Estonia’s population is projected to decline by 2040 in all but two counties. While the whole country will lose about 2% of its population by 2040, most regions will lose more than 20% of their population. A shrinking and ageing population will change the demographic composition of municipalities, erode local tax bases and alter the demand for local public services. Based on research literature and international practices, this chapter analyses the Estonian multi-level governance model, municipal spending assignments and revenue sources. The chapter makes several recommendations on inter-municipal co-operation, the transfer system and central-local relationships.

Shrinking Smartly in Estonia

3. Financing local public services and infrastructure in Estonia: Challenges and ways forward

Abstract

Introduction

The effects of the downward trend of the projected population on the cost of public services and infrastructure will be considerable in the rural and remote municipalities, but also in many small towns and cities of Estonia. Although the 2017 administrative reform reduced the number of municipalities from 213 to 79 and increased the median municipal population size from 1 823 to 7 372 inhabitants, nearly 60% of municipalities still had shrinking populations in 2020. With a diminishing and ageing population, the pressure on further structural reforms at the municipal level remains.

While Estonia’s territory allows for relatively short distances and travel times between the main towns, the challenge is that Estonia’s population density is relatively low (among the lowest in the European Union [EU]). Furthermore, Estonia’s degree of urbanisation (69%) is below the EU average (75%). If the urbanisation process in Estonia picks up with the EU trend during the coming years and decades, the resulting internal migration will probably mean an even faster population decline of remote rural municipalities and small towns.

Estonia is not alone in this development. Shrinking population is a European and global issue. Population decline challenges the conventional wisdom for multi-level governance and how public service provision is organised. Without adjusting measures, municipalities affected by population decline will experience shrinking tax bases and higher per capita costs, forcing cuts on spending, accumulating debt and increasing local tax rates. This can lead to a deteriorating path of local development. Although the most significant effects of the shrinking population are encountered in local communities, the issue is also of wider social and economic significance, for example on local innovation systems and social cohesion. Therefore, there is a need for adaptation strategies at both local and national government levels.

The traditional policy response to declining regions has been growth policy combined with increased financial support, aiming to reverse shrinking trends and stimulate population growth. While such measures may play a role for particular regions that have distinct comparative advantages, given overall population trends and projections, such policies will not work as a general solution for all regions. Thus, relying solely on growth policies may actually result in poorly managed shrinkage rather than regional and local growth. The alternative, the so-called “smart shrinking” policy, means, first, that the decline is accepted and, second, that a systematic plan is developed on how to deal with it. Such a strategy must be tailored to local needs and circumstances. The key elements include a combination of inter-municipal co‑operation (IMC) and collaboration with civil society but also the concentration of service units, budget cuts and increased taxes. At the national level, it should be ensured that the normative regulation allows an efficient local response. This includes a clear legal basis for IMC and rules that are flexible enough to facilitate local experimenting and innovative solutions. In addition, financial interventions may be required at the national level to support municipalities in handling the challenges related to shrinking, as has been applied in some other countries facing similar challenges (for example in Germany, Japan, Sweden, Japan, Germany). Such measures could include support to municipalities to handle unused or only partially used buildings, financial support for upgrading public buildings that are still needed.

Municipal financing is the cornerstone of any successful adjustment at the municipal level. The local tax base together with the transfer system should enable balanced budgets in subnational governments. Municipalities should also be given a realistic timeframe for adjusting their service structure and maintain good service quality, despite shrinking resources.

The purpose of this chapter is to discuss the Estonian multi-level governance and municipal financing model, especially from a shrinking population point of view. The chapter starts with a short description of the main municipal spending assignments and revenue sources. The chapter then briefly discusses the main fiscal impacts of a shrinking population and provides some examples for solutions. The chapter then compares the Estonian multi-level governance model to international peers. The final section of the chapter makes proposals on how to address the key challenges to Estonian multi-level governance and municipal government financing from the shrinkage aspect.

Fiscal effects of population decline at the subnational government level: An overview

Shrinking populations will affect governments across Europe. Declining fertility and increased out-migration alter the demographic structures. A declining population is likely to negatively affect economic activity, resulting in less government revenue. Shrinking workforces will affect the labour market and productivity (Rouzet et al., 2019[1]). At the same time, expenditure may not fall commensurately. The change of demographic structure of the population will strongly affect education, health and long-term care services, but also public infrastructure. In particular, public spending on age-related programmes will increase.

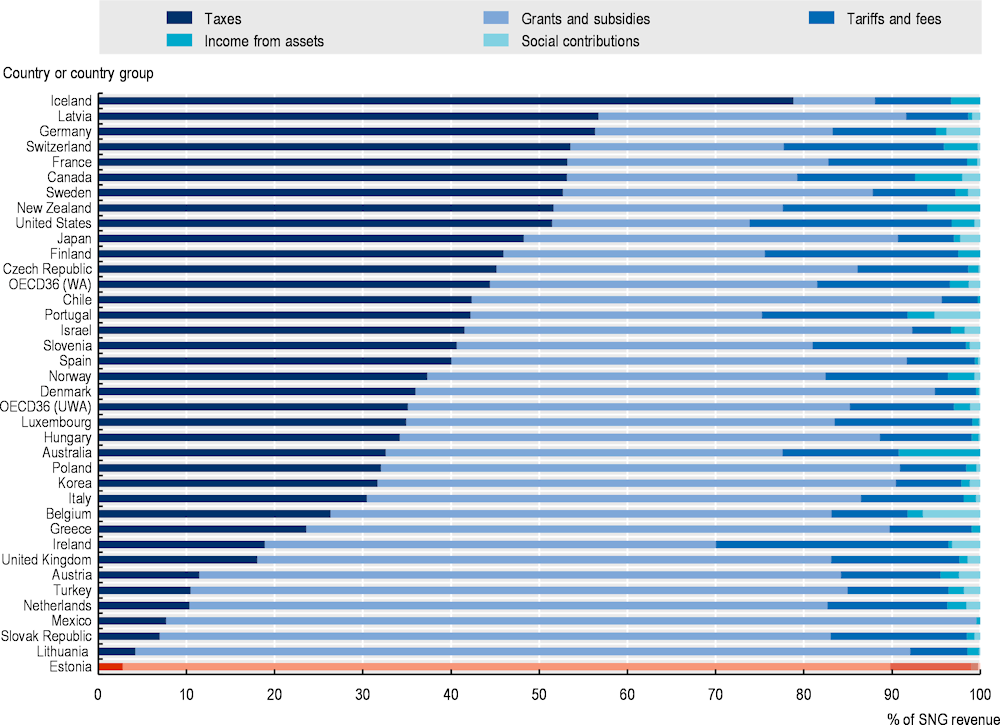

At the subnational level, migration flows are typically stronger, as they include migration flows across regions. The declining population will change the demographic composition of localities more, exacerbating fiscal impacts. It will also erode tax bases, alter the demand for local services and affect grants received from higher levels of government. Usually, municipalities must choose between raising tax rates, cutting spending and increasing borrowing (or using all of them) (Wirth et al., 2016[2]) (see also Figure 3.1).1

Figure 3.1. Potential effects of shrinking population on Subnational Government financing

Source: Author’s elaboration of Das, B. and M. Skidmore (2018[3]), “Asymmetry in municipal government responses in growing versus shrinking counties with focus on capital spending”, Journal of Regional Analysis and Policy, Vol. 48/4, pp. 62-75; Haase, A. et al. (2012[4]), Shrinking Areas: Front Runners in Innovative Citizen Participation; Hospers, G. and N. Reverda (2015[5]). Managing Population Decline in Europe’s Urban and Rural Areas, Springer; Komarek, T. and G. Wagner (2021[6]), “Local fiscal adjustments from depopulation: Evidence from the post–cold war defense contraction”, http://dx.doi.org/10.1086/712917.

The main fiscal impacts of a shrinking population at the subnational government level

In shrinking subnational governments, resource constraints make it more difficult to maintain infrastructure. Insufficient replacement investment further contributes to declining living standards, thus potentially triggering further population decline (Komarek and Wagner, 2021[6]; Wirth et al., 2016[2]). None of these changes are straightforward, however, as subnational governments differ considerably across countries and in their institutional arrangements, such as spending assignments, revenue composition, fiscal rules and degree of regional and municipal self-government.

Fiscal rules affect how municipalities respond to population decline. For instance, balanced budget rules or rules forbidding borrowing to pay for current expenditure are likely to speed up the municipalities’ response to declining tax revenues with equal expenditure cuts (Das and Skidmore, 2018[3]; Komarek and Wagner, 2021[6]). The state grant system can also play a major role in municipalities with a declining population. This is especially important in the Nordic countries for example, where the subnational governments have a major role in public service provision. For example, in Finland, the rural and remote municipalities have suffered from the shrinking population for many decades (Box 3.1). The state grant system has protected municipalities from financial collapse with their equalisation systems. Equalisation systems in the context of shrinking populations are discussed in more detail below.

Box 3.1. Shrinking rural areas in Finland: The Juuka municipality of Northern Karelia

Juuka is a remote and rural municipality located in eastern Finland, about 500 km from the capital city of Helsinki. Juuka´s population is 4 527 inhabitants (2020 situation) and the land area of the municipality is over 1 800 km².

Juuka has experienced population decline for many decades. From the 1970s until today, Juuka’s population has halved from 9 000 inhabitants. Juuka is still projected to lose about 30% of its population between 2020 and 2040. Currently, about 35% of Juuka’s inhabitants are 65 years or older.

The population shrinkage in Juuka was fuelled by out-migration in earlier decades but a natural decrease is currently the main reason for population decline. The main employer, a mining company, has recently experienced a downturn, which has led to high levels of unemployment.

Juuka’s current strategy is to adapt the public services and local infrastructure to shrinkage. Juuka does not actively try to attract new residents. Instead, the focus is on ensuring good living conditions and service infrastructure for the existing residents. Nevertheless, beginning in 2019, the municipality started to pay a “baby bonus” of EUR 1 000 to families having a(nother) child.

Like many other small municipalities in Finland, Juuka is engaged in extensive IMC in education, health and social services, as well as in regional planning. Juuka’s strategy is to co‑operate especially with the other rural and remote municipalities in the North Karelia region. Indeed, co-operation with a neighbouring municipality, Lieksa, in education services has proven to be an effective way to reduce costs and the two municipalities were also jointly able to save a school from closure. At the same time, however, the rural municipalities also compete with each other for residents and funding. Juuka recently resigned from the membership in the regional development company and the municipality increased its activities in the field of business and co-operation with the private sector.

Juuka has responded to shrinking resources with efficiency-improving measures, such as service reorganisation and constant cost-cutting. The local income tax rate in Juuka is slightly lower than the national average. Grants from the central government currently form about 52% of the total revenues of Juuka, which is 5 percentage points higher than in 2015, and the share is also much higher than the national average grant share (38%). Central government grants have ensured a stable revenue source for Juuka and the time needed to adjust its operations.

Source: Fritsch, M., P. Kahila and J. Sinerma (2020[7]), European Shrinking Rural Areas: Challenges, Actions and Perspectives for Territorial Governance. Case Study Juuka, North Karelia, Finland.

Even so, municipalities have also adjusted their spending and increased their own income, notably by raising property tax rates. Typically, local tax rates are the highest in municipalities with a decreasing population. They have also raised debt (Valkama and Oulasvirta, 2021[8]). Central governments have encouraged municipalities to improve efficiency in welfare services, especially by promoting voluntary municipal mergers and IMC. Eventually, each municipality develops its own strategy to deal with shrinkage. In Sweden for example, where municipalities also have important service responsibilities, municipalities have responded to population decline with cutbacks in spending and with increased efficiency, especially through school closures and inter-municipal collaboration (Syssner, 2016[9]).

