This chapter outlines the public, private, domestic and international capital that Uzbekistan could use to finance its ambitions to boost living standards and swiftly reduce GHG emissions as well as the estimated gap between current spending and the flows that are needed. Public domestic financial flows, primarily from the state budget, and public international finance flows, from multilateral and bilateral donors, have been essential sources of Uzbekistan’s development and climate finance, but there are increasing opportunities to harness the country’s developing securities market and attract domestic and international financiers. Given budget constraints, the scale of the transition cannot be achieved without increased private sector financing and more efficient use of available resources.

Financing Uzbekistan’s Green Transition

3. Financing the transition: Capital availability

Abstract

Box 3.1. Key conclusions and recommendations

Uzbekistan depends on public spending more than its peers in the lower middle-income category. Although domestic private financing has increased, Uzbekistan needs to tap into greater volumes of domestic and international private finance.

Uzbekistan’s investment climate has improved since it launched its currency and market liberalisation reforms in 2017. Since then, domestic private financial flows and international private financial flows have increased substantially.

Recent large-scale solar and wind power generation projects have been implemented with investment capital. Although such projects have been financed to date through “vanilla” loans rather than green loans or green bonds, debt instruments could be useful in refinancing the loans. Future projects in a similar vein and of a similar scope represent low-hanging fruit for inclusion in a green bond issuance.

Since 2019, Uzbekistan has issued 10 bonds on international markets, including a sovereign sustainability bond with underlying projects supporting the Sustainable Development Goals (SDGs), a sovereign green bond and a corporate green bond. Compared to other sources of foreign capital, portfolio investments make up only a small fraction, and there is considerable scope for growth through further debt instrument issuances.

3.1. Capital availability in Uzbekistan

Domestic public finance, although it represents a significant portion of total available finance for development and climate goals, is not the only source of finance at Uzbekistan’s disposal. Between 2017 and 2020, domestic public sources accounted for 40% of financial resources at Uzbekistan’s disposal, supplemented by domestic private sources (33%), international private sources (18%) and international public sources, both multilateral and bilateral (9%) (UNDP, 2021[1]).

The sections below provide an overview of capital availability from these four categories in Uzbekistan and how they could best contribute to Uzbekistan’s sustainable transition. In particular, the facilitation of domestic private finance flows through targeted reforms offers an opportunity not only to close the financing gap but also to further develop Uzbekistan’s domestic capital market (see Chapter 4: Composition and regulatory set-up of Uzbekistan’s financial sector).

3.1.1. Domestic public financial flows

Uzbekistan’s public spending is higher than many of its peers. Compared to other lower middle-income countries, Uzbekistan’s consolidated government spending was about seven percentage points higher reflecting the state’s comparatively large role in the country’s economic model. Consolidated government spending as a share of GDP in 2020 was 35%, about seven percentage points higher than other lower-middle income countries on average (World Bank, 2021[2]).

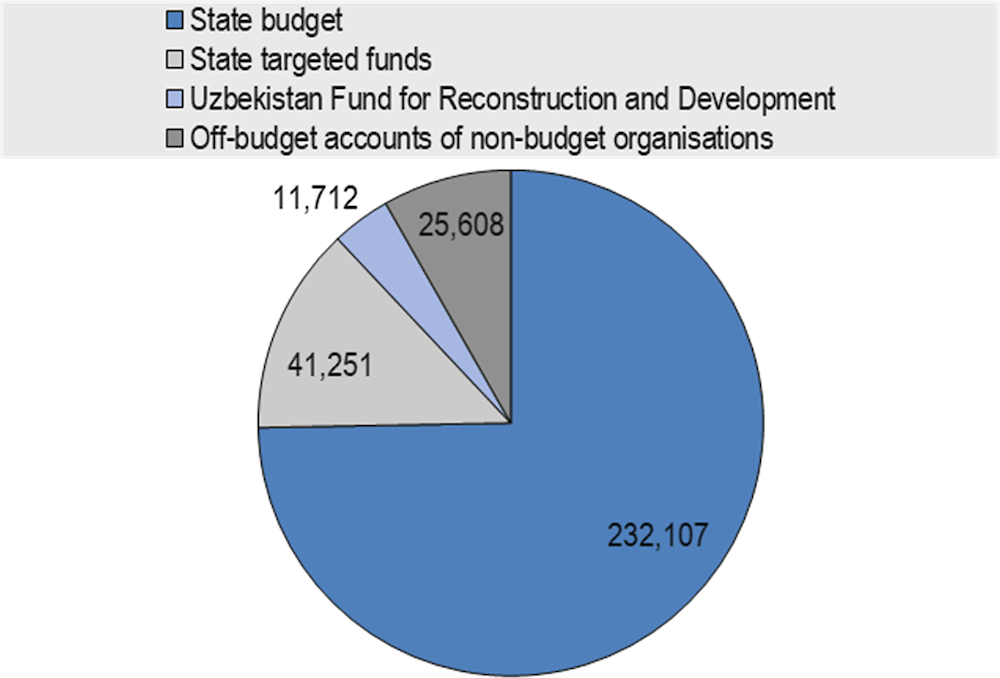

Uzbekistan’s available public finances derive from state budget revenues (taxes and other revenues), 24 targeted state funds, the Uzbekistan Fund for Reconstruction and Development and off-budget funds and organisations. Uzbekistan also has a dedicated environmental fund, the Fund for Ecology, Environmental Protection and Waste Management, created in 2017 (Government of Uzbekistan, 2017[3]). Uzbekistan’s consolidated state budget is expected to be UZS 310.7 trillion in 2023 (or approximately USD 27 billion), UZS 353.7 trillion (USD 31 billion) in 2024 and UZS 397.2 trillion (USD 35 billion) in 2025. In 2023, three quarters of the budget derive from state budget revenues, with state targeted funds (13%), off-budget accounts of budget organisations (8%) and the Uzbekistan Fund for Reconstruction and Development (4%) making up the remainder (see Figure 3.1). According to the 2023 budget, Uzbekistan plans to run a budget deficit of about 10% for the next three years (Government of Uzbekistan, 2023[4]). As a result of ambitious tax reforms supporting more efficient collection, Uzbekistan has gradually expanded its consolidated budget revenue in recent years. The 2020 budget portfolio was equivalent to 26.9% of GDP, whereas it reached 28% of GDP in 2021 (UNDP, 2021[1]).

