Businesses led by women are less likely to export to foreign markets than those led by men. This gender export gap has distributive implications as women-led SMEs are not able to take equal advantage of the scale and productivity benefits of international trade. This chapter examines this phenomenon using data from almost 10.000 firms surveyed on Facebook. The results show that both sector and firm size contribute to the gender export gap but cannot fully explain it, and also reveal other gendered variation in export behaviour. The chapter further examines the challenges that women entrepreneurs face when exporting and explores some of the policy levers and programmes governments can use to support women in trade.

OECD SME and Entrepreneurship Outlook 2023

3. Women-led firms in international trade

Abstract

In Brief

International trade is a major driver of economic growth. Firms that trade tend to be more productive since exporting leads to market expansion and sales growth, while importing can help reduce costs and improve technology. However, small- and medium-sized enterprises (SMEs) export less than large firms, due in part to fixed costs, lack of knowledge and risks associated with accessing international markets.

According to a survey of firms in OECD countries with a presence on Facebook, only 11% of women-led SMEs export, compared to 19% of men-led firms in 2022. Women-led firms are generally smaller than those led by men and are more likely to produce services, which are less traded than goods. These two characteristics mean that women-led firms export less than those led by men. However, about one-third of the gender export gap is unexplained by the sector and size of firms and suggests part of the gap can be attributed to gender-related differences, such as unconscious bias and societal norms.

Although women-led SMEs generally export less, once they start exporting, they do so at a similar level as men in terms of the share of their sales occurring internationally. There may be gender differences in initiating participation in international markets so policies that help women-led firms become export-ready, such as market information, branding, customer relations and business partners and navigating foreign and domestic customs regulations, may help close the gender exporting gap.

Gender differences are also present when it comes to importing. Fifteen percent of men-led firms import, compared to 11% of those led by women, with size and industry explaining only part of the gap. The greater likelihood of importing means that men-led firms gain more of the cost-lowering or technology-enhancing benefits of trade, although it also makes them more vulnerable to sudden supply chain shocks on domestic and global markets such as those they experienced during the COVID-19 pandemic.

The COVID-19 pandemic revealed the importance of e-commerce, including digital cross-border trade. Women-led firms adopted new technologies to a greater extent than men-led firms at the onset of the pandemic: while in 2019 a similar percentage of women- and men-led businesses made at least a quarter of their sales on line (43% and 40% of them respectively), by 2022, these shares had shifted to 53% and 44% respectively. Also, more women business leaders indicated that they would continue their online engagement. Given the importance of online sales and engagement for international trade, one way to facilitate trade is by ensuring easy and affordable Internet access, including in remote and rural areas.

A well-known challenge for women business leaders is accessing finance, including trade finance. Among the businesses surveyed, 12% of women-led firms currently had a bank loan compared to 20% of men-led firms. Complementary research finds that women-owned firms face 50% more rejections in applications for traditional trade finance than men-owned businesses; as such, women are more likely to seek out alternative finance than male-led businesses (41% versus 35%). Some countries have earmarked investment funds and loan facilities for women-led firms. Others provide loan guarantees that are easier to access for women business leaders. Still, others provide training in investment pitches or financial and accounting skills.

Since SMEs tend to trade less due to the fixed costs of entering global markets, trade facilitation reforms benefit them more. Many OECD countries have come a long way in easing procedures and reducing delays at borders. These especially benefit women-led firms that tend to be smaller. Moreover, automation of border procedures reduces opportunities for unequal treatment of women exporters, in cases where presence is required at border crossings, and can expedite customs procedures, which is particularly important for women who have less time given their unpaid work responsibilities.

Since women-led firms tend to export less, even when accounting for firm size and sector of activity, trade promotion agencies can contribute to closing gender gaps by catering specifically to the needs of women-led firms that tend to be smaller and less well-financed. New Zealand Trade and Enterprise is one example of an export promotion agency that has undertaken a wide-ranging set of reforms to better serve women business leaders.

Some recent trade agreements have included comprehensive gender chapters or gender provisions that reaffirm commitments to international standards of gender equality and implement joint activities between trading partners that aim to reduce gender inequalities. One example is the Global Trade and Gender Arrangement (GTAGA), a comprehensive co‑operation agreement.

Many public entities aim to close gender gaps in exporting by putting in place targeted programmes. As these programmes mature, it will be important to measure their effects on women-led firms, as has been done in Ireland and Türkiye. These programmes provide a potential vehicle for data collection on the benefits of actions taken and the challenges women continue to face in engaging in trade.

Gender-differentiated data on international trade are missing in several countries. Closing data gaps is key for monitoring developments and designing policies for women in trade, for instance, by exploring linking various existing data sources (e.g. business registers and trade data).

Issue

Across OECD countries, international trade is a major driver of economic growth. Exporting firms earn higher profits, pay higher wages and grow faster than non-exporting firms.1 SMEs and entrepreneurs engage less in international trade than larger firms. Indeed, around 80% of micro firms do not engage directly in international trade according to the OECD-World Bank-Meta Future of Business Survey (hereafter the Future of Business Survey). A stronger engagement would help support the recovery and ensure that small firms are not left behind. Particularly important in emerging markets, firms that trade are substantially less likely to be in the informal sector (World Bank/WTO, 2020[1]; IFC, 2011[2]).

Women entrepreneurs are less likely to engage in international trade, and, as a consequence, are less able to seize the opportunities for increasing competitiveness and other spillover effects trade could offer. Ensuring that businesses led by women entrepreneurs are able to take advantage of these opportunities will support greater gender equality and help to close gender gaps that increased during the COVID-19 pandemic, in addition to contributing to higher and inclusive economic growth. Focusing on this specific category of firms can also help better tailor policies.

This chapter examines the presence and challenges of business leaders in trade, focusing on women leaders for which little information is currently available and some of the policies that countries have implemented to support them. It relies extensively on the Future of Business Survey, which was specifically designed to examine these questions. First, it explores to what extent women-led and men-led businesses in OECD countries differ in their engagement with international markets. Second, it examines the extent to which those differences have changed, if at all, in the aftermath of the COVID-19 crisis. Third, it identifies the challenges that women-led businesses face when starting and expanding their export operations. Last, it showcases a number of policy initiatives that countries have pursued in order to boost women’s ability to reap the benefits of exporting. The chapter builds on the policy mappings conducted as part of the EC/OECD Scale up Project on network expansion for SME growth.2

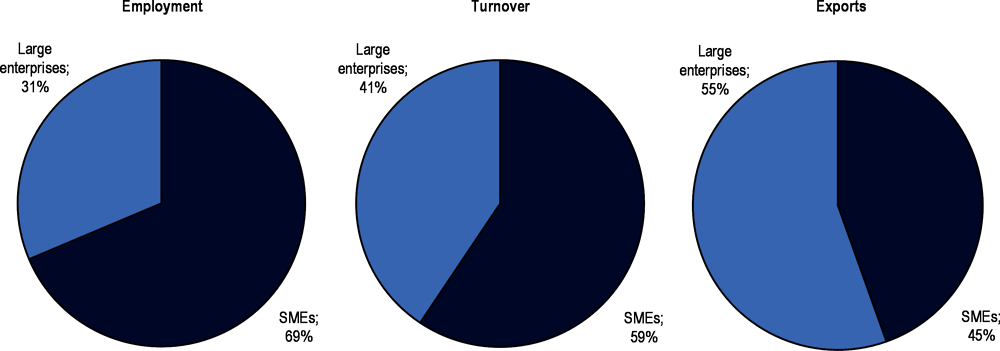

Exporting by entrepreneurs and gender export gaps3

Firms involved in international trade tend to be more productive than those which do not trade and engaging in international trade also improves performance. Indeed, exporting leads to market expansion and sales growth, induces competition and innovation and generates knowledge spillovers, while importing can help reduce costs and access better technologies (Máñez, Rochina‐Barrachina and Sanchis, 2020[3]). SMEs tend to be underrepresented in international trade, accounting for a small proportion of exports relative to their share of turnover and employment (Figure 3.1), as they often have less capacity and knowledge regarding markets and regulations together with the insufficient financial capacity to access foreign markets. Since SMEs are more sensitive to trade barriers than large firms, removing obstacles to trade benefits SMEs disproportionately (WTO, 2016[4]).

Engagement in international trade varies across sectors, with SME importers being concentrated in wholesale trade and exporters in manufacturing, according to the Future of Business Survey (Box 3.1). Most exporting SMEs covered by this survey export to 2-5 countries, while larger firms typically export to 11 or more countries. Internationalisation of SMEs mostly takes place through indirect international channels and SME integration in global value chains (Chapter 4).

