This chapter presents the general characteristics of the public procurement system in the Slovak Republic and the National Digital Agenda of the Slovak Republic. It also presents the state of play in ICT procurement in the Slovak Republic: assessment of the current trends in ICT procurement based on e-procurement database, interviews with stakeholders, analysis of the financial and legal framework. It identifies the main bottlenecks in the current policy and regulatory framework as well as in the practice. It also summarises the efforts of the Slovak government to achieve efficiency in ICT expenditure. Finally, it compares the Slovak practices with other similar purchasing segments in other EU and OECD countries and presents agile approaches in public procurement.

Towards Agile ICT Procurement in the Slovak Republic

2. Current practices of ICT public procurement in the Slovak Republic

Abstract

2.1. Economic background in the Slovak Republic

2.1.1. General overview

With an area of approximately 49,000 km2 and a population of 5.4 million, the Slovak Republic has been noted to be one of the smallest amongst the European states that has been doing notably relatively well in regards to the overall developments of their economy. In the early 2000s, especially after the country’s accession to the European Union and NATO in 2004, and Slovakia’s membership into the OECD in 2000, the country experienced strong developments in exports and access to new external markets. This access to new networks and international partnerships accelerated the country’s economic growth and pushed the country to achieve new economic heights (OECD, 2019[1]). The power of pro-EU and globalisation coalitions for advancing economic strength was particularly proven within the Slovak Republic when the country achieved its highest economic growth at 10.8% in 2007 (WorldBank, 2020[2]). The economy was however heavily affected by the 2008-2009 global financial crisis and the 2011-2012 Eurozone crisis, when the Slovak Republic slowed down economically for a few years (NORDEA, 2020[3]).

2.1.2. Consequences of the COVID-19 pandemic in the Slovak Republic

More recently, the economy in the Slovak Republic has been hit hard by the COVID-19 pandemic. In 2020, the Slovak economy is expected to face the strongest economic downturn in its history. The containment measures along with surrounding uncertainty has led to an abrupt decline in economic activity, particularly in areas dependent on social interactions such as tourism and hospitality. Massive disruption in the global value chain due to concerns over worker’s safety led to temporary shutdown of major automotive production companies. This measure, coupled with the decline in car sales in the EU, a main export for Slovakia, has led to significant impacts on the Slovak economy. (OECD, 2020[4]).

Slovakia’s GDP dropped by 6.16% in 20201. The economic downturn was milder than originally expected, due to a stronger third quarter, a more moderate decline in household consumption and a faster resumption of exports (especially thanks to car manufacturers)2. Previous forecast expected even 7.2% decline based on trends seen in the second quarter, mainly due to the shortfall of foreign demand and the effect of social distancing measures. Despite the government’s efforts to stabilise employment the severe economic downturn is expected to reduce the number of available jobs by 88 000 and increase the unemployment rate to nearly 9%. The fast and severe onset of economic effects of the outbreak are associated with considerable uncertainty. The COVID-19 outbreak is expected to uncover risks in public finances. In 2019, general government deficit reached 1.3% of GDP, considerably above the balanced budget objective. In 2020, deficit increased to 8.4% of GDP and the gross public debt may exceed the level of 60% GDP as a result of the shortfall of tax revenues and the discretionary measures aimed at stabilise the economy (Ministry of Finance of the Slovak Republic, 2020[5]).

Economic indicators from the fourth quarter indicate that the impact of the second wave of the pandemic in the fourth quarter was much more subdued than in the 2020 spring wave. In the first half of 2020, the economy contracted less severely than in many other European countries thanks to more resilient private consumption. Economic activity rebounded rapidly in the third quarter, driven by very strong export growth as car production quickly recovered. Monthly data on retail sales and credit card purchases also indicate a pick-up in private consumption. While the rise in unemployment has been limited, working hours are still far below the pre-crisis level. High-frequency data suggest weakening activity since the recent tightening of lock-down measures (OECD, 2020[4]).

To help minimise the economic fallout that would result from COVID-19, the Slovak Republic announced several fiscal packages to mitigate the consequences on the country’s economy. Announced discretionary fiscal measures amount to around 4.4% of GDP in 2020. The Government has also introduced a number of measures to help mitigate the depth and length of the recession. In particular, the introduction of a short-time work scheme has been effective in preventing a surge in unemployment. The Government has decided to extend this temporary scheme until the end of 2020. Several other temporary policies have also been extended. For instance, the deferral of loan payments for households and the benefit for families with members in need of care were prolonged until the end of the state of national emergency. The government plans to continue fiscal support in 2021. The budget for 2021 foresees extra spending on healthcare, education and transport infrastructure to strengthen the recovery (OECD, 2020[4]).

According to the forecast of the Ministry of Finance, the recovery will continue and GDP growth will reach 3.3% in 2021. This forecast is based on the assumption that the restrictions in connection with the pandemic will remain at the current level during the first quarter and will subsequently gradually ease to the level of September 2020 until the third quarter. The economy could be supported by investments from the EU's Recovery and Resilience Plan. The pandemic will also negatively affect the economies of Slovakia’s trading partners, and foreign demand will be weaker during most of the year. On the other hand, growth may be helped by the release of the billion-dollar COVID reserve to boost the economy and, in the second half of the year, the country will be able to start drawing on the EU's Recovery and Resilience Plan. Overall, the dynamics of the economy will be weaker, especially in the first quarter, so job creation will be postponed until the end of the year. The result will be a slight decrease in employment in 2021 by 0.2%. The economy will gain momentum from 2022, mainly thanks to EU funds. The update of the forecast envisages the drawing of funds under the EU Recovery and Resilience Plan to the amount of 5.8 billion euro. They will support the economy until 2026.3

2.1.3. The main characteristics of the Slovak economy before COVID-19

Before the COVID-19 outbreak, the Slovak Republic experienced sustained and steady GDP growth since its integration into the EU in 2004, except for the financial crisis of 2008-2009 and the Eurozone crisis of 2011-2012. In recent years, the Slovak economy has returned to growth, fuelled by the return of internal and European demand. After a growth rate of 4% in 2018, the country’s economic growth slowed down to 2.3% in 2019 amid a weaker demand from European partners. Domestic demand – fuelled by a strong wage increases and record-low unemployment – was the main growth driver. The unemployment rate fell to historical lows in 2019 (5.8%).

The Slovak economy is benefitting from strong links with the world economy, especially with EU Members, and has been catching up with higher-income countries. Overall, Slovakia has a strong financial system and offers a production platform for the European automotive and electronic industries (OECD, 2019[1]). Slovakia’s most important manufacturing and industrial sector is the automotive industry, accounting for 44% of the country’s total industrial production. Slovakia belongs to the 20 biggest car producers in the world, producing more than one million cars per year.

Yet, not everyone has benefitted from growth. Structural problems that Slovakia faces are regional disparities, poor infrastructure, and an ageing population. This acceleration in growth in less than a decade has also manifested in trends relating to public investment. Representing slightly more than 17% of GDP, public expenditures channelled through public procurement in the Slovak Republic are way above the OECD average. In 2017, the share of government expenditures spent via public procurement was 34,4% compared to the OECD average of 29,1% (OECD, 2019[6]).

2.1.4. The role of EU funds in economic growth

Approximately two-thirds of public investment in Slovakia is financed through the EU Structural and Investment Funds (ESI Funds)4. Over the period of 2014-2020, the Slovak Republic, through 9 national programmes, benefitted from ESIF funding of EUR 15.3 billion.5 This represents an average of EUR 2 830 per person from the EU budget over the period 2014-2020.

The primary purpose of these funds is to reduce economic, social, and territorial disparities across EU regions. Slovakia has the greatest regional economic and social disparities of any EU Member State, notably in the Eastern region. Disbursements to Slovakia under the ESI Funds have been massive (equivalent to a total of 15% of GDP during 2014–2020), with the bulk of this occurring at the end of the cycle, placing large stresses on the country’s Public Investment Management and Public Financial Management systems. (International Monetary Fund - IMF, 2019[7]).

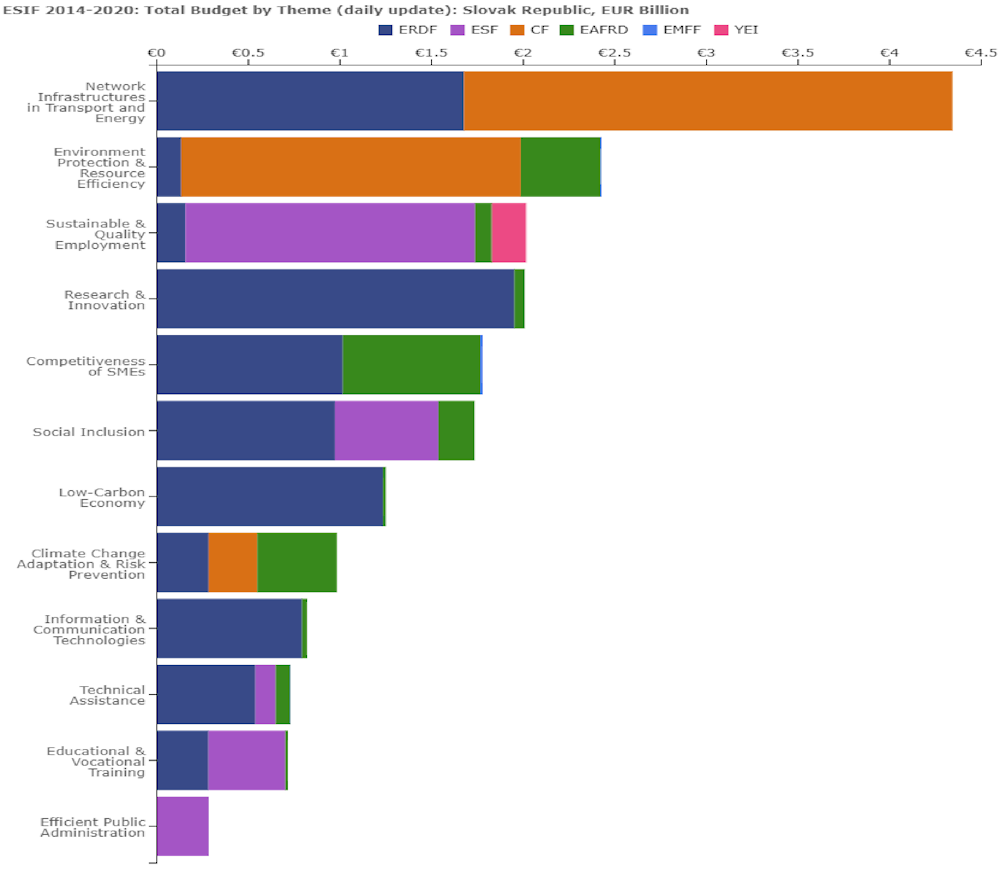

Out of these amounts, around EUR 823 400 000 financed ICT related investments during the 2014-2020 period, mainly using two funds, the European Regional Development Fund (ERDF) (with EUR 796 400 0000) and European Agricultural Fund for Rural Development (EAFRD) (with EUR 27 000 000) as Figure 2.1 shows.

