Jon Pareliussen

OECD

Axel Purwin

OECD

Jon Pareliussen

OECD

Axel Purwin

OECD

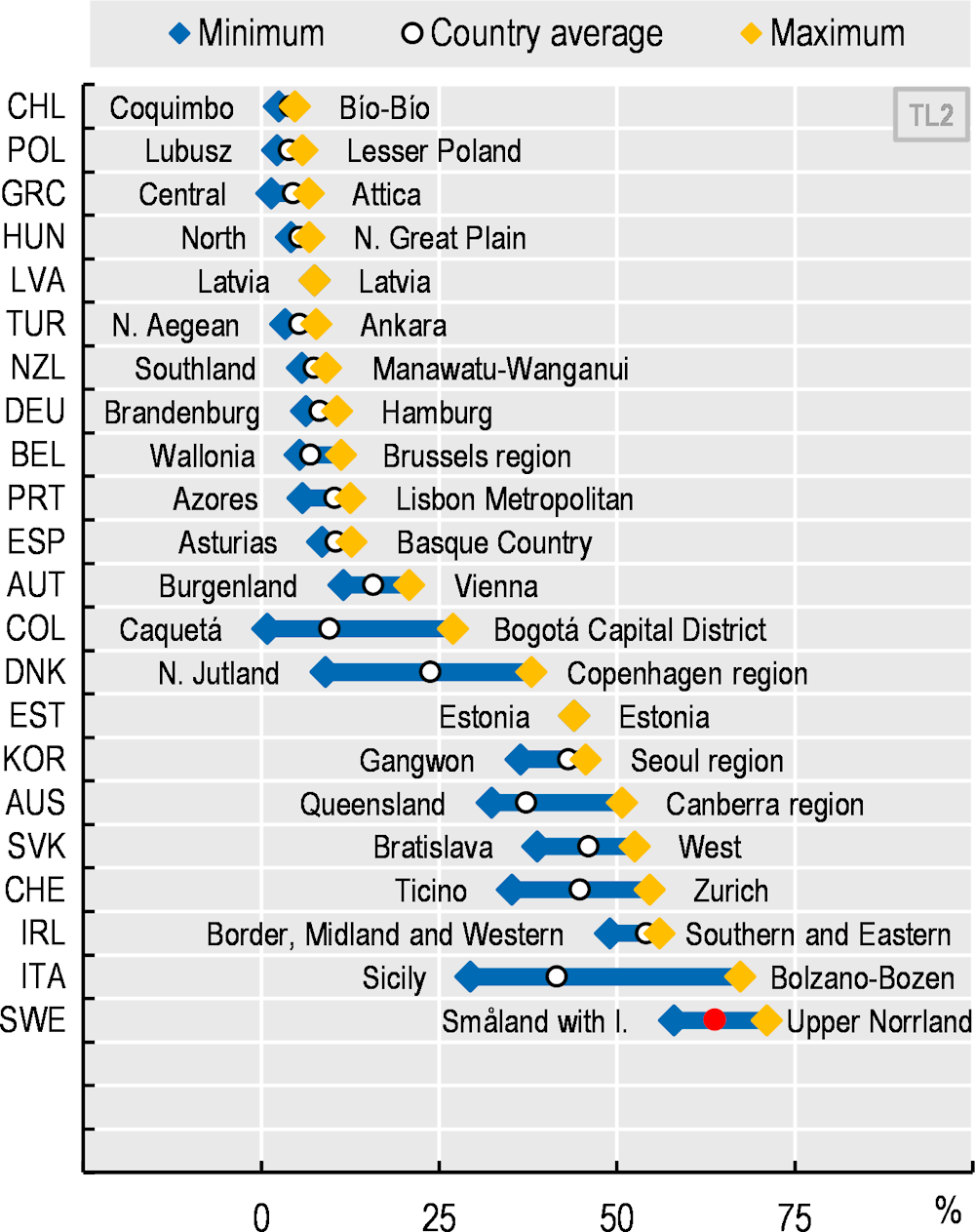

Sweden is among OECD best performers in reducing greenhouse gas emissions, much thanks to a comprehensive policy framework and relatively efficient policies. There is nonetheless room to further improve consistency of targets and policies, notably for transport, agriculture and carbon removals. Sweden’s long record as a climate frontrunner is also threatened by policy changes moving the 2030 reduction target out of reach unless compensated by new ambitious measures. A green industrial revolution is gaining momentum in Sweden’s north, fuelled by an abundant supply of clean electricity. Considerable investments in electricity generation, storage and transmission are needed, but long planning and permitting procedures slow many key projects down. The green revolution depends on people and skills to run industry and complementary public services. This is a challenge for northern regions and municipalities already facing labour shortages.

In October 2021, the first vehicle in the world built from fossil-free steel rolled out of a factory in Braås, Sweden. The steel, produced with hydrogen instead of coal, came from a test facility in Luleå that started production two months before. This marked a milestone of a green wave of industrial development washing over Sweden that can showcase the benefits of green industrialisation, the policies and conditions that can bring it about, and the challenges it brings in terms of rising demand for skills, public and private services, clean energy, housing and infrastructure. Momentum is strong, and Russia’s illegal war of aggression against Ukraine increases the impetus to speed up investments in clean energy and infrastructure. The wave’s epicentre is Sweden’s north, a sparsely populated area in demographic decline for decades with a strong tradition in mining and industry. The area is also home to the Sami people and their traditional reindeer herding and strategically important with a heavy military presence.

Sweden’s consistent climate policies over decades have helped bring this nascent green industrial revolution about, but it is fuelled by access to affordable clean electricity. To maintain momentum, industrial development must be matched by investments in clean energy and electricity transmission, speedier planning and permitting, and the supply of people and skills for industry and supporting public and private services. This chapter analyses Sweden’s successes so far, the climate policy framework and other policies supporting the transition as well as challenges going forward to fuel the continuation of Sweden’s nascent green revolution. The first main section provides a brief overview of the consequences of climate change in Sweden. The second outlines Sweden’s emission reduction efforts to date and points out strengths, challenges and areas of improvement to its policy framework. The third main section describes the green industrial transition sweeping across the country from the north, with its opportunities and challenges.

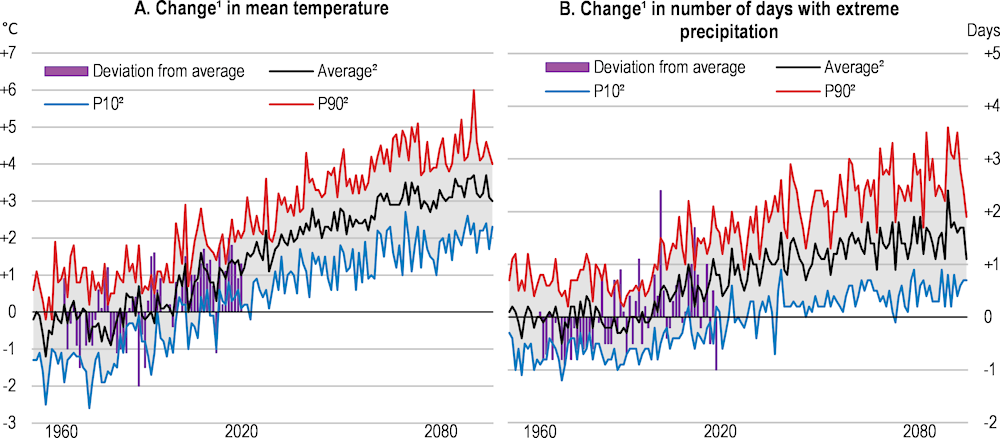

Countries around the world have set increasingly ambitious emission reduction targets since the 2015 Paris agreement. It is increasingly clear that reaching these targets in an effort to avoid the most dangerous and devastating consequences of climate change calls for a rapid green transformation. Mean temperatures are likely to increase more in Sweden than the world average. Assuming a global mean temperature increase of 2.1 degrees Celsius by the end of the century, annual mean temperatures are expected to increase by 3.2 degrees in Sweden (Figure 2.1, Panel A), with an expected increase of 2.5 degrees in summer and 4.1 degrees in winter. There are also considerable regional variations, with the largest temperature increases in the North (SMHI, 2023). The extreme summer of 2018 can illustrate some of the issues to face in the future. Heatwaves and low precipitation caused drought, failed crops and health issues. The most severe wildfires since 1888 ravaged 250 square kilometers of land, mostly forested. Average temperatures over the summer were slightly more than 3 degrees above the 1961-90 normal, which is in line with projections for a normal summer by the end of the century. At the same time, rain was much scarcer than climate models predict for the future (SMHI, 2019). The island of Gotland, which was hit by water shortages in 2018, was hit again in 2022 due to low precipitation during the spring. An innovative “ugliest lawn contest” contributed to reducing water consumption and inspired water conservation and debate beyond Sweden’s borders due to international media coverage.

The direct negative consequences of climate change on economic output will nonetheless likely be less pronounced in Sweden than in most countries. Extreme weather events are projected to increase, with for example longer heatwaves and more days with extreme precipitation (Figure 2.1, Panel B). On the other hand, a warmer climate will extend the growing season and increase forest growth. It will have both positive and negative effects on agricultural output with a difficult to assess overall effect. The expected increase in precipitation will increase the incidence of flooding and landslides, but is also set to increase hydropower production by 15-20% in the north. A number of effects and risks from climate change are difficult to estimate in quantitative models. It increases the risk of dramatic changes to the ecosystems in the Baltic Sea, declining water quality in lakes and waterways, a shortened season for winter tourism and overgrowth affecting reindeer husbandry and tourism. Sweden will also be affected by events around the world triggered by climate change, such as changes to trade patterns, population displacement and international conflict with likely major negative consequences (NIER, 2017; Hassler et al., 2020).

1. Compared with the 1971-2000 average. Projections are based on an average of different climate models.

2. The black line shows an average of several different climate models, based on IPCC's Representative Concentration Pathway 4.5, or intermediate, scenario. P10 and P90 denote the 10th and 90th percentile respectively.

Source: Swedish Meteorological and Hydrological Institute.

