This chapter offers an overview of Samoa’s financing landscape as it relates to the ocean economy. It emphasises the need to tap into a diverse range of financing sources (public, private, domestic and external) to support Samoa’s aspirations of building a sustainable ocean economy. Additionally, the chapter explores the role of official development assistance (ODA) in cultivating a sustainable ocean economy and the potential benefits and challenges associated with adopting innovative financing mechanisms in the Samoan context.

Towards a Blue Recovery in Samoa

3. Financing Samoa’s sustainable ocean economy

Abstract

Key messages

Public finance is a major source of finance for Samoa’s investments, but the country’s limited fiscal space calls for careful prioritisation in a resource-constrained environment.

Tax revenues serve as a major source of finance for the government’s investments, and there is room to explore new instruments (e.g. sustainable tourism taxes) to raise additional financing to implement the Samoa Ocean Strategy (SOS).

Since it is classified as being at high risk of debt distress, Samoa has little room to take on more public debt, which could translate into reduced opportunities for public investment. Strategic investments in climate resilience, including for ocean-related assets, can help provide fiscal relief in the long term.

Official development assistance (ODA), including for the sustainable ocean economy, is relatively high but could be better targeted to support the implementation of the SOS.

Private finance, including remittances, can be a major source of financing, but the enabling environment for private investment needs to be strengthened.

While remittance flows are growing and a source of financing, they require continued international labour mobility, which is a risky proposition given the labour shortages in Samoa.

Although Samoa is recognised as a regional best practice leader in transparent and fair business regulations, structural challenges typical of small and remote economies limit the scope for private investment.

Maximising scarce resources will be key to financing the Samoa Ocean Strategy (SOS) and developing Samoa’s ocean economy. A better alignment of the scarce financing with ocean-related investment needs will be vital for unlocking the potential of Samoa’s ocean economy. The government is developing a financing plan for the SOS, and a holistic assessment of all sources of finance could identify financing gaps and reveal opportunities.

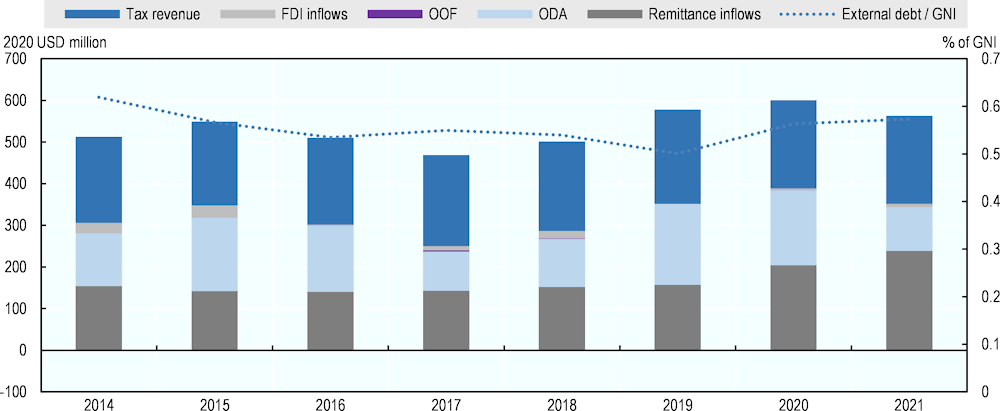

Samoa’s financing landscape reflects the challenges of the economies of small island developing states (SIDS), such as a lack of diversification and limited prospects for international trade and investment. Samoa relies heavily on remittances and official development assistance (ODA), which, in 2021, accounted for 28% and 12% of its finance mix, respectively (Figure 3.1). Samoa’s public debt is at a relatively moderate level, especially in comparison to peer SIDS countries, but its high exposure to natural disasters and external shocks leaves it at high risk of external and overall debt distress (World Bank and IMF, 2021[1]). While structural limitations constrain the government’s ability to raise additional finance for the SOS, ODA and remittances could be better channelled into investment in the ocean economy. New tax instruments (e.g. sustainable tourism taxes) and financing mechanisms like blue bonds and insurance schemes could also be introduced to finance marine conservation.

Figure 3.1. Samoa’s financing landscape is highly dependent on remittances and official development assistance

Note: Tax revenues are calculated by multiplying the tax-to-gross domestic product ratio indicated in the Government Finance data of the Samoa Bureau of Statistics by the USD-denominated gross domestic product data in the World Development Indicators database. FDI = foreign direct investment; OOF = other official flows; ODA = official development assistance; GNI = gross national income

Source: Authors’ calculations based on OECD (2023[2]) Creditor reporting system database, https://stats.oecd.org/Index.aspx?DataSetCode=crs1; World Bank (2023[3]), World Development Indicators database, https://databank.worldbank.org/source/world-development-indicators# ; Samoa Bureau of Statistics (2022[4]), Government Finance Statistics, https://www.sbs.gov.ws/government-finance-statistics/.

3.1. Public finance

Tax revenues are a major source of finance for the government

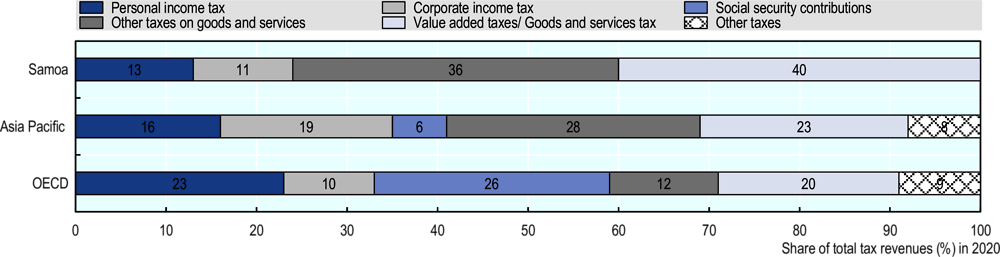

Tax revenues, which account for the largest share (54%) of Samoa’s finance mix, have shown considerable resilience during the COVID-19 pandemic. After reaching a peak in 2019, tax revenues experienced a moderate decrease in 2020 and 2021. Despite the slight decline in absolute volumes, tax revenues demonstrated remarkable stability during the pandemic, partially due to improvements in tax administration (IMF, 2023[5]). As a result, the tax-to-gross domestic product (GDP) ratio rose from 23% in 2015 to 26% in 2020. This is almost 6 percentage points above the Asia and Pacific average of 19%, but in line with the SIDS average of 25% (OECD, 2022[6]).

Compared to other countries in the Asia Pacific region, Samoa derives a relatively large share (40%) of tax revenues from value-added goods and services taxes (OECD, 2022[6]). On average, value-added tax (VAT) income is less significant for ODA-eligible SIDS (27% of total tax revenues, on average), due to policy and administrative challenges limiting VAT revenues and because some SIDS have not yet adopted VAT (OECD, 2022[7]). In Samoa, however, VAT revenues are sizable and expected to increase, due to the phased roll-out of the web-based Tax Invoice Monitoring System, which started in July 2020 and contributed to improved tax compliance (IMF, 2021[8]).

Figure 3.2. Samoa relies heavily on value-added goods and services taxes

Note: The OECD average is based on 2019 data.

Source: OECD (2022[6]), Revenue Statistics in Asia and the Pacific 2022, https://doi.org/10.1787/db29f89a-en.

