This chapter provides a summary of the policy recommendations for the Slovenian pension system developed in the previous chapters. It covers both public and private pensions as well as pension communication.

OECD Reviews of Pension Systems: Slovenia

8. Summary: Improving the pension system in Slovenia

Abstract

8.1. Public earnings-related and first-tier pensions

The average disposable income of individuals older than 65 is equal to 90% of that of the total population in Slovenia, slightly above the OECD average of 87%, from less than 70% in Estonia and Korea to more than 100% in France and Luxembourg. Moreover, old-age income inequality is much lower than in most OECD countries, while relative income poverty rates among older people are similar to the OECD average. However, many single people aged 80 or older, mostly women, face poverty risks as almost 30% of them have a disposable income lower than half the median for the total population, compared to 20% for the 21 EU-OECD countries for which data are available.

Employment after age 60 is very low in Slovenia. Over the last two decades the employment rates among the 55‑59 age group have increased sharply, catching up with the OECD average. However, the drop in employment from age 60 is much steeper than in most OECD countries. In the 60‑64 age group, only one‑quarter of Slovenians were in employment in 2019, half the OECD average. Consequently the average age of labour market exit is about three years below the OECD average while life expectancy at older ages is similar.

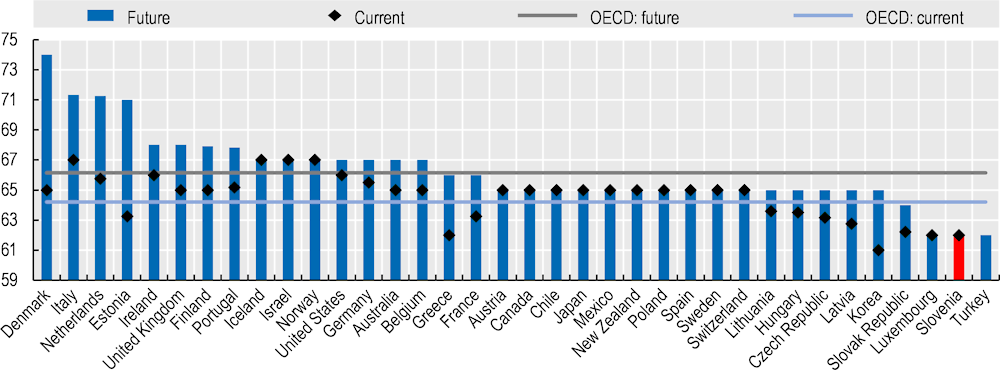

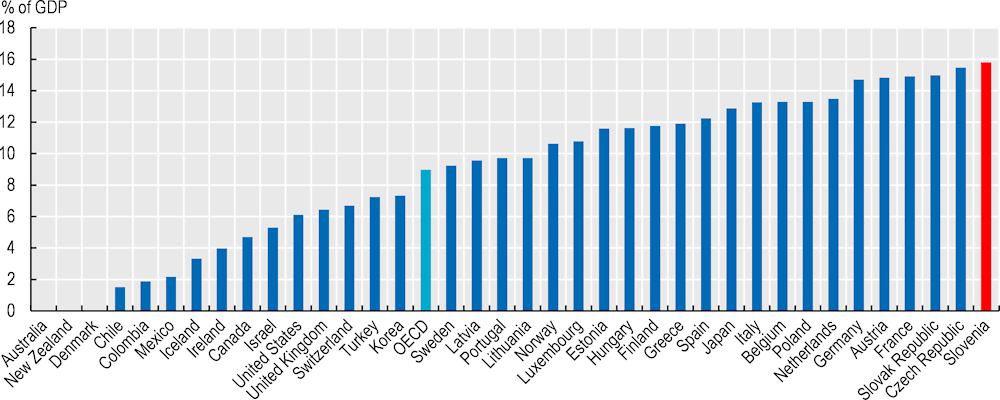

The low labour market participation of older workers is related to Slovenia’s retirement ages, which are among the lowest in the OECD: workers with an uninterrupted career from age 22 (20) can retire today with a full pension at age 62 (60) in Slovenia, which is very low in international comparison. Moreover, as many countries have legislated measures to raise normal retirement ages – defined, for harmonisation purposes, as the retirement age from which an individual with a full career from age 22 can retire with a full pension – the gap between Slovenia and the OECD average will widen further: the normal retirement age will remain at 62 years in Slovenia (40‑year career from age 22), while it will increase for the OECD on average from about 64 years today to about 66 years for someone entering the labour market now (Figure 8.1).

