This chapter discusses the impacts of COVID-19 on employment and the business sector, in particular small and medium-sized enterprises, in the MENA region. It reflects on the vulnerabilities caused by the significant share of informality in the economies of the region and highlights the effects of the pandemic on tourism and trade. It also examines policy approaches to address the challenges of a sustainable and inclusive recovery.

Navigating beyond COVID-19

1. Economic development and employment

Abstract

Key takeaways

The MENA region has among the highest unemployment rates in the world. The outbreak of the COVID-19 pandemic has further increased unemployment and highlighted the need to address the structural weaknesses of the labour market to ensure a sustainable recovery and build resilience to face future crises. This goal can be achieved through coordinated initiatives that encompass private sector development, supporting SMEs, accompanying the transformation of sustainable tourism and strengthening trade including through participation in GVCs.

The public sector currently represents large shares of total formal employment in the MENA countries. Yet in the context of the COVID-19 pandemic, its ability to create and/or maintain jobs has been limited, due to the substantial allocation of public funds to address the socio-economic impacts of the crisis. The scarcity of formal employment opportunities outside the public sector has increased informal activities during the pandemic.

In the region, as elsewhere in the world, a significant portion of private sector formal employment is driven by SMEs. Despite government efforts to support SMEs during the pandemic, various constraints on SME growth, e.g. limited access to finance and use of digital tools, restrained their performance as a factor of resilience. A better entrepreneurial ecosystem would provide a path to recovery. In this process, it would be particularly crucial to ensure the mobilisation, inclusion and empowerment of youth and women in the economy.

The COVID-19 pandemic highlighted the fragility of trade linkages in the MENA region. At the global level, it was observed that countries having Regional Trade Agreements (RTAs) experienced, on average, a lower decline in trade (8.5%-11.2%) compared to countries that lacked them (14.1%). This positive dynamic could be observed as well with regard to MENA region’s RTAs, although with differences depending on the specific RTA and trade direction i.e. export or import flows. While exports between Agadir and PAFTA/GAFTA signatory countries experienced a lesser drop of intra-region exports than the drop of exports to other partners, imports, on the contrary, fell more sharply between the RTAs adherents. Trade between the EU and MENA countries with Association Agreements showed in most cases resilience in 2020, both for imports and exports.

Sustainability is becoming more prominent in tourism choices, due to greater awareness of climate change and the impact of tourism on it. Tourism is an increasingly important sector for the MENA region, accounting for above or close to 10% of GDP and close to 7% of employment in some countries before the pandemic. The crisis has modified travel behaviour, in particular away from busy tourist hotspots to proximity tourism, associated with a decline in air travel. In the long term, this trend could create new opportunities for the travel and tourism sector in MENA countries, as it drives new business models and markets and opens up employment possibilities. MENA countries could benefit from domestic tourism and further develop regional tourism across both shores of the Mediterranean, promoting cultural and economic developments in the region, while making the tourism sector more sustainable and resilient.

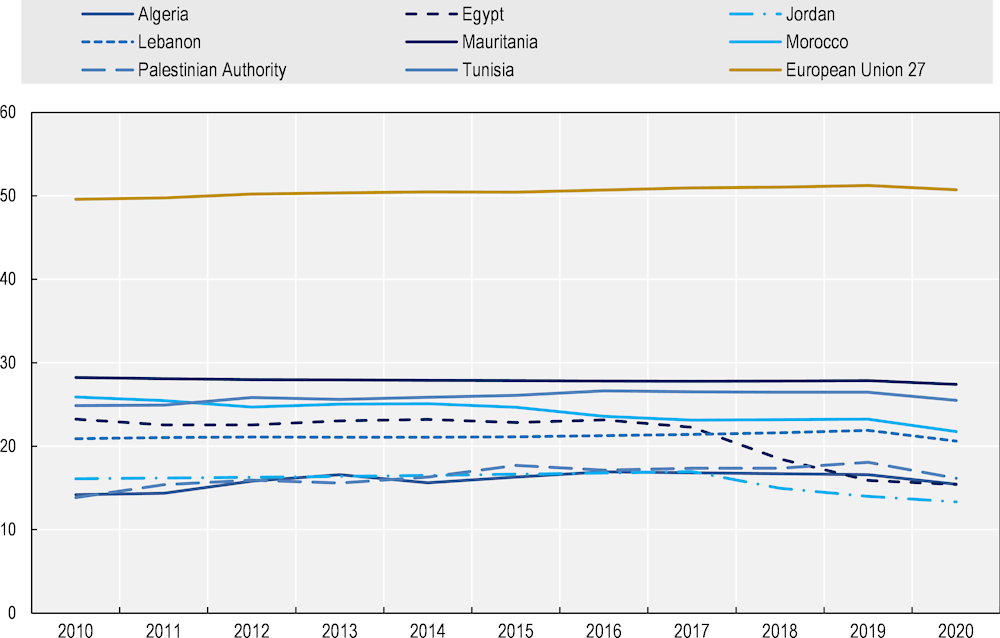

Employment

The outbreak of the COVID-19 pandemic further intensified structural weaknesses of the labour market in the MENA region1, i.e. pervasive informality and a large share of the public sector employment. The labour market participation rate is much lower in the region than in other parts of the world, notably because of the low rates of formal employment of women. Overall, women’s labour force participation in the region is only 21% compared to 70% for men (Figure 1.1).

Figure 1.1. Female labour force participation rate, 2010-19

Note: Labour force participation rate is the proportion of the population aged 15 and older that is economically active: all people who supply labour for the production of goods and services during a specified period. This is a modeled ILO estimate. The series is part of the ILO estimates and is harmonized to ensure comparability across countries and over time by accounting for differences in data source, scope of coverage, methodology, and other country-specific factors. The estimates are based mainly on nationally representative labor force surveys, with other sources (population censuses and nationally reported estimates) used only when no survey data are available. Estimates for countries with very limited labour market information have a high degree of uncertainty. Hence, estimates for countries with limited nationally reported data should not be considered as “observed” data, and great care needs to be applied when using these data for analysis, especially at the country level.

Source: International Labour Organization, ILOSTAT database. https://ilostat.ilo.org/data/.

The size of the public sector in the region, a strong employment provider, tends to be bigger than in other middle-income and emerging economies, although, for some countries it has slighlty declined over time. The public sector wage bill in the MENA region ranges between 4.7% of the GDP (Jordan) to 14.1% (Tunisia), with Algeria, Lebanon, and Morocco also over 10%. Public wages in most emerging economies tend to represent a smaller share of the GDP (2.6% for Kazakhastan, 5.1% for Colombia, 5.4% for Indonesia), yet, other major emerging economies such as Brazil and South Africa devote significant resources to public workers (World Bank, 2021[1]). Rapid labour force surveys conducted during the first year of the pandemic revealed a significant increase of unemployment rates among surveyed individuals, reaching an increase of 50% in the case of Egypt, 33% in Tunisia and 23% in Morocco2. In the context of the COVID-19 pandemic, with raising unemployment, the public sector was no longer in a position to create, or even maintain, jobs, due to the considerable fiscal efforts for supporting national economies from the economic and social impact of the crisis.

Some initiatives exist, such as the reinstatement of compulsory military service in Jordan to limit youth unemployment, but in absolute terms the contraction of the public employment market highlights the necessity of taking action to create more employment opportunities in the private sector.3

COVID-19 and informality

The MENA region has one of the highest rates of informal employment in the world; notably, on average 68% of employment in the region is informal (OECD, 2020[2]). Informality is generally associated with limited to no social protection coverage and low and unstable incomes, making informal workers particularly vulnerable in times of crisis (World Bank, 2021[3]). During the COVID-19 pandemic, social distancing and confinement measures reinforced the vulnerabilities of informal workers in MENA economies, where they are largely concentrated in low-productivity jobs requiring physical presence, with no possibility of working remotely. During the COVID-19 crisis, mobility restrictions have therefore further burdened the activity of informal workers, who faced the dilemma of complying with health measures or maintaining a source of income to meet their basic expenses (OECD, 2020[2]).

While COVID-19 did still contribute to the further development of informality, which is on an upward curve in the MENA region, ad-hoc mobility restrictions, limited role of informality as a crisis-times buffer against negative shocks by temporarily absorbing labour pushed out of the formal sector. This is particularly the case in the economies where regulatory efforts seem to have contained its diffusion (OECD, 2021[4]).

Because of the monitoring difficulties associated with the informal sector’s hidden nature, many informal workers experienced greater difficulty in benefiting from the Government’s pandemic emergency packages (World Bank, 2021[5]). To partially address the absence of official data, MENA countries implemented specific measures to support informal workers, through for example, cash transfers addressed to households (OECD, 2020[2]). Nearly 62% of all female workers are informally employed in the broad MENA region (ILO data) (OECD, 2020[6]). Within the informal employment sphere, women are typically the most vulnerable and lowest paid category, employed heavily in services, especially tourism, agriculture and domestic work. The presence and patterns of women in the informal economy in the region are linked to interrelated socio-economic, cultural, structural and institutional factors. In addition, household chores, coupled with the often limited availability of affordable childcare facilities and family-friendly policies, act as a brake on women's employment (OECD, 2021[7]). Due to those regional-specific barriers related to unequal economic opportunities, women’s job and income security are more exposed to the economic fallout from the pandemic.

