Edwin Lau

Ana Maria Ruiz Rivadeneira

Tenzin Dekyi

Ludovica Mager

Edwin Lau

Ana Maria Ruiz Rivadeneira

Tenzin Dekyi

Ludovica Mager

This chapter identifies the main challenges for enabling investment in environmentally sustainable and climate‑resilient infrastructure, and defines three priority areas where governments can create the conditions to attract and scale up sustainable infrastructure investment, drawing on principles of infrastructure governance These priorities are: aligning the strategic long-term infrastructure vision with environmental policy objectives, strengthening project selection and appraisal, and building public sector capacity. This chapter also provides examples of good practices in infrastructure governance based on OECD and G20 country experiences in each one of these priority areas. The examples in the chapter are supported by data from the 2020 OECD Survey on the Governance of Infrastructure.

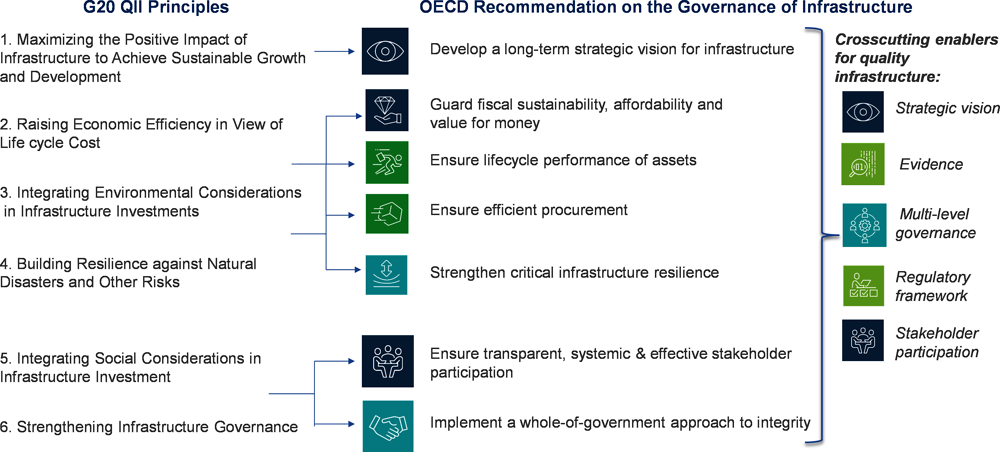

Implementing the G20 QII Principles will require a fundamental realignment of government planning and delivery processes. Under this context, the following challenges have been identified as critical for enabling investment in environmentally sustainable and climate‑resilient infrastructure:

Inadequacy of traditional frameworks and tools: traditional planning and decision-making frameworks and instruments for infrastructure investment are ill-adapted for accommodating multiple objectives, particularly when these extend beyond the direct benefits for users to encompass broader outcomes relating to the environment, such as climate change mitigation, cleaner air, and biodiversity preservation. This is partly due to the fact that understanding the economic impacts of climate change is an evolving field of research and it also depends on key assumptions (Auffhammer, 2018[1]).

Fiscal and budgetary constraints for increased investment in environmentally sustainable and climate‑resilient infrastructure: the global macroeconomic environment has experienced significant changes since the COVID‑19 pandemic and the war in Ukraine, including a normalisation of higher interest rates and non-transitory inflation. This new reality imposes greater importance on making the right public infrastructure decisions that offer the highest value for money.

Heightened uncertainty and rapidly changing environments: uncertainties arising from factors such as rapidly evolving technologies, the impacts of climate change and behavioural changes in society create a challenge for planning infrastructure assets with lifetimes that span decades. Insufficient flexibility, responsiveness and poorly targeted procurement strategies can lead to dated or carbon-intensive technologies encroaching into long-term infrastructure contracts and agreements.

Short-sighted investments: governments have a strong incentive to prioritise infrastructure investments with high visibility and display tangible results to certain constituencies (OECD, 2020[2]). Especially amidst an economic and social crisis, the risk of selecting projects that deliver the most benefits in the short-term but that do not adequately address long-term sustainability targets is higher than ever.

