This chapter reviews Greece’s efforts to mainstream environmental considerations into economic policy and to promote sustainable development. It analyses progress in using economic and tax policies to pursue environmental objectives, as well as steps taken to reform environmentally harmful subsidies. The chapter reviews efforts to scale up investment in environment-related and low-carbon infrastructure. It also examines the country’s eco-innovation performance and opportunities for green industry.

OECD Environmental Performance Reviews: Greece 2020

3. Towards green growth

Abstract

3.1. The environment in economic adjustment programmes 2010-18

After a severe recession, the economy started to recover in 2017 and Greece successfully exited the European stability support programme in 2018. Between 2010 and 2018, the country received EUR 289 billion in loans1 conditional on implementation of comprehensive reforms. The economic adjustment programmes (2010‑12, 2012‑14, 2015‑18) initially focused on reducing the cost of labour and cutting pensions, then broadened to improving the business environment, modernising the public administration and enhancing social protection (OECD, 2018a). Greece has substantially improved its budget balance and current account balance. However, high public debt, a negative net international investment position, the scale of banks’ non-performing loans and a high unemployment rate remain of concern (EC, 2019a).

The economic adjustment programmes included commitments to complete the cadastre and forest and coastal mapping, simplify environmental licensing, streamline environmental impact assessment and facilitate spatial planning, in line with OECD recommendations (OECD, 2010, 2014). Greece has made progress in advancing the cadastral and forest mapping. It has undertaken major efforts to streamline its environmental and spatial planning legislation to facilitate investment (Chapter 2). However, special arrangements, combined with reduced enforcement capacity, have weakened environmental governance. The adjustment programmes also provided for bringing energy markets into line with EU regulations, adopting a transport plan and improving the water regulatory framework. Despite progress in these areas, the economy remains highly reliant on fossil fuels, road transport is predominant and compliance with EU requirements on waste and water management is challenging.

3.2. Framework for sustainable development and green growth

In 2018, Greece renewed its commitment to sustainable development in a voluntary national review on implementation of the 2030 Agenda that was presented at the 2018 UN High-level Political Forum on Sustainable Development (Government of Greece, 2018). The former General Secretariat of the Government, which was in charge of co‑ordination before the shift of power, was instrumental in adopting a whole-of-government approach to define national priorities for sustainable development (Box 3.1). Pending adoption of the first four-year implementation plan for Sustainable Development Goals (SDGs), scheduled for 2020, the 2019 National Strategy for Sustainable and Fair Growth 2030 (NSSFG) has been expected to provide the strategic reference for implementing the 2030 Agenda.

Box 3.1. The voluntary national review on implementation of the 2030 Agenda for Sustainable Development

Greece’s 2018 voluntary national review on implementation of the 2030 Agenda sets eight national priorities for sustainable development. Defined through an in-depth stock-taking exercise in 2017 involving a wide array of stakeholders, they are:

1. fostering a competitive, innovative and sustainable economic growth (SDGs 8, 9)

2. promoting full employment and decent work for all (SDG 8)

3. addressing poverty and social exclusion, and providing universal access to quality health care services (SDGs 1, 2, 3)

4. reducing social and regional inequality and ensuring equal opportunities for all (SDGs 10, 5)

5. providing high-quality and inclusive education (SDG 4)

6. strengthening protection and sustainable management of natural capital as a base for social prosperity and transition to a low-carbon economy (SDGs 6, 7, 11, 12, 13, 14, 15)

7. building effective, accountable and transparent institutions (SDGs 16, 17)

8. enhancing open, participatory, democratic processes and promoting partnerships (SDGs 16, 17).

Priority 6 is broken down as follows:

transition to a circular economy model for sustainable production and consumption patterns (SDGs 12, 8, 9)

elaboration of an integrated environmental framework to support economic development and investment, while safeguarding and protecting natural capital and biodiversity (sustainable water resource management, SDG 6; inclusive, safe, resilient and sustainable cities, SDG 11; sustainable use of seas and of marine resources, SDG 14; protection, restoration and sustainable use of terrestrial ecosystems, SDG 15)

transition to a low-carbon economy and adaptation to the impact of climate change (SDGs 7, 13).

Agriculture and tourism are highlighted as focus areas for enhancing policy coherence for sustainable development and promoting SDG interlinkage.

Source: Government of Greece (2018).

The NSSFG was a welcome update of the 2018 National Growth Strategy. Compared to the earlier version, it put greater emphasis on sustainable development, climate change adaptation and risk management, while keeping a focus on circular economy. It listed 40 key performance indicators, mostly relating to SDG implementation (Table 3.1). However, the coherence between environmental and economic objectives was not always clear; examples include developing both mega-yacht chartering and eco-tourism, promoting renewable energy resources along with hydrocarbon exploration, and reducing GHG emissions in the transport sector while becoming a leading regional logistical hub.

The NSSFG recognised that Greece’s natural capital should be protected and sustainably managed to provide opportunities for employment, prosperity and quality of life for all. However, progress on environmental accounting is slow. Available information on environmental protection expenditure, the environmental goods and services sector and material flow, and natural capital accounts is not sufficient to support policy making.

Table 3.1. Selected key performance indicators of the National Strategy for Sustainable and Fair Growth 2030

|

Key performance indicator (KPI) |

Title |

SDG |

|---|---|---|

|

KPI.1 |

Development of a comprehensive monitoring system to track progress on SDGs by 2020 |

All |

|

KPI.2 |

Reduction of child poverty to pre-crisis levels by 2021 |

1 |

|

KPI.3 |

Creation of at least 10 000 jobs for young researchers by the Hellenic Foundation for Research and Innovation and research programmes by 2021 |

9 |

|

KPI.4 |

Satisfaction of all demand for kindergartens by 2021 |

1 |

|

KPI.6 |

Increase in the manufacturing share of GDP to 12.5% by 2025 |

9 |

|

KPI.7 |

100% increase in R&D expenditure by 2020 (from 2011) |

9 |

|

KPI.9 |

Provision of service of at least 100 Mbps in digitally lagging regions and for 2.5 million citizens by 2023 |

9,10 |

|

KPI.10 |

Introduction of green criteria in 10 public procurement contracts by 2020 |

12 |

|

KPI.13 |

Increase in the share of renewables in gross final energy consumption to 32% by 2030 |

7 |

|

KPI.14 |

Completion of the national cadastre by 2021 |

15 |

|

KPI.16 |

Universal access to 2 years of pre-primary education by 2020 (90% coverage in municipalities by 2019) |

1 |

|

KPI.19 |

100% increase in foreign direct investment by 2025 |

17 |

|

KPI.28 |

Completion of the ratification of forest maps by 2021 |

15 |

|

KPI.29 |

Reduction of greenhouse gas emissions by 22.6% between 2016 and 2030 |

9 |

|

KPI.30 |

Completion of regional plans for climate change adaptation by 2021 |

13 |

|

KPI.32 |

Thessaloniki metro in operation by 2020 |

9,11,13 |

|

KPI.33 |

Creation and operation of 239 local health primary units by 2021 |

1 |

|

KPI.34 |

Modernisation and digitization of the Hellenic Labour Inspectorate for reducing undeclared work (5% in 2021) |

8 |

|

KPI.35 |

Energy interconnection of Crete with the mainland by 2023 and all islands by 2030 |

7 |

|

KPI.36 |

Operation of the National Civil Protection System by 2021 |

13 |

|

KPI.38 |

Operation of the Hellenic Development Bank within 2019 |

17 |

|

KPI.39 |

Provision of 750 new generation buses (equipped with anti-pollution technology) |

9,11,13 |

Source: Government of Greece (2019), National Strategy for Sustainable and Fair Growth 2030.

3.3. Greening the system of taxes, charges and prices

3.3.1. Environmentally related taxes: An overview

As part of its economic adjustment programmes, Greece has undertaken major reforms to remedy its longstanding weakness in tax collection and compliance (EC, 2019a). Value added tax (VAT) and personal income taxes were raised, their base broadened and compliance rates improved. In 2018, Greece was among the EU countries with the highest VAT and income tax rates, although the VAT gap2 and outstanding tax debt3 remain high (EC, 2018a). The ratio of tax revenue to GDP strongly increased from 31.2% in 2007 to 38.7% in 2018, well above the OECD average of 34.3% (OECD, 2019a). This trend was mostly driven by revenue from consumption taxes, which decreased less than GDP until 2013 and increased faster afterwards. Relative to the OECD average, the tax structure in Greece is characterised by higher revenue from consumption and property taxes and social security contributions and lower revenue from taxes on income, profits and gains.

