This chapter reviews recent developments in firm performance and identifies key challenges small firms will have to cope with in the short, medium and long term. Prior to the war in Ukraine, the recovery of the SME sector was essentially driven by stronger performance of micro-firms. SMEs engaged in international trade also performed well compared to non-trading SMEs. The war and the rise in energy costs have slowed down global growth and weighed on firm performance. Even though most SMEs have little direct exposure to Russia and Ukraine, they have been indirectly affected by geopolitical tensions and elevated uncertainty, high inflation, tightening financial conditions, and lesser monetary and fiscal support. Supply-chain disruptions and heightened labour shortages add to the challenges. Looking forward, digitalisation and the green transition are expected to alter the way firms operate. SMEs will have to upgrade their technical skills and knowledge to manage the twin transition.

OECD SME and Entrepreneurship Outlook 2023

1. Recent SME developments and forthcoming challenges

Abstract

In Brief

This chapter reviews recent developments in business dynamics and firm performance and identifies key challenges and opportunities small- and medium-sized enterprises (SMEs) and entrepreneurs will face in the short, medium and long terms.

Prior to Russia’s war of aggression against Ukraine, the recovery of the SME sector was essentially driven by a rebound in the performance of micro firms, which exhibited strong employment growth. However, smaller firms continued to be, on average, less productive than larger firms.

SMEs engaged in international trade also performed well compared to non-trading SMEs. Just over half of SMEs with a digital presence recorded a rise in sales between 2020 and 2021, according to the OECD-World Bank-Meta Future of Business Survey (hereafter the Future of Business Survey). Engagement in international trade is estimated to have increased the probability of an increase in SME sales by between 3 and 10 percentage points.

Even though most SMEs have little direct exposure to Russia and Ukraine, they have been indirectly affected by the sharp increases in energy and commodity prices, tightening financial conditions and lesser monetary and fiscal support. Although declining, inflation has remained at high levels which, together with elevated uncertainty, have hampered firm performance. Early evidence points to firm entry growth slowing markedly in many OECD countries, while firm exit growth and bankruptcy rates have risen. Supply-chain disruptions and financial sector stress have compounded those challenges.

Looking forward, digitalisation and the green transition are expected to lead to durable changes by altering the way firms operate and require rethinking industrial systems and business models.

Retaining and attracting staff has become a major issue in OECD countries, despite emerging signs of easing labour-market pressures. Labour shortages (beyond the Great Resignation) and the competition for skills are likely to persist over time, placing SMEs at an even greater disadvantage. SMEs will have to upgrade their technical and managerial skills and knowledge to make the most of digitalisation and to be able to invest in decarbonisation.

Over the past few years, the global economy has experienced a number of deep shocks, which have had a marked impact on SMEs and entrepreneurs. While rapid and significant support from governments helped protect small businesses from the economic impact of the pandemic, in the wake of Russia’s unprovoked aggression against Ukraine, new threats have emerged. Rising geopolitical tensions and global financial risks, high inflation, tighter monetary and fiscal policy stances, financial sector stress, labour shortages, trade barriers and slowing integration in global value chains are all adding to a more challenging economic environment. Rising interest rates will make debt repayment more expensive for SMEs and entrepreneurs, with many of them being heavily indebted.

Whilst the pace of digitalisation accelerated during the first phase of the COVID-19 crisis and helped many firms weather the economic shock, a number of small firms continue to lack the skills needed to make the most of the digital transition, increasing the risks of deepening digital gaps. Small firms also have difficulties in accessing networks that can provide sources of digital solutions, data and knowledge transfers. Moreover, while small firms have significant potential to drive and benefit from the green transition and the deployment of more sustainable, responsible and circular value chains, these transitions also present significant challenges.

Better understanding the short-, medium- and long-term challenges of SMEs is critical to fostering sustainable growth and long-term resilience. Challenges and opportunities will vary over time and differ by firm. Against this background, this chapter reviews the latest developments in business dynamics and firm performance and how they differ across country, firm size and sector, depending on the economic environment, financial conditions and government policies.

Recent SME performance has been uneven across firms, sectors and countries

The economic outlook has deteriorated since Russia’s invasion of Ukraine and the energy crisis it precipitated and global financial uncertainties have intensified. In the OECD March Interim Economic Outlook, global GDP growth was projected to slow to 2.7% in 2023 from 3.3% in 2022, before picking up slightly to 2.9% in 2024 (OECD, 2023[1]). These figures mask regional differences. Asia is foreseen to be the main engine of growth in 2023 and 2024, whereas growth in Europe, North America and South America is expected to remain below historical trends (OECD, 2022[2]).

Firm dynamics have displayed marked heterogeneity across countries and sectors

Firm entry growth slowed markedly and exits accelerated in the aftermath of the war in Ukraine

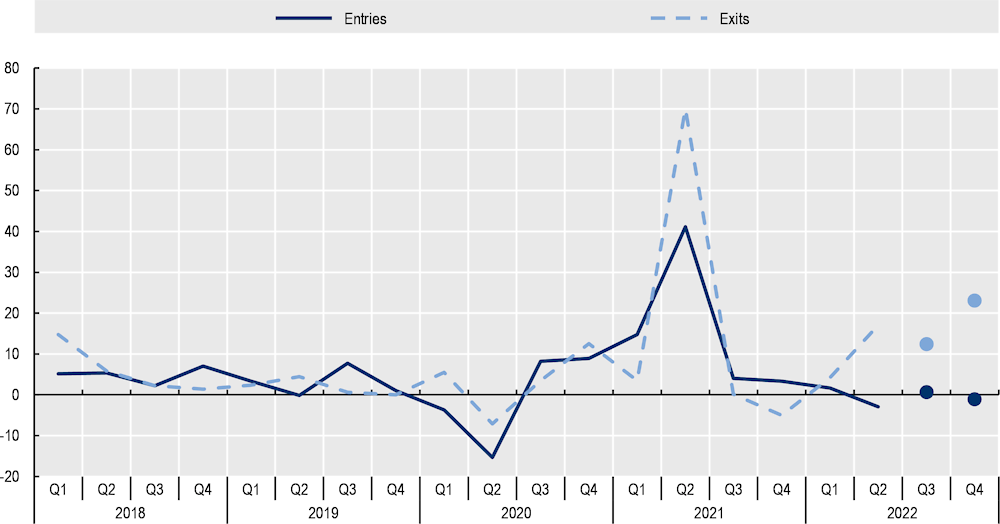

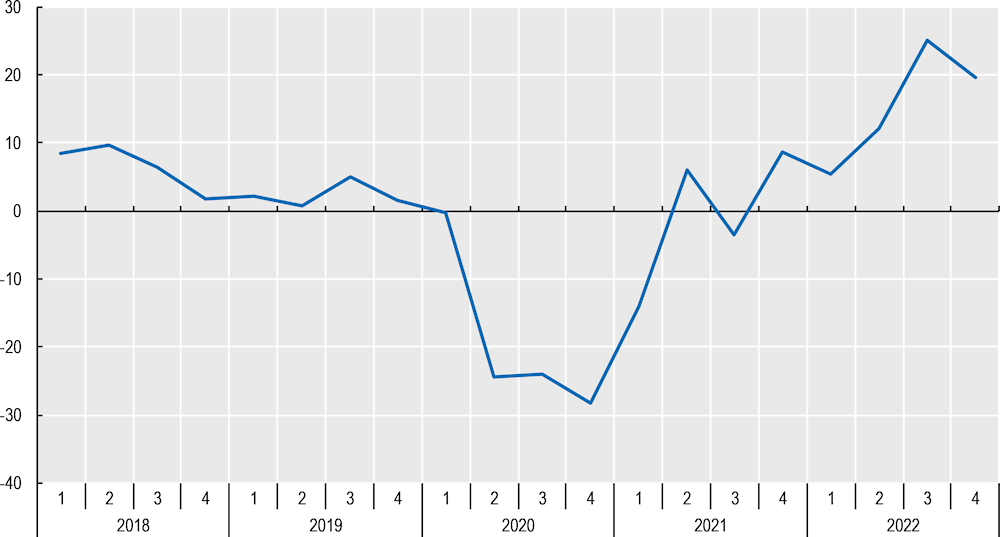

Prior to the war in Ukraine, firm entries rebounded but to varying degrees across countries. The pace of the recovery was on average rapid, with a pick-up in the second half of 2020 and relatively strong growth in firm entries in the first half of 2021, partly explained by the sharp drop in entries at the start of the COVID‑19 crisis (Figure 1.1). Such a pattern was observed in many countries but with marked differences in the shape of the recovery (Agresti et al., 2022[3]).

Firm exits increased in 2021 in many countries, reflecting the drop observed at the start of the COVID-19 crisis and, potentially, the unwinding of COVID-19 support packages and tightening monetary conditions. Evidence suggests that in the United States, the overall rate of business exits is usually driven by very small firms (Crane et al., 2022[4]; Fairlie et al., 2022[5]). In Japan, voluntary exits due to population ageing have also contributed to firm exits in the decade prior to the COVID-19 crisis (Hong et al., 2020[6]).

Figure 1.1. Firm entries and exits since 2018

Note: Entries - The solid line plots the average of Australia, Belgium, Canada, Denmark, Finland, France, Germany, Hungary, Iceland, Italy, Lithuania, the Netherlands, New Zealand, Norway, Portugal, Slovenia, Spain, Sweden, Türkiye, the United Kingdom and the United States. The dot markers plot the average of the same countries excluding Finland (in 2022Q4) and the United States (in 2022Q3 and 2022Q4).

Exits - The dotted line plots the average of Belgium, Canada, Finland, Germany, Italy, the Netherlands, New Zealand, Portugal, Slovenia, Spain, Türkiye, the United Kingdom and the United States. The dot markers plot the same average excluding Finland (in 2022Q4) and the United States (in 2022Q3 and 2022Q4).

Source: OECD.Stat (n.d.[7]), Timely Indicators of Entrepreneurship by Enterprise Characteristics, https://stats.oecd.org/Index.aspx?DataSetCode=TIMELY_IE.