IMC as a response to shrinkage

IMC means that two or more municipalities work together to provide some specific tasks. There are voluntary and compulsory types of co-operation. In the former, the municipalities are free to establish long- or short-term co-operation and to withdraw from co-operation. Mandatory co‑operation is defined by law and compliance is monitored and sanctioned by the central government. IMC usually implies sharing. In this case, municipalities provide joint services and share the costs. IMC can also include joint efforts on the revenue side, although this is less common2 (Slack, 1997[10]). For voluntary IMC, the rationale often is simply to enable more efficient and better services for the local inhabitants. In order to reach these ultimate goals, utilising economies of scale and creating better capacity in terms of know-how or human resources is essential.

IMC is not the only way to utilise economies of scale in municipal service delivery. Municipal mergers or outsourcing to private companies can also lead to a larger scale and cost savings but may have their own problems. For one, municipal mergers can be politically difficult. Furthermore, it is not clear that municipal mergers automatically lead to costs savings (Blom-Hansen et al., 2016[11]; Moisio and Uusitalo, 2013[12]). Municipalities provide a wide variety of services and the optimal production scale varies by type of service. Municipal mergers may then lead to economies of scale in some services but diseconomies in others. In addition, outsourcing is not always a feasible alternative because of legal reasons or the lack of private markets. Regions and municipalities are also in a very different position in the ability to utilise private markets. Often the need to enhance economies of scale is greatest in small and remote regions and municipalities, where little suitable private provision may be available.

Compared with municipal mergers, IMC seems an attractive option especially because it is relatively straightforward to establish. Voluntary IMC involves minimal government restructuring, likely explaining why it has been so popular in many countries (Bird and Slack, 2007[13]; OECD, 2019[14]). Due to the simplicity of the arrangement, a municipality can easily engage in many different co-operative deals at the same time without high administrative costs. IMC is also a flexible solution. As times change, co-operation can be strengthened, scaled back or ended according to the needs of co-operating partners. Joint service provision can be a gate to deeper engagement: a successful IMC in one service area may lead to widened co-operation in other services and in some cases even to a later voluntary merger.

Economies of scale undoubtedly form the major benefit of IMC. Capital-intensive public services (e.g. utility systems such as water, waste, energy) often require a certain minimum size for efficient service delivery. In such a framework, IMC can be a feasible solution because it enables both improved economies of scale and tailoring of services to local needs. IMC may also help secure local democracy because the number of elected local politicians does not diminish as a result of co-operation.

IMC is not without challenges. An extra tier in the hierarchy is introduced and may increase administration and monitoring costs. IMC may also result in a democracy deficit, as inter-municipal organisations are usually governed by representatives that are nominated by the member municipalities. This may reduce the accountability and transparency of local decision-making, compared with municipalities’ own production and with directly elected councils. The latter challenge can be partially addressed, for example, by appointing elected persons to the co-operation bodies.

An important challenge of IMC is also that the member municipalities engaging the co-operation inevitably have less power to affect the services than if the service was provided by their own organisation. It has also been argued that IMC may create a harmful common resource, increasing demand. This can lead to increased costs and inefficiency. Depending on the size of the pool, monitoring of IMC by member municipalities may be lower if the IMC fails to create appropriate incentives (Allers and van Ommeren, 2016[15]).

International examples and experiences of IMC

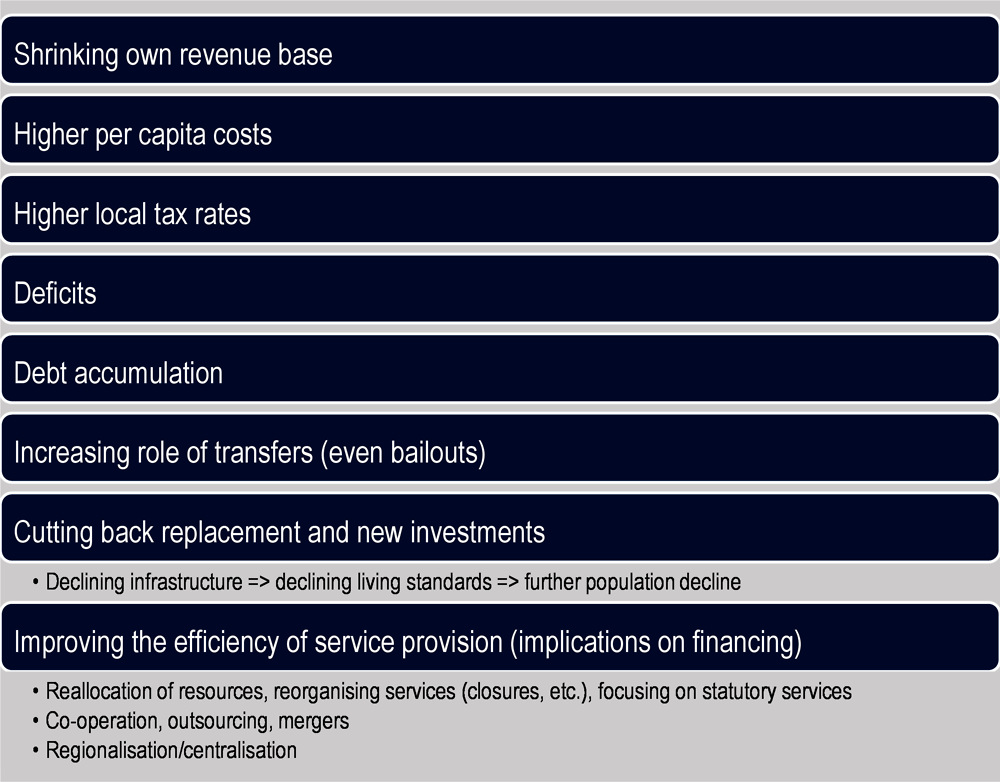

Three main models of IMC can be identified: i) informal voluntary agreements based on private law; ii) legally defined and regulated voluntary co-operation based on public or private law; and iii) mandatory co-operation based on public law (Figure 3.2). OECD countries have often started with a private law model, for example by giving local authorities the freedom to opt for certain formulas, such as contracts, associations and commercial enterprises. The public model means that co-operation is regulated in some detail by public laws, including contractual and financing arrangements, the type of delegated functions, governance structure, and supervision and control. Different degrees of regulation are usually applied for voluntary and mandatory co-operation (OECD, 2019[14]).

Figure 3.2. Formats for inter-municipal co‑operation

Source: Author’s elaboration.

The examples for informal co-operation include shared service arrangements or shared programmes in Australia, Ireland, New Zealand and the United Kingdom (UK). Voluntary but legally structured co‑operation is practised in several countries, for example in Finland, France, the Netherlands and Sweden. Examples of compulsory co-operation with delegated functions can be found in Finland, France, Portugal and Spain (see OECD (2017[16]) and (2019[14])). In some countries, such as Finland, compulsory IMC has been a substitute for an intermediate level of government, notably in specialised healthcare and regional development.

IMC is practised in many service areas, from technical issues like waste and sewerage to healthcare, education and regional development and strategy (OECD, 2017[16]). For example, in Germany, IMC is strongly encouraged by the Länder for their respective municipalities for waste management, sewerage, water or transport. The Czech Republic promoted voluntary municipal associations and microregions in education, social care, health, culture, environment, tourism. Poland introduced “territorial contracts” in 2014. These aim at strengthening partnerships and improving co-ordination (OECD, 2019[14]).

Irrespective of the model of co-operation the inter-municipal bodies are almost without exception managed by nominated councils or boards. While in principle nothing would prevent arranging elections to select the decision-makers for the inter-municipal co‑operative bodies, such elections could considerably increase the administrative burden. Among the few examples of co‑operative arrangements that involve elections are the UK’s devolution deals. Devolution deals are agreements that move funding, powers and responsibilities from central to local government in return for governance reform at a local level, typically through the creation of combined authorities and directly elected mayors (Green, 2018[17]). Elected mayors are responsible for the tasks and report to both central government and local councils. The devolution deals have covered tasks such as public transport, skills and employment, health, land and housing and financing. The first devolution deal was announced by the British Government and the Greater Manchester Combined Authority in 2014 (Sandford, 2018[18]). By early 2018, devolution deals with 12 areas had been agreed upon. Three of the deals have collapsed and two have collapsed and then partially revived (Sandford, 2018[18]).

Municipal co‑operative organisations are usually financed by member municipality contributions and transfers from the central government but, in some countries, like for example in France, IMCs can also collect taxes or levy user fees to pay for services. In the Nordic countries, municipalities co-operate also in financing investments. In Denmark, Finland, Norway and Sweden, joint municipal credit institutions have been formed by the local authorities. The joint credit institutions borrow money from international financial markets and lend it to their member organisations (municipalities, counties and companies owned by local authorities). For example, the Swedish Kommuninvest was created in the 1980s in response to difficulties that the municipalities had faced to raise financing for their investments. The Swedish Kommuninvest, like the other similar Nordic credit institutions, has high creditworthiness because all members have the liability for Kommuninvest’s obligations. Besides, there have never been any credit losses in the operations since the Kommuninvest’s inception. It currently accounts for more than 40% of the Swedish local government sector’s borrowing (Kommuninvest Sweden, 2019[19]). In Finland, the share is even higher, at nearly 70%.

There is little evidence on the effects of voluntary IMC on municipal spending or service quality. Moreover, the results of existing studies are somewhat mixed (Allers and van Ommeren, 2016[15]). In France, a recent study found no effect of co‑operation on the total spending of French municipalities (Frère, Leprince and Paty, 2014[20]). In contrast, in Spain, IMC created economies of scale especially in the smallest towns and municipalities, leading to lower costs for waste collection. Co‑operation also raised the collection frequency and improved the quality of the service in small towns (Bel and Mur, 2009[21]). In the Netherlands, inter-municipal associations paid higher interest rates for their loans compared with independent municipalities (Allers and van Ommeren, 2016[15]), perhaps suggesting that co-operative arrangements were considered inefficient by creditors. In Finland, breaking up municipal health centre federations in the 1990s increased costs and outputs, so the break-ups had no statistically significant effect on inefficiency (Kortelainen et al., 2019[22]).

Grant systems and shrinking population

Inter-governmental grants and in particular the equalisation grants can help limit the negative fiscal effect of shrinkage, giving the local governments more time for adjustment. The link between equalisation and shrinkage is because active people with higher earning potential are likely to out-migrate, while inactive people requiring more social spending are likely to stay. Equalisation grants can be designed so that they take into account both the population change and the effect of shrinkage on demographic composition.

Inter-governmental transfers comprise conditional and unconditional grants. Conditional grants aim to incentivise municipalities to spend funds on specific projects. Conditional grants are typically used by central governments to internalise spatial externalities, to ensure that the recipient municipality or region will take into account the effects of the funded activity on other jurisdictions. Conditional grants can be problematic for municipalities with a shrinking population, especially if the conditional grant is a matching grant, i.e. an own funding share of the recipient municipality is required. This is because the municipalities with a shrinking population often suffer from weak tax bases, making it hard for them to raise enough own revenue to utilise conditional grants.

Unconditional grants give more decision-making freedom. Often, the unconditional grants also aim to ensure equitable and efficient financing of subnational governments. There are three main types: general per capita grants, revenue equalisation grants and expenditure equalisation grants. With a general per capita grant, a municipality with a shrinking population will see its transfer diminish. The plain per capita grant does not consider the (tax) revenue capacity or the expenditure needs of the municipality. Equalisation grants have been developed to take these into account. Revenue equalisation grants assist municipalities whose tax capacity is lower than some level, usually the average. Expenditure equalising grants aim to take into account the service needs (e.g. number of students, demographics, length of roads) and circumstantial factors (e.g. population, population density, remoteness) of expenditures ensure that every municipality can provide at least a standard level of service by levying a standard tax rate.

