The Antofagasta region, located in northern Chile, is a global player in the mining industry and Chile’s main producer of copper and lithium. This chapter benchmarks Antofagasta’s trends with comparable OECD regions also specialised in mining and extractive activities. The benchmark allows the identification of the region’s main strengths and weaknesses. The results of the analysis provide the overall diagnosis and development priorities for the mining strategy of the region of Antofagasta.

Mining Regions and Cities in the Region of Antofagasta, Chile

2. Strengths and challenges for regional development in Antofagasta

Abstract

Assessment and main takeaways

Antofagasta is located in northern Chile, a region carved by the natural contours of the arid Atacama Desert, with a rich presence of mining resources and home to Indigenous communities. Antofagasta is the largest producer of copper and second of lithium in the world, placing it as of strategic importance for the global energy transition and an economic powerhouse for Chile. The regional share of the national gross domestic product (GDP) (12.8%) is over 5 times as high as the share of the country’s population (2.2% that comprises 719 000 inhabitants in 2022). Its GDP per capita ranks the highest in the country and is almost twice as high as the average value of the OECD benchmark for mining regions. Spanning a considerable geographic expanse alongside the Pacific Ocean, Antofagasta’s population density (5.7 individuals per square kilometre) is almost four times below the average in Chile (24.06), ranking it the fourth least densely populated region in the country and among the 25% least dense across the OECD benchmark of 50 mining regions.

Antofagasta’s export-oriented mining sector has propelled the economic development of the region, creating over 113 thousand direct jobs (28.3% of the total employed population1 in May 2023) and contributing to 39.4% of Chile's total exports (March 2023). Nevertheless, the mining wealth has not translated equally to all of the population, leaving important well-being gaps in mining communities. Unemployment in Antofagasta (9.6% in 2021) is slightly above the national average of 9.1% and exceeds the OECD mining region benchmark (7%) (OECD, 2022[1]). Inequality (Gini coefficient of 0.51 in 2019) also remains above the national average (0.46) and the region records the lowest life expectancy (79.2 years) among Chile’s 16 regions. Well-being gaps are acute in Indigenous communities, which perceive 6.4% less income than non-Indigenous communities. These figures reveal that the mining sector’s benefits have fallen short for many inhabitants of Antofagasta, pointing to an ongoing social debt amidst the region’s prosperity.

Antofagasta’s prosperity is highly dependent on its copper mining activity, which makes it volatile in terms of global commodity prices. The regional economy tends to experience pronounced cycles of boom and bust. During boom periods, the labour market attracts mining workers to its communities, including fly‑in fly‑out workers from the country and overseas as well as permanent migration. During bust periods, the region sees a substantial drop in GDP per capita. For instance, amidst plummeting copper prices between 2011 and 2016, Antofagasta’s GDP per capita saw a net decrease of 4.2% from its peak over the 2011-20 decade. This economic downturn directly impacted the labour market, leading to job losses, consequently affecting local businesses and the wider economy.

The chapter systematically compares economic, social and environmental trends in Antofagasta to other Chilean regions and an international benchmark of OECD mining regions at the TL2 level 2. The report also benchmarks smaller geographic units between Antofagasta and OECD mining regions at the TL3 level. The results of the analysis provide the overall diagnosis and development priorities for the mining strategy of the region of Antofagasta.

Main takeaways

Economy:

The highest GDP per capita in the country (USD 68 661 vs. the national average of USD 21 019 in 2020), it is almost twice as high as the average GDP per capita of the benchmark of mining regions (USD 39 225).

Close to three-quarters of the region’s economic growth is primarily driven by mining activities (around 72% of the regional GDP in 2023, 7 percentage point increase in relation to 2022). This sector provided 131,000 jobs, which represents 28.3% of the region's total employment and 41% of the total national employment in the mining sector. Nearly half (45.4%) of these workers are based in Antofagasta but reside elsewhere in Chile (INE, 2023[2]). This leaves room for improvement to employ more workers locally. Additionally, mining boosts the economy by creating indirect jobs in related sectors like transport and services (Cardemil Winkler, 2023[3])

Antofagasta accounts for 39.4% of Chile’s total exports (USD 3.240 billion in March 2023, approximately 95% of which are mining products). Generally, Antofagasta holds significant economic relevance for Chile, contributing 12.8% to the country’s GDP, second only to the capital city of Santiago Metropolitan Region (43.5%).

Antofagasta is a significant contributor to Chile’s exports but its growth performance is associated with high levels of volatility due to limited economic diversification. The region’s mining exports rely on a few trade partners, making it vulnerable to fluctuations in global commodity prices. Moreover, value-added manufacturing or service activities are relatively marginal in the region.

Despite its strong economic performance, Antofagasta exhibits a relatively high unemployment rate (9.6% in 2021) compared to the OECD benchmark of mining regions (7%), and high-income inequality levels (Gini coefficient of 0.51 in 2019) relative to the national average (0.46).

Antofagasta stands out in Chile in terms of access to broadband, with 84.3% of households having broadband access with an average Internet speed of 72.5%. The region ranks first in Chile.

Social

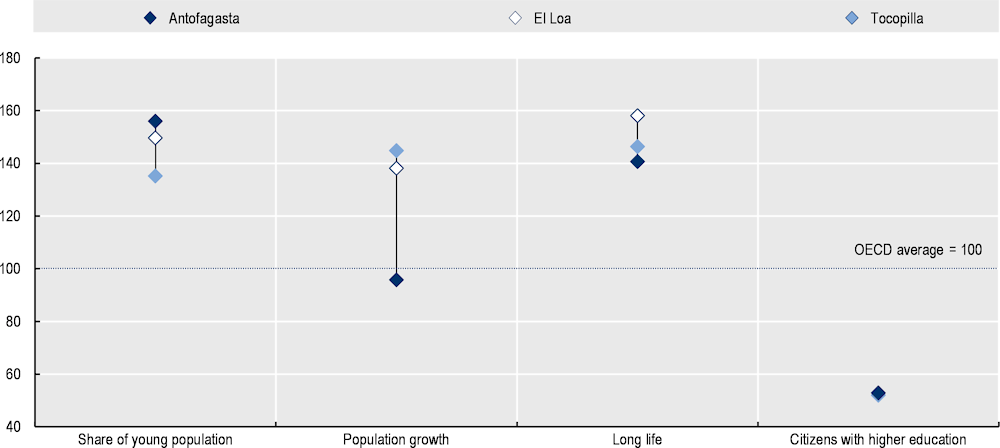

The Antofagasta region has seen rapid growth in its population, boasting an average yearly increase of 2.5% over the last decade, significantly outpacing both the national average growth rate of 1.53% and the mining regions benchmarked by the OECD (0.8%). By 2022, the region’s population reached 719 000, primarily concentrated in the cities of Antofagasta and Calama.

The steady increase in Antofagasta’s population is largely driven by international migration. Between 2017 and 2021, the region received 14 451 immigrants and, as of December 2021, there were 106 000 foreign individuals residing in the region (1/7 of the total), mostly in the cities of Antofagasta (15% of the total population) and Calama (16%). The region’s foreign population primarily comprises individuals from the 25-44 age range (53.2%), with a significant proportion of minors, making Antofagasta the region with the highest proportion of minors among foreign residents.

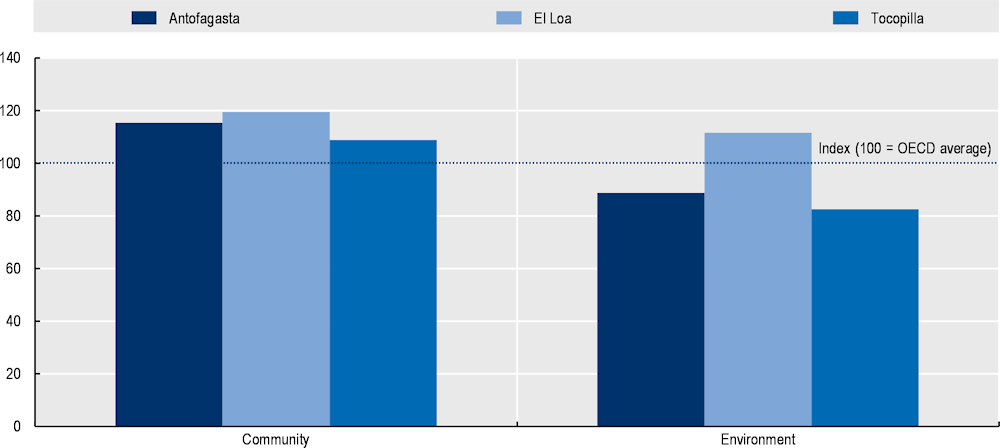

As for social perception, the region exhibits a strong sense of community, with a perceived social support network of 92.0%, ranked second in Chile and in the top 36% across all OECD regions.

The region is relatively younger and has a lower share of elderly population compared to both the national average of Chile and the OECD benchmark, indicating a demographic advantage.

However, the region shows higher mortality data, recording 6.4 deaths per 1 000 people and a life expectancy of 79.2 years, which places it last in mortality among Chile’s 16 regions.

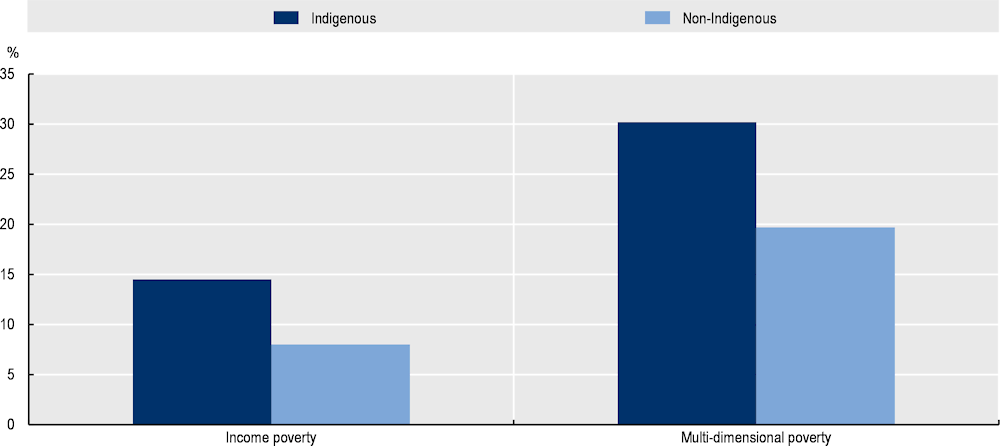

Indigenous peoples face higher income poverty, with a 6.4% disparity in Indigenous communities compared to non-Indigenous communities. Additionally, Indigenous peoples have a 20% childhood poverty rate, higher than the 13% rate for the rest of the country’s children.

The life satisfaction index stands at 6.0 (on a scale of 0 to 10), ranking Antofagasta the fifth Chilean region with the lowest life satisfaction and in the bottom 22% of all OECD regions, despite the economic prosperity brought by the mining activities.