The impact of the pandemic on employment highlights the necessity for governments to facilitate the transition of the labour force away from informality and towards creating more opportunities in the private sector. Governments will need to find additional revenues to finance the significant costs of relief efforts to mitigate the adverse effects of the global pandemic on their economies. This is especially true given the limited tax base in the broad MENA region and the high levels of unemployment and informality. The following sections consider respectively the potential of SMEs, trade and tourism as gateways to economic growth, sustainable development and decent jobs.

SMEs

As virtually everywhere around the world, SMEs also play a central role in MENA economies constituting the majority of business units and accounting for significant shares of jobs.

SMEs play a substantial role in formal employment in the private sector in Egypt (around 33%), Jordan (around 43%), Lebanon (55%), Morocco (nearly 30%), the Palestinian Authority (over 90%) and Tunisia (nearly 40%) (OECD, 2020[2]).

Moreover, formal and informal micro enterprises, i.e. businesses with fewer than 10 employed persons, and self-employed account for 70% of total employment in the region, just behind South Asia and Sub-Saharan Africa, both with a share of 80% (OECD, 2020[2]). MENA countries are fully aware of the importance of SMEs and have put in place strategies to encourage and support entrepreneurship. Reforms are at varying stages of progress, starting with the incorporation of SME issues into national development plans or broad strategies, e.g. Algeria, Jordan, Morocco and Tunisia. Some countries already adopted dedicated SME strategies and laws, notably Egypt, Lebanon and Morocco. These countries also recognise that many SMEs operate in the informal sector and are making efforts to reduce informality in their economies, (IMF, 2019[8]) by for example encouraging informal-sector business owners to formalise their jobs and benefit from targetted services on financing, training and mentoring.

As a result of the COVID-19 crisis, a significant proportion of SMEs in the broad MENA region had to reduce their permanent employment, if not completely shut down. The persistent decline in business activities and the duration of the pandemic increases the risks of permanent job loss for MENA firms. For instance, in Jordan, during the early stage of the pandemic (i.e. July-August 2020), 26% of firms reduced their permanent workers; they were 39% to do so in the period November 2020-January 2021 (ILO, 2021[9]).

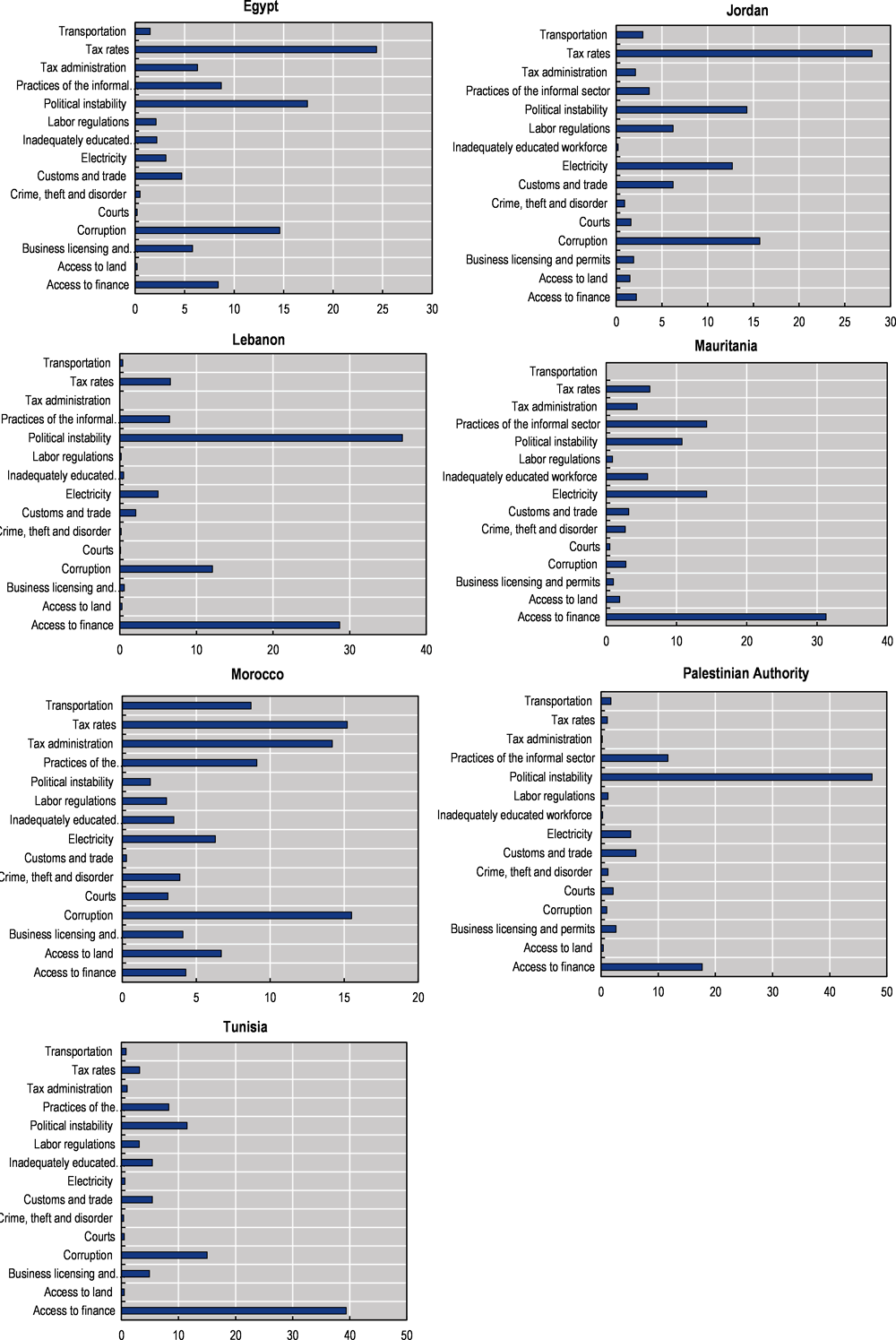

Governments of MENA countries have implemented numerous initiatives to support SMEs against the COVID-19 crisis -for a deeper analysis on initiatives in Egypt and Tunisia, see (OECD, 2021[10]). However, structural weaknesses of the business environment (Figure 1.2) and their reflex on the typical characteristics of the business population, made it more difficult for SMEs in the region to face the pandemic. In particular:

Insufficient access to finance. A smaller proportion of SMEs have a loan or line of credit than large enterprises: only 8% of debt goes to SMEs in the broad MENA region. This is lower than the average of 18% for middle-income countries and 22% for high-income countries. Nearly 63% of MENA MSMEs lack access to finance and the total financing gap for MSMEs in the region is estimated at USD210-240 billion (of which the formal MSME financing gap is estimated at USD180-160 billion) (IFC, 2021[11]). These difficulties seem to be rooted in the lack of an adequate enabling environment, which referes to a lack of sufficient regulation (such as simplyfing licensing requirements, facilitating market access for regional and international etc.), poor financial infrastructure, and often the absence of suitable banking products.

Limited use of digital tools. While some SMEs operating in a number of sectors, notably the retail sector, have been able to maintain their activity thanks to digital tools, a good share of SMEs in the broad MENA region were not yet equipped with the digitalisation of business processes and functions. Prior to the pandemic, only 8% of SMEs in the broad MENA region had an online presence (compared to 80% in the United States) and only 1.5% of the region’s retailers were online (OECD, 2021[12]).

Figure 1.2. Top business environment constraints in the MENA region

Note: Percentage of firms that consider a given business environment obstacle as the most important one from a list of 15 business environment obstacles. The figure presents the top ranking obstacles compared to the regional averages. Data for Egypt and Tunisia refer to 2020 ; for Jordan, Lebanon, Morocco, the Palestinian Authority, to 2019; for Mauritania, to 2014. Data for Algeria are not available

Source: World Bank Enterprise Survey (WBES) (2020), https://www.enterprisesurveys.org/en/enterprisesurveys.

Vulnerability of women-led businesses. Several characteristics of respectively women- and men-owned enterprises affected their resilience to the COVID-19 crisis. In particular, women-owned businesses are more likely than men-owned to operate in services sectors that were severely hit by the pandemic-induced demand shock, e.g. retail trade, hospitality, personal services (OECD, 2020[2]). The lower resilience of women-led businesses in the region is further compounded by the average lower size of these businesses, which also tend to have younger employees and managers. Because of this, women-led businesses are more likely to be self-financed, or financed by friends and family, and have fewer financial assets. In the region, as it happens in other parts of the world, access to credit is easier for businesses owned by men, preferably with previous work experience and collaterals. Conversely, also due to societal considerations, young women entrepreneurs find it more difficult to access traditional financing. Moreover, in the broad MENA region only 38% of women have a bank account, compared to 57% of men (OECD, 2020[13]). Finally, women entrepreneurs have fewer networks of professional contacts to exchange advice on managing the pandemic, and also lower levels of digital connectivity that could have helped them to face and adapt to market disruptions (IFC, 2021[14]).