The main purpose of climate damage estimates should be to identify beneficial adaptation measures. Sweden has a well-developed climate change adaptation strategy including Sweden’s climate change adaptation goals, guiding principles for the work, organisation and distribution of responsibilities, monitoring, financing principles and knowledge-boosting initiatives. It was first presented by the government in 2018 and is to be updated every five years. The Swedish National Expert Council for Climate Adaptation is tasked with presenting a report to the Government every five years with a summary analysis of the effects of climate change on society, a follow-up and evaluation of the national climate change adaptation work, proposed direction of the national climate change adaptation work, and a prioritisation of adaptation measures based on an assessment of risk, cost and benefit. In addition, the Swedish National Knowledge Centre for Climate Change Adaptation has been tasked with gathering and disseminating information about adaptation needs and activities (SMHI, 2018).

In cases where the consequences of climate change are correctly reflected in market prices, households and businesses should be expected to adapt accordingly. Interventions should therefore be targeted at climate consequences affecting parts of society and the environment without a direct market link. Biodiversity, ecosystem services and the natural environment are prime examples of this. Furthermore, climate change will cause a number of interrelated changes simultaneously, and many adaptation measures will be more effective if implemented collectively at scale, which calls for policy intervention. Public infrastructure for transportation, energy and water management are important examples in this respect. Estimates of climate damages should be improved to correctly identify policy interventions with net benefits to society. Such improvement should better incorporate dynamic changes in market prices and how people and businesses can be expected to adapt, increasing accuracy of estimated effects on non-market services both in terms of their value and spatial distribution. For example, farmers would on average see an extended growing season, while their exposure to extreme weather events would depend on their location, their specialisation in terms of crops and livestock, and any adaptation measures taken. A more granular identification of the groups of people and businesses that will be affected positively and negatively, both in terms of sectors and geography would therefore improve the scope for efficient policy responses going forward (NIER, 2017).

Despite relatively benign aggregate effects on GDP from climate change, Sweden is one of the world’s more ambitious countries in fighting climate change, with a target to reach net zero emissions in 2045, and negative emissions thereafter. It also has a solid track record on reducing emissions. Sweden’s fossil fuel use increased largely in line with the global average until the 1960s, but fell rapidly in the 1970s and 1980s, contrary to the global trend. By 1990, fossil fuel use had halved compared to 1970. This development was triggered by higher oil prices and policy changes after the oil crises, notably the large-scale development of nuclear power and combined heat and power plants with feedstock from forestry and waste. Fossil fuel use has continued trending down since, albeit at a slower pace, as fossil fuels were practically phased out from individual and district heating of buildings after the introduction of the carbon tax in 1991 (Hassler et al., 2020).

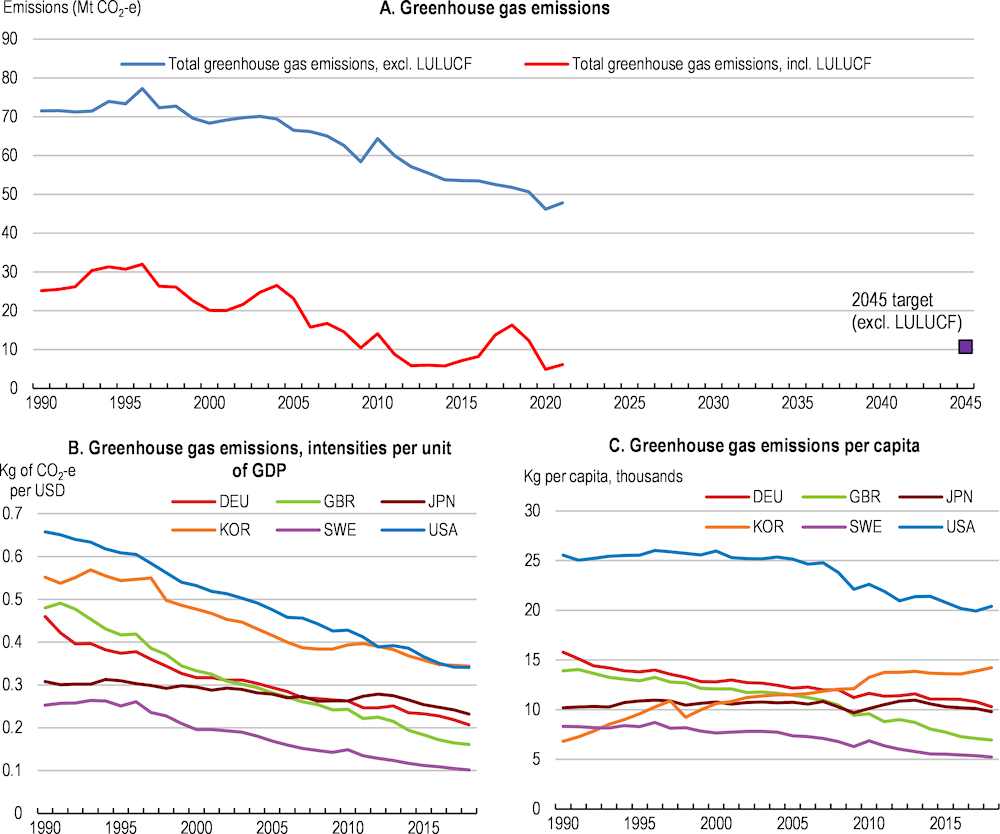

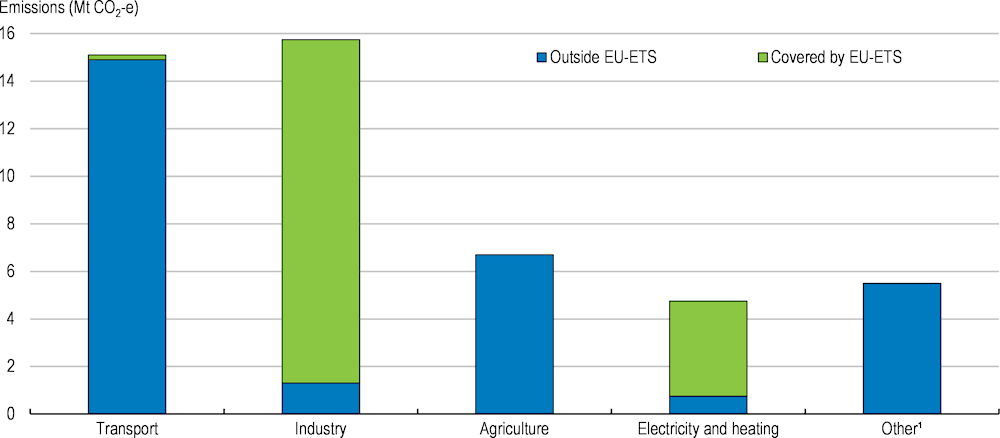

Since 1990, Swedish emissions have fallen from approximately 72 to 46 million tonnes of CO2 equivalents. Greenhouse gas emissions per unit of GDP is 0.1 kg CO2e and emissions per capita about 5 tonnes, both among the lowest in the OECD (Figure 2.2). Main emitting sectors are domestic transport and industry, followed by agriculture (Figure 2.3, Panel A). Emissions from electricity and heat production are low, as it is largely based on renewables and nuclear energy. The manufacture of basic metals stands out with high emissions intensity (Panel B), mostly from the manufacture of iron and steel. The absorption of carbon in Sweden’s soil and forests is considerable, but only partially accounted for against official targets (Hassler et al., 2020). Sequestration from land use, land-use change and forestry (LULUCF) has fluctuated around 40-50 million tonnes a year from 1990 to 2017. Taking this fully into account, annual net emissions would have fallen by three-quarters from 25.0 to 6.2 million tonnes from 1990 to 2021 (Figure 2.2, Panel A).

Note: LULUCF stands for land use, land use change and forestry. Sweden has a 2045 net zero target for emissions excluding LULUCF, and plans to off-set the ~10000 Mt emissions in 2045 with “supplementary measures”, including but not limited to: increased uptake of carbon dioxide by forests, over and above business as usual; verified emission reductions abroad; and bioenergy combustion with carbon capture and storage (BECCS).

Source: OECD, Air and climate (database); Statistics Sweden.

In 2017, a broad political majority of the Riksdag (the Swedish Parliament) approved a climate policy framework to implement the Paris Agreement in Swedish law. This framework rests on three pillars: a climate act; emission reduction targets; and the Climate Policy Council, a climate policy watchdog (CPC, 2022b; Government of Sweden, 2017).

The Swedish Climate Act sets four main duties for the Government. First, climate policy must be based on climate goals. Second, the Government is obliged to present a climate report every year in its Budget Bill. This report should contain a description of emission trends, major policy decisions affecting these trends, and an assessment and plan for additional actions as needed to meet targets. Third, every fourth year the Government is required to draw up a climate policy action plan to describe how the climate goals are to be achieved. Fourth, climate policy goals and budget policy goals should work together (CPC, 2022b; Government of Sweden, 2017).

Sweden’s long-term target is to reduce greenhouse gas emissions to net zero by 2045 at the latest, and achieve negative emissions thereafter. At least 85% of emission reductions (compared to 1990) are to be reached by reducing emissions from existing sources on Swedish soil. The remaining 15% can be reached by so-called “supplementary measures”, which include but are not limited to: increased uptake of carbon dioxide by forests and other natural sinks over and above business as usual; verified emission reductions abroad; and carbon capture and storage from biomass combustion (CPC, 2022b; Government of Sweden, 2017).