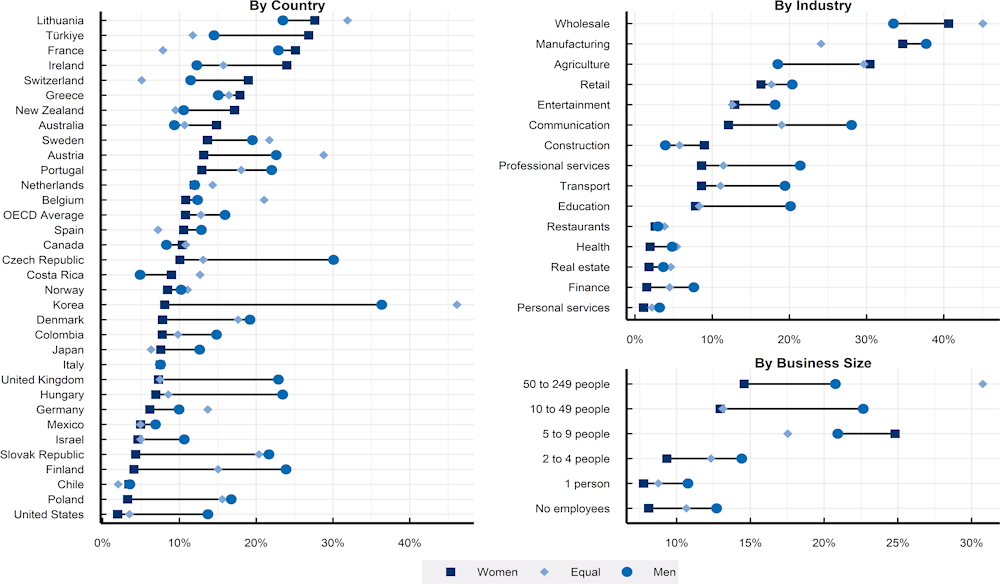

Women-led SMEs are substantially less likely to sell their products and services internationally than those led by men.4 Only 11% of women-led firms in OECD countries export, compared to 19% of men-led and 13% of equal-led firms, according to the Future of Business Survey.5 Women-led firms are less likely to export in most countries, economic sectors and firm-size categories (Figure 3.2).

Figure 3.1. SME share of employment, turnover and export

Note: Turnover is the total value of invoices corresponding to market sales of goods or services.

Source: OECD Structural and Demographic Business Statistics (SDBS) database and Trade by Enterprise Characteristics (TEC).

Box 3.1. The Future of Business Survey

This chapter makes use of data from the OECD-World Bank-Meta Future of Business Survey of firms with an online presence on Facebook. The analysis drawn from the survey should be considered relevant to this type of business.

A questionnaire on firm characteristics and economic activity was distributed among a random sample of businesses in March 2022. This resulted in information on almost 10 000 businesses in OECD countries, including whether or not they engage in trade, the gender make-up of their leadership and other business characteristics such as size and sector of activity.

In the analysis of the survey data, firms are weighted in order to ensure the random sample resembles the population of Facebook page administrators. Since this group is not identical to the wider business population, the survey should be regarded as representative of firms with an online Facebook presence rather than businesses generally.

Firms are defined in this analysis as women-led if they report that the majority of their leadership is women, with the reverse for men, while equal-led businesses are those with a 50-50 division at the time of the survey. Among the surveyed firms, 31% indicated they were women-led, 29% were equal-led and 40% were men-led.

Gender-differentiated, harmonised data on the total population of businesses by size and sector in OECD countries do not exist so this survey is one of few data sources that is comparable across countries. Participation in the survey may be skewed towards SMEs although weights are applied to reflect the general population of Facebook business pages. The data used in this analysis refer to micro, small- and medium-sized firms, i.e. those with fewer than 250 employees.

A detailed breakdown of the distribution of the survey sample can be found in Annex 3.A. For more information on the survey methodology, see Schneider (2020[5]).

The firms that are undoubtedly underrepresented in this survey are those that do not have an online presence. Since Facebook is the most prevalent online platform for businesses and the vast majority of businesses that trade have an online presence, it reflects particularly well the firms targeted by this analysis, i.e. SMEs that trade or are trade-ready.

Figure 3.2. Variation in the gender export gap in firms with a Facebook page, March 2022

Note: The y-axis displays the share of firms in a given group that indicate they engage in either “just exporting” or “both importing and exporting”. Based on a sample of 10 000 SMEs (i.e. with fewer than 250 employees) from 34 OECD countries.

Source: Based on the OECD-World Bank-Meta Future of Business Survey, Data for Good, (March 2022).

This exporting gap is due to several factors, including attitudes towards entrepreneurship and barriers such as access to finance and a perceived lack of entrepreneurship skills (GEM, 2021[6]). Over the period 2016‑20, less than 9% of women in OECD countries created a business or managed a new business relative to about 13% of men (OECD/EC, 2021[7]).

The gender differences in the likelihood to export are also due in part to differences in the characteristics of women-led and men-led businesses such as the sectors in which they operate. Women are more likely to lead firms in services sectors (93% of women-led versus 75% of men-led businesses among those surveyed) and services are generally less likely to be traded internationally.6 Moreover, women often work in services that are less traded like health, education and public administration.7 Evidence shows that services are more costly to provide across borders (Ariu, 2012[8]) and policy barriers to services trade are typically higher than barriers to trade in goods such as tariffs (Benz and Jaax, 2020[9]).

Women-led firms are also generally smaller and younger than those led by men while exporting is done more by firms that are larger and more established. Only 18% of women-led firms that responded to the survey have over 50 employees while 76% have fewer than 5, compared to 30% and 66% respectively for men-led businesses in OECD countries. Consistent with this, between 2016 and 2020, fewer than 11% of early-stage women entrepreneurs in the OECD expected that their new start-up would create at least 19 jobs in the next 5 years relative to 17% of early-stage men entrepreneurs (GEM, 2021[6]). Similarly, in emerging markets, women’s entrepreneurship is concentrated in micro firms: one-third of very small enterprises and only 20% of medium-sized firms are owned by women (WTO, 2016[4]; IFC, 2011[2]).

Unpacking the importance of firms’ characteristics on the gender export gap using a Kitagawa-Oaxaca-Blinder decomposition,8 26% is due to the concentration of women-led firms in industries less inclined towards international trade, 27% can be attributed to the smaller average size of women-led firms, 12% of the variation has captured the country of activity and 1% by business lifespan. This leaves a remaining 34% that cannot be explained by firms’ features and instead seems to be associated with factors related to gender differences.

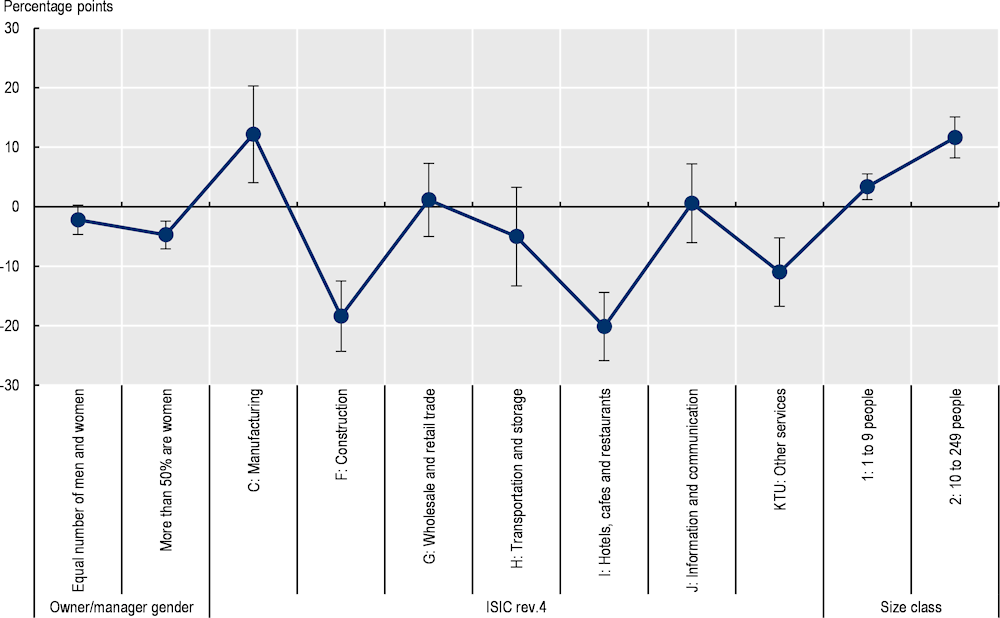

Complementing these results, a logit model shows that women-led small firms in OECD countries have a lower probability to export than their men-led counterparts even after correcting for the country, sectors and firm class-size (Figure 3.3). Having mostly men in the leadership increases on average the probability to export by 2 to 7 percentage points. By contrast, no significant difference is found between men-led firms and firms whose board is comprised of an equal balance between men and women. A similar outcome can be observed when looking more generally at engagement in international trade (which includes both imports and exports).

