takes 15 days and can cost up to CRC 100,000 depending on the type of activity, number of employees or location (World Bank, 2020[28]). OECD countries have succeeded in reducing administrative burden by establishing virtual one-stop shops, where all administrative requirements can be met at once and online. Costa Rica is also moving in that direction. The Costa Rican Export Promotion Agency (PROCOMER) has made good progress in simplifying and digitalising all business processes for firms operating in the free trade zones. This includes the registration phase and licences and permits (such as construction, health or environmental), which can now be completed online. There is ongoing work to extend this also to firms outside the free trade zones. Physical one-stop shops have already being established in 21 municipalities. But they do not allow for solving all licences and permits. An online facility has been launched, but it does not cover all administrative requirements and is available only for firms having a digital signature and operating in certain economic sectors. Keeping a complete count of all licences and permits required, which is currently lacking in Costa Rica and available in many OECD countries, would also facilitate enacting reforms aimed at reducing red tape.

OECD best practices also indicate that adopting the “silence is consent” rule can significantly reduce administrative burden related to obtaining permits and licences. Accordingly, if permits and licences are not issued within the statutory time limit, the activity is deemed to be approved. Costa Rica legislation allows for silence is consent since 2012. It covers permits, licences and authorisation, but not those related to health, animal health, phytosanitary and environmental, some of which are among the authorizations entailing a higher administrative burden. Moreover, applicants need to request the “silence is consent”, which involves submitting a paper application which confirms that all the necessary paperwork had been filed and that the statutory response time has elapsed (OECD, 2018[4]) and (Meehan, 2018[30])). The administration has then three days to either certify that “silence is consent” is granted or provide reasons why it does not apply. These requirements augment themselves administrative burden and are likely to hamper and limit the use and effectiveness of the rules. Removing them would increase the potential role of “silent is consent” rule to speed up authorisation processes.

Figure 2.18. Establishing a company is burdensome

Number of bodies to be contacted

Reducing red tape would also be key to improve productivity in the agro sector, whose productivity is hampered by slow and complicated bureaucratic procedures (OECD, 2017[23]). Shortening the registration process for agrochemicals is critical, given the very low rates of approval and complaints by both trading partners and domestic producers about lengthy, onerous and unpredictable processes (OECD, 2017[23]). Authorities are working towards a better legal framework, improving coordination among the ministries involved in the registration process (Ministry of Agriculture and Livestock, Ministry of Environment and Energy and the Ministry of Health) and aiming at a more streamlined registration process.

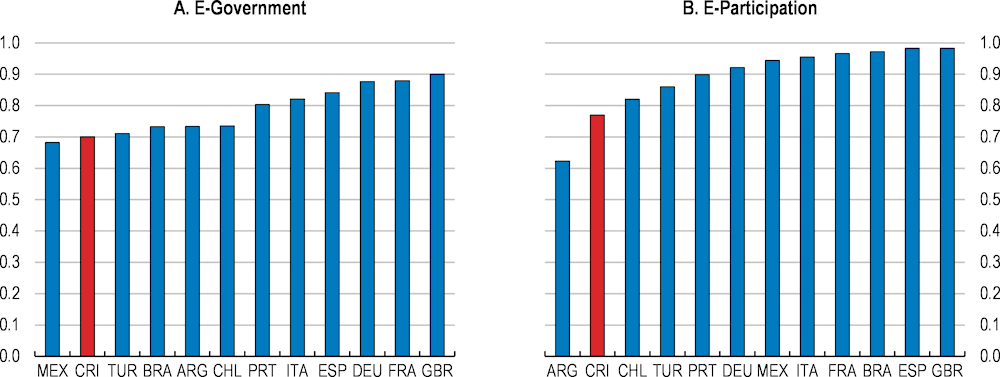

Boosting digital government

Embracing e-government can be a powerful means to reduce the regulatory burden and facilitate firms compliance with needed administrative procedures at a minimal cost. Thus, OECD countries are increasingly making use of digital tools to interact with citizens and firms. Costa Rica lags behind in this area (Figure 2.19), both in comparison with OECD countries and other emerging economies. (Figure 2.20). Authorities have recently launched a web portal, Pura Vida Digital, which widens the number of transactions with government agencies that can be resolved online. Until recently only transactions involving the Foreign Trade Agency could be fully resolved online, with three other agencies (the Ministry of Environment, The Ministry of Culture and Youth and the SOE in charge of water) offering the possibility of completing some of the iterations online (Pastrana Torres, Jiménez Fontana and Segura Carmona, 2019[31]). The Ministry of Economy maintains a national catalogue of all procedures that individuals and firms have to undertake with government agencies, including information on which ones can be resolved online. This is a valuable tool which should help to monitor Costa Rica’s progress towards a more digital government.

Figure 2.19. Costa Rica lags behind in digital governance

E-Government Development Index, 0 to 1 (best), 2018

Note: The E-Government Development Index is a composite measure of three dimensions of e-government: provision of online services, telecommunication connectivity and human capacity. The e-participation index focuses on the use of online services to facilitate provision of information by governments, interaction and engagement.

Source: United Nations 2018 E-Government Development Index.

Figure 2.20. Few administrative transactions with government can be completed online

Share of government transactions that can be completed online, %

Source: IDB 2018 publication, "Wait no more: Citizens, red tape, and digital government". Benjamin Roseth, Angela Reyes and Carlos Santiso.

A key obstacle for increasing the use of digital tools by government, citizens and firms is the existing digital signature mechanism. Costa Rica was a pioneer in establishing a digital signature legislation, which dates back from 2005 and gives electronic signatures the same legal recognition than a handwritten one. In order to electronically sign the documents, the citizen or the firm must have a card with a chip, specially configured for them. A reader is needed to read the card, send the information to a computer and sign the documents with the information in it. Citizens and companies can obtain their digital signature through different entities authorized by the government; most of them are banks. The digital signature must be renewed every four years. It became available in 2009 but it is hardly used, as only 6% of citizens or 20% of business have it. The low use can be partly explained by the low number of procedures, government or commercial services allowing digital signature. Those attempting to use it also face difficulties to get the same validity than a handwritten signature by public institutions. This stems from difficulties for public institutions to develop software to facilitate the use and validation of digital signatures. As a response, the Central Bank has developed a central signature (Firmador Central). There are also technical difficulties, such as limitations regarding mobile solutions or difficulties to replace a lost card (Saso, 2018[32]); (Barahona, Elizondo and Santos, 2015[33]). The Central Bank is currently working towards a solution that would enable the use of the digital signature together with bank credit cards. OECD countries such as Estonia (Box 2.3) exemplifies the cathartic effect that a widely accepted and user-friendly digital signature mechanism can have to reduce red tape and facilitate compliance with administrative requirements by firms and citizens.

Box 2.3. The Digital Signature: the building block of e-government in Estonia

The key element for the development of e-government in Estonia was the Digital Signature Act in 2000. The Act recognised digital signatures as being fully equivalent to hand-written signatures, both in commercial transactions as well transactions with the public sector. The Estonian national identification became the building block for the development of e-government in Estonia. The national digital ID allows for the authentication and authorisation in digital transactions, i.e. electronic signing. The digital signature can be used directly through the ID-card, as the cards embed a chip that can be used as definitive proof of identification in an electronic environment. The signature can be used also through Mobile-IDs, which allow people to use a mobile phone as a form of secure digital ID, or Smart-IDs, which provide an identification solution for anyone that does not have a SIM card in their smart device but needs to securely prove their online identity. The dual use for commercial and public sector transactions, as well as the obligation for the public sector to recognise the national digital ID, created an environment that stimulated the development of compatible public services as well as their take-up by the general population (OECD, 2015[34]). All digital public services can be accessed using the national digital ID, including registration of businesses, electronic voting, electronic prescriptions, electronic health records, declaration of residence and social benefits claims. The use of digital signatures in Estonia is estimated to save 2% of GDP every year (OECD, 2019[35]). Estonia and Costa Rica have recently signed a memorandum of understanding in the field of digital government (MICIT, 2019[36]).

