This chapter examines the demography, economy and labour market of the federal state of Brandenburg in Germany. First, the economic context is explored, including challenges related to economic imbalances and infrastructure. Economic opportunities emerging from the shift from coal to cleaner energy, including the impact of a Tesla factory to build electric vehicles, are examined. This chapter also examines how the labour market is adding jobs and improving living standards, noting differences within local economies. It then analyses challenges in the labour market, including a growing skills shortage and a stagnating supply of graduates with higher degrees, and the impact of demographic shifts, declining completion rates in higher education institutions and low participation in lifelong learning on these trends. Finally, proposals for unleashing opportunities for economic development via greater investment in higher education are offered.

Accessing Higher Education in the German State of Brandenburg

2. The economy and labour market in Brandenburg

Abstract

Demographic context

Brandenburg is situated in the northeast of the Federal Republic of Germany and, together with Saxony, Thuringia, Saxony-Anhalt and Mecklenburg-Vorpommern, belongs to the former East German states (the new Länder). It surrounds the capital city of Berlin and borders on Poland to the east. Brandenburg’s capital Potsdam borders Berlin to the southwest.

Brandenburg’s population (2.5 million in 2019) represents 3% of the total German population. The median age is 50 years, older than the German average (46). This makes Brandenburg’s population the fourth‑oldest of Germany’s 16 states.

Despite significant population growth in the Berlin area and in Potsdam, Brandenburg is the state with the second-lowest population density (86 persons per square kilometre) and with a significant rural population.

The population growth rate is also low, a consequence of a low birth rate (7.6% – 15th of 16 states) and an above-average death rate (sixth among the states). Between 2010 and 2015, refugees from Syria, Afghanistan and Iraq boosted inward migration. This mostly affected the regions directly surrounding Berlin and the city of Cottbus in the south of the state. However, net migration over the next decade is forecast to be low (Statistik Berlin-Brandenburg, 2021[1]).

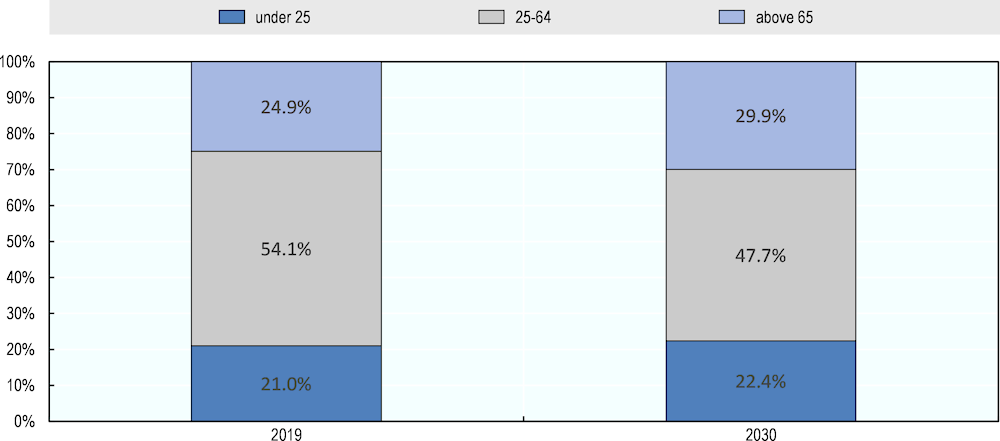

A stable population is forecast for 2020‑30, with a decline of around 3% over the following decade. However, the age distribution of the region’s population is forecast to change. Many young adults are expected to leave the region, leading to a decline of 11% in the population aged 25‑65 between 2019 and 2030. Meanwhile, those aged over 65 are forecast to rise by more than 20%. People aged 65 and over are expected to make up nearly 30% of the state’s population in 2030, compared with almost 25% in 2019 (Figure 2.1).

Figure 2.1. Age distribution of the population of Brandenburg, 2019 and 2030

Source: Statistik Berlin-Brandenburg (2021[1]), „Bevölkerungsvorausberechnung für das Land Brandenburg 2020 bis 2030“ [Population projection for the state of Brandenburg from 2020 to 2030], https://download.statistik-berlin-brandenburg.de/2d433971f996bdf4/ec5cead7539c/SB_A01-08_2021_BB.pdf (accessed on 2 November 2021).

This demographic outlook sees the working age population shrinking, even as it has to support a greater number of children and older adults. The demographic shift also has implications for the skill profile of the population, with the departure of many working age (and, presumably, highly skilled) people. This raises questions about how well the region’s higher education system can support the labour market and hence, the prosperity of the region over the coming decade.

Economic context

Brandenburg’s economy is not structurally strong, but it is on the transformation path

Measured by its gross domestic product (GDP) of EUR 75 billion, Brandenburg is the sixth smallest economy among the German states. However, among the new Länder, Brandenburg ranked second largest (after Saxony) (Eurostat, 2019[2]) and was the most productive (measured in gross value added per worker) in 2019 (OECD, 2019[3]). In the context of the wider OECD, Brandenburg’s productivity is similar to the Central Bohemian region surrounding the capital city of Prague in the Czech Republic; Silesia and Lower Silesia in Poland; Northern and Western Ireland; and the eastern Dutch regions of Overijssel and Drenthe. Brandenburg’s GDP per capita (EUR 29 700) is the third-lowest among German states and is much lower than Germany as a whole (EUR 41 500 per capita); by contrast, neighbouring Berlin’s GDP per capita (EUR 42 300) ranks sixth (Eurostat, 2019[2]). Brandenburg exports are valued at EUR 13.3 billion, which represents 1% of Germany’s total exports (Statistisches Bundesamt, 2019[4]).

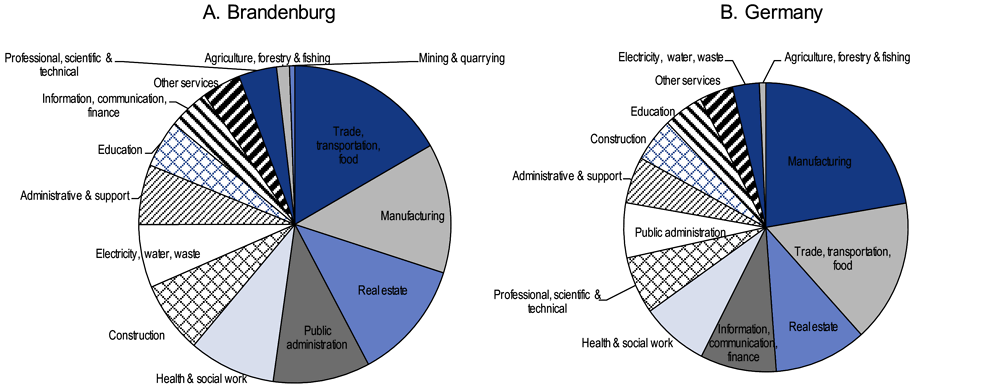

From 2010 to 2019, Brandenburg’s GDP increased by almost 20% in real terms, driven to a large extent (as in the rest of Germany) by growth in business services. Real estate services, wholesale trade, transportation, accommodation and food are the most important service industries in Brandenburg (amounting to 18% of GDP). Information and communication technology, financial services, and professional, scientific and technical services make a relatively small contribution to Brandenburg’s economy – 8% combined compared to 15% for the rest of Germany (Figure 2.2). Similarly, the manufacturing sector in Brandenburg (13%) has played a smaller role than in the rest of Germany (22%). However, its contribution has been increasing; manufacturing contributed 14% of real growth in Brandenburg’s GDP over the last decade.

Figure 2.2. Contribution to gross domestic product, by industry, 2018

Source: Statistisches Bundesamt (2021[5]), VGR der Länder (Entstehungsrechnung) – Bruttowertschöpfung https://www.destatis.de/DE/Themen/Wirtschaft/Volkswirtschaftliche-Gesamtrechnungen-Inlandsprodukt/_inhalt.htmlStatistisches (accessed on 15 April 2021).

Brandenburg’s public services sector plays a major role in the state’s economy. Public administration, education, and the health and social services sectors account for one-quarter of GDP and have been growing significantly in recent years. However, agriculture and mining, traditionally important sectors, have been declining (accounting for less than 2% of Brandenburg’s GDP). This decline is partly attributable to the gradual phase-out of the coal mining industry in Germany (Staatskanzlei Brandenburg, 2020[6]).

Brandenburg has nearly 100 000 companies. The great majority are small and medium-sized enterprises (SMEs), with nearly 90% having fewer than ten employees (Statistisches Bundesamt, 2020[7]).

Some SMEs have been successful beyond the national border. Ortrander Eisenhütte, for example, manufactures iron-carbon cast alloys for the automotive industry and for stove and furnace construction; Flamm Sys Com in Hennigsdorf supplies the automotive industry; and Reuther STC in Fürstenwalde produces steel components for wind turbines (MWAE, n.d.[8]).

Large international firms operating in Brandenburg include the Riva-Stahl Group, Mercedes-Benz and Rolls Royce Germany. Other international companies such as Amazon and Zalando have recently settled in Brandenburg (MWAE, n.d.[8]) and Tesla’s Gigafactory is scheduled to start operation soon. This leads to hopes for economic development and stronger regional integration (see section on economic opportunities).

Spillover effects from the start-up scene in Berlin and exposure to entrepreneurial activities in the state higher education sector (see section on economic opportunities) might help more SMEs increase their capacity to grow and compete in global markets.