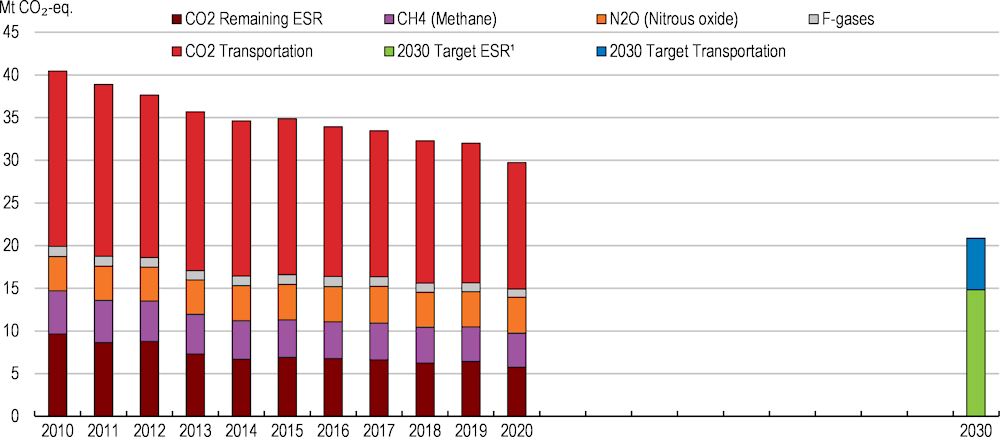

Sweden also has intermediate targets. Contrary to the 2045 target, these only apply to the sectors covered by EU’s Effort Sharing Regulation (ESR). These are the sectors not covered by the EU Emissions Trading Scheme (EU ETS). Sweden achieved its 2020 target to reduce ESR emissions by 40% from the 1990 level by 2020. Emission reductions abroad were allowed to cover up to 13 percentage points, but actual use was about two percentage points. The next milestone is 2030, with a pledge to reduce emissions by 63% compared to 1990, with a maximum of 8% through supplementary measures. This implies at least a reduction of 52% since 2005, which is only slightly tighter than the EU Commission’s proposal for new targets under the Effort Sharing Regulation to reduce ESR emissions by 50% compared to 2005. By 2040, emissions should be 75% lower than 1990, with maximum 2% of the reduction achieved by supplementary measures. Finally, Sweden has a separate target to reduce emissions from domestic transport (excluding aviation) by at least 70% from its 2010 level by 2030 (CPC, 2022b; Government of Sweden, 2017). The likely failure to reach the transport sector target because of recent policy changes, as discussed further below, will require considerable emission reductions in other ESR sectors from 2020 to 2030 (Figure 2.4).

1. Excluding transport. Assuming maximum supplementary measures are used.

Source: Statistics Sweden; The Swedish Environmental Protection Agency.

The third pillar of the framework is a climate policy council. The Climate Policy Council (CPC) is an independent, interdisciplinary expert body tasked with evaluating how well the Government’s overall policy is aligned with the climate targets. Within this overarching mandate, it evaluates existing policy instruments from a societal perspective, identifies areas requiring further action, analyses how to achieve targets cost-efficiently, evaluates the bases and models on which the Government builds its policy, and contributes to the broader societal debate on climate policy (CPC, 2022b; Government of Sweden, 2017).

The CPC consists of experts in the fields of climate, climate policy, economics, social sciences and behavioural sciences. It is required to submit an annual progress report to the Government with an assessment of current emission trends and work carried out to address climate change. Furthermore, the council is obliged to submit an assessment of the Government’s four-year climate policy action plan within three months of its publication (CPC, 2022b; Government of Sweden, 2017).

The structure of the Swedish climate policy framework, with a clear legal framework, targets, action plans and independent assessment by the CPC represents international good practice. A number of other OECD countries have similar frameworks, including the United Kingdom, France and New Zealand (OECD, 2022d). However, there is scope to align domestic targets more closely to EU targets and improve coherency of the target structure. Intermediate targets apply only to those sectors not covered by the EU ETS for good reason. Sweden and fellow EU countries have pooled authority for the main policy tool for ETS sectors at the EU level. Structuring the 2045 target in the same way would therefore increase consistency between targets and between the 2045 target and jurisdiction over the main policy instrument to achieve it. There is nonetheless considerable room for supplementary policies to make the most of the transition also within ETS sectors, such as R&D policies and streamlining regulations and permitting procedures. Mapping options to reduce emissions and expressing a level of ambition at the sectoral level can be a useful analytical exercise and a tool to coordinate policy and stakeholder involvement. However, strict sectoral targets, as the Swedish domestic transport target, are not cost efficient, and may take the pressure off potential emission reductions in other sectors as discussed further below (Hassler, 2021).

Sweden has successfully put in place policy packages combining emission pricing with regulation, investments in infrastructure and innovation and industry dialogue to reduce emissions in their sector-specific context. Carbon pricing has been a central element in these efforts. The EU ETS and the CO2 tax, put a meaningful price on almost 80% of Swedish greenhouse gas emissions in 2021 (OECD, 2022f). Other policies which have been important to drive emission reductions include the renewable electricity certificate system, the blend-in obligation for transport fuels, the bonus-malus system for new cars, various subsidy schemes and systematic government-industry dialogue. EU policies also play important roles outside of the EU ETS. Notable examples are emission performance standards for cars and vans and the Common Agricultural Policy as discussed below.

Sweden and other OECD countries rely on both emissions trading schemes and CO2 (equivalent) taxes (D’Archangelo et al., 2022). The environmental effectiveness of these two instruments is largely equivalent in principle, as the ETS cap can be adjusted over time to hit a desired price level, and a tax can be adjusted over time to hit a desired quantity. Sweden has a long history of taxing energy, with excise duties levied on gasoline to raise revenue at least from the 1920s. As an EU member, relevant Swedish entities have been part of the EU ETS since its inception in 2005. A carbon dioxide tax was introduced in 1991 at a level of SEK 250 per tonne of CO2, and gradually increased to SEK 1 330 in 2023. In 2022, the explicit carbon tax on transport fuels as well as the effective tax on emissions also accounting for fuel excise duties were among the highest in the world. Carbon tax rates have been largely streamlined across sectors since 2018. All in all, almost 80% of Swedish greenhouse gas emissions are priced by the EU ETS (39%) or by the CO2 tax (40%) (OECD, 2022f). The remainder, mostly methane and nitrous oxide emissions from agriculture, remain untaxed. Emissions from domestic shipping, rail traffic and fisheries, are still exempt from both the carbon dioxide tax and the fuel excise duty, and agricultural and forestry machinery carry a reduced carbon tax rate (Hassler et al., 2020).

Regulation and subsidies can be valuable complements to carbon pricing if they are well-designed and targeted to well-identified market imperfections. However, ill-designed and uncoordinated regulations, subsidies and pricing instruments may increase the cost of decarbonisation by complicating performance monitoring, blurring price signals and blunting economy-wide incentives. Furthermore, traditional subsidies and command-and-control regulations give weaker “dynamic” incentives to research, develop and go above and beyond set standards (Blanchard et al., 2022; D’Archangelo et al., 2022) , and they risk being less effective and more costly than assumed before implementation (HMT, 2021). Ex-post performance reviews and evaluations can help, and should be an integral part of policy planning and design (OECD, 2014).

Notable regulations in Sweden include energy efficiency standards for buildings and appliances. The building code sets minimum standards for energy efficiency in new and renovated buildings. Energy labelling and efficiency standards for a range of products like refrigerators, washing machines, and televisions set minimum requirements for energy efficiency and allow consumers to compare the energy efficiency of different products. These policies help overcome information failures, myopia and split incentives between renters and landlords. Standards set at the EU level, notably vehicle tailpipe emissions standards, are also important to reduce Sweden’s emissions, as discussed further below.

In the renewable electricity certificate system, which started in 2003 and was joined by Norway in 2012, electricity consumers except in energy-intensive industries facing international competition are obliged to purchase certificates from producers of renewable electricity. Prices of these certificates fell considerably as wind power increasingly became competitive and new capacity was added. The Riksdag decided to discontinue the support for installations coming on-line after 2021 in order to shore up certificate prices for existing installations.

The bonus-malus system, in which vehicles with low carbon dioxide emissions were awarded a premium, while vehicles with high emissions were subject to increased tax, was put in place in 2018(Hassler et al., 2020). Zero-emission vehicles were rewarded by a SEK 50 000 (around USD 4 900) bonus six months after registration, while low-emission vehicles received a lower bonus. The government abolished the bonus for low-emission vehicles effective from 9 November 2022, noting that electric vehicles are already cost- competitive in a life-cycle perspective. The malus is retained, with vehicles emitting more than 75 grammes per kilometre facing a higher annual vehicle tax by SEK 107 per gramme from 75 to 125 grammes, and SEK 132 above 125 gremmes per kilometre.

The main instrument to reach the transport sector emission reduction target, and by consequence the overall 2030 emission reduction target for non-ETS sectors, was until the 2022 election a progressively increasing blending requirement for biofuels. The blending requirement for diesel is set by law to increase from 21% in 2020 to 66% in 2030, and from 4.2% to 28% for gasoline. This was expected to reduce emissions by more than 7 million tonnes of CO2 per year in 2030 (Energimyndigheten, 2022). In 2022 the Riksdag halted the blending requirements at their 2022 levels of 30.5% for diesel and 7.8% for gasoline due to concerns about increasing prices at the pump in the context of the energy crisis and Russia’s illegal war of aggression against Ukraine. The new government coalition pledged to reduce blending “to EU minimum levels”, defined as 6% for both diesel and petrol. Biofuel blending mandates have a number of shortcomings, including their high cost (OECD, 2022c). However, Sweden does not have an alternative plan to reduce emissions by 2030. Unless such a plan is put in place with concrete policies, Sweden is likely to miss its national 2030 target and could potentially miss its 2030 Effort Sharing Commitment to EU partners, as further discussed below.

Subsidy schemes include the “Climate Leap” (“Klimatklivet”), a funding programme for local and regional climate investments administered by the Environmental Protection Agency and County Administrative Boards, established in 2015 and partially funded by the EU Recovery and Resilience Facility. In 2022, the total programme amounted to SEK 2.7 billion. The budget was increased by SEK 400 million from 2023 to speed up the deployment of electric vehicle charging infrastructure. Companies, municipalities, housing associations, County Councils, etc. may apply for funding. The most common projects are within electric vehicle charging, energy conversion, transportation and vehicles. The National Audit Office concluded in 2019 that even though the programme is implemented reasonably effectively, it is not suited to trigger cost-effective emission reductions. Some methodological shortcomings may be rectified, but in the presence of broad pricing measures and extensive reliance on private information from recipients it is difficult to achieve a cost-effective allocation of the aid. The National Audit Office recommended to reserve support for investments to sectors where other measures are weak or where support can be clearly motivated by market imperfections. Furthermore, it recommended to improve work processes and systems, data gathering, and calculation methodology to ensure that support is given to maximise emission reductions per krona of support (National Audit Office, 2019). Considerable work has since been done to make the scheme more efficient and address these weaknesses. The programme is in general well-run, targeted towards market failures and well-funded. Projects are in principle ranked by cost per tonne of CO2 avoided, and support distributed to achieve cost-effective reductions.