Beyond these vulnerabilities, the broad MENA region has one of the lowest share of women-owned SMEs in the world. Data from 2019 estimate that only 14%, compared to the global average of 34% (OECD/ILO/CAWTAR, 2020[15]). The under-exploited potential of female entrepreneurship is considered a factor that lowers resilience in times of crises (World Bank, 2021[16]).

However, despite adverse factors, start-ups are already helping build resilience of MENA economies. According to data by MAGNiTT, a consultancy based in Dubai, MENA start-ups in 2020 saw a record USD 1 billion in investments, up 13% from 2019, while the number of investment deals decreased. This positive trend also continued in 2021, with start-ups rising and 862 million USD in Q2 2021 (MAGNiTT, 2021[17]). In the MENA region, Egypt is the most dynamic, being one of three main hubs in the broad MENA region, along with Saudi Arabia and the United Arab Emirates. In 2021, these three countries alone attracted 71% of the capital dedicated to start-ups in the Middle East. The sectors benefiting most from high investment are fintech, e-commerce (in the broadest sense of the term, which also includes the transport of goods traded electronically), ED-tech and health (WAMDA, 2021[18]).

Policy considerations

Strengthening the resilience of the region’s SMEs ecosystem and facilitating an inclusive recovery ready for the challenges of the digital economy should take into account major policy considerations:

Promote a more inclusive private sector for disaster response and post-disaster reconstruction. Governments will need to find additional revenues to finance the significant costs of relief efforts to mitigate the adverse effects of the global pandemic on their economies. This is especially true given the limited tax base in the broad MENA region, related to the high levels of informality. Investing in the resilience of SMEs and the private sector in general is an economic imperative for the MENA region. This involves lifting existing constraints on business development to foster growth of inclusive and competitive SMEs that can contribute to employment opportunities in the region. Leveraging the role of the private sector will also require facilitating the accessibility of public support packages and creating harmonised and transparent channels of communication between both sectors.

Create incentives to formalise the informal sector. Governments can build on existing COVID-19 initiatives to enable a healthier environment for SMEs. For example, by improving awareness of the benefits of formalisation, simplifying administrative procedures, reducing tax compliance costs, and addressing the skills gap of informal economy workers.

‒ The Palestinian Authority launched an SME fund to provide soft loans to SMEs and a credit facility of USD 32 million was extended to SMEs (IMF, 2021[19]); Jordan expanded the guarantees provided by the Jordanian Loan Guarantee Cooperation on SME loans, including credit facilities made available for the tourist sector (Central Bank of Jordan, 2020[20]); Lebanon launched a USD 797 million stimulus package aimed at supporting daily workers in the public sector, health care workers and farmers and subsidized loans for SMEs (OECD, 2020[2]).

Support broader adoption of digital tools by their SMEs ecosystem by addressing the main barriers behind SME digitalisation efforts. This includes working on institutional and regulatory gaps (e.g. launch e-government platforms; define clear digitalisation strategies; create incentives for SMEs to digitalise such as including online invoicing), promote specific training on digitalisation for local public officials, mentors, business organisations and youth, expand the development of digital infrastructure (e.g. internet connectivity) and promote specific digital innovation hubs (European Union, 2020[21]).

Enable the delivery of adequate support and training for entrepreneurs, and offer opportunities for MSMEs to adapt their operating modes and business models to the new environment, improving digital education and acquisition of soft and hard digital skills. Digital literacy plays an essential role in fostering employability in the private sector and in formal entrepreneurship. Examples of public efforts to increase the region’s readiness to capitalise on the digital economy already exist. Egypt’s digital strategy, launched in 2020 to support its digital capacity, presents a three-pillar approach that targets the improvement of the country’s digital infrastructure, its regulatory environment and promotes activities in support of skills development and innovation.

Tourism

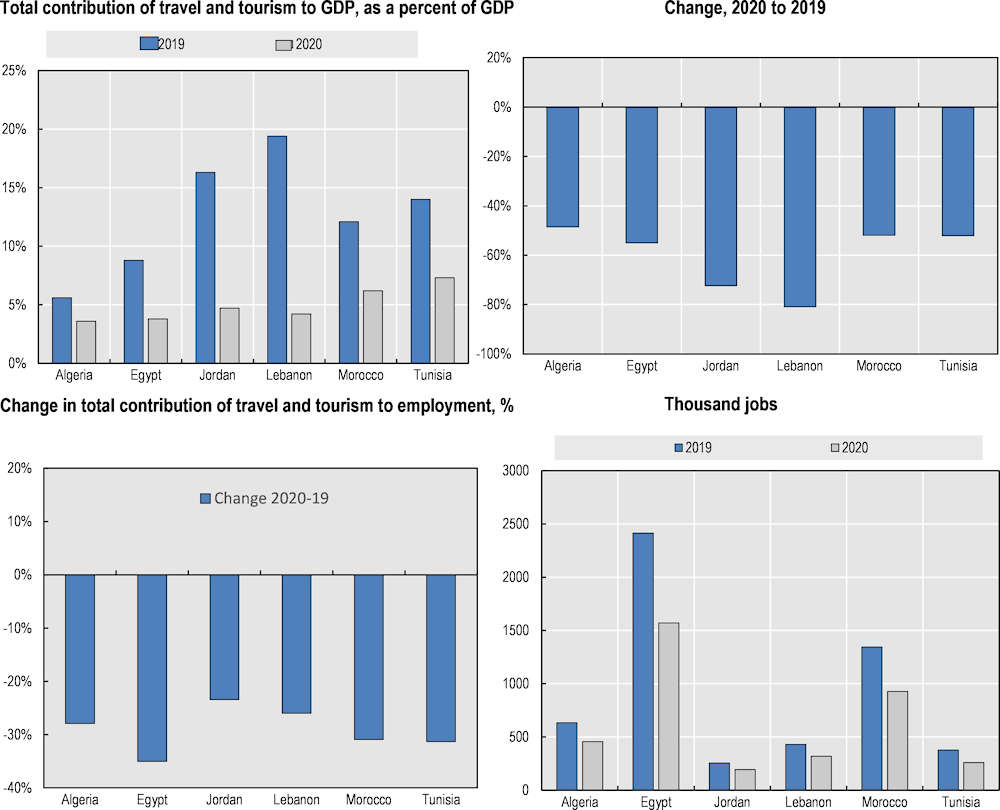

The COVID-19 crisis severely affected the tourism sector in MENA countries, wreaking havoc on social and economic affairs of major cities and tourist sites. Tourism is a highly significant economic sector for the region, accounting for above or close to 10% of GDP and close to 7% of employment in several countries (Figure 1.3). International tourist arrivals to the Middle East declined on par with the global rate, at approximately 70% in 2020 compared to the previous year (UNWTO, 2020[22]).

Figure 1.3. Travel and tourism in the MENA region

Note: Data for the Palestinian Authority and Mauritania are not available. WTTC data are model estimates, figures do not always align with country data

Source: World Travel and Tourism Council, 2021, https://wttc.org/Research/Economic-Impact

Table 1.1. Covid-19 and the travel and tourism sector in the MENA region

Drop in revenues, percentage of GDP and number of jobs, 2019-20

|

% drop in revenues from travel and tourism sectors |

% drop of travel and tourism sectors of GDP |

% decline in travel and tourism jobs |

|

|

Algeria |

-49.1% |

-49.1 % [From 10.4% of GDP in 2019 to 5.5% in 2020] |

-18.5 % From 334 thousands jobs in 2019 to 272 million jobs in 2020 |

|

Egypt |

-55 % |

-55 % [From 8.8 % of GDP in 2019 to 3.8 % in 2020] |

-35% From 2.4 million in 2019 to 1.6 million in 2020 |

|

Jordan |

-80% (during the first eight months of 2020) |

-72.3% [From 16.3 % of GDP in 2019 to 4.7% in 2020] |

-23.4% From 255 thousands in 2019 to 196 thousands in 2020 |

|

Lebanon |

-80.9 % |

-78.4% [From 19.4% of GDP in 2019 to 4.2 % in 2020] |

-26% From 430 thousands in 2019 to 318 thousands in 2020 |

|

Morocco |

-52 % |

-52 % [From 12% of GDP in 2019 to 6.2 % in 2020] |

-31% From 1.35 million in 2019 to 930 000 in 2020 |

|

Palestinian Authority |

-68% |

From 2.5% of GDP in 2019 to 1.7 % in 2020 |

|

|

Tunisia |

-52 % |

-52 % [From 14 % of GDP in 2019 to 7.3 % in 2020] |

-31.3% From 380 thousands in 2019 to 260 thousands in 2020 |

|

Worldwide |

Loss of almost USD 4 trillion Loss of USD 1.3 trillion on total export revenues from international tourism -85% less tourist arrivals between 2020 and 2021 |

From 10.4% of GDP in 2019 to 5.5 % in 2020 |

-18.5% In 2020, 62 million jobs were lost |

Note: Data for Mauritania are not available.