Economic imbalances

Different regions of Brandenburg make a varying contribution to GDP, based on the structure of their economies. The region of Havelland-Fläming accounts for one-third of Brandenburg’s GDP; this region includes the capital city of Potsdam, which is the most populated region and a hub for government, services and business. The Lausitz region is home to the coal mining sector and Cottbus, the second largest city of Brandenburg; this region contributes around one-quarter of Brandenburg’s GDP, but its importance has been declining due to the phasing out (and upcoming closure) of coal-pit mines. Today 8 600 people are employed in coal mining and power plants in the region. LEAG, the second largest German electricity producer, with a workforce of 7 800, will be affected by the closure of coal production. Economic sectors that benefit from mining – and thus affected by the closure – comprise construction, business services and manufacturing (MWAE, 2020[9]).

Brandenburg’s infrastructure is underdeveloped, but solutions are looming

The transport infrastructure of Brandenburg is closely interrelated with, and geared towards, the capital city of Berlin. Daily, more than 200 000 people commute from Brandenburg to Berlin and more than 100 000 in the other direction (Berlin-Brandenburg, n.d.[10]).These numbers are expected to rise in the next decade (VBB, 2020[11]). Since many commute by car, a number of roads are congested, particularly in the areas surrounding Berlin. While railway and public transportation links with Berlin are well developed, Brandenburg’s rural and remote regions lack proper transport infrastructure. Among challenges facing Brandenburg are the absence of a railway link with Poland, and shortages of canals that carry freight.

The Mobility Strategy Brandenburg 2030 recognises these challenges and has set three goals to address them: i) intensifying co-operation on mobility policy with Berlin and with neighbouring Polish provinces by extending cross-border rail links; ii) addressing mobility challenges in rural areas; and iii) adapting, maintaining and developing infrastructure according to need, e.g. by setting priorities for planning and investment funds according to the road network plan (MIL, 2017[12]).

The worldwide trend towards digitalisation will undoubtedly accelerate, not least due to the COVID-19 pandemic, and Brandenburg’s infrastructure will need to keep pace. The availability of broadband in Brandenburg is not as good as the overall German average but better than in the other East German states (Table 2.1): Brandenburg’s households have reasonable take-up of Internet connection (rates of up to 50 Mb/sec) when compared with other East German states but are below the German average. However, the share of households with an Internet connection of up to 100, 200, 400 or 1 000 megabits per second (mbps) is the lowest in Germany (BMDV, 2021[13]).

Table 2.1. Broadband access in the new Länder (in percentage of households), 2020

|

Federal state |

Up to 50 mbps |

Up to 100 mbps |

Up to 200 mbps |

Up to 400 mbps |

Up to 1 000 mbps |

|---|---|---|---|---|---|

|

Brandenburg |

89.0 |

71.6 |

56.3 |

36.9 |

22.1 |

|

Mecklenburg-Vorpommern |

77.8 |

71.1 |

63.5 |

51.9 |

43.2 |

|

Saxony |

87.3 |

79.0 |

66.1 |

52.8 |

42.5 |

|

Saxony-Anhalt |

82.9 |

73.7 |

57.3 |

31.8 |

12.0 |

|

Thuringia |

89.2 |

78.1 |

61.3 |

41.1 |

25.7 |

|

Germany |

93.3 |

85.7 |

77.4 |

67.9 |

55.9 |

Source: BMDV (2021[13]), Aktuelle Breitbandverfügbarkeit in Deutschland (Stand Mitte 2021) [Current broadband availability in Germany (as of mid-2021)], Bundesministerium für Digitales und Verkehr, https://www.bmvi.de/SharedDocs/DE/Publikationen/DG/breitband-verfuegbarkeit-mitte-2021.pdf?__blob=publicationFile.

While availability of broadband increased in the first half of 2020, growth was low in Brandenburg compared with the rest of Germany. Only 83% of households report using the Internet at least sometimes, a much smaller share than Berlin (89%) and the German average but still higher than the other East German states. The same applies to the use of Internet for mobile services (Initiative 21, 2021[14]; Gefak, 2019[15]).

As with transport infrastructure, there are regional variations for broadband within Brandenburg. In particular, the quality of connection in peripheral and rural areas is low. Brandenburg needs to tackle this challenge to attract more young people and companies that cannot find development sites in the Berlin-Brandenburg metropolitan area.

Economic opportunities

Intensified efforts to diversify the economy towards cleaner and more knowledge-intensive industries

The state has increased its efforts to promote innovation, digitalisation and entrepreneurship to ensure transition towards cleaner and more advanced industries. Through several strategies, developed solely or jointly with Berlin, Brandenburg aims to enhance capacity for research, development and innovation in technology (Box 2.1).

However, the research and development (R&D) and innovation sector in Brandenburg remains underdeveloped in comparison with other German regions. The state’s gross expenditure on R&D was 1.8% in 2019, about half of the German average (Eurostat, 2021[16]). The share of regional business expenditure on R&D amounts to only 36% of the total R&D spend (compared to the national average of 69%) (Eurostat, 2021[16]). Most public expenditure on research comes from the government, which contributes to 44% of the total.

Box 2.1. Brandenburg’s policy for innovation and sustainability

In June 2011, Brandenburg and Berlin developed a joint innovation strategy, updated in 2020, (innoBB 2025) that aims to develop clusters in both states.

The regional innovation strategy sets out the framework for five common clusters of specialisation for the Berlin-Brandenburg region: i) health care industries; ii) energy technology; iii) transport, mobility and logistics; iv) information and communications technology (ICT), media and creative industries; and v) photonics. Brandenburg itself has four state-specific clusters: i) food; ii) materials and chemicals; iii) metal; and iv) tourism. Four objectives are common to all these domains of specialisation: digitalisation, development of testbeds, labour for the Fourth Industrial Revolution (Industry 4.0) and the development of start-ups.

In addition, the state government updated the Regional Strategy for Sustainability in 2019. The strategy sets out 33 goals and includes several measures with a focus on the 17 Sustainable Development Goals of the United Nations. Many measures refer directly to innovation in environment-related technologies and environment-friendly consumer behaviour.

Sources: Berlin-Brandenburg (2019[17]), innoBB 2025: Joint Innovation Strategy of the States of Berlin and Brandenburg, Land Brandenburg and Land Berlin, https://innobb.de/sites/default/files/2020-01/innobb_2025_-_joint_innovation_strategy_of_the_states_of_berlin_and_ brandenburg_0.pdf; MLUL (2019[18]) Nachhaltigkeitsstrategie für das Land Brandenburg: Fortschreibung 2019, https://mluk.brandenburg.de/sixcms/media.php/9/Fortschreibung-Nachhaltigkeitsstrategie-BB.pdf.

In 2020, Brandenburg submitted 294 patents to the German Patent and Trademark Office (DPMA) and Patent Co-operation Treaty applications, 0.7% of Germany’s share. The number of patent applications to the DPMA per 100 000 inhabitants (12) was less than one-quarter of the German average1 (51) (DPMA, 2021[19]).

Many of the patents filed by Brandenburg have a focus on environment-related technologies related to engines, pumps and turbines; electrical machinery, apparatus and energy; and transport (DPMA, 2021[19]). Brandenburg is a pioneer in renewable energies with the capital region, jointly with Lausitz, offering test fields for the production and use of hydrogen (Cluster Energy Technology, n.d.[20]). In addition, the state actively supports innovation in biopolymers, plastics recycling and lightweight design (WFBB, n.d.[21]).

The state government has also recognised constraints facing SMEs. It has focused on creating better conditions for growth and innovation in this sector by helping them digitalise production and business processes. To this end, the Innovationszentrum Moderne Industrie Brandenburg – (Innovation Centre of Modern Industry – IMI) was set up in 2015. Located at the Brandenburg Technology University Cottbus-Senftenberg, the IMI helps SMEs handle challenges in automation technology, digital factories and Industry 4.0. The project is financed with support from the European Regional Development Fund.

Spillover effects from the start-up scene in Berlin and strong entrepreneurial activities at Brandenburg’s higher education institutions

Enterprise birth rates (i.e. the number of start-up businesses per 10 000 persons aged 18-64) have decreased for years in Germany. The same is true in Brandenburg, where the rate decreased by about 20% between 2011 and 2020.2 However, over the same period, Brandenburg improved its ranking among the German federal states. While Brandenburg ranked 15th among German states in enterprise birth rates in 2014-16, it is now behind only Berlin (KFW, 2020[22]). This development can be traced to the fact that Brandenburg surrounds Berlin where the enterprise birth rate is notably above average. Brandenburg obviously benefits from this proximity since many young entrepreneurs tend to relocate their homes and their business headquarters to Berlin’s commuter belt where rents are lower.

Brandenburg has a high uptake of the EXIST Gründerstipendium (EGS) funding, which supports students, graduates and scientists in starting a business. Nearly two-thirds of projects funded by EGS in Brandenburg between 2007 and 2019 led to the formation of businesses (Kulicke, 2017[23]; Lübbers, T. et al., 2021[24]).

Bottom-up initiatives in Brandenburg are creating and promoting innovative places for working and living

In recent years, Brandenburg has created a number of locations for innovators and creatives to test new modes of working and living. These locations can be particularly interesting for the young and qualified workforce. Examples include: i) the SAP Innovation Centre in Potsdam, established in 2011; ii) a newly planned digital centre next to the former RAW hall in Potsdam; iii) Coconat in Klein-Glien in the District Potsdam-Mittelmark; and iv) Thinkfarm Co-working Space in Eberswalde.