Strengthening competition

Costa Rica’s competition framework has critical weakness, as presented in previous Economic Surveys (OECD, 2016[10]); (OECD, 2018[4]) and thoroughly analysed in the OECD competition accession review (OECD, 2020[37]). These weakness have been addressed in the new competition law. A key concern is the lack of independence and resources of COPROCOM, the competition authority, which contrast with the situation of other agencies with responsibilities in the competition area in Costa Rica (Box 2.4). Lack of resources have prevented COPROCOM from fulfilling its roles. Since 2016, Costa Rica’s competition authorities have only sanctioned one instance of anticompetitive conduct (OECD, 2020[37]).

Box 2.4. Key agencies with responsibilities in the competition area

The agencies shaping the Costa Rican competition regime are:

The Competition Commission (Comisión para Promover la Competencia, COPROCOM).

The Public Services Regulatory Authority (Autoridad Reguladora de los Servicio Públicos, ARESEP). Established in 1996, its responsibilities involve regulating and setting tariffs for public services, namely water and waste, electricity, buses and taxis, fuels (petroleum and its derivatives), airports, railways and ports. The law clearly mandates that services in these sectors can only be provided upon obtaining a state concession. ARESEP is an independent institution as it was created as a decentralised agency; it has its own budget, partly funded with charges on regulated companies.

The Superintendence for Telecommunications (Superintendencia de Telecomunicaciones, SUTEL). Created in 2008 with the liberalisation of the telecommunications sector; SUTEL has the double role of regulator and competition agency for the telecommunications sector; it is a decentralised agency from ARESEP with its own budget partly funded from fees that are charged on telecommunications operators.

Buttressing the competition framework

Costa Rica has recently approved a Competition Reform Act, a fundamental legislative step forward to buttress its competition framework and adapt it to best global standards. The reform act addresses many of the weaknesses previously identified (Box 2.5) and holds the promise of a reinvigorated and more effective competition regime in Costa Rica. However, until is implemented, existing limitations and weaknesses will remain in place (OECD, 2020[37]).

Acknowledging that a timely and full implementation of the reform is critical, the authorities have elaborated a detailed strategic roadmap for implementation organised around three pillars: regulatory strengthening; institutional strengthening; and effective application of the competition rules. Costa Rica is currently negotiating a partnership with the Inter-American Development Bank regarding its support, particularly as concerns regulatory strengthening, which would proceed gradually over the next two years and would be finalised by end 2022. The institutional strengthening would be completed in the first half of 2023. COPROCOM board members are expected to be appointed in 2020Q1 and the recruitment of staff by the first half of 2021. The effective application of the law has gradually started and would be completed by the second half of 2023.

To ensure that the improved competition framework translates into higher productivity and inclusiveness, a strong and responsive judiciary is required, as this is key to ensure the correct and effective implementation of the new competition law. International experience shows that achieving a good understanding of key competitive concepts by judges, such as those guiding the interpretation of detailed evidence, is essential (OECD, 2019[38]). Technical skills of the court’s staff are also important for the development of a specialisation on economic competition matters. These skills can be developed through training for the staff working with judges, supported by a robust system of continuous judicial training in competition matters. International training is also essential to obtain better practices and experiences from other jurisdictions. External economic experts can also help judges to interpret economic evidence and assess its probative value.

Box 2.5. The Competition reform

The main lines of the Competition Reform Act are:

Scope of application. All business conduct with effects on Costa Rica will be subject to Costa Rican competition law, regardless of where those actions took place.

Independence. COPROCOM will become a de-concentrated body with instrumental legal personality” and is granted functional, administrative, technical and financial independence. A minimum statutory budget is guaranteed. Board members will be employed on a full-time basis and selected based on their expertise and character through a public procedure

Advocacy tools and regulations. It is recognised that COMPROCOM can and should pursue market studies and will empower it to request information and impose sections if those request are not met.

Investigation tools and enforcement procedures. A leniency program will be introduced and a special procedure with specific timeframes for competition investigations will be established.

Infraction and deterrent penalties. Three level of infractions are established and the penalty will depend on the total gross income of the infringer.

Merger procedures. The merger notification thresholds will be modified to allow for a more efficient use of resources. COPROCOM will become competent to review mergers in the financial sector.

International cooperation. COPROCOM will get the legal power to establish international cooperation agreements.

Harmonization between COPROCOM and SUTEL. They will have the same procedures, investigative tools and the substantive rules.

Source: (OECD, 2020[37])

An agile court structure is also an effective means to increase clearance rates and reduce the duration of litigation, which has hampered the effectiveness of competition reforms in some OECD countries. There is room to boost court agility in Costa Rica (Figure 2.21). International experience proves that investment in infrastructure and information technology helps to reduce time lags in courts responses.

Deregulating of lawyers’ fees is also associated with lower litigation and a more agile justice systems (Palumbo et al., 2013[39]). Boosting competition in the legal profession can therefore reduce excessive litigation, make courts more responsive and favour a swifter application of the new competition regime.

Figure 2.21. There is room to make courts more agile

Time to enforce contracts (days), 2019

Note: OECD refers to an unweighted average of member countries with available data.

Source: World Bank Doing Business Indicators.

Reducing exemptions from the competition law

Previous OECD Economic Surveys (OECD, 2018[4]); (OECD, 2016[10]) and competition reviews (OECD, 2016) highlighted that that many markets are exempt from competition law in Costa Rica. Submitting those markets to the scrutiny of the competition authority and to the enforcement of competition law would result in a more efficient functioning of the economy and in substantial gains for consumers and firms. Following this, Costa Rica further examined the scope of exemptions from its competition law and found they were more limited than anticipated. The 2019 Competition Reform Act has further reduced the scope of these exemptions and only acts duly authorised in special laws remain exempt from competition law. Five economic sectors have specific acts exempted from competition law: the sugarcane industry, the coffee industry, the rice market, maritime transport and professional associations (Table 2.1). COPROCOM will continue to assess the justification for these exemptions and issue recommendations. The addressees of the recommendations would need to provide reasons to the competition authority for not implementing these recommendations. Ultimately removing the exceptions will require legislative action.

Table 2.1. Sectors exempted from competition

|

Service sector |

Exempted acts |

|---|---|

|

Sugar |

Setting production quotas and sales prices |

|

Rice |

Importation of rice in grain and distribution among industrialists |

|

Coffee |

Setting profit percentages for the benefiter and exporter |

|

Maritime transport |

Fare agreements and route distribution between Competitors (Maritime Conferences) |

|

Professional services |

Setting professional fees |

Source: (OECD, 2020[37]).

While the reduction in exemptions is a significant step forward to boost competition in Costa Rica, the remaining exceptions have a detrimental impact both on inclusiveness and productivity. COPROCOM has been for long insisting on the necessity to eliminate them by various means, including market studies and opinions.

