While the potential benefits of tourism from a regional development perspective are evident, having a clear understanding of key levers for visitor attraction is critical to ensure development is both inclusive and sustainable, and the benefits of the visitor economy are spread beyond traditional destinations and outside peak periods. This chapter explores the issues shifting the regional playing field for visitor attraction and identifies a range of key drivers of regional attractiveness, including an entrepreneurial economy, good air quality and a pristine natural environment, as well as a high share of foreign students. Furthermore, it highlights the need to align visitor attraction strategies with wider regional development goals. It concludes by providing a roadmap for visitor attraction, clarifying and addressing the main co‑ordination challenges faced by stakeholders involved in the development and implementation of visitor attractiveness policies and highlighting good practice examples to address these challenges.

Rethinking Regional Attractiveness in the New Global Environment

6. International visitor attraction

Abstract

Key messages

Megatrends are providing opportunities to rethink the attractiveness of tourism regions

The acceleration of the digital transition provides regions with the opportunity to attract remote workers and “digital nomads” by ensuring the availability of high-speed Internet access and the provision of co-working spaces or remote working hubs.

Demographic change requires destinations to adapt to emerging markets. As the population ages, tourism regions can enhance their attractiveness to older visitors by providing ready access to healthcare and accessible accommodation and attractions.

The impacts of climate change are increasing demand for sustainable tourism options and providing destinations and regions with the opportunity to leverage their environmental and sustainability credentials.

A range of factors influence the attractiveness of regions to visitors

An entrepreneurial economy, good air quality and a pristine natural environment, as well as a high share of foreign students all act as drivers for a stronger visitor economy.

Providing innovative and creative tourism products building on local strengths can help spread the benefits of the visitor economy beyond traditional destinations and outside peak periods.

Leveraging cultural authenticity and natural assets can help regions stand out from the crowd and provide unique experiences for visitors. If well managed, tourism can help to maintain local natural and cultural heritage, as well as Indigenous traditions, art and culture.

High-speed Internet and quality transport infrastructure are increasingly expected by visitors. Developing information and communication technology (ICT) and transport infrastructure will not only improve accessibility and attractiveness to visitors but also contribute to reducing intra-regional disparities.

Aligning visitor attraction and regional development goals is key

When based on an evidence-based analysis of key strengths and gaps, such as that provided by the OECD’s regional attractiveness compass, regional tourism strategies can provide an overall framework to enhance visitor attractiveness.

As reinforced by the COVID pandemic, an over-reliance on tourism within the regional economy, combined with a lack of diversity in the visitor mix and product offering, present significant risks for regional and local destinations, including increased vulnerability to external shocks.

Many tourism regions and businesses face challenges to attract and retain staff. Improvements in employment practices and providing access to workforce skills development can both enhance the attractiveness of the sector to potential staff and improve the visitor experience.

Adopting an integrated policy-industry-community approach with effective co‑ordination mechanisms will help to align visitor attractiveness policies with regional development goals.

What is shifting the regional playing field for visitor attraction?

As one of the largest, fastest and most consistent growth sectors in the world economy over the last six decades, tourism’s ability to create jobs and a source of export revenue and domestic value-added is well recognised. In this context, traditional tourism regions view the sector as a key pillar of their economic development strategies, while others often seek to support their economic growth by better leveraging the visitor economy – which extends beyond core hospitality and transportation sectors and encompasses direct visitor spending as well as indirect and induced economic activity that stems as a result (Tourism Economics, 2023[1]). While the potential benefits of tourism from a regional development perspective are evident, having a clear understanding of key levers for visitor attraction and potential impacts and trade‑offs associated with tourism development at the regional level is key to achieving more inclusive and sustainable regional development.

The impact of COVID-19 on global tourism in the first quarter of 2020 was both overwhelming and immediate, with asymmetric and highly localised consequences experienced between and within countries and regions. After an estimated 60% decline in international tourism in 2020 (OECD, 2020[2]), the recovery to date has remained uneven. For example, a rapid return of domestic tourism, pent-up demand, combined with pre-bookings and unused travel vouchers helped to boost recovery in 2022, which resulted in some destinations experiencing stronger than expected growth in visitor numbers. Many, however, continue to struggle to fill job vacancies following an exodus from the sector during the pandemic.

The impact of the COVID-19 crisis, compounded by the consequences of Russia’s war of aggression against Ukraine continues to impact consumer preferences and business structures, accelerating existing trends (e.g. digitalisation) and leading to the emergence of new behaviours (e.g. momentum around domestic tourism). Overall, expectations for tourism recovery have been delayed, with domestic tourism now expected to recover by 2023 and international tourism not expected to return to 2019 levels until 2025 or beyond. This is due in part to the continuing uncertain economic and geopolitical outlook stemming from the war in Ukraine and energy market developments, and significant financial vulnerabilities, all of which have potential implications for the tourism sector (OECD, 2023[3]; 2022[4]).

Despite this, the pandemic has served to reinforce the significance of tourism as an economic force and a provider of livelihoods, raising public awareness at both the destination level as well as at the highest levels of government. However, it has also underlined the fragility of the sector, which is highly fragmented and interdependent, with a heavy reliance on micro and small enterprises. Furthermore, it has shown that tourism development can be imbalanced, leading to an over-dependence on the sector in some regions and economies. Increased economic reliance on tourism, lack of diversity in the visitor mix and product offering and lack of integration of tourism into wider economic development present a significant risk for regional and local destinations, particularly those where consistent tourism growth in the past has created expectations of future growth and a focus on targeting high-growth international visitor markets. During the pandemic, places where international tourism accounted for a significant share of economic activity (including in the meetings, incentives, conventions and exhibitions [MICE] sector), experienced a sharp decline in the visitor and wider economy, a decline that hit faster and lasted longer than for regions and destinations with a more balanced product and market mix.