Figure 8.1. Normal retirement age is low and no increase is foreseen in Slovenia

Note: In Turkey, the current normal retirement age is 48 and 51 for women and men, respectively.

Source: Figure 4.6 in OECD (2019[1]), Pensions at a Glance 2019: OECD and G20 Indicators, https://dx.doi.org/10.1787/b6d3dcfc-en.

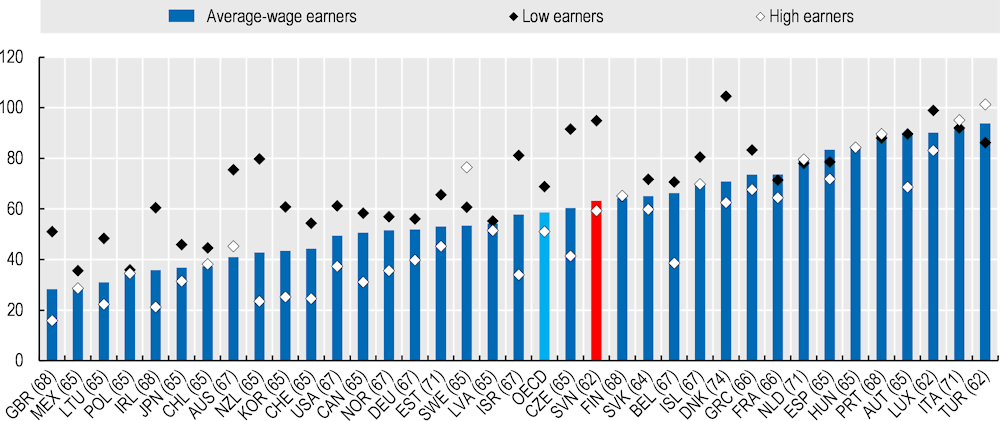

Despite low retirement ages, the future net replacement rate from mandatory pension schemes is equal to 63% for full-career workers at the average‑wage level, against an OECD average of 59% (Figure 8.2). Moreover, the system is very redistributive in favour of low earners, mainly due to the strong effect of the high minimum reference wage used for pension purposes. The net replacement rate for low earners with full careers is very high in Slovenia at 95% compared with an OECD average of 69%.

Figure 8.2. Low earners can expect high net replacement rate in Slovenia

Note: Low and high earners receive earnings at 50% and 200% of average earnings, respectively. The base case assumes a worker who enters labour market at age 22 in 2018 and retires at the normal retirement age. The calculation applies to the pension rules for men. Normal retirement ages are in the brackets.

Source: OECD calculations, OECD (2019[1]), Pensions at a Glance 2019: OECD and G20 Indicators, https://dx.doi.org/10.1787/b6d3dcfc-en.

One synthetic indicator measuring total pension entitlements paid during retirement is pension wealth, defined as the discounted value of lifetime pension flows at retirement age. Pension wealth is high with high replacement rates, low retirement age, high old-age life expectancy and high pension indexation. Low retirement ages, relatively favourable pension indexation and high replacement rates for low earners boost the pension wealth in Slovenia. After a career at the average wage, the total discounted net pensions that will be received at the retirement age equal 14.4 years of net wages, much higher than the OECD average of 11.2 years, on average for men and women. Such a pension wealth level is comparable to that in France and Italy which have much higher contribution rates. For low earners, the pension wealth is second only to Luxembourg among OECD countries, due to the strong effect of the minimum pension, at 21.6 years of wages compared with 13.3 years on average, and as low as 6.1 years in Poland.