Both the revenue and expenditure equalisation is usually formula based. In a simple form, the tax equalisation formula can be written as:

where is the tax equalising grant for municipality , is the number of inhabitants in municipality , is the country average municipal tax rate, is the average municipal per capita tax base, and is the per capita tax base of municipality . In this example, the tax capacity is equalised to the country average.

An example of a simple expenditure equalisation formula for one public service can be written as:

where is the equalisation entitlement for expenditure type for municipality , is the standardised per capita expenditure of public service for municipality , and is the average national per capita standardised expenditure for public service . Equalisation systems are often complicated, consisting of several indicators for service needs and circumstantial factors.

The relationship between municipal population changes and equalisation is less straightforward than in the case of per capita grants. While a population decrease will directly decrease the amount of equalisation grant, population change can also have other implications on equalisation grants. For instance, in the case of tax equalisation, depending on the incomes of the out-migrated (or retired) taxpayers, a shrinking population may mean a lower tax base per capita compared to the national average and thereby higher equalisation. A lower population may also mean higher per capita expenditure, for example, if the out-migration of the working-age population will change the demographic composition of the municipality compared with the national average. Municipalities with a shrinking population will also have lower population density, making them better positioned to receive expenditure equalisation grants.

In most countries, there is no special indicator in expenditure equalisation to consider the negative population change. Perhaps the main argument against using an indicator for a shrinking population in expenditure equalisation is that such an indicator would not incentivise municipalities to improve their efficiency. In Japan, the inter-governmental grant formula includes a “modification coefficient” to protect municipalities from a sharp reduction in grants in case of a strong population decline (Miyazaki, 2016[23]; Mochida, 2011[24]). While such modification coefficients have received criticism for adding the complexity of the transfer system, they have been defended for being based on calculations that municipalities cannot affect directly so do not distort their incentives (Miyazaki, 2016[23]).

In Sweden, a specific indicator for population decline has been used in the municipal grant system as an indicator for additional support to municipalities. The purpose has been to compensate the municipalities for fixed capital costs that cannot be reduced with the same rate of reduction of inhabitants and revenues. The municipality received an increase in its grant if its population had decreased by more than 2% in the last 10 years. Furthermore, in 2000, Sweden introduced a grant which was based on the decrease in the number of school-age children. This compensation was conditioned on the negative population change during the past 3 years (with a 2-year lag), which had to be larger than -2% (Dahlberg et al., 2008[25]).

In the US, some states receive “small state minimum” federal grants. Although not directly a grant for negative population change, it is interesting to note that the small state minimums are intended to ensure that small states receive a basic level of funding under each federal grant. In effect, the small state grants seem to ensure that a grant per person in the recipient states exceeds the national average.

Municipal financing in Estonia

Estonian municipalities are responsible for a wide variety of tasks (Table 3.1). Overall, the spending assignments of Estonian municipalities are relatively clear without major overlapping assignments with the central government. The main exception is secondary education, where the state has taken more responsibility.3 Currently, both the municipalities and the central government provide for upper secondary education. While the purpose of such arrangements is to ensure equity of access to education, such a situation may not be optimal from an overall service delivery aspect. Other shared responsibilities include services for disabled persons, ports, disaster management, new buildings and prevention strategies.

Table 3.1. Mandatory and voluntary municipal tasks

|

Task |

Central government |

County-level co‑operation |

Municipality |

Private sector |

|---|---|---|---|---|

|

Public transportation |

X |

X* |

||

|

Local roads |

X* |

|||

|

Water |

X* |

|||

|

Sewerage |

X* |

|||

|

Nursery, pre‑school, primary school |

X* |

|||

|

Primary health |

X |

X* |

||

|

Social housing |

X* |

|||

|

Child protection |

X |

X* |

||

|

Social assistance |

X* |

|||

|

Support for disabled persons |

X |

X* |

||

|

Metropolitan planning |

X |

X* |

||

|

Local planning |

X* |

|||

|

Drainage (operation and maintenance) |

X* |

X |

||

|

Public libraries |

X |

|||

|

Street vendors |

X |

|||

|

Parks, metropolitan |

X |

|||

|

Parks, local |

X |

|||

|

Public lighting |

X |

|||

|

Ports |

X |

X |

X |

|

|

Logistical areas |

X |

X |

||

|

Industrial parks |

X |

X |

||

|

Enterprise zones |

X |

X |

||

|

Development of economic clusters |

X |

X |

||

|

Secondary education, education for special and adult groups |

X |

X |

||

|

Tertiary education |

X |

X |

||

|

Neighbourhood development |

X |

X |

||

|

Forestation |

X |

X |

X |

|

|

Drainage, construction, public squares |

X |

X |

||

|

Recreation and sport facilities |

X |

X |

||

|

Managing disasters |

X |

X |

||

|

Prevention strategies |

X |

X |

||

|

New buildings |

X |

X |

Note: * denotes a mandatory municipal task.

Source: Author’s elaboration based on OECD questionnaire to Estonian experts.

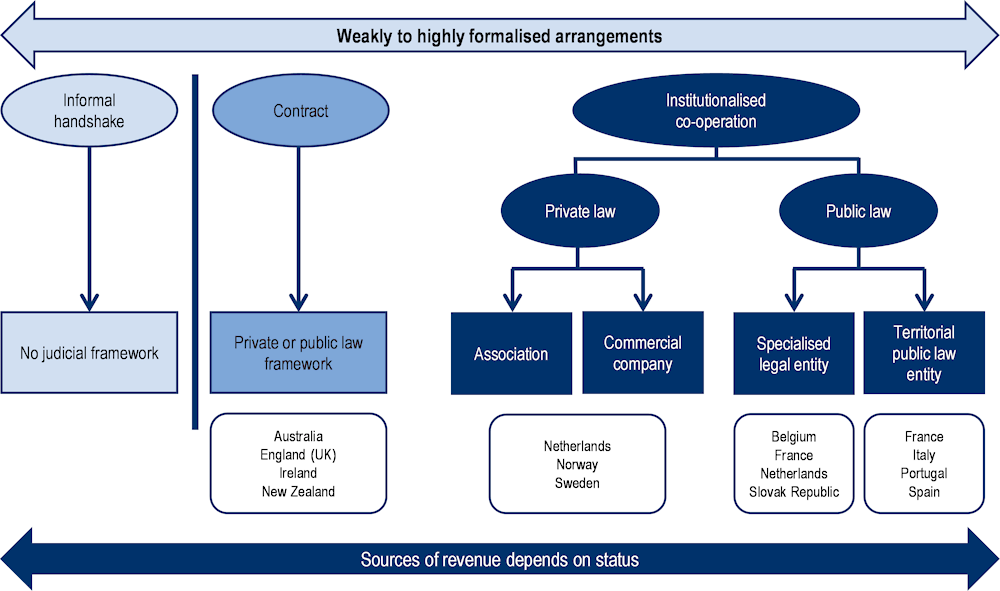

The most important municipal task is education (primary and secondary schooling), which represented over 49% of all municipal expenditures in 2019 (Figure 3.3). The next most important tasks are economic affairs (15%), recreation (11%) and social protection (8%). All municipalities, irrespective of population size or type, are expected to provide the same basic services.

Figure 3.3. Municipal expenditure in Estonia by 10 COFOG groups, 2013-19

Note: Classification of the Functions of Government (COFOG) is a classification defined by the United Nations Statistics Division.

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Revenue assignments

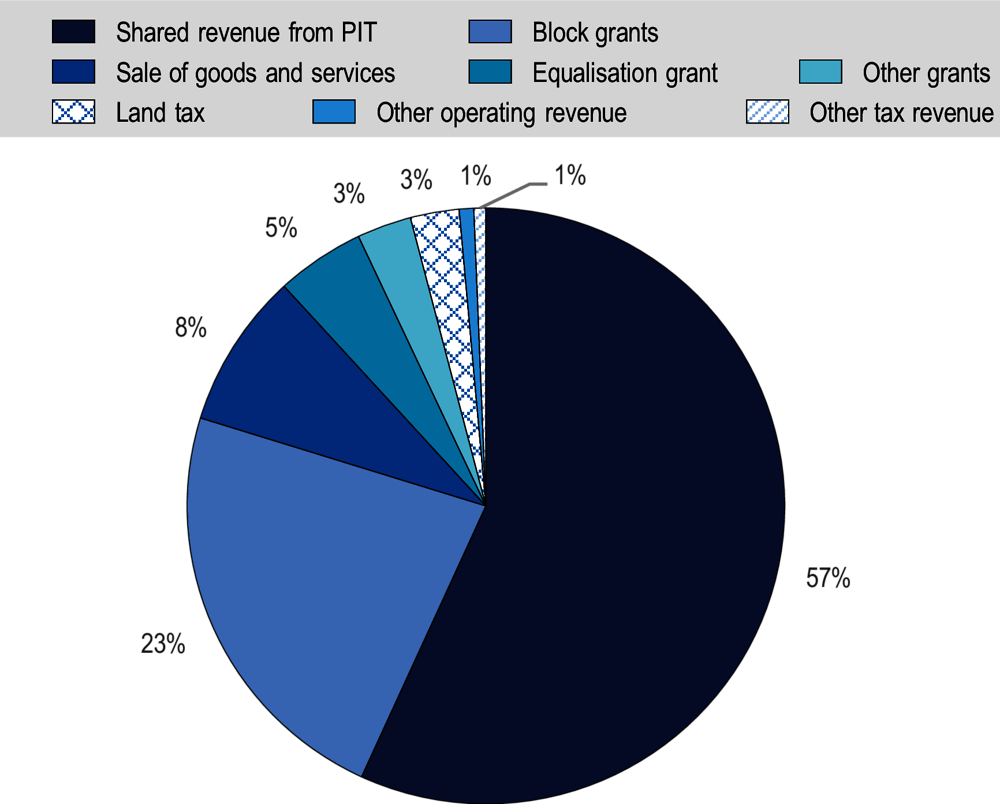

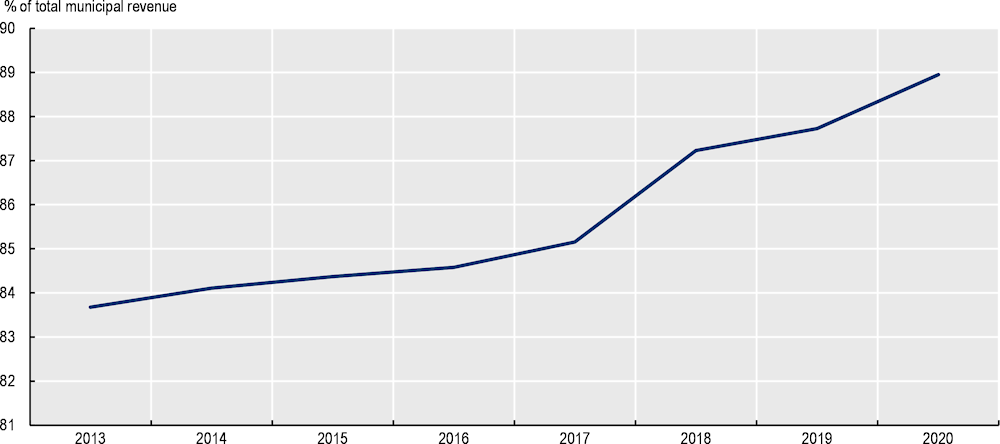

Municipal income in Estonia consists of tax revenue (61% in 2019), central government grants (28%), sales revenue (10%) and other revenue (1%) (Figure 3.4). Over time, the share of grants and shared personal income tax (PIT) revenue (which is classified as a transfer by the OECD) of total municipal revenue has become larger (Figure 3.5). This is because between 2012 and 2020 the municipalities’ own revenues have remained virtually unchanged, while at the same time the state grants and shared tax revenues have increased.

