This chapter assesses Portugal’s performance in attracting and retaining foreign direct investment (FDI) and explores the various economic, social and environmental benefits of foreign multinational activity in Portugal (e.g. green and digital transition, skills development, gender equality, technology uptake, integration into global value chains, regional development). Several data sources are used in the assessment, including official FDI statistics, cross-border mergers and acquisitions (M&A), and greenfield investment data, as well as firm-level data from Statistics Portugal (INE), among other economic indicators.

The Impact of Regulation on International Investment in Portugal

1. Trends and impacts of foreign direct investment in Portugal

Abstract

Key findings

-

After a decade of impressive growth, Portugal has one of the highest levels of inward foreign direct investment (FDI) stocks across OECD member countries, at 71% of GDP in 2021. The uncertainty surrounding the COVID‑19 pandemic and the economic consequences of Russia’s war of aggression against Ukraine might, however, weigh on Portugal’s near-term FDI activity prospects.

-

Foreign investment is actively supporting Portugal’s green and digital transitions, with significant amounts of investment flowing into renewable energy projects, digital technologies and infrastructure. There are also signs of rising investment activity in the manufacturing sector, which had typically been overlooked by foreign investors.

-

More granular evidence shows that foreign affiliates in Portugal contribute to the development of Portugal’s skills base and to job quality improvements, in terms of wage and gender parity. They are also supporting Portugal’s integration into global value chains by purchasing inputs from local firms and selling to international markets.

-

Despite being mostly concentrated in the Lisboa and Norte regions, foreign investors are present throughout the entire territory. Their characteristics and performance vary considerably across regions, reflecting differences in the industrial structure of the regions and in the specialisation profiles of the investors.

-

Further FDI could help to expand and modernise the currently subdued capital base in many sectors, particularly with respect to productivity-enhancing assets, such as machinery, equipment and intellectual property assets. More investment in information and communication technology assets would also be beneficial more broadly across sectors and firms, including for Portugal to deliver on and sustain its reputation as a technology and innovation hub.

-

Further diversification of the investor base, which remains largely concentrated in few traditional European partners, could also contribute to broadening economic opportunities by strengthening ties with other world leading investing economies and regions.

1.1. Introduction

The last decade marked the turnaround of the Portuguese economy. After going through a full-scale economic crisis in 2011, which led the government to request assistance from the European Union (EU) and International Monetary Fund (IMF) and implement a series of fiscal, financial and labour market reforms, Portugal underwent a remarkable economic rebound and transformation, restoring investor confidence, improving its economic competitiveness and resilience, and exiting the agreed economic adjustment programme earlier than expected in 2014 (IMF, 2018[1]; Gouveia et al., 2018[2]). Since then, Portugal has been sustaining an impressive economic record, drastically reducing unemployment and bringing previously large fiscal and current account deficits under control (OECD, 2021[3]). The COVID‑19 pandemic, however, brought many of these positive developments to a sudden halt. Economic activity contracted by 8.4% in 2020, Portugal’s deepest post-war recession. But the economy rebounded well in 2021 partly thanks to government support measures, which helped weather the economic shock. The outlook, however, remains uncertain as the pandemic and its economic effects may still linger in the near term (OECD, 2021[3]). Russia’s invasion of Ukraine might also weigh on Portugal’s economic prospects due to possible disruptions in global supply chains and increased volatility of commodity prices.

While the pressing attention of authorities remains in navigating the economy through these uncertain times, in the longer term Portugal will need to address some of its long-lasting structural challenges. Particularly, Portugal could mobilise further investment to support long-term productivity growth in view of adverse demographic trends and support its transition to a carbon-neutral economy by 2050 (IMF, 2018[1]; EC, 2020[4]). Overall investment levels in Portugal remain among the lowest in the EU (20.3% of GDP against 22% of GDP in the EU in 2021) despite steady improvement over recent years.

Foreign investment can play an important role in addressing these challenges. Beyond capital and jobs, foreign investors can contribute to develop and transfer knowledge and technology, introduce innovative management methods and help upstream and downstream sectors upgrade their products, through close links that could further support productivity growth, particularly for domestic small and medium-sized enterprises (SMEs) (OECD, 2022[5]). They can also bring other social benefits related to job quality, gender equality, digital transition and carbon neutrality (OECD, 2019[6]). As shown throughout this chapter, existing foreign investors are already contributing to advancements in many of these areas in Portugal and, hence, to setting the country on a more sustainable development path. Efforts to further attract foreign investors and retain existing ones could thus prove to be strategic for addressing Portugal’s productivity challenge and for accelerating its green and digital transition.

Foreign investors may also provide crucial support for the economic recovery following the COVID‑19 pandemic.1 Like Portugal, many countries will grapple with recurring outbreaks, but those who manage to remain attractive destinations post-COVID‑19 will have an edge in retaining and mobilising new foreign investment. Increasing the level of international investment is already part of Portugal’s strategic priorities for the next decade (the Internacionalizar 2030 programme approved by the Council of Ministers in July 2020 and the Acordo de Parceria Portugal 2030 programme approved by the Council of Ministers in March 2022 in the context of the Multiannual Financial Framework 2021‑27 and the European Structural and Investment Funds). This is a critical time to pursue this strategy.

Moreover, foreign investment may help to weather some of the economic challenges posed by Russia’s war against Ukraine. Aside from the regretful human losses and humanitarian damages, the war has steepened pressures on the supply of energy, agriculture and minerals, causing significant moves in commodity prices and prompting many countries to revise their strategic priorities. In March 2022, EU countries adopted the Versailles Declaration reaffirming the EU’s intentions to enhance energy security, strengthen defence capabilities and reduce dependencies on critical resources, such as digital technologies, agricultural products and raw materials.2 As showed in this chapter, Portugal has been advancing in many of these fronts already, including with the support of international investors, and may look towards accelerating the pursuit of such strategies and exploring associated opportunities with their support.

This report examines how regulatory reforms could help Portugal build a more enabling and competitive environment for investment, particularly foreign direct investment (FDI), contributing ultimately towards achieving Portugal’s strategic priorities enshrined in the Acordo de Parceria Portugal 2030 and in its Recovery and Resilience Plan. This chapter assesses trends and patterns of FDI as well as its contribution to sustainable development in Portugal. Section 1.2 reviews Portugal’s overall investment situation in comparison to a group of benchmark European economies to better understand how it could best support long-term productivity growth. Section 1.3 examines trends and patterns of FDI, cross-border mergers and acquisitions (M&A) and greenfield investment in Portugal and in the benchmark countries. It looks at their evolution, capital composition and sectoral distribution and at the origin of investors. It also explores the more detailed sectoral information of M&A and greenfield investment data to examine to what extent foreign investors are contributing to advance Portugal’s low-carbon and digital transition. Lastly, Section 1.4 exploits the richness of Portuguese micro-data to describe the broader effects of FDI on skill development and gender equality, on technology uptake and digitalisation, and on the linkages with domestic firms as well as their integration into global value chains (GVCs). The regional impact of FDI is also considered in this section.

1.2. Investment is needed to support long-term productivity growth

1.2.1. Portugal’s productivity has plateaued during the last decade

Like many other developed countries, Portugal has a rapidly ageing and decreasing population.3 In the longer term, the resulting declining share of workers to the total population will weigh on labour’s contribution to economic growth. This demographic evolution will also intensify demand for health care, pension and social services and increase the pressure on the public sector (IMF, 2018[1]).

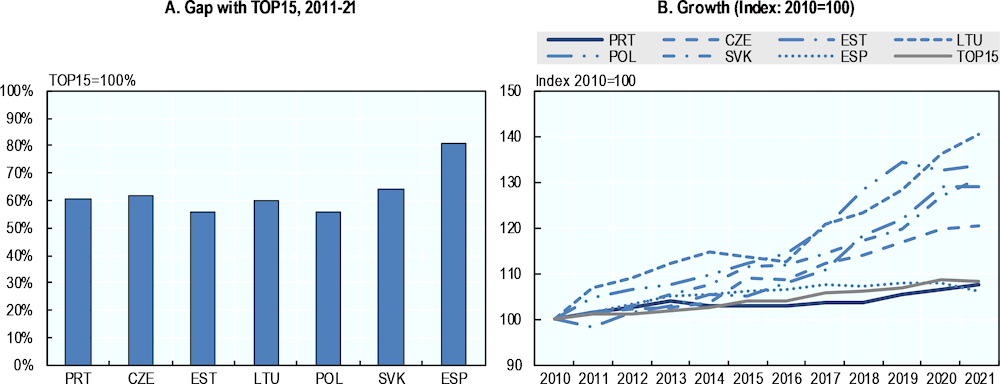

Raising productivity is thus necessary to cope with Portugal’s adverse demographic trends and to continue improving people’s living standards. Productivity has plateaued over the last decade and is no longer converging with the average top 15 most productive European economies (TOP15).4 The productivity gap with the TOP15 stood at about 60% over the period 2011‑21 (Figure 1.1 A). While Portugal’s productivity level is still higher than in some countries in the benchmark group, the latter are seeing their productivity levels converge faster to TOP15 levels (Figure 1.1 B).5 Similar trends hold across the manufacturing and business services sectors excluding real estate.

Figure 1.1. Real labour productivity (hours-based)

Note: Real labour productivity based on GDP per total hours worked; a similar trend holds for labour productivity measured on a per employee basis. Panel A reflects the median labour productivity gap with the average top 15 most productive European economies (TOP15) in USD million, constant prices, 2015 Purchasing Power Parity over the period 2011‑21. Panel B reflects real labour productivity growth in national currency, constant prices. TOP15 refers to the average of the 15 most productive European economies indicated in endnote [4]. Information on the benchmark group selection is available in endnote [5].

Source: OECD (2021[7]), Productivity Statistics Database, https://www.oecd.org/sdd/productivity-stats/.

1.2.2. Investment has been relatively weak and unable to raise capital stock levels

Along with improvements in labour skills and in labour market efficiency and broader efforts to enhance domestic firms’ absorptive capacity, particularly of SMEs (IMF, 2018[1]; Alves, 2017[8]; OECD, 2022[5]), productivity improvements could be achieved with further capital deepening. Total public and private investment – i.e. gross fixed capital formation – has been weak and unable to raise capital stock to levels similar to those of the average TOP15 economy. The ratio of investment to GDP has declined for most of the last decade before starting to recover in 2017. Yet it remains somewhat lower than in most peer economies: 20.3% of GDP in 2021 compared to 22% on average in the benchmark group and 21.7% in the TOP15. When looking at investment by the corporate sector, the gap with TOP15 economies has recently narrowed; however, compared with some peers, corporate investment in Portugal has been considerably lower during the last decade. While the median level of investment to GDP by the corporate sector was 10.7% in Portugal over the period 2011‑21, it was 13.7% on average in the benchmark group and 12.4% in the TOP15, about 30% and 15% greater than in Portugal respectively (OECD, 2021[9]).

