Veronica Lupi, University of Milan, Italy

Valentina Morretta, University of Milan, Italy

Veronica Lupi, University of Milan, Italy

Valentina Morretta, University of Milan, Italy

The increasing availability of earth observation (EO) data results in a growing number of firms penetrating the “downstream” space sector, providing a diverse range of innovative services and applications. This makes space-based infrastructure ever more valuable to society at large. This chapter presents the results of a survey carried out within a sample of Italian firms in the EO downstream sector, providing an overview of their main characteristics, their points of view on EO’s current and potential socio-economic benefits, and on still existing barriers for adoption in Italy.

Earth observation (EO) is a strategic domain of the space industry. It consists of the collection of a wide variety of chemical, biological and physical information about the Earth via remote sensing technologies (GEO, 2020[1]).1 This domain has undergone dramatic changes since the beginning of this century (Craglia and Pogorzelska, 2019[2]). It has rapidly developed over recent years, enabling a wide array of services, applications for national and local governments, public and private firms, scientists, and citizens (PwC, 2016[3]; Tassa, 2019[4]). According to the Union of Concerned Scientists database (UCS, 2021[5]), 27% of the 3 372 satellites in orbit (or around 900) are EO satellites, while this percentage was only 16% in 2014.

This chapter focuses on firms operating in the EO downstream sector, which is one of the most dynamic and promising segments of the value chain. The sector includes the “intermediate users” of EO data who provide EO services and applications for final users (governments, firms and individuals) in a wide range of fields, including climate change, natural disasters, human health and resource efficiency, to name just a few. We are particularly interested in this category as the downstream sector is expected to contribute the most to the growth and maximisation of the socio-economic value of EO and its socio-economic impact (Pogorzelska, 2018[6]). Indeed, in the coming decades, the expansion of EO will be achieved by advancing firms’ capabilities in Big Data collection, storage and analysis through algorithms, artificial intelligence and computing power to effectively manage and intersect a growing amount of information from different sources.

This chapter aims to answer the following research questions: 1) what are the main characteristics of the firms operating in the downstream sector?; 2) what benefits may stem from the increasing availability of EO data?; and 3) what types of barriers currently hinder the development of this sector?

Our research focuses on Italy. Among European countries, Italy is at the forefront of the EO sector (Kansakar and Hossain, 2016[7]). However, although the Italian space manufacturing sector is at the lead of the international space industry (including the construction of cutting-edge satellites), little is known about the return of EO along the value chain, particularly for downstream operators and final users, where the market potential and socio-economic impact is still underexploited.

To answer our research questions, we collected primary data through an online survey of firms operating in the downstream sector to know their characteristics, needs and view on the benefits stemming from EO.

This chapter is divided into five sections. Section 2 introduces a brief review of the literature related to firms in the EO downstream sector, their characteristics, and socio-economic benefits arising from the production and exploitation of EO services. Section 3 discusses the method and the survey design, while Section 4 presents the results. Finally, the last section concludes by presenting possible obstacles to the sector’s development and policy recommendations.

While satellite technology is advancing quickly, a vast and varied amount of new data is becoming increasingly available to improve decision making and quality of life and to solve pressing societal problems (RFF, 2017[8]).

The EO downstream sector mainly includes small and medium-sized companies with high technological know-how, developing commercial applications from satellite data2 (value added services), geo‑information firms, consultancy companies, research institutes with artificial intelligence expertise and hardware/software development companies, among others (PwC, 2016[3]). In this category, we also include companies and departments within large organisations that deal with data archiving, storage, data pre‑processing, and the delivery of middle services to facilitate and enable the creation of final services and applications (Pogorzelska, 2018[6]; PwC, 2016[3]) (this segment is sometimes called midstream).

According to Euroconsult (2020[9]) the global market for value-added EO services was USD 3.0 billion in 2019,3 growing at a five-year compounded average growth rate (CAGR) of 7%, and it is expected to reach about USD 6 billion by 2030. At the European level, EARSC (EARSC, 2020[10]) estimated EUR 1.38 billion of revenues for the European industry in 2019 and a 17% employment growth over 2018, mainly due to new micro-companies or start-ups entering the sector. Europe counts around 580 companies, mostly located in the United Kingdom, followed by Germany and France, while Italy is in fifth position (EARSC, 2020[10]).

The growth and dynamism of this sector are mainly driven by automation with artificial intelligence development and large volumes of high-revisit low-cost data that contribute to the proliferation of new services and applications, mainly for the public sector (Euroconsult, 2020[9]; EARSC, 2020[10]). Fields of applications are numerous, including agriculture, urban planning, transport, land use, monitoring ocean activities, health and civil protection, among others (NEREUS, European Commission and European Space Agency, 2018[11]; Daraio et al., 2014[12]; PwC, 2019[13]). Additionally, the increasing availability of free and open-source data sets such as those provided by Copernicus of the European Union is further raising the awareness of EO services and products, boosting the creation of value-added products (Robinson and Mazzucato, 2019[14]).

Although international and European studies are informative, it is not easy to obtain information about the current situation of the downstream sector in Italy; information is scant and dispersed, a gap that we would like to fill with this research by providing a snapshot of the Italian market. Gaining more information about this sector, its characteristics and its way of working is the first step towards promoting its development and, consequently, pushing the whole EO frontier forward.

Several socio-economic benefits may derive from the increasing availability of satellite imagery and data and accrue to different stakeholders along the value chain (Pogorzelska, 2018[6]; Craglia and Pogorzelska, 2019[2]; Hof et al., 2012[15]; PwC, 2016[3]). Focusing on the downstream sector, one of the most relevant benefits for firms is the learning by doing effect, which refers to an increase in long-term performance achieved through practice (Arrow, 1971[16]; Lucas Jr., 1988[17]). This benefit may stem from the new technological and challenging task firms are called to face, such as creating cutting-edge EO service/applications or archiving, storing and pre-processing large quantities of data with innovative, affordable and smart solutions. Having to face new challenging tasks, firms will likely increase their research and development (R&D) activity, generating new knowledge, which may translate into an innovation or another positive change in their processes (i.e. market, commercial or organisational effects) with an ultimate impact on their productivity and profitability (Edquist et al., 2015[18]; Uyarra and Flanagan, 2010[19]; Edler and Georghiou, 2007[20]). In this learning process, the role played by public sector procurement is crucial, as the global EO downstream market is primarily driven by applications commissioned by governments, representing 50‑60% of the revenues (PwC, 2019[13]). Hence, we expect firms in the downstream sector to register long‑term positive effects in their performance driven by a learning process related to data exploitation and mainly pushed by public procurement activities.

In addition, the benefits of new information captured by EO ultimately accrue to final users of services and applications. In the last 20 years, various methodologies have been applied to evaluate the socio-economic benefits derived from the use of EO services and applications (Smart et al., 2018[21]; PwC, 2016[3]; WMO, 2015[22]; Hof et al., 2012[15]; Craglia and Pogorzelska, 2019[2]), drawing on various techniques, including the value of information (Macauley, 2006[23]; Gallo, Bernknopf and Lev, 2018[24]), cost-benefit analysis (Booz & Company, 2011[25]; Halsing, Theissen and Bernknopf, 2004[26]); cost-effectiveness analysis (Dawes et al., 2013[27]) and value chain approach (Sawyer, Boyle and Khabarov, 2020[28]; Sawyer et al., 2015[29]), among others. This chapter explores the perceptions of downstream firms on the benefits accruing to the final users of their services.