Source: (WTTC, 2021[23]); (Egyptian Cabinet IDSC, 2020[24]); World Bank, 2021, Travel and Tourism direct contribution to employment https://tcdata360.worldbank.org/indicators/tot.direct.emp?country=BRA&indicator=24644&viz=line_chart&years=1995,2028; Central Bank of Jordan, 2021, https://www.cbj.gov.jo/Pages/viewpage.aspx?pageID=93

Covid-19 possibly induced short-term to longer-term travel and tourism changes. Regional and rural coastal destinations fared better than cities in terms of maintaining tourism during the pandemic, a trend that is likely to continue (OECD, 2020[25]). Changing traveller behaviour and ways of travel may lead to new opportunities for the travel and tourism sector in the MENA countries, driving innovation, new business models and niches/markets, opening up new destinations and creating more sustainable and resilient tourism.

MENA countries face important environmental challenges. With the lifting of lockdown measures demand for travel and tourism grew again, helping to mitigate the impact on jobs and businesses in some places and is likely to continue. However, due to continuing crises, there is an ongoing decline in businesses and jobs in the tourism sector with implications for travel behaviour. Coastal tourism for the MENA countries is highly reliant on environmental well-being and existing environmental challenges plaguing the region can negatively affect the successful growth of MENA tourism sectors. Water scarcity in the region will likely increase competition and tension between tourism and other sectors as tourism is a water-intensive industry. Meanwhile, desalination processes, which are necessary for water-scarce countries that rely on tourism as an important economic sector, remains expensive. Rising seas are expected to continue affecting beach-based tourism and coastal areas (C. Michael Hall, 2019[26]). Extreme events, such as heatwaves, floods and droughts also appear to be increasing in the broad MENA region, affecting not only tourism but everyday life for citizens.

The "confinement fatigue", induced by repeated confinements, shifts tourism away from busy tourist hotspots to proximity tourism. People prefer places with lower human density and the opportunity to emerge into local communities by working in the countryside, learning new skills and disconnecting for a while. (Southan, 2021[27]). Thus, there is a tendency for ‘private solutions’ when travelling, avoiding big gatherings, and prioritising private means of transport. Demand for local and smaller accommodations is expected to increase. MENA countries should exploit this opportunity to promote, through investment and promotion, rural or remote areas that were not previously privileged destinations. In this sense, the revival of tourism in the region brings the prospect of cultural and economic development of regions across the Mediterranean.

Sustainability is becoming more prominent in tourism choices due to greater climate change awareness and the impacts of tourism (OECD, 2020[25]). Therefore, shorter travel destinations may be preferred which can also impact spending patterns, as domestic tourists tend to be more price sensitive (OECD, 2020[25]). The MENA region would benefit from developing regional tourism. So far, only a small proportion of tourists from the MENA countries travel intra-regionally.

Travelling by plane travel is on decline, as travellers tend to fly to locations and then continue by ‘low travel’, which is using other means of travel on the ground such as trains, cars and bikes (Barry, 2021[28]). Moreover, the duration of holidays is expected to increase in the near future, as workers were saving their holidays in 2020 and waiting for less strict measures. The average trip duration in 2021 was around two weeks (Southan, 2021[27]). The increase in duration of holidays is also in line with people’s prioritisation of immersing themselves into local environments.

Changes in the supply of tourism

There are several structural changes expected in tourism supply across the ecosystem:

Labour and skills shortages in the tourism sector may be exacerbated, as jobs are lost and workers redeploy to different sectors (OECD, 2020[25]) (Table 1.1). As there is reduced investment, there is a need for policies to incentivise and restore investments in the tourism sector to maintain the quality of tourism offers and promote a sustainable recovery.

COVID-19 accelerated the digitalisation of tourism services, including a higher use of automation, contact-less payments and services, virtual experiences and real-time information provision (OECD, 2020[25]). Tourism policy will need to be more reactive and is expected to move to more flexible systems over the long-term which are more quickly adaptable to changes of policy focus. Particular areas of focus will be crisis management, safety and health policy issues among others.

Policy considerations

In order to enhance the recovery of the tourism industry and promote a more inclusive and sustainable expansion of the sector, MENA countries in cooperation with regional and international actors could take the following considerations into account:

Exploit the shift towards proximity tourism through investment and promotion of rural or remote areas in MENA countries that were not previously privileged destinations. In this sense, the revival of tourism in the region brings the prospect of cultural and economic development.

Incentivise and restore investments in the tourism sector. Labour and skills shortages in the tourism sector were exacerbated as jobs were lost and workers redeployed to different sectors (OECD, 2020[25]). As there is reduced investment, there is a need for policies that will restore and expand investment in the tourism sector to maintain and further improve the quality of tourism and promote a sustainable recovery.

Develop regional tourism to expand travel flights and routes within the Mediterranean. So far, only a small proportion of tourists from the MENA countries travel intra-regionally. There is a strong potential to exploit this post-pandemic shift and attract tourism into the broad region from outside the MENA region. Once implemented, this can be further promoted through innovative advertising and campaigns, drawing attention to the hidden cultural gems and benefits of the region.

Invest and improve travel infrastructure and regional cooperation. The establishment of effective intra-regional modes of transportation would allow for a larger inflow of people moving within the region, creating further opportunities for jobs and economic development. In the long run, the aspiration for the MENA region would be to implement good practices and enhance seamless travel, an objective strongly inspired by the SDGs, which would further support the tourism industry sustainably and contribution to inclusive economic growth (OECD, 2020[29]).

Continue to build on the advances in digitalisation of tourism services already accelerated by the pandemic. The pandemic has inspired a rapid move towards automation, contact-less payment and services, virtual experiences and real-time information provision (OECD, 2020[25]). Tourism policy will need to be more reactive and move to more flexible systems which are more quickly adaptable to changes of policy focus. Particular areas of focus will be crisis management, safety and health policy issues, among others.

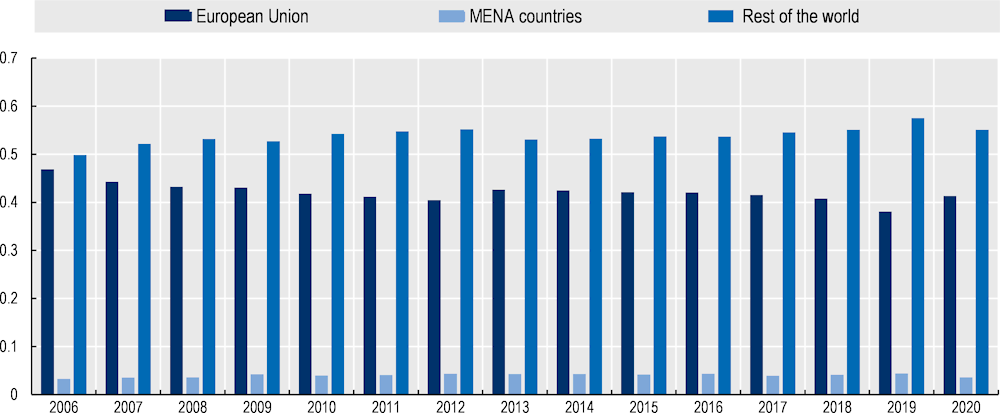

Trade

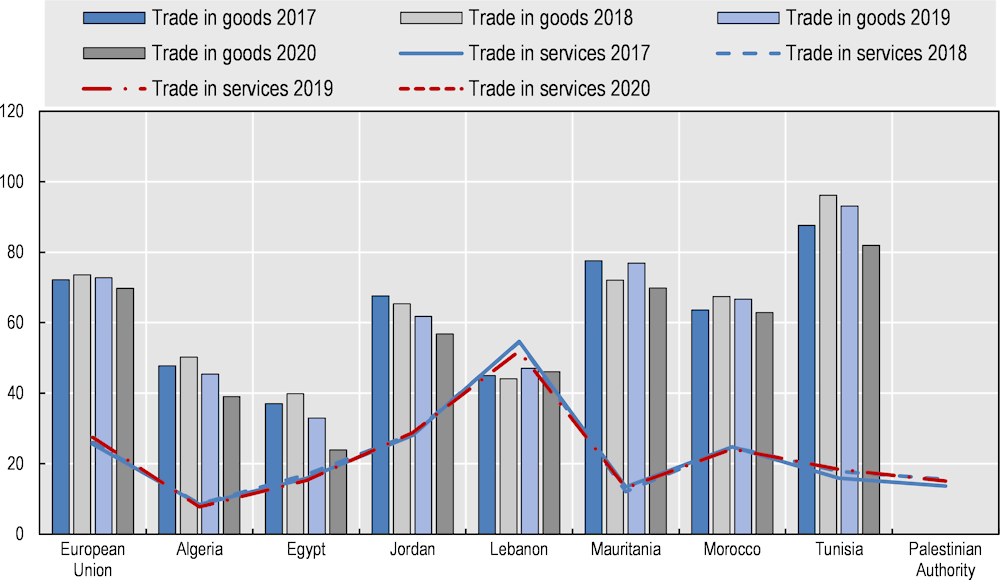

Trade in the MENA region has been historically defined by the considerable size of the European market (Figure 1.4), which has represented since 2006, on average, 46% of MENA countries’ exports and 39% of imports. This dominance has nevertheless slowly decreased in favour of other regions of the world, and intra-MENA trade, which only suffered a considerable drop in the share in 2020.

