This chapter explores the impact of regulatory restrictions on foreign direct investment flows through an econometric analysis of data on cross-border mergers and acquisitions and greenfield investment projects. Several policy measures are considered, including economy-wide and sector-specific restrictions, regulatory differences between the host and the country of origin, restrictions to digital trade and other types of business costs.

The Impact of Regulation on International Investment in Portugal

3. The impact of the regulatory framework on FDI

Abstract

Key findings

-

Portugal’s relatively open regulatory stance creates favourable conditions for foreign direct investment (FDI). Nonetheless, there are still some regulatory hurdles to trade and investment which, if removed, could further increase Portugal’s FDI attractiveness, particularly in a time of tightened worldwide competition for foreign investment and widespread uncertainty over the post-pandemic recovery and Russia’s war of aggression against Ukraine.

-

Countries with higher barriers to trade and investment in services sectors receive, on average, fewer FDI projects overall, partly because services provide essential inputs into several other industries and also because some measures affecting services are cross-sectoral in nature, i.e. affect other sectors too. If Portugal were to implement reforms that would reduce its level of services regulatory restrictiveness – as measured by the OECD Services Trade Restrictiveness Index – and put it on par with the most open economy in the Single Market, it could see 13% more cross-border mergers and acquisitions (M&As) and 6% more greenfield projects.

-

Accounting for sectoral differences and variations in investor motivations, mode of entry and firm characteristics, the highest gains are estimated to come from the removal of regulatory hurdles to trade and investment in professional services. Reforms that would allow Portugal to align itself to the best performing economy in the European Economic Area (EEA) in professional services could boost the number of foreign M&As and greenfield projects in these sectors by 30% and 19%, respectively.

-

Beyond the degree of regulatory restrictiveness, similarities between home and host country regulatory environments are also found to be conducive to more FDI. This partly explains the high number of FDI projects from Spain and France, which have relatively similar regulatory frameworks to Portugal. Reducing Portugal’s average level of regulatory divergence with other countries to Lithuania’s average divergence level (the lowest observed among the benchmarked economies) could increase the number of cross-border M&A deals by 4%. Strengthening regulatory coherence in a similar fashion with EEA countries alone could boost the number of cross-border M&A deals by an extra 1%. Regulatory co‑operation can, therefore, be critical to facilitate FDI, as harmonised rules and regulation lower compliance costs for investors.

-

Foreign firms are also found to privilege investment in countries with limited obstacles to digitally enabled services, suggesting that Portugal’s relatively open regulatory environment for digital trade adds to its international competitiveness. Further efforts to bring Portugal’s level of digital restrictiveness on par with that of the “frontier” country in the Single Market (Estonia) could give it an extra boost: 19% more cross-border M&A deals and 7% more greenfield projects.

-

Foreign investors are also more prone to invest in countries where it is easier to start a company, suggesting that lowering the administrative burden related to setting up businesses and reducing red tape for business overall could further contribute to attracting more FDI.

-

Countries with better logistics services and port infrastructure also generally host more FDI projects, at least in some sectors, indicating that improved efficiency of logistics and ports has potential to strengthen Portugal’s attractiveness to foreign investment.

3.1. Introduction

Portugal has long recognised the importance of foreign direct investment (FDI), stepping up efforts to promote and open the economy to foreign investors over time. Currently, Portugal enjoys one of the highest stocks of inward FDI in proportion to its gross domestic product (GDP) among OECD countries, but further increasing the level of international investment remains high in Portugal’s priorities for the next decade (see the Internacionalizar 2030 and the Acordo de Parceria Portugal 2030 programmes). This seems a timely endeavour in light of the consequences of Russia’s war against Ukraine and the uncertainties surrounding the global economic outlook, which tends to negatively weigh on investor sentiment and intensify the competition for FDI. Ensuring that Portugal remains attractive for investors becomes an ever more critical challenge in this context.

Several factors are known to influence a country’s attractiveness for FDI, but not that many can be shaped or modified by government policy in the short-to-medium term as its own regulatory environment. Beyond the more direct effect of discriminatory measures against foreign investors regulating market access and national treatment, other non-discriminatory measures can influence FDI indirectly by raising the relative costs of doing business in one location versus another, notably if the rules are excessively stringent compared to regulatory frameworks observed elsewhere. As FDI can play a vital role in addressing Portugal’s productivity challenge, supporting economic recovery and progressing on several areas of the Sustainable Development Goals (see Chapter 1), understanding the interplay between domestic regulation and FDI becomes particularly important.

Addressing policy constraints to trade and investment is not an end in itself. Certain policies may sometimes be necessary to achieve intended public goals, but where such regulatory measures are overly strict, they may entail disproportional costs to society (e.g. foregone investment and tax; higher costs and lower product and services differentiation among others). For this reason, countries should regularly assess the extent to which applied regulation is proportional to the risks it is intended to address and if there are alternative and more efficient ways to achieve the same objectives (OECD, 2015[1]).1

As is shown by the OECD Services Trade Restrictiveness Index (STRI; see Chapter 2), some countries have adopted comparatively less burdensome policies for regulating business activity in their jurisdictions. There is certainly no “one‑size‑fits-all” policy regime that would work adequately for all countries, as that depends on a country’s political and economic context, but the experience of other countries shows that alternative approaches may sometimes be feasible.

The comparative regulatory assessment carried out in Chapter 2 and the empirical analysis of the potential effects of the domestic regulatory environment on FDI, discussed in this chapter, serve the objective of informing policy making and discussions in this regard. The empirical assessment builds on a number of possible reform scenarios derived from regulatory settings observed in peer economies to simulate, and put into the perspective, the potential impact of such reforms in the case of Portugal. But it does not consider the social-political-economic particularities of the Portuguese economy. This is an assessment which the Government of Portugal is best placed to undertake. Some more qualitative and contextualised elements complementing and supporting a more comprehensive assessment are provided in Chapter 4, which investigates the perception of foreign investors about Portugal’s business environment.

This chapter is structured as follows: the next section provides a non-technical explanation of the applied empirical approach, while the subsequent section presents the main findings; a short conclusion follows. The methodology used for the analysis is outlined in Annex 3.A.

3.2. Empirical approach

The empirical approach uses transaction-level data on cross-border M&As and greenfield investment into 48 countries between 2012 and 2022.2 Including a large set of countries in the analysis allows one to evaluate how different regulatory settings shape FDI occurrence. The estimated effects are interpreted in relation to the Portuguese context, that is, in what manner FDI activity in Portugal is expected to be impacted if Portugal were to reform its regulatory framework so as to resemble that of the “least restrictive”/best performing country in the Single Market, as measured by the STRI and other indicators (see below).3 The estimation is performed separately for cross-border M&A deals and greenfield projects to better understand how these two types of FDI respond to changes in the regulatory environment.

In examining the effect of the regulatory setting on FDI, the analysis takes into account several factors that have been found to influence investment. These factors include the geographical distance between investing and host countries, their respective market sizes, as well as the existence of a common border and of a common official language (see Box 3.2 further below). Data on foreign greenfield investment used in this chapter did not distinguish among investors’ origin, hence, the analysis of greenfield investment patterns exploits only the information about host countries.4

The link between the regulatory framework and FDI is evaluated using the OECD STRI (see Chapter 2) – a comprehensive policy-based indicator capturing both “at the border” and “behind the border” obstacles to trade and investment – and other complementary indicators from the World Economic Forum and the World Bank, capturing some other important non-regulatory aspects of the business environment (see Annex 3.B for a description of the data).

The following effects are assessed in the analysis:

-

The economy-wide impact on FDI of regulatory barriers to trade and investment in services sectors, as services provide essential inputs to every segment of the economy and as some regulatory measures contributing to services sector restrictions stem from horizontal regulation which is equally applied in other sectors

-

The impact of such barriers on FDI in their respective services sectors

-

The channels behind the impact of these policy measures on FDI, i.e. sector-specific effects, the role of different categories of regulatory restrictiveness and the impact of regulatory divergence between the host and the country of origin

-

The effect of regulatory restrictions on digital trade

-

The role of other types of hurdles to business operation, such as performance of logistics services and ports, as well as administrative burden to start a business.

3.3. The impact of regulation on FDI

This section discusses the main findings on the link between various regulatory measures and FDI. Tables with the estimation results are reported in Annex 3.B.