Several other networks aim to help make locations more attractive. Silicon Sanssouci, for example, is a network that focuses on strengthening Potsdam as a location for IT and media. For its part, Havel Valley, an initiative in the city of Brandenburg an der Havel, aims to establish a sustainable local start-up culture.

Federal funding for the structural change in the Lausitz region offers a unique opportunity to foster innovation and economic development in the region

With the planned closure of coal production in the Lausitz region by 2038, the Federal Republic of Germany is providing significant funds to support structural change. This offers a unique opportunity for the Lausitz region to transition towards a greener and more modern economy and to provide better prospects for its population to thrive in the region. According to Strukturstärkungsgesetz (federal Structural Consolidation Law) for German coal-mining regions, Brandenburg is entitled to about EUR 10 billion, which is about 25% of the overall federal structural funds provided under this law (Staatskanzlei Brandenburg, 2020[6]). The state government is developing a strategic agenda to guide use of the funds (Box 2.2). All the initiatives aim to strengthen Lausitz as a science and research centre, as well as to increase the attractiveness of the region, especially for young people.

The development of a “Model Region for Health Lausitz” is based around the “Innovation-Centre University Medicine Cottbus” (IUC). The IUC will comprise a university medical faculty (to be established at Brandenburg Technical University Cottbus-Senftenberg) and a next-generation hospital linked to a digitally supported network of health care providers in the region. The IUC will focus its research on health systems and digitalisation in health care.

Through the IUC, physicians and researchers will be able to develop, test and evaluate innovative health care models under real life conditions. This is expected to lead to best practice models. The goal is to create a Germany-wide hub for research on health systems and their further development. The IUC will offer master’s level programmes, such as medical data science, advanced nursing practice and health systems science. The Carl-Thiem-Hospital Cottbus will be expanded into a highly digitalised university hospital and form the anchor of the regionwide digital network.

In the future, about 200 new students per year are expected to be trained in medicine, plus additional students enrolled in the master´s level programmes, and around 1 600 new jobs will be created for research and teaching, including 80 professorships. The total cost of the IUC is estimated at EUR 1.9 billion over the period to 2038. It is expected to secure skilled labour for the region, educate professionals for the medicine of tomorrow, strengthen Lausitz as a science and research location and ensure comprehensive, high-quality medical and nursing care.

Box 2.2. Brandenburg’s strategic goals for structural development in Lausitz

Brandenburg has adopted strategic goals for structural development in Lausitz in the “Lausitz Programme 2038”. The programme contains the following fields of action and priorities:

Strengthen regional competitiveness by establishing and upgrading science and research institutions, developing innovation, attracting businesses, and strengthening innovative capacity and digitalisation.

Educate and train a skilled labour force to continue diversifying the regional economy and to develop and future-proof existing capacities and business models.

Strengthen and develop quality of life and diversity in the region, including urban development, social infrastructure, culture, arts and sports.

Ministerium für Wissenschaft, Forschung und Kultur – MWFK (Ministry of Science, Research and Culture) has formulated its own Lausitz strategy, in keeping with those priorities. The MWFK strategy contains four pillars: i) expanding higher education by introducing programmes that complement the profiles of HEIs; ii) developing a “Model Region for Health Lausitz”; iii) strengthening applied research particularly in co-operation with non-academic institutions; and iv) upgrading knowledge and technology transfer. Several new institutes will be established and financed by the federal government, including:

Fraunhofer Institute for geothermal energy and energy infrastructure in Brandenburg, Saxony and North Rhine -Westphalia

DLR (Deutsches Zentrum für Luft- und Raumfahrt, the German Space Agency) Institute for CO2-low industrial processes in Cottbus (Brandenburg) and in Zittau/Görlitz (Saxony) with a focus on the steel, petrochemistry and cement industries, as well as high-temperature heat pumps for heat storage stations

DLR Institute for alternative drive systems for research on aircraft engines of the next generation

Lausitz Centre for artificial intelligence at the BTU Cottbus-Senftenberg

Model Region for Health Lausitz, including university medical faculty and a next-generation hospital.

Sources: MWFK (2019[25]), Umsetzungsplan für die Lausitz-Strategie des Ministeriums für Wissenschaft, Forschung und Kultur, Ministerium für Wissenschaft, Forschung und Kultur; Staatskanzlei Brandenburg (2020[6]), Das Lausitzprogramm 2038, Prozesspapier zum Aufbau von Entscheidungs- und Begleitstrukturen im Transformationsprozess, Lausitz-Beauftragter des Ministerpräsidenten.

Interviewed stakeholders acknowledged the great potential of the Lausitz fund for revitalising the local economy and strengthening the regional research infrastructure. However, they also raised concerns about transparency of the planning process and long-term costs. Specifically, they pointed to the expected graduate numbers of medical professionals and the potential difficulty in retaining them in Brandenburg, which is one of the IUC’s expected outcomes. A structured dialogue with all state HEIs (and not only direct beneficiaries of federal funding) seems needed to consider any pressing concerns raised throughout the process.

The region around the Berlin-Brandenburg airport is likely to thrive despite the COVID-19-related slowdown

Before the COVID-19 pandemic, the region around the Berlin-Brandenburg airport prospered, which led to the creation of businesses and jobs. In 2013-20, 870 settlement and expansion projects creating more than 39 000 jobs were implemented in the region (Airport Region Berlin Brandenburg, 2020[26]). Studies and forecasts compiled before the pandemic projected the creation of up to 70 000 jobs in conjunction with the airport (Unternehmensverbände Berlin-Brandenburg, 2020[27]). Furthermore, demand for industrial and commercial sites for development in the airport region was expected to exceed availability (Agiplan, 2019[28]).

Disregarding the uncertainties resulting from the pandemic, regional stakeholders argue the airport will foster development in the region in the long term. While the airport has been the major driving factor in economic growth, the region’s proximity to urban centres, skills supply and a network of businesses also play an important role. Some bottlenecks are, however, still to be addressed. These comprise the low number of long-distance flights; inadequate railway and motorway connections to the airport and its surrounding region; and the lack of available industrial and commercial development space (Gefak, 2019[15]).

The establishment of the Tesla factory in Brandenburg creates hope for economic development and stronger regional integration

In the spring of 2020, the US automobile maker, Tesla, began building its new Gigafactory in Grünheide, around 30 km east of the Berlin airport. The factory will have an area of 300 hectares. Tesla is planning to produce up to 500 000 electric cars per year beginning in early 2022. It also wants to produce batteries for electric cars in another factory to be built in Grünheide. The investment volume amounts to more than one billion EUR. At full capacity, the company intends to employ up to 12 000 people (Land Brandenburg, 2021[29]). In the final expansion phase, 40 000 employees could work at the factory. The demand for professionals will be high – from engineering and information technology, manufacturing and human resources to legal and government affairs, supply chain, and service and energy installation (Meyer, 2020[30]; Tesla, 2021[31]).

To meet the high demand for a skilled workforce at the factory, Tesla has worked with the Employment Agency Berlin-Brandenburg, particularly the agency’s branch in Frankfurt (Oder) (Land Brandenburg, 2021[29]).

The creation of the Tesla factory will likely lead to positive outcomes: highly skilled jobs; spillover effects such as the establishment of other factories, suppliers and service providers; and co‑operation with the higher education/research sector. Indeed, Microvast, a US-American producer of battery systems, has already established a new factory in Ludwigsfelde to serve as the company’s new European headquarters. Others are likely to follow suit (Industrie- und Handelskammer Berlin, n.d.[32]).

Though acknowledging the great potential of Tesla’s factory for stimulating economic development, social partners have expressed some concerns. SMEs, in particular, are worried about intensified competition for skilled labour. In addition, trade unions want to enforce good working conditions, as well as the right to employee participation in decision making at the Tesla factory. Furthermore, Brandenburg’s HEIs and research institutions need to stand out from the multitude of German and European HEIs approaching Tesla for co‑operation in research and education.

To assess the possible impacts of the Tesla factory on Brandenburg, it is helpful to look at the development around the first Tesla Gigafactory built in Reno, Nevada in 2014. Today, Tesla and Panasonic employ about 7 000 people there. Since 2014, Reno has become an attractive location, particularly for tech companies and young, highly skilled workers. Every fourth new resident in Reno is 20-29 years old – a much higher share of this age group than the American average of 14% (Heuer, 2020[33]).

The location of Tesla’s new factory in Brandenburg raises a number of questions with regard to infrastructure: Can motorways handle increased demand for passenger and goods transport? Can the railway infrastructure absorb the increasing numbers of commuters? The train station in Grünheide is small – can it be upgraded and, if so, how will that be financed?

In March 2021, the Berlin-Brandenburg Joint Spatial Planning Department published a concept for development of the area that surrounds Tesla’s Gigafactory (MIL; Stadtentwicklung Berlin; GL Berlin-Brandenburg, 2021[34]).