Previous assessments of Samoa’s financing landscape made recommendations to broaden the tax base and improve tax compliance. The development finance assessment carried out in 2019, by the United Nations Development Programme, highlighted the need to broaden Samoa’s tax base, for example by reviewing the current system for personal income tax as well as tax exemptions for different businesses and organisations. The assessment further made suggestions to improve tax compliance through web-based electronic tax filing and payment systems, as well as the application of audit systems to more effectively target underreported taxable income and tax evasion (UNDP, 2019[9]). The Tax Invoice Monitoring System roll-out shows the government’s responsiveness to these recommendations. The International Monetary Fund (IMF) advised Samoa to consider introducing new tax measures and expanding existing ones to incentivise and finance climate action. This included an increase in excise taxes on kerosene and liquefied petroleum gas, and taxing electricity at the standard VAT rate of 15%, which could help to incentivise climate change mitigation (IMF, 2022[10]).

Additional tax revenues can be used for value-adding and sustainability-enhancing investments. Introducing sustainable tourism taxes would be a way to leverage the revenue-generating potential of the tourism industry, which was identified as a key driver for economic growth in Chapter 1. An increasing number of countries are introducing tourism taxes as a way to invest in infrastructure and sustainability initiatives. Thailand recently announced plans to introduce an entry fee of 300 Thai Baht (USD 8) for international travellers, which is expected to generate more than USD 115 million in additional revenue (Klurman, 2023[11]). User fees for marine protected areas can also be explored as part of the marine spatial planning process described in Chapter 2. In addition to raising tax revenues to finance ocean-related investments, these instruments can serve the purpose of regulating the use of and sustainably managing Samoa’s marine ecosystem. Tsvetanova and Seetaram (2018[12]) suggest that consumers who pay tourism taxes have a greater awareness of environmental problems and are more willing to pay to reduce the negative impact and correct externalities.

At high risk of debt distress, Samoa has little room to take on more public debt

The IMF-World Bank debt sustainability analysis classifies Samoa as at high risk of external and overall debt distress. While the debt level itself is moderate, the rating reflects Samoa’s high exposure to natural disasters and external shocks (World Bank and IMF, 2021[1]). Public and publicly guaranteed debt amounted to 54% of GDP in fiscal year 2020, comprising central government debt (46.7% of GDP) and central government-guaranteed state-owned enterprise debt (7.1% of GDP). Public debt includes government guarantees (7% of GDP in fiscal year 2020), of which more than half originated from the Credit Line Facility of the Central Bank of Samoa, which was used to support state-owned enterprises (mainly the Development Bank of Samoa), following the aftermath of the natural disasters and to promote inclusive economic growth in the targeted priority sectors (World Bank and IMF, 2021[1]). According to IMF projections, the debt-to-GDP ratio is expected to trend upward over the next 20 years. In the absence of grant financing for reconstruction, an additional near-term natural disaster comparable to historical magnitudes would accelerate these trends and could permanently increase the debt-to-GDP ratio by up to 20-25 percentage points (IMF, 2022[10]).

Samoa’s public debt is almost entirely held by external lenders (Table 3.1). Only 0.1% of the country’s public debt is borrowed domestically from the Unit Trust of Samoa, a public financial institution that acts as an investment vehicle for local and overseas Samoans. External public debt is divided roughly evenly across multilateral and bilateral creditors. The largest creditors are the EXIM Bank of the People’s Republic of China (39.7%), the International Development Association (30.4%) and the Asian Development Bank (20.1%) (Ministry of Finance, 2022[13]).

Table 3.1. Multilateral development banks and China are among the main lenders to Samoa

Public debt breakdown as of September 2022

|

Amount (Samoan Tala) |

Share (%) of total debt |

|

|---|---|---|

|

Multilateral |

482.1 |

52.9 |

|

Asian Development Bank |

182.7 |

20.1 |

|

European Investment Bank |

2.4 |

0.3 |

|

International Development Association |

277.4 |

30.4 |

|

International Fund for Agricultural Development |

2.6 |

0.3 |

|

Organisation of the Petroleum Exporting Countries |

17 |

1.9 |

|

Bilateral |

427.8 |

46.9 |

|

EXIM Bank (China) |

361.7 |

39.7 |

|

Japan International Cooperation Agency |

66.1 |

7.3 |

|

Domestic debt |

1.3 |

0.1 |

|

Unit Trust of Samoa |

1.3 |

0.1 |

|

Total debt |

911.2 |

100.0 |

Source: Samoa Ministry of Finance (2022[13]), Quarterly Public Debt Bulletin, https://www.mof.gov.ws/wp-content/uploads/2022/12/QDB-Sept-22.pdf.

The level of debt service payments is relatively low, due to a large share of concessional loans. Most of the external debt consists of highly concessional loans from multilateral and bilateral donors, with interest rates ranging from 0.45% to 1.5% in 2022. External debt obligations that do not fall into this category are semi-concessional loans from China’s EXIM Bank (at 2%) and non-concessional loans from the Organization of the Petroleum Exporting Countries (OPEC), at a 3.98% annual interest rate. The cost of existing debt amounts to an average interest rate of 1.4% per annum (Ministry of Finance, 2022[13]). In 2021, total debt service amounted to 1.9% of gross national income, down from 2.8% in 2020 and 3.5% in 2019 (World Bank, 2023[14]). The reason for this decline is that under the G20 Debt Servicing Suspension Initiative, Samoa qualified for suspension of debt service payments owed to bilateral creditors, i.e. China, Japan and the European Union, which helped to free up fiscal space to contain the effects of the pandemic. Debt servicing resumed in the latter half of 2022.

The need for prudent public debt management constrains the fiscal space immediately available to the government for large-scale public investment and expenditure, including for the ocean economy. Having made efforts to decrease the public debt burden to keep in line with its medium-term debt strategy (Samoa Ministry of Finance, 2022[15]), which sets a public debt target of 50% of GDP, the government has contracted no new loans since December 2017 and is expected to maintain a cautious stance in the foreseeable future. The implementation of the Ocean Strategy and other investments for the ocean economy is therefore likely to prioritise the use of concessional sources of finance, as well as a greater mobilisation of private sector resources and the identification of new financing sources.

As part of a medium to long-term fiscal strategy, Samoa would benefit from prioritising public investments and expenditures enhancing climate resilience. Once public debt falls below the target levels set in the government’s debt management strategy and additional debt can be taken on again, the evaluation of investment needs will need to take into account the long-term socioeconomic and fiscal impacts of climate adaptation. In light of Samoa’s high vulnerability to climate change, crucial investments in climate resilience (for example to implement sectoral adaptation plans in tourism, agriculture and fisheries) may contribute to the country’s long-term debt sustainability (see Section 1.3). The IMF estimates that investing an additional 2% of GDP in adaptation for the next five years would save Samoa about 4.5% of 2021 GDP in output losses if a natural disaster of typical magnitude were to occur in 2027 (IMF, 2022[10]).

ODA plays an important role in Samoa’s finance mix but could better target the sustainable ocean economy and align with the SOS

Samoa has higher levels of ODA per capita than its peers. ODA totalled USD 105 million (12% of GDP) in 2021, compared to an average of 6% of GDP in all Pacific SIDS from 2014 to 2020. Samoa’s small population and remote location mean that any infrastructure projects have high per capita costs, which is reflected in the amount of ODA the country receives in per capita terms. In the median year from 2010 to 2020, ODA receipts amounted to the equivalent of USD 660 per Samoan citizen, more than three times higher than the USD 192 per capita in all Pacific SIDS, and an order of magnitude larger than the USD 32 per capita among all recipients of ODA. ODA commitments peaked in 2019 and 2020, at USD 194 million and USD 180 million respectively, before falling again close to pre-COVID levels in 2021.

ODA offered significant relief to Samoa’s budget pressures during the COVID-19 crisis. Although more than half of ODA is dedicated to project-type interventions, which made up 54% of ODA commitments in 2021, budget support has grown considerably, from 6% in 2018 to 20% in 2020 and 31% in 2021. In 2021, all ODA commitments took the form of grants, in line with a trend observed since 2017. The only donor to provide ODA loans was the IMF, which committed USD 22.5 million in 2020.