Environment

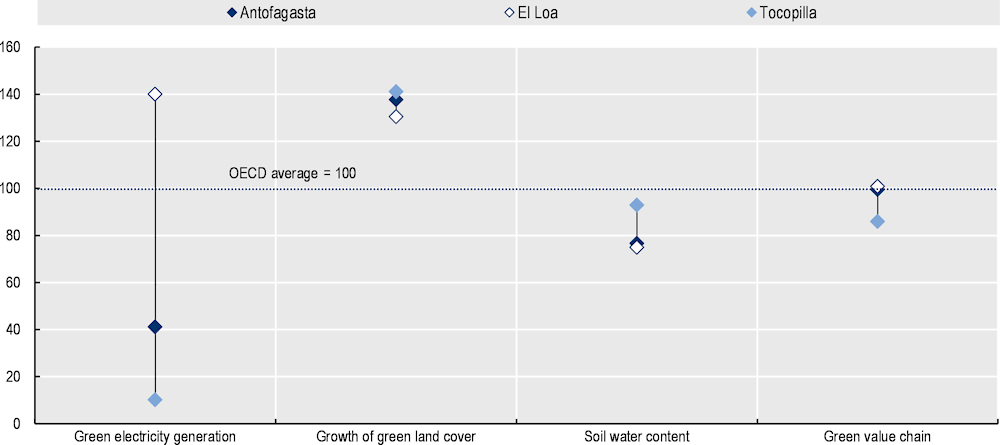

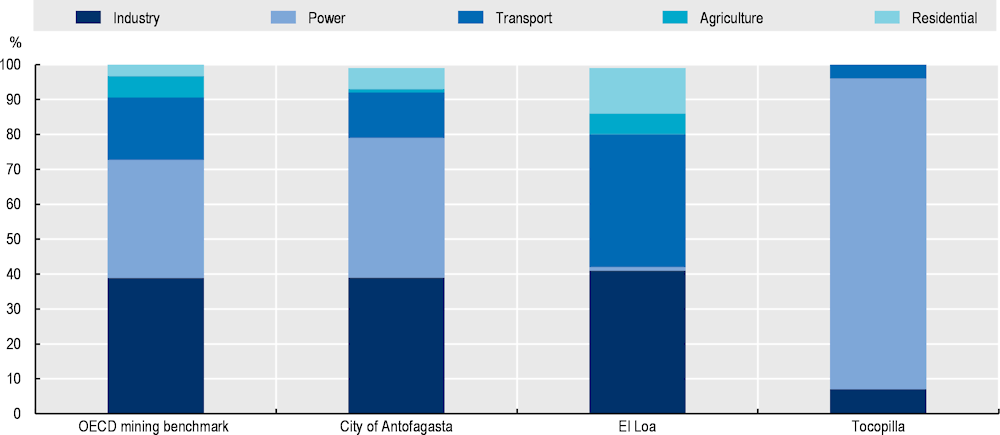

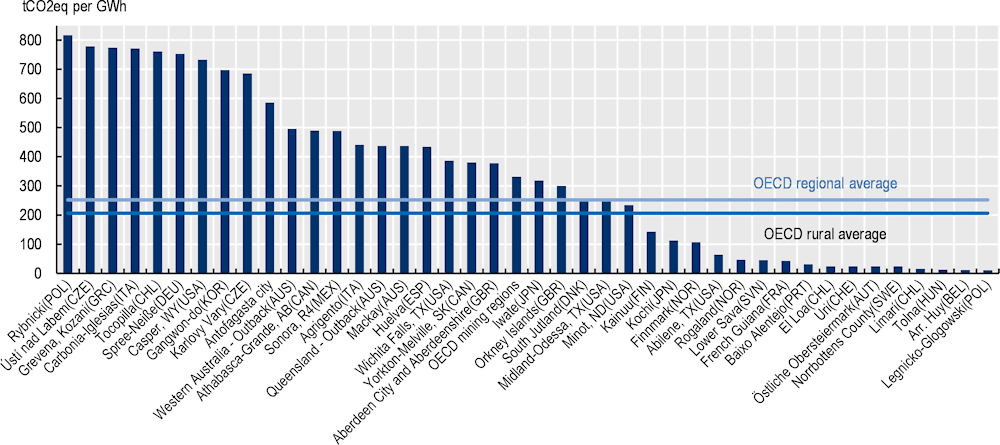

Antofagasta records higher greenhouse gas (GHG) emissions per unit of electricity generated than the average of OECD mining regions. The 3 subregions of Antofagasta emit, on average, 38% more GHG per unit of electricity generated (457 tonnes of CO2 equivalent per gigawatt hour) than the OECD benchmark of mining regions and 82% more than the average of OECD regions. Tocopilla is the subregion with the highest emission per capita, ranking as the fifth OECD mining region with the highest emissions.

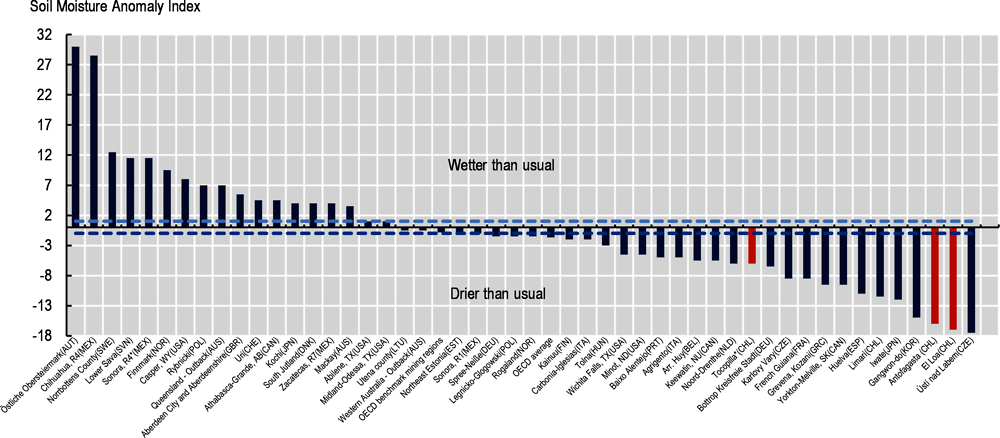

As one of the most arid regions in the world, Antofagasta faces unique challenges in water resource management. Between 2018 and 2019, the three subregions of Antofagasta registered average drier conditions than usual (based on the 1981-2010 period), in contrast to fewer anomalies in the average of OECD mining regions. In fact, El Loa ranks as the second region with the greatest anomalies in soil water content in the group of OECD mining regions. Intensive mining activities put significant pressure on the region’s already limited water resources, posing a risk to local ecosystems and the long-term sustainability of mining operations.

Copper extraction and other mining activities in Antofagasta potentially contribute to elevated levels of fine particulate matter (PM2.5) in the air, which might have harmful health impacts on the population, including respiratory and cardiovascular diseases. These impacts underscore the need for better information systems to better monitor air quality across population settlements and eventually reduce particulate emissions and improve air quality in the region.

Mining activities also have a significant visual impact on the landscape, altering the natural shape of the region and potentially affecting tourism and quality of life for residents. It is important to consider ways to minimise the visual impact of mining, fostering projects and existing programmes on landscape rehabilitation practices. Interestingly, on average, the three sub-regions of Antofagasta register an increase in green land cover above the average of OECD mining regions.

There is a need for improved regional environmental data collection and monitoring systems in the region. Currently, gaps in reliable, up-to-date information limit the ability to accurately assess and respond to environmental impacts. Enhancing these systems would allow for a more accurate representation of environmental conditions, facilitate informed policy decisions and enable more effective management of environmental resources in Antofagasta.

Despite its low population density, Antofagasta stands out by its economic relevance for Chile and strategic importance for the global energy transition. The region also benefits from a younger population relative to OECD mining regions, with a higher share of the population with secondary education than the national average, sound social support networks and an incipient but growing share of green areas relative to OECD mining regions. These strengths can be leveraged in the development of a comprehensive mining strategy that ensures the region’s sustainable growth.

In contrast, the region has high levels of unemployment rates, relative to the country and OECD average, and is economically vulnerable given its long-standing dependency on a single mineral and higher inequality levels than the national average, particularly with the Indigenous population. The region also faces gaps in healthcare and tertiary education access and insufficient environmental-related monitoring. The subsequent chapters will present policy recommendations that feed into a robust mining strategy designed to leverage the region’s strengths and mitigate its weaknesses. This strategy will contribute to Antofagasta’s continued economic, social and environmental prosperity by promoting a sustainable mining sector.

Introduction

This chapter offers a comprehensive diagnosis of the Antofagasta region in Chile. It compares Antofagasta’s development against national trends and a benchmark of other OECD mining regions at Territorial Level 2 (TL2) and Territorial Level 3 (TL3) (see OECD toolbox of mining regions’ well-being) (OECD, 2023[4]). Based on these comparisons, the analysis identifies major strengths and bottlenecks in Antofagasta’s development and well-being. While mining is the main contributor to the region’s GDP and employment, this diagnosis reveals the relevance of leveraging Antofagasta’s mining potential to create a prosperous and sustainable future.

The chapter first describes the mining sector in the Chilean and Antofagasta context. It then examines the demographic patterns in the region, followed by its main economic trends. The final section of the chapter examines the main factors for regional development, including the quality of life of its citizens.

The Antofagasta region is a crucial component of the Chilean economy as it possesses an array of mineral resources such as copper, lithium, silver and gold. Nevertheless, the area’s economic fortunes are tied solely to the mining and extractive industry, which is exposed to fluctuations in global commodity prices. This sector is also heavily reliant on fly-in fly-out workers, which has resulted in significant challenges concerning access to affordable housing, quality education and childcare, and high levels of GHG emissions from transportation.

The region also has opportunities emerging from these challenges, including the potential for infrastructure development and innovative solutions to address inequality. In this context, this chapter not only explores the key challenges and opportunities facing the Antofagasta region and provides takeaways for sustainable development but also frames a roadmap for a robust mining strategy (see Chapter 4) to stimulate regional development.

Megatrends affecting regions specialised in mining and extractive activities

The geographically concentrated nature of mining leads to a highly specialised economy, bringing with it challenges and opportunities to mining regions and the well-being of its inhabitants. Global megatrends, including demographic change, climate change, the transition to a low-carbon economy, and digitalisation and automation, are transforming industries and societies. These megatrends are also bringing new challenges and opportunities to the development of mining regions (Table 2.1).

Table 2.1. Opportunities and challenges of megatrends for the mining industry and regions

|

|

Opportunities |

Challenges |

|---|---|---|

|

Changes in demographic trend (population ageing and migration) |

|

|

|

Climate change and environmental pressures |

|

|

|

Technological innovation (e.g. digitalisation, automation, decentralised energy) |

|

|

Source: OECD elaboration based on inputs from the OECD Mining Regions and Cities network.

The report iscusses the challenges faced by mining environments in the Antofagasta region, including demographic challenges and environmental concerns. However, the region’s mining sector has the potential to address these challenges through workforce availability, gender balance, high retention capacity and the supply of minerals and materials needed for green technologies. Technological change and digitalisation can also increase productivity and sustainability in mining activities. The impact of these megatrends on mining municipalities in the Antofagasta region will depend on policy responses to address changes and prepare firms and communities for the future.

Antofagasta’s future: Mining and its communities

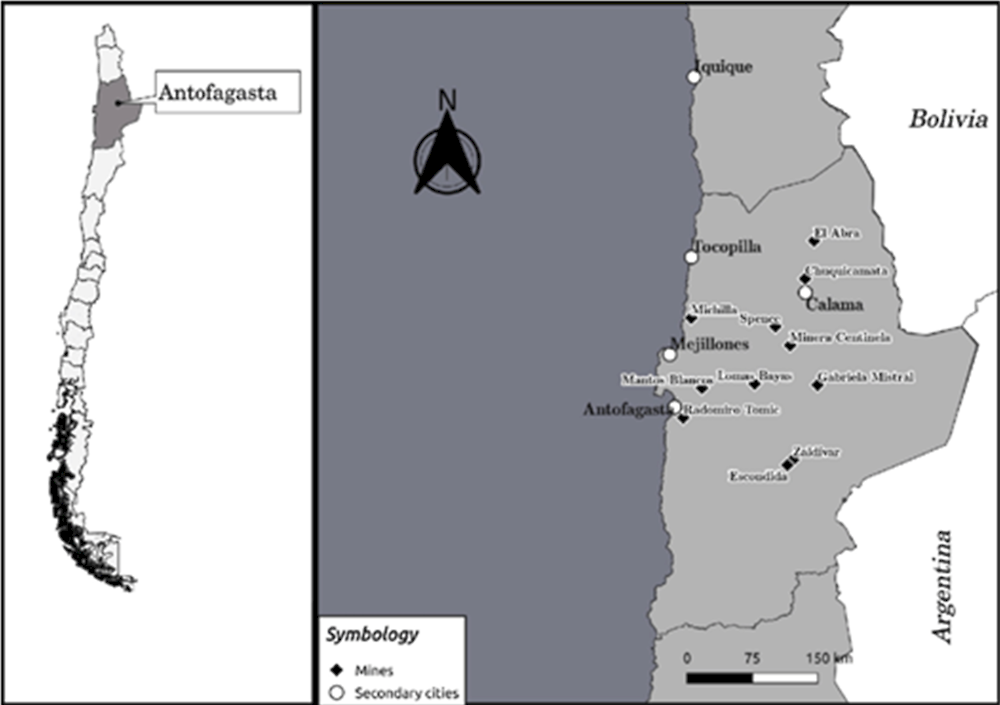

Antofagasta is a region located in the northern part of Chile. The region’s largest city and commercial centre is also named Antofagasta. The region (of about 126 049 square kilometres) is known for its unique natural beauty, warm climate, rich mineral resources and cultural heritage. The region of Antofagasta is bordered by Peru to the north, Bolivia to the east and the Pacific Ocean to the west. The TL2 region of Antofagasta is made up of three TL3 regions: Antofagasta, El Loa and Tocopilla.

The landscape of Antofagasta is dominated by the Atacama Desert, which is considered one of the driest places on the planet. The climate is arid and varies greatly depending on the location, with temperatures ranging from below-freezing at high altitudes to over 38 degrees Celsius in the lower elevations. Despite the harsh climate, the region is a popular tourist destination, attracting visitors with its unique natural beauty, outdoor activities such as hiking and stargazing, and historical and cultural attractions.