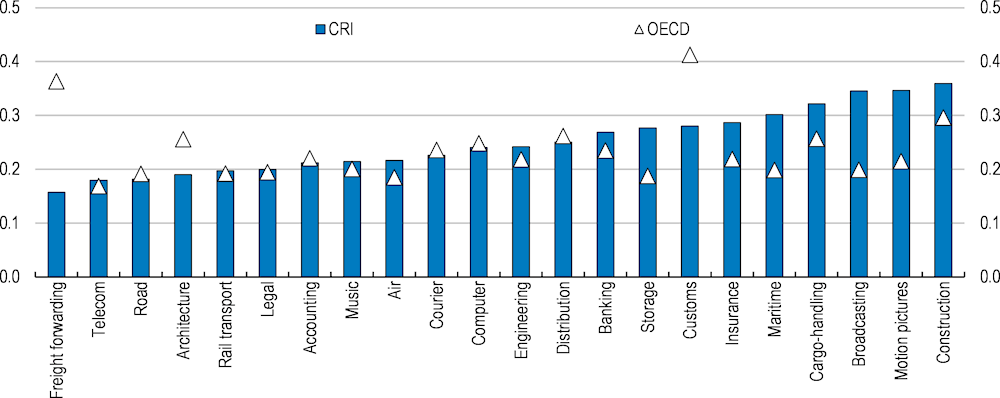

In the case of rice and sugar, remaining exemptions are regressive, reducing the purchasing power of lower income individuals and hampering efforts to reduce poverty in Costa Rica. Maritime transport is vital for Costa Rica as a means to connect with international markets. Boosting competition in this sector would benefit particularly Costa Rican firms outside the free trade zones. The sector also suffers from an inefficient institutional arrangement (see section below). Boosting competition in professional services, by avoiding minimum fees setting, would have a wide-economy positive effect, as these services are key inputs for all firms. International experience shows that this benefits particularly SMEs, as large firms can insource these services and circumvent the fees setting. There is evidence that professional services, such as legal ones, are relatively costly in Costa Rica (Figure 2.22). Both maritime and professional services are upstream suppliers, implying that the share of the economy indirectly affected by these exemptions is much greater.

Figure 2.22. Legal fees are relatively high

Cost of attorney fees (% of claim), 2019

Improving the state involvement

The involvement of the state in the Costa Rican economy is larger than in the average OECD economy. Policy efforts to improve this involvement are therefore warranted. Two areas deserve particular attention, as they have economy wide impact and have a direct bearing not only on economic performance but also on inclusiveness: State-owned enterprises (SOEs) and regulated tariffs.

Improving SOEs performance

The scope of SOEs in Costa Rica is relatively large (Figure 2.23), as state-owned enterprises play a dominant role in many key sectors of the economy, such as banking, network industries (excluding airlines) and petroleum products. Costa Rica has 28 SOEs at the central government level.

Figure 2.23. There is room to improve SOE governance

Index from most (0) to least (6) competition-friendly regulation

There is room to boost the governance of the SOE sector. Recognising this need, authorities have embarked in promising reforms. Boards have been strengthened, by excluding ministers and high-level officials, improving nomination processes and enhancing the objectivity and independence of its members (OECD, 2020[40]). A newly created SOEs advisory unit has developed an ownership policy and has recently published its first annual report on the performance of the SOE sector.

The next step for the unit, in line with best practices, should be to establish performance indicators for each SOE, including their financial sustainability. This is fundamental to achieve a better performing SOE sector, as, historically, indicators tracked by the State focused almost exclusively on the attainment of social goals, without any monitoring of their financial health (OECD, 2020[40]). This greater attention to financial performance of SOEs would offer efficiency gains that would imply lower prices for consumers and firms.

Two areas where additional efficiency gains can be achieved are remuneration of staff and public procurement. SOE’s employees enjoy a relatively high wage premium, both in comparison with private sector and with other public sector entities (World Bank, 2018). In fact increases in remuneration in government entities outside the central government, such as SOEs, made the largest contribution to recent increases in inequality (González Pandiella and Gabriel, 2017[41]), (World Bank, 2019[42]). There is room to rationalise remuneration schemes in SOEs and at the same time maintain attractiveness, as the experience of the Central Bank, who introduced a single and performance-based salary scheme, attests. Bringing public procurement of SOEs within the centralised procurement scheme, lowering and streamlining their thresholds, and phasing out exemptions that give the possibility of direct contracting, can also offer significant savings and would, at the same time, contribute to boost competition (Chapter 1).

Another area where further policy action is warranted concerns the implementation of international financial reporting standards. This is key to boost transparency, accountability and efficiency. Only four SOEs were fully compliant with international standards as of June 2019 (OECD, 2020[40]). The rest, including financial SOEs, continue to report according to national standards. The electricity company reported that implementation will not take place before 2023, which goes beyond the deadlines established by the authorities. Having reliable and comparable information about the financial situation of SOEs is fundamental to assess the potential risks that SOEs pose for the State and the budget, as recent difficulties in several SOEs prove. Reinforcing efforts for a quick and full implementation is therefore warranted.

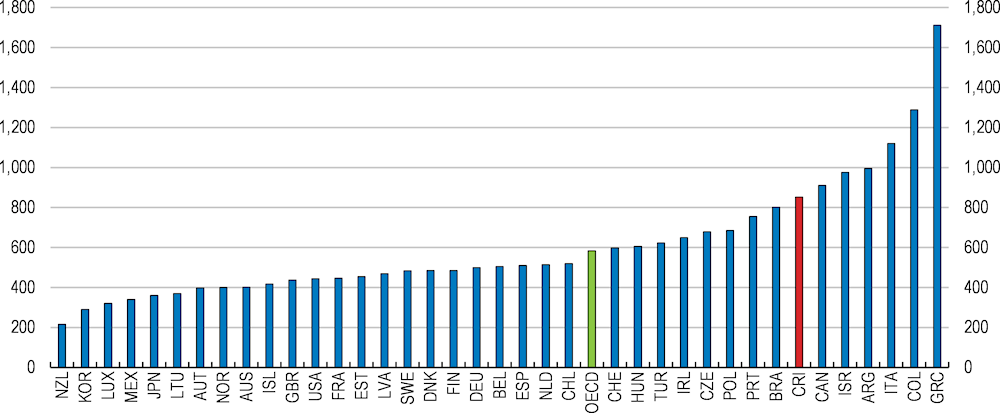

As a whole the SOE sector does not currently present a significant drain on the budget (OECD, 2020[40]), although some SOEs, such as public banks, entail large contingent liabilities (Key Policy Insights). Individual SOEs can , however, have a significant impact on the budget, as recently exemplified by the need to assist JAPDEVA, the ports administrator, in its restructuring process, which contributed to widen the budget imbalance in 2019 above own government projections. The electricity company, ICE, is the one with the weakest financial situation (Figure 2.24). Its operating performance is low when benchmarked with peer institutions (World Bank, 2015[13]). Electricity prices in Costa Rica are higher than in regional peer countries (see below). Waiting periods for new connection and duration of outages are above those of its structural peers. This is particularly detrimental for Costa Rican firms operating in sector where reliable electricity is essential, such as the high-tech industries. ICE offers firms the possibility to finance ICE’s investments in exchange for lower tariffs. These arrangements may be useful for large firms, such as those operating in the free trade zones, but local SMEs are unlikely to be able to afford them. Improving ICE’s performance’s would be fundamental (Box 2.6) and would have economy wide benefits. OECD countries have increasingly introduced some degree of separation between electricity generation, transmission and retail supply. Effectively separating monopolistic activities (such as the operation of the transmission network) from activities that can be subject to competition (such as generation and retail supply) can bring large benefits in the form innovation, customer responsiveness and lower prices (IEA, 2001[43]). Introducing a legal separation would be a good step to boost performance, while ownership separation would offer the largest benefits. Costa Rica should also consider relaxing existing restrictions and caps on private sector participation in this sector to be able to meet upcoming challenges. Allowing private generators to compete in the market, and not only for the market would be a step ahead to boost competition, as exemplified by Costa Rican own experience in the opening of the mobile telecommunication sector.