In rethinking the attractiveness of tourism regions, national and subnational governments will need to consider the longer-term implications of these crises, address the various opportunities and challenges presented by existing megatrends (e.g. climate change, the digital transition, and demographic change) and consider the most appropriate product and market mix to deliver a resilient, sustainable and inclusive visitor economy.

Megatrends provide opportunities to rethink the attractiveness of tourism regions

The acceleration of the digital transition is providing opportunities for the sector

The fast pace of technological advances has been a game changer for tourism businesses, presenting new opportunities for small and medium-sized enterprises (SMEs), which are able to market directly to customers, both domestic and international via online travel agencies (OTAs) or social media outlets. Furthermore, as a result of the pandemic, a major evolution in the workplace is the increased acceptance and often expectation that employees can work “remotely” for extended periods of time. This allows greater flexibility for people to stay and work in locations on a regular (remote workers) or more transient basis (digital nomads), where they can combine work and leisure activities, which may only be limited by the difference in time zone with the main office. For destinations, particularly those in non-metropolitan and rural areas, which may be less dynamic but offer a higher quality of life, attracting remote workers is one way to mitigate the impacts of demographic decline, by attracting newcomers to spend time and money on accommodation, food and entertainment.

For destinations to be attractive to these emerging groups of remote workers, there is an expectation that high-speed Internet access will be readily available at destinations. To leverage the potential benefits, regions can create co-working spaces or remote working hubs to ensure that expected facilities are available. Co-working spaces afford users the opportunity to explore and enjoy natural and cultural assets in the surrounding area. Examples include the Northern and Western Region of Ireland and the Marche region of Italy, which are seeking to attract “digital nomads” as a way to help spread the benefits of the visitor economy and tackle tourism seasonality. The aim is to revitalise historic centres in rural and remote areas by improving healthcare supply as well as digital infrastructure and services, and by enhancing underutilised buildings of historical and artistic value to create places for shared and remote work. When located along and promoted as part of existing tourism routes (driving, cycling, riding, walking), “hub routes” have the potential to generate critical visitor spending and create jobs, beyond major urban centres.

The digital transition can also provide innovative tools to help address the challenge of workforce shortages now faced by many regions, including in the tourism sector. The Arctic regions of Sweden have not been immune to these challenges, where an innovative co-lab1 was created in Norrbotten, utilising advanced artificial intelligence (AI) technology to attract more employees for SMEs, including in the tourism sector (OECD, 2023[5]).

Demographic change requires destinations to adapt to emerging markets

Changing global demographics will continue to impact visitor demand in coming years. As a result, destinations need to adapt to cater to the needs, preferences and demands of emerging markets, and stand out as an attractive option to a wider range of visitors. From a tourism perspective, demographic changes are considered a key driver of future consumer demand leading to new trends and opportunities for businesses to adapt and thrive (Li et al., 2020[6]). For instance, as the middle class grows in emerging economies, these parts of the world will play an increasingly important role as source markets for tourism in developed economies. Furthermore, as the population ages, there will be a growing demand for more accessible and senior-friendly travel options. Older travellers are also seeking safe and secure destinations with comfortable and convenient accommodation, transportation and activities.

Evidence suggests that in Europe, the over-65 age group spend a greater proportion of nights travelling domestically (66%), compared to those aged 15-64 (55%), and accounts for nearly a quarter (23%) of total tourism nights spent for private purposes by European Union residents. As a market, they also tend to make longer trips (6.6 nights versus 4.9 nights) and are more likely to travel outside of peak seasons, thus contributing to reducing the problem of seasonality in destinations (Eurostat, 2021[7]). As such, it is clear that the over-65 age group offer a potentially lucrative and growing market for those regions able to attract them to visit either domestically or from abroad (including longer, off-peak stays). For example, the Ministry of Tourism, Industry and Commerce of the Canary Islands Government, through the Canary Islands Tourist Board, has launched an action plan to attract “senior-plus” tourists, people over 55 years old who want to spend a long vacation. Similarly, the Valencian Community region offers a Social Holidays Programme 2to provide opportunities for the elderly to spend their holidays, particularly in off-peak periods, getting to know and enjoy the Valencian Community, encouraging social and cultural exchanges, and promoting active ageing.

However, with nearly half of those Europeans aged 65+ who did not make tourism trips mentioning health reasons, there are certain steps that can be taken from a policy perspective to ensure older tourists feel as comfortable when visiting tourism regions away from home, including providing ready access to healthcare and accessible accommodation and attractions.

The impacts of climate change are increasing demand for sustainable tourism options

Tourism has a complex relationship with the environment as, more than many other sectors, it both impacts and is highly dependent upon the quality of the natural environment. Accelerating climate impacts have negative consequences for tourism, especially in low-lying coastal areas and mountain areas. It also leads to the increased risk of natural disasters, which are expected to become more prevalent. Adaptation measures are required for a resilient tourism sector, while tourism also needs to play its role in mitigation efforts to achieve net zero targets (OECD, 2022[4]).

In response, travellers are increasingly seeking ecofriendly and sustainable travel options, which is forcing the industry to adapt and become more environmentally responsible. This does, however, provide destinations and regions with the opportunity to leverage their environmental and sustainability credentials to differentiate themselves in an increasingly crowded marketplace. This includes reducing carbon emissions (by promoting longer stays and providing low-emission transport options), conserving natural and cultural resources (by targeting visitors with a greater appreciation of the natural environment and cultural experiences rather than mass tourism) and supporting local communities (through better destination management) (EC, n.d.[8]). For example, water scarcity is a pressing issue in the Algarve region, particularly during summer when the high demand for water for agriculture and human consumption is compounded by increased demand in the peak tourism season. In response, the region is exploring alternative sources and techniques, such as desalination and water reuse, to adapt to the increased demand and the impact of climate change on water availability. At the same time, there is always a risk of negative impacts from tourism if visitor numbers exceed the carrying capacity of the local environment and community, and as such it needs to be carefully managed.