Antofagasta’s economy is heavily reliant on mining, particularly copper. The region is home to some of the largest copper mines in the world, including the Chuquicamata and Escondida mines. The region is also a major producer of other minerals such as gold, silver and lithium. In recent years, the region has also become an important location for solar energy production, with several large-scale solar power plants operating in the area.

Antofagasta has a rich cultural heritage that reflects its history as a crossroads between different civilisations. The region is home to several important archaeological sites, including the famous Atacama Giant geoglyphs, as well as numerous pre-Columbian ruins and ancient rock art. The region’s cultural heritage is also evident in its distinctive music, dance and cuisine, which reflect the influence of Indigenous and colonial traditions. Some of the most popular destinations include the Atacama Desert, the La Portada natural monument, the Tatio Geysers and the town of San Pedro de Atacama. The region is also known for its beautiful beaches, particularly in the towns of Mejillones and Taltal.

Figure 2.1. Distribution of selected mines and city locations, Antofagasta, 2020

Source: Velásquez, D. (2020[5]), “Industrial agglomeration and union resources mobilisation: A comparison between Antofagasta Enclave and Los Lagos Cluster, Chile”, in The Political Economy of Work in the Global South, Red Globe Press.

Comparing Antofagasta using an international benchmark of mining regions

Establishing a benchmark for OECD mining regions and comparing it with Antofagasta is driven by a multi‑faceted motivation grounded in the ambition for holistic growth, integrating economic, social and environmental dimensions. Within this context, Antofagasta serves as a vital mining region and can be comprehensively understood – capturing its strengths, weaknesses and potential growth opportunities – when placed within an international framework. This is where the benchmark of mining regions within the OECD comes into play, offering a structured platform for analysis that enables robust comparative examination and underpins evidence-based policy making.

The comparison with an international benchmark is pivotal, as Antofagasta shares common traits with other mining regions (Box 2.1). These include economic dependencies on mining, demographic dynamics, environmental concerns and societal impacts. When juxtaposed with other OECD mining regions, a clearer picture emerges of how Antofagasta fares on a global scale. Such comparison can uncover transformative insights, inspire innovative solutions gleaned from regions tackling similar challenges and highlight successful strategies towards achieving balanced and sustainable growth. This benchmarking exercise can illuminate patterns and trends which might otherwise remain tainted when viewing Antofagasta in isolation. It can spotlight potential areas for improvement, such as healthcare and life satisfaction, thereby opening avenues for learning and adaptation. Moreover, this international comparison can fuel shared learning, encourage the adoption of best practices and catalyse innovative approaches to tackle common challenges confronting mining regions.

The scale at which trends, assets and challenges are analysed is crucial for policy design and implementation. Recognising the importance of the subnational level in leveraging mining for people’s well‑being, this section presents an approach to identifying mining regions across OECD countries and to constructing a representative benchmark. This comparison enables a well-rounded analysis of well-being levels across mining regions and other OECD regions.

The mining regions are identified at the smallest comparable regional level, TL3. This granularity allows the capture of the positive and negative effects of mining and enables the comparison of common international trends. Additionally, a macro-perspective analysis is conducted at the larger scale of TL2 regions. While these regions may encompass various sub-regions with a diverse range of economic activities, this broader lens is valuable for assessing data that require a comprehensive overview.

At the TL3 level, the benchmark encompasses a diverse array of regions from multiple countries. For instance, regions like Queensland Outback and Western Australia Outback in Australia, and Athabasca-Grande and Yorkton/Melville in Canada, among 50 others, are renowned for their substantial mining activities and strategic contributions to their national economies.

At the TL2 level, the benchmark expands to include regions from a broader spectrum of countries. Similarly, 50 mining regions across the OECD, such as New South Wales, Queensland and Western Australia in Australia, Alberta and Saskatchewan in Canada, and Brandenburg, North Rhine-Westphalia and Saxony-Anhalt in Germany have been used to benchmark Antofagasta.

Box 2.1. What is a mining region?

While mines are located in one specific area, namely a village or municipality, the mining activity often has the potential to impact the development of more than one community. Functional labour markets and economies that are linked with the mining activity can thus involve several municipalities or even regions.

Regions or provinces in a country play an important role in promoting synergies among municipalities around economic, social and environmental activities. They can help attain economies of scale, bridging urban and rural assets, co‑ordinating investments and local labour markets as well as promoting shared protection of natural assets. Across OECD countries, this level of government also establishes development plans and creates links with external markets and investors. This is even more relevant for mining countries with federal structures (e.g. Australia, Canada or the United States), where regions define and conduct mining development strategies and manage natural resources. Moreover, at this level, most well-being data are available and comparable across the country and internationally.

OECD defines two types of regions at different geographical levels for which comparative data are collected. The first type of region is classified as Territorial Level 2 (TL2), which is the first administrative tier of subnational government (i.e. states in the United States, estados in Mexico or regions in France). Smaller regions are classified as Territorial Level 3 (TL3), which are smaller territorial units that make up each TL2 region. In most countries, these regions are aligned with small administrative structures, such as provinces in Chile and Spain or counties in Sweden. For some countries, like Australia, Canada, Mexico or the United States, these TL3 regions do not have an official political-administrative level but only statistical and geographical representativeness. These TL3 regions also vary in their degree of rurality, differentiating between the metropolitan and highly densely populated regions and different types of rural regions.

Therefore, the process to identify the OECD mining regions follows three steps:

1. Identify the small regions in the OECD country (Territorial Level 3). The OECD has more than 2 400 TL3 regions in its 38 member countries. The distribution of these regions by country is a mix of statistical and administrative boundaries that are at a geographically comparable scale and consistent with national classifications. Thus, the segmentation of the country into these territories is consistent for the cross-country analysis. The OECD territorial classification (OECD, 2022[6]) provides a list of all TL3 regions for OECD countries.

2. Defining regional mining specialisation based on employment location quotients (LQ).3 The degree of regional specialisation in mining is obtained by comparing the share of mining employment in the region with the share of mining employment in the country.4 A value of LQ above one implies that the region is more specialised than its respective country. The employment specialisation in mining, based on LQ values, is ranked from highest to lowest. The threshold selected to categorise a mining region is an LQ above 1.5, so a region is considered to be specialised if it exceeds 50% of the country’s mining specialisation. Applying this threshold to the sample of OECD TL3 regions, 360 OECD regions are 1.5 times more specialised in mining than their own country.

3. Final adjustment based on desk research. To build a geographically balanced benchmark and control by country effects of the LQ (e.g. countries highly specialised in mining with a relatively even geographical distribution of the activity), the methodology assigns the regions with a higher LQ than the benchmark by following the country’s weight in total OECD mining employment (Annex 2.A lists the countries included). In other words, the number of regions in the benchmark is in line with the share of the country’s mining employment in the total number of mining workers across the OECD. A desktop research process examines each selected region to ensure there is a good geographical balance in the benchmark (and avoid overrepresentation of a given country). As a result of this process, 50 mining regions constitute the OECD mining regional benchmark.

Source: OECD (2021)

Acknowledging the impacts of mining activities on the territory and looking beyond economic performance

Antofagasta stands at an important crossroad. Its rich mining resources and capable workforce make it a key player in the mining world. But this does not come without environmental, social and technological challenges and these are not isolated: they are woven into a bigger picture, influenced by global shifts. These shifts are towards cleaner energy, the rise of digital technologies, city growth and older populations. They offer new opportunities but also bring new challenges for Antofagasta.

In order to secure a future for the mining industry, Antofagasta needs to find the right balance. This balance must consider the needs of the mining industry, the well-being of local communities and the sustainable sourcing of minerals that are crucial for our world’s transition to greener technologies. The region has a key role to play in supplying minerals for a greener future whilst also protecting the environment and supporting its communities. It is not a straightforward target but, with planning, Antofagasta can help shape a sustainable future for mining and communities alike.

Mining has led to a mix of outcomes within the region, creating substantial prosperity yet also fostering considerable disparity. The growth and evolution of the area have been largely shaped by mining operations, producing side effects that have influenced the well-being of local communities, most notably in terms of environmental impact. While mining activities are progressively adopting more sustainable and ecofriendly practices, they continue to present intricate challenges related to externalities management. Generally, the impacts of mining within the Antofagasta region are multi-faceted and can be classified with an economic, social and environmental lens.

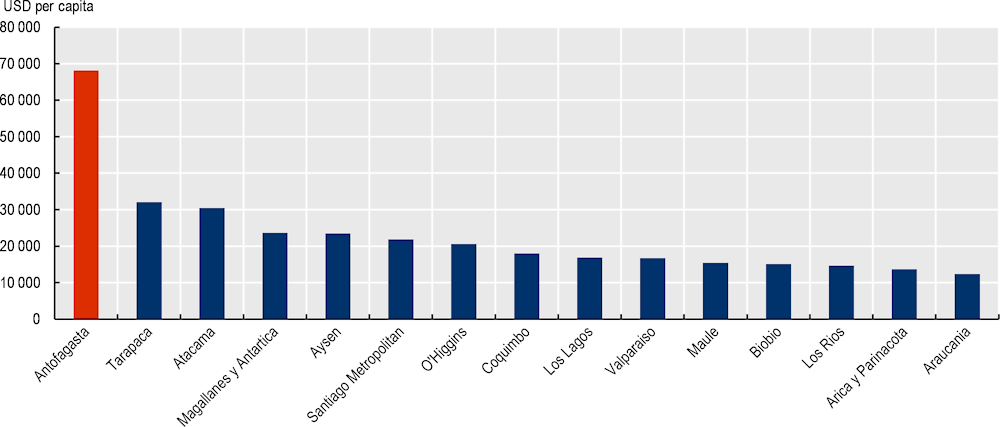

Economically, the prosperity generated by mining is largely attributable to the value of the minerals, ranging from copper to lithium, extracted in the region. This places Antofagasta as the region with the highest GDP per capita in the country (Figure 2.2), significantly exceeding the average for OECD countries. The regional labour market is largely dependent on mining, with employment opportunities across various mining operations. However, the degree to which local employment is utilised varies from one operation to another. Conversely, the reliance on regional suppliers has seen a decline over the past decade.

From a social perspective, the wealth distribution associated with mining has created a dual-speed economy within the region. Mine workers typically earn higher salaries than non-mining workers, leading to discrepancies in purchasing power that affect local prices from housing to basic goods. Together with the fly-in, fly-out (FIFO) workers culture, Antofagasta ranks as one of the regions with the highest cost of living in Chile. The provision of public services is limited and the infrastructure is primarily designed to support mineral extraction and transportation rather than catering to broader civilian needs (e.g., pavement, electric grids).

Environmental impacts are particularly pronounced, especially regarding air and water quality. The emission of PM2.5 from copper mines located near urban areas (such as Calama and Sierra Gorda) creates a climate of social unrest due to health concerns. Additionally, despite a shift from freshwater to seawater usage in some mining operations, this adaptation has not been sufficient to alleviate the region’s water stress.

Figure 2.2. GDP per capita by region in Chile against the national average, 2021

Note: GDP per capita (USD purchasing power parity [PPP] base year 2015). Antofagasta represents 3.24 times the national average.

Source: OECD (2023[7]), OECD Regional Well-Being (database), https://www.oecdregionalwellbeing.org/ (accessed on 27 February 2023).

A future together with its numerous Indigenous communities

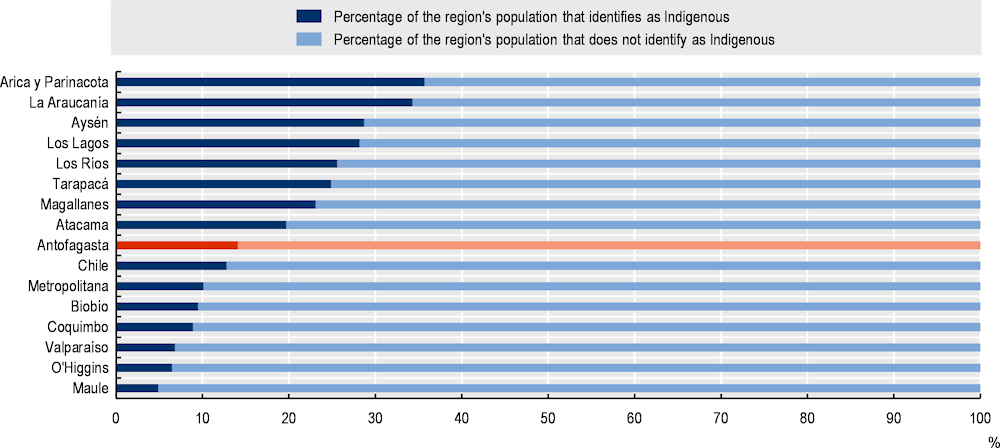

The Antofagasta region, known for its mining wealth, houses a significant Indigenous population. Current data indicate that Indigenous communities represent 9.5% of the regional population, which includes 18.5% of the rural population and 8.2% of the urban population (CASEN, 2017[8]). While these communities are constitutionally recognised and Chile has ratified both the International Labour Organization (ILO) Convention No. 169 and the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP), ensuring their free, prior and informed consent for any activities affecting them, the relationship between mining companies and Indigenous peoples continues to be challenging (UN, 2008[9]; ILO, 1989[10]).