Figure 3.4. Municipal revenue by the main source

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Figure 3.5. Transfers and municipal share of PIT revenue

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Tax revenue

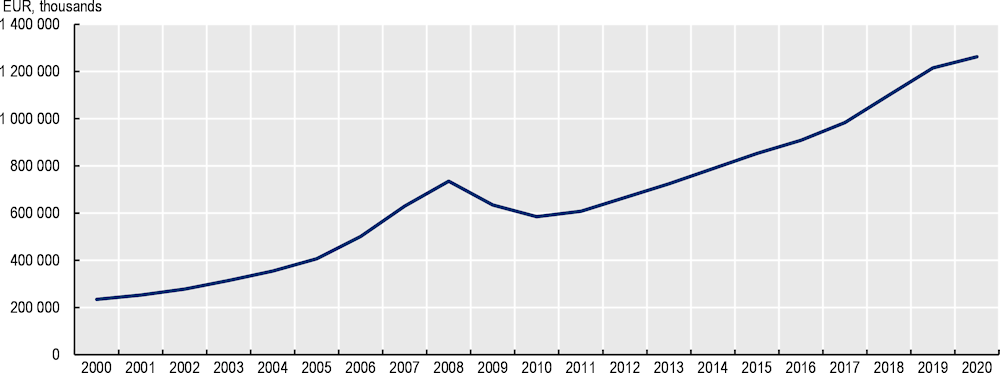

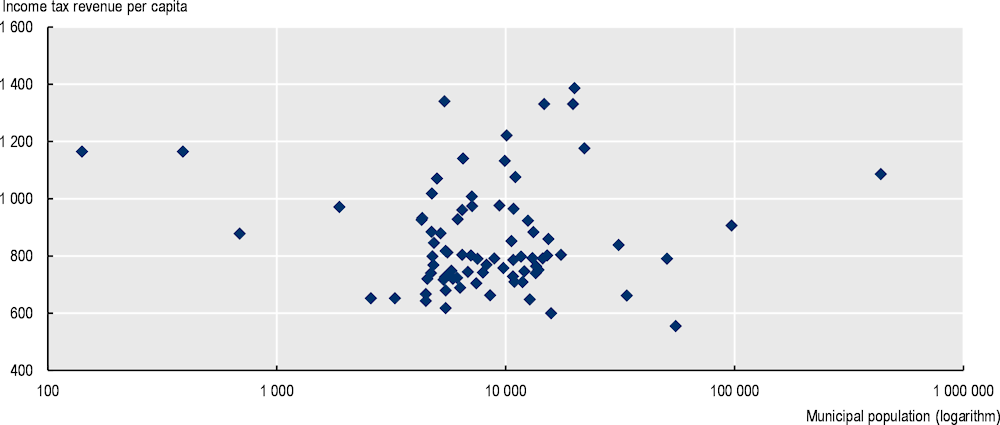

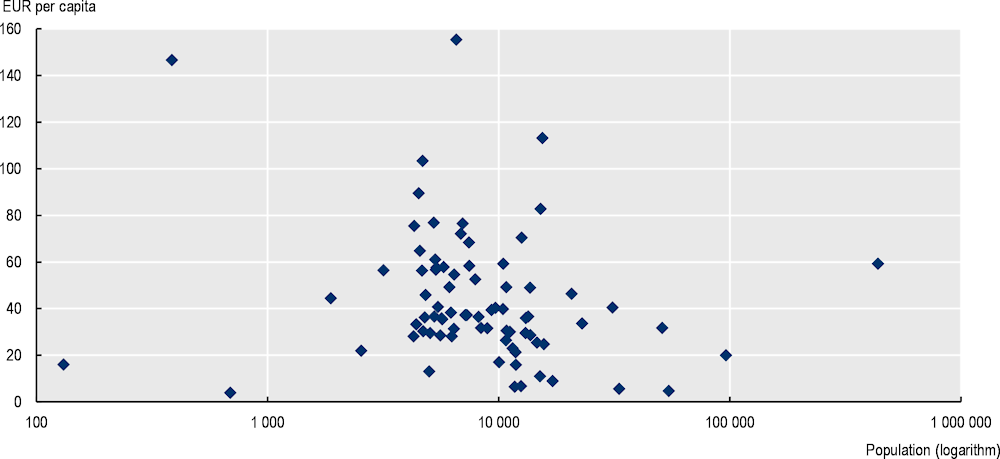

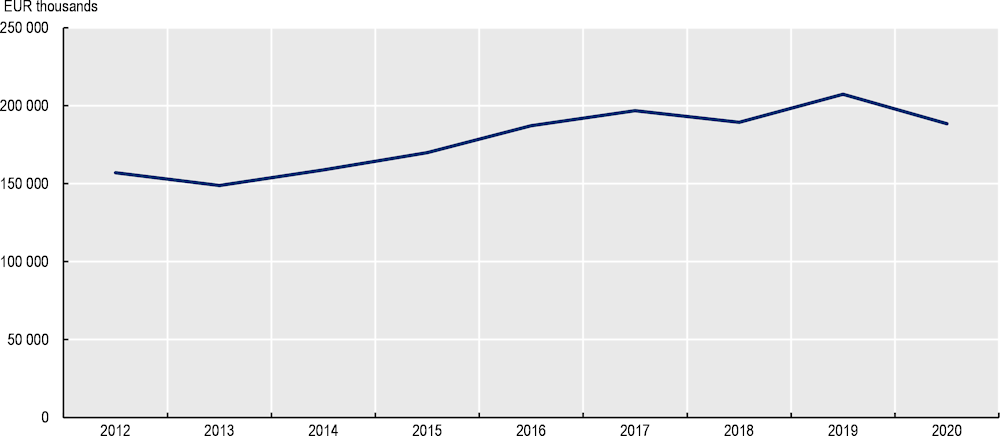

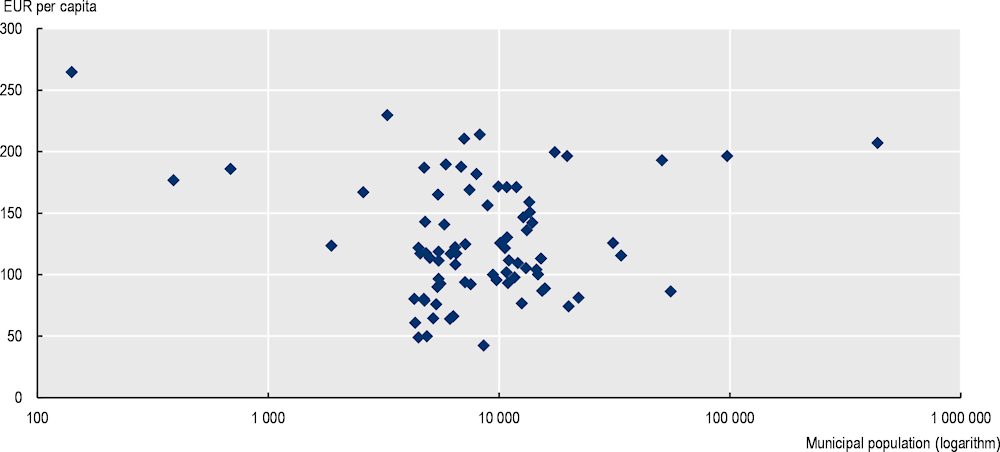

The most important source of income for municipalities is PIT (57% of operating revenue in 2020). The income tax is a central government tax, so municipalities have no powers concerning it (tax rates and tax base). The central government decides yearly the income tax rate and the municipal share of the revenue. Currently, the income tax rate is 20% (plus some adjustments according to income)4 and the rate earmarked to municipalities is 11.93%, thus the rate earmarked to central government is 8.07%. Municipal PIT revenue share is based on residents’ salaries. Municipal PIT revenue has increased since 2010 (Figure 3.6). Income tax revenue varies considerably between municipalities, yet population size is not strongly associated with the variation5 (Figure 3.7). Small municipalities are not necessarily among those with the lowest revenues per capita.

Figure 3.6. Municipal share of PIT revenue, EUR thousands

Note: Calculated at current prices.

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Figure 3.7. Municipal population size and PIT revenue per capita, EUR thousands 2019

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

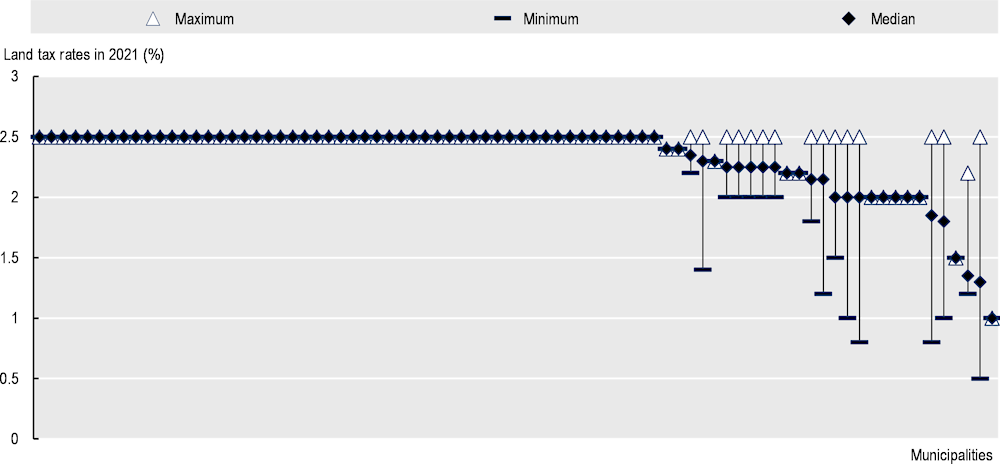

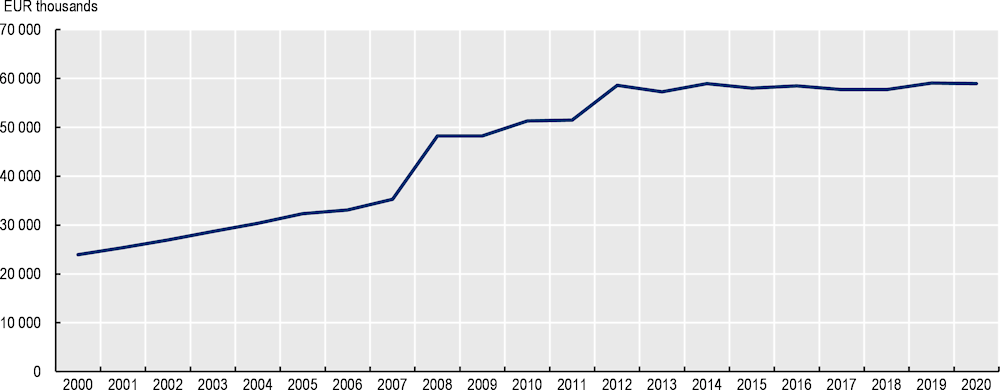

The second most important tax for the municipalities is land tax, though it provides only 4.4% of all municipal tax revenue and 2.6% of total municipal operating revenue (tax revenue, grants received, user fees, other operating revenue). Municipalities are free to set the tax rates within limits set by the central government, at present 0.1-2.5%. Municipalities are also free to set different rates within their area and to give tax relief to special taxpayer groups. At present, the land tax rates vary between 0.5 and 2.5 and the average tax rate is 2.1 when taking into account different land tax zones used by some municipalities. While most municipalities apply the highest rate, a few have chosen a slightly lower rate and some municipalities utilise varying rates depending on the zone (Figure 3.8). Although the taxable land values are still at the level of 2001, the land tax revenues increased between 2007 and 2012, mainly because of increases in land tax rates. Since 2012, land tax rates have not changed markedly. As a result, land tax revenue has not increased even in nominal terms since 2012 (Figure 3.9).