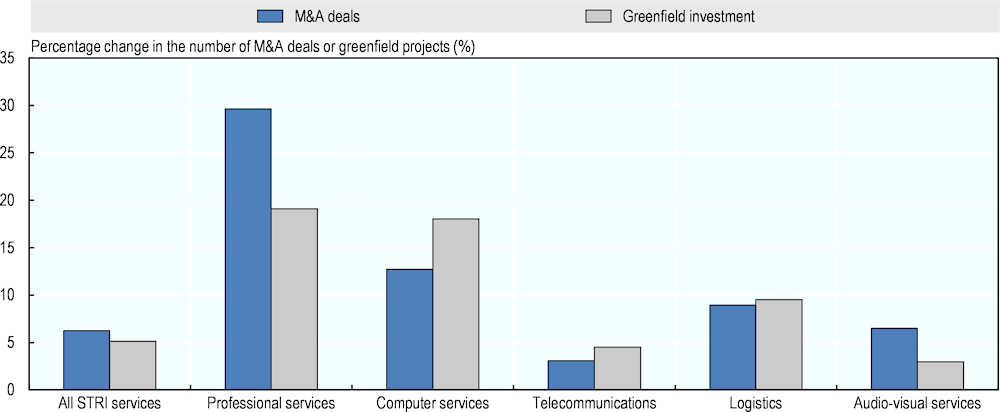

3.3.1. Countries with higher regulatory hurdles attract less FDI

Restrictions to trade and investment in services sectors, as measured by the aggregate STRI score (average across 22 services sectors), are found to be negatively related to the total number of FDI projects a country receives across sectors, both in terms of the cross-border M&A deals and greenfield projects. This result shows the importance of the regulatory landscape for an investor’s location choice.5 For example, implementing reforms that would bring Portugal’s aggregate STRI score on par with that of the Netherlands, the best performing country from the Single Market in the STRI, could increase the total number of M&As in the Portuguese economy by 13% and the number of greenfield projects by 6% (Figure 3.1). As the uncertainty surrounding the global economic outlook may continue to delay investment projects worldwide, addressing the existing regulatory hurdles might be opportune to remain competitive and be better positioned for when investor confidence is restored.

The estimated growth in FDI projects in services sectors as a whole could amount 15% for M&As and 10% for greenfield investment; in manufacturing, to 11% and 3% respectively. The sizeable impact of regulatory hurdles to trade and investment in services on FDI in the whole economy, including manufacturing, is consistent with the increased use of services inputs in productive activities economy-wide. This is observed, for instance, in their substantial contribution to the value added exported by Portugal (see Chapter 1, Section 1.4.4). By deterring entry of foreign firms and restraining competition, excessive regulation of services sectors can limit the ability of all businesses to access high-quality services at the best price, reducing the competitiveness of the whole economy.6

Figure 3.1. Estimated change in the number of FDI projects in all sectors

Note: Estimated impact of a reduction in the STRI score from Portugal’s average to the least restrictive level in the EEA.

Source: Own elaborations on data from Refinitiv M&A database and Financial Times fDi Markets database.

Several factors might contribute to explaining why the predicted increases in the number of FDI projects differ between cross-border M&As and greenfield investment. First, some dimensions of policy restrictiveness can affect one FDI type more heavily than the other (see Section 3.3.3). Secondly, sectoral distribution of M&As and greenfield investment might play a role, as FDI flows into some economic activities might be more responsive to regulatory obstacles in their own or the supplying sectors. Furthermore, the relevance of regulatory costs can vary between M&A and greenfield investment due to the difference in their nature, motivation behind the investment and characteristics of the investing firms (Box 3.1).7

3.3.2. FDI flows less freely to countries with restrictive services sectors

When looking at the direct impact of barriers to trade and investment within the 22 individual services sectors covered by the STRI, one can observe some important variations in the way FDI responds to the regulatory environment in those sectors. On average, across these sectors, reforms that would allow Portugal to align with the STRI of the Netherlands are predicted to give a boost to the number of foreign M&A deals by 6% and of greenfield projects by 5% (Figure 3.2).8

Across the various assessed services, professional services are those from which the impact of reforms streamlining the regulatory environment could be the largest. For consumer protection purposes, professional services have often been somewhat strictly regulated to ensure the quality and optimal provision of these services. In particular, information asymmetries between the average consumer (who typically does not possess technical knowledge on the matter) and suppliers would typically prevent the former from adequately evaluating the quality of such services. Negative externalities have equally been a concern: poorly provided engineering and architectural services, for instance, may put public safety at risk; low-quality legal services can have a negative impact on judicial procedure efficiency, etc. Hence, governments and professional associations have a legitimate interest in regulating such activities to ensure the proper qualification of professionals and the optimal provision of services.

Countries’ experience shows, nonetheless, a wide variation in how governments have addressed such risks. Some countries have found equilibrium in balancing such objectives with relatively less restrictive rules, being able to keep some level of competitive pressure on services providers while still protecting consumers and society from the potential problems that could stem from fully unregulated services.

Increasingly so, professional services provide key inputs to business operations. Companies use legal advice and accounting services to enforce contracts and perform financial transactions. Businesses require engineers and architects when setting up new facilities and developing infrastructure projects.

Where excessively stringent, regulatory restrictions on professional services might unnecessarily deter qualified foreign firms and professionals from entering these sectors, contributing potentially to higher services inputs costs for all firms in the economy. The estimated impact of reforms that would allow Portugal’s regulatory environment for professional services, as measured by the STRI score, to align with that of more open countries, such as Netherlands, could boost the number of M&As and greenfield projects by 30% and 19%, respectively. In legal services, for instance, such a reduction in the score could be achieved by removing the equity restrictions applying to non-licensed individuals.9 In engineering and architectural services, this reduction could be achieved, for example, by easing sector-specific licensing requirements for non-EEA nationals and lifting the economy-wide requirement for foreign companies wishing to exercise their activity in Portugal for more than one year to establish a permanent representation in Portugal.10,11

Figure 3.2. Estimated change in the number of FDI projects in services sectors

Note: Estimated impact of a reduction in the STRI score in a given services sector from Portugal’s current level to the least restrictive level in the EEA. The first two bars (‘All STRI services’) refer to the results for all services included in the STRI database pooled together. Other bars represent the results for individual sectors. Professional services include accounting and auditing, legal, architectural and engineering services. Only selected statistically significant estimations are reported.

Source: Own elaborations on data from Refinitiv M&A database and Financial Times fDi Markets database.

FDI in computer and telecommunication services is also negatively affected by more restrictive regulatory environments, which may further hinder the uptake of digital technologies and prevent firms from exploiting the potential of digitalisation. The number of cross-border M&As and the number of greenfield projects in computer services is predicted to rise by 13% and 18%, respectively, if Portugal’s STRI score in computer services declines from its current level to the lowest level observed in Spain.12 Telecommunications could attract 3% more cross-border M&A deals and 5% more greenfield projects if Portugal were to lift existing regulatory hurdles so as to align itself with the regulatory framework present in Spain, the country with the lowest STRI score among EU economies. Such a reduction in the score could be achieved, for instance, by removing the horizontal restriction on commercial presence to provide cross-border services.13

Well-functioning logistics are essential for delivering intermediate inputs and final products to local and international markets. By supporting the transportation sector, logistics services play a crucial part in operations of firms with a global footprint. Lowering regulatory hurdles in logistics services to match best practice in the EEA (the Netherlands) could attract about 9% more cross-border M&A deals and greenfield projects. The removal of individual licensing requirements to provide warehousing and freight forwarding services could be a step in the direction of narrowing the difference in restrictiveness.

Box 3.1. The cost of regulatory restrictions can differ between M&A and greenfield investors

Entry costs can depend on the mode of entry

Foreign investors’ perception of regulatory restrictions might depend on the type of FDI. Firms undertaking cross-border M&As enter the destination country by transferring ownership of existing assets, whereas greenfield investors often set up their operations from scratch or expand their own existing investment projects in the host economy. These modes of entry involve different kinds of costs and investors’ capabilities. For instance, lengthy approval processes of construction permits might be more discouraging for foreign firms seeking to establish a new facility abroad, whereas uncertainty around the investment screening mechanisms might have a stronger deterring effect on businesses seeking to undertake a cross-border M&A. Investors who have already established their presence in the country might be less affected by various regulatory costs, as they have already incurred the sunk costs related to entry.