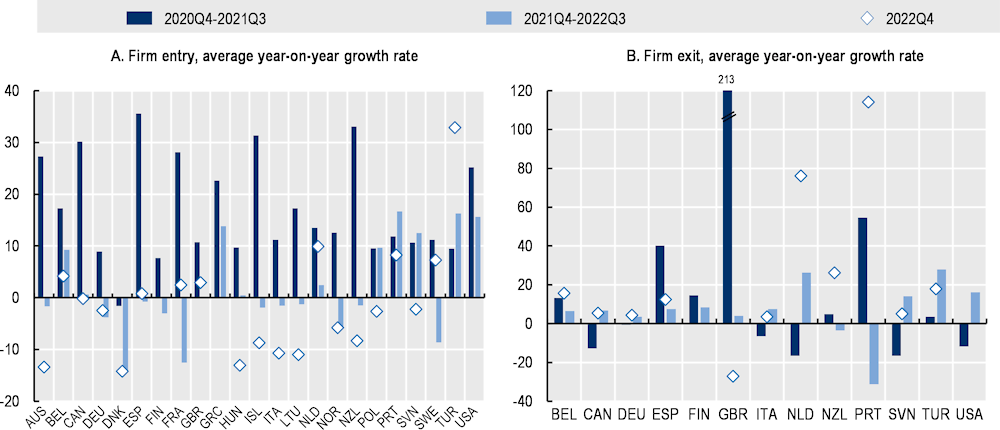

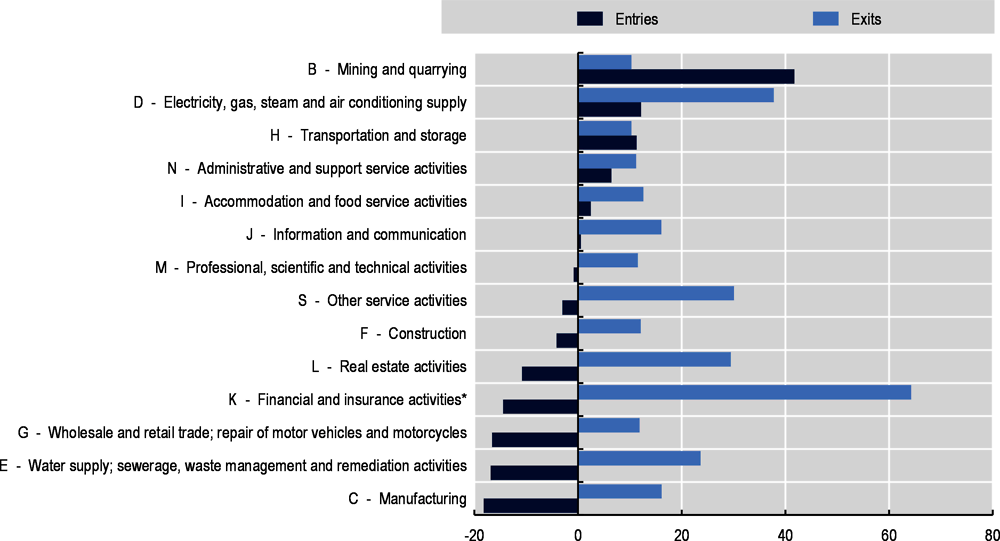

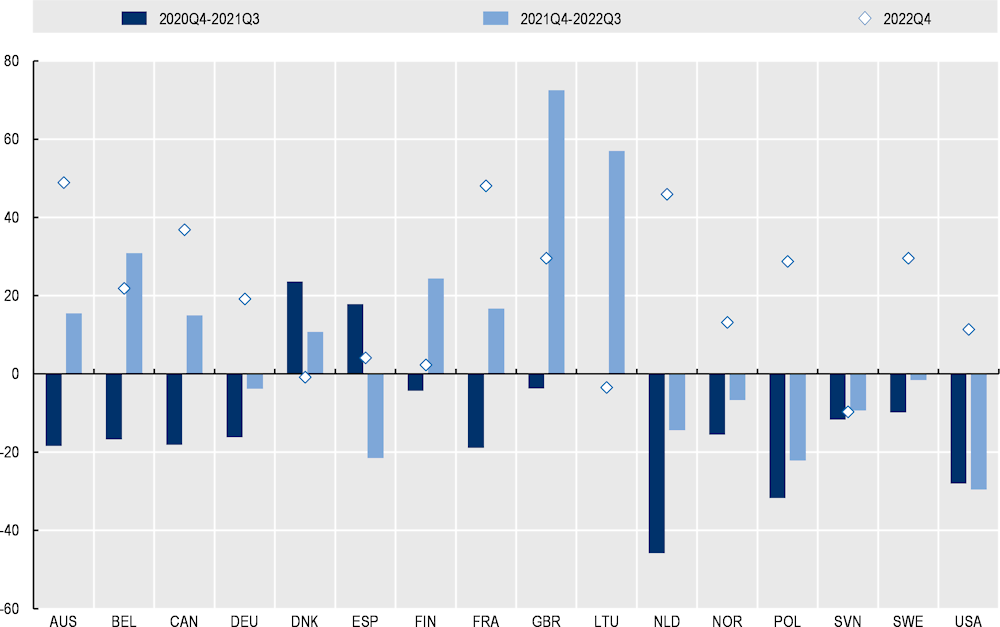

Since the start of the war in Ukraine in February 2022, firm entries have grown at much slower rates, in part reflecting the relatively high growth rates observed in countries as they recovered from the pandemic shock. The deceleration was broad-based, with Portugal, Slovenia and Türkiye being exceptions (Figure 1.2). Information on a subset of countries also points to some heterogeneities across sectors (Figure 1.3). Firm entries declined from 2021 to 2022 in “manufacturing” and “financial and insurance services”, while entries increased in “mining and quarrying” and “electricity, gas and steam”.

Firm exits have risen substantially since the start of Russia’s war of aggression against Ukraine, as firms had to cope with the ensuing energy crisis and high inflation, combined with the tightening of monetary policies and the withdrawal of fiscal support. The increase in firm exits was widespread and can be observed in all of the business sectors for which data are available (Figure 1.3).

Figure 1.2. Firm entries and exits in selected OECD countries

Source: OECD.Stat (n.d.[7]), Timely Indicators of Entrepreneurship by Enterprise Characteristics, https://stats.oecd.org/Index.aspx?DataSetCode=TIMELY_IE.

Figure 1.3. Firm entries and exits by sector

Note: Each bar reports an average of 18 countries for entries and 8 OECD countries for exits. Data usually refer to business registrations, focusing, when possible, on all businesses (including sole proprietorship). In some countries (e.g. Italy and Norway), information on the sector is missing for a significant share of business openings and exits.

* The significant increase in “Financial and insurance activities” reflects developments in the Netherlands.

Source: OECD.Stat (n.d.[7]), Timely Indicators of Entrepreneurship by Enterprise Characteristics, https://stats.oecd.org/Index.aspx?DataSetCode=TIMELY_IE.

Bankruptcies accelerated in 2022

Contrary to the 2007-08 financial crisis, bankruptcies fell in 2020. Greenwood, Iverson and Thesmar (2020[8]) reported that 2020 bankruptcy filings by small businesses in the United States were significantly lower than in prior years. Most OECD countries temporarily modified insolvency processes during the pandemic, complementing more general support to firms and the broader economy, which contributed to the sharp fall in bankruptcies. The most common insolvency measures were exceptional deferrals of payments of liabilities, a relaxation of directors’ duties, extension of deadlines in insolvency procedures and the suspension or simplification of insolvency filing obligations (André and Demmou, 2022[9]). Moratoria in all insolvency procedures were also common. Six countries introduced special insolvency frameworks for SMEs.

Bankruptcy rates have trended up since 2021 (Figure 1.4, (OECD, 2023[10])). In 2021, about 40% of the countries for which data are available registered an increase in bankruptcy rates, compared to only 20% in 2020. The highest increases were registered in the Czech Republic, the Slovak Republic and Spain. However, bankruptcies fell markedly in other economies, notably Estonia, the Netherlands, Sweden and the United States.

Figure 1.4. Firm bankruptcies

Note: The line plots the average of Australia, Belgium, Canada, Denmark, Finland, France, Germany, Iceland, the Netherlands, Norway, Slovenia, Spain, Sweden, the United Kingdom and the United States.

Source: OECD.Stat (n.d.[7]), Timely Indicators of Entrepreneurship by Enterprise Characteristics, https://stats.oecd.org/Index.aspx?DataSetCode=TIMELY_IE.

The pace of bankruptcies accelerated in 2022 in several European countries. Bankruptcies continued to fall in the United States on average during 2022 but have risen in the most recent period. Developments in bankruptcies also reflected policy changes. For instance, the number of bankruptcies in the United Kingdom was partly explained by a change in eligibility limits for Debt Relief Orders in England and Wales, which came into effect on 29 June 2021 (UK Insolvency Services, 2022[11]).

Figure 1.5. Change in bankruptcies in selected countries

Source: OECD.Stat (n.d.[7]), Timely Indicators of Entrepreneurship by Enterprise Characteristics, https://stats.oecd.org/Index.aspx?DataSetCode=TIMELY_IE.

Micro firms have outperformed SMEs in the past two years

Number of firms

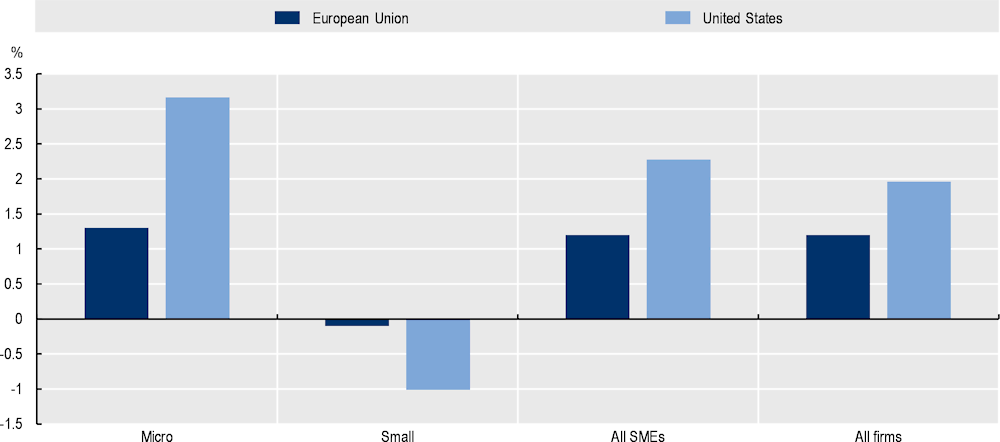

While SMEs were disproportionally hit by the COVID-19 crisis in 2020 (OECD, 2021[12]), their number rose in the European Union and the United States in 2021 (Figure 1.6). Amongst SMEs, the number of firms increased markedly for micro firms (of less than 9 employees), while the number of small firms (between 10 and 249 firms in the European Union) declined. Lower firm exits and some downscaling of firms from small to micro may have happened but those appear to be limited relative to the growth in the number of micro firms, suggesting genuine firm creation in the micro firm segment. Although it is premature to draw any solid conclusions, this may signal that the size of new firms may be smaller than in the past, as already observed in the 2019 edition of the OECD SME and Entrepreneurship Outlook (SME&E) Outlook (OECD, 2019[13]).

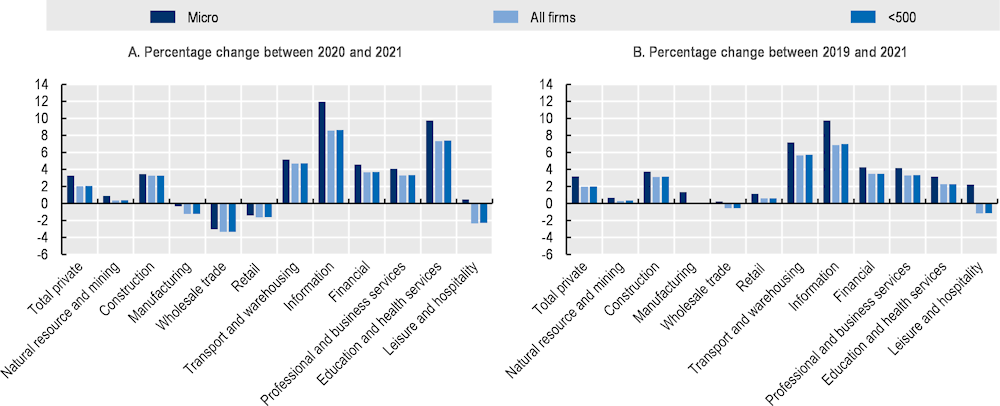

The economic shocks that hit OECD economies since the outbreak of the pandemic have had a sectoral dimension, affecting some sectors more than others (OECD, 2021[12]). Changes in the number of firms have varied accordingly. This is consistent with theory and evidence from the literature according to which the cleansing effect of the COVID-19 crisis has been sector-specific (Ascari, Colciago and Silvestrini, 2021[14]; Andrews, Charlton and Moore, 2021[15]). In the case of the United States, for instance, there is evidence that the number of firms has risen strongly between 2020 and 2021 in “information”, “transport”, “warehouse” and “financial sectors” but have been muted in “manufacturing”, “retail and wholesale trade” (Figure 1.7, Panel A). In 2021 the number of firms was still below those observed in 2019 in the latter sectors (Figure 1.7, Panel B). As observed at the aggregated levels, developments were largely driven by micro firms.

Figure 1.6. Changes in the number of SMEs, 2021

Note: Non-financial business sector for the European Union, private sector (including financial activities) for the United States. SMEs are those with fewer than 250 employees for the European Union and fewer than 500 employees for the United States. The definition of micro (fewer than 9 employees) and small firms (between 10 and 49 employees) is the same in the 2 areas.

Source: EC (2022[16]), Annual Report on European SMEs 2021/2022, European Commission; U.S. BLS (n.d.[17]), Business Employment Dynamics, https://www.bls.gov/bdm/business-employment-dynamics-data-by-age-and-size.htm.

Figure 1.7. Increase in the number of firms by sector in the United States

Note: Firms <500 include micro firms.

Source: OECD using U.S. Bureau of Economic Analysis (BEA) data.

In some economies, such as emerging-market economies, a high proportion of micro and small- and medium-sized firms operate within the informal sector, outside the legal requirements of governments and the conventional regulatory framework. These enterprises are usually very small in size and turnover but collectively can be significant for the economy.