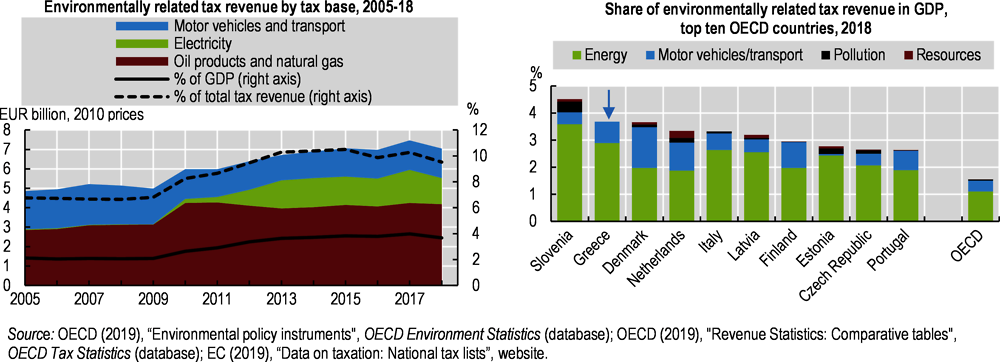

In 2018, Greece recorded one of the highest levels of revenue from environmentally related taxes in the OECD at 3.7% GDP (Figure 3.1). The share nearly doubled over the decade due to increased energy taxation. Taxes on energy products account for a larger share of environmentally related tax revenue than the OECD average (79% vs. 71%), while taxes related to transport (excluding fuels) generate relatively low revenue (21%, vs. 26% in the OECD). Greece is among the few OECD countries that do not raise revenue from other environmentally related taxes (single-use plastic bags is a recent exception). Collecting taxes on pollution and resource use could have important environmental benefits even if they did not raise much revenue.

Figure 3.1. Revenue from energy taxes increased markedly

3.3.2. Taxes on energy use and carbon pricing

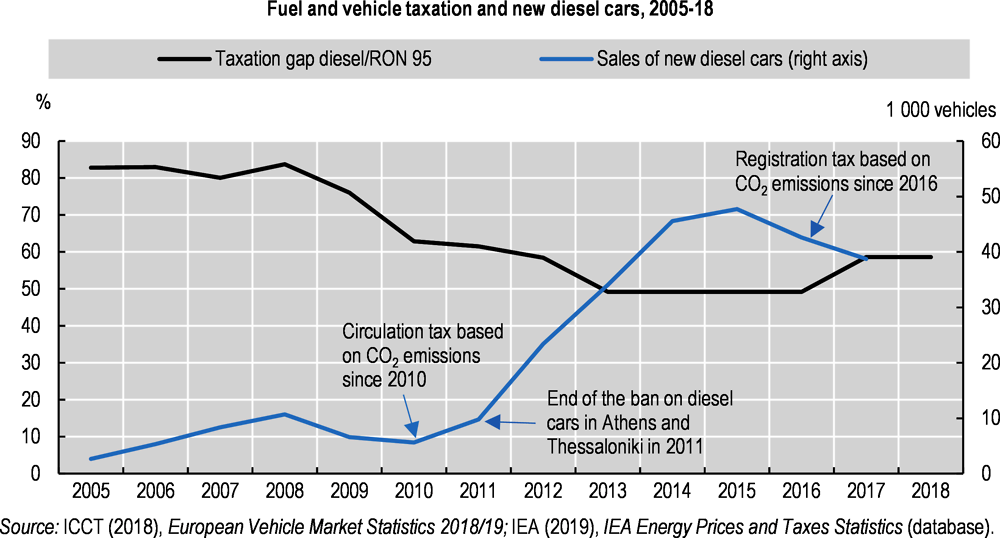

Revenue from taxes on energy products nearly doubled over 2009-18, mainly due to increased taxation on electricity and oil products. In the early 2010s, Greece introduced excise duties on electricity and natural gas to comply with the 2003 EU Energy Taxation Directive. Although rates were not raised thereafter, special duties introduced to cover the cost of support to renewables boosted revenue from electricity taxes (Figure 3.1). Excise duties on transport fuels increased markedly between 2009 and 2010, so revenue went up despite declining oil consumption. Although diesel taxes were reduced in 2012-13, they remained higher than their pre-crisis level. Excises on oil products were increased again in 2017, placing Greece among the OECD countries with the highest prices and taxes on petrol. Greece gives preferential tax treatment to diesel relative to petrol despite diesel’s higher carbon and air pollutant emissions (Harding, 2014). This is common among OECD countries, but generally to a lesser extent. The diesel/petrol taxation gap has widened since the beginning of the crisis despite a slight reduction to 59% in 2017 (Figure 3.2). This, combined with an end to a ban on diesel cars in major metropolitan areas and the introduction of CO2 emission criteria in the circulation tax, has helped boost sales of diesel cars, though petrol cars remain dominant.

Figure 3.2. Tax differentiation has helped boost sales of diesel cars

In 2012, tax rates on heating oil and diesel were equalised to address tax fraud involving heating oil being used instead of more expensive diesel in vehicles. However, the increase in heating oil prices resulted in households switching from oil to wood for heating, with adverse consequences for air quality (Chapter 1). As a result, tax rates on heating oil were reduced over 2014-16 and disconnected from diesel. The government has been trying to tackle the issue of fuel smuggling for years (EC, 2017a). Revenue losses are estimated between EUR 250 million and EUR 3 billion annually (Energyworld, 2018; Alderman, 2015).

Greece reformed natural gas excises in 2016. Before the reform, rate levels were well above the mimima required by the EU Energy Taxation Directive and excises were imposed on natural gas used for electricity generation, which contravened the provisions of the directive and led to overlap with the EU ETS cap (EC, 2017a). The reform eliminated the taxation on gas used for electricity production, reduced taxation for household heating to the EU minimum and introduced regressive taxation for large industrial users. The reform should support gas-based electricity production against more carbon-intensive sources, encourage households to switch from oil to natural gas and reduce the double burden for energy-intensive companies covered by the EU ETS.

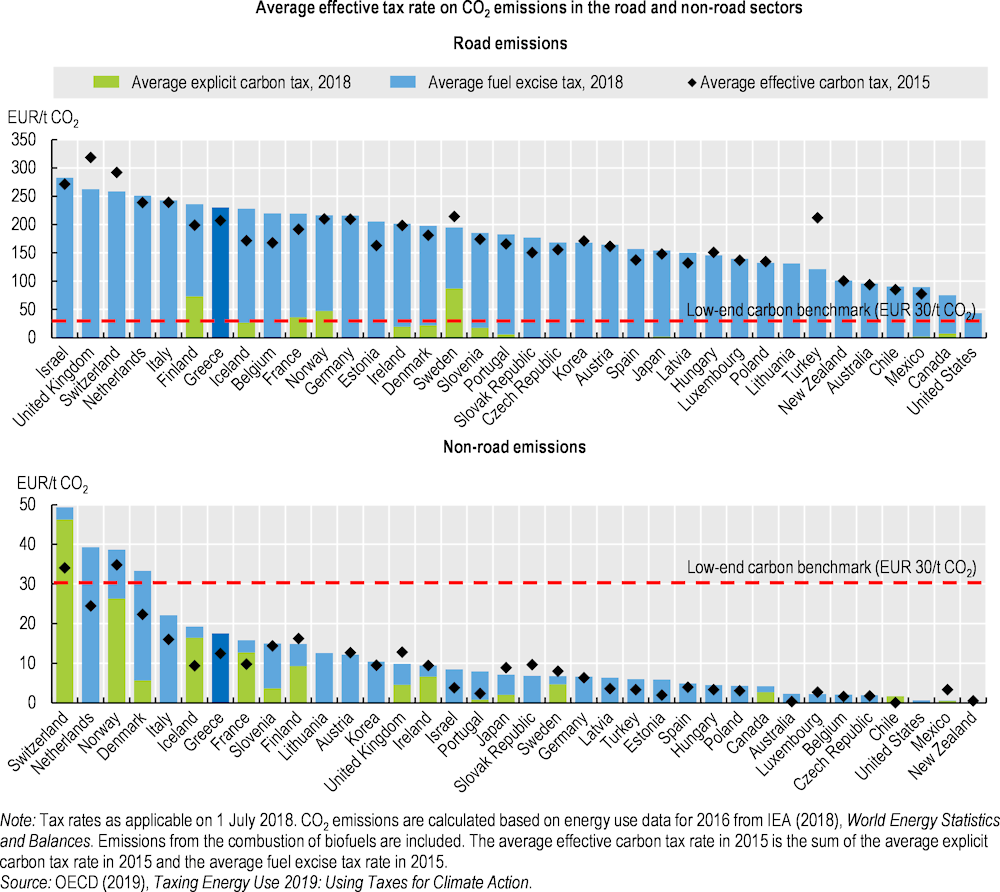

Overall, effective tax rates4 on CO2 emissions from energy use are higher than in most OECD countries (Figure 3.3). However, there remains room to review tax variation across fuels and uses, along with tax concessions (Section 3.3.3), to provide a more consistent carbon price signal. As in other OECD countries, the road sector is taxed at the highest effective rates, which is justified by the higher environmental and social costs of road transport (OECD, 2018b). In the off-road sector, however, fuels used for domestic shipping, including fishing and tourist boats, and for aviation are untaxed, in line with the Energy Taxation Directive. In the industrial sector, specific uses of coal and coke (mineralogical, chemical reduction, electrolytic and metallurgical processes) are untaxed. Fuel oil and diesel used in agriculture are taxed, but diesel used for fishing and liquefied petroleum gas are not. Oil products used to generate electricity are taxed; coal products and natural gas are not. The use of electricity is taxed except in mineralogical, chemical reduction and metallurgical processes and agriculture.