The costs of restrictiveness can depend on investor’s motivation

The motivation behind the entry can also influence the relevance of regulatory costs. Foreign investors might be less sensitive to entry barriers when they intend to access a particular market. Market access is a common driver of greenfield investment, which is in line with the findings that greenfield projects are often less sensitive to the destination country’s institutional quality and cultural barriers than cross-border M&As (Davies, Desbordes and Ray, 2018[2]). Similarly, the intent to access a specific asset – such as technology or knowledge – might play a role in weakening the relevance of these barriers to some foreign investors. For instance, availability of an attractive target might render regulatory obstacles less important for M&A investors (Hebous, 2011[3]). When access to a market or an asset is not a primary objective, the relevance of regulatory costs might depend on the pool of potential locations: if an investor chooses between a large set of countries, even small regulatory hurdles can tilt the location choice towards a destination with a more efficient regulatory environment.

The burden of regulation can vary depending on firm characteristics

Investors’ characteristics might also diminish the importance of some policy obstacles. Larger, more productive firms tend to have more resources to bear the costs of complying with the host country’s regulation. They might be also better equipped to pass the regulatory costs on final prices. For instance, Rouzet, Benz and Spinelli (2017[4]) find that companies with larger turnover are less sensitive to regulatory restrictions, whereas Spinelli, Rouzet and Zhang (2020[5]) show that more productive investors are less responsive to measures restricting commercial presence.

The audio-visual sector is another sector where FDI is expected to respond to further liberalisation reforms. Efficient audio-visual services can facilitate creation of digital content and the additional competitive pressure brought by foreign investors can help to spur such environment. The number of cross-border M&As in audio-visual services, for instance, is expected to grow by 7% if Portugal were to implement reforms that would reduce its average STRI score in audio-visual services from the current level to “best practice” in the Czech Republic. The corresponding rise in the number of greenfield projects is 3%. Example of measures contributing to such a difference in the scores are the quota for domestic music in radio broadcasting time and the existence of music creation subsidies for Portuguese work.

No significant relationship between FDI and regulatory restrictions could be consistently established for some other services sectors, such as construction, finance and distribution, suggesting that even if policy conditions in these sectors were to influence investors’ location choice, they do so in a non-systematic manner. As even a more granular analysis of narrowly defined economic activities within these sectors reveals no significant association between FDI and regulatory restrictions, it is plausible that differences in the profiles of firms investing in these sectors or in the motives behind the investment projects might mask the effect (see Box 3.1). It is also possible that the applied regulatory regimes in these sectors in the countries assessed are already quite enabling and, thus, do not deter FDI. Regulatory compliance measures, for instance, might be relatively less costly for firms in some of the more capital-intensive activities, such as construction and transport.

3.3.3. Different dimensions of policy hurdles matter

Regulatory restrictions to trade and investment can be grouped into several policy areas that could help identify priorities for reforms and design targeted policy interventions. These groupings can reveal how FDI responds to different types of restrictions.

Barriers to entry and competition are most deterring

Results show that the number of FDI projects is lower in countries with higher barriers to foreign entry, for instance in the form of foreign equity restrictions or limitations on the legal forms of new ventures.14 Although Portugal maintains one of the lowest levels of restriction to foreign entry within the EEA, reforms that would further reduce its score from the current average level to the lowest level observed in the Netherlands could still lead to a modest growth in the number of FDI projects – a 3% increase in the number of greenfield projects. No significant results were obtained for cross-border M&A deals in this respect.

Barriers to competition appear to have a strong deterring effect on foreign investment. Although Portugal’s average score in this domain is relatively low on average across sectors, lifting existing obstacles could raise the number of cross-border M&As by 6% and the number of greenfield projects by over 2%.

Obstacles to ongoing operations supress FDI, as do barriers to all modes of supply

Evidence shows that FDI projects are also sensitive to “behind-the‑border” regulation affecting day-to-day business operations, which confirms that in addition to costs associated with the establishment of operations, investors also weigh in the costs of doing business in a location when choosing where to invest.15 The number of foreign M&As and greenfield projects could go up by 6% and 5% respectively if Portugal’s level of restrictiveness associated with “behind-the‑border” measures would decrease from its average level across services sectors to the lowest level in the EEA observed in Spain.16

In terms of mode of supply,17 barriers to all modes are negatively associated with the number of FDI projects, highlighting the interdependencies between trade and investment decisions of global firms. Cross-border M&As are expected to rise by 12% and greenfield projects by 7% if restrictions affecting all modes of supply are reduced to the “best practice” level observed in Spain.

FDI responds negatively to both discriminatory and non-discriminatory policies

Discriminatory measures, i.e. measures that raise costs disproportionately for foreign enterprises as defined in the STRI database, are found to act as a more important hurdle to greenfield projects. Achieving the Czech Republic’s average level of discriminatory restrictions could lead to a 4% growth in greenfield projects to Portugal. Revisiting equity restrictions applying to not locally licensed providers of accounting and legal services would be a step towards reducing Portugal’s level of discriminatory restrictions to the level observed in the Czech Republic.18

Cross-border M&As appear, in turn, more sensitive to non-discriminatory obstacles, i.e. measures that raise costs uniformly for domestic and foreign companies. A reduction in Portugal’s current level of non-discriminatory barriers to the one observed in the Netherlands, the least restrictive country in the Single Market in this respect, could bring 5% more foreign deals.

3.3.4. Regulatory heterogeneity holds back FDI within the EEA

Whereas continued diversification of the investor base to attract more FDI from outside the Single Market could broaden Portugal’s economic opportunities (see Chapter 1), enhancing regulatory co‑operation and coherence with EEA countries could further contribute to boosting FDI from investors operating in such markets. Although restrictions on trade and investment within the Single Market are considerably lower than towards third countries, they are still found to negatively affect FDI, being associated with fewer FDI projects from EEA investors. Reducing regulatory hurdles as measured by the intra-EEA STRI score (which accounts for preferential treatment accorded to EEA investors with respect to the applied most-favoured nation regime) from Portugal’s average level to the lowest average level observed in the Netherlands could increase the number of cross-border M&A deals from within the Single Market by 15% and of greenfield projects by 11%.

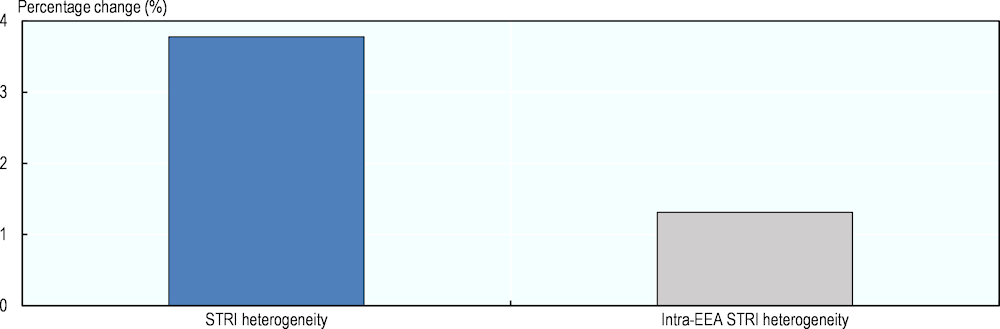

Beyond the absolute degree of restrictiveness of policy barriers, substantial differences in the regulatory framework across countries can also act as a deterring factor to FDI by imposing additional compliance costs for investors present in multiple foreign markets. Evidence shows that foreign firms are less likely to undertake M&As in countries with more dissimilar regulatory environments, as measured by the STRI heterogeneity score, which implies that lack of regulatory co‑operation and coherence between countries can be a drag to FDI.19 In turn, improved regulatory coherence could boost FDI activity.20 This finding is in line with the substantial number of FDI projects in Portugal originating from Spain and France, which have fairly similar regulatory frameworks. Reducing Portugal’s average level of regulatory differences with other countries to the average divergence level of Lithuania, the lowest level observed among the benchmarked economies, could potentially increase the number of cross-border M&A deals by 4% (Figure 3.3).

Figure 3.3. Estimated change in the number of cross-border M&As, regulatory heterogeneity

Note: Estimated impact of a reduction in the heterogeneity score in services sectors from Portugal’s current average level towards all partner countries to the lowest average level in the EEA.

Source: Own elaborations on data from Refinitiv M&A database.