Multi-level governance: an infrastructure project does not exist in a vacuum, but it is rather part of a network of multiple infrastructure assets that are interlinked and cross different jurisdictions. In this regard, governing infrastructure is generally challenging as it requires to co‑ordinate and co‑operate across different administrations, and it all becomes even harder when addressing climate change, considering that its impacts and risks are perceived differently across spaces. Multi-level governance remains a major challenge in ensuring that new skills and capabilities exist in infrastructure planning, preparation and delivery as well as in the deployment and scaling up of new technologies and innovation that the green transition demands. The challenge is especially pronounced in ensuring compliance with new regulatory requirements, and collection and use of quality data on the environmental and climate impacts of infrastructure.Infrastructure governance provides an approach to implement all of the G20 QII Principles, but actions to promote sustainable investment in particular, benefit from an understanding of how Governments can help align other infrastructure actors in order to promote a pipeline of quality infrastructure projects, ensure that project objectives and reporting correspond with investor expectations, and reduce barriers to sustainable infrastructure investment.

Infrastructure governance can be understood as the policies, frameworks, norms, processes and tools used by public bodies to plan, make decisions, implement and monitor the entire life cycle of public infrastructure. Governance has a key role to play in delivering well-articulated and whole‑of-government infrastructure responses and ensuring infrastructure projects are well-targeted. While there has been an increasing focus on infrastructure governance in recent years, the crisis has sharpened the need to accelerate reform efforts in this area.

The OECD Recommendation on the Governance of Infrastructure and the OECD Recommendation on Principles for Public Governance of Public-Private Partnerships provide guidance on key governance strategies to facilitate and promote investment in green and climate‑resilient infrastructure. Based on a recollection of good practices from G20 countries, the OECD has identified three priority areas where governments can support the scaling up of sustainable infrastructure investment, drawing on principles of infrastructure governance;

1. Steering the green agenda: aligning the strategic long-term infrastructure vision with environmental policy objectives

2. Strengthening project selection and appraisal for the delivery of a sustainable infrastructure pipeline

3. Capacity building for sustainable infrastructure investment.

The United States has taken several actions to ensure that the 1.2 trillion USD passed in the Infrastructure Investment and Jobs Act is effectively implemented and meets sustainability objectives:

1. Steering mechanisms: An Executive Order sets six implementation priorities, including for infrastructure that is climate resilient and which helps combat the climate crisis. An Infrastructure Implementation Task Force established by Executive Order and led by a newly-appointed White House Infrastructure Implementation Co‑ordinator, provides guidance from the Centre of Government (National Economic Council Director as co-chair, the Office of Management and Budget (OMB), the Domestic Policy Council, and the Climate Policy Office in the White House), alongside the heads of six federal agencies.

2. Strengthening project alignment: Given that the vast majority of infrastructure investment is implemented at the State level, infrastructure co‑ordinators have been appointed in 53 states and territories to work with the Task Force. The White House has produced a Bipartisan Infrastructure Law Guidebook and a Rural Playbook, factsheets and videos to help local communities understand how they can benefit from funding under the law.

3. Capacity building: The reinforced implementation effort has resulted in Implementation guidance produced by the OMB for ministries and agencies. The federal government is hiring for over 8 000 essential and mission-driven roles to implement the law including engineers and scientists to combat climate change.

Quality infrastructure investment requires a clear vision for the future and a credible roadmap to achieve it. The G20 Principles stress the need to define a long-term vision for infrastructure which can help governments establish an adequate institutional framework, implement clear governance arrangements, define needs and targets, co‑ordinate across stakeholders and develop reliable action plans. Furthermore, transparency and predictability of government intentions is a precondition to enable long-term investment decisions, especially from private investors.

Long-term infrastructure strategies that are aligned with climate change adaptation and mitigation objectives, with complementary medium-term action plans play an important role in steering investments decisions, from both public and private actors (Aguilar Jaberi, A., et al., 2020[3]). OECD countries have now become more aware of the need for coherence between long-term infrastructure plans and broader sustainable development objectives, in light of commitments made under the Sustainable Development Goals of the Agenda 2030. In this regard, most of the surveyed OECD countries back in 2021 (i.e. 24 out of 32, or 75%) have aligned their long-term infrastructure plan with environmental and climate action policies (OECD, 2021[4]).

