This chapter describes the main challenges that Ireland faces in the transition from a linear to a circular economy. Key governance gaps relate to a sectoral approach towards the circular economy, mainly focused on waste management rather than resources management, regulatory gaps, limited use of economic instruments to push behavioural change and a lack of awareness, capacity and information on the circular economy among key stakeholders.

The Circular Economy in Ireland

4. Governance challenges to the transition to a circular economy

Abstract

Governance gaps in Ireland

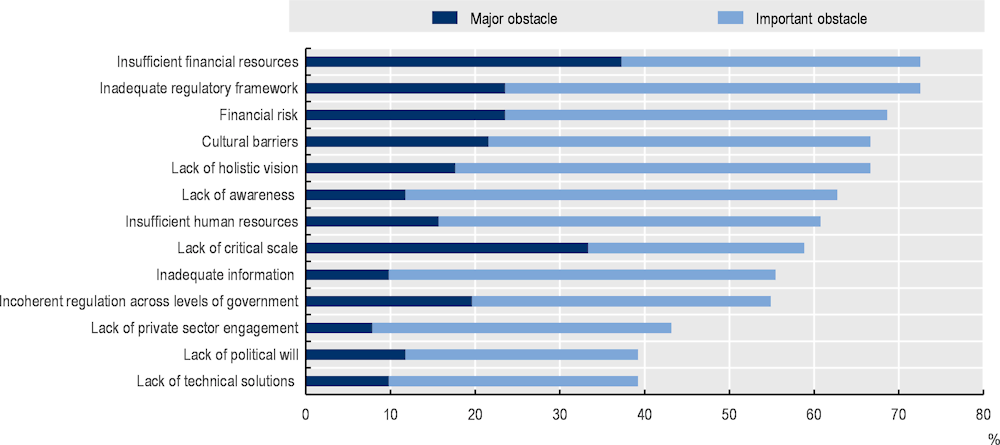

Building on the OECD framework “Mind the gaps, bridge the gaps” (Charbit and Michalun, 2009[1]), which was first applied in depth to identify gaps towards effective multi-level water governance (OECD, 2011[2]), the OECD synthesis report on the circular economy in cities and regions finds that major obstacles for the transition towards a circular economy relate to funding, regulation, policy, awareness and capacity (OECD, 2020[3]). Insufficient financial resources, inadequate regulatory frameworks, financial risks, cultural barriers and the lack of a holistic vision are among the major obstacles identified by more than one-third of the 51 cities and regions surveyed (Figure 4.1).

Figure 4.1. Main obstacles to the circular economy in 51w surveyed cities and regions

Source: OECD (2020[3]), The Circular Economy in Cities and Regions: Synthesis Report, https://doi.org/10.1787/10ac6ae4-en.

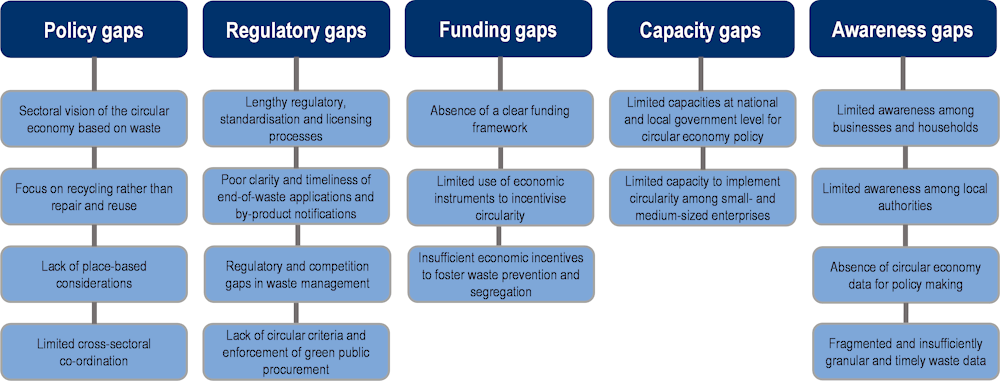

This section presents the main governance obstacles in the transition to a circular economy in Ireland (Figure 4.2), as a result of the interviews of over 80 stakeholders during OECD virtual missions to Ireland (11-13 March, 11-14 October 2020 and 6-9 July 2021), as well as outputs from a policy seminar gathering over 50 stakeholders of the circular economy in Ireland (19 October 2021) and desk-based research.