Figure 3.8. Municipal land tax rates by municipality, 2021

Note: Estonia applies a separate land tax for on arable land and natural grassland used for agricultural production, which is not described here.

Source: Estonian Tax and Customs Board (2021[27]), On Land Tax.

Figure 3.9. Land tax revenue, 2000-20, EUR thousands at current prices

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

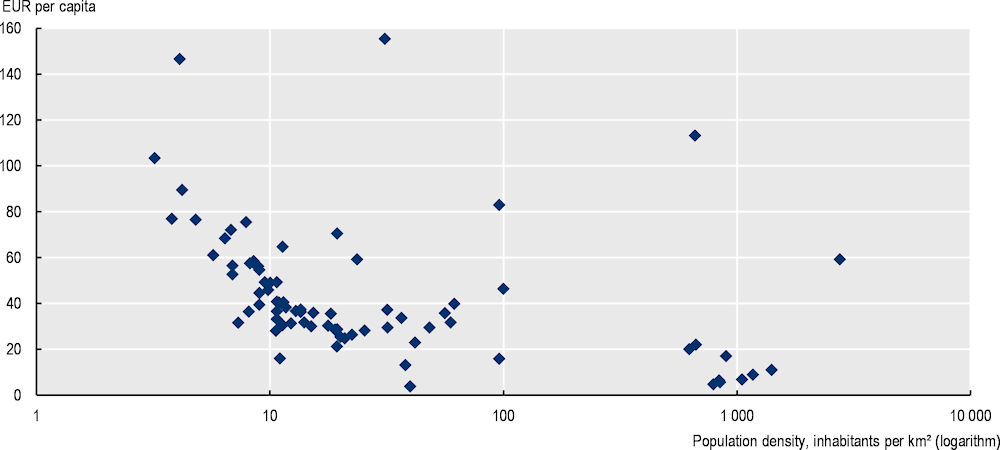

There appears to be no clear association between municipal population size and per capita land tax revenue (Figure 3.10). While it appears that the highest per capita land tax revenues are found in the least dense municipalities, the differences are nonetheless large among municipalities with similar densities (Figure 3.11).

Figure 3.10. Land tax revenue, per capita and municipal population, 2020

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Figure 3.11. Land tax revenue, per capita and municipal population density, 2020

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Revenue from the sale of goods and services

In 2020, about 8.4% of municipal revenue consisted of revenue from user fees and sales of goods and services. According to the available data, the revenue grew from 2013 to 2019 (except in 2018), though less than income tax revenues, and decreased in 2020 (Figure 3.12). Municipal population size seems not to be associated with sales revenue in 2020 (Figure 3.13). Other notable municipal tax revenues comprise advertisement tax, road and street closure tax and parking charges. Taken together, these taxes make 1.1% of municipal tax revenues and 0.6% of total operating revenue (Statistics Estonia, 2021[26]).

Figure 3.12. Municipal revenue from the sale of goods and services, 2012-20, EUR thousands at current prices

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Figure 3.13. Municipal population size and per capita revenue from sale of goods and services

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Grants to municipalities

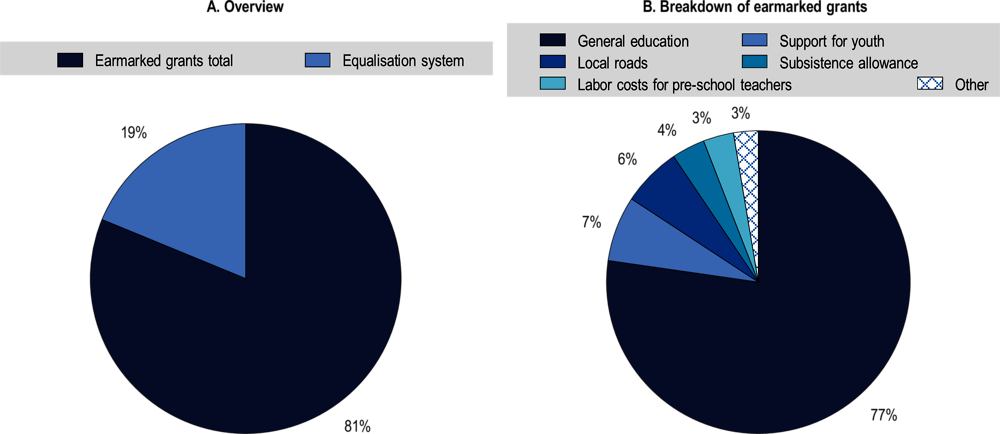

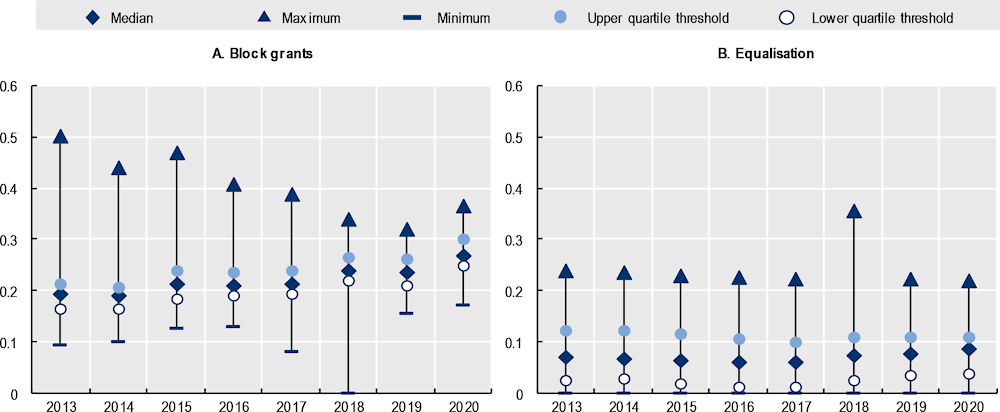

Grants form about 28% of total municipal expenditure. The grant system is formed by two main elements: the block grants (81% of all grants to municipalities) and the equalisation grant (19%) (Figure 3.14, Panel A). While the current grant system has been in place for 15 years, the system has seen some minor changes over the years.

“Block grants”

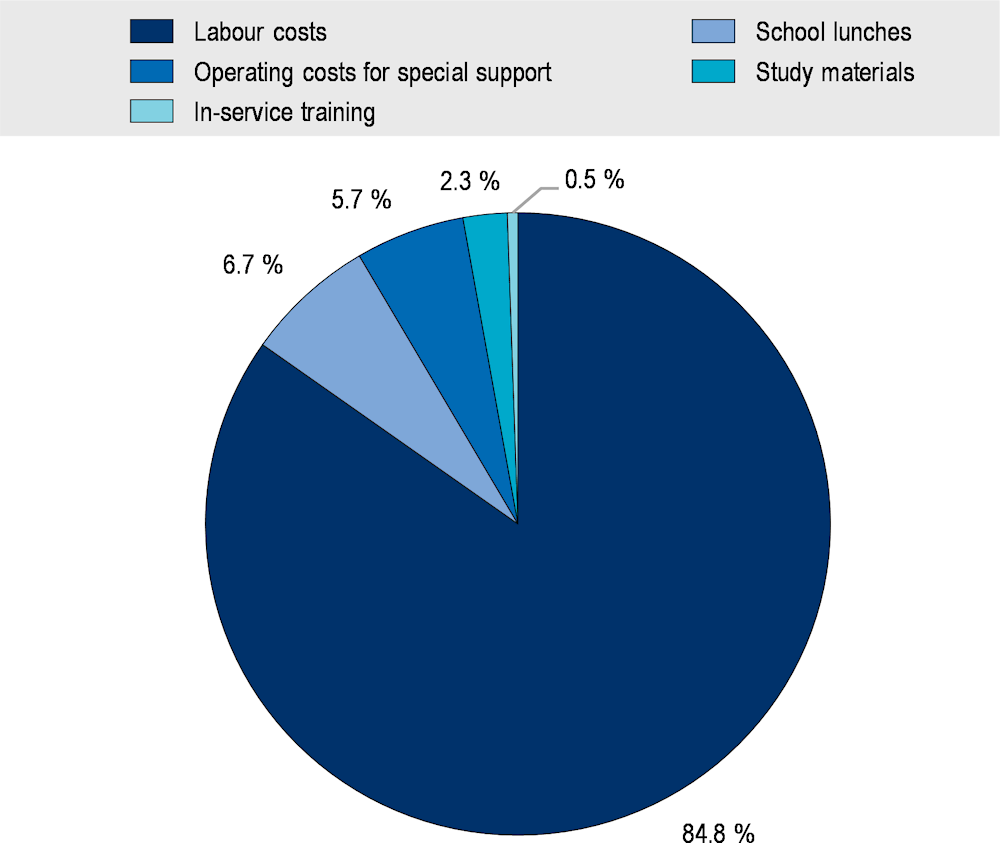

The grant system consists of several specific grants (Figure 3.14, Panel B). Due to the strong regulation on the use of block grants, the grants are in fact earmarked. The most significant is for general education, which is mainly targeted to finance teachers’ and school leaders’ salaries (80% of the grant), school lunches (7%) and the study support to pupils with special needs (6%) (Figure 3.15). The grant is based on the number of pupils and several need indicators.

The negative effect of earmarking is that municipalities may have a disincentive to improve the efficiency of the education services. This is because any efficiency-improving changes that could lead to cost savings will automatically result in cuts in grants. This can, for example, create a disincentive for municipalities to merge schools into bigger units. It is also noteworthy that, while the number of secondary schools has decreased between 2012 and 2020, at the same time, the number of basic schools, which form the majority of Estonia’s current 506 schools, has increased.

Figure 3.14. The transfer system in 2021

Note: The left panel describes the main components of the transfer system and the right panel shows the distribution of block grants.

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Figure 3.15. Breakdown of the education grant

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Equalisation grants

The equalisation grant is based on the difference between the estimated average operating cost of the municipality and the estimated own revenue of the municipality (please see the annex for the equalisation formula and the variables used).6 The estimated revenue consists of the municipal share of income tax revenue and land tax revenue and the estimated expenditure is based on a calculation using the information of expenditure needs. Currently, 90% of the (positive)7 difference is considered. The equalisation formula also takes into account the possible revenue from mining activities and the “island municipality” status. The formula applied can be summarised as:

, where

is the amount of the equalisation grant for the municipality.

is the estimated average operating cost of the municipality.

is the estimated own revenue of the municipality.

is a coefficient for the level of support with a value of 0.9 if , else .

denotes the municipal share of mining revenue.

denotes the support for island municipalities.

While the estimation of municipal revenue is relatively straightforward, the estimated expenditure is based on complex sub formulas with several variables. For expenditure needs, the following indicators were used in 2020:

Age 0-6, pre-schoolers.

Age 7-15, basic education.

Students in municipal gymnasiums.

Age 7-18, non-educational costs.

Age 19-65, working adult.

Age 65 and over, elderly.

Disabled people in care (temporary).

In addition, specific coefficients are used to measure the special needs of rural areas and population dispersion. The coefficients used in the equalisation formula are based on regression analyses on different services. The equalisation calculations are published annually on the Ministry of Finance Internet pages.8 The state budget provides the details of the formula and coefficients.9 It can be seen that in recent years, the importance of earmarked grants has increased (Figure 3.16).

Figure 3.16. The importance of earmarking is growing

Source: Statistics Estonia (2021[26]), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

Decentralisation in Estonia in international comparison

This section provides a snapshot of multi-level governance and decentralisation in Estonia from an international perspective. From a demographic perspective (Table 3.2), among the “small countries” (with a population below 6 million inhabitants) of the EU and the OECD, Estonia stands out with its relatively small population size (1.33 million), negative population change (-0.3%) and a relatively low population density (30.3 While about the third of the population of Estonia is concentrated in the capital area, the degree of urbanisation (68.7%) is not very high compared with the OECD average (81%) or the average of small EU and OECD countries (74.7%).