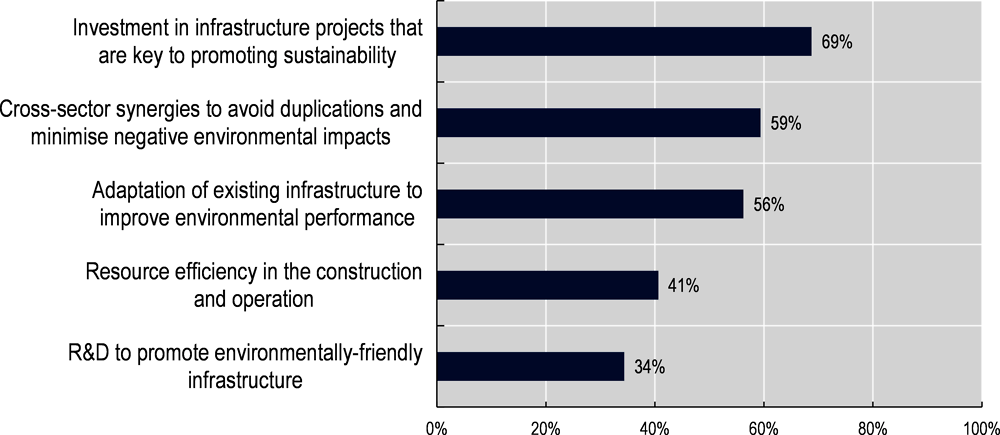

Different strategies and tools have been used to promote alignment of strategic long-term infrastructure visions with environmental policy objectives. To illustrate, 69% of the surveyed countries invest in key projects enabling the implementation of broader sustainability initiatives (e.g. circular economy systems, sustainable mobility, net-zero carbon emissions, climate change mitigation and adaptation), 59% focus on identifying cross-sector synergies to reduce negative environmental impacts, and 56% on adapting existing infrastructure to improve environmental performance. Fewer have adopted resource efficiency targets in the construction and operation of infrastructure (41%) or research and development to promote environmentally friendly infrastructure (34%) (OECD, 2021[4]) (Figure 3.2).

Note: Results are shown for 32 OECD countries.

Source: 2020 OECD Survey on the Governance of Infrastructure.

Based on G20 country practices, the following elements can be highlighted in order to improve infrastructure long-term planning, ensuring that the long-term vision is aligned with climate and environmental objectives, and can be used as an instrument to steer the green agenda.

Demonstrate clear and credible commitment to long-term climate goals, international biodiversity targets, and other environmental objectives. In that regard, Indonesia is integrating climate change considerations into the planning processes in order to enable the transition towards a green economy. To develop the Low-Carbon Development Policy under its 2020‑24 National Medium-Term Development Plan, Indonesia employed a systems-based analysis framework to consider the inter-linkages between different economic sectors and development goals, including the reduction of greenhouse gas emissions and conservation of biodiversity.

Ensure that infrastructure long-term planning takes into account environmental and climate considerations, and the link with other government priorities such as inclusion and territorial development. Canada’s ‘Investing in Canada Plan’ includes a specific funding stream dedicated to investments that support a transition to a clean growth economy in provinces and territories. The plan was recently updated to include a COVID‑19 resilience component to fund shovel-ready, short-term projects that aim to retrofit, repair and upgrade existing infrastructure, as well as disaster mitigation and adaptation projects. Another example is South Korea’s New Deal to combat the economic setbacks caused by COVID‑19, with a distinctive territorial approach. The main objective of the plan is to transform the country into a fast-mover, low-carbon economy and inclusive society.

Use the vision to underline a clear investment strategy that sends a message to financial markets of strong government leadership and will for low-carbon infrastructure. Government leadership in infrastructure investment is vital to shape the direction of a country’s green transformation and to crowd in private investment of sustainable infrastructure. To support the implementation of the Singapore Green Plan 2030, Singapore’s net-zero ambitions and the Green Finance Action Plan, the country has introduced the Significant Infrastructure Government Loan Act (SINGA), designed to support major, long-term infrastructure projects following stringent project appraisal by tapping into the debt market to use public investment to clearly and significantly set the direction of sustainable infrastructure. Under SINGA, Singapore plans also to issue green bonds as a key part of its sustainability agenda and to help finance further development of sustainable infrastructure, mobilising private capital, and catalysing climate actions.

Accommodate future uncertainties resulting from climate change and technological innovation, by providing the appropriate degree of flexibility to enable adjustments over time and reflect changing circumstances or new information (OECD, 2021[5]). In this regard, a number of alternative decision-making approaches have been developed, using scenario planning as their basis, such as real option analysis, robust decision making and adaptive planning. The Netherlands, for example, has adopted adaptive planning water-management as the basis for its long-term planning for its water resources, building on an iterative decision-making process and the use of Nature‑based Solutions (NbS) (Zevenbergena, Rijkeb and van Herkb, 2015[6]; OECD, 2018[7]).

