Small and medium-sized enterprises (SMEs) need to transform and innovate, and their participation in global and local knowledge and innovation networks is essential to leapfrog. This chapter aims to provide a forward-looking view on how SME networks may evolve in the current global context, how governments can support small businesses to participate in different networks to source the strategic assets they need, and where further policy attention could be placed. The chapter first explores the notion of networks and their impact on SME innovation, resilience and growth. It then looks at structural and emerging trends across different types of SME knowledge and innovation networks, including strategic partnerships and clusters, highlighting disruptions of increasing magnitude that these networks have experienced in recent years. The last section presents an overview of key policy orientations in the field, based on an experimental mapping of 601 national policies and 150 institutions in support of SME network expansion across the OECD.

OECD SME and Entrepreneurship Outlook 2023

5. Knowledge and innovation networks for SMEs and start-ups

Abstract

In Brief

Small- and medium-sized enterprises (SMEs) need to transform and innovate, and their participation in global and local knowledge and innovation networks is essential to leapfrog. Recent years have seen network disruptions of increasing magnitude and SMEs’ capacity to be reliable and resilient nodes in these emerging networks is critical, both for SMEs and networks.

Clusters are increasing SME connections. Cluster management organisations play important roles in building groups of SMEs and start-ups in related sectors and activities and developing networking among them and with large firms and research organisations.

For a few high-performing SMEs, dynamic venture capital (VC) markets provide networking opportunities, although there are recent signs of inflexion and integration in disruptive research and development (R&D) networks has intensified. The global R&D system has shown extraordinary resilience during the recent downturn, as actors, small and large alike, aimed to preserve their research capacities. SMEs in these increasingly interconnected and globalised networks are more R&D-intensive and conduct more risky and disruptive research.

Open innovation and partnership continue to spread, bringing a broader population of SMEs into innovation, digitalisation and related networks. Universities and public research institutions (PRIs) play a key role in technology transfer. The providers of knowledge-intensive business services (KIBS) increasingly act as co-producers of innovation for SMEs lacking internal capacities.

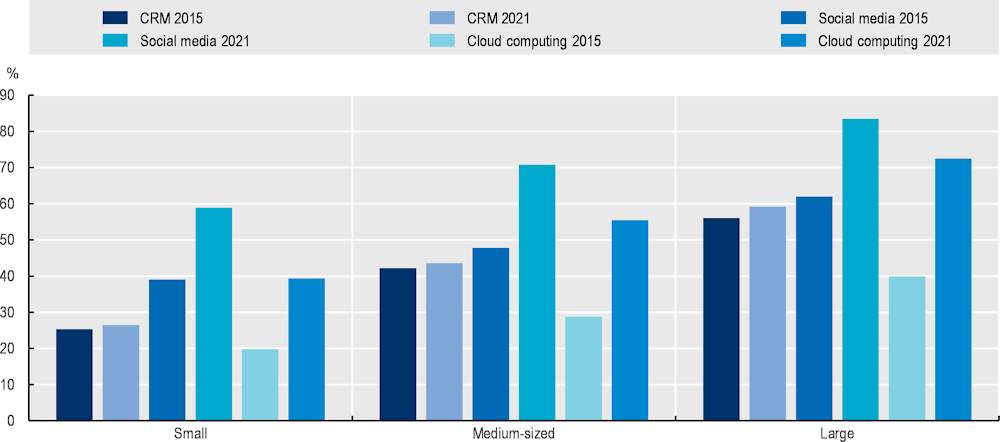

Digital platforms are increasingly used by small firms to access and drive innovation. The smallest gaps between small and large enterprises in sourcing knowledge relate to the use of digital platforms (e.g. social media, open source software, open business-to-business [B2B] platforms).

SMEs have seen a massive migration to cloud and platform technologies. In 2021, the use of social media had become mainstream, with adoption by 59% of small and 70% of medium-sized firms (83% for large firms). The share of SMEs purchasing cloud computing services has doubled in less than six years. This acceleration reflects the increasing value of data for business intelligence and firms moving to the cloud not only for technology upgrading but also, increasingly, for sourcing and instilling business innovation.

However, despite progress, SME integration into knowledge and innovation networks remains uneven and fragile. There is a growing risk of exclusion for those that do not perform R&D, do not access professional networks or equity finance, or do not use platform technologies. Most SMEs lag in R&D and in accessing VC, and large digital gaps remain, in particular with respect to capacities to react to increasing risks of cyberattacks.

Rising cybersecurity risks have made exposure and risk management capacity key factors in partnership decisions. The preparedness of SMEs to respond to data breaches remains low, turning them into potential gateways to infiltrate broader networks. The growing number of digital incidents in KIBS is particularly alarming, because of their role in bridging specialised knowledge gaps of SMEs. There is an urgent need to secure cloud connections, software supply chains and customer networks.

There are also signs that breaches in advanced innovation networks could enlarge. The global R&D system is organised into regionalised and specialised blocks, reducing SMEs’ chances to evolve across different networks, or to differentiate. The concentration of activities, investments and interests could increase territorial and industrial inequalities, innovation capacity and benefits accumulating in a few firms, sectors and places.

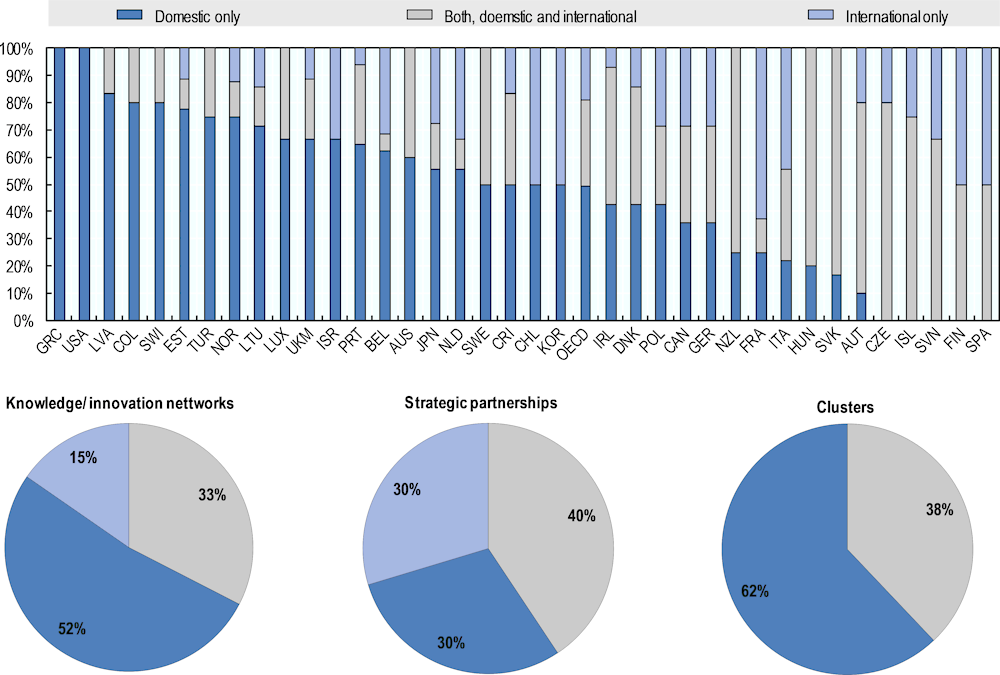

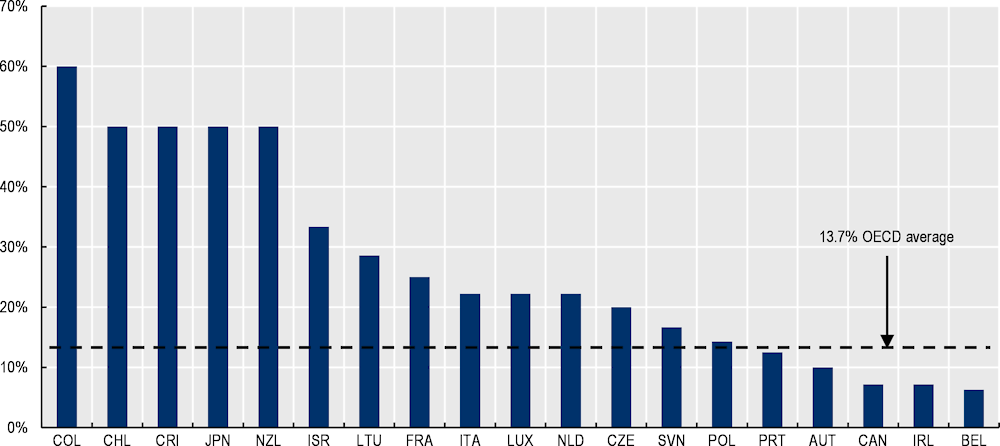

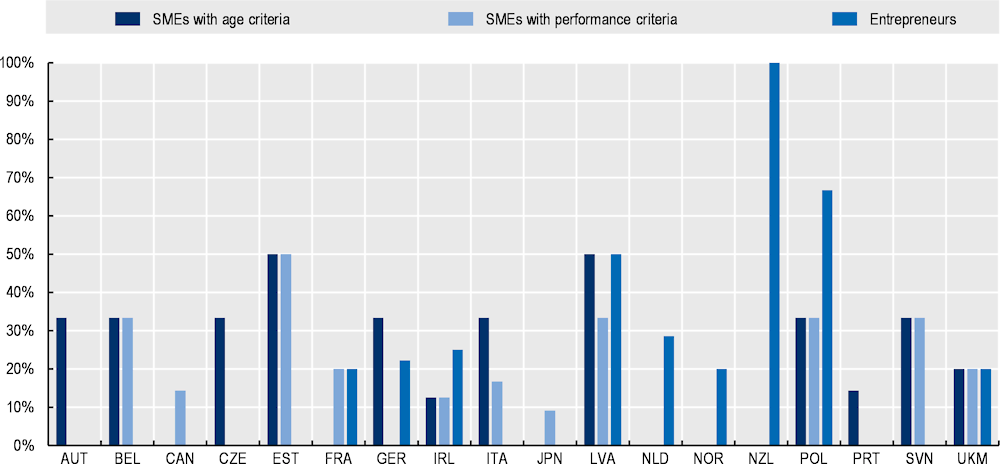

Governments deploy a broad range of measures – some targeted directly at specific actors, others more generic – to support SME integration into (global) knowledge and innovation networks. Indeed, about one-third of policies aim at connecting SMEs to those networks. Moreover, the current distribution of public efforts highlights a preference for more “traditional” innovation channels, notably contractual or collaborative R&D, thus suggesting a possible misalignment with the “innovation reality” that many SMEs face, as most of them tend to rely on other mechanisms – notably KIBS – to carry out innovation activities.

Innovation-related network policies also display a strong international orientation, with about half aiming to strengthen SME connections to international innovation partners. At the same time, less than 15% of policies across the OECD leverage digital platforms to expand SME innovation networks, pointing to significant untapped potential. In addition, efforts to connect the potentially most promising firm populations – e.g. start-ups or high-potential SMEs – to innovation networks are spread unevenly and do not feature in the policy mix of all countries.