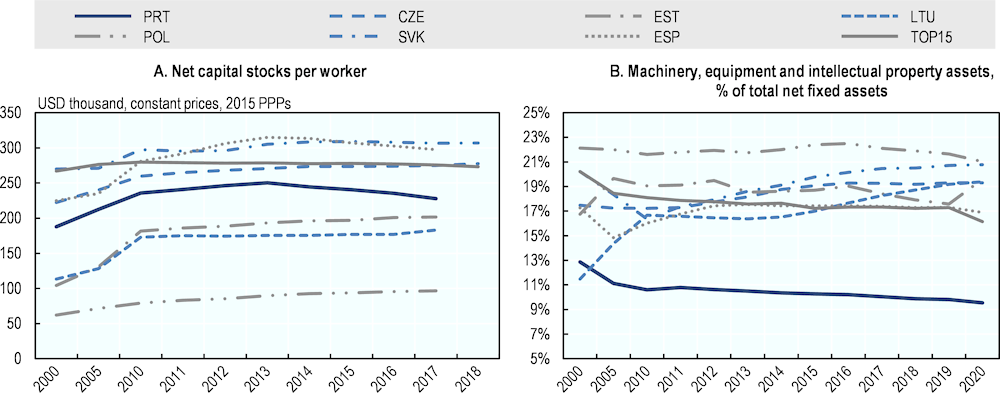

Portuguese workers would particularly benefit from having at hand better machinery, tools and technology that would enable them to work more efficiently and increase productivity. The level of capital stock per worker remains relatively low and the wedge with the average TOP15 economy has been growing more recently (Figure 1.2 A). This is particularly the case in the manufacturing sector, for which Portugal’s level of capital stock per worker stood at 70% of the TOP15 level in 2017. In turn, many services sectors (e.g. construction, distribution, transportation, among others) present relatively high levels of capital stock per worker, but this may partly reflect the misallocation of capital over the years before the Portuguese crisis when large amounts of credit-fuelled resources were drawn into non-tradable activities (Alves, 2017[8]; OECD, 2014[10]). Also, across sectors, capital invested has been mostly allocated to construction assets as opposed to potentially more productivity-enhancing assets, such as machinery, equipment and intellectual property assets (Figure 1.2 B). This divergence is much more pronounced than in the average TOP15 economy and across the benchmark group, and has strongly accentuated in the manufacturing sector over the last decade.

Figure 1.2. Net capital stock per worker is on a declining trend

Note: Panel B data correspond to the share of machinery and equipment and weapon system (transport equipment, ICT equipment and other machinery, equipment and weapons) and intellectual property products (computer software and databases, research and development assets, etc.) in total net fixed assets. Total net fixed assets include construction assets (dwellings and other buildings and structures) and cultivated biological resources in addition to the aforementioned assets. The average top 15 most productive European economies (TOP15) in Panel B excludes Switzerland and Iceland due to the lack of data.

Source: OECD (2020[11]), Structural Analysis database, https://www.oecd.org/sti/ind/stanstructuralanalysisdatabase.htm; OECD (2021[12]), Annual National Accounts database, https://stats.oecd.org/Index.aspx?DataSetCode=SNA_TABLE9A.

1.2.3. Investment in ICT assets remain relatively subdued

Portugal’s reputation as an attractive technology and innovation hub is increasing.6 Yet, investment in information and communication technology (ICT) assets in Portugal has still to pick up across industries. Net ICT capital stock per worker is still much lower in Portugal than in the average TOP15 and is also much lower than in most of the benchmark group (Figure 1.3). Moreover, it has been relatively stable over the past decade in Portugal while it has been growing in most benchmarked economies and in the TOP15. The relatively slow uptake in ICT investment thus far can increasingly become a drag for Portugal’s digital transition and a significant barrier to productivity improvements in the long term (Andrews, Criscuolo and Gal, 2016[13]). A shortfall in ICT assets can also hamper the green transition, as digital technologies play a prominent role in improving energy efficiency (IEA, 2019[14]). Low ICT investment can further amplify the existing digital divides between companies reaping the benefits of technological developments and those struggling to update their business models due to limited digital assets (EIB, 2019[15]) (see Section 1.4.3 for detailed information on technology uptake by Portuguese firms). Foreign investment can be an important complement to the measures envisaged in the Portuguese Recovery and Resilience Plan to boost the country’s ICT stock.

Figure 1.3. Net ICT capital stock per worker

Note: ICT capital refers to computer hardware, telecommunications equipment, software and databases. The average top 15 most productive European economies (TOP15) excludes Iceland, Germany and Switzerland due to the lack of data. Poland is also omitted for this reason.

Source: OECD (2020[11]), Structural Analysis database, https://www.oecd.org/sti/ind/stanstructuralanalysisdatabase.htm.

1.2.4. Portugal preserved labour cost competitiveness in recent years

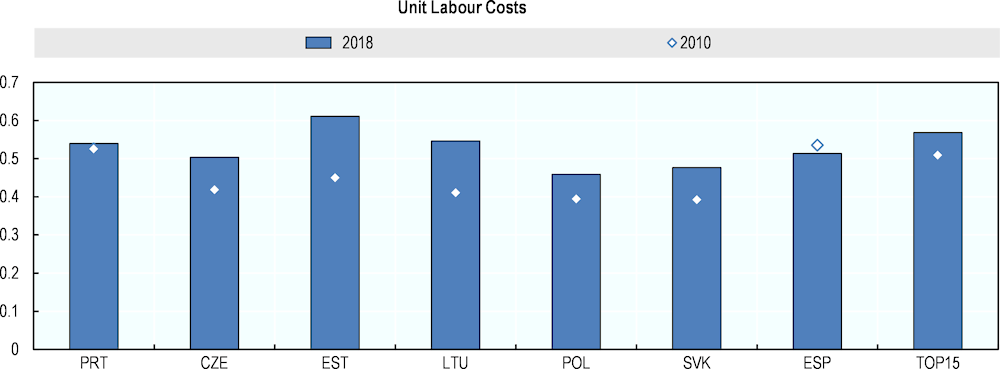

Currently, unit labour costs (ULCs) in Portugal remain lower than in the average TOP15 economy and in some of the economies in the benchmark group, which helps to keep Portugal as an attractive location to investors, although many of its peers prove to be quite competitive too (Figure 1.4).7 Portugal has been able to keep unit labour costs relatively under control over the last decade, having one of the slowest growing rates across the benchmark countries.

Figure 1.4. Unit labour costs

Note: Unit labour costs measure the average cost of labour per unit of output and are calculated as the ratio of total labour costs to real output.

Source: OECD (2020[11]), Structural Analysis database, https://www.oecd.org/sti/ind/stanstructuralanalysisdatabase.htm.

Maintaining relative cost advantages over time can prove challenging, however, without productivity gains. Total unemployment was 6.6% in 2021, one of the lowest levels since 2004 (World Bank, 2021[16]). Investors are already struggling to find qualified workers for certain positions, particularly those requiring information technology (IT) and digital skills, as demand for talent has been outgrowing supply in some areas. Investors consider supporting high-tech industries and innovation and developing talent as key areas of focus to maintain Portugal’s competitive position in the global economy (Ernst & Young, 2020[17]; Ernst & Young, 2021[18]; INE, 2018[19]).

1.3. Foreign investment trends

Foreign investors can and in many ways are already contributing to addressing many of Portugal’s long‑term sustainable development challenges (see Section 1.4). International investment can also play a critical role in accelerating the green and digital transition, including to partly address the consequences of the COVID‑19 pandemic and the war in Ukraine. Stepping up efforts to attract foreign investors and retain existing ones could thus prove to be strategic for making further progress on these priorities.

1.3.1. FDI in Portugal has grown rapidly over the last decade

Portugal has one of the highest levels of inward FDI stocks across OECD countries and compares favourably against most of the benchmark group (Figure 1.5 A). At end‑2021, inward FDI stocks as a share of GDP stood at 71%, having risen slightly below the average of the benchmark group since 2015. However, over the last decade (2011‑21), they have grown at an impressive 6% compound annual growth rate. Such growth has not been nearly matched by any of the benchmarked countries during the period. Most of this growth has been driven by equity capital injections. In the shorter period between 2015 and 2021, for which comparable data are available for most benchmark countries, equity capital injections accounted for over 60% of FDI inflows on average. In turn, FDI into most peer economies has been largely associated with reinvested earnings (Figure 1.5 B).

Figure 1.5. Portugal has relatively strong inward FDI stocks and has seen a significant increase in new equity capital injections in recent years

Note: Inward FDI stock and flow data on a directional basis, excluding resident special purpose entities.

Source: OECD (2022[20]), International Direct Investment Statistics, https://www.oecd.org/corporate/mne/statistics.htm.

1.3.2. Foreign investment activity may be tapering off as uncertain economic outlook continues to weigh on recovery prospects

Although higher frequency data on foreign investment, such as cross-border mergers and acquisitions (M&A) deals and greenfield investment projects, are in some ways conceptually different from FDI statistics, they are a great complement to official FDI statistics as they can help to identify broader investment dynamics taking place in recent periods with greater sectoral detail and, thus, contribute to explaining underlying trends in FDI. They also help to inform about investors’ mode of entry. As in other developed economies, cross-border M&As represent an important entry mode for foreign investors in Portugal, correlating highly with FDI equity flows. In turn, the contribution of announced greenfield investment projects tends to be much smaller overall.8

Cross-border M&A activity has been relatively more important in Portugal than in selected economies in recent years (Figure 1.6 A).9 However, the sum of all deal values as a share of Portugal’s GDP has been on a declining trend since 2015, despite some strong upward M&A activity occurring in 2020 and 2021, thanks to several large‑scale M&A deals. In contrast, the number of deals completed in Portugal, which had declined sharply during the pandemic, has recovered to a level slightly below the pre-pandemic level. The economic disruptions from the COVID‑19 pandemic and possible long-term consequences of Russia’s war against Ukraine might, however, continue to weigh on cross-border M&A activity in Portugal. In 2022, the number of completed cross-border M&A transactions was still about 10% lower than back in 2018 before the pandemic, and in value terms it stood at roughly 50% of the level observed in 2018.

Figure 1.6. Uncertain outlook might curb the upward trends in M&A and greenfield activity

Note: M&A deals refers to the aggregated value of completed cross-border M&A deals that give the investor 10% or more of the voting shares of the acquired company. Greenfield investment refers to the total value of announced capital expenditure. All values are deflated by producer price indices (2020=100).

Source: Refinitiv M&A database, Financial Times fDi Markets database and OECD (2021[12]), Annual National Accounts database, https://stats.oecd.org/Index.aspx?DataSetCode=SNA_TABLE1.