Figure 1.4. MENA’s trade volume with the EU, the MENA region and the rest of the world

Note: Data for Algeria for 2018, 2019 and 2020, and for Tunisia for 2020 are mirrored data from reporting countries.

Source: OECD calculations, UN Comtrade database.

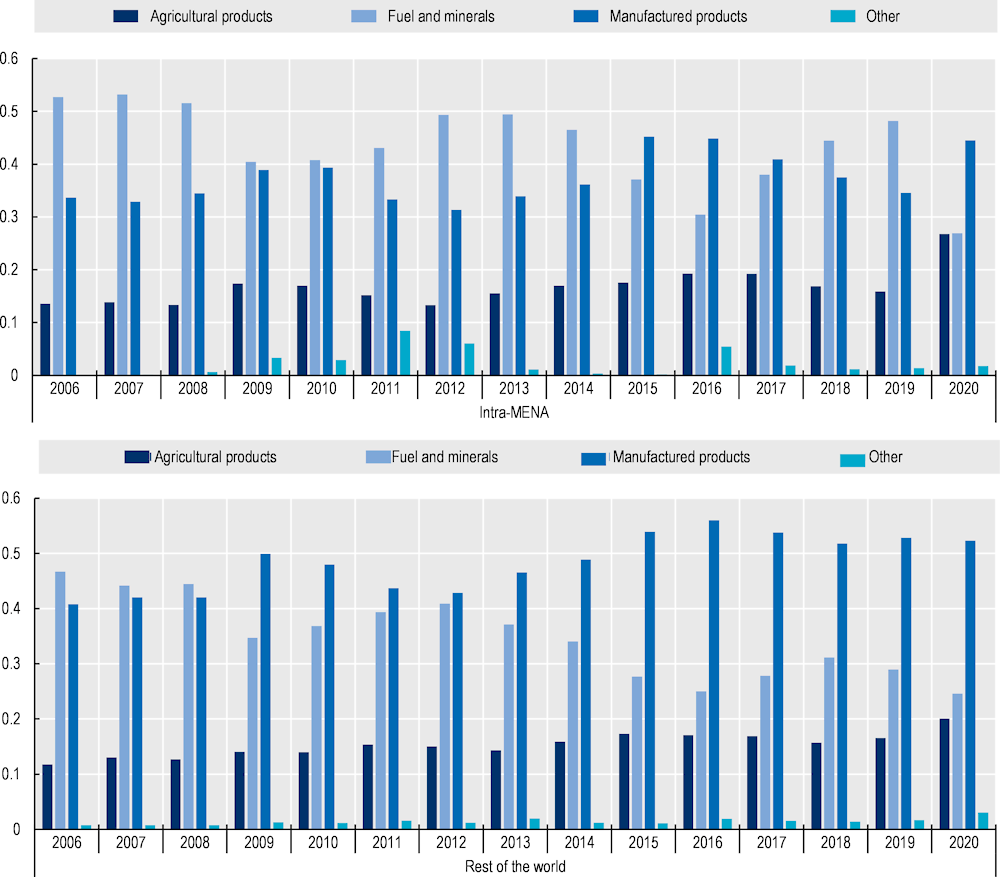

In the early 2000s, trade within the MENA region and between MENA countries and the rest of the world shows a similar relationship as per main commodity groups (Figure 1.5). The oil industry dominated the region’s trade (imports and exports) and with the rest of the world, representing roughly 52% of the trade between MENA countries and 46% of MENA countries’ trade with the rest of the world. Trade in manufactured goods was nonetheless relevant, but more present in trade between MENA and non-MENA countries.

As the decade progressed, intra-MENA and MENA’s global trade slightly diverged. As such, MENA trade with the rest of the world in manufactured goods increased its share, representing by 2020 more than half of the region’s trade outside its borders. Likewise, trade in food and agricultural products doubled its share, while trade in fuels and minerals nearly lost half its value. Accounting for the particular impact the COVID-19 pandemic had on oil and gas global prices, was less abrupt and its dominance over trade in manufactured goods or agricultural products remained solid for most years. Nonetheless, the second decade of the century witnessed a significant increase on the share of these goods against fuels and minerals. In 2020, trade in manufactured goods and agricultural products amounted for 70% of the region’s internal trade, while trade in agricultural products did essentially remain unaffected by the pandemic.

Figure 1.5. Evolution of trade in MENA countries by main commodity categories

Note: Algeria’s data for 2018, 2019 and Algeria’s and Tunisia’s data for 2020 is mirrored data from other reporting countries.

Source: OECD calculations, UN Comtrade database.

The global pandemic slowed down international trade in 2020, but trade gradually resumed in 2021. The MENA countries ultimately experienced less severe drops in trade flows in 2020 than initially estimated (Table 1.2).

Table 1.2. MENA and EU-27 total exports and imports, 2018-20

% of GDP

|

|

Exports of goods and services |

Imports of goods and services |

||||

|---|---|---|---|---|---|---|

|

|

2018 |

2019 |

2020 |

2018 |

2019 |

2020 |

|

Algeria |

25.9 |

22.7 |

18.0 |

32.2 |

29.1 |

27.8 |

|

Egypt |

18.9 |

17.5 |

13.1 |

29.4 |

25.7 |

20.7 |

|

Jordan |

35.2 |

36.3 |

23.7 |

53.4 |

49.4 |

41.7 |

|

Lebanon |

20.6 |

20.4 |

19.7 |

47.2 |

40.7 |

25.9 |

|

Mauritania |

34.3 |

39.2 |

39.8 |

47.9 |

50.0 |

51.3 |

|

Morocco |

38.8 |

39.3 |

34.9 |

49.2 |

47.9 |

42.6 |

|

Tunisia |

45.7 |

40.9 |

32.9 |

58.6 |

52.9 |

39.6 |

|

Palestinian Authority |

16.0 |

15.5 |

16.0 |

55.4 |

53.5 |

51.1 |

|

European Union |

49.2 |

49.3 |

46.6 |

45.3 |

45.9 |

42.9 |

Note: Tunisia’s exports and imports for 2019 and 2020 do not include services.

Source: World Bank national accounts data and OECD National Accounts data files.

Recent research on the impact of the pandemic suggested that trade subject to regional trade agreements (RTAs) was more resilient to the downturn: the decline for an average country was about - 13.8%, -14.1% without an RTA, -11.2 with an RTA and -8.5% if the RTA is deeply integrative (UNCTAD, 2021[30]). This holds for most RTAs involving MENA countries (Table 1.3), with differences depending on the direction of trade flows (export or import) and specific RTA agreement.

In particular, exports between MENA members of RTAs saw in 2020 a smaller drop, compared to 2019, than the countries’ global export performance. Exports between signatory countries of the Agadir Trade agreement fell 4% in 2020, a significantly smaller contraction compared to the 9.8% drop Agadir countries experienced with their exports to the entire world. However, imports between Agadir signatory countries showed a bigger drop (38%) than that of their imports at the global level (13.83%), and a similar effect is observed among PAFTA/GAFTA adherents. This can be partially explained by the nature of the region’s imports. For instance, Egypt’s imports basket in 2020 was dominated by machinery (20% of the total imported products), cereals and other food products (13%), which mostly originate outside the MENA region, and are thus not covered by Agadir’s or PAFTA/GAFTA’s RTAs. On the other side, oil, a crucial commodity produced within the region, and reflected in PAFTA/GAFTA trade flows, suffered the biggest drop in value among all imported products in 2020 with respect to 2019 in countries like Jordan (-75%), Tunisia (-50%), Egypt (-45%), Lebanon (-36%) or Morocco (-32%).

In the context of the EU Association Agreements on Trade, in most cases, both exports and imports between the EU and MENA countries showed higher resilience in 2020 than overall trade in each respective country, with few exceptions, e.g. Egypt’s and the Palestinian Authority’s imports performed better globally than within their respective EU Association Agreements, and Jordan’s exports to the EU were more disrupted in 2020 than the country’s total exports.

From a policy perspective, to build resilience it is important to consider the nature of the trade interaction between partner countries (i.e. what is traded and the level of integration in GVCs), as well as the depth of trade agreements, which help explain the performance of trade in the case of global and regional shocks.