Figure 4.2. Governance gaps for a circular economy in Ireland

Policy gaps

In Ireland, as in many other countries, the circular economy is seen as a waste management policy. As such, the Waste Action Plan for a Circular Economy (WAPCE) is Ireland’s new waste management policy for the 2020-25 period. Ireland’s circular economy policy needs to overcome three main obstacles:

A sectoral view of the circular economy, mainly based on waste. Irish circular economy policy should move from waste to resources management and take a more holistic approach that sees the circular economy as a cross-sectoral driver of economic growth, job creation, social well-being and environmental protection. Many sectoral policies across the Department of the Environment, Climate and Communications (DECC) and other departments mention the circular economy but it is often viewed as a waste management and resource efficiency tool rather than a new economic approach to providing goods and services. Moreover, the suggestion of the recently published Whole of Government Circular Economy Strategy (hereafter “the Strategy”) to invite all members of the current Waste Advisory Group to join the new Circular Economy Advisory Group may hinder the development of a holistic vision for circular economy policy in Ireland. New stakeholders relevant to the circular economy should be invited to join the advisory group, such as knowledge institutions and universities, designers, trade associations and local authority representatives.

A focus on recycling and recovery rather than preventing, repairing and reusing. This is exemplified by the fact that increasing Ireland’s circularity rate (which essentially measures recycling and recovery) to the EU average by 2030 is the only measurable and time-bound objective of the Strategy. This holds two sets of limitations: first, it does not consider with the same level of ambition the impacts of upstream activities in relation to the circular economy, consisting of preventing, repairing and reusing; second, it does not properly take into account that the country’s extractive activities are mostly based on biomass or non-metallic minerals, which are less suited to recycling than materials such as metallic minerals.

Limited place-based considerations. By the end of 2022, Ireland will have moved from Regional Waste Management Plans for each of the three waste management regions (Regional Waste Management Planning Offices, RWMPOs) to a national Waste Action Plan for a Circular Economy 2022-2028 setting the same targets for all three regions. Up to 2020, the regional plans already lacked a place-based approach as they set almost the same targets for each region. The national plan will officialise this homogeneity of targets across regions. On the one hand, this is seen as a way of enhancing the sector’s capability of responding to the policy challenges set out in the WAPCE and an opportunity to enable active collaboration and action with key stakeholders in support of a circular economy. On the other, it may continue to fail to account for local specificities (e.g. differences in income, population density and access to services such as bring banks) and retain a focus on waste, missing out on opportunities to move from waste to resources management in line with a holistic circular economy approach.

The Strategy is a crucial opportunity for the DECC to extend ownership of circular economy policies to other relevant government departments. To date, there has been limited co‑ordination between environmental departments and agencies with economic counterparts (e.g. Department of Enterprise, Trade and Employment) to factor the value-added of the circular transition into Ireland’s economic recovery and growth agenda. The lack of co‑ordination is also visible in relevant sectors of the circular economy: for instance, there are few links between the DECC and the Environmental Protection Agency’s (EPA) work on downstream food waste and work on upstream food loss led by the Department for Agriculture, Food and the Marine (DAFM) and supported by Teagasc and the Department of Housing, Local Government and Heritage (DHLGH). Moreover, the Strategy still lacks a proper framework to measure progress since just one of five objectives is measurable and time-bound, and there is no timeline for the implementation of the objectives aside from a few examples (e.g. the implementation of a national circular economy online platform by the end of 2022).

Regulatory gaps

While awaiting the new Circular Economy Bill expected by mid-2022, there is no legislative framework for the circular economy in Ireland. Until the bill comes into force to provide a crucial foundation to support the transition towards a circular economy in Ireland, regulatory gaps notably relate to end-of-waste and by‑product processes, extended producer responsibility (EPR), the licensing of waste treatment facilities, waste management and green public procurement (GPP).

Regulation enabling timely and reliable decisions on end-of-waste is essential to reduce waste, but many stakeholders observe that the end-of-waste process is lengthy and unreliable in Ireland. End-of-waste criteria specify when certain material considered as waste ceases to be considered as waste and becomes a product or material. National end-of-waste criteria have not yet been defined in Ireland and, at the European Union (EU) level, they are defined for three waste streams only.1 As such, entities (e.g. businesses) wishing to reuse material considered as waste (e.g. metal from a demolition site) from a waste stream outside of the ones covered by EU legislation must apply to the EPA for a decision on end-of-waste status. These decisions are often lengthy and can deter businesses from applying. The WAPCE sets out several actions to streamline the process for priority waste streams, particularly in the construction and demolition sector. These actions keep a focus on individual applications, rather than developing national end-of-waste applications for identified priority waste streams. However, the last measure of the WAPCE on end-of-waste recognises the importance of more strategic action and commits to establishing a working group that will develop national end-of-waste applications.