Similarly, strengthening regulatory coherence with EEA countries can also stimulate further investment from these countries. Although market integration within the Single Market has led to significant regulatory harmonisation among its members, policy regimes can still differ among countries depending on how they transpose EU directives and how they govern policy areas that are not covered at the EU level. The existing regulatory differences are negatively correlated with the number of FDI projects. While Portugal has already transposed most of the Single Market directives, being the Member State with the lowest deficit according to the EU Single Market Scoreboard, it can still benefit from further harmonisation.21 Reducing regulatory divergence within the Single Market from Portugal’s average level to the level observed in Lithuania could lead to an extra 1% in the number of cross-border M&A deals (Figure 3.3).

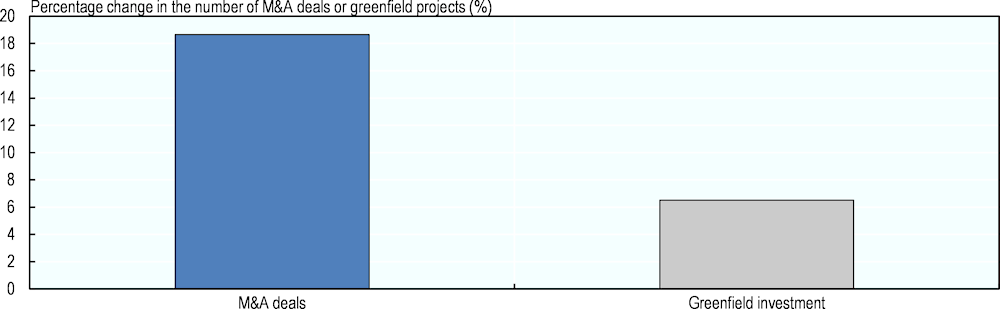

3.3.5. Less FDI goes to countries with restrictive digital services

With the growing digitisation of information, efficient digital services can be vital for a country’s ability to attract FDI in all sectors. The digital transformation enables new types of transactions, helping companies optimise resource management, access new markets and develop novel business models. However, regulatory hurdles inhibiting firms’ ability to supply services using electronic networks may present an obstacle to enterprises with a global footprint.

Regulatory restrictions to digital trade, as measured by the Digital STRI (DGSTRI) score, are negatively associated with the number of FDI projects flowing into economies.22 Implementing reforms that could help lower Portugal’s average level of digital restrictiveness under the DGSTRI to the lowest level in Switzerland could raise the number of cross-border M&As by 19% and the number of greenfield projects by over 7% (Figure 3.4). Making online tax registration and declaration available to all non-resident foreign providers and removing commercial presence requirements for cross-border services provider are examples of measures that could help reduce Portugal’s digital restrictiveness.23

Figure 3.4. Estimated change in the number of FDI projects, digital restrictiveness

Note: Estimated impact of a reduction in the DGSTRI score from Portugal’s current level to the lowest average level in the EEA.

Source: Own elaborations on data from Refinitiv M&A database and Financial Times fDi Markets database.

According to the DGSTRI, Portugal is more restrictive than some of its peers in the area of payment systems (which include measures related to the accessibility of various payment methods and the alignment of security policies with international standards), as it maintains discriminatory access to payment settlement methods. Removing such restrictions associated with payment systems could boost the number of cross-border M&As by nearly 4% and the number of greenfield projects by roughly 1.5%.24

3.3.6. Other types of business costs and hurdles for foreign investors

Beyond regulatory barriers and other more structural factors (see Box 3.2), investors’ location choices also depend on a range of other factors affecting the cost of doing of business. A few of these factors are assessed below, notably those more directly associated with Portugal’s objective to attract investment that can spur further integration into global and regional value chains, taxes and labour regulation.25

Box 3.2. Non-regulatory determinants of FDI

Beyond regulatory aspects, other country-level factors can influence FDI flows. Evidence from the transaction-level data confirm that larger countries receive more FDI projects, indicating that market potential attracts FDI.1 The number of cross-border M&As is also found to decrease the greater is the distance to the host country. Greater distance often entails higher information and transaction costs for foreign investors, which can be particularly dissuading for market-driven investors.

Similarly, sharing a border and an official language typically increases the number of M&As between countries. The importance of these two factors is consistent with the idea that common background facilitates cross-border investment, as a common border and language often indicate strong historical and cultural ties between the economies. Foreign M&As are also more likely between countries within the Single Market, suggesting that economic integration encourages investment flows. These findings confirm the key results of the literature examining the determinants of FDI (e.g. di Giovanni (2005[6]), Hijzen et al. (2008[7]), de Sousa and Lochard (2011[8]) and Bloningen and Piger (2014[9])).

1 These results are reported in Annex Table 3.B.2 and Annex Table 3.B.3.

Evidence shows that countries that perform better in trade logistics infrastructure tend to attract more cross-border M&A deals in manufacturing sectors, for instance, which underlines the overall importance of trade activities for many of such firms, be it for intra‑and-extra firm input trade or simply final product exports. According to the latest World Bank Logistics Performance Index (LPI) (2018[10]), which assesses the overall efficiency of customs, the ease of arranging shipments and the quality of logistics services and transport infrastructure, Portugal ranked 23rd out of 160 economies in the world. Despite Portugal’s overall good performance, implementing reforms that would allow it to move further up to Spain’s 17th place could boost the number of cross-border M&A deals in manufacturing by 6%.26 Improving logistics efficiency to match the score in best-performing Germany could lead to a 19% rise in cross-border activity in the sector. While Portugal’s logistic performance may have already evolved since the release of the latest LPI in 2018, the estimated result gives an idea of the magnitude of the impact that reforms in this area can have on foreign investment activity.

Interestingly, for greenfield projects, efficiency of logistics matters only for the distribution sector, likely reflecting the importance of well-functioning logistical services for the sector’s principal activities. Reforms that would place Portugal in the top LPI position could bring as much as 27% more announced greenfield projects in the distribution sector. The insignificant result for other sectors is likely driven by a combination of factors described in Box 3.1.

Similarly to the findings above, the evidence also suggests that more cross-border M&As take place in countries with efficient ports. According to the latest Quality of Port Infrastructure index (2017‑18), which measures business executives’ perception of their country’s port facilities, Portugal was ranked 25th (WEF, 2018[11]). Moving up in the ranking to reach Estonia’s eleventh position was estimated to potentially lead to a 4% increase in cross-border M&A activity. Raising the quality of port infrastructure to reach the leading place in the ranking held by the Netherlands could potentially boost foreign M&A deals by 19%. While based in 2017‑18 data, these results point to the potentially significant impacts that improvements in seaport services and infrastructure can have on foreign investment activity in Portugal.

Entry costs, as measured by the number of procedures required to register a business (World Bank, 2019[12]), may represent a barrier for new investment if procedures are excessive and complex. Similarly, burdensome construction-related procedures may add to investors’ entry and expansion costs. Albeit limited in scope, these measures can also sometimes be seen as partly indicative of the overall efficiency of the public bureaucracy in dealing with businesses, as entry requirements and permit procedures often rank high in most investment climate reform efforts.

In this assessment, entry costs are found to play a particularly significant role for the number of greenfield projects in information and communication technologies (ICT) and professional services, possibly because the relatively low capital intensity of many firms in these sectors (e.g. software and information technology consultancy firms, law firms, accounting and auditing firms) makes them less dependent on geographical aspects of host countries (than, for instance, firms in energy or heavy manufacturing sectors) and possibly more susceptible to red tape.27 The predicted growth in the number of greenfield projects in these sectors is 11% in ICT and 12% in professional services if Portugal were to halve the number of procedures required (6 in 2019) to the level in Estonia and Slovenia (3).

Interestingly, the number of cross-border M&As is also negatively associated with entry costs even if, in principle, foreign M&A investors are not subject to such measures, which seems to support the idea that such measures capture more than just entry costs and tend to somewhat also reflect countries’ overall level of business red tape. In this respect, implementing reforms that would allow for a reduction in business red tape in a manner correlated with the halving of the number of procedures, as mentioned above, could generate 14% more cross-border M&As. Similarly, the time needed to complete all required procedures for obtaining a permit for building a simple commercial warehouse is also found to be negatively associated with the number of FDI projects (both greenfield and M&A) a country receives.

Corporate taxes can sometimes be seen as a cost for businesses, especially when investors consider it to be incommensurable with the offer and quality of existing public services. This has been somewhat a concern for businesses in Portugal (INE, 2022[13]). But where taxes contribute to financing good quality public services that are critical for a healthy business environment, such as education and infrastructure, they should matter less (Bénassy-Quéré, Fontagné and Lahrèche-Révil, 2005[14]).