ODA is highly concentrated among a few donors and in social sectors. The largest donors are Australia (USD 31 million in 2021), New Zealand (USD 31 million), European Union institutions (USD 15 million), the Asian Development Bank (USD 12 million) and Japan (USD 9 million). Together, these donors accounted for 94% of total ODA commitments to the country. The public sector is the largest channel for ODA, receiving 45% of commitments in 2021. It is followed by multilateral organisations (27%), teaching and research institutes and think tanks (13%) and civil society (7%). Between 2019 and 2021, health and education received the highest amounts of ODA, making up 24% and 21% of all sector-allocable ODA commitments, while general budget support was 14%. In the same period, economic infrastructure accounted for 16% of sector-allocable ODA, most of which (84%) targeted transport infrastructure.

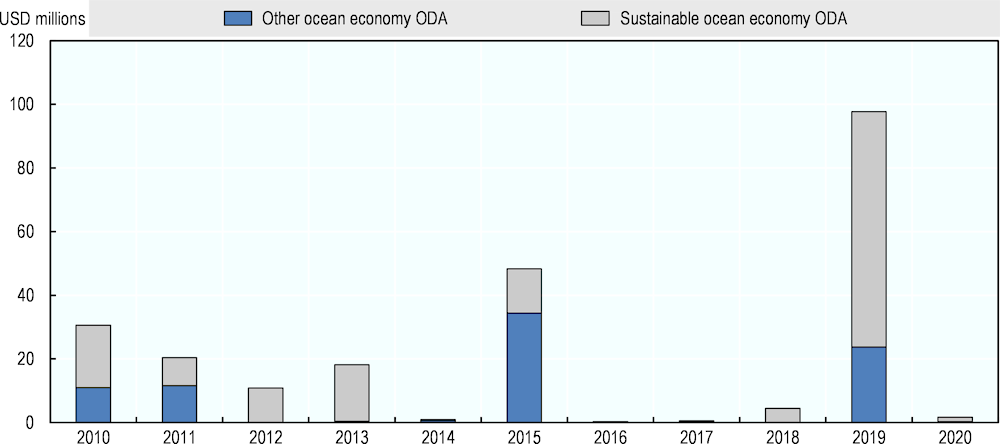

ODA targeting Samoa’s ocean economy (ocean economy ODA) stands at moderate levels but is highly volatile. On average, Samoa received USD 21 million of ocean economy ODA per annum between 2010 and 2020, representing more than 15% of its total ODA. This compares to 8.5% in all Pacific SIDS, 13.7% in all SIDS, 1.2% in all upper middle-income countries and 1.5% globally. However, these numbers are driven by a few large investment projects, particularly two projects to upgrade and improve port infrastructure in Apia, respectively funded by the Asian Development Bank in 2019 and the Government of Japan in 2015.1 The volatility observed in Samoa’s ocean economy ODA is also partly explained by the fact that ocean economy ODA figures are based on commitments, which record the face value of the activity at the date a grant or loan agreement is signed (whereas actual disbursements are often spread out over several years).

Samoa receives a larger share towards its sustainable ocean economy compared to peer countries. Roughly two-thirds (65%) of Samoa’s ocean economy ODA from 2010 to 2020 explicitly integrated marine conservation and/or sustainable economic activities relating to the ocean (i.e., sustainable ocean economy ODA) (Figure 3.3). This figure compares to 63% in Pacific SIDS, 57% in all SIDS, and 55% globally. With 10% of overall ODA targeting its sustainable ocean economy, Samoa receives more assistance towards this sector than its peer group of Pacific SIDS (5%). However, this result is partly driven by the 2019 Asian Development Bank Project to improve the port of Apia, which includes measures to adapt the infrastructure to rising sea levels. Excluding this project from the analysis reduces the share of sustainable ocean economy ODA in Samoa’s overall ODA to 6% in line with its peer group of Pacific SIDS.

Figure 3.3. A relatively large share of ocean economy ODA in Samoa targets the sustainable ocean economy

Note: 2020 constant prices

Source: Authors’ calculations based on OECD (2023[2]) Creditor reporting system database, https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

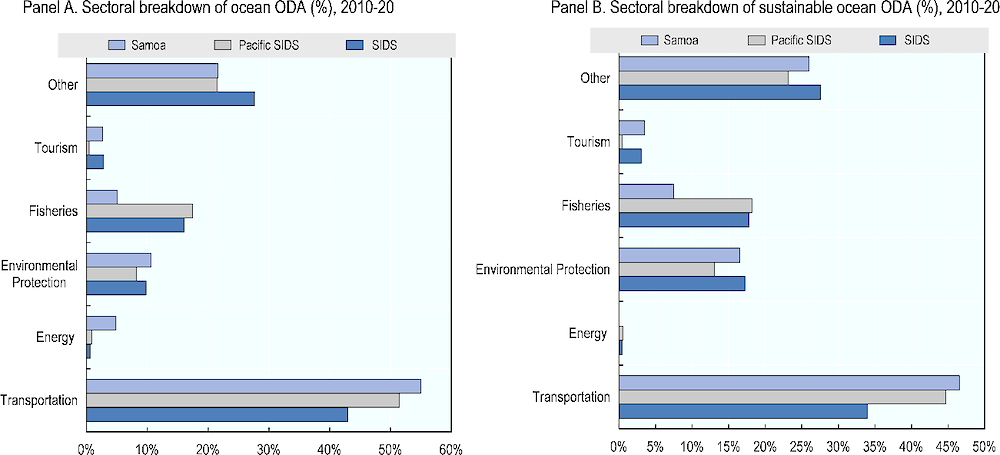

In terms of sectoral allocation, Samoa’s ocean economy ODA primarily targets transportation (55% of the total), followed by environmental protection (11%), fisheries (5%), and energy (5%) (Figure 3.4). The relatively large share of ODA invested in the transportation sector is representative of general patterns in other Pacific SIDS (52%). On the other hand, Samoa receives a smaller share of ocean economy ODA for fisheries compared to other Pacific SIDS (18%), which may be explained by the small size of its exclusive economic zone, as described in Section 1.5. Samoa’s large share of ODA to the energy sector (5% as compared to 1% in other Pacific SIDS) was driven purely by the investment into a single project of USD 11 million by the OPEC Fund for International Development. However, since this project funded the construction of petroleum tanks and a fuel barge, it is not within the scope of ODA for a sustainable ocean economy. Lastly, the tourism sector received a very small share (<1%) of ocean economy ODA, suggesting that there is scope to expand donors’ support in this area, especially in light of the government’s intention to expand this sector.