Figure 3.3. Probability to export, depending on the gender, sector and firm size

Note: The numbers plot the increase in the probability an SME will export depending on the composition of its leader team, sector or size. Marginal effects are derived using a logit regression on SMEs in 34 OECD countries. with observations from March 2022. Effects are relative to the reference category “more than 50% of men” regarding the gender dimension, relative to “agriculture, mining, energy, water supply” regarding the sectoral dimension and relative to “firm with no employees” regarding firm size. Confidence bands are reported at 95% and indicated by the whiskers. Effects are statistically significant when the confidence bands do not cross the zero line.

Source: Using data from the OECD-World Bank-Meta Future of Business Survey, Data for Good, (March 2022).

Data from the Future of Business Survey suggest that women are also less likely to lead firms in industries in which their country has a revealed comparative advantage, defined as sectors or industries where a given country exports more than it imports. Based on regression analyses controlling for country and sector, OECD firms led by women are 3% less likely than those led by men to be in an industry with a comparative advantage.9 A survey of women-owned firms in emerging markets suggests that they are more likely to be in lower value-added sectors (ITC, 2015[10]). Combined with known gender gaps in attaining senior management positions, where entrepreneurial skills are developed, this evidence suggests that women face multi-faceted obstacles to engaging in international trade.

Characteristics of the individual women and men entrepreneurs, rather than their businesses, do not seem to explain gender gaps in export. Among the business leaders surveyed, women and men show a similar distribution across age categories. The gender export gap is relatively larger among the youngest and oldest entrepreneurs (under 30 and over 60), with more modest levels in between. Regarding educational attainment, 54% of women entrepreneurs have completed a university or college degree compared to 44% of men, suggesting that lack of formal training is not what is holding women back from exporting. In fact, the gender export gap is largest among respondents with a college or university degree.

It could be the case that women entrepreneurs do not trade as much because they are looking to get different things out of their business. When asked about their motivation for starting a business, women were significantly more likely to name a desire for work-life balance and the decision to pursue a hobby or passion professionally, while men were more likely to be running a family business or to have started one out of a desire to make more money. These choices are also impacted by domestic polices and societal norms, including those that impact time spent raising children and caring for the elderly, responsibilities that are disproportionately taken on by women. Given the fixed costs and time commitment often associated with beginning export activities for the first time, this investment may appear more worthwhile to men than to women entrepreneurs given their differing aims.

The gender export gap is present in most OECD countries (Figure 3.2) but differs substantially across countries, and in a handful of countries, it is absent or even reversed. The level of exports and the size of the gender export gap are not highly correlated: some countries see large numbers of businesses selling abroad and a small difference between men- and women-led businesses, and vice versa. A gender export gap is also present in almost all industries and the industries in which it is absent tend to have relatively few women entrepreneurs.

The gender gap also increases with business size. There is a clear relationship between the size of a business and its trading behaviour: as businesses grow, their likelihood of exporting increases but this effect is stronger for men-led businesses.

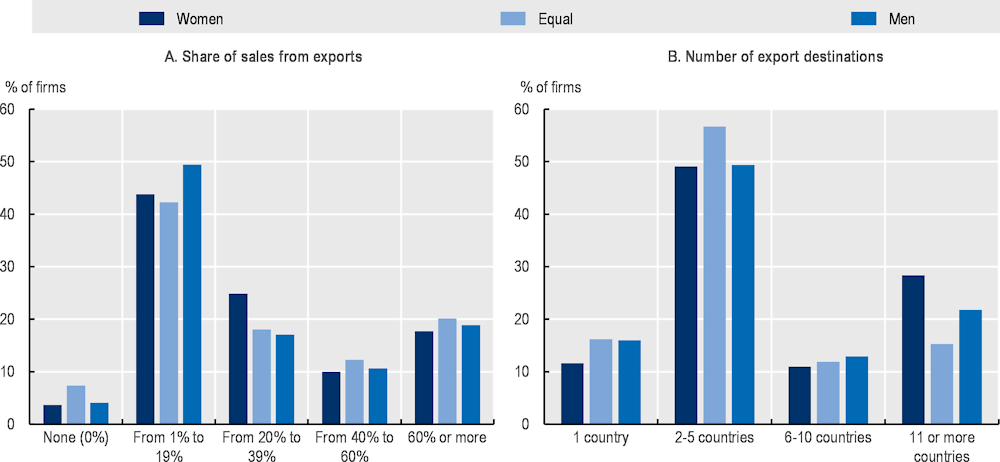

While women-led businesses are generally less likely to export than men-led ones, those that do sell to foreign markets display similar export patterns to men-led firms (Figure 3.4). Firms in the Future of Business Survey that indicated they sell abroad were asked what share of their overall revenues comes from export. Some 46% of businesses indicated that exports amounted to less than 20% of their revenue and only 19% responded that exports accounted for 60% or more of their revenue. These numbers do not differ significantly between men- and women-led firms.

Once involved in export, women-led firms do so to a similar or larger number of countries than firms led by men. Twenty-eight percent of women-led firms and 20% of men-led firms exported to 11 or more countries, while 88% of women-led firms and 84% of men-led firms export to more than 1 country. This suggests a particular role for policy in helping women-led firms overcome the barriers to beginning their export journey, perhaps even more so than support in expanding operations.

Figure 3.4. Export behaviour of exporting firms, March 2022

Source: OECD-World Bank-Meta Future of Business Survey, Data for Good, (March 2022). SMEs with a presence on Facebook.

One striking gender difference in the pattern of foreign sales is that women-led firms tend to export more directly to consumers and less to other businesses. While 79% of the surveyed men-led firms engaged in exporting report selling to foreign companies, only 51% of women-led firms do so according to the Future of Business Survey. A Kitagawa-Oaxaca-Blinder decomposition of this difference shows it is 18% due to the industries in which these firms operate, 16% due to average size differences and 2% due to the more recent creation of women-led businesses in the survey, but most of the remaining gap, i.e. over half of the difference, is not explained by the features of women- and men-led firms. Business-to-business sales are often made up of larger orders and therefore offer more opportunity to increase exports along the intensive margin, i.e. increasing the average size of orders.

Gender differences with regard to exporting are also present when it comes to importing: 15% of men-led firms import compared to 11% of those led by women. In part, this is due to men’s concentration in sectors where inputs are more frequently imported, such as manufacturing and wholesale trade. Yet a statistically significant difference of 3% in the probability of importing remains even when controlling for firm sector, size and country.10 The greater likelihood of importing means that men-led firms gain more of the benefits of the cost-lowering effects of trade liberalisation, although it also makes them more vulnerable to supply chain shocks as the next section shows.

Women-led firms are at least as engaged on line as men-led firms. Women-led firms are more likely than men-led firms to be active on digital platforms. Moreover, a larger share of women-led firms’ sales is made on line compared with men-led firms, even when controlling for other firm characteristics. Larger shares of online sales for exporters also underline the importance of digital sales for international trade (OECD et al., 2023[11]). Firms engaged in international markets are much more likely to use digital platforms compared with those that do not export. Sixty-four percent of women-led firms that export use digital platforms to buy and sell goods and services compared with 37% of women-led firms that do not export.

Given the importance of online sales and engagement for international trade, one way to facilitate trade is by ensuring easy and affordable Internet access, including in more remote or rural areas.

Impact of the COVID-19 pandemic11

The COVID-19 pandemic has had wide-reaching economic impacts and has been particularly challenging for SMEs. One important reason is that younger and smaller SMEs were less likely to receive fiscal support in the first phase of the pandemic (OECD, 2021[12]) and many operate in service sectors which were hit hard by the crisis. SMEs engaged in international trade were particularly vulnerable, as some supply chains were severely disrupted and travel restrictions hampered international trade (Cernat, Jakubiak and Preillon, 2020[13]).

A comparison of Future of Business Survey answers from the March 2022 survey with those given in an earlier edition of the same survey administered in July 2019 allows for investigation of the effects of the pandemic and whether it triggered some long-lasting change in behaviours.

Men-led and women-led businesses experienced different challenges during the COVID-19 pandemic period, with disproportionate negative impacts on women-led businesses, which often operate in the service sectors and are smaller in size, relative to those led by men (OECD/EC, 2021[7]). Women-led businesses were more likely to close than those led by men between January and May 2020 (26% vs. 20%) (Facebook/OECD/World Bank, 2020[14]) and this gap increased in 2021 (25% vs. 17%) (Meta, 2022[15]). Similarly, national surveys frequently show that women entrepreneurs were more likely than men to have their volume of work and income reduced. For example, a German survey revealed that self-employed women were one-third more likely to face income loss due to the pandemic than self‑employed men (Graeber, Kritikos and Seebauer, 2021[16]). Men-led and women-led firms also expressed different types of challenges during the COVID-19 pandemic period. Between 2019 and 2022, men-led businesses reported a significant increase in the difficulty in finding and retaining skilled employees. At the same time, more women-led businesses reported that they could not obtain the necessary financing for daily operations.

