This chapter analyses the evolving landscape of transition finance definitions and approaches and identifies common core concepts across them. A key core concept in transition finance is that it supports the decarbonisation of high-emitting industries and activities with no feasible low-emission alternative. The chapter focuses on the role that definitions of feasibility and related assessments play in eligibility for transition finance. It analyses how different ways to define feasibility and feasibility assessments can potentially increase carbon lock-in risk within existing transition finance approaches. The chapter concludes with key findings and good practices on how feasibility assessments can be conducted to improve the climate impact of technology selection and prevent carbon lock-in risks.

Mechanisms to Prevent Carbon Lock-in in Transition Finance

2. Carbon lock-in considerations in transition finance definitions: the role of feasibility assessments

Abstract

2.1. The evolving landscape of transition finance definitions

Transition finance has grown in importance over recent years, with several jurisdictions and market actors presenting their own approaches to defining transition investments (Tandon, 2021[1]). Its growing popularity is largely due to the perceived limitations of narrower sustainable and green finance approaches1, which have been criticised for being binary, static, and unable to fully support a whole-of-economy net-zero transition and for leaving emerging markets and developing economies (EMDEs) behind (see, for example, (OECD, 2022[2]; OECD, 2022[3])).

Given the plurality of actors operating in this space, existing definitions of transition finance differ not only in the stringency and granularity of their eligibility criteria, but also in how and where those criteria apply: for example, transition taxonomies usually apply eligibility requirements at the economic activity level to define what can qualify as a “transition activity”. Guidance on corporate transition strategies, on the other hand, will mostly focus on the level of the corporate entity and set criteria for credible entity-wide net-zero plans or related sustainability and climate disclosures. Lastly, standards for transition financial instruments will specify the required Key Performance Indicators (KPIs) and related metrics (including, in some cases, taxonomy-related criteria) at the level of the financial instrument (OECD, 2022[2]).

When they are designed to be compatible, these different types of requirements can reinforce each other as part of a holistic approach to financing the net-zero transition: A corporate entity could develop and publish a net-zero transition plan, using a relevant climate-related reporting standard (e.g., based on a legal requirement such as in the United Kingdom (UK) or the European Union (EU), or using an international standard like the one being developed by the International Sustainability Standards Board (ISSB)). The environmental integrity and credibility of that plan can be strengthened by using a taxonomy or equivalent climate alignment tool to guide capital expenditures (CapEx). Lastly, the KPIs and metrics used in the plan to measure progress towards targets can be reflected in the issuance documents of relevant financial instruments, for example sustainability-linked bonds (SLBs) (OECD, 2022[2]).

The OECD Guidance on Transition Finance concludes that to scale up the transition finance market, greenwashing and carbon lock-in risks need to be reduced to provide assurance to market actors to engage in transition finance transactions. The Guidance is predominantly focused on corporates and their climate transition strategies because a robust corporate climate transition plan can provide a good basis for credible transition finance transactions and financial instruments (OECD, 2022[2]).

In this context, after reviewing existing approaches, the Guidance proposes a working definition of transition finance as “finance raised or deployed by corporates to implement their net-zero transition, in line with the temperature goal of the Paris Agreement and based on corporate climate transition plans”. While useful for the specific purposes of the Guidance, this definition may not be applicable in the same way in other contexts, like taxonomies, technology roadmaps, or financial instruments. These tools may instead require definitions that are focused on economic activities or specific assets, technologies, or portfolios.

Taxonomies may provide separate definitions for green and transition economic activities, including through traffic light or tiered approaches that classify transition activities in an “amber” or “tier 2” category (see, for example, the Association of Southeast Asian Nations’ (ASEAN) and Singapore’s taxonomies (ASEAN Taxonomy Board, 2023[4]; Monetary Authority of Singapore, 2023[5])). The former, in a climate change mitigation taxonomy, will usually focus on the low- or zero-emission nature of the activity today. Definitions of transition economic activities, on the other hand, must be forward-looking as the activity is not yet zero-emission but needs to get onto a path to become zero-emission. Existing transition taxonomies tend to use backward-looking concepts such as “Best-Available-Technology” (BAT)2 or similar notions of “best performance in the sector or industry”, in the absence of viable or feasible low-carbon alternatives (see, for example, (European Parliament and Council of the European Union, 2020[6]; South African National Treasury and IFC, 2022[7])). They may focus on facilitating significant emissions reductions, or generating fewer emissions compared to an alternative (see, for example, (OJK, 2022[8]; Green Finance Industry Taskforce, 2022[9]; Government of Canada, 2022[10])). This may be coupled with safeguards like the requirement to prevent carbon lock-in (see, for example, (European Commission, 2022[11]; South African National Treasury and IFC, 2022[7]; Government of Canada, 2022[10])) and ensuring that the investment does not hinder the development of low-carbon alternatives, such as a clear end date for eligibility (see, for example, (ASEAN Taxonomy Board, 2023[4]; Green Finance Industry Taskforce, 2022[9])).