First, with EO, final users can deliver usual or innovative services to groups of citizens (e.g. in the case of governments) or customers (e.g. in the case of private companies) by saving money, gaining efficiency, increasing efficacy and quality (see, for example, the European Association of Remote Sensing Companies [EARSC] for a review of case studies of EO applications and related benefits) (EARSC, 2022[30]). For instance, in Belgium, a group of potato farmers has started using an application based on EO data to get information on their fields for better crop management practices (Sawyer, Oligschläger and Oligschläger, 2019[31]). This information helps to improve yields by up to 20% and the overall quality of potatoes, hence increasing revenues and income for the farmers and the whole potato industry value chain (agronomists, processors, distributors, supermarkets, etc.) up to the final consumers. In road infrastructure and management, a new mapping service showing ground motion based on EO is supporting public administration in Norway. The EARSC estimates an economic benefit of between EUR 3.8 million and EUR 8.7 million per year, mainly deriving from cost savings in the construction and management of the road infrastructure (Sawyer, Boyle and Khabarov, 2020[28]).

Besides economic gains, EO may have an impact on social challenges, such as better protecting fragile ecosystems, ensuring resilient infrastructures, managing climate risks, enhancing food security and building more resilient cities, among others. This is why EO contributes to progress toward the 17 Sustainable Development Goals and its 169 associated targets (GEO, 2017[32]). EO services and applications bring positive externalities and non-market effects for the general public, such as, for instance, improved air quality, reduced traffic accidents or increased safety of citizens (European Commission, 2014[33]). Such benefits can be enormous, although still unexpressed and mostly unmeasured.

All this considered, we expect EO services and applications delivered by firms in the downstream sector to have a significant socio-economic impact on final users and positively contribute to solving critical societal challenges.

Despite the enormous potential of EO and its applications, several obstacles are currently hindering the development of the final segment of the value chain. Thus, an important issue is identifying and overcoming barriers limiting the widespread use of EO services and applications. Such obstacles will be discussed in the concluding section of this chapter.

To answer our research questions, we mapped Italian firms operating in the downstream industry. We integrated information coming from different sources, including ASI and ICE (2020[34]), users of the main Italian EO satellite constellations, members of Italian associations active in the space sector4 and the national cluster (Cluster Tecnologico dell’Aerospazio, CTNA). We validated such sources through interviews with key experts in the industry. Hence, we collected primary data through an online survey based on around 30 semi-structured questions to explore the main characteristics of firms, what benefits they think stem from the availability of EO data and what barriers they identify to the development of this sector in Italy. Most of the questions exploit answers based on a Likert scale.5

Six pilot tests were also carried out with companies and other experts in the sector to verify the clarity of the questions. The questionnaire was then administered by e-mail between February and July 2021 through an online survey. Reminders were sent by e-mail and made by telephone.

The final database consists of 85 companies which, as confirmed by the sector experts interviewed, represent the whole population of companies operating in the downstream sector in Italy. Of these, 63 companies participated in the survey, which has a response rate of approximately 74%. A study available at the European level (EARSC, 2020[10]; 2019[35]) reports information only for about 40 Italian companies.

About half of the 63 interviewed companies (46%) are micro firms with less than ten employees (Table 5.1). This could highlight a lower dynamism of Italian start-ups and newborn firms compared to the European average, where about 70% of companies operating in the sector are micro-sized (EARSC, 2020[10]). Just under a third (32%) of the sample consists of small firms (10-50 employees), 9.5% have 50-250 employees, while 13% are large firms (Table 5.1). The composition of our sample highlights the critical role of medium and large IT firms, which penetrate the EO market by directly opening new EO units and divisions. The average number of employees involved in EO activities is 21. Some firms declare zero employees devoted to EO, as these companies use external collaborations, stressing the difficulty in finding the needed competencies internally in the companies themselves, which is in line with the overall European trend (EARSC, 2020[10]).

|

Firm size |

Percentage of firms (%) |

|---|---|

|

Micro (< 10) |

46.0% |

|

Small (< 50) |

31.7% |

|

Medium (<250) |

9.5% |

|

Large |

12.7% |

|

Total |

100% |

In terms of turnover, 17% of the firms interviewed declare earning less than EUR 100 000/year, while about 40% earn more than EUR 1 million (Table 5.2). The share of turnover deriving from EO activities varies between 1% and 25% in 48% of cases and is more than 76% for one-quarter of the firms (Table 5.2). Considering the distribution of firms by dimension and the share of turnover from EO activities, we gain interesting insights. Seventeen per cent of micro firms declare a percentage of EO turnover between 1% and 25% while 14% declare between 76% and 100%. As expected, most large firms show a share between 1% and 25%, confirming that large firms dedicate special units to EO, but usually this is not their core business.

|

Turnover related to earth observation (%) |

Micro |

Small |

Medium |

Large |

Total firms (%) |

|---|---|---|---|---|---|

|

0% |

1.6% |

1.6% |

0.0% |

0.0% |

3.2% |

|

1-25% |

17.5% |

14.3% |

6.3% |

9.5% |

47.6% |

|

26-50% |

0.0% |

4.8% |

0.0% |

1.6% |

6.3% |

|

51-75% |

6.3% |

1.6% |

0.0% |

0.0% |

7.9% |

|

76-100% |

14.3% |

6.3% |

3.2% |

1.6% |

25.4% |

|

Don’t know |

6.3% |

3.2% |

0.0% |

0.0% |

9.5% |

|

Total |

46.0% |

31.7% |

9.5% |

12.7% |

100.0% |

The average age of firms in our sample is 20 years,6 although the average time since they started some EO activities is 13 years. Twenty-two percent of firms define themselves as a “startup”, while 49% are registered at “registro delle start up e piccole e medie imprese innovative”. Innovative small and medium enterprises (SMEs) represent a step forward compared to startups since they have consolidated their business activity and achieved a stable growth rate. Therefore, this category of firms is crucial for the country’s innovative development (MISE, 2021[36]).