Figure 2.1. ESIF Funds 2014-2020: Total budget by Theme

Note: Data as of 28 November 2020.

Source: Open Data Portal for European Structural Investment Funds, https://cohesiondata.ec.europa.eu/countries/SK

2.1.5. The role of ICT sector in the Slovak economy

The ICT sector plays an important role in the Slovak economy, employing more than 80 000 people and with a significant share of social, health and tax payments, as well as the growth of productivity. (ITAS, 2016[8]). There is a trend for employment growth in the ICT sector: the total number of employees in the sector grew by 60% between 2008 and 2020. ICT share on the total employment was 3.41% in 2019 and the ICT sector's contribution to Slovakia's GDP was 4.2%. (Table 2.1)

Table 2.1. ICT sector in Slovakia

|

ICT’s contribution to Slovakia’s GDP in 1/2021 |

4.2% |

|

ICT share in the total employment in 1/2021 |

3.41% |

|

Growth of employment in the ICT sector (2008-2020) |

60% |

Source: (SARIO, 2021[9])

From 2018, additional tax deductions for R&D expenses of up to 100% were introduced in Slovakia6, making the country more appealing for ICT companies.

The ICT sector is highly specialised with a large number of small companies with one to three employees and a large number of self-employed on one side and some dominant companies on the other. The Slovak economy in general strongly depends on SMEs, not only in the ICT sector. SMEs dominate the Slovak economy, accounting for 99.9% of the total number of business entities.

Out of all challenges the ICT sector faces, the lack of IT experts is probably the most urgent. The sector lacks workforce even though the average wage of an ICT worker is high.7 Although salaries in the ICT sector are above the Slovak average, in comparison with the Western EU countries they remain significantly lower. Differences in salaries also occurs on the regional level in Slovakia allowing the investors to explore regions outside the main hubs (SARIO, 2021[9]).

The majority of IT services in Slovakia are composed of application support and other tailor-made services (such as helpdesk, network administration, cloud storage, remote support, etc.) followed by tailor-made software development and outsourcing. Slovakia is becoming a hub for Shared Services Centres in the field of ICT and financial services. This is important not only due to increased employment in jobs with above-average value added, but also as a potential of innovation development.

2.1.6. The way forward after the COVID-19 pandemic

The economic impacts of COVID-19 will define a new narrative for Slovakia’s economic development. It will be important that the country not only emphasises the importance of minimising economic losses for households and businesses, but also ensures that it manages its macro-financial development so that following the de-escalation of the economic impacts caused by COVID-19, the country can easily shift into a mode of economic recovery.

Going forward, EU funds will provide an opportunity to strengthen the growth potential of the economy and boost productivity and inclusiveness. In particular, room exists to invest in the lagging digital infrastructure to better prepare the country for the likely increase in demand for digital services that the COVID-19 crisis may bring.

Prior to the impacts caused by COVID-19, the Slovak Republic was noted as a country that was not only benefitting from strong links with the world economy, particularly among EU states, but was also catching up with economic development of higher-income countries (OECD, 2019[1]). Hence, moving forward, the Slovak Republic will have to not only consider how it can mitigate immediate impacts from COVID-19, but will also have to ensure it maintains a vision of how to remedy the structural economic gaps.

As the Slovak Republic looks towards its economic future, it will be important for the country to consider stimulants for innovation and entrepreneurship. A significant challenge affecting the economic development of the country is its dependence on the automobile and electronic industry for its development. As a result, other areas such as those relating to innovation, technological development, and research have largely gone unnoticed8 (OECD, 2019[1]). Therefore, by promoting investments into innovation, research and development, and the adoption of new technologies, the country could move into higher valued-added activities, as well as create demand for entrepreneurship.

In the context of public procurement policy, moving forward, the Slovak Republic should continue to promote an entrepreneurial and innovative environment within its economy and continue to evaluate how it can minimise administrative burdens and the slow pace of public procedures that impacts many new businesses (OECD, 2019[1]).

2.2. Digital Government Agenda in the Slovak Republic

Digital technologies increasingly place new demands and expectations on the public sector. Achieving the full potential of these technologies is a key challenge for governmental organisations. Effective digital government can provide a wide variety of benefits including more efficiency and savings for both governments and businesses. It can also increase transparency and openness.

The Slovak Republic ranks 22nd out of the 28 EU Member States in the European Commission Digital Economy and Society Index (DESI) 20209. Based on data prior to the COVID-19 pandemic, Slovakia’s scores slightly increased thanks to the performance in connectivity, the use of internet services and digital public services. However, the majority of indicators have not improved sufficiently to keep pace with the EU average. As a result, Slovakia dropped in the ranking in the dimension of human capital and the use of internet services to the 20th position. The share of ICT specialists on total employment has increased and there are fewer Slovaks who have never used the internet. An increasing share of internet users make video calls and use online banking services. The eGovernment quality indicators are growing but remain below the EU average. (European Commission, 2020[10]).

Even with a higher score than in 2019, Slovakia has dropped to 26th position on digital public services position. The DESI digital public services dimension measures both the demand and supply sides of digital public services as well as open data. Only 52% of Slovak internet users who need to submit forms to public institutions do so online. This is less than in previous years, and significantly below the EU average (67%). Despite some improvement, Slovakia scores 21 percentage points less on pre-filled forms than the EU average. Improvement in the other monitored indicators is modest and overall the scores remain below the EU average. (European Commission, 2020[10])

According to the Supreme Audit Office, the use of national and EU funds to invest in digital public services has not led to a greater take-up by the public10. This could be due to low trust in digital government services, as 19% of Slovaks, compared to an EU average of 8%, are concerned about the security of digital public services and limit or avoid electronic communication with public authorities11. However, the government maintains its ambition and continues to roll out new features to make digital government more attractive. In 2019, Slovak government adopted a new Strategy for the digital transformation of Slovakia 2030.

The 2030 Strategy for Digital Transformation of Slovakia12 is a whole-of- -society and cross-sectorial government strategy that defines the strategic priorities of Slovakia in the context of the digital transformation of economy and society under the influence of innovative technologies and global megatrends of the digital era. The document lays down a long-term vision and aims to guide the economy, society and public administration through the technological change. Its goals are also to stimulate smart regional development and help researchers and innovators to keep pace with global trends.

The Strategy followed up on the priorities of the Digital Single Market Strategy for Europe13 and also reflects the strategic documents and recommendations of international organisations, such as OECD, UN, G7 and G20 that consider digital transformation to be the key to inclusive and sustainable growth. The Strategy puts emphasis on new digital technologies such as artificial intelligence, Internet of Things, 5G technology, big data and analytical processing of data, block chain or high-performance computers, which will eventually become new engines of economic growth and competitiveness. The Strategy entails the introduction of a ‘data-driven state’ concept to improve the public administration’s use of data for analytical purposes. The strategy aims to reach its objectives through the related Action plans. The first one for the years 2019-2022, the Action Plan of Digital Transformation 2019-202214, divided the short-term priorities and measures into three subject areas:

Improvement of education with a focus on digital skills and employment for the modern era;

Strengthening of pillars for a modern digital economy; and

Ability of the public sector to use innovations and data.

The four main objectives in the Action Plan of Digital Transformation 2019-2022 are listed as follows:

digital transformation of schools,

conditions for a data-based economy,

innovating public administration and

support for the development of Artificial Intelligence (AI).

To ensure the timely implementation of the Action Plan, the Slovak government has set up the “Working group for digital transformation of the Slovak Republic” which consists of representatives of the relevant line ministries and other public institutions as well as the professional public. The Working Group’s main task is to ensure whole-of-the-government co-operation for the implementation of the Action Plan. The working group also evaluates new technological trends and other relevant factors that might have an impact on the implementation of the Action Plan. The working group will regularly inform the Government Council for the Digitization of Public Administration and the Digital Single Market about its activities15.

To make the services more user-centric and attractive, the Government set up a unit of behavioural innovation (Behavioural Research and Innovation Slovakia, BRISK).16 The unit trains public servants and has developed principles for user-friendly and quality electronic public services which should be applied across the whole public administration (European Commission, 2020[10]).

The digitalisation of healthcare and the rollout of e-health services are also objectives of the National Digitalisation Strategy. Since its launch in 2018, the national e-health system has already registered over 100 million e-prescriptions17 and 75% of healthcare providers are connected. In 2020, the system has started rolling out a new e-lab service that will help doctors and laboratories exchange laboratory analyses.

However, stakeholders and NGOs are often critical about the digitalisation of public services and administration. Despite the government’s effort to improve the quality of public sector ICT and involve external specialists. The experts grouped in Slovensko.digital18 point out that digitalisation projects in public administration often lack thorough analysis, are not properly prepared, are too costly or do not reflect future technological developments.

