This chapter looks into the financial sustainability of the Slovenian public pension system. It analyses pension financing over the last 20 years, the impact of the COVID‑19 pandemic on pensions and the sources of financing pensions. The chapter discusses pension projections and the driving forces behind the expected increase of pension expenditure. It provides new quantitative evidence on policy trade‑offs between financial sustainability and adequacy when adjusting selected pension parameters.

OECD Reviews of Pension Systems: Slovenia

2. Financial sustainability of public pensions

Abstract

2.1. Introduction

This chapter looks into the financial sustainability of the Slovenian public pension system, building on the overview of the scheme in Chapter 1. It starts by analysing pension financing over the last 20 years, the impact of the COVID‑19 pandemic on pensions and the sources of financing pensions (Section 2.2). The next section discusses pension projections and the driving forces behind the expected increase of pension expenditure. The final section shows the impact of selected adjustments to pension parameters on both future pension expenditure and pension levels.

2.2. Pensions are financed by contributions and transfers from the state budget

2.2.1. Mixed trends in pension financing since 2000

It is not possible to clearly single out revenues financing old-age and survivor pensions. Old-age and survivor pensions are financed together with disability pensions and some long-term care benefits. Spending items can be identified for each category and the expenditure on old‑age, survivor and disability pensions represented about 10% of GDP in 2019, or 88% of total ZPIZ expenditure of 11.5% of GDP (Chapter 1).1 While contributions are the main source of pension financing, total expenditure always equal total revenue because any financial gap is covered by a transfer from the state budget by law.

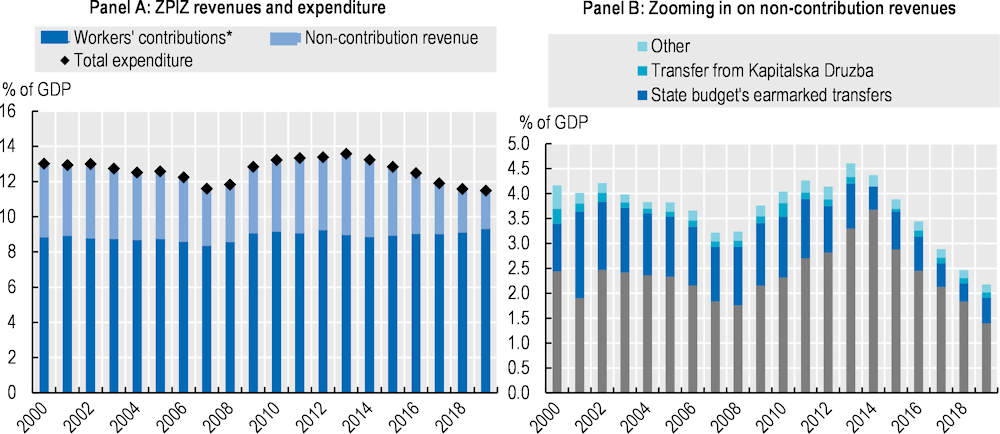

The share of ZPIZ spending in GDP over the last 20 years has been influenced by both the business cycles affecting GDP (denominator effect) and structural factors. Since 2000, ZPIZ expenditure has fluctuated from just below 12% of GDP when labour market was booming in 2007‑08 and 2017‑19 to more than 13% during bad economic conditions in 2000 and in 2010‑14 (Figure 2.1, Panel A). Before the COVID‑19 crisis, ZPIZ expenditure declined from a peak of 13.6% of GDP reached in 2013 to 11.5% in 2019.The freezing of pension indexation between 2012 and 2015, fast growth in GDP and wages, and the rise in the effective age of claiming pensions contributed to the decrease in the share of spending in GDP.

Overall, the decrease of spending, from 13.0% of GDP in 2000 to 11.5% of GDP in 2019, occurred despite fast population ageing. The demographic old-age to working-age ratio, i.e. the number of people aged 65 and more per 100 people aged 20‑64, increased by 50% from 22 to 33 between 2000 and 2019. The demographic pressure was more than offset by the combination of several factors, mainly higher employment and lower pensions. Over this period, the number of pensioners relative to the number of people aged 65 or more declined by 14%. Total employment increased by 11% while the population aged 20‑64 remained stable. Moreover, the ratio of the average pension to the average wage fell from 51% to 39%, hence a drop of 24%. Finally, GDP grew faster, by 6%, than the wage bill.

The share of contributions in ZPIZ revenues has been increasing (Panel A). Over 2000‑19, total pension contributions increased from 8.8% to 9.4% of GDP, allowing for a lower share of non-contributory revenues, mainly transfers from the state budget, from 4.2% to 2.1% of GDP. Panel B provides a breakdown of non-contribution revenues. The contributions financed by the state budget to cover some earmarked entitlements, such as pension credits of unemployment and childcare, stood at 0.5% of GDP in 2019, less than half the 2010 level. Kapitalska Druzba, an enterprise managing state‑owned assets, paid 0.1% of GDP to the ZPIZ budget in 2019, and its input exceeded 0.2% of GDP only in 2000 and 2010. Hence, transfers from the state budget to cover the deficit almost halved from 2.4% to 1.3% of GDP over the last two decades. However, as shown in the next section, this cannot be extrapolated to the future.

Figure 2.1. Expenditure and revenue of ZPIZ in 2000 through 2019

Note: *Workers’ contributions includes employees’, employers’ and the self-employer workers’ contributions.

Source: OECD calculations based on the ZPIZ data.

2.2.2. Limited impact of the COVID‑19 crisis on pensions in 2020

Public pension finances deteriorate during economic downturns. Indeed, low economic growth usually reduces revenues of public pension schemes much more than expenditures, but it is still too early to assess the overall impact of the COVID‑19 crisis in Slovenia. In 2020, in response to the COVID‑19 health crisis, Slovenia introduced job-retention schemes and options to subsidise or defer pension contributions which reduced pension revenues temporarily. In particular, the state budget subsidised wages and pension contributions for workers who were temporarily laid off or whose working time was reduced. Additionally, pension contribution of the self-employed who were not able to perform their activities or who considerably reduced their activity due to pandemic were subsidised. The access to unemployment benefits, which accrue pension entitlements, was eased temporarily.

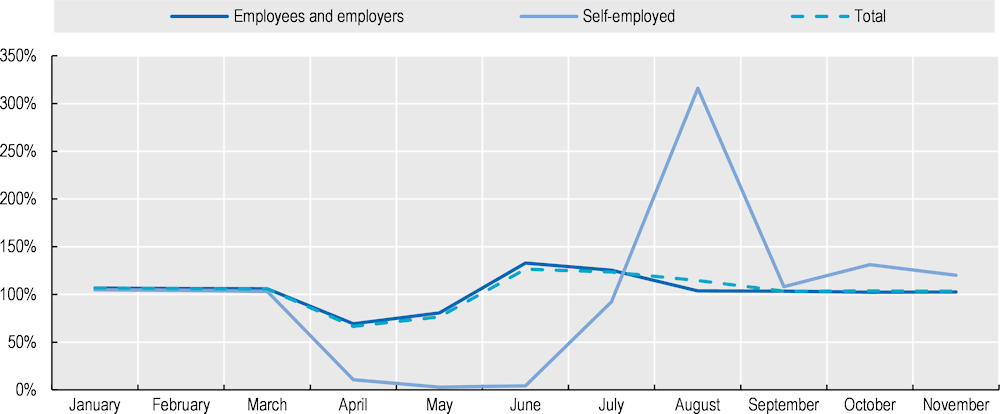

In the first quarter of 2020, before the COVID‑19 crisis, pension contributions were 6% higher than in the same period of 2019 (Figure 2.2). In April and May, contributions dropped to 70% and 81% of the 2019 level, respectively. However, in June, July and August, they strongly rebounded at 127%, 124% and 115% compared to the corresponding 2019 months, helped by state aid paid to employers. As a result, after 11 months, the total employee and employer contributions were 4% higher in nominal terms than over the same period in 2019, only slightly less than in the first quarter.

The contributions of the self-employed, which accounted for only 5% of total contributions in 2019, dropped almost to zero in April, May and June. They were strongly subsidised in August and remained slightly higher than the year before in the remaining months. As a result, contributions paid until November were exactly at the level of those from the corresponding months of 2019.