Figure 3.3. Effective tax rates on CO2 emissions are relatively high

3.3.3. Removing environmentally harmful support to fossil fuel consumption

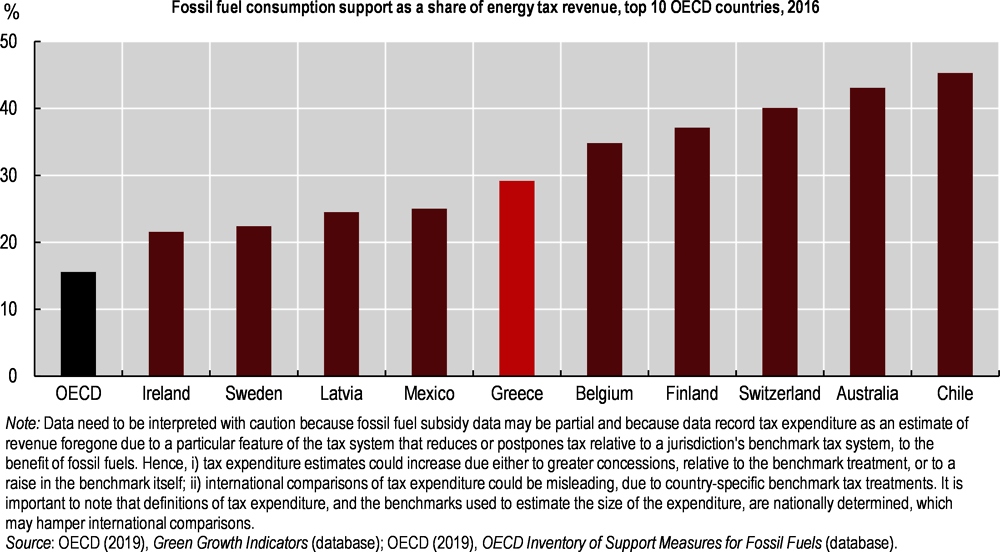

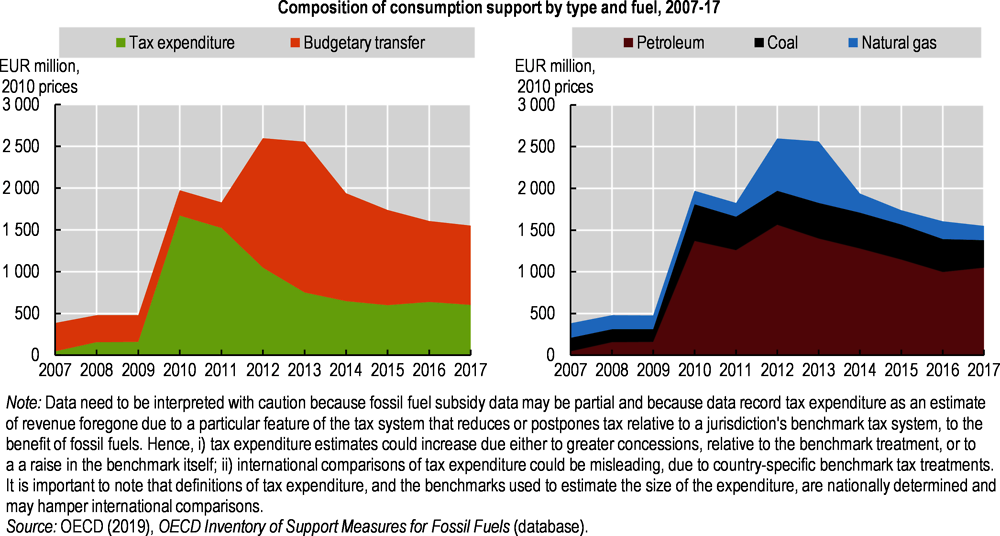

The level of support to fossil fuel consumption expressed as a share of energy tax revenue is among the highest in the OECD (Figure 3.4).

Consumption support is mainly directed at oil products (68% in 2017), followed by coal (21%) and natural gas (11%). It rose significantly in 2010-11 as forgone revenue from tax concessions compliant with the Energy Taxation Directive (excise tax exemption on diesel for aircraft and vessels, reductions and refunds for agriculture, reduced excise on oil for heating) increased with excise duties on oil products (Figure 3.5). After 2011, related tax expenditure fell with the reduction of taxes on diesel and fuel oil and the decline in oil consumption until 2013. In a welcome move, Greece abolished tax relief for diesel used in agriculture in 2016.

Figure 3.4. The fossil fuel consumption support level is among the highest in the OECD

Figure 3.5. Fossil fuel consumption support has decreased since 2012

Since 2012, significant support to fossil fuel consumption has also been provided through budgetary transfers. This includes subsidies paid to oil-based power generators to supply electricity in non‑interconnected islands at the same tariffs as the mainland, capacity payments to compensate gas- and coal-based electricity producers for availability of flexible generation and oil heating allowances paid to households. Greece should pursue interconnection of islands with the mainland transmission system or, where this is not cost‑effective, install storage systems to use the renewables potential (IEA, 2017). Doing so would help meet environmental goals, enhance energy security and reduce the public service obligation levy that all electricity consumers pay to finance the cost of service on the islands. Capacity payments have declined since their 2012-13 peak but continue to account for a significant share of budgetary transfers (33% in 2017). While such mechanisms may help ensure electricity supply security in the short term, Greece should ensure they do not slow down the low-carbon transition by favouring fossil fuel technology. Finally, replacing household oil heating allowances with direct payments not linked to the type of fuel used would help address poverty while providing incentives to switch to cleaner fuels (Section 3.3.7).

There is little information on potentially environmentally harmful subsidies and tax expenditure. The 2019 Energy and Climate Plan lists some subsidies (social tariffs for electricity, heating oil allowances, subsidies to supply electricity in non-interconnected islands) that are expected to support non-fossil energy sources with the planned increased in renewables and interconnection of islands by 2030. As part of regular spending reviews, the Directorate for Evaluation of General Government Actions of the Ministry of Finance could screen public support programmes against their potential environmental impact (OECD, 2019b). Such screening could be used in reforming subsidies and special tax treatment that are not justified on economic, social or environmental grounds.

3.3.4. Carbon pricing through the EU Emissions Trading System

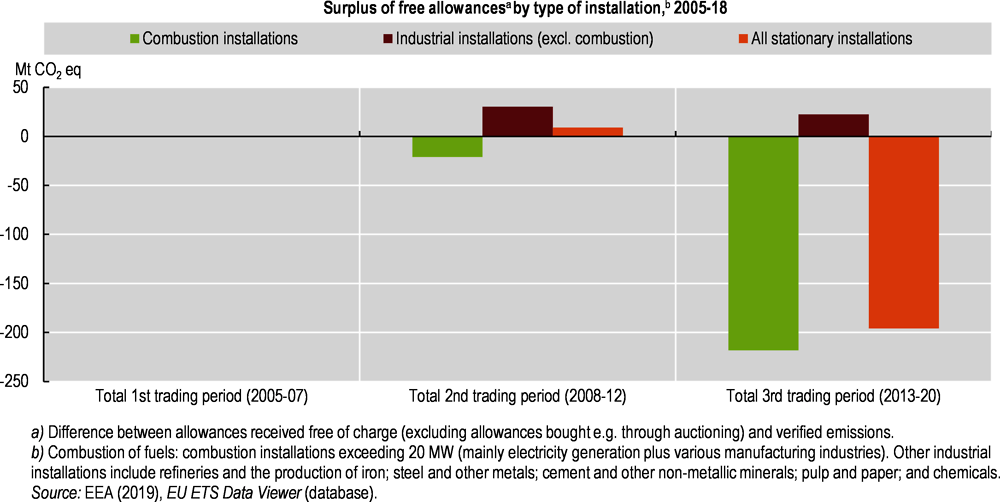

Greece also puts a price on CO2 emissions via the EU ETS, although the carbon price signal has been weak until recently. In 2018, the electricity sector was responsible for 72% of EU ETS-regulated emissions, reflecting the country’s carbon-intensive energy mix.

In the first two trading periods (2005-12), emission caps were determined at the national level and allowances were allocated for free. Over 2005-07, verified emissions matched allocated allowances (Figure 3.6). In the second trading period (2008-12), the power sector faced a shortfall of allowances while other industrial installations, especially in the cement industry, accumulated a significant surplus. The supply of allowances has dropped in the third period (2013-20), with the introduction of an EU-wide emission cap, the extension of auctioning and backloading of allowances. Greece has since experienced a deficit of allowances in the energy sector and a declining surplus in other industries.

The recent rise in allowance prices put the profitability of the state-owned Public Power Corporation at risk, while part of its lignite asset has to be divested to open the market under the economic adjustment programme agreed with the European Union (PPC, 2019). Greece was refused a derogation under Article 10(c) of the ETS Directive to provide transitional free allowances to its power sector. At the end of 2018, Greece removed a special levy on electricity produced by lignite and a charge on electricity suppliers to help alleviate industry losses.

Figure 3.6. A deficit of EU ETS allowances and rising prices make coal-based power costly

3.3.5. Transport-related taxes and charges

Vehicle taxes

While vehicle taxes are less efficient than fuel taxes and distance-based charges in reducing emissions of GHGs and local air pollutants, they can steer the fleet towards cleaner vehicles (van Dender, 2019). Transport tax revenue has decreased in real terms, driven by a sharp drop in car registrations and the growing share of used cars and trucks among vehicles put into circulation. The share of transport-related taxes in total environmental taxes was halved in ten years to 21% in 2018, below the OECD average of 26%.