The National Concept of eGovernment19, approved by the Slovak government in September 2016, defined the strategic Enterprise Architecture of eGovernment and its central co-ordination, and also the principles and objectives of further development in accordance with goals stated in the Strategic Document for Digital Growth and Next Generation Access Infrastructure. This document emphasises process openness, fair competition, and increase of the value of IT in key functions of public administration, whether in a form of the improved services, better decisions thanks to data, better regulation, or more efficient operation. The concept was built around a vision of an innovative and open state that provides citizens and businesses with user-friendly and easy-to-navigate services, and responds swiftly and effectively to the challenges of the dynamic modern era. Informatisation priorities were covering a wide range of areas. The work on the update of the National eGovernment Concept beyond 2020 is currently ongoing, following the 2030 Vision and Strategy for the Development of Slovakia and the 2030 Strategy for the Digital Transformation of Slovakia.

The Operational Programme Integrated Infrastructure (OPII)20 2014-2020 is a strategic document developed for the absorption of EU funds in the transport sector and in the area of enhancing access to, use and quality of, information technologies. The overall focus of OPII’s specific objectives and activities are to ensure promotion of the fulfilment of the priorities of the Europe 2020 Strategy and National Reform Programme of Slovak Republic21. The overall objective of OPII is to support sustainable mobility, economic growth, job creation and to improve the business climate through the development of transport infrastructure, public transport and an information society. The Deputy Prime Minister’s Office for Investments and Informatisation of the Slovak Republic was responsible for the area of information society within the Operational Programme Integrated Infrastructure. Other objectives of the operational programme were managed by the Ministry of Transport, Construction and Regional Development to support sustainable mobility, economic growth, job creation and improving the business environment through the development of transport infrastructure. In the framework of the Operational Programme, the Deputy Prime Minister’s Office for Investments and Informatisation of the Slovak Republic acted as an intermediary body responsible for Priority Axis 7 Information Society. The funds were invested in the development of electronic services for citizens and businesses, arranging complex life events, cross-border interoperability and increasing the availability of government data through open data. At the same time, public administration reform was supported through ICT, including the further expansion of the government cloud.

Negotiations for the new ESIF programming period 2021–2027 began in early 2020. The Deputy Prime Minister’s Office for Investment and Informatisation proposed a follow-up strategy based on the current investments. The strategy had a stronger focus on reducing bureaucracy for businesses and citizens, and speeding up digital up-take with digital-by-default services. Moreover, it was used to support data driven governance, with more public sector data available, building the digital government structure as a platform based on open APIs. It will also increase the quality of public services thanks to continued feedback from the users.22

The Strategic Document for Digital Growth and Next Generation Access Infrastructure (2014-2020)23 defined a strategy for the development of digital services and next generation access infrastructure in Slovakia. It also focuses on the fulfilment of the ex-ante conditionalities by means of which the EU evaluated the readiness of Member States to implement investment priorities of their choice. The document particularly discussed the fulfilment of the two ex-ante conditionalities defined under thematic objective 2, “Enhancing access to and use and quality of information and communication technologies”. The Strategic document set out a strategy for the further development of digital infrastructure services and next generation networks in Slovakia for the 2014 - 2020 period. It also fulfilled the objectives set out in the Position Paper of the European Commission and implements measures in the Digital Agenda for Europe, building on the activities implemented under the Operational Programme Information Society from 2007 – 2013. The vision of further eGovernment development in Slovakia until 2020 includes actions to move towards a functioning information society and building of Smart Government. Information technologies will become inherent in people’s everyday life and an essential driver of Slovakia’s competitiveness.

The following eGovernment investment priorities were emphasised in the 2014-2020 period:

Services for citizens and businesses;

Effective public administration;

Broadband/Next Generation Network.

The document served as a ground for the preparation of the Operational Programme Integrated Infrastructure (Priority Axis Information Society) for the 2014 – 2020 period.

2.3. Current public procurement environment

2.3.1. Strategic and policy framework

The Concept of public procurement development in the Slovak Republic (2015)24 is the strategic document that identifies priorities and establishes a framework for the further development of the public procurement system in the Slovak Republic, with a special focus on ensuring transparency, efficiency and effectiveness of the public procurement system. The strategic document applies to the entire public procurement system, to all types of public procurement procedures and all types of contracts and subsequent contractual relationships, as well as all forms of the use of electronic tools in public procurement. The proposed measures cover the main critical areas of public procurement, such as, in particular, high bureaucracy, inefficiency in the use of public funds, insufficient security and protection of competition, with an emphasis on the interests of the state, non-transparency.

2.3.2. Legislative framework

In the Slovak Republic, public procurement is regulated by a number of laws and decrees. The most important piece of legislation is the Public Procurement Act No 343/2015 (Act No. 343/2015 Coll)25 that governs the public procurement system in the Slovak Republic. The latest amendment, that introduced some changes to reflect the needs of the second wave of the COVID-19 pandemic, has been effective since 19 January 2021.26 The law is supplemented by implementing Regulations and methodical guidance. Some of the most important implementing decrees are the followings:

Decree No. 41/2019 Coll. of 11 February 201927 laying down details on technical and functional requirements for tools and equipment used for electronic communication in public procurement

Decree no. 132/2016 Coll. of 23 March 201628, which lays down the details of the procedure for the certification of systems for conducting an electronic auction

29Decree no. 152/2016 Coll. of 23 March 2016, which lays down the details of the notices used in public procurement and their content

Decree no. 155/2016 Coll. of 23 March 201630 laying down the details of the single European document and its content

Decree no. 428/2019 Coll. of 6 December 201931, which sets the financial limit for the over-limit contract, the financial limit for the over-limit concession and the financial limit for the design contest

Decree no. 157/2016 Coll. of 23 March 201632, which lays down the details of the types of design competitions in the field of architecture, spatial planning and civil engineering, the content of the competition conditions and the activities of the jury

The Public Procurement Act No 343/2015 and its implementing regulations are transposing the relevant European Union legislation on public procurement33. The Act, effective from 18 April 2016, introduced a number of changes and new elements in public procurement regulatory framework. The development and adoption of the 2015 Act was not only an EU law transposition exercise for the Slovak government, but it aimed to implement a bigger modernisation programme for streamlining public procurement processes. While the long-standing principles of transparency, non-discrimination, equal treatment and proportionality are still underpinning procurement operations, the focus on the value for money has increased in the 2015 law. The 2015 legislative framework also marks a shift towards a more strategic approach to public procurement. The Act was amended in 2019 with the aim of further promote green public procurement and to introduce actions against economic operators that abuse the review mechanism.

As Slovakia is a Member State of the European Union, the EU policy and regulatory framework on public procurement must be considered in the development of any rules (and policy) related to public procurement.

As it was briefly presented earlier in the report, a huge part of the public investments (including ICT projects) in the Slovak Republic are financed from European Union funds (ESIF). Public Procurement Act No 343/2015 also governs the procurement procedures carried out for the implementation of the ESIF projects. The fundamental difference lies in the specific control requirements by the relevant Managing Authority / Intermediate Body and the PPO at each procurement stage of ESIF projects.

In terms of procuring ICT goods and services, the general rules of the public procurement legislation apply; there are no special rules or provisions to follow.

2.3.3. Thresholds

There are three different types of thresholds and accordingly three different types of contract:

a) Above-threshold contracts: The highest thresholds are based on those34 set up by the European Union and applied throughout the EU. All contracts with a value that equals or exceeds the thresholds mentioned in Table 2.2 are to be advertised at the European level, in the Supplement to the Official Journal of the European Union (OJEU)35.

Table 2.2. Thresholds for above-threshold contracts (as of 1 January 2020)

|

Thresholds for above-the-threshold contracts |

|||

|---|---|---|---|

|

Contracting Authority (central government) |

Contracting Authority (non-central government) |

Contracting Entity |

|

|

Goods |

EUR 139 000 |

EUR 214 000 |

EUR 428 000 |

|

Service |

EUR 139 000 |

EUR 214 000 |

EUR 428 000 |

|

Service according to Annex 1 to PPA |

EUR 750 000 |

EUR 1 000 000 |

|

|

Works |

EUR 5 350 000 |

||

Source: Decree no. 428/2019 Coll. of 6 December 2019 of the Public Procurement Office laying down the financial limit for the over-limit contract, the financial limit for the over-concession concession and the financial limit for design contests https://www.uvo.gov.sk/extdoc/2514/Financne%20limity%20od%2001-01-2020

b) Below-threshold contracts: contracts with a value does not meet the thresholds mentioned in Table 2.2 but have a value of higher than the thresholds listed in Table 2.3. Below-threshold contracts are divided at national level according to several criteria. The procurement approach that needs to be followed depends on the type of contracting authority and the subject-matter of the contract. These tenders have to be published in the Slovak Official Journal (Official Journal of Public Contracts, “Vestník verejného obstarávania”)36 or in the Electronic Contracting System (EKS in Slovak)37:

EKS is a fully automated platform to procure generally available goods and services and is provided according to the §§ 109 – 111 of the Public Procurement Act. The biggest benefit of using the EKS is time related as the minimal time limit for bid submission is 72 working hours and the contract is automatically valid right after the deadline.

If EKS is not used, the contracting authority has to publish the tender in the Official Journal of Public Contracts and run procedure in accordance with §§ 112 – 116 of the Public Procurement Act. (Contracting authorities can choose this option also for the generally available goods and services). In these types of tenders, most of the principles of the above the threshold tenders have to be applied, including the obligation to use an electronic tool (state system EVO or the systems provided by private companies).