Figure 2.2. During the 2020 lockdown contributions collapsed and then recovered

Thanks to the taken measures, the relatively small impact on pension contributions overall in 2020 means that pension entitlements have not been much affected during the crisis. Moreover, although uncertainty is abnormally large, recent OECD projections show that the labour market should remain relatively strong in Slovenia: total employment between 2020 and 2022 would not be more than 2% lower than in 2019 while the unemployment rate would increase slightly to 5.6% 2021 (against 4.5% in 2019) before declining in 2022 (OECD, 2021[1]).

In April 2020 and January 2021, Slovenia paid a special solidarity grants to recipients of low pensions, along with recipients of some social assistance and social security benefits including unemployment benefits. The benefit amounted to EUR 300 (around 40% of average pension) for pensioners receiving pensions lower than EUR 500 in 2020 (EUR 510 in 2021), gradually phased out for pensions of EUR 700 in 2020 (EUR 714 in 2021).

The heath deterioration of those infected is at the core of the COVID‑19 crisis, and the pandemic is causing enormous human suffering. As for pension finances, higher mortality rates due to COVID‑19, especially among older people, will lower the average length of pension payments compared with what was expected before the crisis. The ultimate impact on the number of deaths and on shortening the life of the different cohorts remains, however, subject to a large uncertainty, and might differ a lot across countries.

In Slovenia, the mortality rate among people aged 65 or more was 16% higher in 2020 compared to 2019. A 16% higher mortality implies that the number of people aged 65 or more at the end of 2020 was about 0.7% lower, resulting in a similar impact on pension expenditure in 2020, i.e. savings of less than 0.1% of GDP. However, this is not the total impact as the mortality will remain elevated at least in 2021. Moreover, long-term health effects among the recovered may shorten their life expectancy as some patients show lingering symptoms and some organs such as heart, lungs or brain can be harmed by the virus (OECD, 2020[2]). On the other hand, the vaccination programme has been progressing in the whole European Union, which provides grounds for optimism that the mortality will soon return to the pre‑crisis levels. The short-term pension savings due to high mortality might fade away quite quickly in most countries because the excess deaths in 2020 have been skewed towards older people and those dying due to COVID‑19 are likely to have had, before the COVID‑19 crisis, a lower life expectancy than individuals of the same age or birth cohort (Cairns et al., 2020[3]).

2.2.3. The contribution rate is relatively high in international comparison…

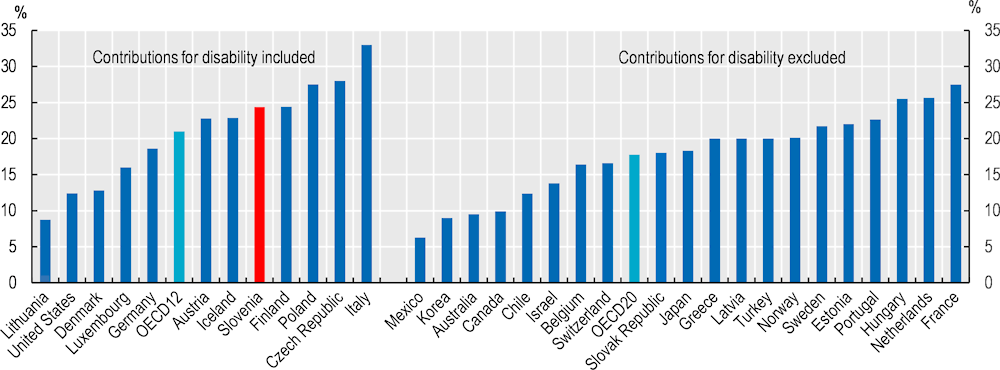

Among the OECD, 32 countries have mandatory pension contributions (Figure 2.3).2 Most countries in this group have a separate contribution rate for old-age and survivor pensions. However, in 12 countries including Slovenia, contributions also finance disability or invalidity benefits. At 24.35% in Slovenia, the effective contribution rate for average‑wage earners is higher than the average of 21.0% within this latter group of countries in 2018. Italy has the highest total mandatory contribution rate at 33.0%, while the Czech Republic and Poland also have substantially higher rates than Slovenia. When pro-rating Slovenia’s contributions based on spending across schemes, out of the 24.35% contribution rate, a contribution rate of about 21.2% would correspond to old-age and survivor pensions. In countries that finance old-age and survivor pensions separately, the contribution rate was equal to 17.8% on average, with France, Hungary and the Netherlands having rates higher than 25%.

Figure 2.3. Effective contribution rate for mandatory pensions is relatively high

Note: New Zealand is not included as there are no mandatory pension contributions. For Ireland, Spain and the United Kingdom it is difficult to separate the pension contributions from the other parts of social insurance such as unemployment.

Source: OECD (2019[4]), Pensions at a Glance 2019: OECD and G20 Indicators, https://dx.doi.org/10.1787/b6d3dcfc-en.

2.2.4. … but contributions will not be structurally sufficient to finance pension promises

One way to examine whether contributions are enough to finance pensions for given career cases is to compare the effective rates of returns they generate for individuals with the internal rate of return that the system can afford. When redistributive instruments are financed by external sources (i.e. not by pension contributions), a pay-as-you-go pension system can provide an internal rate of return equal to the growth rate of total contribution receipts, a good proxy of which being the growth rate of total wages assuming a constant contribution rate.

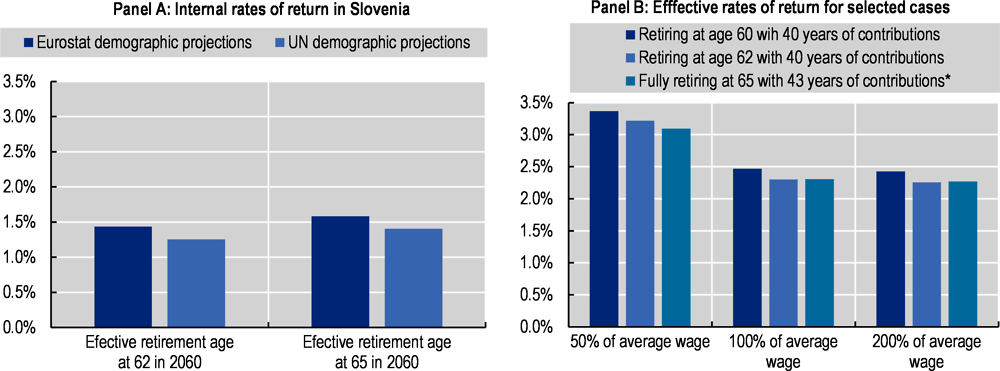

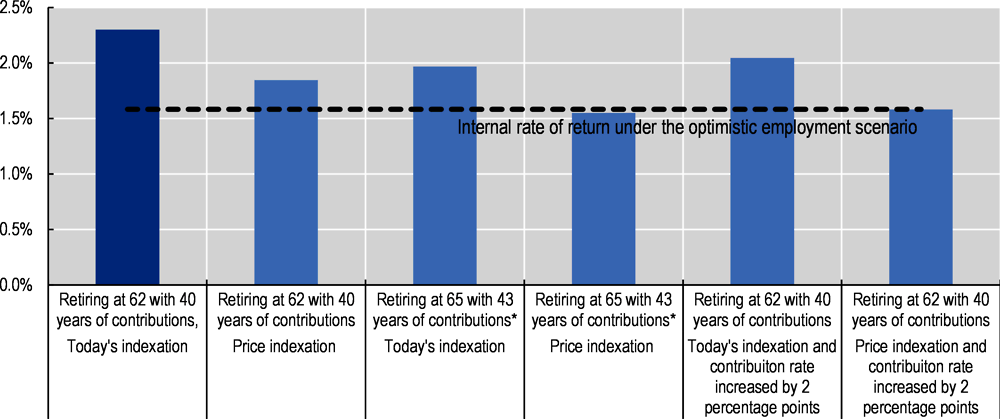

The growth rate of total wages is equal to the sum of the growth rates of the average wage and of total employment. The 2021 Ageing Report by the European Commission assumes an average annual real-wage growth of 1.9% in Slovenia until 2070. Ageing will affect employment and the population aged 20‑64 is projected to shrink by 20% based on Eurostat demographic projections (Europop2019) and by 27% based on UN projections over the same period. As a result, the growth of employment driven by demographic changes, i.e. assuming constant employment rates, would be negative at 0.46% and 0.63% per year, respectively, on average. If the effective age of claiming pension were to increase gradually by 3 years, the annual decline in employment would be reduced to 0.31%‑0.49%. Hence, based on an annual real-wage growth of 1.9%, the wage bill would increase by 1.25‑1.44% with a stable retirement age and by 1.40‑1.58% if the effective retirement age rises by 3 years. Hence, 1.6% is an optimistic real rate of return that the public pension system in Slovenia can deliver for people starting their career now (Figure 2.4, Panel A). By comparison, the Ageing Report projects GDP to grow on average by 1.6% a year in Slovenia by 2070, which is in line with the optimistic scenario for the total wage bill growth.