Estimate the potential effect of the long-term strategic vision on the environment. For the development of the National Development Plan (NDP) 2021‑30, Ireland has undertaken climate and environmental assessment of the NDP measures, along with an assessment of the alignment of the plan as a whole with the ideals of a green recovery plan. Seven climate and environmental outcomes were specified on which each NDP measure is likely to have an impact: climate mitigation, climate adaptation, water quality, air quality, waste and circular economy, nature and biodiversity, and just transition. This assessment could be used to inform priority setting and capital budget planning under the Public Spending Code.

Ensure cross-sector synergies and introduce a systemic approach to improve resilience in the long term. The COVID‑19 crisis provided an opportunity to focus investment on long-term objectives such as pursuing a low-carbon transition, promoting resilience, and reducing regional disparities. In Italy, Milan launched the 2020 Adaptation Strategy to promote a systemic transformation of the city’s infrastructure leveraging synergies across sectors. The strategy aims to rethink the timing, timetables and the rhythm of the city, and to reclaim public spaces for well-being, leisure, and sports. The strategy also aims at stimulating the recovery of the construction sector by launching widespread maintenance and redevelopment projects on existing real estate assets, both public and private, alongside energy-saving initiatives, environmental redevelopment and improved home comfort.

Develop financial instruments to promote the financing of sustainable infrastructure in the medium and long term. France has been one of the pioneer and leading countries on sovereign ESG financing. On 24 January 2017, Agence France Trésor (AFT) launched the first French sovereign green bond for an issuance amount of EUR 7bn. In addition, on 16 March 2021, AFT launched a second Green OAT through syndication: the OAT 0.50% 25 June 2044, for an amount of EUR 7bn matching the level reached during the inaugural issue of the first green OAT. France’s Green OATs funds central government budget expenditure and expenditure under the “Invest for the Future” programme to fight climate change, adapt to climate change, protect biodiversity and fight pollution. The funds raised are handled like funds from a conventional OAT and managed in compliance with the general budget rule. However, they are matched to an equivalent amount of Green Eligible Expenditures and the aggregate of such expenditure in a given year sets the limit for Green OATs issuance.

Develop transparent pathways to create greater investment predictability and strengthen the demand for sustainable investment. Brazil’s Infrastructure Observatory aims to disseminate relevant information on investments and sustainability in infrastructure to improve its planning and regulation. The platform presents scenarios and projections of investment and socio-economic indicators, and lists the projects being planned and executed with participation of the Federal Government as well as private investments. The projects are evaluated from the perspective of sustainability along four dimensions: economic-financial, environmental, social and institutional.

Infrastructure is a long-lived capital-intensive investment. Decisions made today about the nature, location, and design of infrastructure will have long-lasting effects that influence the extent to which investments deliver anticipated benefits over time and align with broader policy objectives (OECD, 2021[8]). Governments have a primary role in defining which investment options are best able to contribute to the achievement of identified policy goals. Political dynamics can undermine sound decision making on infrastructure when processes for identifying priority projects and choosing delivery modes are not sufficiently formalised (OECD, 2017[9]). If the incentives are skewed towards displaying tangible results to a certain constituency, some other infrastructure needs might end up being neglected, resulting in inefficient investments that fail to respond adequately to the needs of the population. Political short-sightedness can indeed hamper sustainable infrastructure investments, whose benefits are often intangible and tend to accrue just in the longer-time horizon. Conversely, it can also lead to window-dressing of climate change actions and policies.

In the context of a wider focus on well-being and sustainable development, infrastructure investment is increasingly required to address multiple economic, social, and environmental objectives. This creates challenges for decision-makers, who are required to weigh and balance different (and sometimes competing goals) in selecting and prioritising projects (OECD, 2021[8]). While there is a natural inclination to promote ‘shovel-ready’ solutions, this must be balanced by the need for environmentally sustainable and climate‑resilient infrastructure.

As pointed out in the OECD Recommendation on the Governance of Infrastructure, governments benefit from decision-making processes that are based on a sound understanding of the expected returns of infrastructure projects and pay due consideration to economic efficiency as well as social, environmental, and climate costs and benefits throughout the whole of the asset’s life cycle. Short lists of projects should be developed using assessment methods that analyse both monetary and non-monetary costs and benefits and consider the projects’ contribution to environmental and resilience policy goals.