Proximity to the capital city of Berlin

Many of Brandenburg’s challenges and opportunities are linked to its proximity to Berlin or have a direct impact on Berlin’s economic development and vice versa. This implies the need for strong co‑operation and co‑ordination of efforts in various domains. In 2020, the governments of both states agreed to advance a broad joint agenda, the “Strategic General Framework for the Capital Region”. This agreement aims to formulate guiding principles to develop the capital region and create a coherent framework for ongoing and future initiatives. It identified eight fields of action: i) settlement development and residential market; ii) mobility; iii) economy, skilled workforce, energy and climate protection; iv) volunteering, media and democracy promotion; v) conservation of nature and quality of life; vi) digital transformation; vii) science, research, culture and education; viii) cosmopolitanism, international networking and co-operation with Poland (Berlin-Brandenburg, n.d.[35]).

Examples of joint initiatives already underway include the project i2030 for the improvement of the railway infrastructure, the innovation strategy and health care provision (Berlin-Brandenburg, n.d.[10]). The two states also have a joint employment agency, Bundesagentur für Arbeit, Berlin-Brandenburg, which addresses their distinct economic and labour market challenges in an integrated approach.

The labour market

The labour market in Brandenburg has been steadily providing jobs

The state’s employment rate of 78.1% in 2019 is impressive when considered alongside the labour market participation rate of 80.7%. One factor driving the employment rate is high female participation (Eurostat, 2018[36]). Part-time employment and the gender difference in the part-time employment rate are among the lowest in Germany. Relatively high levels of educational attainment among women, egalitarian social values and supportive child-care policies all play a role in high labour market participation among women in Brandenburg (and other Eastern German states).

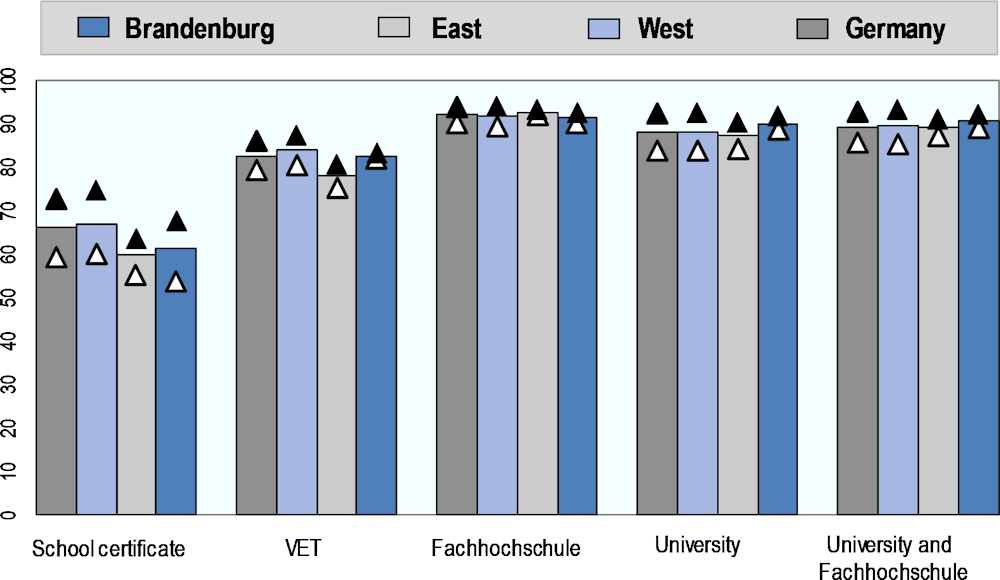

The employment prospects of educated people in Brandenburg are especially positive. In Brandenburg, around 90% of university degree holders, 92% of university of applied sciences (Fachhochschule) degree holders and 83% of vocational education and training (VET) degree holders aged 18-64 are employed (Figure 2.3). These employment rates are close to the averages for the whole of Germany, even slightly above for university degree holders. Furthermore, in Brandenburg, gender differences in employment among VET, Fachhochschule and university degree holders are smaller than the German average.

Brandenburg’s unemployment rate has also fallen since 2005. By 2019, it was close (3.4%) to the national average (3.2%) (Eurostat, 2018[36]). The rate is the lowest among the former East German states and has been consistently lower than Berlin’s since 2004.

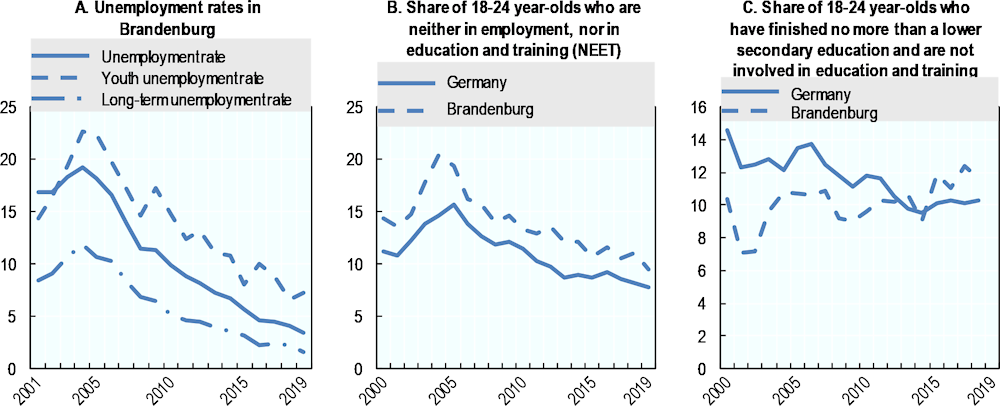

Unemployment in Brandenburg is driven largely by youth unemployment and less so by long-term unemployment (Figure 2.4). As throughout the OECD, youth unemployment is higher than overall unemployment. It is also more volatile as the youth labour market is especially sensitive to macro-economic conditions, leading to spikes in youth unemployment during economic downturns (OECD, 2021[37]). In 2019, Brandenburg’s youth unemployment rate of 7.3% compares with the German average of 5.8%. In addition, Brandenburg has the fifth-highest rate of youth who were neither in employment nor in education and training (NEET) (with 9.5%, compared to the German average of 7.7%) (OECD, 2021[38]). The rate of early leavers from education and training increased between 2001 and 2018. Brandenburg’s rate of early leavers is the fifth-highest of the German states (11.6% vs. 10.3% in Germany on average). In 2000, Brandenburg’s rate was only 10.4% versus 14.6% in Germany on average (OECD, 2021[38]).

Figure 2.3. Employment rate, by educational attainment, 2018

Note: White triangles indicate employment rates of women and black triangles indicate those of men.

Source: OECD calculations based on data for Brandenburg from Statistik Berlin-Brandenburg and from the German Socio-economic Panel for East, West Germany and Germany.

Figure 2.4. Unemployment indicators, 2000-19

Source: OECD (2021[38]), Regional Statistics, https://www.oecd.org/regional/regional-statistics/ (accessed on 15 March 2021).

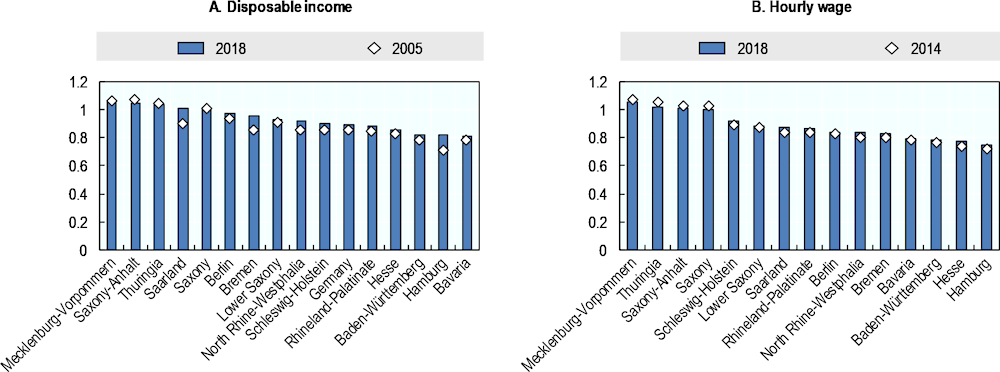

The living standards of Brandenburg’s population have been improving

Better employment outcomes have contributed to higher levels of disposable income in Brandenburg and the other East German states, approaching the German average (Figure 2.5). In 2005, average disposable income in Brandenburg was 86% of the national average; by 2018, the figure was 89% and disposable income in Brandenburg was very close to that of Berlin. This trend has been linked largely to increasing hourly wages relative to other states. The share of Brandenburg’s population at risk of poverty or social exclusion (17%) has been decreasing as well, and was below the German average (17.4%) in 2019.

Figure 2.5. Disposable income per capita and hourly wage of Brandenburg compared to other German states

Note: A value higher than one means that Brandenburg has a higher disposable income or hourly wage than the respective state. An increasing value means that Brandenburg’s disposable income or hourly wage is getting closer to the value of the respective state.

Source: (Statistisches Bundesamt, 2021[39]), VGR der Länder: Verfügbares Einkommen der privaten Haushalte, https://www.destatis.de/DE/Themen/Wirtschaft/Volkswirtschaftliche-Gesamtrechnungen-Inlandsprodukt/Glossar/verfuegbares-einkommen-private-hh.html (accessed on 15 April 2021); (Statistisches Bundesamt, 2021[40]), Verdienste und Verdiensunterschiede, https://www.destatis.de/DE/Themen/Arbeit/Verdienste/Verdienste-Verdienstunterschiede/_inhalt.html (accessed on 23 March 2021).