Figure 2.4. Internal vs effective real rates of return in Slovenia for the cohort born in 1996

Note: All cases assume stable earnings thought career. It is assumed that the real annual wage growth is 1.9% and the mortality is based on the unisex mortality tables for the cohort born in 1996 which is expected to retire around 2060.

* The case for fully retiring at age 65 with 43 years of contributions assumes combining work and pensions for ages 63‑65.

Source: OECD calculations.

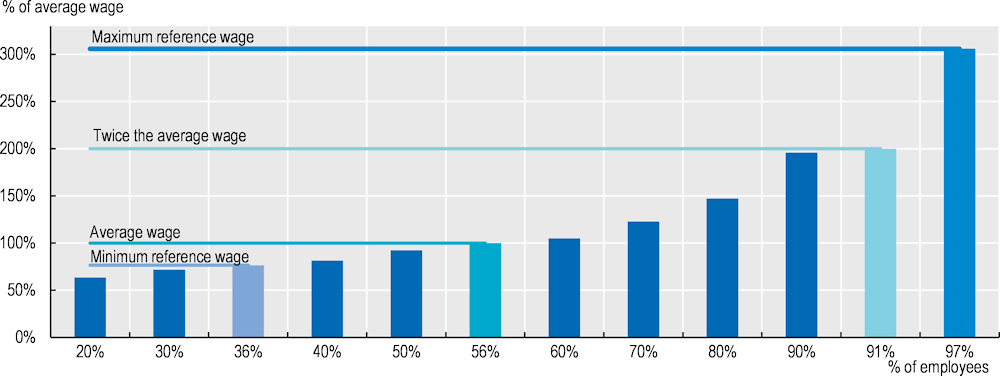

Effective rates of return differ by earning levels mainly due to the effects of the minimum and maximum reference wages, discussed in Chapter 1, which boost low pensions and cap high pensions.3 Based on the 2019 distribution of wages, more than one‑third of employees (36%, Figure 2.5) contributed from less than the minimum reference wage (at 76.5% of the average wage, Chapter 1). Slightly more than half of employees (56%) had wages lower than the average wage. On the top end of the distribution, only 3% of contributions were paid on wages higher than maximum reference wage (at 306% of the average wage). Although the wage distribution determines the distribution of contributions in a given year, it does not inform on the distribution of entitlements as those are based for new retirees on their best 24 years of earnings. However, among new pensioners in 2019, the key numbers above were similar: 34% got their pensions based on the minimum reference wage while slightly more than 1% were capped by the maximum reference wage.

Figure 2.5. Cumulative distribution of pension contribution bases of employees, 2019

Note: The percentiles were calculated based on the linear interpolation of ZPIZ data. The contribution base for part-time workers and those working for less than the whole year was topped up to the full-time equivalent. The wage data does not include remuneration paid for overtime.

Reading note: The bar showing the average wage at 56% means that 56% of employees pay contributions based on the average wage or less.

Source: OECD calculations based on ZPIZ data.

The current pension rules promise annual real rates of return on paid contributions ranging from 3.4% for low earners with a full career until age 60 to 2.5% for average‑wage and 2.4% for high-wage workers (Figure 2.4, Panel B).4 For those retiring at age 62 with 40 years of contributions the effective annual rates of return are about 0.2 percentage points lower. For all these cases, pension promises are based on much higher returns than the internal rate of return of PAYG pensions in Slovenia, around 1.6% based on the optimistic demographic and employment scenario. This implies, that not only pensions of low earners will need to be subsidised, which reduces old-age inequality, but also those of average‑wage and high-wage earners, even after a full career.

Under the current rules, workers older than 60 years who continue to work beyond 40 years of contributions (pensionable service without purchase) can claim 40% of their pensions while, for up to 3 years, accruing entitlements based on the 3% accrual rate, which is substantially higher than the 1.36% rate applying to previous years. Combining work and pensions based on these rules is basically neutral for pension finances over time (Annex A in Chapter 1), and retiring at age 65 after a 43‑year career (while combining work and pensions from the age of 62 years) gives almost the same effective rate of return as retiring at age 62 after a 40‑year career.

When limiting the analysis to an average‑wage worker, increasing the retirement age and reducing pension indexation together would make pension promises more in line with what the pension system can produce in a financially sustainable way. By contrast, maintaining the possibility to retire at age 60 with a full pension cannot be reconciled with a sustainable rate of return. Reducing indexation to prices would reduce the real rate of return for an average‑wage earner retiring at age 62 with 40 years of contributions from 2.3% with current indexation to 1.8%. When the retirement age is increased to 65 while sticking to current indexation, a 43‑year career based on the standard 1.36% accrual rate would additionally reduce the rate of return to 1.5% (Figure 2.6).5 This would still require transfers from the state budget to finance pension redistribution, in particular for low-wage earners. Combining both scenarios – age 65 with 43 years of contributions and price indexation – would bring the rate of return closely in line with what the PAYG scheme can deliver in Slovenia under optimistic employment assumptions. Finally, increasing the contribution rate by 2 percentage points would lower the rate of return by 0.3 percentage points, hence combined with price indexation this would also generate an annual real rate of return of 1.6%. Although the absolute levels of rates of returns differ across earnings levels, the relative impact of the scenarios presented in Figure 2.6 is similar across earnings levels.

Figure 2.6. Real rates of return on paid contributions from pension promises under alternative policies

Note: (*) Contrary to the previous chart, the case with 43 years career assumes here that last three years accrue at the regular rate of 1.36% without combining work and pensions.

Source: OECD calculations.

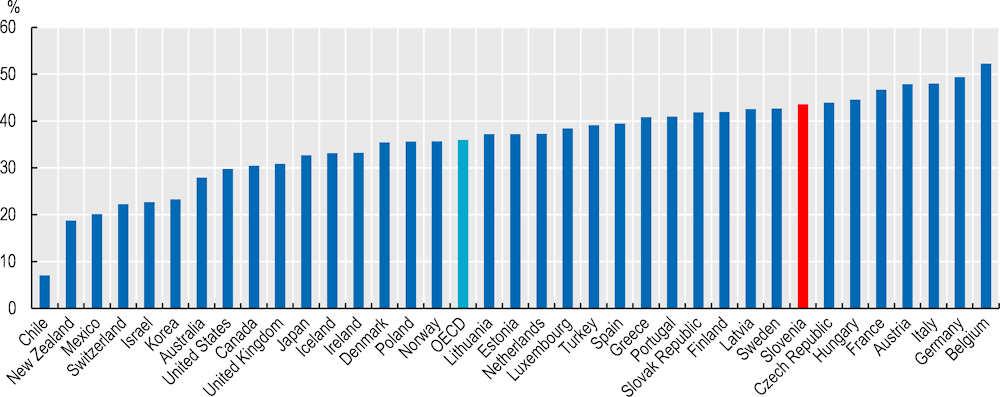

2.2.5. The tax wedge is high

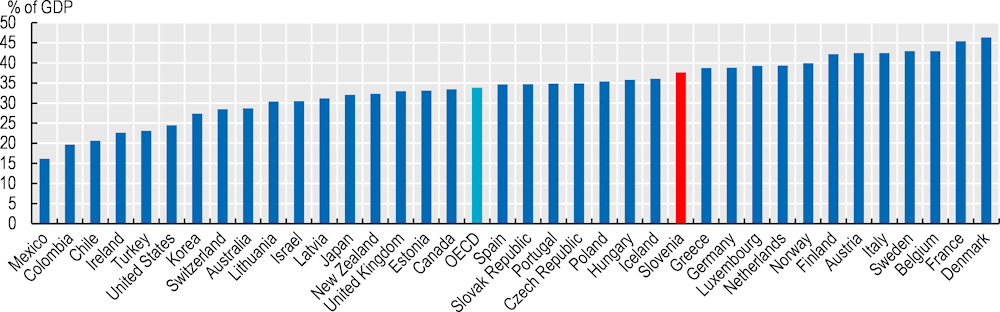

Beyond pension contributions, health contributions and personal income taxes are levied on labour earnings, which creates a wedge between labour cost for employers and net take‑home pay for employees. High tax wedges might be an important constraint for increasing pension contributions because they might lower income, discourage employment and deteriorate international competitiveness. The tax wedge for average earners varies in the OECD countries from below 10% in Chile to more than 50% in Belgium, while the average for all OECD countries stands at 36% (Figure 2.7). At 44%, the tax wedge in Slovenia is substantially above this average. Thus the space for increasing the contribution rate is rather limited.