Introduction and background

To build back better after COVID-19, restore productivity and economic growth, and move towards more sustainability and resilience, SMEs need to transform and innovate. Through their networks, they can overcome size-related barriers to accessing knowledge, technology, data and skills, finding new business partners, diversifying markets and sources of finance, and capturing knowledge spillovers. Networks enable them to create external economies of scale through process optimisation and more cost-efficient sourcing and knowledge creation. Networks are therefore strategic assets for smaller businesses to achieve greater innovation, resilience and growth (OECD, 2019[1]; 2022[2]) (see Chapter 2).

In a global environment where actors are increasingly interconnected and interdependent, it is critical that SMEs gain adaptative capacity and operate as reliable and resilient nodes in changing networks. This is critical for SMEs, networks and all actors in those networks. The massive disruptions that hit global business and knowledge networks during the COVID-19 crisis and following Russia’s war of aggression against Ukraine, as well as the growing frequency and magnitude of the other shocks, e.g. natural disasters and cyberattacks, call for a better understanding of the risks, challenges and opportunities presented by networks for SMEs and in particular their possible impact on SME transformations.

Networks for SMEs, described here as SME networks, can take different forms and are not limited to buyer-supplier relationships. While Chapter 3 of this report discusses the reconfiguration of global production networks and their ability to generate innovation and knowledge spillovers, this chapter looks more closely at networks that are often leveraged on, by design, to drive or foster innovation spillovers, including strategic partnerships and clusters, and their policy implications. Knowledge and innovation networks connect SMEs with actors of global, national and regional innovation systems through collaborative R&D, open innovation and technology transfer. KIBS and digital platforms and technologies (such as cloud computing) are instrumental in connecting SMEs to these knowledge and innovation networks. Strategic partnerships link SMEs with business partners through contractual agreements, joint ventures, consortia, etc., often for innovation or commercialisation purposes. Clusters operate as networks of networks, with strong specialisation and spatial concentration features (see Chapter 2 for more detailed definitions).

This chapter aims to provide a forward-looking view on how SME networks may evolve in the current global context, how governments can support smaller businesses to participate in networks to source the strategic assets they need and where further policy attention could be placed. The first section briefly explores the notion of networks and their impact on SME innovation, resilience and growth, based on a literature review and joint EC/OECD work on network expansion for helping SMEs scale up (OECD, 2023[3]) (see also Chapter 2). The second section looks at structural and emerging trends in SME knowledge networks, focusing on innovation networks, strategic partnerships and clusters, combining empirical, survey and case study evidence. The last section presents an overview of key policy orientations in the field, based on an experimental mapping of 601 national policies and 150 institutions in support of SME network expansion across the OECD.

Issue: The importance of knowledge and innovation networks for SMEs and start-ups

Accessing knowledge networks is critical for SMEs to innovate and transform. Firms seldom innovate in isolation and networks of innovation involving multiple actors are the rule rather than the exception (DeBresson, 1996[4]). Collaborative firms, even smaller ones, tend to be more innovative than non-collaborative ones, even larger firms (see Chapter 2) (OECD, 2004[5]; Eurostat, 2022[6]). This is because innovation results from the accumulation of increasingly specialised knowledge and knowledge-based capital that calls for co‑operating and opening innovation to gain efficiency and reduce time to market (Chesbrough, 2003[7]). Indeed, networks are increasingly seen as an innovation asset (Corrado et al., 2005[8]; OECD/Eurostat, 2018[9]).

The shift towards “open innovation” has considerably reduced the investments needed to access innovation assets, making the innovation endeavour more accessible to SMEs (OECD, 2010[10]; 2019[1]). Firms source knowledge from outside, including from their customers, investors and suppliers, as well as from internal resources (Kratzer, Meissner and Roud, 2017[11]). Strong networks are, for instance, fundamental for driving business development and innovation in the cultural and creative sectors (CCS) (i.e. design, music, dance, videogames, architecture, advertising and museums), where the majority of firms are micro firms (Box 5.1). The importance of networks and collaboration is indeed often considered a defining characteristic of this sector (Potts et al., 2008[12]).

Box 5.1. Innovation networks in cultural and creative sectors and effects on the wider economy

Strong networks are fundamental for driving business development and innovation in the CCS. Firms in CCS are smaller than in the rest of the economy, with a higher proportion of micro enterprises (96.1% vs. 88.9%). They rely more on freelance workers and engage more in project-based, temporary forms of organisation and work. Workers there are more than twice as likely to be self-employed (29% vs. 14%) and are also more likely to have multiple jobs (7% vs. 5%).

Networking and collaboration take place between firms in the same CCS subsector, between firms in different CCS, as well as with other sectors of the economy. CCS firms tend to “cluster” in particular locations (Casadei et al., 2023[13]) to enable stronger horizontal and vertical linkages and share resources and capabilities. The labour pool is particularly important, considering the heavy use of freelance workers, who tend to move between different CCS sectors and non-CCS companies and work on different projects at different times. As such, freelancers can be thought of as the bees who help to cross-pollinate ideas between firms within a cluster.

CCS businesses tend also to rely more on intangible assets and have less formal R&D structures, meaning that they can struggle more to access finance and grow.

CCS have important spillovers to other economic activities, through the diffusion of ideas, skills and knowledge developed in the CCS.

CCS employment accounts for around 1 in 25 jobs on average in the OECD area and as many as 1 in 10 in some major cities. Yet around 40% of CCS employment can be found outside of CCS (e.g. industrial designers working in the automotive industry), highlighting their pervasive importance throughout the economy.

Moreover, CCS businesses are highly innovative and contribute directly to innovation in other sectors through collaboration, interdisciplinary research projects and “soft innovation” across supply chains (i.e. innovations which are primarily aesthetic). The previous decade saw a surge in interdisciplinary projects and business models, with CCS businesses feeding into health, education and high-technology sectors.

Source: OECD (2022[14]), The Culture Fix: Creative People, Places and Industries, https://doi.org/10.1787/991bb520-en.

Networks can enable leapfrogs, to compensate for limited internal capacities (Hilmersson and Hilmersson, 2021[15]). For example, networks, linking SMEs among themselves, SMEs with small and large players of the digital industry, or with public actors (e.g. through accelerators, digital innovation hubs, etc.), can be efficient channels for the digital transformation of SMEs (OECD, 2021[16]) and were extensively mobilised or reinforced during the COVID-19 pandemic to help SMEs move online quicker (OECD, 2021[17]).

Networks can be a source of resilience. Indeed, networks that have a certain degree of redundancy and diversification in their linkages, enable flexibility to cope with uncertainty and reduce interdependencies, and promote a risk management culture are more likely to avoid disruptions (anticipation), reduce the costs of the shocks (mitigation) and bounce back faster after (adaptation) (Brende and Sternfels, 2022[18]; OECD, 2004[5]; 2023[19])(see also Chapter 2 and Chapter 4 for production networks). Knowledge networks in particular channel skills, data, technology and finance contribute to SME agility, reactivity and innovation.

Knowledge and innovation networks are also key to the digital and green transition of SMEs. They support the creation and wide diffusion of digital solutions and green and eco-tech innovation (WTO, 2021[20]; OECD, 2021[16]).

However, despite the benefits of network integration, smaller businesses have a more limited number of business partners, suppliers and customers and are less likely to co‑operate on R&D and innovation activities with external partners (OECD/Eurostat, 2018[9]). Moreover, despite considerable progress in recent years, they continue to lag behind larger firms in the use of digital platforms and digital tools that could support networking (OECD, 2019[1]; 2021[16]; 2023[19]). In addition, SMEs have more limited capacities to take advantage of their integration. In fact, a key challenge for SMEs is to identify and connect to appropriate knowledge partners and networks and to develop the necessary skills and management practices for co-ordinating and integrating external knowledge in in-house practices and innovation processes (OECD, 2015[21]; 2004[5]).

SME integration into knowledge and innovation networks will increasingly depend on their ability to comply with evolving sustainability standards and other regulatory requirements such as environmental, social and governance (ESG) criteria and responsible business conduct (RBC) requirements.

SMEs amidst shifting innovation networks: Structural and emerging trends

Even before the COVID-19 pandemic, SME networks were continuously adapting to transformations in the global economy, transformations driven by technological change, shifting patterns of trade, the rise of open innovation, geopolitics and the imperatives of achieving climate neutrality. The same networks have also adapted to systemic shocks, e.g. economic crises, cyberattacks, natural disasters, etc. There are various examples of innovation and production networks mutating in search of greater resilience and efficiency across places and industries (Box 5.2).

The COVID-19 pandemic and, more recently, Russia’s war of aggression against Ukraine have created new conditions for firms, large and small alike, to reassess their networks in virtually all stages of their business – from the development of new technologies, or innovation, to their production and commercialisation. SME preparedness and capacity to be reliable, innovative and resilient nodes in these emerging networks is critical, for the SMEs, the networks and the global economy.

The next section discusses structural and emerging trends that may affect SME innovation networks, partnerships and clusters. Shifts in production networks and global value chains (GVCs) are explored in more detail in Chapter 3. In the absence of timely and comprehensive data, or data at all, the analysis presents complementary empirical, survey and case study evidence to understand the magnitude and direction of these changes and explore their possible impact on SMEs and SME policies.

Box 5.2. How networks transform for greater efficiency and resilience: Selected examples

The city of Pittsburgh (US): From steel city to “Roboburgh”

To adapt to technological and market changes, beginning in the mid- to late-20th century, Pittsburgh’s economy has transformed from a declining steel industry that used to benefit from proximity to regional coal reserves to a hotbed for robotics and artificial intelligence. Success factors included a wide network of small suppliers and enterprises with expertise in engineering and manufacturing robot components and software, the presence of large multinationals with operations, research offices and investments locally, a dense network of incubators, accelerators and technology transfer offices, co‑operation with a world-class university in computer science and an ecosystem of multidisciplinary colleges and universities.

Fukushima (Japan): Rebuilding after the triple disaster

To rebuild the area of Fukushima after the devastating earthquake, tsunami and nuclear meltdown in 2011, local SMEs, governments, research institutions, universities, schools and communities and the Tokyo Electric Power Company have deployed collective efforts to create a new cluster around the decommissioning industry (and the dismantling of the Daiichi Nuclear Power Station). Action includes developing local SME capacity for creating local supply chains, engaging them in world-class technology developments with universities and research institutions, and diversifying the local economy.

Brainport (Netherlands): Opening innovation

To recover after the departure of Philips corporation, the largest local employer and a dominant firm in Eindhoven (the largest city of Zuid-Nederland), more dynamic and open approaches to innovation were adopted, with the establishment of a knowledge campus and the creation of spinoffs from existing activities. The strengthening of the “knowledge triangle” was exemplified by new governance arrangements bringing together the mayor of Eindhoven, the president of the Eindhoven University of Technology, and the president of the chamber of commerce in order to combine efforts of the three sectors and mobilise stakeholders in the fields of health, mobility, energy and food high technology (tech).