Figure 3.1. Uzbekistan’s public finances consist of revenues from the state budget and a large number of state-owned funds

Source: Government of Uzbekistan (2023[4]), О государственном бюджете Республики Узбекистан на 2023 год [On the state budget of the Republic of Uzbekistan for 2023], https://lex.uz/ru/docs/6333242.

The Uzbekistan Fund for Reconstruction and Development, created in 2006, is tasked with providing government-guaranteed loans and equity investments to strategically important sectors of Uzbekistan’s economy. It plays a particularly important role in the provision of grants, zero-interest loans debt finance, including concessional finance, to Uzbekistan’s state-owned enterprises (SOEs) and capitalisation for state-owned banks, the largest financial institutions in Uzbekistan’s domestic market. SOEs, which dominate key sectors of Uzbekistan’s economy, benefit from generous off-budget government support that amounts to over a third of total consolidated government expenditure. Starting in 2019, Uzbekistan launched a wide-reaching privatisation programme of SOEs, which is expected to yield significant revenue for the Privatisation Fund. Annual revenue from the gradual privatisation of over 400 companies is expected to increase from UZS 223 billion (approximately USD 19.6 million) in 2020 and 2021 to UZS 273 billion (USD 23.9 million) by 2025 (UNDP, 2021[1]).

Uzbekistan is highly centralised and its subnational governments1 have limited autonomy from the central government. They play a crucial role in providing public services in Uzbekistan, implementing about 34% of national public spending, or 56% of total national spending excluding extrabudgetary accounts. Their spending is concentrated on education (43%), healthcare (21%), and public services (15%). Capital spending, in contrast, accounted for only 7% of total subnational expenditure. Transfers from the central government, mostly derived from shared tax revenues, account for about 70% of subnational revenues, and the volumes are decided annually to fill local budget gaps. As a result of Uzbekistan’s largely centralised budget allocation, local authorities lack accountability about efficient expenditure, and perverse incentives may emerge to underestimate locally collected revenue and overestimate expenditure (World Bank, 2019[5]).

Subnational governments are not permitted to run budget deficits. They can increase their expenditures only if their revenue collections exceed the forecasted amount adopted in national government’s budget decree. They also cannot provide guarantees in favour of third parties or grant budget loans to non-governmental entities or individuals. Subnational governments can attract short-term loans from the upper level of government, to be repaid by the end of the fiscal year; they cannot borrow from other sources. These restrictions have stymied attempts by some subnational governments in Uzbekistan to adopt debt instruments like bonds to finance their projects (see 5.3 Subnational bonds).

Only a portion of the state budget is realistically available to finance progress on Uzbekistan’s development and climate goals. In 2022, nearly half of the budget was allocated to social expenditures (e.g., health and education), while development programmes writ large and expenditures on the real economy accounted for 12.5% and 11.3% respectively (UNDP, 2020[6]). Given the size of the financing gap to achieve Uzbekistan’s development and climate goals, Uzbekistan will need to seek financing outside of the domestic public sphere. However, these is still scope for improving the efficiency and impact of domestic public spending to meet national priorities.

Starting in 2022, Uzbekistan began introducing green budgeting and SDG budgeting into the country’s public financial management system (UNDP, 2022[7]). According to SDG tagging of the 2022 budget, Uzbekistan estimates that 71% of the state’s budget spending directly related to the financing of SDGs. Notably, while social SDGs, such as SDG 1 (Poverty), SDG 3 (Health) and SDG 4 (Education), were well supported (UZS 5.1 trillion, UZS 14.9 trillion and UZS 33.1 trillion respectively), SDGs related to the green transition benefited from much lower levels of funding. Uzbekistan allocated only UZS 99 billion to projects in support of SDG 13 (Climate Change), UZS 196 billion to SDG 15 (Life on Land) and UZS 25 billion to SDG 7 (Energy). Some infrastructure-related SDGs, like SDG 6 (Water and Sanitation, UZS 5.6 trillion), SDG 9 (Infrastructure and Industrialisation, UZS 5.1 trillion) and SDG 11 (Cities, UZS 9.4 trillion) received larger shares of public funds (UNDP, 2020[6]). While climate- and environment-related SDGs – and Uzbekistan’s climate ambitions – require significant additional financing, certain aspects of Uzbekistan’s transition strategy could attract private financial flows, particularly infrastructure projects in renewable energy and clean transportation, rather than placing additional strain on the national budget.

3.1.2. Domestic private financial flows

Domestic private financial flows are an increasingly important source of development finance in Uzbekistan. They increased from about UZS 20 trillion (approximately USD 1.8 billion), about 18.5% of GDP, in 2013 to UZS 140 trillion (USD 12.3 billion), over 21% of GDP, in 2018. The government’s market liberalisation and reform efforts explain part of the surge, but over half of the investment in 2018 derived from credit lent by state-owned banks at preferential terms (UNDP, 2021[1]).

Uzbekistan’s commercial banks, most of which are subject to complete or partial state ownership, have expanded their loan portfolios in recent years. Between 2018 and 2019, loan volumes grew by 52.5%, from UZS 135 trillion (approximately USD 11.8 billion) to UZS 224 trillion (USD 19.6 billion). Uzbekistan’s banks have the capacity to invest domestically, and several banks, most notably SanoatQurilishBank (SQB), have begun investing in green projects. However, the banking sector is reputed to be excessively bureaucratic and risk-averse, and it often encourages entrepreneurs and smaller firms to seek other sources of private finance on informal lending markets (UNDP, 2021[1]).

Domestic private financial flows are further constrained by Uzbekistan’s underdeveloped domestic capital market. In 2018, market capitalisation in Uzbekistan stood at only USD 3.2 billion, at approximately the same level as Estonia (USD 2.9 billion), despite the country’s much smaller economy (about half the size of Uzbekistan’s GDP) and population (just under 4% of Uzbekistan’s population). Uzbekistan’s market capitalisation is also much shallower than neighbouring Kazakhstan (USD 45.4 billion), but significantly deeper than other Central Asian countries such as Kyrgyzstan (USD 0.3 billion) and Tajikistan (USD 0.5 billion) (EBRD, 2018[8]). The government plans to further develop the local capital market by achieving market capitalisation equal to 5% of GDP and UZS 3.94 trillion (approximately USD 345.6 billion) in corporate bonds (0.5% of GDP) by 2023. The government also aims to finance 5% of territorial investment programmes by issuing securities (Government of Uzbekistan, 2021[9]).