Since 2016, the registration tax for new passenger cars has been based on taxable value (net retail price), CO2 emissions and Euro emission standards. Hybrid cars benefit from a reduction and electric cars are exempt. For imported used cars, the taxable value is reduced according to the age of the vehicle and the mileage (the older the car, the lower the tax) (ACEA, 2019). The registration tax of heavy goods vehicles is not based on CO2 emissions but is higher for trucks not meeting Euro VI standards. It is also reduced for older trucks. This is a disincentive for vehicle renewal in a country with one of the oldest fleets in Europe.

The annual circulation tax for new and imported used cars has been based since 2010 on CO2 emissions, for vehicles registered after October 2010, or on engine capacity and date of first registration for older cars (the older the registration date, the lower the tax). Electric cars are exempt.5 The tax on heavy goods vehicles increases with weight and does not consider environmental parameters.

Since 2012, an annual luxury living tax has been applied on ownership of passenger cars with engine capacity greater than 1 929 cc. It is based on the presumed income of the car owner.6 As it only applies to cars less than 11 years old, this tax does not promote rejuvenation of the car fleet.

Tax treatment of company cars

Since 2016, the taxable benefit of using a company car for private purposes has been computed as a percentage of the car’s pre-tax retail price and age. The imputation rate does not vary with vehicle emissions, private mileage or fuel cost, thus providing no incentive to employees to drive less. In addition, companies have had no incentive to buy cleaner vehicles or limit their use. Car expenses (depreciation, repair and maintenance, circulation tax, fuel, tolls, leasing or renting) are fully deducted from corporate income tax. The Law on Tax Reform, enacted in December 2019, introduces environmental criteria in the tax treatment of personal use of company cars: i) exemption from the individual’s taxable income of the benefit from the use of low (50 g CO2/km) or zero emission vehicles with a pre-tax retail price up to 40 000 EUR; ii) super deduction (130%) on company’s expense for leasing a low or zero emission vehicle with a pre-tax retail price up to 40 000 EUR, and for purchasing, operating and installing publicly accessible charging points for low or zero emission vehicles; and iii) higher depreciation rates for low or zero emission vehicles. While the metro networks are being extended in Athens and under construction in Thessaloniki, Greece should further develop incentives to commute by public transport or bicycles. Reimbursement of a public transport pass by the employer is not considered a benefit in kind under the law on Tax Reform.

Road pricing and restriction

Road charges are levied on the entire motorway network and on specific bridges and tunnels for all vehicles. Toll levels are based on distance travelled and number of axles. Making the charge vary by vehicle emission characteristics would help address air pollution, especially if taking account of population exposure (e.g. by using population density at the place of driving as a proxy) (van Dender, 2019). A tender is under way for procurement of a full distance-based electronic system that could allow such a pricing system.

Since 2012, only Euro-5 and Euro-6 cars emitting less than 140 g CO2/km have been allowed access to Athens’s inner ring. Other cars are subject to odd/even restrictions. Vehicles over 2.2 tonnes and over 22 years old cannot enter the inner and outer rings except for buses of the Athens Urban Transport Organisation. In addition, since 2011, only Euro‑5 and newer diesel cars have been officially allowed in the greater Athens and Thessaloniki areas. In practice, however, these restrictions are not enforced.

3.3.6. Taxes and charges on pollution and resource use

Greece is among the few OECD countries that do not raise revenue from other environmentally related taxes. A recent exception is the tax on single-use plastic bags. Introduced in 2018, it has proved effective in reducing use of such bags (Chapter 1). Collecting taxes on landfilling, as provided by the 2019 legislation on waste pricing, would help in moving up the waste hierarchy in a country where 80% of municipal waste is sent to landfill. In addition, the system of waste collection charges based on property size hinders progress towards separate collection and waste minimisation. Volume-based (“pay as you throw”) charging systems, combined with extended infrastructure for separate collection of recyclable waste, could be instrumental in diverting waste from landfill.

Greece has other opportunities to expand the use of economic instruments. For example, taxes on fertiliser and pesticide use would help address diffuse pollution, which affects most water bodies. Such taxes have proved successful in other OECD countries (OECD, 2017). There is also room to better reflect financial, environmental and resource costs with water charges, as envisaged by the 2017 law on water pricing (EC, 2018b).

3.3.7. Distributional implications of environmentally related taxes

The economic crisis combined with an ineffective social protection system caused a surge in poverty. In recent years, Greece has embarked on a comprehensive reform of its social welfare system, introducing new benefit programmes and streamlining existing ones (EC, 2019a). In particular, a guaranteed minimum income programme (Social Solidarity Income [SSI]), introduced in 2017, provides basic income support to the poorest households. Greece also established a network of local community centres as one-stop shops where social assistance beneficiaries have access to various social services.

Reforming environmentally related taxes and subsidies requires assessing and minimising the potential impact of higher prices on vulnerable households. While Greece is a median OECD country in term of energy affordability risk,7 nearly half of the most socially deprived households felt unable to keep their homes adequately warm in 2017, more than double the EU average (Flues and van Dender, 2017; Eurostat, 2019).

Since 2011, Greece has introduced measures to mitigate energy poverty: subsidies for heating oil (Section 3.3.3) and social tariffs for electricity up to certain consumption limits. In 2017, nearly 11% of households benefited from the Social Residential Tariff8 (SRT), a share nearly triple that of 2011 (EC, 2019b). Yet less than half of SSI recipients benefitted from SRT in 2018,9 suggesting scope for the SRT to better target the poorest (Marini et al., 2019). Greece developed an observatory to help identify energy-poor households and better target assistance (EC, 2019c). However, social tariffs distort prices and do not encourage people to reduce energy use. They also reduce investment capacity in key infrastructure. Providing direct support to vulnerable households, decoupled from energy consumption, would better address environmental and equity issues. Supporting renovation of the building stock through programmes such as Saving at Home (Section 3.4.2) and expanding gas central heating would also help alleviate energy poverty. Building age and heating type have been found to be influential factors in energy poverty levels (Ntaintasis, Mirasgedis and Tourkolias, 2019).

Social tariffs also apply on provision of water and waste services. For example, the water company of Attica, serving about 40% of the population, provides up to 2 m3 per capita and per month free to SSI beneficiaries. However, only 10% of SSI recipients in the country took advantage of social tariffs on water in 2018.

3.4. Investing in the environment to promote green growth

3.4.1. Public expenditure for environmental protection

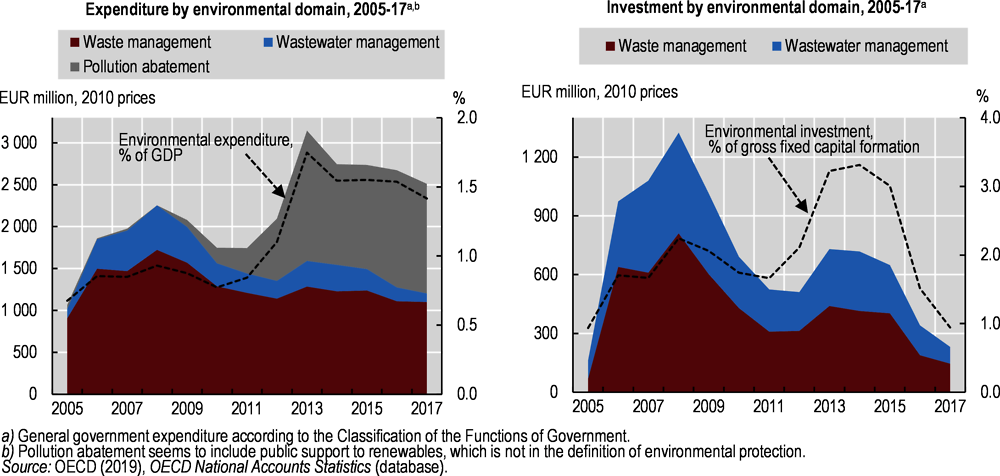

According to national accounts, public environmental expenditure (current expenditure and investment) rose from 0.8% of GDP in 2010 to 1.7% in 2013, then decreased, reaching 1.3% in 2017 (Figure 3.7). Excluding pollution abatement, which is unusually high, public environmental expenditure accounted for 0.7% of GDP in 2017, in line with the EU average. Information on spending by the private sector is not available.

In a context of overall decline in investment, environmental protection has been particularly affected. Public investment in waste and wastewater decreased during the crisis, rebounded over 2013-15 with EU support and fell with the transition to the new EU programming period. Over the past decade, more than three-quarters of investment in environmental protection has been made by the central government.

Figure 3.7. Public investment in environmental protection has decreased

High public operational expenditure on waste management is not reflected in the performance of service provided by municipalities (Chapter 1). A system for benchmarking costs, as developed in France, would help improve waste service provision (OECD, 2016). Greece has planned to allocate a large proportion of EU funds to infrastructure for integrated waste treatment and source separation. It is actively promoting public-private partnerships in waste management, combining private capital and Cohesion Policy funding (European Parliament, 2017). However, investment in residual waste treatment, at the lower levels of the waste hierarchy, seems too high compared with investment in separate collection, sorting and recycling infrastructure (EC, 2019d). Care must be taken not to move from landfilling to poor quality mechanical and biological treatment installations.