In this assessment, statutory corporate income tax (CIT) rates are not found to affect foreign investors’ location choices in a statistically significant manner. Besides being partly related to the quality of public services, as mentioned above, the result might be explained by the fact that they do not reflect the real expected tax burden on business. This is better revealed in the effective average tax rate (EATR), which is found to be negatively associated with the number of cross-border M&A deals a country receives.28 Labour tax and contributions paid by companies are also negatively associated with both the number of greenfield and cross-border M&A projects. These results show that keeping corporate taxes relatively low is likely relevant for attracting FDI, but a truly competitive tax system needs to take into consideration tax distributional effects and tax administration burdens.

Stringent employment protection legislation (EPL) has also been reported by investors to be an obstacle for conducting business in Portugal (see Chapter 4). While stricter rules may potentially raise labour adjustment costs for firms, they are central for productivity growth and social equity, including by providing incentives for firms and workers to invest in long-term training and by ensuring that the social costs associated with unemployment are partly shared by economic actors. In this report, the OECD’s EPL indicator is found to be negatively associated with greenfield FDI, meaning that on average more stringent regimes contribute to deter FDI.29 Striking the right balance between job protection and labour market flexibility is therefore critical to keep an attractive environment for FDI.

3.4. Conclusion

This chapter has provided evidence on the potential impact that liberalising reforms could have on foreign investment in Portugal. Several possible reform scenarios were derived from actual regulatory practices applied in some of Portugal’s peer economies or in EEA countries and their potential impact was estimated using transaction-level data on cross-border M&As and foreign greenfield investment into 48 countries between 2012 and 2022. Other countries’ policy experiences show that alternative regulatory approaches are sometimes possible and can be effective in addressing public interests.

As mentioned in the introduction, regulatory liberalisation is not an end in itself. Countries have legitimate concerns when choosing to regulate business activities, and the most suitable regulatory framework for a country is likely one that adequately captures its own political and economic context. The extent to which the simulated regulatory regimes are suitable to Portugal is thus an assessment that the Government of Portugal is best placed to undertake. This chapter can only support such an exercise by providing evidence on the expected impact of potential liberalising reforms. The analysis, however, does not consider any social-political-economic particularities of the Portuguese economy. Knowledge about potential gains in FDI may represent only part of the information needed to adequately assess the suitability of a regulatory reform in a specific context, but it is a critical one to sustain informed policy making and discussions.

There may also be other complementary issues not captured in the above indicators that might be affecting the degree of restrictiveness of the regulatory framework. Implementation aspects, such as the transparency and predictability of rules and decision making processes, can influence compliance costs and weigh on investment attraction and retention as well. The next chapter seeks precisely to complement this rules-based empirical assessment by investigating how Portugal’s regulatory framework is perceived by foreign investors, which allows for broader considerations of the context and the manner with which measures are implanted.

References

[14] Bénassy-Quéré, A., L. Fontagné and A. Lahrèche-Révil (2005), “How Does FDI React to Corporate Taxation?”, International Tax and Public Finance 12, pp. 583-603, https://doi.org/10.1007/s10797-005-2652-4.

[9] Blonigen, B. and J. Piger (2014), “Determinants of foreign direct investment”, Canadian Journal of Economics/Revue canadienne d’économique, Vol. 47/3, pp. 775-812, https://doi.org/10.1111/caje.12091.

[2] Davies, R., R. Desbordes and A. Ray (2018), “Greenfield versus merger and acquisition FDI: Same wine, different bottles?”, Canadian Journal of Economics, Vol. 51/4, pp. 1151–1190, https://doi.org/10.1111/caje.12353.

[8] de Sousa, J. and J. Lochard (2011), “Does the Single Currency Affect Foreign Direct Investment?”, The Scandinavian Journal of Economics, Vol. 113/3, pp. 553-578, https://doi.org/10.1111/J.1467-9442.2011.01656.X.

[6] di Giovanni, J. (2005), “What drives capital flows? The case of cross-border M&A activity and financial deepening”, Journal of International Economics, Vol. 65/1, pp. 127-149, https://doi.org/10.1016/j.jinteco.2003.11.007.

[18] Geloso Grosso, M. et al. (2015), “Services Trade Restrictiveness Index (STRI): Scoring and Weighting Methodology”, OECD Trade Policy Papers No. 177, https://doi.org/10.1787/5js7n8wbtk9r-en.

[3] Hebous, S. (2011), “The effects of taxation on the location decision of multinational firms: M&a vs. greenfield investments”, National Tax Journal, Vol. 64/3, pp. 817-838.

[15] Herger, N., C. Kotsogiannis and S. McCorriston (2016), “Multiple taxes and alternative forms of FDI: evidence from cross-border acquisitions”, International Tax and Public Finance, Vol. 23/1, pp. 82-113, https://doi.org/10.1007/S10797-015-9351-6.

[7] Hijzen, A., H. Görg and M. Manchin (2008), “Cross-border mergers and acquisitions and the role of trade costs”, European Economic Review, Vol. 52/5, pp. 849-866, https://doi.org/10.1016/j.euroecorev.2007.07.002.

[13] INE (2022), Inquérito aos Custos de Contexto 2021, https://www.ine.pt/xportal/xmain?xpid=INE&xpgid=ine_destaques&DESTAQUESdest_boui=540898022&DESTAQUESmodo=2.

[19] Nocke, V. and S. Yeaple (2007), “Cross-border mergers and acquisitions vs. greenfield”, Journal of International Economics 72, pp. 336-365, https://doi.org/10.1016/j.jinteco.2006.09.003.

[17] Nordås, H. (2016), “Services Trade Restrictiveness Index (STRI): The Trade Effect of Regulatory Differences”, OECD Trade Policy Papers, No. 189, OECD Publishing, Paris, https://doi.org/10.1787/5jlz9z022plp-en.

[16] OECD (2018), “Trade and investment interdependencies in global value chains: Insights from new OECD analysis”, COM/DAF/INV/TAD/TC(2018)1.

[1] OECD (2015), Policy Framework for Investment, 2015 Edition, OECD Publishing, Paris, https://doi.org/10.1787/9789264208667-en.

[4] Rouzet, D., S. Benz and F. Spinelli (2017), “Trading firms and trading costs in services: Firm-level analysis”, OECD Trade Policy Papers, No. 210, OECD Publishing, Paris, https://doi.org/10.1787/b1c1a0e9-en.

[5] Spinelli, F., D. Rouzet and H. Zhang (2020), “Networks of Foreign Affiliates: Evidence from Japanese Micro‐Data”, The World Economy, p. twec.12963, https://doi.org/10.1111/twec.12963.

[11] WEF (2018), The Global Competitiveness Report 2017-2018, World Economic Forum, https://www3.weforum.org/docs/GCR2017-2018/05FullReport/TheGlobalCompetitivenessReport2017%E2%80%932018.pdf.

[12] World Bank (2019), Start-up procedures to register a business, https://data.worldbank.org/indicator/IC.REG.PROC.

[10] World Bank (2018), International Logistics Performance Index, https://lpi.worldbank.org/about.

Annex 3.A. Methodology

The econometric analysis estimates the effect of regulatory obstacles on foreign investment into 48 economies, including Portugal. For cross-border M&As, the estimation approach builds on the gravity model, which has a strong explanatory power in the context of international investment and trade flows.30 As required by the gravity framework, where no cross-border M&A deal from an investing country has been recorded in the database for a given destination country-sector in a given year, it is assumed that no investment has occurred and zero deals are thus imputed to such home‑destination country-sector pair, provided that the investing country has engaged in at least one cross-border transaction in the same sector. As the greenfield project data used in this assessment were not suitable to gravity analysis, the related regressions exploit only sectoral and country-level information of the destination countries.

A count model is used to estimate the number of investment projects that were to be expected in a given country and sector at a given point in time, as this model is well suited to deal with the underlying data and its suitability for the analysis of FDI determinants has been confirmed by several studies (see, for instance, Hijzen et al. (2008[7]), Herger et al. (2016[15]) and Bloningen and Piger (2014[9])). First, a common issue in the empirical analysis of M&A, a large share of deal values is undisclosed, which increases the number of missing values. The imputation of zero investment flows required by the gravity framework aggravates this problem. While this limitation of M&A data decreases the explanatory power of models based on investment values, count models tend to have a good fit to data as they exploit the number of deals instead of values. Secondly, for greenfield projects, a large portion of capital values are estimated by the data provider, which might result in some measurement error. Since count models do not take investment values into account, this shortcoming of greenfield data does not affect the analysis either.