The “Industrial Leap” is a subsidy programme aiming to speed up the green industrial transition. It was established in 2018 and is administered by the Swedish Energy Agency. It had a budget of SEK 900 million in 2022, increased to SEK 1.5 billion in 2023, and is partially funded by the EU Recovery and Resilience Facility. The programme supports projects to develop and implement solutions to reduce process emissions, strategically important projects for industrial transition and capture and storage of carbon from biogenic sources. Historically, applications for support from industrial companies have been focused on production of iron and steel, cement, pulp and paper, chemicals, refineries, electricity and heat. Strategically important initiatives such as hydrogen production, battery production for electric cars, recycling facilities for plastics and biorefineries have been eligible for support since 2021, (Energimyndigheten, 2023). The programme seems to be adequately funded. So far, it has successfully supported a number of projects in the research, development and early deployment phases, thereby contributing to a faster and less costly green transition by speeding up technology learning.

In 2015, ahead of the Paris Summit, the government initiated “Fossil free Sweden”, an initiative for systematic government-industry and stakeholder dialogue. The aim of the initiative is to accelerate the green transition by identifying business opportunities from decarbonisation as well as obstacles holding back emission reductions. Fossil Free Sweden produces policy proposals to help companies, industries, municipalities and regions reduce their emissions. It also produces strategies to suggest how overarching issues such as energy efficiency, bioeconomy, hydrogen and finance can be handled by the government. As part of Fossil Free Sweden, 22 industries have produced their own roadmaps for fossil-free competitiveness, including fossil-free steel, cement, transportation and electricity. These roadmaps are followed up with progress reports, taking stock of progress both in industry and in political decisions to address priority actions identified by industry (Fossil free Sweden, 2021). Persson and Bengtsson (2022) found that Fossil Free Sweden has established strong legitimacy among businesses and policymakers, and has contributed to increased ambition, knowledge diffusion and to removing policy obstacles to decarbonisation.

The Riksbank (Sweden’s central bank) and Finansinspektionen (the Financial Supervisory Authority) are working to green the financial system. This is appropriate, as demand for more environmentally friendly investment portfolios combined with insufficient emission reduction policies and lacking climate risk assessment and disclosure has left a vacuum in Sweden and elsewhere. Key tasks are to improve financial sector resilience by better assessing and disclosing risks from climate change and transition risks from a changing policy and investor landscape, and integrating these risks into the supervisory framework. In order to develop, implement and promote best practices to address climate risks to the financial sector, Sweden participates in various international fora including the Basel Committee on Banking Supervision (BCBS), the Network of Central Banks and Supervisors for greening the Financial System (NGFS) and various EU fora. However, the financial sector does not work in isolation; it can only be a facilitator, delivering climate-friendly investment in response to effective policies. A clearer transition policy path would therefore allow the financial sector to better support the green transition (Pareliussen et al., 2022).

Consistent use of shadow pricing of greenhouse gas emissions in public sector investments also has an important role to play in climate policies. The social cost of emissions in infrastructure projects was previously set close to the level of the carbon tax, but was raised from SEK 1 140 per tonne of CO2 to SEK 7 000 per tonne in 2021. This new shadow price was derived from regulations implementing the biofuel blending requirement, seen by the Swedish Transport Administration as the main tool to achieve the transport sector target (Trafikverket, 2021). A shadow price well above the emission pricing faced in the rest of society and well above global estimates of the social cost of emissions is problematic, but it is to an extent internally consistent with the transport sector target, which is discussed further below. In general, there is scope to better integrate climate and sustainable development in Swedish cost-benefit analyses (Crépin et al., 2018). Lessons could be learned from the United Kingdom, where the “Green book” assigns Greenhouse gas emissions values consistent with the UK’s 2050 net zero target. These are used across the government for valuing impacts on GHG emissions resulting from any policy intervention (Pareliussen et al., 2022).

Sweden will need to tighten policy to reach its targets, and there is room to increase consistency of both targets and policies. The main areas of improvement of the target structure are how to align targets with the division of responsibilities between Sweden and the European Union, as well as the differential treatment of the transport sector and negative emissions. Furthermore, the new government has implemented and proposed a number of policy changes expected to contribute to increased emissions, including the reduced biofuel blending requirements in transport, abolishing the bonus for low-emission cars, reversing a climate-friendly reform of tax deductions for commuting expenses, increased tax deductions for in-work travel and lowering the CO2 tax for agricultural machinery further. These policies are expected to increase emissions considerably compared to previous policies and put both the overall 2030 target and the transport sector target in jeopardy unless urgently compensated by alternative policy measures (CPC, 2023).

The policy change with by far the biggest expected impact on emissions until 2030 is the government’s stated intention to reduce the blending requirement of renewable fuels for road traffic “to the EU minimum level” to reduce fuel prices at the pump (CPC, 2022a). The decision to reduce the blending requirement to 6% for both diesel and petrol could increase road transport emissions by several million tonnes per year compared to previous policies. Without alternative measures this would mean that 2030 non-ETS emissions would be well above target. . So far, the government has not presented sufficient new policies to make up for the expected shortfall (CPC, 2023).

The structure of non-ETS emissions implies that much of the emission reductions up until 2030 will need to come from the transport sector, but the separate target for the transport sector goes against a cost-efficient fulfilment of the overall national target and reduces the pressure to come up with policies and solutions in other sectors. Furthermore, as part of its Fit for 55 package the European Union has decided to start a separate emissions trading scheme (EU ETS2) for transport and heating fuels by 2027, and to ban the sale of (non-e-fuel) combustion engine cars by 2035. The proposal for a revised Energy Taxation Directive sets minimum energy tax rates for fuel consumption based on their energy content and environmental performance. The proposal is still under negotiation (OECD, 2023b).

Using biofuels as the primary solution to reduce road traffic emissions has limitations, which have become increasingly clear in the past few years. Biofuels are expensive, at about EUR 500 per tonne of CO2 emitted (OECD, 2022c). They require stringent certification to assess their net effect on greenhouse gas emissions, as greenhouse gases are emitted in their production. Many biofuels compete with food production and put pressure on land use including forests and other natural sinks. On a global scale, biofuels are not the solution for road transport, as supply could not realistically meet demand if the world was to adopt Sweden’s (past) strategy (De Castro et al., 2014).

Even though there are good reasons to reduce Sweden’s reliance on biofuel blending to reach emission reduction targets, it would be a problem for Sweden’s credibility as a reliable partner in reaching the goals of the Paris Agreement and its EU commitments if the 2030 target for national (non-ETS) emissions was missed. Therefore, such a change in policy should be accompanied by a general tightening of climate policy across sectors. However, emissions in most other non-ETS sectors are already quite low except in agriculture. Unlike in most other countries, emissions from heating of buildings are close to zero, as most buildings are either connected to district heating from renewables or heated with electricity. Therefore, large emissions reductions would still need to happen within transportation (Figure 2.5).

2021

1. Emissions from waste, working machines and product use including solvents.

Source: The Swedish Environmental Protection Agency.

Rapid technological development and falling costs increasingly suggest that electric vehicles are the technology for the future of road transport, notably for light-duty vehicles. There are no greenhouse gas emissions from their use, if electricity comes from clean sources. This is an additional argument for revising Sweden’s past policy on biofuel blending. In 2021, 43% of car sales and 6% of the stock were electric in Sweden, well above the European averages of 17% and 2.3%, respectively, though well below market shares in Norway (IEA, 2022a).

Norway’s experience (Box 2.1) illustrates two points with current relevance to Sweden. First, electrification of the vehicle stock will continue almost regardless of national policies due to technological development and increased price competitiveness. Technology development in a highly globalised car manufacturing industry responds to demand in big markets such as the European Union, the United States and China and their policies. The European Union uses fleet-wide performance standards, where car producers need to meet maximum tailpipe emissions, averaged over all cars sold in a given year, to reduce average emissions per car. Such policies have also reduced tailpipe emissions in the United Kingdom and the United States, amongst others (Pareliussen et al., 2022). The second point is that national policy like the Swedish carbon tax and the bonus-malus system may have important roles to play to speed up a transition by incentivising cleaner cars and overcoming households’ credit constraints and myopia.

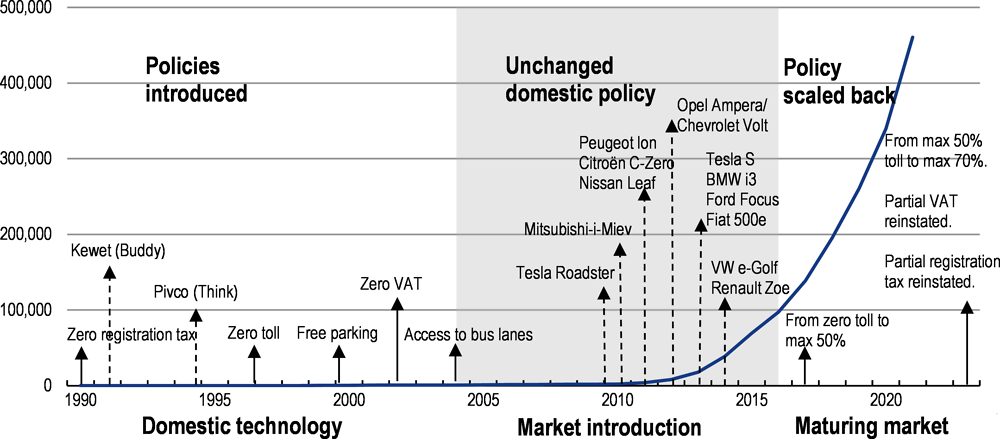

Norway’s experience illustrates the interplay between national policy and global technology development largely outside of the control of a small country. Despite very strong incentives since the 1990s, electric vehicle sales did not take off. The power of incentives already in place only became clear when international car producers started marketing cars with better technical qualities and design (Figure 2.6). This happened for reasons largely outside of Norway’s control, including rapid improvements in battery technology, reduced battery production cost and tailpipe emissions standards in the United States and European Union, amongst others. In 2021, 86% of new cars sold and 25% of the stock in the country were full-electric vehicles, the highest shares in the world (IEA, 2022a).