Figure 2.24. ICE is the worst performing SOE

Net income, % of GDP

Note: The full names and economic sector of SOEs are as follows: INS: Instituto Nacional de Seguros (insurance); RECOPE: Refinadora Costarricense de Petróleo (energy); JPS: Junta de Protección Social (lottery); INCOP: Instituto Costarricense de Puertos del Pacifico (port authority); SINART: Sistema Nacional de Radio y Televisión (broadcasting); JAPDEVA: Junta de Administración Portuaria y de Desarrollo Económico de la Vertiente Atlántica (port authority); CNP: Consejo Nacional de la Producción (agriculture); INCOFER: Instituto Costarricense de Ferrocarriles (rail transportation); AYA: Acueductos y Alcantarillados (water and sewerage); Ice: Instituto Costarricense de Electricidad (electricity). Banco Nacional and Banco de Costa Rica are publicly-owned commercial banks. Correos de Costa Rica is the national postal service.

Source: Informe agregado sobre el conjunto de empresas propiedad del Estado 2019.

Box 2.6. The Costa Rican Electricity Institute: electricity and beyond

The Costa Rican Electricity Institute (ICE) dominates the Costa Rican electricity sector, as private-sector participation is limited by statutory restrictions. It generates around 65% of the electricity (the rest is generated by municipalities, cooperatives and private companies). ICE also provides all transmission service in the country and is responsible for 44% of electricity distribution. One of its subsidiaries distributes around 32% of generated electricity while municipal companies and co-operatives cover the rest of power distribution in rural area.

Private companies are allowed only in the electricity generation and can sell their electricity to ICE only. Private-sector generators compete for the market rather than in the market, because to enter the market they must first win ICE’s tendering contracts, which also specify the quantity of electricity ICE will purchase. In 1995 the share of allowed private-sector electricity generation was increased from 15 to 30%. There are also barriers to foreign participation in the sector, as 35% of the capital of the firm generating the electricity should be Costa Rican. There are also limitations to the amount of electricity that each generator can produce.

The unit in charge of operating and planning the electricity system, the National Centre of Energy Control (Centro Nacional de Control de Energía, CENCE), is an administrative unit of ICE. This means that ICE has the full control over the Costa Rican electricity market, not only as concerns generation, transmission and distribution but also in terms of operation and planning of the system. The General Comptroller Office has recommended reforming the electricity system to increase the independence of the unit in charge of operating and planning the electricity system (CGR, 2019[44]).

Costa Rica faces the challenge of addressing an increasing gap between the demand and supply of electricity with renewables sources only. This will require large investments.

The current role of ICE in the Costa Rican economy goes beyond the electricity sector. ICE also had the monopoly in the telecommunication sector until the opening in 2011 and still plays a major role in that sector. It also participates in the design, construction and supervision of public infrastructure. By making use of exceptions in the procurement law, other public agencies can contract directly ICE without running a public tender (Chapter 1). This has raised concerns by business associations, as it inhibits competition. Both the General Comptroller (CGR, 2019[45]) and the Attorney of the Republic (PGR, 2015[46]) has stated that the current state of the law does not allow ICE to build public infrastructure. The law allows ICE to sell services to other public institutions, but those should be directly related with its core competences: electricity and telecommunications (PGR, 2015[46]).

Enhancing methodologies to set regulated tariffs

Tariffs for SOEs operating under monopoly conditions are set by the Regulatory Authority for Public Services (ARESEP), an autonomous multi-sectoral regulator. Tariffs for telecommunications services are set by the Telecommunications Supervisor (SUTEL), which is a fully independent body.

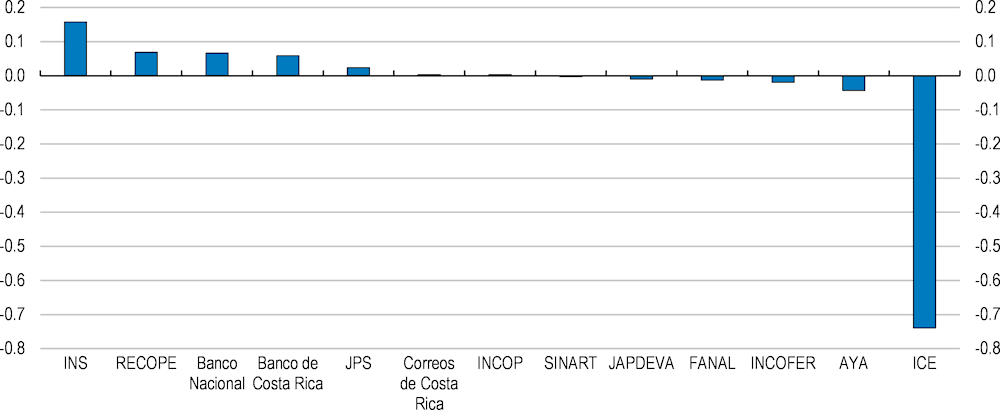

The way tariffs of regulated services – energy, transport and water – are set by ARESEP limits competitive pressures and results in fast-rising costs for users (OECD, 2020[40]). The law instituting and regulating ARESEP clearly mandates that tariffs be based on the (reasonable) costs incurred by service providers and to ensure their financial viability (i.e. cost-based pricing or rate-of-return regulation), which guarantee a certain rate of return on the capital invested. While this type of price regulation ensures tariffs are set at cost recovery levels, it provides no incentives for productivity improvements because cost increases can be easily passed onto consumers. It also implies that consumers bear the burden of higher costs caused by inefficiencies in those SOEs operating under monopoly conditions. Tariffs of regulated services have risen more than any other business cost (CAATEC, 2014[47]). Electricity tariffs are higher than in other countries in the region (Figure 2.25).

Figure 2.25. Electricity prices are high

USD per kWh

Note: For each sector the chart shows the effective rate computing the average across different powers.

Source: Estadísticas del subsector eléctrico de los países del Sistema de la Integración Centroamericana (SICA), 2016, Table 8.

In the electricity sector, while tariffs are meant to be based on technical criteria and verifiable data, ICE, the General Comptroller and ARESEP have come up with different computations and results. According to the General Comptroller, the use of incomplete and obsolete information in the computations by ARESEP implies that higher tariffs have been set and passed on to consumers (GCO, 2019). This case suggests, that policy efforts to update and improve the methodology to set tariffs are warranted.