Table 1.3. Trade Agreements of MENA countries and trade changes, 2019-20

Billion, current USD; percentage

|

Agreement

|

Relation |

Exports of goods |

Imports of goods |

||

|---|---|---|---|---|---|

|

2020 |

2020- 2019 change |

2020 |

2020- 2019 change |

||

|

Agadir Agreement |

Intra |

3.38 |

-4% |

2.18 |

-39% |

|

Total |

89.2 |

-9.8% |

155.2 |

-14% |

|

|

PAFTA/GAFTA |

Intra |

83.8 |

-7.71% |

57.3 |

-27% |

|

Total |

341 |

-16% |

535 |

-19.6% |

|

|

EU Association Agreements: |

|||||

|

Algeria |

Intra |

10.8 |

-30.59% |

14.5 |

-20.77% |

|

Total |

18.8 |

-42.51% |

16.8 |

-22.22% |

|

|

Egypt |

Intra |

9.66 |

-0.21% |

19.56 |

-11.08% |

|

Total |

33.6 |

-11.58% |

56.84 |

-9.92% |

|

|

Jordan |

Intra |

0.52 |

-4.68% |

3.67 |

-14.05% |

|

Total |

9.72 |

-9.79% |

19.1 |

-16.96% |

|

|

Lebanon |

Intra |

0.489 |

-4.68% |

4.7 |

-31.99% |

|

Total |

4.24 |

-9.79% |

12.9 |

-32.81% |

|

|

Morocco |

Intra |

19.95 |

-6.71% |

23.5 |

-11.69% |

|

Total |

32.2 |

-6.94% |

43.2 |

-13.43% |

|

|

Palestinian Authority |

Intra |

0.019 |

34.51% |

0.48 |

-16.46% |

|

Total |

1.15 |

-0.86% |

5.42 |

-2.87% |

|

|

Tunisia |

Intra |

10.63 |

-16.17% |

10 |

-18.79% |

|

Total |

13.7 |

-19.88% |

16.5 |

-25.34% |

|

Note: Intra refers to trade between the members of the RTA. Total refers to the total trade volume of the reporting country on a given year. PAFTA/GAFTA exports do not include exports to unspecified regions.

Source: OECD calculations, UN Comtrade database.

The trade agreements above portrayed reflect the Euro-Mediterranean countries efforts to reduce tariffs on trade of agricultural and manufactured goods, typically not covering trade in services. This contributes to the region’s trade in goods dominance over a much more timid trade in services, which by nature require more ambitious agreements, which comprises consensus on multiple policy areas that have effects beyond the economic relations of signatory countries (OECD, 2021[12])4.

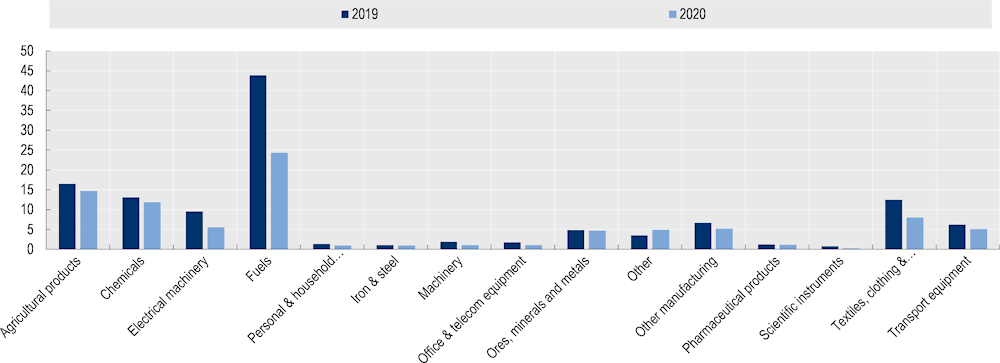

MENA exported products that experienced the deepest impact were those more integrated in the global economy (based on 2020 Economic Complexity Index), notably fuel, for which a drop of 45% (more than USD 19 billion) was observed with respect to the 2019 levels, machinery (drop of 44%), electric machinery (42%), textiles, clothing and footwear (36%) and transport equipiment (21%). Exports of pharmaceutical products were relatively resilient, decreasing by less than 10%. Other resilient export products included ores, minerales and metals, chemicals and agricultural products (Figure 1.6).

Figure 1.6. MENA exports by sector, 2019-20

Source: OECD calculations, UN Comtrade database.

As was the case in other regions of the world, the contraction of trade in MENA stressed the importance of addressing structural problems, to boost trade competitiveness and at the same time strengthen economic resilience against crises.

Supply chains: Following the pandemic, the question of disruptions of supply chains has, indeed, become central in the policy debate on global trade. OECD estimates indicate that the extent of disruption to supply chains around the world was very heterogeneous - on average 7% in value terms over the course of 2020 (Arriola, Kowalski and van Tongeren, 2021[31]). Related to the analysis of the extent of disruptions, the COVID-19 crisis prompted work on ways to strengthen resilience of supply chains, with new tools being developed to guide both governments and businesses to better prepare to face different risks (see below under Policy considerations, the OECD's 4 keys to resilient supply chains).

Trade in services: Even prior to the world pandemic, trade in services lagged behind trade in goods in MENA countries, except for Lebanon (Figure 1.7). This is due to the high degree of regulatory restrictiveness in the different countries, in the absence of international treaties liberalising services. Although less important than trade in goods, trade in services has a relevant place in the MENA countries. The average contribution of trade in services to GDP is higher in most MENA countries than the world average of 13.4%. Moreover, some economies are close to the figures found for the EU-27, the world's largest exporter and importer of services. On average, trade with the EU constitutes 26.3% of the total trade in services of the MENA countries, although with significant cross-country differences; specifically: 64.9% for Tunisia, 43.2% for Morocco, 36.5% forAlgeria, 30.6% for Egypt, 14.9% forJordan, 10% for Lebanon and 9.3% for the Palestinian Authority (EUROMESCO, 2021[32]), (European Union, 2021[33]).

Figure 1.7. Trade in services and goods, MENA countries and EU-27, 2017-20

Note: Trade in goods as a share of GDP is the sum of merchandise exports and imports divided by the value of GDP, all in current USD; Trade in services is the sum of service exports and imports divided by the value of GDP, all in current USD.

Source: International Monetary Fund, Balance of Payments Statistics Yearbook and data files, and World Bank and OECD GDP estimates., https://data.worldbank.org/indicator/BG.GSR.NFSV.GD.ZS

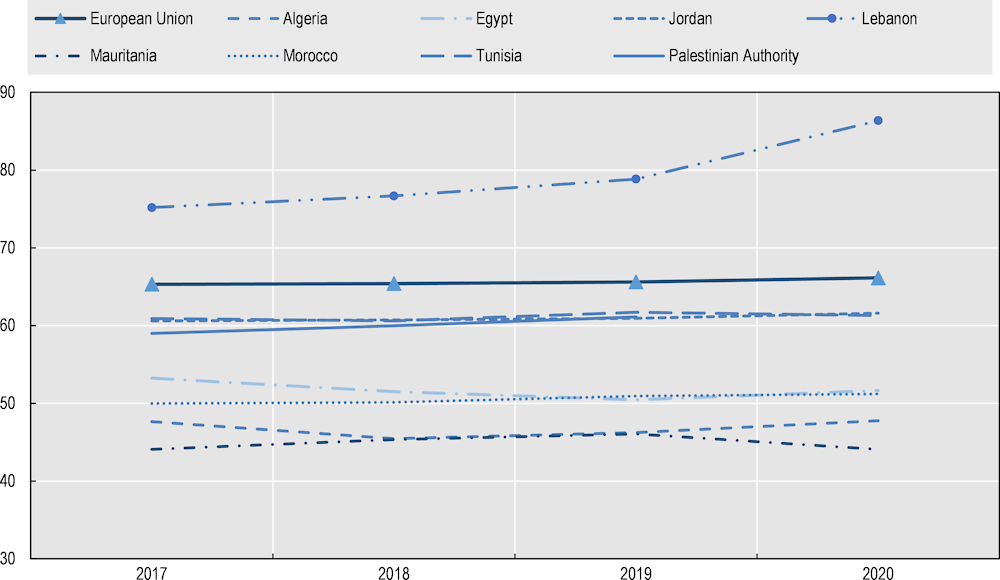

Still, tradable and non-tradable services generate around half of the GDP of MENA countries, employing large shares of the labour force including in the public sector (OECD, 2021[12])(Figure 1.8) (Table 1.4).