Registered electric vehicles in Norway, incentives and new models available

Note: New electric vehicle models after 2015 are not included.

Source: Statistics Norway and Norwegian Institute of Transport Economics (2013) updated and developed by authors.

However, the push to encourage households to purchase electric vehicles has come at a cost. The policy has contributed to a sizeable revenue decline from car-related excise duties. This amounts to about 0.1 percentage points of mainland GDP each year. Also, when viewed only in terms of direct CO2 abatement costs, the policy is not very efficient. The tax breaks and the behavioural responses to them imply an abatement cost of EUR 1370 per tonne of CO2 for battery electric cars (as of 2019) and EUR 640 and EUR 200 per tonne for light and heavy-duty commercial vehicles. A recent OECD study estimates the cost of emission reduction through the tax concessions to be around ten times the EU ETS quota price – the cost of emitting a tonne of carbon under Europe’s emissions trading system. As elsewhere, there are valid arguments for EV-subsidy exceeding the abatement cost. The extra subsidy helps the EV market reach critical mass (reducing the need for a subsidy in the long term). Also, EVs reduce some negative externalities from car use such as reduced noise and air pollution, suggesting that subsidies are worthwhile. However, these benefits are hard to measure and it is unknown how far they justify the current scale of Norway’s EV support (D’Archangelo et al., 2022).

The decision to scrap the clean car bonus therefore comes at an unfortunate time, when Sweden needs to strengthen alternative policies to make up for the reduced biofuel blending requirement. Even though electric vehicles have become more cost competitive and zero-emission vehicles made up a third of new cars in Sweden in 2022, a considerable strengthening of policies promoting electric vehicles is likely a necessary part of a policy package to offset increased emissions from the reduced blending requirement. Reinstating a bonus on zero-emission vehicles to overcome households’ myopia and credit constraints is an option to consider, but an untargeted bonus comes with a substantial fiscal cost while disproportionately benefitting households with relatively high incomes. Continued investments in a functional country-wide charging network as planned under Klimatklivet is another important policy to increase convenience and reduce range anxiety for prospective EV owners. Furthermore, Sweden introduced regulations requiring charging infrastructure for all parking slots in new buildings in 2020, as well as requirements to equip a certain percentage of existing parking spots with charging to implement the EU Energy Performance in Buildings directive (Boverket, 2020). These regulations are backed by grants covering up to 50% of the investment cost. Strengthening these regulations further, for example by increasing the mandated percentage of parking spots with charging, could be considered.

The technological pathway towards zero-emission heavy goods vehicles is less clear, but some mix of electric vehicles, technology which would allow vehicles to draw power from the grid while in use (route electrification) and fuel cell electric vehicles is assumed to be capable of eliminating their tailpipe emissions by mid-century. Given these uncertainties, interventions in the short term should seek to support R&D across a range of technologies (Pareliussen et al., 2022). Sweden has a support scheme for the introduction of lorries, buses and non-road mobility, and Swedish companies are at the forefront in electrifying raod transport. The share of electric heavy duty vehicles sold increased from 2.2% in Q1 2022 to 3.9% Q1 2023, while the share of electrification is much higher for buses and light trucks. It is also home to one of the major test sites for the European Commission’s Green Corridors initiative and for other, similar innovative projects. One of the projects dealing with road freight issues is REEL (Regional Electrified Logistics), a national initiative where leading Swedish actors have joined forces to accelerate the transition to electrified, emission-free heavy road transport (REEL, 2023).

Reducing the emission footprint of road transport will to an extent rely on reducing emissions within the current mix of transport modes for freight and passengers, as the required changes needed to the spatial distribution of the population and transport systems to move a substantial proportion of freight and passenger kilometres to sustainable modes will not alone deliver the necessary reductions by 2030. Shifting journeys to more sustainable modes can nonetheless make a valuable contribution. Countries can reduce emissions and improve well-being if they reduce car demand with transformative policies such as road space reallocation, mainstreaming of on-demand shared services and communication efforts (OECD, 2022g).

Speeding up emission reductions from agriculture, waste, f-gases, working machinery and some remaining non-ETS emissions from the production of electricity and heating could help make up for the shortfall left by likely missing the transport sector target. Apart from ETS sectors and transport, the largest emissions are within agriculture. Except some greening of subsidy schemes, agriculture is a sector with notoriously weak climate policy coverage across the OECD. The main support scheme affecting the Swedish agricultural sector is the Common Agricultural Policy (CAP), set at the EU level. Measures under the CAP have not been effective in reducing emissions in agriculture, pointing to inconsistencies between the European Union’s climate and agricultural policies, and only 0.9% of the CAP budget is dedicated to reducing greenhouse gas emissions. Mitigation policies in agriculture involve mainly voluntary measures with a low potential to reduce emissions. Green direct payments for farmers to adopt potentially climate-friendly practices have had a limited impact, with an uptake of environmentally beneficial agriculture observed on only 5% of EU farmland, reflecting low ambition and the fact that green requirements mostly are adapted to established farming practices. Furthermore, payments are not linked to achieving specific environmental outcomes. For example, some schemes support an expansion of organic farming, although the impact of such practices on greenhouse gas emissions is unclear (OECD, 2023b). Sweden’s Rural development programme, which receives funding from various EU sources including the CAP, focuses on restoring, preserving and enhancing ecosystems related to agriculture and forestry (European Commission, 2020). In addition to the CAP, the Climate leap funds climate investments within agriculture, notably anaerobic digestion and biogas production of manure. Emission reductions from these actions are not captured in the statistics due to measuring and methodology shortcomings. Sweden should push for increasingly ambitious policies for future CAP funding, and for making payments conditional on achieving emission reductions. Moreover, it should use the flexibility in implementing the CAP to incentivize emission reduction and sustainable practices in the sector.

Direct emission pricing belongs in a policy package to effectively and efficiently reduce emissions from agriculture, but comes with two main challenges. The base for taxation or inclusion in an ETS is challenging to calculate. Quantity-based measures like the number of livestock or fertilizer use can be measured relatively straightforwardly, but emissions per unit of such measurable input or output vary considerably from farm to farm. These individual variations and reduced emissions from improved agricultural practices are more challenging to measure. Explicit pricing policies are also politically challenging due to carbon leakage concerns, technological difficulties in reducing emissions from agricultural sources, food security concerns and strong agricultural lobby groups (Arvanitopoulos, Garsous and Agnolucci, 2021; D’Archangelo et al., 2022). Some of these concerns, notably regarding carbon leakage, would be less salient if agricultural emissions were priced in an EU-level mechanism.

A hybrid system, in which quantity-based measures are subject to a carbon price, while improved practices, the provision of nature-based services and green R&D are subsidised would likely increase policy efficiency and should be explored, including its compatibility with the CAP. Lessons could be learned from New Zealand, where quantitative measures of agricultural greenhouse gas emissions have been reported at the farm level under the umbrella of the NZ ETS since 2021 and will be included in the NZ ETS or a separate pricing system from 2025 (Box 2.2). If necessary to win political acceptance, such a reform could be fiscally neutral for the sector as a whole, as is the intention in New Zealand (Pareliussen et al., 2022). A subsidy mechanism to incentivise climate-friendly farm-level practices could be designed to also incentivise bottom-up efforts to improve methodologies and measuring, drawing inspiration from project-based offset schemes such as the Kyoto Protocol’s Clean Development Mechanism and Joint Implementation.

Agriculture accounts for 48% of New Zealand’s 79 MtCO2 equivalent gross emissions (2018). Land-use change and forestry is included in the New Zealand Emission Trading Scheme (NZ-ETS). Forest owners are thereby liable for reductions in the carbon stored and credited for carbon uptake in their forests. New Zealand’s forests increased their carbon stock equivalent to reducing gross national emissions by 30% in 2018. Under the NZ-ETS, forests are defined as “post-1989 forest land” or “pre-1990 forest land”. Post-1989 forests may be voluntarily registered into the ETS and are eligible to earn emissions units that represent the carbon sequestered by the forest since the start of each “mandatory emissions return period” (MERP, a multi-year period defined in legislation, the current one is 2023-25), but are also liable to repay units if there is a reduction in carbon stock. As of June 2018, 50% of post-1989 forest land (approximately 325 000 hectares of 690 000 hectares) had been registered in the NZ-ETS. Furthermore, the majority of landowners with exotic forest land defined as “pre-1990 forest land” (approximately 1 440 000 ha) face deforestation liabilities under the NZ-ETS. There are no liabilities or entitlements for business as usual forest harvest and replanting (Pareliussen et al., 2022).

The 2019 Climate Change Response (Emissions Trading Reform) Amendment Bill mandates pricing of agricultural emissions from 2025 and mandatory farm-level reporting obligations of livestock emissions as of 2024. The government and the agricultural sector are now working in He Waka Eke Noa (Primary Sector Climate Action Partnership) towards developing a system for farm-level pricing by 2025. If an alternative pricing system is not implemented by 1 January 2025, the Climate Change Response Act states that agricultural emissions will be priced under NZ-ETS. In October 2022 the government opened a consultation on farm-level pricing of agricultural emissions, two options for pricing synthetic nitrogen fertiliser emissions, an interim processor-level levy as a transitional step if the farm-level levy cannot be implemented by 2025, and recognition for some types of sequestration in an adjacent contractual system from 2025, with a long-term goal of integration of new vegetation categories into the NZ-ETS (Pareliussen et al., 2022).