Similarly, by-product notification processes lack clarity and timeliness for many Irish businesses. By‑product notification processes enable certain substances to be considered as a by-product, i.e. a secondary product made as the result of a manufacturing process, rather than a waste, allowing its reuse. The lack of clarity and timeliness in by-product notification processes is recognised by the WAPCE, which outlines actions to address it. Under the EU Waste Framework Directive, construction and demolition site managers must notify where waste and by-products go but the absence of procedure to notify direct reuse creates a legislative grey area. This ultimately represents an obstacle to material reuse and waste prevention on construction and demolition sites.

In general, lengthy regulatory, licensing and standardisation processes hamper circular practices and investment. This is notably the case of the aforementioned regulatory processes, the licensing of new waste treatment facilities and the creation of standards for secondary or recycled materials. The licensing process for additional waste treatment facilities can be very lengthy, disincentivising private investment. The Circular Economy Bill is expected to streamline the decision-making process for licensing new facilities while ensuring that adequate environmental safeguards are in place (DECC, 2020[4]). The WAPCE identifies permit exemptions as having the potential to alleviate pressure on existing facilities. It envisages waiving the requirement for a permit for facilities that can dispose of their own non-hazardous waste and recover waste. Furthermore, according to businesses developing circular construction materials, the National Standards Association of Ireland’s accreditation process for secondary and recycled materials can be long enough to discourage the development and use of circular construction materials.

Extended producer responsibility (EPR) schemes can be extended to new waste streams and improved to consider reuse and repair, beyond recycling. The inclusion of four new waste streams (tobacco products, wet wipes, balloons and fishing gear containing plastic) in July 2021 in Ireland, in line with the EU Single-Use Plastics Directive, is a step in the right direction. Existing EPR schemes also show room for improvement. For instance, although the refurbishment and sale of waste electrical and electronic equipment (WEEE) is the only activity formally registered under “preparation for reuse”, WEEE taken back by EPR schemes does not get treated for reuse as there are no companies registered to do so in Ireland. There are also issues with the collection method (collectors lack direct access to WEEE from the general public) and a lack of trust among consumers regarding the wiping of their data on personal devices (Coughlan and Fitzpatrick, 2017[5]).

Waste management in Ireland has undergone significant consolidation over the past 20 years but the current waste governance framework presents regulatory and competition gaps. The Waste Advisory Group of the WAPCE found that the current market structure offered relatively low control for regulators in terms of achieving guaranteed performance levels, contrary to other Irish utilities. Ireland’s side by side waste collection, which requires households to contract with waste management companies to benefit from a kerbside collection service, does not automatically lead to competition: in fact, the market is highly concentrated in many local authorities (CCPC, 2018[6]). Up to 25% of Irish households do not have a choice of operator and 20 operators serve 90% of households with a collection service.

Finally, GPP does not include circular and bioeconomy criteria and is not systematically implemented. In fact, the price is often the dominating criterion for awarding procurement contracts (in addition to the construction period in the built environment sector). The authorities awarding the contracts tend to only consider upfront capital costs rather than the lifecycle costs (e.g. operation, maintenance and end-of-life). This can limit the uptake of circular and sustainable solutions with higher capital costs but lower operation, maintenance and end-of-life costs. The government’s commitment to implement GPP in all tenders using public funds by 2023 is a step in the right direction but circular and green procurement requires a broader shift away from tendering processes that prioritise the lowest price towards one giving greater importance to life cycle costs, environmental impacts and resource efficiency. This may also favour the participation of small- and medium-sized enterprises (SMEs) in tenders, as Irish SMEs are often unable to compete with larger or multinational corporations for procurement contracts favouring the lowest capital investment cost, as highlighted by Irish procurement stakeholders.

Funding gaps

While several government-funded or government-supported funding initiatives for the circular economy exist, this approach is piecemeal and lacks a framework that also considers private funding and investment in the circular economy. Additionally, government incentives and supports for private investment in the circular economy are not outlined in the Strategy. Mobilising private investment is essential, as circular business projects do not currently attract equity and venture capital in Ireland, but Irish investors often perceive investing in the circular economy as risky. For instance, the Halo Business Angel Network, which is responsible for the development of business angel activity and angel syndicates in Ireland, has identified a very limited appetite for circular economy investments due to insufficient or uncertain return on investment and a lack of prior experience.