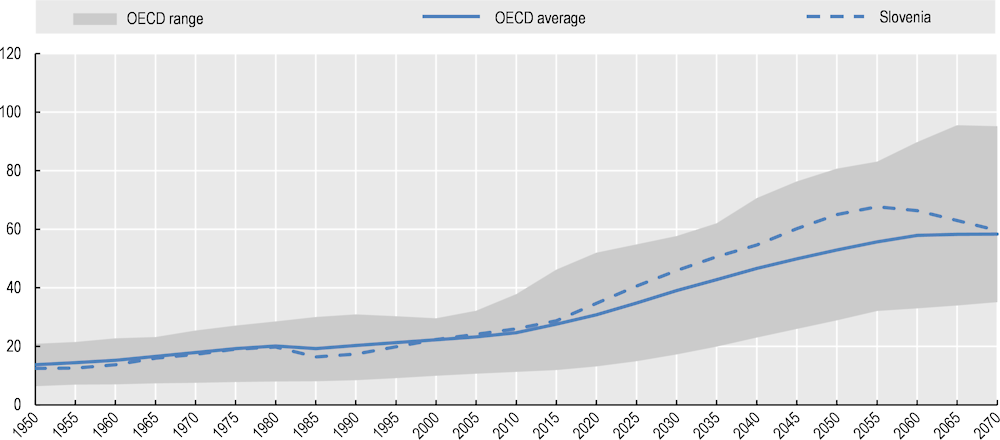

Working longer is critical if Slovenia wants to preserve retirement income levels and finance them in a sustainable way. Driven by longer lives and very low fertility rates during several decades, population ageing has started to accelerate and is projected to be fast until the mid‑2050s (Figure 8.3). This will weigh on the capacity to finance the pay-as-you-go defined benefit pensions.

Figure 8.3. Ageing will be faster in Slovenia than in most OECD countries over the next decades

Note: The demographic old-age to working-age ratio is defined as the number of people aged 65+ per 100 people aged 20‑64. Medium projections are shown, corresponding to the 50% percentile of probabilistic projections.

Source: United Nations, Department of Economic and Social Affairs (2019). Probabilistic Population Projections based on the World Population Prospects 2019: http://population.un.org/wpp/.

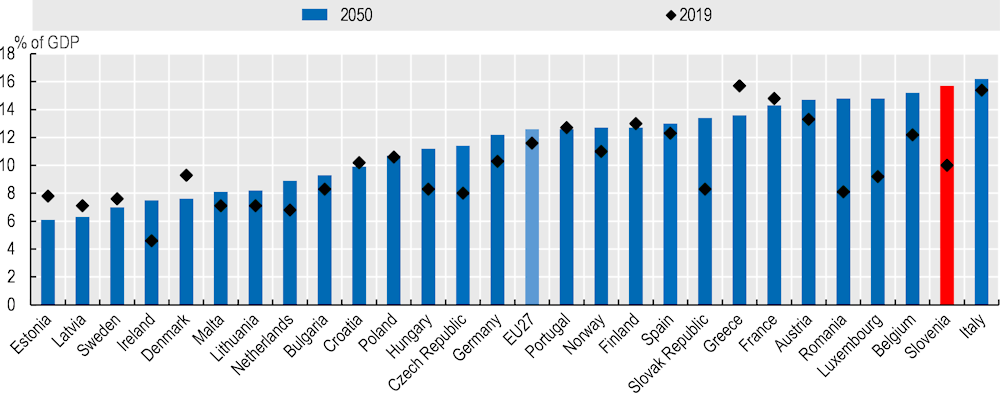

The increase in pension spending will be record high in Slovenia. Under legislated rules, pension expenditure is projected to increase sharply from 10.0% to 15.7% of GDP between 2019 and 2050 based on the 2021 Ageing Report by the European Commission. As a result, only Italy would then have a higher expenditure ratio in 2050, at 16.2%, while in the EU it would increase from 11.6% to 12.6% on average (Figure 8.4). Such an increase implies that Slovenia’s pension system will face severe financial pressure over the next decades, and in particular between 2030 and 2050, and that decisive action must be taken to ensure financial sustainability. According to the Slovenian Recovery and Resilience Plan adopted by the European Commission in July 2021, a comprehensive reform to ensure the fiscal sustainability of the pension scheme will be proposed by the government in 2023 and adopted by the parliament in 2024.