Successful communication and education campaigns, phased policy implementation, grandfathering and support measures for stakeholders helped garner public acceptance for these policies. In the context of the 2019 Act, the government reformed the emission trading scheme in 2020, implementing several measures to cushion the transition and allow stakeholders to prepare: a five-year transition phase before pricing agricultural emissions; free allocation of 95% of the carbon credits at the farm level; financial incentives for early adopters; increased farm advisory efforts to help the residents decrease their emissions most cost-effectively; and tools for estimating farms’ emissions to help them plan ahead (D’Archangelo et al., 2022).

Up to 8% of Sweden’s 2030 target for the non-ETS sectors and 15% of Sweden’s 2045 net zero commitment (relative to 1990 emissions) may be achieved by so-called “supplementary measures”, which include but are not limited to: increased uptake of carbon dioxide by forests, over and above business as usual; verified emission reductions abroad; and carbon capture and storage from biomass combustion (CPC, 2022b; Government of Sweden, 2017). When evaluating the limitations of supplementary measures, one should keep in mind that greenhouse gas emissions do not respect borders, and that a tonne of CO2 sequestered or stored has the same climate effect as a tonne of carbon not emitted from existing sources. Naturally sequestered carbon may be released back to the atmosphere, but this risk can be handled with for example clearly assigned liability for such events combined with an insurance mechanism. Changes to the structure of the national target with consistent treatment of emission reductions and emission sequestration may be necessary to make up for the shortfall created by abolishing the transport biofuel blending obligation.

The EU ETS already incentivises carbon capture and storage (CCS) from covered entities, in which case the CO2 counts as “not emitted” from its source. Likewise, entities paying the carbon tax have incentives to reduce the tax bill by means of carbon capture and storage. In contrast, emissions from burning biofuels are counted as renewable and emission-free, and thereby neither covered by the ETS nor the carbon tax. Capture and storage of such emissions are therefore not incentivised. Likewise, natural removals are not incentivised. Reducing the intensity of forestry activities could carry additional benefits in terms of biodiversity and would better balance the value of using forests as a carbon sink and as an important source of renewable materials and energy. Lessons can be learned from New Zealand, where forest owners are liable for reductions in the carbon stored and credited for carbon uptake in their forests (Box 2.2). Insurance providers provide coverage for forest owners’ carbon liabilities if the carbon is released back into the atmosphere, for example by fire. The 45Q tax credit in the United States has supported engineered emission removals since 2008. It was expanded and extended with the 2022 Inflation Reduction Act, and now provides up to USD 85 per tonne of CO2 permanently stored (IEA, 2022b). Sweden should consider taxing the release of carbon stored in natural sinks combined with a general tax credit for greenhouse gas removals at the level of the CO2 tax to incentivise such cases and increase policy consistency.

The Swedish Energy Agency has been assigned the role as national CCS centre, and is tasked with following the technical, economic and political development within CCS, and to identify barriers to its implementation. In addition to the Industrial Leap, Sweden plans to perform its first reverse auction for capture, transport and storage of biogenic CO2 in 2023. Likely bidders can be found within the paper and pulp industry as well as biomass combined heat and power plants (Energimyndigheten, 2023). Sweden is also working with Norway to facilitate cross-border transport of CO2 for geological storage in reservoirs under the North Sea, which is regulated by the London Protocol on the prevention of maritime pollution. Norway has favourable geological conditions, and has built up technical and practical expertise in the field since the Sleipner Carbon Capture and Storage project was launched in 1996, incentivised by Norway’s CO2 tax. A reverse auction can be a good way to kick-start carbon capture and storage in Sweden, as early projects will suffer from limited experience and infrastructure, while experience and scale will make subsequent projects less costly.

The geographical location of emissions is irrelevant for the atmosphere. The situation of EU ETS sectors, with the overall emission cap set at the EU level illustrates the benefits of international cooperation very clearly. Also for emissions outside the scope of the EU ETS, engaging in international cooperation and market mechanisms can enhance welfare by reducing emissions where it is less expensive. The Paris Agreement allows offsetting residual emissions or reaching negative emissions by emission reductions abroad. The Swedish government has a programme operated by the Swedish Energy Agency to engage in project-based emissions abroad, investing in around 270 projects under the flexible mechanisms of the Kyoto Protocol since the early 2000s. A global tender for projects under the Paris Agreement’s Article 6 in 2019 received 60 proposals, of which six were chosen for further development (Energimyndigheten, 2023). Reflecting Sweden’s ambition to reduce emissions at home, its surplus allowances, both from its allocation under the Kyoto Protocol and from its flexible mechanisms, have been cancelled until 2019, reducing GHG emissions by approximately 130 million tonnes of CO2 equivalents, more than twice Sweden’s 2019 total emissions (OECD Economic Survey of Sweden, 2021). Sweden provides financial, technological and capacity-building support to developing countries to the amount of more than 0.14% of GNI. Sweden is one of the largest per capita donors in the world to the Green Climate Fund and the Global Environment Facility, the financial mechanisms under the UN Framework Convention on Climate Change, and provides considerable amounts in bilateral support for mitigation and adaptation activities (Ministry of Climate and Enterprise, 2023).

Using the Paris Agreement’s Article 6 more actively to fulfil Sweden’s national targets is an option to consider. Any emission rights transferred under the Paris Agreement will be subtracted from the transferring country’s emission cap (Nationally determined contribution, NDC). This eliminates in principle the concerns of the Kyoto Protocol that over-stating or double-counting project-based emission reductions might increase global emissions. However, such trade should be handled with care to ensure that it does not contribute to higher global emissions. If trading with countries whose NDCs are not in line with the overall ambition of the Paris agreement, the prospect of selling emission rights might discourage them from tightening their targets. Furthermore, such trade depends on trust that trading partners will indeed fulfil their net zero-consistent NDCs, demonstrated by clear plans and timely policy action (Climate Action Tracker, 2021).

Steel production is behind around 11% of Sweden’s greenhouse gas emissions, and 7% of global emissions. Eliminating carbon emissions from steel production is now a reality in Sweden’s north, where HYBRIT’s test facility delivered its first steel in 2021 produced with hydrogen instead of coal, thereby reducing emissions by roughly two tonnes of CO2 per tonne of iron produced. HYBRIT plans to follow up with industrial-scale commercial production from 2026. Competitor H2 Green Steel has already begun construction of its full-scale production facility in nearby Boden, with production scheduled to start in 2025. The facility is set to produce about five million tonnes a year when finished. Green steel, however significant, is only one of several innovative fossil-free developments in Sweden’s north, including fossil-free electricity, fertiliser production, battery production and mining for materials needed in the green transition (Box 2.3). Sweden’s high-emitting industries are relatively concentrated, notably in steel, cement, refineries and chemical industries. These industries have concrete plans to apply technological solutions to eliminate most of their greenhouse gas emissions and continue production in their existing locations. For this reason, the green transition is largely seen as an opportunity for new growth in Sweden, rather than a threat to jobs and competitiveness.

A number of climate-friendly industrial developments and mining projects for materials needed in the green transition are at different stages of planning and implementation in the Norrbotten and Västerbotten regions in the north of Sweden. This box presents a selection of these.

Northvolt’s battery factory in Skellefteå started regular production in 2022 and plans to reach full production volume in 2026.

HYBRIT’s pilot plant for green sponge iron and hydrogen production in Luleå started production in 2021, while its pilot facility for hydrogen storage started operations in 2022.

Talga’s pilot plant for battery anode production in Luleå came online in 2022.

Markbygden wind power project west of Piteå is constructed in stages, with two out of three stages in operation. It is on track to be one of the biggest onshore windfarms in the world.

H2 Green Steel’s industrial-scale fossil free steel mill and hydrogen production facility is under construction with production planned from 2024.

Ground works have started on LKAB’s demonstration plant in Gällivare to produce fossil-free sponge iron and a further two sponge iron plants are in the process of application for necessary permits.

Boliden has started ground works to increase the scale of its copper mining operations in Liikavaara.

Revolt’s battery recycling factory is built in parallel with Northvolt’s battery factory in Skellefteå, with operations to start in 2023.

LKAB is planning a large-scale upgrading of its operations in Kiruna, with among others three green sponge iron plants with planned production to start in the 2030s. The permit application process is delayed.

LKAB is preparing an environmental permit application for the circular industrial park Reemap in Luleå, with plans to extract phosphor and rare earth metals from mining waste. Production at the plant is planned from 2027.

LKAB’s Reemap will also process materials from the by far largest-known deposit of rare earth minerals in Europe found close to its existing mine in Kiruna and announced in early 2023. The rare earth deposit is still at the prospecting stage.

SSAB is in the process of applying for permits to construct so-called mini-mills for steel production in Luleå. These facilities include electric arc furnaces, strand casting and rolling mills.

Copperstone has applied for environmental permission to re-open copper production in the Viscari mine close to Kiruna.

Talga plans to open a graphite mine in Vittangi, with environmental permissions expected in 2023. Graphite is a key ingredient in battery production, and mined graphite has a considerably lower carbon footprint than graphite produced by pyrolysis.

Kaunis Iron is awaiting environmental permission to open two additional open-pit iron mines in Palotieva and Sahavaara.

A 1000 kilometres long hydrogen pipeline between northern Sweden and Finland is under planning by Nordion Energi and Gasgrid Finland, with pre-studies carried out by Luleå University and Rise research institute.

Fertiberia plans a factory for green ammonia and fertiliser production in Luleå. The application process has started, construction is planned from 2024, and production from 2027.

Cinis Fertiliser plans a fertilizer factory in Skellefteå, which is in the process of securing environmental permit approval.

Uniper and Luleå municipality has initiated a pre-study for a hydrogen hub in Luleå.

Source: Framtidsfabriken and Region Norrbotten.

Sweden’s green industrial revolution is not confined to the northern regions of Norrbotten and Västerbotten, although it has its epicentre there. Green investments are happening across the country, with for example projects to implement bio-CCS in Uppsala and Stockholm, plans for carbon capture and storage in Cementa’s cement production on Gotland, Renewcell’s innovative chemical recycling of cotton fabrics in Sundsvall, SSAB’s investment in electric arc furnaces in Oxelösund, Northvolt’s battery factory in Borlänge, an industrial collaboration in the Stenungsund chemical industry cluster to build a production facility for sustainable methanol and Volvo’s factory in Mariestad. The green industry has been incentivised and facilitated by policy and Sweden’s long-term commitment to reduce emissions, industry know-how, government-to-business dialogue, and international trends towards increased demand for climate-friendly products. Furthermore, Swedish companies are among the most climate-conscious in the world. A large share of firms have their own climate targets (Figure 2.7, Panel A) and investments in energy efficiency are high and increasing (Panel B).