A negative binomial regression is used to model FDI counts, as this model is well suited for the over-dispersion observed in the data, i.e. the sample variance of count data greatly exceeds the sample mean. The model is specified as follows:

where is the number of cross-border FDI projects undertaken by investors coming from industry i in country k with the investment project taking place in industry j in country l at time t. is a vector of host country regulatory variables, as measured by the various indices. and measure market size of the origin and host economies, measured by their GDP. includes bilateral variables (the distance between the two countries; binary variables for whether the two countries have a common border, share a common language, belong to the EEA). The model includes source‑industry () and destination-industry () fixed effects to control for time‑invariant properties of sectors; source‑country () fixed effects account for time‑invariant characteristics of investor’s countries; time fixed effects are included to control for global economic trends. For greenfield specifications, only the control variables describing the host country and sector are retained (i.e. those indexed by j, l and t). As the key objective of the empirical analysis is to estimate the effects of country and sector-specific policy measures with no or little variation over time, host-country fixed effects are not included in this specification. By controlling for known determinants of FDI, this estimation strategy gives good estimates of the correlation between investment and the policy measures of interest, but cannot ensure that the correlation implies a causal relationship.

Marginal effects are used to report the predicted change in the number of inward FDI projects in response to a given change in the policy variables. These effects are calculated from the fitted model, where all control variables are at their mean level and two levels of the policy variable are considered – Portugal’s average level and best practice in the EEA.

Annex 3.B. Supplementary tables

Annex Table 3.B.1. Definition of variables and data sources

|

Variable |

Definition |

Source |

|---|---|---|

|

Ln(Distance) |

Distance between capitals in km, expressed in logarithms. |

CEPII Gravity |

|

Ln(GDP, origin), Ln(GDP, host) |

GDP of origin and host countries in current USD, million; expressed in logs. The variables are used as a proxy for the market size. Estimates for the year 2022 were included in the estimations involving the policy variables available for that year. |

IMF, World Economic Outlook (WEO), October 2022 |

|

Common border |

Binary variable taking a value of 1 if the origin and host countries share a common border. |

CEPII Gravity |

|

Common language |

Binary variable taking a value of 1 if the origin and host countries share an official language. |

CEPII Gravity |

|

EEA |

Binary variable taking a value of 1 if the origin and host countries belong to the European Economic Area. |

OECD STRI Regulatory Database |

|

STRI |

The OECD Services Trade Restrictiveness Index measures regulatory restrictions to services trade and investment in 22 services sectors. The indices take values between zero (a sector is completely open to trade and investment) and one (a sector is completely closed to foreign services providers). The STRI score for all sectors is calculated as a geometric weighted average of the sector-specific STRI indices, with sectoral weights derived from the OECD Trade in Value‑Added database. The indices are available for 2014‑22. |

OECD STRI Regulatory Database |

|

STRI heterogeneity |

The OECD STRI heterogeneity indices measure regulatory heterogeneity between countries on sectoral level. For each country-sector pair, the indices capture the share of measures for which the two countries have dissimilar regulation. The indices take values between zero (same regulatory measures) to one (completely different regulation) and come in two versions: one based on the qualitative answers in the STRI database (Heterogeneity Answer), the other on the scores (Heterogeneity Score). The indices are available for 2014‑22. |

OECD STRI Regulatory Database |

|

Intra-EEA STRI |

The OECD Intra-EEA Services Trade Restrictiveness Index covers policy measures that restrict trade and investment within the EEA. The indices take values between zero and one, where a higher value represents a sector with more restrictive barriers to services trade and investment. The indices are available for 2014‑22. |

OECD Intra-EEA STRI Regulatory Database |

|

Intra-EEA STRI heterogeneity |

Intra-EEA STRI heterogeneity indices measure regulatory heterogeneity within the EEA. For each country-sector pair, the indices reflect the share of measures for which the two countries have different regulation. The indices are available for 2014‑22. |

OECD STRI Regulatory Database |

|

DGSTRI |

The OECD Digital Services Trade Restrictiveness Index measures barriers to services traded digitally. The indices take values between zero (an economy with a regulatory framework completely open to digitally enabled services) and one (an economy closed to digital trade). The indices are available for 2014‑22. |

OECD DGSTRI Regulatory Database |

|

Logistics Performance Index (LPI) |

The index measures the overall quality of trade‑related infrastructure and procedures (customs performance, simplicity of arranging and tracking shipments, timeliness of shipments, quality of logistics services and transport infrastructure, etc.). The values range from 1 to 5, with a higher score indicating greater efficiency. The measure is available for 2012‑18. |

World Bank, Logistic Performance Indicators |

|

Quality of Port Infrastructure |

The Quality of Port Infrastructure reflects business executives’ perception of their country’s port facilities. The values range from 1 to 7, with a higher score representing more efficient infrastructure. The measure is available for 2012‑17. |

World Economic Forum |

|

Costs of entry and to obtain construction-related permits |

The number of procedures to register a business. The covered procedures include those required to set up a business, such as interactions to obtain necessary permits and licenses and to complete all documents to begin operations. The measure is available for 2012‑19. Time required to build a warehouse is measured as the number of calendar days needed to complete the required procedures for building a warehouse. If a procedure can be speeded up at additional cost, the fastest procedure, independent of cost, is chosen. The measure is available for 2012‑19. |

World Bank, Doing Business |

|

Tax measures |

Corporate Income Tax (CIT) refers to the combined central and sub-central (statutory) statutory CIT measured as the central government rate (less deductions for sub-national taxes) plus the sub-central rate. The measure is available for 2012‑22. EATR refers to the forward-looking effective tax rate impinging on a profit-making investment project when a set of base tax provisions, beyond the CIT rate, are considered (e.g. capital allowances, inventory valuation methods, etc.). Country-specific real interest and inflation rates are used. The measure is available for 2017‑21. Labor tax and contributions refers to the amount of taxes and mandatory contributions on labour paid by businesses. It is measured as a percentage of a company’s commercial profits. The measure is available for 2012‑19. |

OECD, Corporate Tax Statistics OECD, Corporate Tax Statistics World Bank, Doing Business |

|

Employment Protection Legislation (EPL) |

EPL indicators reflect the strictness of regulation on individual and collective dismissals of workers under regular contracts. For each year, indicators refer to regulation in force on the 1st of January. Version 4 of the indicator is used. The measure is available for 2013‑19. |

OECD, Employment Protection Indicators |

Source: Based on CEPII, OECD, World Economic Forum and World Bank databases.