Recognising the ways in which taxonomies and other transition finance approaches differentiate transition finance from sustainable or green finance, the OECD Guidance on Transition Finance proposes the following distinction:

Sustainable and green finance tools and frameworks tend to define what is already sustainable, green or net-zero, whereas

transition finance focuses on the dynamic and forward-looking decarbonisation or greening process of an entity or activity and its pathway towards becoming sustainable, green or net-zero at a pre-defined future point in time.3

Notwithstanding this conceptual distinction, for most issuers of green or transition finance products, both approaches are necessary to reach net zero, especially in high-emitting sectors: to achieve the commitments in a company’s net-zero plan, both use-of-proceeds instruments financing economic activities defined as green or sustainable (such as green bonds or sustainability bonds), as well as general purpose corporate finance instruments (such as sustainability-linked bonds) are likely needed (ICMA, 2023[12]). Concretely, both transition and green investments can be relevant to achieve a decarbonisation strategy: a steel company, for instance, may wish to issue a green bond to fund a renewable energy installation or an electrification project, while also issuing a sustainability-linked bond for overall energy efficiency improvements that may involve non-renewable energy sources, at least in the short term.

Core concepts in transition finance

Several core concepts in transition finance are shared across a range of market actors and jurisdictions. Transition finance is particularly relevant to:

high-emitting industries and activities, where zero- or near-zero emission substitutes are not yet fully feasible,4 but

where corporates can reasonably be expected to reach net zero in the future, based on a long-term, credible climate transition plan (OECD, 2022[2]).

Due to the focus of transition finance on emission-intensive industries and activities that currently lack feasible low-emission alternatives, carbon lock-in is a core concept common to most transition finance definitions and approaches (Tandon, 2021[1]; OECD, 2022[2]). While several of the existing approaches highlight the need for transition finance to avoid locking activities in high-emission pathways, limited guidance exists on ways in which financiers and corporates can practically prevent this risk.

While there is broad consensus on the core concepts on transition finance, their high-level nature and openness to interpretation can lead to significant variation in which activities and investments should qualify for transition finance. This has contributed to a mushrooming of transition finance initiatives over the last two years, with heterogenous definitions of what can qualify as a transition investment. This heterogeneity, in turn, may lead to real and perceived greenwashing risks in transition finance. A key element driving this heterogeneity is a lack of consistency in how the concept of “feasibility” is assessed, which feasibility factors and dimensions are considered, and over what timeframe.

2.2. Navigating the concept of feasibility

As noted, transition finance is considered most relevant for sectors, industries, and activities where there is no feasible low-carbon alternative. Feasibility therefore is central to assessments of eligibility, which in turn influences carbon lock-in exposure. Depending on how much weight is given to institutional factors and whether a long-term approach to economic feasibility and related cost analysis is taken, eligibility for transition finance can vary. These considerations have significant implications for the environmental integrity of different transition finance approaches and the degree to which they lock activities and assets in high-emitting pathways.