Historically, informality has mitigated economic downturns as informal economy output tends to move in the same direction as formal economy output but in a more muted manner (Elgin et al., 2021[18]). This will mechanically reduce economy-wide productivity growth in a typical economic crisis, as informal firms are usually less productive than formal ones (Ohnsorge and Yu, 2022[19]). During the COVID-19 crisis, however, firms in the informal sector, which are mostly concentrated in low-productivity service sectors, were hit severely (Qiang and Kuo, 2020[20]), not least as many were unable to access government support.

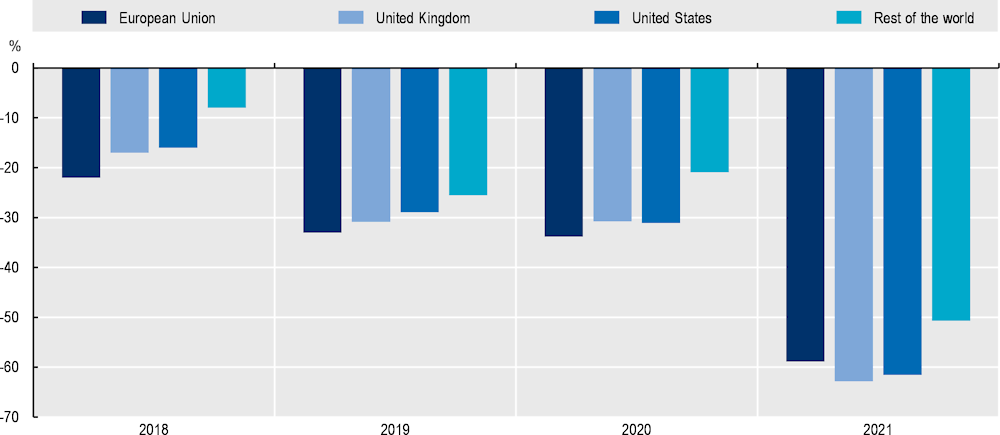

Start-ups

Recent studies have pointed to a drop in start-up creation during the COVID-19 crisis (Benedetti-Fasil, Sedlácek and Sterk, 2021[21]), although there may be some differences across countries. Globally, the number of start-ups is estimated to have been on a downward trend even before the crisis (Figure 1.8). Start-ups are defined here as active, for-profit companies with fewer than 250 employees that were founded between 1st January 2017 and 31st December 2021 and identified using the Crunchbase database, which gathers information on venture capital financed firms. The fall in the number of start-ups accelerated in 2021, falling by 60% in the European Union, the United Kingdom and the United States (EC, 2022[16]). However, the number of start-ups rose somewhat in 2021 in Germany in knowledge-intensive services sectors, after a trend decline since the early 2000s (Deutsche Bundesbank, 2022[22]).

Figure 1.8. Growth in the number of start-ups

Note: Start-ups were identified from the list of companies in the Crunchbase database which were: i) active; ii) for-profit companies with fewer than 250 employees; and iii) were founded between 1 January 2017 and 31 December 2021. Start-ups in Crunchbase have some venture capital financing and differ from business births which cover a wider range of businesses.

Source: EC (2022[16]), Annual Report on European SMEs 2021/2022, European Commission, using Crunchbase.

The missing start-ups can worsen long-term productivity developments. Historically, a severe economic downturn is often associated with a missing generation of start-ups or weaker growth performance of start‑ups that manage to go ahead. While this effect is expected to be marginal in the short term, as new firms account for a small share of firms, the absence of those start-ups can affect long-term productivity as they often play a key role in competition, innovation/creation (Kolev et al., 2022[23]) and/or in diffusing new technologies and business models (Criscuolo, Gal and Menon, 2016[24]). Some start-ups also have strong growth potential, with related economic benefits (OECD, 2021[25]).

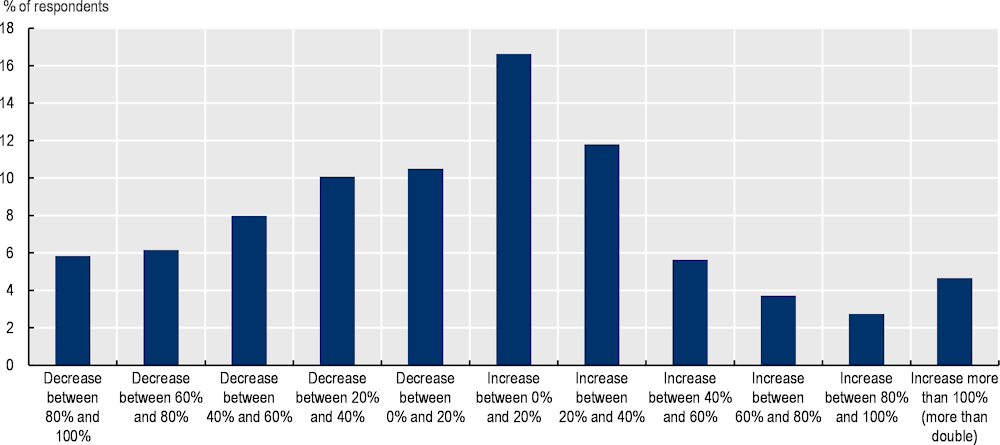

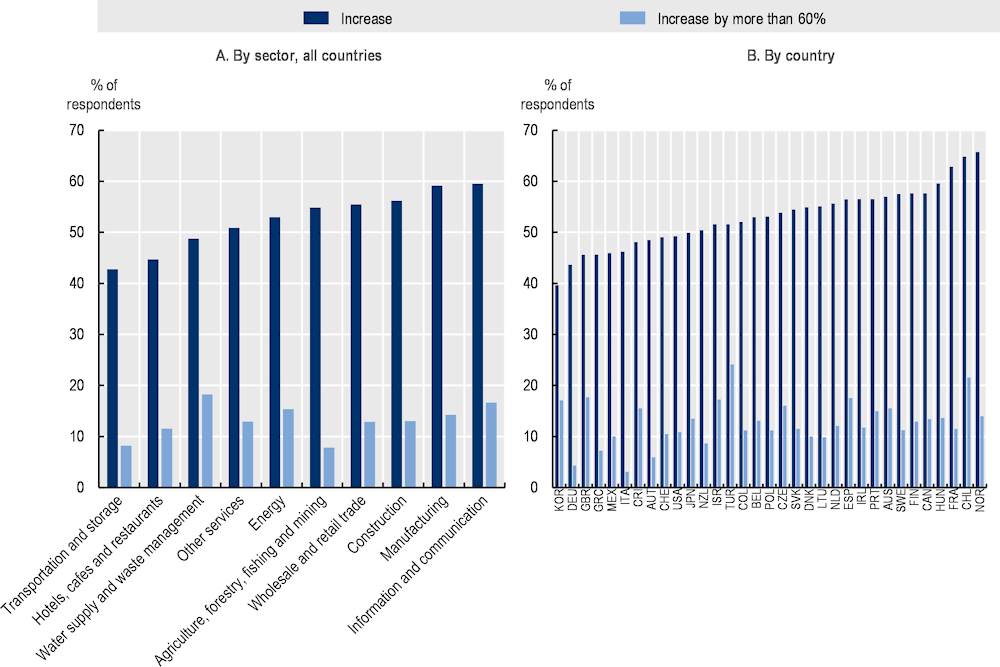

Sales

Sales are a key indicator of firm performance and can sometimes provide useful insights into future developments. Just over half of SMEs in OECD countries with a digital presence, namely a Facebook page, recorded a rise in sales between 2020 and 2021, while more than 40% saw sales contracts, according to the Future of Business Survey (Figure 1.9, Box 1.1). More than 10% of small firms recorded an increase in sales of above 60%. For comparison, SME sales in OECD countries grew on average by 3.4% in 2019, according to the OECD Structural and Demographic Business Statistics (SDBS) database. In 2021, the percentages of SMEs with an increase in sales were higher in “manufacturing” and “information and communications” (in both cases close to 60%) but lower in “transportation and storage” and “hotel and restaurants” (around 40%). Large SME sales (by more than 60%) were recorded in “energy” and “water supply and waste management”. There was also a wide disparity across countries (Figure 1.10). While more than 60% of SMEs were reported to have witnessed an increase in sales in Chile, France and Norway, the percentage was only 40% in Germany and Korea.

Box 1.1. The Future of Business Survey

This chapter relies on data from the Future of Business Survey. A questionnaire was distributed to a random sample of businesses with a Facebook business page in March 2022. There was no compensation delivered to participants for engaging with the survey.

Information for almost 15 000 businesses in every OECD country came from answers on recent performance in sales, main obstacles to operating and engaging in international trade, as well as other business characteristics such as size and sector of activity. The data used in this analysis refer to micro, small- and medium-sized firms, i.e. those with fewer than 250 employees.

Surveys were randomly sampled. Results were weighted using non-response weights for the entire sample (derived from country-specific logistic regressions) to ensure they are representative of the entire Meta population. Such a weighting scheme is found to be relatively constant from one survey wave to another.

As the survey covers only firms with a digital Facebook page and is weighted in accordance with the page administrator population rather than the total business population, it should be regarded as representative of firms with an online presence rather than the entire business population.

Source: Schneider, J. (2020[26]), Future of Business Survey Methodology Note, mimeo.

Figure 1.9. Distribution of SMEs sales growth in 2021

Note: 14.3% of respondents were not in operation in 2020. See Box 1.1.

Source: OECD-World Bank-Meta Future of Business Survey, Data for Good, (March 2022).

Figure 1.10. Percentage of SMEs with an increase in sales

Note: See Box 1.1 for more details.

Source: Using the OECD-World Bank-Meta Future of Business Survey, Data for Good, (March 2022).

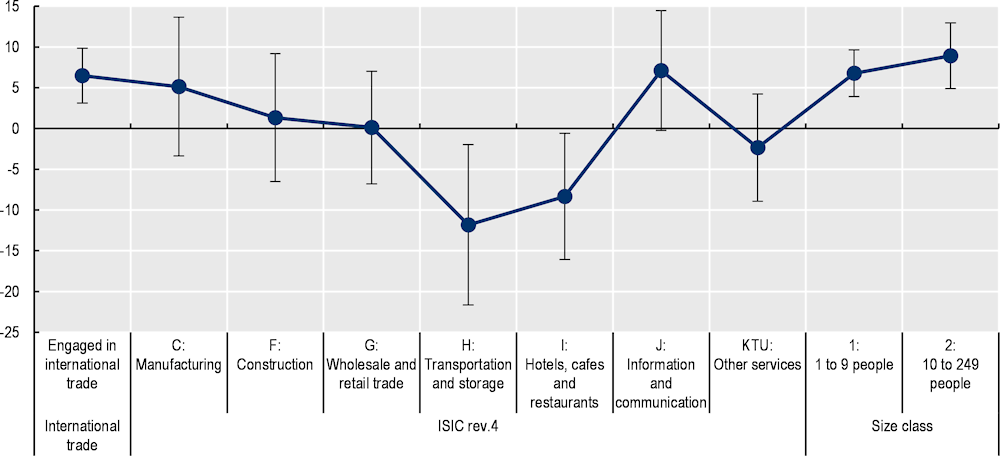

Analysis using the Future of Business Survey covering OECD countries suggests that firms with foreign customers were more likely to record an increase in sales in 2021 (Figure 1.11). Engaging in international trade is estimated to have increased an SME’s probability of experiencing an increase in sales by 3 to 10 percentage points. Micro and small- and medium-sized firms were also found to have a higher probability to have increased sales than those with no employees. Firms in the “transportation and storage” and “hotel, cafe and restaurant” sectors were, by contrast, more likely to experience a decline in sales as compared with those operating in primary sectors, manufacturing or information and communication technology (ICT).

A higher engagement in online trade was found to reduce the probability for a firm to experience a reduction in sales in 2020 according to the last OECD SME&E Outlook (2021[12]). But only firms whose share of online sales was above a certain threshold – of around 75% - were more likely to increase sales in 2021 according to the new wave of the Future of Business Survey.

Figure 1.11. Determinants of the 2021 increase in sales

Note: Marginal effects are derived using a logit regression covering 33 OECD countries for the year 2021. Engaging in international trade increases an SME’s probability of experiencing an increasing in sales by 3 to 10 percentage points. Effects are relative to the reference category “agriculture, mining, energy, water supply” regarding the sectoral dimension and relative to “firms with no employee” regarding firm size. Confidence bands are reported at 95% and are indicated by the whiskers in the chart. Effects are statistically significant when the confidence bands do not cross the zero-line.