Figure 3.4. A majority of ODA for the ocean economy flows to the transportation sector

Source: Authors’ calculations based on OECD (2023[2]) Creditor reporting system database, https://stats.oecd.org/Index.aspx?DataSetCode=crs1

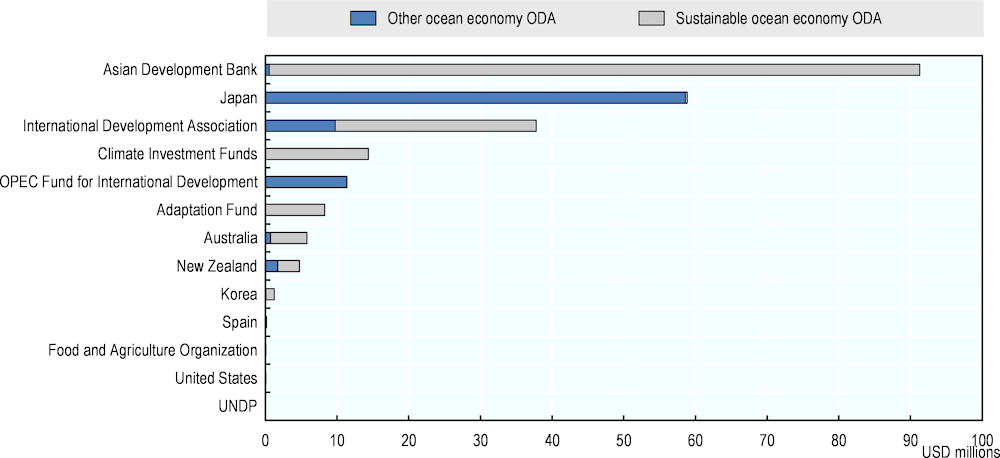

Samoa’s ocean economy ODA is highly concentrated, with the three largest providers contributing 80% of the total. The five largest providers of ocean economy ODA towards Samoa from 2010 to 2020 were the Asian Development Bank with USD 91 million (39%), Japan with USD 59 million (25%), the International Development Association with USD 38 million (16%), the Climate Investment Funds with USD 14 million (6%), and the OPEC Fund for International Development with USD 11 million (5%) (Figure 3.5). The five largest providers of sustainable ocean economy ODA were the Asian Development Bank with USD 91 million (60%), the International Development Association with USD 28 million (19%), the Climate Investment Funds with USD 14 million (10%), the Adaptation Fund with USD 8 million (6%), and Australia with USD 5 million (3%). The largest three contributors thus amounted to 89% of sustainable ocean economy ODA. It is noteworthy that 70% of ocean economy ODA and 94% of sustainable ocean economy ODA were contributed by multilateral providers of development assistance.

Despite relatively high levels of ocean economy ODA, there is room to more explicitly focus donor support on the ocean economy. Interviews with donors in Samoa found that they do not explicitly factor in ocean economy-related considerations into their ODA projects and that they do not consider the SOS a framework for aligning their ODA support with Samoa’s sustainable development priorities. Samoa has a well-functioning donor co-ordination mechanism, led by the Ministry of Foreign Affairs and Trade, which facilitates and streamlines communication between the government and donors. Anchoring the SOS in these mechanisms could help to increase the momentum around the SOS and more systematically mobilise financial and technical support for its implementation.

Figure 3.5. The largest donors of ocean economy and sustainable ocean economy ODA to Samoa are multilateral development banks and Japan

Note: Sum of ODA commitments over the 2010-2020 period; figures in 2020 constant prices.

Source: Authors’ calculations based on OECD (2023[2]). Creditor reporting system database, https://stats.oecd.org/Index.aspx?DataSetCode=crs1

Several SOS priorities, such as tourism and the fight against land-based pollution, receive comparatively limited ODA and would benefit from an increased donor focus. ODA to curb land-based pollution of the ocean is very small in volume. Only 0.2% of ODA in Samoa has been directed at curbing land-based pollution of the ocean. This compares to 0.6% in all Pacific SIDS. Similarly, Samoa received only USD 440 000 (0.03% of overall ODA) towards management of plastics and solid waste management during the 11 years from 2010 to 2020. At 0.3% of ODA, this figure is much larger in all Pacific SIDS, even though overall volumes in this area are low throughout the region. As noted in Chapter 1, Samoa’s tourism sector has a relatively low impact on local employment compared to peer Pacific SIDS countries. Additional donor support for skills development could help increase linkages between the tourism sector and the labour market and enhance the impact on socioeconomic development and reduce poverty.

Donor support for capacity development for the SOS will play a crucial part in its implementation. The European Union’s support for marine spatial planning with technical support from the International Union for the Conservation of Nature exemplifies how donors can help develop local skills and knowledge to facilitate the implementation of the SOS. ODA for capacity development in 2021, estimated using a methodology developed by the OECD (Casado Asensio, Blaquier and Sedemund, 2022[16]), totalled USD 16 million (16% of ODA). In general, ODA for capacity development has been volatile, ranging from USD 5 million in 2014 (4% of total ODA) to USD 28 million in 2012 (25%). The fluctuations are driven by single large projects in water and transport infrastructure, which include technical assistance in policy and administrative management. If investment in local capacity is to have a lasting impact, capacity needs to be internalised and retained in local institutions. Donors can co-operate with local partners and regional institutions to ensure continued capacity development even after their assistance is phased out.

3.2. Private finance

Remittances are a major source of financing, but labour mobility also generates socio-economic challenges

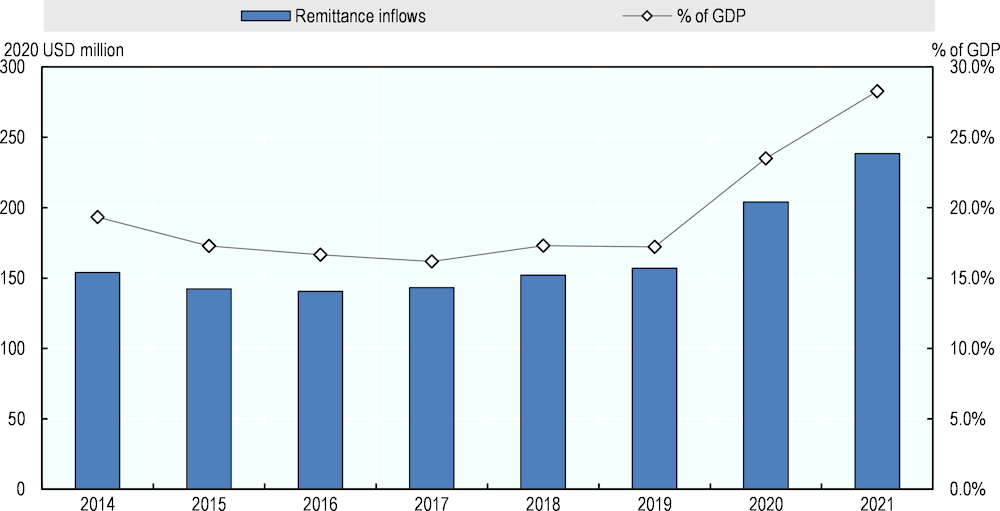

Samoa has a stark reliance on remittances, which have increased steeply from 19% in 2014 to 28% of GDP in 2021. Contrary to concerns that inflows would decline over time, remittances have proved to be a steady and even increasing source of financing. Remittance flows increased especially sharply during the pandemic to an all-time high of USD 239 million in 2021, after growing by 30% and 17% between 2019-2020 and 2020-21 (Figure 3.6).

Figure 3.6. Contrary to expectations, remittances increased sharply throughout the pandemic

Source: Authors’ calculations based on World Bank (2023[3]), World Development Indicators database, https://databank.worldbank.org/source/world-development-indicators#.

Samoa’s largest sources of remittances are New Zealand (40% of remittances in December 2022), and Australia (39%) with smaller amounts from the United States (18%), of which 5% from neighbouring American Samoa (Central Bank of Samoa, 2022[17]). A detailed breakdown of the originating countries of remittance inflows can be found in Chapter 1. Under their labour mobility schemes,2 Australia and New Zealand let Pacific workers seasonally migrate to access higher-paying jobs (e.g. in fruit and vegetable picking and packing, pruning, poultry farming, fishing, tourism, etc.). Transfers from migrants come in various forms besides traditional remittances. They can be recorded as tourism receipts, since migrants visiting relatives for family celebrations and church conferences constitute a substantial share of tourism in Samoa. Returning migrant workers often buy items abroad and bring them back to Samoa, which is effectively a hidden form of imports.