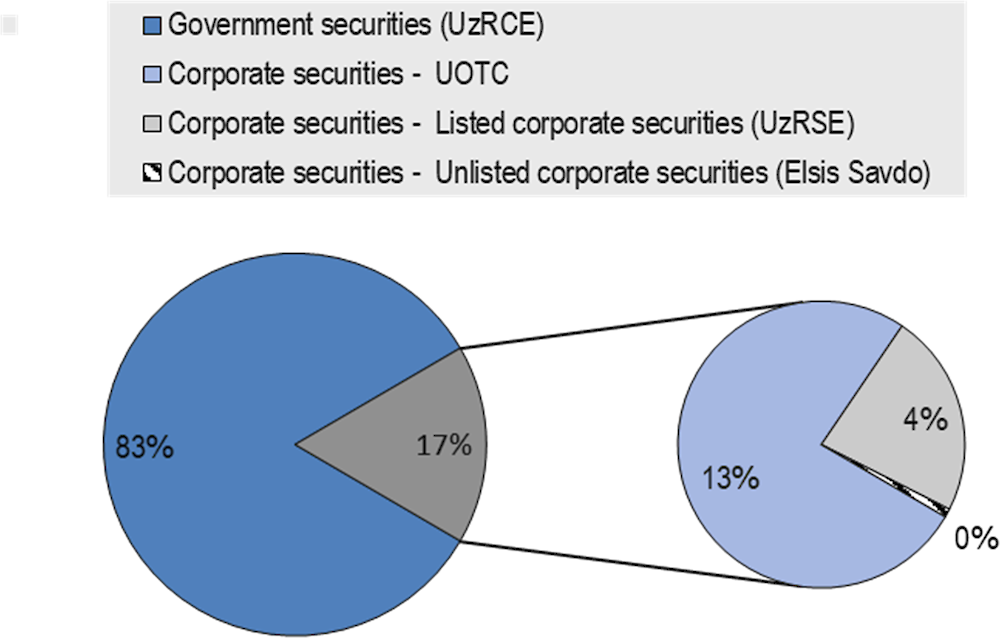

Uzbekistan’s security market is divided across two platforms. Government securities – 71% of trading volume in 2022 – trade on the Republican Currency Exchange, while the “Toshkent” Republic Stock Exchange (UZSE) manages trade in listed equities and corporate bonds. Elsis Savdo, a third smaller over-the-counter trading platform, until recently traded unlisted securities, but its licence was revoked in early 2023 to prepare for the development of an over-the-counter trading platform as part of UZSE (Yerzikov, 2023[10]). However, the majority of corporate securities in Uzbekistan (76% of corporate securities trading and 11% of total securities trading in 2022) are traded on an unorganised, decentralised over-the-counter market via informal broker-dealer networks (see Figure 3.2).

Figure 3.2. Government securities dominate Uzbekistan’s security market and most corporate securities are traded over the counter

As of October 2022, outstanding treasury bills and government domestic bonds totalled UZS 25.3 trillion (USD 2.3 billion) of which only UZS 3.9 trillion (USD 0.35 billion) have a tenor exceeding one year. The corporate bond market is subsequently small and narrow, constituting less than 0.2% of GDP, with only 24 corporate bond issuers outstanding for an aggregate nominal value of UZS 1 trillion (USD 90 million) as of 1 October 2022. Demand for financial instruments is weak. There are few investors, mostly state-owned commercial banks, in the fixed income market, primarily purchasing government securities through auctions held on the Uzbekistan Republican Currency Exchange and/or corporate bonds through private placements (Central Securities Depository, 2022[11]).

On the demand side, Uzbekistan lacks institutional investors. Financial actors that act as institutional investors in other countries (such as insurance companies and pension funds) have a limited role in financing government and corporate bonds because of a lack of investible funds. Only nine investment funds, including two privatisation investment funds, are active on the market, and no pensions funds or private equity funds participate in capital markets (Central Securities Depository, 2022[11]).

In Uzbekistan, insurance companies prefer bank deposits and real estate due to high interest rates and because their investment horizon is limited to the average duration of their liabilities (i.e., insurance products and policies), which averages 12 months, even for life insurance products. The insurance sector is small and inactive on capital markets.

The national Pension Fund is off-balance sheet and a pay-as-you-go defined benefit pension system operated by the Ministry of Economy and Finance. State-owned Halk Bank is the only bank in Uzbekistan that has the right to receive, accumulate and manage the funds of the accumulative pension fund (APF) of individuals in accordance with the 2004 law “On the accumulative pension fund” (Government of Uzbekistan, 2004[12]). The pension fund has limited investment capability with only about USD 5 trillion (USD 0.483 bn) of “free funds”. The type and the amount of investments to be made are determined by the Ministry of Economy and Finance and the Central Bank. As of 1 January 2022, Halk Bank had allocated the accumulated capital of the pension fund mostly to government securities (53.9%), term deposits (29.4%) and loans (16.6%). The average interest rate of allocations is 14% (EY, 2022[13]).

The major investment destination of local institutional investors is short-term government securities and state-owned commercial banks, with investment in the form of short-term, 6-month bank deposits, thereby limiting the contribution to financial market development. Institutional investors promote the growth of market capitalisation in the equity market, and their participation across the maturity spectrum of the government bond market yield curve is critical to support market development. A diverse investor base also lowers debt cost and volatility in market yields.