Source: Using data from the OECD-World Bank-Meta Future of Business Survey, Data for Good, (March 2022).

Value-added and employment

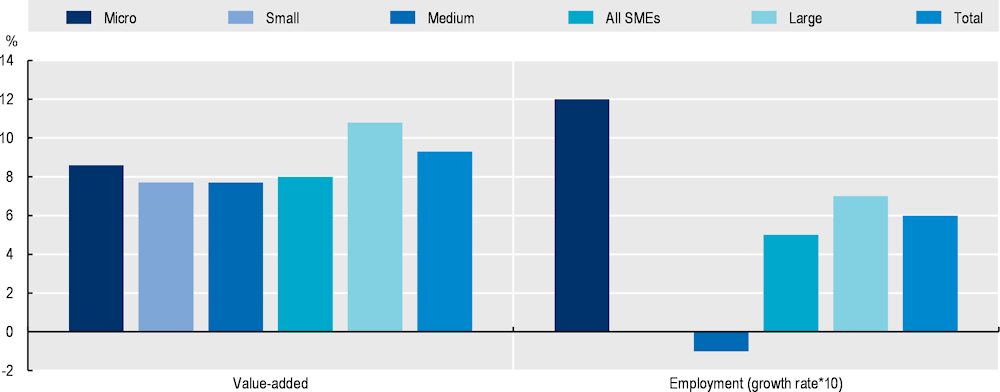

Large firms in Europe experienced a pronounced rise in value-added, with growth amounting to 10.8% in 2021, while micro and small firms’ value-added grew at a healthy but lower rate of 7.7-8%, even though they were hit disproportionally by the crisis in 2020 (Figure 1.12). This points to increasing performance gaps across firm size classes, with possible consequences for investment in the future. Despite strong growth, the level of SME value-added in 2021 remained lower than in 2019 in “accommodation and food services”, “transportation and storage”, “wholesale and retail trade”, which had to cope with lockdowns and measures put in place to limit the spread of the virus in 2020, some of which remained in place in 2021, and “administrative and support services” (EC, 2022[16]).

Micro firms outperformed larger firms in terms of employment in 2021. Employment in micro firms grew by 1.2% in 2021, compared to 0.6% for all firms in Europe, according to the 2021/22 Annual Report on European SMEs (EC, 2022[16]) (Figure 1.12). One potential explanation is that micro firms were less likely to have had access to furlough schemes and other measures put in place to help weather the crisis. Some of the stronger employment growth in 2021 could thus reflect a rebound from 2020 lows. Employment developments differed widely within the European Union. Employment fell in a number of Central and East European countries, while an increase was visible in other European Union (EU) countries such as Belgium or Portugal.

Figure 1.12. Employment and value-added annual growth by firm size in the European Union

SME employment performance did not depend on the initial level of productivity. According to the OECD Structural and Demographic Business Statistics (SDBS) database, 24% of industries with low levels of productivity in 2019 were also in the top 33% group with the strongest employment growth in 2020 (Table 1.1). Part of this could reflect the surge in employment in selected low-productivity sectors such as home care in 2020 (OECD, 2021[12]). At the same time, a number of high-productivity industries experienced a low or moderate increase in employment.

Table 1.1. Employment performance and initial level of productivity

|

Employment growth, 2020 (%) |

||||

|---|---|---|---|---|

|

Top 33% |

Medium range |

Bottom 33% |

||

|

Productivity level, 2019 (%) |

Top 33% |

38.0 |

35.1 |

26.9 |

|

Medium range |

28.8 |

41.8 |

29.4 |

|

|

Bottom 33% |

24.3 |

29.3 |

46.4 |

|

Note: Productivity is measured as value-added per person employed. The analysis covers 25 European countries and business sectors (excluding finance). The ranking is made by country. Only SMEs are considered.

Source: Calculation using OECD.Stat (n.d.[27]), OECD Structural and Demographic Business Statistics (SDBS) database, https://stats.oecd.org/Index.aspx?DataSetCode=SSIS_BSC_ISIC4.

Productivity and wages

A number of factors affected SME productivity during the crisis. Small firms were less able to weather the crisis than larger firms (D’Adamo, Bianchi and Granelli, 2021[28]) as they were less likely to receive government support (OECD, 2021[12]) and experienced larger declines in hours worked (ILO, 2021[29]).

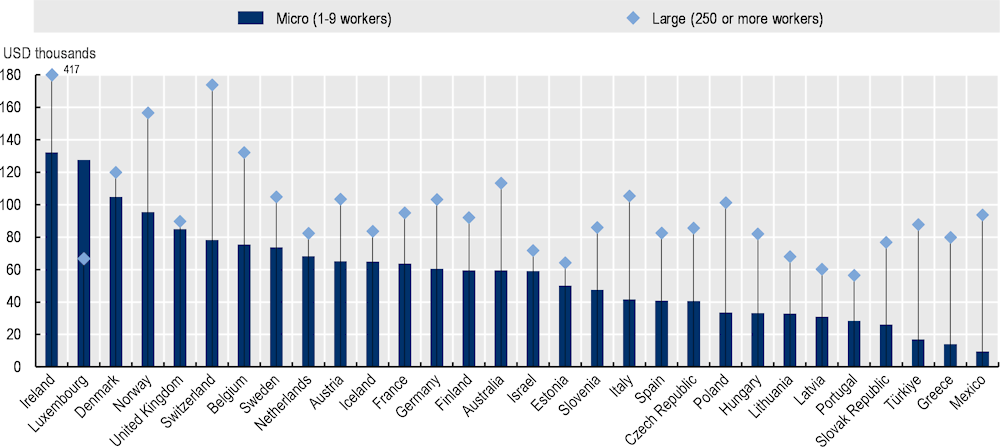

Although labour productivity data by size class are not available for the post-COVID period, pre-crisis data show that larger firms are on average more productive than micro firms (Figure 1.13). This typically reflects increasing returns to scale and capital-intensive production. In most countries, labour productivity gaps between micro and large firms are relatively high, particularly in the manufacturing sector (OECD, 2021[30]). Differences in productivity across size classes are relatively smaller in business services. In some cases, smaller firms can outperform larger firms, particularly in the business services sector, reflecting competitive advantages in niche, high brand or high intellectual property content activities as well as the intensive use of affordable information and communications technologies.

The increasing share of micro firms in employment is likely to be concomitant with a decrease in productivity at the economy-wide level. Labour productivity in the OECD, measured as GDP per hour worked temporarily increased at the outbreak of the pandemic. It accelerated in the first year of the pandemic, with growth exceeding 3% in 2020, compared to less than 1.5% in 2019 and 1.2% on average from 2000 to 2019. The pattern in 2020 was due to hours worked contracting sharply in the first half of the year, which more than offset a contraction in output (OECD/APO, 2022[31]). During the second half of 2020, hours worked recovered in line with output and resulted in a small drop in labour productivity. OECD (2023[32]) suggests that most of these productivity developments can be explained by shifts in activities across sectors (Box 1.2).

Figure 1.13. Labour productivity in micro and large firms

Source: Calculation using OECD.Stat (n.d.[27]), OECD Structural and Demographic Business Statistics (SDBS) database, https://stats.oecd.org/Index.aspx?DataSetCode=SSIS_BSC_ISIC4.

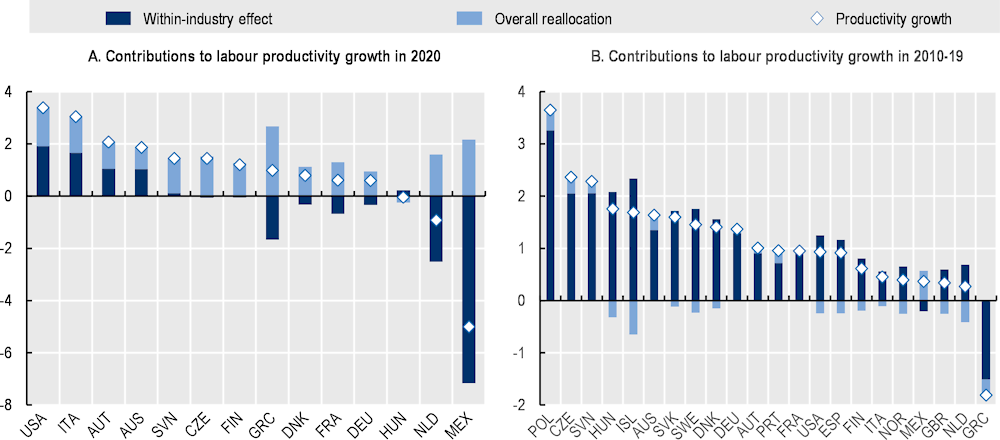

Box 1.2. Shift-share analysis of productivity

Using a shift-share analysis, Pionnier, Zinni and Luu (2023[33]) document unusually large movements in terms of productivity in 2020 in OECD countries, especially in countries which put in place stringent lockdown measures (Figure 1.14). Shifts of activity across sectors were found to be the main sources of economy-wide productivity growth. By contrast, the within-industry contributions to labour productivity growth in 2020 declined compared to the previous decade in most countries for which data are available. They even turned negative in the Czech Republic, Denmark, Finland, France, Germany, Greece, Mexico and the Netherlands. By contrast, these contributions were higher in 2020 than in 2010-19 in Austria, Italy and the United States. In most countries, “transport”, “accommodation” and “personal services” contributed negatively to within-industry productivity growth in 2020, while “trade”, “ICT”, “finance and insurance” and “business services” contributed positively. Countries differed in the relative magnitude of these negative and positive contributions.

Shift-share analysis on the few countries for which detailed industry data are available for 2021 shows that these shifts were largely related to temporary disruptions. In most countries, the allocation of hours worked across sectors started to revert to its pre-pandemic level in 2021. In Austria, Italy and Slovenia, the overall reallocation effect went back to small values, while in the United States, it reached a low negative value that nearly cancelled the large positive effect that was observed in 2020.

Figure 1.14. Shift-share analysis of productivity

Note: The decomposition of economy-wide labour productivity growth includes two terms: a within-industry effect, where labour productivity growth in each industry is weighted by the industry share in total value-added in year t-1, and an overall reallocation. The latter is the sum of a static reallocation effect (accounting for changes between t-1 and t in the total hours worked share of industries with different productivity levels. Industries with an increasing share in total hours worked contribute positively to aggregate labour productivity growth if they have an above-average labour productivity level) and a dynamic reallocation effect (accounting for changes between t-1 and t in the total hours worked share of industries with different productivity growth rates. An increase in the total hours worked share of industries with positive productivity growth has a positive effect on aggregate labour productivity growth. This effect is all the more significant because the industry value-added is high).

Source: OECD (2023[32]), OECD Compendium of Productivity Indicators 2023, https://doi.org/10.1787/74623e5b-en.

Source: Pionnier, P., B. Zinni and N. Luu (2023[33]), “Aggregate labour productivity growth during the pandemic: The role of industry reallocations”, VoXEU.

Wages are highly correlated with productivity across size classes and wages in small and micro firms are generally lower than in larger firms. For instance, according to the U.S. Bureau of Economic Analysis (BEA) data, wages per head were on average about 20% lower in micro and small firms than in large firms in the United States in 2017. In other OECD countries for which data from the OECD Structural and Demographic Business Statistics (SDBS) database are available, wages per head in manufacturing activities were on average about 35% lower in micro and small firms compared to large firms in 2020.

SMEs face mounting short-term challenges

SMEs are facing many challenges in the coming years, including the fallout of the war in Ukraine and the energy crisis. While SMEs are in general only marginally directly exposed to the war in Ukraine, they have been significantly affected by the sharp increases in energy and commodity prices, tightening financial conditions and lesser monetary and fiscal support. Supply-chain disruptions, financial sector stress and labour shortages also add challenges.