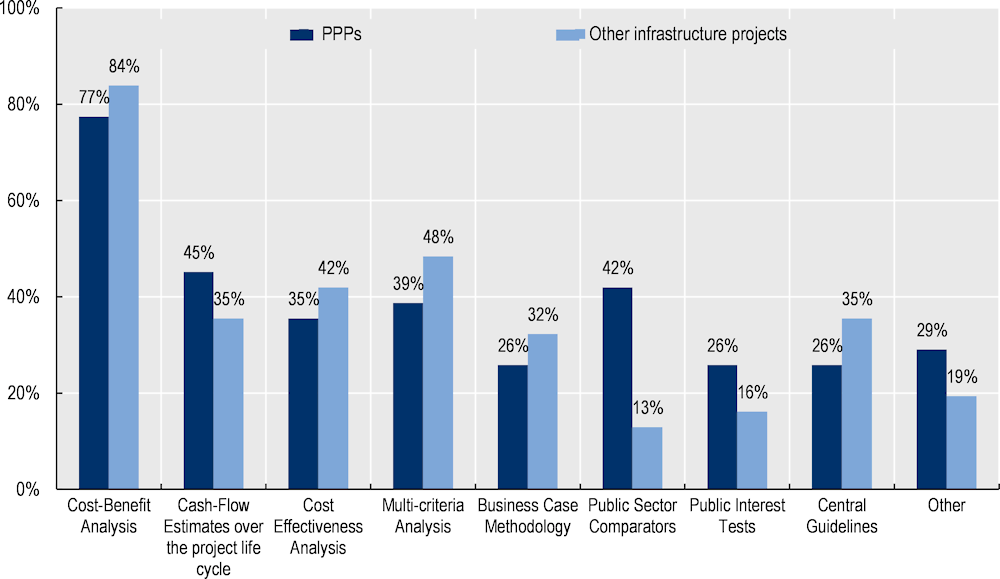

Traditional tools and mechanisms to appraise and prioritise infrastructure projects are often ill-equipped to consider environmental and climate aspects, and this is also due to the inherent difficulty to estimate the environmental costs and benefits of an infrastructure asset and translate them in monetary values. However, valuation of environmental costs and benefits may not always be sufficient to impact the overall costs and benefits of an asset and so setting higher values for environmental and climate impact may be required. Most OECD countries use CBA [(77%, 24 out of 31 countries (for PPPs); 84%, 26 out of 31 countries (for other infrastructure projects)] (Figure 3.3) to inform infrastructure appraisal and decision-making as it is simple in its logic, and it generates clear quantitative values (i.e. Net Present Values, Benefit/Cost ratios) that can be used to compare and rank projects. Nonetheless, it leaves aside a wide range of factors that are not easy-to-monetise, but that are relevant for the purpose of fostering sustainable infrastructure investments (OECD, 2021[5]). Methodologies such as multi-criteria analysis which can accommodate more long-term goals – such as environmental sustainability – are less widely used [39% (for PPPs); 48% (for other infrastructure projects)] (Figure 3.3).

Note: Results are shown for 31 OECD countries.

Source: 2020 OECD Survey on the Governance of Infrastructure.

The following good practices based on OECD and G20 country experiences can serve as tools to ensure the project appraisal and prioritisation process fosters sustainable infrastructure:

Better integrate environmental considerations in project planning, appraisal and prioritisation. The OECD is currently supporting the Department of Public Expenditure and Reform (DPER) in Ireland to strengthen the integration of environmental and climate considerations in the appraisal of infrastructure project investments, within the framework of the Public Spending Code (PSC). This also includes improve the quantification of the emission impact of infrastructure projects in the CBA.

Include sustainability as part of a rigorous project assessment process to inform the capital budgeting process. Australia has developed a transparent method of project selection to inform Australian Federal budget processes and incentivise sub-national governments and other project proponents to undertake robust appraisals that can include sustainability goals. Infrastructure Australia (IA) undertakes independent assessments of infrastructure projects and initiatives on behalf of the Federal Government against criteria that, in part, includes environmental value. Infrastructure Australia publicly releases these evaluations in the form of Infrastructure Priority Lists. For a project or initiative to be assessed, it must be supported by an appraisal deemed adequate by IA (Infrastructure Australia, 2022). While in Australia, this method could be developed further to include sustainability goals, it provides a structured way for countries to ensure projects and initiatives are robustly appraised against sustainable objectives.