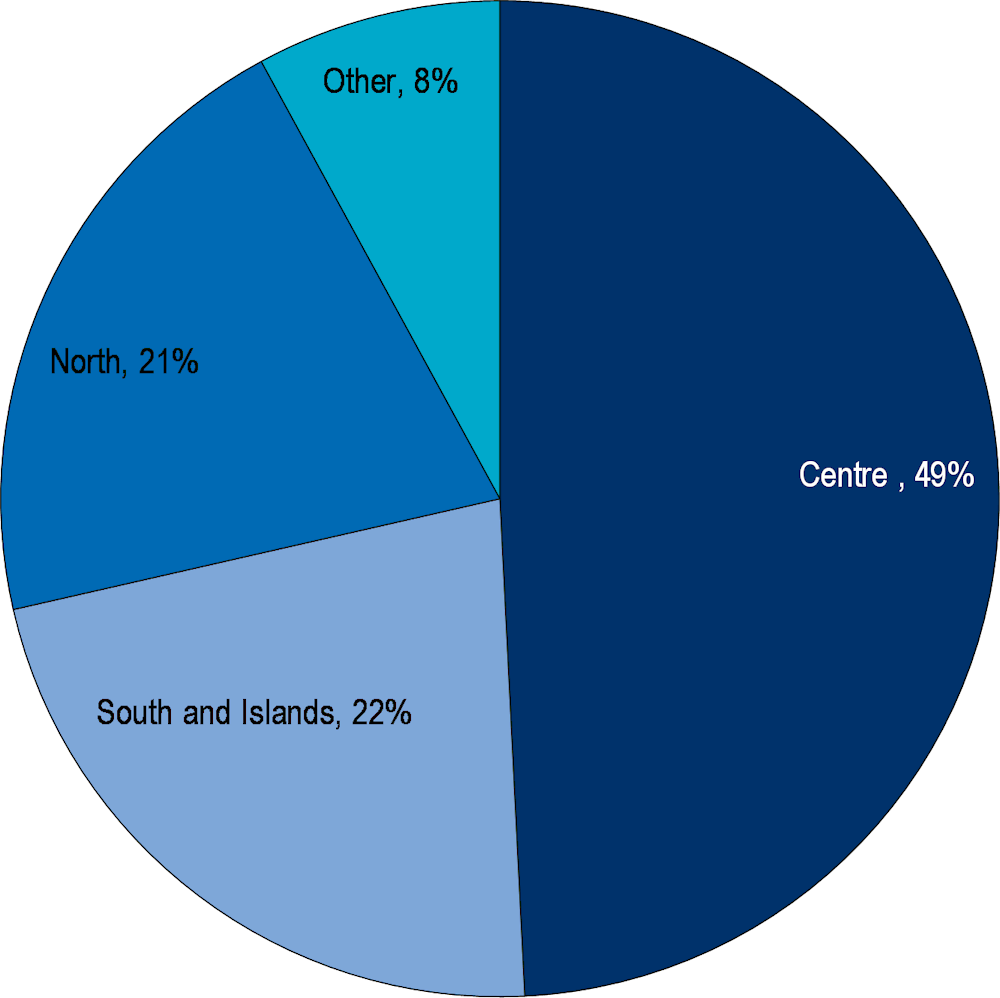

In terms of geographical distribution (by headquarter, which mostly matches with the branch carrying out the EO activities), 49% of companies interviewed are located in the Centre region, 21% in the North and 22% in the South and Islands (Figure 5.1). In particular, almost 41% of firms are located in the province of Rome, 8% in Naples and then, with lower percentages, in Genova, Potenza, Matera, Bari, Milan and so on. The higher concentration of firms in the centre of Italy is due to the presence of clusters of companies working in other segments of the space industry, the presence of the Italian Space Agency (ASI) and the ESA Centre for Earth Observation (ESRIN) which all together act as catalysts.

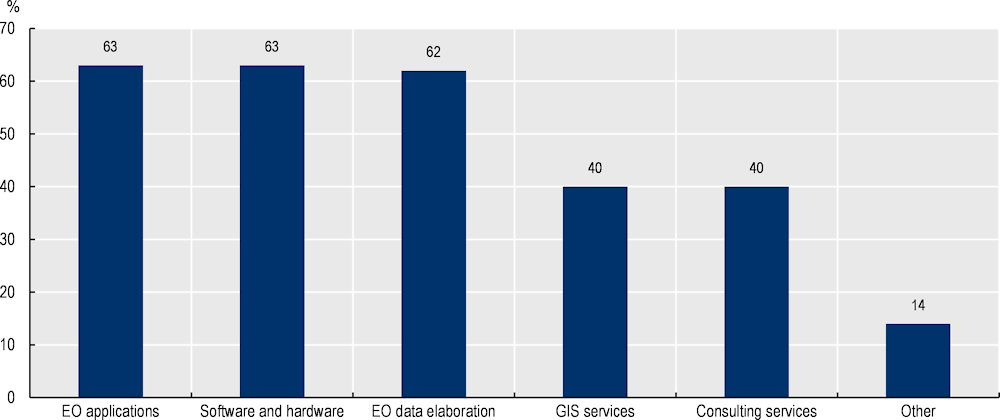

Firms use EO data to offer several products and services (Figure 5.2). 63% of the sample develops hardware and software in the IT sector (not necessarily related to EO), while 62% of firms elaborate EO data to deliver various types of information. In particular, 62% of firms develop innovative EO applications in several fields (e.g. agriculture, environmental monitoring, infrastructures, and natural disasters, among others), 40% of firms offer consulting services, 40% offer GIS services7, and 14% use EO data for other purposes, such as cyber security and research.

Notes: Multiple answers allowed; EO: earth observation; GIS: geospatial information systems.

Copernicus Sentinels of the European Union are the satellites that support the companies’ EO activities the most, utilised by 75% of the respondents. Copernicus data have the advantage of being open and free to public, private organisations and citizens. In the following positions, the most used data are those from the constellation CosmoSkymed of ASI (46% of the firms), Landsat of NASA (38%), and Prisma of ASI (29%). While Landsat data can also be obtained free of charge by applying online on the United States Geological Survey (USGS) website, there are two alternatives to access CosmoSkymed data. For commercial purposes, the company e-geos sells both the raw satellite data and the information extracted from the latter. For national civil purposes, data are made available directly by ASI by granting a license following an onerous bureaucratic procedure (Clò et al., 2019[37]). Lastly, around 30% of companies use EO data from other satellites such as Eumetsat, ESA Heritage Missions, ESA Earth Explorers, Airbus, Maxar, MDA, Planet, SpaceView, Cubesat, Worldview 2-3-4, TerraSAR-X/Paz, CNES, Pleiades Satellogic, and Capella, among others. In percentages, the data that supports most of EO business activities are those from Copernicus Sentinels as 24% of companies declares to use them for about 76% -100% in support to their EO activities (Table 5.3).

|

|

Copernicus Sentinels (ESA) |

Cosmo Skymed (ASI) |

Landsat (NASA) |

Prisma (ASI) |

Modis (NASA) |

|---|---|---|---|---|---|

|

Total use |

75% |

46% |

38% |

29% |

19% |

|

% of use |

|

|

|

|

|

|

76% - 100% |

24% |

5% |

6% |

0% |

3% |

|

51% - 75% |

21% |

11% |

5% |

2% |

2% |

|

26% - 50% |

19% |

13% |

10% |

6% |

3% |

|

1% - 25% |

11% |

17% |

17% |

21% |

11% |

|

0% |

25% |

54% |

62% |

71% |

81% |

Note: Multiple answers allowed.

In most cases, 67% of respondents access free data in open mode, 38% of firms pay to use data, 27% use free licensed data, while in 19% of cases, they access data in another way e.g. via collaborations with service providers, acquisition from their own satellites, through partners, or by developing solutions that integrate services created by others (Figure 5.3). Furthermore, in 60% of cases, EO data are (always or often) combined with other data and information sources. In contrast, 19% of the companies declare not to integrate them with additional sources of information or do so rarely.

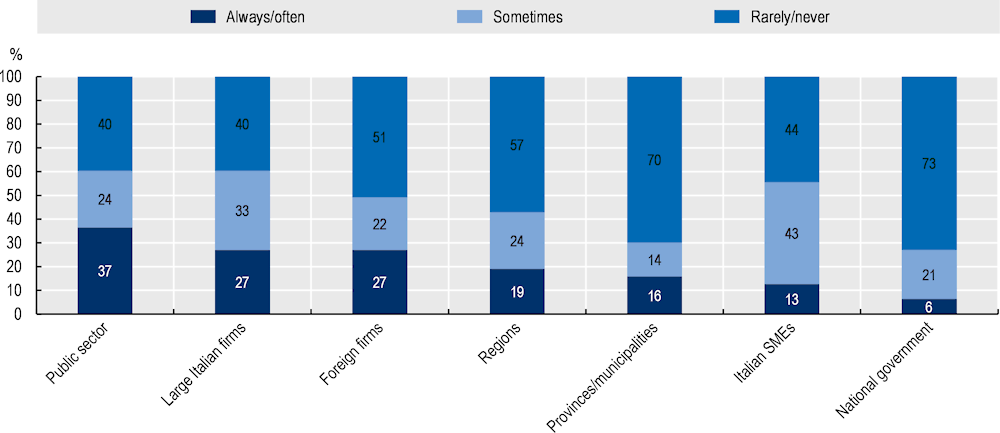

Concerning the final users to whom EO services and applications are addressed, mostly in line with our expectations, these are (often and very often) Italian bodies operating in the public sector (for 37% of the firms interviewed), large Italian companies for 27%, foreign firms for 27%, regions for 19%, provinces and municipalities for 16%, Italian SMEs for 13%, while only 6% usually work with the national government (Figure 5.4). Other clients and users include the European Commission, international agencies, multilateral development banks, and foreign governments. Hence it is evident that services are most popular among public bodies, including entities such as civil protection forces (Protezione Civile) or regional agencies for environment protection (ARPA), among others.