The greater impact of the COVID-19 pandemic on women business leaders can in part be explained by women’s disproportionate responsibility for childcare, elder care and domestic chores. As schools and childcare centres closed due to the pandemic and lockdowns prevented domestic workers from entering homes, women working in those sectors experienced the loss of employment activity and women more generally increased their time spent in unpaid work. Before the pandemic, women typically spent between 33% and 66% more time caring for children compared to men (Korinek, Moïsé and Tange, 2021[17]), and although there is some evidence that the increased burden of caring for children and others during the pandemic was shared, women continued to undertake the vast majority of unpaid work in most households. Single-parent households, which are in their majority headed by women, were particularly affected by the loss of childcare and schooling services. These impacts disproportionately affected women and therefore also women entrepreneurs and business leaders.

The greater difficulty of women-led businesses in accessing the funding they need is also seen in their reduced ability to access government support. Many governments implemented extensive support programmes for firms to help them during the pandemic. In the 2022 survey, firms were asked what types of support they received, e.g. extra credit, deferral of payment and advisory services. In most sectors, a similar share of women- and men-led businesses were supported. However, the types of support they received differed: men-led businesses were more likely to have received non-repayable grants and subsidies than those led by women (26% vs. 22% of firms).12 The lack of both private and non-repayable public funding may hinder the ability of women-led firms to recover from the disruptions brought on by the pandemic.

One of the consequences of the pandemic was a significant strain on international supply chains; these challenges were felt more strongly by male business leaders. Across the board, men-led businesses were more likely than women-led firms to indicate they experienced supply challenges, most prominently “delay in receiving supplies” and “an increase in shipping costs”. This may be due to the higher prevalence of men-led businesses in manufacturing and the higher rates of importing and exporting of men-led firms, all of which may have left them more vulnerable to global supply chain shocks.

Another effect of the pandemic was a switch to the digital sphere, as working and shopping moved on line. Women-led businesses in particular were able to take advantage of this: while in 2019 a similar percentage of women- and men-led businesses made at least a quarter of their sales on line (43% and 40% of them respectively), by 2022 these shares had shifted to 53% and 44% respectively. The use of technology by women entrepreneurs is not limited to online sales: women were less likely to say they do not use digital platforms and more likely to say they use online platforms for advertising and communication with customers. Moreover, women entrepreneurs were more convinced than their male counterparts that they would continue their digital engagement over the longer term.

Yet despite women entrepreneurs’ use of digital technology, gender exporting gaps persist in online sales. Exports are less likely to account for half or more of digital sales for women-led businesses (21% vs. 33% for men-led firms). A similar gap persists when looking just at the firms that indicated that they export. Given the importance of digital business and digital trade, there is a significant opportunity to support women entrepreneurs in using the online experience they have gained to sell abroad.

Challenges accessing international markets13

The challenges faced by small firms in engaging in business abroad are well documented (Table 3.1). They arise from the business environment in which small firms operate, which varies across countries and sectors. In the service sectors, where women-led firms are most represented, there is evidence that the regulatory environment became less stringent in 2021, slowing the steady build-up of trade barriers observed in previous years (OECD, 2022[18]). In 2022, service regulations changed substantially in many countries: services liberalisation, aimed at improving business operations and easing remaining hurdles on business travel after the COVID-19 pandemic, was counterbalanced by new services trade barriers that limited the movement of service providers and increased screening of foreign investments (OECD, 2023[19]). SME access to international trade is also hampered by a lack of access of those firms to finance and their difficulty in attracting high-skill workers and innovating. Informational barriers are also a major impediment to engaging in international trade. While navigating foreign regulation is the main challenge put forward by large firms, small firms rather struggle to find business partners in other countries, according to the Future of Business Survey.

Table 3.1. SME challenges to engage in international trade

|

External barriers arising from the business environment |

||

|---|---|---|

|

Institutional and regulatory framework |

Market conditions |

Infrastructure |

|

Governmental barriers, associated with the actions or inaction of the home and foreign governments in relation to Indigenous companies and exporters. |

Procedural barriers, associated with the operating aspects of transactions with foreign customers. |

Distribution, logistics and promotion barriers, associated with the distribution, logistics and promotion aspects in foreign markets. |

|

Tariff and non-tariff barriers, associated with restrictions on exporting and internationalising imposed by government policies and regulations in foreign markets. |

Customer and foreign competitor barriers, associated with the firm’s customers and competitors in foreign markets, which can have an immediate effect on its export operations. |

|

|

Internal barriers arising from suboptimal access to strategic resources |

||

|

Finance |

Skills |

Innovation assets |

|

Financial barriers, associated with a lack or insufficiency of finance with regard to internationalisation. |

Informational barriers, related to problems in identifying, selecting and contacting international markets due to information inefficiencies. |

Digitalisation barriers, associated with lower digital intensity and difficulties in leveraging information and communication technology (ICT) and data for internationalisation. |

|

Human resource barriers, related to inefficiencies of human resource management with regard to internationalisation. |

Network barriers, associated with connection to fewer business partners and greater reliance on more limited external networks. |

|

Source: Adapted from OECD (n.d.[20]), Glossary for Barriers to SME Access to International Markets, https://www.oecd.org/cfe/smes/glossaryforbarrierstosmeaccesstointernationalmarkets.htm and OECD (2019[21]), OECD SME and Entrepreneurship Outlook 2019, https://dx.doi.org/10.1787/34907e9c-en.

Women-led firms face additional challenges. The lower rates of exporting among women-led businesses raise the question of what obstacles women encounter in engaging in international markets. Identifying such challenges may help to suggest policy solutions that support women in trade.

A substantial part of the gap in exporting is due to the fact that women more frequently lead businesses in the service sectors. Trade costs in services are almost double those in goods and a large share of these costs results from policy barriers (WTO, 2019[22]). Moreover, some evidence suggests that women-owned and women-led firms find barriers to trade more costly to overcome than men-led firms (Davies and Mazhikevev, 2015[23]). Globally, services represent two-thirds of world gross domestic product (GDP) but only 30% of trade, measured in value-added terms.14 Efforts towards removing services trade barriers are particularly important to increasing gender equality in trade, as they will open up foreign markets for women-led businesses that are more commonly found in the service sectors. Moreover, since services are inputs into exports of both goods and services, they can reduce the costs of production for all firms, which is particularly important for small firms with less capital. Increased digitalisation has helped increase the tradability of many services and reduce trade costs incurred in fragmented value chains.

Another challenge women-led firms face in exporting is the smaller average size of their businesses. Larger businesses engage in exporting more in part because there are a number of fixed costs involved, such as gathering information on foreign markets and understanding customs procedures and regulations in the destination market. Women face a variety of obstacles when it comes to growing their businesses, including less access to financing and less available time due to care obligations (Korinek, Moïsé and Tange, 2021[17]; ITC, 2015[24]) (Infographic 3.1). Among the businesses surveyed, 12% of women-led firms currently had a bank loan compared to 20% of men-led firms. This complements other findings such as in the European Union where women entrepreneurs are 25% less likely than their male counterparts to use bank loans to fund their business and, even when they receive external finance, they typically receive smaller amounts, pay higher interest rates and are required to secure more collateral (OECD, 2022[25]). Including other types of financing such as family and friends and equity investors, 24% of women-led firms and 32% of men-led firms surveyed had access to outside financing. Other research has found that women-owned firms face 50% more rejections in applications for traditional trade finance than men-owned businesses; as such, women are more likely to seek out alternative finance than men business leaders (41% vs. 35%) (DiCaprio, Kim and Beck, 2017[26]) (Box 3.2).15

Box 3.2. Reducing the gender gap in trade finance and diversifying funding sources

Improving access to traditional bank credit for women-led firms can help reduce the gender gap in trade finance. To compensate for higher risks in international trade, as compared to domestic trade, financial institutions tend to raise their requirements regarding creditworthiness, due diligence information and collaterals. Women are more penalised than men: available survey data reveal that only 18% of women-led firms requesting trade finance, although most of them have a bank account, receive sufficient trade finance to go global (DiCaprio, Beck and Pokharel, 2016[27]). Women-owned firms also face 50% more rejections in applications for traditional trade finance than men-owned businesses (DiCaprio, Kim and Beck, 2017[26]). Policy responses could address this challenge through programmes that facilitate connections between bank intermediaries and women-led enterprises, with a focus on export loans and guarantees.

Alternative sources of finance can also play a role. Due to high rejection rates, women-owned firms are in fact more likely to seek out alternative finance than men-led businesses (41% vs. 35%) (DiCaprio, Kim and Beck, 2017[26]). Public development banks propose grants as well as venture capital matching programmes as a response to the gender gap in trade finance. Financial technology (fintech) solutions can alleviate some of the barriers to cross-border e-commerce SMEs face, including women-owned businesses (Suominen, 2018[28]). Digitalisation lowers the costs of participating in trade and opens up new opportunities for women to engage in markets abroad (OECD, 2021[29]). In particular, crowdsourcing platforms reduce discrimination against women in accessing finance (Barasinska and Schäfer, 2014[30]) and allow them to find trade finance at much lower costs, even though women tend to ask for less money on average than men (World Bank/WTO, 2020[1]). Fostering new financial skills for women through digital adoption is another promising avenue for policy makers to explore.