The importance of economic and institutional feasibility

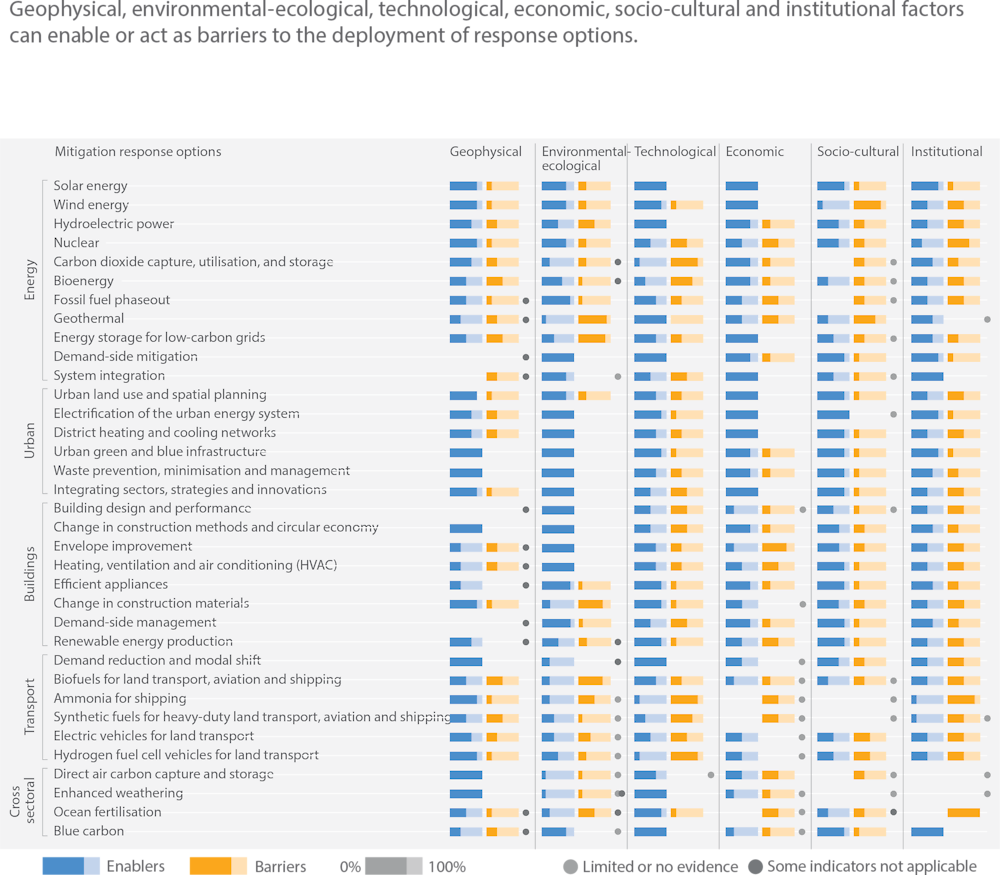

In the context of climate policy, the term “feasibility” broadly refers to the potential for a mitigation action to be implemented. According to the Intergovernmental Panel on Climate Change (IPCC), feasibility can be influenced by several context-specific factors, which constrain or enable the implementation of various mitigation options. The relevance of these factors can change over time. The IPCC identifies six feasibility dimensions: geophysical, environment-ecological, technological, economic, socio-cultural, and institutional (see Figure 2.1 below on feasibility barriers and enablers by sector and mitigation response option). Strengthening enabling conditions, such as through finance, policy, institutional capacity, or technological innovation is necessary to increase the feasibility of different climate change mitigation options (IPCC, 2022[13]; IPCC, 2022[14]).

According to the IPCC, most feasibility challenges for mitigation options are of institutional or economic nature, rather than technological or geophysical (IPCC, 2022[14]). Feasibility, especially economic feasibility, is a dynamic concept, meaning it can be enhanced, for example, through continued investment and technology support, as has been the case for renewable energy production over the last decades. Conversely, a lack of economic feasibility can become a self-fulfilling prophecy, as investment is directed away from less economically feasible low-carbon technologies due to their price, subsequently making them less competitive. This tendency may be exacerbated by institutional constraints and political decisions, such as when continuing the use of fossil fuel subsidies.

Figure 2.1. Feasibility barriers and enablers by sector and mitigation response option

Source: (Pathak et al., 2022[15]), Technical Summary. In: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, doi: 10.1017/9781009157926.002

Not all countries have the same capacity to strengthen enabling conditions or to do so uniformly across all sectors in the economy. As a result, the potential to implement low-carbon mitigation options varies between sectors and regions of the world. The IPCC considers that feasibility challenges are highest in emerging economies, at least over the short- to medium-term (IPCC, 2022[14]). Eligibility determinations under different transition finance approaches reflect this uneven distribution of feasibility challenges, as eligibility of investments in some sectors and regions may be driven by more short-term economic and institutional constraints.

This can, for example, be seen in the heterogeneity of decarbonisation pathways for the steel sector around the world. Previous OECD analysis highlights differences across countries along various indicators, for example asset structure, access to natural resources and renewable energy, and level of innovation. Different starting points, in terms of emission intensity, the choices in low-carbon technologies and the pace of transformation towards near-zero emission steel all increase the variation of countries’ decarbonisation pathways for steel (OECD, 2023[16]).

How economic feasibility is assessed impacts the environmental integrity of technology selection, especially in industry

Economic feasibility is a key determining factor for criteria-setting in transition finance (Tandon, 2021[1]) and is used to select eligible technologies or projects for support. The time horizon taken into consideration for the feasibility assessment can affect technology selection. If a long-term perspective is taken in assessing economic feasibility, the assessment can support plans to use potentially transformative technologies and avoid that an asset becomes locked into high-emitting technologies. This is especially important when comparing low-carbon technologies (such as carbon capture use and storage (CCUS) and low-carbon hydrogen5) with solutions with lower emission reduction potential (such as energy efficiency improvements in existing production plants) that are less costly today but risk hindering the future deployment of or switch to low-emission alternatives.