The social impact of labour mobility programmes is not without controversy, but the programmes can be used for capacity development of the migrant workforce. Although the seasonal worker schemes are intended to target unskilled and/or unemployed workers, in some cases, skilled and employed workers leave their jobs to join the programmes. These schemes have been found to lead to social problems, notably for dependents in Samoa without economic means. As a response, Samoa’s government launched the National Regional Seasonal Workers Programme Policy to come into effect in April 2023, which strengthens the selection criteria of unskilled workers, the terms of employment and working conditions and insists on the strict observation of social, cultural and moral values (Island Business, 2023[18]). Labour mobility programmes can also have a positive social impact, enhancing the skills of the migrant workforce and thereby contributing to the quality of labour. New Zealand introduced a development component in seasonal schemes, providing migrant workers with climate and agricultural training. Australia’s Seasonal Workers Program has an Add-On Skills Training programme that is currently under review and focuses on topics such as first aid, English and information and technology skills (ILO, 2021[19]).

Structural constraints typical of SIDS limit private sector investment

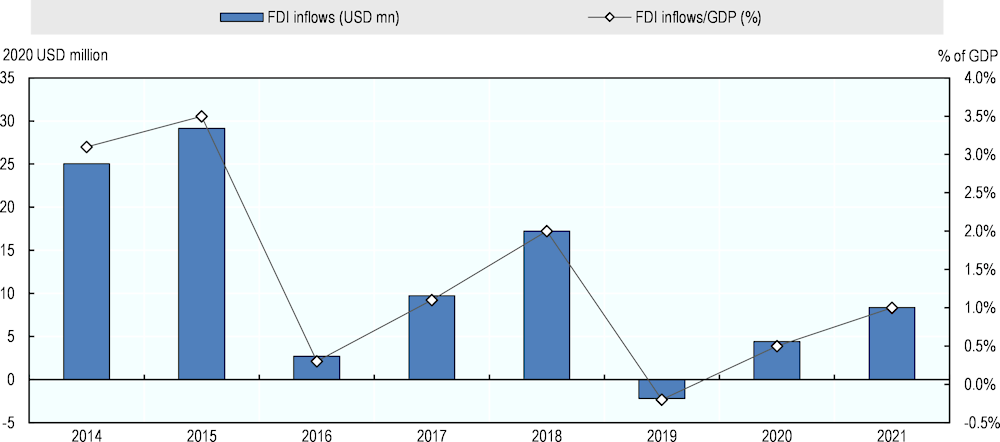

Constrained by the small size of the economy and a challenging business environment, foreign direct investment (FDI) takes a subordinate role in Samoa’s external finance. Net FDI inflows peaked at USD 29 million (3.5% of GDP) in 2015 but fell to a net outflow of USD 2 million in 2019, after which it rose again for two consecutive years, to USD 4 million in 2020 and USD 8 million (1% of GDP) in 2021 (Figure 3.7). In comparison, gross fixed capital formation in Samoa amounted to 33% in 2020 and 2021, suggesting that FDI makes a limited contribution to Samoa’s capital formation. The Ministry of Commerce, tasked with the regulation and promotion of investment, lists tourism, fisheries, food processing, engineering (boat building and metal fabrication), as well as the textile and garment industries, as priority investment sectors (Government of Samoa, 2022[20]).

Figure 3.7. Foreign direct investment inflows to Samoa are small and volatile

Source: Authors’ calculations based on World Bank (2023[3]), World Development Indicators database, https://databank.worldbank.org/source/world-development-indicators#.

Limitations in attracting FDI reflect broader challenges in the general business climate and the constraints of small and remote economies in achieving economies of scale. Samoa’s overall rank in the 2020 Doing Business Survey (ranked 98th, with a score of 62.1 of 100) was higher than other SIDS in the region (World Bank, 2020[21]), and Samoa is recognised as a regional best practice leader for its transparent and fair business regulations (US Department of State, 2022[22]). Accounting, legal and regulatory procedures are all consistent with international norms. However, past assessments found that Samoa faces considerable challenges in access to credit (UNDP, 2019[9]), which are representative of the general constraints faced by SIDS. With four commercial banks operating on the island, the financial sector in Samoa is concentrated and undiversified. Despite the recent growth of the financial sector and several attempts to bring in innovative business solutions, the menu of financial services offered to the public is limited and inaccessible to low-income groups and small and medium-sized enterprises, particularly those in rural areas. In addition to commercial banks, state-owned financial institutions also play a significant role in providing a wide variety of financial services. These include the Samoa National Provident Fund, Development Bank of Samoa, Samoa Housing Corporation, Accident Compensation Corporation and Unit Trust of Samoa.

Donors support private sector development by assisting the government on simplified business laws and registration processes, as well as promoting greater access to finance for micro-, small and medium-sized enterprises. For example, the Pacific Private Sector Development Initiative, a collaborative technical assistance programme by the Asian Development Bank, Australia and New Zealand, developed a secured transactions framework – which allows lenders to accept non-land (movable) assets as security and works with the Central Bank of Samoa to develop a Samoa-domiciled and controlled credit bureau. The initiative also provided technical assistance to the Development Bank of Samoa aimed at strengthening the financial position of the bank, improving its operations and reorienting its role toward a private sector focus (PSDI, 2022[23]).

Building on existing partnerships, donors and their development finance institutions could help to promote private sector development in support of the SOS. This could include financial support and technical assistance for commercial and state-owned financial institutions, to provide loans and other assistance to local businesses in the fisheries and tourism sectors, and to ensure that social and environmental safeguards are in place to ensure alignment with the SOS. A pipeline of eligible projects could be identified in the context of the sector plans listed in Chapter 2 as being relevant to implementing the SOS (e.g. Samoa Tourism Sector Plan, Agriculture and Fisheries Sector Plan, Transport Sector Plan). An example to benchmark is the International Finance Corporation (IFC)’s support for the Bank of Qingdao. In 2022, IFC, in collaboration with the Asian Development Bank, Proparco and Deutsche Investitions- und Entwicklungsgesellschaft (DEG), provided a USD 150 million blue loan to the Bank of Qingdao, enabling the bank to provide USD 450 million in financing for 50 blue finance projects in China by 2025. In advance of this transaction, IFC worked with the Bank of Qingdao to develop business strategies and systems to optimise opportunities while managing risks associated with blue finance activities and to create the bank’s first blue finance framework and taxonomy, which identifies 37 activities across seven categories (Liwei, Shiyu and Ziyi, 2022[24]).

3.3. Innovative finance

Innovative financing can complement the suite of financing instruments

The rising sustainable finance momentum opens new opportunities for ocean-related investments. In recent years, financial markets witnessed the exponential growth of sustainable finance and the emergence of diverse instruments based on green or social use-of-proceeds or sustainability targets. Investors are also showing a growing interest in blue finance, which are investments in projects that restore and protect the ocean environment and support sustainable ocean economic activities. According to a 2020 survey by Responsible Investor, nine out of ten institutional investors are interested in financing the sustainable ocean economy (Responsible Investor, 2020[25]). In parallel, there have been initiatives to develop principles and industry standards, to establish greater clarity around the definition and best practices of blue finance. The Sustainable Blue Economy Financing Principles (European Commission; WWF; WRI; EIB, 2018[26]), developed by the World Wildlife Fund, the European Commission, the European Investment Bank and the World Resources Institute in 2018, outlined a high-level ocean-specific framework for responsible investment. In 2022, the IFC developed a guidance on IFC’s implementation of Blue Finance (IFC, 2022[27]). This guidance identifies project eligibility criteria, translating general Blue Economy Financing Principles, such as the Sustainable Blue Economy Principles and the Sustainable Ocean Principles, towards guidelines for blue bond issuances and blue lending (Table 3.2).