Cybersecurity Tech Accord: Building safer online communities through collaboration

During a period of escalating cyberattacks (e.g. WannaCry and NotPetya) that significantly disrupted business operations worldwide, a group of leading tech companies developed and signed the Cybersecurity Tech Accord (April 2018) with the aim of empowering users, customers and developers to strengthen cybersecurity protection. A key principle of the accord was to create partnerships between companies and like-minded groups to enhance collective cybersecurity. As of 2023, the accord has been signed by over 150 companies from all over the world (Dobrygowski, 2019[22]).

Source: OECD (2022[23]), “From recovery to resilience: Designing a sustainable future for Fukushima”, https://doi.org/10.1787/e40cbab1-en; OECD (2019[24]), Second Japan/OECD Policy Dialogue Decommissioning Industry Cluster Development, OECD, Paris; Dobrygowski, D. (2019[22]), “Why companies are forming cybersecurity alliances”, https://hbr.org/2019/09/why-companies-are-forming-cybersecurity-alliances.

Clusters are increasing SME connections

Clusters play an important role in supporting the network expansion and integration of SMEs in support of their innovation development. Clusters tend to be seen as local concentrations of interconnected firms and organisations in a related field, such as a key industry for a regional economy but there is an increasing focus on embedding the players in regional clusters in broader national and international networks, and in promoting the diversification of clusters into higher-value-added activities (see OECD (2021[25])). Entrepreneurship and innovation policies may support multiple clusters in a region, if the region has a sufficiently diversified and specialised economy, and there are large numbers of local clusters in the world. For example, the European Union (EU) Cluster Collaboration Platform (ECCP) includes over 1 500 clusters across more than 200 EU-27 regions, accounting for 25% of total EU employment, with SMEs accounting for 75% of their members (ECCP, 2022[26]).

There has been an increase in the number of formal cluster organisations created in recent years. The number of formal cluster organisations participating in the ECCP almost doubled across Europe in the period 2010-22, growing to 541 cluster associations in total. More than 70% of these organisations are concentrated in 3 sectors: digital, environmental and logistic services, though there has been a more recent increase in the number of clusters focusing on biopharmaceuticals and medical services (ECCP, 2022[26]). At a more disaggregated industry level, around 40% of clusters (with industry information available) are linked to the manufacturing sector.

Clusters are a key channel for promoting knowledge flows. SMEs in clusters benefit from access to knowledge from other firms and organisations with related activities within the cluster, such as universities and research organisations, specialised suppliers, sophisticated customers and trade bodies. SMEs will often increase their innovation capabilities by attracting skilled labour from other firms or institutions in a cluster and by undertaking R&D and other innovation collaborations with other firms and universities in the cluster. Cluster policies support these knowledge flows by brokering and incentivising local and global knowledge networks. Of particular importance is connecting SMEs and start-ups with research organisations and universities to exploit knowledge generated by research. Cluster policy often includes support for cluster management organisations, which are formal organisations with cluster management agents who play the role of account managers who work with specific firms and research organisations to their development needs and collaboration opportunities. Cluster management organisations are most effective when they have relatively long-term and free funding to provide relevant budgets for joint research and skills development projects and offer start-up support in their clusters, as well as operational support for brokerage.

A key development area for cluster policies is to generate stronger global connections across cluster members, as evidenced by efforts to “internationalise” clusters. The European Union and United States signed in 2015 a co‑operation arrangement to facilitate transatlantic linkages between clusters in both regions and help SMEs find strategic partners. More recently, the European Union launched 30 joint cluster initiatives (Euroclusters), with more than 170 European cluster organisations from 22 different EU member states and including all 14 industrial ecosystems identified for the EU industrial policy. The ClusterXchange pilot programme also exemplifies how the EU aims to promote transnational co‑operation, peer learning, networking and innovation uptake between actors of industrial clusters located in different countries (ECCP, 2023[27]). These cross-border exchanges aim to identify growth opportunities and strengthen connections between industrial ecosystems.

Cluster policies are also increasingly aiming at actions to help transition clusters towards higher-value activities by creating linkages across industries. Cluster policies are increasingly seeking to create new industry path development opportunities through related and unrelated diversification, i.e. either diversifying the cluster into a new related industry building on competencies and knowledge of existing industries in the region, or diversifying into a new industry based on unrelated knowledge combinations. Cluster management organisations can build this type of diversification by creating connections among firms and research organisations across industry boundaries. For example, policy is seeking to generate a high-value functional food cluster in Chiang Mai and Chiang Rai in northern Thailand by connecting advanced applied research undertaken in national research laboratories and universities to start-ups and existing SMEs with innovation capabilities through innovation and entrepreneurship projects supported by Northern Science Park (OECD, 2021[25]). Similarly, cluster actors in Cambridgeshire are supporting the diversification of engineering firms in medical devices to nuclear containers by supporting interactions with researchers and customers with these related knowledge and competencies (OECD, 2021[28]).1 A key tool for success involves cluster management organisations supporting networking across the boundaries of sectors as well as building links across different cluster management organisations, including collaborations on joint visions as well as specific innovation initiatives.

Clusters are also changing to respond to the imperatives of the twin transition, often driven by public action. If policy makers continue to view clusters as catalysts for entrepreneurship and innovation, their priorities are shifting, from promoting the creation and strengthening of existing clusters to enabling them to adapt to the requirements of digitalisation and Industry 4.0, the transitioning to a circular economy and the need for reducing carbon emissions (Kuberska and Mackiewicz, 2022[29]).

At the national level, some countries have aimed to consolidate their clusters into superclusters to drive innovation in strategic areas and broad industrial ecosystems, e.g. Denmark has opted to channel public support to fewer but stronger clusters, following the model of the Canadian super clusters (OECD, 2022[30]). The expectation is to reach a world-class level and capacity more effectively than what smaller, specialised clusters can achieve (Denmark Cluster Excellence, 2022[31]).

For a few high-performing SMEs, dynamic VC markets provide strong network spillovers

Although most SMEs do not or are unable to tap into VC, VC firms and investors are key strategic partners for promising start-ups. Beyond financing, venture capitalists, business angels and VC funds help the firm develop a strategy and provide managerial advisory and network connections in exchange for shared ownership of the business (Gompers and Lerner, 2001[32]). Mentoring, business advice and access to networks offered with equity finance improve the success rate of start-ups and SMEs while providing them with resources to better adapt to new business conditions and changes in consumer behaviour (OECD, 2022[33]). More generally, VC markets provide opportunities for SMEs to network with a broader innovative ecosystem. In the business angel market, for instance, public action has largely focused on improving information flows and networking opportunities between financiers and entrepreneurs (OECD, 2015[34]). Although only a small share of SMEs across OECD countries are supported by equity means, the analysis of VC investments and firms provides a glimpse of how business applications of disruptive technologies are being financed and the role of strategic partners in start-up growth.2

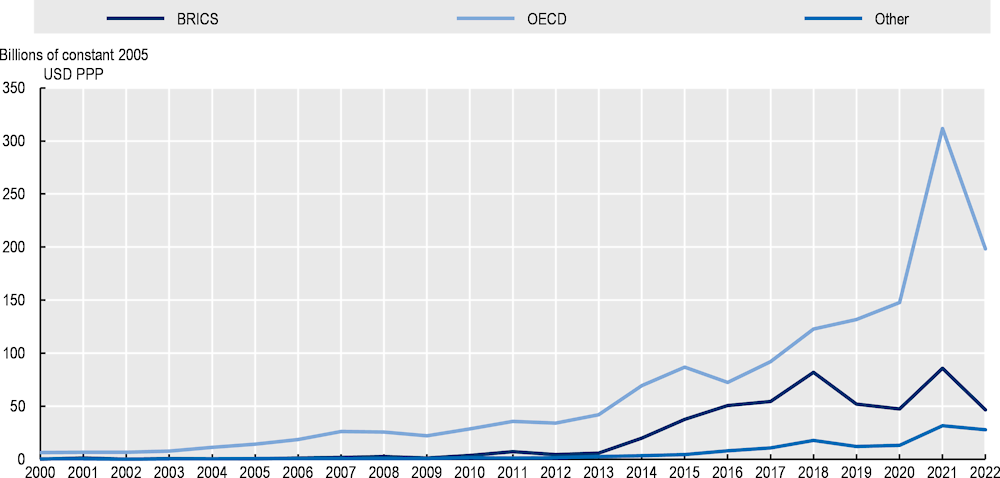

VC investments doubled in 2021, expanding the professional network potentially available to start-ups, albeit slowing in 2022. VC markets have rapidly grown across OECD countries in the last decade. After a sharp decline at the beginning of the pandemic, equity finance recovered fast (OECD, 2021[17]). SMEs in health, science and engineering, telecommunications, agriculture and farming, and education experienced the largest increase in funding relative to the year before (2019-20). Following Russia’s war against Ukraine, VC funding in 2022 significantly increased for firms operating in energy and sustainability, agriculture and farming and government and military. However, with the recent failure of the Silicon Valley Bank, VC capitalists have become more cautious. This trend is likely to continue in the first half of 2023, limiting access to VC and VC networks in the coming months (Grabow, 2023[35]).

The growth in VC funding has come with an effective increase in start-up networks. On average, the number of investors per funding round has been increasing over the last decade from 2.13 investors in 2012 to around 3.3 investors in 2022. While this may be suggestive of risk sharing among investors and an increase in the popularity of VC markets, this trend may open many new networking opportunities for innovation and financing of these SMEs.

Figure 5.1. OECD VC investments surged in 2021 but slowed in 2022, back to historical trends

Note: VC funding in OECD countries for the period 2000-20. VC deals include pre-seed, seed, angel, series funding, convertible bonds, growth funding, late-stage funding and other, less conventional sources of funding such as media for equity and product crowdfunding. They exclude mergers and acquisitions, initial public and coin offerings, post- initial public offering (IPO) funding rounds, debt finance, secondary market finance and investments in more mature and established firms.

Source: Based on Crunchbase.

For a few high-performing SMEs, integration in – often more disruptive – R&D networks is intensifying

SME expenditures in R&D provide a broad measure of the degree of SME integration into global innovation networks.3 While firms perform R&D on the basis of the technology, equipment, human capital and knowledge-based capital (e.g. data, patents, software) they have accumulated, many, especially SMEs, given more limited capacities, source R&D from external providers and partners, including increasingly through co-creations. The R&D endeavour has increasingly become a co‑operative activity requiring partnering and sharing in order to access increasingly specialised knowledge and bear the growing costs of research.