Table 3.2. Estonia in comparison with the other small unitary EU and OECD countries: Demographics

|

Population (thousand inhabitants) |

Area (km2) |

Population growth (average annual rate) |

Urban population (% of total population) |

Density (inhabitants/ km2) |

Population of capital city as % of the total population |

|

|---|---|---|---|---|---|---|

|

Iceland |

343 |

100 243 |

0.6 |

93.8 |

3.4 |

63.0 |

|

Malta |

460 |

320 |

0.5 |

94.5 |

1 438.4 |

46.2 |

|

Luxembourg |

597 |

2 586 |

2.2 |

90.7 |

230.8 |

20.1 |

|

Cyprus |

855 |

5 695 |

0.7 |

66.8 |

150.0 |

31.5 |

|

Estonia |

1 316 |

43 432 |

-0.3 |

68.7 |

30.3 |

33.2 |

|

Latvia |

1 941 |

64 490 |

-1.2 |

67.3 |

30.1 |

32.8 |

|

Slovenia |

2 066 |

20 145 |

0.3 |

54.3 |

102.5 |

13.9 |

|

Lithuania |

2 848 |

65 286 |

-1.3 |

66.1 |

43.6 |

18.8 |

|

Croatia |

4 154 |

56 594 |

-0.4 |

56.7 |

73.4 |

16.5 |

|

Ireland |

4 802 |

70 280 |

0.3 |

62.9 |

68.3 |

25.0 |

|

New Zealand |

4 820 |

267 710 |

1.1 |

86.5 |

18.0 |

8.5 |

|

Costa Rica |

4 906 |

51 100 |

1.1 |

78.6 |

96.0 |

27.7 |

|

Norway |

5 277 |

385 207 |

1.2 |

81.9 |

13.7 |

12.6 |

|

Slovak Republic |

5 438 |

49 036 |

0.1 |

53.8 |

110.9 |

7.9 |

|

Finland |

5 508 |

338 150 |

0.4 |

84.4 |

16.3 |

23.2 |

|

Denmark |

5 767 |

42 924 |

0.5 |

87.8 |

134.4 |

23.0 |

|

“Small country” average |

3 194 |

97 700 |

0.4 |

75 |

160 |

25 |

|

OECD average |

20 942 |

219 486 |

0.3 |

76 |

171 |

20 |

Note: The figures are the latest available year. The table presents data for unitary EU or OECD countries with a population below 6 million inhabitants. The average population size is calculated by dividing the total population by the number of subnational governments.

Source: OECD (2021[28]), World Observatory on Subnational Government Finance and Investment, http://www.oecd.org/regional/observatory-on-subnational-government-finance-and-investment.htm.

Due to the recent administrative reform in 2017, the average municipal population size (16 653 inhabitants) is not particularly low in Estonia, although it is well below the OECD average (40 107 inhabitants) and the average of small EU and OECD and countries (30 804 inhabitants). The number of subnational governments at the municipal level is well below the OECD and “small country” averages (Table 3.3).

Table 3.3. Estonia in comparison with the other small unitary OECD countries: Governance

|

Average number of inhabitants per municipality |

Number of SNGs at municipal level |

Number of SNGs at regional level |

|

|---|---|---|---|

|

Iceland |

4 640 |

74 |

.. |

|

Malta |

6 500 |

68 |

.. |

|

Luxembourg |

5 850 |

102 |

.. |

|

Cyprus |

2 249 |

380 |

.. |

|

Estonia |

16 653 |

79 |

.. |

|

Latvia |

16 312 |

119 |

.. |

|

Slovenia |

9 744 |

212 |

.. |

|

Lithuania |

47 140 |

60 |

.. |

|

Croatia |

7 472 |

556 |

21 |

|

Ireland |

154 912 |

31 |

.. |

|

New Zealand |

70 450 |

67 |

11 |

|

Costa Rica |

60 565 |

81 |

.. |

|

Norway |

12 408 |

422 |

18 |

|

Slovak Republic |

1 856 |

2 930 |

8 |

|

Finland |

17 670 |

311 |

1 |

|

Denmark |

58 449 |

98 |

5 |

|

“Small country” average |

30 804 |

349 |

11 |

|

OECD average |

40 107 |

2 089 |

20 |

Note: The figures are the latest available year. The table presents data for countries classified as “high income” and “upper middle income”. The average population size is calculated by dividing the total population by the number of SNGs. Number of SNGs at regional level not available for countries with a two tier government structure.

Source: OECD (2021[28]), World Observatory on Subnational Government Finance and Investment, http://www.oecd.org/regional/observatory-on-subnational-government-finance-and-investment.htm.

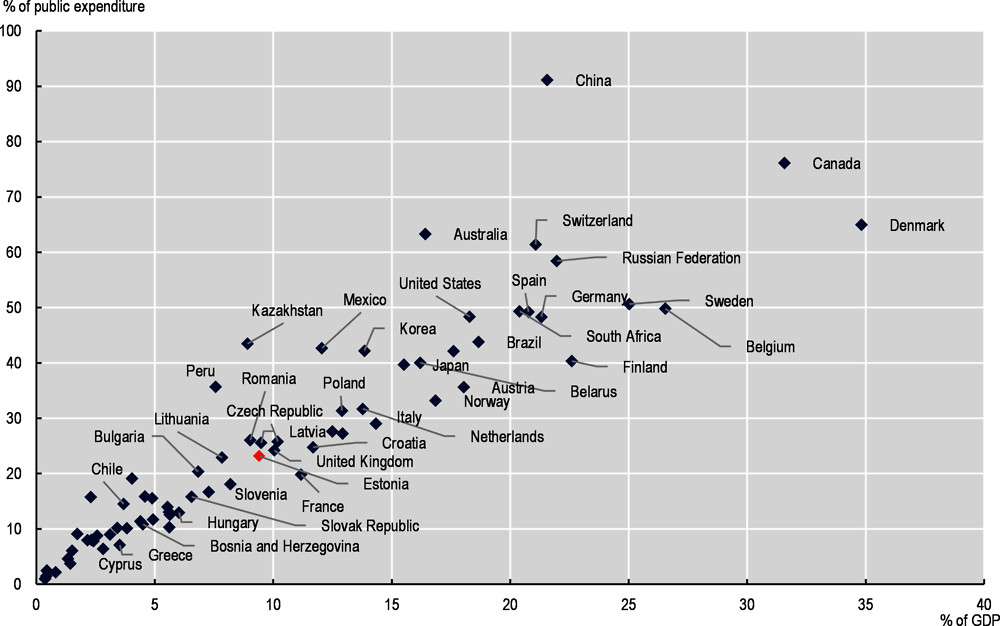

In international comparison, Estonia is clearly among the least decentralised countries, when measured by subnational government share of general government spending and as a share of gross domestic product (GDP) (Figure 3.17). For instance, in Estonia, the subnational government expenditure share of total general government expenditure is 23%, which is lower than the OECD average (32%). Measured with subnational government expenditure of GDP, Estonia´s share (9%) is again lower than the OECD average (13%).

Figure 3.17. Subnational government expenditure as a share of GDP and share of public expenditure

Note: Only countries in groups “high income” and “upper middle income” are included.

Source: OECD (2021[28]), World Observatory on Subnational Government Finance and Investment, http://www.oecd.org/regional/observatory-on-subnational-government-finance-and-investment.htm.

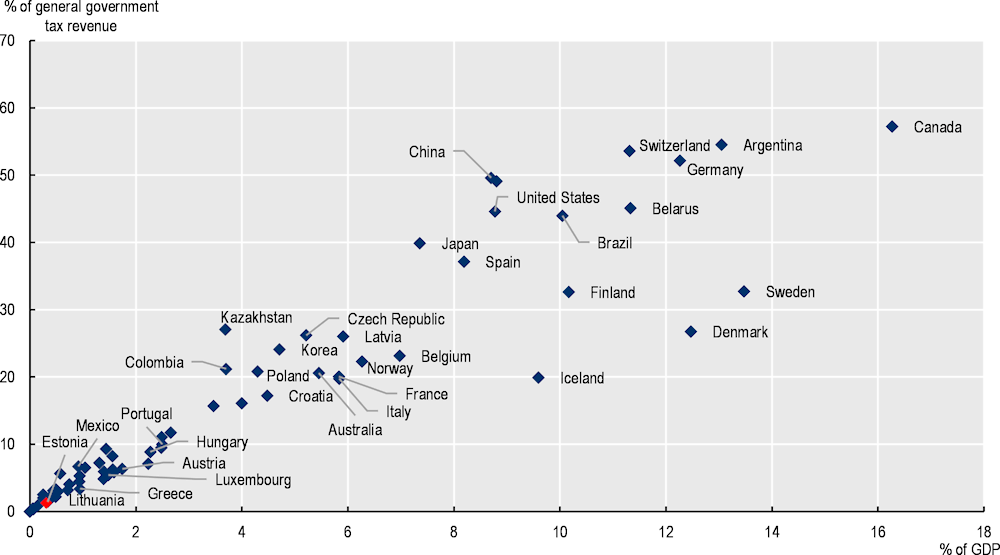

The revenue share of the Estonian subnational government is even lower than the expenditure share in international comparison. In fact, in Estonia, the subnational government share of total tax revenue and GDP shows the lowest values of EU and OECD countries (Figure 3.18). Estonia’s subnational governments receive 1.5% of total general government tax revenue, which is the smallest share of all OECD countries (the OECD average is 20%). Measured as a share of GDP, the Estonian subnational government share is 0.3%, again the smallest share of all OECD countries (OECD average is 5%).

Figure 3.18. Subnational government tax revenue and public expenditure

Note: Only countries in groups “high income” and “upper middle income” are included.

Source: OECD (2021[28]), World Observatory on Subnational Government Finance and Investment, http://www.oecd.org/regional/observatory-on-subnational-government-finance-and-investment.htm.

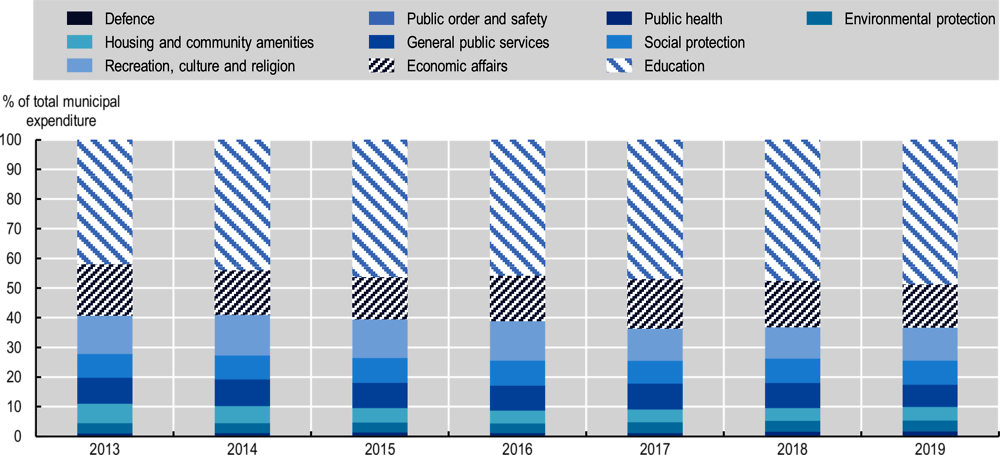

About 3% of subnational government revenue comes from taxes in Estonia (2017 situation). In the OECD, taxes represented 35% of SNG revenue (unweighted average) and 44% (weighted average) (Figure 3.19). Transfers represent 87% of subnational government revenues in Estonia (by OECD definition, the shared PIT revenue in Estonia is classified as grants), compared with 50% (unweighted average) and 37% (weighted average) in OECD countries. As for tariffs and fees, the share of subnational government revenue is 9% in Estonia, compared with OECD averages of 12% (unweighted average) and 15% (weighted average).