Table 3.2. IFC guidelines provide a mapping of sectors and activities suitable for issuing blue bonds and loans

Green bond principles and green loan principles broad categories of eligibility

|

Blue Finance Area |

Pollution Prevention and Control |

Natural Resource Conservation |

Biodiversity |

Climate change |

|

|---|---|---|---|---|---|

|

Mitigation |

Adaptation |

||||

|

Water supply |

*** |

** |

** |

*** |

** |

|

Water sanitation |

*** |

** |

** |

*** |

** |

|

Ocean-friendly and water-friendly products |

*** |

* |

|||

|

Ocean-friendly chemicals and plastic related sectors |

*** |

* |

* |

||

|

Sustainable shipping and port logistics sectors |

*** |

* |

** |

*** |

* |

|

Fisheries, aquaculture, and seafood value chain |

*** |

** |

* |

* |

|

|

Marine ecosystem restoration |

** |

*** |

*** |

* |

* |

|

Sustainable tourism services |

** |

** |

|||

|

Offshore renewable energy production |

* |

** |

*** |

||

Note: *** denotes primary or direct effects; ** denotes secondary or direct effects; * denotes tertiary or derived effects. Dark blue denotes strong impact; medium blue denotes some impact; light blue denotes minor impact

Source: IFC (2022[27]), Guidelines for Blue Finance, https://www.ifc.org/content/dam/ifc/doc/mgrt/ifc-guidelines-for-blue-finance.pdf

A growing sense of urgency about the climate and development challenges has prompted several reform initiatives to fundamentally review and bolster the development finance system by massively scaling up resources to support climate and development objectives. Samoa is well placed to benefit from these initiatives, as they often highlight the specific financing needs of SIDS, which are highly vulnerable to climate change. The World Bank Group-IMF 2023 Spring Meetings centred on discussions of the Evolution Roadmap, which was published in January 2023, to propose a review of the World Bank’s vision and mission, operating model and financial capacity. A key aim of the review is to expand the World Bank’s current dual mission of eradicating extreme poverty and increasing shared prosperity to better support energy transitions in middle-income countries, address growing inequality between countries, and combat the cross-border dimensions of challenges such as climate change, state fragility and pandemics.

Proposals to reform the development finance system, if implemented, could unlock the resources to bring to scale innovative financing techniques for ocean-related investments. Concessional finance from donors is often necessary to adjust risk-return profiles of sustainable ocean economy projects to attract private investors. For many of the innovative instruments, credit enhancement in the form of guarantees or other loss-absorption techniques are vital to make the transaction commercially viable. Moreover, donors can also provide technical assistance to identify and prepare projects that would be eligible for investment through innovative instruments like the ones listed in the following sections.

Blue bonds could be included in the medium- to long-term financing plan of the SOS

Blue bonds are debt instruments that raise and earmark funds for investments like water and wastewater management, reducing ocean plastic pollution, marine ecosystem restoration, sustainable shipping, eco-friendly tourism or offshore renewable energy. Issuance of blue bonds requires the creation of a blue bond framework, which includes a typology of blue projects (categorising the types of eligible projects), as well as eligibility criteria for each sector. The framework also indicates how the blue impact of the projects will be tracked and reported. The proceeds raised from the sale of the bond can only be used to finance projects that fulfil the eligibility criteria outlined in the framework. In return for this commitment, issuers of blue bonds may be able to tap into a new investor base (e.g. impact investors) and sometimes benefit from lower interest rates (e.g. the greenium). TMBThanachart Bank Public Company Limited, a commercial bank based in Thailand, issued a blue bond in 2022, committing to use the funds raised to invest in so-called blue assets such as marine plastic recycling, water conservation and wastewater treatment projects. The USD 50 million bond was sold to IFC through a private placement. In January 2023, Cabo Verde launched a blue bond on its Blu-X sustainable finance platform, a regional platform for listing and trading sustainable and inclusive financial instruments. The issuance aimed to raise domestic, regional and global investment in Cabo Verde’s rising ocean economy, while divesting capital from industries responsible for sea-level rise, pollution and other transgressions against ocean rights. In launching the bond, the government committed to using up to USD 1 million in proceeds (minimum USD 500 000) to supply affordable loans to microentrepreneurs and start-ups in coastal communities, and USD 1.5 million for structural investments in small and medium-sized enterprises operating in the maritime and fisheries sectors.

In Samoa’s case, blue bonds may not be an instrument for immediate consideration, but they could be included in medium to long-term fiscal strategies. The government’s hesitation to take on new debt, due to the debt sustainability constraints described above, rules out the sovereign issuance of blue bonds in the near term. There are also capacity constraints to design or implement blue bonds. On the corporate side, the pool of potential commercial issuers remains limited. The number of commercial lenders is small, and bond issuance by dominant state-owned players such as the Development Bank of Samoa, which could scale up lending for blue economy investments, would add to public sector debt. However, Samoa’s government can consider incorporating blue bonds in its financing toolbox in the long term. Preparation for eventual issuances can include the predetermination of debt levels and terms and conditions at which the issuance of new debt instruments would become acceptable.

Benefits of blue bonds as a financing instrument include the opportunity to broaden and diversify the lender base, increasing the amount of capital that can be invested in the ocean economy. Emerging market borrowers often state that green and sustainability-labelled bonds help them gain access to new investors, including institutional investors from developed markets and impact investors. Colombia’s first sovereign green bond in 2021 registered high levels of demand (resulting in an oversubscription of five times the amount at auction), which led to interest rates that were below those of conventional bonds (OECD, 2022[28]). While it is not likely that the interest rates paid on a commercial bond would be competitive with the concessional rates Samoa has currently access to, donor assistance, for example in the form of credit enhancement, could help to substantially lower borrowing costs compared to alternative solutions to non-concessional borrowing.

Preparing for the issuance of blue bonds in the medium- to long-term future involves putting into place a robust system of ocean governance, sustainable economic activities and sizable pipelines of loan projects. In the case of a sovereign issuance, the blue bond can only be effective and credible as a financing tool to enhance the sustainability of oceans if it is underpinned by an effective ocean governance framework, which includes strong institutions with mandates to protect the ocean and grow a sustainable blue economy, strategies and policies to protect ocean habitats and species, clear regulatory frameworks to define which types of economic activities are allowed in and adjacent to the oceans, and an effective system of monitoring and enforcement (ADB, 2021[29]). The implementation of the SOS is therefore key to laying the foundation for a successful blue bond issuance. As a debt instrument requiring the repayment of principal with interest, blue bonds are best suited to finance projects that generate revenues. A financing strategy of the SOS could therefore include a mapping of eligibility criteria for sectors and projects that would lend themselves for the issuance of blue bonds in Samoa. This can include projects related to sustainable fishing, ecotourism, waste management and marine renewable energy. Conversely, blue bonds are difficult to use as a financing tool for marine protected areas that prohibit economic activities and other conservation activities that do not have a revenue base (ADB, 2021[29]).

Swaps could be considered as a contingency option in the event of an escalating debt situation in Samoa

Debt swaps may be less suitable as a financing instrument for Samoa’s ocean strategy but could be included as a contingency option in the event of an escalating debt situation. Debt for nature (DFNS) and other swaps (e.g. climate or resilience swaps) offer countries in distress or at risk thereof opportunities for debt relief or restructuring in exchange for commitments to protect and conserve their oceans. Debt swaps are usually considered if countries are heavily indebted, and if they have exhausted other more favourable debt relief instruments (e.g. unconditional debt relief) (OECD, n.d.[30]). Creditors need to have an incentive to agree on a haircut on the debt they hold, which is often only the case when their prospects of getting repaid are low. While Samoa’s public debt, at 54% of GDP, is not negligible, it is far lower than in the countries that recently underwent DFNS. Belize’s public debt-to-GDP ratio, for example, stood at 123% in 2020, and in Barbados, which engaged in a DFNS with the Nature Conservancy in 2022, central government debt reached 142% of GDP in 2021.