Figure 8.4. Pension expenditure will increase steeply in Slovenia

Note: The EU average is for 27 EU countries.

Source: European Commission (2021[2]), The 2021 Ageing Report, https://doi.org/10.2765/84455.

There is limited scope to increase contribution revenues. Indeed in Slovenia, the tax structure is heavily skewed towards social security contributions, such that revenues from contributions as a share of GDP are the highest among OECD countries, at 15.8% compared with an OECD average of 9.0% (Figure 8.5). Moreover, raising the contribution rate by 3 percentage points is estimated to generate additional revenues of about 1% of GDP by 2050, which compares with the almost 6%-of-GDP projected increase in pension spending. Hence, raising additional revenues, if that choice is made to balance pension finances, might require expanding tax resources, although the identification of the precise tax measures is well beyond the scope of this pension review. If additional revenues are brought into the picture – and they are most likely part of the solution given the size of projected imbalances – it will be important to raise these revenues soon and build a buffer fund before the financial problem accelerates in the 2030s in order to share the burden more fairly and smooth the increases.

While one can debate the extent to which raising additional revenues is feasible, most action is expected to take place on the spending side, given the size of the required adjustment and the level of projected pension spending. The priority should be to avoid that pension replacement rates are reduced at retirement ages. Various options are possible, as discussed in greater detail in Chapters 2 and 4. In the end, the exact combination of the various measures depends on political choices. All options involve tightening pension eligibility conditions, which are currently loose, and in particular they involve raising the minimum retirement age.

The minimum retirement age of 60 years should be increased to at least 62 years and then linked to life expectancy. The reference contribution period to retire without penalty should be increased from the current 40 years to at least 42 years. Links to life expectancy reduce uncertainty about future pension rules by minimising the need for ad hoc adjustments. They improve credibility and might help to build trust in the pension system. For example, transmitting two‑thirds of gains in life expectancy to the retirement age would broadly keep the shares of the adult life spent working and in retirement constant across generations, thus contributing to equity. However, keeping these shares constant will not suffice to offset the total shift in the population structure, as low fertility rates also have a strong impact. Hence, larger increases in the retirement age than implied by a two‑third link might be needed to ensure financial sustainability.

Figure 8.5. Social security contribution revenues reach record high level in Slovenia

Note: Data on Australia, Japan and Mexico are from 2018.

Source: OECD Revenue Tax Statistics (https://stats.oecd.org/Index.aspx?DataSetCode=REV).

Without other changes in pension parameters, increasing the retirement age in a defined benefit scheme as in Slovenia raises replacement rates. To limit the needed tightening of eligibility conditions, increasing the normal retirement age may be accompanied by the lowering of accrual rates, for example in a way that keeps the target replacement rate at the increasing minimum retirement age constant.

In addition, contrary to what the current rules imply, childcare periods should not result in lowering the minimum retirement age. There are valid reasons to grant pension entitlements for periods of childcare and thereby to limit the impact of childcare‑related breaks on pensions. However, it is far less obvious why parents should be able to retire earlier compared to childless people; only five OECD countries relax pension eligibility conditions based on having children. In Slovenia, mothers and fathers can retire four and two years below the statutory retirement age, respectively.

As the burden of the needed adjustment on the spending side cannot be borne by tighter eligibility conditions alone, it will be difficult to avoid reducing the indexation of pensions in payment. Reducing indexation is a powerful instrument to limit pension expenditure without lowering initial pension levels. There is no optimal indexation mechanism as, for a targeted level of spending, there is a clear trade‑off between lower initial benefit levels when retiring and a lower indexation. Price indexation maintains the purchasing power of pensions, while wage indexation ensures a stable retirement income relative to that of wage earners.

To reduce pension spending, the alternative is therefore to either cut the initial pension (or the replacement rate at retirement) or to reduce indexation. Between the two possibilities, the latter benefits more those with a shorter life expectancy and has the big advantage of generating savings even in the short term. In addition, it affects both current and future pensioners, thus sharing the adjustment cost more broadly, which might be fairer if current pensioners have benefited from relatively favourable pension rules. In principle, there is no reason why current pensioners should not participate in improving financial sustainability provided that their purchasing power is not reduced during retirement. For example, changing pension indexation from today’s mix of 60% of wages and 40% of prices to full price indexation is estimated to reduce pension expenditure in Slovenia by 2.2% of GDP by 2050.