The Irish government applies limited economic instruments to incentivise circularity and resource efficiency beyond a carbon tax and levies on plastic bags and landfill. The levies achieved their intended outcomes (see Chapter 2) but the revenue generated declined as a result of the shrinking tax base, accounting for just 0.5% of revenue from environmentally-related taxes in Ireland. Regulations envisaged under the Circular Economy Bill are set to introduce new levies on single-use cups (the “latte levy”) and on recovery operations at municipal solid wastes landfill, waste-to-energy and co-incineration plants, and the export of municipal solid waste (EUR 5 per tonne). Additional levies on virgin plastics, construction aggregates and fast fashion in the medium to long term should also be examined under the WAPCE. Although these levies will likely be successful in achieving their intended outcome, a more holistic approach that rewards ecodesign, repair, reuse, remanufacturing and recycling across the economy, and penalises the use of virgin materials in general, beyond specific materials such as plastic, is needed to shift from a linear to a circular economy in Ireland. Currently, virgin materials are often significantly cheaper and more readily available than secondary materials, creating a tilted playing field in favour of virgin materials.

Furthermore, there are insufficient economic incentives to unlock a behavioural shift among households and businesses towards waste prevention and more effective waste separation. The recent abolishment of flat fees for household waste collection2 and the move towards lift-based or weight-based charging, enabled by radio-frequency identification chips in all household bins, should incentivise waste prevention, correct waste separation and allow higher recycling rates. However, the effectiveness of an incentivised charging system depends on the prices charged by waste collection operators, as well as public authorities’ capacity to enforce continued collection and disposal, as hikes in collection charges can lead to increased illegal dumping. Implementing incentivised charging and enforcement of correct waste separation in the commercial sector is a significant low-hanging fruit to increase recycling rates in Ireland, as waste separation rates are much lower in the commercial than in the household sector. The Circular Economy Bill should effect incentivised charging for the commercial sector, as is the case for households.

Capacity gaps

There is strong willingness and momentum to transition towards a circular economy at the national government level. However, the DECC is still in the phase of building technical and human capacities and expertise on the circular economy, which is a relatively new concept in Irish policy making. Beyond the DECC, capacity gaps also exist among local authorities and businesses.

Local authorities play a crucial role in Ireland’s circular transition but the lack of local authority staff and capacity currently limits their role in the transition. Local authorities’ proximity to citizens and local businesses and knowledge of local context makes them both essential to ensure popular support for the transition and well placed to support and implement circular economy initiatives. Furthermore, local authorities have competencies in policy areas that are relevant for the circular economy, such as the built environment, land use and waste management. However, local authority staff working on waste and the circular economy currently spend most of their time on litter control and complaints, at the detriment of supporting the circular economy transition locally. More staff, knowledge and financial resources are needed to effect the circular transition from the bottom up in Ireland.

Capacity gaps among Irish SMEs hamper the adoption of circular practices and applications for funding. For instance, moving from simply recycling packaging to implementing a deposit and return system can be operationally challenging and costly. Moreover, while funding from research and innovation schemes is available (e.g. Green Enterprise Fund), small businesses lack the specific knowledge, skills, resources and time to apply to calls. The same gaps in knowledge, skills, resources and time also hamper SME participation in public procurement tenders, including GPP. In addition, the commercialisation of successful research demonstrations is limited due to capacity gaps in operationalising pilots, resulting in lost opportunities for the development of innovative circular solutions.

Awareness gaps

Despite efforts to close the awareness gap on the circular economy among businesses (e.g. establishment of CIRCULÉIRE, Ibec-led circular economy workshops for affiliated trade associations) farmers (e.g. Bioeconomy Ireland Week) and civil society (e.g. Rediscovery Centre, MyWaste.ie), there is still limited awareness and understanding of the costs and benefits of a circular economy. Just 51% of businesses understand what is meant by the circular economy (Ibec, 2019[7]). While built environment policies increasingly emphasise sustainability and resource efficiency, there is little dissemination of knowledge on circular practices within the construction sector. Farmers also lack awareness of the potential of circular economy and bioeconomy solutions to reduce costs and increase income, as well as the sustainability of their activities. Existing agricultural sustainability programmes focus on climate mitigation and environmental degradation, and do not address circularity beyond resource efficiency. Businesses, investors and others with an interest in circular business models and products have access to limited information on relevant funding schemes. There is no national platform providing information and guidance on international, EU and national funds; however, establishing a national online platform for the circular economy is a short-term priority of the Strategy. Regarding civil society, only one in four Irish adults understands what is meant by the circular economy (European Recycling Platform, 2021[8]).