Table 2.3. Thresholds for the below-threshold contracts

|

Contracting Authority |

|

|---|---|

|

Goods |

EUR 70 000 |

|

Service |

EUR 70 000 |

|

Service according to Annex 1 to PPA |

EUR 260 000 |

|

Works |

EUR 180 000 |

Source: https://www.uvo.gov.sk/extdoc/2514/Financne%20limity%20od%2001-01-2020. Valid from 1.january 2020)38

c) Low value contract: all contracts with lower totals than below-threshold contracts, but with a value of 5 000 euros or above. The contracting authorities may use the “market survey” method by either sending a demand for offer directly to at least one potential contractor or they can decide to use EKS. It is not necessary to publish a tender notice in the Official Journal, on the other hand, in order to increase transparency of low-value contracts, since 1 April 2019 it is possible to announce low value contracts in the Official Journal in the form of a notice (this functionality was added to IS ÚVO).

Table 2.4 presents the thresholds for design contest. Design contests refer to procedures that enable the contracting authority to acquire a plan or design, which should be selected by an independent jury after having been put out to competition, with or without the award of prizes. Design contests have been traditionally used for designing works in the fields of town planning, architecture, engineering and data processing, but this procedure is suitable also for other types of projects, and has relevance for the purchasing category subject to this report. Design contests may be organised in view of awarding prizes (with payments) or service contracts by means of a follow-up negotiated procedure without publication of a contract notice. The innovation potential of design contests lies in the fact that the public procurer provides the participants with a significant room to manoeuvre in proposing the best solution for the needs described in the contest notice. The evaluation of the design proposals is performed by an autonomous jury composed of members that are independent from the participants. The particular advantage of design contests lies in the fact that the jury may provide a professional and autonomous evaluation of criteria such as user-friendliness, suitability, ergonomics, and artistic, reputational or innovative character.

Table 2.4. Thresholds for design contest

|

For the contracting authority that is considered as central Government authority |

EUR 139 000 |

|

For the contracting authority that is considered as sub-central contracting authority |

EUR 214 000 |

|

For the contracting entity |

EUR 428 000 |

Source: https://www.uvo.gov.sk/extdoc/2514/Financne%20limity%20od%2001-01-2020 (the same – but those are not the low value contract)

2.3.4. Strategic use of public procurement in the Slovak Republic

In general, the public procurement legislation in Slovakia provides a framework allowing for a more strategic approach to public procurement. While opportunities to leverage on public procurement purchasing power have increased, Slovak contracting authorities still do not benefit from the strategic use of public procurement. For example, they mostly rely on lowest price criteria to award public contracts. The vast majority of procurement officials in Slovakia have never used MEAT criteria, or only rarely, when developing tenders. (OECD, 2017[11]) This one-dimensional criterion prevents contracting authorities from pursuing, through public procurement, broader policy objectives and accounting for other dimensions when purchasing goods, works or services. Further, the limited use of criteria which take into account additional dimensions beyond price also prevent the public sector to seek innovative solutions, although this could be provided by the market.

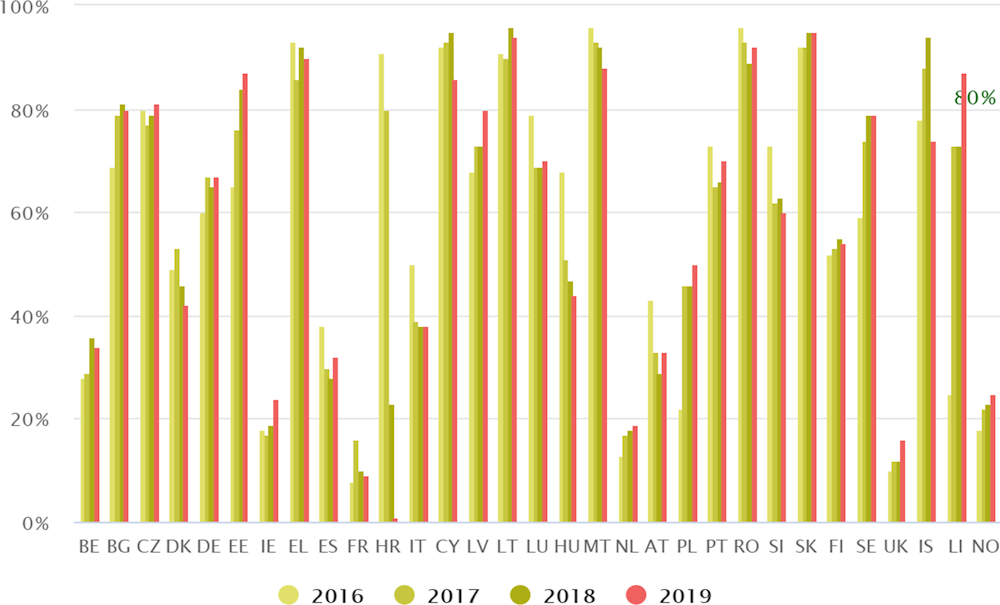

However, according to the EU Single Market Scoreboard39, Slovakia is not the only country in the EU where the use of price-only criteria prevails. Figure 2.2 shows the proportion of procedures awarded solely because the offer was the cheapest one available. While the choice of criteria depends on what is being purchased, over-reliance on price suggests better criteria could have been applied, so a better purchase could have been made.

Figure 2.2. The use of award criteria in the EU and EEA Member States: the proportion of procedures awarded solely on the cheapest offer

Source: EU Single Market Scoreboard,

The Slovak government, and especially the Public Procurement Office, is making efforts to promote and support the use of public procurement as a strategic governance tool. For example, the PPO issued a methodological document “Innovation in Public Procurement” in 2017. (Public Procurement Office, 2017[12]) In addition, as a part of the long-term strategy of the Public Procurement Office, working groups40 were created for certain aspects of strategic public procurement, such as green public procurement, social aspects and innovations in public procurement with the purpose of analysing selected issues of public procurement and issue or update methodological guidance on the topics. (Public Procurement Office, n.d.[13]). PPO also developed and published in February 2021 the Strategy for Social Aspects in Public Procurement in Slovakia 2021 - 202541, which is a long-term plan identifying needs, tools and ways to address social considerations in public procurement.

PPO is also co-operating with OECD on promoting the wider use of MEAT criteria in Slovakia through the project on “Responsible public procurement”. In March 2020, the PPO launched another project, “Increasing efficiency in public procurement in Slovakia (implemented under the Operational Program Effective Public Administration supported by the European Social Fund) with the aim of harmonising the decision-making practices of the PPO, promoting transparency and identifying potential conflicts of interest, and motivating public buyers to use sustainable and strategic public procurement (such as green public procurement, socially responsible public procurement and public procurement of innovation)42.

In 2019, the overall public procurement performance in the Slovak Republic was average according to the EU Single Market Scoreboard.43 The Scoreboard measures performance based on the extent to which purchasers get good value for money. Overall performance is a sum of scores for all 12 individual indicators44. The indicators measure important influences on public procurement performance in a way that is transparent, readily comprehensible and comparable. Although these indicators provide only a simplified picture, they still highlight basic aspects of countries’ procurement markets. Out of the twelve indicators, the Slovak Republic scores unsatisfactory on five indicators. These are: single bidder, co-operative procurement, award criteria, decision speed and missing calls for bids. These indicators could confirm the slow uptake of strategic considerations when carrying out procurement processes, but also raise concerns on the level of competition and transparency.

Although the EU 2020 European Semester report acknowledged the efforts the Slovak government had made so far to simplify public procurement and in particular verification procedures, it also highlighted the insufficiency of the steps taken so far. It stressed that the complexity and length of the public procurement verification procedures remains a blocking factor for potential beneficiaries to draw EU funds. Further efforts to amend the Slovak Public Procurement Act to streamline control procedures of EU funded projects are needed.45

2.4. Overall public spending through public procurement

2.4.1. Public procurement in the Slovak Republic as numbers show – general overview

Public procurement expenditure in the Slovak Republic represents 34.4% of total government expenditure (OECD, 2019[6]).

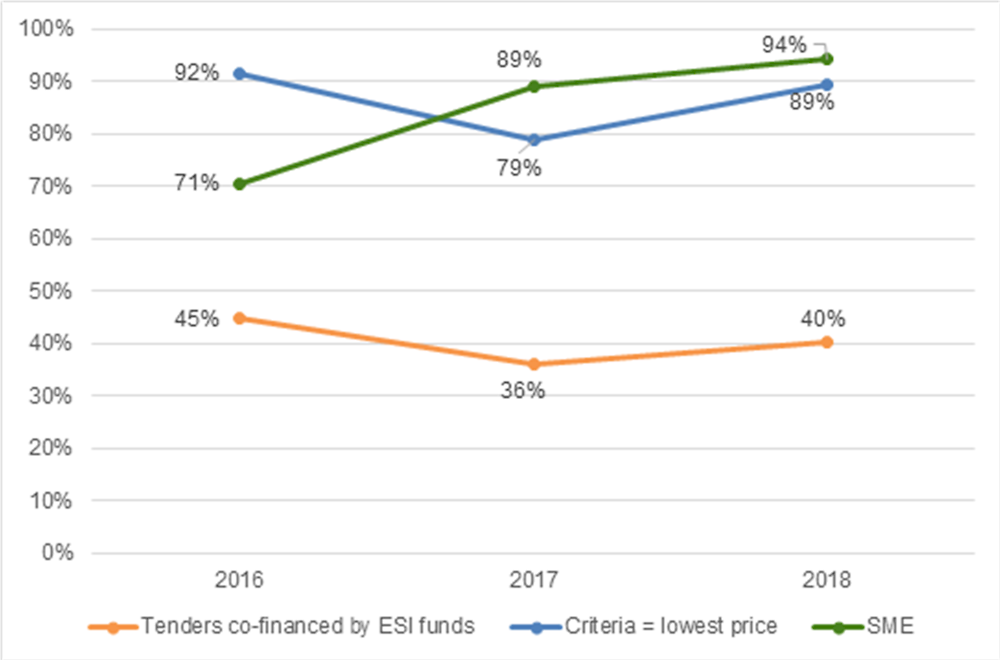

Over a third of all procurements were financed through European Structural and Investment Funds. While almost 90% of procurements were awarded to a company that is categorised as a small and medium size enterprise (SME), lowest price was the single criteria used to award contracts nearly 90% of the time in 2018. (Figure 2.2) This number confirms the findings from interviews with different stakeholders that contracting authorities are often wary of applying most economically advantageous tender (MEAT) criteria to tenders financed through European funds, as they fear that applying such strategic criteria will be perceived as discriminating against other suppliers.