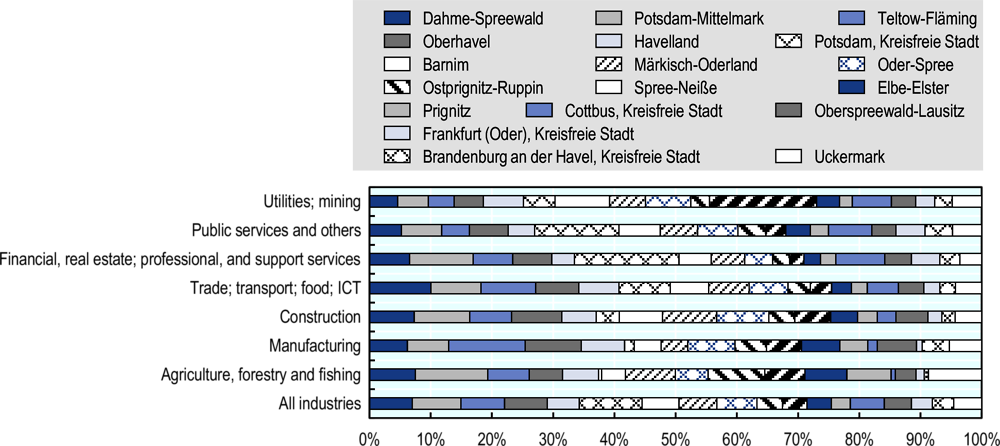

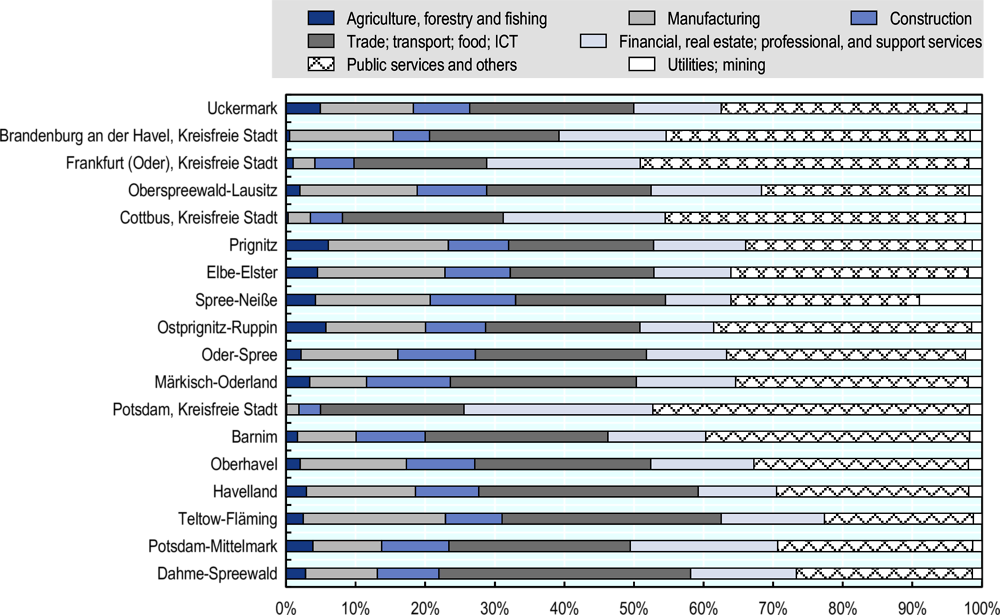

Internal differences due to the varying industrial structures of the local economies

Macro-level indicators mask important internal variations. The relatively high unemployment rate in certain regions of Brandenburg reflects structural changes. All areas except the Havelland-Fläming region (which includes the state capital city of Potsdam and includes one-third of Brandenburg’s labour force), have had above-average unemployment rates. In particular, Uckermark has had unemployment rates 1.7 times higher than the Brandenburg average and almost twice the German average.

The remaining three regions, Lausitz-Spreewald, Oderland-Spree and Prignitz-Oberhavel, and also the city of Brandenburg an der Havel (Havelland), have all experienced continuous above-average unemployment rates. Counties close to the greater Berlin area, and those home to Brandenburg’s regional growth centres and their industrial structures have above-average employment prospects (Figure 2.7) (VBB, 2020[11]). These counties are particularly strong in the business services sector (Figure 2.6).

Figure 2.6. Counties’ shares in Brandenburg’s employment, by industry in 2018

Note: Countries are ordered by their 2018 unemployment rate in increasing order. The legend should be read in horizontal order from left to right.

Source: Eurostat (2018[36]), Regional Statistics (database), https://ec.europa.eu/eurostat/web/regions/data/database (accessed on 15 March 2021).

Figure 2.7. Employment in each county, by industry in 2018

Note: Counties are ordered by their 2018 unemployment rate in decreasing order.

Source: Eurostat (2018[36]), Regional Statistics (database), https://ec.europa.eu/eurostat/web/regions/data/database (accessed on 15 March 2021).

Skills challenges

The demand for a skilled workforce in Brandenburg is expected to continue increasing; skills shortages are evident across the whole economy

Public authorities in Brandenburg can use projections of labour market needs produced by various public agencies to inform workforce planning. The Institut für Arbeitsmarkt und Berufsforschung der Bundesagentur für Arbeit – IAB (Institute for Employment Research) produces projections of jobs by industry, which are updated at regular intervals. The Amt für Statistik Berlin-Brandenburg (Statistics Office Berlin-Brandenburg) produces projections of demography and labour force development but not regularly. The various chambers of commerce survey their members and results are used to model the demand side of Brandenburg Skill Monitoring, which runs forecasts for Brandenburg and publishes its results through the online Skills Portal. The portal appears useful since it visualises the demand and supply side of skill levels in various industries and regions in the state and can easily identify pressing shortages. However, forecasts are run on available data and recent trends. Thus, they do not account well for structural change and other disruptions caused, for instance, by digitalisation.

MWAE (2020[9]) forecasts that Brandenburg’s manufacturing sector will decline to 17% of the workforce in 2040, compared to the German average of 20%. In addition, information and communications technology (ICT) in Brandenburg is expected to employ only 1.8% of the workforce in 2040, compared with 1.6% today. This will place the state in the second-to-last position among German states. These trends are concerns for Brandenburg’s economic development agenda. A lower ICT penetration translates into a lower capacity to capitalise on the benefits of digitalisation. By contrast, public and private services are expected to continue adding more jobs.

The Skills Portal projects that only 16% of jobs will require an advanced qualification (academic and professional) by 2030, but that 61% will require a mid-level post-secondary/tertiary degree. These projections are likely to be overly conservative for several reasons. First, they are based on the minimum educational requirements for entry into an occupation. Second, they assume educational requirements will not change over time. Third, they may not adequately capture emerging jobs in rapidly evolving fields and the opportunities related to factors such as structural change in the Lausitz, the advancing innovation agenda and the settlement of Tesla in the Berlin-Brandenburg region.