Despite progress in urban wastewater treatment, a significant share is still treated in individual sanitation systems (Chapter 1). Investment of around EUR 1.6 billion is needed to ensure that wastewater in agglomerations is properly collected and treated (EC, 2019d). While nearly EUR 1.5 billion of EU funding is allocated to water and wastewater management over 2014-20,10 project implementation has been slow. This is explained by delays in fulfilling conditions for funding: Greece did not pass a law providing for cost recovery in water services, or adopt the second generation of River Basin Management Plans, until 2017. The sustainability, quality and affordability of water provision suffers from lack of transparency, accountability and co‑ordination among actors in the sector (EC, 2019e). In 2019, an information system was set up to monitor water companies’ performance. The system will include information on cost recovery, infrastructure investment and planned human resources, drinking water quantity and quality, and water losses across the country.

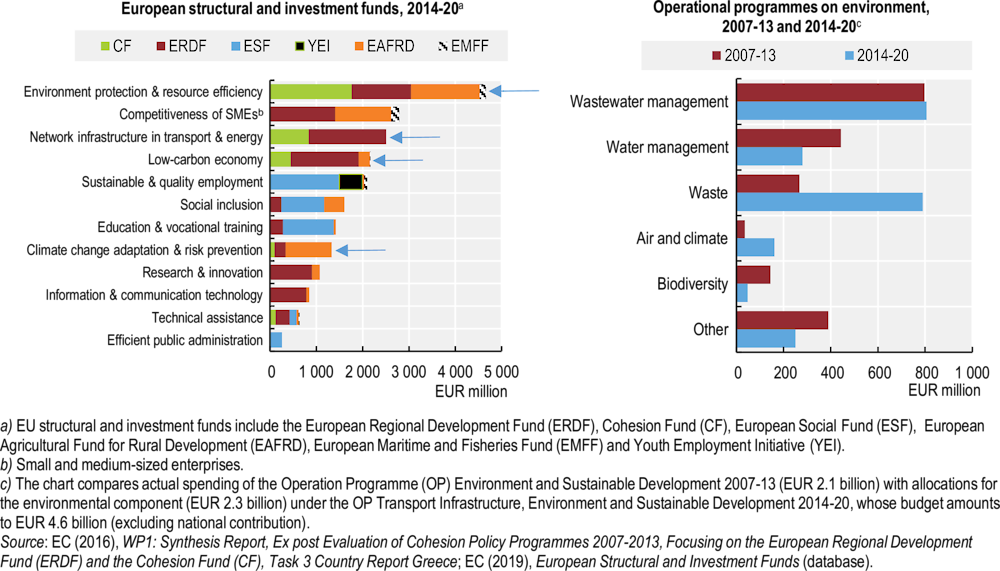

European structural and investment funds

European funds are the main source of public investment in Greece (EC, 2019a). Over 2007-13, Greece was allocated EUR 15.9 billion in Cohesion Policy funding,11 equivalent to 1% of annual GDP and 20% of government capital expenditure (EC, 2016). The EUR 20 billion support originally planned in the National Strategic Reference Framework 2007-13 was reduced by an amount corresponding to national public funding in the context of the economic adjustment programmes. This resulted in Greece being the first EU country to have fully absorbed the EU funds for 2007-13. Over the period, important shifts in funding occurred between and within policy areas. Within transport, funds were moved from rail and public transport to roads and from environment to enterprise support to help firms cope with the credit crunch. As a result, the largest share of funding went to transport (39%), three-quarters of it dedicated to roads. About 12% was spent on energy saving and clean urban transport. Only 13% was allocated to environment (compared to 17% planned), mainly for wastewater treatment and water supply (Figure 3.8). Implementation of major waste projects was hampered by problems with procurement procedures, a lack of public acceptance and limited municipal capacity to manage large tenders for technical investment (EC, 2016).

Figure 3.8. Effective use of EU funds is key to catching up on environmental infrastructure

Over 2014-20, Greece is allocated EUR 21.4 billion in European structural and investment funds (ESIF)12 to deal with the consequences of the financial and economic crisis and address development challenges (Figure 3.8). This represents annual averages of 1.7% of GDP and over 40% of public investment (EC, 2019a). Environmental protection and resource efficiency, the first priority, receives 22% in ESIF, including EUR 3 billion in Cohesion Policy funding, compared with EUR 2.7 billion over 2007-13, and EUR 1.6 billion in support to agriculture and fisheries. Including climate-related objectives (renewables, energy efficiency, sustainable transport, climate change adaptation and risk prevention), EUR 5.8 billion in Cohesion Policy funding was allocated to the environment.

The Operational Programme13 Transport, Infrastructure, Environment and Sustainable Development (OP TIESD)14 aims to comply with EU requirements (Figure 3.8). Although water remains the environmental priority, increased support is devoted to waste infrastructure to catch up with the backlog from 2007-13 and address major needs. Similarly, public transport accounts for most transport funding allocations (Section 3.4.3), reflecting the need to complete projects that had been delayed in the previous period, such as the Athens and Thessaloniki metros. However, implementation progress has been slow (EC, 2019f).

Greece has taken measures to improve its administrative capacity to manage ESIF, including setting up an electronic platform, introducing a simplified payment circuit, streamlining expropriation procedures and simplifying procedures related to archaeological work (EC, 2019a). However, project management is still hampered by inefficiency and capacity problems, notably for small municipalities, utilities and other local beneficiaries.

3.4.2. Investment in clean energy

Investment needs in renewables-based electricity and energy efficiency over the next decade are estimated at more than 2% of 2018 GDP annually (Table 3.2). This category makes up nearly half of funding needs in the energy sector to 2030.

Table 3.2. Investment needs in energy efficiency and renewables-based electricity are high

Investment in key areas of national energy planning

|

Sector |

Total estimated investment over 2020-30 (EUR billion) |

|---|---|

|

Energy efficiency |

11.0 |

|

Electricity generation from renewables |

9.0 |

|

Electricity system infrastructure |

5.5 |

|

Circular economy-recycling |

5.0 |

|

Projects for development of an electricity distribution network-digitisation |

3.5 |

|

Cross-border natural gas pipelines |

2.2 |

|

Natural gas networks and storage |

2.0 |

|

Climate change-flood management-forests |

2.0 |

|

New conventional electricity generation plants and upgrading of existing ones |

1.3 |

|

Investment in the refinery sector |

1.5 |

|

Research and innovation |

0.8 |

|

TOTAL |

43.8 |

Source: MoEE (2019), National Energy and Climate Plan, December.

Renewables

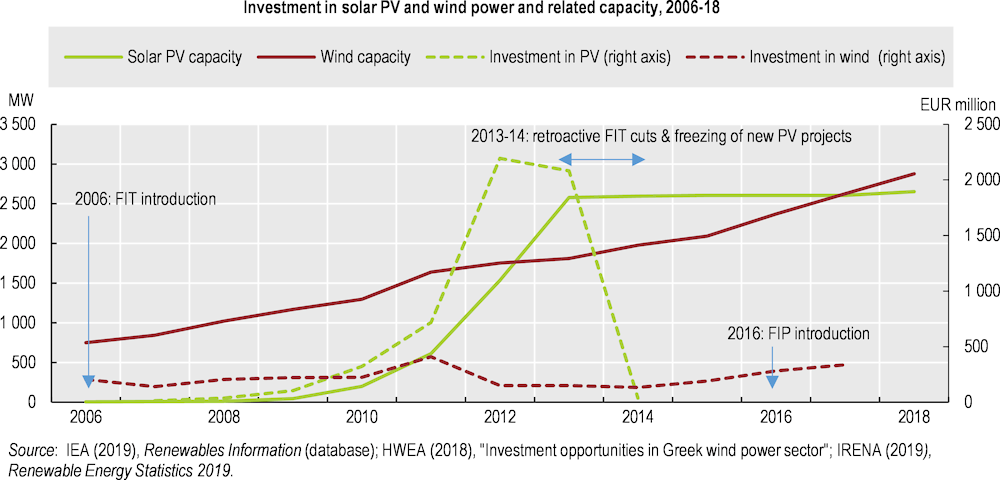

Most GHG emission reductions to 2030 are expected to come from development of electricity production from renewable energy sources (Chapter 4). Over the past decade, solar and wind power generation capacity has grown significantly (Figure 3.9). Investment has been supported by generous feed-in tariffs (FITs), decreasing technology costs and simplified licensing and permitting processes (Chapter 4). However, like some other OECD countries, Greece retroactively reduced, then stopped, its FIT programme,15 thus halting investment in solar photovoltaics (PV). Although it was necessary to limit public support costs, such retroactive measures should be avoided to maintain investor confidence. In 2016, Greece introduced a feed-in premium (FIP) programme intended to gradually integrate renewables in the electricity market.

Figure 3.9. Changes in support programmes have stopped investment in solar PV

Greece is among the OECD countries with the highest share of solar PV in electricity generation (29% vs. 10% on average). Integrating additional variable renewables while ensuring system reliability will require strengthening the internal transmission network, including interconnecting many islands with the main network, investing in flexible generation, enhancing regional interconnections, exploring the potential of energy storage and implementing demand-response programmes (IEA, 2017).

Energy efficiency

Energy efficiency measures in the residential and tertiary sectors are expected to have the largest mitigation impact in sectors not covered by the EU ETS by 2030 (Chapter 4). Buildings account for about 40% of total final energy consumption. Most were built before 1980 and lack insulation (IEA, 2017). Greece has been promoting energy efficiency in buildings through regulatory measures and financial support. The main programme, Saving at Home, mostly financed by EU funds, provided EUR 550 million in loans and grants to almost 52 000 households for energy saving investment over 2011-17 (EIB, 2019). For 2014-20, EUR 292 million (EU and national contribution) has been allocated to Saving at Home II, targeting low‑income owners.