Figure 2.3. Percentage of tenders: financed through ESI-funds, use of the lowest price criteria, and awarded to SMEs (2016-2018)

Source: Author’s elaboration based on data provided by the PPO.

The data in Table 2.5 provides an overarching view of the total procurement statistics and public spend in the Slovak Republic. It intends to provide a general picture and therefore it is not specific to the procurement of ICT goods and services.

Table 2.5. Overall procurement statistics

|

2016 |

2017 |

2018 |

|

|---|---|---|---|

|

Number of tenders published in the national or EU journal |

3 899 |

2 687 |

3 162 |

|

Value of contracts concluded |

EUR 4 384 542 million |

EUR 4 004 798 million |

EUR 4 820 390 million |

|

Number of tenders for different categories of goods |

857 |

694 |

1 284 |

|

Number of tenders for different categories of services |

852 |

602 |

817 |

|

Number of tenders for different categories of works |

2 190 |

1 391 |

1 061 |

|

Percentage of tenders co-financed by ESI funds |

44.7% |

36% |

40.1% |

|

Percentage of tenders with the lowest price award criteria |

91.6% |

78.9% |

89.4% |

|

Percentage of tenders awarded to an SME |

70.5% |

88.9% |

94.3% |

Source: Author’s elaboration based on data provided by the PPO.

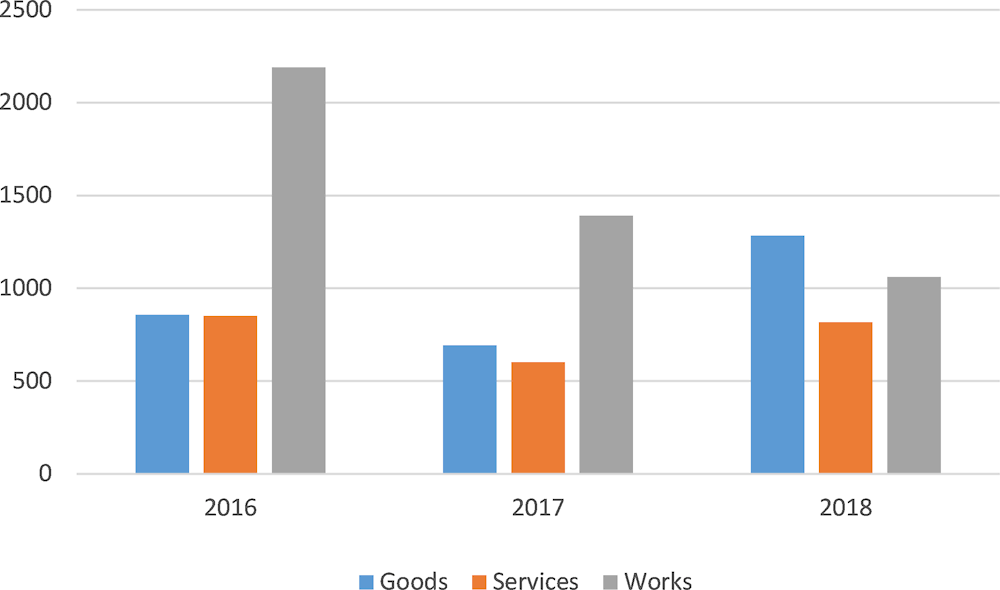

As Figure 2.4 demonstrates, the procurement of works has significantly decreased between 2016 and 2018. However, the procurement of services, which is primarily the category of spend where ICT falls, did not decrease. Goods procurement decreased between 2016 and 2017, but increased significantly in 2018.

Figure 2.4. Total number of goods, services and works purchased between 2016 and 2018

Note: Author’s elaboration based on data provided by the PPO.

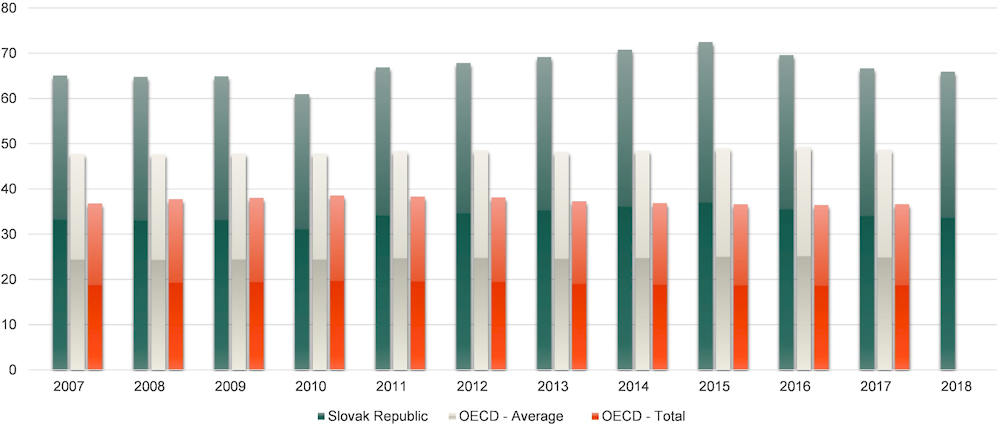

The public procurement system in the Slovak Republic is relatively centralised in a sense that the central government procurement accounts for 65-70% of total procurement expenditure (excluding social security funds) as shows from the recent years. Specific contracts are handled by individual contracting authorities, whilst others are required to purchase generally available goods, services or works from the Ministry of the Interior (MoI), which acts as a central purchasing body. (For further details, see Section 2.6)

Figure 2.5. Central government procurement as a percentage of general government, excluding social security funds

Note: Data for Turkey are not included in the OECD average and OECD total because of missing time series.

Source: Government at Glance, 2019

In terms of type of procedures used, data shows the following:

Open procedure was overwhelmingly the most commonly used procurement method in the Slovak Republic in both 2017 and 2018, with over 80% of contracts awarded using this method during both years. In 2019, it was only 71.8%.

Negotiated procedure without prior publication was the second most used method in 2017, in approximately 9.5% of contract awards.

Restricted procedure was the second most used method in 2018, in approximately 11.3% contract awards.

Innovative partnerships were not used at all in 2017, 2018 or in 2019. (Table 2.6.)

Table 2.6. Types of procedures used in 2017, 2018 and 2019

|

2017 |

2018 |

2019 |

|

|---|---|---|---|

|

Open procedure |

83.2% |

81.7% |

71.8% |

|

Restricted procedure |

5.7% |

11.3% |

20.9% |

|

Negotiated procedure with negotiation |

1.5% |

0.9% |

1.3% |

|

Negotiated procedure without prior publication |

9.5% |

5.8% |

5.9% |

|

Competitive dialogue |

0.1% |

0.3% |

0.1% |

|

Innovative partnership |

0% |

0% |

0% |

Note: Data was provided by the PPO.

2.5. Characteristics of public spend in ICT

The analysis below include an assessment on the overall CPV code values and percentages generated, and of the sub-set of IT services, as this was such a large percentage of the total overall spend. Table 2.7 outlines the main ICT spend categories, divided by type of entity, for the period of 18 April 2016 until by 31 October 2019.

As provided by the PPO, the data that is analysed in the following sections was extracted from the national e-procurement system, using CPV codes pertaining to ICT hardware, software and services46.

Table 2.7. Overall public spend in ICT (18. 4. 2016 until 31. 10. 2019)

|

Central government |

Municipality |

Self-governing region |

Legal entity |

Associated legal entity |

Subsidised entity |

Contracting entity |

TOTAL |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

No. |

EUR |

No. |

EUR |

No. |

EUR |

No. |

EUR |

No. |

EUR |

No. |

EUR |

No. |

EUR |

No. |

EUR |

|

|

IT services: consulting, software development, Internet and support |

102 |

420 286 185.23 |

21 |

4 882 159.18 |

5 |

999 378.60 |

108 |

173 032 394.46 |

1 |

64 500.00 |

38 |

9 792 587.42 |

24 |

110 353 988.03 |

299 |

719 411 192.92 |

|

Computer hardware |

63 |

74 546 110.51 |

4 |

1 158 117.65 |

6 |

792 699.14 |

73 |

23 343 673.87 |

8 |

1 876 410.95 |

8 |

91 647 072.54 |

163 |

193 364 084.66 |

||

|

Information systems and servers |

9 |

57 146 203.07 |

2 |

213 977.08 |

17 |

18 878 850.05 |

3 |

885 487.00 |

3 |

20 814 274.00 |

34 |

97 938 791.20 |

||||

|

Telecommunications services |

14 |

10 312 276.91 |

7 |

697 954.87 |

1 |

540 000.00 |

20 |

10 288 518.37 |

4 |

7 150 000.00 |

46 |

28 988 750.15 |

||||

|

Integrated network |

1 |

4 000 000.00 |

1 |

4 000 000.00 |

||||||||||||

|

Database and operating software package |

2 |

2 231 247.33 |

1 |

107 850.00 |

2 |

3 337 313.52 |

5 |

5 676 410.85 |

||||||||

|

Network equipment |

4 |

1 144 973.35 |

1 |

168 500.00 |

3 |

1 106 390.88 |

8 |

2 419 864.23 |

||||||||

|

Miscellaneous software package and computer systems |

1 |

28 780.00 |

2 |

164 034.00 |

1 |

867 950.00 |

2 |

2 093 554.67 |

6 |

3 154 318.67 |

||||||

|

Telecom equipment and supplies |

1 |

197 588.70 |

3 |

763 750.00 |

1 |

1 590 000.00 |

5 |

2 551 338.70 |

||||||||

|

Communication network |

1 |

163 526.59 |

1 |

163 526.59 |

||||||||||||

|

Financial analysis and accounting software package |

1 |

35 334.00 |

1 |

35 334.00 |

||||||||||||

|

Storage management software package |

1 |

4 264.00 |

1 |

4 264.00 |

||||||||||||

|

Installation of telecom equipment |

1 |

1 198 000.00 |

1 |

1 198 000.00 |

||||||||||||

|

Networking, Internet and intranet software package |

1 |

2,390,000.00 |

1 |

2,619,759.60 |

2 |

5,009,759.60 |

||||||||||

|

TOTAL |

195 |

564 860 117.77 |

35 |

7 070 765.70 |

14 |

2 546 054.82 |

231 |

234 715 899.55 |

1 |

64 500.00 |

53 |

17 145 890.04 |

43 |

237 512 407.69 |

572 |

1 063 915 635.58 |

2.5.1. An area of public spending concentrated in few hands operating in silos

Spend analysis for ICT procurement spend by category and entity

As Table 2.7 shows IT services is the largest spend area, across all levels of government, equalling EUR 719,411,192.92. The biggest spend areas under this sub-heading of IT services are (all over EUR 20 million total):