This challenge arises from several factors, notably land use conflicts and unequal benefit-sharing arrangements. Mining activities frequently occur in traditional Indigenous territories, leading to disputes over land rights and resource allocation.

Despite these communities experiencing higher income poverty rates (14.5%) than non-Indigenous communities (8%), there has been a significant decrease in the extreme income poverty rate from 14.5% to 4% between 2011 and 2017. Nevertheless, disparities extend beyond income, with Indigenous people often reporting greater difficulties in accessing quality healthcare and education. For example, malnutrition affects Indigenous children aged 0 to 6 years more frequently, with the percentage of children aged 0-6 receiving free food from clinics or hospitals in the last 3 months being 10.4 percentage points higher among Indigenous people (63.9% compared to 53.5%) (CASEN, 2017[8]).

Educational challenges are also prominent among the Indigenous population. About 45% of Indigenous individuals aged 19 and above have not completed secondary education, compared to 36.6% for non‑Indigenous individuals. Despite these challenges, the region’s resilience and rich cultural heritage are noteworthy. Several programmes have been put in place by the regional government, private companies and Indigenous communities to leverage their strengths and improve the region’s living conditions. These initiatives aim to respect Indigenous rights, foster inclusivity and promote the equitable sharing of benefits derived from the region’s abundant resources.

Table 2.2. Share of Indigenous population by region over the total of the country

|

Indigenous population |

Percentage of the region’s Indigenous population over the total Indigenous population of the country |

|

|---|---|---|

|

Metropolitana |

695 116 |

32 |

|

La Araucanía |

321 328 |

15 |

|

Los Lagos |

228 766 |

11 |

|

Biobío |

189 632 |

9 |

|

Valparaíso |

119 751 |

6 |

|

Los Ríos |

96 311 |

4 |

|

Antofagasta |

82 412 |

4 |

|

Tarapacá |

80 065 |

4 |

|

Arica y Parinacota |

78 883 |

4 |

|

Coquimbo |

64 956 |

3 |

|

O’Higgins |

57 280 |

3 |

|

Atacama |

55 413 |

3 |

|

Maule |

49 013 |

2 |

|

Magallanes |

37 791 |

2 |

|

Aysén |

29 075 |

1 |

|

Chile |

2 185 792 |

100 |

Source: INE (2017[11]), Censo 2017 [Census 2017], http://www.censo2017.cl/.(accessed on 12 May 2023).

Despite the region’s wealth, the relationship between mining companies and Indigenous peoples remains a challenging issue, including land use conflicts and varied benefit-sharing agreements. Mining operations often take place on traditional Indigenous territories, leading to disputes over land rights and resource allocation. Indigenous populations are often found in concentrated areas within specific regions, experiencing levels of inequality across multiple areas, including access to education and health, vulnerability to climate change and access to business opportunities. Some of these inequalities are further exacerbated by the impact of the mining activities on their territories, which in turn leads to socio-economic disparities.

Figure 2.3. Percentage of Indigenous population within each Chilean region, 2017

Source: INE (2017[11]), Censo 2017 [Census 2017], http://www.censo2017.cl/. (accessed on 10 February 2023).

Several programmes have been implemented by the regional government, private companies and Indigenous communities to harness their strengths and improve the region’s liveability. These initiatives recognise the resilience and rich cultural heritage these communities maintain despite obstacles. Antofagasta’s mining success should not overshadow the needs of its Indigenous communities. The regional strategy proposed in this study will strive to encourage inclusive policies that promote equitable and prosperous communities and minimise disparities in education, health and overall living conditions. A more balanced coexistence can pave the way for a stronger, more united Antofagasta, harnessing the region’s wealth for the benefit of all of its inhabitants.

Charting mining’s future, Antofagasta captures the spotlight

The economic significance of mining in the Antofagasta region is undeniable, with mining activities contributing approximately 35% of Chile’s GDP. A large part of it is derived from copper and lithium mining. In recent years, however, the region has become an increasingly important source of mineral resources, with Atacama, the driest desert in the world, being home to 80% of Chile’s lithium reserves. The lithium industry in the region has brought significant economic benefits, with the GDP per capita in the Antofagasta region being among the highest in Chile; but it has also generated social and environmental challenges. Generally, mining still nowadays employs a substantial portion of the regional workforce. Copper mining is the largest contributor to Antofagasta’s mining industry and this makes it a major global supplier of copper, which is a key input in various industries.

The mining industry in Antofagasta also has a significant impact on other industries. When taking into account its multiplier effects on other industries, its contribution to the national GDP could reach around 20% (Cardemil Winkler, 2023[3]). This industry not only impacts GDP per capita, wages, and local investments but also generates jobs in sectors such as construction, transportation, and services like lodging and dining. Moreover, mining has the potential to foster social benefits, including housing, education, and health, ensuring that the regions benefit from the resources generated.

Some of the biggest copper mines in the world, such as Chuquicamata and Escondida, are located in Antofagasta and have been in operation for decades.

Lithium production has become increasingly important in the region in recent years, with major mines like Maricunga and Salar de Atacama being operated by multinational companies such as Albemarle and SQM.

While many of the mines listed have been in operation for years, there are also several new lithium exploration projects in the region, including Aguas Calientes, Pedernales and Rincon, which could potentially become major producers in the future.

Overall, the data illustrate that mining plays a pivotal role in the regional development of Antofagasta, providing not only direct employment and revenue but also fostering indirect effects on other industries and contributing to community development and infrastructure. The region houses several large mining operations, primarily focused on extracting copper (Table 2.3).

However, it is important to balance this perspective by acknowledging that this heavy reliance on mining can also pose challenges to certain aspects of development. For instance, the mining sector’s dominance may inadvertently overshadow or hinder more traditional forms of living and economic activity. Moreover, while mining brings considerable economic benefits, the environmental impact of these activities could potentially affect the sustainability of other sectors, particularly those dependent on the region’s natural resources. As we chart the future of mining in Antofagasta, these considerations underscore the importance of a balanced approach that seeks to maximise the benefits of mining while mitigating potential drawbacks. This approach entails fostering coexistence between mining and other traditional industries, ensuring environmental sustainability and promoting inclusive growth that benefits all communities.

Table 2.3. Key mines in Antofagasta, 2022

|

Mine name |

Material mined |

Company owner |

Municipality |

Year opened/ expected |

|---|---|---|---|---|

|

Chuquicamata |

Copper |

CODELCO |

Calama |

1915 |

|

Salar de Atacama |

Lithium |

Albemarle and SQM |

San Pedro de Atacama |

1984 |

|

Escondida |

Copper |

BHP Billiton |

Antofagasta |

1990 |

|

Zaldivar |

Copper |

Antofagasta Minerals and Barrick Gold |

Antofagasta |

1994 |

|

Quebrada Blanca |

Copper |

Sumitomo Metal Mining and Teck Resources |

Iquique |

1994 |

|

Lomas Bayas |

Copper |

Glencore |

Antofagasta |

1998 |

|

Cerro Vanguardia |

Gold and silver |

AngloGold Ashanti and Fomicruz |

Antofagasta |

1998 |

|

Collahuasi |

Copper |

Anglo American and Glencore |

Iquique |

1999 |

|

El Peñón |

Gold and silver |

Yamana Gold |

Antofagasta |

1999 |

|

Maricunga |

Lithium |

Albemarle |

Copiapó |

1996 |

|

Sierra Gorda |

Copper and molybdenum |

KGHM Polska Miedz and Sumitomo Metal Mining |

Sierra Gorda |

2014 |

|

Salar del Carmen |

Lithium |

Li3 Energy |

Antofagasta |

2017 |

|

Pedernales |

Lithium |

Lithium Chile |

Antofagasta |

Exploration stage |

|

Rincon |

Lithium |

Lithium Power International |

Antofagasta |

Exploration stage |

|

La Negra |

Lithium |

Minera Exar |

Antofagasta |

2020 (expected) |

|

Aguas Calientes |

Lithium |

International Lithium Corp |

Antofagasta |

Exploration stage |

The strategic importance of Antofagasta’s lithium reserves for the global energy transition

As the world moves towards a zero-carbon economy, Antofagasta’s mining industry can play a significant role in achieving environmental goals. The region possesses the minerals and materials necessary for the development of green technologies (e.g. lithium-ion batteries, renewable energy, sustainable mobility and large-scale energy storage).

The region mainly produces lithium carbonate, followed by lithium hydroxide and lithium chloride, with lithium carbonate holding the highest commercial transaction value. This type of lithium can be produced through hard-rock mining, which is primarily used in Australia, or through extraction from brine, which is more cost-effective and commonly used in Argentina, Bolivia and Chile, also known as the South American “lithium triangle”.

While the lithium sector is smaller than those of copper or gold, it is poised for significant growth in the coming years due to anticipated surges in demand. Lithium is the premier choice for electric vehicle battery production and other low-carbon solutions, attributed to its high density and superior conducting qualities. In merely a decade, the industry has seen a shift, with batteries becoming its primary application. For instance, demand between 2017 and 2021 doubled, with lithium consumption growing an extra 30% in just the past year. The annual output growth has fluctuated between 25% and 35%. Under a net zero scenario, demand is predicted to leap by 422% by 2030, reaching 711 500 tonnes. This is projected to reach a peak at 1.37 million tonnes in 2045, a tenfold increase from 2022 figures (IEA, 2023[12]). Highlighting the industry’s regional significance, at the 11th Lithium Supply & Markets Conference in 2019, Mining Minister Baldo Prokurica announced a large amount of lithium project investment totalling over USD 1.8 billion. This includes Albemarle’s USD 300 million expansion for La Negra plant’s third phase, the USD 527 million Blanco project and SQM’s expansion endeavours. Such initiatives underscore lithium’s pivotal role in the region’s economic prospects.

Table 2.4. Lithium mine production, reserves and resources in tonnes, 2020

|

Country |

Production |

Reserves |

Resources |

|---|---|---|---|

|

Bolivia |

- |

- |

21 000 000 |

|

DR Congo |

- |

- |

3 000 000 |

|

Germany |

- |

- |

2 700 000 |

|

World total |

82 000 |

21 000 000 |

86 000 000+ |

|

Australia |

40 000 |

4 700 000 |

6 400 000 |

|

Chile |

18 000 |

9 200 000 |

9 600 000 |

|

China |

14 000 |

1 500 000 |

5 100 000 |

|

Argentina |

6 200 |

1 900 000 |

19 300 000 |

|

United States |

870 |

750 000 |

7 900 000 |

|

Canada |

0 |

530 000 |

2 900 000 |

Note: The symbol '-' indicates that data is not available.

Source: United States Geological Survey (USGS, 2020[13]) (accessed on 21 November 2022).