Figure 3.19. Subnational government revenue by type in the OECD countries

Policy recommendations

This section explores the main challenges caused by shrinkage to Estonia’s multi-level governance and subnational government financing. It discusses the main alternative paths for municipal financing in Estonia, considering the current institutional setting, the usual recommendations for local financing reforms and experiences from reforms in other countries. It has a focus on the transfer system because grants from the central government form a major source of revenue for the Estonian municipalities. The section also briefly discusses ways to strengthen local own revenue bases.

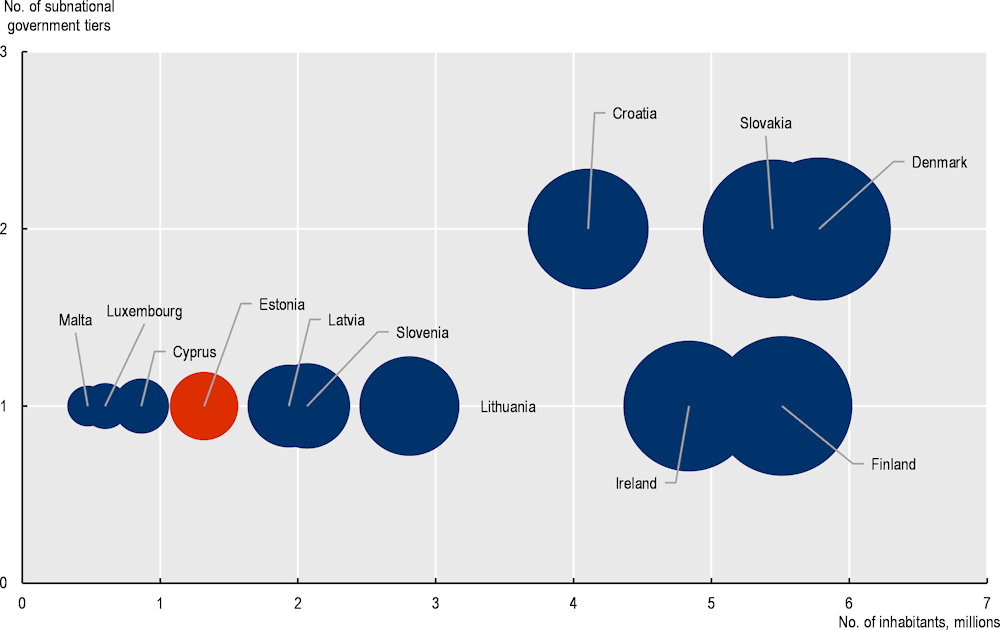

Enhancing IMC to utilise economies of scale

Among the EU28 countries, Estonia belongs to the group of unitary countries with one subnational government level (Figure 3.20 and Table 3.4). Despite the recently enlarged municipal size and the existing co‑operative arrangements, there is still room for a bigger scale in certain services. Because of the recent administrative reform, it is however not realistic to start immediately a further merger reform in Estonia. Instead, IMC could be a viable approach. However, since only 14% of municipal revenue comes from own revenue sources, municipal incentives for engaging in voluntary co‑operation are low.

Figure 3.20. Population size and number of subnational government tiers among the small EU28 and OECD countries

Note: The graph presents data for unitary EU or OECD countries with a population below 6 million inhabitants. The bubble size indicates differences in countries’ population.

Source: Author’s elaboration of based on Eurostat (2021[30]), Eurostat Data, https://ec.europa.eu/eurostat/web/population-demography/demography-population-stock-balance/database and OECD (2021[28]), World Observatory on Subnational Government Finance and Investment, http://www.oecd.org/regional/observatory-on-subnational-government-finance-and-investment.htm.

Table 3.4. Subnational government organisation in EU28 countries

|

|

Countries with one subnational government level* (n=11) |

Countries with two subnational government levels** (n=10) |

Countries with three subnational government levels*** (n=7) |

|---|---|---|---|

|

Federations (n=4) |

Austria |

Belgium Germany Spain § |

|

|

Unitary countries (n=24) |

Bulgaria Cyprus Estonia Finland § Ireland Latvia Lithuania Portugal § Slovenia |

Croatia Czech Republic Denmark Greece Hungary Netherlands Romania Slovak Republic Sweden |

France Italy Poland United Kingdom § |

Note:

* Municipalities; **Municipalities and regions; ***Municipalities, intermediate governments and regions.

§ Spain is a quasi-federal country; Portugal has two autonomous regions; Finland has one autonomous region. By 2023, there will be a regional government level in Finland; The United Kingdom has three “devolved nations” at the regional level.

Source: OECD (2021[28]), World Observatory on Subnational Government Finance and Investment, http://www.oecd.org/regional/observatory-on-subnational-government-finance-and-investment.htm.

To better utilise economies of scale and scope of public service provision at the municipal level, the central government could step up the voluntary co‑operation between municipalities especially in case of services that benefit from a larger scale (e.g. education and some infrastructure such as roads). Enhanced IMC is important also because the municipalities often appear to compete for central government financing and EU funds and, therefore, without special arrangements, the municipalities may not have a strong financial incentive to enter co‑operation.10 This group consists mostly of countries with small population sizes, such as Cyprus, Finland, Ireland, Luxembourg and Malta, and the three Baltic countries. Small countries rarely have more than one tier of subnational government, although Croatia, Denmark and the Slovak Republic are exceptions. Therefore, the single-tier subnational government model currently applied in Estonia seems well justified.

Due to the recent administrative reform, however, municipalities are still in a process of reorganising their services and administration. As for economies of scale beyond the municipal boundaries, municipalities are currently mandated to co‑operate in public transport, spatial planning and county development planning. In the case of these services, the intermunicipal co‑operation is organised usually within county borders. Currently, co‑operation in development planning has been arranged through 15 counties and municipal co‑operative associations have been arranged through 13 counties. There are currently 11 co‑operative transport centres, of which 9 are county-based and 2 are region-based.

Despite the recently enlarged municipal size and the existing co‑operative arrangements, there is still room for a bigger scale in certain services. Because of the recent administrative reform, it is however not realistic to start a further merger reform immediately in Estonia. Instead, IMC could be a viable approach. However, since only 14% of municipal revenue comes from own revenue sources, municipal incentives for engaging in voluntary co‑operation are low.

To better utilise economies of scale and scope of public service provision at the municipal level, the central government could step up the voluntary co‑operation between municipalities especially in case of services that benefit from a larger scale (e.g. education and some infrastructure such as roads) (OECD, 2014[31]). Enhanced IMC is also important because municipalities often appear to compete for central government financing and EU funds and therefore, without special arrangements, the municipalities may not have a strong financial incentive to enter co‑operation.

To be successful, strengthening the policy for voluntary IMC requires a number of interventions by the central government. These include: i) clarifying the legal base for voluntary IMC; ii) using the transfer system to encourage voluntary IMC by, for example, targeting some transfers to IMC instead of municipalities; iii) outlining processes for co‑ordination in the National Spatial Plan and County-wide Spatial Plan (which are legally binding), especially in important areas such as education and infrastructure; iv) utilising piloting and experiments on voluntary IMC to get more experience on best practices of such arrangements; and v) central government support towards municipalities in building administrative capacity to organise IMC. Furthermore, the central government could also help the municipalities to share experts and civil servants, or help create a national pool of municipal experts. This could be a valuable tool in sharing best practices and providing “peer support” between municipalities.

Another issue is that the seriousness of the effects of a shrinking population seems to not yet be widely understood among the municipalities. While the central government planning is systematically based on available projections, at the municipal level, the population forecasting seems to be too optimistic. This could mean that, in such municipalities, the strategy work and service planning is based on unrealistic assumptions.

Raising the awareness in municipalities of the cost and service quality effects caused by shrinking population could entail the central government establishing an advisory service for municipalities to better identify the additional costs caused by shrinking population (mismatch between population base and current infrastructure and service delivery). In addition, a further developed database of the costs and outcomes of main municipal services could be established to support benchmarking between municipalities. As a direct measure, Estonia could also consider financial interventions at the national level to support municipalities in handling the challenges related to shrinking. Such measures could include support to municipalities in handling unused or only partially used buildings, and financial support for upgrading public buildings that can be used in the medium and long terms.

Rethinking municipal spending assignments for future decades

The main spending task of Estonian municipalities is education, forming nearly 50% of the aggregate municipal expenditure. Other important municipal tasks comprise economic affairs, recreation and social protection. In 2020, investment activities were about 16% of total municipal expenditure.

Currently, both municipalities and the central government finance and manage upper secondary education. While the purpose of such arrangements is to ensure equity of access, such a situation is not optimal from the overall service delivery aspect as it may result in inefficiencies. With population shrinking and ageing, there may be pressure for enhanced central government intervention in other services too, especially if IMC does not become more common.

There is thus a need to rethink municipal spending assignments in light of demographic change, especially given the recent administrative reform. While the municipalities probably need several years to reorganise themselves, the central government should already look ahead to potential further reforms. Accordingly, within the next 5 to 10 years, Estonia could consider carrying out a comprehensive review of municipal service responsibilities. Such a review could help identify services where reassignment of spending assignments between central government and municipalities as well as IMC units would be a viable approach. If agreed, the review could be conducted jointly by central and local government representatives, with support from academia and expert organisations. While each country has its specificities and each must define the practical method for reviewing their spending assignments, the following general aspects should at least be considered in such work: i) identifying duplication in the delivery of some services; ii) ensuring clarity of lines of responsibility and accountability; iii) improving the clarity of legal and institutional arrangements; iv) solving complex delivery of public services; and v) identifying the political and administrative sensitivities associated with spending assignments.

Reforming the municipal financing system to meet the challenges and opportunities of the new municipal structure and shrinking population

The central government currently has the main responsibility of financing the municipalities. Eighty percent of municipal revenue is formed by shared PIT revenue and state grants. Municipal own revenue (land tax, other small taxes, sales revenue and other operating income) makes only about 14% of total municipal revenue.

Shared tax revenues are unevenly distributed between municipalities. There are substantial differences between Estonian municipalities in per capita PIT revenue. The reasons behind such disparities are numerous. The fact that people can live and work in one municipality and be reregistered for tax purposes in another municipality, complicates the situation and makes comparisons difficult. While the available data does not allow precise arguments on this, it is possible that the current practice may result in unfair distribution of PIT revenues. Although the biggest cities are the wealthiest municipalities in Estonia, municipal population size alone does not explain the differences in per capita income tax revenue between municipalities.

The taxable land values are from 2001. While this is about to change, if the law proposal for new valuations by the Ministry of Finance is approved by the parliament, there will still be a long adjustment period for the reform to smooth the change. Therefore, the effect on municipal incomes will be only gradual.

Box 3.2. What revenues for subnational governments?

According to the economics literature on subnational government financing, there are two key decisions to be made with respect to revenue assignment to subnational governments: first, which revenue bases should be allocated to subnational government levels, given the spending assignments; and second, how much responsibility the subnational governments should have in financing their own expenditures.

User charges are considered the most efficient local financing instruments, provided that two conditions are fulfilled: i) the benefits of local public services and goods in question are spatially limited within the borders of the jurisdiction; and ii) the exclusion principle can be applied in pricing. User charges can form the primary source of funding in public utilities, such as water, sewerage and public transport (Bahl and Bird, 2018[32]).

Local taxes should be the primary revenue source for most other local public spending categories, provided that the benefits of these services accrue mostly to the local population. This would secure the principle that those who bear the local tax burden will also receive the benefits from the expenditures that are financed by the local taxes. Such services include general administration, primary and secondary education, maintaining streets, street lighting, drainage, garbage collection, public parks, fire protection, police and recreation services (Bahl and Bird, 2018[32]).