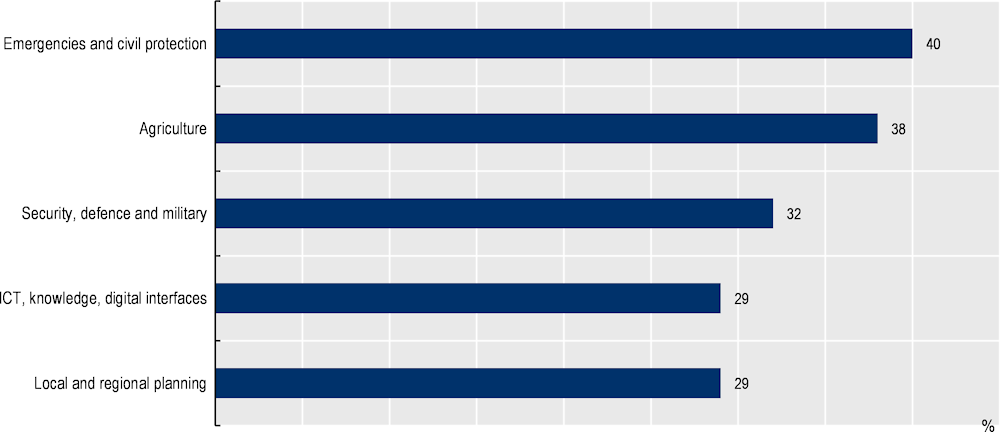

Indeed the main areas of application of EO services are emergency and civil protection (40% of firms offer EO services to support this sector), agriculture (38%), security and defence (32%), the ICT sector, knowledge and digital interfaces (29%), local and regional planning (29%) as shown in Figure 5.4. Other areas include ecosystems, ocean and climate monitoring, buildings, insurances, oil and gas, fishing, health, with lower percentages.

Note: Percentage of firms (%); multiple answers allowed.

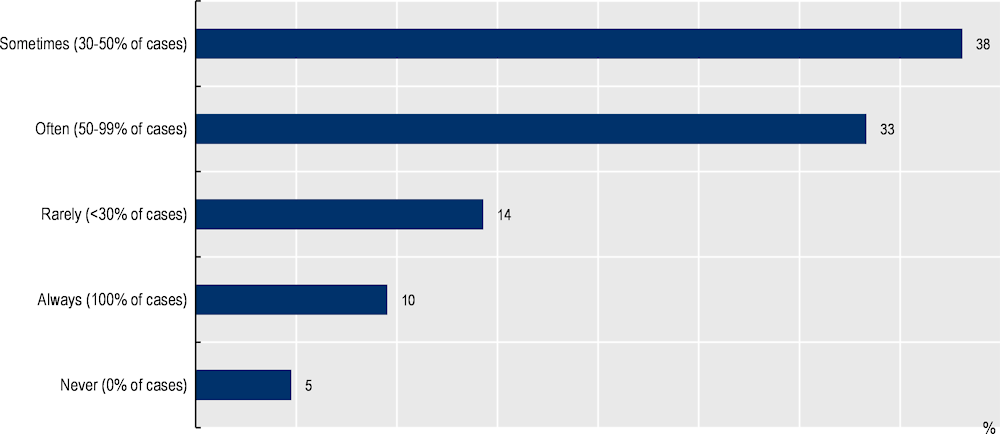

In this respect, most firms (73%) recruit customers mainly in public tenders, stressing the crucial role of public procurement in the demand for EO services (Table 5.4).

|

Methods |

Percentage of firms (%) |

|---|---|

|

Participation in tender |

73% |

|

Marketing/Advertisement |

54% |

|

Personal acquaintances |

52% |

|

Word of mouth |

30% |

|

Italian Space Agency (ASI) support |

25% |

|

Other |

19% |

Note: Multiple answers allowed.

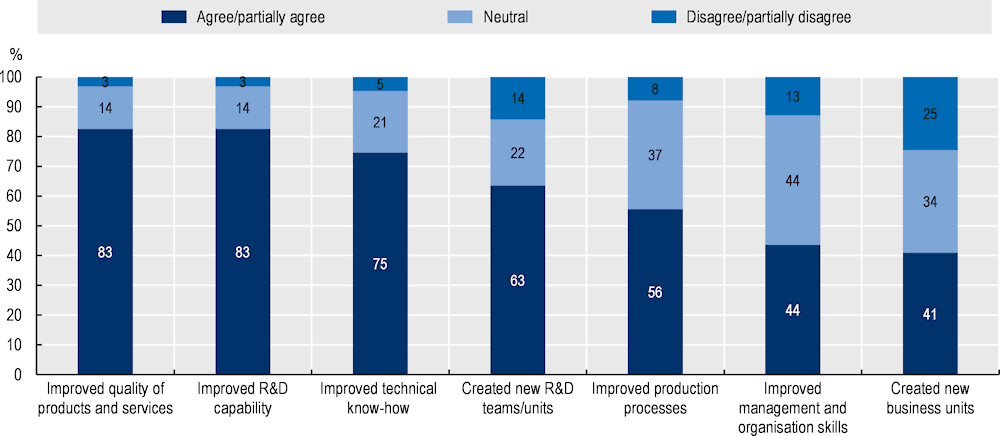

As explained in previous section, we have explored the point of view of downstream firms by distinguishing their opinion about the benefits accruing to themselves and those to final users. Concerning the first category, results from our survey highlight the critical contribution of EO to improving the operational processes of firms in the downstream sector. Indeed, the vast majority of companies (83%) agree (totally or partially) that the availability of EO data has contributed to improving the quality of their products and services. 83% of respondents declare that their R&D capabilities have improved thanks to satellite data, while 63% have created new R&D teams/units. Seventy-five percent have also enhanced their technical know-how, meaning that thanks to satellite data, they have increased the knowledge and technical skills necessary to carry out certain activities within their industrial sector of activity, even outside EO. Fifty-six percent have also improved the production processes while 44% their management and organisation skills. Forty-one percent have opened new business units. Residual percentages have instead declared that they disagree (totally or partially) with the statements above (Figure 5.5).