Figure 1.8. Services, value added, MENA and EU-27, 2017-20

Source: World Bank national accounts data, and OECD National Accounts data files, https://data.worldbank.org/indicator/NV.SRV.TOTL.ZS

Table 1.4. Employment in services, 2020

% of total employment

|

|

% of total employment |

female (% of female employment) |

male (% of male employment) |

|---|---|---|---|

|

Algeria |

59.99 |

73.13 |

57.52 |

|

Egypt |

52.44 |

70.78 |

47.61 |

|

Jordan |

73.09 |

86.27 |

70.46 |

|

Lebanon |

65.1 |

77.59 |

61.25 |

|

Mauritania |

51.56 |

60.63 |

47.47 |

|

Morocco |

43.66 |

34.58 |

46.49 |

|

Palestinian Authority |

63.59 |

85.6 |

59.48 |

|

Tunisia |

52.75 |

58.47 |

50.94 |

Source: International Labour Organization, ILOSTAT database, Modeled ILO estimate, https://ilostat.ilo.org/data/?#

The importance of the services sector is related to the “servicification” of manufacturing, i.e the manufacturing sector increasingly relies on services that are bundled with material goods, e.g. installation, maintenance and repair services. Manufacturing firms more and more export services bundled with goods, and, through this process, firms create more value (Miroudot and Cadestin, 2017[34]). Moreover, evidence suggests that with servicification, service sectors with high productivity stimulate the productivity of other sectors, notably agriculture and manufacturing.

Most MENA countries are largely dependent on services sectors, but these sectors are underperforming. The value-added of services per worker ranges from USD 6 377 in Mauritania to USD 19 900 in Lebanon. These figures are in contrast to the high values found in Europe and OECD countries, respectively. This is due to the dependence on low productivity service sectors in the region, which are characterised by intensive face-to-face interactions, are less knowledge-intensive and employ a low-skilled workforce. This category includes transport, trade, travel and restaurant services (OECD, 2021[12]). Low-value-added services have been strongly disrupted by the containment measures. In contrast, high-productivity services sectors such as ICT, professional and financial services, were found to be resilient worldwide.

The recovery could provide the momentum in the broad MENA region for advancing the formalisation of international trade partnerships that facilitate trade in services. Such partnerships could in turn stimulate the development of high productivity services sectors through capacity building, infrastructure improvement, provision of capital, transfer of technology and know-how, and human capital development.

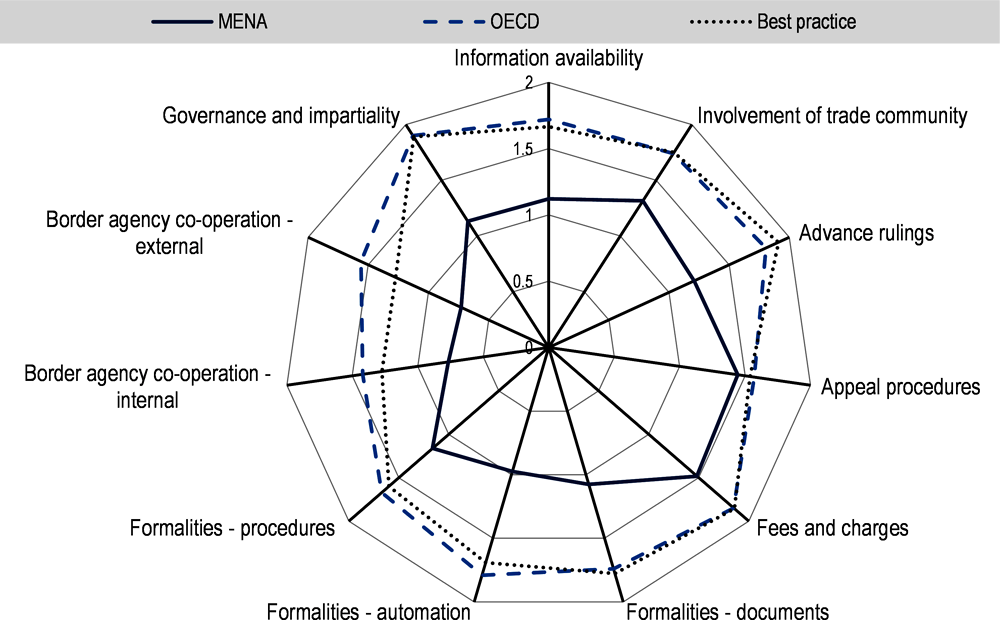

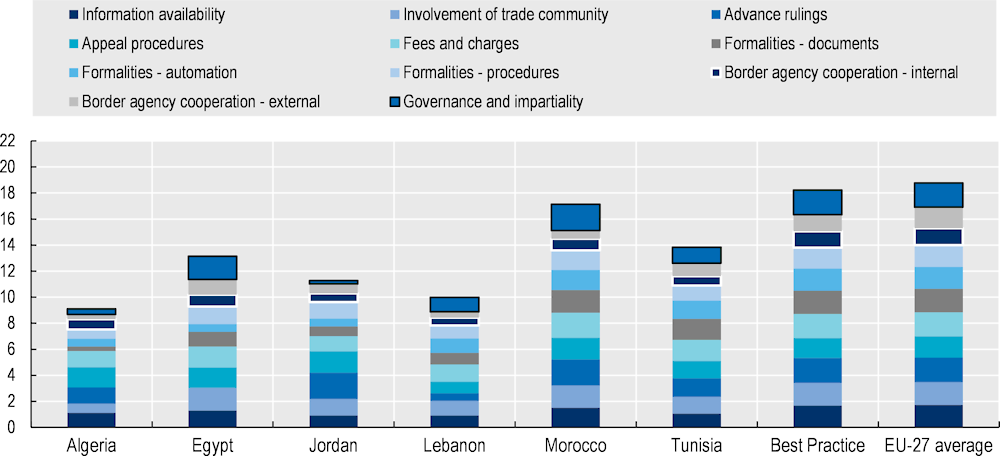

Trade facilitation: The performance of MENA countries on trade facilitation improved in recent years, but weaknesses remain in several areas (Figure 1.9) that should be addressed to enable trade expansion and sustain economic recovery. Figure 1.10 illustrates trade facilitation by country.

Figure 1.9. Trade facilitation, average MENA region, 2019

Note: Best practice represents the top 25% of countries covered by the OECD TFI indices average. Data are not available for the following UfM members of the MENA region: Mauritania and the Palestinian Authority.

Source: OECD Trade Facilitation Indicators (database), www.oecd.org/trade/facilitation/indicators.htm.

Figure 1.10. Trade facilitation in MENA countries, 2019

Note: Each single item has a score from 0 to 2 (best score). Best practice represents top 25% TFI performers average. Data are not available for the following UfM members of the MENA region: Mauritania and the Palestinian Authority.

Source: OECD Trade Facilitation Indicators database, http://www.oecd.org/trade/facilitation/indicators.htm.

Policy considerations

Two reflections should orient policy in support of trade in MENA countries post-pandemic. First, the pandemic confirmed the need to pursue a reform agenda to unleash the untapped trade potential in MENA countries, also in line with the recommendations of the 11th UfM Trade Ministerial Conference in November 2020 (UfM, 2020[35]). These involve:

Increase collaboration on trade regulations and agreements, including the adoption and implementation of treaties that foster trade in services.

Enhance border cooperation with neighbouring countries and advance the automation of trade formalities to further reduce existing trade costs. The minimisation of trade burdens could be achieved through the digitalisation of cross-border systems, custom patrols, entry points and the establishment of electronic single window systems for the registration of trade transactions.

Further invest in telecommunications and transport infrastructure. MENA countries will need to improve their telecommunications infrastructure, a main barrier to high productivity sectors, especially in services. Improved transport infrastructure is equally critical for reducing the costs of trade in goods and encourage business expansions. Currently, the long time and high transport costs in trade with neighbouring countries in the broad MENA region can be dissuasive for businesses that envisage starting or expanding their exporting activities. Better transport infrastructure also allows businesses in rural and remote areas to connect to national and international production networks.

Support trade diversification. The untapped trade potential, in particular South-South, is also a consequence of a limited or inadequate product offer. Improving the general environment for trade, including access to transport and finance, could therefore remain relatively ineffective in the absence of industrial diversification. MENA countries should continue to encourage and facilitate industrial diversification.

Improve production efficiency, technological capacity as well as technical and managerial skills in order to catch up with the trends and opportunities in the use of technology. Moreover, expanding export activities to include non-traditional goods can have further positive impacts on the region’s overall productivity.

Develop sound data and statistics for informing the design of effective trade policies and monitoring their implementation and impact. Today, most MENA countries lack the data needed to assess their capacity to leverage the megatrends of globalisation and digitalisation to improve their international competitiveness.

Second, the crisis stressed the vulnerabilities associated with enhanced industrial and trade integration at a global and regional level, notably in sectors that provide essential goods and services, such as food, medical devices or energy. To increase resilience, measures to be considered include:

Enhance the collaboration between the public and the private sector, to tackle and prevent upcoming risks. Collaboration between public authorities and businesses towards preventing and minimising risks and unexpected threats against supply chains can involve a clear understanding of the local and international actors participating in value chains and trade routes, collecting and sharing information, or developing stress tests for essential goods. Policy that seek strengthening the resilience of supply chains should also explore how to accompany the benefits from specialisation of existing industries with increased competition and diversification.