The green revolution is first and foremost fuelled by an until recently abundant and reliable supply of clean and reasonably priced electricity from hydropower, nuclear and increasingly wind power. Large-scale climate-friendly industrialisation requires roughly a doubling of Sweden’s electricity supply, and large investments in the grid (Bergman, 2022), storage and plannable electricity generation capacity. Russia’s illegal war of aggression against Ukraine increases the impetus to speed up these investments, but the energy crisis also puts strain on the electricity market structure and institutions. Competing land uses, long planning and permitting processes and municipalities vetoing clean electricity investments in their backyards are all challenges that need to be overcome.

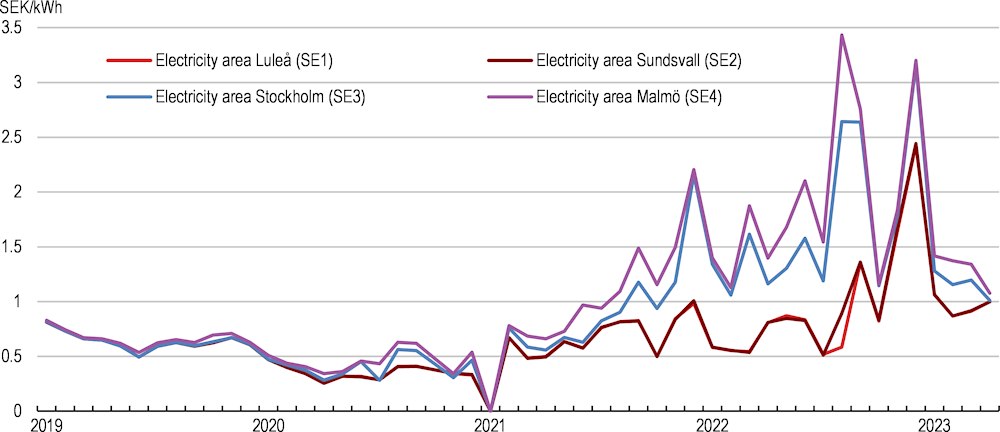

Russia’s war on Ukraine has highlighted energy security risks. It is also a forewarning of potential shortages and instability to come should investments in production, transmission and storage of electricity not keep up with demand from electrification of industry and transport. Sweden’s direct exposure to Russia and Ukraine is relatively low (OECD, 2022b). Only around 2% of energy consumption is natural gas (the lowest in the European Union) and around half of that came from Russia before the war. Dependency on Russian oil was also low (around 8% of imported oil and 6% of biodiesel, came from Russia). It is nonetheless affected indirectly, with high electricity prices in the south (electricity bidding areas Stockholm and Malmö) and large price differences between electricity bidding areas since late 2021 (Figure 2.8) reflecting natural gas shortages in Central Europe, notably Germany (Chapter 1).

1. Prices for variable-rate contracts. Assumed annual consumption of 2,000 kWh.

Source: Statistics Sweden.

The government has responded to soaring electricity bills by introducing a number of support policies (OECD, 2022b), notably in the form of compensation to households and businesses for electricity use and reduced taxes on fuels. Going forward, Sweden should move from broad-based untargeted energy support to targeted interventions that maintain incentives to reduce energy use, while contributing to reducing inflation pressures (see Chapter 1).

Sweden’s electricity market was deregulated in the mid-1990s. Electricity producers sell their production on an exchange to electricity suppliers who supply households and businesses. Some large electricity consumers buy their electricity directly on the exchange or through power purchase agreements with electricity producers. Electricity is traded in the financial market up to ten years ahead of delivery. Spot contracts are traded the day ahead of delivery, and there is an intraday market to adjust volumes. The Transmission System Operator Svenska kraftnät trades electricity in real time to balance the market in the so-called balancing market. Transmission services, the mirror image of the wholesale electricity market, is a natural monopoly and is regulated as such and supervised by the Swedish Energy Market Inspectorate. State-owned Svenska kraftnät is responsible for the national transmission grid and international connections, while a mix of public and private regional and local grid companies have their respective regional and local transmission monopolies (Brännlund et al., 2022).

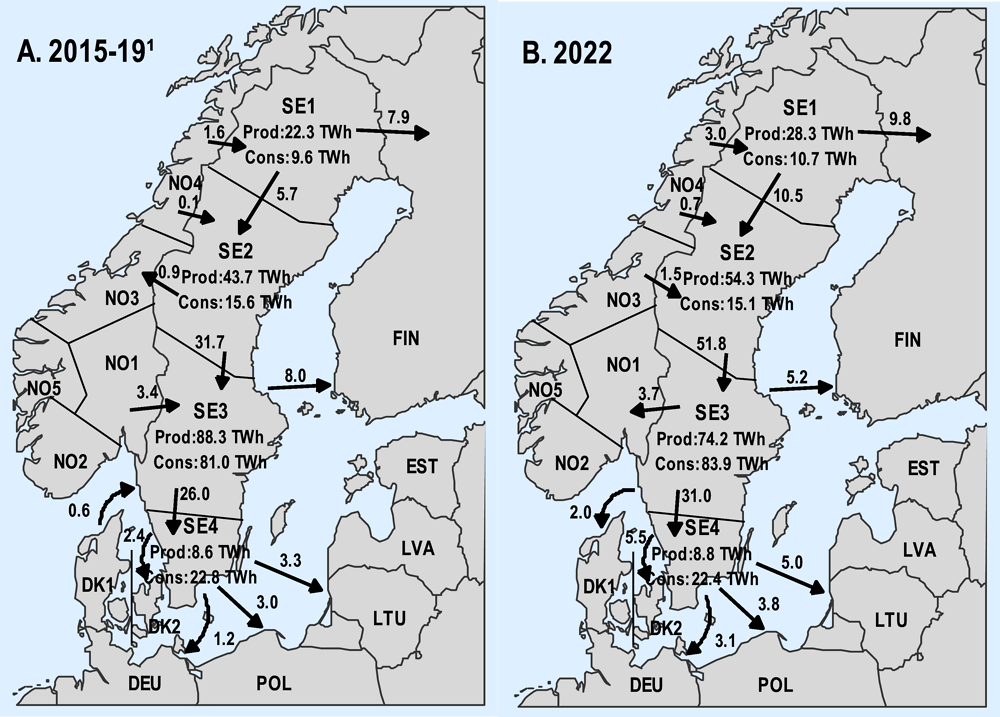

Sweden is part of the Nordic-Baltic integrated electricity market and is also increasingly connected to electricity markets in the rest of Europe. The country is a net exporter of electricity, but depends on interconnections with neighbouring countries for efficiency and security of supply. Electricity is 98% fossil-free, dominated by hydropower and nuclear power (Figure 2.9).

Electricity use and electricity generation by type

In 2011, Sweden was divided into four electricity areas to better reflect scarcity and bottlenecks in transmission capacity in prices and investment decisions in line with OECD best practice. There are considerable geographical variations in the balance of supply and demand. Areas Luleå (SE1) and Sundsvall (SE2) are the two northernmost areas. They are both characterised by surplus production, predominantly from hydropower, and are connected to Norway and Finland. Area Stockholm (SE3), which also encompasses Gothenburg, is dominated by nuclear power, and demand surpasses supply. The area is connected to Norway, Denmark and Finland. Area Malmö (SE4) also has a supply deficit, it is connected to SE2 only indirectly via SE3, but is connected by undersea cables to Denmark, Germany, Poland and Lithuania (Brännlund et al., 2022) (Figure 2.10). Limited transmission capacity between the north and the south has at times resulted in price differences. These differentials reached extremes in 2021 and 2022. In the southernmost energy area, which is importing the bulk of its electricity, prices were set largely in tune with Germany, Denmark and Lithuania, reflecting the marginal cost of producing electricity from natural gas. Prices in the north reflected the variable cost of hydropower and wind power. In late 2022 prices aligned with SE3 and SE4 to reach record levels also in SE1 and SE2 due to a combination of necessary temporary operational adjustments to hydropower output, feeble winds and cold weather.

Total electricity supply and demand per Swedish energy area and net exports between areas

1. The figures next to the arrows indicate net exports of electricity in TWh. Panel A shows the 2015-19 average for electricity production, consumption and net exports. For net exports to Lithuania, the 2017-19 average is shown.

Source: NordPool; Statistics Sweden.

Swedish electricity consumption has been stable for decades. As recently as 2019, a scenario analysis commissioned by Swedenenergy (an organisation for electricity companies) forecasting a 35% increase in demand until 2045 was seen as bold. An updated analysis in 2021, based on investments plans and inputs from industry, shows a potential electricity demand of 240-310 TWh per year in 2045, roughly a doubling compared to current demand of about 140 TWh (Figure 2.11). The largest increase is within industry, where iron, steel, metals and mines are seen to increase electricity demand by 72 to 127 TWh. This is connected to concrete investment plans within green steel production (see Box 2.3), where in particular the production of hydrogen to reduce iron ore to sponge iron, but also electric arc furnaces to turn iron into steel and rolling mills consume large amounts of electricity. Electrification of transportation and chemical industries will also contribute considerably. Most of the increase is expected in northern Sweden’s electricity area SE1, encompassing the regions of Norrbotten and Västerbotten, where most investments within the iron and steel sector are planned. Electricity demand in SE1 is approximately 10 TWh today, but could increase seven- to twelvefold by 2045 to between 75 and 127 TWh if currently planned investments come to fruition. As an example, H2 Green Steel’s Boden facility alone is set to consume around 17 TWh a year, approximately three-quarters of average annual electricity production in SE1 from 2015-2019. Installed capacity may not need to increase commensurately, as industrial users could add demand flexibility, notably by producing hydrogen when electricity is abundant and cheap, while halting production or even using stored hydrogen to produce electricity at times of peak demand or low supply from weather-dependent sources (Gode et al., 2021). Even so, a near-doubling of installed capacity could be necessary.