The COVID‑19 outbreak also hit greenfield investment projects hard (OECD, 2020[21]; 2021[22]). In 2020, the number of greenfield projects in Portugal fell by 36% compared to 2019, but already in 2021 greenfield investment activity had recovered.10 In 2022, it continued to grow reaching its peak at year-end. Similarly to M&A, however, the uncertainty surrounding the global economic outlook might still pose challenges for investment projects. While greenfield investment has been on the rise over the past few years, with the share of announced and undertaken greenfield investment projects to GDP increasing steadily over the years, the trend has slowed down in 2022 (Figure 1.6 B).11

1.3.3. Further diversification of the investor base could be beneficial

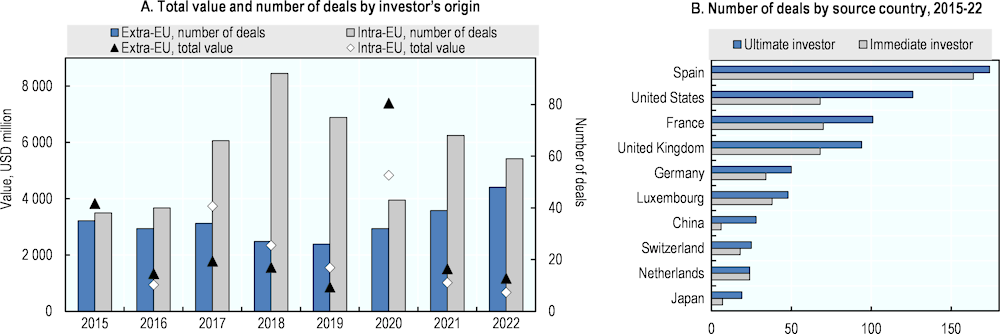

With the increasing role played by new outward investors in international markets, it could be strategic for Portugal to intensify efforts to diversify further its investor base, which remains predominantly based on traditional European investors, although there are signs of further investor diversification taking place in recent years.

Most cross-border M&As in Portugal come from the intra-EU market (Figure 1.7 A). Although less numerous, M&A transactions by investors located outside the Single Market are often larger: total deal value of extra-EU M&A was nearly 20% higher than that of intra-EU deals over the reported period.

Figure 1.7. Portugal attracts both EEA and non-EEA M&A investors

Note: Intra-EU refers to the investment originating in the EU’s Single Market (the EU, Iceland, Liechtenstein, Norway and Switzerland); Extra-EU comprises all the countries outside the EU’s Single Market. Panel A reports investor origin on the ultimate basis, Panel B on the ultimate and immediate basis as recorded in Refinitiv.

Source: Refinitiv M&A database.

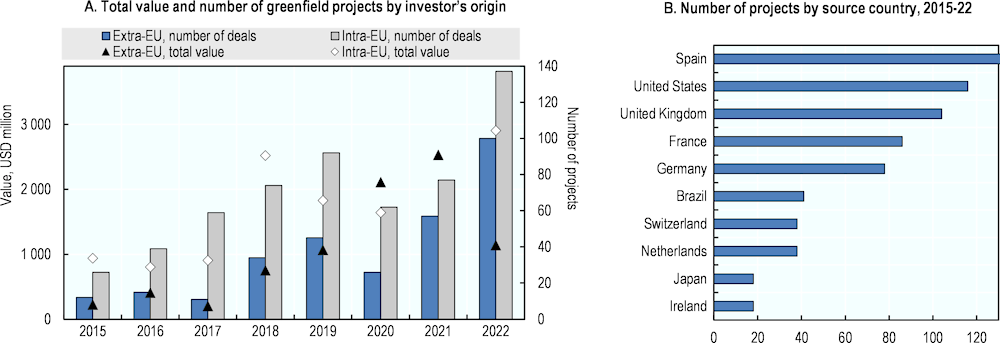

Figure 1.8. Most greenfield projects come from the EEA

Note: Intra-EU refers to the investment originating in the EU’s Single Market (the EU, Iceland, Liechtenstein, Norway and Switzerland); Extra-EU comprises all the countries outside the EU’s Single Market. The data provider reports only a single source country per greenfield project (the immediate investor).

Source: Financial Times fDi Markets database.

The largest number of M&A deals in Portugal originated in Spain, both on an immediate and ultimate investor basis (Figure 1.7 B). Many cross-border transactions in the last decade were also undertaken by investors from the United States, the United Kingdom and France, all of which were home to more ultimate than immediate investors. In value terms, the People’s Republic of China (hereafter ‘China’) and Brazil are also among the top sources of M&As in Portugal from an ultimate owner point of view.

Intra-EU investors have equally been the main proponents of greenfield projects in Portugal, both in terms of the number and value of announced projects, but extra-EU investors have been catching up in recent years (Figure 1.8 A), as measured on an immediate investor basis.12 From 2015 to 2022, the number of greenfield projects announced both by intra and extra-EU investors gradually increased, reaching its peak in 2022 when several larger projects took place.

Like for M&As, most greenfield investment projects in Portugal originate in Spain, France and the United Kingdom, even on an immediate investor basis – the only one available for these data (Figure 1.8 B). The United States, Germany and Brazil are also home to a great number of greenfield investors in Portugal. These countries are also among the leading investors when looking at the value of announced investment, along with Korea.

The geographical distribution of leading foreign investors in Portugal observed in recent years is broadly in line with the more historical perspective portrayed by the Bank of Portugal’s new statistical series on FDI positions by the ultimate investing country (Figure 1.9), with Spain, France and the United Kingdom also accounting for a substantial share of FDI stocks. The presence of Portugal among the major ultimate investors denotes the existence of “round-tripping” investment, i.e. funds transferred abroad by investors resident in Portugal that are then channelled back to the country in the form of direct investment through intermediary entities abroad, for instance in the Netherlands and Luxembourg (59% and 17% respectively) (Banco de Portugal, 2021[23]).13

Figure 1.9. Foreign direct investment position by ultimate investor, 2021

Source: Banco de Portugal (2021[23]), New statistics on foreign direct investment by ultimate investor: statistical press release, https://bpstat.bportugal.pt/conteudos/noticias/1579/.

1.3.4. Manufacturing and ICT sectors have proved attractive to foreign investors

Portugal’s manufacturing sector has been historically overlooked by foreign investors. The manufacturing share in total inward FDI stocks is the lowest across the benchmark group. Across the benchmarked economies, only in Portugal and Estonia the manufacturing sector is underrepresented in the stock of inward FDI and the extent of such divergence is greater in Portugal. Recent trends, however, point to rising investment activity in export-oriented manufacturing industries (e.g., mineral and metal products, chemicals, machinery, agro-food, transport material) (OECD, 2022[5]).

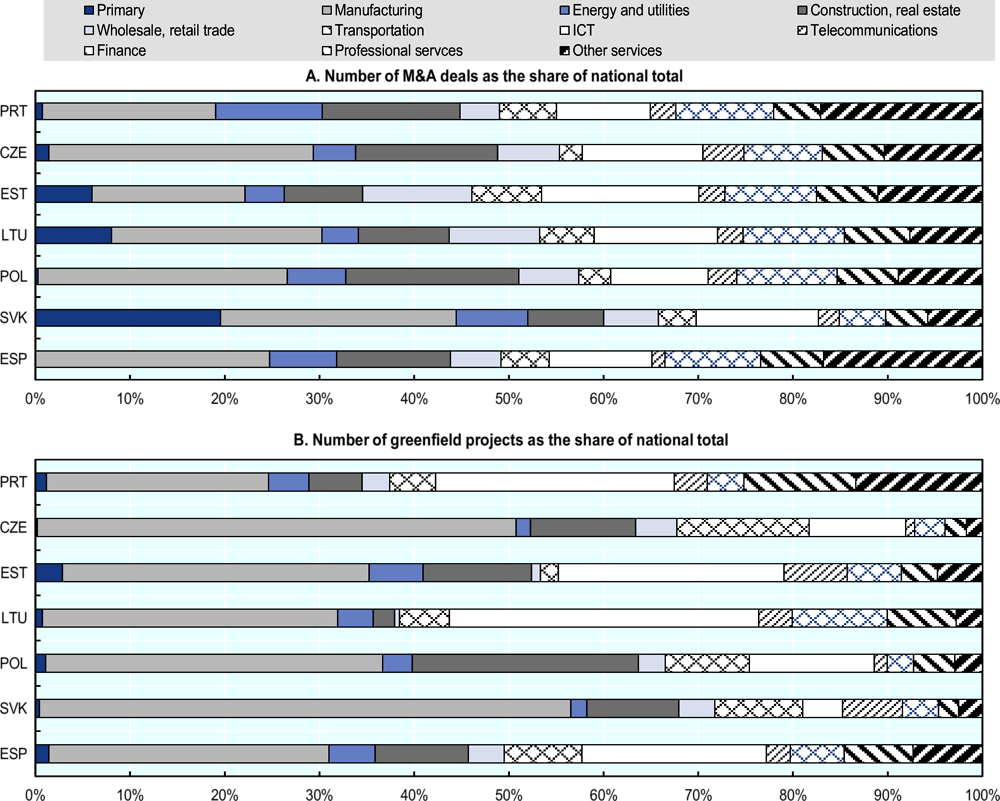

Manufacturing accounted for most cross-border M&As in Portugal in the last decade (Figure 1.10 A). The sector’s share in all foreign M&As in Portugal is, however, just 18%, among the smallest in benchmarked economies with only Estonia’s share being lower (16%). The relative number of deals in the manufacturing sector has been steadily declining since 2014, to the point that the share of the sector in the total number of M&A transactions has fallen from 27% in 2014 to 17% in 2022 on a 3-year moving average basis. Likewise, the share of manufacturing in total deal values contracted from 28% in 2014 to 2% in 2022.14

Figure 1.10. Portugal’s manufacturing attracts many M&As and greenfield projects

Note: Other services include accommodation, food services, health, social work, arts and administrative activities. Data are from 2012 to 2022.

Source: Refinitiv M&A database; Financial Times fDi Markets database.

A sizeable portion of greenfield projects into Portugal also went to the manufacturing sector (20%), albeit lower than in the benchmarked countries (Figure 1.10B). Over the years, the share of manufacturing in Portugal’s greenfield activity has been quite stable, accounting for nearly a quarter of all projects and a fifth of total greenfield investment, while the sector is steadily losing its relevance in peer countries.

Manufacturing plays a prominent role in foreign investment supported by AICEP Portugal Global, the country’s investment promotion agency (AICEP, 2022[24]). Over recent years, the sector’s share accounted for 78% of total value of investment contracts, with most projects targeting the automotive industry (26%) and chemicals (17%).

Despite these developments, overall FDI activity continues to be largely concentrated in services sectors, notably in financial and professional services which accounted for the largest shares of total inward FDI stocks as of end‑2021, although both sectors have seen their shares decline considerably over the last decade.15 The sectors that have been driving FDI growth in Portugal more recently are energy and utilities, information and communication, accommodation and food services, transportation and storage, and real estate activities.

Energy and utilities, for instance, accounted for 11% of all cross-border M&A deals in Portugal and was the largest sector in terms of investment value (25%) over the period analysed, driven largely by rising activity in the renewable energy sector (see Section 1.3.5). While relatively less pronounced in terms of numbers of projects (5%), energy and utilities activities absorbed the largest share of greenfield investment in value terms (22%) too over the period assessed.

In turn, FDI activity in the ICT sector has been mostly associated with greenfield investment projects. A third of greenfield projects in Portugal target ICT, the second largest share in the benchmark group after Lithuania (34%). While in value terms the sector’s share is smaller (15%), it is still the third largest in the group. This contrasts somewhat with the M&A trend, where the share of cross-border M&A deals in ICT is the lowest among peers (12%) and has changed little over time. In comparison, in Estonia, for instance, the sector’s share went up from 9% in 2014 to 26% in 2022 on a 3‑year moving average basis, making it the leading recipient of ICT deals in the group (18% over the period of observation).