The 2018 long-term building renovation strategy aims to improve the energy performance of at least 7% of the current building stock by 2030 (MoEE, 2018). Investment needs are estimated at between EUR 1.7 billion (moderate renovation) and EUR 2.1 billion (deep renovation). Beyond the use of EU funds, the strategy envisages developing private funding via energy service companies. Market immaturity, skills shortages, limited access to bank loans and low public awareness are barriers to investment.

3.4.3. Investment in low-carbon transport

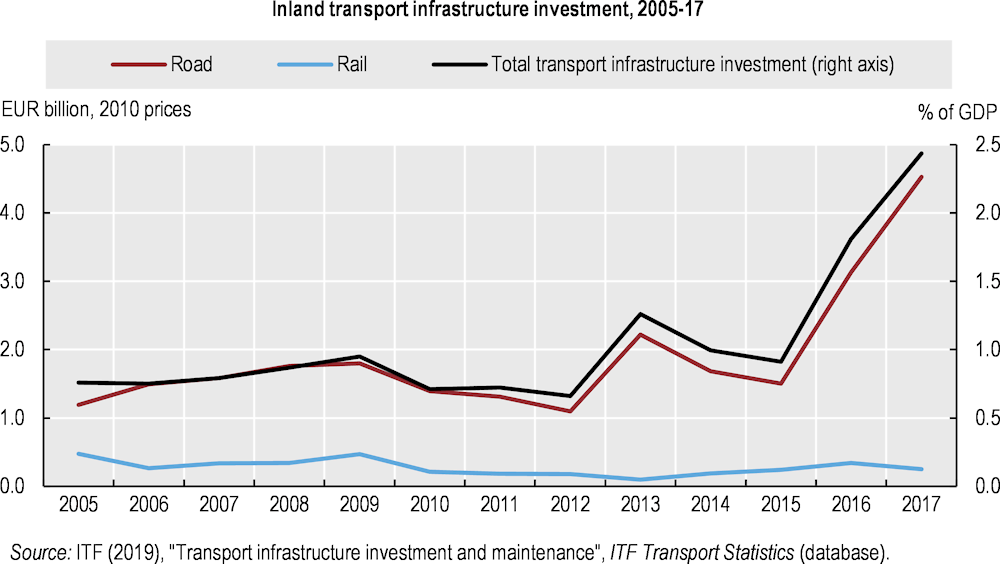

Transport is the largest energy consumer and second highest greenhouse gas emitter due to the predominance of oil-based road transport (Chapter 1). Since 2015, investment in roads has surged (Figure 3.10). In 2017, it accounted for 2.3% of GDP, the largest share in the OECD. With support from EU structural and Cohesion Policy funding, Greece has doubled its motorway network over the past decade. Links between Athens and Thessaloniki, the port of Piraeus and Athens International Airport contribute to growth and competitiveness (EC, 2019a).

Figure 3.10. Transport investment has been mostly dedicated to road transport

Rail infrastructure quality lags that of most OECD countries (OECD, 2018a). Although rail investment has risen in recent years, it accounted for 0.1% of GDP in 2017, among the lowest rates in the OECD. The shares of rail in passenger and freight transport are among the lowest in the EU (EC, 2019g).

Out of the EUR 6 billion allocated to transport over 2014-20,16 48% is to be spent on public transport, 38% on road, 9% on rail and the remainder on ports and other elements (MED, 2019). In addition, the Connecting Europe Facility selected rail-focused Greek transport projects worth around EUR 0.9 billion over 2014-18. Major sustainable transport projects include extension of the urban public transport systems in Athens and the Attica region and construction of the metro in the Thessaloniki metropolitan area. Despite delays, Greece is moving these projects forward but the lack of sustainable urban mobility plans and weak development of soft transport modes result in continued reliance on cars (MIT, 2019).

A shift between road and rail investment has yet to materialise. The National Transport Plan 2019-37 projects that road will account for 61% of additional infrastructure cost and rail for 30%17 (MIT, 2019). Over 2017-37, passenger rail transport is expected to double and rail freight transport to increase by 75%, albeit from very low levels. At the same time, road transport is projected to grow significantly, keeping its dominance in the modal split (92.7% in land passenger transport and 97.8% in freight transport by 2037).

3.5. Promoting eco-innovation and green markets

3.5.1. General innovation performance

Greece is a moderate innovator, ranking 20th among the 28 EU countries in 2018 (EC, 2019h). However, significant progress has been made in recent years. Research and development (R&D) spending increased from 0.7% of GDP in 2008 to 1.1% in 2017, chiefly due to higher contributions from the business sector. This trend puts Greece on track to reach the national target of 1.2% by 2020, but R&D intensity remains well below the OECD average of 2.4%. Although business R&D expenditure is rising, it is still lagging at 0.6% of GDP, compared with the 1.7% OECD average.

Framework conditions for innovation are not favourable, as R&D policies are fragmented and access to finance is limited (OECD, 2018; Amanatidou, Damvakeraki and Karvounaraki, 2018). Despite improved tertiary education attainment, the crisis led to significant brain drain. Advances in scientific excellence are hindered by the low intensity of public R&D, lack of a performance-based funding system and weak science-business links (EC, 2019a). Investment is needed to boost the low level of technological development, reflected in the very low number of patents. The small size of Greek companies limits their capacity to develop and commercialise innovations.

The National Research and Innovation Strategy for Smart Specialisation 2014-20 (RIS3) aims to promote links between research and industry and accelerate dissemination of innovation. National and regional RIS strategies identified key growth sectors, including agro-food, tourism, health, information and communication technology, energy, environment and sustainable development, and transport and logistics. However, regional administrations lack the capacity and innovation policy experience, and co‑ordination with the national RIS strategy has not been adequate (EC, 2019i). Implementation across regions is uneven and slow. Strengthening bottom-up participatory approaches (via the entrepreneurial discovery process) will help focus investment on Greece’s strengths and long-term needs over the next RIS programming period (2021-27).

3.5.2. Performance in eco-innovation

Environment-related R&D, technology and innovation

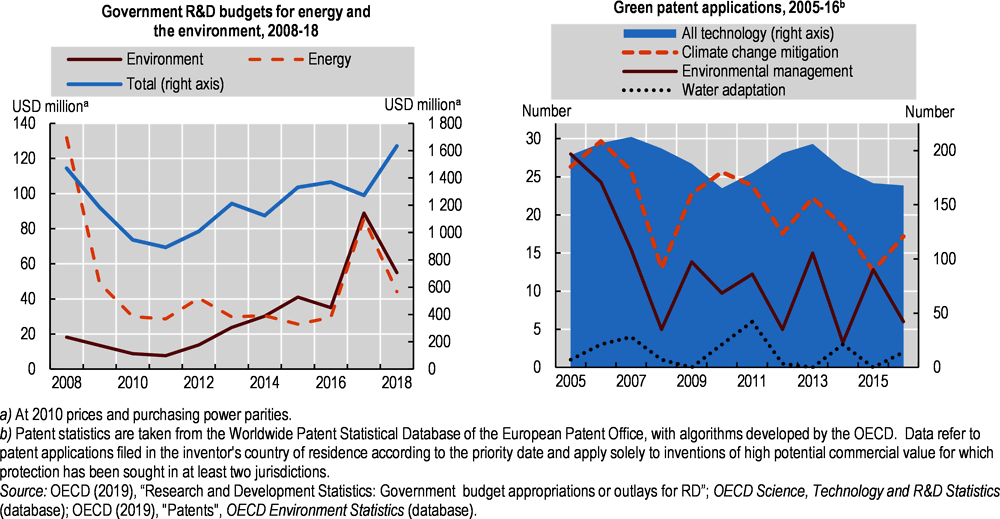

Greece’s eco-innovation performance is modest, placing it in the bottom third of EU countries in 2017 (EC, 2019j). The government R&D budget on environment has increased since 2012, though the trend for energy is unclear. As EU funds are the main source of R&D funding, EU programming cycles may explain variation in trends (Figure 3.11). From 2017 to 2018, the shares of environment and energy in the government R&D budget fell by more than half to 3% each – above the OECD average for environment (2%) but well under that for energy (5%). While an information system is in place for public funded R&D projects, there is no inventory of private energy R&D spending or beneficiaries and outcomes (IEA, 2017). Such an inventory would be useful in assessing the technology outlook for long-term energy sector development. In a context of limited green patent applications, those related to climate change mitigation (mostly energy generation, transmission and distribution) have been declining.

Figure 3.11. The public environmental R&D budget has grown but green patent applications are declining

Despite the lack of a coherent approach on eco-innovation, some funding programmes have supported innovation in environment-related areas. Climate change, assessment of ecosystems and natural capital, environmental technology, sustainable energy and transport were among the priorities of the Strategic Plan for the Development of Research, Technology and Innovation under the National Strategic Reference Framework 2007-13. EUR 1.3 billion in EU Cohesion Policy funding was spent on research and innovation over this period, although the environment-related share is unclear.

Issues related to environment (waste management; prevention, protection and restoration of air, soil, groundwater and marine environment; climate change; standard systems of monitoring and measuring environmental impact), energy (promoting renewables, energy efficiency in buildings, smart grids) and transport remain among the eight priorities18 of the 2015 National Research and Innovation Strategy for Smart Specialisation 2014-2020, which were allocated EUR 1.1 billion in ESIF. The 2018 National Circular Economy Strategy aims to use these funds to develop research on the environmental footprint of the agro‑food sector and life-cycle analysis of products. The strategy highlights eco-innovation as a main pillar.