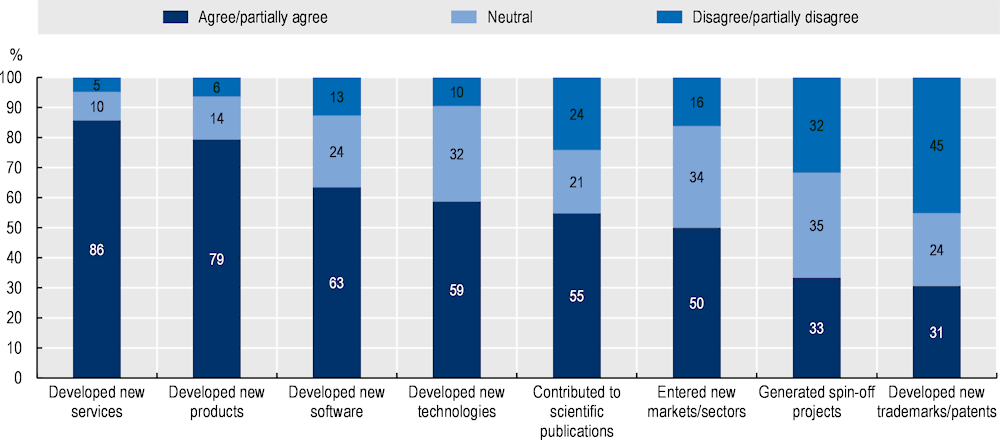

EO has also significantly contributed to improving corporate output and product innovation. Indeed, 86% of firms declare to have developed new services and 79% new products thanks to EO. 63% have created new software, Fifty-nine percent have developed new technologies, while 55% have contributed to scientific publications. As a consequence, 50% of respondents have entered new markets or sectors, and 33% have registered new spin-off projects. In addition, 31% have developed new trademarks and patents. However, Forty-five percent disagree (totally or partially) with the latter statement highlighting that many of these innovations have not been patented for reasons which would require further investigation (Figure 5.6).

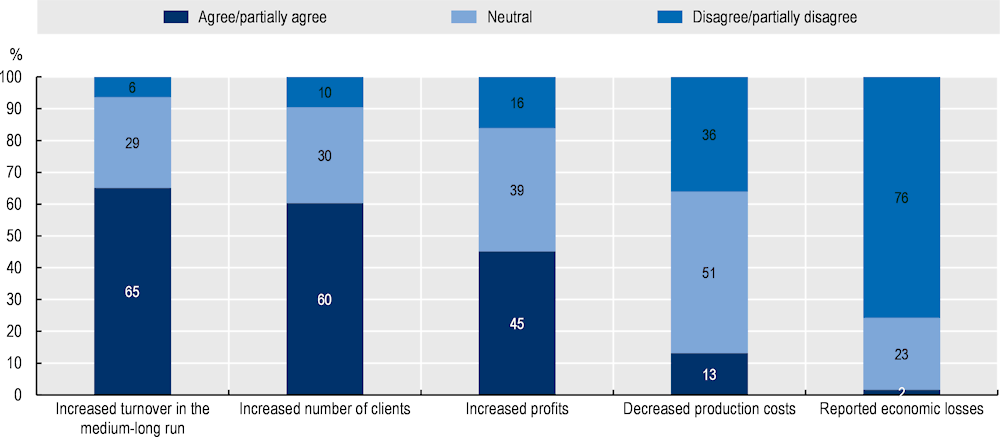

Concerning the ultimate impact of EO in economic terms, 65% of firms declare to have increased their long-term turnover, 60% the number of customers, 45% have raised profits, 13% have decreased production costs. In comparison, only 2% have reported losses (Figure 5.7).

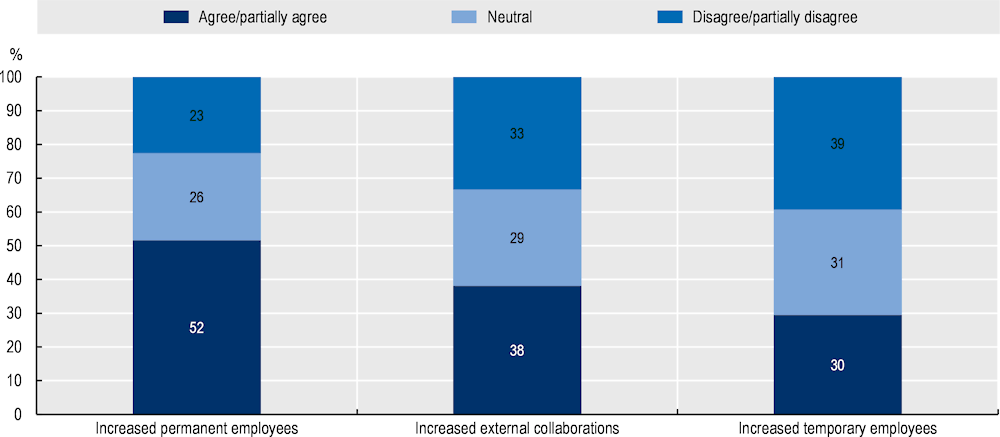

Additionally, in terms of effects on employment, 30% of companies agree (totally or partially) with the statement that, due to the EO, they have increased the number of temporary employees, 52% permanent employees, while 38% have expanded the number of collaborations with self-employed workers (Figure 5.8).

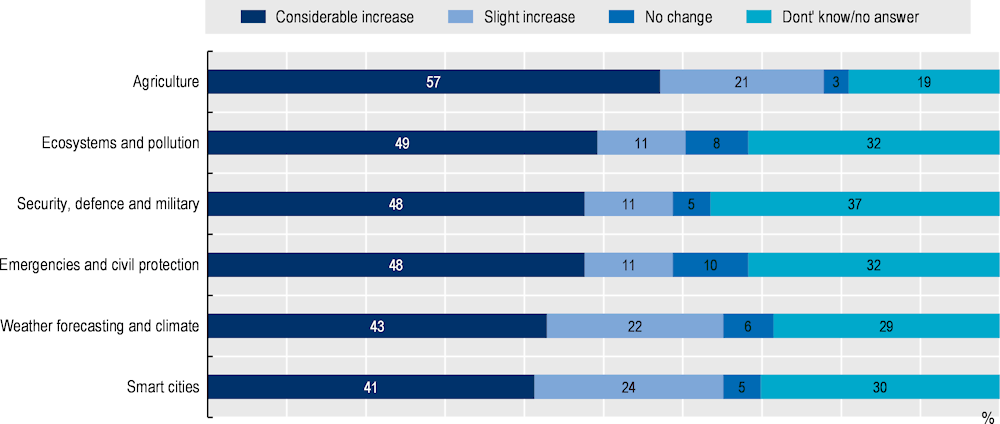

Concerning the impact of EO for final users, firms were asked to give an opinion about the expected economic gain for users of their EO services. A considerable increase in profits is expected in agriculture (57% of respondents), ecosystems and pollution (49%), emergencies and civil protection (48%), security, defence and military (48%), weather forecasting and climate (43%) and smart cities (41%) as shown in Figure 5.9.

Firms were also asked to choose three ATECO8 sectors that, in their opinion, will mainly benefit from the EO services offered in the next five years. About 26% of the answers went to agriculture, silviculture, and fishing, 12% to public administration and the defence sector, 7% to scientific and professional activities.

Note: Percentage of firms (%).