For the services with major externalities and benefit spill-overs to other jurisdictions or the whole country, such as major roads and highways, health services or higher education, intergovernmental transfers should be the primary source of local revenue. This is because local authorities are likely to neglect the potential benefits received by users in other jurisdictions, which would lead to the under-provision of these services from a wider (national and regional) perspective (Bahl and Bird, 2018[32]; King, 1984[33]).

It is generally agreed that the efficiency and accountability of local service provision are best secured if subnational governments finance a considerable share of their spending with their own revenues. While the literature does not provide a blueprint on the target share of own revenues, it is widely accepted that subnational governments should finance their spending with their own revenues at the margin. Such a principle would help ensure that decisions to expand public programmes are made keeping in mind the additional costs (Oates, 2008[34]). Moreover, when residents self-finance the local services through local taxes and charges, they have an incentive to evaluate the costs and benefits of local service provision, and benchmark local government performance against neighbouring jurisdictions. Such “yardstick competition” can encourage local politicians to maximise the welfare of residents instead of promoting their own self-interested goals (Oates, 2008[34]).

Source: Bahl, R. and R. Bird (2018[32]), Fiscal Decentralization and Local Finance in Developing Countries: Development from Below, Edward Elgar; King, D. (1984[33]), Fiscal Tiers: The Economics of Multi-level Government, Allen & Unwin; Oates, W. (2008[34]), “On the evolution of fiscal federalism: Theory and institutions”, National Tax Journal, Vol. LXI/2.

The main problem with the current earmarked grant system is that municipalities may have a disincentive to improve the efficiency of the education services. The fact that the Estonian transfer system consists mostly of earmarked grants (80% of all transfers) weakens the municipal decision-making power. Furthermore, as some of the indicators used in the transfer system (equalisation system and earmarked transfers) are based on dispersed population (e.g. the “tagamaalisuse koefitsient”) and small schools, the incentives for municipalities to reduce dispersed settlement structure may be diminished. The transfer system reform should ensure that financial support that induces sprawl and disperse settlement is abolished.

Estonia should consider strengthening the municipal own revenue base in a gradual manner. High reliance on transfers and shared taxes may have a negative effect on the efficiency of municipal service delivery. After the merger reform of 2018, the municipalities should have the adequate administrative capacity to take bigger responsibility not only for their spending but also for their financing. Measures in that direction could include carrying out a land tax base revaluation (which is already underway), easing the land tax rate regulation by increasing the upper band from the current 2.5% and considering a local income tax in some form, for example, to establish a “piggyback” tax on the national income tax.

Estonia should also seriously consider reforming the municipal transfer system. The current system is complex and, due to overlapping indicators, the equalisation model and earmarked grants system do not work well together. Estonia should abandon, or at least considerably reduce, the complex earmarked grants system. The money saved from earmarked grants could instead be used to strengthen the equalisation system. All municipalities, including the ones with a shrinking population, could benefit from such a reform because they could better allocate the financing according to their local needs and demand. The transparency of the transfer system also needs to be improved and specific circumstantial factors, such as remoteness and low population density, should be taken into account using a maximum of one or two criteria.

The current transfer system contains elements that allow municipalities to influence their own state aid. Replacing the current factors used to support remoteness and low density with more neutral indicators, such as population density, is another important aspect of reform. The advantage of population density as an indicator for state support is that the recipients (municipalities) cannot directly influence the grants they receive with their own measures. Furthermore, population density, as a measure of equalisation, does not discourage municipalities to improve the efficiency of their settlement structure. On the contrary, if the municipality managed to obtain the cost benefit of a denser settlement structure, it could keep the benefit to itself, as the population density would remain unchanged in this case and the state contribution would not be reduced.

Finally, from the perspective of shrinking populations, population change could be taken into account more explicitly in the equalisation system. This could be done for example with a specific indicator on population change. Such an indicator could be used to support not only the municipalities with a shrinking population but also the municipalities that are growing.

References

[15] Allers, M. and B. van Ommeren (2016), “Intermunicipal cooperation, municipal amalgamation and the price of credit”, Local Government Studies, Vol. 42/5, pp. 717-738, https://doi.org/10.1080/03003930.2016.1171754.

[32] Bahl, R. and R. Bird (2018), Fiscal Decentralization and Local Finance in Developing Countries: Development from Below, Edward Elgar.

[21] Bel, G. and M. Mur (2009), “Intermunicipal cooperation, privatization and waste management costs: Evidence from rural municipalities”, Waste Management, Vol. 29/10, pp. 2772-2778, https://doi.org/10.1016/j.wasman.2009.06.002.

[13] Bird, R. and E. Slack (2007), “An approach to metropolitan governance and finance”, Environment and Planning C: Government and Policy, Vol. 25/5, pp. 729-755, https://doi.org/10.1068/c0623.

[11] Blom-Hansen, J. et al. (2016), “Jurisdiction size and local government policy expenditure: Assessing the effect of municipal amalgamation”, American Political Science Review, https://doi.org/10.1017/S0003055416000320.

[25] Dahlberg, M. et al. (2008), “Using a discontinuous grant rule to identify the effect of grants on local taxes and spending”, Journal of Public Economics, Vol. 92/12, pp. 2320-2335, https://doi.org/10.1016/j.pubeco.2007.05.004.

[3] Das, B. and M. Skidmore (2018), “Asymmetry in municipal government responses in growing versus shrinking counties with focus on capital spending”, Journal of Regional Analysis and Policy, Vol. 48/4, pp. 62-75.

[27] Estonian Tax and Customs Board (2021), On Land Tax.

[30] Eurostat (2021), Eurostat Data, https://ec.europa.eu/eurostat/web/population-demography/demography-population-stock-balance/database.

[20] Frère, Q., M. Leprince and S. Paty (2014), “The impact of intermunicipal cooperation on local public spending”, Urban Studies, Vol. 51/8, pp. 1741-1760, https://doi.org/10.1177/0042098013499080.

[7] Fritsch, M., P. Kahila and J. Sinerma (2020), European Shrinking Rural Areas: Challenges, Actions and Perspectives for Territorial Governance. Case Study Juuka, North Karelia, Finland.

[17] Green, A. (2018), “Developing more local strategies for a changing labour market”, Unpublished manuscript.

[4] Haase, A. et al. (2012), Shrinking Areas: Front Runners in Innovative Citizen Participation.

[5] Hospers, G. and N. Reverda (2015), Managing Population Decline in Europe’s Urban and Rural Areas, Springer.

[33] King, D. (1984), Fiscal Tiers: The Economics of Multi-level Government, Allen & Unwin.

[6] Komarek, T. and G. Wagner (2021), “Local fiscal adjustments from depopulation: Evidence from the post–cold war defense contraction”, National Tax Journal, Vol. 74/1, pp. 9-43, https://doi.org/10.1086/712917.

[19] Kommuninvest Sweden (2019), Vision and Basic Concept, https://kommuninvest.se/en/about-us-3/vision-and-basic-concept/ (accessed on 2 May 2019).

[22] Kortelainen, M. et al. (2019), Effects of Healthcare District Secessions on Costs, Productivity and Quality of Services.

[23] Miyazaki, T. (2016), Intergovernmental Fiscal Transfers and Tax Efforts: Evidence from Japan.

[24] Mochida, N. (2011), Fiscal Decentralization in Japan, UN-HABITAT.

[12] Moisio, A. and R. Uusitalo (2013), “The impact of municipal mergers on local public expenditures in Finland”, Public Finance and Management, Vol. 13/3, https://www.researchgate.net/publication/272795680.

[34] Oates, W. (2008), “On the evolution of fiscal federalism: Theory and institutions”, National Tax Journal, Vol. LXI/2.

[29] OECD (2021), OECD Statistics, OECD, Paris, https://stats.oecd.org/ (accessed on 12 Oct 2021).

[28] OECD (2021), World Observatory on Subnational Government Finance and Investment, OECD.SNG-WOFI Database, OECD, Paris, http://www.oecd.org/regional/observatory-on-subnational-government-finance-and-investment.htm.

[14] OECD (2019), Making Decentralisation Work: A Handbook for Policy-Makers, OECD Multi-level Governance Studies, OECD Publishing, Paris, https://dx.doi.org/10.1787/g2g9faa7-en.

[16] OECD (2017), Multi-level Governance Reforms: Overview of OECD Country Experiences, OECD Multi-level Governance Studies, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264272866-en.

[31] OECD (2014), Recommendation of the Council on Effective Public Investment Across Levels of Government, OECD, Paris, https://www.oecd.org/cfe/regionaldevelopment/recommendation-effective-public-investment-across-levels-of-government.htm.

[35] OECD (2010), Fiscal Policy Across Levels of Government in Times of Crisis.

[1] Rouzet, D. et al. (2019), “Fiscal challenges and inclusive growth in ageing societies”, OECD Economic Policy Papers, No. 27, OECD Publishing, Paris, https://doi.org/10.1787/c553d8d2-en.

[18] Sandford, M. (2018), “Devolution to local government in England”, House of Commons, http://www.parliament.uk/commons-library.

[10] Slack, N. (1997), “Intermunicipal cooperation: Sharing of expenditures and revenues”.

[26] Statistics Estonia (2021), Local Budgets Expenditure by Region/Administrative Unit [Statistical database], https://andmed.stat.ee/en/stat/Lepetatud_tabelid__Majandus.%20Arhiiv__Rahandus.%20Arhiiv/RR301 (accessed on 1 February 2021).

[9] Syssner, J. (2016), “Planning for shrinkage? Policy implications of demographic decline in Swedish municipalities”, Ager, Vol. 20, pp. 7-31, https://doi.org/10.4422/ager.2015.14.

[8] Valkama, P. and L. Oulasvirta (2021), “How Finland copes with an ageing population: Adjusting structures and equalising the financial capabilities of local governments”, Local Government Studies, Vol. 47/3, pp. 429-452, https://doi.org/10.1080/03003930.2021.1877664.

[2] Wirth, P. et al. (2016), “Peripheralisation of small towns in Germany and Japan – Dealing with economic decline and population loss”, Journal of Rural Studies, Vol. 47, pp. 62-75, https://doi.org/10.1016/j.jrurstud.2016.07.021.

Annex 3.A. Municipal equalisation grant formula in Estonia, 2018

The equalisation formula is calculated as follows:

, where

;

;

;

Here,

is the amount of the equalisation grant for the municipality.

is the estimated average operating cost of the municipality.

is the estimated own revenue of the municipality.

is a coefficient for the level of support with a value of 0.9 (if , ).

is compensation based on the estimated income and expenditure for the municipality.

is the number of various population groups in the municipality, according to the population register: pre-schoolers (0-6 years); school-age population (7-18 years); primary school-age population (7-15 years); working-age population (19–64 years); elderly population (from 65 years of age); estimated length of local roads and streets (hard-cover roads with a coefficient of 0.26; hard-cover streets 0.74; non-hard-cover roads 0.047) in km according to the National Road Register at the beginning of the year; the weighted average number of disabled persons maintained and receiving carer’s services, the number of pupils in municipal upper secondary schools.

is the estimated average operating cost measured for various population types (separately for each population type in euros): pre‑school-aged, basic school-aged, working-age, elderly persons, handicapped persons and pupils of municipal upper secondary schools. In addition, the estimated operating cost of one km of the estimated length of roads and streets in euros.

is a coefficient for the remoteness of the municipality, also considering the diversity of the population, such as the number of primary school-age children aged 7-15 and the number of upper secondary school pupils in municipal schools.

is personal income tax received by the municipality for three previous years (special rules may apply for specific years).

is the estimated land tax of the municipality in euros.