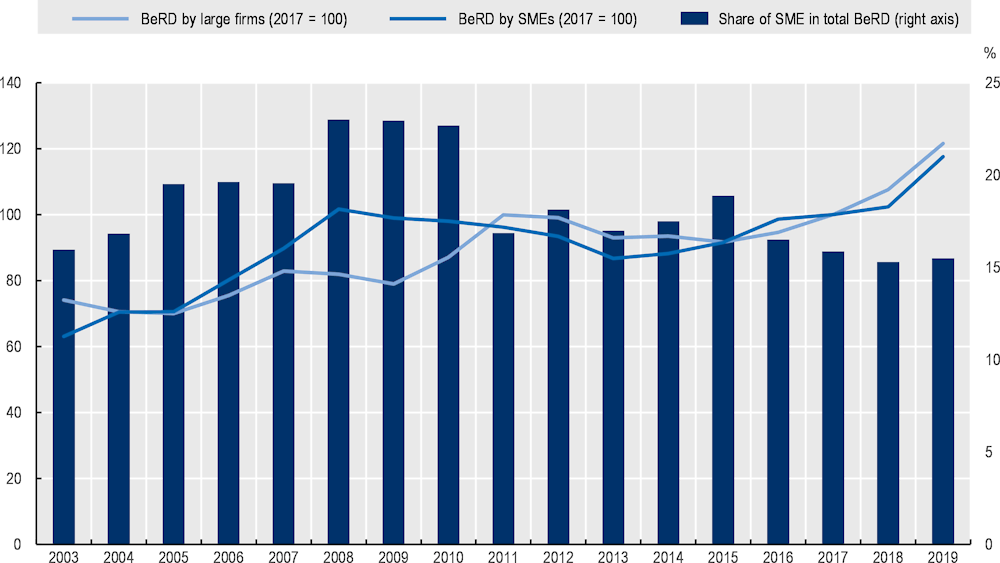

SME R&D investment is intensifying, now as rapidly as large firms. SME expenditures in R&D have accelerated since 2013, following the decline in the wake of the global financial crisis, with growth in recent years keeping pace with larger firms (Figure 5.2). The growing R&D investment by SMEs is partly related to the decline in the industrial concentration of R&D in countries, meaning more R&D is performed in services sectors where SMEs are in the majority, as well as greater adoption of more generous R&D tax (Appelt et al., 2022[36]).

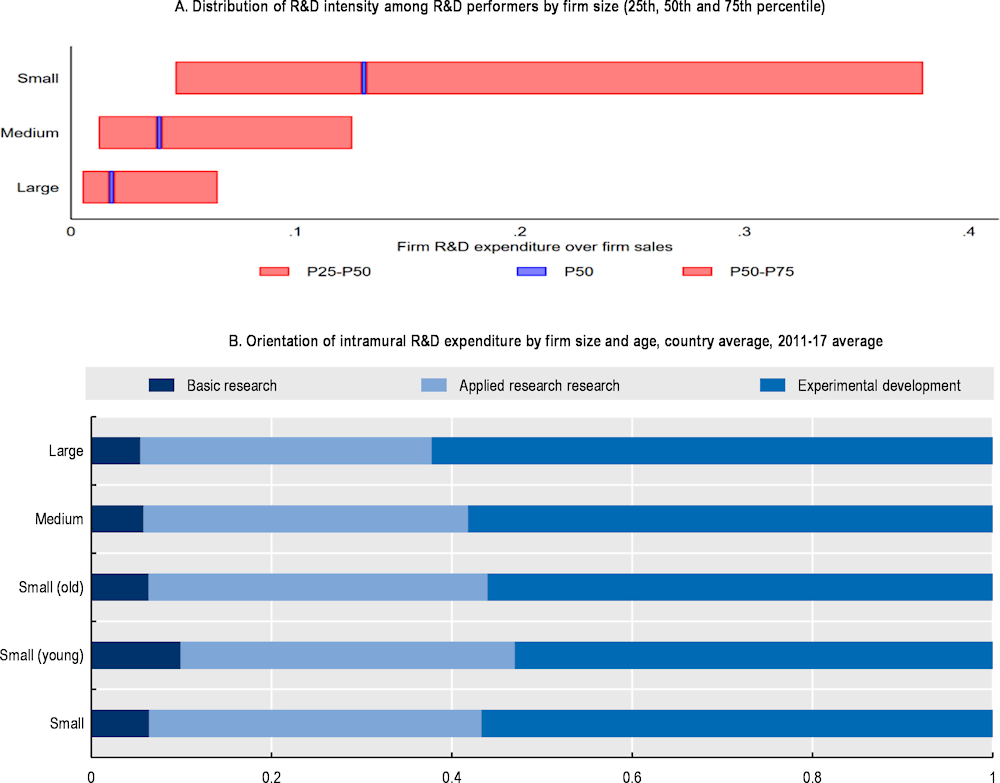

Although the majority of SMEs do not engage in R&D, smaller and younger performers have high levels of R&D intensity, compared to their size, and they invest the largest share of their business R&D expenditure into basic and applied research, which is riskier but can bring more disruptive outcomes (Appelt et al., 2022[36]) (Figure 5.3). In fact, growth in strategic sectors such as software, nanotechnology, biotechnology and clean technologies, is largely driven by new and small firms, which often bear the risks and costs of early market developments (OECD, 2019[1]).

These results are consistent with more recent data from the EU Industrial R&D Investment Scoreboard that monitors investment by the top 2 500 R&D investors – companies that invested the largest sums in R&D worldwide (Grassano et al., 2022[37]). Among these 2 500 world leaders, around 5-8% of companies in the list are SMEs and this share is fairly stable at 7-8% since 2016. A pooled cross-section analysis over the period 2014-21 shows that SMEs have a significantly higher intensity than larger firms (defined as R&D per employee) and the volume of their R&D and their R&D intensity increased significantly in the period of analysis. In financial terms, SMEs generally spend between EUR 100 000 to EUR 200 000 more on R&D per employee than larger firms. However, further analysis indicates that in 2021 the R&D intensity gap between SMEs and larger firms actually decreased.

Figure 5.2. SMEs’ R&D spending has accelerated in recent years, catching up with large firms

Note: Cross-country average of R&D expenditure performed in the business enterprise sector in 2015 USD constant PPPs. Data include total business enterprise intramural expenditure on R&D by size class. Some missing values, mainly due to the timing of data collection, were interpolated for Austria, Belgium, Canada, Denmark, Estonia, Germany, Greece, Ireland, Luxembourg, Norway, New Zealand, Sweden and Switzerland.

Source: OECD (n.d.[38]), Research and Development Statistics (RDS) (database), https://www.oecd.org/sti/inno/researchanddevelopmentstatisticsrds.htm.

Figure 5.3. Smaller R&D performers tend to spend relatively more on R&D and do more basic and applied research

Note: Panel A. The figure displays averages across countries. It is based on average values across all years available for a given country in the period 2011-16. Countries: AUS, AUT, BEL, CHL, CZE, FRA, DEU, IRL, ISR, JPN, NZL, PRT, ESP, SWE. The micro-aggregated statistics reported for Ireland are based on tax relief microdata and are not directly comparable with the R&D survey-based results reported for other countries.

Panel B. The figure displays averages across countries. Country-specific effects have been removed by subtracting country-specific means and replacing them with the overall population mean. The figure is based on average values across all years available for a given country-industry in the period 2011-2016. Countries: AUS, AUT, BEL, CHE, CHL, CZE, FRA, DEU, ISR, ITA, JPN, NLD, NOR, PRT, ESP, SWE.

Source: OECD (2021[39]), The OECD micro BeRD Project, https://oe.cd/microberd.

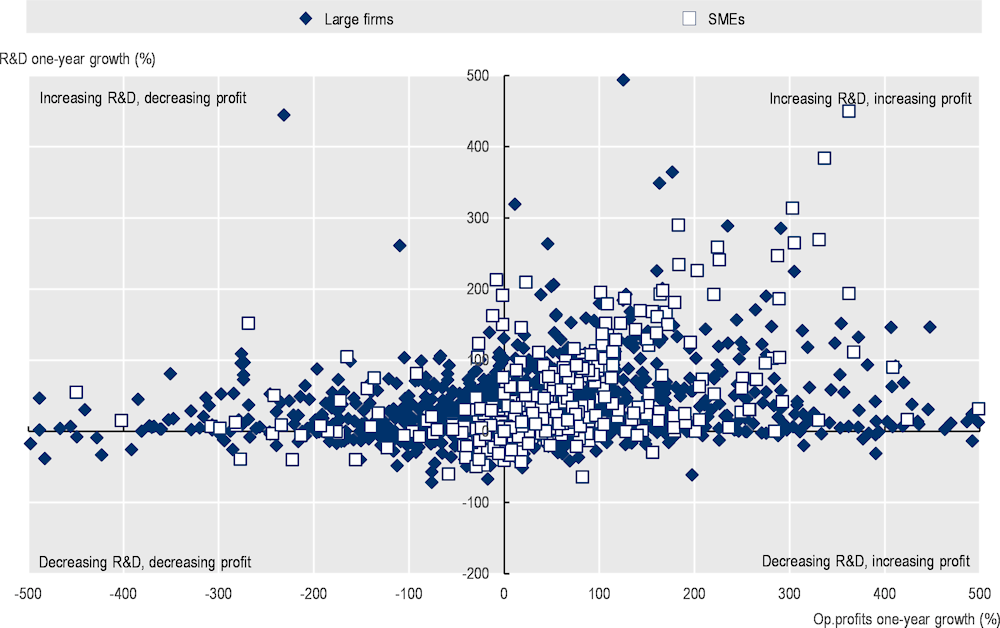

Growing spending by the top global R&D investors has accelerated, for both small and large firms. The COVID-19 crisis was the first time on record in which a global recession did not lead to a drop in global R&D expenditures. R&D expenditure in the OECD area grew by 1.5% in real terms in 2020 (OECD, 2022[40]), outpacing gross domestic product (GDP) growth in all major economies. The top 2 500 global R&D investors, equivalent to 86% of the world’s business-funded R&D, passed the EUR trillion mark for the first time in 2021 (Grassano et al., 2022[37]), with R&D investment increasing by 83.4%, in the previous 10 years, compared to an increase of 33.5% of net sales and 17.7% in employment. The fastest increases were observed in the automotive and transport manufacturing sectors for EU firms and the information and communication technology (ICT) manufacturing and services and health industries for US firms. The resilience of R&D networks during the COVID-19 pandemic reflects that they were an integral part of the response to the crisis (Figure 5.4). Moreover, short-term indicators signal a significant recovery in business R&D spending (7% for 2021, compared to 2% in 2020) (OECD, 2022[40]).

Figure 5.4. Most influential R&D actors, small and large alike, have kept growing R&D capacity despite difficult economic conditions

Note: Each dot represents one enterprise. SMEs are defined as enterprises with net sales below USD 500 million. SME definition employment-based.

Source: Based on Grassano, N. et al. (2022[37]), The 2022 EU Industrial R&D Investment Scoreboard, https://iri.jrc.ec.europa.eu/scoreboard/2022-eu-industrial-rd-investment-scoreboard.