Setting tariffs for public service in a way to encourage productivity improvements and the adoption of cost saving technologies would lead to lower prices, with economy-wide benefits. The experience of OECD countries, such as the United Kingdom, the Netherlands and France, shows that alternative tariff-setting methodologies – such as price- and revenue-cap regulation – strengthens competitive pressures and contribute to curtail tariff inflation (Sappington and Weisman, 2010[48]); (Mirrlees-Black, 2014[49]). By setting limits to the tariffs regulated companies may charge, or the revenues they may earn, price- and revenue-cap regulation replicate the discipline of competitive market forces and compel regulated firms to search for productivity gains (OECD, 2016[10]). The experience of OECD countries also suggests that price cap regulation coupled with independent regulators promotes infrastructure investment (Égert, 2009[50]).

Box 2.7. Providing better incentives in regulated sectors: price cap regulations

Price-cap regulation is the most widespread type of incentive regulation in OECD countries. They are the main alternative to rate-of-return regulations, where prices are set to account for the production costs of the firm and the margin that is allowed by the regulator or agreed on between the regulator and the firm. These regulations facilitate that costs can be easily passed onto consumers and can result in tariff inflation. Under price to cap regulations, the regulator initially studies the firm’s capabilities and its operating environment in order to determine the revenues that would likely allow the firm to secure reasonable earnings. Unlike rate-of-return regulations, price-cap regulation does not require detailed and continuous information about costs and demands. Instead, the aim of price-cap regulation is to provide adequate incentives for the company to reveal costs and to induce lower cost techniques. With incentive-price regulation the regulator sets a cap, including an adjustment factor X, for a specified period, which the firm can charge for a defined basket of goods and services. The typical price cap regulation plan specifies a price cap period (often 4 or 5 years) and a maximum rate at which the regulated firm's inflation-adjusted prices can rise annually, on average, during this period. The firm's realized costs and earnings are usually reviewed at the end of the specified price cap period, and often employed to update estimates of the pricing restriction that would allow the regulated firm to secure a reasonable level of earnings in the next price cap period. Price cap regulations are less vulnerable than rate-of-return regulation to cost-plus inefficiency and over-capitalisation since the firm has the incentive to minimise all of its costs. Part of this expected increase in efficiency can then be passed on to consumers via the level of X.

Improving regulations in key sectors

Improving regulations in key sectors of the economy, such as network sectors, can have a large positive impact on economic growth, as the share of the economy indirectly affected is very wide. International evidence shows that inappropriate regulations in those upstream sectors impact on incentives to improve productivity downstream, decreases international competitiveness and reduces economic resilience (Monteiro, Fontoura and Santos, 2017[51]).

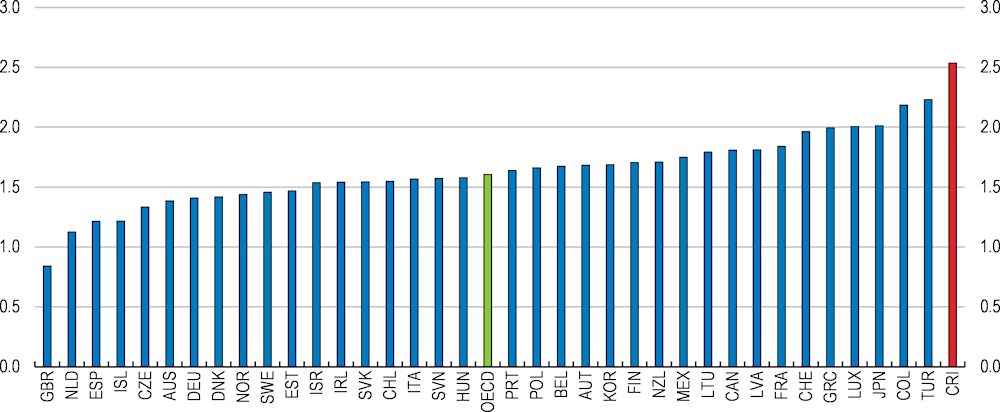

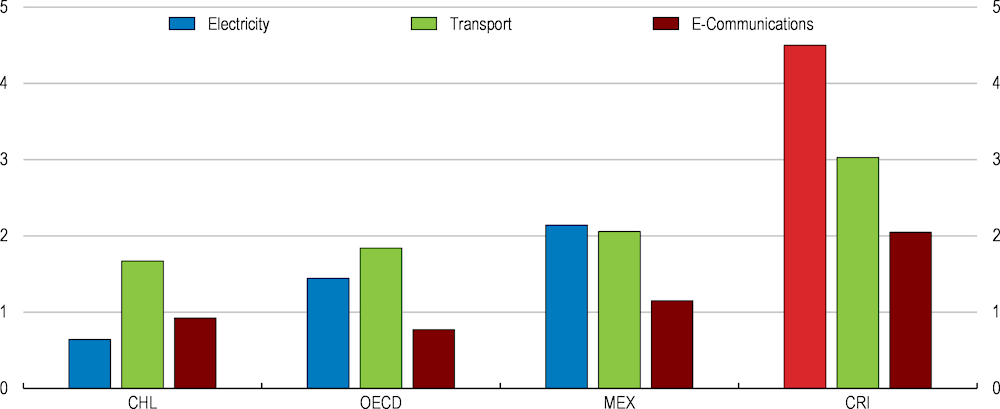

There is room to improve regulations in network sectors in Costa Rica (Figure 2.26). The telecommunication sector displays better regulations, thanks to the process of opening the mobile market since 2011. Even in this market there remains a gap with respect to regulations in OECD countries, as there remains a monopoly for fixed telephony. Traditional public switched telephone network (PSTN) services are still a monopoly held by ICE, and these services still represent the bulk of the fixed telephony market. Competition is only possible in Voice over Internet Protocol (VoIP) services, which represent a small share of the market. In the electricity sector, by contrast, there is a large scope to align regulations with those in OECD countries. International experience suggests that Costa Rica would benefit from introducing a legal or ownership separation between generation, distribution and retail supply and from opening up to competition so that consumers have the option to choose their retail electricity supplier. In the transport sector, the Product Market Regulations index suggests that there is room to improve regulations in all subsectors, but the need is particularly acute in rail and water transportation.

Boosting the performance of the rail sector would be key to improve logistics and reduce traffic congestions in Costa Rica. The sector, which suffers from years of underinvestment, would benefit from adopting best regulatory standards. The rail state-owned company fully dominates passenger and freight transport and is also in charge of operating the railroad infrastructure. OECD countries have been gradually increasing vertically separation and allowing for several operators competing in the same geographic area or rail district as ways to improve performance and provide users with better services. Allowing for private participation would also help to overcome the underinvestment suffered by this sector.

Water transportation is particularly important for Costa Rica as it is key for export competitiveness. State-owned enterprises play a critical role there, as two state owned enterprises, INCOP and JAPDEVA, have the exclusive right to manage all ports on the Pacific and Atlantic coasts respectively. In February 2019, a new containers terminal (TCM) started its operations, ending with the monopoly of JAPDEVA. Both INCOP and JAPDEVA have the double role of port authorities and port operators. Despite operating under monopolistic conditions the financial situation of JAPDEVA is weak and is in the process of being restructured. Given the importance of maritime transport for Costa Rica, as a means to connect with international markets, the country would benefit from adopting the management concept of landlord port, whereby port authorities owns and manages the land and basic ports’ infrastructure that are then rented or leased to different private port operators on a competitive basis. Similar changes in Mexico and other countries have resulted in significant improvements in the productivity of ports and reductions in cargo handling charges (Pisu, 2016[52]).