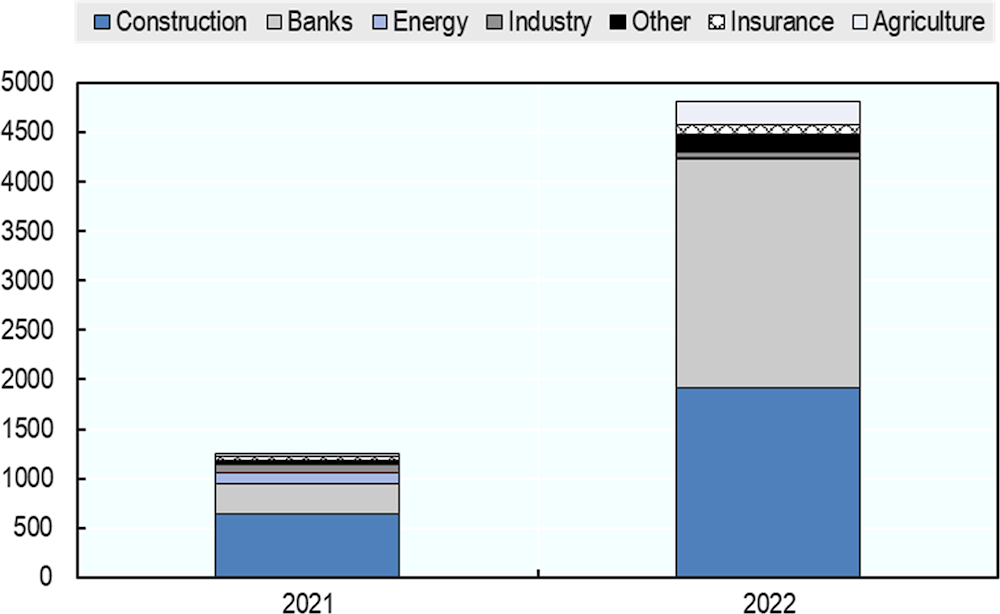

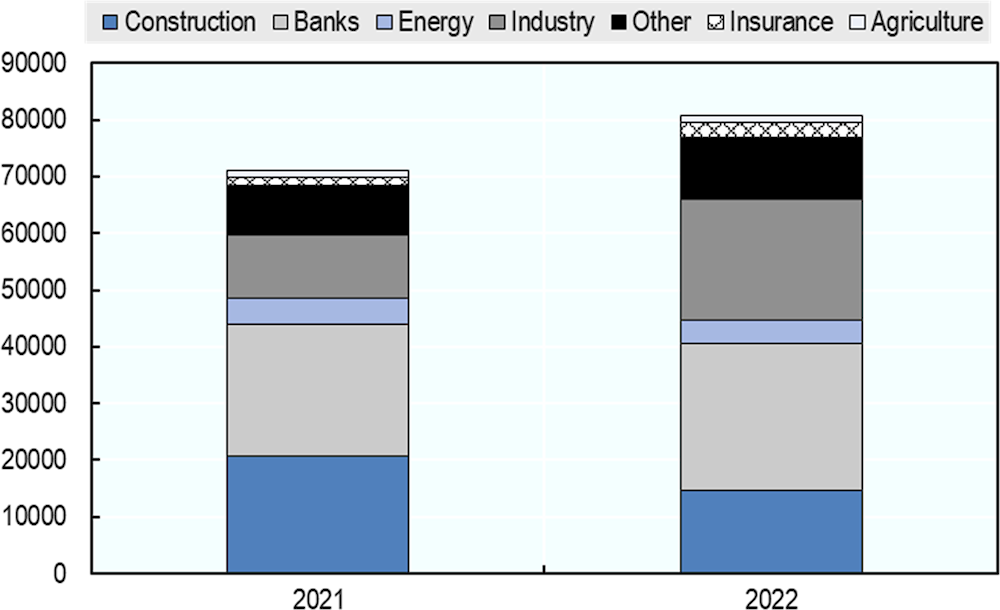

In November 2020, capitalisation of the Toshkent Republican Stock Exchange (UZSE), the largest stock exchange in the country, exceeded USD 5 billion, and the rate of new listings on the exchange has increased (41 new companies listed stocks in the first ten months of 2020 compared to only 23 over the same period in 2019) (UzReport.News, 2020[14]). 110 companies participated in trades on UZSE by 2022 (Toshkent Republican Stock Exchange, 2023[15]). Although the market remains small, the number of trading deals has increased rapidly (see Figure 3.3), but compared to stock exchanges of neighbouring Kazakhstan and Russia, trading activity on UZSE has been sluggish (Dettoni, 2019[16]). Moreover, although there have been more trades, aggregate trading volume has increased only marginally and most activity is concentrated in just a handful of sectors, mostly construction and banking (see Figure 3.4). State-owned banks, which are obliged to list on the exchange, account for the majority of banking-related deals (Dettoni, 2019[16]).

Figure 3.3. The number of deals on UZSE has increased rapidly, particularly in the construction and banking sectors

Figure 3.4. Trade volumes have increased slightly on UZSE but remain concentrated in the construction, banking and industry sectors

Energy, transport and industry, sectors with a large impact on Uzbekistan’s GHG emissions, account for only a fraction of total trading volume on the exchange (1.9%, 0.001% and 2.5% respectively) (Toshkent Republican Stock Exchange, 2023[15]). As the UZSE develops, corporate securities issued by companies in high-impact sectors for Uzbekistan’s green transition could offer an additional source of financing for green projects.

3.1.3. International public financial flows

International public financial flows, from multilateral development banks (MDBs) and bilateral donors, are an essential source of finance for Uzbekistan’s development projects. Uzbekistan is eligible for both grants and loans under concessional development financing terms. Given the international community’s renewed interest in Uzbekistan following the recent wave of reforms, Uzbekistan’s efforts to develop its private sector and usher in a green transition stand to benefit from policy advice and technical assistance from the international development finance institutions, particularly in public finance management.

Uzbekistan benefits from both official development assistance (ODA) and other official flows (OOF). The OECD DAC defines ODA as flows to territories on the DAC List of ODA Recipients from official agencies that promote economic development and contain a grant element determined by the recipient country’s income level. For Uzbekistan, a lower-middle income country, 15% of a bilateral loan would be structured as a grant to qualify as ODA. OOF are transactions that do not meet these criteria, either due to a smaller grant component or a focus on export facilitation rather than economic development. Since 2012, OOF has overtaken ODA as Uzbekistan’s main source of international public financing. MDBs accounted for 85% of total OOF from 2002 to 2018, with the Asian Development Bank (45%) as the largest lender, followed by the International Bank for Reconstruction and Development (15%), the Islamic Development Bank (12%), the International Development Association (9%) and the European Bank for Reconstruction and Development (4%). Over the same period, Korea was the only bilateral source of OOF, representing 15% of total flows (UNDP, 2021[1]).