Open innovation and partnerships continue to spread including to a broader population of SMEs

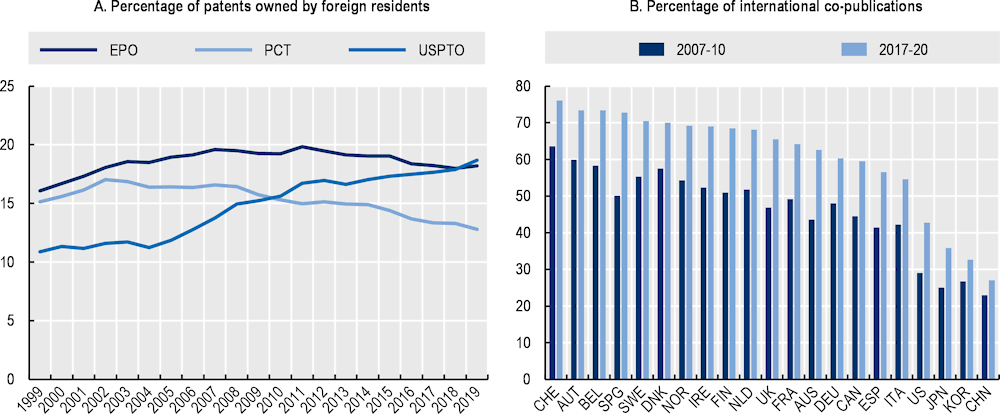

SMEs are participating in knowledge and innovation networks that have become more international and collaborative in nature. Co-patenting and co-authorship are common indicators to monitor co‑operation in knowledge and innovation networks, including across borders. The share of patents invented outside the United States in the total filed in the United States Patent and Trademark Office (USPTO) increased significantly over the past decade, from 11.3% in 2001 to 18.6% in 2019 (OECD, 2019[1]). A similar, albeit more modest, trend is observed in the European Patent Office (EPO).

Before the COVID-19 crisis, access to knowledge and collaboration networks was the least of business concerns for innovating, for firms across all size classes (Figure 5.5). In 2020, only 5.3% and 6.2% of firms (with 10 employees or more) across EU countries reported a lack of collaboration partners and a lack of access to external knowledge as hampering their innovation activities. These numbers increase slightly as the average firm size decreases (2.5% and 3.0% for large firms, 3.9% and 5.9% for medium-sized firms 6.0% and 6.9% for small firms) but remain overall inferior to those reported for other barriers.

The COVID-19 crisis gave new impetus to open innovation and partnering. Over the past year and a half, at the time of drafting, many institutions have opened up R&D and innovation, on a massive scale and at record speed, in order to cope with health and societal emergencies (OECD, 2021[17]). The COVID-19 pandemic fostered collaboration between governments, the scientific community and firms to inform and limit the spread of the virus and to develop effective vaccines (OECD, 2021[41]). National and international collaborative platforms for technology have revolutionised vaccine design and production. Public-private partnerships (often involving several firms) have played central roles in the fight against the pandemic.

Figure 5.5. Before COVID-19, access to knowledge and collaboration networks was the least of business concerns for innovating

Source: Based on Eurostat (2022[6]), Community Innovation Survey 2020 (CIS2020) (database), https://ec.europa.eu/eurostat/web/science-technology-innovation/data/database.

Small businesses, and large ones alike, were part of these co‑operation networks, combining assets and comparative advantages (Box 5.3). SMEs typically brought tailored solutions, flexibility and agility in the implementation of the responses to the crisis, and proximity to end users for diffusion, signalling once again that the terms of their competitiveness stand in their higher capacity for differentiation, specialisation and reactivity (OECD, 2019[1]).

At the same time, a collective impulse has been given to lagging SMEs to go digital faster, involving more digital-savvy SMEs and start-ups themselves, as well as business associations and large firms (OECD, 2021[17]). Players in the digital industry, in particular, have deployed services and support for helping SMEs innovate and remain in business, integrating them into their own networks of users and community of practices.

More recent evidence calls for some reservations in formulating too optimistic prognoses as the greater engagement of SMEs in innovation could be limited to more incremental and less disruptive forms of innovation. The OECD SME and Entrepreneurship (SME&E) Outlook (2021[17]) questioned whether the change in business practices triggered by the COVID-19 pandemic would be sustained over time and what their impacts in terms of economic and societal benefits would be, especially in terms of productivity and job creation. The 2022 EU Intellectual Property SME Scoreboard provides new evidence. Between 2016 and 2022, the proportion of SMEs that introduced any innovations has grown, especially among non-intellectual property right (IPR) owners – the proportion among IPR owners has remained fairly stable – and, for 70% of SMEs that introduced an innovation, this innovation was novel only to their own company. Innovations new to the market (21%) or the world (3%) were few. In the same vein, fewer SMEs have reported being highly familiar with IPRs than in 2019 (EUIPO, 2022[42]).

Box 5.3. Collaboration networks and open innovation to tackle the COVID-19 urgency

SME-multinational: The case of SolGent (Korea), a molecular diagnosis SME, that received support from the Ministry of SMEs and Startups (MSS) and Samsung Electronics to develop a COVID-19 detection kit. Through the MSS Smart Factory Supporting Project, Samsung Electronics provided SolGent with technology, know-how and infrastructure support.

SME-SME: The case of PlantForm (Canada), a privately-held biopharmaceutical SME, that develops speciality antibodies and proteins. During the pandemic, they partnered with three other companies in the Ontario Chamber of Commerce network to produce reagents for blood tests that could indicate immunity to COVID-19.

Multinational-public sector: The case of Siemens’ Additive Manufacturing Network. Siemens made its network available to the global medical community in order to hasten the production of medical components. Siemens designers and engineers collaborated with hospitals and medical professionals across this network in the creation of 3D printable medical equipment. 3D printers were also made available to members of the network.

SME-SME: Dr Gab’s, a Swiss brewery, forged a partnership with a local distillery in order to extract alcohol from its beer. This was later sold to pharmacies and medical schools for the production of sanitary gels and other disinfectants.

SME-multinational: The case of Ariniti (Belgium), a health tech start-up that uses artificial intelligence (AI) to create Healthbots. Ariniti, in co-operation with Microsoft, developed during the pandemic a self-diagnostic tool for people potentially infected to get advice depending on their symptoms. Healthbots were used to streamline the onboarding process of patients in hospitals.

Source: Ford (2020[43]), “Ford works With 3M, GE, UAW to speed production of respirators for healthcare workers, ventilators for coronavirus patients”, https://media.ford.com/content/fordmedia/fna/us/en/news/2020/03/24/ford-3m-ge-uaw-respirators-ventilators.html (accessed on 14 October 2022); ImmunityBio (2020[44]), “ImmunityBio combines supercomputing power with Microsoft Azure to target infection “doorway” of the coronavirus”, https://immunitybio.com/immunitybio-combines-supercomputing-power-with-microsoft-azure-to-target-infection-doorway-of-the-coronavirus/ (accessed on 14 October 2022); Samsung (2020[45]), “Master key for manufacturing applied to virus test kits (video)”, https://news.samsung.com/global/video-master-key-for-manufacturing-applied-to-virus-test-kits (accessed on 14 October 2022); Plantform (2020[46]), “PlantForm partnerships responding to COVID-19 testing and treatment needs”, https://www.plantformcorp.com/file.aspx?id=e5d1cf3e-ffdb-47f4-a3a3-4b62c089f389 (accessed on 14 October 2022); Siemens (2020[47]), “Siemens connects healthcare providers and medical designers to produce components through additive manufacturing”, https://press.siemens.com/global/en/pressrelease/siemens-connects-healthcare-providers-and-medical-designers-produce-components-through (accessed on 14 October 2022); Bivona, E. and M. Cruz (2021[48]), “Can business model innovation help SMEs in the food and beverage industry to respond to crises? Findings from a Swiss brewery during COVID-19”, https://doi.org/10.1108/BFJ-07-2020-0643; OECD (2022[49]), OECD Digital for SMEs Global Initiative (D4SME), https://www.oecd.org/digital/sme/.

Knowledge service providers have become key co‑operation partners for many SMEs

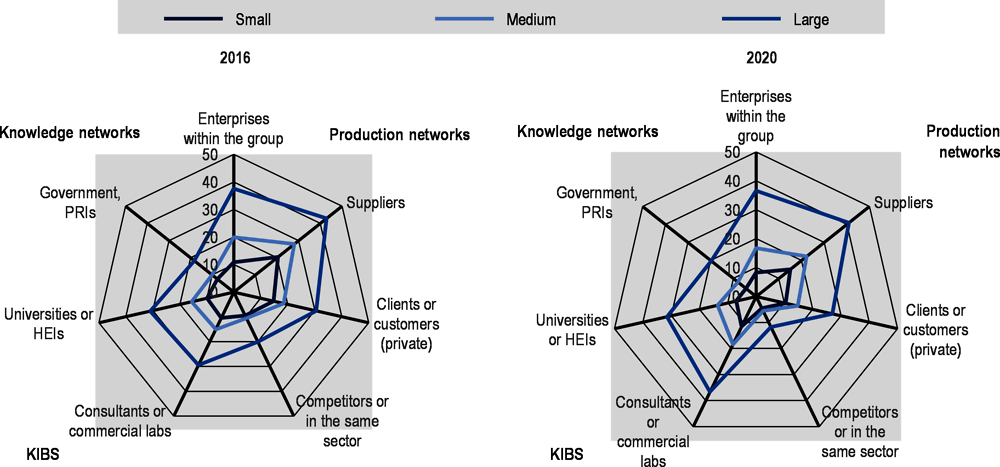

KIBS providers are the second main co‑operation partners for SMEs (Figure 5.6) (OECD, 2021[17]). The EU Community Innovation Survey (CIS) (Eurostat, 2022[6]) shows that in 2020, 11.6% of small innovative firms on average reported co-operating with consultants, commercial labs or private R&D institutes, compared to 18.4% and 36.6% of medium-sized and large firms respectively. These shares are higher than those observed in 20164 (10.5%, 15.0% and 29.4%).

Figure 5.6. For co‑operating on innovation, SMEs turn increasingly towards KIBS providers

Note: EU average based on countries for which data are available. Refers to firm responses to the question: “Did your enterprise co-operate with other enterprises or organisations (Yes/No)? And what type of innovation co-operation partner?”. CIS data may not be fully comparable across different rounds of surveys. The different vintages of the CIS surveys can be compared up to and including the 2016 CIS, modulo possible changes in question wording. The evolution of adjustment methods may affect certain developments at the margin. See INSEE (2023[50]).

Source: Based on Eurostat (2022[6]), Community Innovation Survey 2020 (CIS2020) (database), https://ec.europa.eu/eurostat/web/science-technology-innovation/data/database; and Eurostat (2016[51]), Community Innovation Survey 2016 (CIS2016) (database), https://ec.europa.eu/eurostat/web/science-technology-innovation/data/database.