Another significant weakness of the current system is that the calculation of contributory benefits is unnecessarily complicated. Hence, it is difficult for workers to estimate their future retirement income, which can generate uncertainty and stress, as well as resignation and distrust, as people do not have a proper understanding of how the pension system works. The poor understanding of the rules and the lack of trust in the system might lead workers to retire as soon as possible even with low benefits. Simple and transparent pension calculation is an important ingredient to build effective pension communication about workers’ future entitlements in order for them to make informed retirement decisions.

One main reason why pension entitlements are unclear to workers before they are actually claimed is that the reference wage is based on the best consecutive 24 years of (adjusted) earnings. Workers do not know what pension entitlements they have been accruing, for example, in a given year, nor which consecutive 24 years in the whole career are the best. Moreover, while using the best consecutive 24 years of earnings protects everyone by ignoring the remaining, less favourable years, this rule particularly benefit people with strong career progressions, who also tend to have higher lifetime earnings. Furthermore, basing the reference wage on the best consecutive 24 years compared with the full career provides very limited cushioning of career breaks on pensions, despite widespread beliefs, as explained in Chapter 1. For a given level of spending, this rule is thus regressive, redistributing from low to high earners.

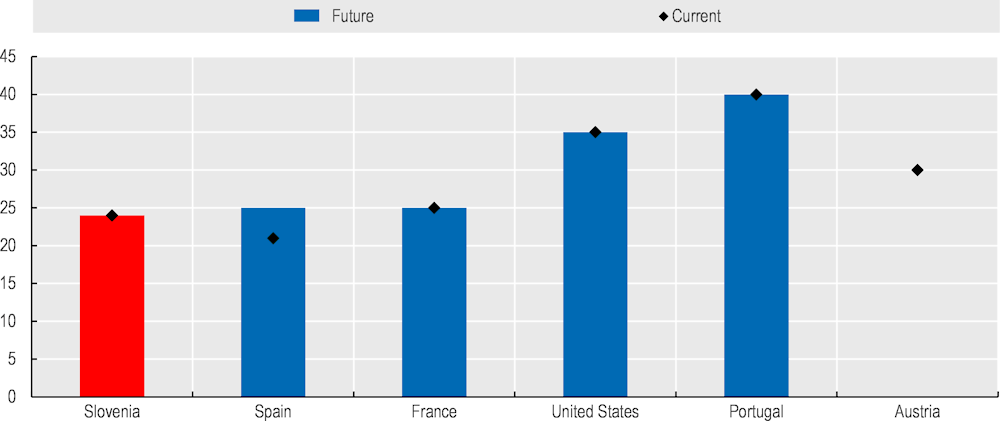

Basing pensions on the average lifetime earnings rather than the 24 best consecutive years would eliminate these unfavourable elements and greatly simplify the calculation of accrued entitlements and pension benefits. The large majority of OECD countries takes into account wages throughout the whole career for calculating the pension benefit. Exceptions are Austria (which will use lifetime earnings for people born from 1955), France, Portugal, Slovenia, Spain and the United States (Figure 8.6). France, Slovenia and Spain are the only countries using 25 years or less. As the objective of this change is not to reduce pensions, it should be combined with raising accrual rates as needed, for example in a budget neutral way thus keeping the average pension unchanged (this would imply increasing the accrual rates by about 10%). As is the case today, the impact of career breaks on pensions should be cushioned by other instruments, i.e. granting pension entitlements for unemployment and childcare periods.

Figure 8.6. Few countries do not take into account the full career for pension calculation

Note: In Austria, the contribution base will steadily increase and reach 40 years for the 1954 birth cohorts while for generations born from 1955 it will be the whole lifetime.

Source: OECD (2019[1]), Pensions at a Glance 2019: OECD and G20 Indicators, https://dx.doi.org/10.1787/b6d3dcfc-en.

Key recommendations for public pensions

Tighten the minimum eligibility conditions to pensions (minimum retirement age and contribution-period condition for a full pension) and link retirement ages to life expectancy.