There are considerable risks connected to Sweden’s drive for fossil-free steel production. A social cost-benefit analysis by Johansson and Kriström (2022) indicates that the net benefit of HYBRIT’s pilot facility is negative if it either replaces EU steel production on the margin and therefore reduces scarcity of emission permits in the EU ETS, or if its high electricity consumption increases electricity prices. These concerns need to be taken seriously, also as HYBRIT is owned by a consortium of state-owned companies, and has received considerable funding through the Industrial Leap. H2 Green Steel’s facility in Boden was initially developed with minimal public support, but applied for funding in early 2023, arguing that subsidies are necessary to level the playing field with its competitors. Norwegian company Blastr Green Steel, which is considering fossil free steel production in Ingå, 60 kilometers west of Helsinki in Finland. These developments illustrate that HYBRIT’s initial deployment of a new clean technology can have repercussions for the entire industry in the longer term. In this case, the argument that these developments on the margin only reshuffle demand for emission permits in the EU ETS is weakened considerably. There is however a technology risk, as potentially more cost-effective technologies such as closed-loop carbon recycling mature (Kildahl et al., 2023). There is also a clear risk that large investments in electricity-intensive fossil-free steel production will be unprofitable unless electricity production and transmission capacity develop at a similar pace as industry.

Hydropower, which represents a considerable share of supply and plays an important role to balance supply and demand, is largely seen as fully exploited in Sweden due to concerns about its effect on nature and wildlife (Bergman, 2022), but there is some scope for upgrading existing facilities and increased precipitation due to climate change is expected to increase output by 15-20%. Solar power is technically ill-suited for production in the far north due to a lack of sunlight in high-demand winter months, but has been expanding rapidly from a low base in the south. Substantial wind power developments since the early 2000s have increased its share in production from near-zero to 17% in 2020, and its share of installed capacity to 24% of the total. Closure of reactors in southern Sweden have reduced nuclear’s share of installed capacity from 53% in 2000 to 40% in 2020, and its share of production from 39% to 29% over the same period.

The new government has pledged its support to new nuclear capacity, marking a turn in policy from previous governments that have restricted new nuclear power through tax policy and regulation. In January 2023, the government issued a proposal to lift restrictions in the Environmental Code limiting the number of reactors on Swedish soil to 10 and their placement to the three existing nuclear generation sites (Government of Sweden, 2023).

Nuclear power is a zero-emissions source of electricity, disregarding some emissions connected to the extraction and transport of fuels, but faces commercial and safety challenges. The European Commission has in its taxonomy labelled nuclear power as sustainable, and OECD countries including the United Kingdom, France and Korea are increasingly seeing nuclear power as part of a low-carbon electricity generation mix. Others, notably Germany, are phasing it out. Sweden’s approach to nuclear energy should be pragmatic, handling issues of profitability and financial risk sharing as well as nuclear safety and waste concerns responsibly and taking the full range of associated costs and benefits into account (Pareliussen et al., 2022).

Concerns have been raised about the profitability of nuclear power compared to renewable alternatives when the risk of delays and cost overruns as well as life-time social costs of decommission and the risk of accidents are taken duly into account. On the other hand, nuclear is a good low-carbon complement to intermittent supply from wind and solar power (Pareliussen et al., 2022). A global push to develop so-called small modular reactors can potentially overcome commercial hurdles by lowering the initial investment and streamlining their construction, but these reactors have yet to come to the market. The commercial case for new reactors in Sweden without government support or guarantees therefore seems weak for the moment.

Sweden is the second country in the world after Finland to designate a permanent disposal facility for used nuclear fuels. Following a thorough review- and permitting process that started as early as 2011, plans by the Swedish Nuclear Fuel and Waste Management Company for permanent storage of nuclear waste were approved by the government in 2022. The system consists of a plant for interim storage and encapsulation of spent nuclear fuel in Oskarshamn Municipality and a final repository for nuclear waste at Forsmark in Östhammar Municipality. The used fuels will be buried in the bedrock 500 meters underground, encapsulated in copper canisters and Bentonite clay (Government of Sweden, 2022).

There is great potential for further wind power development in Sweden, offshore and on-shore, but wind power faces political barriers motivated by NIMBY-ism, conflicting land claims and technical-commercial barriers due to its weather-dependent nature. The example of Gotland is telling, where habitat protection, territorial defence and owners of expensive holiday homes have conflicting interests, while transmission capacity with the mainland is limited (OECD, 2022e). The United Kingdom’s Contract for Difference Scheme is an example of how some of these hurdles can be overcome (Box 2.4). The combination of plannable hydropower and baseload nuclear power ensured a high level of security of supply and stable prices in Sweden in the past, while an increasing share of wind and solar power makes supply dependent on the weather (Bergman, 2022).

Wind power investments in Sweden have increased dramatically in the past few years and have so far been dominated by land-based turbines. The Swedish Energy Agency and the Swedish Environment Protection Agency published a wind power strategy in 2021 with a goal of 100 GWh of electricity produced by wind power by 2040, based on an assumption of 180 GWH of total electricity demand (Swedish Energy Agency and Swedish Environomental Protection Agency, 2021). Considerable plans for further investments exist, with an estimated doubling of on-shore wind power production from 27 GWh in 2021 to 50 GWh in 2024 expected from wind projects already in the pipeline based on previously given permits.

Renewables are characterised by high capital costs and low marginal costs. Price uncertainty over the lifetime of a new plant is therefore a significant barrier for investment in high capital-cost technologies. Wind conditions tend to be similar over vast areas, which leads to depressed prices when it is windy and concerns about security of supply when the wind does not blow. This gives ground to “cannibalisation” where the profitability of wind power falls the larger its share of installed capacity.

The United Kingdom’s Contract for difference (CfD) scheme is an example of how these hurdles can be overcome. It complements pricing by awarding a 15-year fixed price for new renewable electricity generation in competitive auctions. It is a well-designed subsidy, as it encourages competition and minimises the fiscal cost of reaching policy goals through its auction design. Indeed, in recent auctions the strike price for allocations to established technologies has been below the market-derived reference price, which means that instead of receiving a top-up, successful bidders are likely to pay the government-owned Low Carbon Contracts Company.

As part of CfD, the United Kingdom holds separate auctions for less established technologies. This is a way to scale up solutions for the future and could inspire competitive subsidy designs also in other sectors, provided policy objectives are clear and outputs are measurable. However, sector- or technology-specific auctions face a dilemma: grouping technologies together risks crowding out technologies at a current cost disadvantage but high future potential, while more narrowly targeted auctions may waste resources by picking unviable technologies and reducing competition.

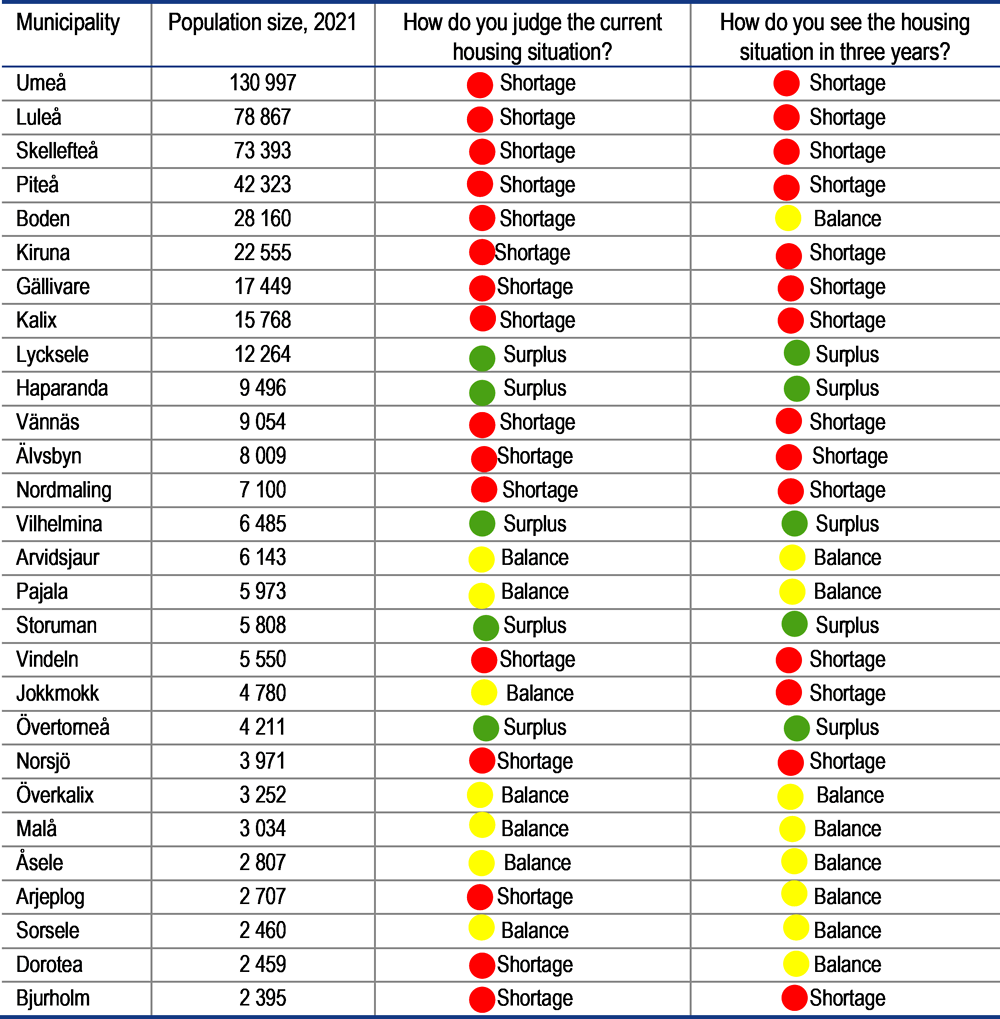

Source: OECD Economic Surveys: United Kingdom 2022.