Potential trade-offs associated with tourism development at the regional level

While the impact of megatrends provides a range of opportunities to rethink the attractiveness of tourism regions to international visitors, it is also worth noting potential trade-offs and negative externalities associated with tourism development.

Despite tourism’s potential as a driver for positive change, it is also clear that for many tourism regions and destinations, tourism growth in recent years has been economically, socially and environmentally unbalanced, often the result of rapid and unplanned growth in visitor numbers, or when tourism “success”, measured by increased visitation or expenditure, was seen as the primary objective. Such an approach can result in a range of negative impacts. For example, overcrowding and congestion of tourism-related infrastructure – often referred to as overtourism – can lead to the degradation of natural and cultural capital, inflation of rental accommodation and real-estate prices, which can squeeze locals out of traditional residential areas or lead to a shortage of available land for residential purposes, as experienced in the Balearic Islands (OECD, 2023[9]). All of this can lead to a loss of identity and authenticity for destinations, negatively affecting not only the visitor experience but also the environment and host communities upon which tourism so clearly depends (OECD, 2020[10]).

Finding a balance between environmental, economic and social impacts remains elusive yet critical for regions to transition toward a more sustainable and resilient tourism sector. As such, there is a need to move towards a model of tourism development where “success” is judged not by the number of tourists but by the positive impacts that visitors can provide at the destination level and the benefits delivered to local economies, communities (including Indigenous peoples) and the environment. For example, Destination Canada is working closely with Canadian provinces and has adopted a “high-value guest” approach that prioritises higher spending visitors that value nature, engage with the locals, are less time-sensitive and are eager to explore lesser-known areas and engage in cultural exchanges. This approach is at the crux of Destination Canada’s new strategy, which looks at tourism through the lens of “wealth and well-being”. Targeting visitors with a higher propensity for return travel leads to greater returns and higher contributions to gross domestic product (OECD, 2022[11]).

Taking steps to understand and then improve the attractiveness of regions to international visitors, while being mindful of potential trade-offs, can have the spillover effect of also improving the attractiveness of regions as places to live, work and invest (discussed in more detail in Chapters 4 and 5).

What works for visitor attractiveness

Chapter 3 highlights a range of factors that may influence visitor attractiveness and boost both domestic and international tourism in regions, including:

Good air quality and a pristine natural environment, which are features influencing destination attractiveness – a result that, while perhaps not surprising, highlights the need to align tourism development with sustainable regional development more broadly.

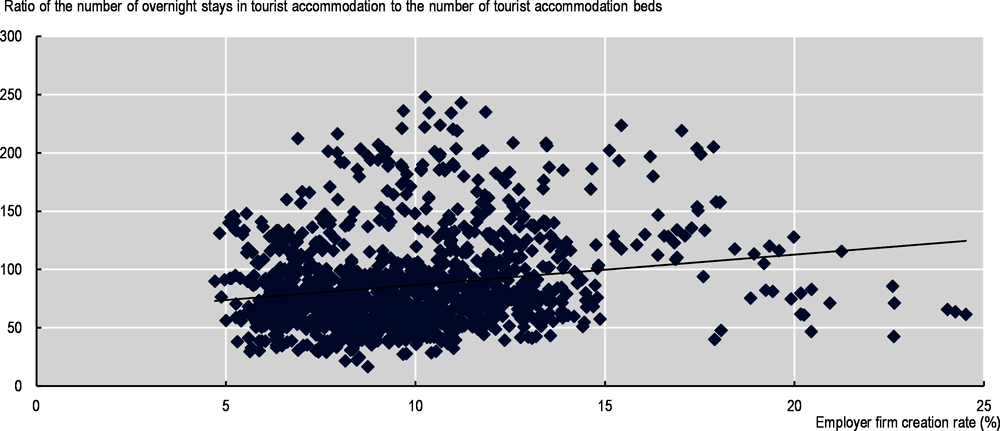

An entrepreneurial economy (represented by the employer firm creation rate), which is also likely to be attractive not only to talent and investors eager to be involved in emerging or new firms but also those drawn to visit such places on business trips and leisure tourists wishing to experience the vibrant atmosphere and society often linked to these creative environments (Figure 6.1). Therefore, supporting entrepreneurship policies could be seen as not only a useful lever to attract investors and talent (including students) but also visitors.

Figure 6.1. An entrepreneurial economy as a driver for visitor attractiveness

Note: Time-series data were analysed spanning 2008 to 2020.

Source: OECD (2022 or latest available) Regional Attractiveness Database; (Eurostat, 2022[12]) Business demography by size class and NUTS 3 regions (database), https://ec.europa.eu/eurostat/databrowser/view/bd_size_r3/default/table?lang=EN (accessed 1 December 2022).