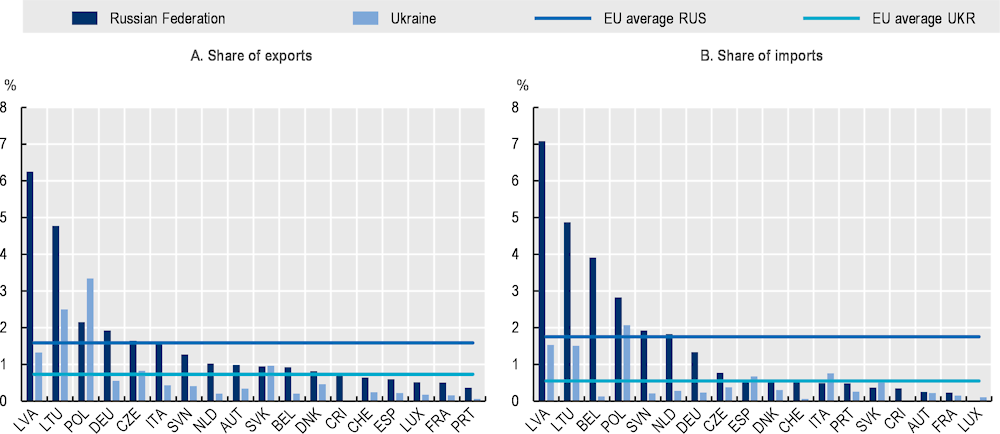

SMEs direct exposure to Ukraine and Russia is limited

The direct international trade effects of the war in Ukraine on SMEs on average across countries and sectors are estimated to be limited, as they are generally little exposed to direct trade with Belarus and Russia (Figure 1.15). In 2020, the share of EU SME trade to/from Ukraine was generally below 3% of their total exports. SME exposure to Russia is higher but still limited, except in a few East European countries, such as Latvia, Lithuania and Poland. SMEs operating in tourist regions with traditionally high numbers of Russian visitors will also likely be hit severely.

Figure 1.15. Exposure of SMEs to trade with Russia and Ukraine

Note: Share of exports (imports) is the percentage of the value of exports (imports) relative to the total exports (imports). For example, imports from Russia make up 7% of total imports of Latvia and imports from Ukraine make up 1.5% of total imports of Latvia.

Source: Calculations based on OECD.Stat (n.d.[34]), I - TEC by Sector and Size Class, http://stats.oecd.org/Index.aspx?DataSetCode=TEC1_REV4.

At the sectoral level, SMEs in the energy sector where Russia is a global player are expected to exhibit more vulnerability. Sectors, where SMEs account for the largest share of employment, are generally highly vulnerable to a rise in energy prices (Box 1.3).

Box 1.3. A snapshot of SME vulnerability to energy prices

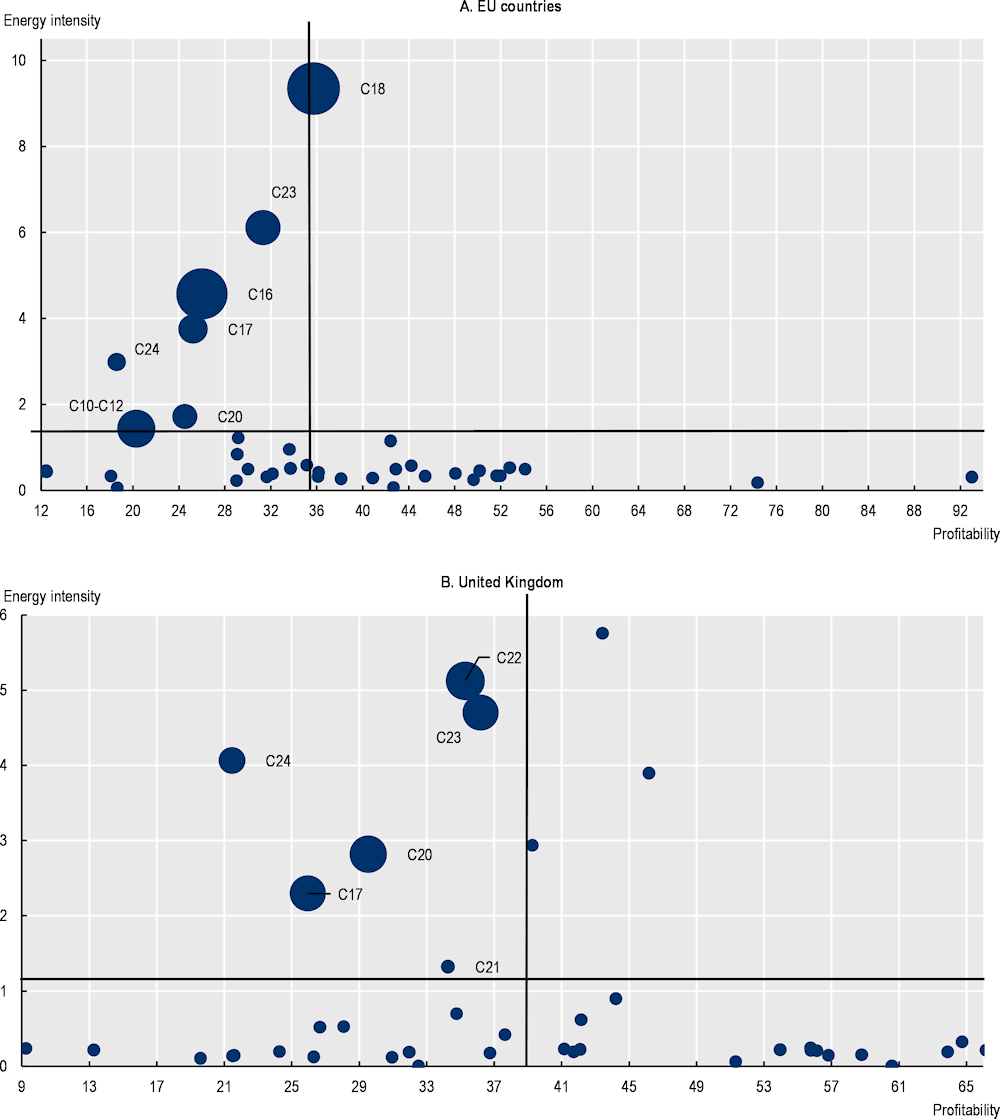

This box examines the vulnerability of SMEs to a rise in energy prices looking at two dimensions of SMEs: financial health (proxied by profitability) and exposure to energy prices (proxied by use of energy in the production process – energy intensity). Firms located in the upward-left quadrant (high-risk sectors) will be in general more vulnerable to a rise in energy prices than those located in the bottom-right quadrant (low-risk sectors) (Figure 1.16).

Figure 1.16. Framework to assess the vulnerability of SMEs to energy prices

The analysis is conducted at a two-digit sector level for the European Union and the United Kingdom in 2018. It covers enterprises of all sizes and uses Eurostat’s complete energy balances and the OECD Structural and Demographic Business Statistics (SDBS) database. The size of the bubble indicates the share of SME employment in that specific sector.

The comparison between the European Union and the United Kingdom points to the following conclusions (Figure 1.17). First, sectors, where SMEs account for the largest share of employment, are generally in the high-risk quadrant. Second, some of these sectors are common between the two regions such as: manufacturing of paper and paper products (C17); manufacturing of chemicals and chemical products (C20); manufacturing of other non-metallic mineral products (C23). However, some vulnerable sectors are country/region specific, for instance, the manufacturing of rubber and plastic products (C22) for the United Kingdom, and printing and reproduction of recorded media (C18) for the European Union.

Figure 1.17. Vulnerability analysis, 2018

Note: C10-C12 - Manufacturing of food products; beverages and tobacco products; C13-C15 - Manufacturing of textiles, wearing apparel, leather; C16 - Manufacturing of wood and products of wood and cork; C17 - Manufacturing of paper and paper products; C18 - Printing and reproduction of recorded media; C20 - Manufacturing of chemicals and chemical products; C21 - Manufacturing of basic pharmaceutical products and pharmaceutical preparations; C22 - Manufacturing of rubber and plastic products; C23 - Manufacturing of other non-metallic mineral products; C24 - Manufacturing of basic metals; C33 - Repair and installation of machinery and equipment.

Source: OECD calculation using Eurostat data and OECD.Stat (n.d.[27]), SDBS Structural Business Statistics (ISIC Rev. 4), https://stats.oecd.org/Index.aspx?DataSetCode=SSIS_BSC_ISIC4.

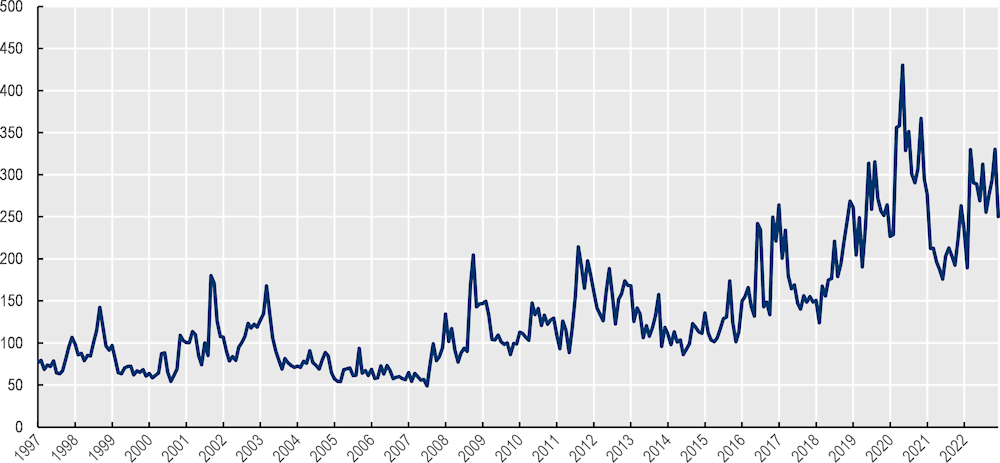

Elevated uncertainties and geopolitical tensions

Global economic and policy uncertainties have hovered around elevated levels, even though they remain below the peak observed in 2020 (Figure 1.18). Recent credit shocks have increased uncertainties related to financial developments and monetary policy reactions. This uncertain economic and political environment is likely to have several implications for SME performance. First, this, together with increased indebtedness as a result of the COVID-19 crisis, could lead to increased risk premia in loans and other forms of external financing. Second, this may depress demand and sales expectations everything else being equal. All these factors are likely to deter investment, in a context where digitalisation and decarbonisation are increasing investment needs.

Figure 1.18. Global economic and policy uncertainties

Note: The Global Economic and Policy Uncertainty (GEPU) Index is a GDP-weighted average of national EPU indices for 21 countries: Australia, Brazil, Canada, Chile, China, Colombia, France, Germany, Greece, India, Ireland, Italy, Japan, Mexico, the Netherlands, Russia, South Korea, Spain, Sweden, the United Kingdom and the United States.

Source: EPU (n.d.[35]), Economic Policy Uncertainty Index, https://www.policyuncertainty.com.

Inflation and rising costs

Inflation has become a major concern amongst SMEs. According to the U.S. Chamber of Commerce survey conducted between 29 April and 17 May 2022, inflation and related concerns are dominating small business leaders’ thinking as COVID-19 concerns started to fade. Forty-four percent of the small businesses surveyed cited inflation as the biggest challenge facing small business owners, up from 33% the previous quarter. This is up significantly from 19% in the third quarter of 2021. Furthermore, 88% were concerned about the impact of inflation on their business, with 49% indicating they were very concerned, up from 44% in the first quarter of 2022 (U.S. Chamber of Commerce, 2022[36]).

Year-on-year consumer price index (CPI) inflation in the OECD reached a level in mid-2022 not recorded since the late 1980s. The rise started at the end of 2020, prior to the invasion of Ukraine, but the war has exacerbated inflationary pressures, through energy and commodity prices. Inflation has been falling since the end of 2022, as energy costs have dropped, but has remained at high levels in most OECD countries. Core inflation (which strips out food and energy inflation) has remained at elevated levels, in line with high levels of labour shortages in some countries, tight labour markets and a slow adjustment of margins (OECD, 2023[1]).

Most SMEs increased the prices of their goods and services in the first 6 months of 2022, for most of them between 5-15% according to the Global State of Small Business Survey, fielded from 5-17 July 2022. This was particularly the case for firms operating in “hotel, cafe and restaurant”, “other services” and “wholesale and retail sales” sectors. Most small firms in the OECD reported an increase in the cost of their business input and labour, of between 25-50% of the cost of operating. Firms reporting such an increase were found in sectors such as “hotel, cafe and restaurant”, “agriculture, foresting, fishing and mining” and to a lesser extent “construction”. One of the leading factors in increasing costs was rising energy bills. Energy inflation recently decreased but has remained elevated. According to OECD estimates, a 10% rise in energy prices is estimated to Increase by 7.5% the number of firms exiting the market (Dechezleprêtre, Nachtigall and Stadler, 2020[37]).