SMEs are operating a massive migration to the cloud and platform technologies

The COVID-19 crisis gave a big push to SME digitalisation and served as an accelerator of digital innovation. Smart working solutions, including teleworking and video conferencing, online selling and digital platforms have blossomed (OECD, 2021[17]). Evidence from the OECD-World Bank-Meta Future of Business Survey of 2020 showed that the crisis sped up SME digital uptake, especially among medium-sized firms, and that the changes were likely to be permanent for 60-80% of them. For instance, European SMEs selling online on Amazon’s marketplace increased average sales from EUR 70 000 to EUR 90 000 between June 2019 and June 2020 (OECD, 2021[52]). Digital adoption (especially e-commerce) was a predictor of greater resilience.

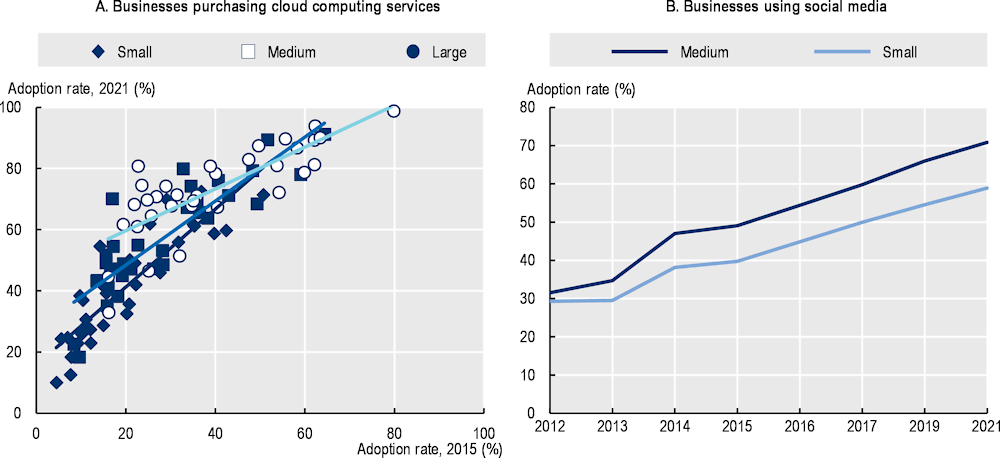

Three digital technologies are of particular relevance for increasing SME networking capacity and achieving network effects: social media, (more broadly) digital platforms and cloud computing (Jiang, Yang and Gai, 2023[53]) (Figure 5.7). Other digital technologies contribute to network expansion and can increase the scope for SMEs to achieve external economies of scale, such as customer relationship management (CRM) and supply chain management (SCM) software. Those technologies are however not covered in this analysis for lack of recent data (with respect to SCM) and limited changes in adoption rates over the past six years (with respect to CRM) (Annex Figure 5.A.2). The information on trends given below is based on the most recent ICT use surveys and SME testimonies (OECD.Stat, 2023[54]; OECD, 2022[49]).

Figure 5.7. Smaller businesses are catching up in the adoption of platform technologies

Note: Firms with ten or more employees. Micro firms are not covered in ICT surveys. The trendlines (Panel A) mark an acceleration in cloud computing (CC) adoption, the higher the slope, the faster the diffusion. There are no data available in 2020 to compute the average percentage of businesses using social media. Set of countries changes from year to year.

Source: OECD.Stat (2023[54]), ICT Access and Usage by Businesses (database), http://stats.oecd.org/Index.aspx?DataSetCode=ICT_BUS.

In 2021, the use of social media had become broadly mainstreamed, with over 60% of the total business population reporting using them (Datareportal, 2021[55]) (Figure 5.7). Over 2020-21, adoption by SMEs has kept momentum, following past trends. The average adoption rate has increased continuously across OECD countries for which data are available over the past decade (2012-21), doubling or more than doubling- across all firm size categories. In 2021, there were still imbalances between small (59%) and medium-sized (70%) and large firms (83%).

More generally, digital platforms keep increasing audience and revenues. During lockdowns, platforms played an instrumental role in connecting users to markets, suppliers or resources, which mitigated the economic impact of the crisis on SMEs (OECD, 2021[17]). The use of online platforms increased by about 20% in the first half of 2020, especially mobile payments, marketplaces to consumers, professional services and restaurant delivery (OECD, 2021[56]). In areas requiring physical proximity (such as accommodation, restaurant bookings and transport), platform activity declined markedly, by around 90%.

Box 5.4. Platform technologies: Expanding networks, creating network effects and achieving external economies of scale

Social media

Social media include “social networks, blogs, file sharing, wikis” (OECD, 2015[57]). They can reduce costs on marketing and customer services, and improve customer relations and information accessibility (Ainin et al., 2015[58]; Chatterjee and Kumar Kar, 2020[59]). The presence of hundreds of millions/billions of users on line makes appearing on the search algorithms of the larger search engines or social media platforms a crucial marketing tool for SMEs, especially since the cost of setting up a social media profile or an account on a large platform is usually very low, most platforms offering “free to use” model or services for relatively small fees. These “basic accounts” are also usually designed to be user-friendly and do not require particular skills to be operated (OECD, 2021[16]). Prior to COVID-19, ICT surveys showed that SMEs tend to start their digital journey with basic functions, primarily general administration and marketing operations, and the digital gap between SMEs and large firms is smaller in their online interactions with the government, in electronic invoicing or in using social media.

Digital platforms

Digital platforms provide a means to access new markets, sourcing channels and a multitude of digital networks. They serve to optimise business functions and have been transforming a wide range of them, from advertising and marketing (e-commerce) to service delivery, financing, human resources, administration (payments), R&D and design, etc. Digital platforms enable SMEs to partly compensate for weak internal capacity through access to external digital (software) solutions and systems, and require low (to no) digital skills. Machine-learning techniques are for instance extensively integrated into social media and marketplace algorithms, providing scope to benefit from “state-of-the-art” technologies at relatively low cost. For managing digital security risks, SMEs also rely on external consultants or the security-by-design features of the products and services they use. Online platforms also allow SMEs to capitalise on large network effects. Network effects arise as the number of users on each “side” of the platforms increases, increasing the benefits for all users to operate on the same platform. The larger the user base,5 the more likely SMEs are to find a match (e.g. with service providers, suppliers, clients), which in turn can reduce transaction costs and information asymmetry. Digital platforms can help substantially lower a broad range of costs: search costs, replication costs, distribution costs, tracking costs and verification costs (Goldfarb and Tucker, 2019[60]). Empirical evidence converges in stressing the positive impact of digital platforms on the productivity of SMEs, or on business dynamics and the reallocation of workers to more productive firms (Bailin Rivares et al., 2019[61]; Costa et al., 2021[62]). Experimental evidence suggests that the use of Natural Language Processing software such as generative language models (e.g. ChatGPT, Bard) integrated into popular search engines (i.e. Bing and Google Search) can raise average productivity while compressing the productivity distribution (i.e. benefitting low-ability workers more), complementing workers’ skills (Noy and Zhang, 2023[63]).

Cloud computing

Cloud computing (CC) helps enhance information technology (IT) systems and capacity along a “pay-as-you-go” model.6 CC refers to services accessed over the Internet, including servers, storage, network components and software applications (OECD, 2019[64]). SMEs can access extra processing power or storage capacity, as well as databases and software, in quantities that suit and follow their needs. In addition to its flexibility and scalability, CC reduces costs of technology upgrading by exempting firms from upfront investments in hardware and regular expenses on maintenance, IT team and certification. CC services for instance allow AI solutions to be sourced from knowledge markets and, in turn, the ability to leapfrog to new AI systems with CC-based software as a service (SaaS), with no prerequisite of technical knowledge and digital security features directly embedded in the software (OECD, 2019[1]).

Source: Abridged from OECD (2021[16]), The Digital Transformation of SMEs, https://dx.doi.org/10.1787/bdb9256a-en.

Recent years have also witnessed a massive migration to the cloud. Relocation to the cloud consists in moving business data and IT processes to data centres. Increasingly more businesses aim to infuse enterprise applications with multi-cloud and hybrid cloud architectures, edge computing, “anything-as-a” service and serverless computing (TechTarget, 2020[65]). A main rationale for faster cloud adoption is the value that can be created from data and business analytics, the cloud becoming, in addition to a means for technology upgrading, a driver of business innovation (OECD, 2022[2]; Gartner, 2023[66]). In 2021, almost 43% of all businesses were purchasing CC services, ranging from 39.3% for small firms, to 55.5% for medium-sized firms and 72.5% for large firms across OECD countries for which data are available. This represents a doubling of small-size users compared to 6 years before. The share of CC users doubled in almost half the time as it did to double social media shares.

Networks as a service (NaaS) have emerged as a solution for SMEs to operate within secure digital networks. There is indeed a rising demand for digital networks to evolve, driven by the deployment of remote work and cloud adoption. The main challenges firms face today as regards the management of their networks are to connect to multiple clouds, secure networks, users and applications, and ensure they can deal quickly with digital security issues (CISCO, 2022[67]). NaaS have appeared as an alternative to maintaining own networks, embedding different elements, such as network management platforms (e.g. wired and wireless LANs), security components (e.g. virtual private networks or VPNs), data centres, and multi-cloud and hybrid cloud environments (CISCO, 2022[67]; WEF, 2022[68]).

A number of threats weigh on future SME capacity to build and expand linkages

A first threat to SME network expansion is related to multiple risks of exclusion for those SMEs that are lagging today. The likelihood of SMEs to network depends on their awareness of the existence and benefits of these networks and on their internal capacities to adapt to the standards, requirements and practices prevailing in these networks. The gap to integrate could be large and further widening as networks evolve with the technological changes and structural transformations at play. Laggards will lose ground in the race, dragged back by their current productivity gaps and lack of absorptive capacities.

R&D and VC remain the prerogative of a few high-performing SMEs and start-ups. Even if small R&D performers have performed well in recent years, the vast majority of SMEs are foreign to the world of research. Likewise, VC financing remains inaccessible – and an inappropriate funding mechanism – to many SMEs (OECD, 2022[69]). R&D and VC prospects, and the consolidation of innovation networks, are also strongly related to macroeconomic conditions. High inflation and tightening market conditions (Chapter 1) are likely to weigh on firm profits and incentives to invest in R&D, negatively affecting R&D networks and systems, and in particular smaller firms.