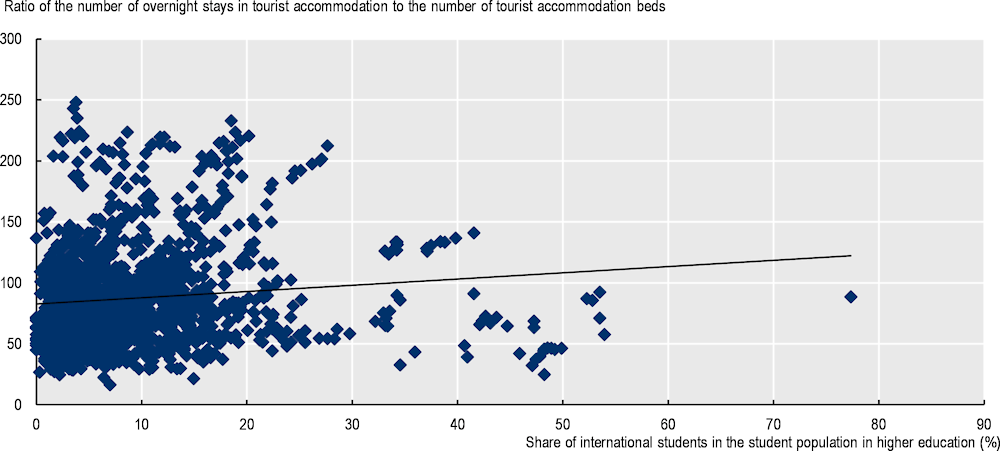

A higher share of foreign students can also contribute to a stronger visitor economy, as in addition to typically being tourists themselves (when they stay in a location away from home for less than 12 months at a time), students are also promoters of the place they live on social media, while friends and family members often visit the city and region where they are studying (Figure 6.2). Policies to help universities stand out in a crowded international marketplace and increase the share of foreign students could include partnerships with foreign universities, participation in international university networks, communication strategies to attract foreign students and opportunities for work experience with local businesses. Such approaches could be important levers to help enhance the attractiveness of universities to foreign students, with flow-on benefits to the visitor and wider economy.

The relationship between the share of employment in cultural and creative industries and international tourism activity, while not unexpected, has implications for regional visitor attraction strategies, such that regions that support firms and employment growth in this sector tend to have a flourishing tourism sector.

Figure 6.2. Share of foreign students as a driver for visitor attractiveness

Note: Time-series data were analysed spanning 2011 to 2020.

Source: OECD (2022 or latest available) Regional Attractiveness Database; (Eurostat, 2022[13]) Nights spent at tourist accommodation establishments by NUTS 2 regions (database), https://ec.europa.eu/eurostat/databrowser/view/TOUR_OCC_NIN2/default/table?lang=en&category=tour.tour_inda.tour_occ.tour_occ_n, (accessed on 1 December 2022) ; OECD elaboration of the (EETER, 2020[14]) European Tertiary Education Register (database), https://www.eter-project.com/data-for-download-and-visualisations/database/ (accessed on 1 December 2022).

Regional policy makers understand that tourism can be an asset when looking to enhance economic development and promote the region’s unique characteristics to the world. However, not all regions are endowed with an entrepreneurial economy, standout natural capital or world-class tertiary institutions. Below is a selection of opportunities for regions to enhance their tourism sector and attractiveness to international visitors observed in our work with regions to rethink regional attractiveness.

Providing unique experiences to spread the benefits of the visitor economy

Diversifying the tourism product to provide options for visitors beyond traditional destinations with high visitor flows and outside of peak periods, is an approach employed by many regions seeking to spread the benefits of the visitor economy to new and emerging destinations. Such an approach can serve the dual purposes of tackling overcrowding in popular existing destinations/attractions (with the associated impacts on the delivery of services), whilst also playing an important, stimulating role for economies in non‑metropolitan and rural areas within regions. Approaches employed to achieve a more geographically and temporally diverse and inclusive tourism sector include thematic tourism (gastronomy, wine, natural and/or cultural heritage, etc.), community-based and Indigenous tourism, niche and regional festivals and events, development of tourism clusters and regional tourism incubators, and tourist routes (road, bicycle, walking, pilgrimage, etc.) (OECD, 2020[10]).

For example, Latvia is taking steps to increase the competitiveness and export capacity of the tourism sector through the development of new, innovative and creative tourism products utilising a tourism cluster system. The programme will support eight tourism clusters: four thematic clusters (MICE, health tourism, cultural tourism and nature tourism) and four regional clusters. The programme is co-financed with European Regional Development Fund (ERDF) funding of EUR 6.5 million (OECD, 2022[4]). Tourism Ireland, via the International Programming Ireland Fund, provides funding to selected producers of high-quality international programming that feature or are made on the island of Ireland. Now in its third year, Tourism Ireland seeks to build on the success of previously supported projects to profile Ireland’s landscapes, heritage and living culture (Tourism Ireland, 2023[15]). The impacts of screen tourism can be significant, with the Game of Thrones series alone attracting an estimated 1 in every 6 out-of-state visitors to Northern Ireland in 2018 and injecting over GBP 50 million into the local economy. Throughout its entire production, the series injected over GBP 251 million into the Northern Ireland economy (Tourism Northern Ireland, 2021[16]).

Providing options for visitors outside of peak periods can also have benefits for tourists. Prices for flights, accommodation and attractions are often lower during off-peak periods, making travel more affordable, while smaller crowds are often conducive to a more authentic experience of the local culture (OECD, 2022[4]). Such approaches were employed by several of the regions participating in the current project on rethinking regional attractiveness in the new global environment. In addition to examples provided in Box 6.1, others include: Cascais, located 25 km from Lisbon in Portugal, which is targeting visitors, digital nomads and remote workers by offering assistance with visa application, navigating business start-up regulations and even finding suitable workspaces. Such campaigns can serve the dual purpose of tackling overcrowding in popular existing destinations such as the city of Lisbon, whilst also playing a stimulating role for the economies in less well-known destinations; Campania in Italy, which is seeking to reduce congestion in the most crowded areas such as Naples and the Amalfi Coast and reduce seasonality by encouraging slow and sustainable forms of tourism building on natural and cultural assets including local gastronomy; while the Balearic Islands in Spain have introduced a Better in Winter campaign to promote tourism activities (e.g. gastronomy, sport, cultural tourism) during the off-season to support local economies.