Some of the factors affecting prices are likely to be of a short-term nature, including those driven by shipping costs and supply disruptions (Carriere-Swallow et al., 2022[38]; di Giovanni et al., 2022[39]), labour markets (Blanchard, 2022[40]) and aggregated demand (di Giovanni et al., 2022[39]). During the period 2019-21 for instance, sectoral labour shortages accounted for around one-half of inflation in the euro area and only one-third in the United States (di Giovanni et al., 2022[39]). The remaining part of inflation was explained by the demand side, with aggregate demand playing a larger role than sectoral demand shifts. International spillovers also drove inflation in the euro area. More generally, international connectedness, as measured by global value chains, is often reported as a reason for the increasing importance of global factors in explaining national inflation (Auer, Borio and Filardo, 2017[41]).

Ultimately, inflation developments over the medium term will depend on the extent to which Central Banks manage to keep inflation expectations anchored and whether the rise in price inflation will spiral into a surge in wages. Nominal wage growth has picked up in most economies but has not kept pace with inflation. With inflation expected to remain well above target over at least the next year, it is probable that many wage demands in 2023-24 will be considerably higher than previously anticipated (OECD, 2022[2]). While inflation could come down rapidly if supply-chain disruptions continue to ease and global policy tightening results in fast declines in energy and goods prices, the risk that high inflation becomes entrenched cannot be excluded. Inflation rates in services appear to be picking up from already elevated levels and they are likely to stay elevated for some time, together with cost pressures from tight labour markets. Finally, further geopolitical tensions can ignite a renewed surge in energy prices or compound existing disruptions keeping inflation high.

Heightening labour and skill shortages

Retaining and attracting staff has become a major issue for SMEs in OECD countries, despite recent signs of easing labour-market pressures in developed economies (OECD, 2023[1]). It is reported to be the second most pressing challenge SMEs with an online presence and older than two years faced in the first quarter of 2022 according to the Future of Business Survey. This is also 1 of the 2 top challenges that 60% of firms faced in the United States in the 12 months prior to October-November 2021, according to the 2022 SEBC employer firms survey.

The number of firms reporting labour shortages rose significantly in the second half of 2021 and early 2022, in many countries and industries. In OECD countries, increases in job vacancy rates and vacancy-to-unemployment ratios have been broad-based in the post-COVID period but particularly pronounced in “manufacturing”, “accommodation and food”, and “health and social work” (Causa et al., 2022[42]).

The Great Resignation – the rise in voluntary resignations – that followed the first lockdowns has resulted in pockets of labour shortages, adding to the labour-market tensions arising primarily from a strong global demand and massive recovery plans which boosted labour demand (OECD, 2022[43]). Resignation rates have risen particularly – but not only – in the United States and originated to a large extent from young and less-educated workers in industries and occupations that were most adversely affected by the pandemic (Hobijn, 2022[44]). Resignations are estimated to have been triggered by a mix of tighter labour markets and an increase in workers’ bargaining power (Bachmann et al., 2021[45]; Abendschein, Causa and Luu, 2022[46]) and potentially a change in workers’ preferences, especially those in part-time or out of the labour force (Faberman, Mueller and Şahin, 2022[47]) or in low-pay, low-quality jobs often contact-intensive activities (IMF, 2022[48]; Parker and Horowitz, 2022[49]). Official statistics on resignation rates by industry in the United States provide further evidence of the importance of job quality: higher quit and vacancy rates have been generally found in industries with lower pre-pandemic earnings and worse working conditions, such as “retail trade”, “food and hospitality” and “manufacturing”.

Preliminary evidence suggests that the Great Resignation is unlikely to lead to long-lasting changes in labour markets (Pizzinelli and Shibata, 2023[50]). First, only a small share of job quitters in the United States seem to be changing the industry of employment or occupation (Hobijn, 2022[44]). Second, the decline in willingness to work is found to be, in the case of the United States, essentially for those out of the labour force (Faberman, Mueller and Şahin, 2022[47]). Third, while the pandemic caused a sizeable reduction in job searches for most of 2020, job search efforts rebounded strongly in 2021 (Faberman, Mueller and Şahin, 2022[47]). Industries and occupations with the biggest increase in their quits rate during the pandemic also saw the fastest job growth in 2021 (Hobijn, 2022[44]).

By contrast, changes in the working environment may have permanent impacts on labour markets. There are some emerging signs that the increase in teleworking is likely to persist over time, even though full teleworking is unlikely to become the norm. Survey data collected by the OECD Global Forum on Productivity suggest that managers and workers wish to increase substantially the share of regular teleworking from pre-crisis levels (Criscuolo et al., 2021[51]). Respondents, on average, find that the ideal amount of teleworking is around 2-3 days per week, in line with other recent evidence and with the idea that the benefits (e.g. less commuting) and costs (e.g. impaired communication and knowledge flows) need to be balanced at an intermediate level of teleworking intensity. Empirical analyses also point to an asymmetric reaction of the recourse of teleworking to restrictions, with a strong increase in teleworking after a tightening in restriction but no strong effect after an easing. This asymmetry implies that the increase in teleworking experienced at the start of the pandemic is likely to be only partially reverted (Adrjan et al., 2021[52]). One feature that is likely to influence the decision to telework is the quality and the ease of access to broadband as well as the housing market situation (Ahrend et al., 2022[53]).

The need to adapt to a new environment and cope with uncertainty has negatively affected the mental well-being of SMEs, entrepreneurs and employees. The mental health impact of the pandemic has been huge, with a prevalence of anxiety and depression more than double the levels observed pre-crisis in most countries with available data, most notably in Mexico, the United Kingdom and the United States (OECD, 2021[54]). Such a consideration needs to be accounted for when designing SME policies.

Beyond the economic shocks, digitalisation and the green transition are expected to lead to durable sectoral changes by altering business models and the way firms operate (OECD, 2019[13]) and put further pressure on labour markets. For instance, artificial intelligence is foreseen to extend the range of automatable tasks, including routine cognitive tasks that are typical of service activities, or business capacity for anticipation and differentiation (e.g. customer profiling) that are key to SME performance. The adoption of new technologies may disrupt temporarily existing production processes and operations, as SMEs will have to retrain employees or hire new ones. Adapting skills to emerging needs should also be an important component of the ecological transformation. Indeed, the transition to a low-carbon economy will only be possible if workers can flexibly adapt and transfer to greener jobs or industries. Estimates suggest that a little bit less than half of green-task jobs are currently located in micro and small firms (OECD, 2023[55]).

Overall, labour shortages (beyond the Great Resignation) and the competition for skills are likely to persist over time, placing SMEs at an even greater disadvantage. They are likely to accentuate SMEs’ traditional difficulties in attracting and retaining skilled employees as they tend to offer less attractive remuneration and working conditions than large firms (OECD, 2019[13]) and lack the capacity and networks needed to identify and access talent (Chapter 4).

Supply-chain pressures

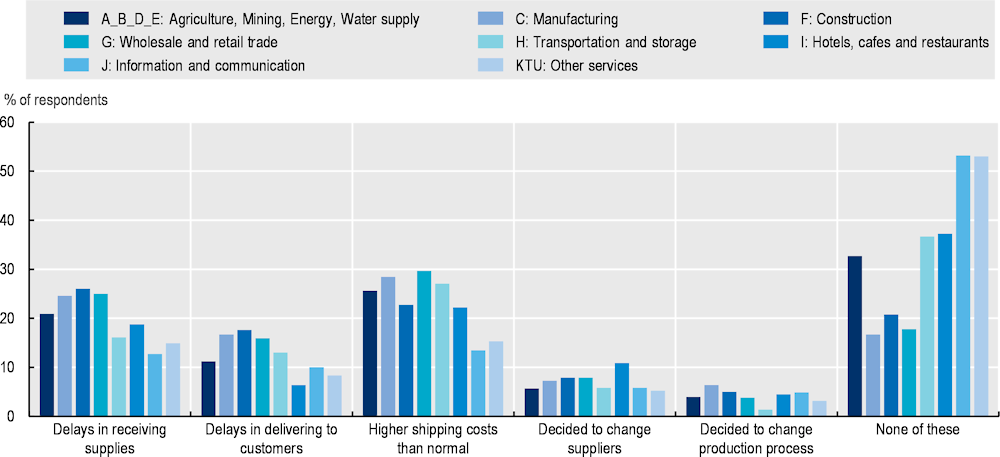

The many shocks faced by the world economy since the start of the pandemic have favoured the emergence of supply-chain disruptions. According to the Future of Business Survey, about 62% of SMEs, with a Facebook page, reported having faced supply-chain disruptions in 2021. Delays in receiving supplies and higher shipping costs than normal were the most common forms of disruption mentioned (Figure 1.19). This is consistent with the 2022 SEBC employer firms survey, fielded in October-November 2021 in the United States, according to which navigating supply-chain issues was 1 of the 2 top operational challenges that 60% of the firms faced in the prior 12 months.

Figure 1.19. Supply-chain disruptions in SMEs in 2021

Despite transport bans, including airspace bans, that have followed the Russian invasion of Ukraine and the reintroduction of pandemic restrictions including China’s zero-COVID policy in 2021-22, global supply-chain pressures decreased significantly in 2022. They have however remained well above the historical average (New York Fed, 2022[56]).

The reopening of China has disrupted supply chains in the short term, as the rapid spread of the virus has slowed down the world’s major suppliers. This is estimated to have partially contributed to the pause in global supply-chain pressures’ reversal toward its historical range over the last three months of 2022 (New York Fed, 2023[57]). China’s reopening is likely to relieve some supply-chains pressures in the medium term, although it is unlikely to fully revert to the ongoing process of slowing down supply-chain expansion (Chapter 3).

The extent of disruptions varies widely across sectors. While the majority of small firms in “information and communications” and in “other services” reported no disruption, most SMEs experienced disruptions in “manufacturing”, “retail and wholesale trade”. Beyond those sectors, disruptions are likely to occur in sectors where Russia and Ukraine are major producers, such as wheat. Likewise, the disruption in fertiliser manufacturing risks putting agricultural supply under stress for the years to come. Small firms have also to cope with shortages of semi-conductors. Russia and Ukraine are leading global suppliers of metals and raw materials, mostly directed to the EU market, and important sources of intermediate inputs in several sectors across the OECD (Chapter 3).

Tightened credit conditions

The COVID-19 crisis has tested the financial resilience of firms, in particular small firms which have traditionally less access to finance than larger firms. According to some estimates, 25% of firms exhausted their liquidity buffers in the European Union by the end of 2021 (Archanskaia et al., 2022[58]). Further, 10% of pre-shock viable firms appear to have shifted into insolvency status as a result of the COVID-19 crisis. These results appear more prominent in sectors that were affected more by the pandemic and the associated containment measures. The rise in energy costs is likely to have enhanced those financial needs.

Monetary policy stances have tightened to counter inflation in both developed and some emerging-market economies. After years of very favourable financial conditions since 2020, financial markets around the world have also become more volatile, reflecting greater risk aversion and uncertainty. In 2021, SME interest rates increased in 16 out of 34 Financing SMEs and Entrepreneurs Scoreboard countries (OECD, 2023[10]). However, the increase in the cost of lending did not translate into tighter lending conditions for SMEs compared to large companies, as more than half of the countries registered narrower SME interest rate spreads in 2021 (OECD, 2022[59]) This is consistent with survey data in different regions. In the euro area, access to finance was one of the least important concerns of SMEs, despite an increasing share of SMEs reporting higher interest throughout 2021 (ECB, 2021[60]). Similarly, in the United States, credit conditions tightened following the end of the Paycheck Protection Program but SME credit quality increased in 2021 with particular improvements in the debt-to-income levels and the liquidity positions of SME borrowers (kcFED, 2022[61]). Improved liquidity positions might have also contributed to a decline in the demand and uptake of SME loans in 2021.