Lower indexation of pensions in payment.

Simplify the pension rules, while adjusting accrual rates as needed for example to stabilise pension levels on average, by increasing the reference period from the best 24 years to lifetime earnings.

Remove the lowering of the minimum retirement age based on childcare periods.

Based on the analysis in Chapters 1 to 3, Chapter 4 provides detail about the following additional policy options, to fully address financial sustainability issues and improve public earnings-related and first-tier pensions. This includes in particular suggestions to enhance the transparency of pension finances and the co‑ordination between old-age safety nets and contributory pensions.

Additional recommendations for public pensions

Fully addressing financial sustainability issues

Depending on the extent of the tightening of eligibility conditions and of the reduction in pension indexation, additional measures may be needed. Pension finances would be enhanced by combining some of the following options, with different impacts as discussed in Chapter 4:

Adjust benefits to life expectancy or to the ratio of contributors-to-pensioners, increase contribution rates, finance pension redistributive components from the state budget, and lower the minimum and/or the maximum reference wages.

Improving public earnings-related pensions

Improve the transparency of pension finances by: creating an independent expert body in charge of monitoring pensions to provide support for a sound management of the system; separating the financing of old-age and disability pensions as a first step to run separate budgets; improving the reporting of the net cost of minimum and maximum reference wages; and, explicitly recording the cumulative balance between contributions and entitlements over time.

Simplify further the pension rules, while adjusting accrual rates as needed for example to stabilise pension levels on average, by using gross wages for the reference‑wage calculation and eliminating the annual discretionary allowance.

Remove the restrictions to combine work and pensions once a worker is eligible for a full pension, provided that combining work and pensions does not deteriorate public finances in the long term.

Raise the contribution base of the self-employed from 75% of profits (86% of profits will harmonise contributions with employees).

Roll back the reform which removed the requirement to provide a justified reason when dismissing an employee who has met eligibility conditions to the old-age pension.

Align pension contributions and entitlements between civil servants and private‑sector workers.

Improving first-tier pensions

Remove the means-testing of social assistance benefits (both financial social assistance and supplementary allowance) to children of beneficiaries.

Eliminate the conditionality of financial social assistance and supplementary allowance on employment and hours worked; make the supplementary allowance eligible at the statutory retirement age for both men and women; and, merge the supplementary allowance with financial social assistance by granting a higher benefit threshold for people older than the retirement age relative to people below the retirement age.

Merge the guaranteed pension with the minimum pension in a budget-neutral way.

Adopt an integrated framework for old-age safety nets and contributory pensions by ensuring that contributions paid (at least from 15 years) result in higher total benefits through the withdrawal of safety-net benefits at a much lower rate than the current 100%.

8.2. Supplementary retirement savings plans

Slovenian supplementary retirement savings plans complement the public earnings-related and first-tier pensions. Having a good supplementary retirement savings system is an important way for countries to align themselves with OECD advice to diversify sources of retirement income. While the Slovenian pension system already provides for supplementary retirement savings plans, coverage is far from universal and contributions are relatively low. The system also suffers from other shortcomings, such as lower outcomes for women, relatively conservative investment choices, and incoherent disclosures of fees and retirement income projections.

Coverage of retirement savings plans and contributions to those plans are somewhat low when compared with other countries. Slovenia has mandatory coverage for public servants and workers in arduous and hazardous occupations. For workers in these mandatory plans, coverage is expectedly high. However, not all those plans actively receive contributions (Table 8.1). Further, low contributions to the mandatory scheme for civil servants means that the scheme will not significantly enhance retirement incomes to people who have those plans. Voluntary supplementary schemes, on the other hand, suffer from relatively low coverage (at around 20% of the working age population), and only about 62% of policies are active. Considered together, relatively low voluntary plan coverage and low contributions in some plans mean that, overall, assets in supplementary retirement plans are low by international standards. As such, the plans will not provide a meaningful retirement income boost to most of the Slovenian population.