Research institutions, innovative firms and individual researchers have benefited from EUR 0.8 billion in funding from the EU Horizon 2020 programme (EC, 2019a). The programme supported a pioneer hybrid system with renewables and energy storage technology allowing Tilos island to become fossil fuel free. It also helped develop an innovative biological nitrogen and phosphorus removal system for wastewater, a SMART-Plant project for which the Athens Water Supply and Sewerage Company won an environmental award.

Eco-innovation faces the same challenges as general innovation: fragmented R&D policies, limited research activity, weak business participation and limited co‑operation between academia and business (MoEE, 2019; EC, 2018c). As in most other OECD countries, the eco-innovation policy mix is geared towards supply-side measures, mainly financial R&D support but also networks and partnerships (e.g. clusters on nano/microelectronics and embedded systems and on space technology). Demand-side instruments, including regulations, standards and certification, are undermined by weak enforcement of environmental policies (Chapter 2). The use of price and tax instruments is limited or inconsistent and uptake of green public procurement is low.

Expanding environment-related markets and employment

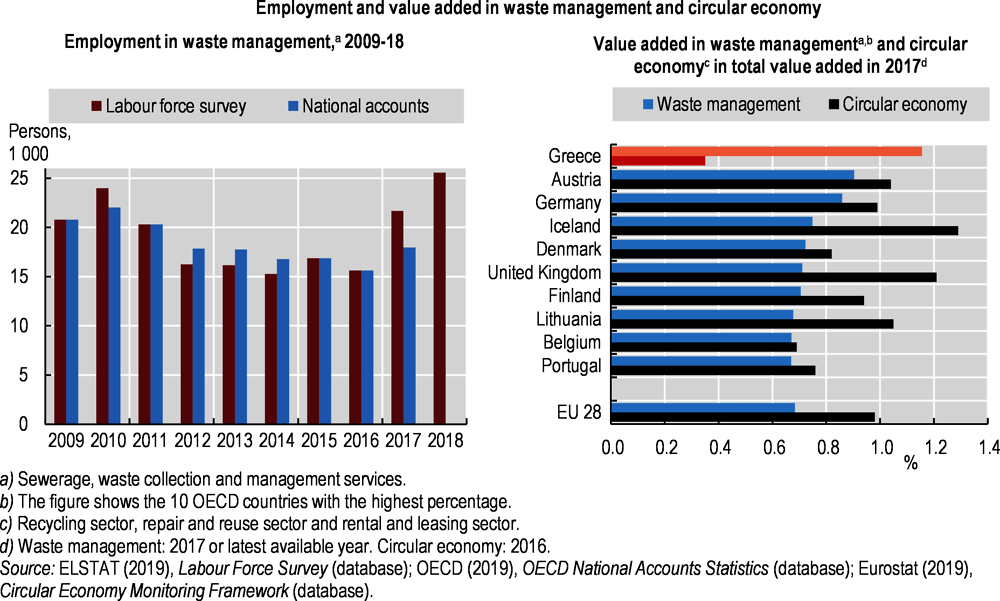

There is insufficient information on the environmental goods and services sector. The 2015 National Waste Management Plan quoted an EU report suggesting that 16 000 jobs could be created in the waste sector but progress is not being tracked (EC, 2017b). Employment in waste management seems to be showing a rising trend, although the growth rate varies by data source (Figure 3.12). Additional effort is needed to monitor the transition to a circular economy, for example via the EU Circular Economy Monitoring Framework. While waste management accounts for a high share of total value added, the sectors of waste recycling, repair and reuse and rental and leasing are underdeveloped compared with other EU countries.

Figure 3.12. Employment in waste management is growing but value added in circular economy is low

The 2019 Energy and Climate Plan estimates that measures to promote renewables and improve energy efficiency in buildings will increase domestic value added by EUR 12.6 billion and EUR 8.1 billion, respectively, by 2030 (MoEE, 2019). More than 37 000 full-time jobs are expected to be created in renewables and 22 000 in energy efficiency. By comparison, there were 25 000 direct and indirect jobs in renewables in 2017, twice the upper-bound estimate of direct and indirect coal-related jobs19 (EurObserv'ER, 2018; Alves Dias et al., 2018). National statistics need to be improved to monitor employment trends and support reallocation of labour from shrinking to growing activities. The Austrian and French governments, for example, regularly monitor skills and forecast requirements for the transition to a low-carbon economy (OECD, 2015), then use this information to inform education and training policy.

Recommendations on green growth

Framework for sustainable development and green growth

Adopt the national SDG implementation plan and ensure coherence with the revised Growth Strategy and its future updates.

Further develop environmental accounts (environmental protection expenditure, environmental goods and services sector, material flow and natural capital accounts) and promote their use in policy making.

Greening the system of taxes, charges and prices

Review tax variation across fuels and uses to provide a consistent carbon price signal. Gradually close the gap between diesel and petrol taxes.

Establish an institutional mechanism to assess the environmental effects of fiscal instruments, identify subsidies with adverse environmental effects and prioritise which to phase out.

Harmonise the taxation of new and old vehicles. Vary the circulation tax by air emission standards in addition to CO2 until road tolls are linked to vehicle emissions. Enforce access restrictions for the most polluting vehicles in metropolitan areas.

Continue to improve information on energy poverty to better target assistance and assess the cost-effectiveness and environmental impact of such assistance. Consider replacing social energy and water tariffs with direct payments (not linked to energy or water use) as part of the Social Solidarity Income.

Investing in the environment to promote green growth

Ensure effective use of EU funding for environment-related infrastructure by strengthening beneficiaries’ administrative capacity for management of the funds, improving project planning and co‑ordination, reinforcing public procurement procedures and supporting municipalities in implementing investment plans.

Improve the accountability and co‑ordination of actors in the water sector. Further assess utilities’ performance to ensure that water prices cover the cost of service provision and reflect environmental and resource costs.

Align waste investment with circular economy objectives. Establish a system to assess municipalities’ performance in providing waste services.

Rebalance investment from road to rail. Implement sustainable urban mobility plans and develop soft transport modes.

Promoting eco-innovation and environment-related markets

Strengthen energy research and promote eco-innovative technological solutions in the framework of Smart Specialisation Strategies. Focus investment on the R&D activities with the highest social return.

References

ACEA (2019), ACEA Tax Guide, European Automobile Manufacturers’ Association, Brussels, www.acea.be/uploads/news_documents/ACEA_Tax_Guide_2019.pdf.

Alderman, L. (2015), “In Greece, Bailout May Hinge on Pursuing Tycoons”, The New York Times, www.nytimes.com/2015/02/27/business/international/in-greece-bailout-may-hinge-on-pursuing-tycoons.html (accessed in June 2019).

Alves Dias, P. et al. (2018), EU coal regions: opportunities and challenges ahead, Publications Office of the European Union, Luxembourg, http://dx.doi.org/10.2760/064809.

Amanatidou, E., T. Damvakeraki and A. Karvounaraki (2018), RIO Country Report 2017: Greece, Publications Office of the European Union, Luxembourg, http://dx.doi.org/10.2760/352631.

EC (2019a), “Country report Greece 2019, including an in-depth review on the prevention and correction of macroeconomic imbalances”, Commission staff working document SWD(2019) 1007 final, European Commission, Brussels, https://ec.europa.eu/info/sites/info/files/file_import/2019-european-semester-country-report-greece_en.pdf.

EC (2019b), “Energy prices and costs in Europe”, Commission Staff working Document COM(2019)1 final, PART 1/4, European Commission. Brussels, https://ec.europa.eu/energy/sites/ener/files/documents/swd_-_v5_text_6_-_part_1_of_4.pdf.

EC (2019c), Energy Poverty Observatory in Greece, European Commission, Brussels, www.energypoverty.eu/sites/default/files/downloads/observatory-documents/19-07/case_study_-_epov_greece.pdf.

EC (2019d), The Environmental Implementation Review 2019: Country Report Greece, European Commission, Brussels, http://ec.europa.eu/environment/eir/pdf/report_el_en.pdf.

EC (2019e), Enhanced Surveillance Report: Greece, November 2019, Institutional Paper, No. 116, European Commission, Luxembourg, http://dx.doi.org/10.2765/114254.

EC (2019f), Open Data Portal for the European Structural Investment Funds, https://cohesiondata.ec.europa.eu (accessed in June 2019).

EC (2019g), Transport in the European Union: Current Trends and Issues, European Commission, Brussels, https://ec.europa.eu/transport/sites/transport/files/2019-transport-in-the-eu-current-trends-and-issues.pdf.

EC (2019h), European Innovation scoreboard 2019, European Commission, Brussels, https://interactivetool.eu/EIS/EIS_2.html#a (accessed in June 2019).

EC (2019i), “Smart Specialisation Platform *Greece”, https://s3platform.jrc.ec.europa.eu/documents/20182/374428/MORE+ON+GREECE+%28Final%29.pdf/10250e8e-88b7-4cae-bfde-76b962484090.

EC (2019j), Eco-Innovation Scoreboard 2017, European Commission, Brussels, https://ec.europa.eu/environment/ecoap/indicators/index_en (accessed in June 2019).