Ensure decisions on infrastructure investments are informed by robust evidence‑based analysis. This helps overcome political short-sightedness, enhances the opportunity to opt for sustainable infrastructure investments. In this regard, Norway’s Ministry of Finance foresees an additional scrutiny for large transport projects via a two‑stage quality assurance process, which includes inputs from independent reviewers and evaluates environmental and social impacts (OECD, 2017[10]).

Accurately account for the financial cost of carbon and environmental externalities in the financial evaluation of infrastructure projects. Germany’s Federal Ministry of Finance identifies climate action as a priority (Federal Ministry of Finance, 2022). As part of this, Germany launched its national emissions trading system (nEHS) in 2021 for the heating and transport sectors. The fixed price for a tonne of CO₂, which started at EUR 25 in 2021, will gradually increase to EUR 55 by 2025. All revenues will be recycled into new sustainable investment projects and initiatives.

Supplement CBA with other methodological tools to analyse both monetary and non-monetary costs, such as multi-criteria analysis. The United Kingdom has adopted general guidelines for the incorporation of multi-criteria analysis (MCA) in decision-making processes (Department for Communities and Local Government, 2009[11]). The guidelines describe various techniques to perform MCA, encompassing a wide range of quite distinct approaches. MCA can bring a degree of structure, analysis and openness that lie beyond the practical reach of CBA, as it often involves combinations of some criteria which are valued in monetary terms, and criteria for which monetary valuations do not exist. MCA is then a good instrument to integrate and evaluate the environmental (i.e. water and air pollution, impacts on biodiversity and landscape, etc.) and climate impacts (i.e. GHG emissions) of projects, as it considers both elements for which monetary values can be estimated even just indirectly (i.e. through hedonic pricing techniques and stated preferences), as well as elements for which monetary values are not applicable.

Integrate sustainability considerations in the evaluation of projects. In 2021, the Ministry for Sustainable Infrastructure and Mobility (MIMS) in Italy introduced sustainability considerations in the planning and evaluation of infrastructural projects, placing great focus on the environmental sustainability, along with the economic, social and governance dimensions. Among the novelties, the ministry designed new guidelines for the ex-ante valuation of projects, together with the related operational guidelines specific to the different sectors that fall under its competence, including railway, public transport and road sectors. It also introduced a new scoring system to define an order of priority for projects that builds on multiple criteria, encompassing also the environmental dimensions, as well as new guidelines for the Technical and Economic Feasibility Project that include a study on the environmental impact of project and a sustainability report.

Value ecologically sustainable project design. In Australia, the Southbank Education and Training Precinct Project aimed to provide the highest level of ecologically sustainable design. It was awarded the 2009 Southbank Business Sustainability Award for environmental design, water conservation, waste management and energy management. The project was among the six major case studies selected by the Council of Australian Governments’ Infrastructure Working Group in 2010 to highlight those facets of major infrastructure projects that demonstrate best practice (Department of Infrastructure and Transport, Australian Government, 2010[12]).

Adopt a life‑cycle perspective to estimate environmental benefits and costs of an infrastructure asset – from construction to operation and maintenance to decommissioning. Infrastructure are capital-intensive assets with a lifetime that spans across several years. This entails that environmental considerations should not be limited to construction, but rather extend to the operation, maintenance and decommissioning phase. With the support of the EU, the OECD is currently supporting Hungary in promoting green public procurement, with a special focus on life cycle costing (LCC). A comprehensive LCC analysis takes into consideration the costs of mitigating/reducing (external) environmental impacts when awarding a public contract. Hungary, for example, has used LCC during the public procurement process for the construction of a sewage treatment plant for better compliance with environmental regulations.

Promote stakeholder participation that can channel infrastructure needs in a sustainable, inclusive and effective way. This will feed up legitimacy, trust, and shared ownership on infrastructure investment projects that support environmental objectives, while ensuring other important aspects and sustainability dimensions are not disregarded. In France, stakeholder engagement is mandatory for any transport infrastructure project with a budget from EUR 300 million or a length of more than 40 km. The Tours-Bordeaux project involved 150 public meetings to provide information on the project from its very earliest stages and 2 000 stakeholder consultations. Five hundred visits to four construction sites were organised, principally for local residents, with nearly 20 000 people attending over a period of three years. Stakeholder consultations resulted in agreements on environmental protection, avoiding sensitive sites, and creating natural environments close to the line in compensation for comparable sites disturbed or destroyed.