Box 6.1. Regional initiatives to spread the benefits of the visitor economy

Marche, Italy – Redevelopment of villages and historic centres to support sustainable tourism

Marche launched an important measure to tackle the challenge of redistributing tourists more evenly throughout its territory. Although endowed with important and impressive natural landscapes and cultural attractions, inner areas of the region welcome only 2.6% of total arrivals. The regional government approved a financial endowment of EUR 7.8 million, in addition to European funds (around EUR 75 million in 2023) for sectoral interventions, to revitalise historic centres and develop sustainable tourism. Foreseen interventions include improving healthcare supply as well as digital infrastructure and services in rural and remote areas. The region is seeking to support initiatives to enhance underutilised buildings of historical and artistic value to create places for shared and remote work, and also accommodation structures, including through innovative models, such as the “Spread hotels”. The latter consists of several buildings, which are located within the perimeter of the same historic centre. This regional law matches the objectives of the national programme for the requalification of villages funded with National Recovery and Resilience Plan (NRP) funds, having 2 lines of action: i) EUR 420 million designated for pilot projects in each Region or Autonomous Province (the selected pilot project in Marche is the Montalto village); and ii) EUR 580 million for at least 229 villages selected through public tender (OECD, 2023[17]).

Southern Region, Ireland – Corridors to develop less-visited parts of the region

The Wild Atlantic Way is a coastal tourist route in Ireland and one of the longest-defined coastal routes in the world. Running along the country’s western coastline from Malin Head, the northernmost point of the island, to the port of Kinsale in the southwest. This tourism development project aims to bring more tourists to the west side of Ireland and develop little-visited areas. With an investment over a decade, the Wild Atlantic Way improved the visibility of the route of interest and developed 159 points of interest, Through the development of a brand identity, the route increased visitor numbers along all of its parts and reinforced the strengths and characteristics of all of the areas located along the west coast, while offering visitors a compelling reason to visit. In 2015, a follow-up programme to the Wild Atlantic Way, Ireland’s Ancient East tourism corridor, was launched to unify the region as a marketable tourism destination and deliver an extra 600 000 overseas visitors and increase visitor revenue (OECD, 2023[18]).

Source: OECD (2023[17]), Rethinking Regional Attractiveness in the Italian Region of Marche, http://www.oecd.org/regional/rethinking-regional-attractiveness-in-the-italian-region-of-marche.pdf; OECD (2023[18]), Rethinking Regional Attractiveness in the Southern Region of Ireland, http://www.oecd.org/regional/rethinking-regional-attractiveness-in-the-southern-region-of-ireland.pdf.

Supporting the promotion of cultural authenticity and natural assets

Cultural authenticity and natural assets are important tools for regions to leverage in their efforts to attract international visitors. When built upon broad stakeholder engagement and sustainable development principles, tourism can raise awareness of cultural and environmental values, and help finance the protection and management of protected areas and sensitive sites. Tourism can also play an important role in demonstrating the economic value of environmental and cultural heritage conservation and the authenticity of a destination, primarily through the level of activity that it can stimulate in the local, regional and national economy (OECD, 2021[19]).

Developing cultural attractions such as museums, art galleries and historical sites can attract visitors who are interested in learning about a destination’s culture and heritage. Cultural heritage protection and management must be placed at the centre of cultural tourism policies and planning. Well-managed cultural heritage tourism enables communities to participate in the visitor economy, while maintaining their heritage, social cohesion and cultural practices (ICOMOS, 2021[20]). For instance, in the Spanish region of Cantabria, the government aims to establish a cultural hub, with projects like Espacio Pereda, a culture centre which will be inaugurated in 2024 and will benefit from over EUR 85 million of investment and more than 1 000 private art pieces from the Santander Bank Foundation. Another example is the project for the construction of the new Prehistory Art Museum (MUPAC), which would be co-financed by ERDF funds.

In many countries, tourism also plays an important role in promoting and maintaining Indigenous traditions, art and culture, which are typically major attractions for visitors. In turn, tourism represents a major source of revenue for many Indigenous communities. For example, Haida Gwaii in British Columbia, Canada,3 is a prime example of Indigenous communities having agency over tourism in their region. The number of visitors who can visit the region is fixed and visitors are expected to contribute to the local communities and environmental sustainability, which in turn offers an opportunity to have a truly authentic visit to a picturesque Pacific island protected by Indigenous peoples. As for the region of Norrbotten in Sweden, it is seeking to promote its unspoiled landscapes and vibrant Sámi culture to develop nature and experience-based tourism activities for the benefit of local communities (OECD, 2019[21]).

Improving regional connectivity through information and communication technology (ICT) and transport infrastructure

Quality ICT and transport infrastructure providing access beyond urban centres are increasingly expected by visitors. Developing infrastructure such as roads, ports and airports in regions, as well as access to high-speed Internet, will not only improve accessibility but contribute to reducing intra-regional disparities. Improved transport infrastructure and public transport services not only play a significant role in attracting and distributing tourists beyond major transport hubs but also in improving the quality of life for local residents. For instance, the National Association of Mexican World Heritage Cities created a voluntary network for promoting local business in Mexican World Heritage Cities with an online platform that connects and supports SMEs promoting regional tourism and increases local businesses’ digital presence; this strengthens inland tourism beyond beach tourism, which is already well developed (UNESCO, 2021[22]; OECD, 2023[23]). Furthermore, it promotes the distribution of socio-economic benefits flowing from tourist expenditure (e.g. incomes, jobs), while tourism growth can also help to generate additional funding for the development and maintenance of transport systems, public spaces and cultural attractions, which all contribute to the attractiveness of destinations (OECD, 2021[19]). As seen in Chapters 3, 4 and 5, improved infrastructure can also increase access to education, healthcare and other services, making the region more attractive to talent and investors.