Figure 2.26. There is room to improve regulation in network sectors

Index from most (0) to least (6) competition-friendly regulation

Note: Data refer to 2018. Transport includes transport of freight and passengers by air, road, rail and water.

Source: OECD Product Market Regulation database.

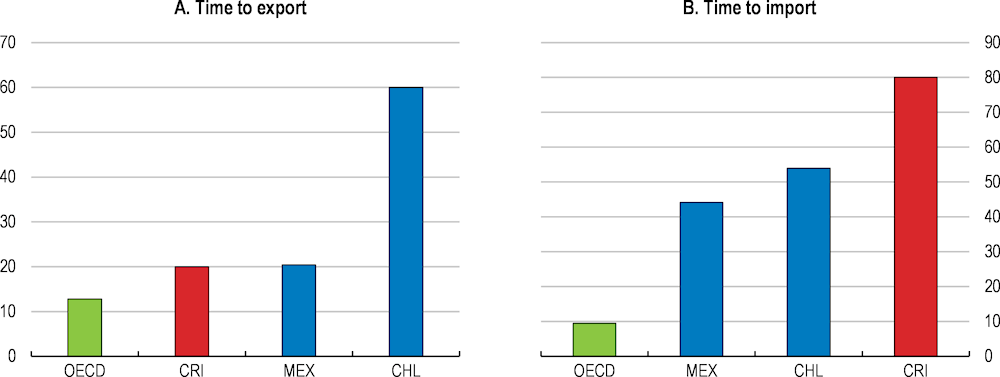

Regulations in network sectors, such as in maritime transport, have a detrimental impact of logistics, where Costa Rica performance is lacklustre (Figure 2.27). The time needed to import is particularly large (Figure 2.28), which hampers the access of Costa Rican firms to foreign inputs, which in turn, hampers its export competitiveness. Empirical analysis undertaken for this chapter suggests that improving logistics can give a significant boost to exports (Dek and Gonzalez Pandiella, 2020[53]). Should Costa Rica have improved its logistic performance in line with improvements made by peer countries, exports would have been significantly higher (Box 2.8). Lifting existing restrictions to foreign participation in services which are key to logistics, such as cargo handling, maritime services, customs or storage, where restriction are higher than in the OECD (Figure 2.29), can help to improve logistics operations and boost export competiveness. Authorities acknowledge that logistics is a key policy area and that there is a need to improve both port and land borders. Concerning ports, efforts have been focused on improving the performance of the Port of Limón, the most important in the country, which have been recently concessioned. Concerning land borders, the so-called Border Integration Program has been launched with the aim of modernizing infrastructure and streamlining procedure and is expected to be finalised in 2022.

Figure 2.27. Logistics operations in Costa Rica are perceived to be lacklustre

Index, 1 to 5 (best)

Figure 2.28. Time to import is lengthy

Border compliance (hours), 2019

Figure 2.29. Lifting restrictions in services can boost logistic performance

Index from 0 to 1 (most restrictive regulations)

Box 2.8. Assessing the impact of logistics on exports: a synthetic control method approach

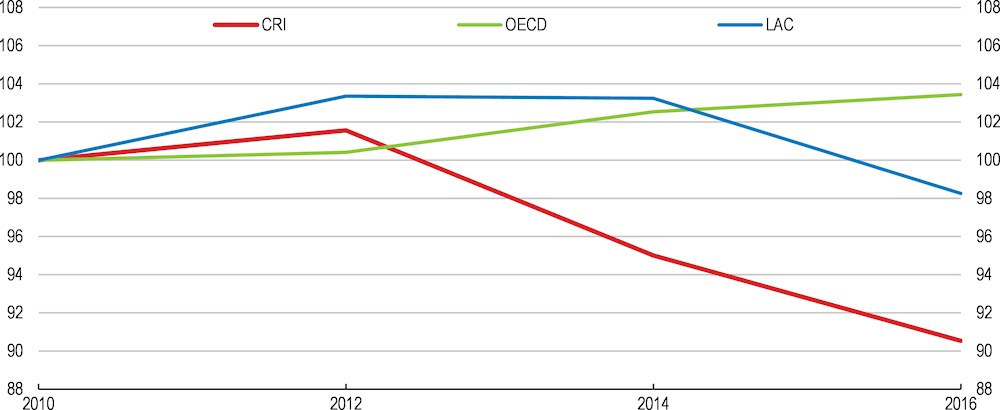

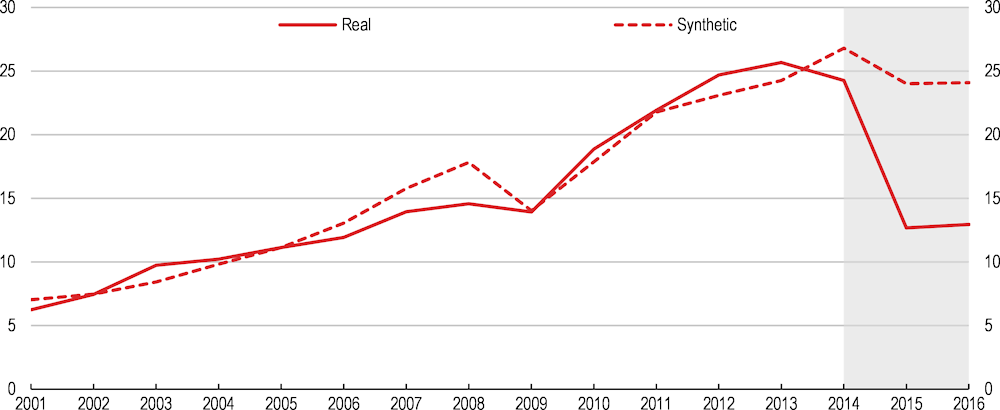

Progress in improving logistics has been significantly lower than in OECD and regional peer countries, with logistics indexes showing a worsening since 2012 (Figure 2.30). The synthetic control method (see Abadie, Diamond, and Hainmueller, 2010, 2011, 2014) can help to gauge the impact that this weak performance in logistics has on exports (Dek and Gonzalez Pandiella, 2020[53]). The synthetic control method uses a data-driven procedure to construct a synthetic control unit, so-called synthetic Costa Rica, using a weighted combination of comparison units (other countries) that approximates the characteristics of the exposed unit (Costa Rica) before an event or intervention. The synthetic Costa Rica can then be used to simulate the development of Costa Rica after the event (in this case the lack of progress in improving logistics services). Results indicate that, had Costa Rica improved its logistic performance in line with improvements made by peer countries, exports would have been significantly higher (Figure 2.31). This highlights that, beyond physical infrastructure, logistics also matters and that policy efforts in this area will pay off in terms of higher exports and growth.

Figure 2.30. Logistics performance has deteriorated

Logistics Performance Index, 2010=100

Note: LAC refers to the World Bank group of 25 Latin American and Caribbean countries (excludes high income countries).

Source: World Bank Logistics Performance Index.

Figure 2.31. Real Costa Rican exports vs synthetic Costa Rican exports

Exports excluding oil and minerals, billions of USD

Note: The following countries were used to construct the synthetic Costa Rica values: Latvia, Lithuania, Mexico and Tanzania.

Source: OECD calculations.