Align existing evaluation tools and processes with green objectives to streamline implementation. The United States has released a new Permitting Action Plan to strengthen and accelerate federal permitting and environmental reviews by fully leveraging existing permitting authorities to implement new provisions of the Infrastructure Investment and Jobs Act. The Action Plan outlines the Administration’s strategy for ensuring that federal environmental reviews and permitting processes are effective, efficient, and transparent, guided by the best available science to promote positive environmental and community outcomes, and shaped by early and meaningful public engagement.

Sustainable and resilient infrastructure investment is increasingly required to address multiple economic, social and environmental objectives beyond a narrow definition of user needs. This creates challenges for decision-makers, who are required to weigh and balance different (and sometimes competing goals) in selecting and prioritising projects. Existing decision-making frameworks are not always well-adapted to accommodating a more diverse set of objectives. If the political incentives are skewed towards displaying tangible results to a certain constituency environmentally sustainable and climate resilient infrastructure can be neglected. This will result in inefficient investments that fail to respond adequately to the needs of the population.

Closing the infrastructure financing gap and attracting private sector investment will depend on the capacity of governments to ensure a pipeline of quality, environmentally sustainable projects that respond to investor needs. Building capacity to create and use evidence‑based tools and metrics will better inform infrastructure planning and prioritisation, providing countries with a clearer understanding of the environmental impacts of investments. Supporting innovative financing instruments, such as green and sustainable bonds, with adequate resources allocated will further support the successful rollout of quality, environmentally sustainable project pipelines.

Identify key challenges and reasons for failure and provide support to develop a mitigation strategy. For example, the Commercial Law Development Program (CLDP), a division of the United States Department of Commerce advises policy makers and government officials in developing and post-conflict countries to develop transparent legal and procedural frameworks to oversee complex infrastructure projects. Identifying the common reasons for project failure, the CLDP provides technical assistance in mitigating these risks through due diligence considerations, political considerations, and inter-stakeholder communications.

Increasing awareness and providing capacity building on green infrastructure. The OECD in collaboration with the European Union, is supporting Italy to integrate a green infrastructure approach into the planning of transport infrastructure. An important component of the project includes providing training and capacity building to increase awareness, and strengthen the capacities of public servants on green infrastructure, by improving definitions, cost benefit methodologies, and processes to include the consideration of green infrastructure options, alongside traditional grey infrastructure proposals.

Improving capability to translate climate objectives into functional specifications for PPP and project tenders. Indonesia uses PPP as an innovative financing scheme to integrate considerations of environmental aspects, climate change issues and green financing early on in the project life cycle. Examples of green considerations integrated into PPP projects include, but are not limited to, implementing a project design that promotes efficient use of energy, implementing reuse of treated wastewater, rainwater harvesting, and rainwater aquifer recharge system, and the use of materials which minimise operation and maintenance costs. Indonesia is also implementing an ESG framework into PPP and non-PPP projects as part of its commitment to addressing climate change, as well as capturing financing opportunities.

Leverage public development finance institutions to play a catalytic role and strengthen public sector’s capacity. This type of institutions can be particularly helpful to develop the infrastructure finance market and strengthen the pre‑investment phase in emerging and developing economies. For example, the National Development Financial Corporation (FDN) in Colombia, a financial corporation specializing in the financing and structuring of infrastructure projects, offers innovative products and services to attract resources that facilitate the private sector’s participation in the development of infrastructure projects in Colombia. The FDN plays a catalytic role in overcoming gaps in the market and mobilises financial resources to develop national infrastructure, while appropriately managing risks. The FDN is also committed to ensuring that infrastructure investment actively contributes to the achievement of national and international commitments on environmental protection, climate resilience and low greenhouse gas emissions. Similarly, the Brazilian Development Bank (BNDES), the main financing agent for development in Brazil, plays a fundamental role in stimulating the expansion of industry and infrastructure in the country. In its efforts to build markets, promote a green economy, and engage in green innovation financing, the BNDES has made direct equity investments in Sunew, a company aiming at the large‑scale manufacturing and commercialisation of Organic Photovoltaic (OPV) films to generate solar energy.