The SME digital gap is still a reality. Still, many SMEs use digital technologies mainly for advertising and communication (6 in 10 users) (Facebook/OECD/World Bank, 2022[70]). Digital adoption is often limited to basic business functions and the digital gap tends to increase as technologies become more sophisticated (OECD, 2021[16]). Little progress has been made for instance in closing the gap in CRM adoption (Annex Figure 5.A.2), while some progress made, e.g. in CC adoption, comes with “lock-in” risks. Low interoperability, standardisation and portability of cloud computing services result in SMEs finding themselves unable to switch providers – and networks – without incurring hefty costs or losing proprietary data (Opara-Martins, 2018[71]; Opara-Martins, Sahandi and Tian, 2016[72]; OECD, 2021[16]), or having de facto to manage multiple cloud environments. SME lags with more advanced use of ICT has consequences not only on their ability to transition to new business models, adapt to the reconfiguration of production networks and global value chains (see Chapter 3), turn data into business and achieve greater resource efficiency (OECD, 2022[69]) but it also limits their capacity to respond to cyberattacks. Firms using AI and automation are in fact better prepared to react, which results in making the breach lifecycle shorter and cutting the average cost, by two according to an IBM survey (2023[73]).7

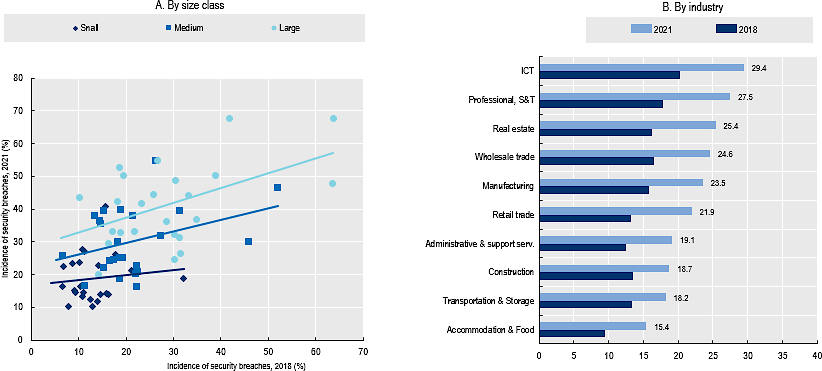

A second threat to SME networks is therefore related to rising cybersecurity risks and the low preparedness of SMEs. As the attack surface keeps growing with digital adoption, remote work and cloud migration, data breaches are becoming more common and affect all types of firms across virtually all industries. Even if still less often victims of attacks, SMEs are particularly vulnerable as they rarely have the dedicated resources and awareness to mitigate digital security risks (OECD, 2021[16]). In 2021, 17.6%, 27.4% and 36.9% of small, medium-sized and large firms reported having experienced ICT issues in the past 12 months across the OECD area (Figure 5.8). This represents 6 to 13 percentage points more than only 3 years before (2018). It is estimated that the cost of a data breach has also reached an all-time high in 2022, at an averaged USD 4.35 million, i.e. a 2.6% increase from the year before (IBM, 2023[73]).8

The increased number of digital incidents in KIBS is particularly alarming, because of the role they play in bridging specialised knowledge to SMEs and as key knowledge partners. The sectors that experienced the highest numbers of security breaches in 2021 and topped the ranking in 2018 as well, are highly digitalised and knowledge-intensive services, including IT, professional, science and technology, and financial and insurance services, and commerce (i.e. wholesale and retail trade) (Figure 5.8). The potential for malicious actors to compromise the software supply chain from early stages could have far-reaching consequences on smaller actors that are particularly dependent on their services (from software to infrastructure, platform and network as a service), emphasising the need to secure the supply chain by design (ENISA, 2021[74]).

Figure 5.8. SMEs face increasing security breaches, especially medium-sized ones and those operating in KIBS

Note: Firms with ten or more employees. Micro firms are not covered in ICT surveys. The trendlines (Panel A) mark an acceleration in the occurrence of ICT incidents: the higher the slope, the higher the increase.

Source: OECD.Stat (2023[54]), ICT Access and Usage by Businesses (database), http://stats.oecd.org/Index.aspx?DataSetCode=ICT_BUS.

Financial services are traditionally a preferred target for hackers and have been under continuous fire in 2022. Akamai (2023[75]) notes a staggering surge in the number of attacks against financial technology (fintech) web applications and application programming interfaces (API), estimated to have grown by 257% in 2022 compared to the year before. These are typically banking applications. Within 24 hours, the exploitation of newly discovered vulnerabilities can reach multiple thousands of attacks per hour and peak quickly, leaving little time to react.

Cybersecurity risks are endangering interconnected networks and have made exposure and risk management capacity key factors in partnership decisions. An in-depth security analysis of 58 web applications across different sectors over 2020-21 shows vulnerabilities in 98% of the cases studied, most often due to flaws in web application code (Positive Technologies, 2022[76]). SMEs have become de facto gateways for attackers to infiltrate larger and more profitable targets, especially through their supply chains (Chapter 3). Alternately, knowledge networks and platforms can provide “by design” solutions that suit the needs of smaller firms and contribute through information sharing to developing their digital risk management culture.

A third threat to SME networks is related to growing signs of fragmentation and breaches in innovation networks. First, innovation, especially disruptive innovation, is highly concentrated in a few sectors. SMEs account for around half of total business R&D expenditure (BERD) in scientific R&D services and information and communication services, but for only around 10% of total BERD in pharmaceuticals and transport equipment. At the same time, around 90% of SMEs that make the top 2 500 global R&D investors work in the pharmaceutical industry and this concentration has increased over the years, reaching a peak of 96% in 2020 (Grassano et al., 2022[37]). Historically, equity capital is also highly concentrated in ICT and biotechnology, with no sign of any redeployment towards new sectors. This may reduce SMEs’ chances to evolve across different networks or to differentiate.

Second, innovation within OECD countries is highly concentrated in a few regions, often capital city regions (OECD, 2018[77]). Likewise, VC is concentrated within a few regions and the signs of a possible democratisation of capital that emerged during COVID are fading. Around half of all VC investment made globally between 2010 and 2022 was allocated to companies headquartered in a few cities such as Beijing, Bengaluru, Cambridge, Hangzhou, London, New York, San Francisco and Shanghai (China).9 COVID‑19 had enabled the spread of capital outside of technology hubs (PitchBook, 2023[78]). In fact, the median distance in miles between a company and the lead investor in its seed round grew from 151 miles in 2019 to 401 miles in 2021, a consequence of lockdowns and remote work (PitchBook, 2023[78]). However, since 2022, it is estimated that 73% of all US VC commitments went to firms located in only 2 markets, New York City and the San Francisco Bay Area. All in all, the high sectoral and geographical concentration of innovation activities, investment and interests raises risks of growing territorial and industrial inequalities if efficient diffusion channels are not in place to enable transfers. Innovation capacity and benefits to accumulate. During the COVID-19 pandemic, as digital adoption increased, the digital gap increased between sectors that were already digital-intensive before the crisis and those that were lagging (OECD, 2021[17]).

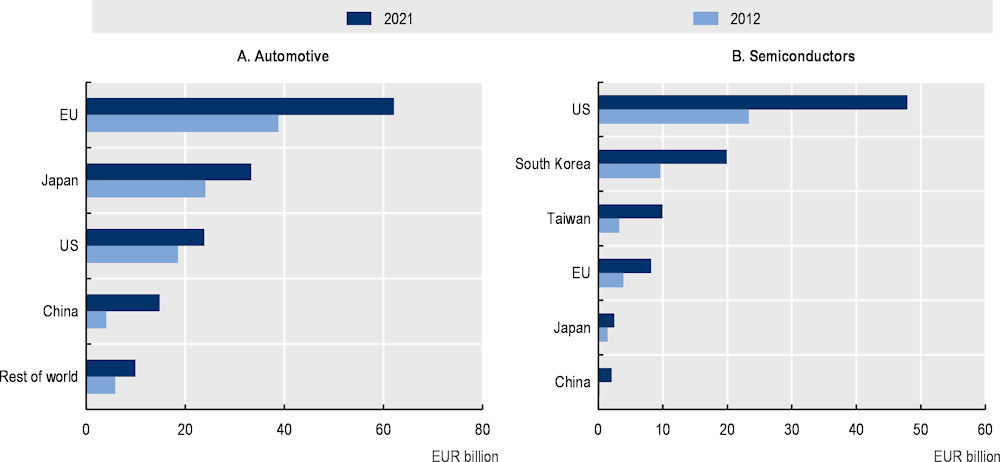

There are also signals that the global R&D networks could crack into regionalised and specialised blocks. Trends in the investment of the top 2 500 largest R&D spenders between 2012 and 2021 show a further specialisation and concentration of advanced business research in large world regions (Figure 5.9) (Grassano et al., 2022[37]). Likewise, geopolitical tensions between China and the United States are affecting global research co‑operation. Data on collaboration based on scientific publications show that international collaboration between China and the United States grew rapidly over the last decades, with even more US co-authorship with China than with the United Kingdom between 2017 and 2019 (OECD, 2023[79]). This has since fallen sharply, mostly due to the decline – which started in 2020, accelerated in 2021 and could further accelerate – in engineering and natural sciences. These two fields account for the bulk of China-US bilateral collaboration. Meanwhile, collaboration in other research fields, such as life and health sciences and social sciences and humanities, continued to grow.

Figure 5.9. R&D networks are organised into regionalised and specialised blocks

Source: Grassano, N. et al. (2022[37]), The 2022 EU Industrial R&D Investment Scoreboard, https://iri.jrc.ec.europa.eu/scoreboard/2022-eu-industrial-rd-investment-scoreboard.

The role of public policy in shaping and strengthening SME knowledge and innovation networks

Governments deploy a broad range of measures – some targeted directly at specific actors, others more generic – to support SME integration into (global) knowledge and innovation networks.

The following section provides a more granular view of the character and intensity of government efforts to strengthen SME linkages to R&D and innovation networks, their integration into clusters and/or the formation of strategic partnerships involving SMEs. The analysis highlights emerging patterns, similarities and differences across countries, as well as relevant policy examples. This section builds on several large-scale mappings of institutions and policy initiatives in place across OECD countries that were conducted as part of the multiannual EC/OECD projects on Unleashing SME potential to Scale up (OECD, 2023[80])and Fostering FDI-SME ecosystems to boost productivity and innovation (OECD, 2023[81]), and forms part of the OECD Data Lake on SMEs and Entrepreneurship10 (OECD, 2023[82]). On that basis, a total of 280 policies were identified, seeking to expand SME linkages with knowledge and innovation networks.

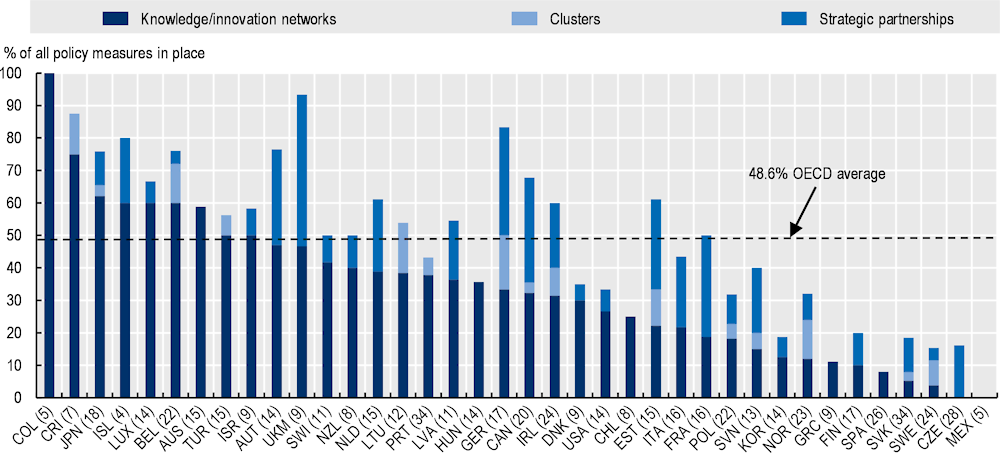

About one-third of policies aim at connecting SMEs to knowledge and innovation networks, with a more complementary role for other types of linkages

While most OECD governments place the strongest focus on integrating SMEs into (global) production and supply chain networks (see Chapter 3 for a more detailed discussion), the rise of the open innovation paradigm, along with the increasing internationalisation of innovation activities, is clearly reflected in national policy mixes, with about one-third of network expansion policies across the OECD dedicated to connecting SMEs to knowledge and innovation networks (Figure 5.10).