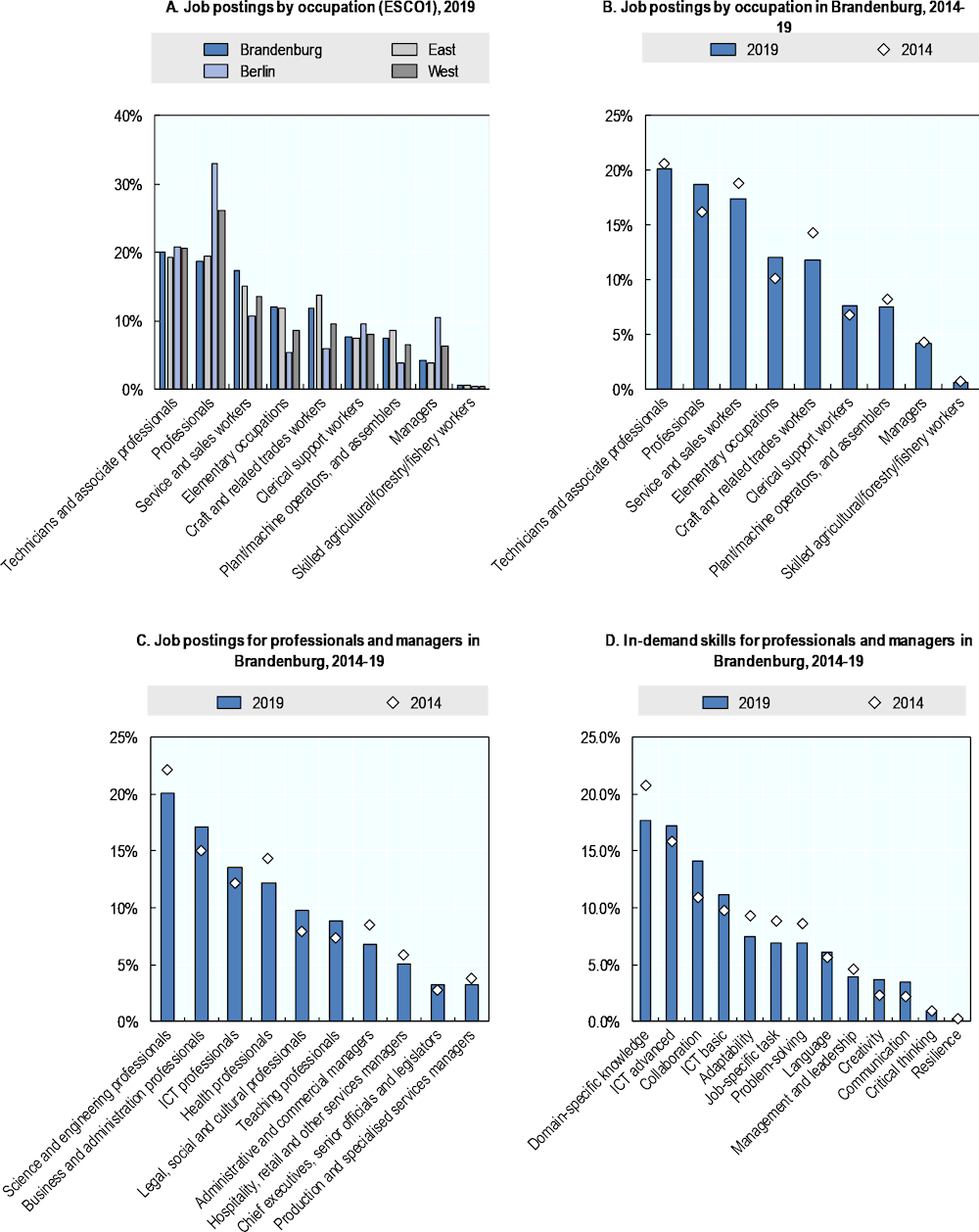

Burning Glass Technologies3 report that almost one-quarter of Brandenburg job advertisements call for an advanced qualification (professionals and managers), and this trend has been increasing (Figure 2.8, Panels A and B). The highest demand for these qualification levels in 2019 was for science and engineering, business and administration, and ICT professionals. Since 2014, demand for the latter two has particularly increased (Figure 2.8, Panel C). Burning Glass Technologies data show the top jobs at highly skilled occupations were for engineers and software developers, system analysts, social workers and counsellors, specialist medical and nursing practitioners, and also business development, marketing and accounting specialists. Employers increasingly look for ICT skills across all occupations and they value transversal skills, such as collaboration. Although domain-specific expertise remains key, its importance is declining (Figure 2.8, Panel D).

However, many of the top ten in-demand jobs pre-COVID-19 did not necessarily require a post-secondary qualification. For example, the highest identified demand was for sales assistants, labourers, freight handlers and cleaners, none of which specified a post-secondary requirement. In contrast, 32% of occupations on the list required a post-secondary qualification (nurses, life technicians and administrative assistants) and another 22% a higher education degree (engineering, social work professionals and system analysts).

Figure 2.8. Job postings by occupation in Brandenburg and Germany

Unmet demand for highly skilled professionals is already evident in many sectors of the Brandenburg economy. The Skills Portal reports shortages of graduates with an advanced degree in many occupations. Such shortages are likely to increase. A shortage of around 9 200 engineering, science and advanced technical jobs was reported in 2019; this shortfall is forecast to exceed 10 000 by 2030. In addition, Brandenburg’s economy was short of 13 700 business professionals and managers, a shortage expected to increase to 19 000 by 2030. Demand for ICT skills also exceeds supply. Finally, growing shortages are forecast for the medical, nursing and teaching professions.

These skills shortages create both economic and social risks across the state. On the economic side, stakeholders report shortages of qualified workers as the number one challenge hampering growth in Brandenburg. The social impact of skills shortages can also be acute, especially around health care. In 2018, the state had only 373 physicians per 100 000 inhabitants compared to the German average of 431 (OECD, 2021[38]). There are also disparities within the state. Regions with the highest number of day-care and school places are those directly surrounding Berlin. Meanwhile, regions on the outskirts of Brandenburg have less than half of approved day-care places and schools (Statistik Berlin-Brandenburg, 2021[41]).

At the same time, the supply of new higher education degrees to the labour market has recently stagnated or declined

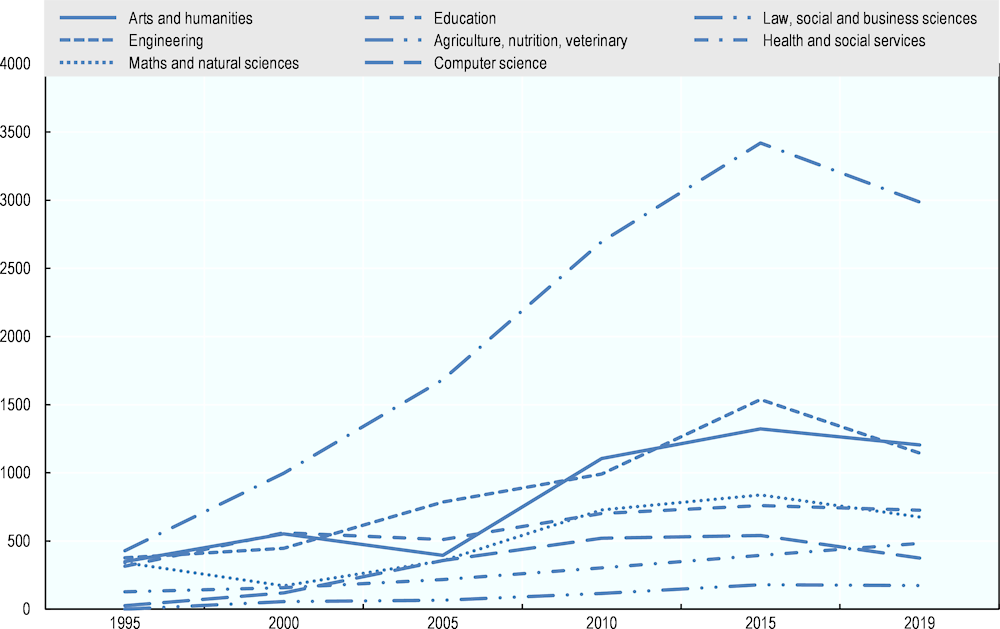

Figure 2.9. Number of degrees awarded by Brandenburg’s HEIs in 1995-2019, by field of study

Source: Statistisches Budesamt (2021[42]), Hochschulstatistik, https://www.destatis.de/DE/Themen/Gesellschaft-Umwelt/Bildung-Forschung-Kultur/Hochschulen/Methoden/Erlaeuterungen/hochschulen.html (accessed on 15 March 2021).

While the number of people graduating from Brandenburg’s HEIs increased steadily in 2005-15, graduation numbers in most degrees have been stagnating over the last five years (Figure 2.9). Graduate numbers in 2019 fell almost to their levels of a decade ago, with human medicine and health care as the only growing field. Despite significant drops in law, social and business sciences, and engineering, these fields remain the strongest in Brandenburg, along with arts and humanities. In 2019, 36% of graduate students in Brandenburg acquired a degree in law, social and business sciences, 14% in engineering and 14.6% in the arts and humanities.

Skills shortages are largely driven by demographic change: Brandenburg is one of the fastest ageing and least populated federal states in Germany

Ensuring enough skilled workers to meet current and future economic needs is an ongoing concern in Brandenburg. As noted, the population of Brandenburg is expected to decline by about 3% by 2040. The share of people older than 65 is forecast to reach 30% by 2030, up from 25% now. This increase is due in part to the expected reduction in the population aged 25-65, which is expected to fall by 11% between 2019 and 2030; that age cohort will drop, as a share of the whole from 54% to 48% in the same period.

The outward migration of people in the 25-65 age group will see a shrinking working age population supporting more older people. It will also see the departure of mid-career, highly skilled people. This will make it difficult for the labour market to capitalise on opportunities (Statistik Berlin-Brandenburg, 2021[1]; MWAE, 2020[9]).

But skill shortages are also due to declining attainment of higher education in Brandenburg, particularly among youth and women…

Advances in digital technology, climate change commitments and demographic change are transforming Brandenburg’s economy, and, in turn, its skills needs. New economic sectors and jobs are emerging, while others, particularly the coal and related “brown” sectors, are shrinking. Even within existing occupations, the tasks performed by workers, and the skills needed to carry them out, are changing significantly. However, the trend in higher education attainment may pose a challenge to Brandenburg’s economic transformation.

The educational attainment of Brandenburg’s adult population has remained relatively stable over the last two decades. More than 90% of 25-64 year-olds hold at least an upper secondary qualification. In 2019, 29% of Brandenburg’s adult population held a tertiary qualification (ISCED levels 5-8), close to the German average of 30%. However, this represents a decline over the last 20 years (Eurostat, 2018[36]). In 2000, 33% of women in Brandenburg held a tertiary degree compared to only 19% in Germany. In 2019, the figures showed a (slight) decline to 30% for women in Brandenburg but a significant increase (27%) in Germany overall (Eurostat, 2018[36]). At the same time, Brandenburg’s men have had lower higher education attainment rates than the German average since 2009, yet have also had an increased and above-average attainment of upper secondary and non-tertiary post-secondary education, including VET (Eurostat, 2018[36]).

Brandenburg’s youth is not keeping pace with educational attainment. In 2019, 12% of 25‑34 year-olds had not attained even a secondary education certificate compared to only 6% two decades before. The young men of Brandenburg had a non-attainment rate of 15% compared with the German average of 14%. However, 20% of young people hold a higher education degree, a rate that has remained stable over the last two decades but remains well below the German average (34% in 2019). Young women’s attainment rates have dropped below the German average since 2009 (Eurostat, 2018[36]).