Based on existing net-zero scenarios, evidence suggests that net-zero technologies will be a better value in 2030, compared with emissions-intensive alternatives (Race to Zero, 2021[17]). But market uptake of less mature low-carbon technologies, notably CCUS and low-carbon hydrogen, remains limited as these technologies are initially costlier than their high-emission counterparts. This is, amongst others, due to high upfront capital costs and higher perceived risks because of the technology’s novelty (Cordonnier, forthcoming[18]). Particularly in industry, there continues to be a high risk that new investment in emissions-intensive technologies and solutions will continue, since, for instance, energy efficiency improvements in existing plants result in almost immediate production cost savings due to lower energy demand and a relatively short payback period. Continued investment in unabated fossil fuel infrastructure over the coming years will continue to increase feasibility risks, i.e., the likelihood of negative economic feasibility findings for potentially transformative technologies (IPCC, 2022[13]).

Support for transformative zero-emission technologies, on the other hand, is more cost-effective when costs are projected over the lifetime of the asset, take into account negative externalities, future transition risk due to policy changes, and subsequent additional investment needs associated with a future switch to a near-zero or zero-emission alternative (European Commission, 2021[19]; OECD, 2022[2]; Cordonnier, forthcoming[18]). The IPCC recognises the need for taking a long-term view for the assessment of economic feasibility to ensure the environmental integrity of technology selection, when including “costs now, in 2030 and in the long term” as part of their economic feasibility indicators (IPCC, 2022[14]). Box 2.1 includes current estimates showing that the cost of net zero is lower than the cost of inaction and that transition risk will become increasingly important in cost assessments.

In the context of heavy industry, carbon lock-in is a key risk as heavy industry facilities are long-lived, capital intensive and currently high-emitting. The IEA recommends that renewal of relevant existing high-emitting assets in G7 countries should be very carefully considered, given the long lifetimes of assets in these sectors: for example, blast furnaces and cement kilns have an average lifetime of 40 years (IEA, 2022[20]). Such plants are often refurbished at around the 20- or 25-year mark to extend their lifetimes. It is thus an important decision point when aiming to avoid carbon lock-in. According to the IEA, 90% of steelmaking and 80% of cement production capacity in the EU is over 20 years old, with similar figures in the United States (US). This suggests that investments in new assets or refurbishments and retrofits of existing assets can make use of a rare window of opportunity today to put in place mechanisms that will minimise lock-in in the future.

For example, investing in incremental improvements in high-emitting assets such as coal plants is not always compatible with net-zero pathways and can lead to lock-in. This risk can be mitigated when taking a longer-term perspective and using appropriate metrics to situate any incremental improvements in risky fossil fuel assets within a series of retrofits (and if necessary, eventual retirement or repurposing) that can eventually transition an asset to zero- or near-zero emissions (IEA, 2022[20]).

Similarly, taking a short-term perspective to assessing feasibility can have a negative impact on an economy’s capacity to leapfrog, which is particularly relevant to EMDEs. Leapfrogging refers to accelerated development marked by the skipping of less efficient and polluting technologies through the faster adoption of more advanced ones (OECD, 2022[2]). This is more difficult and costly when economies are already locked-in to emissions-intensive infrastructure.

Box 2.1. The cost of net zero is lower than the cost of inaction.

To transform the global economy to achieve net zero emissions by 2050, based on research by the Network for Greening the Financial System (NGFS), McKinsey estimates that a total of USD 9.2 trillion in annual average spending on physical assets is required. This includes current spending on low-emission assets (USD 3 trillion), a reorientation of current spending away from high-emission assets (USD 2.7 trillion), and additional funds to invest in more low-emission assets (USD 3.5 trillion) (McKinsey, 2022[21]). At the same time, reaching net zero by 2050 could bring gains of USD 43 trillion by 2070, while unchecked climate change could cost the world economy USD 178 trillion over the same period (Deloitte, 2022[22]).

Anticipated regulatory costs and market opportunities associated with climate change are beginning to be reflected in financial markets:

Analysis by ECB staff in 2022 found that transition risk premia in euro area equity markets have increased since the Paris Agreement (Bua et al., 2022[23]);