Improving the governance of regulators

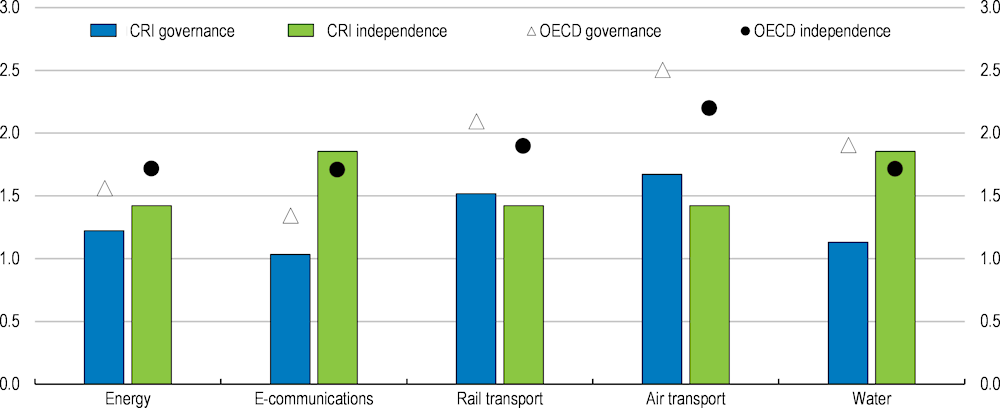

Fostering the role of regulators can also help to move to a more competition-friendly environment in network sectors. OECD indicators in this area suggest that there is room to strengthen the governance of regulators (Figure 2.32) in all sectors by fostering their independence. The independence of a regulator is an important factor in preventing undue influence in regulatory actions and maintaining trust in the regulatory system (Koske et al., 2016[54]). Adopting OECD best practices in the nomination of agency head and board members would be a promising step to increase independence in regulators in Costa Rica. This could be achieved by having these positions publicly advertised and candidates examined by independent selection panels, instead of the current practice of direct nomination by the government. There is also room to provide them with a wider scope of action, such as enforcing compliance with industry and consumer standards and regulatory commitments through legal punitive powers for non-compliance (e.g. inspections and fines) or mediating to resolve disputes between market actors and regulated entities.

Figure 2.32. Indicators on governance of sector regulators

Index from 1 to 6 (better governance)

Note: The Indicators on the Governance of Sector Regulators capture the governance arrangements of economic regulators in the energy, e-communications, rail transport, air transport and water sectors. These indicators are based on the OECD Best Practice Principles for Regulatory Policy: The Governance of Regulators and further guidance developed by the OECD Network of Economic Regulators.

Source: OECD.

|

MAIN POLICY FINDINGS |

RECOMMENDATIONS |

|---|---|

|

Reducing barriers to entrepreneurship |

|

|

Barriers to entry are large. Setting up a firm is costly and burdensome. Regulatory burden is high. Few procedures can be resolved online. |

Introduce online one-stop mechanisms and ensure physical ones cover all licences and permits and are present in all major cities Eliminate the requirement for using a notary to register a company |

|

Digitalization is low in government and among firms and citizens. Few individuals and firms have a digital signature. |

Make the electronic signature mechanism more user-friendly. |

|

Silent is consent rules do not cover all key authorizations and permits. For those included, there is a need to administratively apply for the silent is consent. |

Widen the scope of silent is consent rules and remove the need to require administratively its application |

|

Competition |

|

|

The competition framework suffer from a number of limitations, which are expected to be remedied through implementation of the recently approved competition reform law. |

Ensure a full and timely implementation of the competition reform road map. |

|

A good understanding of competition matters by judges and courts would be fundamental for an effective implementation of the competition bill. |

Deploy training on competition issues for judges and courts staff. |

|

Remaining exemptions to competition are regressive and inefficient. |

Gradually phase out remaining exemptions to competition law in rice, sugar, coffee, maritime services and professional services. |

|

Costa Rica court system is relatively slow. This can prevent a swift implementation of the new competition bill, as experienced in some OECD countries. |

Boost competition in the legal profession by deregulating lawyers fees. |

|

Improving the involvement of the State in the economy |

|

|

SOEs play a dominant role in key sectors of the economy, providing key services for consumers and firms. Some SOEs entail large contingent liabilities. |

Establish and monitor performance indicators for SOEs, including their financial health. Ensure full implementation of international accounting standards. |

|

ICE’s dominates the electricity market. Its operating performance is low. Private companies are allowed only in the electricity generation and up to 30%. Private firms can only 35% of the capital of the firms generating electricity should be Costa Rican. Its activities go beyond its legal mandate, as it receives direct contracts for public works from other government agencies. |

Increase the share of allowed private-sector electricity generation and allow private participation in distribution and retail supply. Remove barriers to foreign participation in the electricity sector. Introduce legal or ownership separation between generation, transmission and retail supply. Focus ICE’s activity in the electricity sector. |

|

The methodology used to set regulated tariffs results in cost increases being passed onto consumers. Tariffs have been increasing above other business costs. |

Introduce price-to-cap methodologies. |

References

[5] Alfaro-Urena et al. (2019), “The Effects of Joining Multinational Supply Chains: New Evidence from Firm-to-Firm Linkages”, Avaiable at SSRN, http://dx.doi.org/10.2139/ssrn.3376129.

[11] Angulo, J. (2014), “¿Es Costa Rica un país caro?: Costo de vida, disparadores del costo de producción y retos para la competitividad”, Estado de la Nacion.

[33] Barahona, J., A. Elizondo and M. Santos (2015), “The dilema of public e-procurement in Costa Rica : case on the duality of technological platforms and implementation models”, Journal of Information Technology Teaching Cases, 5: 57-64.

[26] Barquero, M. (2017), “Comisión para a Competencia se pronuncia contra la fijación de precios del arroz”, La Nación, https://www.nacion.com/economia/agro/comision-para-la-competencia-se-pronuncia-contra-la-fijacion-de-precios-del-arroz/3TFSKMFD4RB7DNTKLN2FVCWTKM/story/.

[2] Bouis and Duval (2011), “Raising Potential Growth After the Crisis: A Quantitative Assessment of the Potential Gains from Various Structural Reforms in the OECD Area and Beyond”, OECD Economics DepartmentWorking Papers, No. 835..

[47] CAATEC (2014), Indice General de Costos Empresiarial, available at www.caatec.org/sitio1/igce., Comisión Asesora en Alta Tecnologia.

[44] CGR (2019), Informe de la auditoría operativa coordinada sobre energías renovables en el sector eléctrico, Contraloria General de la República de Costa Rica, https://cgrfiles.cgr.go.cr/publico/docs_cgr/2019/SIGYD_D_2019012476.pdf.

[45] CGR (2019), oficio DFOE-DI-1935 (14613) de 27 de setiembre del 2019.

[14] De Loecker, J. and J. Eeckhout (2017), “The Rise of Market Power and the Macroeconomic Implications”, BER Working Paper 23687, National Bureau of Economic Research, Cambridge, MA..

[53] Dek, M. and A. Gonzalez Pandiella (2020), “Assessing the impact of logistics on exports: a synthetic method approach (forthcoming)”, OECD Economics Working Paper, OECD Publishing.

[50] Égert, B. (2009), “Infrastructure Investment in Network Industries:The Role of Incentive Regulation and Regulatory Independence”, CESifoWorking Paper Series, No. 2642..

[3] Égert, B. and P. Gal (2016), “The quantification of structural reforms in OECD countries: A new framework”, Economics Department Working Papers No.1354, http://www.oecd.org/eco/workingpapers.

[18] Egert, B. and A. Vindics (2017), “Mark-ups and Product Market Regulation in OECD countries: what do the data whisper?”, mimeo.