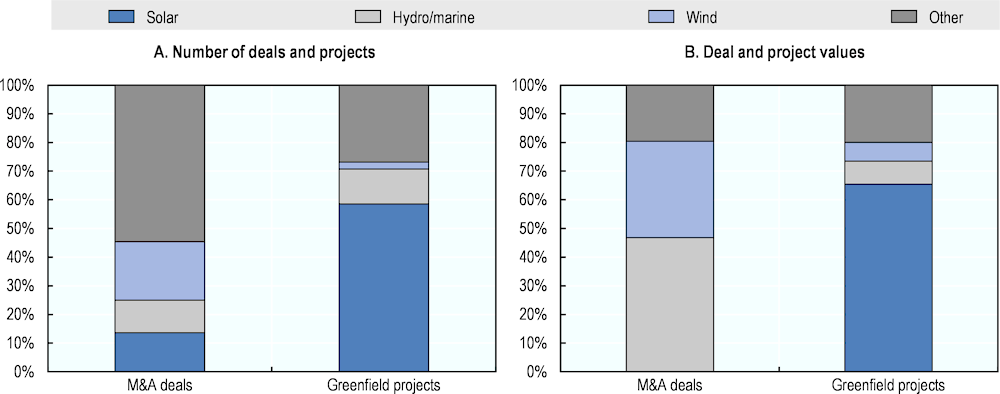

1.3.5. Foreign investment into renewable energy projects has been on the rise

Renewable energy has dominated both cross-border M&A and greenfield investment in the energy sector in Portugal in recent years (Figure 1.11A-B). Renewables accounted for 96% of all cross-border M&As in the energy sector (and 5% of all cross-border M&As in Portugal). This is in stark contrast with most peer economies, where transactions in fossil energy dominated, the share of renewables averaging only 37% of all energy sector cross-border M&As. Greenfield projects in fossil energy have been generally less prevalent across countries.

Figure 1.11. Renewable energy dominates M&A and greenfield investment in energy

Note: Renewable energy includes the production of energy from naturally replenishing sources, i.e. solar, wind, geothermal, marine, biomass and hydroelectric energy. Fossil energy includes the generation of fuels, such as coal, oil and natural gas, and related extraction activities. Nuclear energy is not considered. M&A deals refer to completed ones, greenfield projects refer to announced investment plans. M&A data cover the period from 2012 to 2022. Greenfield data are from 2015 to 2022.

Source: OECD elaborations on Refinitiv M&A and Financial Times fDi Markets databases.

Most foreign investment in the Portuguese renewables sector were in solar energy (Figure 1.12). For instance, in 2020, new projects in solar photovoltaic and storage capacity were announced by Korean investors and Chinese investors. In 2018, a German investor also acquired a solar plant in the Algarve region. Hydropower and marine energy also attract foreign investors. In 2020, for instance, Swedish investors established a subsidiary in Porto to develop wave energy projects. In the same year, a group of French investors acquired six hydropower plants from EDP Energias de Portugal for USD 2.4 billion.

Figure 1.12. Solar power attracts most foreign investment

Note: Deal values of all M&As in solar energy were undisclosed. Other renewable energy refers to transactions where the source of the alternative energy is unknown. M&A data cover the period from 2012 to 2022. Greenfield data are from 2015 to 2022.

Source: OECD elaborations on Refinitiv M&A and Financial Times fDi Markets databases.

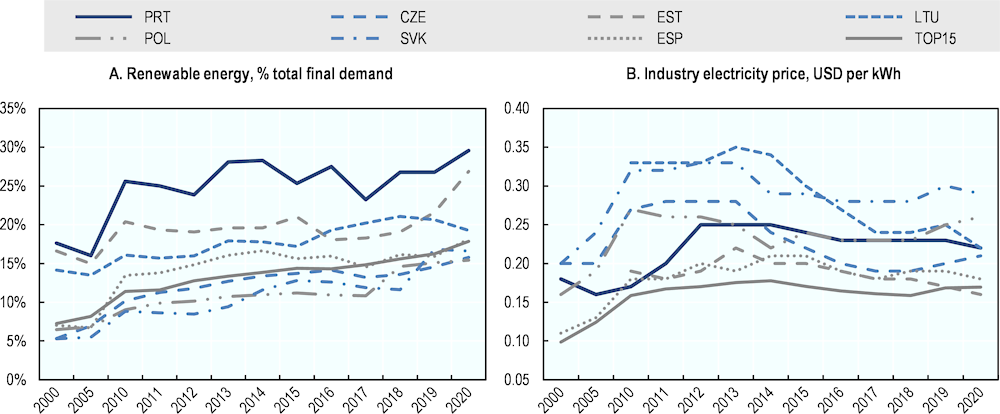

The increasing appetite of foreign investors for renewable energy projects in Portugal resonates with Portugal’s leadership and policy orientation in this matter, being among the first countries in the world to set 2050 carbon neutrality goals and placing great emphasis on the expansion of renewable electricity generation as a means to achieve carbon neutrality, together with increased energy efficiency and broad electrification of energy demand. In its long-term strategy for carbon neutrality (Portugal’s Roadmap for Carbon Neutrality 2050), Portugal has set the goal for renewables to cover 46‑47% of final energy consumption by 2030, 71‑72% by 2040 and 86‑88% of final energy consumption by 2050. In 2020, renewables already covered a significant portion (30%) of the total energy consumption – one of the highest rates among the International Energy Agency (IEA)’s members (IEA, 2021[25]). However, after rising by almost 10 percentage points from 2005 to 2010, the growth in the share of renewables in total energy consumption has been relatively modest in comparison to the benchmarked group (Figure 1.13 A).

Portugal’s energy demand is still largely supplied by imported fossil fuels, which accounted for roughly 73% of Portugal’s total energy supply in 2019 (43% oil, 24% natural gas and 6% coal), driven particularly by demand from transport and industrial sectors (IEA, 2021[25]). All these are imported as Portugal has no domestic oil, natural gas or coal. The remaining part is sourced domestically from Portugal’s domestic energy production sources, which are almost entirely renewable sources, notably bioenergy, wind and hydro. Impressive strides were made in expanding domestic renewable energy production over 2005‑12, when it passed from covering 18% of total energy supply to 27%, largely due to growth in wind generation supported by a feed-in tariff scheme. Solar energy has also been trending up slightly more recently (IEA, 2021[25]). But such increments in domestic energy production have slowed down and, together with seasonal variations in the output of Portugal’s hydropower plants, impeded a more pronounced reduction in Portugal’s energy import dependency. As of end‑2019, Portugal remained one of the most external energy dependent economies among IEA countries.

Boosting investment in renewable energy generation and energy efficiency is thus critical both to ensure carbon neutrality targets are achieved and to decrease energy import dependency. Adding renewable energy capacity to the grid might also contribute to further curtail electricity prices, which remains an area of concern for investors despite recent improvements (EIB, 2020[26]) (Figure 1.13 B). Over the last decade, the cost of electricity from utility-scale solar plants and onshore wind farms has dropped drastically to levels below those of various fossil fuel-fired options, increasingly undercutting even the cheapest and least sustainable forms of existing coal-fired power plants (IRENA, 2021[27]).16 The war in Ukraine has further underlined the potential benefits of expanding Portugal’s renewable energy production capacity.

Figure 1.13. Renewable energy intensity and industrial electricity prices

Note: Industry electricity prices are expressed at constant 2015 USD using PPP per kilowatt-hour. They represent the annual average end-user price for industrial users. To ensure better comparability with data on residential prices (not-showed here, but available in the database), the price is deflated by the GDP deflator and includes value added tax.

Source: IEA (2022[28]), World Energy Balances Highlights, https://www.iea.org/data-and-statistics/data-product/world-energy-balances-highlights; OECD (2021[29]), Green Growth Indicators, https://stats.oecd.org/Index.aspx?DataSetCode=GREEN_GROWTH#.

1.3.6. Foreign investment is also flowing into digital technologies and infrastructure

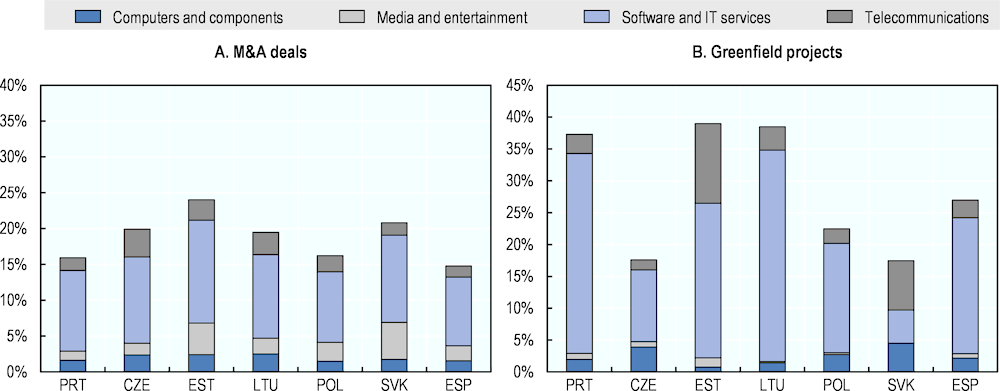

The digital economy has attracted a significant share of inward FDI across Portugal and the benchmarked economies, with software and IT services accounting for most investment (Figure 1.14).17 Although Portugal hosts many cross-border M&As in digital sectors, their share in the total number of foreign deals was the second lowest in the benchmark group (16%). Greenfield projects into the digital economy were relatively more numerous, amounting to 37% of all greenfield investment announced in Portugal, surpassed only by Estonia (39%) and Lithuania (37%). Portugal is also attracting foreign investment in business services centres (BSC), particularly IT-related services. According to a recent survey, IT stands for over 40% of functions performed by BSCs in Portugal (AICEP and IDC Portugal, 2019[30]).

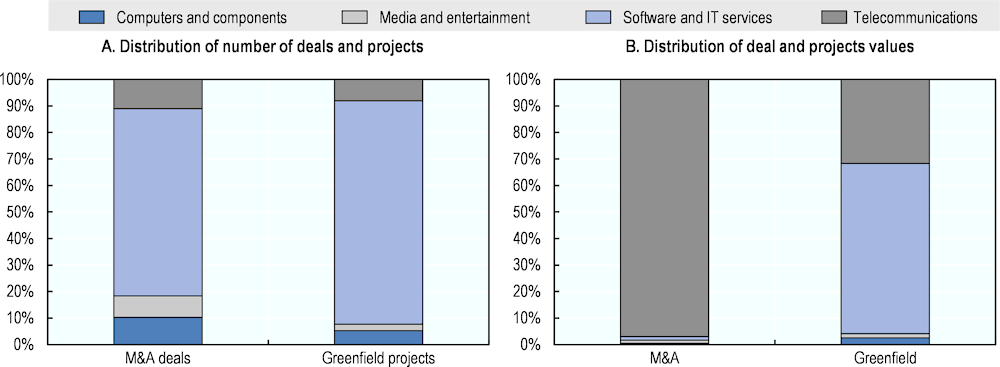

Most foreign investment into the Portuguese digital economy targets software and IT services (Figure 1.15 A). However, in value terms, software and IT services account for only half of all announced greenfield investment, whereas a substantial share of capital comes from projects in telecommunications (44%). The telecommunications sector clearly dominates in the value of foreign M&A activity (97%) (Figure 1.15 B).