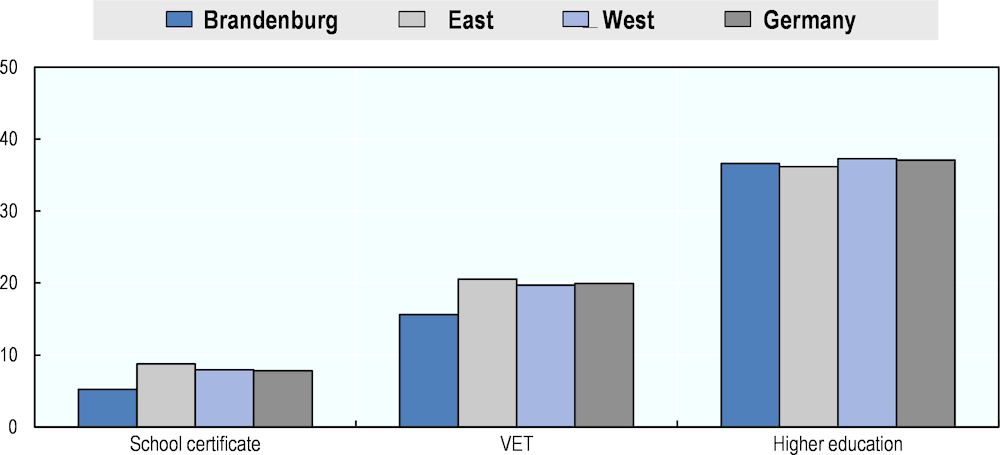

…and due to low participation in lifelong learning

Rates of participation in continuing education programmes among mature learners are also low. This is a cause for concern for the future labour market performance of Brandenburg’s workers, with marked differences by level of educational attainment. In Brandenburg, as well as in Germany on average, 37% of higher education degree holders take part in formal or informal further learning (Figure 2.10. ). This share is much smaller among VET qualification holders and individuals with only a school certificate. For those groups, the participation rate in further learning is lower in Brandenburg than in Germany. The low rate of uptake of continuing education is a cause for concern. The pursuit of knowledge and skills throughout one’s entire life and career is key to success in today’s modern knowledge-driven economy. It helps individuals adapt to rapidly changing demands for skills and to increasing labour market flexibility. Moreover, in Brandenburg, the pool of young workers with up-to-date skills is continuously shrinking. Consequently, the upskilling and reskilling of the labour force appears essential for responding to emerging skills.

Figure 2.10. Participation in lifelong learning by educational level, 2014-18

Note: Participation in formal or informal further training in the year prior to the interview. Latest available information of respondents with an interview between 2014 and 2018.

Source: OECD calculations based on data from the German Socio-economic Panel.

The structural change in Brandenburg due to an ageing society and sectoral change processes emerges as a central and future-oriented task for the state. The most important goal for the state’s research and education policy would be to generate long-term growth, innovation and a skilled labour force. To achieve this, Brandenburg needs a nationally and internationally attractive higher education system. The state higher education policy is thus a decisive and important factor in shaping the future of Brandenburg.

Unleashing opportunities for economic development via higher education

Opportunities for Brandenburg are, in most cases, underpinned by research, innovation and skills. Exchange between the world of higher education and the world of work, including SMEs and the public sector, is important for Brandenburg’s economic transformation agenda. To grow and to connect their companies to international markets, SMEs and entrepreneurs largely rely on local labour markets; they need the education system to create a pool of highly skilled professionals. However, if the local economies are stuck in a low-skill trap and cannot put the skills of the available labour force to good use, SMEs and entrepreneurs will be unable to exploit growth and development opportunities.

Therefore, Brandenburg’s higher education system, as the engine of skills development and research, will play an important part in helping the state realise those opportunities. A high-performing higher education sector could play a more active role in the state’s economic development across many areas:

Proximity to Berlin: The governments of Brandenburg and Berlin have a shared development agenda, the “Strategic general framework for the capital region”. This agreement, which aims to create a coherent framework for initiatives, includes skills development, and research and innovation among its focus areas. That creates opportunities for Brandenburg’s HEIs. For example, they can enhance co‑operation with the large research and innovation sector in the capital – with Berlin’s HEIs and, especially, the independent research institutes located there. By sharing expertise and research infrastructure, they can work together to attract international research talent. Berlin’s high rate of start-up enterprises provides opportunities for Brandenburg’s state government to attract those start-ups to the state. The provision of services (in training, research and innovation) to those new enterprises by the higher education sector is an important part of that offer.

Federal funding for structural change: The federal government will invest substantially from structural funds to support the phase-out of the coal industry around Lausitz. The state government’s agenda to guide use of the funds focuses on strengthening Lausitz as a science and research centre. Building on the short-term transition funding, the state could harness the expertise of the state’s entire higher education sector (not simply the HEIs in the Lausitz region) to create centres of excellence in higher education and research in the region.

New ways of working and learning: The COVID-19 pandemic led to new ways of working, enabling businesses (and HEIs) to operate more flexibly. People had less need to be physically present in their places of work (and study). This, in turn, enables HEIs to offer hybrid teaching, making it easier for out-of-state students to study at Brandenburg HEIs. Meanwhile, employees of Berlin-based firms who are residents in Brandenburg will likely no longer have to commute daily (and vice versa). However, the quality of broadband Internet connection would need to be enhanced for HEIs to fully benefit from this trend.

Tesla development: The scale of the Tesla investment in its new plant in Grünheide is expected to have great benefits for the economy, labour market and infrastructure in that area of the state. As a company at the leading edge of a new technology, Tesla will likely draw associated companies to the region. That could create more demand for advanced engineering, analytical and research services, and other services to which HEIs are well placed to contribute. As German HEIs position themselves as preferred suppliers to Tesla and its associates, Brandenburg’s HEIs could differentiate themselves from other German HEIs in their relationships with Tesla. Specifically, they could present themselves as a higher education system (supported by state government ministries, rather than as individual disconnected institutions) that can provide bundled services in research and talent development.

Federal government’s strategy of encouraging lifelong learning: Continuing education and training (CET)/lifelong learning is essential to the progress of firms throughout the world. It can allow firms to respond to advanced technologies that are changing the nature of work and increasing the complexity of work processes and required skills. CET/lifelong learning also enables people to stay longer in the workforce. This is vital as life expectancy grows, as the health and mobility of older people improves and as the traditional working age population shrinks as a proportion of the whole.

References

[28] Agiplan (2019), Gewerbeflächenkonzept im Umfeld des Flughafens Berlin Brandenburg ‘Willy Brandt‘ (BER), https://www.airport-region.de/fileadmin/redaktion/Praesentationen_GeFlaeko/01_Flashlights_agiplan.pdf (accessed on 15 April 2021).

[26] Airport Region Berlin Brandenburg (2020), Steinbach: “Airport region boom growing ever stronger”, 12.04.2020, https://www.airport-region.com/news/business/flughafenregion-boomt-immer-staerker/.

[17] Berlin-Brandenburg (2019), innoBB 2025: Joint Innovation Strategy of the States of Berlin and Brandenburg, Land Brandenburg and Land Berlin, https://innobb.de/sites/default/files/2020-01/innobb_2025_-_joint_innovation_strategy_of_the_states_of_berlin_and_brandenburg_0.pdf.

[10] Berlin-Brandenburg (n.d.), Strategischer Gesamtrahmen: Mobilität, https://www.berlin-brandenburg.de/zusammenarbeit/strategischer-gesamtrahmen/mobilitaet/ (accessed on 5 February 2022).

[35] Berlin-Brandenburg (n.d.), Überlegungen zu einem Strategischen Gesamtrahmen, https://www.berlin-brandenburg.de/zusammenarbeit/strategischer-gesamtrahmen/.

[13] BMDV (2021), Aktuelle Breitbandverfügbarkeit in Deutschland (Stand Mitte 2021), Bundesministerium für Digitales und Verkehr, https://www.bmvi.de/SharedDocs/DE/Publikationen/DG/breitband-verfuegbarkeit-mitte-2021.pdf?__blob=publicationFile.

[43] Burning Glass Technologies (n.d.), Burning Glass Technologies - Home, https://www.burning-glass.com/ (accessed on 5 October 2021).

[20] Cluster Energy Technology (n.d.), Hydrogen | Energy of the future, https://energietechnik-bb.de/en/topics/hydrogen-energy-future (accessed on 5 January 2022).

[19] DPMA (2021), Aktuelle Statistiken: Patente, Deutsches Patent- und Markenamt, https://www.dpma.de/english/our_office/publications/statistics/patents/index.html.

[16] Eurostat (2021), GERD by sector of performance and NUTS 2 regions, https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=rd_e_gerdreg (accessed on 30 October 2021).

[2] Eurostat (2019), Gross domestic product (GDP) at current market prices by NUTS 3 regions [NAMA_10R_3GDP__custom_832187], https://appsso.eurostat.ec.europa.eu/nui/show.do?dataset=nama_10r_3gdp&lang=en (accessed on 18 April 2021).

[36] Eurostat (2018), Regional Statistics, https://ec.europa.eu/eurostat/web/regions/data/database (accessed on 2 November 2021).

[15] Gefak (2019), Unternehmensbefragung 2019, Wirtschaftsförderung Brandenburg GmbH.

[33] Heuer, S. (2020), Verteilungskrämpfe: Was passiert wenn eine Tesla-Gigafactory in der Provinz landed? Was Brandenburg bevorstehen könnte, lässt sich in Reno im US-Staat Nevada schon besichtigen, https://www.brandeins.de/magazine/brand-eins-wirtschaftsmagazin/2020/wie-wollen-wir-leben/verteilungskraempfe.