[19] Ennis, S. and Y. Kim (2017), “Market Power and Wealth Distribution”, in A Step Ahead: Competition Policy for Shared Prosperity and Inclusive Growth, OECD Publishing, Paris/World Bank Group, https://dx.doi.org/10.1787/9781464809460-1-en.

[41] González Pandiella, A. and M. Gabriel (2017), “Deconstructing income inequality in Costa Rica: An income source decomposition approach”, OECD Economics Department Working Papers, No. 1377, OECD Publishing, Paris, https://dx.doi.org/10.1787/77759015-en.

[16] Gonzalez Pandiella, A., A. Rodriquez Vargas and R. Tusz (2020), “Measuring mark-ups in Costa Rica”, OECD Working Paper Series, Vol. Forthcoming.

[43] IEA (2001), Competition in Electricity Markets, Energy Market Reform, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264192768-en.

[15] IMF (2019), The Rise of Corporate Market Power, Chapter 2 in World Economic Outlook.

[9] Klapper, L. et al. (2006), “Entry regulation as a barrier to entrepreneurship”, Journal of Financial Economics, Vol. 82, pp. 591-629, http://dx.doi.org/10.1016/j.jfineco.2005.09.006.

[1] Koske et al. (2015), “The 2013 Update of the OECD’s Database on Product Market Regulation: Policy Insights for OECD and Non-OECD Countries”, OECD Economics DepartmentWorking Papers, No. 1200, OECD Publishing.

[54] Koske, I. et al. (2016), “Regulatory management practices in OECD countries”, OECD Economics Department Working Papers, No. 1296, OECD Publishing, Paris, https://dx.doi.org/10.1787/5jm0qwm7825h-en.

[22] Lang, G. and A. Gonzalez Pandiella (2020), “Assessing the impact of the opening of Costa Rican telecommunication sector: a machine learning approach”, OECD Economic Papers Series, Vol. Fothcoming.

[24] Mata, A. and V. Santamaría (2017), “Impacto para el consumidor de la regulación de precios del arroz en Costa Rica”, ámara de Comercio de Costa Rica.

[30] Meehan, L. (2018), “Structural policies to boost productivity and inclusion in Costa Rica”, OECD Economics Department Working Papers, No. 1485, OECD Publishing, Paris, https://dx.doi.org/10.1787/715509d0-en.

[36] MICIT (2019), Costa Rica y Estonia firman convenios de cooperación en temas de Gobierno Digital y La Cuarta Revolución Industrial.

[49] Mirrlees-Black, J. (2014), “Reflections on RPI-X Regulation in OECD Countries”, CCRP Working Paper Series, No. 25, City University, London..

[25] Monge-Gonzalez et al. (2015), “Do Multinationals Help or Hinder Local Firms? Evidence from the Costa Rican ICT Sector”, Comisión Asesora en Alta TecnologíaWorking Paper, http://caatec.org/sitio1/index.php/en/publications/others.

[8] Monge-González and Torres-Carballo (2014), “Productividad y Crecimiento de las Empresas en Costa Rica: ¿Es posible combatir la pobreza y la desigualdad por medio de mejoras en la productividad?”, Inter-American Development Bank.

[51] Monteiro, G., A. Fontoura and S. Santos (2017), “Product markets’ deregulation: a more productive, more efficient and more resilient economy?”, OECD Productivity Working Papers, No. 9, OECD Publishing, Paris, https://doi.org/10.1787/86cc3b5e-en.

[17] Nordas, H. and A. Ragoussis (2015), “Trade restrictiveness and competition in services”, OECD mimeo, http://www.etsg.org/ETSG2015/Papers/138.pdf.

[37] OECD (2020), Competition accession review: Costa Rica,.

[40] OECD (2020), Corporate Governance Accession Review of Costa Rica, mimeo.

[38] OECD (2019), “Competition assessment reviews: Mexico”, http://www.oecd.org/daf/competition/competition-assessment-mexico-2019-highlights-ENG.pdf.

[35] OECD (2019), OECD Economic Surveys: Estonia 2019, OECD Publishing, Paris, https://dx.doi.org/10.1787/f221b253-en.

[4] OECD (2018), OECD Economic Surveys: Costa Rica 2018, OECD Publishing, Paris, https://dx.doi.org/10.1787/eco_surveys-cri-2018-en.

[23] OECD (2017), Agricultural Policies in Costa Rica, OECD Food and Agricultural Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264269125-en.

[10] OECD (2016), OECD Economic Surveys: Costa Rica 2016: Economic Assessment, OECD Publishing, Paris, https://dx.doi.org/10.1787/eco_surveys-cri-2016-en.

[34] OECD (2015), OECD Public Governance Reviews: Estonia and Finland: Fostering Strategic Capacity across Governments and Digital Services across Borders, OECD Public Governance Reviews, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264229334-en.

[27] OECD/BID (2014), Derecho y política de la competencia en Costa Rica. Examen inter-pares.

[39] Palumbo, G. et al. (2013), “The Economics of Civil Justice: New Cross-country Data and Empirics”, OECD Economics Department Working Papers, No. 1060, OECD Publishing, Paris, https://dx.doi.org/10.1787/5k41w04ds6kf-en.

[31] Pastrana Torres, G., P. Jiménez Fontana and R. Segura Carmona (2019), “Análisis del Catálogo Nacional de Trámites en Costa Rica: una primera aproximación”, Estado de la Nacion.

[46] PGR (2015), • Procuraduría General de la República (2015, Nov 5th). Opinión Jurídica: 122-J del 05/11/2015., Procuraduría General de la República, http://www.pgrweb.go.cr/scij/Busqueda/Normativa/pronunciamiento/pro_ficha.aspx?param1=PRD¶m6=1&nDictamen=19155&strTipM=T.

[20] Philippon, T. (2019), The Great Reversal: How America Gave Up on Free Markets, Harvard University Press.

[52] Pisu, M. (2016), “Costa Rica: Boosting productivity to sustain income convergence”, OECD Economics Department Working Papers, No. 1318, OECD Publishing, Paris., https://doi.org/10.1787/5jlv23bhvnq7-en.

[6] Sandoval, C. et al. (2018), “FDI spillovers in Costa Rica: boosting local productivity through backward linkages”, OECD Economic Survey of Costa Rica: Research Findings on Productivity.

[48] Sappington, D. and D. Weisman (2010), “Price Cap Regulation: What Have We Learned from 25 years of Experience in the Telecommunications Industry”, of Regulatory Economics, Vol. 38(3), 227-257.

[32] Saso, R. (2018), “¿Por qué tantos peros a la firma digital?”, La Nacion.

[21] SUTEL (2018), Estadísticas del sector de Telecomunicaciones, Superintendencia de Telecomunicaciones.

[12] UCCAEP (2019), Pulso Empresarial, Unión Costarricense de Cámaras y Asociaciones del Sector Empresarial Privado.

[7] Vitale et al. (2020), “The 2018 Edition Of The Oecd Pmr Indicators And Database – Methodological Improvements And Policy Insights”, Economics Department Working Paper, Vol. March 2020.

[28] World Bank (2020), Doing business. Costa Rica..

[42] World Bank (2019), Costa Rica Public Finance Review.

[29] World Bank (2016), Doing business. Starting a business. Third-party involvement in company formation.

[13] World Bank (2015), “Costa Rica - Systematic country diagnostic”.