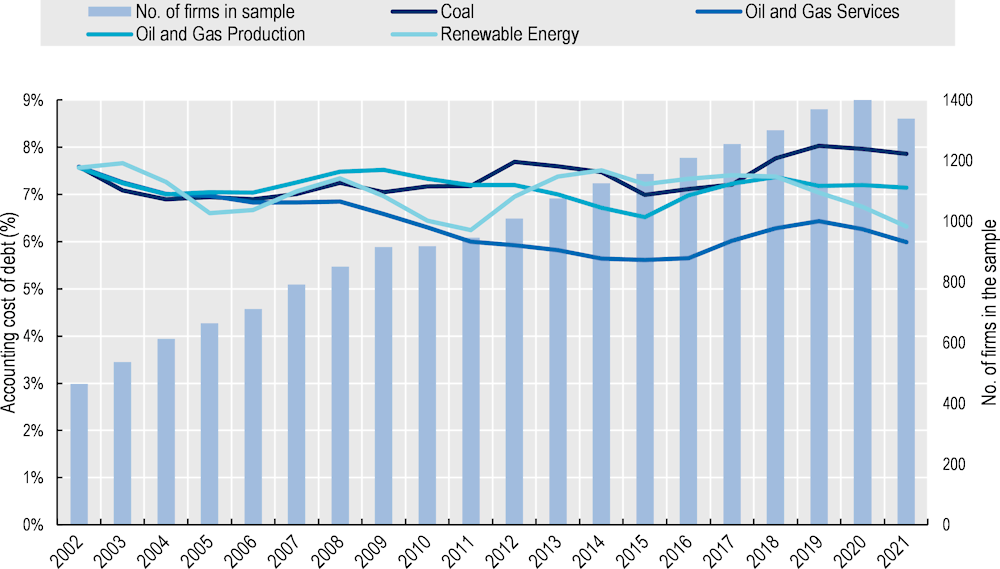

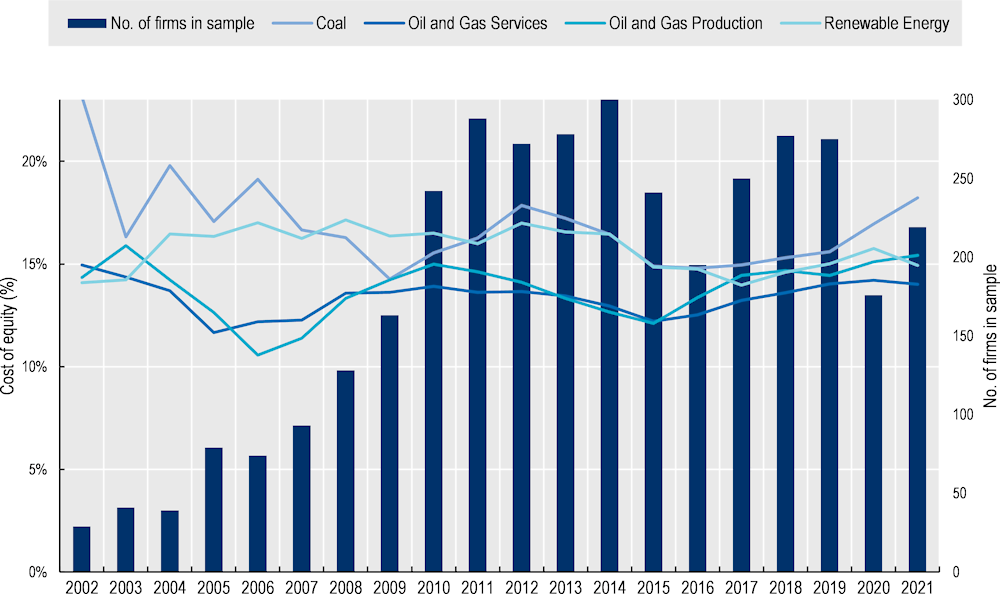

A similar trend can be observed in the cost of capital for renewables, compared with the cost of capital for fossil fuels: in Europe, where climate policy is most advanced, low-carbon electric utilities have a lower cost of capital than high-carbon ones, which suggests that low-carbon policies in Europe have been successful at decreasing risk for those projects and technologies. The gap is larger for equity than for debt, which might indicate that transition risk is starting to be priced in. Similarly, coal mining has the highest cost of capital globally (Zhou et al., 2023[24]). See Figures 2.2 and 2.3 below.

These findings suggest that as climate policy towards net zero is continuing to advance, transition risk will become increasingly important in cost assessments.

Figure 2.2. Accounting cost of debt, global Trend TRBC classification

Source: (Zhou et al., 2023[24]), Energy Transition and the Changing Cost of Capital: 2023 Review, https://sustainablefinance.ox.ac.uk/wp-content/uploads/2023/03/ETRC-Report-2023_March.pdf

Figure 2.3. Cost of equity, global trend TRBC classification

Source: (Zhou et al., 2023[24]), Energy Transition and the Changing Cost of Capital: 2023 Review, https://sustainablefinance.ox.ac.uk/wp-content/uploads/2023/03/ETRC-Report-2023_March.pdf

Institutional and social feasibility are likely key factors influencing eligibility under existing transition finance approaches

Most transition finance approaches cite technological and economic feasibility as key determining factors for eligibility. However, another important variable in the decision-making process appears to be institutional and social factors.6 Notably, such factors are acknowledged as key limiting variables in the choice of mitigation options by the IPCC (IPCC, 2022[14]).