Source: OECD (2022[31]), Financing Growth and Turning Data into Business: Helping SMEs Scale Up, https://doi.org/10.1787/81c738f0-en; DiCaprio, A., S. Beck and S. Pokhare (2016[27]), “Trade and supply chain finance”, in Integrating SMEs into Global Value Chains, Asian Development Bank; DiCaprio, A., K. Kim and S. Beck (2017[26]), “2017 Trade finance gaps, growth, and jobs survey”, ADB Briefs, No. 83, Asian Development Bank, Manila; Suominen, K. (2018[28]), “Closing in on the holy grail of world trade: Using blockchain to expand Southeast Asia’s trade”, International Institute for Sustainable Development; OECD (2021[29]), “Seizing opportunities for digital trade”, https://doi.org/10.1787/bc4081f3-en; Barasinska, N. and D. Schäfer (2014[30]), “Is crowdfunding different? Evidence on the relation between gender and funding success from a German peer-to-peer lending platform”, German Economic Review, Vol. 15/4, pp. 436-452; World Bank/WTO (2020[1]), Women in Trade: The Role of Trade in Promoting Gender Equality, https://www.wto.org/english/res_e/publications_e/women_trade_pub2807_e.htm; and national sources.

Therefore, efforts toward supporting the growth of women-led businesses by removing barriers to their access to finance will also play a role in enabling them to export. This situation may have been exacerbated during the COVID-19 pandemic when risk assessments in financial institutions were heightened.

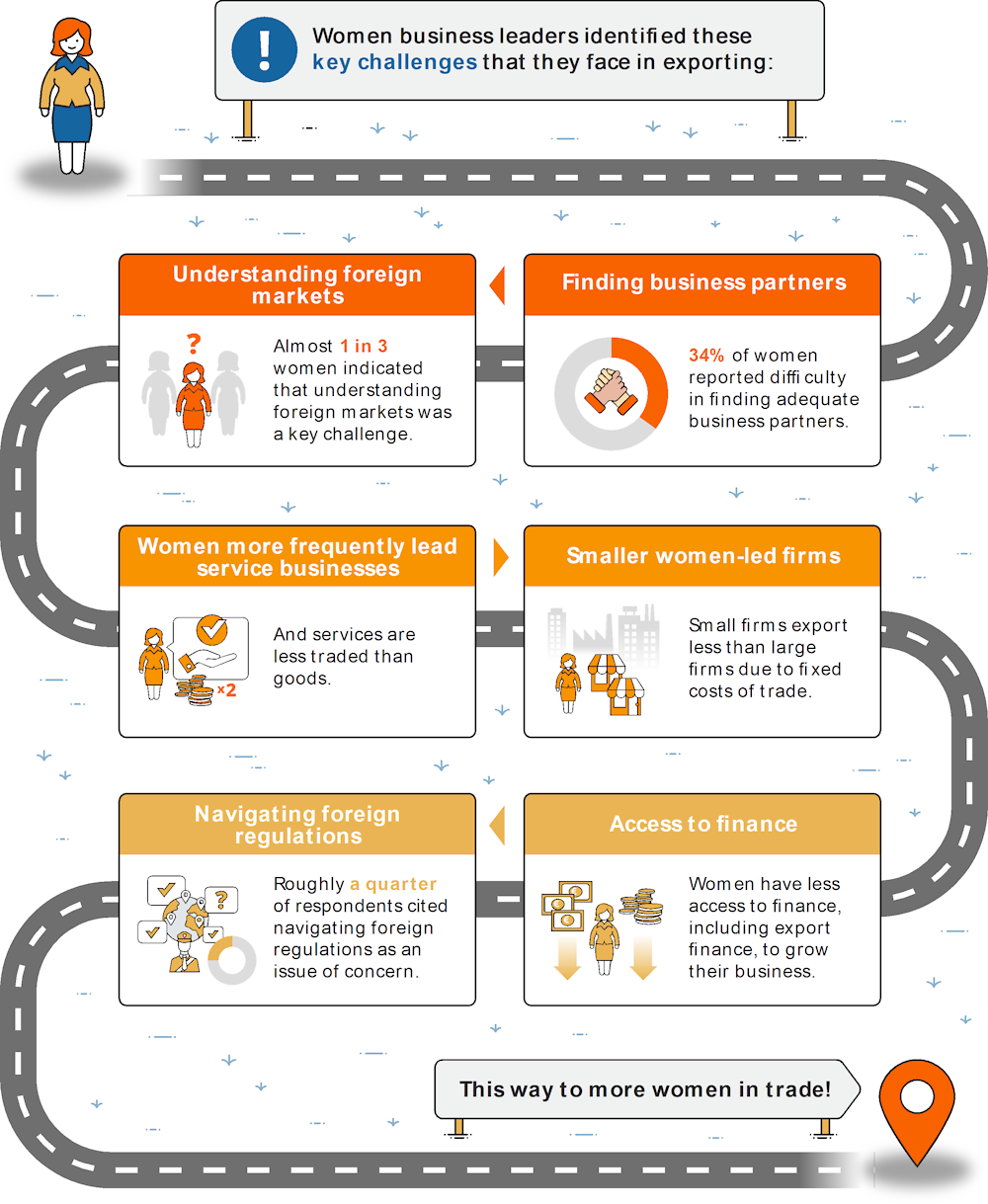

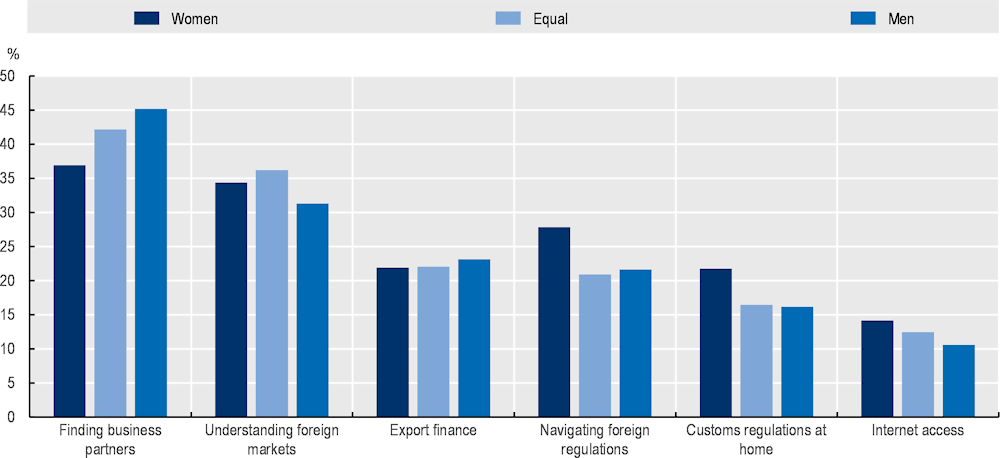

When asked what challenges they face in selling abroad, for the most part, men- and women-led firms identified similar obstacles (Figure 3.5).16 The most common response was finding local business partners; other commonly named challenges were understanding foreign markets and navigating both domestic customs procedures and foreign regulations. The challenges expressed by business leaders to exporting were similar among SMEs. Women business leaders more often indicated challenges navigating domestic customs procedures and foreign regulations, which suggests a potential knowledge gap that could be filled by export promotion agencies. This finding mirrors the challenge women face in accessing professional networks: women’s professional networks are generally shallower and smaller than those of men whereas such networks can provide information on foreign markets, potential partners and distributors (Korinek, Moïsé and Tange, 2021[17]). Women-led businesses are also more concerned with the quality of Internet access, in line with the finding that they are more likely to sell goods on line.

Challenges to selling abroad identified by survey respondents can depend on their export status. Firms that already export listed different obstacles than those not yet selling abroad. Both men- and women-led firms that do not yet export are more likely to identify export finance as a barrier than firms already selling abroad. Women-led firms that do not yet trade are more likely to identify understanding foreign markets as an obstacle, while women-led firms that already trade are more likely to point to customs regulations and Internet access as a barrier. These findings suggest that the types of policy responses and support needed may be different for firms that are aiming to export compared with those that are looking to expand existing export operations.

Figure 3.5. Challenges faced by SMEs to exporting, March 2022

Note: Responses of firms that are currently exporting or have considered selling abroad.

Source: Calculations based on the OECD-World Bank-Meta Future of Business Survey, Data for Good, (March 2022) of online firms with a presence on Facebook.

To gain more insight into what holds back firms from starting to export, firms that indicated they do not export were asked whether they had considered selling abroad. A sizeable share of both men- and women-led firms (31% and 27% respectively) replied “yes” but identified different obstacles holding them back. The two most common concerns were the need for further information and financing, which are both common components of many trade promotion programmes. Among those firms responding that they had not considered exporting, the overwhelming majority said this was because their product is not suitable to export, something that may shift with the increasing move towards digital trade in many services sectors.