EC (2018a), Taxation Trends in the European Union, European Commission, Luxembourg, http://dx.doi.org/10.2778/708899.

EC (2018b), “Report on the implementation of the Water Framework Directive River Basin Management Plans - Member State: Greece”, Commission Staff Working Document SWD(2015) 54 final/2, European Commission, Brussels, http://ec.europa.eu/environment/water/water-framework/pdf/4th_report/Greece_CORRECTED_5_EN_autre_document_travail_service_part1_v5-1_FINAL.pdf.

EC (2018c), Eco-innovation in Greece: EIO Country Profile 2016-17, European Commission, Brussels, https://ec.europa.eu/environment/ecoap/sites/ecoap_stayconnected/files/field/field-country-files/greece_eio_country_profile_2016-2017_1.pdf.

EC (2017a), The ESM Stability Support Programme, Greece: First & Second Reviews – July 2017 Background Report, European Commission, Luxembourg, http://dx.doi.org/10.2765/466433.

EC (2017b), “The EU Environmental Implementation Review: Country Report – Greece”, Commission Staff Working Document SWD (2017) 41 final, European Commission, Brussels, http://ec.europa.eu/environment/eir/pdf/country-reports-archive/report_el_en.pdf.

EC (2016), WP1: Synthesis report, Ex post evaluation of Cohesion Policy programmes 2007-2013, focusing on the European Regional Development Fund (ERDF) and the Cohesion Fund (CF) – Task 3 Country Report Greece, European Commission, Brussels, https://ec.europa.eu/regional_policy/sources/docgener/evaluation/pdf/expost2013/wp1_el_report_en.pdf.

EIB (2019), Energy Savings in Existing Housing Programme: Greece, European Investment Bank, Luxembourg, www.fi-compass.eu/sites/default/files/publications/Energy%20Savings%20in%20Existing%20Housing%20Programme%2C%20Greece.pdf.

Energyworld (2018), 250 million Euros lost from fuel smuggling, www.energyworldmag.com/energyworld-27-november-december-2018/ (accessed in June 2019).

EurObserv’ER (2018), The state of renewable energies in Europe: Edition 2018 - 18th EurObserv’ER Report, EurObserv’ER Consortium, Paris, www.eurobserv-er.org/category/2018.

European Parliament (2017), Research for REGI Committee - Public Private Partnerships and Cohesion Policy, European Parliament, Strasbourg, www.europarl.europa.eu/RegData/etudes/STUD/2017/602010/IPOL_STU(2017)602010_EN.pdf.

Eurostat (2019), Income and living conditions (database), https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=ilc_mdes01&lang=en (accessed in June 2019).

Flues, F. and K. van Dender (2017), The impact of energy taxes on the affordability of domestic energy, OECD Publishing, Paris, http://dx.doi.org/10.1787/08705547-en.

Government of Greece (2019), National Strategy for Sustainable and Fair Growth 2030, Athens, www.nationalgrowthstrategy.gr/images/anaptuxiakh_strathgikh_2030.pdf

Government of Greece (2018), Voluntary National Review on the Implementation of the 2030 Agenda for Sustainable Development, General Secretariat of the Government, Office of Coordination, Institutional, International & European Affairs, Athens, https://sustainabledevelopment.un.org/content/documents/19378Greece_VNR_Greece_2018_pdf_FINAL_140618.pdf.

Harding, M. (2014), The diesel differential: Differences in the tax treatment of gasoline and diesel for road use, OECD Publishing, Paris, http://dx.doi.org/10.1787/5jz14cd7hk6b-en.

IEA (2017), Energy Policies of IEA Countries: Greece 2017 Review, IEA/OECD Publishing, Paris, https://doi.org/10.1787/9789264285316-en.

Marini, A. et al. (2019), A Quantitative Evaluation of the Greek Social Solidarity Income, World Bank, Washington, DC, http://documents.worldbank.org/curated/en/882751548273358885/pdf/133962-WP-P160622-Evaluation-of-the-SSI-Program-Jan-2019.pdf.

MED (2019), ANAPTYXI, Ministry of Economy and Development, Athens, http://anaptyxi.gov.gr/en-us (accessed in June 2019).

MIT (2019), National Transport Plan for Greece: Final Transport Plan Report, Ministry of Infrastructure and Transport, Athens, www.nationaltransportplan.gr/wp-content/uploads/2019/06/Final_NTPG_en_20190624.pdf.

MoEE (2019), National Energy and Climate Plan, December, Ministry of Environment and Energy, Athens, https://ec.europa.eu/energy/sites/ener/files/el_final_necp_main_en.pdf.

MoEE (2018), Report on the long-term strategy to mobilise investment in the renovation of private and public residential and commercial buildings in the national building stock, Ministry of Environment and Energy, Athens, https://ec.europa.eu/energy/sites/ener/files/documents/el_building_renov_2017_en.pdf.

Ntaintasis, E., S. Mirasgedis and C. Tourkolias (2019), “Comparing different methodological approaches for measuring energy poverty: Evidence from a survey in the region of Attika, Greece”, Energy Policy, Vol. 15, pp. 160-69, http://dx.doi.org/10.1016/j.enpol.2018.10.048.

OECD (2019a), Revenue Statistics, OECD Publishing, Paris, https://doi.org/10.1787/0bbc27da-en.

OECD (2019b), "Budgeting in Greece", OECD Journal on Budgeting, Vol. 2, https://doi.org/10.1787/2f5e7d7a-en.

OECD (2018a), OECD Economic Surveys: Greece 2018, OECD Publishing, Paris, http://dx.doi.org/10.1787/eco_surveys-grc-2018-en.

OECD (2018b), Taxing Energy Use 2018: Companion to the Taxing Energy Use Database, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264289635-en.

OECD (2017), Diffuse Pollution, Degraded Waters: Emerging Policy Solutions, OECD Studies on Water, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264269064-en.

OECD (2016), OECD Environmental Performance Reviews: France 2016, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264252714-en.

OECD (2015), Aligning Policies for a Low-carbon Economy, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264233294-en.

OECD (2014), Measurement and Reduction of Administrative Burdens in Greece: An Overview of 13 Sectors, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264213524-en.

OECD (2010), OECD Environmental Performance Reviews: Greece 2009, OECD Publishing, Paris, http://dx.doi.org/10.1787/9789264061330-en.

PPC (2019), Annual Report 2018, Public Power Corporation, Athens, www.dei.gr/Documents2/ANNUAL%20REPORT/AR-2018/ANNUAL_18_eng%20WEB%20USE.pdf.

van Dender, K. (2019), Taxing vehicles, fuels, and road use: Opportunities for improving transport tax practice, OECD Publishing, Paris, http://dx.doi.org/10.1787/e7f1d771-en.

Notes

← 1. EUR 257 billion from European partners and EUR 32 billion from the International Monetary Fund.

← 2. The VAT gap is the difference between the amount collected and the theoretical net total VAT liability for the economy under the current VAT system.

← 3. The total amount of tax overdue for payment at the end of the fiscal year.

← 4. Effective tax rates on energy use translate excise and carbon tax rates into rates per tonne of CO2.

← 5. The tax does not apply on hybrids up to 1 549 cubic centimetres registered by 31 October 2010. For hybrids with higher engine capacity registered by that date, the tax is reduced by 60%.

← 6. A presumption about an individual’s annual personal income is made, depending on their possessions (including house, car, boat) in the year they are being taxed for, on the basis of the expenses the possessions imply. Regarding cars, the presumed income is calculated according to engine size. If the individual’s declared income is lower than the calculated presumed income based on their possessions, their personal income tax for the year is calculated on the higher amount.

← 7. 8% of households spend more than 10% of disposable income on heating fuel and electricity and are below the poverty line after expenditure on energy.

← 8. In addition, in 2015-16, 300 kWh per month was provided free of charge to residential customers facing severe poverty.

← 9. This is likely due to the cost of the non-refundable deposit required for electricity meters.

← 10. Under the various operational programmes.

← 11. From the Cohesion Fund and European Regional Development Fund, after decommitment and correction.

← 12. Including the national contribution, the total budget amounts to EUR 26.8 billion. In addition, Greece received EUR 2.7 billion from the European Fund for Strategic Investments, EUR 627 million from the EU’s Connecting Europe Facility funding instrument and EUR 781 million from the Horizon 2020 programme.

← 13. Greece adopted 20 programmes setting priorities for funding over 2014-20: Competitiveness, Entrepreneurship and Innovation; Transport Infrastructure, Environment and Sustainable Development; Human Resources Development, Education and Lifelong Learning; Reform of the Public Sector; Rural Development; Fisheries; Technical Assistance; and 13 regional programmes.

← 14. The operational programme budget amounts to EUR 4.6 billion (excluding national contribution). Environment and transport each account for half the budget.

← 15. Fixed price support continues to be offered to small-scale and demonstration projects and non‑interconnected islands.

← 16. EU structural and investment funds and national contribution under OP TIESD and regional operational programmes.

← 17. The cost of the preferred scenario is estimated at EUR 7.5 billion in addition to the EUR 7 billion secured investment in the reference scenario.

← 18. Agro-food; life sciences and health-pharma; information and communication technology; energy; environment and sustainable development; transport and logistics; materials and construction; culture, tourism, cultural and creative industries.

← 19. 6 500 jobs in coal mining and power plants and 6 000 jobs dependent on coal activities throughout the coal value chain, taking intra- and inter-regional trade into account.