Lastly, regarding the social impact, companies have been called upon to express which Sustainable Development Goals (SDGs) their EO services primarily contribute to (Table 5.5). The first target appears to be number 13 (Adopting urgent measures to combat climate change and its consequences), with 12% of the answers and in line with the European survey (EARSC, 2020[10]). In the second position, target 9 (Building a resilient infrastructure, promoting inclusive and sustainable industrialisation and supporting innovation) with 11% of preferences, and in the third position (10%) both target 11 (Make cities and human settlements inclusive, safe, resilient and sustainable) and target 15 (Protect, restore and promote the sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, halt and reverse soil degradation and stop the loss of biodiversity). Regarding the contribution to targets 9 and 11 these are more peculiar for firms working in the Italian market as their European counterparts have given a lower credit to the contribution of their EO services to such goals (EARSC, 2020[10]).

|

SDGs |

Percentage of firms (%) |

|---|---|

|

13: Take urgent action to combat climate change and its impacts |

12% |

|

9: Building resilient infrastructure, promote inclusive and sustainable industrialisation and foster innovation |

11% |

|

11: Make cities and human settlements inclusive, safe, resilient and sustainable |

10% |

|

15: Protect, restore and promote the sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, halt and reverse soil degradation and stop the loss of biodiversity |

10% |

To sum up, according to the view of firms working in the Italian downstream market, EO significantly contributes to their performance in terms of several indicators of innovation, employment and long-term turnover. EO also positively contributes to the economic performance of final users and in tackling critical societal challenges.

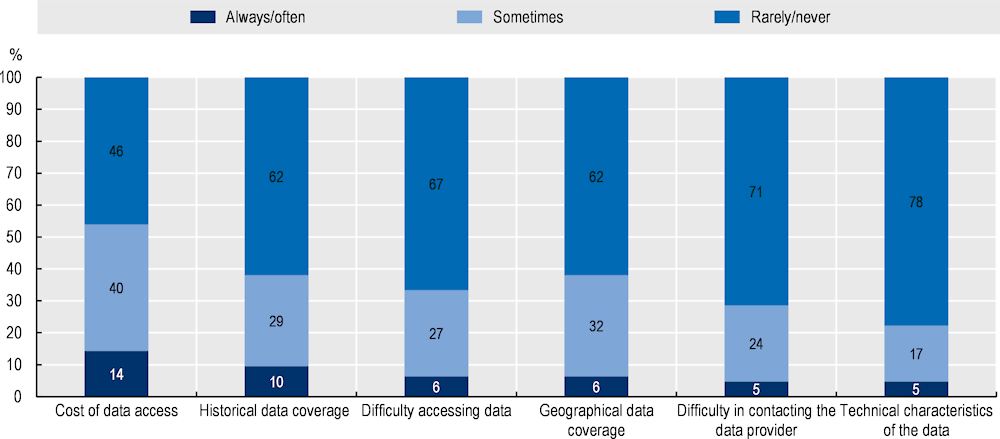

The factors hindering the development of EO vary. For this survey, it was essential to investigate the difficulties that firms in the downstream sector encounter in developing EO services and applications and disseminating the services and applications to final users, as shown in Figure 5.10.

Note: Answers refer to the main data used

According to our survey, companies in the downstream sector do not seem to encounter any particular difficulties in accessing data. Only 14% of companies declare having (often or very often) problems with the cost of data, while 40% responded “sometimes.” Furthermore, only 10% of firms declared that there are no time series suitable to develop their services effectively, 6% have problems accessing data or geographical coverage issues, while 5% encounter difficulties in the data’s technical characteristics and interacting with the data provider.

As for the relationship with the data provider, 38% of intermediate users said they often or very often had a stable relationship. A similar percentage is found when asking if the firms received support from the data provider. At least in 35% of cases, firms have reached solutions with data providers in the event of an unexpected situation.

In contrast, a significant obstacle for firms in the Italian downstream sector concerns recruiting qualified personnel. Forty-three percent of companies have (always or often) challenges in recruiting, while 19% declared not having such a problem or only rarely (Figure 5.11).

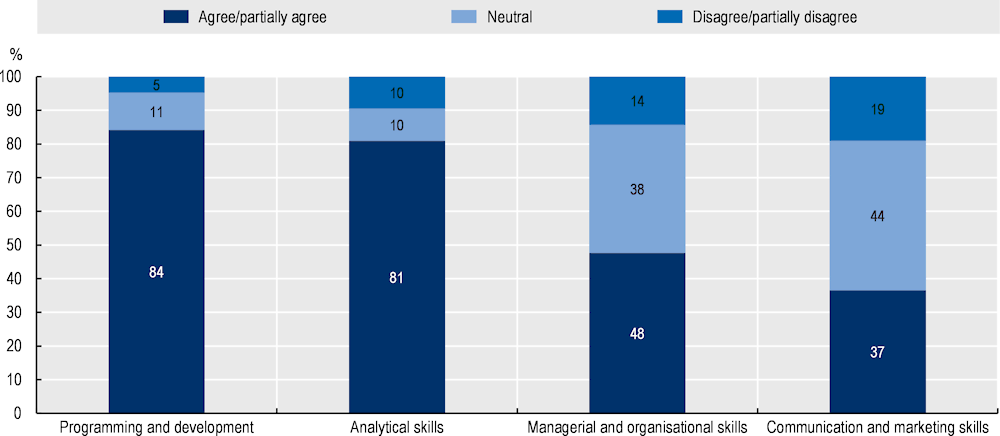

Firms are mainly looking for professionals who deal with programming and development (84%), analytical skills (81%), managerial and organisational skills (48%), and communication and marketing skills (37%), as shown in Figure 5.12. Similar results are found at the European level. EARSC (2019[35]) reports that 80 of the respondents to its survey have difficulties finding and hiring candidates, particularly people with suitable programming and development skills.

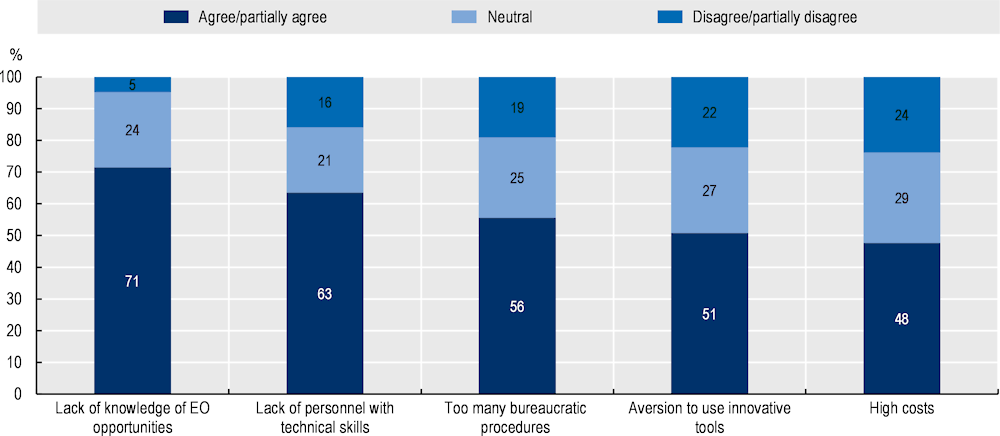

Regarding the second type of barrier to the sector development, firms were asked to express their opinions about factors hindering the diffusion of their EO services and applications to final users, displayed in Figure 5.13. These include the lack of knowledge of the opportunities deriving from EO (71%), the lack of personnel with technical skills capable of receiving information (63%), too many bureaucratic procedures (56%), aversion to the use of innovative tools (51%) and high costs9 (48%).

Such results are consistent with the taxonomy of the main obstacles defined by NEREUS (2016[38]), ranging from political barriers (e.g. low awareness at the political level concerning the social value of EO data), to economic obstacles (e.g. concerning the efficient allocation of financial and human resources), social barriers (e.g. reluctance to accept new tools of work) and technological ones (e.g. lack of infrastructure to analyse the information to take decisions).

Note: EO: earth observation.

This work contributes to understanding the importance of maximising the socio-economic value of EO from the perspective of firms in the Italian downstream sector. Results from our survey confirm that the development and widespread use of EO applications, products and services is one of the most promising channels to maximise the effect of space investment on several performance indicators, such as new job creation, economic growth, innovation and a better quality of life.