As of October 2022, concessional loans (ODA and some OOF) from international finance institutions accounted for USD 11.3 billion (49%) of Uzbekistan’s total state external debt, while debt to bilateral creditors – including China, a major donor not included in the DAC database – amounted to USD 9.3 billion (40%). The state external debt, composed primarily of loans from multilateral and bilateral donors, is used primarily for budget support (USD 6.6 billion in 2022), as well as targeted support to key sectors: oil and gas (USD 2.9 billion), electric power (USD 2.7 billion), agriculture and water (USD 2.5 billion) and transport (USD 2.4 billion) (Ministry of Finance, 2022[17]).

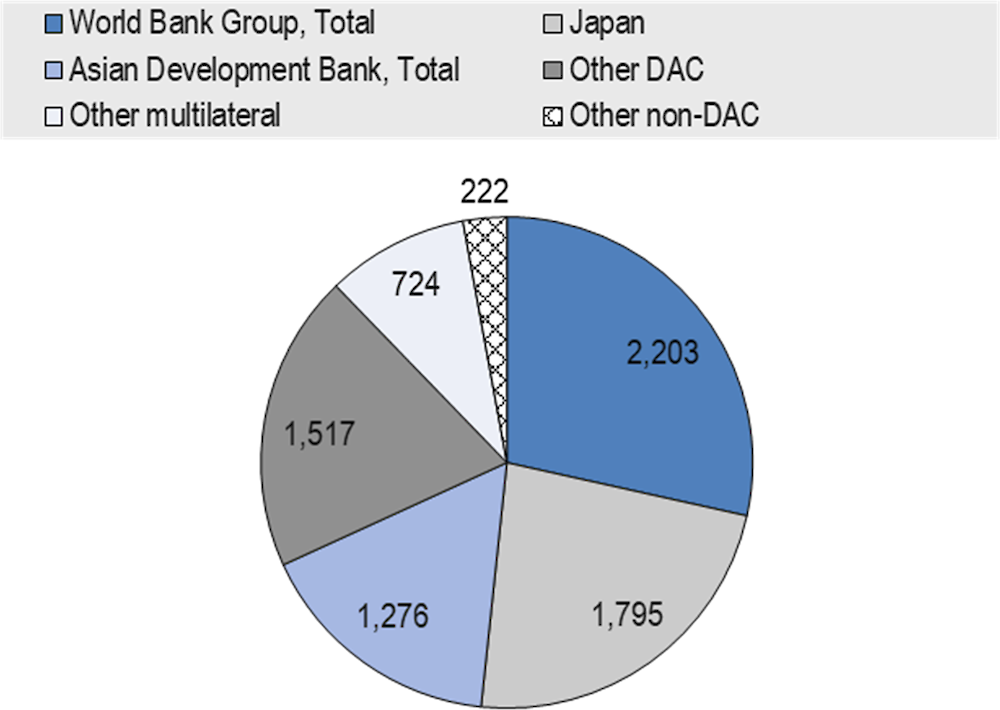

According to the OECD’s Development Assistance Committee (DAC) database, Uzbekistan’s largest multilateral donors between 2010 and 2021 were the World Bank Group (USD 2.2 billion) and the Asian Development Bank (USD 1.3 billion), while Japan is its most significant bilateral donor (USD 1.8 billion) (see Figure 3.5). Other major DAC donors include France (USD 451 million), Korea (USD 384 million), Germany (USD 250 million) and EU Institutions (USD 249 million). Among non-DAC donors tracked by the OECD DAC database, Türkiye (USD 81 million), Kuwait (USD 64 million) and the United Arab Emirates (USD 62 million) were the largest over the same period. Among multilateral donors, the United Nations institutions provided USD 190 million in ODA, the International Monetary Fund provided USD 128 million and the Islamic Development Bank provided USD 12 million (OECD, 2023[18]).

Figure 3.5. The World Bank Group, Asian Development Bank and Japan are Uzbekistan’s largest international donors

Source: OECD (2023[18]), DAC statistics, https://www.oecd.org/dac/financing-sustainable-development/development-finance-data/idsonline.htm.

MDBs have been an important source of development finance in Uzbekistan, particularly on climate-related projects. Uzbekistan has been the main recipient of climate finance from MDBs in Central Asia, receiving 49% (USD 4.4 billion) of the total disbursed in the region between 2015 and 2019. The World Bank and Asian Development Bank have focused their climate-related efforts on energy efficiency, renewable energy, rural housing, sustainable agriculture, climate mitigation, water supply, transportation and the modernisation of hydrometeorological services. The European Bank of Reconstruction and Development (EBRD) supports solid waste management and water reforms in Tashkent, and three Uzbek banks (Ipak Yuli Bank, SanoatQurilishBank (SQB) and Hamkorbank) have already joined the EBRD’s pilot Green Economy Financing Facility (GEFF). Within the frame of the GEFF program, all three banks signed up as the local partners, receiving in total USD 60 million EBRD credit line for on-lending to private companies. Loans will cover investments in green technologies, such as thermal insulation, photovoltaic solar panels, geothermal heat pumps and water efficient irrigation systems (UNDP, 2021[1]). Since 2016, Uzbekistan has launched four projects worth USD 105.9 million with support from the Green Climate Fund (GCF) (GCF, n.d.[19]).

Several international organisations are also active in Uzbekistan on donor-funded climate-related projects. The United Nations Development Programme (UNDP) mainly supports medium-sized projects and small grants through the Global Environment Facility (GEF) and the Adaptation Fund, focusing on energy efficiency in buildings. The UNDP also delivered a pre-feasibility study on the use of Islamic finance for the green transition, which helped identify barriers to the adoption of green Islamic finance instruments like green sukuk. The Food and Agriculture Organisation (FAO) supports projects on forests, agriculture and climate (UNDP, 2021[1]).