Beyond the direct investment into digital technologies and infrastructure, foreign investors can also play an important role in Portugal’s digital transition by providing funding for the start-up ecosystem. In 2020, the top 25 Portuguese technological start-ups raised 60% of their funding from foreign sources, with the United States (32%) and Singapore (17%) being the leading contributors, followed by other EU economies (EIT Digital, 2020[31]). The vibrant development of Portugal’s start-up ecosystem, fuelled by the growing number of business incubators and accelerator programmes, strengthens the country’s image as an attractive destination for foreign capital (Portugal Ventures, 2022[32]).18

Figure 1.14. The digital economy attracts foreign investment, but there is room for more

Note: The classification of M&A deals and greenfield projects into the subsectors of the digital economy is based on the activity classification in the source data. M&A deals refer to completed ones, greenfield projects refer to announced investment plans. M&A data cover the period from 2012 to 2022. Greenfield data are from 2015 to 2022.

Source: OECD elaborations on Refinitiv M&A and Financial Times fDi Markets databases.

Figure 1.15. Most transactions are in software and IT services, most value is in telecommunications

Note: The classification of M&A deals and greenfield projects into the subsectors of the digital economy is based on the activity classification in the source data. M&A deals refer to completed ones, greenfield projects refer to announced investment plans. M&A data cover the period from 2012 to 2022. Greenfield data are from 2015 to 2022.

Source: OECD elaborations on Refinitiv M&A and Financial Times fDi Markets databases.

1.4. FDI contribution to sustainability and inclusiveness in Portugal

Investment is central to growth and sustainable development. It can support the expansion of an economy’s productive capacity in a sustainable manner and drive job creation and income growth. Most investment is undertaken by domestic firms, but FDI can provide additional advantages beyond its contribution to the capital stock and as an additional source of tax revenues. It can directly contribute to progressing on several areas of the Sustainable Development Goals (SDGs) (e.g. productivity and innovation, job quality and skills, gender equality and carbon emissions) by stimulating allocative efficiencies across and within sectors (e.g. when concentrated in more sustainable activities and when outperforming the average firm in its sector in respect to sustainable outcomes). It can also indirectly serve as a conduit for the local diffusion of technology and expertise and improved access to foreign markets, and potentially for other sustainable development outcomes, if its competitive pressure and linkages to the domestic economy pushes customers and firms throughout the value chain to improve their sustainable performance (OECD, 2021[33]). Several of these potential FDI contributions to sustainable development are assessed below, exploiting the richness of Portugal’s micro-level statistics on firms and employees.

In 2020, foreign-owned firms19 represented only 2% of all firms in Portugal but contributed substantially to the Portuguese economy: they employed 18% of the domestic workforce, accounted for 28.4% of total value added and 24.6% of business-funded research and development (R&D). Aside from the direct contribution to economic activity, foreign multinational enterprises (MNEs) are also found to bring broader benefits to Portugal. As shown below, they contribute to the development of Portugal’s skills base and to job quality improvements, in terms of wage and gender parity. They are equally contributing to speed up the country’s rate of digitalisation and, by purchasing inputs from local businesses and selling to international markets, are also supporting Portugal’s integration into GVCs.

Table 1.1. Foreign firms perform better than Portuguese ones

Characteristics of foreign and domestic firms by size group (average values)

|

Foreign firms |

Domestic firms |

|||||

|---|---|---|---|---|---|---|

|

Micro |

SMEs |

Large |

Micro |

SMEs |

Large |

|

|

Distribution of firms |

||||||

|

Total number of firms |

5 048 |

4 718 |

439 |

376 115 |

59 932 |

771 |

|

Share of firms in manufacturing |

8% |

21% |

41% |

11% |

29% |

26% |

|

Share of firms in services |

83% |

71% |

52% |

71% |

53% |

59% |

|

Firm characteristics |

||||||

|

Number of employees |

4.3 |

52.2 |

939.3 |

3.5 |

27.9 |

787.0 |

|

Labour productivity, in thousands (EUR) |

47.4 |

46.2 |

41.1 |

19.2 |

23.3 |

32.1 |

|

Sales, in thousands (EUR) |

2 328 |

16 177 |

148500 |

273 |

3 025 |

104 068 |

|

Export intensity |

27% |

25% |

38% |

4% |

11% |

22% |

|

Domestic purchases, in thousands (EUR) |

619 |

4 579 |

36585 |

22 |

330 |

14 580 |

|

R&D expenditure, EUR |

437 |

4 600 |

58543 |

121 |

2 138 |

121 989 |

|

Share of high-skilled employees |

48% |

37% |

30% |

24% |

22% |

24% |

|

Monthly wage, EUR |

1 474 |

1 326 |

1 193 |

778 |

943 |

1 091 |

|

Share of female employees |

44% |

44% |

44% |

45% |

40% |

44% |

Note: Micro-firms are enterprises with less than ten employees, SMEs employ 10‑249 workers, and large firms have 250 or more employees. Labour productivity is value added per employee. Export intensity is the ratio of exports to firm sales.

Source: Own calculations based on Statistics Portugal (INE), QP and SCIE, 2009‑20.

Micro-level evidence shows that most foreign-owned businesses in Portugal are micro‑enterprises (49%) or SMEs (46%), with only 4% being large‑sized (Table 1.1). Most foreign firms are in the services sector, although many large foreign enterprises operate in manufacturing. For every size group, foreign companies are larger, more productive and generate more sales than their Portuguese peers. They are also more integrated in GVCs, as shown by their higher export intensities and larger volumes of domestic purchases. They hire more skilled workers and pay higher wages. On average, foreign micro‑enterprises and SMEs invest more in R&D than their domestic counterparts. Foreign-owned SMEs employ slightly more women than their domestic peers, while shares of female employment are very similar in foreign and domestic companies of the other size groups.

1.4.1. FDI supports skill development in Portugal

Foreign enterprises tend to hire more high-skilled workers than domestic firms, possibly because their business operations might involve more advanced technologies or more complex tasks, which increases the demand for skilled labour and can raise the host country’s skill intensity (OECD, 2019[6]). Moreover, foreign MNEs tend to pay higher wages to their employees, especially to highly qualified ones (Hijzen et al., 2013[34]; Setzler and Tintelnot, 2021[35]). Foreign businesses can increase the supply of skills by training their own employees and employees of partner firms, but also by inducing domestic firms to invest in skill development to stay competitive. Upskilling of the domestic workforce can also take place through mobility of labour from foreign to local firms.

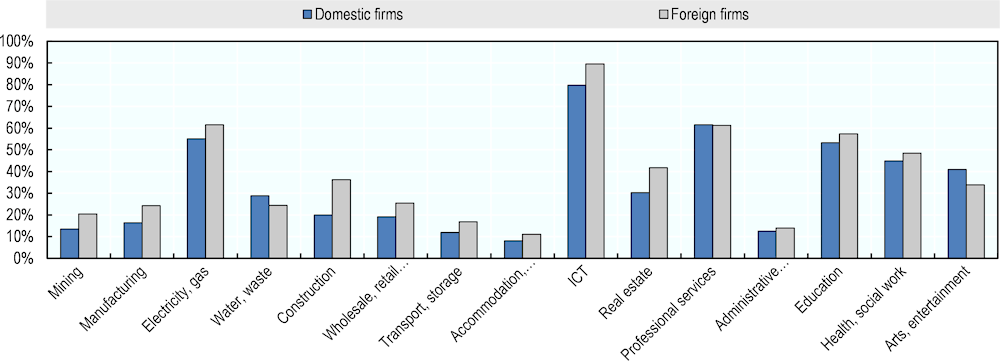

Foreign firms employ more high-skilled workers

In Portugal, foreign affiliates employ more high-skilled workers than domestic businesses in most sectors of the economy (Figure 1.16). Discrepancies in skill intensity in some sectors, such as construction and manufacturing, reflect the differences in the industrial specialisation with foreign enterprises operating in more technology-intensive activities. In other sectors, such as ICT and electricity, foreign-owned businesses employ more high-skilled workers than their domestic counterparts even within narrowly defined economic activities, likely because they perform more technologically advanced tasks. Skill intensity in foreign firms is higher even when looking only at workers in managerial positions.20 Additional estimates show that foreign enterprises are more skill-intensive even when compared to domestic firms with the same characteristics.21

Figure 1.16. Foreign businesses employ more high-skilled workers

Note: High-skilled occupations include managerial, professional, technical and associated professional occupations.

Source: Own calculations based on Statistics Portugal (INE), QP and SCIE, 2009‑20.

Foreign firms pay higher wages

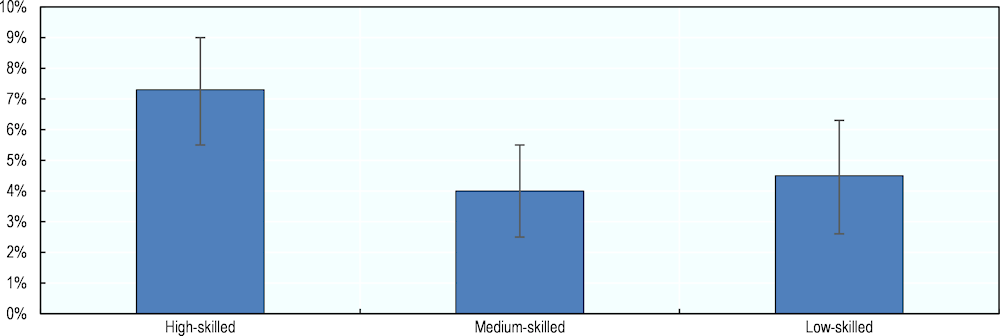

Foreign-owned firms pay higher wages than domestic firms. The wage premium holds even when comparing employees and firms with similar characteristics.22 Furthermore, the premium exists for all skill groups (Figure 1.17). It is estimated that wages paid by foreign firms to employees in high-skilled occupations are 7.3% higher than in domestic firms, whereas the estimated wage premiums for medium and low-skilled occupations are 4% and 4.5%, respectively.23

The foreign wage premium exists even after accounting for the differences in observable firm and worker characteristics, suggesting that other factors might explain why foreign firms reward their workers more generously. For instance, foreign wage premium might reflect greater complexity of tasks that employees of foreign firms perform (Nilsson Hakkala, Heyman and Sjöholm, 2014[36]) or better management practices, possibly adopted from headquarters (Bloom et al., 2021[37]; Hjort, Li and Sarsons, 2020[38]). It is also plausible that employees of foreign companies systematically differ from workers of domestic firms in ways that cannot be captured by the data but are important for wage setting (e.g. fluency in foreign languages).