Looking forward, securing financial expansion is the second challenge put forward by firms with an online presence and younger than two years, according to the Future of Business Survey. Bank loans have remained the most common source of external financing, although most SMEs reported not having recourse to external financing and debt is not the most appropriate source for financing growth, especially for start-ups (OECD, 2022[62]). Higher interest rates are likely to impact the conditions for SME borrowing. Survey data suggest that tightening monetary stance in 2022 increased the cost of credit for SMEs in the United States, while loan demand started to rise to cope with supply-chains disruptions (kcFED, 2022[61]).

Difficulties in accessing finance have risen for firms that are highly indebted. The share of zombie firms – firms that are in distress but avoid default thanks to their continued access to cheap funding and forbearance from their lenders – in assets, capital and debt is much higher among SMEs than among large companies. In a sample of 14 advanced economies, around 6-7% of the assets, capital and debt of all listed firms are sunk in zombie firms but this proportion reaches about 40% for listed SMEs (Banerjee and Hofmann, 2020[63]). Evidence from Japan suggests a decline in the exit of unhealthy firms (weaker cleansing mechanism) and an increase in borrowing, especially in long-term debt (Ito, Saito and Hong, 2022[64]). The pockets of vulnerabilities are concentrated in Japanese sectors most affected by the pandemic, with a sharp increase in the number of zombie firms that would otherwise have been healthy without the pandemic. In Central Europe, around 20% to 25% of all firms are estimated to be financially vulnerable (ERBD, 2022[65]). Just over a quarter of those vulnerable firms – or around 5% of all firms by total assets – can be classified as true zombies (Acharya et al., 2022[66]). Zombie firms then create negative spillovers for healthy companies: strong firms see weaker growth in investment, revenue and employment when they operate in sectors with more zombie firms. Firms which are highly integrated in global value chains are particularly vulnerable to such negative spillovers. In addition, firms operating in countries with a high share of loans issued in foreign currency, are vulnerable to exchange-rate fluctuations.

Recent credit shocks have increased financial uncertainties and blurred signals on expected interest rates, in the context of still elevated core inflation. Financial conditions have tightened, which is likely to entail lower lending and activity if they persist (IMF, 2023[67]).

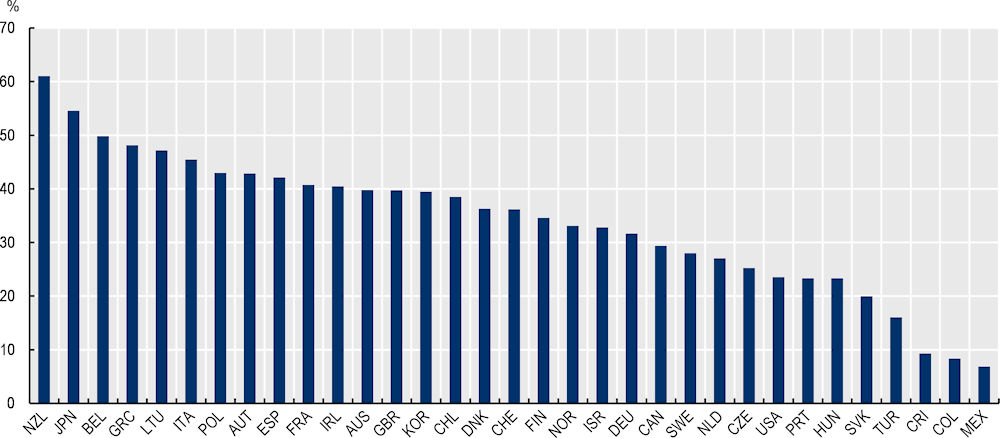

Change in the nature of direct fiscal support to SMEs

Since the beginning of the COVID-19 crisis, countries have supported small firms through various instruments. The most common forms of support were non-repayable grants or subsidies. The share of small firms that benefitted from this support varied widely across countries. More than half of small firms received support in Japan and New Zealand (Figure 1.20). Cross-country differences appear to be unrelated to the magnitude of the economic shock and existing fiscal space (OECD, 2021[12]). The extent of support varied also depending on the sectors of the firm. In OECD countries, the proportion of small firms which reported having received support is higher in the “hotel, cafe, restaurant”, “energy”, “transport and storage” and “water supply and waste management” sectors. By contrast, there is no difference depending on whether the firm is engaged in international trade or not, or on the age or the gender of the owner. Firms older than five years reported more often to have received support than younger firms.

Figure 1.20. Proportion of SMEs with a Facebook page receiving government support since the start of the pandemic

Source: Calculations, based on OECD-World Bank-Meta Future of Business Survey, Data for Good, (March 2022).

Since June 2020 and in particular in the first half of 2021, governments have increasingly focused on supporting the recovery (OECD, 2021[68]), changing the nature and the extent of fiscal support. Compared to rescue measures implemented to respond to the COVID-19 crisis, support to firms in recovery packages included fewer measures specifically targeted to SMEs (OECD, 2022[59]). Within the group of SMEs, rescue packages appeared to have a stronger focus on start-ups and high-growth firms.

The type of support and design of instruments vary widely across countries (Box 1.4) but the policy focus appears to be primarily on greening the economy and digitalisation and to a lesser extent skills and innovation. While SMEs can benefit from generic measures in recovery packages, the limited explicit emphasis on SMEs in this central policy area calls for further action to ensure in particular that SMEs are equipped to finance actions or introduce non-finance instruments related to reducing their carbon footprint and contributing to sustainability objectives.

Fiscal measures have been implemented to shield households and companies from surging energy and food prices in almost all countries in the second half of 2022 (OECD, 2022[69]). Especially in Europe, where energy prices have risen the most, many governments announced new policy packages or extended existing ones, with budget costs approaching or exceeding 2% of GDP in some large economies (OECD, 2022[2]). In Europe, measures include energy price regulation through price caps and through a reduction in network and distribution costs, together with some tax relief and compensation for the increase in energy-related costs and in several countries a substantial increase in the statutory minimum wage (EC, 2022[70]). Fiscal energy-related support is expected to be gradually phased out in 2024 (OECD, 2023[1]).

Box 1.4. Financing instruments in rescue packages

This box draws on the report Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard (OECD, 2022[59]) and details the main characteristics of financing instruments introduced in the recovery packages, which do not include the most recent policy response to the energy crisis. The use and design of debt instruments for SME liquidity support in recovery packages varies across countries. While some loan schemes target viable firms, others aim to reach underserved companies owned by vulnerable groups. Similarly, although a large number of SME guarantee schemes were extended until the end of 2021 and beyond, their coverage varies.

The decreased attention to SMEs in the recovery packages is also evident in liquidity support. Efforts to boost liquidity through debt, grants and deferral instruments carry less weight in the recovery packages compared to crisis measures in terms of the number of policies.

In general, and in particular, at the outset of the crisis, rescue measures did not mobilise alternative sources and instruments of finance for SMEs. This is also the case during the recovery, contrasting with the pre-COVID period when alternative financing for SMEs gained significant ground. Despite their limited use alternative finance instruments that are present in the recovery packages for SMEs include factoring, leasing and hire purchases, trade finance and equity and quasi-equity tools. The recovery strategies also include regulatory changes to foster the use of such instruments.

Banks continue to be important partners in the deployment of recovery packages, along with digital platforms, given their existing presence and effectiveness in reaching a broader range of beneficiaries.

Source: OECD (2022[59]), Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard, https://doi.org/10.1787/e9073a0f-en.

The pace of digitalisation is rapid but still brings challenges to SMEs

Most SMEs, including micro firms, have access to basic broadband connections but are not engaged with the most advanced technologies. SMEs tend to start their digital journey with basic applications for general administration and marketing. As technologies become more sophisticated, they tend to lose ground compared to larger firms. Indeed, digitalisation is multi-faceted and involves the use and applications of different technologies for different purposes. Digital applications and combinations offer strong complementarity, as technology supports further technology adoption. This also means that SME lag in the digital transition is likely to weigh down on their capacity to engage in future digital transformations.

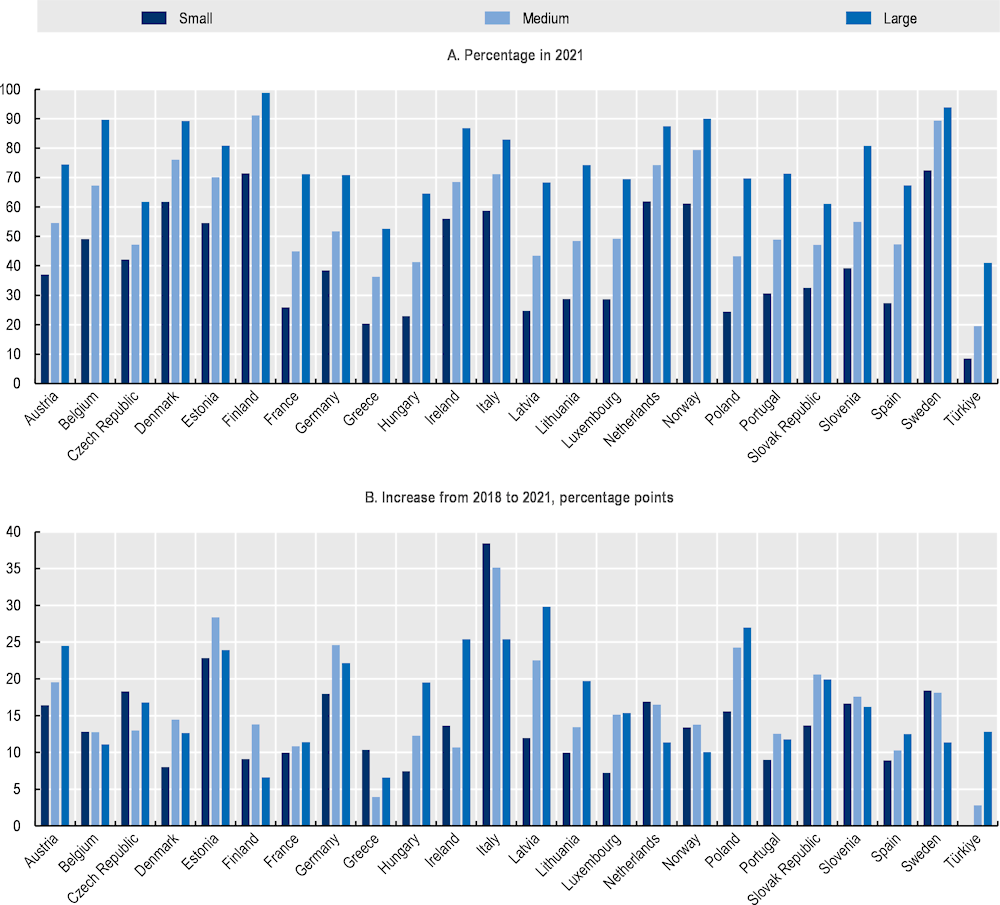

Cloud computing for instance provides access to digital services over the Internet and can help SMEs leapfrog to new and more advanced digital solutions, by enabling smaller businesses to access on-demand offers that fit their needs (flexibility and scalability), without incurring (sunk) investment costs in hardware and software upfront, and supporting maintenance costs (OECD, 2021[71]). The percentage of small firms buying cloud computing services increased by 13.6 percentage points between 2018 and 2021 on average in 24 OECD countries but by 16.1 percentage points for medium-sized firms and 16.8 percentage points for large firms, according to OECD data on ICT access by business (Figure 1.21). In 2021, the gap between small and large firms remains significant in the 24 OECD countries covered.

Another example is online trading that is likely to improve the resilience of firms to future shocks. There is now widespread evidence that digitalisation and engagement in online trade have helped cushion the downturn (OECD, 2021[71]; 2021[12]). SMEs are increasingly into “hybrid” business models, as in the case of “hybrid retail”, where activities through physical stores and online sales are more and more integrated (OECD, forthcoming[72]). Furthermore, survey evidence on retail SMEs from selected OECD countries shows that operational complexity can increase substantially when multiple sales channels are used. Most small businesses task existing employees to manage online sales, with little or no investment in training.

According to some estimates, 70% of SMEs have intensified their use of digital technologies due to the pandemic (OECD, 2021[71]). Further development of communication technologies can increase possibilities to outsource service tasks (Gal et al., 2019[73]) and access skills externally, or leapfrog to more advanced technologies, such as data analytics (OECD, 2021[71]), and turn data into an economic asset (OECD, 2022[62]). This suggests that digitalisation is likely to continue for some time, even though its pace could slow as compared to the high rates observed during the pandemic. At the same time, recent evidence suggests an increase in the digital gaps between small and larger firms.