Table 8.1. Summary of coverage and contributions by plan type

|

Scheme |

Membership |

Contributions |

Percentage of policies which are active |

|---|---|---|---|

|

Mandatory scheme for workers in arduous and hazardous occupations |

Around 48 300 |

9.25% of gross wages |

Slightly more than half |

|

Mandatory scheme for civil servants |

Around 235 000 |

EUR 32.18 per month |

About 80% |

|

Voluntary schemes (personal or occupational) |

Around 310 000 contracts |

Varies. For collective plans, subject to minimum of EUR 316.20 per month. |

62% |

Note: Data on voluntary plans cannot be separated into occupational and personal plans. Data on the mandatory schemes for workers in arduous and hazardous occupations and civil servants refer to 2019 data. Data on voluntary plans refer to 2017 data, except Generali’s Leon umbrella pension fund and Intesa’s Moj umbrella pension fund. Data on voluntary plans refer to contracts or policies rather than people.

Source: IER data, Slovenian authorities.

The Slovenian authorities can consider policy changes that boost take‑up of supplementary plans. Introducing compulsory enrolment to an occupational pension arrangement for all workers, or if doing so is not opportune, automatic enrolment with an opportunity to opt out, can be a good way to boost coverage of occupational schemes. In this context, setting the appropriate contribution rate for employers and employees is essential to ensure adequacy.

There is scope to improve the incentives for low income people to contribute to retirement savings plans. A lack of financial incentives to use retirement savings plans is unlikely to be a hindrance to utilisation for most people, but low income earners are an exception. The tax benefit of saving in a voluntary plan in Slovenia is among the highest compared to other OECD countries. However, lower income earners benefit less from these tax benefits, so the government can consider introducing matching contributions or fixed nominal subsidies which tend to resonate more with low income earners.

Like many OECD countries, Slovenia faces a gender gap in retirement savings which the government can address. Women are less likely to have an occupational retirement savings account than men and tend to have lower balances in their accounts. Other features of retirement savings plans exacerbate the gender pension gap. Employers are not legally required to continue contributing to employee plans during maternity and parental leave, and the government can consider mandating that they do so. Furthermore, pension rights and assets are often not split equally upon divorce, which disproportionately affects women. As such, enforcing an automatic split of pension assets in divorce settlements can help address this.

More can be done to improve investment returns on retirement savings. While historical investment performance has been good, retirement savings are mostly invested in conservative options, which can drag down returns in the future. Although a life‑cycle investment strategy now exists, 85% of assets saved in supplementary pension plans are still saved in funds with a guaranteed minimum return.1 Further, the rigidity of the investment framework in Slovenia can be loosened, to give people enough choice to adjust investments according to their risk profiles. Investment rules can also be amended to allow people to invest in riskier strategies or investment options intended for a lower age group within a life‑cycle strategy.

The government can take steps to address the existence of multiple accounts. There are different reasons multiple accounts arise. First, the threshold for withdrawing assets as a lump sum is assessed on a contract level. This means that there is an incentive for people to hold multiple accounts which are under the threshold if they have a preference for lump sums. The Slovenian authorities should define lump sum thresholds at an individual level rather than at an account level, to remove this incentive and encourage the take‑up of annuities unless savings are genuinely too low for annuities to be suitable. In other cases, multiple accounts may be unintentional, and having multiple accounts can mean high fees erode members’ pots. For instance, when people change jobs their pots do not follow them. International best practice is to have arrangements whereby accounts follow members when they change employers, which the Slovenian authorities can consider implementing. Alternatively, introducing sector-wide schemes mean individuals can keep the same account when moving between employers within the same sector. To support these measures, the Slovenian authorities can set up a central register of all supplementary savings accounts to help consolidate accounts and inforce an individual-level lump sum threshold.

To make sure people are well equipped to make retirement saving decisions, disclosures of fees and retirement income projections can be improved. While information about fees charged is available, it is not easy to find on many providers’ websites, and not at all on the regulator’s website. Furthermore, no framework currently exists to harmonise retirement income projections. As such, the Slovenian authorities can consider defining frameworks to better disclose fees and costs as well as to compute retirement income projections.