Businesses that use digital technology in the process of their exports face particular challenges with regard to this technology. When asked what challenges firms face when using digital platforms, the need for greater technical skills and knowledge is identified as the most common challenge. The other top challenges that particularly affect women-led firms are paying for access fees, complying with legal standards and dealing with extreme competition on digital platforms. Women-led businesses in general indicated more often that they experienced difficulties using digital platforms despite (or because of) their higher usage of such technology.

In OECD countries on average, gender gaps in accessing the Internet are almost non-existent. In high-income countries, 92% of women and 93% of men access the Internet, a difference which is not statistically significant (ITU, 2022[32]). Differences in Internet use in upper-middle-income countries are also not statistically significant (79% of women and 80% of men). Basic information technology skill levels between women and men in non-digital-intensive industries are similar (OECD, 2018[33]). However, differences may exist in some countries. In Colombia, for example, fewer women know how to download software programmes (35%), compared to men (41%) (Consejo Nacional De Política Económica y Social, 2022[34]). More generally, large gender gaps exist in almost all OECD countries regarding jobs that require deep digital skills, which are in part the result of low levels of women and girls’ enrolment in science, technology, engineering and mathematics higher education.

Government policy can be instrumental in helping firms overcome some of these challenges to international trade. The OECD Trade Facilitation Indicators (TFI) measure a wide range of border procedures and the extent to which these have been streamlined. Surveyed exporting firms in countries with a higher TFI score are less likely to name navigating their country’s customs regulations as a challenge to trade, which underscores the importance of trade policies for women business leaders. This chapter now turns to the broader question of what governments can do to support SMEs, particularly women-led firms, in their exporting journey.

Infographic 3.1. Challenges to exporting faced by women-led firms

Policies to support women business leaders in trade

The above analysis suggests that the gender exporting gap is wide – women-led businesses are substantially less likely to export than their men-led counterparts – and it is even wider than the gender gap in entrepreneurship. Moreover, the gender exporting gap widens as firms grow.

Since engaging in international markets generally increases firms’ productivity and offers greater opportunities for them to grow their businesses, targeted policies to support women in trade may be a low-hanging fruit to promote gender equality. Indeed, 127 World Trade Organization (WTO) member countries confirmed this by signing the 2017 Buenos Aires Joint Declaration on Trade and Women’s Economic Empowerment for mainstreaming gender in trade policy.

Moreover, many countries have implemented policies that aim to support women entrepreneurs in their export journey, ensure that trade opportunities are available to them and lessen barriers to trade and international expansion that particularly impact women. Some policies target SMEs or generally aim to improve the ease of doing business but are not gender-specific; others support women entrepreneurs but are not specific to trade. Some countries, such as Canada, Ireland and Spain, have developed an overarching strategy to support women entrepreneurs and business leaders, including in trade. In 2020, Enterprise Ireland launched an Action Plan for Women in Business, which included as its first priority (of four) doubling the number of women-led companies growing internationally (Box 3.3). Spain has implemented specific measures to increase women’s participation in trade in the areas of access to finance, trade-related training for women, data and information and ensuring compliance with Spain’s Gender Equality Law. The Asia-Pacific Economic Cooperation (APEC) La Serena Roadmap for Women and Inclusive Growth provides a clear strategic direction for women’s economic empowerment, including through trade, for countries seeking to mainstream gender-responsive policies and drive structural reforms.

Box 3.3. Ireland’s Action Plan for Women in Business

Ireland has pursued a wide-ranging strategy to increase women’s participation in entrepreneurship and business leadership since it launched its Action Plan for Women in Business in 2020. The strategy has four objectives:

1. Increase the number of women-led established companies growing internationally.

2. Increase the number of women in middle and senior management and leadership roles in Irish companies.

3. Increase the number of women entrepreneurs.

4. Increase the number of women-led start-ups with high potential growth.

Increasing the number of women in leadership positions is expected to positively affect the pipeline of women entrepreneurs, as women with senior management experience are more likely to become growth-oriented entrepreneurs and acquire the means to succeed (such as professional networks and managerial and business strategy skills). A number of actions were undertaken to encourage more women to become entrepreneurs since existing gender export gaps among women-led businesses and gender gaps in start-ups with high growth potential are in part due to the smaller pool of women who choose entrepreneurship.

Taking a broad approach has meant implementing actions in a wide range of areas such as: requiring large firms to publish their pay gaps; raising awareness throughout Enterprise Ireland, Ireland’s export promotion agency, of the need to support women entrepreneurs by creating a steering group of Women in Business Champions; organising networking meetings of women business leaders in Ireland with those in Australia and New Zealand; and organising women-only high-level trade missions to the United States.

Targets were set for each of the objectives, to be met by 2026: a 100% increase in the number of women-led international trading companies; a 100% increase in the participation rate of women on Enterprise Ireland management development programmes; a 50% increase in women participants in start-up programmes; a 50% increase in Local Enterprise Office support to women in business; an increase in the proportion of female-founded High Potential Start-Ups to 30% of the total.

The objective of doubling the number of women-led firms (defined as having a woman chief executive officer) in trade over the six-year period is particularly ambitious. At the beginning of 2023, the target looks challenging as the 2020 benchmark of 10% of women-led firms exporting has increased by only a few percentage points. Data have been collected from the 5 000 or so firms that make up Enterprise Ireland’s client base. Enterprise Ireland’s client firms are usually either high-potential start-ups or established firms that have more than ten employees and are already exporting. Enterprise Ireland has expanded its client base to women-led firms that are not yet exporting.

Support to women-led high-potential growth start-ups has included creating a ringfenced investment fund for early-stage start-ups led by women. Investment amounts are lower than in other funds (EUR 50 000) and requirements for matching funding are also less stringent. Funds exist to invest in 10-15 selected start-ups in 3-4 investment rounds per year. Training is also available to founders to develop skills such as pitching their firms to investors and developing financial acumen.

Source: Enterprise Ireland (2020[35]), 2020 Action Plan for Women in Business, Fuelling Growth Through Diversity, https://www.enterprise-ireland.com/en/Publications/Reports-Published-Strategies/Action-Plan-for-Women-in-Business.pdf.

Trade policies are only one aspect of the policy mix necessary to support women entrepreneurs in their export journey. Complementary domestic policies that favour and remunerate women’s participation in labour markets are equally, if not more, important. Domestic policies that serve to share the burden of unpaid work, close gender wage gaps, promote women in leadership, close gaps in access to finance, encourage women and girls in science, technology, engineering and mathematics (STEM) studies and professions, and support women-owned and women-led firms in government procurement, are some of the main policy areas that increase women’s ability to lead and expand businesses, including internationally.

The preceding analysis on women-led businesses in trade, combined with previous OECD research (Korinek, Moïsé and Tange, 2021[17]; OECD, 2022[36]) as well as research undertaken in other organisations (World Bank/WTO, 2020[1]; ITC, 2015[24]; 2020[37]) suggests a number of specific areas of trade policy that can most benefit women entrepreneurs and their businesses. These are:

Applying a gender lens to trade agreements.

Ensuring market access for goods and services produced and consumed by women and their businesses.

Implementing trade-facilitating measures.

Ensuring inclusive access to the Internet and digital spaces.

Ensuring trade promotion services reach women exporters and cater to their needs.

Providing adequate finance, including trade finance and promoting financial literacy.

Ensuring professional and business networks are inclusive of women.

Closing data gaps.

Some of the main areas of targeted policy intervention to support women in trade that have been undertaken by OECD countries are outlined below, with a selection of illustrative examples of programmes implemented.

Applying a gender lens to trade agreements

Increasingly, countries include gender-specific provisions in their trade agreements. This is particularly the case of newer trade agreements negotiated by Canada, Chile, the European Union (EU) and New Zealand.17 The preceding analysis indicates that much of the gender gap in exporting is unexplained by firms’ characteristics, which suggests the gap may be due in part to unconscious bias and wider societal norms. Many trade agreements include provisions to reaffirm trading partners’ commitments to international standards of gender equality, such as those defined by International Labour Organization (ILO) Conventions on Non-discrimination and Equal Remuneration, or the Convention on the Elimination of All Forms of Discrimination Against Women (CEDAW). Such provisions can go some way to ensuring basic equal rights, especially if the provisions are subject to dispute settlement within the agreement.

Trade agreements increasingly call for co‑operation and implement joint activities, between the trading partners that aim to reduce gender discrimination and barriers to trade and labour market participation that women face. One example of a wide-ranging co‑operation agreement on trade and women’s empowerment is the Global Trade and Gender Arrangement (GTAGA),18 which was signed in 2020 by Canada, Chile and New Zealand, and has now been joined by Colombia, Mexico and Peru. The GTAGA provides a forum for the adhering countries to share good practices in ongoing, regular activities in the trade area as well as wider domestic policies that affect women’s ability to engage in labour markets and trade such as access to finance, parental leave and care policies, women’s representation in STEM, and improving women’s business and digital skills (Box 3.4).