Demographic patterns

Population growth in Antofagasta has accelerated in the last decade

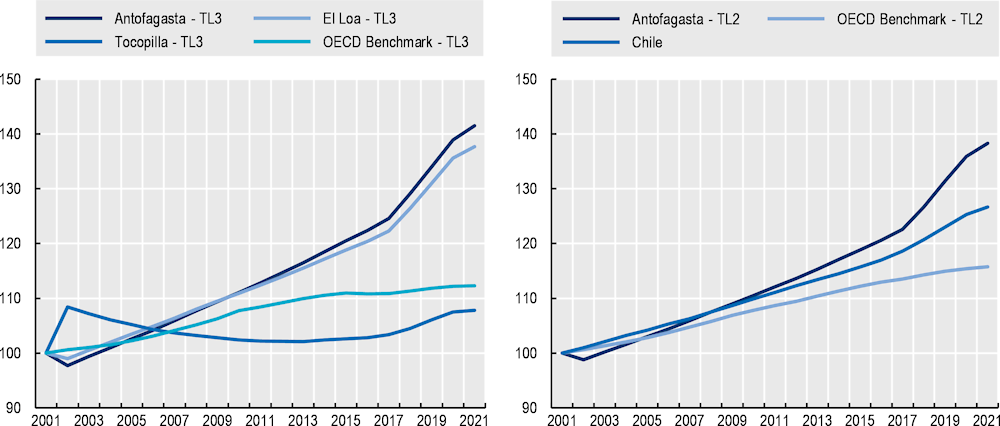

The population of Antofagasta has consistently grown over the last two decades. While this trend mirrors that of the mining regions benchmarked by the OECD at both TL2 (average yearly increase of 0.8%) and TL3 (0.6%) levels, the pace of growth in Antofagasta has been notably more rapid (1.9%). As a region, Antofagasta’s situation mirrors a broader trend, with population growth rates surpassing national averages. This is particularly evident in the last decade, when Antofagasta’s population growth has significantly accelerated. The region has seen an average yearly increase of 2.5%, distinctly outpacing the national average growth rate of 1.53%. This trend underscores the region’s dynamic demographic landscape and its ability to attract an ever-growing population (Figure 2.4). As a result, by 2022, Antofagasta’s population reached 719 000 individuals, primarily concentrated in the cities of Antofagasta (437 000 residents), Calama (195 000 residents) and, to a lesser extent, smaller municipalities like Tocopilla (28 000 residents) and Mejillones (15 000 residents).

As a region, Antofagasta’s situation mirrors a broader trend, with population growth rates surpassing national averages. This is particularly evident in the last decade, when Antofagasta’s population growth has significantly accelerated. The region has seen an average yearly increase of 2.5%, distinctly outpacing the national average growth rate of 1.53%. This trend underscores the region’s dynamic demographic landscape and its ability to attract an ever-growing population.

Figure 2.4. Growth population index, Antofagasta, El loa, Tocopilla, OECD Mining regions benchmark and Chile, TL2 and TL3 levels, 2001-21

Note: 2001=100.

Source: (OECD, 2022[1]) OECD Regional Statistics database (accessed on 14 January 2023).

Foreign migration as a key driver of the population increase in the region

This steady population increase is largely driven by migration. As of December 2021, it was reported that 106 000 foreign individuals were residing in the region. Indeed, between 2017 and 2021, Antofagasta welcomed 14 451 immigrants who established their residence in the region, predominantly from Bolivia (38.6% of total migrants), followed by Colombia (29.4%). This influx positions the region as the second highest in absolute increase during this period, trailing only behind the Santiago Metropolitan Region (INE, 2022[14]). In 2021, at the regional level, the metropolitan region concentrates the majority of the foreign population residing in the country, with 61.3%. Antofagasta is the region with the second highest number of foreigners, with 7.2% of the foreign population, slightly surpassing Valparaíso, with 6.5% (INE, 2021[15]). Meanwhile, the commune of Calama ranks 8th, providing a home to 31 812 foreign residents.

When delving deeper into the data on the foreign population residing in the region, it is worth noting that 53.2% are in the 25-44 year-old age range. In addition, 11.6% are concentrated between the ages of 0 and 14, making Antofagasta the area with the highest proportion of minors across the Chilean regions (INE, 2021[15]).

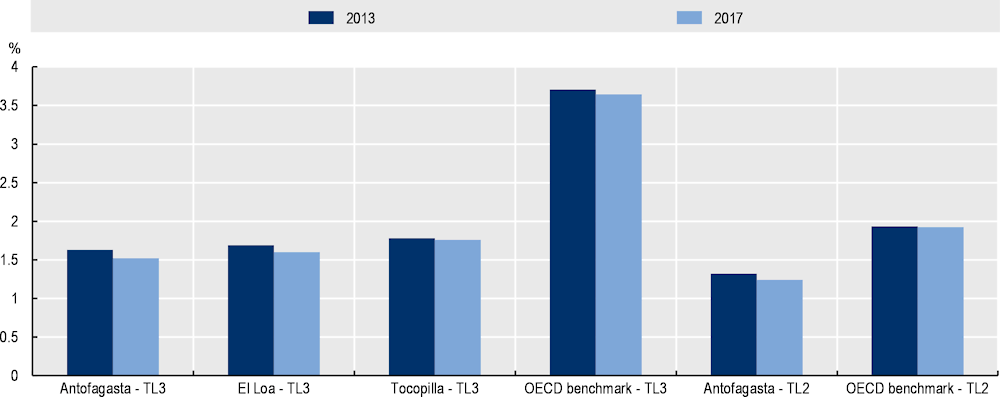

Within Chile, the inter-regional mobility rate of Antofagasta was 1.63% in 2013 and decreased slightly to 1.52% in 2017. Similarly, the mobility rate for El Loa declined from 1.69% in 2013 to 1.6% in 2017. Tocopilla, on the other hand, maintained a relatively steady mobility rate with 1.78% in 2013 and 1.76% in 2017. These values, while demonstrating some level of inter-regional movement, are significantly lower than the OECD TL3 benchmark, which stands at 3.71% in 2013 and 3.65% in 2017. At the TL2 level, Antofagasta’s mobility rate decreased from 1.32% in 2013 to 1.24% in 2017. This rate is also lower than the OECD TL2 benchmark, which remained constant at 1.93% over the same period.

Figure 2.5 suggests that Antofagasta and its municipalities, while experiencing some degree of inter‑regional mobility, attract fewer new residents from other regions than the average OECD region. This could potentially indicate factors such as economic opportunities, living conditions and regional policies that might be less attractive to potential movers. Therefore, efforts to enhance the attractiveness of Antofagasta and its municipalities could potentially increase their inter-regional mobility rates.

Figure 2.5. Inter-regional mobility rate

Note: Calculated as the percentage of newcomers from another region over the population.

Source: (OECD, 2022[1]) OECD Regional Statistics database (accessed on 4 December 2022).

Yet more efforts are needed towards gender parity for social prosperity in Antofagasta

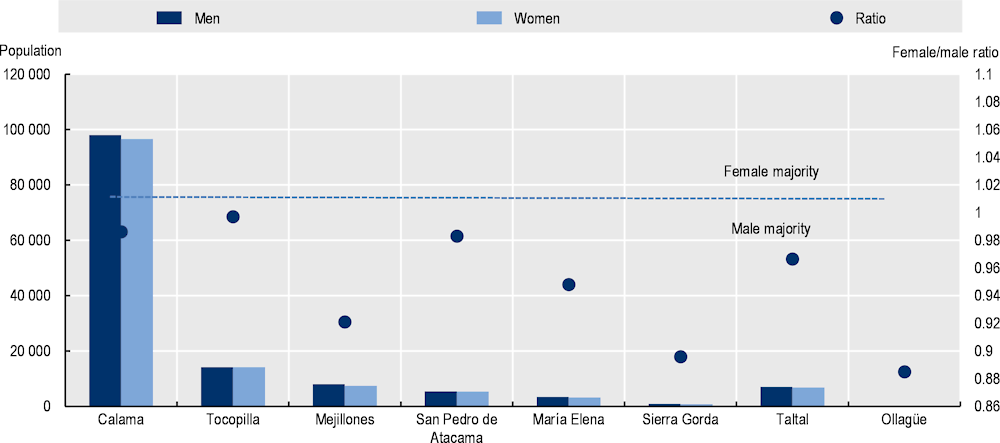

The population in Antofagasta’s municipalities is predominantly male. Meaning the region experiences a significant gender imbalance. For instance, there are 97 966 men in Calama for 96 609 women, yielding a female-to-male ratio of approximately 0.99. Similarly, in Tocopilla, the count of males stands at 14 171, slightly higher than the female population of 14 130, resulting in a similar ratio of 0.997. This pattern not only applies to the city of Antofagasta (219 709 men for 218 174 women) but also extends to smaller municipalities. In Mejillones, the male population of 8 032 outnumbers the female population of 7 398, presenting a female-to-male ratio of 0.92. Likewise, in the rural commune of Ollagüe, the male count (148) also surpasses the number of females (131), resulting in a significantly lower ratio of 0.89. This trend, with female-to-male ratios ranging from around 0.89 to 0.99, underscores the broader demographic landscape of the Antofagasta region, reflecting a more male-dominated population structure across its municipalities (Figure 2.6).

Indeed, the notable male majority in Antofagasta’s municipalities, likely due to the historically male-dominated mining sector, has implications for regional development. However, mining companies are now implementing programmes to attract female talent, gradually helping to rebalance the gender dynamics and foster a more diverse labour market. For instance, predominantly male populations could influence social dynamics and the labour market structure within the region. This male dominance might also subtly shape community interests and public policies. Moreover, the region’s appeal to potential families or residents seeking a balanced gender demographic could be affected.

Figure 2.6. Gender balance across the municipalities of Antofagasta region, 2022

Antofagasta has a demographic bonus but ageing is an increasing trend

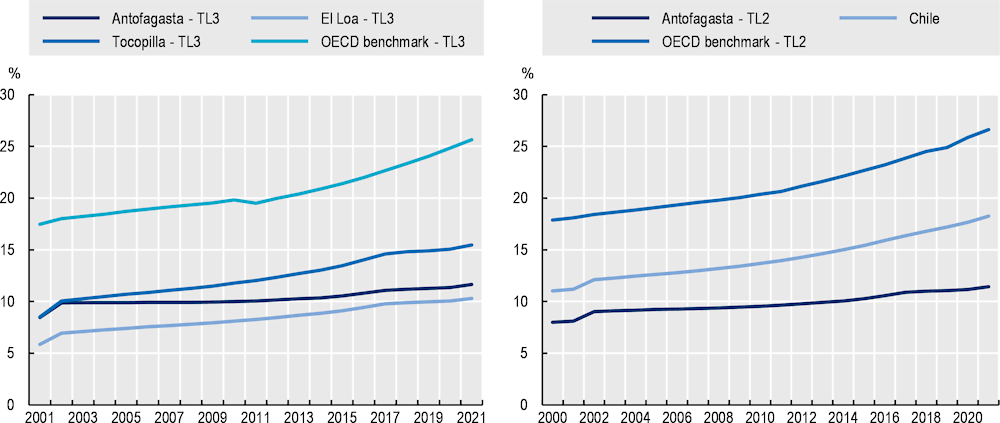

Antofagasta, at the TL2 level, has seen a gradual increase in its elderly dependency ratio from 2001 to 2021, rising from 8% to 11% (Figure 2.7). Despite this growth, the region maintains a significantly lower elderly dependency rate than both the national average of Chile and the OECD TL2 benchmark. In 2021, while Chile’s elderly dependency rate stood at 18%, the OECD TL2 benchmark was at a notable 27%. This figure reflects a demographic advantage for Antofagasta, with a relatively smaller proportion of the population in the “elderly dependent” category, which can have positive implications for the region’s workforce.

At the TL3 level, Antofagasta, El Loa and Tocopilla all show a similar pattern of a slow yet steady increase in their elderly dependency ratios over two decades. Antofagasta’s rate rose from 8% to 12%, El Loa’s from 6% to 10% and Tocopilla’s from 9% to 15%. Like their TL2 counterpart, these rates remain below the OECD TL3 benchmark, which reached 26% in 2021. This gap highlights the regions’ demographic advantage with a relatively lower elderly dependency ratio, signifying a larger proportion of the population in the active workforce. In particular, El Loa’s consistently low elderly dependency ratio points to a strong demographic bonus that can bolster the region’s economic vitality. On the other hand, Tocopilla, while still below the OECD benchmark, has experienced a higher rate of increase, indicating a more rapidly ageing population. This calls for a proactive approach in these regions to manage the ageing trend while capitalising on their demographic advantage.

However, despite Antofagasta’s relatively low elderly dependency rate compared to national and OECD benchmarks, the region has seen a steady increase in this rate over the past two decades. This suggests a gradual ageing trend of the population in Antofagasta, similar to what is seen in many places around the world. That being said, efforts to attract and retain a dynamic and diverse working-age population can help Antofagasta maintain its demographic advantage and support its long-term economic and social prosperity.