Annex Table 3.B.2. Regulatory hurdles and cross-border M&As

|

All sectors |

Services sectors |

Professional services |

Computer services |

Telecommunications |

Logistics |

Audio-visual services |

|

|---|---|---|---|---|---|---|---|

|

STRI, level |

-3.130*** |

-1.533*** |

-1.535*** |

-4.502*** |

-2.066*** |

-1.361** |

-3.096*** |

|

(0.620) |

(0.413) |

(0.363) |

(0.660) |

(0.514) |

(0.611) |

(0.573) |

|

|

Ln(GDP_d) |

0.644*** |

0.603*** |

0.685*** |

0.649*** |

0.432*** |

0.587*** |

0.664*** |

|

(0.033) |

(0.034) |

(0.041) |

(0.038) |

(0.042) |

(0.040) |

(0.052) |

|

|

Ln(GDP_o) |

0.052 |

0.141 |

0.118 |

0.092 |

0.118 |

0.101 |

0.260 |

|

(0.112) |

(0.151) |

(0.356) |

(0.288) |

(0.623) |

(0.514) |

(0.583) |

|

|

Ln(Distance) |

-0.286*** |

-0.344*** |

-0.192** |

-0.278*** |

-0.369*** |

-0.374*** |

-0.275** |

|

(0.078) |

(0.083) |

(0.088) |

(0.089) |

(0.111) |

(0.085) |

(0.121) |

|

|

Common border |

0.466*** |

0.427** |

0.283 |

0.389* |

0.687*** |

0.586*** |

0.154 |

|

(0.160) |

(0.177) |

(0.200) |

(0.207) |

(0.199) |

(0.194) |

(0.264) |

|

|

Common language |

1.046*** |

1.161*** |

1.264*** |

1.235*** |

1.100*** |

0.815*** |

1.330*** |

|

(0.102) |

(0.114) |

(0.147) |

(0.118) |

(0.131) |

(0.149) |

(0.178) |

|

|

EEA |

0.303** |

0.305* |

0.687*** |

0.412** |

-0.203 |

0.316* |

0.520* |

|

(0.154) |

(0.173) |

(0.176) |

(0.161) |

(0.305) |

(0.191) |

(0.302) |

|

|

Observations |

2 009 472 |

558 336 |

71 237 |

121 401 |

27 458 |

42 675 |

32 305 |

|

Likelihood-ratio test |

1.138*** |

1.062*** |

0.490 |

0.650*** |

0.759* |

0.778*** |

0.379 |

|

(0.160) |

(0.174) |

(0.301) |

(0.178) |

(0.449) |

(0.277) |

(0.383) |

|

|

Pseudo R-squared |

0.161 |

0.160 |

0.179 |

0.206 |

0.138 |

0.155 |

0.170 |

Note: The table reports estimated coefficients from the negative binomial regressions. The dependent variable is a number of cross-border M&A. In the specification in the first column, the STRI for all sectors is used. All specifications include a constant, source‑country, source‑industry, destination-industry and year fixed effects. Robust standard errors are reported in the parentheses. ***, ** and * denote statistical significance at 1%, 5% and 10% levels respectively. The period of analysis is from 2014 to 2022.

Source: Own elaborations on data from Refinitiv M&A database.

Annex Table 3.B.3. Regulatory hurdles and greenfield investment

|

All sectors |

Services sectors |

Professional services |

Computer services |

Telecommunications |

Logistics |

Audio-visual services |

|

|---|---|---|---|---|---|---|---|

|

STRI, level |

-1.590*** |

-1.268*** |

-1.033*** |

-6.231*** |

-3.008*** |

-1.446*** |

-1.432*** |

|

(0.113) |

(0.357) |

(0.206) |

(0.668) |

(0.340) |

(0.031) |

(0.483) |

|

|

Ln(GDP_d) |

0.489*** |

0.449*** |

0.515*** |

0.489*** |

0.445*** |

0.524*** |

0.395*** |

|

(0.006) |

(0.028) |

(0.045) |

(0.033) |

(0.024) |

(0.046) |

(0.137) |

|

|

Observations |

14 164 |

3 971 |

538 |

697 |

342 |

424 |

296 |

|

Likelihood-ratio test |

-0.863*** |

-0.689*** |

-0.983*** |

-0.433*** |

-1.814*** |

-0.836*** |

-2.246*** |

|

(0.020) |

(0.158) |

(0.082) |

(0.069) |

(0.188) |

(0.046) |

(0.272) |

|

|

Pseudo R-squared |

0.167 |

0.122 |

0.118 |

0.094 |

0.151 |

0.122 |

0.125 |

Note: The table reports estimated coefficients from the negative binomial regressions. The dependent variable is a number of greenfield investment projects. In the specification in the first column, the STRI for all sectors is used. All specifications include a constant, destination-industry and year fixed effects. Robust standard errors are reported in the parentheses. ***, ** and * denote statistical significance at 1%, 5% and 10% levels respectively. The period of analysis is from 2014 to 2022.

Source: Own elaborations on data from Financial Times fDi Markets database.

Annex Table 3.B.4. Regulatory hurdles (by types) and cross-border M&As

|

(1) |

(2) |

(3) |

(4) |

(5) |

|

|---|---|---|---|---|---|

|

STRI, Restrictions on foreign entry |

-0.419 |

||||

|

(0.563) |

|||||

|

STRI, Restrictions to movement of people |

0.644 |

||||

|

(1.350) |

|||||

|

STRI, Other discriminatory measures |

-8.435*** |

||||

|

(2.574) |

|||||

|

STRI, Barriers to competition |

-3.167*** |

||||

|

(0.838) |

|||||

|

STRI, Regulatory transparency |

-6.155*** |

||||

|

(1.378) |

|||||

|

STRI, Mode 1 |

-4.734** |

||||

|

(2.206) |

|||||

|

STRI, Mode 3 |

0.363 |

||||

|

(0.574) |

|||||

|

STRI, Mode 4 |

0.936 |

||||

|

(1.535) |

|||||

|

STRI, All modes |

-4.850*** |

||||

|

(0.996) |

|||||

|

STRI, DR & other |

-4.080*** |

||||

|

(1.076) |

|||||

|

STRI, MA & NT |

-0.088 |

||||

|

(0.406) |

|||||

|

STRI, Establishment |

-0.666 |

||||

|

(0.661) |

|||||

|

STRI, Operations |

-2.350*** |

||||

|

(0.718) |

|||||

|

STRI, Discriminatory |

-0.510 |

||||

|

(0.485) |

|||||

|

STRI, Non-discriminatory |

-3.182*** |

||||

|

(1.100) |

|||||

|

Observations |

558 336 |

508 806 |

526 031 |

558 336 |

526 031 |

|

Likelihood-ratio test |

1.046*** |

1.063*** |

1.069*** |

1.062*** |

1.071*** |

|

(0.173) |

(0.170) |

(0.174) |

(0.173) |

(0.173) |

|

|

Pseudo R-squared |

0.161 |

0.163 |

0.161 |

0.160 |

0.161 |

Note: The table reports estimated coefficients from the negative binomial regressions. The dependent variable is a number of cross-border M&A. All control variables reported in Annex Table 3.B.2 are also included in these regressions, but not displayed for brevity. All specifications include a constant, source‑country, source‑industry, destination-industry and year fixed effects. Robust standard errors are reported in the parentheses. ***, ** and * denote statistical significance at 1%, 5% and 10% levels respectively. The period of analysis is from 2014 to 2022.

Source: Own elaborations on data from Refinitiv M&A database.

Annex Table 3.B.5. Regulatory hurdles (by types) and greenfield investment

|

(1) |

(2) |

(3) |

(4) |

(5) |

|

|---|---|---|---|---|---|

|

STRI, Restrictions on foreign entry |

-0.877* |

||||

|

(0.468) |

|||||

|

STRI, Restrictions to movement of people |

0.588 |

||||

|

(2.247) |

|||||

|

STRI, Other discriminatory measures |

-8.521*** |

||||

|

(2.539) |

|||||

|

STRI, Barriers to competition |

-2.874*** |

||||

|

(0.776) |

|||||

|

STRI, Regulatory transparency |

2.798 |

||||

|

(1.901) |

|||||

|

STRI, Mode 1 |

-4.872 |

||||

|

(3.055) |

|||||

|

STRI, Mode 3 |

-0.493 |

||||

|

(0.573) |

|||||

|

STRI, Mode 4 |

-0.101 |

||||

|

(1.422) |

|||||

|

STRI, All modes |

-2.923** |

||||

|

(1.395) |

|||||

|

STRI, DR & other |

-2.592*** |

||||

|

(0.571) |

|||||

|

STRI, MA & NT |

-0.793 |

||||

|

(0.539) |

|||||

|

STRI, Establishment |

-0.793 |

||||

|

(0.649) |

|||||

|

STRI, Operations |

-1.947*** |

||||

|

(0.437) |

|||||

|

STRI, Discriminatory |

-1.072** |

||||

|

(0.515) |

|||||

|

STRI, Non-discriminatory |

-1.975** |

||||

|

(0.820) |

|||||

|

Observations |

3 971 |

3 455 |

3 675 |

3 971 |

3 675 |

|

Likelihood-ratio test |

-0.724*** |

-0.633*** |

-0.657*** |

-0.692*** |

-0.655*** |

|

(0.159) |

(0.155) |

(0.156) |

(0.158) |

(0.154) |

|

|

Pseudo R-squared |

0.125 |

0.112 |

0.116 |

0.122 |

0.116 |

Note: The table reports estimated coefficients from the negative binomial regressions. The dependent variable is a number of greenfield investment projects. All specifications include a constant, destination-industry and year fixed effects and a logarithm of GDP of the destination country. Robust standard errors are reported in the parentheses. ***, ** and * denote statistical significance at 1%, 5% and 10% levels respectively. The period of analysis is from 2014 to 2022.

Source: Own elaborations on data from Financial Times fDi Markets database.