Figure 2.7. Tax wedge for an average earner is high in Slovenia

Note: Data on Australia, Japan and Mexico are from 2018.

Source: OECD Taxing Wages Dataset, https://stats-1.oecd.org/index.aspx?DatasetCode=AWCOMP.

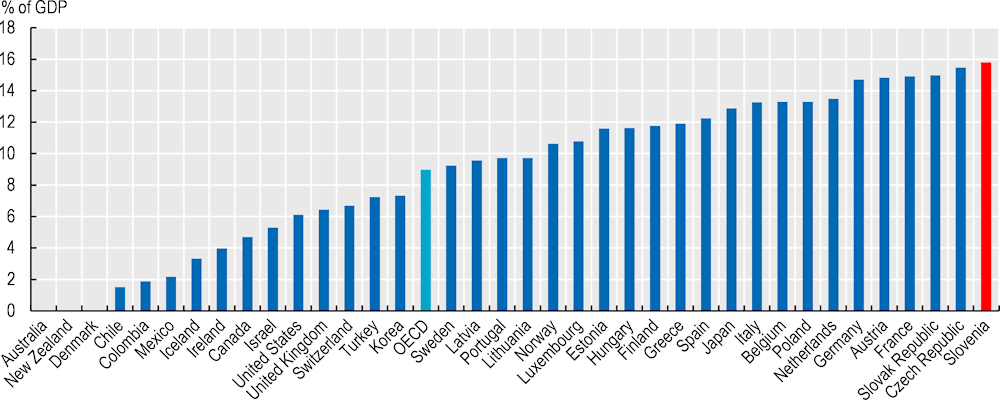

In Slovenia, the tax structure is heavily skewed towards social security contributions, such that revenues from contributions as a share of GDP are record high, at 15.8% compared with an OECD average of 9.0% (Figure 2.8). If additional revenues are needed to finance pensions, other sources than social security contributions that are less detrimental to employment and productivity should be considered. Total tax revenues in Slovenia amounted to 37.7% of GDP in 2019 against an OECD average at 33.8% while Austria, Belgium, Denmark, Finland, France, Italy and Sweden raise more than 40.0% (Figure 2.9).

Figure 2.8. Social security contribution revenues are record high in Slovenia

Note: Data on Australia, Japan and Mexico are from 2018.

Source: OECD Revenue Tax Statistics (https://stats.oecd.org/Index.aspx?DataSetCode=REV).

Figure 2.9. Total tax revenues in the OECD

Note: Data on Australia, Japan and Mexico are from 2018.

Source: OECD Revenue Tax Statistics (https://stats.oecd.org/Index.aspx?DataSetCode=REV).

2.3. Pension expenditures are projected to increase strongly after 2030

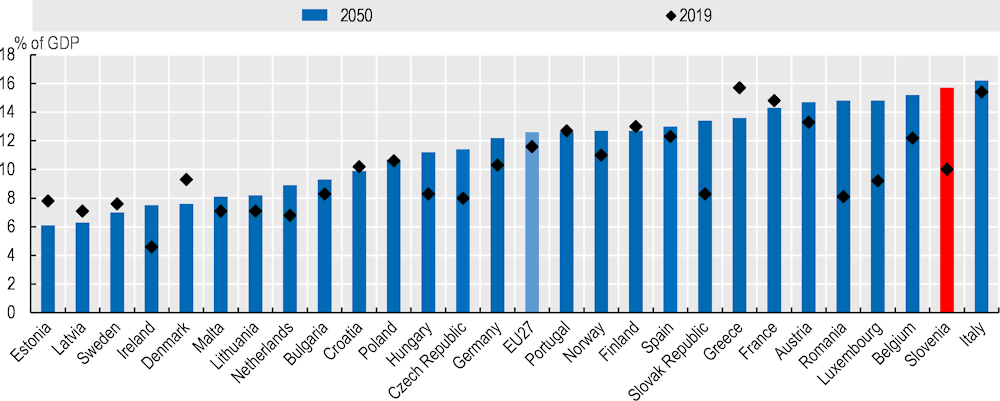

One crucial element of the Ageing Reports published every three years is the projection of public pension expenditure as a percentage of GDP for each EU country. Based on the current legislation, pension expenditure is projected to increase in Slovenia more than in most EU countries (European Commission, 2021[5]).

2.3.1. The 2019 reform to accentuate the already steep increase in future pension deficits

The 2021 Ageing Report (European Commission, 2021[5]) projects pension expenditure to increase sharply from 10.0% to 15.7% of GDP, i.e. by 5.7 percentage points, between 2019 and 2050 in Slovenia, which is the largest except for Romania in the EU. Only Italy is projected to have a higher expenditure ratio in 2050, at 16.2%, while in the EU it would increase from 11.6% to 12.6% on average (Figure 2.10).

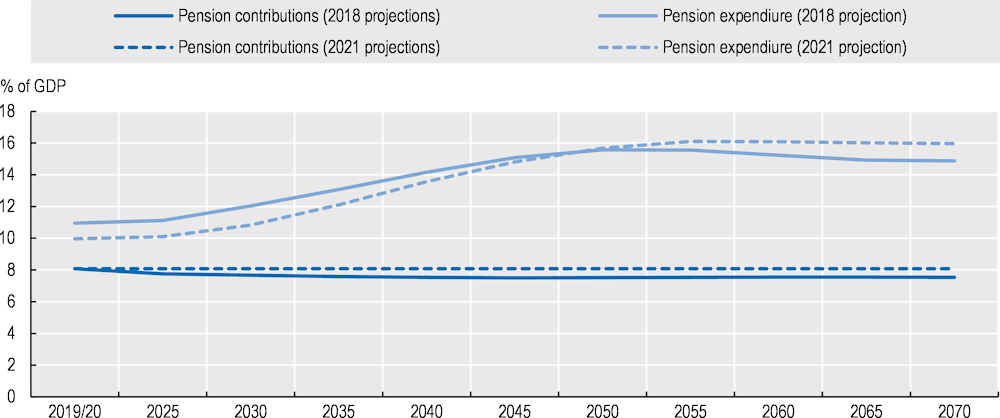

Overall, between 2019 and 2070, the 2021 Ageing Report projects pension expenditure to increase from 10.0% to 16.0% of GDP, while the 2018 projections showed a substantially smaller increase, from 11% of GDP to 14.9% between 2020 and 2070 (Figure 2.11). After a modest increase in the 2020s of less than 1 percentage point, the pension expenditure ratio is projected to accelerate from 2030, increasing by 2.8 percentage points in the 2030s and by 2.1 percentage point in the 2040s. After having reached 15.7% in 2050, pension spending is projected to increase only slightly to 16.0% of GDP in 2070.