[32] Industrie- und Handelskammern, B. (ed.) (n.d.), Willkommen in Berlin, https://www.berliner-wirtschaft.de/schwerpunkt/wirtschaftsfaktor-ber/ (accessed on 14 April 2021).

[14] Initiative 21 (2021), D21 Digital Index 2020/2021: Jährliches Lagebild zur Digitalen Gesellschaft, https://initiatived21.de/app/uploads/2021/02/d21-digital-index-2020_2021.pdf.

[22] KFW (2020), KfW-Gründungsmonitor 2020: Gründungstätigkeit in Deutschland 2019: erster Anstieg seit 5 Jahren – 2020 im Schatten der CoronaPandemie, KfW Bankengruppe, https://www.kfw.de/PDF/Download-Center/Konzernthemen/Research/PDF-Dokumente-Gr%C3%BCndungsmonitor/KfW-Gruendungsmonitor-2020.pdf.

[23] Kulicke (2017), EXIST-Gründerstipendium – Gründungsquote und Entwicklung der neuen Unternehmen: – Gründungsvorhaben mit Förderbeginn September 2007 bis Dezember 2014 (nach alter Richtlinie), Fraunhofer Institut für System und Innovationsforschung, Karlsruhe, https://www.isi.fraunhofer.de/content/dam/isi/dokumente/ccp/exist/EXIST-Gruenderstipendium-Gruendungsquote-und-Entwicklung-der-jungen-Unternehmen_2017.pdf.

[29] Land Brandenburg (2021), Frequently asked questions about the settlement of the Tesla factory, https://www.brandenburg.de/cms/detail.php/bb1.c.658136.de (accessed on 12 March 2021).

[24] Lübbers, T. et al. (2021), Evaluationen der Fördermaßnahmen EXIST-Gründerstipendium und EXIST-Forschungstransfer des Bundesministeriums für Wirtschaft und Energie im Förderzeitraum 2014 bis 2018, Ramboll Management Consulting GmbH.

[30] Meyer, S. (2020), Tesla in Grünheide. Das sind die neuen Jobs in Elon Musks Gigafactory, Lausitzer Rundschau, https://www.lr-online.de/nachrichten/brandenburg/tesla-in-gruenheide-das-sind-die-neuen-jobs-in-elon-musks-gigafactory-43845735.html.

[12] MIL (2017), Mobilitätsstrategie Brandenburg 2030, Ministerium für Infrastruktur und Landesplanung des Landes Brandenburg, https://mil.brandenburg.de/sixcms/media.php/9/Mobilit%C3%A4tsstrategie_bf.pdf.

[34] MIL; Stadtentwicklung Berlin; GL Berlin-Brandenburg (2021), Landesplanerisches Konzept: Entwicklung des Umfeldes der Tesla-Gigafactory Berlin-Brandenburg in Grünheide (Mark), Ministerium für Infrastruktur und Landesplanung des Landes Brandenburg, Senatsverwaltung für Stadtentwicklung und Wohnen Berlin, Gemeinsame Landesplanungsabteilung Berlin-Brandenburg, https://mil.brandenburg.de/sixcms/media.php/9/Landesplanerisches%20Konzept%20zur%20Entwicklung%20des%20Gigafactory-Umfeldes.pdf.

[18] MLUL (2019), Nachhaltigkeitsstrategie für das Land Brandenburg: Fortschreibung 2019, Ministerium für Ländliche Entwicklung, Umwelt und Landwirtschaft des Landes Brandenburg, https://mluk.brandenburg.de/sixcms/media.php/9/Fortschreibung-Nachhaltigkeitsstrategie-BB.pdf.

[9] MWAE (2020), Entwicklung von Betrieben und Beschäftigung in Brandenburg: Ergebnisse der vierundzwanzigsten Welle des Betriebspanels Brandenburg, Ministerium für Wirtschaft, Arbeit und Energie des Landes Brandenburg, https://www.brandenburg.de/media/bb1.a.3814.de/IAB-Betriebspanel_Brandenburg_2019.pdf.

[8] MWAE (n.d.), Industriestandort Brandenburg, Ministerium für Wirtschaft, Arbeit und Energie des Landes Brandenburg, https://mwae.brandenburg.de/de/industriestandort-brandenburg/bb1.c.478812.de (accessed on 13 April 2021).

[25] MWFK (2019), Umsetzungsplan für die Lausitz-Strategie des Ministeriums für Wissenschaft, Forschung und Kultur, Ministerium für Wissenschaft, Forschung und Kultur des Landes Brandenburg, https://mwfk.brandenburg.de/sixcms/media.php/9/Umsetzungsplan.pdf.

[37] OECD (2021), Employment rate by age group, OECD Publishing, https://data.oecd.org/unemp/unemployment-rate-by-age-group.htm#indicator-chart.

[38] OECD (2021), Regional Statistics, https://www.oecd.org/regional/regional-statistics/ (accessed on 15 March 2021).

[3] OECD (2019), Regional Economy: GVA by industry, large TL2 and small TL3 regions, https://stats.oecd.org/index.aspx?queryid=67059 (accessed on 4 November 2021).

[6] Staatskanzlei Brandenburg (2020), Das Lausitzprogramm 2038. Prozesspapier zum Aufbau von Entscheidungs- und Begleitstrukturen im Transformationsprozess, Lausitz-Beauftragter des Ministerpräsidenten, https://lausitz-brandenburg.de/wp-content/uploads/2020/09/Lausitzprogramm-2038_20200914.pdf.

[1] Statistik Berlin-Brandenburg (2021), Bevölkerungsvorausberechnung für das Land Brandenburg 2020 bis 2030, Statistik Berlin-Brandenburg, https://download.statistik-berlin-brandenburg.de/2d433971f996bdf4/ec5cead7539c/SB_A01-08_2021_BB.pdf (accessed on 2 November 2021).

[41] Statistik Berlin-Brandenburg (2021), Daten und Karten, https://www.statistik-berlin-brandenburg.de/ (accessed on 5 November 2021).

[42] Statistisches Bundesamt (2021), Hochschulstatistik, https://www.destatis.de/DE/Themen/Gesellschaft-Umwelt/Bildung-Forschung-Kultur/Hochschulen/Methoden/Erlaeuterungen/hochschulen.html (accessed on 15 March 2021).

[40] Statistisches Bundesamt (2021), Verdienste und Verdienstunterschiede, https://www.destatis.de/DE/Themen/Arbeit/Verdienste/Verdienste-Verdienstunterschiede/_inhalt.html (accessed on 23 March 2021).

[5] Statistisches Bundesamt (2021), VGR der Länder (Entstehungsrechnung) – Bruttowertschöpfung, https://www.destatis.de/DE/Themen/Wirtschaft/Volkswirtschaftliche-Gesamtrechnungen-Inlandsprodukt/_inhalt.htmlStatistisches (accessed on 15 April 2021).

[39] Statistisches Bundesamt (2021), VGR der Länder: Verfügbares Einkommen der privaten Haushalte, https://www.destatis.de/DE/Themen/Wirtschaft/Volkswirtschaftliche-Gesamtrechnungen-Inlandsprodukt/Glossar/verfuegbares-einkommen-private-hh.html (accessed on 15 April 2021).

[7] Statistisches Bundesamt (2020), Unternehmen (Unternehmensregister-System): Bundesländer, Jahre, Wirtschaftszweige (Abschnitte), Beschäftigtengrößenklassen, https://www.destatis.de/DE/Themen/Branchen-Unternehmen/Unternehmen/Unternehmensregister/_inhalt.html (accessed on 8 April 2021).

[4] Statistisches Bundesamt (2019), Aus- und Einfuhr (Außenhandel): Bundesländer, Jahre, https://www-genesis.destatis.de/genesis/online?operation=abruftabelleBearbeiten&levelindex=1&levelid=1644961108993&auswahloperation=abruftabelleAuspraegungAuswaehlen&auswahlverzeichnis=ordnungsstruktur&auswahlziel=werteabruf&code=51000-0030&auswahltext=&w (accessed on 29 October 2021).

[31] Tesla (2021), Jobs Portal, https://www.tesla.com/de_DE/careers/search/?country=DE (accessed on 6 May 2021).

[27] Unternehmensverbände Berlin-Brandenburg (2020), Spät, aber oho: Der Flughafen BER nimmt endlich den Betrieb auf. Schon heute sorgt er für einen Boom in der Region, https://www.uvb-online.de/de/spaet-aber-oho (accessed on 15 April 2021).

[11] VBB (2020), Mobilität in der wachsenden Hauptstadtregion – Chancen und Herausforderungen, Verkehrsverbund Berlin-Brandenburg, https://www.i2030.de/wp-content/uploads/2020/02/i2030-Metropolbroschuere.pdf (accessed on 4 February 2021).

[21] WFBB (n.d.), Brandenburg – Sustainable Today, Wirtschaftsförderung Brandenburg GmbH, https://innovatives-brandenburg.de/en/sustainable-today.

Notes

← 1. Note that patenting rates tend to be higher in areas with high population density, in large cities and cities where large, high-performing research establishments are headquartered. Compared with other federal states of Germany, Brandenburg lags on some of those criteria.

← 2. The Brandenburg enterprise birth rate increased between 2016 and 2019, but the COVID-19 pandemic caused a decline on all administrative levels from 2019 to 2020.

← 3. Burning Glass Technologies (n.d.[43]) pools data of job announcements from all online job portals.