IT Software-related services

System and support services

Information technology services

Software support services

Maintenance of information technology software

Software maintenance and repair services

Software programming and consultancy services

The biggest spenders in the highest spend area are shown by Table 2.8. The Ministry of Finance (Ministerstvo financií Slovenskej republiky) proved to be the highest spender and has purchased the most IT services, in comparison with all other agencies. (The Report gives more detailed analysis about the big spenders in this category in session 2.6. The main stakeholders in ICT procurement in Slovakia.)

Table 2.8. The biggest spenders, in terms of contracting authority, in highest spend areas

|

IT software-related services |

National Highway Company, a.s. |

EUR 37 590 212.40 |

|

Agricultural paying agency |

EUR 26 375 088.00 |

|

|

Západoslovenská distribučná, a. s. |

EUR 25 120 536.75 |

|

|

National Network and Electronic Services Agency |

EUR 16 083 390.00 |

|

|

System and support services |

Ministry of Finance of the Slovak Republic |

EUR 31 727 332.00 |

|

Social Insurance Agency, headquarter |

EUR 13 211 316.16 |

|

|

Information technology services |

Ministry of Finance of the Slovak Republic |

EUR 36 064 000.00 |

|

Slovak Ministry of Justice |

EUR 8 996 952.00 |

|

|

Software support services |

Slovenská pošta, a.s. |

EUR 11 466 406.01 |

|

Maintenance of information technology soft ware |

Ministry of Finance of the Slovak Republic |

EUR 23 403 836.28 |

|

Software maintenance and repair services |

Financial Directorate of the Slovak Republic |

EUR 11 141 806.50 |

|

Software programming and consultancy services |

National Network and Electronic Services Agency |

EUR 16 083 390.00 |

|

System and support services |

Ministry of Finance of the Slovak Republic |

EUR 31 727 332.00 |

|

Social Insurance Agency, headquarters |

EUR 13 211 316.16 |

Source: Author’s elaboration based on data provided by the PPO.

Contracts funded by the European Structural and Investment Funds (ESIF)

As already presented in the Report, approximately two-thirds of public investment in Slovakia is financed through the EU Structural and Investment Funds (ESI Funds). Out of this, around EUR 823 400 000 financed ICT related investments during the 2014-2020 period.

There are 112 contracts funded by the ESIF, totalling 20% of total contracts. Of these 112 contracts, 63 are related to the provision of IT services. This represents 21% of total IT services procured using ESI funding. This includes for example:

10 for Software programming and consultancy services

11 for Custom software development services

6 for Computer and related services

6 for Software development services

5 for Database services

Joint public procurement

The data indicates that very little joint ICT procurement takes place. In total, there were only 12 instances of a joint procurement occurring: three for software related services, two for system and support services, and one each for software support services, software maintenance and repair services, maintenance of information technology software, database services, website design services, mobile-telephone services, and computer equipment and supplies.

2.5.2. Current procurement strategies limit competition

Use of electronic auction

An electronic auction (e-auction) is a process that allows for the submission of new prices (revised downwards) and/or the submission of new elements of tenders electronically, in both cases after an initial full evaluation of tenders has been undertaken. E-auctions occur at the final stage of a tender process, which has been conducted up to that point in accordance with one of the standard procurement procedures – the open procedure, restricted procedure and negotiated procedure with negotiation, or in a mini-competition run under a framework agreement and in dynamic purchasing systems. E-auctions involve an online electronic system that allows economic operators to submit new, downward-revised prices and/or other revisions to elements of their tenders for a particular contract. An e-auction is conducted in real time, and economic operators are in direct, anonymous competition with other economic operators. E-auctions can only be used when the specifications can be established with sufficient precision. Only the elements of a tender that are suitable for evaluation using electronic means alone may be the subject of an e-auction. (SIGMA, 2016[14])

Of the total CPV codes provided, approximately 40%, both in terms of number of contracts and contractual value, were awarded by the use of an electronic auction. In the field of IT services, only 15% were awarded via e-auction. The data does not state what medium was used when e-auction was not the mode of choice.

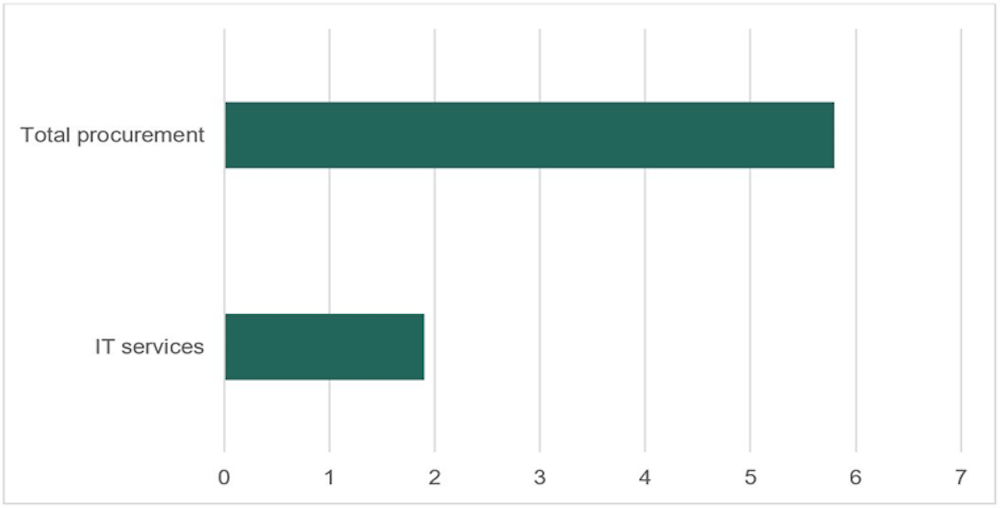

Subdivision into lots

A common tool that is often used to support SMEs in public procurement is the subdivision of large contracts into lots. One of the main choices in public procurement is to determine whether the works, goods or services that are the subject matter of the procurement are to be acquired by using one contract or by using a number of separate contracts or “lots”, which may be awarded and performed by different economic operators (SIGMA, 2016[15]). While the use of a single contract can promote savings from economies of scale, the diversity resulting from multiple contracts or lots can enhance competition and increase efficiency. Dividing public contracts into lots is a good way to attract small and innovative companies. The size of each lot can reflect the operational capacities of start-ups and innovative SMEs. In principle, under the EU Public Procurement Directives as well as the Slovak public procurement rules, contracting authorities are expected to divide all public contracts into lots47. In practice, they have to find the right balance between facilitating the participation of smaller innovative suppliers by using lots and minimising their own administrative burden by contracting with a single contractor who will take care of all tasks.

In Slovakia, 16% of contracts were subdivided into lots between 2016 and 2019. Within the specific dataset of IT services, just 6% were sub-divided during the same period (Table 2.9). The meetings with different stakeholders confirmed that dividing contracts into lots is a common issue for contracting authorities, and they apply this tool quite rarely.

Table 2.9. Subdivision into lots

|

Yes (% of contracts) |

No (% of contracts) |

|

|---|---|---|

|

IT services |

6% |

94% |

|

Total procurement |

16% |

84% |

Note: This data includes contracts that were announced from 18.04.2016 and for which the result of the tender was published by 31.10.2019.

A potential explanation of this lack of subdivision of contracts in IT is the phenomenon known as vendor lock-in. Vendor lock-in refers to a situation where the cost and/or feasibility of switching to a different vendor is so high that the customer is essentially stuck with the original vendor. Because of financial pressures, an insufficient workforce, or the need to avoid interruptions to business operations, the contracting authority is "locked in" to what may be an inferior product or service (Armbrust, 2010[17]). This is particularly relevant in the field of ICT, where contracting authorities are dependent (i.e. locked-in) on a single technology provider and cannot easily move in the future to a different vendor without substantial costs, legal constraints, or technical incompatibilities. Additionally, a significant number of ICT systems cannot easily be migrated to other ICT platforms, resulting in contracting authorities becoming vulnerable to any changes made by their providers.

During stakeholder interviews with both the private and public sector, vendor lock-in was comprehensively identified as the primary issue facing IT procurement in Slovakia. With the primary supplier locked-in to an IT contract, this results in it becoming increasingly more difficult to subdivide a contract into lots, with many smaller suppliers unable to ensure their systems are compatible with the primary IT system.