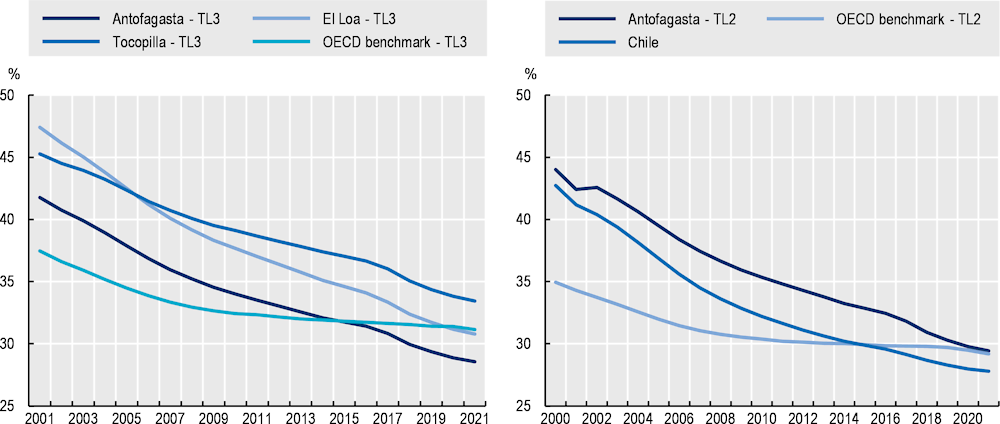

Figure 2.7. Elderly dependency ration in Antofagasta, El loa, Tocopilla, OECD mining regions benchmark and Chile, TL2 and TL3 levels, 2001-21

Note: Calculated as a share of individuals over 65 years old over the working-age population (15-65 year-olds).

Source: (OECD, 2022[1]) OECD Regional Statistics database (accessed on 14 January 2023).

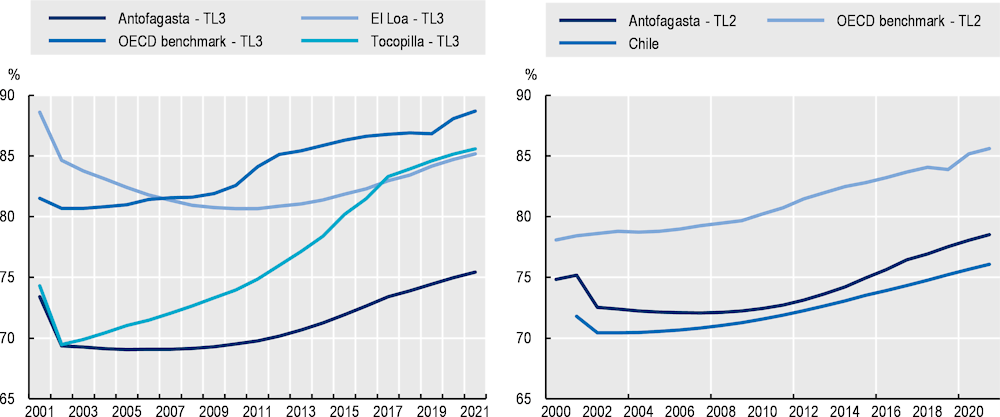

Figure 2.8. Gender ratio, elderly population, Antofagasta, El loa, Tocopilla, OECD mining regions benchmark and Chile, TL2 and TL3 levels, 2001-21

Note: The ratio is calculated as a percentage of 65-year-old and more population, males over females. A high value indicates there are more elderly males compared to elderly females, while a low value suggests there are fewer elderly males relative to elderly females.

Source: (OECD, 2022[1]) OECD Regional Statistics database (accessed on 14 January 2023).

From 2001 to 2021, data from Antofagasta, El Loa, Tocopilla, and the TL2 and TL3 levels of the OECD mining regions benchmark, alongside Chile, show distinct trends. For instance, the TL2 level, Antofagasta showed a gender ratio ranging from 72% to 79%, while the OECD mining regions benchmark remained relatively stable between 78% and 86%. In Chile, the gender ratio fluctuated between 70% and 76% during the same period. Moving to the TL3 level, Antofagasta experienced a slight decrease from 73% to 75%, El Loa remained consistently around 82% to 85%, and Tocopilla saw an increase from 69% to 86%.

Antofagasta’s declining youth dependency ratio since 2000 signals an evolving demographic landscape, yet the region still retains a demographic bonus

From 2000 to 2021, Antofagasta at the TL2 level experienced a steady decrease in its youth dependency ratio, from 44% to 29% (Figure 2.9). This trend signifies a declining proportion of young dependents relative to the working-age population, potentially indicating shifts in family size, fertility rates or other demographic factors over the last two decades. Despite the decrease, Antofagasta’s youth dependency ratio has consistently remained above the OECD TL2 benchmark, which was at 29% in 2021, and is now closely aligned with the national average of 28%.

Figure 2.9. Youth dependency ratio in Antofagasta, El Loa, Tocopilla, OECD mining regions benchmark and Chile, TL2 and TL3 levels, 2001-21

Note: Calculated as a share of 15 year-old individuals over the working-age population (15-65 years old).

Source: (OECD, 2022[1]) OECD Regional Statistics database (accessed on 14 January 2023).

From 2001 to 2021, the youth dependency ratios at the TL3 level in Antofagasta, El Loa and Tocopilla exhibited a similar decreasing trend. Antofagasta’s ratio decreased from 42% to 29%, while El Loa’s declined from 47% to 31%. Tocopilla also experienced a decrease, with the ratio dropping from 45% to 33%. Comparing these figures to the OECD TL3 benchmark, which remained relatively stable at around 31% throughout the period, Antofagasta, El Loa and Tocopilla all initially had higher youth dependency ratios. However, their ratios have gradually converged with the benchmark, suggesting a shift in the demographic structure towards a more balanced age distribution.

This decrease in the youth dependency ratio represents an evolving demographic profile in Antofagasta that could have implications for its social and economic landscape. While a lower youth dependency ratio can ease pressure on resources allocated for education and childcare, it also highlights the need for focused investments in the workforce to capitalise on the productive potential of the region’s relatively larger working-age population.

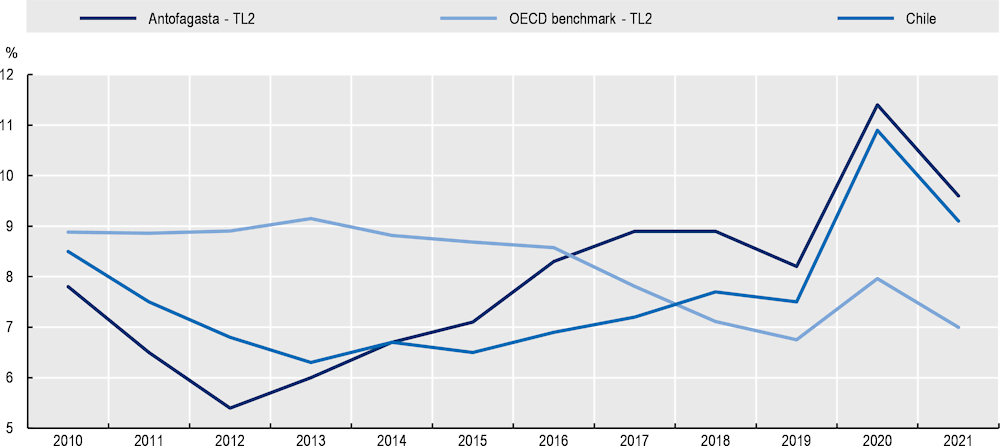

Antofagasta’s recent rise in unemployment has created a stark economic challenge offsetting the region’s demographic advantage

While the region of Antofagasta enjoyed lower unemployment rates relative to the OECD TL2 benchmark and the national average from 2010 to 2021, it has experienced considerable volatility over this period (Figure 2.10). In 2010, the unemployment rate in Antofagasta was 7.8%, lower than both the OECD TL2 benchmark of 8.9% and the national average of 8.5%. This relative advantage was maintained until 2015, when the unemployment rate in Antofagasta increased to 7.1%, edging closer to the national average and the OECD benchmark.

However, the region was unable to sustain this positive trend. Between 2015 and 2021, the unemployment rate in Antofagasta increased, reaching a peak of 11.4% in 2020 before falling to 9.6% in 2021. The fluctuations in Antofagasta’s unemployment rate during this period contrast with the relative stability of the national average and the OECD benchmark. In particular, the gap between the unemployment rate in Antofagasta and the OECD benchmark, which had been shrinking until 2015, widened significantly by 2021.

Figure 2.10. Unemployment rate in Antofagasta, OECD mining benchmark and national average, 2010-21

Note: Unemployment rate (% unemployed over labour force 15-64)

Source: (OECD, 2022[1]) OECD Regional Statistics database (accessed on 20 November 2022).

The experience of Antofagasta underlines the importance of looking beyond demographic trends when assessing regional economic conditions. Even with a favourable age structure, the region has faced challenges in maintaining stable employment levels. As will be explained in the following section, these unemployment trends have implications for Antofagasta’s working-age population. The year-over-year increases in unemployment rates from 2015 to 2021 indicate the region’s growing struggle with joblessness, notably outpacing the national average and OECD TL2 benchmark. By 2021, despite a slight recovery, Antofagasta’s unemployment rate remained above both the Chilean national average and the OECD TL2 benchmark.

Regional economic trends

Antofagasta is thriving, with the mining sector fuelling robust economic growth in the region

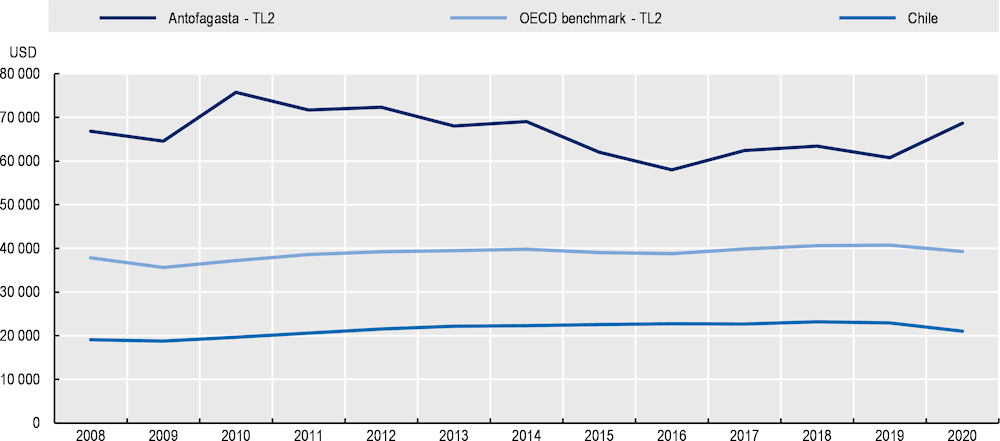

In 2022, Antofagasta contributed 12.8% to Chile’s total GDP, ranking second only behind the Santiago Metropolitan Region, which contributed 38.1%. Since 2008, Antofagasta’s GDP per capita has consistently surpassed both the OECD TL2 benchmark and Chile’s national average (Figure 2.11). Starting from a robust USD 66 809 in 2008, Antofagasta’s GDP per capita notably exceeded the OECD TL2 benchmark of USD 37 833 and the national average of USD 19 072. By 2020, Antofagasta’s GDP per capita was 175% of the OECD TL2 benchmark and over 326% of Chile’s national average.

Figure 2.11. GDP per capita of Antofagasta, OECD mining regions and national average, 2008-20

Note: GDP per capita (USD PPP base year 2015).

Source: (OECD, 2022[1]) OECD Regional Statistics database (accessed on 20 November 2022).

The region’s dependency on copper extraction underlines the region’s pivotal economic role, as global copper demand and pricing can significantly affect its economic performance. Between 2010 and 2016, influenced by a downturn in global copper prices, Antofagasta’s GDP per capita decreased by 23.5%. In contrast, from 2016 to 2020, it saw a recovery. However, even with this resurgence, it did not surpass its 2011 peak (USD 75 748). This pattern reveals the region’s sensitivity to fluctuations in global copper prices. Overall, while Antofagasta’s GDP per capita experienced these variations due to its copper reliance, the GDP per capita of the OECD TL2 benchmark and Chile’s national average remained more consistent over the same period.

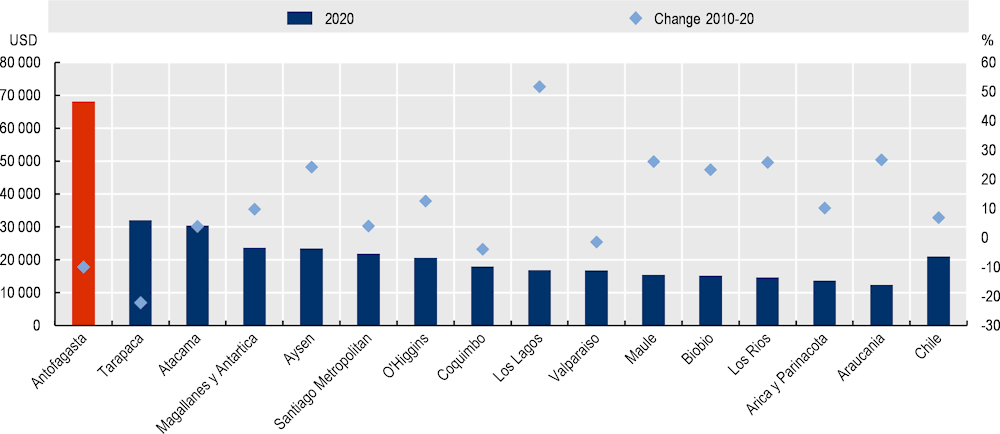

Between 2008 and 2020, Antofagasta consistently topped the list of Chilean regions in terms of GDP per capita, following the Santiago Metropolitan Region (Figure 2.12). While Antofagasta’s prominence stands out, the dynamics of other regions offer nuanced insights into Chile’s regional disparities and growth trajectories. Each region’s GDP per capita is not only a reflection of its economic productivity but also provides insights into its unique social and economic conditions.