Figure 1.17. Foreign firms reward skills better

Note: The figure shows the estimated effects of foreign ownership on hourly wages and their respective 95% confidence intervals. The regressions control for individual (education and experience) and firm characteristics (size, productivity and export intensity), as well as industry-year and regional effects. High-skilled occupations include managerial, professional, technical and associated professional occupations. Medium-skilled occupations refer to clerks, craft and related trades workers, plant and machine operators, and assemblers. Low-skilled occupations include service workers, shop and sales workers and elementary occupations.

Source: Own calculations based on Statistics Portugal (INE), QP and SCIE, 2009‑20.

FDI contributes to the diffusion of skills

Foreign businesses can contribute to upskilling workers through training. One indication that foreign companies actively invest in employee training comes from the Portuguese ICT use survey (IUTICE): nearly two‑thirds of surveyed foreign firms (62%) reported providing training to their employees to develop their ICT skills, whereas only around a third of domestic firms (36%) did so. Among foreign companies, training was offered extensively by both large firms (76%) and SMEs (53%), whereas employees of domestic companies were substantially more likely to access training if they worked in large firms (63% offered ICT training), than those working for domestic SMEs (30%).

FDI can also support skill upgrading in the host economy through labour mobility. Micro-level evidence shows that from 2009 to 2020, nearly 979 000 workers in Portugal had experience working in a foreign-owned firm, that is 24% of all the working population in Portugal. Over time, around 259 000 of these employees, representing nearly 6.5% of all workers, left foreign MNEs and started working in domestic companies.24 This labour mobility translates into a growing share of domestic businesses employing workers with experience from foreign MNEs. In 2020, 18% of domestic firms employed one or more workers with recent experience from foreign-owned enterprises, against 5% in 2012. On average, workers moving from foreign to domestic enterprises experienced a 2% increase in real hourly wages.25

Experience acquired in foreign MNEs might be seen as especially valuable to their domestic competitors if, for instance, employees of foreign multinationals gain insights about international markets, embrace superior management practices or learn to use advanced technologies (Balsvik, 2011[39]). A recent study finds that Portuguese employers value experience accumulated in firms with international operations, as seen from the wage premium that workers coming from these firms get (Mion, Opromolla and Ottaviano, 2020[40]). This result is consistent with the notion that employees of foreign affiliates are bringing new knowledge and skills when changing their jobs to start working in domestic companies.

1.4.2. Foreign MNEs contribute to gender equality

Through their demand for female workers, foreign affiliates can affect employment and wage gaps. Their corporate practices, such as hiring and promotion, can influence women’s opportunities for career progression, including their ability to reach leadership positions. More demanding international and national standards, including responsible business conduct principles, may prompt foreign firms to include gender equality considerations in their corporate strategy. Foreign-owned businesses can also enhance women’s labour market prospects in local enterprises, if domestic companies adopt more gender-inclusive employment policies to imitate successful foreign firms (OECD, 2019[6]).

Foreign firms offer women better opportunities in some sectors

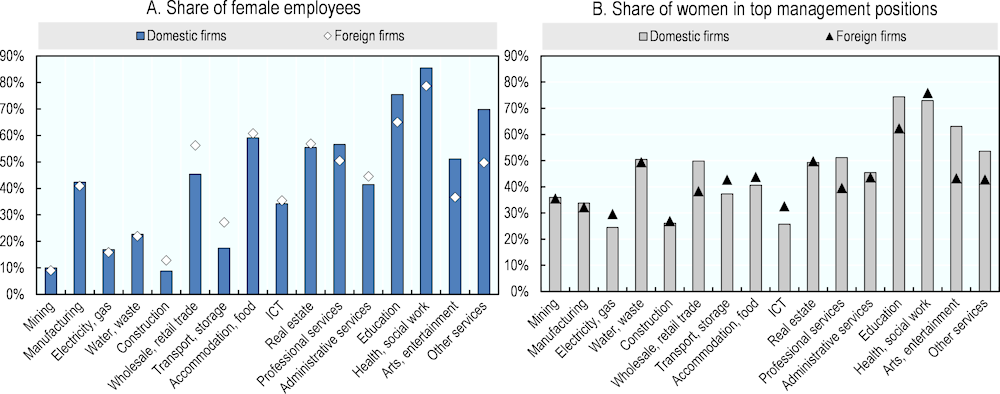

As in other OECD countries, female employment in Portugal is concentrated in low value‑added services sectors, such as education, health and social work activities, which typically offer lower pay (OECD, 2019[6]). Domestic firms employ relatively more women in these sectors than foreign affiliates (Figure 1.18 A). Female participation is very similar between foreign and domestic companies in other economic activities, although foreign firms have noticeably higher shares of women working in wholesale and retail trade and in transport and storage.26

Figure 1.18. Better female employment opportunities in retail and storage

Note: Top management positions include “Senior Executives” as defined by the classification of employees into hierarchical levels reported in the micro-data (the levels are defined according to Portuguese Decree‑Law No. 121/78 of 2 July 1978). These positions include occupations responsible for the main strategic decisions of the firm: the organisation of firm’s resources, strategic planning, etc.

Source: Own calculations based on Statistics Portugal (INE), QP and SCIE, 2009‑20.

In many sectors, women are less likely to reach the top levels of management. The share of female executives is over one half only in sectors traditionally dominated by women (education, arts, health and social work). However, foreign firms employ more women in senior positions than their domestic counterparts in many sectors, including ICT, transport and storage, accommodation and food services (Figure 1.18 B).

Women earn more in foreign firms, but they face slightly larger pay gaps

Foreign-owned companies pay higher wages to female employees than domestic firms. In 2020, the median monthly wage of women working in foreign firms was EUR 972 and EUR 796 in domestic firms (for comparison, men’s median wages were EUR 1 144 in foreign and 856 in domestic enterprises).

A slightly higher gender pay gap is observed in foreign firms than in domestic ones, when accounting for employees’ education, experience and occupation, as well as the differences in firm characteristics (size, productivity and export intensity; see Annex Table 1.A.3).27 However, the estimated wage penalty in foreign firms disappears completely for women in high-skilled occupations and in top management positions.28

The absence of foreign wage penalty for women in highly skilled and top management positions is in line with the finding that wage discrepancies tend to be smaller for highly skilled workers. The gender wage gaps may also vary considerably across industries due to the differences in investors’ sectoral specialisation and technological profiles.29

1.4.3. Foreign firms support Portugal’s digitalisation

Foreign MNEs can support the host country’s digital transition by investing in digital technologies and infrastructure (see Section 1.3.6), and by transferring ICT solutions across borders. Some studies find that the development of key digital technologies is highly concentrated in a few source countries, hence, foreign investors can play an important role in technology diffusion by sharing new tools and practices with their affiliates, but also with partners and customers in the host economy (OECD, 2019[41]).

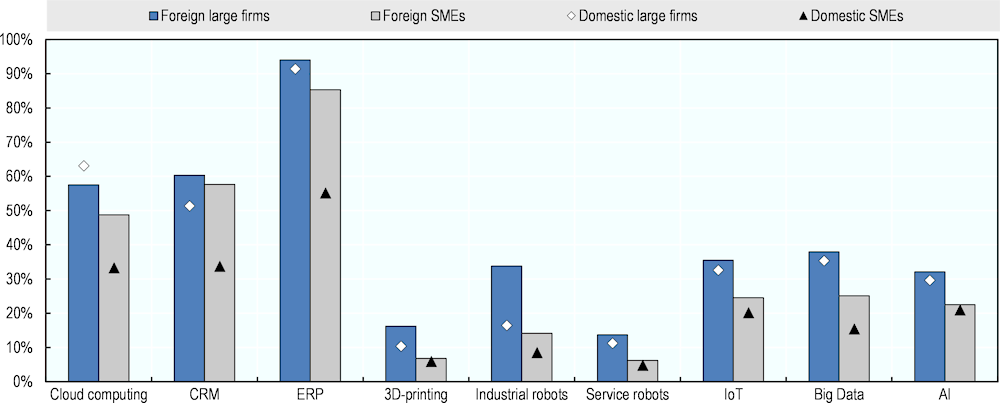

FDI supports ICT diffusion in Portugal

Although Portugal enjoys high levels of Internet penetration, with 60% of businesses connected to high-speed broadband, technology uptake by Portuguese firms remains well below best performing OECD and EU countries, especially among SMEs (OECD, 2021[3]; EC, 2021[42]). For instance, Portuguese SMEs lag substantially behind in the adoption of cloud computing, which can help firms scale up without incurring costly investment into IT infrastructure.

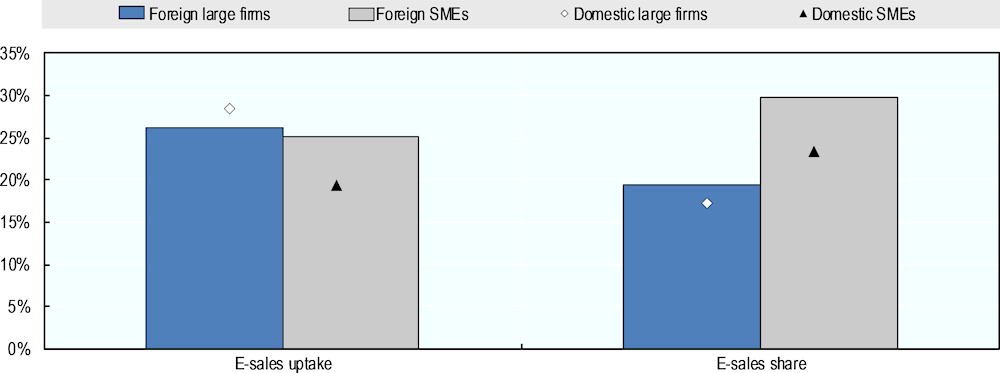

Foreign firms in Portugal extensively use digital technologies,30 thus actively exploiting opportunities to strengthen innovation capacity and optimise costs. Overall, foreign affiliates’ uptake of key digital technologies is 1.1 to 2 times higher than of domestic enterprises, and compared to domestic SMEs, foreign-owned ones are more likely to use most of the selected technologies (Figure 1.19). Domestic large companies use cloud technologies more extensively than their foreign counterparts do, although higher shares of foreign businesses adopt industrial robots, 3D printing and artificial intelligence technologies.31 For many firms in Portugal, online sales are an important source of revenue, as reflected in the country’s relatively high e‑commerce uptake compared to other EU economies (EC, 2021[42]). Among SMEs selling online, both domestic and foreign-owned ones generated over a fifth of their turnover online (Figure 1.20). The share of web sales in large firms is generally lower, partly reflecting the fact that larger enterprises tend to depend on a mix of electronic and more traditional sales channels (OECD, 2019[43]). In general, for a given firm size, firms with higher labour productivity and export intensity tend to generate a larger share of their revenue from online sales (Annex Table 1.A.4).32

Figure 1.19. Foreign firms extensively use digital technologies, while domestic SMEs lag behind

Note: Cloud computing is the delivery of information technology services over the Internet. Customer relationship management (CRM) software organises data about customers, employees and suppliers. Enterprise resource planning (ERP) systems integrate information on business processes. 3D-printing includes use of 3D printers to create three‑dimensional physical objects. Industrial robots are automatically controlled machines used in industrial automation. Service robots are machines that can perform tasks involving interaction with people or other devices with some autonomy. The Internet of Things (IoT) is the use of interconnected devices that collect/process data and can be controlled over the Internet. Big data uses tools to analyse data in complex formats. Artificial Intelligence (AI) refers to the use of selected technologies to make decisions with some autonomy. Data on robots refer to 2018, Big Data and 3D printing to 2020. SMEs are firms with 10‑249 employees, large firms with 250 or more.