Two recent factors have raised future expenditure, even further than previously estimated. First, the changes introduced in 2019 are expected to increase pension spending gradually, and by 1.5% of GDP from 2055 (MDDSZ, 2019[6]). The largest element relates to the increase in the total accrual rate after 40 years of contributions for men from 57.5% to 63.5% and the cancellation of the previously legislated reduction of women’s total accrual rate from 63.5% to 60.25% from 2023, which together would inflate long-term pension spending by 1.3% of GDP. In addition, the bonus for childcare of 1.36% of additional accruals per child (Chapter 1), also introduced in 2019, would increase long-term spending by 0.3 percentage points.6

Figure 2.10. Pension expenditure will increase sharply in Slovenia

Note: The EU average is for 27 EU countries.

Source: European Commission (2021[5]), The 2021 Ageing Report, http://dx.doi.org/10.2765/84455.

Second, the increased possibility to combine work and pensions, following the changes introduced in 2012 – which were not fully accounted for in the 2018 projections – and modified in 2019, would raise both spending and contributions by about 0.4% of GDP over time.7 Consistent with this, Annex A of Chapter 1 showed that the increased flexibility to combine work and pensions – the 2019 reform increased the part of the pension that can be claimed together with full-time work from 20% to 40% whereas the accrual rate when doing so was lowered from 4% to 3% – is close to actuarial neutrality.

Figure 2.11. State budget financing would need to quadruple to cover pension expenditure by 2050

Note: Projections of the 2018 and 2021 Ageing Reports are shown for 2020 and 2019, respectively, due to data limitations Projected total ZPIZ contributions are multiplied by the 2019 share of pension expenditure in total ZPIZ expenditure (10%/11.5%=0.88).

Source: OECD calculations based on European Commission (2018[7]), The 2018 Ageing Report, http://dx.doi.org/10.2765/615631, and (2021[5]), The 2021 Ageing Report, http://dx.doi.org/10.2765/84455.

Pension financing from the state budget would become so large that it is projected to exceed contribution revenues by 2050. The share of pension contributions in GDP is projected to remain stable at around 8% of GDP between 2020 and 2050 (Figure 2.11), about 0.5% of GDP higher than the 2018 projections. Therefore, an increasing part of pension payments will not be financed from contributions but from transfers from the state budget, which would increase from around 2% of GDP in 2020 to 8% in 2070.8

The Slovenian Government has committed to implement reforms needed to ensure pension fiscal sustainability. The Slovenian Recovery and Resilience Plan, adopted by the European Commission in July 2021, foresees that a comprehensive reform will be proposed by the Slovenian Government in 2023 and adopted by Parliament in 2024.

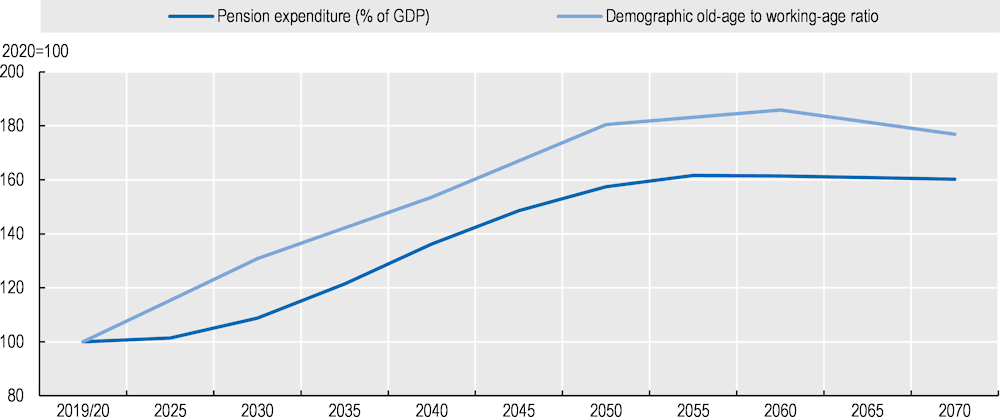

2.3.2. Building-up of pension financial imbalances driven by demographic changes

Pension expenditures are expected to be largely driven by demographic developments. Absent any pension reform and any change in the labour market, a 1% change in the old-age to working-age ratio affects the share of pension spending in GDP by 1%. The ratio of the number or people aged 65 or older to the working age population (20‑64) is expected to soar by 80%, from 34 to 60 between 2020 and 2050, whereas the share of pension spending in GDP is projected by European Commission (2021[5])to increase by 57% (Figure 2.12). The difference between the two, which accounts for about 2% of GDP in pension spending in 2050, is mainly due to higher employment (see below). These demographic developments are subject to some uncertainty, in particular about longevity trends, but are largely determined today for at least next 30 years. They could be attenuated by net immigration flows in the medium term and by increased fertility rates over the longer term, but both these areas are beyond the scope of pension policy.

Figure 2.12. Pension expenditure will accelerate due to demographic shifts

Source: OECD calculations based on the European Commission (2021[5]), The 2021 Ageing Report, http://dx.doi.org/10.2765/84455.

2.3.3. Higher employment rates are expected to partially offset demographic pressure

The most important factor offsetting the impact of the demographic shift is the increasing employment of older people leading to claiming pensions at older ages. As a result, the number of pensioners divided by the number of people aged 65 or more is projected to decline by 11% between 2019 and 2070 (European Commission, 2021[5]). Overall, the labour market participation rate among individuals aged 20‑74 is projected to increase slightly in Slovenia, from 68% to 70%, similar to the EU average. However, despite a substantial increase in the age group 55‑64, from 50% to 65%, Slovenia will remain well below the EU average of 72% in 2070. Among people aged 65‑74, the participation rate is expected to increase from 4.6% to 9.4%, remaining twice lower than the EU average. Overall, the average age of labour market exit is expected to increase by 0.9 years to 62.9 in 2070 in Slovenia against a projected increase of 1.8 years to 65.6 in the EU on average. All these developments account for the expected impact of already legislated pension reforms. As for 2021, the Slovenian legislation does not foresee any increase in eligibility conditions.

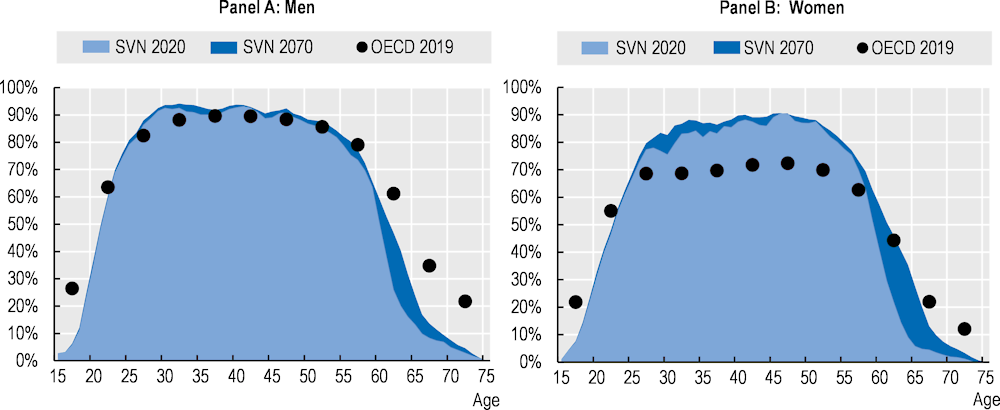

Even after the projected increases, the employment rates of people older than 60 in Slovenia in 2070 will be much lower for both men and women than the OECD averages in 2019 (Figure 2.13). This means that there will still be a large room to increase employment rates at older ages in Slovenia.

Figure 2.13. Employment rates are projected to improve moderately in Slovenia

Note: Slovenia 1‑year age groups projections smoothed with 3‑period moving average. The OECD average for 5‑year age groups presented in the centre of the intervals.

Source: OECD calculations based on European Union (2020[8]), The 2021 Ageing Report Underlying Assumptions & Projection Methodologies, http://dx.doi.org/10.2765/733565, and OECD Employment data.

2.3.4. Benefit ratios are projected to increase

By contrast to most EU countries, the average pension is projected to increase relative to the average wage (the so-called benefit ratio) in Slovenia. The benefit ratio is projected to increase from 30.8% in 2020 to 34.2% in 2070 against a drop from 42.5% to 33.1% in the EU on average (European Commission, 2018[7]). This would increase pension expenditure by 1.4% of GDP in Slovenia compared with a decrease of 2.3% of GDP in the EU on average (European Commission, 2018[7]). The benefits are expected to increase as a response to the 2019 pension reform which has been raising accrual rates and due to the growing popularity of combining work and claiming part of pensions. While these trends shed light on one factor behind spending projections, the benefit ratio would rise from a low level in Slovenia towards a ratio close to the EU average in 2070. The currently low benefit ratio is consistent with relatively high spending only because of the high retirees-to-workers ratio, well in excess of what the pure demographic old‑age to working-age ratio can explain. In short, the big factor behind this whole nexus is low effective retirement ages in Slovenia.