Political and social considerations can be key drivers of carbon lock-in risks (Frontier Economics, 2021[25]). As such, they can influence decision-making on feasibility, which in turn can determine eligibility for transition investments and activities. Political and social feasibility are closely interconnected and are impacted by factors such as employment and income implications, and presence of interest groups. Research suggests that in some cases, decarbonisation options may be technically and economically feasible but difficult to realise due to political feasibility concerns (Patterson et al., 2018[26]). Social feasibility can be affected by considerations related to environmental justice,7 for instance, ensuring access to energy for all, sustaining the livelihood of impacted workers and communities, meaningfully involving all people in decision-making processes and, more broadly, protecting vulnerable people from the impacts of climate change, air pollution and other environmental factors.

For example, the financing of unabated natural gas assets for domestic energy production is unlikely to be the only technologically and economically feasible option, given the existence of low-carbon and renewable alternatives. Alternatives may include building energy efficiency, installation of heat pumps, or generation of heating, cooling and power, using renewable energy sources (European Commission, 2021[19]), though their upfront capital costs may still be relatively high in some EMDEs. Unabated natural gas may, however, still be chosen due to institutional factors, including political acceptability and administrative constraints such as a lack of a policy and legal framework for renewables development, investment, and deployment.

The continued uptick in demand and investment in natural gas seems to confirm this. According to the IEA, new oil and gas resources approved for development are expected to increase by 25% in 2023, relative to 2022, mainly for natural gas (IEA, 2023[27]). The IEA expects investments in unabated fossil fuel supply to increase by more than 6% in 2023, reaching USD 950 billion, of which more than half is going to upstream oil and gas. Oil and gas upstream CapEx is projected to continue to increase through 2025 and 2030 (IEF, 2023[28]), 500 GW of natural gas-fired power plants are planned or under construction, and new Liquefied natural gas (LNG) import and export terminals with a total capacity of 1.3 billion tonnes are under development (Kemfert et al., 2022[29]). At the same time, the current energy crisis increased concerns about the future cost and availability of natural gas and therefore its reliability to serve as a transition fuel (IEA, 2022[30]). In IEA’s Stated Policies Scenario, IEA’s scenario with the highest gas consumption, natural gas demand rises by less than 5% between 2021 and 2030 and then remains flat from 2030 to 2050, with growth in emerging market and developing economies offset by declines in advanced economies. In IEA’s Announced Pledges Scenario, by 2030 demand is 10% lower than 2021 levels. In the Net Zero Emissions by 2050 Scenario, demand is 20% lower by 2030, relative to 2021 levels, and is 75% lower than 2021 by 2050 (IEA, 2022[30]).

Another example of factors influencing institutional feasibility in the power sector is the presence of long-term Power Purchase Agreements (PPAs)8, which often have rigid clauses. According to the IEA, some PPAs include clauses allowing the seller to source power from different sources if demand is met at the agreed volumes and price. This would allow the replacement of electricity produced by, e.g., an unabated coal power plant with electricity from renewables or other low‐emission sources. However, some PPAs have rigid provisions on the minimum levels of generation from a specific plant, thus creating risks of contractually locking in emissions from the current coal power plant fleet (IEA, 2022[30]). The IEA shows that PPAs risk locking in a significant share of coal‐fired generation. Another major factor influencing institutional feasibility in coal-fired power generation relates to the fact that most of their operations are shielded from market competition, because they are often financed by state-owned utilities. For example, approximately 60% of current coal power plants in EMDEs are financed by state‐owned utilities (IEA, 2022[30]).

2.3. Key findings and good practices for transition finance methodologies and definitions

Transition finance definitions can be strengthened and made more transparent by providing clarity on how to assess feasibility as part of eligibility criteria, and by taking a long-term approach in the assessment.

Including the concept of feasibility in transition finance definitions, when setting eligibility criteria, is likely necessary to distinguish transition finance from green or sustainable finance, where low-carbon options are, by definition, readily available. Transition finance definitions, on the other hand, need to identify in which cases low-carbon alternatives are not possible, which is the role of the feasibility assessment.

Taking a long-term perspective in feasibility assessments and explicitly stating which feasibility dimensions were considered can help strengthen the environmental integrity of technology selection and reduce carbon lock-in risks. Concretely, transition finance approaches that credibly prevent carbon lock-in will provide a more detailed definition of what feasibility entails, notably by specifying the need to:

Take into account project costs in 2030 and beyond, using an appropriate net-zero scenario;

Take into account costs of reinvestment in order to achieve net zero;

Appropriately assess and monetise transition risk, including by projecting it over a longer time horizon (2030 and beyond), as it may not immediately materialize; and

Explicitly acknowledge and address potential challenges related to institutional and social feasibility, which may affect economic feasibility, for example by providing adequate support, social protection, training, and reskilling to impacted workers, households and communities.