Annex Table 3.B.6. Regulatory heterogeneity and FDI

|

MA |

GI |

MA |

MA |

|

|---|---|---|---|---|

|

Intra EEA STRI, level |

-9.492*** |

-6.825* |

-7.058*** |

|

|

(2.128) |

(3.788) |

(1.903) |

||

|

STRI, level |

-1.333*** |

|||

|

(0.507) |

||||

|

STRI, Heterogeneity Score |

-1.379*** |

|||

|

(0.464) |

||||

|

Intra-EEA STRI, Heterogeneity Score |

-4.194** |

|||

|

(1.700) |

||||

|

Observations |

136 432 |

1 960 |

484 058 |

117 156 |

|

Likelihood-ratio test |

0.654*** |

-0.799*** |

0.768*** |

0.464*** |

|

(0.155) |

(0.196) |

(0.131) |

(0.154) |

|

|

Pseudo R-squared |

0.120 |

0.138 |

0.177 |

0.135 |

Note: The table reports estimated coefficients from the negative binomial regressions. The dependent variable is a number of FDI projects, the type of FDI is reported in the column name. The control variables and fixed effects are as in Annex Table 3.B.2‑Annex Table 3.B.3. Robust standard errors are reported in the parentheses. ***, ** and * denote statistical significance at 1%, 5% and 10% levels respectively. The period of analysis is from 2014 to 2022.

Source: Own elaborations on data from Refinitiv M&A database and Financial Times fDi Markets database.

Annex Table 3.B.7. Restrictions to digital services and FDI

|

MA |

GI |

|

|---|---|---|

|

Digital STRI |

-2.030*** |

-0.755*** |

|

(0.401) |

(0.204) |

|

|

Observations |

2 005 305 |

14 164 |

|

Likelihood-ratio test |

1.201*** |

-0.846*** |

|

(0.132) |

(0.075) |

|

|

Pseudo R-squared |

0.152 |

0.165 |

Note: The table reports estimated coefficients from the negative binomial regressions. The dependent variable is a number of FDI projects, the type of FDI is reported in the column name. The control variables and fixed effects are as in Annex Table 3.B.2‑Annex Table 3.B.3. Robust standard errors are reported in the parentheses. ***, ** and * denote statistical significance at 1%, 5% and 10% levels respectively. The period of analysis is from 2014 to 2022.

Source: Own elaborations on data from Refinitiv M&A database and Financial Times fDi Markets database.

Annex Table 3.B.8. Other types of business costs and FDI

|

MA, manuf. |

GI, distribution |

MA |

MA |

GI, Prof. Services & ICT) |

MA |

GI |

MA |

GI |

MA |

GI |

MA |

GI |

GI |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

LPI |

0.304* |

0.424*** |

||||||||||||

|

(0.158) |

(0.032) |

|||||||||||||

|

Quality of Port Infrastructure |

0.109** |

|||||||||||||

|

(0.049) |

||||||||||||||

|

No. procedures to start a business |

-0.044*** |

-0.036*** |

||||||||||||

|

(0.012) |

(0.010) |

|||||||||||||

|

Time required to build a warehouse |

‑0.001** |

-0.001*** |

||||||||||||

|

(0.001) |

(0.000) |

|||||||||||||

|

CIT rate |

-0.005 |

-0.002 |

||||||||||||

|

(0.006) |

(0.002) |

|||||||||||||

|

Labor tax and contributions |

‑0.006* |

‑0.002** |

||||||||||||

|

(0.003) |

(0.001) |

|||||||||||||

|

EATR |

-0.011* |

-0.003 |

||||||||||||

|

(0.006) |

(0.003) |

|||||||||||||

|

EPL |

-0.092** |

|||||||||||||

|

(0.036) |

||||||||||||||

|

Observations |

292 098 |

141 |

1 271 616 |

1 698 480 |

2 903 |

1 698 480 |

12 439 |

2 331,158 |

17 006 |

1 698 480 |

12 439 |

1 050 505 |

7 517 |

8 613 |

|

Likelihood-ratio test |

0.679*** |

-1.111*** |

1.155*** |

1.121*** |

-0.902*** |

1.121*** |

-0.961*** |

1.184*** |

-0.861*** |

1.127*** |

-0.947*** |

1.095*** |

-0.826*** |

-0.902*** |

|

(0.205) |

(0.098) |

(0.181) |

(0.162) |

(0.127) |

(0.168) |

(0.073) |

(0.156) |

(0.072) |

(0.167) |

(0.072) |

(0.153) |

(0.077) |

(0.082) |

|

|

Pseudo R-squared |

0.163 |

0.122 |

0.152 |

0.155 |

0.185 |

0.154 |

0.175 |

0.153 |

0.165 |

0.154 |

0.173 |

0.161 |

0.164 |

0.175 |

Note: The table reports estimated coefficients from the negative binomial regressions. The dependent variable is a number of FDI projects, the type of FDI is reported in the column name. The control variables and fixed effects are as in Annex Table 3.B.2‑Annex Table 3.B.3. Robust standard errors are reported in the parentheses. ***, ** and * denote statistical significance at 1%, 5% and 10% levels respectively.

Source: Own elaborations on data from Refinitiv M&A database and Financial Times fDi Markets database. The period of analysis varies depending on the availability of the independent variables (see Annex Table 3.B.1 for such information).

Notes

← 1. Potential benefits and costs to upstream and downstream sectors and end consumers should also be considered. Such a broader cost-benefit assessment of specific measures of the regulatory framework lies beyond the scope of this chapter.

← 2. The time coverage differs across policy measures. The countries include Australia, Austria, Belgium, Brazil, Canada, Chile, the People’s Republic of China, Colombia, Costa Rica, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Kazakhstan, Korea, Latvia, Lithuania, Luxembourg, Malaysia, Mexico, the Netherlands, New Zealand, Norway, Peru, Poland, Portugal, Russian Federation, the Slovak Republic, Slovenia, South Africa, Spain, Sweden, Switzerland, Thailand, Turkey, the United Kingdom, the United States.

← 3. Throughout this chapter, a number of concrete policy reform examples are used to illustrate the types of regulatory changes that could correspond to the simulated policy reform scenarios (based on the STRI framework) used in the empirical estimations. The examples should not be interpreted as being directly associated with the estimated impacts. For methodological reasons, the various measures within a policy domain in a sector are treated equivalently within the STRI framework. In practice, however, their “real” degree of restrictiveness might differ. Hence, two different reforms having the same impact on the STRI score should not necessarily be expected to impact FDI in a similar manner. Potential social, political and economic costs associated with the implementation of reforms leading to a reduction in restrictiveness may also differ depending on the existing policy landscape and are not incorporated in the analysis.

← 4. Although information on the investors’ origin was available in the greenfield dataset specific to Portugal and used in Chapter 1, due to contractual limitations, the OECD could not retrieve data of similar granularity for a larger set of countries required for the econometric analysis.

← 6. Potential policy reforms and their impact on Portugal’s STRI scores at the sectoral level can be simulated via the STRI Simulator web tool. https://sim.oecd.org/. Throughout this chapter, examples of possible reforms identified via the STRI simulator are used to simulate the potential impact of reforms on investment based on the estimations obtained in the regression analysis. The examples are only illustrative of a possible reform based on existing regulatory practice in peer economies. It might not necessarily be adequate in the Portuguese context.

← 7. Furthermore, as explained in Section 3.2, the discrepancies in the estimates might be driven by the differences in the estimation models. In addition, properties of the underlying data might play a role. More specifically, both M&A and greenfield databases cover completed FDI projects, but the greenfield dataset also includes projects that were announced (i.e. projects that might have not been realised or that have been realised later) and the two types of projects cannot be distinguished in the greenfield data.

← 9. See Law No. 145/2015 approving the Statute of the Portuguese Bar Association (Art. 213).

← 10. See Law No. 119/92 on the Statute for Portuguese Engineers (Art. 13), Law No. 2/2013 on the Statute for Portuguese Technical Engineers (Art. 12), and Regulation 350/2016 on the Registration with the Portuguese Order of Architects and Traineeship (Article 4 and Annex II).

← 11. Several other existing regulatory requirements also affect the movement of foreign professionals to Portugal for the provision of such services, affecting “Mode 4” of international supply of such services. While Portugal does not impose quotas nor labour market tests for foreign contractual services suppliers and independent service suppliers to provide accounting and auditing services in Portugal, it imposes several other residency, stay and qualifications requirements for foreign professionals to be able to supply such services in Portugal. See Chapter 2 for more information.