2.4. Adjusting pension parameters to improve financial sustainability

Given the weaknesses identified in Chapter 1, the political choice could be made to overhaul the pension system through a systemic reform that would be designed to ensure financial sustainability. The PAYG part could be shifted from DB to a points or an NDC system. Funded DC pensions could also be developed as a complement along the lines of the analysis presented in a separate analysis of supplementary pension schemes, but this does not impact the needed adjustment of the public system. Using part of the current contributions to fund DC schemes is not an option as this would complicate even more the efforts to achieve financial sustainability.

Box 2.1. Models used for pension simulations

Pension simulations were prepared by the Institute for Economic Research (IER) with models that are used by the Slovenian Government for projecting pension expenditure and evaluating pension reform options. For example, IER delivered projections for the Ageing Report of the European Commission as well as for evaluating pension reforms in 2010 and 2019. Three models were used for the current project: Generational Accounting Model (GAM), dynamic microsimulation pension model (DYPENSI) and recursive dynamic CGE model (SloMod).

In GAM the economic per capita categories are distributed by age groups (sometimes called “age profiles”) and multiplied by population projections by age to obtain estimates for future development of public expenditures and public revenues. Within the current project, the model was extended to provide results for every year and for every cohort.

As GAM was used for the preparation of the 2021 Ageing Report, the results are consistent with the 2021 Ageing Report projections for the whole projections horizon from 2020 to 2070. Technically, GAM builds on three types of matrices: the age‑profile matrix (PROF) with per capita averages of economic variables, the population matrix (P) and the coefficient matrix (C). PROF includes average values of projected categories by age groups or cohorts. It rests on the age profiles from the base year (2019). GAM assumes that next generations “inherit” the situation of the previous ones in the base year. This model was used to simulate the scenarios of changing the pension indexation rule, reducing the accrual rates.

To provide results for the scenarios that could not be provided by GAM – tightening the eligibility conditions to pensions, and adjusting minimum and maximum reference wages DYPENSI based on 1‑year age cohorts was used.

The starting population for DYPENSI is an administrative database merged from many sources. The current model version is based on 2007 administrative data records constituting a 5% sample representative of the Slovenian population. In a running project for the MLFSAEQ, the model will be updated, refined and extended using data for the new base year 2017 based on a 20% sample of the Slovenian population.

Additionally, DYPENSI was extended with SloMod to assess the impact of increasing contribution rate on total employment. The construction of SloMod is based on standard general equilibrium theory. General equilibrium modelling helps better evaluate the socio‑economic and environmental impacts of different economic policy instruments. General equilibrium models are based on individual (decentralised) optimising behaviour of economic agents. SloMod is currently calibrated on the Social Accounting Matrix (SAM) for 2015. SAM 2015 is built with data mainly provided by the Supply and Use Tables (SUT) 2015. It is built following the European System of Account (ESA 2010) structure. It is composed of different accounts (blocks) retracing the exchanges between different agents at different places (firm or market level). The model distinguishes different components, including commodities, outputs, factors of production, institutional setting, capital, and the rest of the world account. The model has been solved by using the general algebraic modelling system (GAMS).

Source: Information provided by IER.

Eight OECD countries – Estonia, Germany, Italy, Latvia, Lithuania, Norway, Poland, the Slovak Republic and Sweden – now have a points or NDC scheme at the core of their PAYG pension system. However, such a systemic reform would require a strong political commitment in order to build a broad consensus as a pre‑condition to prepare it well and implement it successfully. An alternative is to opt for a parametric reform of the PAYG DB scheme. Given the magnitude of the needed adjustments in Slovenia, ensuring sound financing of pension promises will also require substantial political efforts and a clear mandate for reform.

This section assesses how adjustments in parameters of the Slovenian public pension scheme would affect financial sustainability and benefit adequacy. The assessed parameters include: retirement age, pension indexation, contribution rate, minimum and maximum reference wages and accrual rates. All options are assessed with models used by the Institute for Economic Research which were used in the past e.g. to deliver pension projections for the European Commission Ageing Report as discussed in Box 2.1. Most scenarios have been calibrated to generate savings of about 1% of GDP in 2050 relative to the non-reform projections (baseline).

2.4.1. Tightening eligibility conditions (retirement ages and contribution period)

Tightening eligibility conditions could improve financial sustainability by shortening the duration of benefit payments and raising GDP and contribution and tax receipts. More employment generally results in higher pension entitlements, which tends to lower the long-term effects on pension expenditure, if other accompanying measures, such as adjusting accrual rates, are not adopted to stabilise pension replacement rates.

The following scenarios assume that the tightening of eligibility conditions is accompanied by applying the regular accrual rates until the increased minimum contribution condition is reached. As of 2021, the minimum contribution condition is 40 years and the regular accrual rate of 1.36% is inflated in the 41st, 42nd and 43rd years of contributions to 3%.

Two scenarios tightening eligibility conditions are considered here:

a) Raising the minimum retirement eligibility conditions to 62 and 42 years by 2028 and linking age and contribution conditions to life expectancy thereafter.

b) One‑off tightening of eligibility conditions in 2027 by 2.6 years.

These scenarios were modelled with DYPENSI (Box 2.1).

Raising the minimum retirement eligibility conditions to 62 and 42 years by 2028 and linking age and contribution conditions to life expectancy thereafter

The first scenario is based on the following assumptions: increasing the eligibility conditions from age 60 with 40 years of contributions (pensionable service without purchase) to age 62 with 42 years of contributions by 2028; eliminating the reductions of the minimum retirement age of 58 years for men and 56 years for women based on childcare, working before age 18 and military service; and, increasing from 2028 all these conditions along with the statutory retirement age, of 65 years in 2021, by eight months for every year of gains in remaining life expectancy at age 65. Under this scenario, remaining life expectancy at age 65 is projected to increase from 21.9 years in 2030 to 23.8 years in 2050 and 25.6 years in 2070.9 Thus, the minimum retirement age is assumed to reach 63.4 with 43.4 years of contributions in 2050 and 64.6 with 44.6 years of contributions in 2070, while the statutory retirement age would remain 3 years higher. The extension of the contribution period would increase replacement rates after a full career similarly across all earnings levels.

The reforms envisaged in this scenario would gradually lower pension expenditure, by 0.9% of GDP in 2050 and by 1.6% in 2070 compared with the baseline. Both the average age of new old-age pensioners and the length of their contribution records increase, while the total number of pensioners decreases. In 2050, the retirement age of new old-age pensioners is expected to increase by 1.7 years among women and 2.2 years among men, relative to the no-reform baseline scenario (Table 2.1). The increases are 3.1 and 3.8 years, respectively, in 2070, as employment rates raise, especially among the 65‑69 age group.

As a result of longer careers, the gross average pension is expected to be 3.8% and 4.0% higher for women or men, respectively, in 2050. By 2070, the average pensions would further increase by 4.8% and 6.1% in total, respectively.

Table 2.1. Impact of raising the minimum retirement eligibility conditions to 62 and 42 years by 2028 and linking age and contribution conditions to life expectancy thereafter

Deviations from the baseline (2021 Ageing Report)

|

Variable |

Gender |

Age groups |

2030 |

2040 |

2050 |

2060 |

2070 |

|---|---|---|---|---|---|---|---|

|

Pension expenditure (% GDP) |

|

‑0.7 |

‑0.8 |

‑0.9 |

‑1.5 |

‑1.6 |

|

|

Average pension as (%) |

Women |

|

‑0.4 |

1.9 |

4.0 |

4.2 |

4.8 |

|

Men |

|

1.3 |

1.9 |

3.8 |

4.3 |

6.1 |

|

|

Employment rates (percentage points) |

Women |

55‑59 |

0 |

0 |

‑1 |

0 |

0 |

|

60‑64 |

17 |

11 |

5 |

10 |

8 |

||

|

65‑69 |

1 |

9 |

19 |

31 |

39 |

||

|

Men |

55‑59 |

3 |

0 |

‑1 |

‑1 |

0 |

|

|

60‑64 |

15 |

15 |

12 |

16 |

18 |

||

|

65‑69 |

1 |

8 |

16 |

26 |

33 |

||

|

Average age when claiming the old-age pension (years) |

Women |

|

1.3 |

1.4 |

1.7 |

2.5 |

3.1 |

|

Men |

|

1.6 |

1.8 |

2.2 |

3.2 |

3.8 |

Source: IER simulation models.