References

[4] ASEAN Taxonomy Board (2023), ASEAN Taxonomy for Sustainable Finance Version 2, https://www.sfinstitute.asia/wp-content/uploads/2023/03/ASEAN-Taxonomy-Version-2.pdf.

[23] Bua, G. et al. (2022), Transition versus physical climate risk pricing in European financial markets: a text-based approach, European Central Bank, https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2677~9fc49e8300.en.pdf.

[18] Cordonnier, J. (forthcoming), Financing solutions to foster industry decarbonisation, OECD Publishing.

[32] Cordonnier, J. and D. Saygin (2022), “Green hydrogen opportunities for emerging and developing economies: Identifying success factors for market development and building enabling conditions”, OECD Environment Working Papers, No. 205, OECD Publishing, Paris, https://doi.org/10.1787/53ad9f22-en.

[22] Deloitte (2022), The turning point: A Global Summary, https://www.deloitte.com/content/dam/assets-shared/legacy/docs/gx-global-turning-point-report.pdf.

[33] EPA (2007), Environmental Justice, https://www.epa.gov/environmentaljustice#:~:text=Environmental%20justice%20is%20the%20fair,laws%2C%20regulations%2C%20and%20policies. (accessed on 31 May 2022).

[11] European Commission (2022), “C/2022/631”, in Commission Delegated Regulation (EU) 2022/1214 of 9 March 2022, pp. 1-45, http://data.europa.eu/eli/reg_del/2022/1214/oj.

[19] European Commission (2021), “Commission Notice: Technical guidance on the application of ’do no significant harm’ under the Recovery and Resilience Facility Regulation 2021/C 58/01”, Official Journal of the European Union, Vol. OJ C 58, pp. 1-30, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021XC0218%2801%29.

[6] European Parliament and Council of the European Union (2020), “PE/20/2020/INIT”, in Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending Regulation (EU) 2019/2088 (Text with EEA relevance), pp. 13-43, http://data.europa.eu/eli/reg/2020/852/oj.

[25] Frontier Economics (2021), Lock-in all over the world, https://www.frontier-economics.com/media/4902/lock-in-all-over-the-world.pdf (accessed on 6 April 2023).

[10] Government of Canada (2022), Taxonomy Roadmap Report, https://www.canada.ca/content/dam/fin/publications/sfac-camfd/2022/09/2022-09-eng.pdf.

[9] Green Finance Industry Taskforce (2022), Identifying a Green Taxonomy and Relevant Standards for Singapore and ASEAN, https://www.ojk.go.id/keuanganberkelanjutan/en/publication/detailsflibrary/2352/taksonomi-hijau-indonesia-edisi-1-0-2022.

[12] ICMA (2023), Climate Transition Finance Handbook, https://www.icmagroup.org/assets/documents/Sustainable-finance/2023-updates/Climate-Transition-Finance-Handbook-CTFH-June-2023-220623v2.pdf (accessed on 30 April 2022).

[27] IEA (2023), World Energy Investment 2023, IEA, https://www.iea.org/reports/world-energy-investment-2023.

[20] IEA (2022), Africa Energy Outlook 2022, https://iea.blob.core.windows.net/assets/220b2862-33a6-47bd-81e9-00e586f4d384/AfricaEnergyOutlook2022.pdf.

[30] IEA (2022), World Energy Outlook 2022, https://iea.blob.core.windows.net/assets/830fe099-5530-48f2-a7c1-11f35d510983/WorldEnergyOutlook2022.pdf.

[28] IEF (2023), Upstream Oil and Gas Investment Outlook, https://www.ief.org/focus/ief-reports/upstream-investment-report-2023.

[14] IPCC (2022), AR6 WGIII Draft Technical Summary, https://report.ipcc.ch/ar6wg3/pdf/IPCC_AR6_WGIII_FinalDraft_TechnicalSummary.pdf.

[13] IPCC (2022), Sixth Assessment Report - Mitigation of Climate Change: Summary for Policymakers, https://www.ipcc.ch/report/sixth-assessment-report-working-group-3/.

[29] Kemfert, C. et al. (2022), “The expansion of natural gas infrastructure puts energy transitions at risk”, Nature 7, pp. 582-587, https://doi.org/10.1038/s41560-022-01060-3.

[21] McKinsey (2022), Six characteristics define the net-zero transition, https://www.mckinsey.com/capabilities/sustainability/our-insights/six-characteristics-define-the-net-zero-transition.

[5] Monetary Authority of Singapore (2023), Green Finance Industry Taskforce: Identifying a Green Taxonomy and Relevant Standards for Singapore and ASEAN, https://www.mas.gov.sg/-/media/mas-media-library/development/sustainable-finance/consultation-paper-for-gfit-taxonomy-version-3-final.pdf.

[16] OECD (2023), The Heterogeneity of Steel Decarbonisation Pathways, OECD Publishing, https://doi.org/10.1787/fab00709-en.