Irish cities also lack local circular economy strategies, which could be a consequence of high centralisation and limited awareness of the potential benefits of the circular economy at the local government level. Some circular initiatives are in place at the city level, such as repair events with data collection to drive policy and manufacturing change in Limerick. Other cities such as Dublin have identified the circular economy as a sector for the city to support (Dublin City Council, 2020[9]). However, this sectoral view of the circular economy underscores the lack of awareness of the wide-ranging benefits of the circular economy in terms of value creation, employment, resilience and the environment at the local level. The awareness gap also stems from a data and information gap.

Data for circular economy policy (e.g. on reuse and repair) are currently limited to waste data in Ireland. Additionally, data on waste are fragmented and lack the disaggregation and timeliness needed to inform circular economy policy in a holistic, place-based and timely way. Data and insights on total waste are unavailable on EPA and Central Statistics Office (CSO) platforms.3 The EPA produces official waste statistics for reporting on compliance with EU targets and certain other datasets of national interest, including municipal waste (which accounts for one-sixth of total waste generated in Ireland), waste from selected sectors (such as construction and demolition) and waste streams required for European reporting including WEEE, packaging and end-of-life vehicles. This fragmentation hinders a holistic view of waste streams in Ireland. Regionally and locally disaggregated data on waste is scarce: the EPA’s National Waste Statistics have regionally disaggregated data only for household waste and data publications from RWMPOs are sparse, with the latest available data going back to 2014-15. Additionally, the current time lapse required for data publication hampers real-time, data-driven policy making. Furthermore, the reliability of new indicators is insufficient to support public authorities in taking informed decisions. This is notably the case of food waste, which does not currently have a harmonised measurement methodology across waste sources; the further upstream food waste occurs, the more data quality weakens. However, data quality on food waste is set to improve as part of a new EU requirement for member states to report food waste data. The EPA is working on a national food waste measurement protocol, which is in its final stages of development.

References

[6] CCPC (2018), The Operation of the Household Waste Collection Market, Competition and Consumer Protection Commission, Ireland, https://www.ccpc.ie/business/wp-content/uploads/sites/3/2018/10/The-Operation-of-the-Household-Waste-Collection-Market.pdf (accessed on 3 December 2021).

[1] Charbit, C. and M. Michalun (2009), “Mind the Gaps: Managing Mutual Dependence in Relations among Levels of Government”, OECD Working Papers on Public Governance, No. 14, OECD Publishing, Paris, https://dx.doi.org/10.1787/221253707200.

[5] Coughlan, D. and C. Fitzpatrick (2017), TriREUSE - Trialling the Preparation for Reuse of Consumer Laptops, Tablets and Smartphones, EPA Research Report No. 333, Environmental Protection Agency, https://www.epa.ie/publications/research/waste/Research_Report_333.pdf (accessed on 17 December 2021).

[10] DECC (2021), Waste Collection Charges, https://www.gov.ie/en/publication/a467a-waste-collection-charges/ (accessed on 18 December 2021).

[4] DECC (2020), Waste Action Plan for a Circular Economy, Department of the Environment, Climate and Communications, https://www.gov.ie/en/publication/4221c-waste-action-plan-for-a-circular-economy/ (accessed on 19 July 2021).

[9] Dublin City Council (2020), Dublin City Council Corporate Plan 2020-2024, https://www.dublincity.ie/sites/default/files/2020-06/dublin-city-council-corporate-plan-2020-2024.pdf (accessed on 22 November 2021).

[8] European Recycling Platform (2021), “ERP highlights increase in Electronic Recycling through pandemic”, https://erp-recycling.org/ie/news-and-events/2021/05/erp-highlights-increase-in-electronic-recycling-through-pandemic/ (accessed on 22 November 2021).

[7] Ibec (2019), “New Ibec survey shows just half of businesses understand the Circular Economy”, https://www.ibec.ie/connect-and-learn/media/2019/08/14/new-ibec-survey-shows-just-half-of-businesses-understand-the-circular-economy (accessed on 30 April 2021).

[3] OECD (2020), The Circular Economy in Cities and Regions: Synthesis Report, OECD Urban Studies, OECD Publishing, Paris, https://dx.doi.org/10.1787/10ac6ae4-en.

[2] OECD (2011), Water Governance in OECD Countries: A Multi-level Approach, OECD Studies on Water, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264119284-en.

Notes

← 1. These waste streams are: iron, steel and aluminium scrap; glass cullet; copper scrap.

← 2. In June 2017, the government phased out flat fees for household waste collection by ensuring that all household customers were moved to pricing plans that based charges on usage when renewing their annual waste collection contracts (DECC, 2021[10]). By October 2018, all household customers should have transitioned from flat fees.

← 3. The CSO is the competent authority for fulfilling Ireland’s obligations under the Waste Statistics Regulation, which it does in co‑operation with the EPA.