Figure 5.10. About one-third of policies aim at connecting SMEs to knowledge and innovation networks, with a more complementary role for other types of linkages

Note: OECD average refers to the cumulated average share that the three depicted network types represent in national policy mixes. Shares are calculated on the basis of a total of 280 policies related to strengthening SME linkages to knowledge and innovation networks and/or their integration into clusters, and/or the formation of strategic partnerships.

Source: Estimates based on an experimental mapping of 601 national policies and 150 institutions supporting SME network expansion across OECD countries ( (OECD, 2023[80]), EC/OECD project on Helping SMEs Scale Up – Phase II).

The formation of strategic partnerships and connecting SMEs to clusters feature less prominently in national policy mixes, with only 12% and 3% of dedicated measures respectively. Still, when considering the important complementary role that these mechanisms can play in fostering both SME trade and innovation via connections to relevant partners, the share of innovation network-related measures rises to about half (48.6%) of policies in place across the OECD. Box 5.5 provides a few examples from selected OECD countries, highlighting the diverse forms of partnerships that clusters and strategic alliances can support.

Box 5.5. Expanding SME networks via clusters and strategic partnerships: Selected policy examples across the OECD

Strategic partnerships

Czech Republic: CzechInvest’s CzechLink StartUp project brings domestic and foreign investors together with Czech start-ups and thus supports the development of innovative businesses in the country.

Ireland: The InterTradeIreland Venture Capital Conference brings together entrepreneurs, venture capitalists, business angels, investors and anyone with an interest in venture capital. It allows different actors to get up to date on the current investment scene in Ireland, network with active investors in the country and learn about the fundamentals of VC.

Netherlands: The Top Consortia for Knowledge and Innovation (TKI) programme is a key initiative for organising co‑operation between business, science and government around 12 strategic top sectors. Dedicated mechanisms allow for the participation of entrepreneurs, SMEs and research organisations to share knowledge, risks and investments.

Slovak Republic: The Slovak Matchmaking Fair is the largest international B2B event organised by the Slovak Investment and Trade Development Agency (SARIO). The event focuses on bilateral talks among individual companies, as well as on the presentation of subcontracting partnership offers, tenders, available production capacities, joint venture creation demands with foreign partners, and search for co‑operation partners.

United States: The Small Business Innovation Research (SBIR) programme encourages domestic small businesses to engage in federal research and R&D activities with the potential for commercialisation. Small businesses may apply as joint ventures if all the partners involved meet the eligibility criteria.

Clusters

Germany: Clusters4Future (Zukunftscluster) seek to contribute to the emergence of outstanding next-generation clusters in emerging fields of innovation with excellent growth potential through cross-thematic, technology and inter- and transdisciplinary co‑operation. The initiative is based on the creation of a new, innovation-oriented cluster approach with an explicit focus on emerging topics and a faster transfer of fundamental research results into application.

Norway: Norwegian Innovation Clusters is a government-funded cluster programme that aims to contribute to value creation through sustainable innovation. This is achieved by triggering and reinforcing collaborative development activities in the clusters, with the aim of increasing the clusters’ dynamics and attractiveness, as well as increasing the individual companies’ ability to innovate.

Canada: The Innovation Superclusters Initiative (ISI) invites industry-led consortia to lead and invest in bold and ambitious proposals to boost regional innovation ecosystems. The programme supports new partnerships between large firms, SMEs and industry-relevant research institutions, promoting the development of globally competitive technology. A small number of high-value, strategic investments will be made to build on shared private sector commitment, demonstrated through matched industry funding, to position firms for global leadership.

Source: Based on an international mapping of national policies and institutions supporting SME network expansion (OECD, 2023[80]), EC/OECD project on Helping SMEs Scale Up (data extracted on 21 April 2023). The mapping forms a building block of the OECD Data Lake on SMEs and Entrepreneurship (OECD, 2023[82]).

Moreover, in nearly a quarter of OECD countries, the innovation agenda clearly prevails over trade and GVC issues, with half of policies or more dedicated to engaging SMEs in collaborative innovation activities. This can take the form of more infrastructure-oriented measures, like the Cooperative Research Centres in Australia, which aim to facilitate industry-research collaboration, and targeted financial support as in Türkiye’s Artificial Intelligence Ecosystem Call, which funds AI projects carried out by consortia composed of at least one SME as a technology provider, one university, research centre or PRI, and the TÜBİTAK Artificial Intelligence Institute.

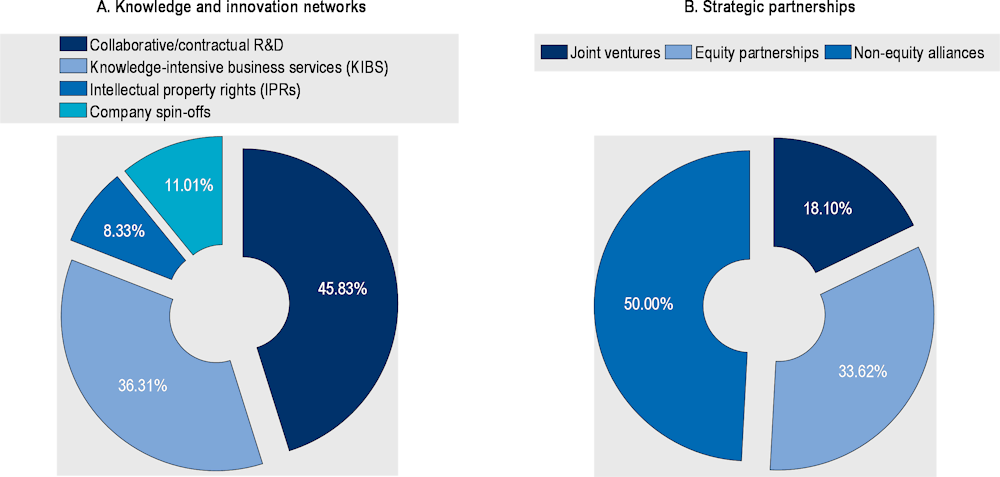

There is a clear policy focus on “traditional” innovation channels and more accessible forms of strategic partnerships

Zooming further into the specific channels that receive policy attention across different innovation-related network types, a clear focus on more ‘traditional’ innovation channels emerges, with nearly half (46%) of measures aiming to connect SMEs to knowledge and innovation networks dedicated to involving them in collaborative or contractual R&D activities (Figure 5.11). While this is closely followed by efforts to link SMEs with providers of KIBS, with a little over one-third of measures dedicated to this area, this distribution does suggest a possible misalignment with the “innovation reality” that most SMEs face, including the fact that R&D remains out of reach for most of them and that they tend to rely on other mechanisms – including KIBS – to carry out innovation activities.

Given that knowledge service providers have indeed become key co‑operation partners for SMEs, this may call for more targeted measures that could help orient SMEs toward relevant actors that can provide support in specific areas. Such measures would likely need to go beyond “classic” innovation vouchers, which certainly allow purchasing most of these types of services but which frequently lack the complementary service of identifying relevant partners that may fit a firm’s particular business needs.

Table 5.1 provides a structures overview of the different types of measures that governments deploy to connect SMEs to knowledge and innovation networks via different channels, including the level of targeting, geographic scope and policy instrument(s).

Figure 5.11. Across innovation networks, policy efforts focus on SME co‑operation through R&D and via non-equity alliances

Note: Shares are calculated on the basis of a total of 280 policies related to strengthening SME linkages to knowledge and innovation networks and/or their integration into clusters, and/or the formation of strategic partnerships.

Source: Estimates based on an experimental mapping of 601 national policies and 150 institutions supporting SME network expansion across OECD countries ( (OECD, 2023[80]), EC/OECD project on Helping SMEs Scale Up – Phase II).

In the area of strategic partnerships, on the other hand, policy efforts clearly focus on non-equity alliances, with half of the measures in this category dedicated to this type of arrangement. Non-equity alliances indeed make up the vast majority of business alliances and come in many forms and shapes, including outsourcing arrangements, licensing agreements, distribution agreements and supply contracts for example. They also play a central role in the context of joint R&D, production and sales and marketing activities. Importantly, though, they have an overall much less formal character than joint ventures (when two or more parent companies form a separate entity) or equity alliances (when one company purchases equity in another business) and are therefore generally considered more accessible to SMEs, as the partnership is usually formed on some sort of contractual basis, which does not involve making a direct financial investment in each other.

Still, the importance of SME network expansion via joint ventures and equity partnerships should not be underestimated, in particular for the financial resources that these linkages can unlock. As a result, many governments have implemented measures that aim to facilitate connections between SMEs and different actors in the financial market, including notably private investors and investment funds.

Business accelerators and incubators are a case in point. These support programmes – of a private or public nature in fact – have become increasingly important for enhancing SME networking and financing opportunities, as they create direct or indirect social connections with potential funders, and can facilitate information transfer between investors and entrepreneurs. Their success is evidenced by their rapid deployment in recent years. The number of US-based accelerators increased by an average of 50% each year between 2008 and 2014 only (Hathaway, 2016[83]). Out of firms that received investments from VC between 2015 and 2020 in OECD countries, around 20-25% received at least 1 investment from accelerators, incubators or universities (Crunchbase, 2021[84]). Recent empirical evidence suggests that participation in such communities (including open source) may help firms reach funding milestones.

Table 5.1. Selected examples of policies to enhance SME integration into knowledge and innovation networks

|

Policy instruments |

Policy targeting |

Country initiative |

Timing |

Geographic dimension |

Overlap with other networks |

|---|---|---|---|---|---|

|

Collaborative/contractual R&D |

|||||

|

Financial support |

Targeted (technology) |

Spacelabs (Belgium): Collaborative project between at least two companies and a knowledge institution aimed at the demonstration and further development of space technology for downstream applications. |

2023-until now |

Domestic |

No |

|

Financial support |

Targeted (all SMEs) |

Propyme+Clústeres (Costa Rica): Provides funding for R&D and technology and knowledge transfer actions between SMEs participating in clusters or value chains. |

2022-until now |

Domestic |

Yes (clusters) |

|

Platforms & networking infrastructure |

Generic |

Business Partnership Facility (Luxembourg): The facility aims to encourage the Luxembourg and European private sector to join forces with partners in developing countries to set up sustainable and innovative business projects. |