One‑off tightening of eligibility conditions in 2027 by 2.6 years

The second scenario assumes increasing all the eligibility conditions to old-age pensions – but for the 15 years of insurance required to access pensions at the statutory retirement age – in 2027 by the same 2.6 years. Compared to the first scenario, the second scenario assumes the same final statutory retirement age in 2070 of 67.6 years but with a different time path and smaller adjustments overall to the minimum eligibility conditions: 42.6 of contribution period at age 62.6 from 2027 (while the previous scenario has 42 and 62 in 2028, gradually increasing to 44.6 and 64.6 in 2070). However, although this has no impact for the simulations, one important policy difference is that 67.6 years is the statutory retirement age from 2027 irrespective of changes in life expectancy, while under the first scenario it is achieved only if current mortality projections effectively materialise. In addition in this second scenario, the options to retire below the minimum retirement age are not eliminated.

Under this scenario, pension expenditure would be by 1.1% of GDP lower in 2050 and slightly less (0.8%) in 2070, compared to the baseline scenario (Table 2.2). The effect of the reform will wane gradually as eligibility conditions do not adjust to longevity gains. Compared with the first scenario, this one generates larger savings in 2030 as initially the measures are stronger. As in the first scenario, the average age of new old-age pensioners is expected to increase, more until 2060 and less afterwards, and likewise for employments rates. Pensions are expected to be 8.7% and 7.2% higher in 2070, respectively, which is higher compared to the first scenario where the full effect materialises later.

Table 2.2. One‑off tightening eligibility conditions in 2027

Deviations from the baseline (2021 Ageing Report)

|

Variable |

Gender |

Age group |

2030 |

2040 |

2050 |

2060 |

2070 |

|---|---|---|---|---|---|---|---|

|

Pension expenditure (% GDP) |

‑1.1 |

‑1.2 |

‑1.1 |

‑1.0 |

‑0.8 |

||

|

Average pension as (%) |

Women |

|

‑0.7 |

2.8 |

6.5 |

7.9 |

8.7 |

|

Men |

|

0.6 |

2.9 |

5.3 |

6.4 |

7.2 |

|

|

Employment rates (percentage points) |

Women |

55‑59 |

0 |

0 |

‑1 |

‑1 |

‑1 |

|

60‑64 |

20 |

11 |

4 |

8 |

6 |

||

|

65‑69 |

12 |

25 |

33 |

35 |

34 |

||

|

Men |

55‑59 |

3 |

1 |

‑1 |

0 |

1 |

|

|

60‑64 |

17 |

13 |

10 |

15 |

16 |

||

|

65‑69 |

9 |

19 |

26 |

26 |

26 |

||

|

Average age when claiming the old-age pension (years) |

Women |

2.3 |

2.4 |

2.5 |

2.6 |

2.7 |

|

|

Men |

|

1.9 |

2.4 |

2.9 |

3.0 |

2.9 |

Source: IER simulation models.

2.4.2. Reducing benefits

Reducing pension indexation

In this scenario the indexation of pensions is adjusted from 2027 onwards in a way to reduce pension expenditure by 1% of GDP in 2050. To create such savings the pension indexation would need to shift from today’s mix of 60% of wages and 40% of prices to 34% of wages and 66% of prices. The effects of this measure are phased in during the life of the first generation of retirees who are affected. Its total effects are thus produced from 2060 onward. Under this scenario, the average pension would be lower by about 6.6% from 2060, compared to the baseline Table 2.3.

Table 2.3. Reducing pension indexation

Deviations from the baseline (2021 Ageing Report)

|

|

Gender |

2030 |

2040 |

2050 |

2060 |

2070 |

|---|---|---|---|---|---|---|

|

Pension expenditure (% GDP) |

‑0.3 |

‑0.8 |

‑1.0 |

‑1.1 |

‑1.1 |

|

|

Pensions of new retirees (%) |

‑0.7 |

‑0.5 |

‑0.4 |

‑0.4 |

‑0.4 |

|

|

Average pension (%) |

Women |

‑2.7 |

‑5.7 |

‑6.5 |

‑6.8 |

‑6.7 |

|

Men |

‑2.7 |

‑5.6 |

‑6.2 |

‑6.5 |

‑6.6 |

Source: IER simulation models.

Linking benefits to changes in life expectancy

This scenario assumes that from 2029 all newly-granted pensions are multiplied by a factor that lowers (increases) benefits proportionally to gains (losses) in remaining life expectancy (RLE) at age 65. Such a link is implicit in NDC schemes, and therefore applies for NDC pensions in Italy, Latvia, Norway, Poland and Sweden, although the exact formula depends of indexation rules and assumptions about the notional interest rate. Among countries with DB or point schemes, a sustainability factor based on such a link is in place in Finland and Germany (Chapter 4). Given mortality projections in Slovenia, this would imply that new pensions, across all earnings levels, will be lowered by 9.4% in 2050 and 17.8% in 2070 relative to the baseline (Table 2.4).10 The impact of lower benefits on pension expenditure is gradual because it applies only to new retirees. Hence, the average pension would drop by 4.3% in 2050 and by 11.3% in 2070 compared to the baseline.

Table 2.4. Linking retirement benefits to remaining life expectancy

Percentage deviations from the baseline (2021 Ageing Report)

|

|

Gender |

2030 |

2040 |

2050 |

2060 |

2070 |

|---|---|---|---|---|---|---|

|

Pension expenditure (% GDP) |

0.0 |

‑0.2 |

‑0.7 |

‑1.2 |

‑1.8 |

|

|

Pensions of new retirees (%) |

‑0.9 |

‑5.2 |

‑9.4 |

‑13.6 |

‑17.8 |

|

|

Average pension (%) |

Women |

0.0 |

‑1.5 |

‑4.1 |

‑7.5 |

‑11.3 |

|

Men |

‑0.1 |

‑1.6 |

‑4.3 |

‑7.7 |

‑11.4 |

Source: IER simulation models.

Reducing accrual rates in a one‑off manner

A straightforward way of adjusting pensions is to modify the accrual rates. This scenario looks into how much the accrual rates would need to be lowered in 2027, applied to the contribution records after this year, to decrease pension expenditure by 1% of GDP in 2050. To achieve such savings, the annual accrual rate should be lowered from the current 1.36% to 1.05%, i.e. by 23%, for the 16th through 40th years of contributions. For the first 15 years, the scenario maintains the current total accrual of 29.5%. As a result, total accruals after a 40‑year career decreases from 63.5% to 55.7%, i.e. by 12%, across all earnings levels. A similar approach was used in the 1999 pension reform (Chapter 1) when the accrual rates earned from 2000 onwards were reduced from 2% to 1.5% while the accrual rate for the first 15 years remained constant. This scenario has the larger effects the longer the career after the reform.

The effect of this scenario is still partial in 2050 because entitlements earned before 2027 are not impacted, and in particular pensioners who will have retired before 2027 while still being alive are not affected at all. Under this scenario, pension expenditure decreases by 1% of GDP in 2050 compared to the baseline, and by 1.8% in 2070, while the average pension is lowered by 6.4% in 2050 and 11.3% in 2070 (Table 2.5).