Source: Own calculations based on Statistics Portugal (INE), QP, SCIE and IUTICE, 2018‑21.

Figure 1.20. Participation in online sales

Note: E‑sales uptake refers to the share of firms selling their goods or services online. E‑sales share is the average share of online sales in the revenue of firms that are selling online. SMEs are firms with 10‑249 employees, large firms have 250 or more employees.

Source: Own calculations based on Statistics Portugal (INE), QP, SCIE and IUTICE, 2020‑21.

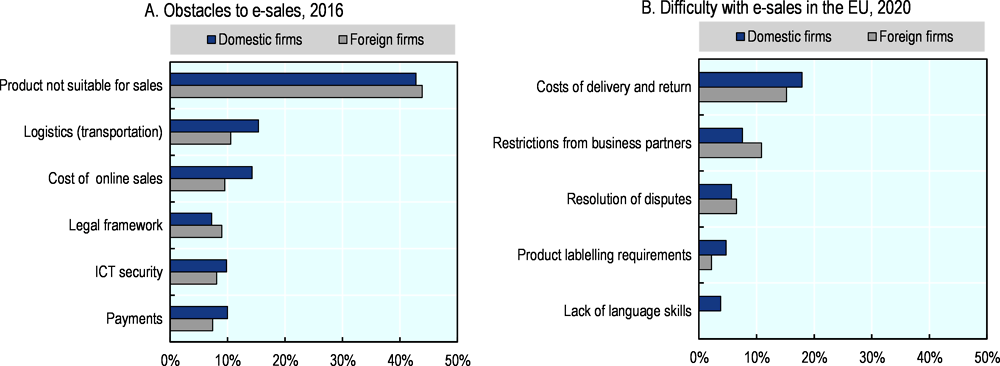

Various firm characteristics influence the decision to sell online, but other factors can be important too.33 Micro-data evidence from the Portuguese ICT use survey suggests that many firms in Portugal abstain from online sales because their goods or services are not fit for electronic transactions (43% domestic firms, 44% foreign; Figure 1.21 A).34 Costs of introducing sales on the web, logistics related to the transport of goods and services and difficulties with the legal framework are also cited among the key obstacles, with the latter being reported slightly more often by foreign firms, particularly those from outside the European Economic Area (EEA).35 When asked about the difficulties for web sales within the EU, 18% of domestic and 15% foreign e‑sellers indicated high costs of delivery and return as the main challenge (Figure 1.21 B).

In terms of destination markets, most online sales by firms in Portugal target domestic consumers. In 2020, web sales within Portugal accounted for 88% of all electronic orders received by foreign MNEs and 86% by domestic enterprises. Foreign markets make up a slightly higher share of online sales of domestic businesses than for foreign firms, possibly because many foreign firms enter Portugal with the intention to serve the Portuguese consumer.

Figure 1.21. Various factors hinder the uptake of e‑commerce

Note: Panel A presents shares of firms reporting a given obstacle to online sales (of all firms that participated in the survey). Panel B presents shares of firms selling online reporting a given difficulty with online sales within the EU. The latest data available are for 2020 as the above questions were only included in the more recent survey.

Source: Own calculations based on Statistics Portugal (INE), QP, SCIE and IUTICE, 2016‑20.

1.4.4. FDI facilitates the integration of domestic firms into global value chains

Foreign firms can be important buyers of domestically produced goods and services. Backward linkages of foreign MNEs help domestic businesses access new markets and improve the competitiveness of their products. These linkages can also stimulate knowledge transfers if foreign firms demand higher-quality inputs from local suppliers and are willing to share their technology or corporate practices (OECD, 2019[6]). Furthermore, foreign affiliates can enhance the host country’s export performance by selling their own outputs abroad and also by incorporating inputs from domestic companies in products destined for export.

These features can be particularly critical for a country like Portugal whose level of trade is relatively low for a small open economy. Despite impressive strides over the past decade, with exports of goods and services rising rapidly as a share of GDP, partly supported by structural reforms that followed from the economic adjustment programme, Portugal’s level of trade to GDP ratio still stood at 86% of GDP in 2021, while it averaged 137% across the benchmarked countries. This low level is particularly marked with respect to merchandise trade, but also holds true for services trade, albeit to a much lower extent. In comparison to the benchmarked countries, and despite improvements in the last decade, Portugal’s export basket is also still dominated by relatively lower complexity goods and services (i.e. involving less sophisticated productive know-how), which can be a constraint for long-term income growth (Hausmann, Hwang and Rodrik, 2006[44]).36

Foreign affiliates based in Portugal source extensively from local firms

In 2020, foreign-owned enterprises located in Portugal purchased most of their inputs from Portuguese businesses (77% of services, 53% of goods).37 Intermediate inputs sourced domestically accounted for nearly half of foreign firms’ output (47%), indicating that foreign-owned investors incorporate a substantial amount of domestic value added in their production. Industries where foreign firms rely heavily on domestic goods include wholesale and retail trade (43% of turnover) and manufacturing (25%). Domestically sourced services accounted for more than half of foreign firms’ turnover in professional services (50%) and transport and warehousing (46%).

Foreign MNEs boost Portugal’s export performance

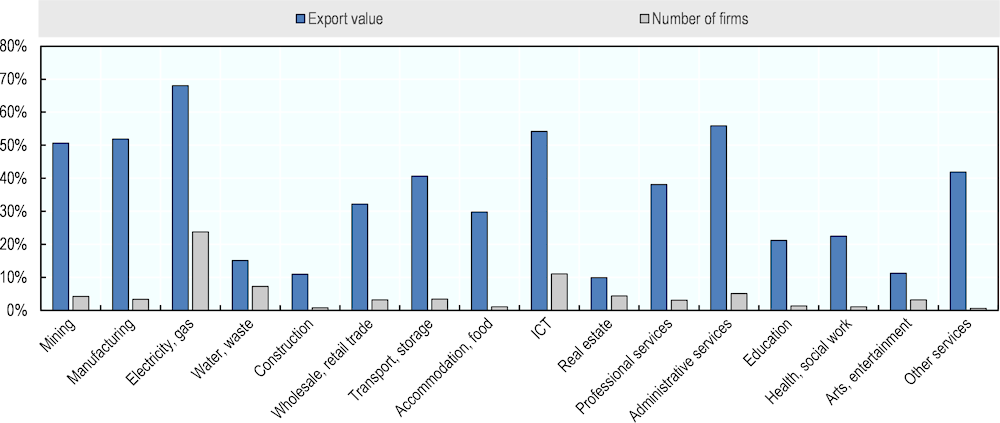

Apart from its capital contribution, FDI plays an important role in Portugal’s export performance. While representing only a small fraction of the entire business population, foreign firms were responsible for 46% of total exports by Portugal (39% of services exports and 53% of merchandise exports) in 2020, a share that has been growing over time (38% in 2010). Their contribution is especially important in key exporting industries: in 2020, foreign MNEs accounted for nearly 55% of Portugal’s overall international sales in ICT, 52% in manufacturing and 32% in wholesale and retail trade (Figure 1.22).

Figure 1.22. Foreign firms contribute significantly to Portuguese exports

Source: Own calculations based on Statistics Portugal (INE), QP and SCIE, 2010‑20.

Foreign firms are more likely to export than domestic companies. In 2020, more than half of all foreign-owned firms sold their goods or services in international markets, whereas only 17% of domestic enterprises did so. Among the businesses that exported, foreign-owned enterprises sold a larger share (48% of total sales of a median firm) of their turnover on international markets than their domestic counterparts (14% of total sales of a median domestic company).

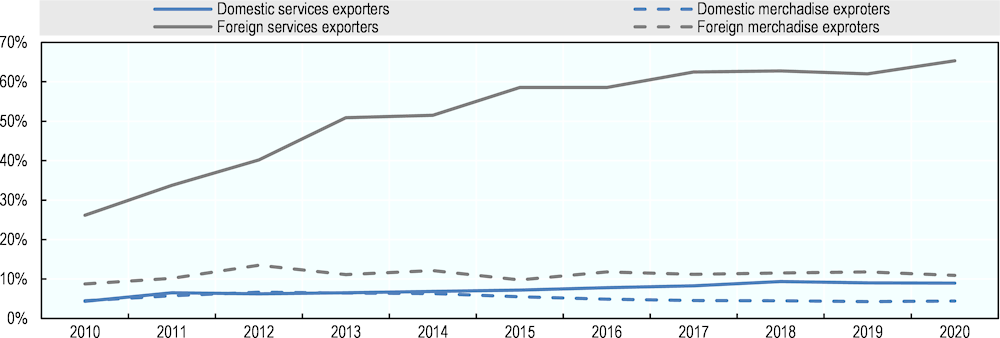

Over the past decade, export intensity of foreign firms has been steadily increasing, mostly driven by accommodation and food services, professional services, wholesale and retail trade (Figure 1.23).38

Figure 1.23. Export intensity of foreign services exporters has been on the rise

Note: Export intensity is measured as the share of exports in firms’ turnover.

Source: Own calculations based on Statistics Portugal (INE), QP and SCIE, 2010‑20.

Foreign MNEs provide additional channels for GVC integration

In 2020, domestic purchases by foreign-owned firms in Portugal accounted for slightly over a quarter of all domestic purchases in Portugal (25% of services and 26% of goods). By incorporating local goods and services into production, part of which is exported abroad, foreign companies promote greater integration of Portuguese firms in global value chains.

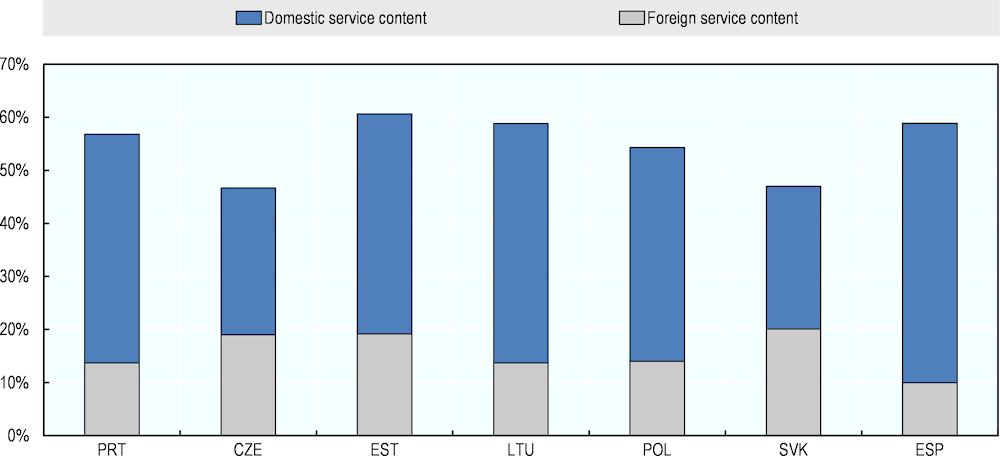

Similarly, a greater use of imported inputs by both domestic and foreign exporters is an indication of increasing integration into GVCs. Figure 1.24 shows that around a third of Portuguese gross exports reflects value added from imported inputs and the share climbed up from 28% in 2010 to 31% in 2018. The share of foreign content is substantially larger in the Czech Republic (42%) and the Slovak Republic (48%), reflecting greater reliance of these economies on inputs sourced from abroad. This suggests that there is room for enhancing Portugal’s level of GVC integration and export performance.