Improve visibility and technical assistance to projects and make smart use of financial resources. To achieve climate objectives and solve the infrastructure financing gaps, the European Union has accelerated the development of strategically important infrastructure projects by providing institutional access, public guarantees and funds. In 2014, the European Commission launched the Investment Plan for Europe (IPE) to remove obstacles to investments, provide visibility and technical assistance to projects and make smart use of financial resources across Europe. The Plan has three pillars: first, the European Fund for Strategic Investments (EFSI); second, the European Investment Advisory Hub and the European Investment Project Portal; third, targeted efforts to remove national and EU-level regulatory barriers to investments (OECD, 2018[7]).

In the wake of COVID‑19, G20 countries understand more than ever the need to leverage infrastructure investment to fully realizing their potential to deliver on key policy priorities, including catalysing the low-carbon transition, incorporating circular economy solutions, safeguarding biodiversity, building resilience to climate change, and underpinning countries’ sustainable development.

Governments can improve the environment for sustainable infrastructure investment by improving the alignment of public and private expectations regarding sustainability objectives, pathways and measures. This begins with high-level dialogue at the political level, e.g. through the OECD-G20 Investors’ Dialogue, but the work of alignment does not stop here. Implementing the G20 QII Principles, requires governments to cascade their environmental and climate commitments and plans through their infrastructure planning and capital budgeting across sectors, to operationalise high level objectives into project prioritisation and appraisal criteria, and to ensure that key capacities are in place across the public sector to make the right decisions in line with government objectives in order to ensure a pipeline of bankable quality infrastructure projects.

In support of this complex challenge, the OECD is preparing a Toolbox for the Implementation of the Recommendation on the Governance of Infrastructure that will draw on the examples laid out in this paper and its annexes and further develop the infrastructure governance pillars that can support country ambitions. Furthermore, it is developing Infrastructure Governance Indicators that operationalise the Recommendation in terms of functional practice. Extending these indicators beyond OECD countries and collecting addition good practice examples to include other G20 members and beyond would provide an additional step in filling the data gap on key practices to implement the G20 principles.

[3] Aguilar Jaberi, A., et al. (2020), “Long-term low emissions development strategies: Cross-country experience”, OECD Environment Working Papers, Vol. 160, https://doi.org/10.1787/1c1d8005-en.

[1] Auffhammer, M. (2018), “Quantifying economic damages from climate”, Journal of Economic Perspective, Vol. 32/4, pp. 33-52, https://doi.org/10.1257/jep.32.4.33.

[11] Department for Communities and Local Government (2009), Multi-criteria analysis: a manual, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/7612/1132618.pdf.

[12] Department of Infrastructure and Transport, Australian Government (2010), Infrastructure Planning and Delivery: Best Practice Case Studies, https://www.infrastructure.gov.au/sites/default/files/documents/best_practice_guide.pdf.

[4] OECD (2021), “Goals and targets in long-term plans among countries that reported alignment of their long-term” in Government at a Glance 2021, OECD Publishing, Paris, https://doi.org/10.1787/1c258f55-en.

[5] OECD (2021), “Building resilience: New strategies for strengthening infrastructure resilience and maintenance”, OECD Public Governance Policy Papers, No. 05, OECD Publishing, Paris, https://doi.org/10.1787/354aa2aa-en.

[8] OECD (2021), OECD Implementation Handbook for Quality Infrastructure Investment., https://www.oecd.org/finance/OECD-Implementation-Handbook-for-Quality-Infrastructure-Investment.htm.

[2] OECD (2020), Supporting Better Decision-Making in Transport Infrastructure in Spain : Infrastructure Governance Review, OECD Publishing, Paris, https://doi.org/10.1787/310e365e-en.

[7] OECD (2018), “An overview of project pipelines”, in Developing Robust Project Pipelines for Low-Carbon Infrastructure, OECD Publishing, Paris, https://doi.org/10.1787/9789264307827-5-en.

[9] OECD (2017), Gaps and Governance Standards of Public Infrastructure in Chile: Infrastructure Governance Review, OECD Publishing, Paris, https://doi.org/10.1787/9789264278875-en.

[10] OECD (2017), OECD Economic Surveys: Norway 2018, OECD Publishing, Paris, https://doi.org/10.1787/eco_surveys-nor-2018-en.

[6] Zevenbergena, C., J. Rijkeb and S. van Herkb (2015), “Room for the River: a stepping stone in Adaptive Delta Management”, International Journal of Water Governance, Vol. 1, pp. 121-140, https://doi.org/10.7564/14-IJWG63.