The mandatory scheme for workers in arduous and hazardous situations should be redesigned to better meet an intended objective. The scheme was designed to provide bridge income between early retirement and the statutory retirement age, for workers unable to perform their occupation during these years. However, few members use the assets they have accumulated in the scheme to retire early. This is partly because the jobs that make people eligible for this scheme include those that can be easily performed until workers attain the retirement age for the public pension. As such, there is a case to clarify the objectives of the scheme and reassess the list of occupations and criteria to allow workers to retire early.

Main recommendations for improving supplementary pensions

To boost coverage of retirement savings plans, introduce compulsory enrolment, or if it is not opportune, automatic enrolment, for occupational plans for all workers.

Improve incentives for lower income earners to contribute to supplementary schemes, such as through fixed nominal subsidies or matching contributions.

Improve communication on the effect of retirement savings on future retirement income and to boost awareness of the supplementary pension system.

To improve investment returns, allow for investments in riskier investment options. Better communicate on the potential risks and rewards of different investment strategies and provide tools to help people assess their personal risk profile and investment horizon. Introduce an appropriate default investment strategy that applies to all providers.

To narrow the gender gap in retirement savings, make employer contributions to occupational pension schemes mandatory during maternity and parental leave, and automatically split pension assets in divorce settlements.

Take steps to reduce the incidence of multiple retirement savings accounts. Define the lump sum threshold at the individual level, rather than the account level. Ensure occupational accounts follow when members change employers and encourage sector-wide occupational schemes. Set up a central register of all supplementary pension savings accounts

Establish frameworks for communicating on fees and costs and computing retirement income projections.

Clarify the objectives of the scheme for workers in arduous and hazardous occupations, and revise the list of occupations and the criteria to retire early.

8.3. Pension communication

Communication about pensions has, to date, failed to raise awareness about pensions and garner public support for reforms in Slovenia. Pension communication is therefore a key area of concern, particularly should the authorities seek to undertake a much-needed reform process. Succeeding in implementing a reform means the authorities need to communicate a compelling case for reform, and for stakeholders to support it. They also need to craft thought-out communication campaigns with clear objectives that make use of innovative communication techniques and tools.

Previous communication efforts regarding pensions have generally been unsuccessful in Slovenia. An expert report commissioned as part of this review found that government communication has lacked a vision and strategy, and has been done with insufficient resources. There are certainly some examples of good communication initiatives, such as those by the Pension and Disability Insurance Institute of Slovenia and private providers. However, communication on the system as a whole is not coherent and large communication gaps remain. As such, the public perceives pensions as confusing and have a low level of trust in them and in the Slovenian Government.

This report discusses the international experience in communicating effectively on pensions. It emphasises that carefully designed national pension communication campaigns can help raise awareness about pensions and build the case for reforms. Those campaigns should refer to clearly set and measurable objectives. Ideally, those campaigns should also be divided into stages to stagger key messages, and should rely on a range of distribution channels to account for people’s different communication needs. Good communication also comes from leveraging the main pathways individuals get their information from – such as employers, social partners, or the media.

When it comes to communication, the governments’ role extends beyond national pension communication campaigns. Authorities also have a role in influencing the design of different tools that help people understand their pensions, such as pension statements, online calculators, dashboards, and other digital tools. Their efforts should help ensure that products have consistent messages, are clear, and encourage people to take action where necessary. In all communication, whether from policy makers themselves or third parties, the paramount concept should be framing communication appropriately and using language that ensures people will understand the messages being communicated.

Main recommendations for improving communication

Launch national pension communications campaigns to raise awareness about pensions and build a case for reform.

Any complex messages should be broken up and communicated in phases.

Make use of different communication channels to better reach different groups of people and tailor messages to different audiences.

Work with key partners such as employers, social partners, and the media to help reach individuals.

Take steps to ensure different communications materials such as pension statements and digital tools provide information clearly and encourage people to take action.

In all communication, ensure concepts are explained simply and clearly, with minimal jargon.

References

[2] European Commission (2021), The 2021 Ageing Report, Publications Office of the European Union, http://dx.doi.org/10.2765/84455.

[1] OECD (2019), Pensions at a Glance 2019: OECD and G20 Indicators, OECD Publishing, Paris, https://dx.doi.org/10.1787/b6d3dcfc-en.

Note

← 1. Excluding assets in the scheme for workers in arduous and hazardous occupations.