EU institutions have increased their presence as a donor in Uzbekistan. They provided EUR 168 million of financing to support sustainable development between 2014-2020. The EU’s focus has centred on rural development and the agriculture sector, but they have also worked closely with the Uzbek government to improve sector governance and public administration reform. Through the EU’s Investment Facility for Central Asia (IFCA) the European Investment Bank (EIB) and bilateral partners fund key infrastructure projects. In Uzbekistan, IFCA co-funds sovereign loans along with the EIB as well as the Agence française de développement (AFD) in water management, energy, solid waste management and environmental infrastructure projects, including technical assistance and capacity building for the national authorities. EU IFCA grants amounting to EUR 33.5 million leveraged EUR 780 million in loans from the EIB and the AFD between 2014 and 2019. Through IFCA, the EU seeks to contribute to the SDGs related to clean water and sanitation, affordable clean energy and climate action (UNDP, 2021[1]).

To date, the European Bank for Reconstruction and Development (EBRD) has invested a cumulative EUR 3.8 billion in Uzbekistan. Its current portfolio amounts to EUR 2.6 billion, spread over 84 active projects. Strategic priorities for the EBRD’s engagement in Uzbekistan are i) enhancing competitiveness by strengthening the private sector’s role in the economy; ii) promoting green energy; and, iii) support regional and international co-operation and integration (EBRD, 2023[20]).

Japan, Uzbekistan’s largest DAC donor, provides over 90% of its support in the form of loans. It has three priority interests in Uzbekistan. First, it aims to support development of Uzbekistan’s economic infrastructure, particularly in the energy and transport sectors. Second, it supports human capital and institutional development for the transition towards a market-based economy as well as economic and industrial development. Third, it focuses on agriculture, regional development and healthcare (Government of Japan, 2017[21]).

China, which is not included in the DAC database, has also emerged as a major bilateral donor in Uzbekistan. Between 2000 and 2017, China committed USD 12.7 billion of financing to support Uzbekistan. USD 8.9 billion (70%) of the financing took the form of OOF-like financial flows, while 20% (USD 2.5 billion) was comparable to ODA in terms of concessional conditions. The conditions of the remaining financing could not be determined (USD 1.7 billion, or 10%). State-owned policy banks (e.g. China Development Bank, Export-Import Bank of China, Industrial and Commercial Bank of China) provided the majority of the support across all categories (89% of ODA-like financing, 74% of OOF-like financing and 87% of the uncategorised flows). Official flows from China have concentrated in the industry, mining and construction sector (USD 4.1 billion, or 32.6%), followed by the energy sector (USD 1.9 billion, or 15.1%) and the banking sector and financial services (USD 1.7 billion, or 13.5%). The distribution of support by sector is broadly similar across the different types of support, but the transport and storage sector received a larger proportion of ODA-like support (24.3% of total ODA-like financing). The projects vary considerably in their environmental impacts, from emissions-intensive projects related to support to coal mining and the natural gas industry and construction of several cement plants to the expansion of Uzbekistan’s new hydroelectric generation capacity and improvements to energy efficiency and the reliability of the country's electrical grid (AidData, 2021[22]).

3.1.4. International private financial flows

Foreign direct investment

Uzbekistan’s more open stance to trade and foreign investment since 2017 has made it a more attractive destination for international capital. In 2017 Uzbekistan abolished its long-standing exchange rate peg, allowing the Uzbek som to float freely on the foreign exchange market, and in 2020 it adopted a new investment law that strengthened other protections for foreign investors. There have also been marked improvements in Uzbekistan’s overall business environment, including the simplification of procedures to approve investments and register businesses (Jivraj, 2023[23]). As a result of these reforms, annual foreign direct investment (FDI) inflows have increased. Average FDI inflows between 2010 and 2016 equalled USD 1.2 billion, but inflows increased to USD 2.3 billion in 2019, USD 1.7 billion in 2020 and USD 2.0 billion in 2021, despite the COVID-19 pandemic (UNCTAD, 2022[24]). China has emerged as Uzbekistan’s largest provider of FDI, accounting for 22.3% of inflows in 2021. Other major investors include Russia (21.5%), Türkiye (7.5%) and Germany (7.3%) (UzStat, 2021[25]).

The number of total foreign investments Uzbekistan reached USD 56.3 billion by the end of Q2 of 2022. Of this total, USD 12.5 billion or 21.8% were in the form of direct investments. Over the past five years, the number of operating enterprises with foreign capital has increased by 2.8 times, from 5 370 in 2017 to 14 546 in August 2022. Russian capital is of particular importance in this development: 2 705 enterprises (18.6% of all Uzbek companies with foreign capital) rely fully or partially on Russian capital. After Russia, Türkiye (14.1% of the total number of operating enterprises with foreign capital in the country), China (14.0%), Kazakhstan (8.1%) and Korea (6.2%) are the largest sources (UzStat, 2022[26]).

Foreign investors are taking a growing interest in Uzbekistan’s green transition, particularly the transition towards renewable energy. Saudi Arabia’s ACWA Power has invested in the USD 2.4 billion 1.5 GW wind power project in Karakalpakstan, the largest onshore wind project in the world, and it has since expanded its portfolio to include other wind and renewable projects (Jivraj, 2023[23]). Masdar, a company from the United Arab Emirates, has signed a joint development agreement with Uzbekistan’s Ministry of Energy and Ministry of Investments, Industry and Trade to develop 2 GW of solar and wind projects as well as 500 MWh of battery energy storage (Masdar, 2023[27]). Several OECD country-based companies, including EDF, Siemens, Mitsubishi, Orano, Siemens, Sumitomo, Total Eren, Toyoto Tsusho, Veolia and Voltalia, have taken stakes in solar, wind and energy infrastructure modernisation projects across the country (Jivraj, 2023[23]).

Large-scale renewable power generation projects, like those championed by ACWA Power and Masdar, have been financed through loans. However, given the growing interest from international investors in Uzbekistan’s dynamic renewable power sector, such large projects could form the basis of green bond issuances. Representatives of the Toshkent Republican Stock Exchange, during a 2023 OECD visit to Tashkent, identified large-scale renewable energy projects as “low-hanging fruit” for financing through green bonds.