Implement national and regional mechanisms on resilient supply chains. It is recommended to MENA countries to consider holistic policy tools, such as the OECD's 4 keys to resilient supply chains. This has been developed as an interactive web tool, with the goals to deepen the common evidence base, identify a toolkit of options, and improve communication about the importance of open markets during the pandemic. The tool is meant to help governments and businesses to address disruptions in international trade.

References

[31] Arriola, C., P. Kowalski and F. van Tongeren (2021), “The impact of COVID-19 on directions and structure of international trade”, OECD Trade Policy Papers, No. 252, OECD Publishing, Paris, https://doi.org/10.1787/0b8eaafe-en.

[28] Barry, S. (2021), euronews.travel, euronews.travel, https://www.euronews.com/travel/2021/05/26/travel-industry-experts-on-the-post-covid-travel-trends-emerging-from-bookings.

[26] C. Michael Hall, A. (2019), Tourism and Innovation, Routledge, https://doi.org/10.4324/9781315162836.

[20] Central Bank of Jordan (2020), The Central Bank of Jordan announces a set of procedures aimed to contain the repercussions of the emerging Corona virus impact on the national economy, https://www.cbj.gov.jo/DetailsPage/CBJEN/NewsDetails.aspx?ID=279.

[36] EC (2021), Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions- Trade Policy Review - An Open, Sustainable and Assertive Trade Policy, https://trade.ec.europa.eu/doclib/docs/2021/february/tradoc_159438.pdf.

[24] Egyptian Cabinet IDSC (2020), Information and Decision Support Center, https://www.idsc.gov.eg/.

[32] EUROMESCO (2021), Post-COVID-19 EU-Sounthern Neighbourhood Trade Relations, https://www.euromesco.net/wp-content/uploads/2021/05/Post-Covid-19-EU-SN-Trade-Relations.pdf.

[33] European Union (2021), Trade - Countries and Regions, https://ec.europa.eu/trade/policy/countries-and-regions/countries/.

[21] European Union (2020), Digitalisation of Small and Medium Enterprises (SMEs) in the Mediterranean, https://www.iemed.org/publication/digitalisation-of-small-and-medium-enterprises-smes-in-the-mediterranean/.

[14] IFC (2021), How Firms Are Responding And Adapting During COVID-19 And Recovery, https://www.ifc.org/wps/wcm/connect/publications_ext_content/ifc_external_publication_site/publications_listing_page/how+firms+are+responding+and+adapting+during+covid-19+and+recovery.

[11] IFC (2021), IFC Knowledge Series in MENA - Overcoming Constraints to SME Development, https://www.ifc.org/wps/wcm/connect/c458e2c5-1d69-40a5-8a85-9342f8d0fdb8/SME+Banking+in+MENA+-+issue+1.pdf?MOD=AJPERES&CVID=kcA9gOF.

[9] ILO (2021), The impact of COVID-19 on enterprises in Jordan: One year into the pandemic, https://www.ilo.org/beirut/media-centre/news/WCMS_814253/lang--en/index.htm.

[19] IMF (2021), Policy responses to COVID-19, https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19.

[8] IMF (2019), Enhancing the role of SMEs in the Arab World, https://www.imf.org/en/Publications/Policy-Papers/Issues/2019/12/13/Enhancing-the-Role-of-SMEs-in-the-Arab-World-Some-Key-Considerations-48873.

[17] MAGNiTT (2021), MENA Q3 2021 Venture Investment Report, https://magnitt.com/research/mena-q3-2021-venture-investment-report-50778.

[34] Miroudot, S. and C. Cadestin (2017), “Services In Global Value Chains: From Inputs to Value-Creating Activities”, OECD Trade Policy Papers, No. 197, OECD Publishing, Paris, https://doi.org/10.1787/465f0d8b-en.

[10] OECD (2021), “An in-depth analysis of one year of SME and entrepreneurship policy responses to COVID-19: Lessons learned for the path to recovery”, OECD SME and Entrepreneurship Papers, Vol. No. 25, https://doi.org/10.1787/6407deee-en.

[4] OECD (2021), “Issue Paper Session 4. Social resilience: moving away from informality to formal employment and businesses”, MENA-OECD Government Business Summit, https://www.oecd.org/mena/competitiveness/issue-paper-session-4.pdf.

[12] OECD (2021), Regional Integration in the Union for the Mediterranean: Progress Report, OECD Publishing, Paris, https://doi.org/10.1787/325884b3-en.

[7] OECD (2021), Social resilience: moving away from informality to formal, https://www.oecd.org/mena/competitiveness/issue-paper-session-4.pdf.

[13] OECD (2020), COVID-19 crisis in the MENA region: impact on gender equality and policy responses, https://read.oecd-ilibrary.org/view/?ref=134_134470-w95kmv8khl&title=COVID-19-crisis-in-the-MENA-region-impact-on-gender-equality-and-policy-responses.

[25] OECD (2020), “Mitigating the impact of COVID-19 on tourism and supporting recovery”, OECD Tourism Papers, No. 2020/03, OECD Publishing, Paris, https://doi.org/10.1787/47045bae-en.

[2] OECD (2020), OECD Policy Responses to Coronavirus (COVID-19) : COVID-19 crisis in MENA countries, https://www.oecd.org/coronavirus/policy-responses/covid-19-crisis-response-in-mena-countries-4b366396/.

[6] OECD (2020), OECD Policy Responses to Coronavirus (COVID-19) : COVID-19 crisis in the MENA region: impact on gender equality and policy responses, https://www.oecd.org/coronavirus/policy-responses/covid-19-crisis-in-the-mena-region-impact-on-gender-equality-and-policy-responses-ee4cd4f4/.

[29] OECD (2020), “Safe and seamless travel and improved traveller experience: OECD Report to G20 Tourism Working Group”, OECD Tourism Papers, Vol. 2020/02, https://www.oecd-ilibrary.org/industry-and-services/safe-and-seamless-travel-and-improved-traveller-experience_d717feea-en.

[15] OECD/ILO/CAWTAR (2020), Changing Laws and Breaking Barriers for Women’s Economic Empowerment in Egypt, Jordan, Morocco and Tunisia, Competitiveness and Private Sector Development, OECD Publishing, Paris, https://doi.org/10.1787/ac780735-en.

[27] Southan, J. (2021), Travel-industry experts weigh-in on post-COVID trends, https://www.euronews.com/travel/2021/05/14/what-will-travel-look-like-in-a-post-covid-world.

[35] UfM (2020), Joint statement of the 11th Union for the Mediterranean (UfM) Trade Ministers Conference (10th November 2020), https://trade.ec.europa.eu/doclib/docs/2020/november/tradoc_159033.pdf.

[30] UNCTAD (2021), Trade Agreements and Trade Resilience During COVID-19 Pandemic, https://unctad.org/system/files/official-document/ser-rp-2021d13_en.pdf.

[22] UNWTO (2020), The impact of COVID-19 on international tourism, https://www.unwto.org/events/impact-of-covid-19-on-international-tourism.

[18] WAMDA (2021), “Startup Investment in MENA August 2021”, https://www.wamda.com/2021/09/mena-startups-raised-160-million-august-2021.

[16] World Bank (2021), Living with Debt : How Institutions Can Chart a Path to Recovery in the Middle East and North Africa, https://openknowledge.worldbank.org/bitstream/handle/10986/35275/9781464816994.pdf.

[5] World Bank (2021), MENA Development Report: Distributinal Impacts of COVID-19 in the Middle East and North Africa Region, https://openknowledge.worldbank.org/bitstream/handle/10986/36618/9781464817762.pdf?sequence=2&isAllowed=y#page=58&zoom=100,188,761.

[3] World Bank (2021), The Long Shadow of Informality.

[1] World Bank (2021), Worldwide Bureaucracy Indicators (WWBI), https://databank.worldbank.org/source/worldwide-bureaucracy-indicators-(wwbi).

[23] WTTC (2021), “Economic Impact Reports”, Economic Impact Reports, https://wttc.org/Research/Economic-Impact (accessed on October 2021).

Notes

← 1. MENA region or MENA countries refer to the group of countries that are members of the Union for the Mediterranean. These countries are: Algeria, Egypt, Jordan, Lebanon, Mauritania, Morocco, Palestinian Authority and Tunisia. Where the term “broad MENA region” is used, it refers to the group of MENA countries that include UfM and non-UfM members.

← 2. ILO Rapid Labour Force Surveys on the Impact of COVID-19, conducted in 2020 and 2021.

← 3. Also, the Tunisian law n°38 of 2020 (not yet enforced) aims to recruit into the public sector unemployed graduates who have been unemployed for 10 years or more.

← 4. Negotiations to create Deep and Comprehensive Free Trade Areas (DCFTAs) have been launched between the EU, Morocco, and Tunisia. In 2021, as part of the new EU trade policy review, the EU announced a sustainable investment initiative for interested partners in the Southern Neighbourhood and Africa (EC, 2021[36]).