Figure 1.24. A large share of domestic inputs is embedded in gross exports

Source: OECD (2021[45]), Trade in Value Added database, https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm.

Exported products embody a substantial share of services inputs. When all those intermediate services that went into producing goods (and services) are accounted for, their contribution amounts to more than half (57%) of the value added exported by Portugal (Figure 1.25). The largest share of the service content embedded in gross exports in Portugal is produced domestically (43% in 2018). In contrast, the Czech Republic and the Slovak Republic rely on foreign services inputs more extensively (19% and 20% respectively). Thus, although foreign services contribute substantially to Portugal’s exports, there is even further potential for Portugal to strengthen its integration into global production networks, including through more foreign investment into services.

Figure 1.25. Services contribute extensively to gross exports, 2018

Source: OECD (2021[45]), Trade in Value Added database, https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm.

1.4.5. Benefits of FDI may not materialise automatically

Strong linkages can facilitate FDI spillovers…

The strength of supplier linkages between foreign and domestic firms tends to be critical for the ability of host economies to benefit from activities of foreign MNEs (Görg and Greenaway, 2004[46]). For instance, a recent study argues that knowledge spillovers from FDI into the Portuguese textiles sector in the 1970s were limited, as foreign investors generated few linkages with local producers (Lopes and Simões, 2017[47]). In contrast, in the 1980s, local producers of automotive parts managed to substantially upgrade their capabilities thanks to their extensive interactions with Renault’s manufacturing facility, which allowed many of these firms to become suppliers of Renault plants outside Portugal. In the 2000s, Siemens set up a number of new training centres in Portugal, strengthening linkages with local universities, which in turn attracted highly skilled individuals and spurred business creation (Lopes and Simões, 2017[47]).

… but other factors can be important for the benefits of FDI to materialise

A recent OECD report assesses the extent to which different FDI diffusion channels are at play in Portugal, focusing on the linkages between FDI and domestic SMEs (OECD, 2022[5]). The report concludes that although foreign MNEs appear better integrated into Portugal’s economy than in comparable countries, strengthening capabilities of firms in high-tech sectors and advancing the innovation potential of domestic SMEs would facilitate linkages with foreign investors in Portugal. The study also proposes several policy options that could enhance the impact of FDI for SMEs. Several other studies have also pinpointed key factors that influence the strength of positive effects of FDI on the Portuguese economy. For instance, Teixeira and Tavares-Lehmann (2014[48]) find that knowledge sharing between foreign MNEs and Portuguese businesses is stronger for more R&D-intensive local firms. Crespo, Fontoura and Proença (2009[49]) show that geographical proximity between foreign and domestic enterprises in Portugal also facilitates the occurrence of FDI spillovers. Benefits of FDI may also fail to materialise when the host economy lacks absorptive capacity or experiences low labour mobility (OECD, 2019[6]).

Beyond factors that might hinder the accrual of potential positive FDI spillovers, there is also the need to have appropriate policies and institutions to address any potential adverse impact that may directly or indirectly result from the presence of foreign firms (e.g. potential crowding out of local firms, wider wage inequality and regional disparity, greater pressures on existing infrastructures and natural resources, etc.) (OECD, 2021[33]).

1.4.6. Foreign firms are unevenly distributed across Portugal

Foreign-owned businesses are largely concentrated around Lisbon (Figure 1.26). Compared to domestic companies, the concentration of foreign micro-firms and SMEs is twice as high. Large foreign enterprises are also significantly overrepresented in the capital region, which might partially reflect that the Lisboa region hosts many head offices of foreign companies, even if they operate in other regions as well.39 Many foreign-owned companies locate in the Norte region, although to a lesser extent than domestic ones. The Centro region also hosts a substantial share of foreign-owned businesses, but disproportionately fewer micro‑enterprises and SMEs compared to domestic peers. Foreign presence in other regions is much lower, but similar to the distribution of domestic firms.

Figure 1.26. Lisboa and Norte regions host the majority of foreign firms

Note: The bars represent the number of foreign firms of a given size group as percentage of the total number of foreign firms in that size group. The symbols show the number of domestic firms of a given size group as percentage of the total number of domestic firms in that size group.

Source: Own calculations based on Statistics Portugal (INE), QP and SCIE 2010-20.

Characteristics and performance of foreign affiliates vary considerably across regions, reflecting differences both in the industrial structure of the regions themselves and in the specialisation profiles of foreign investors (Table 1.2). Most productive and skill-intensive firms are located in the Lisboa region. Although only a relatively small number of companies operate in Madeira, the region hosts foreign firms that are among the most productive and skill-intensive, driven largely by businesses performing data hosting and processing. Most export-intensive foreign firms are located in the Norte and Centro regions. Both regions host many manufacturing exporters, whereas Norte also enjoys a large presence of ICT firms that extensively sell their services abroad. Foreign companies in Algarve employ on average more women, particularly in accommodation and food services. The share of women is also among the largest in foreign companies operating in Norte, mostly reflecting the high female participation in manufacturing of food, clothing and leather products.

Table 1.2. Characteristics of foreign firms vary across regions

Characteristics of foreign firms by region (average values)

|

Acores |

Alentejo |

Algarve |

Centro |

Lisboa |

Madeira |

Norte |

|

|---|---|---|---|---|---|---|---|

|

Labour productivity, in thousands (EUR) |

38.4 |

39.0 |

27.2 |

37.6 |

53.7 |

43.4 |

39.5 |

|

Share of high-skilled employees |

34% |

29% |

26% |

30% |

49% |

40% |

33% |

|

Share of female employees |

32% |

43% |

55% |

44% |

47% |

49% |

45% |

|

Export intensity |

9% |

27% |

10% |

32% |

22% |

31% |

36% |

|

Domestic purchases, in thousands (EUR) |

1 584.6 |

3 447.9 |

171.7 |

4 389.8 |

6 223.3 |

347.9 |

3 789.3 |

Note: Labour productivity is value added per employee. Export intensity is the ratio of exports to firm sales.

Source: Own calculations based on Statistics Portugal (INE), QP and SCIE, 2009‑20.

1.5. Conclusion

Portugal needs to mobilise further investment to support long-term productivity growth in view of adverse demographic trends and to accelerate the transition to a carbon-neutral economy by 2050, the latter becoming increasingly strategic in view of Portugal’s external energy dependency and current rampant energy prices. Despite recent improvements, overall investment levels remain relatively low, particularly with respect to productivity-enhancing assets, such as machinery, equipment and intellectual property assets. Increased investment in ICT assets more broadly across industries and firms could also enable further productivity improvements and help to strengthen Portugal’s reputation as a technology and innovation hub.

Foreign investors can be important partners to address these challenges. Indeed, as shown in this chapter, FDI can play a valuable role in addressing Portugal’s productivity challenge as well as serve as a conduit to progress on many other SDGs. Evidence from the micro-data analysis shows that foreign affiliates in Portugal support skill development, contribute to more gender-inclusive corporate practices, speed up the host country’s digital transformation and provide new channels to integrate domestic businesses into global production networks. Foreign investment is also actively contributing to accelerate Portugal’s green and digital transition, with significant amounts of investment flowing into renewable energy projects, digital technologies and infrastructure in recent years.

Portugal has long turned to FDI as a vehicle for capital renewal and innovation, taking several steps to promote and further open the economy to foreign investors over time. Currently, Portugal holds one of the highest levels of inward FDI stocks to GDP ratio across OECD member countries. Yet, there are still several areas where FDI could be further leveraged. Portugal’s investor base, for instance, remains largely concentrated in traditional European partners. In addition to greater resilience, further diversification could broaden Portugal’s economic opportunities by strengthening its ties with other world leading outward investing economies and more dynamic regions. Relatively little FDI has also gone into the manufacturing sector, although there are signs of foreign investment activity picking up in the sector more recently. Further FDI could help to modernise the capital base of tradable activities more broadly and ensure that Portugal’s recent trade expansion and gains in competitiveness are sustained over the long run.

Economic uncertainty brought up by the COVID‑19 pandemic and Russia’s war against Ukraine will also likely have near and long-term consequences for global FDI flows, and for Portugal as a recipient country. Besides the economic shock and other disruptions associated with such events, recent shifts in economic and political priorities at the EU level towards reducing economic dependencies, strengthening defence capabilities and bolstering the green and digital transition might also bring new investment opportunities and give a boost to existing ones. Portugal may benefit from its recent track record in attracting increasing amounts of FDI, notably in the renewable energy and digital sectors, including to facilitate foreign investment more broadly and take advantage of any arising opportunity.

The next chapter assesses Portugal’s investment and trade regulatory environment to identify possible inefficiencies that may be holding back foreign investment from reaching its full potential. It provides a comparative overview of regulation and laws affecting the entry and operation of foreign businesses in Portugal and in the benchmark countries, as well as of other behind-the‑border rules impacting business operations more widely (e.g. labour market regulation, non-competitive practices and red-tape).

References

[24] AICEP (2022), Investimento Direto Estrangeiro contratualizado com a AICEP, no âmbito do PT2020, 2015-2021.

[30] AICEP and IDC Portugal (2019), “Business Service Centres in Portugal”.

[60] Alfaro, L. and M. Chen (2012), “Surviving the Global Financial Crisis: Foreign Ownership and Establishment Performance”, American Economic Journal: Economic Policy, Vol. 4/3, pp. 30-55.

[8] Alves, R. (2017), “Portugal: A Paradox in Productivity”, International Productivity Monitor, Vol. 32, pp. 137–160.

[13] Andrews, D., C. Criscuolo and P. Gal (2016), “The Best versus the Rest: The Global Productivity Slowdown, Divergence across Firms and the Role of Public Policy”, OECD Productivity Working Papers, No. 5, OECD Publishing, Paris, https://doi.org/10.1787/63629cc9-en.

[62] Andrews, D., G. Nicoletti and C. Timiliotis (2018), “Digital technology diffusion: A matter of capabilities, incentives or both?”, OECD Economics Department Working Papers, No. 1476, OECD Publishing, Paris, https://doi.org/10.1787/7c542c16-en.

[39] Balsvik, R. (2011), “Is labor mobility a channel for spillovers from multinationals? evidence from norwegian manufacturing”, Review of Economics and Statistics, Vol. 93/1, pp. 285-297, https://doi.org/10.1162/REST_a_00061.

[23] Banco de Portugal (2021), “New statistics on foreign direct investment by ultimate investor: statistical press release”, https://bpstat.bportugal.pt/conteudos/noticias/1579/.