Table 2.5. Lowering the accrual rate in a one‑off manner in 2027

Deviations from the baseline (2021 Ageing Report)

|

|

Gender |

2030 |

2040 |

2050 |

2060 |

2070 |

|---|---|---|---|---|---|---|

|

Pension expenditure (% GDP) |

‑0.1 |

‑0.4 |

‑1.0 |

‑1.5 |

‑1.8 |

|

|

Pensions of new retirees (%) |

‑2.0 |

‑7.0 |

‑12.0 |

‑12.0 |

‑12.0 |

|

|

Average pension (%) |

Women |

‑0.5 |

‑2.8 |

‑6.3 |

‑9.4 |

‑11.3 |

|

Men |

‑0.5 |

‑2.9 |

‑6.5 |

‑9.5 |

‑11.3 |

Source: IER simulation models.

Lowering the minimum reference wage

The minimum reference wage provides low earners with a much higher replacement rate than average and high earners with the same contribution period. The following scenario assumes decreasing the minimum reference wage by 2 percentage points of the net average wage every year between 2027 and 2036, i.e. from 76.5% to 56.5%. Thus, the replacement rate of low earners would be lowered by up to 26%. This would be fairly extreme, as it will amount to almost eliminating the minimum reference wage given that the full-time minimum wage is slightly above 50% of the average wage. Only new pensions are affected under this scenario.

Gradually lowering the minimum reference wage from 76.5% to 56.5% between 2027 and 2036 is projected to reduce expenditure by only 0.4% of GDP in 2050 and by 0.6% in 2070 (Table 2.6). The number of new old‑age pensioners, whose pension would be calculated using the lowered minimum pension base, would be sharply reduced, by 67% in 2050 and by 60% in 2070 compared to the baseline, for which the share of pensions being assessed at the minimum reference wage is projected to equal about one‑quarter in both 2050 and 2070. At the aggregate level, this huge cut in the minimum pensions would to lead to a gradual decline of the average pension by around 3.0% in the long term.

Table 2.6. Reducing the minimum reference wage

Deviations from the baseline (2021 Ageing Report)

|

Variable |

Gender |

2030 |

2040 |

2050 |

2060 |

2070 |

|---|---|---|---|---|---|---|

|

Pension expenditure (% GDP) |

0.0 |

‑0.2 |

‑0.4 |

‑0.5 |

‑0.6 |

|

|

Average pension (%) |

Women |

‑0.2 |

‑1.5 |

‑2.5 |

‑3.2 |

‑3.7 |

|

Men |

‑0.2 |

‑1.4 |

‑2.4 |

‑3.0 |

‑3.2 |

|

|

Number of new old-age pensions based on the minimum reference wage (%) |

All |

‑27.2 |

‑66.3 |

‑66.9 |

‑61.0 |

59.5 |

Source: IER simulation models.

Lowering the maximum reference wage

Lowering the maximum reference wage would reduce pension expenditure by lowering high pensions. This scenario assumes decreasing the pension ceiling by 10 percentage points of the average wage every year between 2027 and 2036, i.e. from 306% to 206% of the average wage in total. This means that the new old-age pensions based on the reference wage ranging between 206% and 306% of the average wage would be reduced by 0% and 33%, respectively.

As a result, compared to the baseline, the average pension would be about 3% lower while the pension expenditure would be lower by 0.5% of GDP from 2050 onwards (Table 2.7). The share of high pensions in the baseline is low at about 1% of all pensions, and the number of new old-age pensioners whose pension would be based on the reduced maximum reference wage would be multiplied by a factor of 5 to 6.5 depending of the time horizon.

Table 2.7. Lowering the maximum reference wage

|

Variable |

Gender |

2030 |

2040 |

2050 |

2060 |

2070 |

|

Pension expenditure (% GDP) |

0.0 |

‑0.1 |

‑0.3 |

‑0.5 |

‑0.5 |

|

|

Average pension (%) |

Women |

‑0.1 |

‑0.9 |

‑1.8 |

‑2.5 |

‑2.8 |

|

Men |

‑0.1 |

‑1.5 |

‑2.6 |

‑3.3 |

‑3.6 |

|

|

Number of new old-age pensions based on the maximum reference wage (%) |

All |

54 |

661 |

436 |

550 |

646 |

Source: IER simulation models.

2.4.3. Increasing the contribution rate

Increasing pension revenues might also be needed to improve pension finances. This scenario assesses the needed increase in the contribution rate to raise revenues by 1% of GDP in 2050. Based on simulations from the CGE model (SloMod, Box 2.1), the contribution rate would need to gradually increase by 3 percentage points, from 24.35% to 27.2%, between 2028 and 2050. Were the negative impact of the higher contribution rate on GDP absent, this contribution rate would need to increase to 26.95% which is 0.3 percentage points less.11

References

[3] Cairns, A. et al. (2020), “The Impact of COVID-19 on Future Higher-Age Mortality”, SSRN Electronic Journal, http://dx.doi.org/10.2139/ssrn.3606988.

[5] European Commission (2021), The 2021 Ageing Report, Publications Office of the European Union, http://dx.doi.org/10.2765/84455.

[7] European Commission (2018), The 2018 Ageing Report, Publications Office of the European Union, http://dx.doi.org/10.2765/615631.

[10] European Commission (2020), Country Report Slovenia 2020, European Commission, Brussels.

[8] European Union (2020), “The 2021 Ageing Report Underlying: Assumptions & Projection Methodologies”, European Economy Institutional Papers, http://dx.doi.org/10.2765/733565.

[9] Fiscal Council (2019), Position of the Fiscal Council, http://www.fs-rs.si/wp-content/uploads/2019/09/Position-of-the-Fiscal-Council-September-2019.pdf.

[6] MDDSZ (2019), Ocena Javnofinančnih Posledic Predlaganih Sprememb Pokojninske Zakonodaje, Ministrstvo za elo, družino, socialne zadeve in enake možnosti, http://www.fs-rs.si/wp-content/uploads/2019/09/Simuliranje-ucinkov-sprememb-pokojninske-zakonodaje.docx.

[1] OECD (2021), OECD Economic Outlook, Interim Report March 2021, OECD Publishing, Paris, https://dx.doi.org/10.1787/34bfd999-en.

[2] OECD (2020), OECD Pensions Outlook 2020, OECD Publishing, Paris, https://dx.doi.org/10.1787/67ede41b-en.

[4] OECD (2019), Pensions at a Glance 2019: OECD and G20 Indicators, OECD Publishing, Paris, https://dx.doi.org/10.1787/b6d3dcfc-en.

Notes

← 1. As Chapter 1 shows, ZPIZ expenditures consist of the following main categories: old age pensions (66% of total expenditure in 2019), survivor pensions (3%), annual allowance (3%), health contributions for pensioners (8%), disability pensions (9%), other benefits and expenses (12%). Around 80% of recipients of disability pensions are older than 60.

← 2. For Ireland, Spain and the United Kingdom it is difficult to separate the pension contributions from the other parts of social insurance such as unemployment. There are no mandatory pension contributions in New Zealand.

← 3. For example, the top-up from the minimum reference wage could inflate pension benefits by up to 27.5% given that the minimum contribution base and the minimum reference wage are set at 60% and 76.5% of the average wage, respectively.

← 4. The estimates are based on assuming that 90% of pension contributions finance old-age pensions. In 2019, the share of old-age, survivor and disability pensions in ZPIZ expenditure stood at 88%.

← 5. This scenario excludes the possibility to combine work and pensions.

← 6. Similar assessment was presented by the Fiscal Council, which expected financial balance of the pension budget to deteriorate by 1% of GDP in 2040 due to the 2019 changes in the pension law (Fiscal Council, 2019[9]; European Commission, 2020[10]). More precisely, the MDDSZ (2019[6]) showed the total impact on the financial balance of pensions to be 1.1% in 2040.

← 7. MDDSZ (2019[6]) showed that the option to combine 20% of pension with full-time work while accruing 4% in 2012, introduced in 2012, is largely neutral for pension finances in the long run, increasing expenditures by 0.4% of GDP offset by higher pension contributions due to people prolonging their careers.

← 8. The 2020 number is lower than the deficit of the total ZPIZ scheme of over 2% of GDP as only old-age, survivor and disability pension expenditure is included here.

← 9. These projections are based on cohort life expectancy from the UN data.

← 10. This is under the strong assumption that this link does not lead to any increase (decrease) in effective retirement ages.

← 11. The increase of contribution rate is expected to have a very small impact on pension expenditure as a share in GDP. Lower employment would reduce the average contribution period, harming the average pension, but it would also lower the GDP.