However, it is important to ensure that transport modes are well managed and do not inadvertently exceed the carrying capacity of local communities. For example, in 2021, due to concerns over the number of cruise ships and tourists visiting in peak periods, the regional government of the Balearic Islands signed a five-year agreement with the Cruise Lines International Association (CLIA), validated by the national authorities, to limit the number of cruise ships calling at the port of Mallorca, becoming the first and only region in Spain to do so. In 2023, the number of visitors will be limited to 8 500 passengers and 3 cruise ships per day. Limiting the volume of passengers that generally disembark for short periods of time will provide an opportunity to improve the tourist experience, relieve pressure in the city’s historic centre and benefit local residents. Taking steps to ensure that visitor flows are more in line with the island’s carrying capacity will also contribute to mitigating environmental impacts and better addressing long-term sustainability on the island.

Aligning visitor attraction with regional development goals

Economic diversification is key

The pandemic highlighted that those regions more dependent on the tourism sector as an economic engine, and in particular those heavily dependent on inbound tourism (including leisure, business and MICE), were more likely to be negatively affected by the crisis and for longer. A lack of economic diversification is often associated with increased vulnerability to external shocks that can undermine prospects for longer-term economic growth (OECD, 2019[24]). As such it is imperative that tourism is treated as only one component of a diverse regional economy and policy makers need to ensure that visitor attraction strategies are pursued within the wider context of relevant city, regional and national economic development strategies, and in close co-operation with industry and local communities.

Tourism strategies can provide a visitor attractiveness framework

Tourism strategies are central to providing strategic direction and maximising the positive contribution of tourism to a region’s prosperity and well-being. When based on an evidence-based analysis of key strengths and gaps, such as that provided by the OECD’s regional attractiveness compass (outlined in Chapter 3), regional tourism strategies can provide an overall framework to enhance visitor attractiveness, highlighting policy priorities, investment needs, mechanisms for stakeholder collaboration and benchmarks to monitor, adapt and evaluate regional attractiveness policies. For example, the regional strategy for tourism in Sicily, Italy, has three long-term objectives: lengthening the tourism season, reducing territorial disparities and enhancing sustainability. Connecting regional tourism strategies to wider government priorities can also help to minimise policy conflicts and provide an opportunity to leverage investment and programmes that may not be targeted at tourism alone.

Enhancing tourism job attractiveness and workforce skills to enhance the visitor experience

Following an exodus from the sector during the pandemic, many tourism regions and businesses continue to face challenges in attracting and retaining staff, which is leading to ongoing workforce shortages and impacting the visitor experience in many destinations. Workforce shortages have also been exacerbated by longstanding issues impacting the ability of the sector to attract and retain workers (e.g. unsociable working hours, job insecurity, salary levels and career prospects). Increasing labour demand in general is making it difficult for tourism to compete for the required workforce in a competitive global job market. Implementing initiatives to make the sector more appealing to prospective employees, including improving skills levels, enhancing qualifications, supporting training opportunities and developing innovative recruitment initiatives, can help to encourage talent into the sector. Selected country examples to enhance workforce skills and the visitor experience are outlined in Box 6.2.

Box 6.2. Initiatives to enhance workforce skills and recruitment

France: A communications campaign in 2022 targeted young people aged 16-25 years looking for a job or undergoing professional retraining, with a budget of EUR 8 million. The campaign aims to strengthen and perpetuate jobs and skills in the sector to improve the attractiveness of tourism employment. An amplification mechanism is also planned by mobilising all of the local institutional players, including schools, training institutions, employment centres, prefectures, regions, professional federations and the private sector. This initiative was renewed in 2023 with the organisation of the Week of Tourism Professions in early April and the support of the Ministry of the Economy. It aims to raise awareness among young people, middle and high school students of opportunities in the tourism sector.

Ireland: The Employer Excellence initiative was launched by the Irish National Tourism Development Authority (Fáilte Ireland) in September 2022. The new initiative will provide tourism businesses with a competitive edge as they recruit and retain staff in a highly competitive employment market. It will help to drive improvements in employment practices across the industry and provide businesses with tailored action plans and a trusted symbol that denotes a rewarding and appealing workplace. Additional initiatives include the creation of a learning hub to provide free high-quality, self-directed learning courses to upskill staff and build business capability.

Portugal: The Programa Formação+Próxima (local based training programme) was implemented in January 2022 and aims to train 75 000 professionals over 3 years, free of charge and adapted to the local needs of each municipality throughout the territory. The programme will implement upskilling and reskilling processes that contribute to adding value to the local business fabric and their respective territories and functions as an instrument to attract talent, including qualifying people from other sectors or unemployed people. Content will be adapted to the diversity of tourism companies and the sector’s future needs.

Source: OECD (2022[4]), OECD Tourism Trends and Policies 2022, https://doi.org/10.1787/a8dd3019-en.

An example of a national initiative to help the recovery of the sector following the COVID-19 pandemic is the Travel, Tourism and Outdoor Recreation programme in the United States. As of September 27, 2022, the U.S. Economic Development Administration (EDA) programme had invested USD 750 million in American Rescue Plan funding to support communities across every state and territory in the United States where the travel and tourism sector had been hard hit by the COVID-19 pandemic, to make it more equitable, competitive and resilient. The programme was delivered in two parts: i) state grants totalling USD 510 million, to help states quickly invest in marketing, infrastructure, workforce and other projects to rejuvenate safe leisure, business and international travel; and ii) competitive grants, totalling USD 240 million across 126 projects, to help communities that have been hardest hit by challenges to the travel, tourism and outdoor recreation sectors invest in infrastructure, workforce or other projects to support the recovery of the industry and economic resilience of the community in the future.

In the State of Washington, for example, the Port Angeles Waterfront Center, in partnership with Peninsula College, received USD 1 million to train workers for high-paying, high-demand jobs in the Olympic Peninsula’s rapidly growing travel and tourism industry and to enable a rural region whose rich natural resources are now threatened by climate change to attract visitors to the area and diversify its economy in a growing and sustainable sector (U.S. EDA, 2023[25]).