Portfolio investments and bonds on international exchanges

Portfolio investment reached USD 4 billion, making up 7.2% of total foreign investments in Uzbekistan. More than half (55.1%) of portfolio investment is allocated in government securities. The share of foreign investors in domestic corporate debt market is still small (2.9% as of October, 2022). Government debt instruments are the largest and main destination of foreign investments, constituting 26.9% of all foreign investments into the country (Central Bank of Uzbekistan, 2022[28]). Portfolio investments emerged as an important source of capital in 2019, when Uzbekistan issued its first-ever sovereign bond on the London Stock Exchange in two tranches of USD 500 million with 5- and 10-year tenors. The bond performed well, raising USD 1 billion on global market. As bond prices rise, their effective yield goes down. Investors at issuance were promised annual interest payments of 4.75 percent for a 10-year bond and 5.375 percent for a 5-year one. But the current effective yield (November, 2022) is 7.22 percent for the 10-year bond and 7.12 percent for the 5-year bond, which indicates that the cost of borrowing has raised for Uzbekistan.

Following this move from the government, there has been a flurry of activity in Uzbekistan on international markets with 10 sovereign and corporate bond issuances between 2019 and 2023 (see Table 3.1). All corporate issuances were carried out by state-owned enterprises or banks. The second and third sovereign issuances included tranches denominated in UZS. Notably, after the 2020 issuance of its second sovereign bond (“Development Finance Institution (DFI) Bond”), in 2021 Uzbekistan became the first country in the former Soviet Union to issue a so-called “SDG Bond”, a sustainability bond, in 2021 (see Chapter 5: State of play of green finance in Uzbekistan”). In 2023, two green bonds were issued: one by SanoatQurilishBank (SQB) in a private placement, which became the first commercial bank in Uzbekistan to issue a green bond (UzReport, 2023[29]), and one sovereign green bond (Ministry of Economy and Finance, 2023[30]).

Table 3.1. Uzbekistan has issued 10 bonds on international markets since 2019

|

Issuer |

Type |

Issued value |

Date of issuance |

Maturity |

Issuance yield |

|---|---|---|---|---|---|

|

I. Sovereign bonds |

|||||

|

Uzbekistan* |

conventional bond |

USD 500 million |

20/02/2019 |

5 years |

4.75% |

|

USD 500 million |

10 years |

5.375% |

|||

|

Uzbekistan* |

conventional, so-called “DFI bond” |

USD 555 million |

25/11/2020 |

10 years |

3.7% |

|

UZS 2 trillion |

3 years |

14.5% |

|||

|

Uzbekistan* |

sustainability, so-called “SDG bond” |

USD 635 million |

19/07/2021 |

10 years |

3.9% |

|

UZS 2.5 trillion |

3 years |

14.0% |

|||

|

Uzbekistan* |

conventional tranche |

USD 660 billion |

06/10/2023 |

5 years |

8.125% |

|

green bond tranche |

UZS 4.25 trillion |

3 years |

16.25% |

||

|

II. Corporate bonds (issued by banks) |

|||||

|

SanoatQurilishBank (SQB) |

conventional bond |

USD 300 million |

12/2019 |

5 years |

5.75% |

|

National Bank (NBU) |

conventional bond |

USD 300 million |

10/2020 |

5 years |

4.85% |

|

Ipoteka Bank |

conventional bond |

USD 300 million |

11/2020 |

5 years |

5.50% |

|

SQB |

green bond |

USD 100 million |

08/2023 |

5 years |

Not disclosed |

|

III. Corporate bonds (issued by industrial firms) |

|||||

|

Uzautomotors |

conventional bond |

USD 300 million |

04/2021 |

5 years |

4.85% |

|

Uzbekneftegaz |

conventional bond |

USD 700 million |

06/2021 |

7 years |

4.75% |

Note: *Uzbekistan’s sovereign bonds were each issued with two tranches. The last three issuances included tranches in UZS.

Source: Author’s compilation.

Most issuances, however, have been for conventional rather than green or other thematic bonds. Uzbekistan’s planned large privatisation programme and sovereign bond issuances, as well recent tax incentives for foreign investors are expected to increase portfolio inflows in the coming years as foreign investors acquire equity securities, including shares, stocks and direct purchases of shares in local stock markets. Continued financial market development will be vital to help the country absorb potentially large capital flow fluctuations and the economic shocks that come with them. Strong regulatory frameworks are essential to this effort. Building foreign reserves and, where feasible, allowing exchange rates to adjust and absorb shocks can help insulate economies from the impact of capital flow volatility.

References

[22] AidData (2021), AidData’s Global Chinese Development Finance Dataset, Version 2.0, https://www.aiddata.org/data/aiddatas-global-chinese-development-finance-dataset-version-2-0 (accessed on 26 June 2023).

[28] Central Bank of Uzbekistan (2022), Statistical Bulletin: January-September 2022, Central Bank of Uzbekistan, Tashkent, https://cbu.uz/upload/medialibrary/fee/1yi6xtrrzd5nj9gi78h3wbzglno4hrw7/Statistical-bulletin-January_September-2022.pdf (accessed on 27 June 2023).

[11] Central Securities Depository (2022), State Enterprise “Central Securities Depository”, https://deponet.uz/en (accessed on 23 June 2023).

[16] Dettoni, J. (2019), “Uzbekistan greenlights 2020 capital market reform”, FDI Intelligence, https://www.fdiintelligence.com/content/news/uzbekistan-greenlights-2020-capital-market-reform-75988 (accessed on 23 June 2023).

[20] EBRD (2023), Data on EBRD work in Uzbekistan, European Bank for Reconstruction and Development (EBRD), https://www.ebrd.com/where-we-are/uzbekistan/data.html (accessed on 26 June 2023).

[8] EBRD (2018), Local Currency and Capital Markets Development (LC2) Strategy 2019 – 2024. European Development Bank. LC2 Strategy., European Bank for Reconstruction and Development, London.

[13] EY (2022), Halk Bank consolidated financial statements and independent auditor’s report for 2021, Ernst and Young (EY), https://xb.uz/en/page/hisobotlar-2/ (accessed on 23 June 2023).

[19] GCF (n.d.), Areas of Work: Countries: Republic of Uzbekistan, Green Climate Fund (CGF), https://www.greenclimate.fund/countries/uzbekistan (accessed on 25 June 2023).