Box 3.4. The Global Trade and Gender Arrangement (GTAGA)

The GTAGA is a co‑operation agreement that was signed by Canada, Chile and New Zealand on 5 August 2020. They have since been joined by Mexico on 6 October 2021, in a ceremony that took place at the OECD, and Colombia and Peru on 13 June 2022. The arrangement aims to “promote mutually supportive trade and gender policies and unlock new opportunities to increase women’s participation in trade as part of broader efforts to improve gender equality and women’s economic empowerment”. The arrangement is a comprehensive tool for operationalising trade policies and ensuring that they support women. It works toward improving women’s access to trade and investment opportunities and removing the barriers they face to engaging in labour markets and entrepreneurship, recognising that this contributes to prosperity, competitiveness and the well-being of society.

The arrangement is comprehensive in that it references trade, domestic labour market and gender policies. It acknowledges the importance of not weakening or reducing the protection afforded in the participants’ respective gender equality laws and regulations to increase trade or investment. The arrangement also commits the participants to:

Enforcing their laws and regulations promoting gender equality and improving women’s access to economic opportunities.

Jointly implementing co‑operation activities to facilitate women’s access to international trade opportunities.

Avoiding discrimination on the basis of gender for licensing and certification in the services sector.

Co‑operating and sharing best practices to eliminate discrimination in employment and occupation, including on the basis of sex, pregnancy, the possibility of pregnancy, maternity, gender and gender identity, and sexual orientation.

Encouraging enterprises operating in their territory to incorporate into internal policies gender equality principles.

Working together in international fora, such as the WTO, OECD and APEC, to advance trade and gender issues.

The arrangement establishes a working group to identify, co‑ordinate, implement and report on the activities and to engage with stakeholders.

It points to areas where trade disproportionately affects women and how countries can address them. The text and activities of the arrangement can also be used to provide input into increasing the inclusiveness of regional trade agreements.

Source: Government of Canada (n.d.[38]), Global Trade and Gender Arrangement, https://www.international.gc.ca/trade-commerce/inclusive_trade-commerce_inclusif/itag-gaci/arrangement.aspx?lang=eng.

Ensuring market access for goods and services produced and consumed by women and their businesses

One way that trade policy makers can support women is to prioritise sectors where women work and lead businesses in market access negotiations, in particular services, where barriers to trade are generally higher. As outlined above, women work and lead businesses in their majority in services, so trade negotiations could provide an important opportunity to advance market access for women-led firms.19 Services commitments are often extended by establishing equivalencies in qualification requirements, as well as harmonising and mutually recognising licensing requirements and technical standards. Services commitments also include the movement of services providers between trade partner countries. The OECD Services Trade Restrictiveness Index regulatory database includes indicators of barriers to services trade in 50 countries that can be used to benchmark trading partners’ services restrictions in 22 services sectors.

In December 2021, 67 WTO member countries agreed to a Joint Initiative on Services Domestic Regulation20 which included, for the first time in the history of the WTO, a clause on non-discrimination between men and women. This means that the signatory countries agree not to discriminate between women and men when adopting and applying measures relating to the authorisation of services suppliers.

In order to understand the impacts of trade agreements on workers, consumers and entrepreneurs, it is desirable to undertake ex ante impact assessments including measuring gender-differentiated effects, as also suggested by the ILO (2011[39]) as well as the World Bank and WTO (2020[1]). Since women work and own businesses disproportionately more in some sectors than men, they are affected differently by the opportunities and competition that result from trade agreements. When these effects are measured, they can inform negotiating strategies, for example by prioritising sectors where women export for gaining market access in partner countries.

Implementing trade-facilitating measures

The preceding analysis found that 30% of the gender exporting gap can be attributed to the smaller size of women-owned and women-led firms. The smaller size of women-led firms means they are more strongly impacted by non-transparent and overly cumbersome border processes that increase the trade costs of smaller businesses more (ITC, 2019[40]; World Bank/WTO, 2020[1]). The gender exporting gap is also more pronounced in manufacturing, where more trade takes place and where trade facilitation measures are most effective.

Trade facilitation reforms that make border processes more efficient can reduce trade costs on average for OECD countries by more than 10%. Moreover, smaller firms benefit more from improvements in the overall trade facilitation environment relative to large firms (López González and Sorescu, 2019[41]). Even modest improvements in trade facilitation policies such as transparency, automation and streamlining of processes at borders, as well as border agency co-operation, are found to have a positive impact on exports of parcels of between 6% and 14% (López González and Sorescu, 2021[42]). An increase in the ease of trade in parcels may affect women-owned businesses even more than those owned by men given that women-owned businesses tend to export more to individuals whereas men-owned businesses export more to other businesses.

Many countries have implemented trade-facilitating policies that have lowered barriers to trade. The OECD benchmarks such measures in the TFI dataset.21 Since women entrepreneurs have less time than men due to their greater unpaid responsibilities in the home, trade-facilitating measures aimed at easing importing and exporting procedures are particularly beneficial to them. Greater automation of border procedures is key to facilitating border crossings; preferred exporter programmes also help to save time for traders. Some countries particularly target women exporters in their trade facilitation programmes. For example, Australia’s export promotion agency AusTrade has developed a programme called Women in Export that offers market information, resources and advice that caters specifically to women exporters.

Ensuring inclusive access to the Internet and digital spaces

The findings above, and our collective experience throughout the COVID-19 pandemic, underline the importance of e-commerce and online access to customers, suppliers and information. Digitalisation can help level the playing field by enabling greater access to digital inputs and international markets, including in services sectors where women are more active. As outlined above, firms that export are much more likely to be engaged in online sales and digital platforms. Therefore, ensuring that women-led firms have affordable access to the Internet and online platforms can help close gender gaps.

Although in most of the OECD area, women and men access the Internet in similar proportions, this may not be the case in all countries. In high-income countries, 92% of women and 93% of men have Internet access but in lower-middle-income countries, gender gaps increase: 51% of women and 61% of men have Internet access (ITU, 2022[32]). If Internet access is lacking, slow or unaffordable, this will affect women-led firms particularly since they are very active on line. The high cost of access to high-speed Internet connections will particularly affect women-led firms since they are less well-financed. Ensuring high-speed access is key to ensuring women-led firms can engage in international markets.

Many of the highly traded and highly remunerated jobs today, as well as projections for the future, require deep digital skills. Although women and men in OECD countries generally have similar levels of digital skills required in jobs in less digitally intensive industries, large gender gaps remain when considering ICT skills in digitally intensive industries. This is in part due to lower participation rates of women and girls in STEM studies in OECD countries. Although many governments have implemented policies to counter this trend, they have had limited success thus far (OECD, 2022[43]). Moreover, when women do study STEM, they often choose alternate career paths, a phenomenon described as the “leaky pipeline” of technology professionals.

Ensuring trade promotion services reach women exporters and cater to their needs

The findings outlined above suggest that women exporters trade with fewer countries and sell more to individuals than to businesses, which may impede women-owned and women-led businesses from expanding their exports. Moreover, a large part of the gender exporting gap cannot be explained by differences in firm characteristics; this suggests that targeted export support to women entrepreneurs could help close these gaps. In most countries, trade promotion agencies support exporters and potential exporters with information and trade promotion services, and organise trade missions. APEC created a toolkit22 for trade promotion organisations to better understand the challenges in providing gender-responsive support services and suggests what they can do to support women entrepreneurs in building their export readiness and capacity to access global markets.

Trade promotion services are more effective when they cater to the stage of businesses’ export readiness. Early-stage exporters may be helped by programmes that provide export readiness assessments and information about export procedures. Global Affairs Canada, AusTrade and the International Trade Centre, for example, provide online export readiness assessments. The Canadian Trade Commissioner Service offers step-by-step guides23 for women business leaders exporting to the European Union in the context of the EU-Canada Comprehensive Economic and Trade Agreement (CETA). Other guides provide more detail on particular dimensions of exporting such as customs procedures or supply chain management.

More seasoned exporters may be helped more by stronger business networks and specific services catering to them, in order to close the gender exporting gap that widens with firm size. Chile’s trade promotion agency ProChile’s Mujer Exporta programme provides export training, business planning (including for digital transformation), coaching, workshops and support networks aimed at women exporters. Mexico has implemented a similar programme for women exporters, including organising trade missions.

New Zealand has been actively working toward more inclusive trade. Its Trade for All strategy includes a strong gender component. In 2022, the Ministry of Foreign Affairs and Trade of New Zealand partnered with the OECD to produce the first-ever Trade and Gender Review of that country. The review included a list of policy recommendations to make trade more supportive of New Zealand women. One area for reform was its trade promotion policy and New Zealand Trade and Enterprise, its export promotion agency, has been implementing those reforms (Box 3.5).