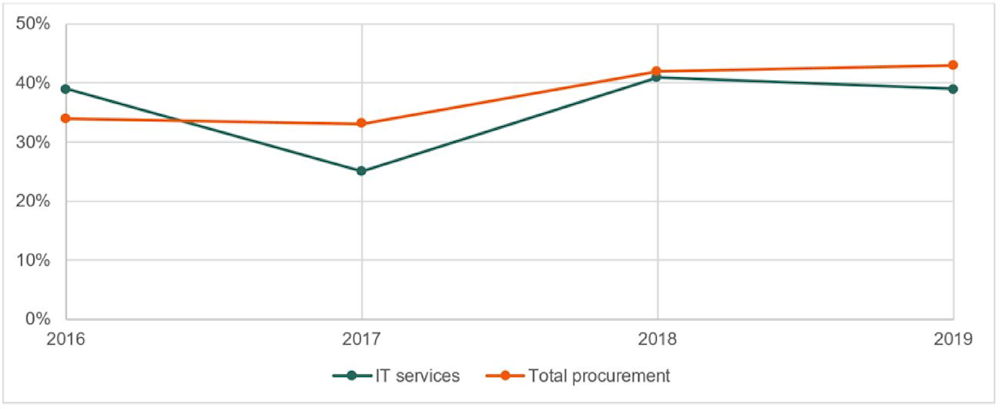

Level of competition: number of submitted tenders

Research indicates that as well as leading to better outcomes for the procurement activity of contracting authorities, a high number of bids increases competition, as well as having a broader impact on economic productivity (OECD, 2015[18]). Contracting authorities benefit from choosing between different providers and so does the economy as a whole. The number of submitted tenders is often indicative of the level of competition existing in a certain sector. As demonstrated by Figure 2.6, the average number of submitted tenders per concluded contract is much higher for the total procurement dataset, compared with contracts in IT services. The average number of bidders per procedure for the total procurement dataset was 3.6 in 2017 and 3.1 in 2018. Per concluded IT service-related contract, the average number of submitted tenders was 1.9 between 2016 and 2019. This is consistent with the anecdotal evidence gathered during the fact-finding missions, where suppliers and supplier associations feel that due to the vendor lock-in problem the ICT industry in Slovakia faces, placing a bid on a tender rarely leads to success due to the incompatibility of the systems.

Figure 2.6. Average number of submitted tender per concluded contract

Note: This data includes contracts that were announced from 18.04.2016 and for which the result of the tender was published by 31.10.2019.

The 2030 Strategy for Digital Transformation of Slovakia48 identifies this low level of bids (and therefore competition) as a risk area Slovakia faces. Therefore in the future vision it is stated that such digital transformation should provide entrepreneurs in Slovakia with “regulations adapted to the digital era that will support fair economic competition, fix problems of digital monopolies and support innovative business mode” (2019[19]). This is where a standards- and assurance-based approach to ICT investment decision making at the pre-procurement stage is critical, to minimise the risk of vendor or technology lock-in. In the United Kingdom, the Technology Code of Practice49 is used to help government teams introduce or update technology so that it: (1) meets user needs, based on research with their users; (2) is easier to share across government; (3) is easy to maintain; (4) scales for future use; (5) is less dependent on single third-party suppliers; and (6) provides better value for money. Having a team that focuses on this, will help transform Slovakia's ICT procurement.

Table 2.10 identifies the average number of submitted tenders per concluded contract on a year by year basis (2016 to 2019). Already, it is apparent that for IT services, the number of submitted tenders has increased since 2018, from 1.1 to 2 bids per concluded tender. There is, however, room for significant improvement.

Table 2.10. Average number of submitted tenders per concluded contract per year

|

IT services |

Total procurement |

|

|---|---|---|

|

2016 |

1.1 |

6.8 |

|

2017 |

1.6 |

8 |

|

2018 |

2.1 |

5.7 |

|

2019 |

2 |

3.1 |

Note: This data includes contracts that were announced from 18.04.2016 and for which the result of the tender was published by 31.10.2019.

Increasing competition, particularly in the field of ICT, is vital for a functioning public procurement system and is a well-known tool for reducing public spending or increasing value from public procurement activities. During interviews with stakeholders, many indicated that very little market consultation for ICT tenders takes place in Slovakia. Often, a tender is simply published directly into the national journal without any prior indication from contracting authorities. Early exchanges with suppliers may maximise participation in the tender procedure, allowing potential bidders the time to prepare their offers.

According to the 2015 OECD Recommendation on Public Procurement “adherents should engage in transparent and regular dialogues with suppliers and business associations to present public procurement objectives and to assure a correct understanding of markets” (Principle on participation, paragraph VI) (OECD, 2015[18]). A good understanding of markets is essential if contracting authorities are to develop more realistic and effective tender specifications and provide vendors with a better understanding of the public sector’s needs. Engaging suppliers at different stages of the procurement process also helps reduce the information asymmetry between the market and the procuring entity.

Structured early engagement with potential suppliers would help the Slovakian contracting authorities to learn more about the market possibilities, as well as giving the opportunity for the business sector to get information on the opportunities in the public sector. Thorough market investigation would provide the contracting authorities with a greater understanding of the structure and appetite of the supply side, which might result in enhanced competition in the call for tender phase.

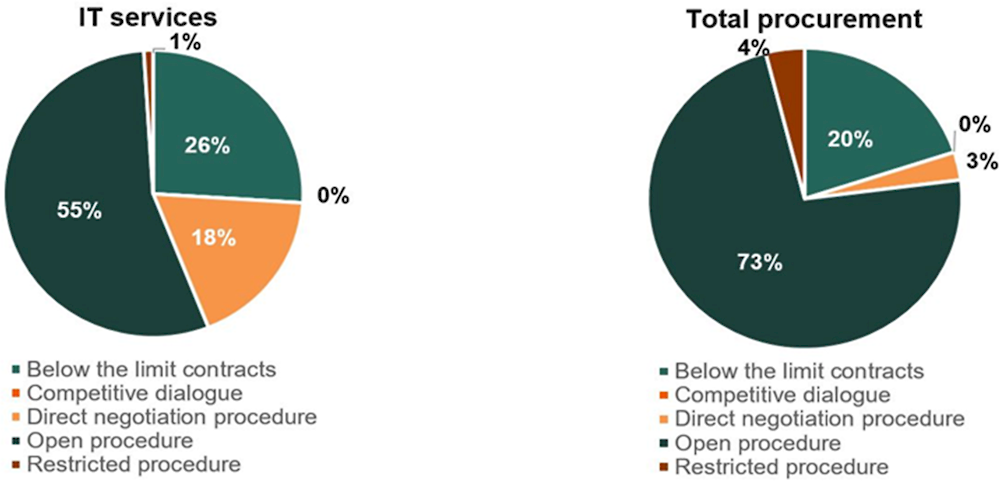

2.5.3. Types of procedures used

Open procedures

Open procedures are used for 42% of the overall ICT spend, and in 50% of tenders for IT services. Interestingly, in the field of overall ICT spend; restricted procedure is used in 19% of procurements, compared with only 1% within the specific field of IT services. In contrast, the second most used procedure is direct negotiation (not taking into account the below limit contracts). Competitive dialogue is not used in any circumstance. (Table 2.11.)

Table 2.11. Procedures used for overall ICT spend and for IT services

|

|

Contractual value in % |

Number of contracts in % |

||

|---|---|---|---|---|

|

Type of procedure |

Overall |

Within IT services |

Overall |

Within IT services |

|

Below the limit contracts without the use of Electronic contracting system (ECS) |

25% |

26% |

27% |

29% |

|

Competitive dialogue |

0% |

0% |

0% |

0% |

|

Direct negotiation procedure |

11% |

18% |

11% |

20% |

|

Open procedure |

48% |

55% |

42% |

50% |

|

Restricted procedure |

17% |

1% |

19% |

1% |

|

Total |

100% |

100% |

100% |

100% |

Note: This data includes contracts that were announced from 18.04.2016 and for which the result of the tender was published by 31.10.2019.

Restricted procedures

Interestingly, within the specific subset of IT services, restricted procedures were used in only 1% of procurements, compared with 4% in the total subset (total procurement and not overall ICT spend) (Figure 2.7).

Figure 2.7. Procedure used for IT services and for total procurement (number of contracts)

Note: This data includes contracts that were announced from 18.04.2016 and for which the result of the tender was published by 31.10.2019.

Competitive dialogue

Competitive dialogue, a key agile procurement procedure, was not utilised at all in any of the three cases. Competitive dialogue is a public-sector tendering option that allows bidders to develop alternative proposals in response to a client's outline requirements. Only when their proposals are developed to sufficient detail, are tenderers invited to submit competitive bids.

Contracting authorities interviewed during the fact-finding mission indicated that there was a lack of guidance on how to use the competitive dialogue procedure in practices, and feared incorrectly applying it to their procurements. The PPO has recently published an educational material on Negotiated Procedure with Publication and Competitive Dialogue50 that might be inspirational for the contracting authorities to experiment with this type of procedure.

Direct negotiation procedure

In direct negotiation of contracts, or sole source contracting, only one contractor is involved, and that contractor, along with the officials representing government, negotiates the terms and conditions of the contract. This method is applicable when there are few potential bidders, when there are few, or only one, qualified contractors, when a monopoly situation exists, or when one contractor has the specialised skills required to fulfil the contract requirements.

For IT services, the second most utilised procedure was direct negotiation, used in 18% of cases. This compared to just 3% in the total procurement dataset.

The aforementioned vendor lock-in problem that is limiting contracts being subdivided into lots is also a possible explanation for the high usage of direct negotiation procedure. When a supplier has previously provided an IT service to a contracting authority, the authority is conceivably more likely to utilise direct negotiation procedure to contract again with the same supplier for a related IT contract or even for a new IT contract.