Effective multi-level governance and co‑ordination are critical

Due to the interlinked nature of the sector, effective multi-level governance – between and across different levels of government, industry and civil society – with the necessary institutional capacity, is critical. Adopting an integrated policy-industry-community approach with effective co‑ordination mechanisms across levels of government and between stakeholders will help to align visitor attractiveness policies with regional development goals (see Chapter 7).

A roadmap for visitor attraction in the new global environment

The OECD has developed a tool, in the form of a roadmap for visitor attraction, to clarify and address the main co‑ordination challenges faced by stakeholders involved in the development and implementation of attractiveness policies, and to highlight good practice examples to address these challenges. The roadmap aims to support the dialogue between stakeholders from the tourism sector and the action of the different actors, including across levels of government, who are involved in enhancing the attractiveness of regions.

The roadmap for visitor attraction includes five concrete steps to address multi-level governance issues and support dialogue between stakeholders. It also highlights the need to link visitor attraction policies to related policy areas, such as investment, employment, innovation, local development, SMEs and entrepreneurship, and the green transition, to enhance not only the benefits for local communities and opportunities for visitors but also ensure that all relevant parties are involved in the co‑ordination process.

Step 1 – Inventory and mapping of the touristic assets and their accessibility

Take steps to understand the unique characteristics of the region by mapping the touristic assets and their accessibility to provide an overview of strengths and weaknesses. Careful consideration of the potential risks, gaps and trade-offs is essential to have a clear understanding of how best to achieve the region’s potential.

Tools and methods available to address this challenge

Portray the region’s assets and infrastructure at the territorial level – from natural attractions like mountains, parks and beaches, to cultural attractions like museums and historical sites, and universities, and existing transportation and connectivity options like airports, ports, train stations and digital connections.

The OECD regional attractiveness compass serves as a powerful tool for diagnosing the attractiveness of a region to investors, talent and visitors (mentioned in Chapter 3).

Step 2 – Rethinking the regional strategy for visitor attraction

Develop a regional tourism strategy that is aligned with any national strategy, adapted to environmental, demographic and technological megatrends and aims to provide the most appropriate product and market mix to deliver a resilient, sustainable and inclusive visitor economy.

Tools and methods available to address this challenge

Identify more precisely the target: types of visitors the region would most like to attract (seniors, families, youth, students, digital nomads, international, domestic, etc.) and for what purpose (leisure, business, adventure, cultural, medical, educational, volunteer sports, religious, culinary, etc.).

Identify the infrastructure and service needs: in order to ensure that your region can accommodate the needs and expectations of visitors, it is important to invest in facilities, equipment and overall infrastructure needed. This could also include safety measures and the supply of public and private sector services. Having a clear image of public service capacity is essential to identify strengths as well as gaps. Measuring both the infrastructure needs and the supply of public services can lead to a more efficient use of resources and inform decision-making of visitor attractions. From a private sector perspective, improvements in employment practices and providing access to workforce skills development can both enhance the attractiveness of the sector to potential staff and improve the visitor experience.

Identifying the cost/benefit of tourism development options in the region associated with key targets and activities:

Clarify investment and services costs to propose new activities in the region and estimate spending from visitors to measure the cost-benefit of tourism development.

Assess the potential economic and socio-cultural impacts, such as job creation, services exports, cultural exchanges and increased pride in the territory, as well as conservation of local cultural heritage, versus potential negative externalities associated with unplanned or overtourism, for example the overcrowding and congestion of tourism-related infrastructure, the degradation of natural and cultural capital, inflation of rental accommodation and real-estate prices, all of which can lead to a loss of identity and authenticity for destinations.

Evaluate the environmental impacts of the different options for tourism development as tourism is responsible for a large share of air and road traffic and consumption of energy (transportation, tourist infrastructure, etc.), adding further to the emissions of greenhouse gases and acidifying substances. Tourists consume not only energy but several other local, non-renewable resources like water (EC, 2002[26]). Policy makers should consider the variety of infrastructure solutions (for tourism transport, housing, and leisure) and measure their environmental impact to be sure they select the most resilient ones.

Selecting tourism development priorities in terms of places and tourism activities: diversifying the tourism product to provide options for visitors beyond traditional destinations with high visitor flows and outside of peak periods can serve the dual purpose of: i) tackling overcrowding in popular existing destinations/attractions (with the associated impacts on the delivery of services); ii) playing an important, stimulating role for economies in non-metropolitan and rural areas within regions.

Step 3 – Institutional mapping for coherent visitor attractiveness strategy co‑ordination

An integrated, whole-of-government approach, linking visitor attraction policies to related policy areas, such as investment, employment, innovation, local development, SMEs and entrepreneurship and the green transition, is essential to enhance benefits for the local community and opportunities for visitors and to ensure that all relevant parties are involved in the co‑ordination process.

Tools and methods available to address this challenge

Produce the institutional mapping of “who does what” to help all stakeholders involved in visitor attraction situate their partners (real or potential ones), including government agencies at the local, regional and national levels, non-governmental organisations, private sector entities and community organisations.

Identify co‑ordination and capacity gaps to effectively implement the strategy for visitor attraction.

Implement multi-level governance and co‑ordination mechanisms, involving the private sector and local communities to address these gaps and facilitate the convergence of each stakeholder action.

Step 4 – Promoting the region to visitors through cohesive territorial marketing

Consideration of the region’s assets (Step 1), targets and priorities (Step 2) can inform the development of a cohesive territorial brand and marketing strategy to provide a unified image for the destination that speaks to the identified target group(s), mobilises all stakeholders (identified in Step 3) and can profile the region on relevant social media/websites.

Tools and methods available to address this challenge

Digital presence: an online presence is essential to reach visitors directly as they evaluate potential destination choices and then as they gather detailed information on their destination of choice. This “front office” should provide access to information from different actors in the “back office” contributing to the visitor attractiveness of the region.

Foreign language translation: access to information in other languages, and in particular English, is a primary gateway to the region for foreign targets (visitors including investors and talent).