[3] OECD (2022), Equitable Framework and Finance for Extractive-based Countries in Transition (EFFECT), OECD Development Policy Tools, OECD Publishing, Paris, https://doi.org/10.1787/7871c0ad-en.

[2] OECD (2022), OECD Guidance on Transition Finance: Ensuring Credibility of Corporate Climate Transition Plans, Green Finance and Investment, OECD Publishing, Paris, https://doi.org/10.1787/7c68a1ee-en.

[31] OECD (2020), Best Available Techniques (BAT) for Preventing and Controlling Industrial Pollution, Activity 4: Guidance Document on Determining BAT, BAT-Associated Environmental Performance Levels and BAT-Based Permit Conditions, https://www.oecd.org/chemicalsafety/risk-management/guidance-document-on-determining-best-available-techniques.pdf.

[8] OJK (2022), Indonesia Green Taxonomy, https://www.ojk.go.id/keuanganberkelanjutan/en/publication/detailsflibrary/2352/taksonomi-hijau-indonesia-edisi-1-0-2022.

[15] Pathak, M. et al. (2022), Technical Summary. In: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, Cambridge University, https://doi.org/10.1017/9781009157926.002.

[26] Patterson, J. et al. (2018), “Political feasibility of 1.5°C societal transformations: the role of social justice”, Current Opinion in Environmental Sustainability, Vol. 31, pp. 1-9, https://doi.org/10.1016/j.cosust.2017.11.002.

[17] Race to Zero (2021), What’s the cosy of net zero?, https://climatechampions.unfccc.int/whats-the-cost-of-net-zero-2/ (accessed on 6 June 2023).

[7] South African National Treasury and IFC (2022), South African Green Finance Taxonomy, http://www.treasury.gov.za/comm_media/press/2022/SA%20Green%20Finance%20Taxonom.

[1] Tandon, A. (2021), “Transition finance: Investigating the state of play: A stocktake of emerging approaches and financial instruments”, OECD Environment Working Papers, Vol. No. 179, https://doi.org/10.1787/68becf35-en.

[24] Zhou, X. et al. (2023), Energy Transition and the Changing Cost of Capital: 2023 Review, Oxford Sustainable Finance Group, https://sustainablefinance.ox.ac.uk/wp-content/uploads/2023/03/ETRC-Report-2023_March.pdf.

Notes

← 1. It is worth noting that while green finance is indeed narrow in its scope, the term ‘sustainable finance’ generally refers to finance for all sustainability objectives, whether economic, environmental or social, thus often encompassing green and transition finance.

← 2. While the concept of ‘Best-available technology’ or ‘Best-available technique’ (BAT) to prevent and control industrial emissions and pollution has different interpretations across the world, the EU definition is the most widely referenced one. According to that definition, “BAT” generally refers to techniques that can be implemented at scale, “under economically and technically viable conditions, taking into consideration the costs and advantages” (OECD, 2020[31]). BAT-associated environmental performance levels are based on “the range of emission levels obtained under normal operating conditions using a best available technique” and are fundamentally based on the performance of existing installations (OECD, 2020[31]).

← 3. This distinction acknowledges that transition finance could be applied to several environmental and social objectives, despite to-date being for the most part focused on climate mitigation (net-zero) goals.

← 4. In the context of transition finance, the term “viable” and “feasible” are sometimes used interchangeably. Reflecting the broader use of the term “feasibility” in the climate change mitigation context and related IPCC definitions, this report will utilise the terms “feasible” / “feasibility”.

← 5. Currently, there is no standard classification of hydrogen based on a transparent and universally accepted methodology (Cordonnier and Saygin, 2022[32]). In the context of this report, “renewable hydrogen” refers to hydrogen produced using renewable energy sources. Hydrogen is often referred to as “low-carbon” when associated lifecycle emissions are below a specific threshold, which varies across jurisdictions. As a cross-cutting energy vector, hydrogen can be used to decarbonise end-use sectors like heavy industry or maritime and air transport, and integrate higher shares of variable renewable energy (VRE) sources (such as solar and wind) into the energy system.

← 6. “Institutional feasibility” refers to factors like political acceptance, institutional capacity, and legal and administrative capacity, as affecting the possibility to implement different mitigation options.

← 7. The US Environmental Protection Agency (EPA) defines environmental justice as the fair treatment and meaningful involvement of all people regardless of race, colour, national origin, or income, with respect to the development, implementation, and enforcement of environmental laws, regulations, and policies (EPA, 2007[33]).

← 8. Power Purchase Agreements (PPAs) are “contracts that set the terms of sale of power between two entities over a defined period, usually years or decades, and help to underpin the financing required for a power generation project” (IEA, 2022[30]).