Figure 2.12. GDP per capita in 2020 and GDP change across regions of Chile and national average, 2010-20

Note: GDP per capita (USD PPP base year 2015).

Source: (OECD, 2022[1]) OECD Regional Statistics database (accessed on 14 January 2023).

For instance, other Chilean regions like Tarapacá began the period with a GDP per capita of USD 38 392, which is nearly 83% higher than the national average of that year. However, by 2020, it adjusted to USD 32 053 – a value still 52% higher than the national average but falling short of the OECD TL2 benchmark by approximately 18%. On the other hand, Aysén’s economic performance showcased an increase from an initial GDP per capita of USD 17 434 in 2008, slightly below the national average, to a notable peak of USD 30 190 in 2019. Even though it adjusted down to USD 23 489 in 2020, it remained 11.7% above the national figure, yet still around 40% less than the OECD TL2 benchmark.

For instance, during this timeframe, Tarapacá saw its GDP per capita decrease from USD 38 392 to USD 32 053, a decline of 16.5%. On the other hand, Aysén experienced a more dramatic swing: a growth of almost 73% from its 2008 GDP per capita of USD 17 434 to a peak of USD 30 190 in 2019 before settling at USD 23 489 in 2020, still a net gain of 34.8% from 2008. Certain regions, such as Los Lagos and Magallanes y Antartica Chilena, demonstrated progress, with their GDP per capita growth rates surpassing the national average. Los Lagos, for instance, increased from USD 11 287 in 2008 to USD 16 828 in 2020, indicating substantial economic development in the region. These shifts underscore the diverse economic landscapes and growth patterns across Chile’s regions.

Yet, the region is still not using all of the wealth generated to improve living standards at a faster pace

Antofagasta faces one of the most significant social challenges associated with the mining industry in the region: a high level of income inequality. While the mining industry has generated considerable wealth for the region, this wealth is concentrated among a small group of individuals and companies, resulting in a significant gap between the rich and poor. According to data from the Chilean National Statistics Institute (INE), the Gini coefficient for the Antofagasta region was 0.51 in 2019, higher than the national average of 0.46, indicating a high level of income inequality. Consequently, this region boasts the highest per capita GDP in Chile, with the mining sector contributing over 72% of the regional GDP. All in all, the concentration of wealth has led to social tensions and has been identified as a significant obstacle to improving the quality of life in the region.

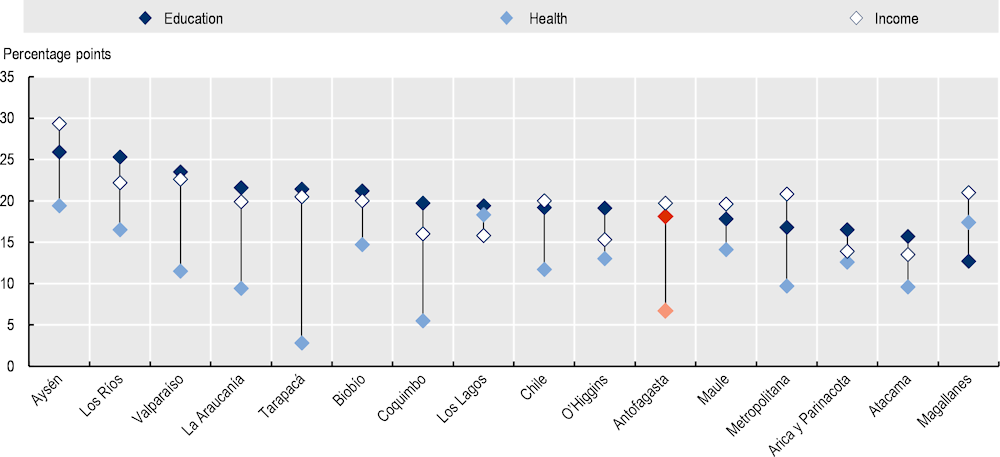

Figure 2.13 underscores the central challenge for Antofagasta: ensuring that the wealth generated by its robust mining sector is utilised to drive faster improvements in key areas of human development. While the region’s economic prosperity is notable, it has yet to fully capitalise on this wealth to enhance education and health outcomes at a rate that would allow it to close the gap with the ideal target5. The task ahead lies in focusing on these key areas to ensure a more equitable distribution of wealth and an improved standard of living for its inhabitants. The gap reduction percentages between 2006 and 2017 across the Chilean regions show that Antofagasta has reached its disparities levels compared to the ideal targets in education and health.

Education: Antofagasta ranks sixth lowest in the country in terms of gap reduction, indicating a slow pace of improvement compared to other regions. A score of 18.1 suggests that, although progress has been made, the region has not fully harnessed its wealth to improve education at a pace commensurate with its economic growth.

Health: Antofagasta’s situation is more pronounced. With a gap reduction score of just 6.7, it ranks as the third lowest region in the country. This low score shows that the region’s robust GDP has not translated into health advancements, a key component of living standards.

Income: The income dimension shows a similar picture for Antofagasta. Despite its high per capita GDP, Antofagasta only ranks 11th out of the 16 Chilean regions in terms of income gap reduction, with a score of 19.7. This difference indicates a significant income inequality within the region, illustrating that the considerable wealth, primarily generated by the prosperous mining industry, is not evenly distributed among its inhabitants.

Figure 2.13. Reduction of the gap with respect to the ideal target between 2006 and 2017 across the Chilean regions

Source: UNDP (2020[16]), Regional Inequality in Chile, https://www.estudiospnud.cl/wp-content/uploads/2020/04/DesigualdadRegionalPDF.pdf; based on data from the Casen survey, INE and the Ministry of Health.

With a solid foundation in mining, Antofagasta’s economy needs to steadily diversify and expand into new sectors to sustain its growth

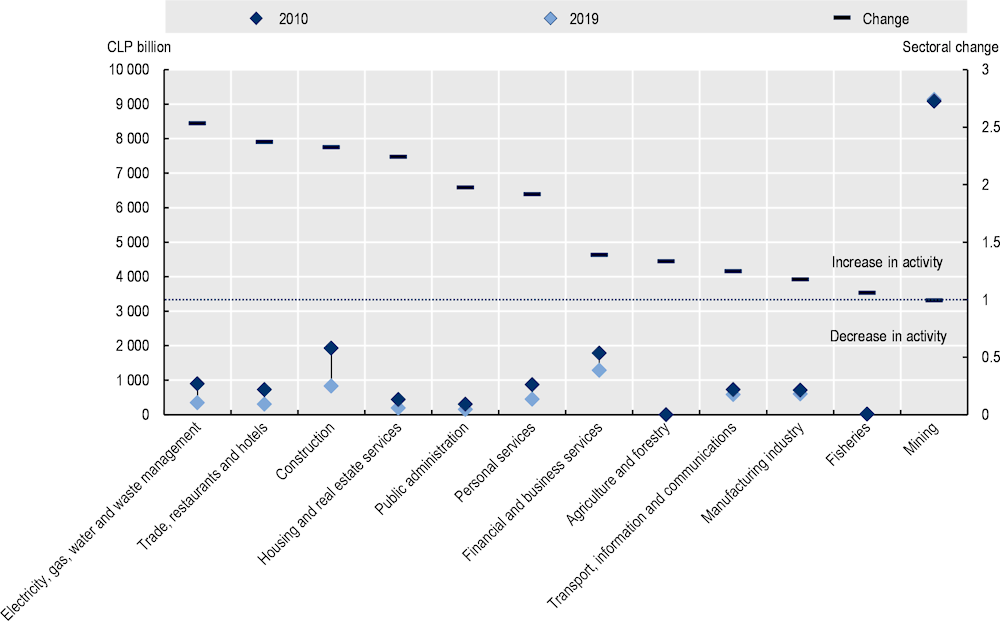

Overall, these changes in the sectorial specialisation of Antofagasta reflect the evolving economic landscape of the region, marked by significant growth in service-oriented sectors and a slight contraction in the traditionally dominant mining sector (Figure 2.14). From 2010 to 2019, Antofagasta experienced substantial shifts in its sectorial specialisation, marked by significant growth in certain sectors and a decrease in others.

Sectors such as electricity, gas, water and waste management saw the most substantial growth, more than doubling in size from 354 billion Chilean pesos in 2010 to 897 in 2019, a change of 2.53 times. Likewise, the trade, restaurant and hotel sector experienced substantial growth, with 2.37 times increase over the same period. The construction sector also showed robust growth, more than doubling its size from 831 billion Chilean pesos in 2010 to 1 931 in 2019. Housing and real estate services and public administration saw growth rates of approximately 2.24 and 1.97 times respectively, suggesting an expanding service sector in the region. Personal services, financial and business services, and transport, information and communications also expanded during this period, but at slower rates. The agriculture and forestry sector saw a marginal increase, showing limited growth potential within the timeframe.

Interestingly, the manufacturing industry showed only modest growth of about 1.18 times from 2010 to 2019, which might indicate a shift in the region’s industrial dynamism. The fisheries sector also showed very minimal growth. Contrary to the growth trend in most sectors, the mining sector, a significant contributor to the region’s economy, remained stable.

Figure 2.14. Economic participation by sector and change between 2010 and 2019, Antofagasta

Note: GDP by economic activity, Antofagasta region, current prices, spliced series, 2013 benchmark.

Source: BCC (2023[17]), Base de Datos Estadísticos (BDE) - Cuentas Nacionales 2010‑2020, https://si3.bcentral.cl/Siete/ES/Siete/Cuadro/CAP_CCNN/MN_CCNN76/CCNN2013_PIB_II_ACT_N/CCNN2013_PIB_II_ACT_N?cbFechaInicio=2010&cbFechaTermino=2020&cbFrecuencia=ANNUAL&cbCalculo=NONE&cbFechaBase=.

Despite mining’s dominance, Antofagasta’s employment allocation has shown signs of diversification, particularly into public services and hospitality

Antofagasta’s employment landscape has evolved substantially over the last decade, reflecting a dynamic labour market between traditional economic pillars and emerging sectors (Table 2.5). From 2013 to 2023, the region experienced a robust 30.3% surge in total employment, rising from 255 590 to 333 040 jobs.

Central to Antofagasta’s identity, the mining and quarrying sector posted an 8.4% growth, showcasing its great relevance for the region. With numbers climbing from 56 160 to 60 910, this sector remains the economic bedrock, even if its relative growth appears stable against the broader employment landscape. However, a deeper dive into the data reveals transformative trends.

The accommodation and food service sector’s growth – nearly doubling its numbers – might be indicative of an increasing tourism industry coupled with local consumerism. Its contribution to the regional job market leapt from 3.38% in 2013 to 5.08% by 2023.

Administrative and support service activities experienced a more than twofold increase, elevating its regional labour market representation from 1.97% to 3.61%. Meanwhile, public administration and defence grew from 10 170 to 19 870 jobs, suggesting a regional emphasis on bolstering public services and security. Its stake in regional employment transitioned from 3.98% in 2013 to 5.97% a decade later.

As for human healthcare and social work activities, the figure rose from 11 010 to 18 980, and its employment share increased from 4.31% to 5.70%. This points to a heightened focus on public health, welfare programmes and a society necessitating more healthcare services.

Conversely, the decline in sectors like agriculture, livestock, forestry and fishing might be attributed to factors such as industrialisation, urbanisation or perhaps challenges posed by climate change. The dip in manufacturing industries, from 23 460 to 18 850, could be due to shifts in global manufacturing hubs, technological advancements leading to automation or changes in regional economic policies.