The EO Italian downstream sector counts less than 100 firms primarily concentrated in the central regions of Italy, and our sample represents a good approximation of the industry. Most interviewed firms operate in the IT sector and elaborate EO data to deliver various information and services. About half of these companies have less than ten employees, while medium and large firms have also invested in EO technologies. Half of the sample is represented by innovative consolidated small and medium-sized enterprises and less than a quarter by start-ups.

Firms in the Italian downstream sector primarily work with data provided by Copernicus Sentinels, followed by CosmoSkymed, Landsat, Prisma and other minor satellites. Their customers are primarily Italian public bodies followed by large national companies. Most firms recruit their clients by participating in public tenders and the main application areas are emergency and civil protection, agriculture, security and defence.

Our survey confirms that EO data availability improves the quality of firms’ products and services, R&D capabilities, technical know-how, production processes, and management and organisation skills. Thanks to EO, most firms have developed new services and products; opened new business units; developed technologies; entered new markets or sectors; and developed trademarks, patents and scientific publications. In such a way, EO contributes to increasing firms’ long-term turnover, number of customers, profit and number of employees.

EO also benefits final users of services and applications by increasing their profits, particularly those working in agriculture, ecosystems, pollution, emergencies and civil protection, security, defence and the military. In addition, EO supports work towards the achievement of critical societal challenges, including the Sustainable Development Goals. The main contribution of Italian firms relates to climate change, industry innovation and infrastructures, sustainable cities and communities, and life on land.

Regarding the main factors hindering the full development of the sector, the first category of obstacles concerns the downstream operators themselves. While firms in our sample do not encounter any particular difficulties handling data or in the relationship with their service providers, simplifying data accessibility, as in the case of Copernicus, would widen the data use, boosting the number of services. In terms of accessibility, after past privatisation and commercialisation trends with low success for the entire market (Borowitz, 2017[39]), space agencies are now increasingly moving toward an open data model to maximise the return of public investment in EO (Harris and Baumann, 2015[40]). In terms of firms’ capabilities, machine and deep learning techniques have made remarkable advances in recent years in a large and ever-growing number of disparate application areas. However, an obstacle faced by Italian downstream firms refers to the shortage of skills, particularly programming and development and analytical skills. Promoting multidisciplinary groups from industry and academia could be an effective way to overcome these difficulties (see, for example, eo4geo (2018[41])).

Another category of barriers relates to the lack of competencies and knowledge about the cost-benefits of EO technology among final users. Hence, there is a need to raise awareness of EO technology applications and related benefits. As suggested by the European Commission (Probst et al., 2016[42]), larger and established players can increase awareness of applications based on EO data. This could be achieved by building international networks and clusters to favour connections between downstream players, bringing together the customers and the products available on the market. Other important obstacles for final users refer to a shortage of personnel with the technical skills capable of receiving information, bureaucratic procedures, aversion to using innovative tools, and related high costs. The diversity of the user communities in the public and private sectors and their dispersion at different geographic levels also cause user uptake initiatives to be complex to manage (European Commission, 2016[43]). Additionally, the increased capacity of individual administrations is insufficient for an efficient use of these information assets in the absence of standards and tools that allow full interoperability and sharing of information between public entities (PNRR, 2021[44]).

These issues are a long-lasting concern within the space community, and efforts for user uptake and capacity building have already been put in place (e.g. on earth observation) (European Commission, 2016[43]). User uptake initiatives have been undertaken or are currently under development by the European Commission to promote the use of Copernicus data, including business incubators, master prices, networks and relays, training sessions, data-handling tools and, recently, tailored cloud computing services (European Commission, 2016[43]; Tassa, 2019[4]). The Copernicus Services are now operational, and their products are increasingly leveraged for policy making. However, experience has proven that there is a clear need for a more systemic and integrated framework to ensure the continuity and sustainability of these initiatives (European Commission, 2016[43]), something that should be increasingly pursued at the Italian level as well. Understanding data governance and policies aimed at overcoming the barriers that currently inhibit the use of these data is a key element to overcoming the current obstacles to the full exploitation of EO and maximisation of its socio-economic impact.

[16] Arrow, K. (1971), “The economic implications of learning by doing”, in Readings in the Theory of Growth, pp. 131-149, Palgrave Macmillan, London.

[34] ASI and ICE (2020), Italian SPace Industry Catalogue 2020: Products – Services – Applications – Technologies, Italian Space Agency, Rome, https://www.asi.it/wp-content/uploads/2020/10/Catalogo-2020-aggiornato.pdf.

[25] Booz & Company (2011), Cost-benefit Analysis for GMES, European Commission, Brussels, https://www.copernicus.eu/sites/default/files/2018-10/ec_gmes_cba_final_en.pdf.

[39] Borowitz, M. (2017), Open Space: The Global Effort for Open Access to Environmental Satellite Data, MIT Press.

[37] Clò, S. et al. (2019), “Earth Observation in a cost-benefit analysis perspective: Cosmo SkyMed satellites of the Italian Space Agency”, Università degli Studi di Milano, Department of Economics, Management and Quantitative Methods.

[2] Craglia, M. and K. Pogorzelska (2019), “The Economic Value of digital Earth”, in Guo, H., M. Goodchild and A. Annoni (eds.), Manual of Digital Earth, pp. 623-643, Springer, Singapore, https://doi.org/10.1007/978-981-32-9915-3_19.

[12] Daraio, M. et al. (2014), “Cosmo-SkyMed data utilization and applications”, Proceedings of the International Astronautical Congress, pp. 2621–2631.

[27] Dawes, S. et al. (2013), Socioeconomic Benefits of Adding NASA Satellite Data to AirNow, US Environmental Protection Agency, Research Triangle Park, NC, https://www.ctg.albany.edu/media/pubs/pdfs/sti_finalreport.pdf.

[30] EARSC (2022), Sentinel Benefit Studies Project website, https://earsc.org/sebs/all-cases (accessed on 8 August 2022).

[10] EARSC (2020), Industry Survey 2020, European Association of Remote Sensing Companies.

[35] EARSC (2019), A Survey into the State & Health of the European EO Services Industry, European Association of Remote Sensing Companies, Brussels, https://earsc.org/wp-content/uploads/2020/11/Industry-survey-2019-final-version-07_11_2019.pdf.

[20] Edler, J. and L. Georghiou (2007), “Public procurement and innovation – Resurrecting the demand side”, Research Policy, Vol. 36/7, pp. 949-963, https://doi.org/10.1016/j.respol.2007.03.003.

[18] Edquist, C. et al. (eds.) (2015), Public Procurement for Innovation, Edward Elgar Publishing.

[41] EO4GEO (2018), EO4GEO Project website, http://www.eo4geo.eu/about-eo4geo (accessed on 8 August 2022).

[9] Euroconsult (2020), Satellite-Based Earth Observation Market Prospects to 2028, Euroconsult.

[43] European Commission (2016), Copernicus User Uptake: Engaging with Public Authorities, the Private Sector and Civil Society – Final Version, European Commission, Brussels, https://www.copernicus.eu/sites/default/files/2018-10/Copernicus_User_Uptake_Engaging_with_Users_0.pdf.

[33] European Commission (2014), Guide to Cost-benefit Analysis of Investment Projects: Economic Appraisal Tool for Cohesion Policy 2014-2020, European Commission, Brussels, https://ec.europa.eu/regional_policy/sources/docgener/studies/pdf/cba_guide.pdf.