According to the March 2022 Future of Business Survey, 62% of SMEs with a Facebook page reckon that the COVID-19 crisis has changed the use of digital technology for their business permanently. This share is higher for the firms which have invested in technology (Internet or computer) training. But there are significant differences across sectors. The percentage of SMEs which viewed the changes as permanent was lower in “primary sectors” (agriculture, energy), “construction and water management”, but higher in “hotel, cafe and restaurant”, “ICT”, “retail and wholesale trade”. Younger firms, which were created less than a year before they answered the survey, had a higher probability to view the change as temporary.

Despite recent progress, a number of factors continue to hamper the digital transformation of SMEs, including their lack of information and awareness, skills gaps at the working and management levels and insufficient capital (OECD, 2019[13]). According to the Future of Business Survey, the most prevalent challenges reported by small firms, and in particular micro firms, are the lack of technical skills and knowledge. This is true in all sectors but the issue is particularly acute in “manufacturing”. Smaller businesses also often face more difficulties in adapting to changing regulatory frameworks, dealing with digital security and privacy issues or simply accessing quality digital infrastructure. One key barrier to cloud computing adoption is related to uncertainty about the location of data and the competent jurisdiction in case of dispute (OECD, 2021[71]). The COVID-19 crisis has also revealed the vulnerability of SMEs to cyberattacks, which have intensified in recent years (OECD, 2021[71]). SMEs were ill-prepared to move rapidly on line and have become weak nodes within complex business networks, offering an entry door to supply chains.

Figure 1.21. Firms purchasing cloud computing services

Source: OECD (n.d.[74]), ICT Access and Usage by Businesses, https://stats.oecd.org/Index.aspx?DataSetCode=ICT_BUS.

OECD countries have focused on accelerating digital innovation diffusion to SMEs and ensuring they keep pace with the digital transformation (OECD, 2021[71]). Government interventions range from subsidising investments in digital technologies (e.g. Japan, Lithuania), to offering technical assistance or training (e.g. Australia, Portugal), to raising their digital security profile and capacity to protect data (e.g. Chile, European Union), to help them connect to digital platforms and business networks (e.g. Colombia, France) (Table 1.2). Public-private partnerships are a means for pooling resources and knowledge and are increasingly used (e.g. the Netherlands). Efforts also focus on expanding and securing the broadband and digital infrastructure (e.g. Denmark, Iceland). Regulators have paid attention to the risks of competition distortion and abusive behaviours, especially for SMEs operating on digital platforms and start-ups in digital markets. The public administration can play a role model in diffusion through its own transformation, e.g. e‑government services and one-stop-shops for service delivery to SMEs (OECD, forthcoming[75]). Higher education institutions also have an important role in SMEs’ uptake of digital skills, and their ability to adapt to constantly changing technologies (Chapter 5).

Table 1.2. Selected examples of programmes to help SMEs go digital in OECD countries

|

Typologies of policy instruments |

Targeted/ Generic |

Country initiatives |

Timing |

|

|---|---|---|---|---|

|

Creating a supportive business environment |

||||

|

Institutional and regulatory framework |

Regulation |

Generic |

EU General Data Protection Regulation (GDPR) and translation into national legislation (EU countries) – Data privacy and security law imposing obligations to organisations worldwide, when they target or collect data related to people in the European Union. |

2018-... |

|

Non-financial support |

Targeted (SMEs) |

Digital Ethics Compass (Denmark) – A toolbox to teach SMEs how to work with data and digital design in a responsible and ethical way, and avoid legal issues. Aimed at technological and data-driven SMEs in financial technology (fintech), health technology and mobility technology as well as design consulting. |

2021-… |

|

|

Platforms and networking infrastructure |

Generic |

AuroraAI programme (Finland) – AI solutions that help link central government’s services together and also interact with services in other sectors, to provide centralised services for citizens and companies in a timely, co‑ordinated and ethical manner. |

2020-22 |

|

|

Market conditions |

Regulation |

Generic |

GWB Digitalisation Act (Germany) – Extends the scope of German antitrust law to tackle the abuse of a dominant position of platforms on multi-sided markets by prohibiting these firms from engaging in anti-competitive practices including self-preferencing or leveraging data to create market entry barriers, among others. |

2021-… |

|

Financial support |

Targeted (SMEs) |

Digital Export Bonus (Italy) – Non-repayable grant of EUR 4 000 for the purchase of at least EUR 5 000 of digital solutions useful for internationalisation, such as the creation of e-commerce sites and/or mobile applications, promotion strategy to amplify the online presence through digital marketing activities (e-commerce, campaigns, social presence) suitable for the sector of competency. |

2022-… |

|

|

Platforms and networking infrastructure |

Targeted (SMEs) |

Connecting Services (Austria) – Matching services for innovation, co‑operation, investments and internationalisation. Connects Austrian SMEs and start-ups with international investors, multinationals and innovative, established companies. |

2019-… |

|

|

Infrastructure |

Platforms and networking infrastructure |

Generic |

Computer Security Incident Response Team (Denmark) – Preventing and responding to information technology (IT) security incidents, i.e. vulnerability scanning and developing educational/information materials, also operating the Data Protection Officer service to help research and education institutions comply with the EU GDPR. |

2022-… |

|

Platforms and networking infrastructure |

Targeted (firms) |

X-tee (Estonia) – Data exchange layer (technological and organisational environment) enabling a secure Internet-based data exchange between information systems to help businesses improve their processes. Developed by Estonia, Finland and Iceland, through the MTÜ Nordic Institute for Interoperability Solutions. |

2018-… |

|

|

Platforms and networking infrastructure |

Targeted (industry) |

Made Smarter Technology Accelerator (United Kingdom) – Involving both large United Kingdom (UK) manufacturers and technology start-ups to develop innovative solutions to UK manufacturing challenges. |

2020-21 |

|

|

Non-financial support |

Targeted (SMEs) |

Digital Route (Chile) – Training to facilitate SME use of technology in the management of their businesses, e.g. online training courses on cybersecurity challenges and related tools. |

2022-… |

|

|

Improving access to strategic resources |

||||

|

Finance |

Financial support |

Targeted (women) |

Female Digital Entrepreneurs (Spain) – Match funding for women entrepreneurs to support digital investments in the form of loans (maximum of EUR 1.5 million over 9 years and minimum contribution of EUR 25 000). Up to EUR 51 million is available for companies to apply in this period. |

2021-23 |

|

Financial support |

Targeted (SMEs) |

IT Utilisation Promotion Fund (Japan) – A fund that supports SME adoption of IT through long-term capital and working capital to acquire computers, software, communication devices, advanced numerical control processing equipment and other equipment. |

2001-… |

|

|

Financial support |

Targeted (private financial sector) |

Walloon Invests Loans (Belgium) – Funding provided to companies through a mix of public and private capital in order to offer SMEs diversified and flexible financing solutions in the form of loans that respond to the needs of their digital transformation. Walloon Invests act as a complementary actor to the private financial sector. The programme forms part of the Digital Wallonia strategy. |

2022-… |

|

|

Skills |

Financial support |

Targeted (SMEs) |

Voucher for Raising Digital Competencies (Slovenia) – Encourages SMEs to provide adequate skills for employees and management staff in key areas of digitalisation and co-financing eligible training costs (group, individual) for raising digital competencies (outsourcing costs). |

2022 |

|

Non-financial support |

Generic |

Digital Training (Portugal) – Online training courses to support companies and individuals in their digital transition. The courses cover a range of topics, e.g. disruptive technologies, cybersecurity, cloud technology, data analysis and digital marketing. |

2022-… |

|

|

Governance arrangement |

Generic |

DigKomp: Digital Competence Framework (Hungary) – A reference framework operating as a unified system that enables the definition, development, measurement and evaluation of digital competencies, skills gaps and training needs. |

2013-… |

|

|

Innovation assets (e.g. data, networks, technology etc.) |

Financial support |

Generic |

Corporate Profit Tax Incentives for Investment in New Technologies (Lithuania) – Corporate tax relief on taxable profits by up to 50% of investments in new technologies. |

2008-… |

|

Non-financial support |

Targeted (SMEs) |

Digital Solutions programme (Australia) – Offers broad advice on how digital tools can help SMEs, including social media, business software and data security. |

2023 |

|

|

Mix of financial and non-financial support |

Targeted (SMEs) |

Digital Israel (Israel) – Training, awareness campaigns, grants and financing solutions for the diffusion of data-driven innovation and technological infrastructure and tools, especially among SMEs. |

2014-… |

|

|

Platforms and networking infrastructure |

Targeted (SMEs and industry) |

Business Digital Transformation Centres (Colombia) – Support manufacturing SMEs in the appropriation of technologies and developing long-term business strategies. |

2015-… |

|

|

Platforms and networking infrastructure |

Targeted (SMEs) |

France Num (France) – Online platform to connect SMEs with a network of specialised consultants to create a digital strategy, increase online presence, sell online, enhance internal processes, train and recruit, better use data, find financing options, etc. |

2022-23 |

|

|

Platforms and networking infrastructure (based on public-private partnership) |

Generic |

Commit2Data (Netherlands) – Multi-year research and innovation programme based on a public-private partnership to explore new business models and opportunities around big data (e.g. smart industry, energy and logistics). Includes six data innovation hubs providing companies, particularly SMEs that are late adaptors, with up-to-date knowledge, tools and training modules for the responsible use of AI and data. |

2017-… |

|

|

Improving SME&E policy governance |

||||

|

Policy co‑ordination and monitoring |

National strategies and action plans |

Generic |

Digital Switzerland Strategy 2023 (Switzerland) – Creates a clear overview of sovereign activities and introduces measures of progress for each domain (education and skills, security and trust, framework, infrastructure, digital public services). |

2023-… |

|

Other guiding documents |

Generic |

Integrated Review of Security, Defence, Development and Foreign Policy (United Kingdom) – Integrated vision for the United Kingdom to embrace innovation and boost national prosperity and strategic advantage. Provides the strategic framework of the National Cyber Strategy. |

2021-… |

|

|

Government settings, agencies |

Targeted (SMEs) |

SME Taskforce (Ireland) – Bringing together a broad range of business leaders with expertise in a range of sectors, SME representative groups and other individuals uniquely positioned to contribute to the government’s long‑term vision for the SME sector. It aims to equip SMEs for the rapidly accelerating transition to digital ways of working. |

2021-… |

|

Source: Based on (OECD, 2023[76]) , OECD Data Lake on SMEs and Entrepreneurship.

While some countries have sought to mainstream SME policy considerations in other policy agendas, others specifically target SMEs with tailor-made instruments, often combined with place-based or sector-wide policy mixes. The diversity of barriers SMEs face calls for government interventions that span across a large range of policy domains and require policy co‑ordination across the board. A policy mapping was conducted between June 2021 and February 2022 across OECD countries to identify institutions and policies intending to help SMEs turn data into business, either through better infrastructure or improving SMEs’ access, use and protection (i.e. governance) of data (OECD, 2022[62]). Among the 209 institutions identified, only 26% had SMEs and entrepreneurship in their core mandate. Among the 487 policy initiatives in place, less than 20% target SMEs or entrepreneurs explicitly. Most initiatives in this relatively new policy field remain generic reflecting efforts to primarily build the data policy system.

The transition to a decarbonised economy requires rethinking industrial systems and business models

The environmental urgency requires tapping into all possible areas of improvement and, although SMEs are on average less energy- and resource-intensive than large firms, on aggregate, they have a substantial environmental footprint. At the EU level, SMEs in the business sector are estimated to have accounted for between 37% and 45% of greenhouse gas emissions in 2018 (OECD, 2023[77]). The circular economy carries a high-profit potential for a broad range of industries, including those where SMEs are in the majority (OECD, 2019[13]). Improving energy efficiency could bring multiple benefits to SMEs, beyond a cut in their intermediary costs, including raising product quality and visibility, improving operations and workplace environment, gaining access to new markets, reducing vulnerability to energy price volatility or ensuring compliance with environmental standards (UNEP, 2010[78]; Eurostat, 2018[79]; OECD, 2019[13]). However, fewer SMEs have taken steps to improve their environmental performance as compared to large firms (OECD, 2021[80]).