Table 2.5. Employees by sector in Antofagasta, 2013 vs. 2023

Employees, January-March, first quarter (Q1)

|

Sector |

2013 Q1 |

2023 Q1 |

Change (%) |

|---|---|---|---|

|

Agriculture, livestock, forestry and fishing |

5,540 |

2,860 |

-48 |

|

Mining and quarrying |

56,160 |

60,910 |

8 |

|

Manufacturing industries |

23,460 |

18,850 |

-20 |

|

Electricity, gas, steam and air conditioning supply |

3,110 |

2,900 |

-7 |

|

Water supply |

1,280 |

4,430 |

246 |

|

Construction |

15,380 |

21,130 |

37 |

|

Wholesale and retail trade |

47,410 |

52,290 |

10 |

|

Transport and warehousing |

21,510 |

29,150 |

36 |

|

Accommodation and food service activities |

8,640 |

16,910 |

96 |

|

Information and communications |

1,890 |

3,290 |

74 |

|

Financial and insurance activities |

3,750 |

2,230 |

-41 |

|

Real estate activities |

250 |

2,880 |

1032 |

|

Professional, scientific and technical activities |

6,180 |

9,220 |

49 |

|

Administrative and support service activities |

5,030 |

12,020 |

139 |

|

Public administration and defence |

10,170 |

19,870 |

95 |

|

Education |

22,400 |

27,670 |

24 |

|

Human healthcare and social work activities |

11,010 |

18,980 |

72 |

|

Arts, entertainment and recreation activities |

2,290 |

5,090 |

122 |

|

Other service activities |

5,650 |

12,410 |

119 |

|

Activities of households as employers |

4,470 |

8,950 |

100 |

|

Total employed |

255,590 |

333,040 |

30 |

Note: Sectorial classification according to Clasificador de Actividades Económicas Nacional para Encuestas Sociodemográficas (CAENES), adapted from the Chilean Classifier of Economic Activities ISIC4.CL 2012.

Source: INE (2023[2]), Ocupación y Desocupación, https://regiones.ine.cl/antofagasta/estadisticas-regionales/sociales/mercado-laboral/ocupacion-y-desocupacion.

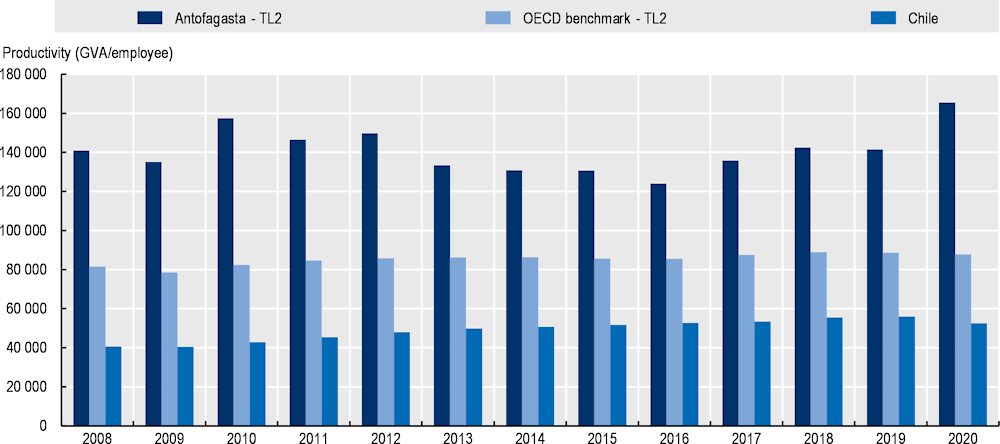

Antofagasta, the productivity powerhouse amidst an extractive economy

Productivity in Antofagasta, marked by its high economic reliance on mining, significantly outpaces both Chile and the OECD average, demonstrating the region’s robust economic performance. Indeed, figures for Antofagasta, Chile and the OECD in 2008 were approximately USD 140 890, USD 40 626 and USD 81 453 respectively (Figure 2.15).

When analysing these numbers, the productivity in Antofagasta was about 3.46 times higher than Chile’s average and 1.73 times higher than the OECD average in 2008. By 2020, Antofagasta’s productivity escalated to about USD 165 549, representing a growth of 17.5%. In comparison, Chile’s overall productivity witnessed a growth of approximately 29.4% to reach around USD 52 564 by 2020. However, it is worth noting that despite a higher growth rate percentage-wise for Chile, in absolute terms, Antofagasta’s productivity was still 3.15 times greater. The OECD TL2 benchmark regions had an average productivity figure of approximately USD 87 691 in 2020. This is almost half Antofagasta’s productivity, revealing a growth rate of about 7.6% from 2008.

Figure 2.15. Productivity in Antofagasta, OECD Benchmark TL2 and National average, 2008-2020

Note: Gross value added (GVA) as USD millions, constant prices, constant PPP, base year 2010.

Source: BCC (2023[17]), Base de Datos Estadísticos (BDE) - Cuentas Nacionales 2010-2020, https://si3.bcentral.cl/Siete/ES/Siete/Cuadro/CAP_CCNN/MN_CCNN76/CCNN2013_PIB_II_ACT_N/CCNN2013_PIB_II_ACT_N?cbFechaInicio=2010&cbFechaTermino=2020&cbFrecuencia=ANNUAL&cbCalculo=NONE&cbFechaBase=.

However, around 2015 and 2016, Antofagasta did experience a brief dip in productivity, hitting a trough of roughly USD 123 959 in 2017. The region’s strong economic performance, primarily due to its robust mining industry, allowed for a relatively swift recovery, with productivity rebounding to new heights by 2020. In summary, Antofagasta maintained high productivity levels throughout the 2008-20 span, consistently overshadowing Chile and the OECD average.

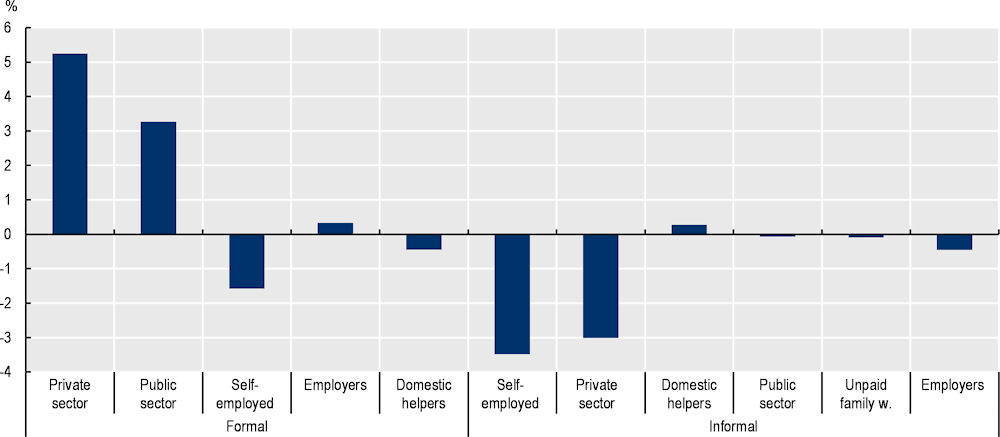

Antofagasta’s level of formal employment, when compared to Chile, displays less dependence on informal self-employment

Analysing the labour composition of Antofagasta in 2023, we can spot interesting differences compared to Chile’s national averages (Figure 2.16). These variations exist in both the formal and informal employment sectors, adding layers of complexity to the region’s employment landscape. In the formal sector, 57% of Antofagasta’s workforce is employed in the private sector, compared to the national average of 51%. This 5.2% differential is a clear sign of a stronger private sector in Antofagasta, likely underpinned by the region’s prosperous mining industry. The public sector in Antofagasta also outperforms the national average, with 14% of the workforce compared to 11% across Chile, reflecting a 3.3% higher rate.

However, it is not all positive. The data reveal Antofagasta lags behind the national average by 1.6% for self-employed workers in the formal sector, with a rate of 5% compared to 6% in Chile. The region’s rates for employers and domestic helpers in the formal sector align with the national average, sitting at 3% and 1% respectively.

The region’s labour sector shows that Antofagasta (21%) has a lower degree of informality in its labour market compared to the national average (27%). With fewer self-employed workers and a smaller private sector within the informal economy, the region demonstrates a stronger emphasis on formal employment. This highlights the significance of the formal sector in supporting Antofagasta’s workforce.

Figure 2.16. Percentage point difference by occupation, formal/informal situations, between Antofagasta and the national average, 2023

Note: Data correspond to March 2023.

Source: Based on data from INE (2023[2]), Ocupación y Desocupación, https://regiones.ine.cl/antofagasta/estadisticas-regionales/sociales/mercado-laboral/ocupacion-y-desocupacion.

Well-being in Antofagasta region

Quality of life in the region of Antofagasta

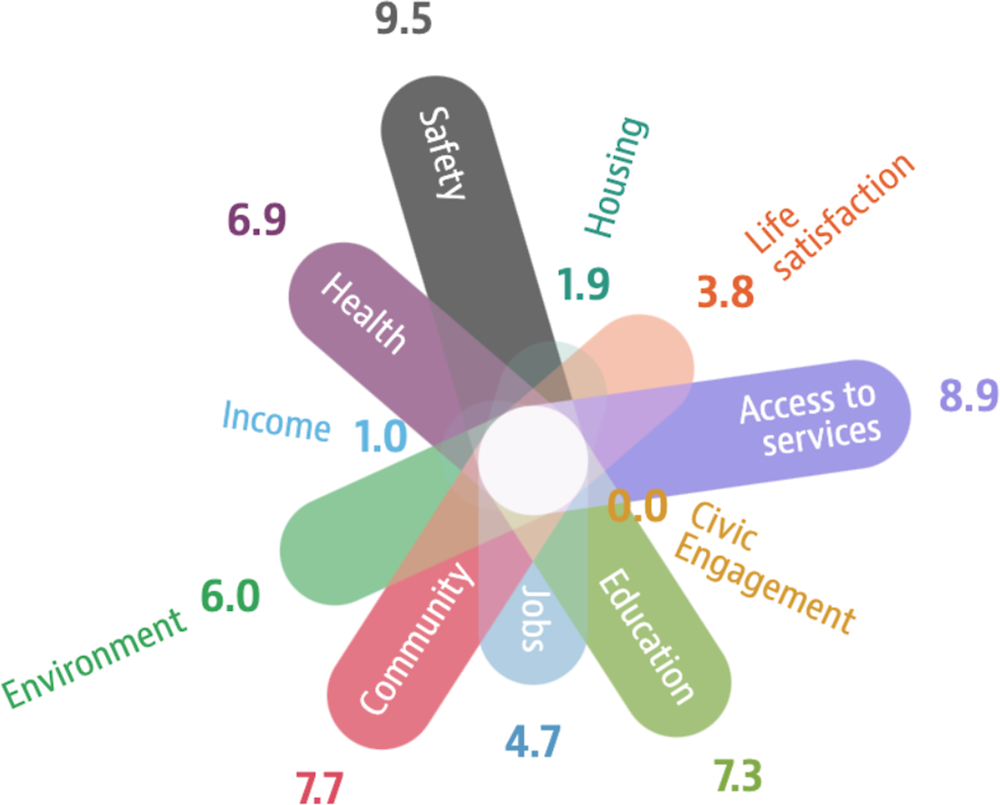

Progress in the region and the development of its business environment are relevant to ensure the well‑being of Antofagasta. Retaining and attracting people and businesses are some of the aspects which depend directly on policies aimed at the well-being of the citizens. This is partly achieved by offering sufficient high living standards to make the region attractive to both foreigners and locals. The OECD regional well-being analysis provides a tool for policy makers to assess the region’s strengths and weaknesses, monitor trends and compare their results with those of other regions, nationally and internationally (Box 2.2). To better understand the relationship between well-being and mining regions, the analysis presented in this section adopts the OECD regional well-being framework to compare the quality of life outcomes in Antofagasta with the average for OECD TL2 mining regions and for Chile.

Box 2.2. OECD Regional Well-being indicators

Building comparable well-being indicators at a regional scale

The OECD framework for measuring regional well-being builds on the OECD Better Life Initiative at the national level. It goes further to measure well-being in regions with the idea that well-being data are more meaningful if measured where people experience it. Besides place-based outcomes, the framework also focuses on individuals since both dimensions influence people’s well-being and future opportunities.

Figure 2.17. Indicators by well-being dimension

Source: OECD (2023[7]), OECD Regional Well-Being (database), https://www.oecdregionalwellbeing.org/ (accessed on 27 May 2019).

In line with national well-being indicators, regional well-being indicators concentrate on informing about people’s lives rather than on means (inputs) or ends (outputs). In this way, policies are directed to well‑being features that can be improved by policies. Regional well-being indicators also serve as a tool to evaluate how well-being differs across regions and groups of people.

Regional well-being indicators are multi-dimensional and include both material dimensions and quality of life aspects. They also recognise the role of citizenship, institutions and governance in shaping policies and outcomes.