DFNS can help government fund resilience when access to traditional grants or debt relief is limited. The IMF shows cautious optimism about DFNS, arguing that in the absence of other measures to invest in nature or climate action, DFNS present a welcome tool (Georgieva, Chamon and Thakoor, 2022[31]). To the extent that debt reduction exceeds the new spending commitments, borrowers get fiscal relief through budget savings. Swaps also create additional revenue for countries with valuable assets such as biodiversity or carbon sinks, by allowing them to charge others for protecting it and providing a global public good. According to the IMF, however, it is more effective to address debt and climate or nature separately. A climate-conditional grant, for example, finances climate action more efficiently than a complex and costly debt swap transaction. Swaps are also no substitute for broad-based debt restructuring for countries in debt distress. Recently, several SIDS countries engaged in DFNS transactions to free up resources to protect and conserve marine assets. In November 2021, Belize signed a debt-for-nature swap with the Nature Conservancy, which reduced its external debt by 10% of its GDP. In return, Belize agreed to spend about USD 4 million a year on marine conservation until 2041, and to double its marine-protection parks – spanning coral reefs, mangroves and the sea grasses where fish spawn – from 15.9% of its oceans to 30% by 2026. An endowment fund of USD 23.5 million will finance conservation after 2040 (Owen, 2022[32]).

Samoa can explore how to benefit from emerging opportunities in blue carbon, payment for ecosystem services and insurance

Carbon credit sales from additional sequestration and storage in coastal ecosystems, blue carbon, may provide a source of financial incentive for locally led climate change mitigation and adaptation. Coastal ecosystems like mangroves are increasingly being recognised as key assets in climate change mitigation and adaptation efforts. From a mitigation perspective, these ecosystems, despite the small area covered, store a high density of carbon (up to six times as much as tropical forests). This presents an opportunity to invest a relatively small amount in local communities, which can restore these areas and return large carbon sequestration and storage gains per unit of area. The most successful and oldest mangrove-based carbon-crediting project, Mikoko Pamoja of Gazi Bay, in Kenya, has been issuing credits since 2010 under the Plan Vivo carbon standard. The project leverages the restoration of 117 hectares of mangrove forest to generate approximately USD 24 000 per annum to support community projects and development priorities.

The value of carbon credits depends on several factors, such as the risk of non-permanence, the geography, the co-benefits and the degree to which these benefits are represented in the price, and the carbon standard used. In general, the value ranges between USD 10 and USD 25 per ton of CO2, although outliers exist below and above this range. Although the returns of carbon credits rarely cover the costs of the restoration efforts that underpin their generation, the co-benefits of the work far outweigh the revenue generated through credit sales. For example, coastal ecosystems deliver value through their productivity of fisheries resources, timber and non-timber forest products, and coastal asset protection against increasing storm pressures.

The drive to engage in carbon crediting is often to generate a fund that can be used to support target community development priorities, with the drive for restoration often being to increase climate change resilience and long-term food security through restoring ecosystem goods and services. However, carbon credit projects require robust systems for measurement, reporting and verification, which are necessary to measure and prove whether and by how much a mitigation project has reduced greenhouse gas emissions. Like many other SIDS, Samoa currently lacks the resources and capacity to set up these systems, and support from donors will be critical to enhance the feasibility of any blue carbon projects. Samoa received support from several development partners including the United Nations Climate Technology Centre and Network to access the Reducing Emissions from Deforestation and Forest Degradation-plus programme (UN CTCN, 2022[33]).

Payments for ecosystem services (PES) programmes can be used to conserve marine and coastal ecosystems. Under PES programmes, those who would benefit from the enhanced provision of ecosystem services make payments to resource owners to incentivise higher (or additional) ecosystem service provision. Potential buyers may include ocean-based industries (e.g. fishing, tourism, recreation and marine renewable energy), municipalities, and governments. For example, local hotels and tourism operators could pay for reef conservation due to the benefits associated with decreased beach erosion and species conservation (e.g. for scuba divers). Samoa is currently investigating the feasibility of a PES programme as part of the Green Climate Fund-supported Vaisigano Catchment Project (Samoa Observer, 2020[34]). The aim is to introduce a PES programme that would pay landowners for maintaining or enhancing the services that the Vaisigano catchment provides in terms of clean water, air, safeguarded biodiversity and forested slopes. In the pilot phase, to end in May 2023, landowners are being consulted to identify suitable watershed management activities and governance and financial distribution mechanisms to allow for the sustainable operations of the PES programmes. Based on the results of the pilot phase, the government of Samoa, with support from international donors, could explore options to implement and expand PES programmes to generate funding for different areas outlined in the Samoa Ocean Strategy.

Samoa could benefit more from insurance against natural disasters. Samoa already has access to several global and regional risk transfer instruments. Since 2015, it has been a member of the regional catastrophe insurance platform, the Pacific Catastrophe Risk Insurance Company, which is a parameter-based insurance cover against disaster hazards. Annual insurance premiums through 2023, of around USD 0.5 million a year, are mostly financed through the World Bank-funded Pacific Resilience Program, with the Samoan Government contributing a small share of the premiums that will increase over time. In 2020, the insured hazards were earthquakes and tropical cyclones, with coverage of up to USD 10.7 million. In the case of climate change-induced natural disasters, Samoa can also access the Asian Development Bank’s Contingent Disaster Financing and the Asia-Pacific Disaster Response Fund. However, according to the IMF, public assets insurance could be extended to cover major infrastructure, and domestic private insurance can be further developed (IMF, 2022[10]). Under the 2001 Public Finance Management Act (Samoa Ministry of Finance, 2001[35]), the government pays into an insurance fund to cover government buildings against fire, earthquake or other hazards on an indemnity value basis, but it excludes coverage of other public infrastructure assets, such as bridges or roads.

Attempts have recently been mounted to devise insurance mechanisms to incentivise coastal protection. The Nature Conservancy, in co-operation with insurers such as Munich Re, has explored insurance instruments for coastal ecosystems (Reguero et al., 2020[36]). The proposed insurance scheme would incentivise the restoration of coral reefs to harness their potential to mitigate coastal flood risks. The insurance buyer (e.g. governments), who would receive compensation against flood-related losses, is granted a reduction in premiums if an investment is made in coral reef restoration. The annual savings from reduced insurance premiums can be used to partially finance the upfront investment in the restoration project. In addition to expanding public and private insurance against the effects of climate change, insurance schemes could be designed to incentivise disaster risk reduction through nature-based solutions and the conservation of ocean assets. In this area in particular, Samoa could benefit if international donors covered a portion of the insurance premiums and/or provided technical assistance on setting up innovative insurance solutions. Samoa could also benefit from international initiatives to ensure financing for loss and damage to complement existing funds for climate disaster relief. The 27th Conference of the Parties to the United Nations Framework Convention on Climate Change concluded with a decision to set up a loss and damage fund to support countries particularly vulnerable to the adverse effects of the climate crisis. During its G7 Presidency, Germany also launched the development of a “Global Shield against Climate Risks” to expand the role of climate risk insurance and prevention, in close co-operation with the Vulnerable Twenty Group.

References

[29] ADB (2021), Sovereign blue bonds – A quick start guide, https://www.adb.org/sites/default/files/publication/731026/adb-sovereign-blue-bonds-start-guide.pdf.