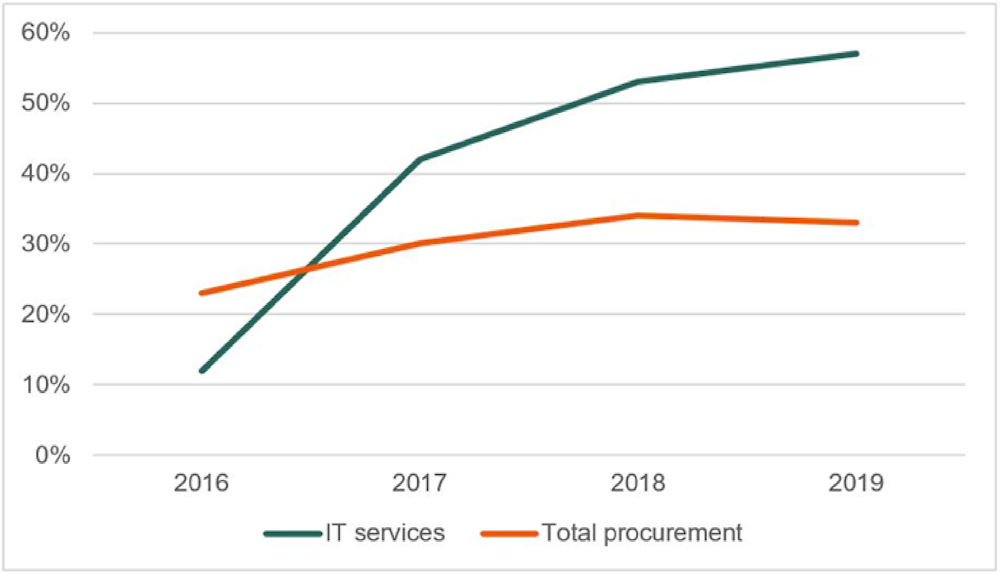

Open procedure, year on year

In an open procedure, any business may submit a tender. The minimum time limit for submission of tenders is 35 days from the publication date of the contract notice. If a prior information notice was published, this time limit can be reduced to 15 days. The use of an open procedure, in both the total procurement dataset and the IT services subset, vary substantially between 2016 and 2019.

For IT services, open procedures were used in just 12% of cases in 2016, growing by 44% to 56% in 2019. The total procurement subset is more stable, growing just 11% between 2016 and 2019 (Figure 2.8). The significant growth between 2016 and 2017 in IT services could be attributed to the utilisation of EU funds from the Operational Programme Integrated Infrastructure 2016-2020, which allocated almost 1 billion EUR towards ICT projects. Since the procurement process takes some time, the bump did not happen in 2016, but a year later, when the first procurement processes were finished.

Figure 2.8. Use of open procedures, 2016-2019

Note: This data includes contracts that were announced from 18.04.2016 and for which the result of the tender was published by 31.10.2019.

The 2015 Recommendation on Public Procurement calls on “Adherents to ensure an adequate degree of transparency of the public procurement system in all stages of the procurement cycle” (Principle on transparency, paragraph II). The Recommendation contains guiding principles for countries to promote fair and equitable treatment for potential suppliers by providing an adequate and timely degree of transparency in each phase of the public procurement cycle. The principles take into account the legitimate needs for protection of trade secrets and proprietary information and other privacy concerns, as well as the need to avoid information that can be used by interested suppliers to distort competition in the procurement process (OECD, 2015[18]).

The further use of open procedures within ICT procurement might give a range of different suppliers the ability to compete for opportunities to participate in government contracts, and to improve the perception of accessibility of public procurement procedures. Open and inclusive competition builds trust between citizens and governments, and promotes a transparent and accountable government. Open government also supports a level playing field for businesses, and this contributes to economic development. Transparency is widely regarded as an effective tool for fighting corruption.

Increased competition creates a market environment that fosters innovation and diffusion of new technologies, and makes businesses more productive and competitive both domestically and when competing overseas. Contracting authorities also benefit from choosing between different providers, and so does the economy as a whole. Their ability to choose forces firms to compete with one another.

2.5.4. Public buyers are not capitalising on the benefits of available procurement techniques

Contract award criteria

Using both the percentage of contracts and the percentage of spend, it is apparent from the data that the Most Economically Advantageous Tender (MEAT) criteria are not commonly used in Slovakia, both in terms of percentage of contracts and percentage of contract value. The MEAT criterion enables the contracting authorities to take account of criteria that reflect qualitative, technical, and sustainable aspects of the tender bids as well as price to award the contract. The MEAT criteria are based on costs and encompass other aspects using a ‘best price-quality ratio’ (e.g. quality of product, organisation, qualification and experience of the supplier, delivery time and conditions, etc.). Tender documents available to bidders typically define award criteria, including how they are combined and the relative weight allocated. Percentage or points systems for evaluation criteria can include environmental and social factors, i.e. complementary policy objectives.

As demonstrated for the total procurement dataset in Table 2.12, only 13% of contracts use MEAT criteria. Despite this low percentage, this is almost 10% higher when compared with the IT services subset, where MEAT criteria are utilised in only 4% of contracts. During the interviews, contracting authorities indicated that the qualification of experts/consultants is the most commonly utilised MEAT criteria, as it is a criterion that actually has a comparable and certified standard.

Table 2.12. Contract award criteria

|

Price criteria |

MEAT criteria |

|||

|---|---|---|---|---|

|

% of contracts |

% of value |

% of contracts |

% of value |

|

|

IT services |

96% |

96% |

4% |

4% |

|

Total procurement |

86% |

91% |

13% |

8% |

Note: This data includes contracts that were announced from 18.04.2016 and for which the result of the tender was published by 31.10.2019.

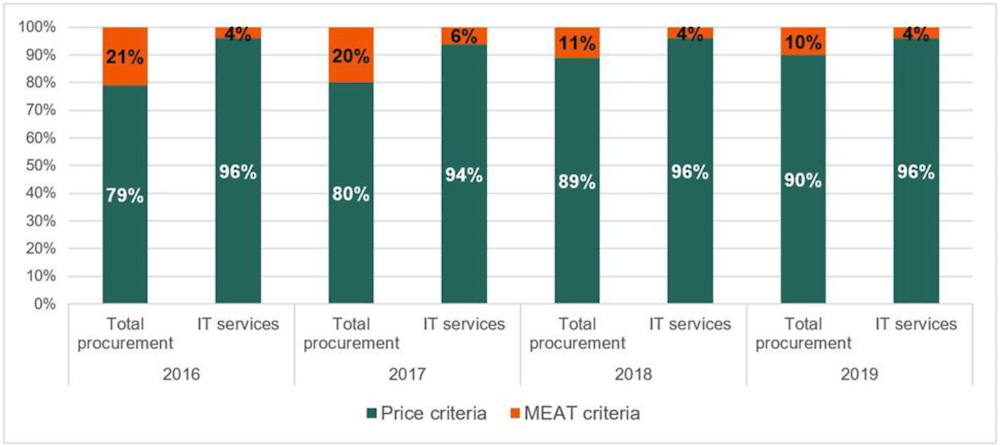

When looking at a year upon year analysis (Figure 2.9), it is apparent that from 2016 to 2019 there is consistently little use of MEAT criteria. For the total procurement dataset, while MEAT criteria are used in 21% of contracts, this decreases to just 10% in 2019.

Figure 2.9. Contract award criteria (in terms of percentage of contracts)

Note: This data includes contracts that were announced from 18.04.2016 and for which the result of the tender was published by 31.10.2019.

This consistent lack of use of MEAT criteria in IT services can be anecdotally linked to testimonies given by contracting authorities during the fact-finding missions. These authorities emphasised that they are extremely cautious of using award criteria beyond price, in the fear that the MEAT criteria signals that they are indeed giving preference to a certain supplier.

While both the European Union Directives and the 2015 Public Procurement Act in Slovakia feasibly enable contracting authorities to use criteria that reflect qualitative, technical and sustainable aspects of the tender as well as price when reaching an award decision, there currently exists little guidance on how MEAT criteria can be compared and accredited (European Commission, 2014[20]) (Public Procurement Office, 2015[21]).

Using MEAT criteria is particularly important for ICT procurements. Beyond costs, a wide range of factors may influence the value of a tender for the contracting authority, and this includes environmental, social and ethical aspects. But even in terms of costs, not only the pure acquisition costs are (should be) considered: other types of costs need to be included in the evaluation. In this regard, the use of life cycle costing (LCC) as a method for assessing tender costs can be also part of the MEAT approach. Contracting authorities may select to include costs imputed to externalities in this calculation. The externalities that can be imputed under LCC can refer to societal challenges such as environment but can also refer to other types of external costs such as the lack of interoperability. Interoperability removes the costs associated with linking to incompatible systems. Additionally, other non-monetary aspects can be considered in a MEAT concept as part of tender evaluation, such as training and customer service offered, response time for helpdesk services, extended maintenance for software, improved energy consumption, just to name a few.

Providing supportive measures to help contracting authorities navigate the complex strategic procurement frameworks in their daily work, including MEAT criteria is important in all public procurement systems. A range of training courses should target different levels of sophistication in using MEAT criteria successfully, from introductory courses to implementing complex evaluation criteria and conducting supplier due diligence. These efforts can be supported through broader use of implementation tools and templates.

The 2015 OECD Recommendation on Public Procurement states, “Adherents should implement sound technical processes to satisfy customer needs efficiently”, including through “identifying appropriate award criteria” (Principle on efficiency, paragraph VII). Award criteria must be objective, relevant to the subject matter of the contract, and precisely defined in the tender/solicitation documents (OECD, 2015[18]).

In order to ensure that contracting authorities are able to implement such sound processes through their award criteria, contracting authorities in the Slovak Republic should be supported by MEAT-related guidance, relevant to the procurement of ICT products and services. This guidance should build on the points and percentages system and on the model of the most economically advantageous tender (MEAT) to select bidders and award points according to complementary policy objectives.

Use of framework agreements

The use of framework agreements is not uncommon for ICT purchasing in Slovakia. For the total dataset, framework agreements represent approximately 42% of the contractual value. For IT services, approximately 24% of purchasing is done via a framework agreement. (Table 2.13.)

Table 2.13. Use of framework agreements

|

|

Conventional contract |

Framework agreement |

||||

|---|---|---|---|---|---|---|

|

|

Number of contracts |

Number of agreements |

Contract value |

Number of contracts |

Number of agreements |

Contract value |

|

Total |

463 |

513 |