Visual identity: branding allows public actors to promote their territory on a national and international scale. The development of territorial brands also helps to create added value to locally produced goods and services.

Developing a cohesive territorial marketing strategy is also an opportunity for dialogue and consensus building among regional attractiveness stakeholders and can be used to build effective relationships based on common references and objectives.

Step 5 – Monitor and evaluate the visitor attractiveness strategy

Select and track key metrics to better understand the effects and impact of visitor attraction strategies, not only on the visitor economy but also inclusive and sustainable regional development more broadly.

Tools and methods available to address this challenge

Monitor selected indicators in a regular, transparent and inclusive way.

Integrate the economic, social and environmental impact indicators of these strategies to ensure that they contribute to the local, inclusive and sustainable development of the territories. These tools can provide, for example, data on job creation, tax revenue and environmental impact that informs the situation in the region.

References

[26] EC (2002), Defining, Measuring and Evaluating Carrying Capacity in European Tourism Destinations, European Commission.

[8] EC (n.d.), Sustainable Tourism, European Commission, https://single-market-economy.ec.europa.eu/sectors/tourism/eu-funding-and-businesses/funded-projects/sustainable_en.

[14] EETER (2020), European Tertiary Education Register (database), https://eter-project.com/data-for-download-and-visualisations/database/ (accessed on 1 December 2022).

[12] Eurostat (2022), Business demography by size class and NUTS 3 regions, https://ec.europa.eu/eurostat/databrowser/view/bd_size_r3/default/table?lang=EN (accessed on 1 December 2022).

[13] Eurostat (2022), Nights spent at tourist accommodation establishments by NUTS 2 regions (database), https://ec.europa.eu/eurostat/databrowser/view/TOUR_OCC_NIN2/default/table?lang=en&category=tour.tour_inda.tour_occ.tour_occ_n (accessed on 1 December 2022).

[7] Eurostat (2021), Tourism Trends and Ageing – Statistics Explained, https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Tourism_trends_and_ageing.

[20] ICOMOS (2021), ICOMOS International Charter for Cultural Heritage Tourism.

[6] Li, Z. et al. (2020), “Does the demographic structure affect outbound tourism demand?”, Journal of Travel Research, Vol. 59/5, https://doi.org/10.1177/0047287519867141.

[23] OECD (2023), “Key takeaways: Webinar on rethinking the attractiveness of tourism regions”, OECD, Paris, https://www.oecd.org/regional/Key_Takeaways_Rethinking_the_attractiveness_of_tourism_regions.pdf.

[3] OECD (2023), OECD Economic Outlook, Interim Report March 2023: A Fragile Recovery, OECD Publishing, Paris, https://doi.org/10.1787/d14d49eb-en.

[9] OECD (2023), Rethinking Regional Attractiveness in the Balearic Islands Region of Spain, OECD, Paris, https://www.oecd.org/regional/globalisation.htm.

[17] OECD (2023), Rethinking Regional Attractiveness in the Italian Region of Marche, OECD, Paris, http://www.oecd.org/regional/rethinking-regional-attractiveness-in-the-italian-region-of-marche.pdf.

[5] OECD (2023), Rethinking Regional Attractiveness in the Norrbotten County of Sweden, OECD, Paris, https://www.oecd.org/regional/globalisation.htm.

[18] OECD (2023), Rethinking Regional Attractiveness in the Southern Region of Ireland, OECD, Paris, http://www.oecd.org/regional/rethinking-regional-attractiveness-in-the-southern-region-of-ireland.pdf.

[4] OECD (2022), OECD Tourism Trends and Policies 2022, OECD Publishing, Paris, https://doi.org/10.1787/a8dd3019-en.

[11] OECD (2022), “Webinar on rethinking the attractiveness of tourism regions”, OECD, Paris.

[19] OECD (2021), “Managing tourism development for sustainable and inclusive recovery”, OECD Tourism Papers, No. 2021/01, OECD Publishing, Paris, https://doi.org/10.1787/b062f603-en.

[10] OECD (2020), “Rethinking tourism success for sustainable growth”, in OECD Tourism Trends and Policies 2020, OECD Publishing, Paris, https://doi.org/10.1787/82b46508-en.

[2] OECD (2020), “Tourism policy responses to the coronavirus (COVID-19)”, OECD Policy Responses to Coronavirus (COVID-19), OECD, Paris, https://www.oecd.org/coronavirus/policy-responses/tourism-policy-responses-to-the-coronavirus-covid-19-6466aa20/#abstract-d1e26.

[24] OECD (2019), “Economic diversification lessons from practice”, OECD, Paris.

[21] OECD (2019), Linking the Indigenous Sami People with Regional Development in Sweden, OECD Rural Policy Reviews, OECD Publishing, Paris, https://doi.org/10.1787/9789264310544-en.

[1] Tourism Economics (2023), Visitor Economy, https://www.tourismeconomics.com/economic-impact/visitor-economy/ (accessed on 25 May 2023).

[15] Tourism Ireland (2023), International Programming Ireland Fund, https://www.tourismireland.com/news-and-press-releases/press-releases/article/tourism-ireland-announces-applications-for-international-programming-ireland-fund (accessed on 6 January 2023).

[16] Tourism Northern Ireland (2021), Game of Thrones Territory: The Making of a Screen Tourism Destination.

[25] U.S. EDA (2023), Travel, Tourism, and Outdoor Recreation Fact Sheet, United States Economic Development Administration, http://www.eda.gov/sites/default/files/2022-11/TTOR_Fact Sheet.pdf (accessed on 25 May 2023).

[22] UNESCO (2021), Promoting Local Businesses in Mexican World Heritage Cities, United Nations Educational, Scientific and Cultural Organization, https://whc.unesco.org/en/canopy/smes-mexico/.