[24] Gallo, J., R. Bernknopf and S. Lev (2018), “Measuring the socioeconomic value of data and information products derived from earth observations and other geospatial data”, in Kruse, J., J. Crompvoets and F. Pearlman (eds.), GEOValue: The Socioeconomic Value of Geospatial Information, CRC Press.

[1] GEO (2020), FAQ: What is earth observation?, web page, Group on Earth Observations, https://www.earthobservations.org/g_faq.html.

[32] GEO (2017), Earth Observations in Support of the 2030 Agenda for Sustainable Development, Group on Earth Observation, https://www.earthobservations.org/documents/publications/201703_geo_eo_for_2030_agenda.pdf.

[26] Halsing, D., K. Theissen and R. Bernknopf (2004), A Cost-benefit Analysis of The National Map, US Geological Survey Circular 1271, US Department of the Interior, https://pubs.usgs.gov/circ/2004/1271.

[40] Harris, R. and I. Baumann (2015), “Open data policies and satellite Earth observation”, Space Policy, Vol. 32, pp. 44-53, https://doi.org/10.1016/j.spacepol.2015.01.001.

[15] Hof, B. et al. (2012), Design of a Methodology to Evaluate the Direct and Indirect Economic and Social Benefits of Public Investments in Space, SEO Economic Research, Amsterdam, https://25cjk227xfsu3mkyfg1m9xb7-wpengine.netdna-ssl.com/wp-content/uploads/2020/04/2012-42_Public_Investment_in_Space.pdf.

[7] Kansakar, P. and F. Hossain (2016), “A review of applications of satellite earth observation data for global societal benefit and stewardship of planet earth”, Space Policy, Vol. 36, pp. 46-54, https://doi.org/10.1016/j.spacepol.2016.05.005.

[17] Lucas Jr., R. (1988), “On the mechanism of economic development”, Journal of Monetary Economics, Vol. 22/1, pp. 3-42, https://doi.org/10.1016/0304-3932(88)90168-7.

[23] Macauley, M. (2006), “The value of information: Measuring the contribution of space-derived earth science data to resource management”, Space Policy, Vol. 22/4, pp. 274-282, https://doi.org/10.1016/j.spacepol.2006.08.003.

[36] MISE (2021), PMI innovative, https://www.mise.gov.it/index.php/it/impresa/piccole-e-medie-imprese/pmi-innovative (accessed on 2 June 2022).

[38] NEREUS (2016), Improving Copernicus Take Up among Local and Regional Authorities (LRAs) via Dedicated Thematic Workshops, http://www.nereus-regions.eu/wp-content/uploads/2017/11/Analysis.pdf.

[11] NEREUS, European Commission and European Space Agency (2018), The Ever Growing use of Copernicus across ’Europe’s Regions: A Selection of 99 User Stories by Local and Regional Authorities, NEREUS, European Commission and European Space Agency, https://www.copernicus.eu/sites/default/files/2018-10/copernicus4regions.pdf.

[44] PNRR (2021), Mission 1: Digitalisation, Innovation, Competitiveness and Culture, Funding Aid Strategies Investments, https://fasi.eu/images/PNRRSchede.pdf.

[6] Pogorzelska, K. (2018), EOValue: Review of EO Market Studies, European Commission, https://ec.europa.eu/jrc/communities/en/community/eovalue/document/review-eo-market-studies.

[42] Probst, L. et al. (2016), Business Innovation Observatory: Space Tech and Services: Applications Related to Earth Observation, Case Study 63, European Union, https://ec.europa.eu/docsroom/documents/16591/attachments/1/translations/en/renditions/native.

[13] PwC (2019), Copernicus Market Report: February 2019, Issue 2, European Union, https://doi.org/10.2873/011961.

[3] PwC (2016), Study to Examine the Socio-economic Impact of Copernicus in the EU: Report on the Copernicus Downstream Sector and User Benefits, European Commission, Brussels, https://www.copernicus.eu/sites/default/files/2018-10/Copernicus_Report_Downstream_Sector_October_2016_0.pdf.

[8] RFF (2017), “Understanding the benefits of observing Earth from space”, web page, https://www.rff.org/events/all-events/understanding-the-benefits-of-observing-earth-from-space.

[14] Robinson, D. and M. Mazzucato (2019), “The evolution of mission-oriented policies: Exploring changing market creating policies in the US and European space sector”, Research Policy, Vol. 48/4, pp. 936-948, https://doi.org/10.1016/j.respol.2018.10.005.

[28] Sawyer, G., D. Boyle and N. Khabarov (2020), A Case Study: Ground Motion Monitoring in Norway, Sentinels Benefits Study (SeBS), European Association of Remote Sensing Companies, https://earsc.org/sebs/wp-content/uploads/2020/07/Ground-Movement-Monitoring-in-Norway-final.pdf.

[29] Sawyer, G. et al. (2015), Copernicus Sentinels’ Products Economic Value: A Case Study of Winter Navigation in the Baltic, European Association of Remote Sensing Companies, https://esamultimedia.esa.int/docs/EarthObservation/case_report_winter_navigation_in_the_baltic_final.pdf.

[31] Sawyer, G., C. Oligschläger and N. Oligschläger (2019), A Case Study: Growing Potatoes in Belgium, Sentinels Benefits Study (SeBS), European Association of Remote Sensing Companies, https://earsc.org/sebs/wp-content/uploads/2019/08/1_full-report-Growing-Potatoes-in-Belgium.pdf.

[21] Smart, A. et al. (2018), “A review of socioeconomic valuation methods and techniques”, in Kruse, J. (ed.), GEOValue: The Socioeconomic Value of Geospatial Information, Chapter 10.

[4] Tassa, A. (2019), “The socio-economic value of satellite earth observations: Huge, yet to be measured”, Journal of Economic Policy Reform, Vol. 23/1, pp. 34-48, https://doi.org/10.1080/17487870.2019.1601565.

[5] UCS (2021), UCS Satellite Database, https://www.ucsusa.org/resources/satellite-database.

[19] Uyarra, E. and K. Flanagan (2010), “Understanding the innovation impacts of public procurement”, European Planning Studies, Vol. 18/1, pp. 123-143, https://doi.org/10.1080/09654310903343567.

[22] WMO (2015), Valuing Weather and Climate: Economic Assessment of Meteorological and Hydrological Services, WMO-No. 1153, World Meteorological Organization, Geneva, https://library.wmo.int/doc_num.php?explnum_id=3314.

← 1. Remote sensing is the process of detecting and monitoring an object at a distance.

← 2. EO may include other means of data collection, such as aircraft, drones, etc. In this study, we focus exclusively on satellites.

← 3. Figure refers to companies offering commercial solutions for data and services.

← 4. Associazione delle Imprese per le Attività Spaziali (AIPAS), Federazione Aziende Italiane per l'Aerospazio, la Difesa e la Sicurezza (AIAD) and Associazione per i Servizi, le Applicazioni e le Tecnologie ICT per lo Spazio (ASAS).

← 5. This is a multidimensional scale that allows “measuring” opinions and attitudes of the interviewees. It is made up of a series of statements semantically linked to the phenomena we want to investigate (e.g. I totally agree, I partially agree, I neither agree nor disagree (neutral), I partially disagree, I totally disagree).

← 6. Min = 0; Max =160; standard deviation = 27.

← 7. Geo information systems allow the acquisition and analysis of spatial and geographical data.

← 8. IStat classification of economic activity.

← 9. For acquiring the service and incorporating it into their decisional process.