[16] Casado Asensio, J., D. Blaquier and J. Sedemund (2022), Strengthening capacity for climate action in developing countries: Overview and recommendations, OECD Publishing, Paris, https://doi.org/10.1787/0481c16a-en.

[17] Central Bank of Samoa (2022), Visitor earnings & remittances, https://www.cbs.gov.ws/statistics/visitor-earnings-and-remittances/.

[26] European Commission; WWF; WRI; EIB (2018), Sustainable Blue Economy Finance Principles, https://www.unepfi.org/blue-finance/the-principles/.

[31] Georgieva, K., M. Chamon and V. Thakoor (2022), Swapping Debt for Climate or Nature Pledges Can Help Fund Resilience, https://www.imf.org/en/Blogs/Articles/2022/12/14/swapping-debt-for-climate-or-nature-pledges-can-help-fund-resilience.

[20] Government of Samoa (2022), Samoa Investment Guide, https://www.mcil.gov.ws/storage/2022/05/Samoa-Investment-Guide-2022-FINAL-27-05-22-1.pdf.

[27] IFC (2022), Blue Finance Guidelines, IFC, https://www.ifc.org/content/dam/ifc/doc/mgrt/ifc-guidelines-for-blue-finance.pdf.

[19] ILO (2021), Seasonal worker schemes in the Pacific through the lens of international human rights and labour standards: A summary report, International Labour Organization, https://www.ilo.org/suva/publications/WCMS_832224/lang--en/index.htm.

[5] IMF (2023), IMF Staff Completes 2023 Article IV Mission to Samoa, https://www.imf.org/en/News/Articles/2023/02/02/pr2329-imf-staff-completes-2023-article-iv-mission-to-samoa.

[10] IMF (2022), Samoa: Technical Assistance Report – Climate Macroeconomic Assessment Program, https://www.imf.org/en/Publications/CR/Issues/2022/03/21/Samoa-Technical-Assistance-Report-Climate-Macroeconomic-Assessment-Program-515505.

[8] IMF (2021), Samoa: 2021 Article IV Consultation: Press Release and Staff Report, IMF, https://www.imf.org/en/Publications/CR/Issues/2021/03/19/Samoa-2021-Article-IV-Consultation-Press-Release-and-Staff-Report-50283 (accessed on 30 March 2023).

[18] Island Business (2023), Samoa’s RSE Scheme resumes with 1 200 workers this month, https://islandsbusiness.com/news-break/samoas-rse-scheme-resumes-with-1200-workers-this-month/.

[11] Klurman, M. (2023), “Thailand becomes latest country to impose a ’tourist tax’ as trend spreads globally”, https://thepointsguy.com/news/thailand-proposes-new-tourist-tax/.

[24] Liwei, W., W. Shiyu and T. Ziyi (2022), “IFC Provides $150 million Blue Syndicated Loan to Bank of Qingdao”, Caixin Global, https://www.caixinglobal.com/2022-06-25/ifc-provides-150-million-blue-syndicated-loan-to-bank-of-qingdao-101904201.html.

[13] Ministry of Finance (2022), Quarterly Public Debt Bulletin, https://www.mof.gov.ws/wp-content/uploads/2022/12/QDB-Sept-22.pdf.

[2] OECD (2023), Creditor Reporting System, https://stats.oecd.org/Index.aspx?DataSetCode=crs1.

[28] OECD (2022), Green, social, sustainability and sustainability-linked bonds in developing countries: How can donors support public sector issuances?, OECD Publishing, https://www.oecd.org/dac/green-social-sustainability-and-sustainability-linked-bonds.pdf.

[7] OECD (2022), Recovering from COVID-19: How to enhance domestic revenue mobilisation in small island developing states, OECD Publishing, https://www.oecd.org/coronavirus/policy-responses/recovering-from-covid-19-how-to-enhance-domestic-revenue-mobilisation-in-small-island-developing-states-45f29680/.

[6] OECD (2022), Revenue Statistics in Asia and the Pacific 2022, https://www.oecd.org/tax/tax-policy/revenue-statistics-asia-and-pacific-samoa.pdf.

[30] OECD (n.d.), Debt-for-environment swaps, https://www.oecd.org/env/outreach/debt-for-environmentswaps.htm.

[32] Owen, N. (2022), “Belize: Swapping Debt for Nature”, IMF Finance & Development, https://www.imf.org/en/News/Articles/2022/05/03/CF-Belize-swapping-debt-for-nature.

[23] PSDI (2022), Pacific Private Sector Development Initiative Annual Report FY2021, https://www.pacificpsdi.org/publications/read/pacific-private-sector-development-initiative-annual-report-fy2021.

[36] Reguero, B. et al. (2020), “Financing coastal resilience by combining nature-based risk reduction with insurance”, Ecological Economics, Vol. 169, https://doi.org/10.1016/j.ecolecon.2019.106487.

[25] Responsible Investor (2020), Investors and the Blue Economy, https://www.esg-data.com/blue-economy.

[4] Samoa Bureau of Statistics; (2022), Government Finance Statistics, https://www.sbs.gov.ws/government-finance-statistics/ (accessed on 28 April 2023).

[15] Samoa Ministry of Finance (2022), Medium Term Debt Management Strategy, https://www.mof.gov.ws/wp-content/uploads/2022/05/GoS-Medium-Term-Debt-Management-Strategy-FY2122-FY2526-1.pdf.

[35] Samoa Ministry of Finance (2001), Public Finance Management Act, https://www.mof.gov.ws/wp-content/uploads/2020/03/Public-Finance-Management-Act-2001.pdf.

[34] Samoa Observer (2020), “Land payment programme to benefit communities”, https://www.samoaobserver.ws/category/samoa/71538?utm_content=buffer59a1d&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer.

[12] Tsvetanova, E. and N. Seetaram (2018), “Consumers’ attitude to the air passenger duty in the UK: An exploratory study”, Journal of Air Transport Studies, Vol. 9/2, pp. 78–93, https://doi.org/10.38008/jats.v9i2.24.

[33] UN CTCN (2022), “Developing a framework and methodology to carbon sinks from the forestry sector using Earth observation in Samoa”, https://www.ctc-n.org/technical-assistance/projects/developing-framework-and-methodology-carbon-sinks-forestry-sector.

[9] UNDP (2019), Development Finance Assessment for Samoa, https://inff.org/assets/resource/undp-rbap-development-finance-assessment-samoa-2020.pdf.

[22] US Department of State (2022), 2022 Investment Climate Statements: Samoa, https://www.state.gov/reports/2022-investment-climate-statements/samoa/.

[14] World Bank (2023), International tourism, receipts (% of total exports) - Samoa, Wor, https://data.worldbank.org/indicator/ST.INT.RCPT.XP.ZS?locations=WS (accessed on 11 April 2023).

[3] World Bank (2023), “World Development Indicators”, https://databank.worldbank.org/source/world-development-indicators#.

[21] World Bank (2020), Doing Business 2020: Comparing Business Regulation in 190 Economies, https://openknowledge.worldbank.org/entities/publication/130bd2f3-f4b5-5b77-8680-01e6d6a87222.

[1] World Bank and IMF (2021), Samoa: Joint World Bank-IMF Debt Sustainability Analysis (English), http://documents.worldbank.org/curated/en/788041619792274473/Samoa-Joint-World-Bank-IMF-Debt-Sustainability-Analysis.

Notes

← 1. When these two projects are excluded from the analysis, annual ocean economy ODA to Samoa drops to USD 137 per annum and makes up 9% of overall ODA, roughly on par with the peer group of Pacific SIDS.

← 2. Samoa participates in Australia’s Seasonal Workers Program since 2011 and New Zealand’s Recognised Seasonal Employer Scheme since 2007.