Some of the lessons learned from the New Zealand experience were that women business leaders may not be aware of the export promotion services available to them, possibly due to their shallower business networks. Export promotion agencies can reach women business leaders by going to their networks and being more intentional about engaging with them. The findings above that women-led businesses are less likely to export but when they do, they do so to the same extent as men, suggests that export promotion services may need to target firms that do not yet export in order to close gender gaps. Some export promotion agencies lower the capital requirements or size categories of the firms they target in the case of women-led or minority-led firms.

Box 3.5. How New Zealand’s export promotion agency has enhanced its support for women exporters

In 2021, New Zealand’s Ministry for Foreign Affairs and Trade (MFAT) partnered with the OECD Trade and Agriculture Directorate to undertake the global-first Trade and Gender Review of New Zealand, which was launched in June 2022 in the margins of the OECD ministerial meeting. Working closely with government agencies across New Zealand, including New Zealand Trade and Enterprise (NZTE), its export promotion agency, the OECD suggested policy reforms in 11 distinct policy areas with the aim of increasing support for women in trade. One of those areas was export promotion. The NZTE has been implementing many of those recommendations in order to better support women-owned and women-led businesses on their export journeys. The main reforms undertaken as a response to the review are outlined below.

Table 3.2. Gender mainstreaming in New Zealand's trade promotion agency

|

NZTE action taken |

OECD recommendation |

|---|---|

|

Established a target of doubling the number of women in firms supported by NZTE by 2026. |

Gender-specific targets could be considered for inclusion of women-owned and women-led businesses in the 1400 Focus (NZTE-supported) firms. |

|

Women now represent 16% of NZTE Focus firms. Data collection has been expanded to include areas such as: the number of Focus firms with women in senior leadership by export sector, the number of women advisors (Beachheads) that are matched with exporters, investment supported by the NZTE of women-led firms by investment round, number of people engaging with Women in Export directly and participating in their events and the number of new, engaged women customers in MyNZTE online platform. |

The NZTE could increase its knowledge base of engagement with women entrepreneurs by collecting information on the number of women contacts or women-led firms that make contact with the agency and the share that become customers. |

|

Established a target of women’s participation among NZTE-matched advisors (Beachheads) of 40% in 2023 to 50% in 2024 (from 25% in 2022). The NZTE has fostered an online engaged community through LinkedIn and has concluded partnerships with women’s professional organisations. |

The NZTE could further reach out to women’s professional networks and networks of small business owners and leaders to ensure the offer of services is known and procedures for accessing export promotion assistance are understood. |

|

Creation and extension of a dedicated Export Lead specialised in supporting Women in Trade. |

New Zealand should be commended for prioritising export promotion. Consideration could be given to making the Women in Export Lead a permanent position to ensure support builds over time. |

|

The NZTE has established a target of 40% women among participants in trade missions by 2023 and 50% women by 2024. Invitations to trade missions have been intentionally diverse. Anecdotal evidence in recent trade missions suggests participation by gender has been close to parity. |

Ensure that women are represented in New Zealand’s trade missions and conferences. A first step would be to develop a more deliberate approach to the membership of trade missions, including developing a strategy to better represent women. Such an approach requires the collection of gender-differentiated information on participation in trade delegations. |

|

Data on investment were collected in June 2022, which indicated that women-led firms raise 1.67 times less than men-led firms in NZTE-supported pre-seed and Series A funding rounds. Twenty-one percent of NZTE investment objectives are led by women but only 17% of completed deals and 7% of total capital raised. Work has been underway, in particular with the University of Auckland, to examine investor behaviours and investment ecosystems. |

Collecting gender-differentiated data on NZTE investment initiatives, in order to track the amount of investment going to women-led firms is also important. Where investment in women-led firms is lacking, a closer examination of the ecosystem of women-led firms could be undertaken, to better understand how to match entrepreneurs and investors, and pitch firms. |

|

Cohorts of women-only or mixed men-women groups have been established to supplement networks that women need to scale their businesses globally. Five hundred women participated in 13 Women in Export Leadership events between February and June 2022. A Women in Export podcast was started in May 2022 and 4 000 listeners were recorded in the first month. |

NZTE’s network of women exporters could be expanded, providing training in areas where women entrepreneurs feel they need support; organising information sessions on procedures necessary for different aspects of importing and exporting; engaging with officials on the content and implications of specific trade agreements; and showcasing successful women entrepreneurs and their journey to export. |

|

Target established to halve the number of Focus firms with no women in senior leadership (from 39% to 20%) by 2026. |

No relevant recommendation. |

|

Worked on a code of conduct to reduce bullying which was found to be a problem affecting women more acutely. |

No relevant recommendation. |

|

Worked with an incubator to increase the inclusivity and participation of women founders. |

No relevant recommendation. |

The NZTE has established a target of doubling the number of women-led firms that it supports through its export promotion activities by 2026. There are a number of ways it intends to do this: by engaging NZTE customer managers to intentionally engage with women leaders; communicating more widely the export promotion services offered and educating business leaders about exporting through events, online women’s networks and networks of cohorts; increasing the number of NZTE-funded experienced women advisors (called Beachheads) that counsel exporting firms; and communicating about successful women in export through online content, a podcast and events. Interestingly, the NZTE has set a target to halve the number of firms that it supports that do not have any women in senior leadership. It aims to do this in large part through awareness-raising, communication and influencing. NZTE trade missions aim to be at gender-parity by 2024; some evidence from recent trade missions suggests that gender-parity has already been achieved.

The NZTE has clearly gone far and fast toward establishing ambitious targets of support for women exporters and is actively pursuing those goals through a variety of means. It should be commended both for the breadth of scope and the speed of implementation of its policies in support of women business leaders.

Source: OECD Trade and Gender Review, NZTE Board Report August 2022, NZTE Women in Export Report for FY 2022.

Another way trade promotion agencies support exporters is by organising trade missions where entrepreneurs benefit from the networks established by trade officials in partner countries. Monitoring the gender balance in such missions and ensuring a gender balance can provide networking and business opportunities for women entrepreneurs. Some countries and organisations such as Canada, Chile, Switzerland, the United States and the Organization of Women in International Trade (OWIT) organise women-only trade missions. OWIT is a women-run, volunteer-led organisation of women business leaders in trade that provides a network of services (Box 3.6).

Box 3.6. The Organisation of Women in International Trade (OWIT)

The OWIT is a volunteer-run network of women who work in international trade. OWIT International is the global umbrella organisation that includes independently established chapters in a specific geographic region. OWIT chapters host programmes and events enabling their members to learn, network and forge professional relationships in their business communities. Local chapter members are automatically members of the OWIT International global network which is comprised of over 2 000 individual members. Local chapters have been founded in Africa (4 chapters), the Americas (17) and Europe (3). OWIT International encourages the creation of chapters in areas where a local group does not exist.

OWIT chapters organise events to encourage networking and information sharing about export procedures and challenges. These include better understanding and taking advantage of trade agreements; digital tools for export processing, branding and marketing; intellectual property and protecting a brand; leveraging partnerships; networking between specific geographical chapters; and formalisation of micro, small- and medium-sized enterprises (MSMEs).

In February 2022, the OWIT-Toronto and OWIT-Monterrey chapters organised a trade mission to Mexico in collaboration with the Canadian Trade Commissioners in Mexico City and Monterrey for Canadian businesswomen wishing to better explore trading opportunities and make business connections. Participating businesswomen were active in manufacturing, IT, education and government. The aim was to promote Canadian women-led businesses to men and women industry leaders in Mexico and learn more about the Mexican market. In March 2022, OWIT-Toronto organised a webinar on exporting to Mexico with a focus on the agri-food sector that aimed to support women business leaders wishing to access the Mexican market through US-Mexico-Canada trade agreement (USMCA). The webinar included information about exporting to Mexico and virtual B2B meetings with matched buyers or partners.

Source: OWIT (n.d.[44]), Homepage, https://owit.org/.

Providing adequate finance, including trade finance and promoting financial literacy

It was seen above that women are less likely than men to access credit and equity. Moreover, potential women exporters indicate that one of the main barriers they face is export financing (see section on challenges to exporting above). To tackle the barriers in access to credit and equity as well as export financing, some countries have put in place targeted export financing mechanisms. Export Development Canada, Canada’s export credit agency, has provided women-owned and -led businesses with diversified financial solutions and the international insights they need to grow in the wider context of Canada’s Export Diversification Strategy (Box 3.7). The International Finance Corporation (IFC) Banking on Women Global Trade Finance Programme (BOW-GTFP) aims to close gender gaps in trade financing by creating incentives for partner banks in emerging markets to lend more to women entrepreneurs for importing and exporting and encouraging partner banks to better serve women-owned SMEs.24 Some research has identified gender gaps in financial literacy as well as the need for financial institutions to be more gender-sensitive; programmes in place in some countries aim to tackle those barriers. Banco Estado, Chile’s state-owned bank, offers training to increase women’s financial knowledge and management skills.

Box 3.7. Mainstreaming support to SMEs owned and led by women in Canada