[21] Government of Japan (2017), Политика страновой помощи Республики Узбекистан [Policy for country-level support to the Republic of Uzbekistan], https://web.archive.org/web/20220724101608/https://www.uz.emb-japan.go.jp/files/000306082.pdf (accessed on 26 June 2023).

[4] Government of Uzbekistan (2023), О государственном бюджете Республики Узбекистан на 2023 год [On the state budget of the Republic of Uzbekistan for 2023], https://lex.uz/ru/docs/6333242 (accessed on 23 June 2023).

[9] Government of Uzbekistan (2021), Kapital bozorini yananda rivojlantirish chora-tadbirlari to’g’risida [On measures for further development of the capital market], https://lex.uz/docs/-5371091 (accessed on 14 June 2023).

[3] Government of Uzbekistan (2017), Об утверждении положения о порядке формирования и использования средств Фонда экологии, охраны окружающей среды и обращения с отходами [On approval of the regulations on the procedure for the formation and use of funds of the Fund for Ecology, Environmental Protection and Waste Management], https://lex.uz/docs/3234983 (accessed on 23 June 2023).

[12] Government of Uzbekistan (2004), О накопительном пенсионном обеспечении граждан [On the accumulative pension fund], https://lex.uz/docs/391377 (accessed on 23 June 2023).

[23] Jivraj, H. (2023), “Will Uzbekistan retain its position as Central Asia’s FDI star?”, Investment Monitor, https://www.investmentmonitor.ai/features/uzbekistan-central-asia-fdi-star/ (accessed on 27 June 2023).

[27] Masdar (2023), Masdar Signs Agreement to Develop over 2 GW of Clean Energy in Uzbekistan, https://news.masdar.ae/en/News/2023/05/19/07/43/Masdar-Signs-Agreement-to-Develop-Clean-Energy-in-Uzbekistan (accessed on 27 June 2023).

[30] Ministry of Economy and Finance (2023), The Republic of Uzbekistan for the first time placed “green” international bonds in the national currency, https://www.imv.uz/en/news/category/yangiliklar/post-1621 (accessed on 21 November 2023).

[17] Ministry of Finance (2022), The State Debt of the Republic of Uzbekistan: For the 3rd quarter of 2022, Ministry of Finance of the Republic of Uzbekistan, Tashkent, https://api.mf.uz/media/post_attachments/State_debt_3Q_2022.pdf (accessed on 24 June 2023).

[18] OECD (2023), Total flows by donor, OECD.Stat Development Database, https://stats.oecd.org/Index.aspx?datasetcode=TABLE1 (accessed on 24 June 2023).

[15] Toshkent Republican Stock Exchange (2023), “2022 Exchange Review”, https://uzse.uz/system/analytics/pdfs/000/000/154/original/Exchange_review_for_full_year_2022.pdf?1676883361 (accessed on 21 June 2023).

[24] UNCTAD (2022), Foreign direct investment: Inward and outward flows and stock, annual, United Nations Conference on Trade and Development Database, https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96740 (accessed on 27 June 2023).

[7] UNDP (2022), Uzbekistan introduces green budgeting and SDG budgeting, https://www.undp.org/uzbekistan/news/uzbekistan-introduces-green-budgeting-and-sdg-budgeting (accessed on 23 June 2023).

[1] UNDP (2021), Development Finance Assessment for the Republic of Uzbekistan, United Nations Development Programme (UNDP), https://www.undp.org/uzbekistan/publications/development-finance-assessment-republic-uzbekistan (accessed on 23 June 2023).

[6] UNDP (2020), Citizens’ Budget 2020: COVID-19 Response Measures, United Nations Development Programme (UNDP), https://www.undp.org/uzbekistan/publications/budget-citizens (accessed on 23 June 2023).

[29] UzReport (2023), Oʻzsanoatqurilishbank 100 million AQSH dollarlik obligatsiyalarni xususiy joylashtirishni muvaffaqiyatli amalga oshirdi [Uzsanoatqurilishbank has successfully implemented a private placement of bonds worth 100 million US dollars], https://uzreport.news/finance/o-zsanoatqurilishbank-100-million-aqsh-dollarlik-obligatsiyalarni-xususiy-joylashtirishni-.

[14] UzReport.News (2020), “Капитализация Ташкентской фондовой биржи превысила $5 млрд [Capitalisation of the Tashkent stock exchange exceeded $5 billion]”, UzReport.News, https://www.uzreport.news/exchange/kapitalizatsiya-tashkentskoy-fondovoy-birji-previsila-5-mlrd (accessed on 23 June 2023).

[26] UzStat (2022), Сколько предприятий с участием иностранного капитала работают в Узбекистане? [How many companies with foreign capital work in Uzbekistan?], https://stat.uz/ru/press-tsentr/novosti-goskomstata/25437-davlatlarning-kapitali-ishtirokidagi-korxonalari-ko-p-3 (accessed on 27 June 2023).

[25] UzStat (2021), Прямые иностранные инвестиции в основной капитал по странам – инвесторам по республике [Foreign direct investment in fixed capital by investing country in the republic], https://stat.uz/ru/press-tsentr/novosti-goskomstata/12833-respublikada-investor-mamlakatlar-bo-yicha-to-g-ridan-to-g-ri-xorijiy-investitsiyalar-2 (accessed on 27 June 2023).

[2] World Bank (2021), Assessing Uzbekistan’s Transition: Country Economic Memorandum, World Bank, Washington, D.C., https://documents1.worldbank.org/curated/en/862261637233938240/pdf/Full-Report.pdf (accessed on 22 June 2023).

[5] World Bank (2019), Uzbekistan Public Expenditure Review, World Bank, https://documents1.worldbank.org/curated/en/471601582557360839/pdf/Uzbekistan-Public-Expenditure-Review.pdf (accessed on 23 June 2023).

[10] Yerzikov, V. (2023), “Лицензия внебиржевой платформы Elsis-Savdo приостановлена [Licence of over-the-counter trading platform Elsis Savdo suspended]”, Kursiv.

Note

← 1. Uzbekistan’s subnational governments include the administrations of Tashkent city, twelve regions (viloyat) and one autonomous republic (Republic of Karakalpakstan) as well as 40 cities or urban districts and 162 rural districts.